Volatility and Arbitrage ††thanks: We are grateful to Adrian Banner, David Hobson, Blanka Horváth, Antoine Jacquier, Vassilios Papathanakos, Josef Teichmann, Minghan Yan, and Alexander Vervuurt for helpful comments. I.K. acknowledges support from the National Science Foundation under Grant NSF-DMS-14-05210. J.R. acknowledges generous support from the Oxford-Man Institute of Quantitative Finance, University of Oxford.

Abstract

The capitalization-weighted total relative variation in an equity market consisting of a fixed number of assets with capitalization weights is an observable and nondecreasing function of time. If this observable of the market is not just nondecreasing, but actually grows at a rate which is bounded away from zero, then strong arbitrage can be constructed relative to the market over sufficiently long time horizons. It has been an open issue for more than ten years, whether such strong outperformance of the market is possible also over arbitrary time horizons under the stated condition. We show that this is not possible in general, thus settling this long-open question. We also show that, under appropriate additional conditions, outperformance over any time horizon indeed becomes possible, and exhibit investment strategies that effect it.

Keywords and Phrases: Trading strategies, functional generation, relative arbitrage, short-time arbitrage, support of diffusions, diffusions on manifolds, nondegeneracy.

AMS 2000 Subject Classifications: 60G44, 60H05, 60H30, 91G10.

1 Introduction and summary

At least since Fernholz, (2002), it has been known that volatility in a stock market can generate arbitrage, or at least relative arbitrage between a specified portfolio and the market portfolio. However, the questions of exactly what level of volatility is required, and how long it might take, for this arbitrage to be realized, have never been fully answered. Here we hope to shed some light on these questions and come to an understanding about what might represent adequate volatility, and over which time-frame relative arbitrage might be achieved.

A common condition regarding market volatility, sometimes known as strict nondegeneracy, is the requirement that the eigenvalues of the market covariation matrix be bounded away from zero. It was shown in Fernholz, (2002) that strict nondegeneracy, coupled with market diversity, the condition that the largest relative market weight be bounded away from one, will produce relative arbitrage with respect to the market over sufficiently long time horizons. Later, Fernholz et al., (2005) showed that these two conditions lead to relative arbitrage over arbitrarily short time horizons. Market diversity is actually a rather mild condition, one that would be satisfied in any market with even a semblance of anti-trust regulation. However, strict nondegeneracy is a much stronger condition, and probably not amenable to statistical verification in any realistic market setting. While it might be reasonable to assume that the market covariation matrix is nonsingular, it would seem rather courageous to make strong assumptions regarding the behavior over time of the smallest eigenvalue of a random matrix, where is usually a large integer, standing for the number of stocks in an equity market.

Accordingly, it is preferable to avoid the use of strict nondegeneracy as a characterization of adequate volatility, and consider instead measures based on aggregated relative variations. The most important such measure is the so-called cumulative excess growth . This measure is based on the weighted average of the variances of the logarithmic market weights. The weights used are exactly the market weights; more precisely, we have

| (1.1) |

This quantity will be discussed at some length below. Here, represents the market weight of the -th stock at time , for each . Fernholz and Karatzas, (2005) show that if the slope of is bounded away from zero, then relative arbitrage with respect to the market will exist over a long enough time period. We shall see in Section 6 that this condition does not necessarily imply relative arbitrage over an arbitrarily short period of time. However, not all is lost: in Section 5 we shall see that under additional assumptions, such as when there are only two stocks or when the market weights satisfy appropriate time-homogeneity properties, relative arbitrage does exist over arbitrary time horizons. Other sufficient conditions are also provided. We remark also that Pal, (2016) recently derived sufficient conditions for large markets that yield asymptotic short-term arbitrage.

Preview: The structure of the paper is as follows: Sections 2, 3, and 4 introduce the basic definitions, including the concept of generating functions. Introduced by Fernholz, (1999, 2002) and developed in Fernholz and Karatzas, (2009) and Karatzas and Ruf, (2016), these functions are useful in creating trading strategies that produce arbitrage relative to the market. Section 5 establishes conditions under which relative arbitrage can be shown to exist over arbitrary time horizons. Section 6 constructs examples of markets which have adequate volatility but no arbitrage — indeed, the price processes in this examples are all martingales. Section 7 summarizes the results of this paper and discusses some open questions.

One final note before we begin, and this regards classical arbitrage as compared to relative arbitrage. Classical arbitrage is measured versus cash, which in our context can be considered to be a constant, positive process. The relative arbitrage we present here is generally versus the market portfolio, and this means that the market portfolio replaces cash as the benchmark against which the relative arbitrage is measured. All types of arbitrage have a boundedness restriction to prevent “doubling” strategies. For classical arbitrage, the value of the trading strategy that creates the arbitrage must be bounded from below relative to cash. In relative arbitrage, this bound is relative to the market. In general, there is no bound on market value, so one bound does not yield the other one, and vice versa. Hence, these two types of arbitrage can be incompatible.

2 The market model and trading strategies

We fix a probability space , endowed with a right-continuous filtration . For simplicity, we take , mod. P. All processes to be encountered will be adapted to this filtration. On this filtered probability space and for some , we consider a continuous –dimensional semimartingale taking values in the lateral face of the unit simplex

where denotes the hyperplane

| (2.1) |

We assume that , where we set

| (2.2) |

We interpret as the relative weight, in terms of capitalization in the market, of company at time . An individual company’s weight is allowed to become zero, but we insist that must hold for all .

In this spirit, it is useful to think of the generic market weight process as the ratio

| (2.3) |

Here is a continuous nonnegative semimartingale for each , representing the capitalization (stock-price, multiplied by the number of shares outstanding) of the -th company; whereas the process , assumed to be strictly positive, stands of the total capitalization of the entire market.

For later reference, let us introduce the stopping times

| (2.4) |

To avoid notational inconveniences below, we assume that holds for all and ; in other words, zero is an absorbing state for any of the market weights.

One of our results, Theorem 5.10 below, needs the following notion.

Definition 2.1 (Deflator).

A strictly positive process is called deflator for the vector semimartingale of relative market weights, if the product is a local martingale for every .

Except when explicitly stated otherwise, the results below will hold independently of whether the market model admits a deflator, or not.

We now consider a predictable process with values in , and interpret as the number of shares held at time in the stock of company . Then the total value, or “wealth”, of this investment, measured in terms of the total market capitalization, is

Definition 2.2 (Trading strategies).

Suppose that the –valued, predictable process is integrable with respect to the continuous semimartingale . We shall say that is a trading strategy if it satisfies the so-called “self-financibility” condition

| (2.5) |

We call a trading strategy long-only, if it never sells any stock short: i.e., if holds for all .

