Options as Silver Bullets: Valuation of Term Loans, Inventory Management, Emissions Trading and Insurance Risk Mitigation using Option Theory

Ravi Kashyap (ravi.kashyap@stern.nyu.edu)111Dr. Yong Wang, Dr. Isabel Yan, Dr. Vikas Kakkar, Dr. Fred Kwan, Dr. William Case, Dr. Srikant Marakani, Dr. Qiang Zhang, Dr. Costel Andonie, Dr. Jeff Hong, Dr. Guangwu Liu, Dr. Humphrey Tung and Dr. Xu Han at the City University of Hong Kong; the editorial board, anonymous reviewers and numerous seminar participants, particularly at a few meetings of the econometric society and various finance organizations, provided valuable suggestions to improve this paper. The views and opinions expressed in this article, along with any mistakes, are mine alone and do not necessarily reflect the official policy or position of either of my affiliations or any other agency.

Estonian Business School, Tallin, Estonia / Formation Fi, Hong Kong / City University of Hong Kong, Hong Kong

Keywords: Securities Lending; Term Loan; Derivative Theory; Model Errors; Inventory Management; Emissions Trading; Financial Stability; Uncertainty; Information Systems

JEL Codes: G11 Investment Decisions; G13 Contingent Pricing; G17 Financial Forecasting and Simulation; Q5 Environmental Economics; O33 Technological Change: Choices and Consequences

AMS Subject Codes: 91G20 Derivative securities; 90B05 Inventory; 60G25 Prediction theory; 91B76 Environmental economics; 68U35 Computing methodologies for information systems

March 19, 2024

1 Abstract

Models to price long term loans in the securities lending business are developed. These longer horizon deals can be viewed as contracts with optionality embedded in them. This insight leads to the usage of established methods from derivatives theory to price such contracts. Numerical simulations are used to demonstrate the practical applicability of these models. The techniques advanced here can lead to greater synergies between the management of derivative and delta-one trading desks, perhaps even being able to combine certain aspects of the day to day operations of these seemingly disparate entities. These models are part of one of the least explored, yet profit laden, areas of modern investment management.

A heuristic is developed to mitigate any loss of information, which might set in when parameters are estimated first and then the valuations are performed, by directly calculating valuations using the historical time series. This approach to valuations can lead to reduced models errors, robust estimation systems, greater financial stability and economic strength. An illustration is provided regarding how the methodologies developed here could be useful for inventory management, emissions trading and insurance risk mitigation. All these techniques could have applications for dealing with other financial instruments, non-financial commodities and many forms of uncertainty.

2 Introduction

The bulk of the existing studies on securities lending primarily focus on the belief that activity in the securities lending markets can be used to predict future security returns. Many existing studies develop theoretical models and empirically test the corresponding concepts on different public and proprietary data-sets. A quick survey of existing studies on securities lending (Section 3) makes it clear that there is hardly any paper that considers the motivations of the main players, the actions that arise due to the incentives the participants face and the impact of these actions on the securities lending market.

In this paper and related works, (Kashyap 2016a; 2016b) we attempt to bridge this gap by deriving various results that consider the incentive structure and the modus operandi of the players in the lending business. Section (3) has a detailed review of the literature. The references in this introductory section mainly serve as a guide to familiarize the reader with this niche area of finance and also seek to position this paper among other works in this realm. Kashyap (2016a) has a recent and comprehensive coverage of the literature on short selling and the stock loan space including a background on securities lending. D’Avolio (2002); Jones & Lamont (2002); Duffie, Garleanu & Pedersen (2002) have more details on the historical evolution and the mechanics of the securities lending market.

Kashyap (2016a) has a detailed discussion of the organization of the securities lending industry. The motivation of the main players and the actions they undertake, including some new innovations, that could lead to increased profitability are considered. Kashyap (2016a) also looks at how to either design an appropriate securities lending exclusive auction mechanism or to come up with a strategy for placing auction bids, depending on which side of the fence a participant sits. These two facets are dependent on whether the interest is: 1) to procure the rights to use a portfolio for making stock loans such as for a lending desk, or, 2) to obtain additional revenue from a portfolio such as from the point of view of a long only asset management firm. Kashyap (2016b) looks at a few other recent innovations being used by lending desks towards establishing theoretical borrow rates, the allocation of inventory to clients and estimating which securities are likely to become harder to borrow. These two papers (Kashyap 2016a; 2016b) and the present paper are in a niche area of finance related to securities lending. The contributions from these papers provide a suite of methodologies that have wide application across the entire spectrum of financial market participants. The corresponding insights can be useful for both buy side and sell side institutions with potential uses outside the financial landscape.

The following are some of the key contributions of this present paper to the practice of investment management and to the wider set of tools and methodologies in economics, finance and decision theory. Whenever it is applicable, throughout the article, most of our results are supplemented with practical considerations that can be operationally useful on a daily basis.

-

1.

We illustrate a novel application of derivative theory by considering in detail the problem of long-term loans in the securities lending business. We develop models to determine the loan rates on long term loans. Section (3.1) has a discussion of the fundamentals regarding how a term loan is structured and the need for such a contract. Sections (4.2; 4.3) have the formal theoretical development.

-

2.

We show that longer horizon deals can be viewed as contracts with optionality embedded in them and priced using established methods from option theory. This becomes, to our limited knowledge, the first application that can lead to greater synergies between the operations of derivative and delta-one trading desks222Delta one products are financial derivatives that have no optionality and as such have a delta of (or very close to) one – meaning that for a given instantaneous move in the price of the underlying asset there is expected to be an identical move in the price of the derivative. (Delta One, Wikipedia Link). These two desks are usually organized as distinct business units in most investment firms. The associated synergies could lead to the direct use of risk management software, related tools and procedures, and even personnel from derivative trading desks for delta-one desks. This could perhaps even lead to combining certain aspects of the day to day operations of these two seemingly disparate entities. Consolidation of the information systems of these business units would bring down costs significantly and also reduce the burden on personnel in terms of having to use multiple information systems. Not to mention, additional and diverse revenue sources are generated, which could be shared across these desks. All of this will reduce business risks in various forms including market risk, technology risk, information security risk, among others.

-

3.

We run numerical simulations to demonstrate the practical applicability of these models. Section (6.1) has a discussion of how we generate the simulation data set and how we endeavor to stay as close as possible to real data, which is difficult to obtain. The complete real data set is only available to intermediaries and most other market participants will have access to only some portion of the dataset . Sections (7.1; 7.2) discuss the results of the simulations. Many well known properties of option valuations are observed in the results, which confirm the soundness of our techniques and the application of derivatives theory for term loans.

-

4.

We develop a heuristic that can mitigate the loss of information that sets in, when parameters are estimated first and then the valuation is performed, by directly calculating the valuation using the historical time series (Section 6). To address and mitigate the many recent concerns about economic and financial stability, sophisticated models are being created and their parameters estimated using historical data. By first doing an estimation and then using the estimates for final calculations, we are potentially introducing multiple levels of errors. Our technique is a way to perform calculations directly using the historical time series. This ensures that not much is lost in translation due to the need to first estimating the parameters of a model or probability distribution and then using those to perform model calculations. This can lead to reduced models errors and greater financial / economic stability333 We summarize current views on the size and stability of the securities lending space below: (a) The value of available inventory as of June 22, 2015, stands at $13.22 trillion, according to a new info-graphic on the global securities finance market from DataLend. Of the available inventory worldwide, $1.72 trillion was out on loan. The value of equity on loan was $851 billion, while fixed income on loan stood at $876 billion. Some 41,673 unique securities were out loan, according to the info-graphic, yielding an estimated gross revenue of $19.2 million per day on average, which equates to $2.26 billion for the first half of 2015. The US is still the largest market with $954 billion out on loan as of 22 June. Canada is the closest market in size, with an estimated $131 billion of securities out on loan. Despite its size, the US commands a fee of 38 basis points (volume-weighted average, year to date), whereas Hong Kong, which has $28.8 billion out on loan, yields fees of 210 basis points. (Securites Lending Three) (b) As the potential risks of securities lending are discussed and debated by the Financial Stability Oversight Council (FSOC), the U.S. Treasury’s Office of Financial Research (OFR), and the Financial Stability Board (FSB), it is important to try to understand both the overall size of the securities lending market and the share of it attributable to different participants. Based on one estimate from the FSOC the percentage is typically around these values (Retirement and Pension, Mutual Funds, Endowments, Insurance: 50%, 35%, 8%, 6%). (Securites Lending Four). .

-

5.

We show how the techniques developed here could be potentially useful for supply chain management (Section 5.1), emissions trading (Section 5.2) and insurance risk mitigation (Section 5.3). With globalization emerging as a permanent fixture of modern business, our methodologies can be useful for negotiating contracts with international partners, for making investment decisions and to promote socially responsible behavior.

