Applications of Distance Correlation to Time Series

Abstract.

The use of empirical characteristic functions for inference problems, including estimation in some special parametric settings and testing for goodness of fit, has a long history dating back to the 70s (see for example, [Feuerverger and Mureika (1977)], Csörgő (1981a,1981b,1981c) [Feuerverger (1993)]). More recently, there has been renewed interest in using empirical characteristic functions in other inference settings. The distance covariance and correlation, developed by [Székely and Rizzo (2009)] for measuring dependence and testing independence between two random vectors, are perhaps the best known illustrations of this. We apply these ideas to stationary univariate and multivariate time series to measure lagged auto- and cross-dependence in a time series. Assuming strong mixing, we establish the relevant asymptotic theory for the sample auto- and cross-distance correlation functions. We also apply the auto-distance correlation function (ADCF) to the residuals of an autoregressive processes as a test of goodness of fit. Under the null that an autoregressive model is true, the limit distribution of the empirical ADCF can differ markedly from the corresponding one based on an iid sequence. We illustrate the use of the empirical auto- and cross-distance correlation functions for testing dependence and cross-dependence of time series in a variety of different contexts.

Key words and phrases:

Auto- and cross-distance correlation function, testing independence, time series, strong mixing, ergodicity, Fourier analysis, -statistics, AR process, residuals1991 Mathematics Subject Classification:

Primary 62M10; Secondary 60E10 60F05 60G10 62H15 62G201. Introduction

In time series analysis, modeling serial dependence is typically the overriding objective. In order to achieve this goal, it is necessary to formulate a measure of dependence and this may depend on the features in the data that one is trying to capture. The autocorrelation function (ACF), which provides a measure of linear dependence, is perhaps the most used dependence measure in time series. It is closely linked with the class of ARMA models and provides guidance in both model selection and model confirmation. On the other hand, the ACF gives only a partial description of serial dependence. As seen with financial time series, data are typically uncorrelated but dependent for which the ACF is non-informative. In this case, the dependence becomes visible by examining the ACF applied to the absolute values or squares of the time series. In this paper, we consider the application of distance correlation in a time series setting, which can overcome some of the limitations with other dependence measures.

In recent years, the notions of distance covariance and correlation have become rather popular in applied statistics. Given vectors and with values in and , the distance covariance between and with respect to a suitable measure on is given by

| (1.1) |

where we denote the characteristic function of any random vector by

The distance correlation is the corresponding version of standardized to values in . The quantity is zero if and only if -a.e. In many situations, for example when has a positive Lebesgue density on , we may conclude that and are independent if and only if . An empirical version of is obtained if the characteristic functions in (1.1) are replaced by their corresponding empirical versions. Then one can build a test for independence between and based on the distribution of under the null hypothesis that and are independent.

The use of empirical characteristic functions for univariate and multivariate sequences for inference purposes has a long history. In the 1970s and 1980s, [Feuerverger and Mureika (1977)], Csörgő (1981a,1981b,1981c) and many others proved fundamental asymptotic results for iid sequences, including Donsker-type theory for the empirical characteristic function. Statisticians have applied these methods for goodness-of-fit tests, changepoint detection, testing for independence, etc.; see for example Meintanis and coworkers ([Meintanis and Iliopoulos (2008), Hlávka et al. (2011), Meintanis et al. (2015)]), and the references therein. The latter authors employed the empirical distance covariance for finite measures . [Feuerverger (1993)] was the first to apply statistics of form (1.1) for general measures. In particular, he advocated the infinite measure

for testing independence of univariate data.

Székely et al.111They appeared to have coined the terms

distance covariance and correlation.

([Székely et al. (2007)],

[Székely and Rizzo (2014), Székely and Rizzo (2009)], see also the references therein)

developed asymptotic techniques for the empirical distance covariance and correlation of

iid sequences for the infinite measure given by

| (1.2) |

where is a constant (see (2.13)) and . With this choice of , the distance correlation, is invariant relative to scale and orthogonal transformations, two desirable properties for measures of dependence. As a consequence this choice of measure is perhaps the most common. However, there are other choices of measures for that are also useful depending on the context.

[Dueck et al. (2014)] studied the affinely invariant distance covariance given by , where are the respective covariance matrices of and and is given by (1.2). They showed that the empirical version of , where and are estimated by their empirical counterparts is strongly consistent. In addition, they provide explicit expressions in terms of special functions of the limit in the case when are multivariate normal. Further progress on this topic has been achieved in [Sejdinovic et al. (2013)] and [Lyons (2013)], who generalized correlation distance to a metric space.

In this paper we are interested in the empirical distance covariance and correlation applied to a stationary sequence to study serial dependence, where and assume values in and , respectively. We aim at an analog to the autocorrelation and autocovariance functions of classical time series analysis in terms of lagged distance correlation and distance covariance. Specifically we consider the lagged-distance covariance function , , and its standardized version that takes the values in We refer to the auto- and cross-distance covariances functions and their correlation analogs. We provide asymptotic theory for the empirical auto- and cross-distance covariance and correlation functions under mild conditions. Under ergodicity we prove consistency and under -mixing, we derive the weak limits of the empirical auto- and cross-distance covariance functions for both cases when and are independent and dependent. From a modeling perspective, distance correlation has limited value in providing a clear description of the nature of the dependence in the time series. To this end, it may be difficult to find a time series model that produces a desired distance correlation. In contrast, one could always find an autoregressive (or more generally ARMA) process that matches the ACF for an arbitrary number of lags. The theme in this paper will be to view the distance correlation more as a tool for testing independence rather than actually measuring dependence.

