Adaptive Euler-Maruyama method for

SDEs with non-globally Lipschitz drift:

part I, finite time interval

Abstract

This paper proposes an adaptive timestep construction for an Euler-Maruyama approximation of SDEs with a drift which is not globally Lipschitz. It is proved that if the timestep is bounded appropriately, then over a finite time interval the numerical approximation is stable, and the expected number of timesteps is finite. Furthermore, the order of strong convergence is the same as usual, i.e. order for SDEs with a non-uniform globally Lipschitz volatility, and order for Langevin SDEs with unit volatility and a drift with sufficient smoothness. The analysis is supported by numerical experiments for a variety of SDEs.

keywords:

[class=MSC]keywords:

arXiv:0000.0000 \startlocaldefs \endlocaldefs

and

1 Introduction

In this paper we consider an -dimensional stochastic differential equation (SDE) driven by a -dimensional Brownian motion:

| (1) |

with a fixed initial value The standard theory assumes the drift and the volatility are both globally Lipschitz. Under this assumption, there is well-established theory on the existence and uniqueness of strong solutions, and the numerical approximation obtained from the Euler-Maruyama discretisation

using a uniform timestep of size with Brownian increments , plus a suitable interpolation within each timestep, is known [12] to have a strong error which is so that for any

The interest in this paper is in other cases in which is

again globally Lipschitz, but is only locally Lipschitz.

If, for some , also

satisfies the one-sided growth condition

where denotes an inner product,

then it is again possible to prove the existence and uniqueness

of strong solutions (see Theorems 2.3.5 and 2.4.1 in [16]).

Furthermore (see Lemma 3.2 in [6]), these solutions

are stable in the sense that for any

The problem is that the numerical approximation given by the uniform timestep Euler-Maruyama discretisation may not be stable. Indeed, for the SDE

| (2) |

it has been proved [9] that for any and

This behaviour has led to research on numerical methods which achieve strong convergence for these SDEs with a non-globally Lipschitz drift. One key paper in this area is by Higham, Mao & Stuart [6]. First, assuming a locally Lipschitz condition for both the drift and the volatility, they prove that if the uniform timestep Euler-Maruyama discretisation is stable then it also converges strongly. Assuming the drift satisfies a one-sided Lipschitz condition and a polynomial growth condition, they then prove stability and the standard order strong convergence for two uniform timestep implicit methods, the Split-Step Backward Euler method (SSBE):

and the drift-implicit Backward Euler method:

Mao & Szpruch [19] prove that the implicit -Euler method

converges strongly for under more general conditions which permit a non-globally Lipschitz volatility.

However, except for some special cases, implicit methods can require significant additional computational costs, especially for multi-dimensional SDEs; therefore, a stable explicit method is desired. Milstein & Tretyakov proposed a general approach which discards approximate paths that cross a sphere with a sufficiently large radius [21]. However, it is not easy to quantify the errors due to . The explicit tamed Euler method proposed by Hutzenthaler, Jentzen & Kloeden [10] is

for some fixed constant . They prove both stability and the standard order strong convergence. This approach has been extended to the tamed Milstein method by Wang & Gan [23], proving order 1 strong convergence for SDEs with commutative noise. Finally, Mao [17] proposes a truncated Euler method which has the form

By making a function of , strong convergence is proved for SDEs satisfying a Khasminskii-type condition which again allows a non-globally Lipschitz volatility; in [18] it is proved that the order of convergence is arbitrarily close to .

In this paper, we propose instead to use the standard explicit Euler-Maruyama method, but with an adaptive timestep which is a function of the current approximate solution . The idea of using an adaptive timestep comes from considering the divergence of the uniform timestep method for the SDE (2). When there is no noise, the requirement for the explicit Euler approximation of the corresponding ODE to have a stable monotonic decay is that its timestep satisfies . An intuitive explanation for the instability of the uniform timestep Euler-Maruyama approximation of the SDE is that there is always a very small probability of a large Brownian increment which pushes the approximation into the region leading to an oscillatory super-exponential growth. Using an adaptive timestep avoids this problem.