-

6.

The immediate beneficiaries of the term loan techniques would be the securities lending desks of sell side firms, since it would provide them a theoretical basis for structuring term loans. Buy side firms would benefit by entering into such contracts with sell side firms and being able to lock down in advance what their cost of borrowing would be for strategies that require short sales. Section (3.2) has a more detailed discussion on the benefits for the participants involved.

-

7.

These models are part of one of the least explored, yet profit laden, areas of modern investment management. The next generation of models and empirical work on securities lending activity would benefit by factoring in the methodologies considered here. Sections (8; 9) suggest improvements and conclude.

-

8.

To our limited knowledge, this is the first known instance of such an application of options theory in the securities lending space, for inventory management and the direct use of the historical time series for model calculations.

-

9.

In addition, the methodologies we have advanced have numerous applications towards dealing with, and risk managing, several types of financial instruments, non-financial commodities and many forms of uncertainty. Hence, we could view the principal tools we have proposed, built using option theory, as silver bullets for combating uncertainty and to aid improved decision making.

3 Fundamentals and Related Literature

While our study provides a direct application of option theory to securities lending, there are many studies that consider the implicit links between options prices and the short selling market. Evans et al. (2009) examine short-selling constraints when options trade on the underlying stock. Options market makers are effectively allowed to sell short without borrowing the stock. By looking at the transactions of a major options market maker, they find that in most hard-to-borrow situations, the market maker, chooses not to borrow and instead fails to deliver stock to its buyers. Battalio & Schultz (2006) find no evidence from apparent arbitrage opportunities that short-sale restrictions prevented investors from shorting Internet stocks in the 1999 to 2000 period, using intra-day options data. They also show that investors could have easily shorted stock synthetically by purchasing puts and writing calls; investors can expect to receive almost as much from a synthetic short sale as from an actual short. Battalio & Schultz (2011) examine how the September 2008 short sale restrictions impacted equity option markets. They find that for options on banned stocks, the trading costs (bid-ask spreads) increased dramatically. In addition during the ban, synthetic share prices become significantly lower than actual share prices, for banned stocks. They find similar results for synthetic share prices of hard-to-borrow stocks, suggesting that the dislocation in actual and synthetic share prices is attributable to the increased hedging costs for options on banned stocks during the short sale ban.

3.1 Term Loans and Optionality

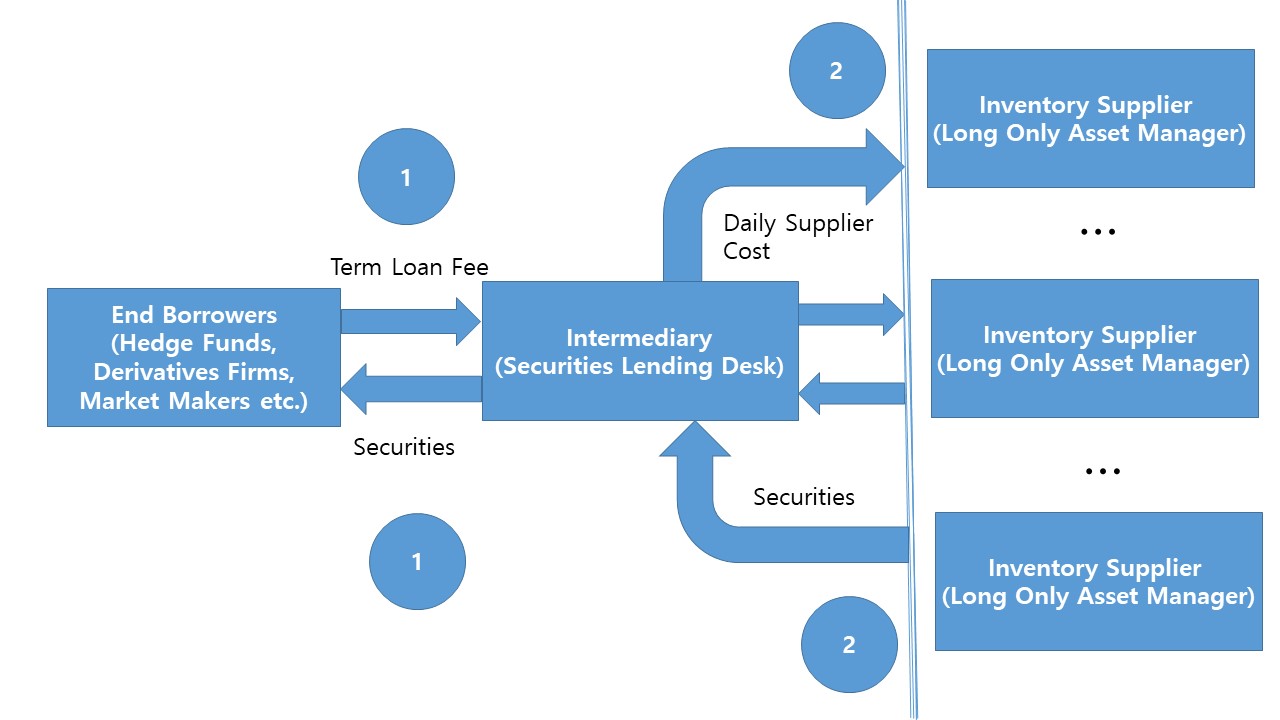

Figure (1) is a typical term loan structure showing how an intermediary (securities lending desk) sits between an inventory supplier (long only asset manager) and final end borrowers (hedge funds, derivative traders, market makers, etc.) who have short positions. The first portion of the figure (near the circle marked one) shows the term loan contract arranged between the intermediary and the end borrowers. Unlike regular stock loans, term loans, as the name indicates, are decided for a fixed term when the contract is initiated. Such long term loans can be arranged for three to six months (other durations are also possible for some securities) and the fees are fixed when the loan is made. The second half of the figure (near the circle marked two) shows the intermediary sourcing inventory from suppliers to make loans to the final end borrowers. The final end borrowers pay a fixed fee for the term loan, unlike regular loans for which the intermediary can change the fees on a daily basis. Section (3.2) has details on the motivation for participating in such a long term contract. Section (4) considers the valuation methodologies, including many alternate structures that provide flexibility in terms of the amount of shares transacted and the fees that apply, to arrive at a basis point estimate including various assumptions that would be realistic from a securities lending point of view. Definition (1) follows from the above discussion. We want to clarify that this definition is an adaptation of the word loan, which is common in financial circles, to the specific case of securities lending.

Definition 1.

A long term loan is a structure wherein the intermediary will guarantee a certain quantity to a short seller for a certain time period at a fixed loan rate or within a band of rates.

The guarantee is meant to imply that the intermediary will have to provide the number of shares agreed upon in the term loan, but the short seller can choose not to take on all the shares that are being provided, highlighting the optionality present in the agreement. If the intermediary is unable to meet the obligations of the term loan, it will be liable for certain contractual commitments under the terms of the term loan. The intermediary can guarantee a certain quantity to a final end borrower by considering the fluctuations in the supply of shares it receives, the rate at which it can source the shares and the impact on profits when it is not able to meet the obligation to fulfill the loan amount. This leads to the main assumption (1) of this paper which enables us to use pricing and risk management tools from derivative theory to create term loan structures.

Assumption 1.

A long term security loan has optionality due to the availability of shares being modeled as a Geometric-Brownian-Motion (GBM).

Even though shares are traded, availability from a loan perspective is a non-traded asset, making our model to price loans a “pseudo real option” based methodology. Hence, we relate our methodology to the use of options pricing for non-traded assets and briefly review the literature on real options. The techniques in these studies can be useful for extensions to our model, which adds to the growing use of option theory in aiding decision making against various forms of uncertainty. The links to real options will be clearer when we discuss the inventory management application in Section (5).

Bollen (1999); Adner & Levinthal (2004); Trigeorgis (2005); Cuypers & Martin (2010) describe the distinction between real options and the broader class of sequential decision-making processes including examples of the use of real options and frameworks that explicitly incorporate product life cycles. Lambrecht & Perraudin (2003) discuss preemption, cases when a firm fears that a competitor may seize an advantage by acting first, under incomplete information. Trigeorgis (1993) deals with the nature of option interactions and the valuation of capital budgeting projects possessing flexibility in the form of multiple real options. Tong & Reuer (2007); Belderbos & Zou (2009); Loulianou et al. (2021) consider real options portfolio perspectives on foreign affiliate divestments and risk implications within multinational firms. Lee & Makhija (2009) consider the effect of domestic uncertainty on the real options value of international investments. Chi et al. (2019); Trigeorgis & Tsekrekos (2018) are detailed reviews about real options in international business and operations research settings.

