New kids on the block: an analysis of modern blockchains

Abstract

Half a decade after Bitcoin became the first widely used cryptocurrency, blockchains are receiving considerable interest from industry and the research community. Modern blockchains feature services such as name registration and smart contracts. Some employ new forms of consensus, such as proof-of-stake instead of proof-of-work. However, these blockchains are so far relatively poorly investigated, despite the fact that they move considerable assets. In this paper, we explore three representative, modern blockchains—Ethereum, Namecoin, and Peercoin. Our focus is on the features that set them apart from the pure currency use case of Bitcoin. We investigate the blockchains’ activity in terms of transactions and usage patterns, identifying some curiosities in the process. For Ethereum, we are mostly interested in the smart contract functionality it offers. We also carry out a brief analysis of issues that are introduced by negligent design of smart contracts. In the case of Namecoin, our focus is how the name registration is used and has developed over time. For Peercoin, we are interested in the use of proof-of-stake, as this consensus algorithm is poorly understood yet used to move considerable value. Finally, we relate the above to the fundamental characteristics of the underlying peer-to-peer networks. We present a crawler for Ethereum and give statistics on the network size. For Peercoin and Namecoin, we identify the relatively small size of the networks and the weak bootstrapping process.

category:

C.2.2 Computer-Communication Networks Network Protocolscategory:

C.2.4 Computer-Communication Networks Distributed Systems1 Introduction

Since the advent of Nakamoto’s Bitcoin in 2008 [14], a diverse range of blockchain implementations have emerged. The common goal of blockchain-based technologies is to decentralise control of a particular asset, typically replacing one or a small set of trusted central entities with a network of untrusted nodes. A majority of these nodes need to act faithfully to the respective blockchain protocol in order to secure the operation of the blockchain as a whole.

Bitcoin’s asset is the Bitcoin currency (BTC) and the trusted centralised entity it attempts to replace is the traditional bank. Newer blockchains provide more intricate features, such as Namecoin’s attempt at providing decentralised name registration, or Ethereum’s globally distributed Ethereum Virtual Machine that allows executing code in the form of so-called smart contracts on the Ethereum network. Perceptions of blockchains are varied, with opinions ranging from highly sceptical to enthusiastic. Success of the technology would have broad implications for legislation, policy-making, and financial processes, due to the inherently decentralised nature of the technology. We believe it is too early to make a definitive call; however, blockchains are already used to move assets on a large scale. Now is the time to investigate them: at the time of writing, the total value of all existing bitcoin currency equates roughly USD 7B; Ethereum’s Ether follows in second place with approximately USD 750M111Data from http://coinmarketcap.com/ on 3/5/2016..

In this paper, we carry out analyses for three blockchains that have considerably extended Bitcoin’s original mechanism. Ethereum has added a Turing-complete scripting language that makes it possible to define programs that are executed by participants of the blockchain. Namecoin has added a decentralised name registration service. Peercoin, finally, has made a switch to a new consensus mechanism to ensure the security of the blockchain, namely proof-of-stake. For the blockchains whose asset is a service that is provided in a decentralised fashion—Namecoin and Ethereum—we focus on how the service is used and supported by the blockchain. An analysis of Ethereum is one of our main contributions: we show the development of the blockchain and give fundamental statistics that describe its use. In particular, we explore the smart contracts and uncover oddities, including some security-related (so far low-impact) issues. We also provide a first analysis of similarity between contracts on the blockchain, which gives hints at how they have been developed. For the ‘pure-currency’ blockchain, Peercoin, we investigate how much the new proof-of-stake algorithm is involved in moving currency around. Finally, we investigate briefly some core properties of the networks that keep these blockchains running, including peer crawling data and tests of the bootstrapping process.

The remainder of this paper is organised as follows. In the next section, we provide the necessary background to understand the blockchains we investigate and discuss previous related work. Section 3 presents our methodology and provides an overview of our data sets. Section 4 presents our results for Ethereum, Namecoin, and Peercoin. We offer our conclusions in Section 5.

2 Background and related work

We provide the necessary background on blockchain technology in this section and discuss related work.

2.1 Background

A blockchain is an append-only, public ledger that keeps track of transactions relating to an asset. In Bitcoin, for instance, a transaction is the transfer of some amount of Bitcoin currency (BTC) from one account to another. An account is expressed as a public key; ownership of the corresponding private key proves ownership of the account. Transactions are grouped into blocks, which are cryptographically linked—i.e., block contains a hash value of block . Transactions are digitally signed: only the holder of the private key can create a valid signature, but all participants of the blockchain can verify its validity with the known public key222Keys are based on elliptic-curve cryptography and are thus short and suitable for inclusion in the blockchain.. All participants maintain the entire history of the blockchain, and in most blockchains every participant knows the ownership status of all assets and all accounts. However, one typically does not know the identity of an account owner by only looking at this data.

A serious problem that all early crypto-currency proposals shared was the need to maintain a trusted authority that could issue cryptographic coins and track transactions so as to ensure that no digital coin could be spent twice, and that the payer is able to transact if her balance permits. One of Bitcoin’s declared goals was to remove this central authority. The key insight was that double-spending can be prevented if all participants in the digital currency are able to maintain the same, correct view of all transactions in the network.

Proof-of-work Bitcoin introduced the blockchain as a cryptographic ledger that stores all transactions ever made. Bitcoin nodes relay transactions to all nodes that they are connected to. This is insufficient to prevent double-spending, however, as an attacker could always try to partition the network and spend the same coin independently in each partition. Hence, Bitcoin requires all nodes to achieve consensus regarding which transactions have been made or rejected, e.g., due to insufficient balance. This is solved by block mining. Nodes collect transactions into a block and compute a hash over the whole block, together with a nonce of their choosing. A block will only be accepted by the entire network if the hash value, interpreted as a number, is smaller than a given target value, which depends on the previous blocks’ hash values, and which each node can compute independently and deterministically.

When a miner finds a valid hash, the block header containing the valid hash is announced to the network. Other miners in the network then validate the new block header before accepting it. Acceptance is indicated by miners starting to work on subsequent blocks, incorporating the newly mined block as the parent. To mine a block, a node must thus invest computational resources to find a nonce that when used in the hashing process will yield the necessary block hash.

It may occasionally happen that two miners find a block at the same time (a ‘fork’). In that case, the blockchain is not ‘in consensus’ until the next block is found, which takes one of the two candidates as its chosen previous block. The new, longest blockchain is then accepted by the network as the ‘consensus view’.

By requiring not just one, but a number of blocks to have been found since the first inclusion of a transaction, it becomes exceedingly unlikely that an attacker is able to forge a different, longer blockchain that contains a different set of transactions: to change a transaction in an already confirmed block, one must recompute the hashes for all subsequent blocks. Bitcoin’s author suggested that an attacker would need to control strictly more than 50% of the network’s computational power for this attack to succeed [14], although more recent research has identified attacks that succeed with less [6].