The vector stochastic integral in (2.5) gives the gains-from-trade realized over . The self-financibility requirement of (2.5) posits that these “gains” account for the entire change in the value generated by the trading strategy between the start and the end of the interval .

The following observation, a result of straightforward computation, is needed in the proof of Theorem 5.7.

Remark 2.3 (Concatenation of trading strategies).

Suppose we are given a real number , a stopping time , and a trading strategy . We then form a new process , again integrable with respect to and with components

| (2.6) |

Then the process is a trading strategy itself, and its associated wealth process is given by

3 Functional generation of trading strategies

There is a special class of trading strategies, for which the representation of (2.5) takes an exceptionally simple and explicit form; in particular, one in which stochastic integrals disappear entirely from the right-hand side of (2.5). In order to present this class of trading strategies, we start with a regular function: a continuous mapping that satisfies a generalized Itô rule. By this, we mean that the process can be written as the sum

| (3.1) |

of a constant initial condition , of a stochastic integral with respect to of another measurable function evaluated at , and of a process which has finite variation on compact time-intervals. The precise definition can be found in Karatzas and Ruf, (2016). We stress here that the notion of regular function is relative to a given market weight process ; a function might be regular with respect so some such process, but not with respect to another.

In this paper, we shall only consider regular functions that can be extended to twice continuously differentiable functions in a neighborhood of the set in (2.2). From now on, every regular function we encounter will be supposed to have this smoothness property. Then we may assume that is the gradient of evaluated at , at least for all . Moreover, the finite-variation process will then be given, on the stochastic interval and in the notion of (2.4), by the expression

| (3.2) |

There are two ways in which a regular function can generate a trading strategy.

-

1.

Additive generation: The vector process with components

(3.3) is a trading strategy, and is said to be additively generated by . The wealth process associated to this trading strategy has the extremely simple form

(3.4) That is, can be represented as the sum of a completely observed and “controlled” term , plus a “cumulative earnings” term . It is important to note that this expression is completely devoid of stochastic integrals.

-

2.

Multiplicative generation: The second way to generate a trading strategy requires the process to be locally bounded. This assumption allows us to define the process

(3.5) Then the vector process with components

(3.6) is a trading strategy, and is said to be multiplicatively generated by . The value this strategy generates, is given by the process of (3.5), namely: .

If the regular function is concave, then it can be checked that both strategies and are long-only. Moreover, in this case, the process in (3.1) is actually nondecreasing. More generally, we introduce the following notion.

Definition 3.1 (Lyapunov function).

A regular function is called Lyapunov function, if the process in (3.1) is nondecreasing.

For a Lyapunov function the process has the significance of an aggregated measure of cumulative volatility in the market; the Hessian matrix-valued process , which effects the aggregation, acts then as a sort of “local curvature” on the covariation matrix of the semimartingale to give us this cumulative measure of volatility.

The theory and applications of functional generation were developed by Fernholz, (1999, 2002); see also Karatzas and Ruf, (2016). All claims made in this section are proved in these references, and several examples of functionally generated trading strategies are discussed. We introduce now four regular functions which will be important here.

-

1.

The entropy function of statistical mechanics and information theory

(3.7) with the convention is a particularly important regular function. Note that is concave, thus also a Lyapunov function, and takes values in . It generates additively the long-only entropy-weighted trading strategy

(3.8) Here

(3.9) denotes the cumulative earnings of the strategy , as well as the aggregated measure of cumulative volatility in the market in the manner of (3.1). This nondecreasing, trace-like process has already been encountered in (1.1); it is called the cumulative excess growth of the market in Stochastic Portfolio Theory, and plays an important role there.

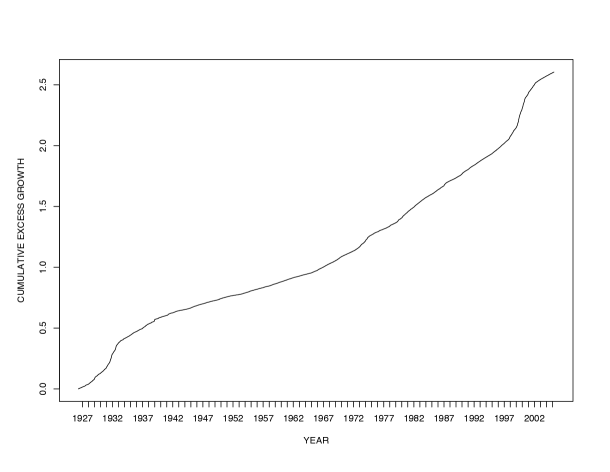

The process measures the market’s cumulative total relative variation – stock-by-stock, then averaged according to each stock’s weight. As such, it offers a gauge of the market’s “intrinsic volatility.” Figure 1 uses the monthly stock database of the Center for Research in Securities Prices (CRSP) at the University of Chicago, to plot the quantity of (3.8) over the 80-year period 1926-2005.

Figure 1: Cumulative intrinsic variation for the U.S. Market, 1926-2005. -

2.

The quadratic

(3.10) takes values in , and is also a concave regular function. It is mathematically very convenient to work with , so this function will play a major role when constructing specific counterexamples in Section 6. The corresponding aggregated measure of cumulative volatility is given by the nondecreasing trace process

(3.11) we note also that the difference is nondecreasing, where is given in (3.9).

-

3.

We shall also have a close look at the concave, geometric mean function

(3.12) -

4.

Finally, for , we shall use, in one of the proofs, the power

(3.13) Note that is, for , a convex rather than concave function, as was the case in the other three examples. It is nevertheless regular, so it can still be used as a generating function. Indeed, if is locally bounded away from zero, the multiplicatively generated strategy of (3.6) exists. More precisely, with the process of (3.5) given now by

(3.14) the expression in (3.6) can be written here as

(3.15)

4 Relative arbitrage, and an old question

We introduce now the important notion of relative arbitrage with respect to the market.

Definition 4.1 (Relative arbitrage).

Given a real constant , we say that a trading strategy is a relative arbitrage with respect to the market over the time horizon if , , and

If in fact holds, this relative arbitrage is called strong.

Remark 4.2 (Equivalent martingale measure).

Fix a real number . Then no relative arbitrage is possible over the time horizon with respect to a market whose relative weights are martingales under some equivalent probability measure defined on .

Suppose now that no relative arbitrage is possible over the time horizon , with respect to a market with relative weights . Provided that a deflator for exists, an equivalent probability measure then exists on , under which the relative weights are martingales; see Delbaen and Schachermayer, (1994) or Karatzas and Kardaras, (2007).