Quigg (1993) examines the empirical predictions of a real option pricing model using a large sample of real estate market prices. Tee et al. (2014) analyze the effects of an emissions trading scheme on the value of bare-land on which pine trees are to be planted by applying a real options method, assuming stochastic carbon and timber prices. Baldi & Trigeorgis (2015) develop a real options theory of strategic human resource management based on human capital flexibility or adaptive capability to respond to a range of future contingent landscapes in contrast to the static traditional human resources view of employee groups as a portfolio based on specificity and value. Grullon, Lyandres & Zhdanov (2012) close the loop between traded assets and real options, by finding evidence that the positive relation between firm-level stock returns and firm-level return volatility is due to firms’ real options. Consistent with real option theory, they find that the positive volatility-return relation is much stronger for firms with more real options and that the sensitivity of firm value to changes in volatility declines significantly after firms exercise their real options. Martínez-Ceseña & Mutale (2011); Fernandes, Cunha & Ferreira (2011); Boomsma, Meade & Fleten (2012); Reuter et al. (2012); Liu & Ronn (2020); Locatelli et al. (2020) are studies regarding real options in the energy sector.

3.2 Buy Side and Sell Side Perspective

The sell side here would be the collection of intermediary firms that source supply and lend it on to final end borrowers. The buy side here would have two segments of firms. One, the end borrowers who either have a proprietary trading strategy or hedging that requires shorting certain securities. Two, the beneficial owners who are long securities and provide supply to the intermediaries also fall under the buy side category. Depending on which side a firm falls under, they will find the below derivations useful, since it will affect the rates they charge or the rates they pay.

The primary beneficiaries of long term loans would be the actual short sellers that have trading strategies dependent on being implemented for a certain time horizon. If they are able to short securities at reasonable loan rates without getting recalled or the rate getting hiked, their trading strategies are more likely to be profitable. Clearly, they would be willing to pay more for term loans, since the rates on regular loans can be changed on a daily basis and the number of shares on loan can either be reduced or the loan can be closed out forcibly (known as a recall). The intermediaries that make term loans will find this as a lucrative new revenue stream that eliminates some of the corresponding volatilities. A similar reasoning on the inventory supply side gives the following term loan structure.

Remark 1.

An alternate structure, or a long term borrow, that locks in the rate and amount the intermediary borrows from external suppliers can also be easily priced using our methodology.

Such a structure can ensure that the intermediary can lock in a minimum level of profits on securities with volatile supply or if they are expected to become hard to borrow. It is worth noting a stark difference between an exclusive contract and a long term borrow. In an exclusive contract, one intermediary will have access to all the long positions of a beneficial owner or supplier; but the owners can still take back their shares at any time or demand a higher borrow rate. Term loans are less common on the supply side since inventory owners are not willing to lock up their positions for extended periods of time. The administrative hassle of having to put in place contracts for individual securities, periodic assessments of being able to uphold those contracts and other ongoing maintenance concerns for the beneficial owners makes exclusive contracts more popular on the supply side.

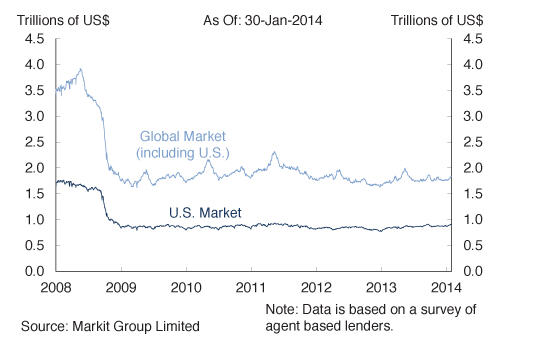

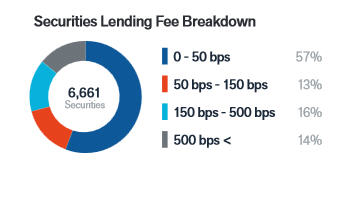

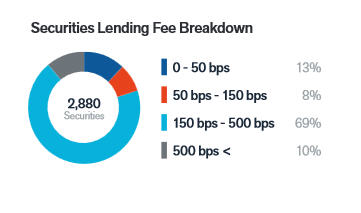

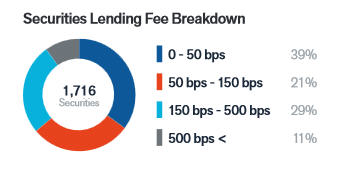

Term loans have been offered by short selling desks for at-least the last ten to eleven years. Though, to our awareness, there is no rigorous work that provides a pricing methodology or connects the creation and ongoing maintenance of term loans to established financial-economic principles. Baklanova, Copeland & McCaughrin (2015); Kashyap (2016a); Footnote (3) have more details on the size of the securities lending market. Though, there is also no data available on the size and profitability of term loans. The global securities on loan is around 2 trillion USD (Figure 2). More than 10% of the securities in all regions have loan rates in excess of 5% annually and there are securities with loan rates of almost 25%, indicating that there could be strong drivers for both term loans and borrows, from both sides of the market. Perhaps, part of the obstacle for the further development of the term loan business could be the lack of a more technical approach and the training of the personnel on the desk regarding option pricing and risk management.

USA

Asia Western

Europe

Western

Europe

3.3 Uncertainty and Unintended Consequences

As we will see in Sections (4; 4.1; 4.2; 4.3) valuation of a term loan requires understanding uncertainty from numerous angles. As the participants try to find better and improved ways to capture this uncertainty (Kashyap 2017), we might see that the profitability of using this mechanism might decrease for participants from both sides. This can lead to us believe that over time, as better valuation methods are used by the participants, in an iterative fashion, the profits will continue to erode. The other effect might be that with more participants doing term loans, a secondary market for the options on a term loan could get established. Also perhaps, with increasing number of term loans, the availability of shares will get locked in causing exponential pressure on the rates. A welcome outcome might be the mitigation or hedging of the risk or exposure from the rest of the loan book by reducing the total variance of profits. Froot (1995) examines the hedging properties of real assets444 Real assets increase in price in response to inflation shocks, with some similarities to our earlier discussion on real options. , with respect to a portfolio of stocks and bonds and finds that leveraged positions in commodities with a high energy component, such as oil, exhibit strong hedging properties by reducing the total variance significantly.

The cyclical nature of the transactions, which in some case can have its tentacles spread far and wide, can result in catastrophic repercussions, especially when huge sums of money move back and forth (Kashyap 2017). Uboldi (2016) looks at the distortions (and perhaps instability) in the prices of agricultural goods caused by the huge volumes of derivatives traded on them. No discussion involving randomness is complete (Taleb 2005; 2007), especially one involving randomness to the extent that we are tackling here, without being highly attuned to spurious results mistakenly being treated as correct and extreme situations causing devastating changes to the expected outcomes. Things can go drastically wrong even in simple environments Sweeney & Sweeney (1977), hence in a complex valuation of the sort that we are dealing here, extreme caution should be the rule rather than the exception. Kashyap (2017) looks at recent empirical examples related to trading costs where unintended consequences set in. With the above background in mind, let us look at how we can model a term loan and come up with an indicative price.

4 Rainbows and Baskets of Binary Barrier American Options

A simple term lending structure can be modeled as a Binary American cash or nothing / asset or nothing put option. This option pays a fixed cash rebate or the payoff of another asset if a certain binary condition is satisfied during the life of the option. The binary condition occurs when the underlying price falls below the strike price or a preset barrier is breached making this a Binary Barrier down-and-in put option. For a term loan, the underlying process is the availability of shares being modelled as a GBM (Assumption 1). The event when the availability falls below a certain threshold, which in our scenario is the number of shares that are being loaned out, is the binary condition when the barrier is breached. (Section 4.2) develops this analogy using all the variables that arise when pricing such an option.

By using this insight, we can use established ways from derivative pricing theory to price and even possibly hedge such deals. Windcliff et al. (2007) discuss hedging with correlated assets. As a comparison, it is worth noting that the basic structure will be cheaper than the corresponding vanilla put option and we will report this benchmark in the numerical results. Additional structures can be created by using other combinations of European, American, Asian, call, put, up, down, in, out, etc. and even on multiple securities, Rainbows and Baskets, depending on the preferences and willingness of loan desks and their clients. The possibilities are endless.

Barrier options are among the most common types of exotic options. They are prevalent enough to almost consider them as plain simple options (Carr 1995). The techniques introduced in the seminal paper by Black & Scholes (1973) can be applied for the valuation of barrier options. Merton (1973) is the first work to present the valuation of barrier options with the example of the down-and-out European call option. Carr (1995) presents a brief but essentially complete survey of the literature on barrier option pricing along with two extensions of European up-and-out call option valuation. Rich (1991); Rubinstein & Reiner (1991) provide closed form solutions for a variety of standard European barrier options (i.e. calls or puts which are either up-and-in, up-and-out, down-and-in, or down-and-out). Using a conventional Black-Scholes option-pricing environment, Hui (1996), obtains analytical solutions of one-touch double barrier binary options that include features of knock-out, knock-in, European and American style options. Nunes et al. (2020) look at the early exercise boundary of American-style double knock-out options.

