On Optimal Retirement

Abstract

We pose an optimal control problem arising in a perhaps new model for retirement investing. Given a control function and our current net worth as for any , we invest an amount in the market. We need a fortune of “superdollars” to retire and want to retire as early as possible. We model our change in net worth over each infinitesimal time interval by the Ito process . We show how to choose the optimal and show that the choice of is optimal among all nonanticipative investment strategies, not just among Markovian ones.

keywords:

Retirement; optimal control problem; Ito processPhilip A. Ernst, Dean P. Foster, Larry A. Shepp

[The Wharton School, University of Pennsylvania] Philip A. Ernst \addressone3730 Walnut Street, Philadelphia, PA 19104

[The Wharton School, University of Pennsylvania] Dean P. Foster \addresstwo3730 Walnut Street, Philadelphia, PA 19104

[The Wharton School, University of Pennsylvania] Larry A. Shepp \addressthree3730 Walnut Street, Philadelphia, PA 19104

60H1060J60

1 Introduction

We begin by discussing the rationale and assumptions underlying the process chosen to model our change in wealth over each infinitesimal time interval. The model employs deflated (“constant”) dollars and assumes that the investor borrows at the risk-free rate. The optimal control function ensures that the investor will only be able to borrow an amount of money such that, with probability 1, for all . Like [2], the model assumes that the investor can either put money into or take out money out of the market in continous time and that there is no transaction fee for doing so.

The investor chooses to invest solely in the “Sharpe asset,” explicitly defined on page 12 of [3]. [3] proves that the Sharpe asset has close to unit variance (this is why in the volatility term ). In formalizing the Ito process, we first normalize our unit of time so that the Sharpe asset is expected to return 100 percent over a unit time interval. This normalization forces in the term . We proceed to normalize salary. Our monetary unit, which we will call a “superdollar,” is normalized such that we have a steady income of in each time interval of length . We need a fortune of superdollars to retire and wish to retire as early as possible. See [8] and [9] for broader economic discussion of retirement processes.

The solution to this optimal control problem in retirement investing is especially interesting because it involves what seems to be a new phenomenon in boundary behavior, where a process hits a boundary and reflects “softly” from it, without the need for local time as in reflecting Brownian motion. We show the reflection takes place by using what seems to be a new approach to stochastic differential equations which avoids the clock changing methods of [4] and [7], namely by first defining a particular “unit” diffusion, which is a diffusion where the diffusion coefficient is identically unity, which is then easier to construct using Picard’s method than a general diffusion. If we then take a particular monotonic function of the unit diffusion to construct the diffusion which is obtained as the answer, , above, where the monotone function is everywhere nonnegative, it follows that the final diffusion is also always nonnegative.

We also consider a more general model of retirement investing where the diffusion coefficient, , is replaced by . The general case reveals that the optimal investment strategy as well as the expected time until retirement are very strongly dependent in interesting ways on the particular model used.

2 Formal Model and Approach

Formally, the problem is stated as follows: given , and a Brownian motion, , to find a nonanticipating process, , so that if is the hitting time of of the Ito process , with , and

then is a minimum over all such allowable . Note that we are assuming that the state space for this optimal control problem is the right half line so that we do not allow negative values of . Later, we will prove that, in our setup, cannot be negative. If for some , which is possible if is bounded away from zero and also bounded, then there is a need to define what happens if the investor is in debt; we assume the game is over in this case and then so that with our definition, we do not even achieve a finite expectation, much less a minimum. Other definitions allow for borrowing additional capital, but our model assumes that we are extremely adverse to being in debt.

We will show that under this assumption, the optimum control, , exists and is unique. Any reasonable person would guess that , i.e., that the optimal is “Markovian”, i.e., the optimal strategy depends only on the present fortune. But even if we guess that should be Markovian, how do we learn which particular is best? There is a nice way, involving a lot of nice guessing. Once one guesses the proof that it is optimal is routine crank-turning, by martingale theory as we will see.

3 Formal Statement of Results

To get lower bounds on , one needs to find, in the usual way, a function, , with , for which, for any , the process, is a submartingale. If this is the case, then, we have from optional sampling . This gives that for any and ,

and since this holds for any and , we get that .

Equality will hold for all , for the greatest lower bound, . The class of all such ’s is a convex class determined by the Ito inequalities defining a submartingale, which are that , and that for all and all ,

Since this must hold for all choices of and all choices of in , and since this is quadratic in the real variable (if this seems somewhat aggressive with respect to logic, recall that we are just using this reasoning for guessing the right ). For any such , we have that for any , , which gives us the lower bound, on . Which ’s satisfy the above submartingale condition?

