Li

Inverse Optimization of Convex Risk Functions

Inverse Optimization of Convex Risk Functions

Jonathan Yu-Meng Li \AFFTelfer School of Management, University of Ottawa, Ottawa, Ontario K1N6N5, Canada, \EMAILJonathan.Li@telfer.uOttawa.ca

The theory of convex risk functions has now been well established as the basis for identifying the families of risk functions that should be used in risk-averse optimization problems. Despite its theoretical appeal, the implementation of a convex risk function remains difficult, as there is little guidance regarding how a convex risk function should be chosen so that it also well represents a decision maker’s subjective risk preference. In this paper, we address this issue through the lens of inverse optimization. Specifically, given solution data from some (forward) risk-averse optimization problem (i.e., a risk minimization problem with known constraints), we develop an inverse optimization framework that generates a risk function that renders the solutions optimal for the forward problem. The framework incorporates the well-known properties of convex risk functions—namely, monotonicity, convexity, translation invariance, and law invariance—as the general information about candidate risk functions, as well as feedback from individuals—which include an initial estimate of the risk function and pairwise comparisons among random losses—as the more specific information. Our framework is particularly novel in that unlike classical inverse optimization, it does not require making any parametric assumption about the risk function (i.e., it is non-parametric). We show how the resulting inverse optimization problems can be reformulated as convex programs and are polynomially solvable if the corresponding forward problems are polynomially solvable. We illustrate the imputed risk functions in a portfolio selection problem and demonstrate their practical value using real-life data.

1 Introduction

The theory of convex risk functions, established since the work of Artzner et al. (1999) and later generalized by Föllmer and Schied (2002), Ruszczyński and Shapiro (2006), and others, has played a central role in the development of modern risk-averse optimization models. The work of Ruszczyński and Shapiro (2006) in particular brings to light the intimate relationship between convex risk functions and optimization theory and provides necessary tools for analyzing the tractability of risk-averse optimization problems involving convex risk functions. The unified scheme that Ruszczyński and Shapiro (2006) provided through convex analysis also explains the success of several convex risk functions that have now been widely applied for risk minimization, among which the most well known is arguably Conditional Value-at-Risk (CVaR) (Rockafellar and Uryasev (2000)).

It was however not for the purpose of optimization (i.e., risk minimization), at least not solely, that the theory was first established. Rather, the motivation lay in the need for alternative measures of risk that could better characterize how individuals perceive risk. For example, the property of convexity, which led to the term “convex” risk function, was postulated by the theory as an essential and universal characteristic of how risk-averse individuals would perceive risk, namely that diversification should not increase risk. The industry-standard measure of risk, Value-at-Risk (VaR), unfortunately does not satisfy the property of convexity, whereas CVaR, as its counterpart, which does satisfy convexity, has become a popular theory-supported alternative. Other properties of the theory that have also been widely referenced in justifying the choice of a measure for risk include monotonicity and translation invariance (Föllmer and Schied (2002)), law invariance (Kusuoka (2001)), positive homogeneity (Artzner et al. (1999)), and comonotonicity (Acerbi (2002)), among others. Each of these properties represents a certain well-grounded rationale for how risk might be perceived over random variables. Some are applicable fairly generally (e.g., monotonicity and law invariance), whereas some others can be domain dependent (e.g., positive homogeneity and comonotonicity).

However, despite the general attractive features of convex risk functions from the point of view of both optimization and risk modelling, very little guidance has been provided to date regarding how to choose a convex risk function that can also well represent a decision maker’s subjective perception of risk. In current practice, the choice of a convex risk function is mostly ad hoc and involves very little knowledge of decision makers’ true risk preferences. This raises the question of how ones’ risk preferences may be observed and how to generate a convex risk function that complies with the observed preferences. Delage and Li (2018) appear to be the first to address this question, by proposing a means to construct a convex risk function from the assessments provided by the decision maker, who compares pairs of risky random losses. Their work is closely related to the scheme of preference (or utility) elicitation (see, e.g., Clemen and Reilly (2014)), where queries are considered for extracting users’ preferences in establishing their utility functions. One of the main challenges facing this line of inquiry is that in reality decision makers may only be able to provide limited responses because of potential time and cognitive constraints, and thus the elicited preference information is often incomplete. This situation is formulated in Delage and Li (2018) as a preference robust optimization problem where a worst-case risk measure is sought that complies with a finite number of pairwise preference relations elicited from the decision maker. Similar ideas can be found also in the context of expected utility theory. Armbruster and Delage (2015) and Hu and Mehrotra (2015) consider the formulation of a worst-case expected utility function based on limited preference information, whereas Boutilier et al. (2006) considers a worst-case regret criterion over utility functions.

In this paper, we attempt to provide an alternative perspective on the search of a convex risk function that takes into account decision makers’ true risk preferences, namely through the lens of inverse optimization. The motivation is that in many current applications, it becomes possible to have access to the record of the decisions made by individuals, and the past decisions, if optimal, provide useful preference information. Such kinds of preference information may be viewed as a special form of pairwise preference relations, where the random variable chosen according to a made decision is considered preferable to the random variables that could be chosen by alternative decisions. In the case that the alternative decisions are finite, the pairwise preference relations are also finite, which can then be handled by existing frameworks such as Delage and Li (2018). However, this work emphasizes the case where the alternative decisions may be described through a convex set, which leads to infinitely many pairwise relations that existing frameworks cannot handle. Moreover, we also recognize that, in practice, even though individuals may perceive risk differently, they often start by agreeing upon some seemingly reasonable risk measure. They then adjust their measurement of risk after receiving more precise preference information. One such example is that many investors tend to follow the principle of safety first (Roy (1952)), which states that the top concern of an investor is to avoid a possible catastrophic event. They would thus naturally start by choosing a downside risk measure that they feel safe enough to apply (e.g., Fabozzi (2015)). For example, this could be the CVaR risk measure that has now been widely applied in various areas. Although staying aligned with the downside risk measure is desirable, decisions made by individuals are often inconsistent with (e.g., more aggressive than) what the risk measure prescribes. In this paper, we refer to such a risk measure as a reference risk function, which should be followed closely before more precise preference information can be revealed. A natural framework to address the above issues is the setup of inverse optimization; namely, given the solutions for some forward problem (i.e., a decision optimization problem with known constraints), the inverse problem seeks a risk function that renders the solutions optimal for the forward problem by minimally deviating from the reference risk function. Our formulation of the inverse problem will allow for incorporating preference information in both the forms of pairwise relations and “most preferable” decisions in convex sets of alternatives, and also the important properties of convex risk functions, namely the monotonicity, convexity, translation invariance, and law invariance. We show how the resulting inverse optimization problems can be tractably analyzed by applying conjugate duality theory (Rockafellar (1974)).

To the best of our knowledge, little has been discussed in the literature about inverse optimization for convex risk functions. Bertsimas et al. (2012) considered inverse optimization for a financial application involving the use of coherent risk measures, but they assumed that the measure is given a priori and focused instead on the estimation of parameters characterizing random returns and risk budgets. Iyengar and Kang (2005) also applied inverse optimization to estimate parameters of expected returns in a financial problem. More generally, inverse optimization methods have been developed for linear programs (Ahuja and Orlin (2001), Dempe and Lohse (2006)), conic programs (Iyengar and Kang (2005)), and convex separable programs (Zhang and Xu (2010)) for estimating the parameters that characterize the programs. Early works also include Burton and Toint (1992), Zhang and Liu (1996), and Hochbaum (2003), who focused on network and combinatorial optimization problems (see Heuberger (2004) for a survey), whereas more recent works include Schaefer (2009) on integer programs, Chan et al. (2014) on multi-objective programs, Ghate (2015) on countably infinite linear programs, Chan et al. (2018) on the issue of sub-optimality of an observed solution, and Keshavarz et al. (2011), Bertsimas et al. (2014), Aswani et al. (2015), and Mohajerin Esfahani et al. (2015) on various issues related to the observations of multiple responses from an agent solving a parametric optimization problem.

In much of the literature referenced above, the problems are structured in a parametric fashion, and the goal is to estimate the parameters that characterize the forward problems from observed decisions. However, the parametric assumption is too limiting for the purpose of identifying a decision maker’s true risk function because it restricts the class of functions to which the true risk function may belong. It also provides no guarantee regarding the convergence to the true risk function even if some elicited information, such as pairwise preference relations, is available. In contrast, the inverse optimization formulations presented in this paper are parameter-free and search over the entire space of convex risk functions for the true risk function. With the collection of more elicited information, their solutions can converge to the true risk function, if it is a convex risk function. In this sense, our work broadens the scope of inverse optimization and opens the door for nonparametric approaches to function estimation through inverse optimization. However, we should note that Bertsimas et al. (2014) provide a kernel method for inverse optimization, which can also be considered non-parametric. While their method focuses on estimating a function characterizing all the subgradients associated with an unknown function, the method developed in this paper addresses directly the estimation of the unknown function. More detailed discussions along this line are provided later in Section 3. We should also mention that the inverse problem considered in this paper generally falls into the class of inverse problems that focus on estimating the objective function of an optimization problem. Although this class of inverse problems is known to be tractable in a parametric setting, the class of inverse problems that seek to impute parameters defining the feasible region of an optimization problem is generally much less tractable (see, e.g., Birge et al. (2017)). This paper’s focus on the former may help explain why tractably solving the inverse problem, even in a non-parametric setting, is a reasonable hope.