Karatzas & Wang (2000) obtain closed-form expressions for the prices and optimal hedging strategies of American put-options in the presence of an “up-and-out” barrier (also, Ingersoll 1998), both with and without constraints on the short-selling of stock, demonstrating the close links between option theory and need for securities lending. Zvan, Vetzal & Forsyth (2000) present an implicit method for solving partial-differential-equation models of contingent claims prices with general algebraic constraints on the solution. Examples of constraints include barriers and early exercise features. In this framework, barrier options with or without American-style features can be handled in the same way. Either continuously or discretely monitored barriers can be accommodated, as can time-varying barriers.

Haug (2001) uses the reflection principle (Harrison 1985) to provide closed form valuation of American barrier options. In a barrier context (e.g. a down-and-in call) the reflection principle basically states that the number of paths leading from the stock price, , at a particular point in time, , to a point higher than , that touch a barrier level before maturity, is equal to the number of paths from an asset that starts from and that reach a point higher than . Using the reflection principle we can then simply value both European and American barrier options on the basis of formulas from plain vanilla options. Thavaneswaran, Appadoo & Frank (2013) use fuzzy set theory (Zimmermann 1996; Carlsson & Fullér 2001) to price binary options since traditional option pricing models determine the option’s expected return without taking into account the uncertainty associated with the underlying asset price at maturity.

Brockman & Turtle (2003) propose a framework for corporate security valuation based on path-dependent, barrier option models instead of the commonly used path-independent approach by arguing that path dependency is an intrinsic and fundamental characteristic of corporate securities because equity can be knocked out whenever a legally binding barrier is breached. A direct implication of this framework is that equity will be priced as a down-and-out call option. This deviates from the work of Black & Scholes (1973), after which corporate securities have been viewed in terms of standard (i.e., non-exotic) options written on the underlying assets of the firm.

Margrabe (1978) started the theory of rainbow (multi-asset) options by evaluating the option to exchange one asset for the other at expiry. Stulz (1982) provides analytical formulas for European put and call options on the minimum or the maximum of two risky assets. Ouwehand & West (2006) derive the Black–Scholes prices of several styles of rainbow options using change of numeraire machinery. Hucki & Kolokoltsov (2007) develop a general approach for the pricing of rainbow options with fixed transaction costs from a game theoretic point of view, with applications for the framework of real options. Alexander & Venkatramanan (2012) derive general analytic approximations for pricing European basket and rainbow options on multiple assets. Chen, Wang & Wang (2015) study the valuation and hedging problems of forward-start rainbow options. We will point out other useful references in the relevant sections below.

4.1 Setting the Stage

We first discuss some properties of the different variables and how the intermediary looks to influence them to increase profits. We define all the variables as we introduce them in the text but (Appendix 11) has a complete dictionary of all the terminology and symbols used in the main results. The total amount of regular loans made, , other than the term loans on a security, has to meet the criteria in Condition (1) with five numbered inequalities. Before can satisfy the inequality on the subsequent level it must be lesser than the earlier combination of the following five variables: internal inventory the intermediary holds, ; amount used from any exclusives, ; amount available from the exclusives, ; external borrows, ; and , any other supply that can be sourced externally.

Condition 1.

1) ; 2) ; 3) ; 4) ; 5) .

Should there be a shortage, the amount on regular loans will be used towards fulfilling obligations on terms loans. This should make it clear that the total availability, . This excludes amounts on other terms loans on the same security. Should there be a shortage, we can create a pecking order of term loans depending on the profitability / risks on a specific loan and factors related to the counter party, in terms, of the value of the business being carried out with that counter party by the desk and even other parts of the business. We assume that the process for total availability, , follows a GBM (Eq: 1). It is possible to assume that the individual components follow processes of their own and find the properties of the combined process. We make this simplifying assumption and take the availability as exogenously driven. Pirjol & Zhu (2016) is a good resource regarding the sum of GBMs.

Stock prices and the borrow rates are also taken as exogenous GBMs (Eq: 1; 2). What happens in practice is that there is usually a baseline for the loan rates that is derived from a combination of the borrow rate and a theoretical rate. The theoretical rate is used to moderate the loan rate in case the borrow rate is completely absent or is stale (no recent borrow for many days or even weeks sometimes). It is also useful when supply becomes available cheaply from some sources and remains expensive from other sources. Weighted average borrow rates or the latest borrow rate are also used sometimes. The theoretical rate and the spread added to the borrow rate to form the loan rate are other decision variables at the disposal of the intermediary.

For simplicity, we take the spread to be a proportion of the borrow rate, that is, . , is the spread added to the borrow rate, , to form the loan rate . is the constant factor governing the spread and the borrow rate (Eq: 3). This assumption is the most realistic scenario, but depending on the size of the exclusive and internal inventory (indicative of market share and hence pricing power), the loan rates can further be taken as variables the intermediary can influence. A deeper discussion of how loan rates are set including the addition of a spread component will be taken up in subsequent papers (Kashyap 2016b) devoted to just the complex mechanics of rate manipulations, where we relax this assumption and consider a wide array of factors that can alter the spread.

The external borrows, external supply, the internal inventory and exclusive holdings represent number of shares, and hence are always positive making them good candidates to be modelled as GBMs. The borrow process is highly volatile, with the order of magnitude of the change in the total amount of shares lent out, over a few months, being multiple times of the total amount. The internal inventory and external supply can change significantly as well, though there would be less turnover compared to the borrow process. This would of course depend on which parts of the firm the inventory is coming from. The holdings of the exclusive are the least volatile of the three processes that govern shares (or at-least the intermediary would hope so). The volatility of inventory turnover (or any supply) can be a sign of the quality of the inventory and this can be used to price a rate accordingly. This extension and other improvements, where the loan rates and the internal inventory can be made endogenous as opposed to the present simplification, where they are exogenous, will be considered in a subsequent paper (Kashyap 2016b). is the security price at a particular time, until the next time period, . Here, subscript denotes the security in a portfolio and the number securities ranges from . is the number of securities available in the term deal, . This applies when we are looking at rainbows, baskets or other multi-security structures.

| Geometric Brownian Motion | (1) |

| Geometric Brownian Motion | Log Normal Processes | (2) | |||

| (3) |

The locate process555Another piece of the puzzle is the locate requests received by the lending desk on a daily basis. These locate requests are sent by end borrowers, in advance of actually borrowing shares to short, to get an indication of the quantity of shares they can borrow. This is done to ensure that their shorting needs for the trading day can be met. The intermediary can fill either a portion or the entire locate request depending on its inventory situation and also depending on how many firms are sending it locates for that particular security for that trading day. But once a locate request is filled by a lending desk, they are expected to have that number of shares ready for the borrowing firm. A borrowing firm, on the other hand, can borrow as much of the filled locate amount as it chooses to. This mismatch between locate approvals and actual borrows then leads to another aspect of the lending business that can be optimized by implementing different variations of the Knapsack Algorithm (Martello & Toth 1987) and we consider this in another paper (Kashyap 2016b). The conversion factor from locates to borrows can be estimated as part of the locate approval optimization. For the present purpose of estimating a term loan value, we take this conversion factor as exogenously given. Lending desks have been considering charging a nominal fee based on the locate amount they agree to fill to discourage borrowers from sending in spurious locate requests, though this practice is yet to be formally institutionalized across the lending industry. is more precisely modelled as a Poisson process since it would be reasonably accurate to consider locates as discrete events occurring in time (Eq: 4; 5) . That is, requests for a certain number of shares being received in a given time interval. Given that most of the time, the number and size of the share requests can be large, we would need to use a high value of the arrival rate, . Hence, we approximate this poison process as the absolute value of a normal distribution with appropriate units (Cheng 1949; Eq: 6). This introduces a certain amount of skew, which is naturally inherent in this process. The locate process can be useful to know what demand the desk can expect and when higher demand is anticipated, it can supplement the volatility of the availability, as an indicator that the rate on the term loan needs to be higher. are the locate requests received in shares at a particular time, , for security, .

| (4) | ||||

| Locate Process | (5) | |||

| (6) |

Given the number of GBMs the complete system incorporates, a standard theoretical approach to solving systems involving multiple GBMs (Eq: 1) or obtaining a closed form solution, is presently unknown to the best of our knowledge. In later sections, we provide closed form solutions to simple scenarios. An alternate approach would be to estimate the parameters of all the random variables from historical data and run simulations that would provide the required valuation. We also provide another technique to use the historical data set directly in Section (6). Another simplifying assumption in the numerical results is that the Wiener process governing each of these variables is independent666The Wiener process is characterised by the following properties (Baxter & Rennie 1996): 1. . 2. has independent increments: for every , the future increments , are independent of the past values , . 3. has Gaussian increments: is normally distributed with mean and variance , . 4. has continuous paths: is continuous in . . In addition, our baseline models are diffusions without mean-reversion which we can justify since a term loan contract is unlikely to exceed one or two years and the variables will not take on excessively large values in this duration. Non-negative drift rates can grow a variable to infinity over time, but some of our variables have negative drift rates as well as we see in the numerical results in Section (6.1). Hull (2010) provides an excellent account of using GBMs to model stock prices and other time series that are always positive.