The literature on distance correlation for dependent sequences is sparse. To the best of our knowledge, [Zhou (2012)] was the first to study the auto-distance covariance and its empirical analog for stationary sequences. In particular, he proved limit theory for under so-called physical dependence measure conditions on and independence of and . [Fokianos and Pitsillou (2016)] developed limit theory for a Ljung-Box-type statistic based on pairwise distance covariance of a sample from a stationary sequence. In both papers, the measure is given by (1.2).

Typically, a crucial and final step in checking the quality of a fitted time series model is to examine the residuals for lack of serial dependence. The distance correlation can be used in this regard. However, as first pointed out in his discussion, [Rémillard (2009)] indicated that the behavior of the distance correlation when applied to the residuals of a fitted AR(1) process need not have the same limit distribution as that of the distance correlation based on the corresponding iid noise. We provide a rigorous proof of this result for a general AR() process with finite variance under certain conditions on the measure . Interestingly, the conditions preclude the use of the standard weight function (1.2) used in [Székely et al. (2007)]. In contrast, if the noise sequence is heavy-tailed and belongs to the domain of attraction of a stable distribution with index , the distance correlation functions for both the residuals from the fitted model and the iid noise sequence coincide.

The paper is organized as follows. In Section 2 we commence with some basic results for distance covariance. We give conditions on the moments of and and the measure , which ensure that the integrals in (1.1) are well-defined. We provide alternative representations of and consider various examples of finite and infinite measures . Section 3 is devoted to the empirical auto- and cross-distance covariance and correlation functions. Our main results on the asymptotic theory of these functions are provided in Section 3.1. Among them are an a.s. consistency result (Theorem 3.1) under the assumption of ergodicity and asymptotic normality under a strong mixing condition (Theorem 3.2). Another main result (Theorem 4.1) is concerned with the asymptotic behavior of the empirical auto-distance covariance function of the residuals of an autoregressive process for both the finite and infinite variance cases. In Section 5, we provide a small study of the empirical auto-distance correlation functions derived from simulated and real-life dependent data of moderate sample size. The proofs of Theorems 3.2 and 4.1 are postponed to Appendices A and B.

2. Distance covariance for stationary time series

2.1. Conditions for existence

From (1.1), the distance covariance between two vectors and is the squared -distance between the joint characteristic function of and the product of the marginal characteristic functions of and with respect to a measure on . Throughout we assume that is finite on sets bounded away from the origin i.e., on sets of the form

| (2.1) |

In what follows, we interpret as a concatenated vector in equipped with the natural norm . We suppress the dependence of the norm on the dimension. The symbol stands for any positive constant, whose value may change from line to line, but is not of particular interest. Clearly if and are independent, . On the other hand, if is an infinite measure, and and are dependent, extra conditions are needed to ensure that is finite. This is the content of the following lemma.

Lemma 2.1.

Let and be two possibly dependent random vectors and one of the following conditions is satisfied:

-

(1)

is a finite measure on .

-

(2)

is an infinite measure on , finite on the sets , , such that

(2.2) and for some .

-

(3)

is infinite in a neighborhood of the origin and for some , and

(2.3)

Then is finite.

Remark 2.2.

If for some measures and on and , respectively, and if is finite on the sets then it suffices for (2.2) to verify that

Proof.

(1) Since the integrand in is uniformly bounded the statement is trivial.

(2) By (2.1),

for any . Therefore it remains to verify the integrability of

on one of the sets . We consider only the case ; the cases when

, and , are similar. An application of the Cauchy-Schwarz inequality yields

| (2.4) |

Since

for an independent copy of , a Taylor expansion and the fact that have finite th moments yield for and some constant ,

| (2.5) | |||||

In the last step we used Markov’s inequality and the fact that . A corresponding bound holds for . Now, follows

from (2.2) and (2.4).

(3) By (2.3), is finite. Therefore we need to show integrability of

only for .

Using the arguments from part (2) and the finiteness of the th moments, we have

Now integrability of the left-hand side at the origin with respect to is ensured by (2.3). ∎

2.2. Alternative representations and examples

If for measures and on and we write for and ,

for the real parts of the Fourier transforms with respect to , respectively. We assume that these transforms are well-defined. Let be an independent copy of , are independent copies of which are also independent of . We have

| (2.6) | |||||

Notice that the complex-valued trigonometric functions under the expected value may be replaced by their real parts. We intend to interchange the integral with respect to and the expectation.

2.2.1. Finite

For a finite measure on , we may apply Fubini’s theorem directly and interchange integration with expectation to obtain

If we also have

2.2.2. The case of an infinite measure

We consider an infinite measure on which is finite on for any . We assume that is finite and . In this case, we cannot pass from (2.6) to (LABEL:eq:13) because the Fourier transform is not defined as a Lebesgue integral. We have

| (2.8) |

where

Using the fact that

calculation shows that

A Taylor series argument shows that for ,

Under condition (2.2) the right-hand side is integrable with respect to if

| (2.9) |

An application of Fubini’s theorem yields

If we assume that the restrictions of to and are symmetric about the origin then we have

Together with the symmetry property of this implies that .

We summarize these arguments. For any measure on we write

Remark 2.4.

For further use, we mention the alternative representation of (2.10):

Example 2.5.

Assume that has density on given by

| (2.12) |

for some positive constant . For any and , one can choose such that

| (2.13) |

Under the additional moment assumption (2.9) we obtain from (2.10)

This is the distance covariance introduced by [Székely et al. (2007)].