Setting the derivative wrt. equal to zero we see that we must have for each , , and then the minimum occurs at . Putting this back into the submartingale inequality we need that

For the best , we need equality to hold everywhere in the string of inequalities above so that we would choose to satisfy the last inequality with equality throughout. If we set

then we seek to satisfy

Integrating, we have for some integration constant

Since the left side is of the form for all , it is tempting to choose since this makes the right side greater than or equal to one for (it is our privilege to do this, since we are just guessing). We have almost arrived at a guess for the best , namely we have to solve the last equation for , and then is determined because we have .

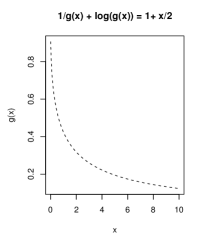

A plot of vs. is given in Figure 1 which shows that the inverse function defining by

is not unique since the inverse is not one-one.

Which one do we use, the left side branch or the right side branch to define for each ? Recall that we must have , so we guess to use the left side to determine . There is then clearly a unique solution, , and we declare this as our guess at .

Using the condition , we have

We have already set up the proof that this . We have also seen that any optimal choice of must satisfy , which we can express in terms of the we have already defined because we have seen that can be expressed in terms of , and so we get that

Near , we can easily show through Maclaurin expansions for and that , and so it follows that

For an approximation of when is large, recall that we have defined for as the smaller of the two solutions of:

| (1) |

We proceed to define:

Rewriting (1) in terms of and , we arrive at:

| (2) |

We now need an approximation for in terms of .

We guess:

| (3) |

Substituting our approximation into (2) we obtain:

When is large, is small, so the left hand side of (2) is very close to . Substituting our definitions of and into (3), we obtain:

Or, equivalently,

To complete that proof that this is optimal, with this choice of , and , the inequalities now hold for every other choice of that is a submartingale. It follows that for all . We need to show that equality holds for given above. It is true that in this case the submartingale is a local martingale, except possibly at zero. We need to show the equality holds, where is the process, . It is enough to prove that w.p. 1. The difficulty is that the process, hits zero uncountably many times with positive probability starting from any . How do we know that cannot take negative values? When , then the unit drift moves it to the right, but how do we know that the term does not cause the process to reach the negative half-line, or to get stuck at zero? Intuitively, each time the process hits zero, imagine that is turned off, so that for . There is still a unit drift present so that the process takes time to reach the point . The probability starting at that the process hits before it reaches zero again is easily seen to be . It seems to follow from this that the expected time to reach starting from any is finite and the conclusion seems to follow. However, there is a mystery as to how the process pushes off from zero and we shall now resolve this point.

It seems remarkable that the process behaves as if there is a reflecting barrier at zero. It does not pass through zero to the negative half-axis because . This means that it slows down as it gets near zero, but, unlike the Black-Scholes process [1], it actually hits zero. The drift, , so that it then moves away from zero but it hits zero uncountably many times (if it hits it once), just as the reflecting Brownian process, , does, because the set of zeros of is a perfect set.

It is instructive to consider a closely related reflecting process, the process

How does one prove that for all ? This appears to be difficult because uncountably many times, until one realizes that is simply .

Theorem 1.

reflects off zero even though there is no local time in its Ito representation.

Proof 3.1.

It is interesting that reflects off zero even though there is no local time in its Ito representation. The way we prove that this makes sense seems to be new and it seems to shed much light on the basic existence proofs of Ito theory. In Ito theory, Picard iteration shows easily that a diffusion, with a unit diffusion coefficient,

can be constructed on any space on which a process with continuous sample paths is available, path by path, if has bounded difference quotients. It is then possible to construct a very general diffusion, , satisfying

by constructing the unit diffusion, , with appropriate drift, , and then setting , for an appropriate function, . It is easy to check that to make into an diffusion, we must choose as follows:

If we do this for the case of which solves the problem, we see that , so it follows that the diffusion never goes negative and reflects softly at , just as in the case of .

It seems remarkable that is defined only by the diffusion coefficient, . But this is somewhat illusory, because enters as well in that the unit diffusion process, , depends on , and if does not satisfy a Lipschitz condition then the domain of the diffusion may be a subset of the whole line. Let us look at the case

in more detail since this is an example which is very similar to the optimal control process of the paper. We can carry out the steps of the determination of , above to see that

We see there is an infinite singularity in at except if . If the process never hits zero, but if , then cannot be defined after it hits zero, at least not by the diffusion equation above.

This completes the proof that for the optimal investment strategy, , the fortune of the young man reaches in a finite time with minimum expected value. It is remarkable that the young man goes broke repeatedly with positive probability before achieving his goal.