Our formulation of the inverse problem does require, albeit implicitly, an assumption that may affect the scope of application of our inverse models, and we should point it out here. Namely, our formulation assumes that in the case where decisions are based on some probabilistic views (or beliefs) of the decision makers, these views (i.e., the probabilistic assessments of random outcomes), either stay unchanged over time or, if not, can always be disclosed together with the decisions made. This may not always be possible because some decision makers may only have a vague sense of probability driven by their intuition and find it cognitively too demanding to articulate how their views change over time. As extensively discussed in this paper, while it is possible to address the case where decision makers take no view or a constant (personal) view on the likelihood of outcomes, namely by applying non-law-invariant risk functions, it remains an open question as to how a (law-invariant) risk function can possibly be learned from past decisions when the decision makers did hold different probabilistic views over time but were not able to disclose them. This question is important because the scenario, as described, could happen in practice; and from a statistical point of view, the use of law-invariant risk function can be necessary. As a preliminary step, we have conducted some experiments, which we describe in this paper, to examine first how the performances of the solutions optimized based on imputed risk functions may be affected by the misspecification of probability distributions in our inverse models (i.e., distributions applied in the models are inconsistent with the actual views of the decision maker). We observe that, despite the misspecification, the performances can still be noticeably improved towards the optimal performances as more decision data are incorporated into the inverse models. However, it still requires the full development of a formal and rigorous theory to satisfactorily answer the question, and we leave this for future study.

One natural application of our inverse optimization framework is to identify a risk function that captures the risk preference of an investor from his/her past investment decisions (see, e.g., Delage and Li (2018)). While this is the application that we primarily focus on in this paper, we should point out that our framework can also be naturally applied to other settings that involve budget allocation decisions under uncertainty. For instance, Haskell et al. (2018) consider a setting of homeland security and the problem of learning the risk preference of the Department of Homeland Security (DHS), which makes decisions to allocate budget across a number of cities so as to protect them from potential terrorist attacks. While covering these other applications in depth may go beyond the scope of this paper, the framework established in this paper shall provide the basis for further exploring these other applications.

We briefly summarize our main contributions below:

-

1.

We develop for the first time an inverse-optimization framework for convex risk functions that generates a risk function incorporating the following information: 1) the properties of monotonicity, convexity, translation invariance, and law invariance promoted in the theory of convex risk functions, 2) observable optimal solutions from forward problems, 3) a reference risk function, and 4) elicited pairwise preference relations.

-

2.

We formulate the inverse optimization problem in a non-parametric fashion and show that for a large number of cases, the computational tractability of the inverse problem is largely determined by the forward problem: namely that the former is polynomially solvable if the latter is so.

-

3.

Methodologically speaking, we show that to solve the inverse problem it suffices to search over a particular class of risk functions for an optimal solution. This class of risk functions is representable in terms of the random variables resulting from the observed decisions and a fixed set of parameters. Based on this representation, the inverse problem reduces to determining the values of the parameters in the representation, and these values correspond to the amounts of risk estimated for the chosen random variables. The number of parameters needed in the representation is set by the number of observed decisions. This offers an intuitive and computationally tractable interpretation of the (non-parametric) inverse problem.

-

4.

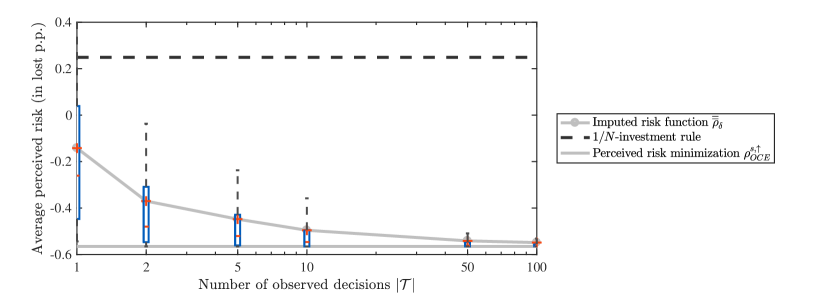

We demonstrate the application of our framework in a portfolio selection problem and provide computational evidence that the imputed risk functions utilize well the preference information contained in observable solutions and a reference risk function. This leads to a solution that can be well justified in terms of both its performance evaluated based on the true risk function and the reference risk function. We also demonstrate how quickly the performances of the solutions optimized based on the imputed risk functions can converge to the performances of the solutions optimized based on the true risk function, as the number of observed decisions increases.

2 Forward and Inverse Problem of Risk Minimization

We begin by formalizing the forward problem of risk minimization and characterizing the problem using the theory of convex risk functions. We then proceed to the formulation of the inverse problem.

2.1 Forward problem of risk minimization

Our general setup of the forward problem follows closely the setup in the literature of choice over acts (i.e., random variables ) (Savage (1954)). In this setup, it is assumed that a decision maker’s preference over random variables can be specified and that the forward problem seeks the most preferable random variables. In the special case where a probability measure can be identified over the sigma-algebra of sample space , the preference can be alternatively defined over the distributions, denoted by , of the random variables. This special case is considered in the literature of choice over lotteries (i.e., distributions) (Von Neumann and Morgenstern (1944)).

We will first continue formalizing the forward problem under the general setting, and the special case will follow naturally as we proceed. Without loss of generality, we assume that any random variable represents some form of loss, by which we mean that it has the interpretation that for any , the larger the value of is, the worse it is. We denote by a system of preference relations that is complete, transitive, and continuous 111These are the conditions required to ensure that there exists a function that captures the system of preference relations (Debreu (1954))., where denotes that is preferred to . A risk function is a numerical representation that captures the preference relation in terms of the riskiness of random losses (i.e., a random loss is preferable if it is perceived less risky). In this paper, we will focus on the case where a risk function is defined over random losses based on a sample space with finitely many outcomes . In this setting, any random loss can be represented also by a vector , where , and the random loss resulting from a decision can be written by . If a random loss is perceived at least as risky as (i.e., ), the risk function should satisfy . Accordingly, a solution is optimal if and only if it satisfies ), , and a risk minimization problem can be formulated as

| (1) |

Throughout this paper, we assume that the function is convex in (i.e., is convex in for all ), and the feasible set is a convex set.

It is hypothesized in the theory of convex risk functions (Föllmer and Schied (2002)) that any risk function that represents a reasonable or “rational” preference system would satisfy certain axioms. The most widely known ones are the following three:

-

1.

(Monotonicity) for any ,

-

2.

(Convexity) , where , and

-

3.

(Translation Invariance) .

The first axiom, monotonicity, captures the fact that any reasonable preference system would never prefer a random loss that is known to have higher loss for any possible outcome (i.e., any , such that , must lead to ). The axiom of convexity describes the diversification preference, namely that any convex combination (diversification) must be (at least equally) preferable to non-diversified counterparts (i.e., or ). Lastly, translation invariance is necessary when a monetary interpretation of risk is required, which is the case in finance where a deterministic amount such as cash can always be used to offset the risk by the same amount. The corresponding preference system is insensitive to any constant amount added to or subtracted from all random losses (i.e., ). Based on these three axioms, we define the following class of functions that capture risk-averse preferences.

Definition 2.1

(Risk-averse functions) Let denote the set of functions that satisfy axioms (1)–(3) and .

The condition is imposed for the purpose of normalization so that risk estimated based on different risk functions is comparable. We now also formalize the special case where a probability measure can be defined over . This naturally leads to the consideration of the following axiom for a risk function (see, e.g., Kusuoka (2001)).

-

4.

(Law Invariance) , for any (distributionally equivalent).

The above axiom immediately implies that the risk function in this case is essentially a function of distributions. We define the following class of functions when the distributions for all random variables are available.

Definition 2.2

(Law-invariant risk-averse functions) Let denote the set of risk-averse functions that are law invariant. Without loss of generality, we can equivalently write as (i.e., a function of distributions ).

Depending on the decision maker’s knowledge about the distribution, one may decide which class of risk functions (i.e., risk-averse versus law-invariant risk-averse) is more appropriate to assume in defining the forward problem. In particular, we provide the following examples, which cover three possible cases: the case with no distribution, the case with ambiguous distributions, and the case with a specific distribution. The first two cases can be treated as special cases of our general setup (i.e., preference over acts), whereas the third case invokes the property of law invariance.

Example 2.3

(General case) If a decision maker’s choices are made by knowing only that there are possible outcomes for the uncertain losses, we may assume that the individual solves a forward problem based on a certain risk-averse function .

Example 2.4

(Distributional ambiguity) If a decision maker actually has in mind a certain distribution-based convex risk measure , where denotes the distribution, for evaluating risk but is concerned about the estimation error associated with an empirical distribution , we may assume that she is ambiguity-averse and that her choices follow a distributionally robust version of the risk measure. Namely, it can take the following form with uncertain probability :

where measures the difference between two distributions and is usually defined based on some -divergence function (see Ben-Tal et al. (2013) for more details). It is not hard to confirm that in this case . Of course, in reality we do not know the structure of and and may assume only that the true risk function is a risk-averse function .