The distance covariance introduced in (2.5) has several good properties. It is homogeneous under positive scaling and is also invariant under orthonormal transformations of and . Some of these properties are shared with other distance covariances when is infinite. We illustrate this for a Lévy measure on , i.e., it satisfies (2.3) for . In particular, is finite on sets bounded away from zero. Via the Lévy-Khintchine formula, a Lévy measure corresponds to an -valued infinitely divisible random vector (with assuming values in and in ) and characteristic function

Lemma 2.6.

Remark 2.7.

We observe that (2.16) always vanishes if and are independent.

Proof.

By the symmetry of the random vectors in (2.6) and the measure , we have

The last step is justified if we can interchange the integral and the expected value. Therefore we have to verify that the following integral is finite:

We denote the integrals over the disjoint sets and by and , respectively. The quantity is bounded since the integrand is bounded and is finite on sets bounded away from zero. A Taylor expansion shows for ,

and the right-hand side is finite by assumption.

Proceeding in the same way as above for the remaining expressions in (2.6), the lemma is proved. ∎

Example 2.8.

Assume that is a probability measure of a random vector in and that and are independent. Then

For example, consider independent symmetric and with multivariate -stable distributions in and , respectively, for some . They have joint characteristic function given by . Therefore

Example 2.9.

Assume that and are integer-valued. Consider the spectral densities and on of two real-valued second-order stationary processes and assume . Denote the covariance functions on the integers corresponding to and by and , respectively. We have the well-known relation

where we also exploit the symmetry of the functions . If we restrict integration in (2.6) to we obtain, abusing notation,

The spectral density of a stationary process may have singularities (e.g. for fractional ARMA processes) but this density is integrable on . If are positive Lebesgue a.e. on then if and only if are independent. Indeed, the characteristic function of an integer-valued random variable is periodic with period .

Example 2.10.

To illustrate (2.16) we consider a symmetric -stable vector for with log-characteristic function

and is a finite symmetric measure on the unit sphere of . Then we have

A special case is the sub-Gaussian -stable random vectors with characteristic function

where is the covariance matrix of an -valued random vector and we write for the concatanation of any and . Then

In particular, if is block-diagonal with a covariance matrix and a covariance matrix, we have

and if is the identity matrix,

| (2.18) | |||||

We notice that for these examples, is scale homogeneous () and (2.18) is invariant under orthonormal transformations ( for orthonormal matrices and ), properties also enjoyed by the weight function in Example 2.5.

3. The empirical distance covariance function of a stationary sequence

In this section we consider the empirical distance covariance for a stationary time series with generic element where and assume values in and , respectively. The empirical distance covariance is given by

where the empirical characteristic function is given by

and and .

3.1. Asymptotic results for the empirical distance correlation

Under the conditions of Lemma 2.1 that ensure the finiteness of , we show that is consistent for stationary ergodic time series.

Theorem 3.1.

Consider a stationary ergodic time series with values in and assume one of the three conditions in Lemma 2.1 are satisfied. Then

Proof.

We denote the differences of the characteristic functions and its empirical analog by

Each of the processes , , is a sample mean of iid bounded continuous processes defined on . Consider the compact set

| (3.1) |

for small . By the ergodic theorem on , the space of continuous functions on , as ; see [Krengel (1985)]. Hence

It remains to show that

If is a finite measure we have

Now assume that is infinite on the axes or at zero and (2.2) holds. We apply inequality (2.4) under the assumption that has the empirical probability measure of the sample , . Since the empirical measure has all moments finite we obtain from (2.5) that for ,

where are independent and each of them has the empirical distribution of the -sample. The right-hand side is a -statistic which converges a.s. to as provided this moment is finite. This follows from the ergodic theorem for -statistics; see [Aaronson et al. (1996)]. The same argument as for part (2) of Lemma 2.1 implies that on ,

By the ergodic theorem,

and the latter integral converges to zero as by assumption.

If the measure is infinite at zero and (2.3) holds the proof is analogous. ∎

In order to prove weak convergence of we assume that the sequence with values in is -mixing with rate function ; see [Ibragimov and Linnik (1971)] and [Doukhan (1994)] for the corresponding definitions. We have the following result.

Theorem 3.2.

Assume that is a strictly stationary sequence with values in such that for some . Set and write and .

-

(1)

Assume that and are independent and for some , and , the following hold:

(3.2) and

(3.3) Then

(3.4) where is a complex-valued mean-zero Gaussian process whose covariance structure is given in (3.9) with and depends on the dependence structure of .

-

(2)

Assume that and are dependent and for some , and for the following hold:

(3.5) and

(3.6) Then

(3.7) where is a mean-zero Gaussian process.

Remark 3.4.

If and are two independent iid sequences then the statement of Theorem 3.2(1) remains valid if for some , and

| (3.8) |

Remark 3.5.

The distribution of the limit variable in (3.4) is generally not tractable. Therefore one must use numerical or resampling methods for determining quantiles of . On the other hand, the limit distribution in (3.7) is normally distributed with mean 0 and covariance that can be easily calculated from the covariance function of and . Notice that if , the limit random variable in (3.7) is 0 and part (1) of the theorem applies. Again resampling or subsampling methods must be employed to determine quantiles of .

3.2. Testing serial dependence for multivariate time series

Define the cross-distance covariance function (CDCVF) of a strictly stationary sequence by

and the auto-distance covariance function (ADCVF) of a stationary sequence by

Here and in what follows, we assume that for suitable measures on and on . In the case of an ADCVF we also assume . The empirical versions and are defined correspondingly. For example, for integer , one needs to replace in the definition of by

with the corresponding modifications for the marginal empirical characteristic functions. For finite , the change from the upper summation limit to has no influence on the asymptotic theory.