A major assumption is that miners are incentivised to act faithfully. As a reward for mining a block, a miner may assign a certain amount of thus newly generated currency to itself in the new block. In Bitcoin, the exact amount is currently 25 BTC and this reward halves at certain intervals (52,500 blocks), with the next halving expected to occur in July 2016. Senders of transactions may also choose to pay transaction fees that the block miner can claim. The input of a transaction must be the output of a previous transaction (except for the aforementioned currency generation). The output is one or more currency values with the public keys of the receivers, all signed by the sender. If the output value is lower than the input value, the miner can claim the difference; a transaction fee. With block rewards halving, the reward for mining will ultimately consist of only transaction fees. Mining pools The difficulty in finding new blocks can grow rapidly with every new block as the target difficulty is dynamically adjusted. Participants first switched to GPUs for increased computational power (over CPUs) and then to specialised hardware (ASICs)—but the energy costs are still very high [15]. One way to participate in the network while still realising a profit is participation in a mining pool. A mining pool is an organisation that distributes a portion of the mining workload to individual participants and shares the block reward amongst all participants when a block is mined by just one participant in the pool. The drawback of a mining pool is that it introduces a form of centralisation: particularly large mining pools may, when they collude, hold more than 50% of the network’s computational power.

Namecoin Bitcoin uses a scripting language to express how a transaction output can be claimed. Bitcoin’s scripting language was extended by Namecoin to allow name registration. A sender can invest currency (NMC) to request a mapping of a name to some value to be stored in the blockchain. There are three primary operations. name_new announces the intention to register a name by providing a hash value of the desired name in a transaction333A hash value is announced to avoid another participant deciding to race for the name.. This transaction carries a special fee of 0.01 NMC. A name_new is followed by a name_firstupdate, which costs a fixed fee of 0.005 NMC plus the so-called network fee, which is a quasi-linear function in the number of blocks and decreases over time. The network fee was high in the beginning (50 NMC when Namecoin started on 19 April 2011) and dropped to (rounded) zero in November 2012444The intention of the network fee was to discourage early mass-registration.. Names expire (currently after 250 days) and can be renewed; they can also be transferred. Renewal and transfer are done with the name_update operation, whose fee is 0.005 NMC. Namecoin is built off the Bitcoin code and continues to import code from the Bitcoin repository555The last full commit that Bitcoin and Namecoin share is from 6 May 2016..

Merge mining Namecoin also introduced merge mining whereby miners can participate in two blockchains at once. This is a response to a persistently relatively small number of dedicated (Namecoin-only) miners. The Namecoin software was changed to accept Bitcoin blocks as valid, too. Miners carrying out merged mining can collect Namecoin transactions, hash them, and include this hash value in a normal Bitcoin block. If the miner finds a block that meets only Namecoin’s target difficulty, the block is sent for incorporation to the Namecoin network only. If the block also meets Bitcoin’s target—which is more difficult to achieve than Namecoin’s—the block is sent to both networks, and the miner can profit twice. The Bitcoin network ignores the extra data, but the Namecoin blockchain stores Bitcoin’s data. The drawback of merge mining is that it can introduce a strong dependency of one blockchain on another.

Peercoin: proof-of-stake Proof-of-work is wasteful as the entire network participates in the mining process. Estimates in 2014 found the Bitcoin network’s electricity consumption to be on par with that of Ireland [15]. Other consensus-building forms have been investigated, with proof-of-stake arguably being the most interesting. The idea of proof-of-stake is to assign the right to mine a block not based on finding a certain hash value but on being able to demonstrate that the miner holds a certain stake in the network, such as ‘coin-age’, i.e., a certain amount of currency held for a certain number of days. Peercoin uses this form of proof-of-stake. A special function in the code determines which miners have a right to mine the next block for a given ‘stake’. A miner who mines a block resets the coin-age for the stake to 0 and must accumulate it again before being allowed to mine a block. Peercoin does not have transaction fees; rewards are only given out for mining blocks. Peercoin is not entirely proof-of-stake-based: its codebase switches over gradually from proof-of-work in Bitcoin fashion to proof-of-stake. The software is built off a relatively old version of Bitcoin of June 2012666The last full commit that Bitcoin and Peercoin share is 397737b9133118d71d2c8ba6a95afea0ba7d4350 of April 2012; the last cherry-picked commit is from 20 August 2012..

Ethereum: smart contracts Ethereum’s currency is Ether. Ethereum added a novelty to blockchains: its scripting language is Turing-complete and allows to define smart contracts. These are small applications that are executed by the entire network. The author of a smart contract offers a certain reward for executing the code: she defines an amount of ‘gas’ she is willing to spend, together with an exchange rate from Ether to gas. Smart contracts can be relatively complex; they can even instantiate other sub-contracts and can have storage. This makes it possible to implement various forms of contractual agreement, expressed in code. Smart contracts are written (currently) in the high-level languages Solidity or Serpent. Mining in Ethereum currently implements a proof-of-work model using a specialised hashing algorithm called Ethash. Prior to the software release of Ethereum, 72 million Ether was pre-mined and shared amongst the Ethereum foundation and early investors. Ethereum intends to switch to proof-of-stake, which allows it to create an unlimited supply of Ether.

2.2 Related work

There is a body of work on Bitcoin, both for its formal properties as well as the data stored in the blockchain. Other blockchains seem to have received much less attention, with Peercoin and Ethereum apparently still entirely unexplored.

Bonneau et al.provide a description of Bitcoin’s technical details and outline major challenges and research directions in [4]. In [1], Barber et al.also analyse Bitcoin in depth, identify some structural weaknesses, and propose forms of remediation. A critical property of Bitcoin is that it assumes miners are incentivised not to collude and execute the protocol faithfully. In [6], Eyal and Sirer describe Selfish Mining, a strategy that a mining pool can follow to obtain more revenue than its share of overall computational power suggests. The strategy does not depend on the size of the misbehaving mining pool. The authors propose a change to Bitcoin that does not eliminate the flaw entirely but requires a mining pool to hold at least 25% of the computational power of the network in order for the strategy to succeed. Karame et al.[9] were the first to analyse the window of opportunity for double-spending Bitcoins that is open when there is an insufficient number of confirmations to ascertain that a transaction has been accepted by the network. Their findings highlighted how careful one has to be in accepting Bitcoin transactions as a basis for the transfer of real-world assets. Decker and Wattenhofer [5] analysed the propagation of Bitcoin messages in the network and showed the relevance of network delay to increase the chance of a blockchain fork. Interestingly, Bitcoin was not designed to be an anonymous system. Although it is possible to use a different public/private key pair for every transaction, it is still possible to match these to real-world entities by a probabilistic argument. Meiklejohn et al.[12] used a number of heuristics and scraping of Web sites (to obtain Bitcoin addresses) to show that actors in Bitcoin can be identified by their transactions and purchases they make. Ron and Shamir, finally, provide an analysis of the Bitcoin transaction graph in [16]. Our work shares some methodical aspects with these analyses, but focuses on the innovations that Ethereum, Namecoin, and Peercoin introduced.