Example 2.5

(Known Distribution) Suppose that a decision maker can identify which distribution to use in and that the information about the distribution is available. In this case, we may assume that the individual solves a certain law-invariant risk-averse function based on the distribution .

Remark 2.6

One scenario that can also be of practical interest but is not covered above is the case where a decision maker solves some distribution-based risk measure but the individual does not reveal which distribution is used. While it remains possible to address this case if stays unchanged over time, namely by assuming that the true risk function is a risk-averse function because for a fixed , it becomes less clear how to address the case when the distribution may differ from one time point to another. In the latter, the observed decisions can actually appear inconsistent with the assumption . This can be easily seen by considering for instance the case where the decision maker’s true risk function is the simple expected value function. We may observe between two random variables and that at one point and at the other point based on two different distributions and . Clearly, there exists no that can capture such preferences. For this reason, we find it necessary to assume throughout this paper that in the case where the decision makers applied different distributions, these distributions can always be disclosed together with the decisions made. Later in the numerical section, Section 5.2, we will revisit this assumption and address the case where the disclosed distributions may not be fully accurate.

2.2 Inverse problem of risk minimization

In the inverse problem, the risk function is unknown, but one has access to decisions made according to forward problems as defined in the previous section. The goal is to generate a risk function that renders the observed decisions as optimal as possible in the forward problem. Specifically, let represent each observation, which denotes that was made with respect to the random vector and the feasible region . We can write down the following optimality condition that characterizes the risk function through the observed decisions.

- Optimality Condition:

-

Given a list of observations , where , the set of risk functions that render the decisions optimal admits

Note that the risk function does not depend on (i.e., the decision maker’s risk preference is assumed to stay constant when the past decisions were made). In the case where is small, the above set may not be sufficient to build a meaningful inverse problem, since it can contain some degenerate form of functions. It would thus be necessary to assume that some “prior” knowledge about the risk function can be acquired. The most direct way to acquire such knowledge is through preference elicitation (e.g., Clemen and Reilly (2014)) where the decision maker would be asked to make comparisons among a selective list of random variables. We can also borrow the concept of reference solution from the literature of inverse optimization, which stands for a solution that can be used as a reference while searching for an alternative better solution.

- Elicited Preference Relations:

-

Given a list of pairs of random losses , where , that satisfy for , we define the set

- Reference Risk Function:

-

Given a reference risk function and a parameter that describes the maximum discrepancy between the candidate risk function and the reference risk function, the following set of risk functions can be defined accordingly:

where stands for the infinity norm defined over functions .

Remark 2.7

The constraints defining can also be viewed as a special case of the constraints inferred from preference elicitation. While the random losses considered in are “forward-problem” dependent, in preference elicitation any pair of random losses may be considered for comparison. We take such a unified perspective in formulating the inverse problem.

Remark 2.8

It is worth mentioning here that it is also possible to consider norms other than the infinity norm in the definition of . For instance, one might consider norm for some probability measure . However, it may not be clear whether this is practically useful because one may find it hard to specify the measure and to interpret the norm. In the case where is discrete, which requires only comparing and over finite points, the analysis presented in this paper can easily accommodate such a case.

With the above definitions of , , and , one may consider different criteria to determine which risk function described by the above sets is the optimal choice. In particular, we consider the following four criteria. The first three are primarily concerned about the fitting of risk levels, whereas the fourth one addresses the fitting of prescribed decisions. The first criterion follows most closely the spirit of classical inverse optimization.

-

1.

Minimizing the deviation from the reference risk function :

subject to

This model assumes that in addition to capturing the preferences implied by the observed decisions, there is a practical need to stay aligned with the reference risk function whenever possible. As mentioned in the introduction, the reference risk function can for example be the CVaR risk measure used to implement the safety-first principle. In general, one can apply the model to generate an alternative risk function that not only renders the observed decisions optimal but also maximally aligns with the chosen downside risk measure.

One may argue that in some cases the observed decisions might not be “rigorously” optimal given that human beings are not perfectly rational. We can accommodate such a possibility by replacing the set with the following set based on sub-optimality:

Thus, if observed decisions are known to be sub-optimal, the following model may be considered that seeks to close the optimality gap.

-

2.

Minimizing the sub-optimality of observed decisions:

subject to where is fixed beforehand.

Here, one’s priority is to ensure that the imputed risk function will render the observed decisions as favorable as possible. One may choose to set if needed. The central idea behind this model is that the observed decisions, albeit sub-optimal, still closely follow the decision maker’s true preference. However, if the accuracy of the decision data is in doubt, one may instead fix to some value larger than the optimal solution in (2). Moreover, if the concern is about potential risk underestimation, the following model provides a means to examine the worst possible risk.

-

3.

For any , seek a worst-case risk function 222Although it may not be immediately obvious, one can actually confirm that the worst-case function is itself a feasible solution to the constraints in (3) (see Lemma 9.1) and hence the problem can be equivalently stated as: seek a function such that :

subject to where and are fixed beforehand.

The last criterion we consider is closely related to the idea behind the second criterion, where the goal is to reconcile the decision data. The difference is that not only do we like to ensure the optimal solution generated from the imputed risk function is aligned with the decision maker’s risk preference, but we also want the solution itself to be close to the observed decision. To formalize this, we define the following set parameterized by a decision :

Note that to facilitate our later discussion in Section 4, we consider here only the case of single observation indexed by (indicating the most recent observation). Clearly, by fixing , the above set reduces to . Our last criterion can be modelled as follows.

-

4.

Minimizing the deviation from an observed decision:

subject to where is an arbitrary norm and is fixed beforehand.

More detailed discussion about the case of multiple observations will be given in Section 4. The above model is particularly useful when there is a preference for the status quo decision . For instance, an investor can prefer that the portfolio generated from the imputed risk function does not differ much from his most current portfolio.

3 Solving the Inverse Problems

In this section, we address first the inverse problems (1)–(3). In particular, we will base our discussions primarily on the inverse problem (1), which best highlights the fundamental complexity behind all the inverse problems. Once we walk through the steps it takes to resolve the complexity, it will also be clear how to solve inverse problems (2)–(3). To put the problem into perspective, let us recast first the inverse problem (1) into

| (8) | |||||

where and .

The above problem cannot be solved by traditional analysis for inverse optimization due to the non-parametric nature of the risk function . In a more specialized setting where one removes the optimality constraints (8) and replaces the norm by a norm that requires only comparing and over finite points (see Remark 2.8), the problem might be solvable based on the non-parametric method developed in Delage and Li (2018). This method hinges on the observation that if only finitely many points need to be compared (e.g., (8) involving only pairs), the problem can be reduced to a finite-dimensional convex program whose size grows polynomially with the number of points needing comparison. Unfortunately, in the setting of the above inverse problem, because of the infinity norm and the optimality constraints (8) it necessarily involves infinitely many points (e.g., ) that must be compared and thus renders the method of Delage and Li (2018) inapplicable.

While these difficulties may put in doubt the tractability of the inverse problem (8)–(8), our key finding is that it is possible to bypass the difficulties by new analysis based on conjugate duality theory (see, e.g., Rockafellar (1974)). Our goal here is to present from a high-level perspective the key analysis steps to approach the problem. The technical details of the theory and proofs can be found in Appendix 7 and 10.

3.1 Imputing risk-averse functions

We start by considering the general case where the observed decisions to a forward problem were made over acts, as described in Example 2.3. That is, we intend to solve the inverse problem (8)–(8) with . From here on, we make the following assumption about the reference risk function .

Definition 3.1

A risk function is called a coherent risk measure if and it further satisfies for any (scale invariance).

The reference risk function is a coherent risk measure.

The above assumption is not stringent because most risk measures applied in practice are coherent risk measures. Moreover, we apply the following well-known representation result of coherent risk measures and assume that such a representation is available (see Appendix 8 for the representations of several popular risk measures).

Theorem 3.2

(Artzner et al. (1999)) Any coherent risk measure admits the supremum representation of

| (9) |

where is a non-empty, closed, convex set of probability measures (i.e., with ).

For convenience, in this paper we say that the coherent risk measure is supported by the set . Our first observation to solving the inverse problem (8)–(8) is that it is possible to identify a subset of risk functions that is “sufficiently” large to contain an optimal solution to the inverse problem. We rely on the following definition to characterize this subset of risk functions.

Definition 3.3

Given a set of random losses for some and a set , we say that a function is supported by the pair if it belongs to the following set of functions:

We also need the following definition that will be applied throughout the rest of this paper.

Definition 3.4

Let be the random losses in the union . Without loss of generality, we assume .

Proposition 3.5

Given that Assumption 3.1 holds and the set of optimal solutions is non-empty, there must exist a function , where is the set that supports the reference risk function , which is optimal to the inverse problem (8)–(8). Moreover, given any optimal solution to the inverse problem (8)–(8), there always exists a function that is also optimal and bounds from above the solution :

| (10) |

namely, by setting , .