We also introduce the corresponding cross-distance correlation function (CDCF)

and auto-distance correlation function (ADCF)

The quantities assume values in , with the two endpoints representing independence and complete dependence. The empirical CDCF and ADCF are defined by replacing the distance covariances by the corresponding empirical versions .

The empirical ADCV was examined in [Zhou (2012)] and [Fokianos and Pitsillou (2016)] as an alternative tool for testing serial dependence, in the way that it also captures non-linear dependence. They always choose the measure with density (2.12).

In contrast to the autocorrelation and cross-correlation functions of standard stationary time series models (such as ARMA, GARCH) it is in general complicated (or impossible) to provide explicit (and tractable) expressions for and or even to say anything about the rate of decay of these quantities when . However, in view of (2.4) we observe that

While this is not the autocovariance function of a stationary process, it is possible to bound each of the terms in case is -mixing with rate function . In this case, one may use bounds for the autocovariance functions of the stationary series and which inherit -mixing from with the same rate function. For example, a standard inequality ([Doukhan (1994)], Section 1.2.2, Theorem 3(a)) yields that

for positive and such that . If is bounded we also have for some positive constant. Similar bounds can be found for provided is -mixing.

Next we give an example where the ADCVF can be calculated explicitly.

Example 3.6.

Consider a univariate strictly stationary Gaussian time series with mean zero, variance and autocovariance function . We choose a Gaussian probability measure which leads to the relation (2.8). Choose iid -distributed independent of the independent quantities . Then for ,

For the evaluation of this expression we focus on the first term, the other cases being similar. Observing that are the eigenvalues of the covariance matrix

calculation shows that

Now the moment generating function of a -distributed random variable yields

Proceeding in a similar fashion, we obtain

If as Taylor expansions yield . A similar result was given in [Fokianos and Pitsillou (2016)], where they derived an explicit expression for for a stationary Gaussian process with weight function (1.2).

If is strictly stationary and ergodic then is a strictly stationary ergodic sequence for every integer . Then Theorem 3.1 applies.

Corollary 3.7.

Applying Theorem 3.2 and Theorem 3.1, we also have the following weak dependence result under -mixing. [Zhou (2012)] proved the corresponding result under conditions on the so-called physical dependence measure.

Corollary 3.8.

Assume that and are independent for some and the sequence satisfies the conditions of Theorem 3.2. Then

where is a centered Gaussian process on .

Remark 3.9.

From the proof of Theorem 3.2 (the central limit theorem for the multivariate empirical characteristic function) it follows that has covariance function

In the special case when and are independent sequences is the same across all with covariance function

Since is centered Gaussian its squared -norm has a weighted -distribution; see [Kuo (1975)], Chapter 1. The distribution of is not tractable and therefore one needs resampling methods for determining its quantiles.

Remark 3.10.

Corollary 3.8 can be extended to the joint convergence of the function at finitely many lags , provided and are independent for these lags.

Remark 3.11.

Corollary 3.8 does not apply when and are dependent. Then a.s. and a.s.

4. Auto-distance covariance of fitted residuals from AR process

An often important problem in time series is to assess the goodness-of-fit of a particular model. As an illustration, consider a causal autoregressive process of order (AR) given by the difference equations,

where is an iid sequence with a finite moment for some . It is further assumed has mean 0 if . It is often convenient to write the AR() process in the form,

where , and . Since the process is assumed causal, we can write for absolutely summable constants ; see [Brockwell and Davis (1991)], p. 85. For convenience, we also write for and .

The least-squares estimator of satisfies the relation

where

If , we have by the ergodic theorem,

| (4.1) |

Causality of the process implies that the partial sum is a martingale and applying the martingale central limit theorem yields

| (4.2) |

where is distributed.

The residuals of the fitted model are given by

| (4.3) |

For convenience, we set , since this choice does not influence the asymptotic theory. Each of the residuals depends on the estimated parameters and hence the residual process exhibits serial dependence. Nevertheless, we might expect the test statistic based on the distance covariance function of the residuals given by

to behave in a similar fashion for the true noise sequence . If the model is a good fit, then we would not expect to be extraordinarily large. As observed by [Rémillard (2009)], the limit distributions for and are not the same. As might be expected, the residuals, which are fitted to the actual data, tend to have smaller distance covariance than the true noise terms for lags less than , if the model is correct. As a result, one can fashion a goodness-of-fit test based on applying the distance covariance statistics to the residuals. In the following theorem, we show that the distance covariance based on the residuals has a different limit than for the distance covariance based on the actual noise, if the process has a finite variance. So in applying a goodness-of-fit test, one must make an adjustment to the limit distribution. Interestingly, if the noise has heavy-tails, the limits based on the residuals and the noise terms are the same and no adjustment is necessary.

Theorem 4.1.

Consider a causal AR process with iid noise . Assume

| (4.4) |

- (1)

-

(2)

If is in the domain of attraction of a stable law of index , i.e., for and is a slowly varying function at , and

as for some ([Feller (1971)], p. 313). Then we have

(4.6) where is a Gaussian limit random field on . The covariance structure of is specified in Remark 3.9 for the sequence .

The proof is given in Appendix B.

Remark 4.2.

[Rémillard (2009)] mentioned that and for an AR process have distinct limit processes and he also suggested the limiting structure in (4.5).