Since the process expresses the market portfolio, the arbitrage of Definition 4.1 can be interpreted as relative arbitrage with respect to the market. The question of whether a given market portfolio can be “outperformed” as in Definition 4.1, is of great theoretical and practical importance – particularly given the proliferation of index-type mutual funds that try to track and possibly outperform a specific benchmark market portfolio (or “index”). To wit: Under what conditions is there relative arbitrage with respect to a specific market portfolio? over which time horizons? if it exists, can such relative arbitrage be strong?

Functionally-generated trading strategies are ideal for answering such questions, thanks to the representations of (3.2) and (3.4) which describe their performance relative to the market in a pathwise manner, devoid of stochastic integration. The following result is taken from Karatzas and Ruf, (2016); its lineage goes back to Fernholz, (2002) and to Fernholz and Karatzas, (2005). In our present context, it is a straightforward consequence of the representation (3.4).

Theorem 4.3 (Strong relative arbitrage over sufficiently long time horizons).

Suppose that is a Lyapunov function with . Suppose, moreover, that there is a real number with the property

| (4.1) |

Then the trading strategy , generated additively in the manner of (3.3) by the function , is strong relative arbitrage with respect to the market over any time horizon with .

The following is a direct corollary of Theorem 4.3.

Corollary 4.4 (Slope bounded from below).

Suppose that is a regular function with such that

| (4.2) |

Then the trading strategy of Theorem 4.3 is strong relative arbitrage with respect to the market, over any time horizon with

| (4.3) |

The assertion of Corollary 4.4 appears already in Fernholz and Karatzas, (2005) for the entropy function of (3.7). In this case, the condition of (4.2) posits that the cumulative relative variation as in (3.9) is not just increasing, but actually dominates a straight line with positive slope.

This assumption can be read most instructively in conjunction with the plot of Figure 1. Under it, Corollary 4.4 guarantees the existence of relative arbitrage with respect to the market over any time horizon of duration .

Remark 4.5.

The following question was posed in Fernholz and Karatzas, (2005), and was asked again in Banner and Fernholz, (2008). Assume that (4.2) holds with , given in (3.7). Is then relative arbitrage with respect to the market possible over every time horizon with arbitrary length ?

In Section 5 we shall present results which guarantee, under appropriate additional conditions, affirmative answers to this question. Then in Section 6 we shall construct market models illustrating that, in general, the answer to the above question is negative. This settles an issue which had remained open for more than ten years.

5 Existence of short-term relative arbitrage

Given a Lyapunov function with , Theorem 4.3 provides the condition on the length of the time horizon as sufficient for the existence of strong relative arbitrage with respect to the market over this time horizon.

In this section, we study conditions under which relative arbitrage exists on the time horizon , for any real number . Subsection 5.1 discusses conditions that guarantee the existence of strong short-term relative arbitrage. The conditions of Subsection 5.2 guarantee only the existence of short-term relative arbitrage, not necessarily strong.

5.1 Existence of strong short-term relative arbitrage

The following result greatly extends and simplifies the results in Section 8 of Fernholz et al., (2005) and in Section 8 in Fernholz and Karatzas, (2009).

Theorem 5.1 (One asset with sufficient variation).

In a market as in Section 2, with relative weight processes , suppose there exists a constant such that holds on the stochastic interval with

Then, given any real number there exists a long-only trading strategy which is strong relative arbitrage with respect to the market over the time horizon .

Proposition 5.13 below is a direct consequence of Theorem 5.1; its proof requires, however, the technical observation made in Lemma 5.12. Proposition 5.13 shows that, in the case the condition in (4.2) yields, for every given time horizon, the existence of a long-only trading strategy which is strong relative arbitrage with respect to the market over this time horizon.

Proof of Theorem 5.1.

Let us fix a real number and consider the market with weights . It suffices to prove the existence of a long-only trading strategy which is strong relative arbitrage with respect to the new market with weights over the time horizon . For then the long-only trading strategy is strong relative arbitrage with respect to original market with weights over the time horizon .

For some number to be determined presently, we recall the regular function of (3.13). Since is locally bounded, generates multiplicatively, for the market with weight process , the strategy given by (3.15), with replaced by . We note for and that is given as in (3.14). We introduce now the long-only trading strategy

with associated wealth process

In particular, we note and . On the event we have

whereas, on the event we have

provided we choose large enough such that

This shows , as claimed. ∎

Remark 5.2 (Dependence of on the length of the time horizon).

The trading strategy of Theorem 5.1 is constructed in a very explicit and “model-free” manner, but does depend on the length of the time horizon over which it effects arbitrage with respect to the market.

The following two remarks recall two alternative ways to obtain the existence of strong relative arbitrage opportunities over arbitrary time horizons.

Remark 5.3 (Smallest asset with sufficient variation).

In the spirit of Theorem 5.1, Banner and Fernholz, (2008) also prove the existence of a strong relative arbitrage over arbitrary time horizons. However, they do not assume that one fixed asset contributes to the overall market volatility – but rather that it is always the smallest stock that has sufficient variation. The strategy they construct is again “model-free”, but does depend on the length of the time horizon.

Remark 5.4 (Completeness and arbitrage imply strong arbitrage).

If the underlying market model allows for a deflator (recall Definition 2.1) and is complete (any contingent claim can be replicated), then the existence of an arbitrage opportunity implies the existence of a strong one; see Theorem 8 in Ruf, (2011). However, this strong arbitrage usually will depend on the model and on the length of the time horizon.

Diversity and strict nondegeneracy

Definition 5.5 (Diversity).

We say that a market with relative weight processes is diverse if

| (5.1) |

Diversity posits that no company can come close to dominating the entire market capitalization. It is a typical characteristic of large, deep and liquid equity markets.

Let us assume now that the continuous semimartingales in (2.3), to wit, the capitalization processes of the various assets in the market, have covariations of the form

| (5.2) |

for suitable progressively measurable processes .

Corollary 5.6 (Diversity and strict nondegeneracy).

Suppose that a market as in (2.3) is diverse, that (5.2) holds, and that the asset covariation matrix-valued process satisfies the strict nondegeneracy condition

| (5.3) |

for some . Then, given any real number , there exists a long-only trading strategy which is strong relative arbitrage with respect to the market over the time horizon .

5.2 Existence of short-term relative arbitrage, not necessarily strong

In this subsection we provide three more criteria that guarantee the existence of relative arbitrage with respect to the market over arbitrary time horizons. The first criterion is a condition on the time-homogeneity of the support of the market weight vector . The second criterion uses failure of diversity. The third criterion is a condition on the nondegeneracy of the covariation process of .

5.2.1 Time-homogeneous support

Let us recall the condition in (4.1). There, the threshold “is at its lowest”, when the initial market-weight configuration is at a site where attains, or is very close to, its smallest value on ; these are the most propitious sites from which relative arbitrage can be launched.