Proof 3.6

Proof of Proposition 3.5 The general strategy of the proof is to show that if there exists a risk function that is optimal to the inverse problem with some optimal value , there must exist a risk function that is also optimal to the problem, namely by setting

We leave the details of confirming this claim and that it implies (10) to Appendix 10. \Halmos

The above result implies firstly that there is no loss of optimality if we restrict our search of an optimal solution to the set . This significantly reduces the complexity of solving the inverse problem (8)–(8) because the search over the set can be effectively done by searching the space of parameter . This provides the assurance that even though one cannot identify a decision maker’s risk function through any parametric form, it is still possible to learn the risk function by tuning only a finite number of parameters (i.e., many parameters). Moreover, we know from the inequality (10) that in the case where the optimal solution to the inverse problem is not unique, the optimal solution found in the set would be the most “robust” because it provides the most conservative estimate of risk. What can appear counterintuitive is that the representation of does not depend on the feasible set , and one may wonder how an imputed risk function then takes into account the information about the set . The short answer is that the information would be incorporated into the risk function when it comes to the point of determining the value of the parameter 333 To provide a better grasp of this, let us suppose for now that one is able to efficiently determine if belongs to the following set: Then, one can quickly confirm that because of (10) there exists such that will necessarily satisfy the optimality condition (i.e., ). Indeed, we have . This explains why the complexity actually lies in dealing with the set . It is not necessarily clear, however how one can tractably search over the set . The fact that suggests that we may first consider the relaxed problem of searching over the set .. To show how the value of can be calculated, we first need the following intermediate result. The result shows that searching over the set can be equivalently formulated as a finite-dimensional system of constraints over the parameter where the solution corresponds to how function values may be assigned over the set that supports the risk function.

Proposition 3.7

Given any , there must exist , such that satisfies the following system of constraints:

Conversely, given any solution that satisfies the system below:

| (11) | |||

there must exist a that satisfies , namely the function

| (12) |

We next show that by restricting ourselves to the search in the set , we can also identify how to search in the subset Namely, it is equivalent to adding additional constraints to the system (11). This final system comprises finite-dimensional convex constraints.

Proposition 3.8

Given any , the function further satisfies if and only if there exists , such that satisfies the following system:

| (13) | |||

| (14) | |||

| (15) | |||

| (16) |

where and .

One can thus resort to solving the above system (13)–(16) to determine more efficiently the values of the parameters , , so that its corresponding risk function would necessarily satisfy all the imposed conditions. It is also clear at this point that the above system indeed incorporates the information about the set (i.e., in the definition of ).

As the final step, we discuss how to ensure that the risk function also minimizes the objective function . It turns out that the absolute difference between and at any random loss can always be bounded by the difference at one of the random losses from the set (which supports the risk function ). This is due to the piecewise linear structure embedded in the representation of (i.e., the term 444In particular, the linearity of each piece in the term has the implication that the largest difference can always be found at the support points , .). As a result, we need only to seek a risk function that minimizes the absolute differences over finite points (i.e., ). Combining this with the above observation that can be found by solving a finite-dimensional convex system over the parameter , we arrive at the conclusion that to solve the inverse problem (1), one only needs to solve a convex program over the parameter . This main result is presented below, and its detailed proof can be found in Appendix 10. We note here that the steps we present to analyze the problem are particularly important from a methodological perspective. This for example enables us to unravel the more complicated case presented in the next section.

Theorem 3.9

Given that Assumption 3.1 holds and that the set of optimal solutions is non-empty, the inverse optimization problem (1) can be solved by a risk function , where is the support set of the reference risk function and the parameter is calculated by solving

| (17) | |||||

The problem (17) is a convex optimization problem and is polynomially solvable if

-

1.

given any , the forward problem is polynomially solvable in the case where for any , and

-

2.

the support set for is equipped with an oracle that can for any either confirm that or provide a hyperplane that separates from in polynomial time.

Intuitively, the above theorem summarizes a two-step procedure to identify an optimal risk function to the inverse problem (1). First, it computes the parameter by solving (17) so that it can determine the function values over finite points , namely by setting , . Then, it interpolates (and extrapolates) other function values (i.e., for any ), based on the structure of (i.e., the definition of the set ). It is guaranteed by the theorem that a risk function interpolated (and extrapolated) as such will necessarily satisfy all the imposed conditions and reach the optimal value. The main computational complexity of the procedure lies in solving the problem (17), whose complexity, roughly speaking, is in the same order of the complexity of the forward problem. It is thus assured by the theorem that one can always efficiently learn decision makers’ risk preference from their past decisions as long as the forward problems that they solved are amenable to efficient solution methods. This is the case, for example, when one tries to learn about investors’ risk functions from their past investment decisions, given that many portfolio selection problems (i.e., the forward problem) can be solved efficiently. Note that the condition about the oracle is very mild, which is usually required for proving any general tractability result. Note also that the problem (17) can be solved efficiently as a conic program (Nemirovski (2007)), under mild regularity conditions, if the forward problem and the set are conic representable.

To help deepen one’s understanding and intuition about how the function values are interpolated (and extrapolated), we present the following two alternative formulations of .

Corollary 3.10

The risk function can be equivalently formulated as

It can also be formulated as

where . In the case and , we have

The first formulation of indicates that once the parameter is determined, the function then evaluates any random loss by a linear function that bounds from below all s (i.e., all assigned function values over ) as tightly as possible subject to its sub-gradient bounded by . In the second formulation, the definition of the set is well known in the risk theory (see, e.g., Artzner et al. (1999)), which stands for an “acceptance set” (i.e., the set of random losses with acceptable (non-positive) risk). In particular, here the function value can be translated into the minimum amount of cash (i.e., constant ) required to render the final loss acceptable (i.e., lying in the set ). This sub-level set, as shown above in the second formulation of , can be viewed as a monotone convex set generated from the non-negative span of the sets and . This sheds light on how the whole contour (which determines for any value) is interpolated (and extrapolated) once is determined: namely, having set , over the finite points is equivalent to fixing first the points on the boundary of . Then, the rest of the boundary of is interpolated by spanning a cone from at every point in the monotone convex hull of .

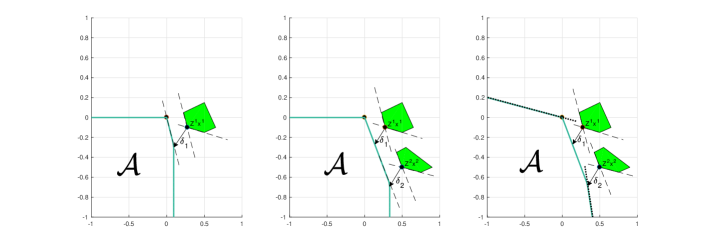

Figure 1 provides an illustration, in two states, of the updates of as more information is acquired. In each of the plots, the level set is drawn over losses bounded between -1 and 1. Note that because of the property of translation invariance, this level set completely characterizes the risk function 555That is, , which implies that any other level set is just the zero-level set shifted along by .. In all three plots, we consider a decision maker optimizing a linear function , where , subject to budget constraints . In the first plot, we have and the observed decision and 0 otherwise. Here, the risk function is updated according to the largest possible that is feasible. To verify this, one can see from the dash lines the range of feasible subgradients that render the decision optimal. For any other convex function that assigns a value larger than (i.e., the level set is “farther” from ), its subgradient at the point will fall outside the range of feasible subgradients. In the next plot, an additional observation is considered. We have and the observed decision and 0 otherwise. One can see that , which is feasible in the first plot, is no longer feasible. This is because to make the subgradients at feasible (i.e., rendering optimal) and retain the convexity of the sublevel set , we must reduce . One would not be able to find any other level set that is farther from (and resp. ) than (and resp. ) and retains the convexity of . In the last plot, we assume that a measure with is provided as the reference risk function , which is supported by the set . Now the values of and can only be feasible if the subgradients at and are “confined” by . Moreover, the set is “extrapolated” by also (e.g., over the points ).

It is valuable to point out here the similarities and differences between our approach and other non-parametric approaches. In particular, Bertsimas et al. (2014) also consider a non-parametric inverse problem, albeit in a very different setting from ours, and show that it is possible to reduce the problem by restricting the search of an optimal solution to a smaller class of functions supported by finite points only. More specifically, they show that to seek a subgradient function that satisfies the optimality conditions

| (18) |

it suffices to search in the set , where is a kernel function. The insight here is that such a class of functions provides sufficient flexibility to locally fit any given values , . There is however a fundamental difficulty to apply this method in our setting: namely that it is not amenable to incorporating global properties such as convexity. On the other hand, the class of functions we consider (i.e., ) can both provide the flexibility for local fitting and incorporate the global properties of convex risk functions. We should note, however, that their kernel approach does not rely on convex analysis as we do in this paper and hence might be useful to handle the case of non-convexity where local and global optimality do not coincide.