Adaptive timesteps have been used in previous research to improve the accuracy of numerical approximations. Some approaches use local error estimation to decide whether or not to refine the timestep [2, 20, 13] while others are similar to ours in setting the size of each timestep based on the current path approximation [7, 22]. However, these all assume globally Lipschitz drift and volatility. The papers by Lamba, Mattingly & Stuart [14] and Lemaire [15] are more relevant to the analysis in this paper. They both consider drifts which are not globally Lipschitz, but they assume a dissipative condition which is stronger than the conditions assumed in this paper. Lamba, Mattingly & Stuart [14] prove strong stability but not the order of strong convergence, while Lemaire [15] considers an infinite time interval with a timestep with an upper bound which decreases towards zero over time, and proves convergence of the empirical distribution to the invariant distribution of the SDE.

In this paper we are concerned with strong convergence, not weak convergence, because our interest is in using the numerical approximation as part of a multilevel Monte Carlo (MLMC) computation [3, 4] for which the strong convergence properties are key in establishing the rate of decay of the variance of the multilevel correction. Usually, MLMC is used with a geometric sequence of time grids, with each coarse timestep corresponding to a fixed number of fine timesteps. However, it has been shown that it is not difficult to implement MLMC using the same driving Brownian path for the coarse and fine paths, even when they have no time points in common [5].

Paper [5] also provides another motivation for this paper, the analysis of Langevin equations with a drift where is a potential function which comes from the modelling of molecular dynamics. [5] considers the FENE (Finitely Extensible Nonlinear Elastic) model which in the case of a molecule with a single bond has a 3D potential . Considerations of stability and accuracy lead to the use of a timestep of the form for some . Because of this, we pay particular attention to the case of Langevin equations, and for these we prove first order strong convergence, the same as for the uniform timestep Euler-Maruyama method for globally Lipschitz drifts. Unfortunately our assumptions do not cover the case of the FENE model as we require to be locally Lipschitz on .

The rest of the paper is organised as follows. Section 2 states the main theorems, and proves some minor lemmas. Section 3 has a number of example applications, many from [8], illustrating how suitable adaptive timestep functions can be defined. It also presents some numerical results comparing the performance of the adaptive Euler-Maruyama method to other methods. Section 4 has the proofs of the three main theorems, and finally Section 5 has some conclusions and discusses the extension to the infinite time interval which will be covered in a future paper.

In this paper we assume the following setting and notation. Let be a fixed positive real number, and let be a probability space with normal filtration corresponding to a -dimensional standard Brownian motion . We denote the vector norm by , the inner product of vectors and by , for any and the Frobenius matrix norm by for all

2 Adaptive algorithm and theoretical results

2.1 Adaptive Euler-Maruyama method

The adaptive Euler-Maruyama discretisation is

where and , and there is fixed initial data .

One key point in the analysis is to prove that increases without bound as increases. More specifically, the analysis proves that for any , almost surely for each path there is an such that .

We use the notation for the nearest time point before time , and its index.

We define the piecewise constant interpolant process and also define the standard continuous interpolant [12] as

so that is the solution of the SDE

| (3) |

In the following subsections, we state the key results on stability and strong convergence, and related results on the number of timesteps, introducing various assumptions as required for each. The main proofs are deferred to Section 4.

2.2 Stability

Assumption 1 (Local Lipschitz and linear growth).

and are both locally Lipschitz, so that for any there is a constant such that

for all with . Furthermore, there exist constants such that for all , satisfies the one-sided linear growth condition:

| (4) |

and satisfies the linear growth condition:

| (5) |

Together, (4) and (5) imply the monotone condition

which is a key assumption in the analysis of Mao & Szpruch [19] and Mao [17] for SDEs with volatilities which are not globally Lipschitz. However, in our analysis we choose to use this slightly stronger assumption, which provides the basis for the following lemma on the stability of the SDE solution.

Lemma 1 (SDE stability).