The following result assumes that the essential infimum of the continuous semimartingale remains constant over time. In particular, that sites in the state space which are close to this infimum – and thus “propitious” for launching relative arbitrage – can be visited “quickly” (i.e., over any given time horizon) with positive probability. The result shows that relative arbitrage with respect to the market can then be realized over any time horizon of arbitrary length .

Theorem 5.7 (A time-homogeneity condition on the support).

Suppose that for a given generating function and appropriate real constants and , the condition in (4.2) is satisfied, along with the lower bound

| (5.4) |

and the “time homogeneous support” property

| (5.5) |

Then arbitrage relative to the market exists over the time horizon , for every real number .

The basic argument in the proof of Theorem 5.7 is quite simple to describe: Given a time horizon , the condition in (5.5) declares that the vector process of relative market weights will visit before time , with positive probability, sites which are “very propitious” for arbitrage relative to the market. The moment this happens, it makes good sense to abandon the market in favour of the trading strategy generated by the function in the manner of (3.3), for some appropriately chosen constant . The challenge then is to show that such a strategy does not underperform the market, and has a positive probability of outperforming it strictly.

Proof of Theorem 5.7.

For an arbitrary but fixed real number we introduce the regular function

and denote

We also introduce the stopping time

with the usual convention that the infimum of the empty set is equal to infinity, and note that (5.5) implies

| (5.6) |

We let denote the trading strategy generated by the function in the manner of (3.3), and introduce the trading strategy which follows the market portfolio up to the stopping time , then switches for the remainder of the time horizon to the trading strategy ; namely,

in the “self-financed” manner of (2.6). According to (5.6), this switching occurs with positive probability. As we saw in Remark 2.3, the value that results form this concatenation is given by

Here we have used the comparisons and in the first inequality, and (4.2) in the second inequality.

Now it clear from this last display that holds, and that holds on the event ; it is also clear that holds on . Since has positive probability on account of (5.6), it follows that the trading strategy is relative arbitrage with respect to the market over the time horizon . ∎

Remark 5.8 (On the type of arbitrage).

There is nothing in the above argument to suggest that the probability in (5.6), which is argued there to be positive, is actually equal to 1. Thus, the relative arbitrage constructed in Theorem 5.7 need not be strong. It should also be noted that the trading strategy which implements this arbitrage depends on the length of the time horizon – in marked contrast to the strategy of Theorem 4.3, which does not, as long as .

5.2.2 Failure of diversity

Theorem 5.7 has the following corollary. Taken together, Corollaries 5.6 and 5.9 illustrate that both diversity, and its failure, can lead to arbitrage over arbitrary time horizons – under appropriate additional conditions in each case. For the statement, we let denote the extremal points (unit vectors) of the lateral face of the unit simplex.

Corollary 5.9 (Failure of diversity).

Suppose that diversity fails for a market with relative weights , in the sense that

Suppose also that, for some generating function which satisfies

the condition in (4.2) holds for some real constant . Relative arbitrage with respect to the market exists then over the timehorizon , for every real number .

5.2.3 Strict nondegeneracy

Theorem 5.7 has an important consequence, Theorem 5.10 below; this establishes the existence of relative arbitrage with respect to the market, under the “sufficient intrinsic volatility” condition of (4.2) and under additional nondegeneracy conditions.

In order to prepare the ground for this result, let us recall the trace process of (3.11). From Proposition II.2.9 of Jacod and Shiryaev, (2003) we have the representation

| (5.7) |

for some symmetric and nonnegative-definite matrix-valued process , whose entries are progressively measurable and satisfy for every . Furthermore, thanks to the Kunita-Watanabe inequality (Proposition 3.2.14 in Karatzas and Shreve, (1991)), the process takes values in for every .

We also consider the sequence of stopping times

| (5.8) |

Theorem 5.10 (A strict nondegeneracy condition).

Suppose that there exists a deflator for the process of relative market weights, as well as a regular function which satisfies (4.2) for some real constant . Moreover, assume that the largest eigenvalues of the matrix-valued process in (5.7) are bounded away from zero on uniformly in , for each , in the notation of (5.8). Then relative arbitrage with respect to the market exists over , for every real number .

The proof of Theorem 5.10 is at the end of this subsection. Proposition 6.11 below shows that, in this theorem, it is not sufficient that the largest eigenvalues of the matrix-valued process be strictly positive. If they are not additionally bounded away from zero, an example can be constructed in which relative arbitrage with respect to the market does not exist over the time horizon for some real number .

It is important to stress that Theorem 5.10 establishes only the existence of a trading strategy, which effects the claimed relative arbitrage. Moreover, unlike the trading strategy of Theorem 4.3 which is strong arbitrage, explicit, model-free, and independent of the time horizon, the trading strategy whose existence is claimed in Theorem 5.10 may be none of these things.

Remark 5.11 (Itô-process covariation structure).

If holds for all , then

Hence, in this case, a sufficient (though not necessary) condition for the nondegeneracy assumption in Theorem 5.10 to hold, is that the largest eigenvalues of the matrix-valued process be bounded away from zero and from infinity on , for each .

The proof of Theorem 5.10 uses the following lemma.

Lemma 5.12 (Sum of quadratic variations bounded from below).

Assume that there exist a generating function and a constant such that (4.2) is satisfied. Then, for each , there exists a real constant such that the mapping is nondecreasing on .

Proof.

Proposition 5.13 (The case of two assets).

Assume that and that there exist a regular function and a real constant such that (4.2) is satisfied. Then strong arbitrage relative to the market can be realized by a long-only trading strategy over the time horizon , for any given real number .

Alternatively, a weaker formulation of Proposition 5.13, which guarantees the existence of relative arbitrage over any given time horizon, but not the fact that this relative arbitrage is strong, can also be proved via Theorem 5.10. To apply this result, it suffices to check that the largest eigenvalue of equals . However, this is easy to see here: we have ; hence and , so the eigenvalues of the matrix are then indeed and .

Proof of Theorem 5.10.

First, we may assume without loss of generality that is nonnegative. We shall argue by contradiction, assuming that for some real number no relative arbitrage is possible with respect to the market on the time horizon . Remark 4.2 gives then the existence of an equivalent probability measure on on , under which the relative weights are martingales.