Although in a different context there is another non-parametric approach for convex interpolation, which has been successfully applied for instance in regression under the name of convex regression (Boyd and Vandenberghe (2004)). This approach seeks a convex function that best fits observed function values over finite points . The approach involves solving the constraints (13) also to determine the function values over finite points, and it uses a piecewise linear function to interpolate other function values. In this vein, closer to the context of this paper is the work of Delage and Li (2018) mentioned earlier in the section (also Armbruster and Delage (2015)), which in fact involves also solving the constraints (13) to determine function values over finite points and from there to identify the worst-case convex function. Indeed, as these works and our work are both concerned about convexity, the constraint (13) naturally arises. Our work in this sense can be viewed as a generalization of these works: namely that our work further addresses the comparison of function values over infinite points by expanding the system (13) and interpolating via a richer class of functions .

The discussions up to this point have laid enough ground work for solving other inverse problems. In particular, to solve the inverse problem (2), one needs only note that the property of translation invariance enables us to formulate the constraint in equivalently as

Based on the same analysis, we arrive at the following.

Corollary 3.11

To solve the problem (3), we know already from Lemma 9.1 that there exists a feasible function that bounds from above all other feasible functions. Following the proof of Proposition 3.5, one can further confirm that there must exist that bounds from above the risk function . We can thus conclude that it suffices to search in the set for a worst-case risk function by maximizing all s. This can be formulated equivalently as the following problem.

3.2 Imputing permutation-invariant risk-averse functions

We introduce in this section the notion of permutation invariance, which will enable us to identify a subclass of risk-averse functions that can be of practical interest. The notion also provides the basis for the discussion of law invariance in Section 3.3. We say that an operator is a permutation operator over if it satisfies for any , where is a bijective function that permutes over elements. We denote by the set of all permutation operators.

Definition 3.13

(Permutation-invariant risk-averse functions) Let denote the set of permutation-invariant risk-averse functions defined by

Here we should revisit Example 2.4 in Section 2.1, which provides an important class of permutation-invariant risk-averse functions. Namely, any distributionally robust risk measure defined based on a phi-divergence criteria and an empirical distribution satisfies . This is not hard to confirm once one recognizes that the function satisfies . Indeed, although a distributionally robust risk measure provides more conservative estimates of risk, in principle it should not be sensitive to the ordering of given that are built based on samples. More generally, in any case where the decision maker is found to be insensitive to the ordering, one may consider solving the inverse problems by replacing with . Moreover, we should assume in the inverse problems that the reference risk function employed is also permutation invariant. As shown in Lemma 9.3, it is equivalent to making the following assumption. {assumption} The support set of the reference risk function , now denoted by , satisfies .

It is technically involved however to solve the inverse problems that take into account all the possible permutations. In particular, difficulty arises when one seeks a risk function satisfying the optimality condition that now takes the form

where the set is non-convex. However, as detailed in Appendix 10, Proposition 10.6, one can resolve this difficulty by following closely the steps presented in the previous section. Namely, one can apply the following definition to search over the subset , which necessarily contains an optimal solution to the inverse problem, and there again the conjugate duality theory comes to our rescue.

Definition 3.14

Given a support set that is permutation invariant, we say that a function is permutation invariant and supported by the pair if it belongs to the following set of functions

The figure below provides some intuition of the above functions, where we continue the examples presented in Figure 1. In particular, we see that the sub-level set now takes a symmetric shape.

However, there is also the difficulty of handling the size of the inverse problems, which grows exponentially with respect to the input data of because of the need to take into account all the permutations (e.g. , ). We detail also in Appendix 10 how to reduce the problems to programs that grow only polynomially in the size of the input data (e.g., ).

Proposition 3.15

Given that Assumption 3.13 holds and that the set of optimal solutions is non-empty, the inverse problem (8)–(8) with can be solved by a risk function , where is the support set of the reference risk function and the parameter is calculated by solving

| (19) | |||||

where , , , , the set , and denotes the function .

Moreover, the supremum representation in can be reduced to

| (22) | |||||

The fact that the size of the above programs (19) and (22) grows only polynomially, rather than exponentially, with respect to the input data should provide a strong incentive to consider applying the above models. In particular, we should emphasize here that the above models offer an opportunity to learn a decision maker’s risk function potentially much faster, in terms of requiring fewer observations of past decisions to reach certain learning performance, than the models presented in the previous section. Indeed, recall from the representation of the risk function that for each random loss chosen by an observed decision, the representation will automatically incorporate exponentially many more points (i.e., all the permutations of ) and carry over the preference relations learned from to all its permutations. In other words, the above models allow for incorporating “exponentially” more preference information with the “cost” of taking only polynomially longer time to solve the models. This should stress the importance of always checking first whether a decision maker is sensitive or not to the ordering (i.e., for different ). Following the same analysis, we can derive similar results for the inverse problems (2)–(3). For brevity, we defer them to Appendix 9, Corollary 9.5 and 9.6.

3.3 Imputing law-invariant risk-averse functions

As mentioned in Section 2.1, imposing the condition of law invariance on a risk-averse function is equivalent to considering it as a function of distributions. That is, we necessarily assume by default that the distributions of all random variables are available, as discussed also in Example 2.5, Section 2.1. For this reason, we should start by assuming that all elements involved in the inverse problems are distribution-based.

Each entry of the random loss admits the form of , where . The random vector has finite support and a probability distribution that satisfies for .

We also make the following assumption about the reference risk function . {assumption} The reference risk function is law invariant (i.e., ).

The key to solving the inverse problems that account for distributions lies in identifying the connection between the condition of law invariance and permutation invariance discussed in the previous section. Namely, supposing that the probability measure is uniform, one can observe that for any two random losses , that share the same distribution, their vector representations , must satisfy for some . That is, in the case of uniform probability measure, a law-invariant risk measure must satisfy . To exploit this fact further, we make the following mild assumption. {assumption} All probability distributions of random losses take rational numbers as probability values.

In this case, given any discrete probability distribution specified by a pair of support and probability vector (i.e., , where is the Dirac measure with all its weight on ), one can always equivalently express the probability value , by a ratio , for some . The random loss can thus be equivalently defined as a mapping from an outcome space with uniformly distributed outcomes to that satisfies and , . However, it might be costly to implement such a procedure because the constant might need to be large and thus significantly increases the size of the optimization problems (3.15) and (22). In the following proposition, we show that the optimization problems can always be further reduced to programs whose sizes depend (almost) only on the size of the supports of distributions (i.e., ), rather than the size of the outcome space (i.e., ). The proof is deferred to Appendix 10.

Proposition 3.16

Let be the distributions of the random losses in the support set , and each distribution be specified by a pair of such that . Given that Assumption 3.3, 3.3, and 3.3 hold and that the set of optimal solutions is non-empty, the inverse problem (8)–(8) with can be solved by a risk function , where

| (23) | |||||

is the Hadamard product; the coefficient is calculated by , , ; and the parameter is calculated by solving the following optimization problem

where , , , ; ; the set ; and denotes the function . The coefficient is calculated by , , .

Moreover, the above set , can be derived from the set (i.e., the support set of the reference risk function in the case where is uniform) using

| (27) |

where , , and , and stands for an operator associated with that generates a vector in from a vector in the dimension of . Specifically, it replicates each entry of a given vector by many times, where we denote the replications by , and generates a vector in by concatenating the replication vectors (i.e., ).

It is not hard to confirm that the convex programs presented above are similar to those presented in the previous section (see Proposition 3.15). In particular, the programs here would recover the ones presented in Proposition 3.15 if we set the size of the support to be the same across all the distributions and assign equal weight to each support. In other words, there is simply more freedom in these programs to describe distributions in terms of both support and probabilities. More importantly, this extra freedom adds no additional computational burden (in the sense that incorporating this information only affects the parameter values, but not the size, of the above convex programs). Thus, this may provide a further reason to encourage the decision maker to disclose the probability information (see Remark 2.6). Similar results for the inverse problems (2)–(3) can be found in Appendix 9, Corollary 9.7 and Corollary 9.8.

It is the complexity of the set that appears to remain dependent on the size of the outcome space . As shown in the examples below, such a dependency can often be removed by considering more specifically the exact form of the reference risk function . This would thus allow the whole problem in Proposition 3.16 to be recast independently from the exact construction of the sample space. In particular, we consider below the implementation of several popular risk measures as the reference risk function and derive their corresponding set using the relation (27). The distribution here is generally expressed by . The support set required in (27) can be identified through the dual representation of these risk measures (see Appendix 8) with the use of a uniform probability measure (i.e., ).

Example 3.17

(Risk measures and their corresponding set of support )

-

1.

(Maximum loss) The risk function is defined by , and its corresponding set of support is simply

-

2.

(Expectation) The risk function has the following set of support:

-

3.

(Mean-upper-semideviation) The risk function is defined by

and its set of support takes the form

-

4.

(Conditional value-at-risk (CVaR)) The risk function can be defined by

where stands for the generalized inverse distribution function, and its corresponding set of support admits

-

5.

(Spectral risk measures) As a generalization of CVaR, the risk function is defined by

where the function is non-decreasing and satisfies . The function is also known as the risk spectrum. We should note that it is not possible to derive the reduced set that is independent of the sample space for general spectral risk measures because one can always seek a more “detailed” spectrum by increasing the size of the sample space. Even so, for practical purposes, a “step-wise” spectrum, for some and , is usually sufficient, which can approximate any general spectrum to a pre-determined precision. By assuming that takes rational numbers as values, we prove at the end of Appendix 10 that, based on the representation from Example 8.7, the set of support can be reduced to

where and , .