Kalodner et al.provided a first analysis of Namecoin in [8]. The authors’ focus was on the use of the namespace and on the development of an appropriate model for decentralised namespaces. They found only 28 names in Namecoin that did not appear to be ‘squatted’ (registered entirely for the purpose of transferring them later for a lucrative price). Our focus in this paper is very different: we investigate the blockchain with respect to the merge-mining property and its development over time.

3 Methodology and data sets

We chose the following three blockchains for our analyses: Namecoin, Peercoin, and Ethereum. Namecoin was chosen as it was the first blockchain to introduce a non-financial service, namely name registration, and because it was also the first blockchain to support merge mining with Bitcoin. Peercoin was chosen because it was the first blockchain to introduce proof-of-stake, albeit in a hybrid fashion. Ethereum was the first blockchain to introduce a Turing-complete scripting language, with support for smart contracts, and is the most active and representative blockchain of its kind.

| Blockchain | First block time | Block cut-off time |

|

No. TX | TX volume | ||

|---|---|---|---|---|---|---|---|

| Namecoin | 2011-04-19 12:59:40 | 2016-04-18 09:32:24 | NMC | ||||

| Peercoin | 2012-08-20 04:19:16 | 2016-04-18 09:44:20 | PPC | ||||

| Ethereum | 2015-07-30 15:26:28 | 2016-04-18 09:59:22 | ETH |

| Blockchain | Size on Disk |

|

||

|---|---|---|---|---|

| Bitcoin | 73.0 GB | 27.0 MB | ||

| Namecoin | 3.0 GB | 1.5 MB | ||

| Peercoin | 0.5 GB | 0.5 MB | ||

| Ethereum | 17.0 GB | 64.5 MB |

There are two parts to our methodology. To gain a comprehensive picture of transactions in each blockchain, we downloaded and analysed the blockchains themselves. To gain a first understanding of the underlying peer-to-peer networks, we analysed their bootstrapping process and carried out a crawl.

3.1 Blockchain download

We compiled each reference client from source, at the latest revision available at the time our study began, and from the master branch of the repositories: namecoin-core777https://github.com/namecoin, at revision 5624a2233facea2cd6785954999b46a40b8362ac, ppcoin888https://github.com/ppcoin/ppcoin, at revision f01ccea4b515ce6e01f4a50cc6b50a4f3337c7ee, and ethereum999https://github.com/ethereum/go-ethereum, at revision 9e323d65b20c32ab1db40e8dde7172826e0e9c45.

For our study, we only considered blocks with a timestamp less than 18 April 09:59:59 UTC (17 April 23:59:59 UTC-11), but we ran each client for a further 24 hours to ensure consensus was established. A summary of this is provided in Table 1. We extracted data from the blockchains either via the JSON-RPCs that each daemon provided (namecoind, ppcoind) or directly from the data structure on disk (in the case of Ethereum, with geth as a client). Where applicable, we used the RPC calls or provided APIs to decode or compute certain additional values (e.g., decoding Namecoin scripts or computing transaction fees). We use the PostgreSQL database to store and query our data. Our code is available from Github101010github.com/modernblockchains. Table 2 provides an overview of storage requirements for the blockchains we analysed. We added Bitcoin for comparison, which is by far the largest blockchain. The two Bitcoin-based derivations Peercoin and Namecoin need only a fraction of the space. This is due to the much lower number of transactions.

3.2 Blockchain networks

Ethereum uses a variant of the Kademlia/Kad protocol [11]. Instead of forwarding messages and providing a DHT-service, the protocol is only used for peer discovery. The node distance metrics used in Ethereum differ from the traditional Kademlia XOR metrics by the fact that SHA3 [2] is used to modify peer selection in the discovery process. The discovery protocol operates by transmitting a FIND_NODE query with a NodeId parameter, which is the node ID (public key) of the client that is querying. The receiver hashes the NodeId using SHA3, i.e. TargetHash = SHA3(NodeId). Then, it computes the hashes of all its known peers and performs the XOR operation on all the computed hashes with TargetHash. Finally, the receiver sorts the results in ascending order and selects the top 16 of the peers.

We implemented a Kad crawler to gather peers using a recursive process of issuing FindNode queries. We modified the original geth client for this to carry out the recursive queries and log all replies. This ensures that our crawler uses valid protocol messages.

As described, a query with TargetID will result in getting peers whose SHA3 hash of the NodeID starts with the same prefix as our supplied TargetID—if the queried peer has such peers in their database. The algorithm for our crawler is shown in Algorithm 1. We add a peer to our set of known peers if we are able to exchange the so-called PING-PONG messages—these are a necessary part of the protocol before one can send a FIND_NODE message. We log unsuccessful attempts to establish a connection.

Our algorithm requires the pre-computation of TargetIDs for a number of prefixes (we chose a 13 bit prefix to cover the address space well). This can be simply done by repeatedly creating an array of 64 bytes as the TargetID and forward-computing the value it hashes to when received by a peer.

Namecoin and Peercoin use a much simpler peer discovery. Peers keep track of all peers they have encountered, together with a timestamp, and connect to a number of them. We did not investigate the networks systematically: some information is already publicly available [3]. However, we investigated the bootstrapping process for all three blockchain networks. In the case of Namecoin and Peercoin, the official clients ship with both hard-coded IP addresses as well as DNS names that, when looked up, return seed IPs. To simulate a normal bootstrap process (with DNS caching effects), we queried the DNS names several times. In the case of Ethereum, the IP addresses and public keys for four seed nodes are hard-coded into the official client.

4 Results

We first present a comparison of global statistics and then discuss our results for each blockchain.

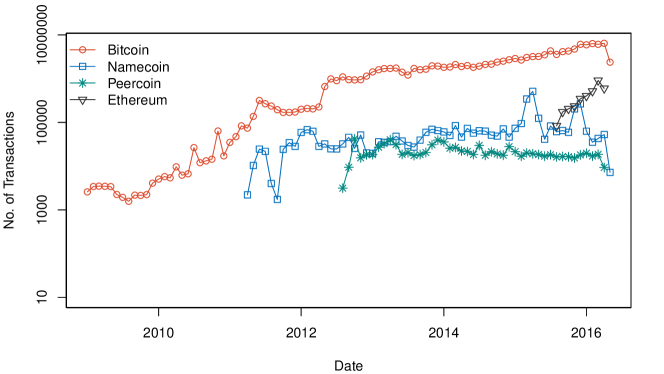

4.1 Comparison of blockchains

It is instructive to analyse how our blockchains compare to each other. Figure 1 shows the number of transactions that they include in blocks (and thus accept), by month. We added data for Bitcoin from the Coindesk public service111111http://www.coindesk.com/price/. The figure shows that Bitcoin is much more active (note the logarithmic axis). Starting with meagre beginnings in 2009, it has grown to process millions of transactions a month121212The drop at the end is due to the month of April not being completed, not a drop in transactions.. Namecoin is almost two orders of magnitude less active: we can identify a strong period at the beginning in 2011, followed by a drop at the end of the year and then stabilisation starting in 2012. Despite a short peak in 2015, it has remained at roughly the same level. Peercoin shares this fate: a strong start, and then stabilisation at a level two entire orders of magnitude below Bitcoin. However, the number of transactions still translates to a serious movement of assets. Ethereum is clearly the star among the newcomers. It started in 2015, but its transaction count is climbing fast and it is just one order of magnitude below Bitcoin.