If the SDE satisfies Assumption 1, then for all

Proof.

We now specify the critical assumption about the adaptive timestep.

Assumption 2 (Adaptive timestep).

The adaptive timestep function is continuous and strictly positive, and there exist constants such that for all , satisfies the inequality

| (6) |

Note that if another timestep function is smaller than , then also satisfies the Assumption 2. Note also that the form of (6), which is motivated by the requirements of the proof of the next theorem, is very similar to (4). Indeed, if (6) is satisfied then (4) is also true for the same values of and .

Theorem 1 (Finite time stability).

Proof.

The proof is deferred to Section 4. ∎

To bound the expected number of timesteps, we require an assumption on how quickly can approach zero as .

Assumption 3 (Timestep lower bound).

There exist constants , such that the adaptive timestep function satisfies the inequality

Given this assumption, we obtain the following lemma.

Lemma 2 (Bounded timestep moments).

2.3 Strong convergence

Standard strong convergence analysis for an approximation with a uniform timestep considers the limit . This clearly needs to be modified when using an adaptive timestep, and we will instead consider a timestep function controlled by a scalar parameter , and consider the limit .

Given a timestep function which satisfies Assumptions 2 and 3, ensuring stability as analysed in the previous section, there are two quite natural ways in which we might introduce to define :

The first refines the timestep everywhere, while the latter concentrates the computational effort on reducing the maximum timestep, with introduced to ensure stability when is large.

In our analysis, we will cover both possibilities by making the following assumption.

Assumption 4.

Given this assumption, we obtain the following theorem:

Theorem 2 (Strong convergence).

Proof.

The proof is essentially identical to the uniform timestep Euler-Maruyama analysis in Theorem 2.2 in [6] by Higham, Mao & Stuart.

The only change required by the use of an adaptive timestep is to note that

and and ∎

To prove an order of strong convergence requires new assumptions on and :

Assumption 5 (Lipschitz properties).

There exists a constant such that for all , satisfies the one-sided Lipschitz condition:

| (8) |

and satisfies the Lipschitz condition:

| (9) |

In addition, satisfies the locally polynomial growth Lipschitz condition

| (10) |

for some .

Note that setting gives

Hence, Assumption 5 implies Assumption 1, with the same and an appropriate .

Also, if the drift and volatility are differentiable, the following assumption is equivalent to Assumption 5, and usually easier to check in practice.

Assumption 6 (Lipschitz properties).

There exists a constant such that for all with , satisfies the one-sided Lipschitz condition:

| (11) |

and satisfies the Lipschitz condition:

| (12) |

and in addition satisfies the locally polynomial growth Lipschitz condition

| (13) |

for some .

Theorem 3 (Strong convergence order).

Proof.

The proof is deferred to Section 4. ∎

Lemma 3 (Number of timesteps).

Proof.

The conclusion from Theorem 3 and Lemma 3 is that

which corresponds to order strong convergence when comparing the accuracy to the expected cost.

First order strong convergence is achievable for Langevin SDEs in which and is the identity matrix , but this requires stronger assumptions on the drift .

Assumption 7 (Enhanced Lipschitz properties).

There exists a constant such that for all , satisfies the one-sided Lipschitz condition:

| (14) |

In addition, is differentiable, and and satisfy the locally polynomial growth Lipschitz condition

| (15) |

for some .

Lemma 4.

Proof.

If we define the scalar function for by

then is continuously differentiable, and by the Mean Value Theorem for some , which implies that

The final result then follows from the Lipschitz property of . ∎

We now state the theorem on improved strong convergence.

Theorem 4 (Strong convergence for Langevin SDEs).

Proof.

The proof is deferred to Section 4. ∎

Comment: first order strong convergence can also be achieved for a general by using an adaptive timestep Milstein discretisation, provided satisfies an additional Lipschitz condition. A formal statement and proof of this is omitted as it requires a lengthy extension to the stability analysis. In addition, this numerical approach is only practical in cases in which the commutativity condition is satisfied and therefore there is no need to simulate the Lévy areas which the Milstein method otherwise requires [12].