4 Solving the Inverse Problem in Decision Space

There is a distinct difference, from the complexity point of view, between the inverse problem (4) and the inverse problems addressed in the previous section. In particular, in this setting both the risk function and the decision variable are variables and the problem becomes non-convex even in the simplest case where is linear (i.e., for some unknown ). The goal of this section is to discover cases where the problem can be solved in a relatively efficient way, by which we mean from a practical standpoint. In particular, we assume the following structure for the problem. Note that for simplicity we suppress the index in and in the rest of this section.

The loss function is linear; namely, it generally admits for some , and in the case of law invariance it has finite support and a probability distribution that satisfies for . In addition, the feasible set is a non-empty, bounded full-dimensional polytope that takes the form for some and .

We show in the following proposition that the inverse problem (4) reduces to solving an inverse linear optimization problem.

Proposition 4.1

In the case where Assumption 3.1 and 4 hold, the inverse problem (4) can be solved by a risk function , where is the support set of the reference risk function , and , , , . The values of and are calculated by solving

Moreover, the above problem can be solved by the following mixed-integer program (MIP):

| (29e) | |||||

for a sufficiently large .

The problem (4.1) has also been studied in the context of inverse linear optimization, and it is known that it may be solved in closed-form in the special case where is unconstrained and the rank of equals the dimension of (Chan et al. (2018)). Unfortunately, the problem in the general form (4.1) is known to be difficult to solve, as the set of feasible solutions to (4.1) is non-convex. Nevertheless, the MIP program that we present above can be very relevant from a practical standpoint. In particular, in the case where the 1-norm or -norm is applied in the objective function, this class of programs can often be solved efficiently as mixed-integer linear programs (MILPs) on a large scale using commercial solvers such as Gurobi or Cplex.

Next, we consider the case where satisfies permutation-invariance. Because we must take into account all possible permutations, the inverse problem (4) in this case is more involved and cannot be reduced as cleanly as (4.1). Nevertheless, we show in the following proposition that it remains possible to solve the problem through a MIP program where the number of binary variables grows in the order of .

Proposition 4.2

As detailed in Appendix 10, by carefully examining constraints that take into account all the permutations, the constraints boil down to requiring an ordering matching condition between and subgradient (i.e., ). We can equivalently state this condition by the first four constraints (30)–(30) using binary variables. To address the case of law invariance, we employ the same technique used in Section 3.3 to first map the distribution to a random variable over an outcome space with a uniform probability measure. Based on this constructed random variable, we can then apply the previous proposition to formulate a MIP program. We show in the following proposition how the program can be further reduced to a program depending only on the size of the support .

Proposition 4.3

In the case where Assumption 3.3, 3.3, and 4 hold, the inverse problem (4) can be solved by a risk function , where , , , , and . The values of and are calculated by solving the following mixed-integer program (MIP):

for a sufficiently large .

Moreover, the set can be derived from (27) and the set can be derived from , where is the support set of the reference risk function in the case of uniform probability measure.

All the MIP programs presented above could be solved in seconds in our experiments conducted in the next section. It is natural to consider extending the inverse problem (4) more generally to incorporate multiple observations (or preference elicitation relations). Unfortunately, not only do these more general cases quickly become intractable to analyze, but it also appears unreasonable to assume that their solutions admit any particular structure as observed in the above propositions. To solve these problems directly, one faces the complexity of bilinear constraints that are highly interdependent, which is computationally intractable even on a small scale.

Although it appears not possible to solve the problems in general, we believe the true value of the above MIP programs lies in providing a reasonable means to “extrapolate” an optimal decision from the observed sub-optimal decision. What we meant by extrapolation here is that the decision is extrapolated from the optimality condition of some risk-averse function over the set of feasible decisions. This guarantee should make the extrapolated decision a more ideal candidate to incorporate in the inverse models than the original observed decision. Hence, we recommend applying the MIP programs in either one of the following two ways when there is a need to incorporate more observations:

-

1.

First, solve the MIP programs based on the latest observation of decision . Obviously, if the observed decision is already optimal, then the MIP programs will return . Otherwise, replace by the solution generated from the programs and then run the inverse model (2) discussed in the previous section by setting the optimality condition associated with to be tight (i.e, ).

-

2.

Same as above, but run the inverse model (2) without imposing .

Based on the results in the above propositions, in either case there must exist at least one feasible risk function (even in case 1) that renders the decision optimal. The difference is that the first approach essentially puts absolute priority on the fitting to the decision , whereas the second approach treats the sub-optimality of each observed decision equally important to improve. Thus, if one’s main interest is to fit perfectly the decision (based on most current information), one can apply the first approach. Otherwise, if the interest is to seek a potentially better decision as the input to the other inverse models, one may apply the second approach.

5 Numerical Study

In this section, we illustrate the use of inverse optimization on a portfolio selection problem. We simulate the situation where a fund manager is required to construct a portfolio that aligns with a client’s personal preference but has fairly limited opportunity to assess the client’s risk preference. We assume that the client’s true risk function satisfies the conditions of monotonicity, convexity, and translation invariance and that his/her past investments were made according to the following forward risk minimization problem:

where denotes the random returns of an asset and stands for the proportion of the total wealth invested in the asset . The non-negativity constraint assumes that the client considers only long positions.

Remark 5.1

Although throughout this paper we have assumed the ability to specify the constraints that define the forward problem, we should mention here a few words about the possibility that the constraints may be misspecified. For instance, although the long-only constraint is common in the practice of portfolio management, at times the client may actually be open to taking some short positions without the manager’s awareness. The question then arises as to how well in this case our inverse models capture the true risk function (by assuming the long-only constraint in the forward problem) and if it is possible to detect potential misspecification. As discussed with more details in Appendix 11, we find it generally not possible to conclude, solely based on observed decisions, if there is any constraint misspecification. However, even without this confirmation, we discuss in the appendix why and how our inverse models may still be effective in capturing the true risk function.

In Section 5.1, we demonstrate the case with limited observations of made decisions. In Section 5.2, we consider more generally the cases where multiple observations are available. All computations are carried out in Matlab 2014a using GUROBI 5.0 as an optimization solver. YALMIP (Lofberg (2004)) is used to implement our models in Matlab.

5.1 The case of single observation

In this section we first consider the case of small , particularly . We assume in all experiments that the client’s true risk preference is captured by the risk measure, optimized-certainty-equivalent (OCE), which was first introduced by Ben-Tal and Teboulle (2007). This class of risk measures was widely referred to in both the literature of optimization (e.g., Natarajan et al. (2010)) and risk theory (e.g., Drapeau and Kupper (2013)), given its generality and its one-to-one correspondence to a (dis-)utility function. Namely, it is defined as

where the function stands for a proper, closed, convex, and nondecreasing disutility function that satisfies and and denotes the subdifferential of . We assume that the client’s risk preference is captured by the OCE risk measure, denoted by , with the exponential disutility function , where is a parameter that controls the level of risk aversion. This class of disutility function is fairly standard in the literature (see, e.g., Natarajan et al. (2010)).

We assume further that one chooses a reference risk function by following the safety-first principle but is not fully ignorant of the upside of uncertain outcomes. Specifically, the reference risk function takes the following form of spectral risk measure, where a CVaR- is chosen to capture downside risk and a small weight is put on the average:

We ran our experiments against the dataset of daily historical returns from 335 companies that are part of the S&P500 index during the period from January 1997 to November 2013. We conducted 5000 experiments, each consisting of randomly choosing a time window of 60 days and 5 stocks from the 335 companies. The first thirty days of data were used for in-sample calculation, whereas the second thirty days were for out-of-sample evaluation.

The following steps were taken to simulate how the manager may employ imputed risk functions. First, to simulate the past investment, we solved the forward problem based on the OCE risk measure with different choices of the parameter . Then, we fed the obtained portfolio together with the pre-specified spectral risk measure into the model in Proposition 3.16 to generate an imputed convex risk function . Finally, we solved the forward risk minimization problem again based on the imputed risk function to obtain a portfolio . Note that in solving the forward problem, it is possible that the optimal portfolio may not be unique. Throughout our experiments, we added a regularization term to the objective function with a small weight so as to ensure the uniqueness of the optimal solution. Intuitively, we looked for the most diversified portfolio among the optimal portfolios, as the L2 norm is known to encourage the diversification (DeMiguel et al. (2009)).

We compared both in-sample and out-of-sample performances of the portfolios , , and optimized respectively based on the OCE risk measures , the spectral risk measure , and the imputed risk functions . In establishing the outcome space and the associated distribution used in any of these risk functions, we used a uniform distribution constructed based on the first thirty days of joint returns in each sample. In comparing the out-of-sample performances, we additionally compute the optimal out-of-sample portfolios and optimized respectively based on the risk measure and using the out-of-sample data (i.e., the second thirty days of joint return in each sample). We benchmark the performances of the in-sample portfolios (i.e., , , and ) against the optimal out-of-sample portfolios and .