The structure of the limit process in (4.5) is rather implicit. In applications, one depends on resampling methods. Relation (4.5) can be extended to a joint convergence result for finitely many lags but the dependence structure of the limiting vectors is even more involved. Condition (4.4) holds for probability measures on with finite second moment but it does not hold for the benchmark measure described in (2.12). A reason for this is that is in general not well defined in this case. If has characteristic function then by virtue of (B.2), is finite a.s. if and only if

Now assume that has a density function and choose . Then by Plancherel’s identity, the first integral becomes

If one chooses to be a symmetric gamma distribution with shape parameter , i.e., , then the integral and hence the limit random variable in (4.5) cannot be finite.

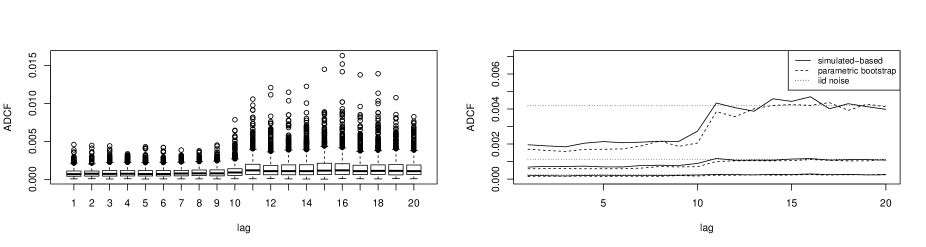

AR simulation. We illustrate the results of Theorem 4.1. First, we generate independent replications of a time series from a causal AR model with and

In this and the following examples, we choose the weight measure as the -distribution for which (4.4) is satisfied. From the independent replications of the simulated residuals we approximate the limit distribution of by the corresponding empirical distribution.

The left graph in Figure 1 shows the box-plots for based on 1000 replications from the AR(10) model, each with sample size . As seen from the plots, the distribution at each lag is heavily skewed. In the right panel of Figure 1, we compare the empirical , , quantiles of to those of , the scaled ADCF of iid noise, all of which have the same limit, . The asymptotic variance of the ADCF of the residuals is smaller than that of iid noise at initial lags, and gradually increases at larger lags to the values in the iid case. This behavior is similar to that of the ACF of the residuals of an AR process; see for example Chapter 9.4 of [Brockwell and Davis (1991)].

Theorem 4.1 provides a visual tool for testing the goodness-of-fit of an AR model, by examining the serial dependence of the residuals after model fitting. Under the null hypothesis, we expect to be well bounded by the quantiles of the limit distribution . For a single time series, this quantity can be approximated using a parametric bootstrap (generating an AR(10) process from the estimated parameters and residuals); see for example [Politis et al. (1999)]. In the right graph of Figure 1 we overlay the empirical , , quantiles of estimated from one particular realization of the time series. As can be seen in the graph, the parametric bootstrap provides a good approximation to the actual quantiles found via simulation. On the other hand, the quantiles found by simply bootstrapping the residuals provides a rather poor approximation, at least for the first 10 lags.

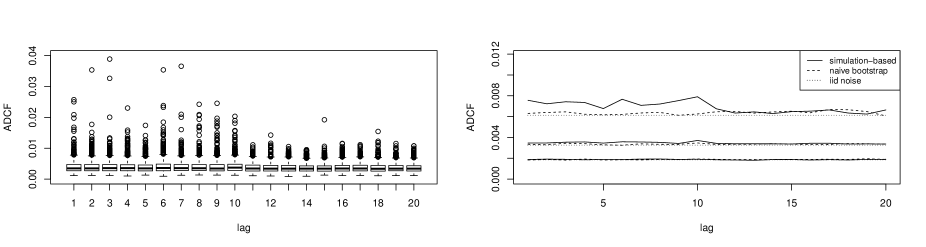

We now consider the same AR(10) model as before, but with noise having a -distribution with 1.5 degrees of freedom. (Here the noise is in the domain of attraction of a stable distribution with index 1.5.) The left graph of Figure 2 shows the box-plots of based on 1000 replications, and the right graph shows the , , quantiles of and , both of which have the same limit distribution . In this case, the quantiles of can be approximated naively by bootstrapping the fitted residuals of the AR model. The left graph of Figure 2 overlays the , , quantiles from bootstrapping with those from the simulations. The agreement is reasonably good.

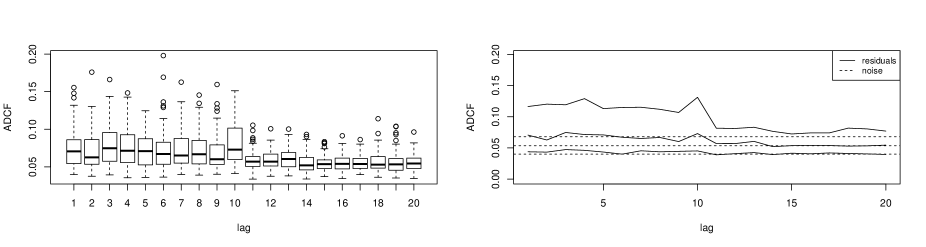

We next provide an empirical example illustrating the limitation of using the measure in (2.12). Again, we use the same AR(10) model as before, but with noise now generated from the symmetric gamma distribution with . The corresponding pair of graphs with boxplots and quantiles for is displayed in Figure 3. The quantiles for for lags 1-10 are now rather large compared to those of iid noise.