It is worth keeping in mind that the intermediary firm or the beneficial owner will have access to a historical time series of some of the variables and hence can estimate the actual process for the corresponding variables. External parties will not know the time series of all the variables with certainty and hence would need to substitute the unknown variables with a simulation based process, similar to what we have used in Section (6.1). A simplification is to assume that the variables are independent. Phillips & Yu (2009) provide an overview of maximum likelihood and Gaussian methods of estimating continuous time models used in finance. Campbell et al. (1998); Lai & Xing (2008); Cochrane (2009) are other handy resources on using maximum likelihood estimation (MLE) and generalized method of moments (GMM). A backward induction based computer program, which simulates the randomness component of the variables involved, can calculate the value of the term loans based on the payoff expressions we will derive. See: Miranda & Fackler (2002) for a discussion of using numerical techniques. Chiani, Dardari & Simon (2003) for approximations to the error function. Norstad (1999) for a discussion of the log normal distribution. Gujarati (1995); Hamilton (1994) discuss time series simplifications and the need for parsimonious models.

4.2 Benchmark Valuations

The objective of a rational, risk neutral decision maker at the intermediary would be to maximize profits from the overall loan book by swapping the supply available to either term loans or regular loans and this action forms a crucial part of his decision making. With the setting discussed earlier (Section 4.1; Assumption 1; Definition 1), a term loan becomes an American down-and-in binary put option with the availability process being equivalent to the underlying price process. The strike and the time to expiration are the quantity and the time period of the term loan respectively. The volatility governing this option is the volatility of the availability process. The value of this option, , can be expressed as a continuously compounded annualized rate, , over the duration of the loan. Here, is the quantity of the term deal for security for the entire duration of the loan extending from is also the valuation of the term loan for the overall duration. represents the notional amount in monetary terms when the contract is initiated. We first consider two simple forms of payoffs:

-

1.

A single constant payoff, , if there is a breach: . This applies only the first time the breach happens. It is to be understood that the contract is complete after the first breach and the payoff is made (Eq: 7). The valuation, , is given by,

(7) Here, is the indicator function. is the infimum or the greatest lower bound.

-

2.

A single payoff proportional to the time left on the deal, or , if there is a breach: . The proportional payoff could be based on something time varying such as interest rates or other values as well, denoted here by ; it could also be proportional to a constant value, . Again, this is valid only when the first breach happens (Eq: 8). The valuation, , is given by,

(8)

Carr (1998) gives a semi-explicit approximation for American put option values in the Black-Scholes model. Garlappi (1996) uses dynamic programming to value an American put. Zhu (2006) gives an exact and explicit solution of the Black–Scholes equation for the valuation of American put options. The closed-form solution is written in the form of a Taylor’s series expansion that generates a convergent numerical solution if the solution of the corresponding European option is taken as the initial guess of the solution series. The optimal exercise boundary is found as an explicit function of the risk-free interest rate, the volatility and the time to expiration. Ingersoll (2000) uses digitals as building blocks, since their payoffs are either on or off, to give accurate approximations for American options.

Dai & Kwok (2004) present analytic price formulas for knock-in American options under the Black-Scholes pricing framework. The knock-in region and the exercise region of the underlying American option may intersect with each other, hence the price formulas take different analytic forms depending on the interaction between the knock-in region of the down-in feature of the option contract and the exercise region of the underlying American option. The price function of a knock-in American option can be expressed in terms of the price functions of simple barrier options and American options, facilitating numerical valuation attempts.

Another interesting technique is the static hedging portfolio (SHP) approach. The main idea is to create a static portfolio of standard European options whose values match the payoff of the path-dependent options being hedged at expiration and along the boundary. A SHP is formulated in two different ways. The first approach, proposed by Carr & Bowie (1994); Carr, Ellis & Gupta (1998) is to construct static positions in a continuum of standard European options of all strikes, with the maturity date matching that of the exotic option (e.g. a barrier option). The second approach, developed by Derman, Ergener & Kani (1995), uses a standard European option to match the boundary at maturity of the exotic option and a continuum of standard European options of maturities from time to time to match the boundary before maturity of the exotic option, with the strike equaling the boundary before maturity (e.g. the barrier level of a knockout option).

In comparison to dynamic hedging, there are three major advantages of static hedging (Chung & Shih 2009). First, static hedging is considerably cheaper than dynamic hedging when transaction costs are large. The dynamic hedge portfolio has to be adjusted often, for example for options with large gamma (such as barrier options), increasing the transaction costs. Second, it is widely documented that static hedging is less sensitive to the model risk such as volatility mis-specification. Third, due to discrete trading, dynamic hedging may have substantial hedging errors

Chung & Shih (2009) further show that the SHP approach may also serve as a good pricing method for American options and by its nature, a good hedging method as well. Unlike the use of numerical methods to pricing American options, one specific advantage of applying static hedge techniques is that the recalculation of the American option price in the future is as easy as the valuations of European options because there is no need to solve the static hedge portfolio again since the value of the static hedge portfolio is simply the summation of the European option prices in the portfolio. Hence, the proposed static hedge approach is especially advantageous when the European options have closed-form solutions.

Chung, Shih & Tsai (2013) extend the SHP approach to price and hedge American knock-in put options under the Black–Scholes model and the constant elasticity of variance (CEV) model of Cox (1975; 1996). They first derive the American knock-in option values on the barrier and then construct a SHP which matches the knock-in option prices before maturity at evenly-spaced time points on the barrier. They use standard European calls to construct SHPs for American up-and-in put options and standard European puts to construct SHPs for American down-and-in put options, respectively.

A cash or nothing American binary put option has a closed form solution, given by the expressions for the Laplace transform of the distribution of the conditional first passage time of Brownian motion to a particular level (Shreve 2004; Azimzadeh 2015; Eq: 9; 10). The asset-or-nothing case is a simple scaling (by the strike price) of the cash-or-nothing case. The price of a cash-or-nothing American binary put with strike , volatility of availability process , drift , the set of real numbers and time-to-expiry is given below. It is assumed , the initial value of availability, since a binary option is exercised as soon as it is in the money.

| (9) |

| (10) | |||

Since the work of Boyle (1977) provided a proper framework for Monte Carlo pricing of options, numerous extensions have been done. Longstaff & Schwartz (2001) continues to be a popular technique that uses least squares to estimate the conditional expected payoff to the option-holder from continuation, making this approach readily applicable in path-dependent and multi-factor situations where traditional finite difference techniques cannot be used. Zanger (2018) analyzes the convergence of the Longstaff–Schwartz algorithm using a single set of independent Monte Carlo sample paths that is repeatedly reused for all exercise time-steps.

Rogers (2002); Haugh & Kogan (2004) calculate the lower and upper bound of American option prices using Monte Carlo simulation by representing the price as a solution of a properly defined dual minimization problem. Nadarajah, Margot & Secomandi (2017) look at least squares Monte Carlo methods with applications to energy real options.

4.3 Extremely Exotic Extensions

The below payoff expressions are more realistic and reflect the full cost borne by the desk to fulfill the obligations on a term loan. The American style exercise option is only partly applicable, since the proper way to look at them is by considering a series of cash flows being exchanged between the two parties for the duration of the loan, though any mid-term terminal clauses can be modelled as American options being exercised.

-

1.

A constant or proportional payoff is levied every-time the barrier is passed in a downward direction giving the valuations, or respectively. The indicator function can be used to count the number of instances when this occurs, i.e. . When the availability moves back above the barrier, a reverse cash flow can be accumulated. An approach from Erdos & Hunt (1953) derives results regarding the change of signs of sums of random variables. This can be used to estimate the number of times the availability falls below the term loan quantity and hence the number of times a penalty, or , is incurred.

Alternately, we can proceed as follows to arrive at the following result (Proposition 1). Let the following variables, represented by the corresponding functions below (Eq: 11; 12), denote the criteria that captures whether availability is more than the quantity on the term loan for security or vice versa and the cash-flows to be made accordingly. When availability is more than the quantity, we are in the state. This means, that the barrier breach that can happen next when we are in the state is in the reverse direction, or it will be in the downward direction.