We shall show next that this leads to the property (5.5) with and hence, on the strength of Theorem 5.7, to the desired contradiction. In order to make headway with this approach we fix and , define

choose a point , and fix an integer large enough so that

We recall the constant from Lemma 5.12 and define the stopping time

| (5.10) |

For future reference, we note that Lemma 5.12 yields the set inclusion

| (5.11) |

Now, in order to obtain (5.5) , it suffices to show that the stopped process

| (5.12) |

satisfies . This, in turn, will follow as soon as we have shown

| (5.13) |

Here is sufficiently small so that, for all , we have

Clearly, on account of (5.10), we have for the stopped process in (5.12) the upper bound

| (5.14) |

In order to establish (5.13), we modify the arguments in Stroock and Varadhan, (1972) and Stroock, (1971). We fix the vector

| (5.15) |

and let denote the Moore-Penrose pseudo-inverse of the matrix in (5.7). Next, note that the vector is in the range of on since the matrix has rank and satisfies , where . Thus, we have on . We now introduce the continuous –local martingale

The quadratic variation of this local martingale is dominated by a real constant: namely,

on account of (5.14) and (5.15), where the real constant stands for a lower bound on the smallest positive eigenvalue of on the stochastic interval . Likewise, we have

| (5.16) |

On account of Novikov’s theorem (Proposition 3.5.12 in Karatzas and Shreve, (1991)), the stochastic exponential is a uniformly integrable –martingale. Thus, this exponential martingale generates a new probability measure Q on , which is equivalent to . According to the van Schuppen-Wong extension of the Girsanov theorem (ibid., Exercise 3.5.20), we have then the decomposition

where is a Q–local martingale with .

We now consider the event

Thanks to (5.16), any vector with components for each is a convex combination of and ; this leads to . Now, in conjunction with (5.11) and (5.16), this set inclusion implies that

and therefore

Consequently, the claim (5.13) will follow from the equivalence , as soon as we have established that .

In order to argue this positivity, we start by introducing the processes

and noting

| (5.17) |

Hence, it suffices to argue that

| (5.18) |

To this end, define the Q–local martingale

whose quadratic variation is dominated again by a real constant: namely,

on account of (5.14). Here the real constant stands again for a lower bound on the smallest positive eigenvalue of on the stochastic interval . Recalling the Q–local martingale in (5.17), we obtain

Another application of Novikov’s theorem yields that the stochastic exponential is a uniformly integrable Q–martingale and generates a probability measure on , which is equivalent to Q. Under this new probability measure , the process is a local martingale. However, this continuous –local martingale is bounded from below by and satisfies ; thus the property

holds, and (5.18) follows on the strength of the equivalence . This concludes the proof. ∎

In the absence of strict nondegeneracy conditions as in Theorem 5.10, the controllability approach of Kunita, (1974, 1978) yields conditions which guarantee that the assumptions of Theorem 5.7 hold when the vector market weight process is an Itô diffusion. In the same spirit, suitable Hörmander-type hypoellipticity conditions on the covariations of the components of this diffusion, along with additional technical conditions on the drifts, yield good “tube estimates” which then again avoid the need to impose strict nondegeneracy conditions; see Bally et al., (2016), and the literature cited there.

6 Lack of short-term relative arbitrage opportunities

In Remark 4.5 we raised the question, whether the condition of (4.2) yields the existence of relative arbitrage over sufficiently short time horizons. In Section 5 we saw that, under appropriate additional conditions on the covariation structure of the market weights, the answer to this question is affirmative. In general, however, the answer to the question of Remark 4.5 is negative, as we shall see in the present section. Specific counterexamples of market models will be constructed in a systematic way, to illustrate that arbitrage opportunities over arbitrarily short time horizons do not necessarily exist in models which satisfy (4.2).

In Subsections 6.1, 6.2, and 6.3 we shall focus on the the quadratic function of (3.10). More precisely, we construct there variations of market models that satisfy (4.2) with , but do not admit relative arbitrage over any time horizon. We recall that is nondecreasing for the cumulative excess growth of (3.9); thus, if (4.2) is satisfied by the quadratic function , it is automatically also satisfied by the entropy function of (3.7). This then also yields a negative answer to the question posed in Remark 4.5. In Subsection 6.4, market weight models are constructed, such that moves along the level sets of a general Lyapunov function at unit speed, namely, with and , but which do not admit relative arbitrage over any time horizon.

Remark 6.1 (Some simplifications for notational convenience).

Throughout this Section we shall make certain assumptions, mostly for notational convenience.

-

•

We shall focus on the case . Indeed, Proposition 5.13 shows that it would be impossible to find a counterexample to the question of Remark 4.5 when . The counterexamples below can be generalized to more than three assets, but at the cost of additional notation and without any major additional insights.

-

•

We shall construct market models that satisfy, for a certain Lyapunov function the condition

(6.1) We may do this without loss of generality. Indeed, let us assume we have a market model that satisfies (6.1) and does not allow relative arbitrage over any time horizon. By appropriately adjusting the dynamics of , say after time , it is then always possible to construct a market model that satisfies (4.2), and also does not allow for arbitrage over short time horizons (as it displays the same dynamics up to time ).

6.1 A first step for the quadratic generating function

Here is a first result on absence of relative arbitrage under the condition of (6.1).

Proposition 6.2 (Counterexample with Lipschitz-continuous dispersion matrix).

Assume that the filtered probability space supports a Brownian motion . Then there exists an Itô diffusion with values in , a time-homogeneous and Lipschitz-continuous dispersion matrix in , and the following properties:

-

(i)

No relative arbitrage exists with respect to the market with relative weight process , over any time horizon with .

- (ii)

We provide the proof of Proposition 6.2 at the end of this subsection. The following system of stochastic differential equations will play a fundamental role when deriving the dynamics of the relative market weight process in this proof:

| (6.2) | ||||

| (6.3) | ||||

| (6.4) |

where denotes a Brownian motion. The Lipschitz continuity of the coefficients guarantees that this system has a pathwise unique strong solution for any initial point . If, moreover, is point in the hyperplane of (2.1), then we also have , for each .

Remark 6.3 (Explicit solution).

Remark 6.4 (Representation in a special case).

With the initial condition

for some and , we find another useful representation of the solution in Remark 6.3. Indeed, a computation shows

| (6.5) |

hence . We now claim that

| (6.6) |

solves the system (6.2)–(6.4). To this end, note that Itô’s formula yields the dynamics

Moreover, since , it suffices to argue that

This is a basic trigonometric identity, from which the claim follows.

To study the dynamics of the solution for the system in (6.2)–(6.4) further, we introduce the function:

| (6.7) |

The following result shows that is the distance from the “node” on the lateral face of the unit simplex.

Lemma 6.5 (Another representation for ).

Proof.

Proof of Proposition 6.2.

We let denote the solution of the system of stochastic equations described in (6.2)–(6.4) for some . Next, we define the stopping time

and the stopped process . This is a vector of martingales, so relative arbitrage, with respect to a market with the components of as its relative weights, is impossible, over any given time horizon with ; see also Remark 4.2.