4.2 Ethereum

We begin with an investigation of Ethereum. Table 3 shows the number of transactions per month in Ethereum, grouped by transaction type. Despite Ethereum being primarily intended to run smart contracts, we can see that contract-related activity is much less pronounced than ordinary currency transfer131313Once again note that we stopped recording data on 18 April; there is no considerable drop in the number of transactions compared to March.. The number of transactions whose destination address is a contract (i.e., implying interaction with a contract) is approximately 15% of the quantity of transactions destined for regular accounts. The number of contract creation transactions is rising, but compared to the overall transaction count it remains small. Evidently users are not making very good use of smart contracts yet but use Ethereum as another currency. Note, however, that contract creation can fail due to programming mistakes or insufficient gas in the transaction. We discuss this below.

| Month |

|

|

|

||||||

|---|---|---|---|---|---|---|---|---|---|

| 2015 Aug | |||||||||

| 2015 Sep | |||||||||

| 2015 Oct | |||||||||

| 2015 Nov | |||||||||

| 2015 Dec | |||||||||

| 2016 Jan | |||||||||

| 2016 Feb | |||||||||

| 2016 Mar | |||||||||

| 2016 Apr |

4.2.1 Smart contracts

At our cut-off time, we found a total of contracts in the blockchain. (89.2%) were created by transactions directly, which implies creation by an Ethereum client and hence most likely a human actor. (10.8%) contracts were created by other contracts. Contracts can be terminated with a special opcode (SUICIDE)—of the contracts we had found, (92.7%) were active, and (7.3%) terminated. The active contracts had a balance of 3.7M Ether between them. Most of the terminated contracts had no balance left, with the exception of 260, where 98 had a minuscule balance of 100 Wei (1 Wei is Ether). However, the remaining 162 contracts have a balance of Ether together—with Ether held by just ten. At the time of writing, 1 Ether is evaluated at roughly USD 9, so this translates to about USD lost as this Ether can never be retrieved. We return to the topic of such lost money below.

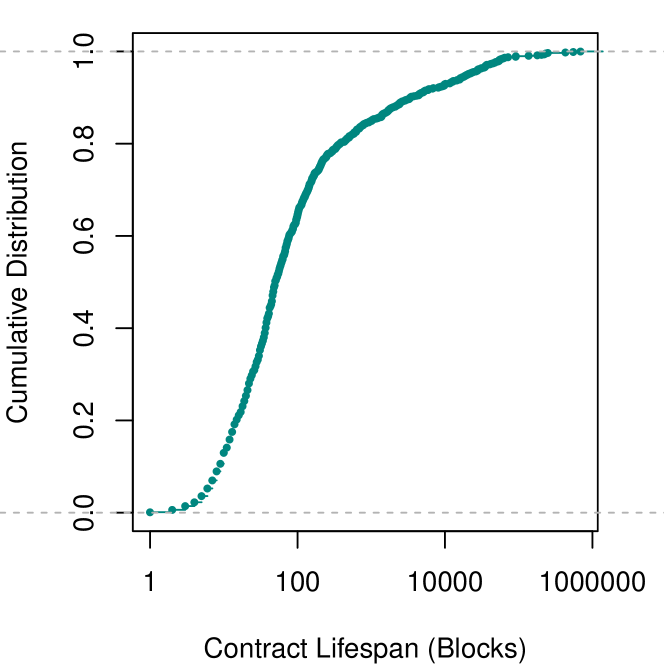

We investigated the lifetimes for terminated contracts, i.e., the time between their creation and their termination. Figure 2 shows the result. The lifetime is expressed in blocks; the average time between two blocks in Ethereum is between 14–17 seconds. As can be seen, many of the terminated contracts had rather short lives: 60% of them lasted for only 100 blocks, and another 20% for about blocks.

Zombie Contracts

A contract creation transaction is defined by setting the ‘to’ field to null. Typically, this type of transaction would include some compiled EVM code in the ‘input’ field, which would then be executed to create a new contract. An ‘endowment’ of gas is often provided which provides the new contract with a positive balance upon initialisation. If a transaction is submitted to the network with a blank ‘to’ field and an empty ‘input’ field, a contract will be created which has no EVM code. It is safe to assume that this is almost never intentional since these contracts lack code that defines their operation and hence they cannot perform any actions. The Ether that the contract was endowed with is lost forever. We call these ‘zombie contracts’.

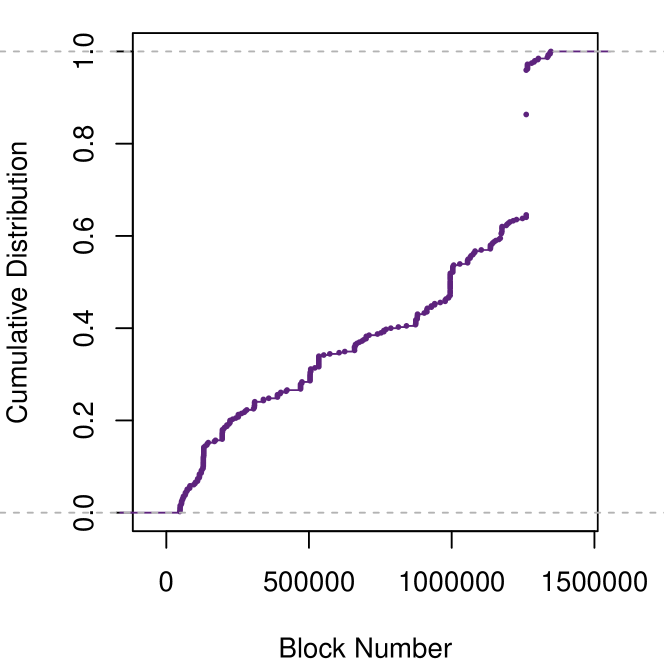

We identified 395 such contracts in Ethereum. Their balances amount to Ether, 97% of which ( Ether) belongs to the top 10 (ranked by balance). The highest balance in a single one of these contracts is Ether, which at the time of writing means USD . We originally hypothesised that these errors happened more frequently in the early days of Ethereum; however, this is not so. The median block number for all contract creation transactions is . Of the 395 zombie contracts, 188 were created in blocks before and including block number ; 207 contracts were created after. Evidently, the mistake still happens. Figure 3 shows a cumulative distribution function of all zombie contracts, plotted by block number. The quasi-linear distribution reinforces that this apparent mistake is a regular occurrence throughout Ethereum’s short history.

We speculate that the zombie contracts were accidentally created by users of geth (a command line client) while attempting to send Ether in a transaction. When constructing a transaction, it is necessary to enter a long string of characters. Due to the amount of scrolling involved, this can lead to the sender inadvertently omitting the ‘to’ field.