(11) (12) Proposition 1.

The valuation expressions that capture a constant or proportional payoff every-time the barrier is passed are given by,

Here, is the floor or the greatest integer function, which gives the largest integer less than . is the expectation taken at time . are the constant payoffs on the term deal if the barrier is breached for security in the downward and in the upward direction respectively.

Proof.

See Appendix (12). ∎

-

2.

Valuation, , is based on a payoff equal to the cost of holding a stock position equal to the extent of shortfall in any given time period, considered for the entire duration of the term loan (Eq: 13). In the first period, we accrue the cost of buying the amount of short fall and from the subsequent periods we need to either buy or sell to make up for whether the availability is higher or lower than the deal amount. After the last time period, we dispose of any excess stock accumulated. We use the following notations in some of the formulations below: , , , , and .

(13) (14) This can be simplified to (Eq: 15),

(15) In continuous time777 Brennan (1979) considers contingent claims pricing in discrete time models. Shieh, Wang & Yates (1980); Barraud (1981); Sung, Lee & Lee (2009) are exhaustive references for methods for the conversion of discrete to continuous models and vice versa. with discounting using the interest rate, , we have (Eq: 16),

(16) A forward starting loan that starts at time, , further than the present time, can be handled by considering a modified summation (Eq: 17) below,

(17) This has some similarities to Asian options 888 Rogers & Shi (1995) try a partial-differential-equation, PDE, approach. Grant, Vora & Weeks (1997) extend Monte Carlo methods to path dependent securities and use it to value American Asian options. Milevsky & Posner (1998) approximate the finite sum of correlated log-normal variables required to calculate the payoff of arithmetic Asian options. Dufresne (2000; 2001) obtains a Laguerre series expansion for both Asian and reciprocal Asian options. Fusai (2004) prices Asian options by computing a Laplace transform with respect to time-to-maturity and a Fourier transform with respect to the logarithm of the strike. Callegaro, Fiorin & Grasselli (2019) introduce a pricing methodology based on the Fourier transform of the asset process. Bormetti et al. (2018); Jeong et al. (2019) detail other monte carlo based option pricing methods. though we have two sources of uncertainties, from the availability and from the stock price assuming the interest rate is not stochastic, and the payoff would be more than just a simple average, though it involves some form of time summation. Barraquand & Martineau (1995); Andersen & Broadie (2004) provide Monte Carlo based numerical techniques for multi-dimensional American options. Broadie & Detemple (1997) identify optimal exercise strategies and provide valuation formulas for several types of American options on two or more assets. A powerful Markov chain method to simulate multivariate distributions is given in Hastings (1970); Chib & Greenberg (1995).

-

3.

The examples thus far ignore the borrow rate at which availability is sourced. A realistic scenario that considers this would add the payoff from the other scenarios as a spread on top of the borrow rate giving the valuations, . To the cost of holding a stock position equal to the extent of shortfall, adding a borrow rate corresponding to the amount on the term loan fulfilled from the availability, gives a complete formulation for the revenue that can be expected from this structure. This gives the valuation of the term loan with three sources of uncertainty (Eq: 18; 19).

(18) (19) (20) The above formulation (Eq: 18; 19) treats the borrow rate at any particular point in time, as being applicable to the entire availability used up for the term deal. A more realistic scenario can treat even the quantity that applies to the borrow as being brought in or taken out similar to the way a stock position is bought or sold at the prevailing prices (Eq: 21; 22; 23). This is realistic since different borrow amounts are sourced at different rates. Either form can be used, depending on the specifics of how the borrow rates are managed by the desk. In the last period, unlike a stock position, there is no cash-flow from unwinding the shares borrowed, but for simplicity, we can assume that the shares borrowed are used for another loan at the prevailing borrow rate (though the actual proceeds will be higher since the loan rate will be more than the borrow rate). This gives,

(21) (22) (23) -

4.

We could calculate the revenue of the desk by looking at the cost of sourcing external borrows at the borrow rate, utilizing internal inventory and exclusive holdings to meet the shorting demands of external clients at the loan rate (Eq: 24; 25). This would also differ from the previous scenarios by factoring in the different sources of inventory and the corresponding costs. This assumes that there is no cost to use internal inventory and a constant daily fee for the use of the exclusive holdings. Further complications are possible by including transaction costs for the use of exclusives and funding rates for the internal inventory. These benchmark revenue figures can act as a sanity check and provide practical bounds for the term loan valuation.

(24) (25) Here is the profits of the loan desk from the entire loan book comprised of securities over the duration . is the constant fee to utilize the exclusive holdings. This is converted from the payment made for the duration of the exclusive to apply on a daily basis.

-

5.

Another structure could consider the varying utilizations or shorting needs of clients, reflecting the scenario when demand or the term loan quantity is stochastic resulting in the valuation, . This means the client can be given access to a loan facility and the utilization of the loan could be changed at the discretion of the client (Eq: 26; 27). Hence, the amount on the term loan or the strike can be made to vary according to another suitably defined GBM999 Henderson & Wojakowski (2002) give a symmetry result between the floating and fixed-strike Asian options involving a change of numeraire and time reversal of Brownian motion. Eberlein & Papapantoleon (2005) extend this result by considering a general Levy process as the driving process of the underlying and prove a symmetry result for look-back options using the same technique. Though in our case, both the strike and the underlying process vary under different GBMs. .

(26) (27) Considering the stochastic demands of a client, acts as a natural segue to Section (5) on the application of our methodology to inventory management.

5 Application to Inventory Management, Emissions Trading and Insurance Risk Mitigation

The methodology we have developed (Sections 4.2; 4.3) can be useful for supply chain management, emissions trading and insurance risk mitigation. We provided numerous examples of how our insights can be useful for inventory management. We briefly outline how the main ideas can be used for emissions trading and insurance risk mitigation. We hope to develop these applications further in subsequent papers. The main reason for including these examples right now are to illustrate the wide variety of situations where our techniques be applied.

5.1 Inventory Management

Our methodology can aid in Inventory management by evaluating the profit and loss over a certain time period. Specifically, the demand process can be modelled as the underlying price and when it breaches barriers indicative of the level of supply or inventory, cash-flows (costs or revenues) can be accumulated over a certain duration. This can give an estimate of the expected profitability of entering a business, starting a new venture or maintaining a certain level of inventory. If the payoffs are used to structure options with other parties, care needs to be taken to ensure that the retailer or other participants are not gaming the system and manipulating the demand to meet the terms of the contract. Khouja (1999); Qin et al. (2011) provide a comprehensive review of the news-vendor problem including suggestions for future research. Wang & Chen (2017) look at option pricing policies with regards to fresh produce supply chain.

Let represent the supply received (quantity ordered) by the retailer before time, with the requirement to sell it before the next time period, (Eq: 28). Retailer faces stochastic demand, for the corresponding time period, which can be modelled using suitable GBMs, perhaps more accurately with jumps. Let the unit cost to manufacture the product be . The wholesale price at which manufacturer produces and sells to the retailer be . The salvage value of any unsold product is per unit and the stock-out cost of unsatisfied demand is per unit. The final price at which retailer sells is . To avoid unrealistic and trivial cases, we assume that , and . The profit and loss, , over a time period, to can be calculated as,

| (28) |

The approach of optimizing the quantity ordered to maximize expected payoff is well known. Instead or in addition, the retailer could structure the payoffs when the demand breaches barriers by viewing payoffs as suitable option contracts. The treatment from Sections (4.2 ; 4.3) can apply with some modifications as below. The inventory management valuations are denoted similar to the terminology we have used in Sections (4.2; 4.3) but with an extra suffix that denotes that these are for inventory management, .

-

1.

If demand falls below a certain threshold, , that is, if there is a breach in a particular time period within the full duration, the retailer incurs a loss or payoff . This covers the case wherein a certain quantity is ordered for all the time periods over a predetermined horizon, perhaps with contractual commitment. An additional cost (storage, disposal or salvage value less than wholesale price) is involved when there is excess inventory on any particular time period within the full horizon of the contract (Eq: 29). This applies only the first time the breach happens and is similar to an American down-and-in binary put option yielding the below formulation,

(29) -

2.

A single payoff proportional to the time left on the deal (Eq: 30). This payoff could be before the supply contract can be renegotiated and could be related to the interest rates. This proportionality is represented as or , if there is a breach . Again, this is valid only when the first breach happens.

(30) The scenarios where demand goes above a certain upper limit giving rise to costs, , from loss of goodwill due to shortages etc. can be handled analogously.

-

3.

Other extensions can cover scenarios where costs are incurred every-time there is a demand breach in the downward or upward direction (Eq: 31; 32) respectively,

Up State / Down Breach (31) (32) The valuation expressions that capture a constant (Eq: 33) or proportional payoff (Eq: 34) every-time the barrier is passed are given by,

(33) (34) -

4.