Remark 6.6 (A sanity check).

We can verify that holds with the notation of the above proof, and in accordance with Corollary 4.4.

Remark 6.7 (Expanding circle).

Let us observe from (6.9), that the market weights constructed in Proposition 6.2 live on an expanding circle. More specifically, from (6.8), (6.9), and (3.10) we have

hence the vector of relative market weights lies on the intersection of the hyperplane with the sphere of radius centered at the origin. This intersection is a circle of radius centered at the node .

6.2 Starting away from the node, and “moving slowly”

As (6.9) shows, in the context of Proposition 6.2, the process starts out away from the node on the lateral face of the unit simplex, then spins outward very fast (namely, exponentially fast), until it reaches the boundary of the simplex at some time ; this time is bounded away from zero.

We construct here another market model, similar to the one in Subsection 6.1, but in which the spinning motion of is “slowed down” quite considerably. More precisely, the diffusion process of Theorem 6.8 starts away from the node then moves outwards along level sets of the quadratic function . This takes time at least ; on the interval the condition in (6.1) is satisfied with and , but no arbitrage with respect to the market can exist.

Theorem 6.8 (Lack of short term relative arbitrage opportunities).

Assume that the filtered probability space supports a Brownian motion . Fix with . Then there exists an Itô diffusion with values in , a time-homogeneous dispersion matrix, starting point , and the following properties:

-

(i)

No relative arbitrage exists with respect to the market with relative weight process , over any time horizon with .

-

(ii)

The condition of (6.1) is satisfied for the quadratic function with and with .

We prove this theorem at the end of the subsection, after a remark and a preliminary result.

Remark 6.9 (An open question).

Suppose that the condition in (4.2) is satisfied by a market model with relative weight process , for the quadratic function with . Theorem 4.3 yields then the existence of a strong relative arbitrage with respect to this market, over any time horizon with . On the other hand, Theorem 6.8 shows that, for time horizons with , there exist market models with respect to which no relative arbitrage is possible, even if (4.2) holds for them. We do not know what happens for time horizons with . We conjecture that relative arbitrage is possible for those time horizons, but that it need not be strong.

For the next result, we recall the function from (6.7).

Proposition 6.10 (Time-changed, slowed-down version of (6.2)–(6.4)).

Assume that the filtered probability space , supports a Brownian motion . Then, for any initial condition with the following system of stochastic differential equations has a pathwise unique strong solution , taking values in

| (6.10) | ||||

| (6.11) | ||||

| (6.12) |

Proof.

Let denote any solution to the system (6.10)–(6.12) with . Then it is clear that holds for all . Next, we define the stopping time

and note as in Lemma 6.5, via an application of Itô’s formula, that

Hence, if , the process is nondecreasing and deterministic; indeed, we then have for all , and . For this reason, given any , any solution to the system (6.10)–(6.12) solves also the system

| (6.13) | ||||

| (6.14) | ||||

| (6.15) |

Since the system (6.13)–(6.15) has Lipschitz-continuous coefficients, its solution is unique. This yields uniqueness of the solution to the system (6.10)–(6.12). Existence of a solution to the system (6.10)–(6.12) follows by checking that any solution to (6.13)–(6.15) is also a solution to (6.10)–(6.12). ∎

Proof of Theorem 6.8.

We proceed exactly as in the proof of Proposition 6.2. With , we recall the process of Proposition 6.10, define the stopping time

and set . This process is a vector of continuous martingales; hence, no relative arbitrage is possible with respect to this market, over any given time horizon. Finally, we note that holds for all , and that . This then yields the statement. ∎

6.3 Modifications

We provide here modifications of the examples in the previous subsections. More precisely, let us recall the first system of stochastic differential equations (6.2)–(6.4) along with the solution given in (6.6). That is, let us consider, for some and , the corresponding market model

where is Brownian motion and a real number.

The first modification perturbs this model radially in the plane of so that the resulting new model has a covariation matrix-valued process as in (5.7) with two strictly positive eigenvalues.

Proposition 6.11 (Nondegeneracy and absence of arbitrage).

Assume that the filtered probability space , supports two independent Brownian motions and . Then there exist a real number and an Itô diffusion with the following properties:

-

(i)

No relative arbitrage with respect to the market exists, over any time horizon with .

- (ii)

-

(iii)

The covariation matrix of has two strictly positive eigenvalues on that is, for each the matrix of (5.7) has two strictly positive eigenvalues.

Proof.

To describe the model, let us fix a real constant . We consider also a martingale of the filtration generated by the Brownian motion with values in the interval and starting point . More precisely, we introduce the Itô diffusion

with state space we note that is strictly increasing thanks to Feller’s test of explosions; and define the martingale with takes values in the interval .

We now define and the market weights as positive Itô processes

| (6.16) |

Since and are independent, is a martingale for each . Indeed, we have the dynamics

for all and . As a result, no relative arbitrage can exist with respect to the market. Moreover, we note

Recall that ; hence we get

yielding (ii). Here, the last equality follows from the same type of computations as the ones in Remark 6.4.

Of the two Brownian motions that drive this market model, generates circular motion in the plane of about the point ; while generates the martingale , whose quadratic variation has strictly positive time-derivative. Thus these two independent random motions span the two-dimensional space, and the covariation process of the market weight process has rank . ∎

Remark 6.12 (Contrasting Theorem 5.10 to Proposition 6.11).

Theorem 5.10 yields the existence of short-term arbitrage, if the largest eigenvalues of the covariance matrix are uniformly bounded away from zero. According to Proposition 6.11 the weaker requirement, that all these largest eigenvalues be strictly positive, is not sufficient to guarantee short-term relative arbitrage. Indeed, the slope of in the proof of Proposition 6.11 can get arbitrarily close to zero over any given time horizon, with positive probability. This prevents the second-largest eigenvalue of the covariance matrix from being uniformly bounded from below, away from zero.

Remark 6.13 (Spiral expansion).

In the market model of (6.16), the relative weights take values on a circle that is allowed to expand at the rate ; more precisely, we have

Therefore, at any given time the vector of relative market weights lies on the intersection of the hyperplane with the sphere of radius centered at the origin. This intersection is a circle of radius contained in and centered at its node ; see also Remark 6.7. Thus, a more precise description of the current situation might be that the market weights live on a spiral. The rate of this “spiral expansion” is exactly that one, for which the market weights become martingales.

This remark raises the following question: What happens if the market weights are confined to a stationary circle in ? Such a diffusion, confined to a circle, is incompatible with a martingale structure. This is the subject of the example that follows.