An exception to the linear increase in zombie contracts is a spike around block , which is caused by 127 zombie contracts being created by a single Ethereum address. We have no plausible hypothesis why this happened.

Contracts referenced before creation

We discovered a curious pattern where a smart contract is sent Ether prior to its creation. We found 10 examples of this pattern. When a contract is created, it assumes a particular Ethereum address that is subsequently used to interact with that contract. This contract address is calculated with a deterministic function that depends only on details of the creator’s Ethereum account (defined by equation 82 in [17]). It is therefore possible to pre-compute all potential contract addresses that a particular account is able to create.

The reason for this pattern is unclear to us. Without knowing who the address owners are, one can only speculate. It may simply be the result of experimentation with the blockchain; however, a more intriguing speculation is that this is a weak form of ‘security by obscurity’ with the intention to hide ownership of Ether. An individual could start by generating a new Ethereum account, then calculate the contract addresses that can be created by the new account. Finally, she may send Ether to one of those contract addresses, without actually creating a contract at that address. Naïve inspection of the individual’s accounts would lead observers to believe they have a zero balance. It would also allow the individual to receive Ether from other sources, without the contract address being easily linkable to her identity. When the individual wants to redeem the balance, she would only need to create a contract at the address and provide code that simply pays the entire balance to an account of her choosing.

4.2.2 Security analysis of smart contracts

Smart contracts can be terminated with the SUICIDE command (opcode 0xff as specified in [17]), which must be called from within a contract that is to be terminated. A smart contract should first check if the caller is authorised to execute the SUICIDE command, however responsibility for this check is left to the programmer of the smart contract. This is an example of necessitated defensive programming in Solidity, also described in [13]. We investigated how many Ethereum smart contracts have an unprotected SUICIDE command that can be activated by an unauthorised party. For this purpose, we cloned the Ethereum blockchain and ran a private copy that does not interfere with the real network.

A SUICIDE command, by the Ethereum specification, refunds all the remaining balance that is held by a contract to a specific address. This address can be specified by a parameter passed to the SUICIDE command, which could be the creator of the contract, the message sender, a hard-coded address, or a calculated address. A function call costs a base amount of gas for the call itself, plus any additional gas that is consumed by the opcodes present in the function. The SUICIDE command provides a gas refund of gas. It is one of only two commands that provide a refund; the other is used to set a storage value in a smart contract from non-zero to zero. Any method that uses less than gas is likely to have called the SUICIDE command.

In order to cause contracts to execute the SUICIDE command, it is necessary to call a function within the smart contract that contains that command. To call a function within a contract, one simply sends a transaction to the contract with the ‘input’ field set to the signature of a function. This signature is the hash of the function name as it appeared in the source code. Since one cannot simply read the function names from the compiled EVM code, we first had to determine which functions could be called to achieve our desired outcome. We did this with a dictionary attack by trying commonly used words that may be used as function names for contract termination, e.g. ‘kill’, ‘terminate’, ‘destroy’.

We then analysed all active contracts and called Ethereum’s estimateGas method with our potential SUICIDE function calls. This allowed us to leverage our gas consumption metric (see above) without actually sending transactions. Any function call with a gas consumption estimate of less than was considered to be a potentially vulnerable contract. After identifying a small subset of potentially vulnerable smart contract functions (using our function name guessing method), we then queried historical data from the Ethereum public blockchain to identify function signatures that were used to terminate contracts. We then used some of these signatures to further identify additional active contracts that are vulnerable. After identifying a contract that was potentially vulnerable, we invoked the function on that particular contract and checked whether the we did indeed terminate the contract. We also observed the account to which the contract sent its remaining balance, if any.

We analysed the active contracts and found that 816 (4.5%) are vulnerable to at least one of the 14 function signatures that we use.

The total balance of these 816 contracts is only 0.285 Ether. No contracts could be terminated with the method names suicide, end, destroy, done, delete, redeem, or terminate. One contract had a remove method, but a zero balance. 754 contracts were vulnerable to the kill method. Out of these, 728 had a zero balance. We also identified 58 contracts that are vulnerable to unknown function names, i.e., where we only know the function signature. There were three contracts that seemed vulnerable to all tested functions. However, none of the instructions to terminate the contracts were successful. We suspect that they implemented a default entry function. This will make them seem vulnerable without actually being so.

For the 813 contracts that we terminated successfully, we analysed where their remaining balance was sent. 76 contracts refunded their balance to us, at a total of 247 Wei. 11 contracts sent their balances to the null Ethereum address. The remaining 726 contracts refunded their balances to their respective creators’ accounts. Over their lifetime, these 813 contracts participated in a total of transactions, with a combined transaction volume of 7 Ether. Only one of them was a contract-created contract, while all others are human-created contracts.

We found that we had to pay gas on average to terminate a contract. But even though the termination methods were obviously unprotected, we never received a positive refund. In other words, there is no monetary incentive to terminate a contract.

4.2.3 Similarities between smart contracts

At this stage, it is plausible to assume that participants still experiment with the technology. As such, it is reasonable to believe that they may also test contracts from tutorials, or variants. We investigated this.

We chose nine particularly easy-to-find example contracts and compiled each of them with and without the optimisation flag that the compiler offers. We then calculated the Levenshtein distance to all contracts on the Ethereum blockchain. We disregarded anything beyond a threshold of substitutions, which is equivalent to 500 ASCII characters. Table 4 shows the Levenshtein distance () for each of the example contracts, categorising the results into exact copies, minor changes (), and heavy modifications (). There are 309 contracts that are exact copies of the tutorial contracts and contracts that are very similar to the tutorial contracts. This is a surprisingly large number, given the small number of contract creations. As contracts from tutorials are generally small toy examples, the higher distances may either indicate heavy modifications or entirely new contracts that are similarly structured.

| Tutorial Contract | Size (compiled) | Levenshtein Distance () | |||

|---|---|---|---|---|---|

| Ballot∗ | optim | 7 | 1 | 3 | |

| Blind Auction∗ | optim | 0 | 0 | 0 | |

| Safe Remote Purchase∗ | optim | 0 | 0 | ||

| Simple Auction∗ | optim | 1 | 0 | ||

| Coin⋄ | optim | 94 | 1 | ||

| non-optim | 18 | 93 | |||

| Crowdsale† | optim | 4 | 0 | 29 | |

| non-optim | 1 | 0 | 15 | ||

| Greeter† | optim | 127 | 47 | ||

| non-optim | 39 | 11 | |||

| Mortal† | optim | 7 | 48 | ||

| non-optim | 11 | 7 | |||

| Token† | optim | 0 | |||

| non-optim | 0 | 1 | |||

4.2.4 Network

As described in Section 2.1, Ethereum uses a peer discovery protocol that is modelled on Kademlia. Ethereum nodes are specified by public keys, called ‘node IDs’, which are used to secure communications.