5. Data Examples

5.1. Amazon daily returns

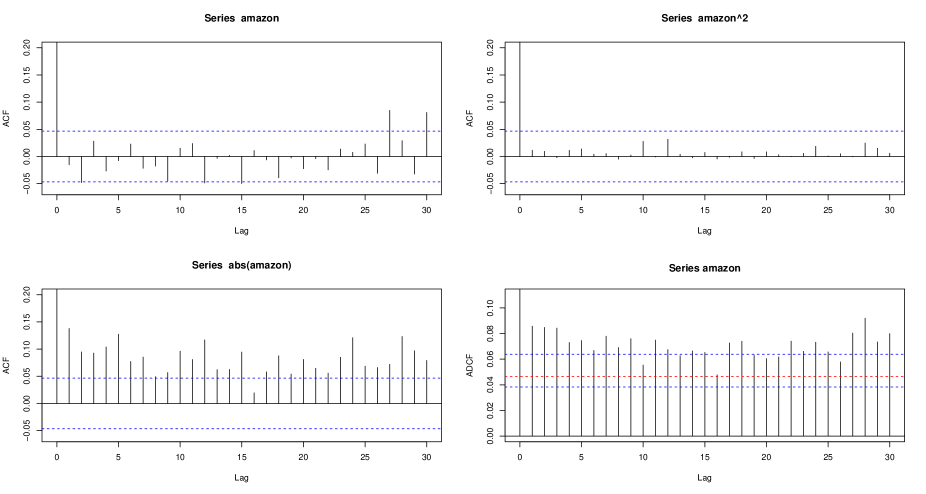

In this example, we consider the daily stock returns of Amazon from 05/16/1997 to 06/16/2004. Denoting the series by , Figure 4 shows the ACF of , , and ADCF of with weight measure . In the right panel, we compare the ADCF with the , , confidence bounds of the ADCF for iid data, approximated by the corresponding empirical quantiles from 1000 random permutations. With most financial time series, which are typically uncorrelated, serial dependence can be detected by examining the ACF of the absolute values and squares. Interestingly for the Amazon data, the ACF of the squared data also fails to pick up any signal. On the other hand, the ADCF has no trouble detecting serial dependence without having to resort to applying any transformation.

5.2. Wind speed data

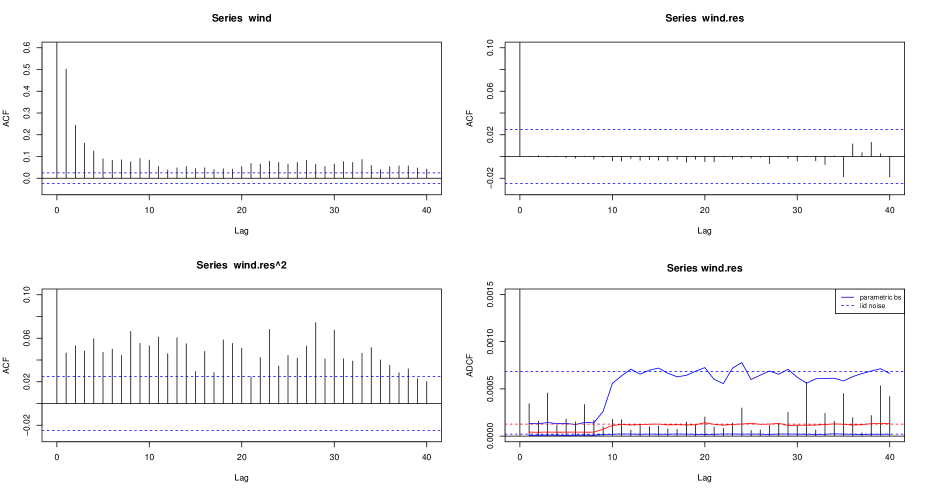

For the next example we consider the daily averages of wind speeds at Kilkenny’s synoptic meteorological station in Ireland. The time series consists of 6226 observations from 1/1/1961 to 1/17/1978, after which a square root transformation has been applied to stabilize the variance. This transformation has also been suggested in previous studies (see, for example, [Haslett and Raftery (1989)]). The ACF of the data, displayed in Figure 5, suggests a possible AR model for the data. An AR(9) model was found to provide the best fit (in terms of minimizing AICC among all AR models) to the data. The ACF of the residuals (see upper right panel in Figure 5) shows that the serial correlation has been successfully removed. The ACF of the squared residuals and ADCF of the residuals are also plotted in the bottom panels Figure 5. For computation of the ADCF, we used the N(0,.5) distribution for the weight measure, which satisfies the condition (4.4). The ADCF of the residuals is well bounded by the confidence bounds for the ADCF of iid noise, shown by the dotted line in the plot. Without adjusting these bounds for the residuals, one would be tempted to conclude that the AR model is a good fit. However, the adjusted bounds for the ADCF of residuals, represented by the solid line in the plot and computed using a parametric bootstrap, suggest that some ADCF values among the first 8 lags are in fact larger than expected. Hence this sheds some doubt on the validity of an AR(9) model with iid noise for this data. A similar conclusion can be reached by inspecting the ACF of the squares of the residuals (see lower left panel in Figure 5).

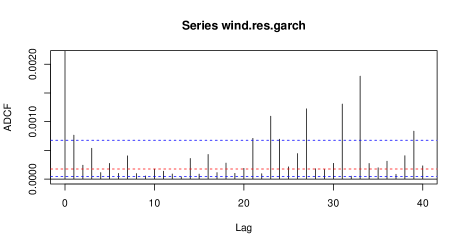

One potential remedy for the lack of fit of the AR(9) model, is to consider a GARCH(1,1) model applied to the residuals. The GARCH model performs well in devolatilizing the AR-fitted residuals and no trace of a signal could be detected through the ACF of the GARCH-residuals applied to the squares and absolute values. The ADCF of the devolatilized residuals, seen in Figure 6, still presents some evidence of dependence. Here the confidence bounds plotted are for iid observations, obtained from 1000 random permutations of the GARCH-residuals and as such do not include an adjustment factor. Ultimately, a periodic AR model, which allows for periodicity in both the AR parameters and white noise variance might be a more desirable model.