3 Examples and numerical results

In this section we discuss a number of example SDEs with non-globally Lipschitz drift. In each case we comment on the applicability of the theory and a suitable choice for the adaptive timestep.

We then present numerical results for three testcases which illustrate some key aspects.

3.1 Scalar SDEs

In each of the cases to be presented, the drift is of the form

| (16) |

for some constants , . Therefore, as , the maximum stable timestep satisfying Assumption 2 corresponds to and hence . A suitable choice for and is therefore

| (17) |

3.1.1 Stochastic Ginzburg-Landau equation

This describes a phase transition from the theory of superconductivity [9, 12].

where , . The SDE is usually defined on the domain , since for all , if . However, the numerical approximation is not guaranteed to remain strictly positive and the domain can be extended to without any change to the SDE.

3.1.2 Stochastic Verhulst equation

This is a model for a population with competition between individuals [9].

where The SDE is defined on the domain , but can be extended to by modifying it to

so that the drift is positive in the limit .

3.2 Multi-dimensional SDEs

With multi-dimensional SDEs there are two cases of particular interest. For SDEs with a drift which, for some and sufficiently large , satisfies the condition

one can take and therefore a suitable definition of for large is

For SDEs with a drift which does not satisfy the condition, but for which as , an alternative choice for large is to use

| (18) |

for some . The difficulty in this case is choosing the best value for , taking into account both accuracy and cost.

3.2.1 Stochastic van der Pol oscillator

This describes state oscillation [8].

where . It can be put in the standard form by defining

It follows that

Therefore the drift and volatility satisfy Assumption 1 and the numerical approximations will be stable if the maximum timestep is defined by (18).

However, it can be verified that is not uniformly bounded for an arbitrary such that , and therefore the drift does not satisfy the one-sided Lipschitz condition. Hence the stability and strong convergence theory in this paper is applicable, but not the theorems on the order of convergence. Nevertheless, numerical experiments exhibit first order strong convergence, which is consistent with the fact that the volatility in uniform, so it seems there remains a gap here in the theory.

3.2.2 Stochastic Lorenz equation

This is a three-dimensional system modelling convection rolls in the atmosphere [8].

where , and so we have:

The diffusion coefficient is globally Lipschitz, and since consists solely of quadratic terms, the drift satisfies the one-sided linear growth condition. Noting that as , an appropriate maximum timestep is

for any . However, the drift does not satisfy the one-sided Lipschitz condition, and therefore the theory on the order of strong convergence is not applicable.

3.2.3 Langevin equation

The multi-dimensional Langevin equation is

| (19) |

In molecular dynamics applications, represent the potential energy of a molecule, while in other applications where is an invariant measure. is usually defined on , infinitely differentiable, and satisfies all of the assumptions in this paper so the theory is fully applicable, leading to order 1 strong convergence.

3.2.4 FENE model

The FENE (Finitely Extensible Nonlinear Elastic) model is a Langevin equation describing the motion of a long-chained polymer in a liquid [1, 5]. The unusual feature of the FENE model is that the potential becomes infinite for finite values of . In the simplest case of a molecule with a single bond, is three-dimensional and takes the form The SDE is defined on , with the drift term ensure that for all . Also, it can be verified that .

Because the SDE is not defined on all of , the theory in this paper is not applicable. However, it was one of the original motivations for the analysis in this paper, since it seems natural to use an adaptive timestep, taking smaller timestep as approaches 1, to maintain good accuracy, as the drift varies so rapidly near the boundary, and to greatly reduce the possibility of needing to clamp the computed solution to prevent it from crossing a numerical boundary at radius for some [5]. Numerical results indicate that the order of strong convergence is very close to 1.

3.3 Numerical results

The numerical tests include three testcases from [10] plus one new test which provides some motivation for the research in this paper.