In the above cases, the costs are time invariant or proportional to time, without any dependence on the demand process or the level of inventory. All the cost variables can be set as stochastic processes with a slight abuse of notation or by assuming some of them hold at the start and others at end of each time period (Eq: 35; 36), giving,

(35) (36)

Increasing globalization has meant that firms looking for growth might need to have business partners in other countries, which brings with it many elements of uncertainty and the necessity of better risk management tools (Rugman 1976; Mascarenhas 1982; Miller 1992; Reeb, Kwok & Baek 1998). The techniques in this section can be helpful for firms to manage contract risks as they negotiate terms with suppliers, distributors, make investments in different parts of the world and seek to display socially responsible behavior (Levy 1995; Choi, Lee & Kim 1999; Celly, Spekman & Kamauff 1999; Strike, Gao & Bansal 2006).

5.2 Emissions Trading

In recent years, there has been a surge in interest in emissions trading. Rubin (1996) provides a general treatment of emission trading, banking, and borrowing in an inter-temporal, continuous-time model using optimal-control theory. He shows that an efficient equilibrium solution exists that achieves the least cost, which is the solution attained by a social planner who knows the cost functions of all firms. Daskalakis, Psychoyios & Markellos (2009) study the three main markets for emission allowances within the European Union Emissions Trading Scheme. They develop an empirically and theoretically valid framework for the pricing and hedging of intra-phase and inter-phase futures and options on futures, respectively (also: Bayer & Aklin 2020; Gladwin & Walter 1976). Wen, Wu & Gong (2020) analyze the impact of carbon emissions’ environmental regulation on the stock returns of companies. Narassimhan et al. (2018) is a comprehensive review of the implementation of emissions trading systems in various jurisdictions across the globe.

We relate our methodology (Sections 4.2; 4.3) to emissions trading indirectly through the demand process. Higher demand, for certain products, will generate higher levels of emissions due to the corresponding dependency on manufacturing the required output. Option contracts, based on the demand process, can be structured depending on whether certain upper limits of demand will be breached. Hence, options that breach certain upper limits of demand will indicate when emission thresholds might be breached. This will indicate whether any payments might need to be made or emissions contracts can be put in place to handle the outcomes accordingly. A direct approach can be along the lines of Chaabane, Ramudhin & Paquet (2012), who present a model that explicitly considers environmental costs and can assist decision makers in designing sustainable supply chains over their entire life cycle. This facilitates the understanding of optimal supply chain strategies under different environmental policies for recycling and green house gas emissions reductions.

5.3 Insurance Risk Mitigation

Anastasiadis & Chukova (2012) is a comprehensive literature review that summarizes the results from a collection of research papers that relate to modeling insurance claims and the processes associated with them. Kliger & Levikson (1998) use the demand for insurance to find the optimal premium an insurer should charge. Brockett & Xiaohua (1997) review the applications of operations research methods in the insurance industry. Mills (2005; 2012) look at the role insurance firms need to play in managing climate change risk. Michel-Kerjan & Kunreuther (2011); Michaels et al. (1997). suggest that government programs, scientific institutions and private insurers have to work together to provide flood and other disaster insurance since the losses from large catastrophes can deplete the capital pools that reinsurance companies hold.

The amount of insurance claims any insurer faces in a given period will be the variable that dictates how much reinsurance coverage is necessary. The amount of claims will be modeled using our methodology presented in Sections (4.3; 5;5.2). Higher levels of claims will need higher coverage. Option contracts can be structured that will depend on the whether certain upper limits on insurance claims are breached. Payments can be put in place depending on whether the corresponding options contracts cross any thresholds or boundaries of claims made in a given time period. In a similar way, asset and liability management can be done based on how the net amounts of assets and liabilities change over time. If certain thresholds are breached, option contracts related to certain monetary amounts can be in put place. This will ensure that asset and liability mismatches can be handled with less discrepancies. Since our methodology is built using many features of binary options, catastrophic events can be handled depending on whether particular disaster related incidents occur.

6 Lost in Estimation: Option Valuation using Historical Time Series

As a complementary technique to performing a standard simulation based valuation, we show a way to utilize the rich historical data-set at the disposal of the intermediary. As it will become clear, this technique can be used to price many kinds of derivative contracts and has wide application beyond pricing term loans. Given the complexity and the number of variables to be estimated, a simple transformation provides a heuristic to calculate the payoff from the historical time series of each of the variables. This can then be used as a possible guide to the calculation of the term loan rate. The initial values of the stochastic variables in the historical data-set, as well as the barrier level or strike as necessary, can be scaled by a constant to match the values of the corresponding variables at the start of the option contract. This gives us a path of the evolution of the stochastic process, the GBM in our case. Depending on the amount of historical data, the historical series is split into partitions and the valuation is done on each portion and then averaged.

Calculating the value of the option contract directly ensures that nothing is lost in translation by first estimating the parameters of a distribution and then using those to perform the valuation. A key assumption made is that the GBM process has stationary moments or that the volatility is not time varying. Clearly this is different from the change of numeraire technique (Geman, El-Karoui & Rochet 1995; Benninga, Björk & Wiener 2002) since a numeraire is a traded asset and a constant is not, unless interest rates are zero, otherwise there will be risk-less arbitrage opportunities. An open question is regarding the convergence of the valuation using the historical time series (Cowles & Carlin 1996; Broadie & Glasserman 1997; Sherman, Ho & Dalal 1999; Shapiro & Homem-de-Mello 2000; Stentoft 2004). Convergence can be improved by making more partitions, including overlapping samples of the historical series and applying this method to each portion. The efficiency of this new approach with overlapping paths, especially in the presence of jumps in the stochastic process, needs to compared to the efficacy of standard Monte Carlo variance reduction techniques (Boyle, Broadie & Glasserman 1997; Glasserman 2003).

In our case, the scaling constants are chosen such that the starting value of the historical availability and stock price time series match the corresponding values at the inception of the contract (Eq: 37; 38). are the scaling constants for security in the partition for the availability and stock price time series. is the number of partitions of the historical time series for option valuation. and are the start and end times of the historical time series. The amount of the term loan or the strike is not scaled in the structures we have discussed, but might be necessary in other situations. Using this the historical valuation for the cost of holding a stock proportional to the extent of shortfall, , is shown below,

| (37) |

| (38) |

All the different valuations structures,

, can be calculated using the historical approach. This approach also allows the calculation of the time series of the daily profits that would accrue to the intermediary firm. The volatility of the daily profits can be suggestive in terms of how aggressive one should be in picking one of the various alternative loan structures.

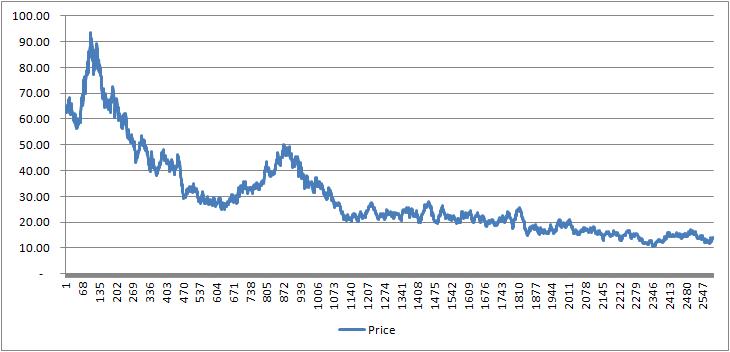

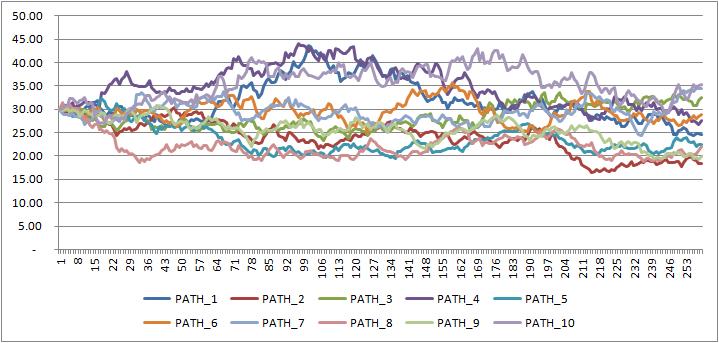

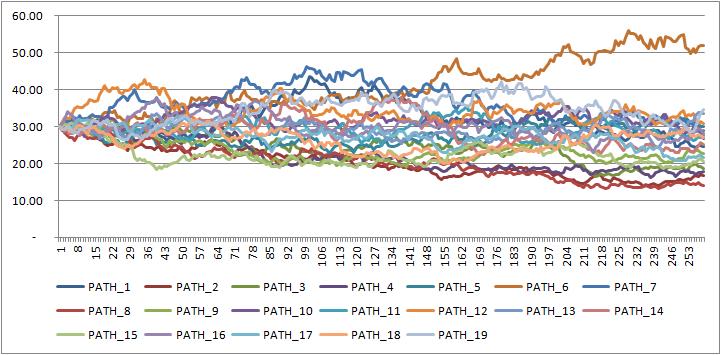

We give an illustration of how different paths can be generated from a single historical time series and used to value options akin to a simulation based procedure. Figure (3) shows the full time series that is available. This includes the starting value, the drift and the volatility, which were also chosen randomly from suitable uniform distributions, since we are simulating this series. The full series has about 2590 observations, equivalent to say ten years of historical data. In Figure (4) we show multiple paths that have been generated by splitting the overall series into smaller portions and scaling the starting value of each sub-portion to coincide with the starting value of our underlying process. In Figure (4a) we split the full series into ten non-overlapping portions and in Figure (4b) we split the full series into nineteen paths with almost half of each sub-portion overlapping with one of the other sub-portions. In both the overlapping and non-overlapping cases, each smaller series has 259 observations. We see that despite the overlapping, we have a rich set of paths that captures the jumps or movements inherent in the true process.