Appendix A Proof of Theorem 3.2

The proof follows from the following lemma.

Lemma A.1.

Remark A.2.

Notice that when and are independent.

Proof.

(1) We focus on the proof under the assumption of independence.

At the end, we indicate the changes necessary when and are dependent.

We write

where we suppress the dependence of and on and , respectively. Then

We have by stationarity

Since and are independent . In view of the -mixing condition (see [Doukhan (1994)], Section 1.2.2, Theorem 3(a)) we have

In the last step we used that and that . We have for

Therefore and since we have

Now we turn to . By the Cauchy-Schwarz inequality and since and are bounded by 2 we have

for any . In view of Lemma 18.5.1 in [Ibragimov and Linnik (1971)] we have for ,

Similar arguments as for show that

Combining the bounds for and , we arrive at (A.1).

Now we indicate the changes necessary when and are dependent.

We use the notation above and, additionally, write . We have

Then

Since , we have by stationarity

Observe that and

Since we have and in a similar manner, . We also have . Finally, we conclude that

With the -mixing condition we obtain

This together with yields

The remaining term can be treated in the same way as in the independent case.

Combining the bounds for and , we arrive at (A.1).

(2) We need an analog of S. Csörgő’s central limit theorem

(Csörgő (1981a,1981b,1981c))

empirical characteristic function of an iid multivariate sequence with Gaussian limit.

For ease of notation we focus on the -sequence; the proof for the -sequence is analogous and therefore omitted.

The convergence of the finite-dimensional distributions of

follows from Theorem 18.5.2 in [Ibragimov and Linnik (1971)]

combined with the Cramér-Wold device.

We need to show tightness of the normalized empirical characteristic function on compact sets.

We use the sufficient condition of Theorem 3 in [Bickel and Wichura (1971)]

for multiparameter processes. We evaluate the process on cubes

, where and

and , . The increment of

the normalized empirical

characteristic function on is given by

| (A.3) | |||||

where and

We apply the sums inductively to derive (A.3). Observe that

By the Lipschitz property of trigonometric functions we have for some constant and ,

Proceeding as for (A) and noticing that , we have

Using the summability of and the moment condition on , we may conclude that

If the condition of Theorem 3 in [Bickel and Wichura (1971)] yields that the processes are tight on compact sets. ∎

Proof of Theorem 3.2(1).

Appendix B Proof of Theorem 4.1

We proof the result for the residuals calculated from least square estimates. One may show that the same result holds for maximum likelihood and Yule-Walker estimates. We start with a joint central limit theorem for and .

Lemma B.1.

Proof.

We observe that, uniformly for ,

In view of the functional central limit theorem for the empirical characteristic function of an iid sequence (see Csörgő (1981a,1981b)) we have uniformly for ,

Therefore it suffices to study the convergence of the finite-dimensional distributions of . In view of (4.1) it suffices to show the convergence of the finite-dimensional distributions of . This convergence follows by an application of the martingale central limit theorem and the Cramér-Wold device. It remains to determine the limiting covariance structure, taking into account the causality of the process . We have

By causality, and are independent for . Hence is non-zero if and only if and , resulting in

This implies (B.1). ∎

Lemma B.2.

For every ,

where are specified in Lemma B.1,

| (B.2) |

the convergence is in , is a compact set. In particular, we have

| (B.3) |

Proof.

We observe that, uniformly for ,

| (B.4) | |||||

Write

In view of the uniform ergodic theorem, (4.2) and the causality of we have

| (B.5) |

where the convergence is in . By virtue of Lemma B.1 and the mapping theorem we have the joint convergence in . Denoting the sup-norm in by , it remains to show that The proof for and is analogous to (B.5) by observing that the limiting expectation is zero. We have by a Taylor expansion for some positive constant ,

In the last step we used the uniform ergodic theorem and (4.2). ∎

Proof of Theorem 4.1(1).

We proceed as in the proof of Theorem 3.2. By virtue of (B.3) and the continuous mapping theorem we have

Thus it remains to show that

| (B.6) |

Following the lines of the proof of Theorem 3.2, we have

see also Remark 3.4. Thus it suffices to show

For convenience we redefine

This version does not change previous results for .

Using telescoping sums, we have for ,

where, suppressing the dependence on in the notation,

Write and for any positive constant which may differ from line to line. By Taylor expansions we have

The quantities are stochastically bounded. From ergodic theory, and . Hence

where the term does not depend on and . Thus we conclude for that

| (B.7) |

A similar argument yields

Then (B.7) holds for . Taylor expansions also yield

This proves (B.7) for . By a symmetry argument but with the corresponding bound , (B.7) for follows as well. By Taylor expansion, we also have

We may conclude that (B.7) holds for . The case follows in a similar way with the corresponding bound . ∎

Proof of Theorem 4.1(2).

We follow the proof of Theorem 4.1(1) by first showing that

| (B.8) |

in for compact, and then (B.6). The convergence in continues to hold as in the proof of Theorem 4.1 since the conditions in Csörgő (1981a,1981b) are satisfied if some moment of is finite. For (B.8) it suffices to show that

| (B.9) |

in . Recalling the decomposition (B.4), we now can show directly that for any and , which implies (B.9). We focus only on the case to illustrate the method; the cases are analogous. We observe that for ,

| (B.10) | |||||

On the other hand, under the conditions of Theorem 4.1(2) [Hannan and Kanter (1977)] showed that ,

For , and since we can choose such that . The ergodic theorem finally yields that the right-hand side in (B.10) converges to zero a.s. As regards the case , we have for any small and

If we choose close to and close to zero the right-hand side in (B.10) converges to zero in probability.