3.3.1 Testcase 1

The first scalar testcase taken from [10] is

with . The three methods tested are the Tamed Euler scheme, with , the implicit Euler scheme, and the new Euler scheme with adaptive timestep

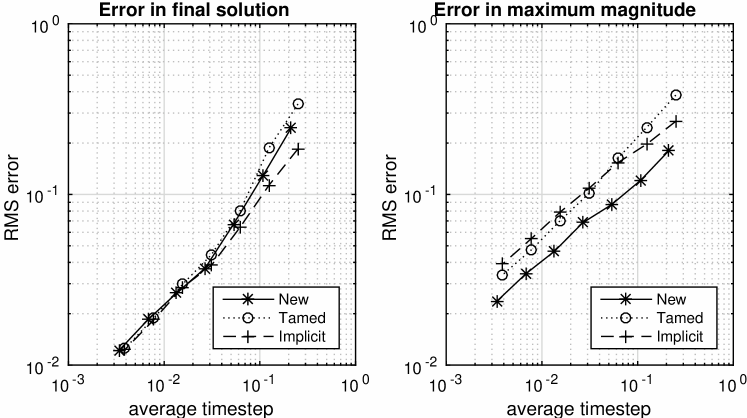

Figure 1 shows the the root-mean-square error plotted against the average timestep. The plot on the left shows the error in the terminal time, while the plot on the right shows the error in the maximum magnitude of the solution. The error in each case is computed by comparing the numerical solution to a second solution with a timestep, or , which is 4 times smaller.

When looking at the error in the final solution, all 3 methods have similar accuracy with order strong convergence. However, as reported in [10], the cost of the implicit method per timestep is much higher. The plot of the error in the maximum magnitude shows that the new method is slightly more accurate, presumably because it uses smaller timesteps when the solution is large. The plot was included to show that comparisons between numerical methods depend on the choice of accuracy measure being used.

3.3.2 Testcase 2

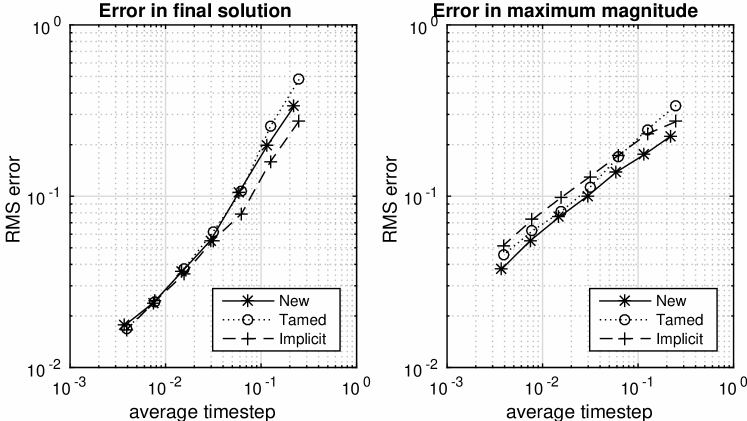

The second scalar testcase taken from [10] is

with . The results in Figure 2 are similar to the first testcase.

3.3.3 Testcase 3

3.3.4 Testcase 4

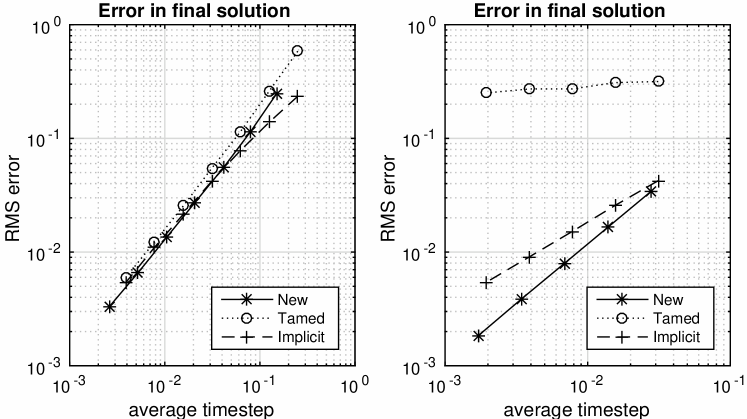

The final testcase is for the 3-dimensional FENE SDE discussed previously,

with . As commented on previously, this SDE is not covered by the theory in this paper, but it is a motivation for the research because it is natural to use an adaptive timestep of the form

to reduce the timestep when approaches the maximum radius.

