Augmented Factor Models with Applications to Validating Market Risk Factors and Forecasting Bond Risk Premia ††thanks: Fan gratefully acknowledges the support of NSF grant DMS-1712591.

Abstract

We study factor models augmented by observed covariates that have explanatory powers on the unknown factors. In financial factor models, the unknown factors can be reasonably well explained by a few observable proxies, such as the Fama-French factors. In diffusion index forecasts, identified factors are strongly related to several directly measurable economic variables such as consumption-wealth variable, financial ratios, and term spread. With those covariates, both the factors and loadings are identifiable up to a rotation matrix even only with a finite dimension. To incorporate the explanatory power of these covariates, we propose a smoothed principal component analysis (PCA): (i) regress the data onto the observed covariates, and (ii) take the principal components of the fitted data to estimate the loadings and factors. This allows us to accurately estimate the percentage of both explained and unexplained components in factors and thus to assess the explanatory power of covariates. We show that both the estimated factors and loadings can be estimated with improved rates of convergence compared to the benchmark method. The degree of improvement depends on the strength of the signals, representing the explanatory power of the covariates on the factors. The proposed estimator is robust to possibly heavy-tailed distributions. We apply the model to forecast US bond risk premia, and find that the observed macroeconomic characteristics contain strong explanatory powers of the factors. The gain of forecast is more substantial when the characteristics are incorporated to estimate the common factors than directly used for forecasts.

Keywords: Heavy tails, Forecasts; Principal components; identification.

1 Introduction

In this paper, we study the identification and estimations of factor models augmented by a set of additional covariates that are common to all individuals. Consider the following factor model:

| (1.1) |

Here is the multivariate outcome for the observation in the sample; is the -dimensional vector of latent factors; is an matrix of nonrandom factor loadings; denotes the vector of idiosyncratic errors. In addition to , we also observe variables, denoted by , that have some explanatory power on the unknown factors and hence impact on observed vector . We model by using the model

| (1.2) |

for some (nonparametric) function . Here is interpreted as the component of the factors that can be explained by the covariates, and is the components that cannot be explained by the covariates. We aim to provide an improved estimation procedure when the factors can be partially explained by several observed variables . In addition, by accurately estimating , we can estimate the percentage of both explained and unexplained components in the factors, which describes the proxy/explanatory power of covariates.

Note that model (1.1) implies:

| (1.3) |

where and respectively denote the variance-covariance matrices of and ; denotes the variance-covariance matrix of . Under usual factor models without covariates, is identified asymptotically as the first eigenvectors of as and can be estimated using the first eigenvectors of the sample covariance matrix of (e.g,, Stock and Watson (2002); Bai (2003)).

With additional covariates, on the other hand, exact identification can be achieved through covariance of the “smoothed data”. By (1.1), assuming exogeneity of , we have so that it becomes a “noiseless” factor model with smoothed data as input and as latent factors. The factor loadings and latent factors can be extracted from

| (1.4) |

It is easy to see from the model that

| (1.5) |

where is a low-dimensional positive definite matrix. This decomposition is to be compared with (1.3), where the noise covariance removed. Therefore, as long as is of full rank, falls in the eigenspace generated by . In other words, is identifiable up to an orthogonal transformation. Because of such exact identification, we allow to be finite as a special case. The number of factors is assumed to be known throughout the paper. In practice, can be consistently estimated by many methods such as AIC, BIC-based criteria, or eigenvalue-ratio methods studied in Lam and Yao (2012); Ahn and Horenstein (2013).

The above discussion prompts us the following new method to estimate the factor loadings that incorporates the explanatory power of : (See Section 3 for details of estimators)

(i) (robustly) regress on and obtain fitted value ;

(ii) conduct the principal components analysis (PCA) on the fitted data to estimate the factor loadings.

We employ a regression based on Huber (1964)’s robust M-estimation in step (i). The procedure involves a diverging truncation parameter, called adaptive Huber loss, to reduce the bias when the error distribution is asymmetric (Fan et al., 2017).