Remark 3.2.

It is often remarked of some rich people that because they were “aggressive, they went into bankruptcy several times before making it.” Somehow, mathematics seems to have already been aware of this common observation! Note that it is always true that since an investor can always choose and “save the way to retirement”.

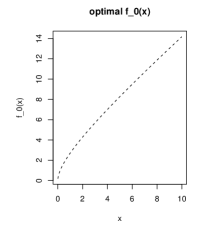

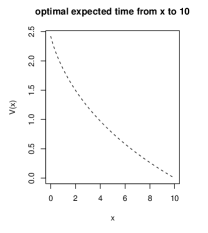

A graph of is given in Figure 2(a), a graph of the optimal payoff, , is given in Figure 2(b), and a graph of the optimal investment strategy, , is given in Figure 2(c).

4 Generalization of the problem

A more general model for retirement than the one of Section 3, namely,

would allow the diffusion term to be any fixed function of rather than simply itself. The most natural choice was made above because this is used in the Black-Scholes-Samuelson model for stock prices which was arrived at under the argument that doubling an investment empirically seems to double the volatility, but this is a crude argument and other possibilities seem to be worth exploring. We propose considering the more general model:

where is any increasing function. For tractibility, we will restrict the discussion to the particular forms , where , and are parameters.

The same method of proof shows that for , as before, but using general , we have

It follows that

This is as expected; the original model used as both the drift and the diffusion parameter because one could scale time to make the diffusion equal to one in appropriate time units. However if one wants to compare models, then the parameter must be retained. If one does this, one sees that

so that

The conclusion is that if the investor has the choice of investing in a risky market or instead to be conservative by saving his salary without investing, then the conservative strategy is asymptotically (as ) superior even though the resulting time to retirement is , which is the maximum delay among all models since there is no advantage to investment. The conservative investment advice to avoid risk is usually given to older investors; our modelling assumptions conclusions bear this out, even for young investors in the limit as risk gets very large.

We next consider the case , and . Since the diffusion speed is larger for than for , one would think that as decreases the expected time would increase and investing would be disadvantageous, but this is surprisingly not the case, as we see below. Moreover we will show that for , and , one can find investment strategies that allow retirement in time , arbitrarily small. Another surprise is that there is a sharp discontinuity in as . We show that for but as we see below

We turn to the problem: again we define , and we want to find .

Again we seek any function for which

is a submartingale for any choice of . Any such will be a lower bound on since we will again have

To be a submartingale, we need in the same way as in the case, ,

For fixed , this is a minimum in at the point

Requiring that be a martingale for the best choice of above gives an ode for . After a calculation, very similar to the one above for , the ode is:

Integrating gives

Again we guess that and we can solve for for any . We see that so long as , there is no trouble. We can write (since ),

where

Finally we have that is given by

5 General Model in the Case of

The case is especially interesting. The argument given for guessing the optimal breaks down.

Theorem 2.

There is no that will make a submartingale for all choices of except the trivial case . This is the best lower bound that submartingale theory can provide which lead one to suspect that for .

Proof 5.1.

Here we assume that . We need to find an that makes the expected time to reach arbitrarily small. Consider the investment strategy

If we can find a function, for which is a martingale and , then the martingale theorem gives that . Ito calculus gives that must be, for appropriate constants, ,

We determine from continuity at of and that

Finally, set , and let and verify that and tend to zero as and we have shown that for .

Remark 5.2.

Under this model one can retire in arbitrarliy small expected time. This should probably be interpreted that the model with does not represent the real world; models should be looked at carefully and rejected if they do not conform to reality, unless of course, reality is incorrect.

We thank Professor Lawrence Brown and Professor Michael Harrison for their invaluable advice.

References

- [1] Black, F. and Scholes, M. (1973). The pricing of options and corporate liabilites. Journal of Political Economy.

- [2] Cover, T. M. (1991). Universal portfolios. Mathematical Finance.

- [3] Foster, D Kakade, S. and Ronen, O. Early retirement using leveraged investments. 2007.

- [4] Ito, K. and McKean, H. P. (1965). Diffusion Processes and Their Sample Paths. Springer.

- [5] Karatzas, I. and Shreve, S. (1991). Brownian Motion and Stochastic Calculus. Springer-Verlag.

- [6] Karlin, S. and Taylor, H. M. (1981). A Second Course in Stochastic Processes. Academic Press.

- [7] McKean, H. P. (1969). Stochastic Integrals. Academic Press.

- [8] Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The continuous-time case. Rev. Economics Statist..

- [9] Merton, R. C. (1992). Continuous-Time Finance. Blackwell Publishers.