All three methods are clamped so that they do not exceed a radius of ; if the new computed value exceeds this radius then it is replaced by .

The numerical results in the right-hand plot in Figure 3 show that the new scheme is considerably more accurate than either of the others, confirming that an adaptive timestep is desirable in this situation in which the drift varies enormously as approaches the maximum radius.

4 Proofs

This section has the proofs of the three main theorems in this paper, one on stability, and two on the order of strong convergence.

4.1 Theorem 1

Proof.

The proof proceeds in four steps. First, we introduce a constant to modify our discretisation scheme. Second, we derive an upper bound for . Third, we show that the moments are each bounded by a constant which depends on and but is independent of . Finally, we reach the desired conclusion by taking the limit and using the Monotone Convergence theorem.

The proof is given for ; the result for follows from Hölder’s inequality.

Step 1: K-Scheme definition

For any we modify our discretisation scheme to:

| (20) |

where and therefore . The piecewise constant approximation for intermediate times is again , and the continuous approximation is

Since is continuous and strictly positive, it follows that

This strictly positive lower bound for the timesteps implies that is attainable.

Step 2: th-moment of K-Scheme solution

, so if we define , then (20) gives

Using condition (6) for then gives

| (21) | |||||

Similarly, for the partial timestep from to , since

| (22) |

and therefore we obtain

| (23) | |||||

Summing (21) over multiple timesteps and then adding (23) gives

Re-writing the first summation as a Riemann integral, and the second as an Itô integral, raising both sides to the power and using Jensen’s inequality, we obtain

| (24) | |||||

Step 3: Expected supremum of th-moment of K-Scheme

For any we take the supremum on both sides of inequality (24) and then take the expectation to obtain

where

We now consider in turn. Using Jensen’s inequality, we obtain

For , we begin by noting that ue to condition (6), for we have

and hence by Jensen’s inequality

In addition, the linear growth condition (5) gives

and combining the last two equation, there exists a constant depending on and , in addition to , such that

Then, by the Burkholder-Davis-Gundy inequality, there is a constant such that

For , we start by observing that by standard results there exists a constant which depends solely on such that for any ,

| (25) |

One variant of Jensen’s inequality, when are both positive and , is

Using this, and (25) with so that ,

Using condition (5), and Jensen’s inequality, we then obtain

For , using (22) and following the same argument as for , there exists a constant depending on both and such that

Therefore, again using (25),

Similarly, using the same definition for , we have

Collecting together the bounds for , we conclude that there exist constants and such that

and Grönwall’s inequality gives the result

Step 4: Expected supremum of th-moment of

For any , for all if, and only if, . Therefore, by the Markov inequality,

as . Hence, almost surely, and is attainable. Also,

and for ,

Therefore, by the Monotone Convergence Theorem,

∎

4.2 Theorem 3

Proof.

The approach which is followed is to bound the approximation error by terms which depend on either or , and then use local analysis within each timestep to bound the former, and Grönwall’s inequality to handle the latter.

The proof is again given for ; the result for follows from Hölder’s inequality.

We start by combining the original SDE with (3) to obtain

and then by Itô’s formula, together with , we get

Using the conditions in Assumption 5, (8) implies that

(10) implies that

where , and (9) gives

Hence,

and then by Jensen’s inequality we obtain

Taking the supremum of each side, and then the expectation yields

By the Hölder inequality,

and is uniformly bounded on due to the stability property in Theorem 1.