Using the same bounds as in part (1), but writing this time , we have

The same argument as above shows that for close to . Since a similar argument shows that . These facts establish (B.7) for . The same arguments show that bounds analogous to part (1) can be derived for for . We omit further details. ∎

References

- Aaronson et al. (1996) Aaronson, J., Burton, R., Dehling, H., Gilat D., Hill, T. and Weiss, B. (1996) Strong laws of - and -statistics. Trans. Amer. Math. Soc. 348, 2845–2866.

- Bickel and Wichura (1971) Bickel, P.J. and Wichura, M.J. (1971) Convergence criteria for multiparameter stochastic processes and some applications. Ann. Statist. 42, 1656–1670.

- Billingsley (1999) Billingsley, P. (1999) Convergence of Probability Measures, 2nd ed. Wiley, New York.

- Brockwell and Davis (1991) Brockwell, P. and Davis, R.A. (1991) Time Series: Theory and Methods. Springer, New York.

- Csörgő (1981a) Csörgő, S. (1981a) Limit behaviour of the empirical characteristic function. Ann. Probab. 9, 130–144.

- Csörgő (1981b) Csörgő, S. (1981b) Multivariate characteristic functions and tail behaviour. Z. Wahrsch. verw. Gebiete 55, 197–202.

- Csörgő (1981c) Csörgő, S. (1981c) Multivariate empirical characteristic functions. Z. Wahrsch. verw. Geb. 55, 203–229.

- Doukhan (1994) Doukhan, P. (1994) Mixing: Properties and Examples. Springer-Verlag, New York.

- Dueck et al. (2014) Dueck, J., Edelmann, D., Gneiting, T., and Richards, D. (2014) The affinely invariant distance correlation. Bernoulli 20, 2305–2330.

- Feller (1971) Feller, W. (1971) An Introduction to Probability Theory and its Applications. Vol. II, 2nd ed. Wiley, New York.

- Feuerverger and Mureika (1977) Feuerverger, A. and Mureika, R.A. (1977) The empirical characteristic function and its applications. Ann. Statist. 5, 88–97.

- Feuerverger (1993) Feuerverger, A. (1993) A consistent test for bivariate dependence. Int. Stat. Rev. 61, 419–433.

- Fokianos and Pitsillou (2016) Fokianos, K. and Pitsillou, M. (2016) Consistent testing for pairwise dependence in time series. Technometrics, to appear.

- Hannan and Kanter (1977) Hannan, E.J. and Kanter, M. (1977) Autoregressive processes with infinite variance. J. Appl. Probab. 14, 411–415.

- Haslett and Raftery (1989) Haslett, J. and Raftery, A.E. (1989) Space-time modelling with long-memory dependence: Assessing Ireland’s wind power resource. J. R. Stat. Soc. Ser. C. Appl. Stat. 38, 1–50.

- Hlávka et al. (2011) Hlávka, Z., Hušková, M. and Meintanis, S.G. (2011) Tests for independence in non-parametric heteroscedastic regression models. J. Multivariate Anal. 102, 816–827.

- Ibragimov and Linnik (1971) Ibragimov, I.A. and Linnik, Yu.V. (1971) Independent and Stationary Sequences of Random Variables. Wolters–Noordhoff, Groningen.

- Krengel (1985) Krengel, U. (1985) Ergodic Theorems. With a supplement by Antoine Brunel. Walter de Gruyter, Berlin.

- Kuo (1975) Kuo, H.H. (1975) Gaussian Measures in Banach Spaces. Lecture. Notes in Math. 463. Springer, Berlin.

- Lyons (2013) Lyons, R. (2013) Distance covariance in metric spaces. Ann. Probab. 41, 3284–3305.

- Meintanis and Iliopoulos (2008) Meintanis, S.G. and Iliopoulos, G. (2008) Fourier methods for testing multivariate independence. Comput. Statist. Data Anal. 52, 1884–1895.

- Meintanis et al. (2015) Meintanis, S.G., Ngatchou-Wandji, J. and Taufer, E. (2015) Goodness-of-fit tests for multivariate stable distributions based on the empirical characteristic function. J. Multivariate Anal. 140, 171–192.

- Politis et al. (1999) Politis, D.N., Romano, J.P. and Wolf, M. (1999) Subsampling. Springer, New York.

- Rémillard (2009) Rémillard, B. (2009) Discussion of: Brownian distance covariance. Ann. Statist. 3, 1295–1298.

- Sejdinovic et al. (2013) Sejdinovic, D., Sriperumbudur, B., Gretton, A. and Fukumizu, K. (2013) Equivalence of distance-based and RKHS-based statistics in hypothesis testing. Ann. Statist. 41, 2263–2291.

- Székely et al. (2007) Székely, G.J., Rizzo, M.L. and Bakirov, N.K. (2007) Measuring and testing dependence by correlation of distances. Ann. Statist. 35, 2769–2794.

- Székely and Rizzo (2009) Székely, G.J. and Rizzo, M.L. (2009) Brownian distance covariance. Ann. Appl. Stat. 3, 1236–1265.

- Székely and Rizzo (2014) Székely, G.J. and Rizzo, M.L. (2014) Partial distance correlation with methods for dissimilarities. Ann. Statist. 42, 2382–2412.

- Zhou (2012) Zhou, Z. (2012) Measuring non linear dependence in time-series, a distance correlation approach. J. Time Series Anal. 33, 438–457.