Bootstrapping

The official Ethereum client, geth, comes with four hard-coded IP addresses that serve as bootstrap nodes for the P2P network. Their public keys are also hard-coded to prevent Eclipse attacks [7] upon initial bootstrapping, where the attacker controls the paths to IP addresses that are vital for the peer’s integration into the network and tries to impersonate the bootstrap nodes. We scanned the four IP addresses to determine their availability. The first three geth clients were available for connection on the Ethereum standard port (30303) via both TCP and UDP. They appeared to be running on AWS infrastructure based in Ireland, São Paulo, and Singapore. The fourth client appears to be located at a German IP address and was not available for connection on the standard Ethereum port.

Since 3 of 4 seed nodes appear to be operating on stable infrastructure (AWS), they are not likely to become unreachable. However, denying a client access to these three IP addresses would prevent automatic P2P bootstrapping. Bootstrapping via DNS would be an addition; however, depending on his position in the network, the attacker could try to modify the DNS replies.

Crawling

We ran our crawler, described in Section 3, for three days, starting on 2016-05-06 and ending on 2016-05-09. We crawled from our host in Sydney, Australia, which features a 100Mbit/s uplink to the Australian Research Network. The hardware was a quad-core Xeon at 2.4GHz, with 64 GB of RAM. We capped it at a maximum of 500 concurrent FIND_NODE queries. Table 5 summarises our findings.

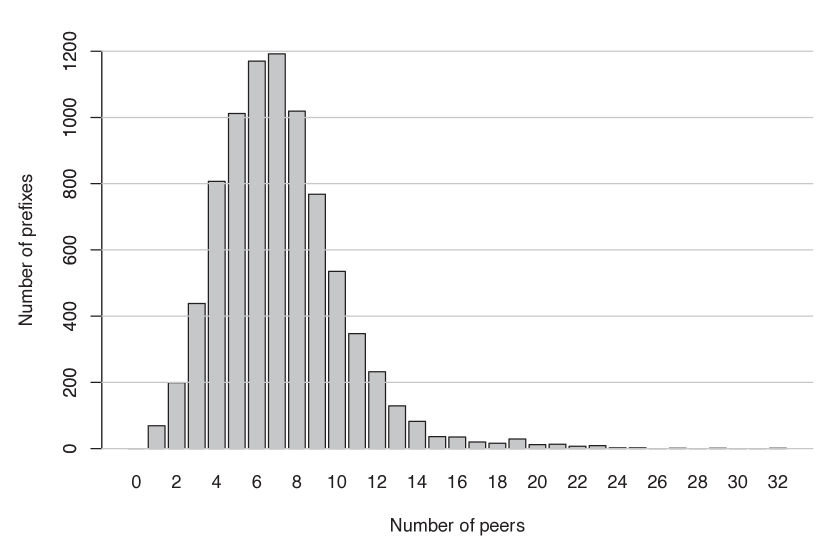

Over the three days, we collected unique NodeIds from the responses to our FIND_NODE queries. As Ethereum clients generally do not change their NodeIds (unless reinstalled), this gives us an estimate of the number of peers in the network. Figure 5 shows how many 13-bit prefixes (-axis) contained a certain number of peers (-axis). Although it may seem nearly normal, there is a long tail. One would expect a uniform distribution of PeerIds over the address space; this does not seem to be the case. Table 6 shows a further peculiarity: just five IP addresses were returned for over PeerIds, with one IP from a German hosting provider being responsible for almost PeerIds alone. It is hard to determine what the reason for this might be; but running such a high number of PeerIds on one machine alone could be indicative of an attack on the network. However, as Ethereum’s Kad variant is not used for forwarding messages and there are more nodes available for discovery, this seems not too plausible here.

Mapping the NodesIds to IP addresses and ports, we found a total of combinations of IP and port, but only distinct IPs. During the crawl, we received valid replies from only unique IP addresses. Many clients are not reachable from the public Internet. In fact, IP addresses in our result were from the ranges 172.16.0.0/12, 192.168.0.0/16, and 10.0.0.0/8—although only 50 of them were distinct. A total of distinct ports were in use—once again a sign of peers being behind NATs. The standard port, UDP/30303, was found times in the IP:port combinations. This has only a small impact on the blockchain, however: peers that are behind NATs cannot be freely contacted by others to receive relayed transactions. They rely entirely on the number of connections they make themselves. However, they are free to make many such connections. Ideally, they should choose peers with low latencies; this does not seem to be implemented yet, however.

| IP:Port combination | |

|---|---|

| Unique IPs | |

| Unique Ports | |

| IPs in private ranges |

| IP address |

|

||

|---|---|---|---|

| 78.46.49.102 | |||

| 24.65.141.220 | |||

| 62.176.104.144 | 743 | ||

| 115.66.178.58 | 650 | ||

| 188.166.179.233 | 29 |

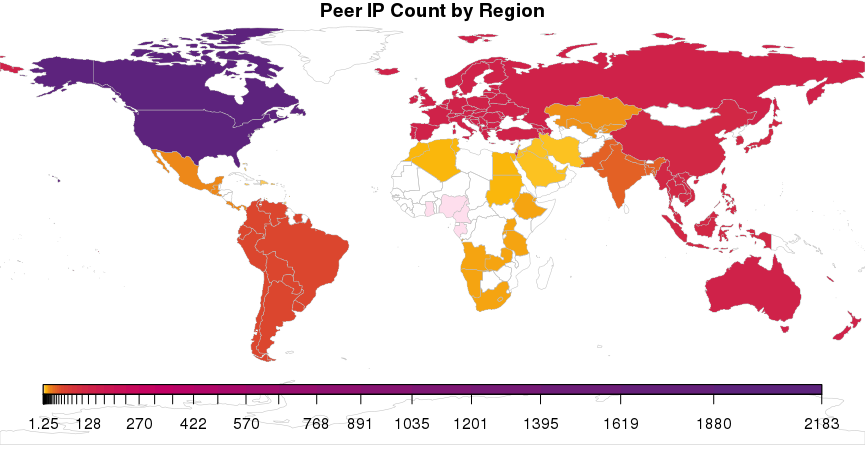

We were also interested in understanding the geographic distribution of peers in the Ethereum blockchain. We resolved the IP addresses we had obtained with the Maxmind GeoLite database of May 2016. Figure 4 plots the distribution on a world map. The dominance of Western countries, China, and Russia is evident.

4.3 Namecoin

Namecoin is different from Bitcoin in two important aspects. First, it allows merge-mining. Second, it allows the registration of names in the blockchain.

The total number of Namecoin blocks included in our study until our cut-off time was . Of these, 93% were merge-mined (). Given that merge-mining was only introduced with block , this means that since that block—mined on 8 October 2011—only 130 true Namecoin blocks were mined. All other blocks were mined by Bitcoin miners that support merge-mining with Namecoin. This demonstrates an enormous dependency of Namecoin on Bitcoin, which is also reflected in the number of transactions: just 1.7% () of them are in classic Namecoin blocks while the remaining 98.3% (M) are in merge-mined blocks. Concerning name operations, we find that more than 99% of these are in merge-mined blocks. Table 7 summarises this. It is fair to say that the Namecoin blockchain presently receives almost its entire computational power from merge-mining with Bitcoin.