In addition, by the Burkholder-Davis-Gundy inequality (which gives the constant which depends only on ) followed by Jensen’s inequality plus the Lipschitz condition for , we obtain

Hence, using , there are constants such that

| (26) |

For any , , and hence, by a combination of Jensen and Hölder inequalities, we get

and are both uniformly bounded on due to stability and the polynomial bounds on the growth of and . Furthermore, we have , and by standard results there is a constant such that . Hence, there exists a constant such that , and therefore equation (26) gives us

and Grönwall’s inequality then provides the final result. ∎

4.3 Theorem 4

Proof.

The error satisfies the SDE and hence

due to the one-sided Lipschitz condition (8), so therefore

| (27) | |||||

Within a single timestep, , and therefore Lemma 4 gives

where . Hence,

where

We now bound in turn. Noting that ,

The last integral is finite because of stability and the polynomial bounds on the growth of both and , and hence there is a constant such that

Similarly, using the Hölder inequality,

and hence, using stability and bounds on from the proof of Theorem 3, there is a constant such that

For the next term, , we start by bounding . Since

by Jensen’s inequality and Assumption 7 it follows that

where . We again have an bound for , while Theorem 3 proves that there is a constant such that

Combining these, and using the Hölder inequality and the finite bound for for all , due to the usual stability results, we find that there is a different constant such that

Now,

so using the Hölder inequality and the usual stability bounds, we conclude that there is a constant such that

Lastly, we consider . For the timestep , we have

and therefore, integrating by parts within each timestep,

where . Hence, where

By the Burkholder-Davis-Gundy inequality,

with uniformly bounded on so that there is a constant such that

Turning to , Young’s inequality and Hölder’s inequality give

for any , and hence there is a constant such that

Returning to (27), and inserting the bounds for , , , , , and , with , gives

for certain constants . Rearranging and using Grönwall’s inequality we obtain the final conclusion that there exists a constant such that

∎

5 Conclusions and future work

The central conclusion from this paper is that by using an adaptive timestep it is possible to make the Euler-Maruyama approximation stable for SDEs with a globally Lipschitz volatility and a drift which is not globally Lipschitz but is locally Lipschitz and satisfies a one-sided linear growth condition. If the drift also satisfies a one-sided Lipschitz condition then the order of strong convergence is , when looking at the accuracy versus the expected cost of each path. For the important class of Langevin equations with unit volatility, the order of strong convergence is 1.

The numerical experiments suggest that in some applications the new method may not be significantly better than the tamed Euler-Maruyama method proposed and analysed by Hutzenthaler, Jentzen & Kloeden [10], but in others it is shown to be superior.

One direction for extension of the theory is to SDEs with a volatility which is not globally Lipschitz, but instead satisfies the Khasminskii-type condition used by Mao & Szpruch [17, 19]. Another is to extend the analysis to Milstein approximations, which are particularly important when the SDE is scalar or satisfies the commutativity condition which means that the Milstein approximation does not require the simulation of Lévy areas. Another possibility is to use a Lyapunov function in place of in the stability analysis; this might enable one to prove stability and convergence for a larger set of SDEs. For SDEs such as the stochastic van der Pol oscillator and the stochastic Lorenz equation, if we could prove exponential integrability using the approach of Hutzenthaler, Jentzen & Wang [11] then it may be possible to prove the order of strong convergence using a local one-sided Lipschitz condition.

A future paper will address a different challenge, extending the analysis to ergodic SDEs over an infinite time interval. As well as proving a slightly different stability result with a bound which is uniform in time, the convergence analysis will show that under certain conditions the error bound is also uniformly bounded in time. This is in contrast to the analysis in this paper in which the bound increases exponentially with time.

References

- [1] J.W. Barrett and E. Süli. Existence of global weak solutions to some regularized kinetic models for dilute polymers. SIAM Multiscale Modelling and Simulation, 6(2):506–546, 2007.

- [2] J.G. Gaines and T.J. Lyons. Variable step size control in the numerical solution of stochastic differential equations. SIAM Journal on Applied Mathematics, 57(5):1455–1484, 1997.

- [3] M.B. Giles. Multilevel Monte Carlo path simulation. Operations Research, 56(3):607–617, 2008.