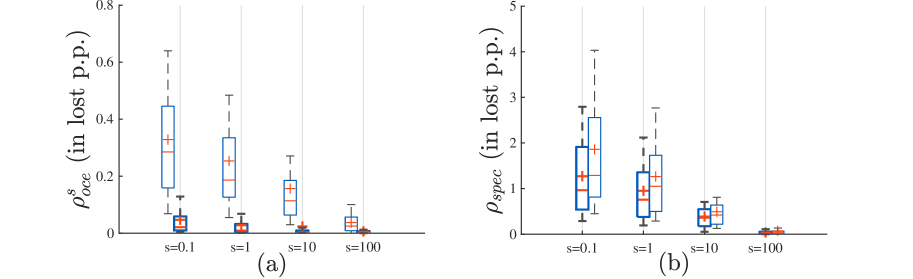

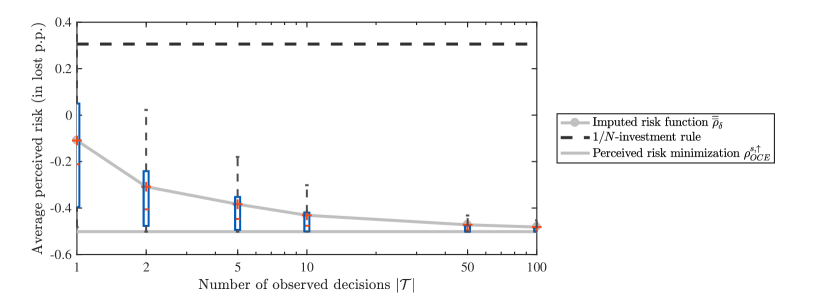

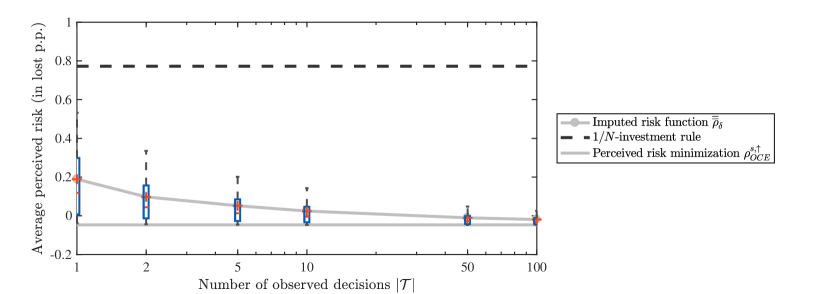

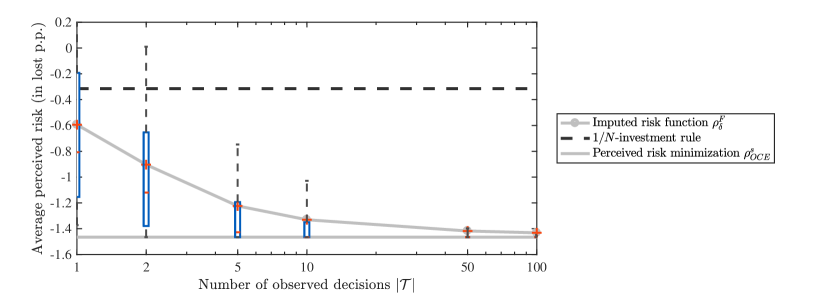

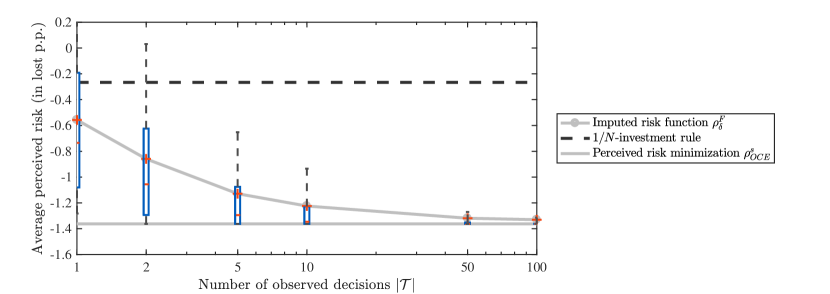

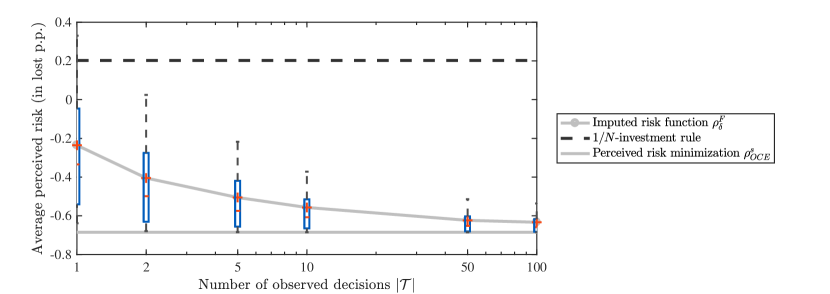

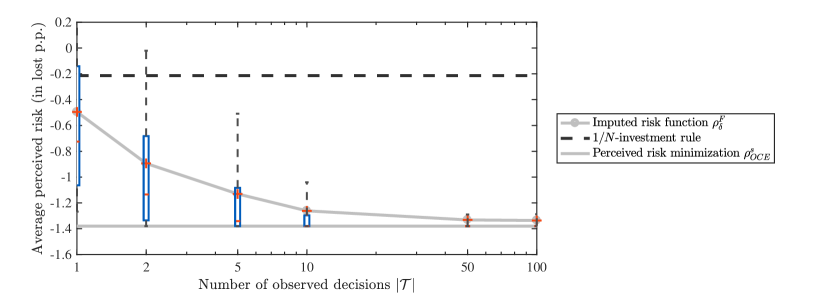

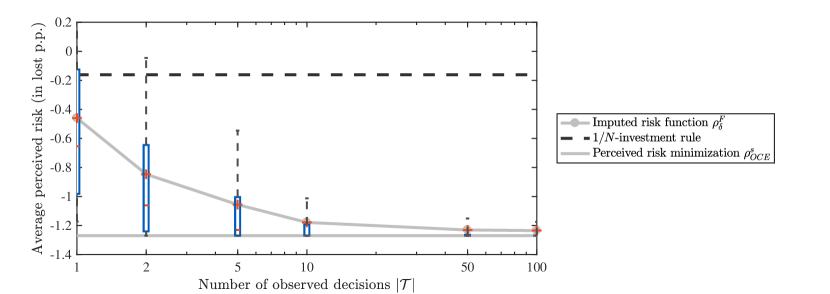

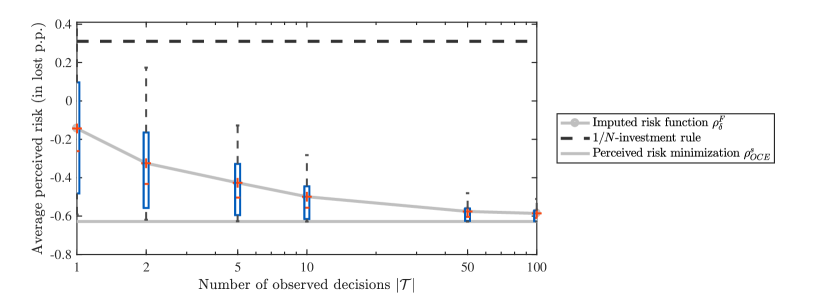

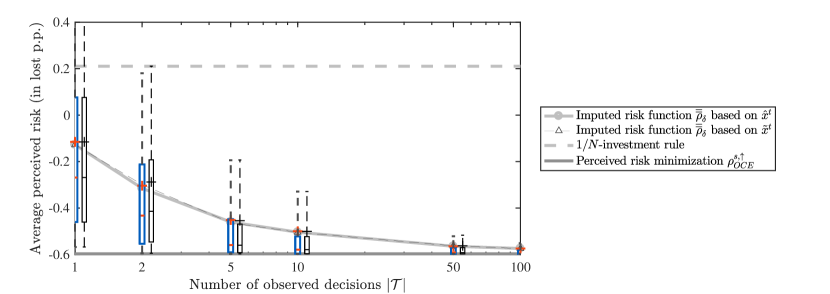

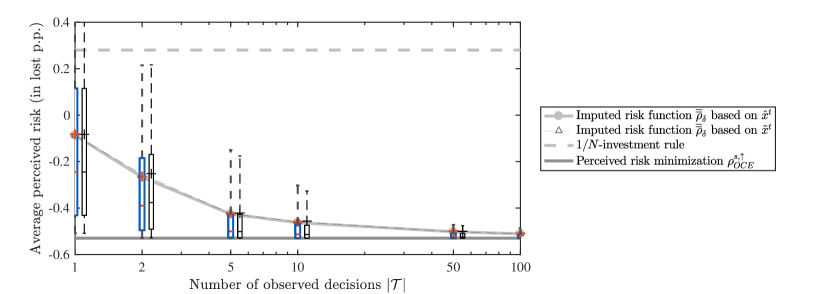

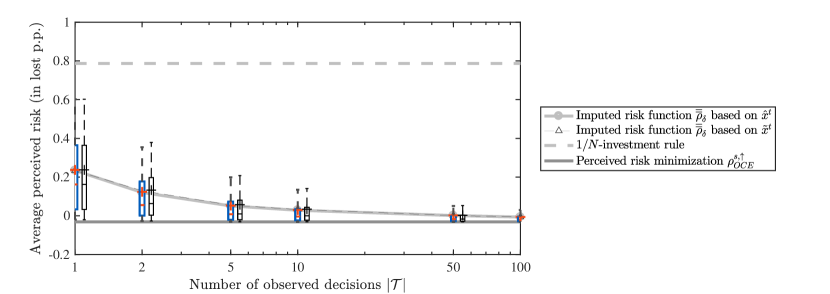

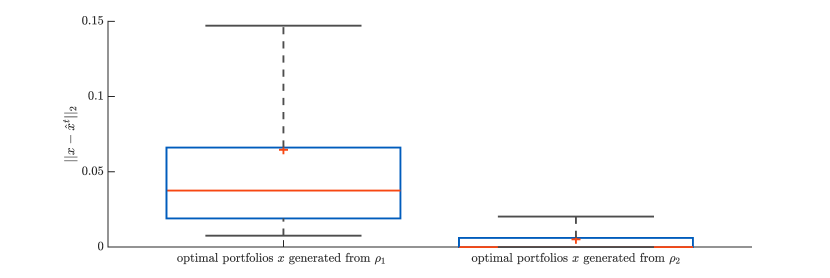

Table 1 and 2 present respectively the in-sample and out-of-sample results in terms of the averages. In reading the tables, when an entry corresponds to the portfolio or and/or the measure parameterized by , the value on the top of each column is the value specifying the parameter. All values in the tables are calculated by averaging the performances over 5000 experiments. We also provide other statistics in terms of boxplot in Figure 3 and 4. Note that the plus sign “+” in the boxplots refers to the average.

| portfolio | (in lost p.p. relative to ) | (in lost p.p. relative to ) | ||||||

|---|---|---|---|---|---|---|---|---|

| 0.33 | 0.25 | 0.16 | 0.04 | 0.00 | 0.00 | 0.00 | 0.00 | |

| 0.05 | 0.03 | 0.02 | 0.01 | 1.27 | 0.95 | 0.39 | 0.04 | |

| 0.00 | 0.00 | 0.00 | 0.00 | 1.86 | 1.26 | 0.49 | 0.08 | |

It is not surprising to see in Table 1 that, in terms of in-sample performance, the best-performing portfolios are those optimized according to the measures used for performance evaluation. Note that the portfolios optimized based on the reference risk function (i.e., ) can be deemed unsatisfactory when evaluated according to the true risk measure . They underperform the optimal portfolios by an amount up to 33 basis points (i.e., 0.33 p.p.), which can be difficult to justify in terms of their alignment with the performances desired by the client. On the other hand, the portfolios optimized based on the imputed risk functions (i.e., ) perform more closely to the optimal portfolios with less than 5 basis points’ difference. Note that although by construction the imputed risk functions guarantee the optimality of the portfolios , minimizing in the forward problem does not necessarily lead to the same optimal solution (i.e., ). Even so, the benefit of incorporating the solution into the imputed risk function is still clear when one considers the improvement of over in terms of the true risk (i.e., ). It is expected also from our formulation of the inverse problem that the imputed risk function should not differ too significantly from the spectral risk measure . We can see that the results evaluated based on provide the evidence for that (i.e., that the portfolio