Example 6.14 (Immediate arbitrage).

Let denote a scalar Brownian motion, fix a real constant , and define the positive market weight processes

These market weights take values in the interval ; in fact they live on a circle, namely

in the notation of (6.7), and have dynamics

As above, we have

Let us introduce now the normalized quadratic function , where . For the trading strategy generated additively by this function as in (3.3), and the associated wealth process of (3.4), we get

Hence, the additively-generated strategy yields a strong relative arbitrage over any given time horizon . Investing according to this strategy is a sure way to do better than the market right away, and to keep doing better and better as time goes on.

Indeed, the existence of such “egregious”, or “immediate”, arbitrage, should not come here as a surprise, since the so called “structure equation” is not satisfied; in particular, no deflator as in Definition 2.1 exists for ; see, for example, Schweizer, (1992), or Theorem 1.4.2 in Karatzas and Shreve, (1998). ∎

Remark 6.15 (General submanifolds).

The diffusion constructed In Example 6.14 lives on a submanifold of , which is incompatible with a martingale structure. By contrast, in Subsection 6.1 the submanifold was allowed to evolve as an expanding circle. The diffusions in these examples could probably be generalized to diffusions with support on an arbitrary submanifold of , for , and then the submanifold could be allowed to evolve through in the manner of our expanding circle in .

In this case, a natural question would be to characterize the evolution that would cause the diffusion on the evolving submanifold to become a martingale. How would this martingale-compatible evolution depend on the diffusion? What would become of this evolving submanifold over time? Would the evolving submanifold develop singularities? Et cetera. We provide some partial answers to such questions in the following Subsection 6.4, but the picture that emerges seems to be far from complete.

6.4 General Lyapunov functions

We extend now the construction of market models, for which (6.1) is satisfied but no short-term arbitrage is possible, to a general class of generating functions. Throughout this section we fix a Lyapunov function ; this function is assumed to be strictly concave, and twice continuously differentiable in a neighborhood of . We assume moreover that its Hessian is locally Lipschitz continuous. Next, we introduce the nonnegative number

If attains an interior local (hence also global) maximum at a point , we call this the “navel”, or “umbilical point”, of the function .

Theorem 6.16 (General Lyapunov functions, lack of short-term relative arbitrage).

Assume that the filtered probability space , supports a Brownian motion . Suppose also that we are given a Lyapunov function with the properties and notation just stated, along with a vector such that . Then there exists an Itô diffusion with starting point , values in , and the following properties:

-

(i)

No relative arbitrage is possible with respect to over any time horizon with .

-

(ii)

The condition of (6.1) is satisfied with and .

Moreover, we have

Proof.

We introduce the vector function with components

If , then is the umbilical point. Indeed, if for some we have , then the strict concavity of yields

Next, we introduce the function

| (6.17) |

and note that holds, as long as is not the umbilical point .

Let us now consider the Itô diffusion process with initial condition and dynamics

| (6.18) |

It is clear from this construction and the property for all that, as long as the process is well defined by the above system, it satisfies . Furthermore, if the process is well defined, elementary stochastic calculus and the property

lead to the dynamics

This last double summation is identically equal to , by virtue of (6.17). Thus, is decreasing, and stays clear of the navel (if this exists). Hence, by analogy with the proof of Proposition 6.10, we get that the process is well defined since the system of stochastic differential equations in (6.18) has a pathwise unique, strong solution, up until the time . This stopping time was defined in (2.4) and describes the first time when hits the boundary of ; in particular, we have for it

| (6.19) |

The market weight processes for are continuous martingales with values in the unit interval . As a result, no relative arbitrage can exist with respect to the resulting market, over any given time horizon. Since , we can conclude the proof. ∎

Theorem 6.8 is a special case of Theorem 6.16. We do not know whether it is possible to remove the assumption from Theorem 6.16, but conjecture that this should be possible.

Remark 6.17 (Presence of a gap).

We continue here the discussion started in Remark 6.9. It is very instructive to compare the interval of (4.3), which provides the lengths of time horizons over which strong arbitrage is possible with respect to any market that satisfies the condition in (4.2) with ; and the interval of Theorem 6.16, giving the lengths of time horizons over which examples of markets can be constructed that do not admit relative arbitrage but satisfy the condition in (4.2).

Remark 6.18 (Absence of a gap).

The gap in Remark 6.17 disappears, of course, when ; most eminently, when the function vanishes on the boundary , but is strictly positive on .

7 Summary

In this paper we place ourselves in the context of continuous semimartingales taking values in the –dimensional simplex . Each component of is interpreted as the relative capitalization of a company in an equity market, with respect to the whole market capitalization. We then study conditions on the volatility structure of that guarantee the existence of relative arbitrage opportunities with respect to the market. More precisely, we consider conditions that bound a cumulative aggregation of the volatilities of the individual components of from below. Here, the aggregation is done according to a so-called generating function , assumed to be sufficiently smooth. Then is given by (3.2), namely,

and the condition on the cumulative aggregated market volatility by (4.2):

Section 4 recalls the trading strategy , which is a strong relative arbitrage on the time horizon for all , provided that (4.2) holds. It is important to note that this strategy is “model-free”: it does not depend on the specifications of a particular model, and works for any continuous semimartingale model that satisfies (4.2).

Section 5 provides several sufficient conditions guaranteeing the existence of short-term relative arbitrage. First, Subsection 5.1 studies the question of strong short-term relative arbitrage. If a specific stock contributes to the overall market volatility, then Theorem 5.1 yields the existence of such a strong arbitrage opportunity. The corresponding trading strategy turns out to be independent of the model specification but will be dependent on the choice of time horizon. A similar construction is the underlying idea of Banner and Fernholz, (2008). There, not a specific stock, but always the smallest one in terms of capitalization, contributes to the overall market volatility; see also Remark 5.3.

Subsection 5.2 yields sufficient conditions for the existence of short-term relative arbitrage, not necessarily strong. The first sufficient condition concerns the support of and assumes that it is, in a certain weak sense, time-homogeneous (Theorem 5.7). The second sufficient condition is on the strict nondegeneracy of the covariance process of (Theorem 5.10). Any of the two conditions yields, in conjunction with (4.2), the existence of a relative arbitrage opportunity for the time horizon , for any . However, the corresponding trading strategies usually depend on the model specification (including the specification on drifts) and also on the time horizon . Moreover, these sufficient conditions usually do not yield strong relative arbitrage. Nevertheless, if the market is complete, the strategies can be chosen to be strong relative arbitrages; see Remark 5.4.