- [4] M.B. Giles. Multilevel Monte Carlo methods. Acta Numerica, 24:259–328, 2015.

- [5] M.B. Giles, C. Lester, and J. Whittle. Non-nested adaptive timesteps in multilevel Monte Carlo computations. In R. Cools and D. Nuyens, editors, Monte Carlo and Quasi-Monte Carlo Methods 2014. Springer, 2016.

- [6] D.J. Higham, X. Mao, and A.M. Stuart. Strong convergence of Euler-type methods for nonlinear stochastic differential equations. SIAM Journal on Numerical Analysis, 40(3):1041–1063, 2002.

- [7] N. Hofmann, T. Müller-Gronbach, and K. Ritter. The optimal discretization of stochastic differential equations. Journal of Complexity, 17(1):117–153, 2001.

- [8] M. Hutzenthaler and A. Jentzen. Numerical approximations of stochastic differential equations with non-globally Lipschitz continuous coefficients, volume 236. American Mathematical Society, 2015.

- [9] M. Hutzenthaler, A. Jentzen, and P.E. Kloeden. Strong and weak divergence in finite time of Euler’s method for stochastic differential equations with non-globally Lipschitz continuous coefficients. Proceedings of the Royal Society of London A: Mathematical, Physical and Engineering Sciences, 467(2130):1563–1576, 2011.

- [10] M. Hutzenthaler, A. Jentzen, and P.E. Kloeden. Strong convergence of an explicit numerical method for SDEs with nonglobally Lipschitz continuous coefficients. Annals of Applied Probability, 22(4):1611–1641, 2012.

- [11] M. Hutzenthaler, A. Jentzen, and X. Wang. Exponential integrability properties of numerical approximation processes for nonlinear stochastic differential equations. Mathematics of Computation, to appear, 2016.

- [12] P.E. Kloeden and E. Platen. Numerical Solution of Stochastic Differential Equations. Springer, Berlin, 1992.

- [13] H. Lamba. An adaptive timestepping algorithm for stochastic differential equations. Journal of Computational and Applied Mathematics, 161(2):417–430, 2003.

- [14] H. Lamba, J.C. Mattingly, and A.M. Stuart. An adaptive Euler-Maruyama scheme for SDEs: convergence and stability. IMA Journal of Numerical Analysis, 27(3):479–506, 2007.

- [15] V. Lemaire. An adaptive scheme for the approximation of dissipative systems. Stochastic Processes and their Applications, 117(10):1491–1518, 2007.

- [16] X. Mao. Stochastic Differential Equations and Applications. Horwood Publishers Ltd., 1997.

- [17] X. Mao. The truncated Euler-Maruyama method for stochastic differential equations. Journal of Computational and Applied Mathematics, 290:370–384, 2015.

- [18] X. Mao. Convergence rates of the truncated Euler-Maruyama method for stochastic differential equations. Journal of Computational and Applied Mathematics, 296:362–375, 2016.

- [19] X. Mao and L. Szpruch. Strong convergence and stability of implicit numerical methods for stochastic differential equations with non-globally Lipschitz continuous coefficients. Journal of Computational and Applied Mathematics, 238:14–28, 2013.

- [20] S. Mauthner. Step size control in the numerical solution of stochastic differential equations. Journal of Computational and Applied Mathematics, 100(1):93–109, 1998.

- [21] G.N. Milstein and M.V. Tretyakov. Numerical integration of stochastic differential equations with nonglobally Lipschitz coefficients. SIAM Journal on Numerical Analysis, 43(3):1139–1154, 2005.

- [22] T. Müller-Gronbach. Optimal pointwise approximation of SDEs based on Brownian motion at discrete points. Annals of Applied Probability, pages 1605–1642, 2004.

- [23] X. Wang and S. Gan. The tamed Milstein method for commutative stochastic differential equations with non-globally Lipschitz continuous coefficients. Journal of Difference Equations and Applications, 19(3):466–490, 2013.