The implications of this can be discussed controversely. On the one hand, adding Bitcoin’s power to Namecoin means that any attack on the name registration system requires an inordinate amount of computational resources. On the other hand, it means that Namecoin is essentially a kind of ‘side-chain’ of Bitcoin. Since merge-mining implies that entire Bitcoin blocks must be written into the Namecoin blockchain, there is also an extreme overhead of storage required in Namecoin. Recall that the Namecoin blockchain requires 3GB on disk, and compare this to the requirements of Peercoin. Peercoin has a third of the transactions of Namecoin, but requires only a sixth of the space that the Namecoin blockchain needs. The storage overhead for Namecoin is close to 100%.

| Name operations | |||||

|---|---|---|---|---|---|

| Blocks | Transactions | new | firstupdate | update | |

| Normally mined | |||||

| Merge-mined | (93.2%) | (98.3%) | (99.4%) | (99.7%) | (99.8%) |

It is instructive to inspect if Namecoin is used in some sensible way. An initial analysis of Namecoin was provided by Kalodner et al.in [8]. The authors report that they could only identify 28 domains that did not seem to be registered by squatters for the purpose of transferring or selling them later. We refer the reader to their publication for details as we did not attempt to replicate their study. In the following, we are more concerned with how the usage of Namecoin has developed over time. At the time of writing, we find registered names, and there are unique addresses (public keys) in Namecoin, distributed over approximately 4M transactions.

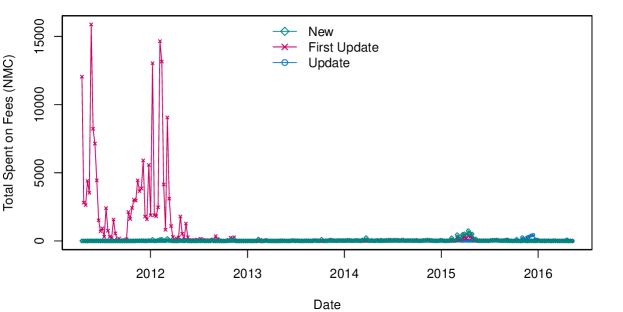

Recall that registration of names costs fees in Namecoin. Figure 6 shows these fees over time (plotted per week), for each type of name operation. The high network fees in the beginning for the name_firstupdate are the cause for spikes for this operation. The costs for registrations became very small—near 1 NMC—in recent years. Two bumps in the plot indicate sudden surges of registrations—but apart from this, there does not seem to be too much activity. This is also reinforced by the second plot in Figure 6. We used the exchange rates provided by the Poloniex currency exchange141414https://poloniex.com in its API to convert Namecoin values to Bitcoin and from there to USD. One can see that investment per week topped out at 200 USD during spikes, but has generally been very low.

We analysed two of the spikes that were prominent in April 2015, namely on 2015-04-11 and 2015-04-25. Our hypothesis was that these might be renewals of expiring names. We first checked for name_update operations. We found that only of the name operations on 2015-04-11 belonged to that category, and only on 2015-04-25. When checking the first_updates for 2015-04-11, i.e., registration of a name that is not in the system (any more), we found names registered on that day (for 2015-04-25, we found ). Of these, 170 had been previously registered, mostly in 2014 and before. These were thus re-registrations of expired names. The names themselves consisted of nouns, adjectives, and a person’s first name. With the exception of just four names, all were re-registered again after 2015-04-11. We repeated the exercise for 2015-04-25 and found very similar numbers, both absolute and relative (although the names were more entertaining, e.g., thepiratesbay, starwar (sic!), and disney-world. The conclusion that seems most likely here is that this is a form of the squatting behaviour that the authors of [8] had also found.

4.3.1 Network

We investigated how the Namecoin blockchain is supported by its own network. We note that the website BitinfoCharts [3] shows roughly 200 Namecoin ‘active’ nodes, although it is not clear from the site how ‘active’ is defined.

The Namecoin software is shipped with 16 hard-coded IP addresses, plus two Onion addresses for use over Tor. Five of them did not have reverse DNS entries. Of the remaining 11 names, we could identify two to be from networks for private customers. We could identify five as hosted/co-located. One IP belonged to a mining pool. The rest were second-level domains in COM/NET/ORG. We did not check activity for Onion addresses.

Namecoin also hard codes five DNS names whose A records can be queried for bootstrap nodes. Of these, only four replied with DNS records. We queried each domain ten times. On every occasion, two replied with 26 A records each, one with 32, and one with 17. The overlap was relatively small, at about 10% of IP addresses that were returned by more than one source. A round-robin or random selection was also evidently taking place as we collected new IP addresses with every run: after two runs, we had 137 unique addresses, after five runs 207, and after ten runs 337. We queried their PTR records and identified about 180 IP addresses for private customers, 4 AWS IPs, and 26 addresses from colocation providers.

In total, we had obtained 347 seed IP addresses from both the hard-coded and DNS seeds. Scanning these addresses, we found 126 (36%) of them had the Namecoin port (8334) open, but in 183 cases (53%) the IP seemed to be behind a firewall, and in 39 cases the port was closed (11%).

Our conclusion is that the Namecoin network profits from DNS-based seeding, where servers evidently keep track of a relatively large number of other Namecoin clients that they reveal on subsequent DNS queries. A significant number of revealed IP addresses seem to be from private households, however, and only about a third of them have an actual Namecoin client running on that port.

4.4 Peercoin

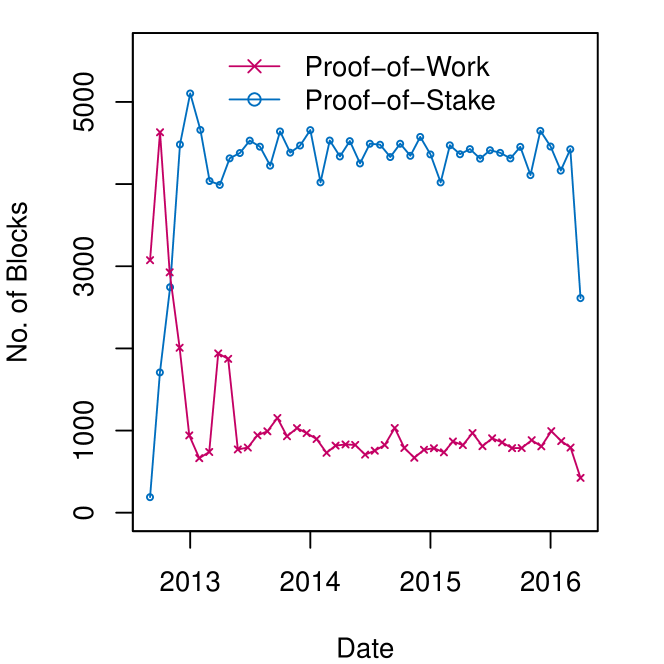

We also briefly investigated the Peercoin blockchain. Here, our primary interest was to determine the exact usage of proof-of-stake. This concept is described in rather vague terms in the project’s whitepaper [10]. The whitepaper—which is from 2012—also announces that the network will gradually move to proof-of-stake. Proof-of-work blocks will continue to play a role, but their importance decreases. Figure 7 shows how many blocks were mined by proof-of-work and how many were created with proof-of-stake. The switch-over has, in fact, happened at an early stage of the network, and since ca. 2013 proof-of-stake blocks constitute the vast majority.