also performs more similarly to the optimal portfolio in this case than the portfolio ). This also confirms the effectiveness of the imputed risk functions to take into account the information contained in the reference risk function . Moreover, from Figure 3 we can further see that the improvements of over (in terms of ) and (in terms of ) are also evident across all the statistics presented in the boxplots. The observation that the performances of in fact dominate the performances of the others indicates a clear gain from employing an imputed risk function.

| portfolio | (in lost p.p. relative to ) | (in lost p.p. relative to ) | ||||||

|---|---|---|---|---|---|---|---|---|

| 0.55 | 0.42 | 0.37 | 1.10 | 1.12 | 1.26 | 1.12 | 1.11 | |

| 0.57 | 0.47 | 0.37 | 0.99 | 2.25 | 1.79 | 1.13 | 1.02 | |

| 0.57 | 0.49 | 0.39 | 0.95 | 2.91 | 2.08 | 1.18 | 0.99 | |

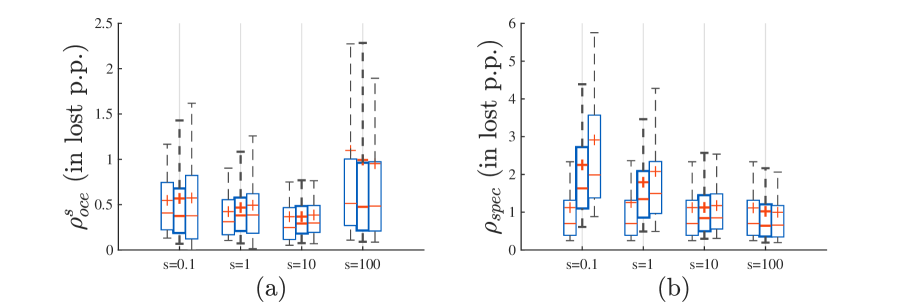

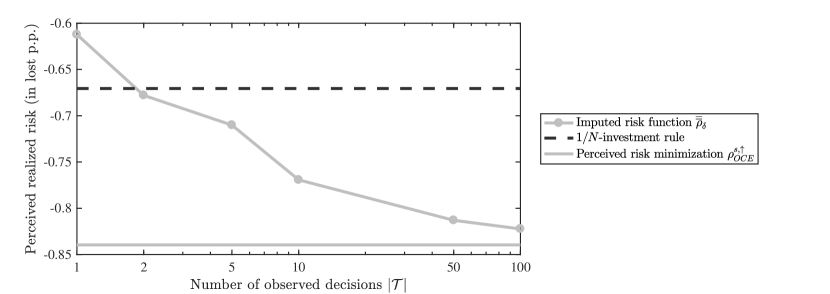

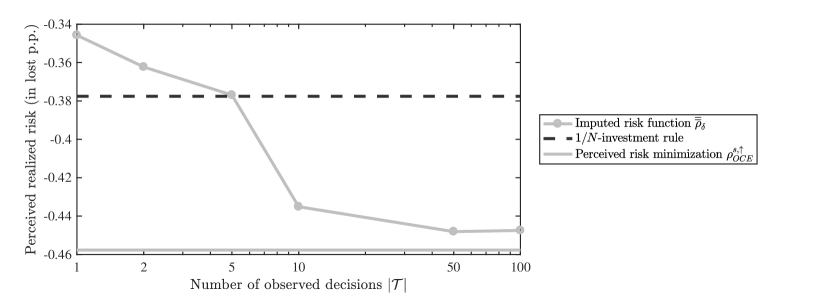

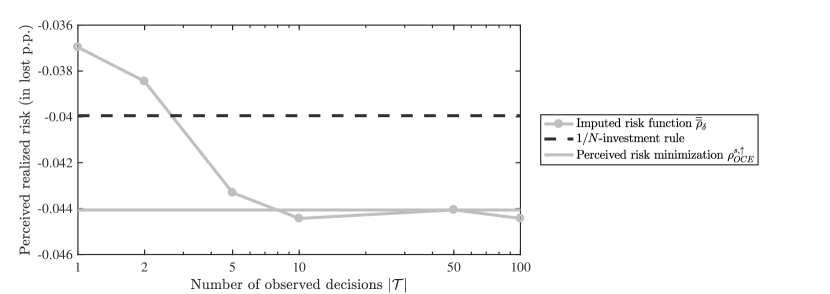

The out-of-sample results presented in Table 2 are calculated by subtracting the performances of the optimal out-of-sample portfolios and from the performances of the in-sample portfolios , , and . Like Table 1, the best performances (i.e., the lowest values) are bold in Table 2. Perhaps quite surprisingly, in the cases of , the in-sample portfolio actually underperforms the portfolio when evaluated according to the true risk measure . This means that in these cases the portfolios optimized based on do not generalize well to out-of-sample data. It is possible to explain this by drawing the connection between the risk measure and expectation, namely that is close to expectation when is small. It is well known in portfolio optimization that portfolios optimized based on sample averages are highly unstable and suffer from poor out-of-sample performances. Indeed, we can see from Figure 4 (a) that, in the cases and , the performances of are not only higher in terms of the average but also in terms of the spread, in comparison with that of . We believe the reason why portfolios optimized based on appear more stable is that provides more conservative estimates of risk than for small . This can be seen by comparing Figure 4 (a) and (b), where the values of the former are clearly smaller than the latter, except the case of where the two are more similar. Actually, we see in the case of , which is the most risk-averse case, the portfolio turns to outperform also in terms of both risk measures and . These observations appear to align with the common belief in robust optimization that solutions optimized based on more conservative estimates are likely to enjoy more stable performances.