Section 6 answers negatively the long-standing question, whether the condition in (4.2) yields indeed the existence of relative arbitrage opportunities with respect to the market on for any given real number . Specific counterexamples are constructed. In this section we assume that , namely, that we are in a market of only three stocks. This is done for notational convenience, as a lower-dimensional market can always be embedded in a higher-dimensional one. A smaller choice for is not possible, as Proposition 5.13 yields that in the case of two stocks the condition of (4.2) always yields the existence of relative arbitrage opportunities over any time horizon.

Section 6 differs from the earlier ones. In Section 5 we considered a fixed market model and formulated conditions on the market model that yield (possibly strong) relative arbitrage opportunities for short-time horizons. These trading strategies might or might not depend on the specific characteristics of . Now, in Section 6, we fix the generating function and then construct market models for which there exist no relative arbitrage opportunities over time horizon for some , but (4.2) holds. To be precise, the models we construct do not satisfy exactly (4.2) but only the local (in time) version (6.1). As pointed out in Remark 6.1, this is done for notational convenience only. Some additional technical assumptions are made on the generating function in Section 6, most importantly that is strictly concave and its second derivative is locally Lipschitz continuous.

The constructed market models not only prevent relative arbitrage and satisfy (6.1), but also yield that is a deterministic function of time. That is, flows along the level sets of the Lyapunov function .

Moreover, Proposition 6.11 yields the existence of a market model, which satisfies the nondegeneracy conditions of Theorem 5.10 but not strictly, and does not allow for relative arbitrage. This shows that the conditions on in Theorem 5.10 are tight; see also Remark 6.12.

While this paper answers some old open questions, it suggests several new ones. The three most important, in our opinion, are the following:

-

1.

Under (4.2) with , strong relative arbitrage opportunities exist on for all . In Section 6, market models are constructed that satisfy (4.2) but do not admit relative arbitrage opportunities on , for some real number . What can be said for time horizons with ? In this connection, see also Remarks 6.6, 6.9, and 6.17.

-

2.

The following question arises from the methodology used in Section 6 to construct the counterexamples. Assume a diffusion lives on a submanifold of , which is incompatible with a martingale structure (e.g., on a sphere). If we now want to turn the diffusion into a martingale, how will the submanifold evolve through (e.g., it could turn into an expanding sphere)? In this connection, see also Remark 6.15.

-

3.

Section 6 contains examples for diffusions, which could be turned into market models where short-term relative arbitrage is impossible but long-term relative arbitrage is possible. There are no additional frictions (e.g., trading costs, etc.) necessary to achieve this. Are there any interesting economic implications and, if so, what are they? For instance, can such models arise from equilibrium theory in an economy where agents have preferences with respect to different time horizons?

References

- Bally et al., (2016) Bally, V., Caramellino, L., and Pigato, P. (2016). Diffusions under a local strong Hörmander condition. Part II: tube estimates. Preprint, arXiv:1607.04544.

- Banner and Fernholz, (2008) Banner, A. and Fernholz, D. (2008). Short-term relative arbitrage in volatility-stabilized markets. Annals of Finance, 4(4):445–454.

- Delbaen and Schachermayer, (1994) Delbaen, F. and Schachermayer, W. (1994). A general version of the Fundamental Theorem of Asset Pricing. Mathematische Annalen, 300(3):463–520.

- Fernholz, (2002) Fernholz, E. R. (2002). Stochastic Portfolio Theory, volume 48 of Applications of Mathematics (New York). Springer-Verlag, New York. Stochastic Modelling and Applied Probability.

- Fernholz, (1999) Fernholz, R. (1999). Portfolio generating functions. In Avellaneda, M., editor, Quantitative Analysis in Financial Markets. World Scientific.

- Fernholz and Karatzas, (2005) Fernholz, R. and Karatzas, I. (2005). Relative arbitrage in volatility-stabilized markets. Annals of Finance, 1(2):149–177.

- Fernholz and Karatzas, (2009) Fernholz, R. and Karatzas, I. (2009). Stochastic Portfolio Theory: an overview. In Bensoussan, A., editor, Handbook of Numerical Analysis, volume Mathematical Modeling and Numerical Methods in Finance. Elsevier.

- Fernholz et al., (2005) Fernholz, R., Karatzas, I., and Kardaras, C. (2005). Diversity and relative arbitrage in equity markets. Finance and Stochastics, 9(1):1–27.

- Jacod and Shiryaev, (2003) Jacod, J. and Shiryaev, A. N. (2003). Limit Theorems for Stochastic Processes. Springer, Berlin, 2nd edition.

- Karatzas and Kardaras, (2007) Karatzas, I. and Kardaras, C. (2007). The numéraire portfolio in semimartingale financial models. Finance and Stochastics, 11(4):447–493.

- Karatzas and Ruf, (2016) Karatzas, I. and Ruf, J. (2016). Trading strategies generated by Lyapunov functions. Preprint, arXiv:1603.08245.

- Karatzas and Shreve, (1991) Karatzas, I. and Shreve, S. E. (1991). Brownian Motion and Stochastic Calculus, volume 113 of Graduate Texts in Mathematics. Springer-Verlag, New York, second edition.

- Karatzas and Shreve, (1998) Karatzas, I. and Shreve, S. E. (1998). Methods of Mathematical Finance. Springer.

- Kunita, (1974) Kunita, H. (1974). Diffusion Processes and Control Systems. Course at University of Paris VI.

- Kunita, (1978) Kunita, H. (1978). Supports of diffusion processes and controllability problems. In Proceedings of the International Symposium on Stochastic Differential Equations (Res. Inst. Math. Sci., Kyoto Univ., Kyoto, 1976), pages 163–185. Wiley, New York-Chichester-Brisbane.

- Pal, (2016) Pal, S. (2016). Exponentially concave functions and high dimensional stochastic portfolio theory. Preprint, arXiv:1603.01865.

- Ruf, (2011) Ruf, J. (2011). Optimal Trading Strategies Under Arbitrage. PhD thesis, Columbia University, New York, USA. Retrieved from http://academiccommons.columbia.edu/catalog/ac:131477.

- Schweizer, (1992) Schweizer, M. (1992). Martingale densities for general asset prices. Journal of Mathematical Economics, 21:363–378.

- Stroock, (1971) Stroock, D. W. (1971). On the growth of stochastic integrals. Z. Wahrscheinlichkeitstheorie und Verw. Gebiete, 18:340–344.

- Stroock and Varadhan, (1972) Stroock, D. W. and Varadhan, S. R. S. (1972). On the support of diffusion processes with applications to the strong maximum principle. In Proceedings of the Sixth Berkeley Symposium on Mathematical Statistics and Probability (Univ. California, Berkeley, Calif., 1970/1971), Vol. III: Probability Theory, pages 333–359. Univ. California Press, Berkeley, Calif.