We were also interested to see how large the network was. There are currently , which is an order of magnitude less than in Namecoin. This corresponds well with the lower number of transactions that we found for this blockchain. The website BitinfoCharts [3] gives an estimate of just under nodes.

For bootstrapping, 15 IP addresses are hard-coded seeds in the Peercoin client. Peercoin also ships with 7 hard-coded domain names. We queried these for their A records, six times in total. Each time, we received 2 NXDOMAIN. Four times, a domain yielded a SERVFAIL, although it did respond in two cases. This was one of the domains that we identified to return IP addresses in a round-robin fashion. After two tries, we had obtained 71 unique IP addresses. This rose to 92 after four tries and 100 after six tries. The vast majority (around 30 addresses each try) were provided by just two seed domains. Together with the hard-coded addresses, we now had 113 seed IPs. For 95 of them, we could obtain the reverse DNS entries. 69% of them belonged to customers of ISPs; of the rest, almost half could be clearly identified as co-located servers. The remainder were second-level domains where it was unclear how they were hosted. We found one IP address that belonged to the cryptocurrency exchange Nixmoney. We scanned all 113 seed IPs to test whether they responded on the Peercoin port (TCP/9901). 82 had the port open, in 26 cases it was filtered (indicating the presence of a firewall), and in the remaining cases closed. None of the 15 hard-coded IPs responded to our probes on Peercoin port (12 filtered, 3 closed).

Compared to Namecoin, Peercoin bootstrapping depends evidently more on transient setups by private users. For all practical purposes, bootstrapping into Peercoin is limited to just two domains, making Peercoin the network with the poorest bootstrapping mechanism.

5 Summary

In this paper, we have studied the characteristics of modern blockchains. We chose three representatives of these: Ethereum as the first and very successful blockchain that allows to run Turing-complete programs on the blockchain, Namecoin as an attempt to base a name registration service on Bitcoin technology, and Peercoin as the first blockchain to make use of a proof-of-stake mechanism. We found that Ethereum is by far the most active blockchain gaining in popularity. However, most transactions are still transfers from one account to another, and smart contracts are only slowly created. A good part of them is based on widely available tutorials. Furthermore, there are some security risks involved when defensive programming guidelines are not adhered to—although there does not seem to be a strong financial motivation for an attacker yet. We also found curious transaction patterns that may be used to hide the balance of accounts. Ethereum nodes are distributed over the globe, with particularly many nodes in Western countries, but also in Russia and China. In the case of Namecoin, we found that the blockchain shows very little activity. Previously reported name-squatting seems to be going on, but even this is at a low rate, despite very cheap registration costs. Peercoin, meanwhile, has switched to proof-of-stake long ago. Despite there being no formal analysis of its proof-of-stake mechanism, it does move considerable assets around, albeit two orders of magnitude less than Bitcoin. Both Namecoin and Peercoin have very few clients; we showed furthermore that their bootstrapping process relies on unavailable seed nodes.

References

- [1] Simon Barber, Xavier Boyen, Elaine Shi, and Ersin Uzun. Bitter to better - how to make bitcoin a better currency. In Proc. Financial Cryptography and Data Security, 2012.

- [2] Guido Bertoni, Joan Daemen, Michaël Peeters, and Gilles Van Assche. The keccak sha-3 submission. Submission to NIST (Round 3), 6(7):16, 2011.

- [3] Bitinfocharts. Website. https://bitinfocharts.com/namecoin/nodes-active/, 2016.

- [4] Joseph Bonneau, Andrew Miller, Jeremy Clark, Arvind Narayanan, Joshua A. Kroll, and Edward W. Felten. SoK: Research perspectives and challenges for Bitcoin and cryptocurrencies. In IEEE Symposium on Security and Privacy (S&P), 2015.

- [5] Christian Decker and Roger Wattenhofer. Information propagation in the Bitcoin network. In Proc. IEEE Conf. peer-to-peer networks (P2P), 2013.

- [6] Ittay Eyal and Emin Gün Sirer. Majority is not enough: Bitcoin mining is vulnerable. In Proc. Financial Cryptography and Data Security, 2014.

- [7] Ethan Heilman, Alison Kendler, Aviv Zohar, and Sharon Goldberg. Eclipse attacks on bitcoin’s peer-to-peer network. In 24th USENIX Security Symposium (USENIX Security 15), pages 129–144, 2015.

- [8] Harry Kalodner, Miles Carlsten, Paul Ellenbogen, Joseph Bonneau, and Arving Narayanan. An empirical study of Namecoin and lessons for decentralized namespace design. In Proc. Workshop on the Economics of Information Security (WEIS), 2015.

- [9] Ghassan O. Karame, Elli Androulaki, and Srdjan Capkun. Double-spending fast payments in Bitcoin. In Proc. ACM Conf. Computer and Communications security (CCS), 2012.

- [10] Sunny King and Scott Nadal. PPCoin: Peer-to-peer crypto-currency with proof-of-stake. Whitepaper by project. Online: https://peercoin.net/whitepaper, 2012.

- [11] Petar Maymounkov and David Mazieres. Kademlia: A peer-to-peer information system based on the XOR metric. In Peer-to-Peer Systems, pages 53–65. Springer, 2002.

- [12] Sarah Meiklejohn, Marjori Pomarole, Grant Jordan, Kirill Levchenko, Damon McCoy, Geoffrey M. Voelker, and Stefan Savage. A fistful of Bitcoins: Characterizing payments among men with no names. In Proc. ACM SIGCOMM Internet Measurement Conference (IMC), 2013.

- [13] Andrew Miller, Brian Warner, and Nathan Wilcox. Ethereum analysis: Gas economics and proof of work, 2015.

- [14] Satoshi Nakamoto. Bitcoin: A peer-to-peer electronic cash system. Published online: https://bitcoin.org/bitcoin.pdf, 2008.

- [15] Karl J O’Dwyer and David Malone. Bitcoin mining and its energy footprint. In Irish Signals & Systems Conference 2014 and 2014 China-Ireland International Conference on Information and Communications Technologies (ISSC 2014/CIICT 2014). 25th IET, pages 280–285. IET, 2013.

- [16] Dorit Ron and Adi Shamir. Quantitative analysis of the full bitcoin transaction graph. In Proc. Financial Cryptography and Data Security, 2013.

- [17] Gavin Wood. Ethereum: A secure decentralised generalised transaction ledger. Ethereum Project Yellow Paper as published on https://github.com/ethereum/yellowpaper at commit hash: 9954c1932070cb44c7e64c74691b21ce42f697fe, 2014.