6.1 Sample Data Generation

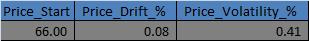

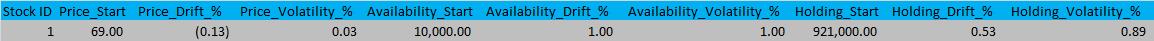

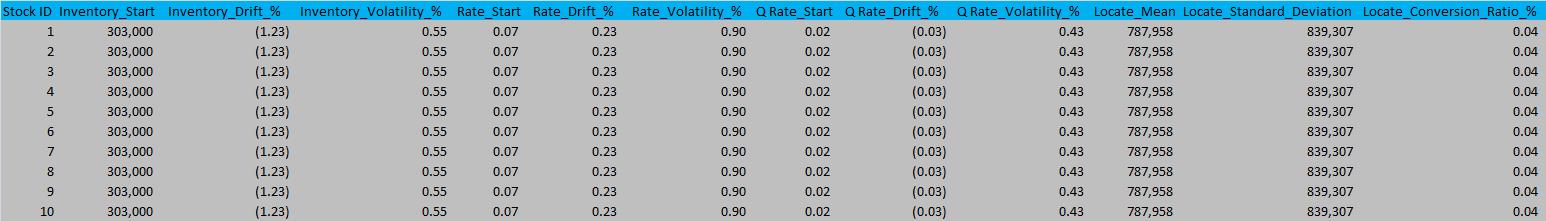

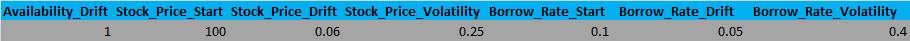

A typical intermediary can have positions on anywhere from a few hundred to upwards of a few thousand different securities and many years of historical data. It is therefore, a good complement to use the historical time series and calculate the valuation from the corresponding formulae derived in Sections (4.2; 4.3). To demonstrate how this technique would work, we simulate the historical time series. Also, the term loan buyer (as opposed to the intermediary, who would be the writer of the contract) is unlikely to have access to the full historical time series (but might have the time series of loan rates and availability) and hence could simulate the variables for which the historical data is absent as shown in this section to come up with a valuation. We create one hundred different hypothetical securities with the same starting value, volatility and drift and come up with one hundred different paths and hence the different hypothetical time series of all the variables involved (Price, Availability, Quantity Borrowed, Exclusive Holding, Inventory Level, Loan Rate, Alternate Loan Rate) by sampling from suitable log normal distributions. It is worth noting that the starting value, mean and standard deviation of the time series are themselves simulations from other appropriately chosen uniform distributions (Figure 5). The locate process can be modelled as a Poisson distribution with appropriately chosen units. It is simpler to consider it as the absolute value of a normal distribution. The mean and standard deviation of the locate distribution for each security are chosen from another appropriately chosen uniform distribution.

The simulation seed is chosen so that the drift and volatility we get for the variables (mean and standard deviation for the locate process) are similar to what would be observed in practice. For example in Figure (5), the price and rate volatility are lower than the volatilities of the borrow and other quantities, which tend to be much higher; the range of the drift for the quantities is also higher as compared to the drift range of prices and rates. This ensures that we are keeping it as close to a realistic setting as possible, without having access to an actual historical time series. The volatility and drift of the variables for each security are shown in Figure (6). The length of the simulated time series is one year or 252 trading days for each security. A sample of the time series of the variables generated using the simulated drift and volatility parameters is shown in Figure (7). The full time series shown below is available upon request.

7 Simulate and Accumulate

7.1 Closed Form Benchmark Valuation

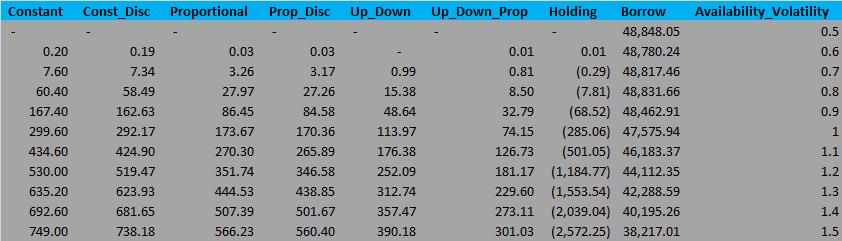

We first show a grid with the results for the American binary put closed form valuation using Equation (9) in Figure (8) in currency terms. As expected, the results seem to confirm well known properties such as; longer expiration date, higher volatility, starting value and strike (term loan amount) being closer, lower drift away from the strike; lead to higher valuations. For example: when the availability starting value, availability drift, availability volatility, term loan amount, payment when barrier is breached and maturity date are 10000, 100%, 100%, 5000, 1000 and 1 year respectively, the valuation is 225.83 in terms of currency units. This is our baseline scenario and we vary one variable at a time and keep the other variables at these baseline values. When the maturity increases to 2 years the valuation is 246.16. When the availability volatility increases across 10%, 50%, 100% and 150% the valuation increases from 0, 3.43, 225.83 and 508.56 units respectively. When the availability staring value decreases to 8000 and 6000 the valuation increases to 370.51 and 694.81 respectively. When the availability drift changes across 50%, 100% and 200% the valuation varies across 400.69, 225.83 and 61.70 respectively. This suggests that the valuation is most sensitive to the volatility and starting value (with reference to the strike) of the underlying process, though further analysis needs to be carried out to find out the exact sensitivity of the valuation to changes in the different parameters.

7.2 Valuation Matrix

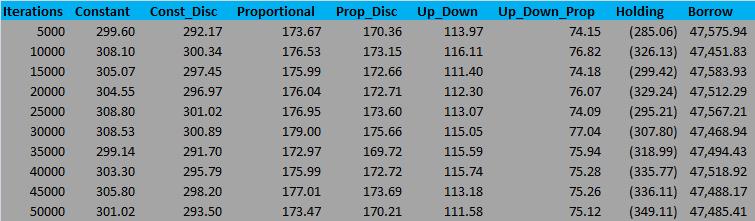

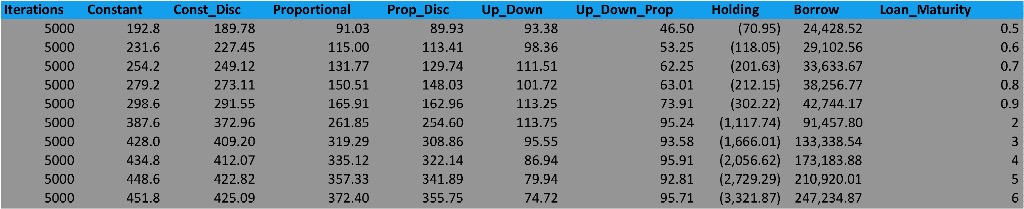

As noted earlier, given the complexity of the system and the number of random variables involved, the computational infrastructure required to value term loans would require a Monte-Carlo engine and can be tremendous; though, such a framework is readily accessible since most existing intermediaries have this setup as part of their derivative desks. We build a simple Monte-Carlo framework in R (Paradis 2002; Matloff 2011; Venables & Smith 2016). To try different scenarios, each of the variables (availability drift / start value / volatility, interest rate, payment up / down and expiration date) are increased and decreased by 10% for five steps to get a maximum increase (decrease) of 150% (50%) of the initial values of the corresponding variables. We also repeat each of the variable value change scenarios with different number of iterations of the Monte-Carlo sampling, ranging from 5000 to 50,000 with an increase of 5000 iterations each time. This results in a total of 611 different scenarios for each valuation.