This allows our procedure to be applicable to data with heavy tails.111In this paper, by “heavy-tail” we mean tail distributions of that are heavier than the usual requirements on the high-dimensional factor model (which are either exponentially-tailed or have eighth or higher moments). But we do not allow large outliers on the covariates.

There are two important quantities that determine the rates of convergence for the estimators: the “signal” and the “noise” . The rates of convergence are presented using these two quantities. Their relative strengths determine the rates of convergence of the estimated factors and loadings.

Under model (1.2), we can test almost surely in the entire sampling period, under which the observed fully explain the true factors. This is the same as testing

While it is well known that the commonly used Fama-French factors have explanatory power for most of the variations of stock returns, it is questionable whether they fully explain the true (yet unknown) factors. These observed proxies are nevertheless used as the factors empirically, and the remaining components ( and ) have all been mistakenly regarded as the idiosyncratic components. The proposed test provides a diagnostic tool for the specification of common factors in empirical studies, and is different from the “efficiency test” in the financial econometric literature (e.g., Gibbons et al. (1989); Pesaran and Yamagata (2012); Gungor and Luger (2013)). While the efficiency test aims to test the asset pricing model through whether the alphas are zero for the specified factors, a rejection could be due to either mispecified factors or the existence of outperforming (underperforming) assets. In contrast, here we directly test whether the factor proxies are correctly specified. We test the specification of Fama French factors for the returns of S&P 500 constituents using rolling windows. We find that the null hypothesis is more often to be rejected using the daily data compared to the monthly data, due to a larger volatility of the unexplained factor components. The estimated overall volatility of factors varies over time and drops significantly during the acceptance period.

1.1 Further Literature

In empirical applications, researchers frequently encounter additional observable covariates that help explain the latent factors. In genomic studies, in the study of breast cancer data such as the Cancer Genome Atlas (TCGA) project (Network, 2012), there are additional information of cancer subtype for each sample. These cancer subtypes can be regarded as a partial driver of the factors for gene expression data. In financial time series forecasts, researchers often collect additional variables that characterize financial markets. The Fama-French factors are well-known to be related to the factors that drive financial returns (Fama and French, 1992).

Most existing works simply treat as a set of additional regressors in (1.1). This approach does not take advantage of the difference of observed variables (e.g. aggregated versus disaggregated macroeconomic variables; gene expressions versus clinical information) and the explanatory power of the covariates on the common factors, and hence does not lead to improved rates of convergence even if the signal is strong. The most related work is Li et al. (2016), who specified as a linear function of . Also, Huang and Lee (2010) proposed to use the estimated to forecast. Moreover, our expansion is also connected to the literature on asymptotic Bahadur-type representations for robust M-estimators, see, for example, Portnoy (1985), Mammen (1989), among others.

The “asymptotic identification” was described perhaps first by Chamberlain and Rothschild (1983). In addition, there has been a large literature on both the static and dynamic factor models, and we refer to Lawley and Maxwell (1971); Forni et al. (2005); Stock and Watson (2002); Bai and Ng (2002); Bai (2003); Doz et al. (2012); Onatski (2012a); Fan et al. (2013), among many others.

The rest of the paper is organized as follows. Section 2 establishes the new identification of factor models. Section 3 formally defines our estimators and discusses possible alternatives. Section 4 presents the rates of convergence. Section 5 discusses the problem of testing the explanatory power. Section 6 applies the model to forecasting the excess return of US government bonds. We present the extensive simulation studies in Section 7 Finally Section 8 concludes. The supplement also contains all the technical proofs.

Throughout the paper, we use and to denote the minimum and maximum eigenvalues of a matrix . We define , , and . For two sequences, we write or if and if and

2 Identification of the covariate-based factor models

2.1 Identification

Suppose that there is a fixed -dimensional observable vector that is: (i) associated with the latent factors , and (ii) mean-independent of the idiosyncratic term. Taking the conditional mean on both sides of (1.1), we have

| (2.1) |

This implies

| (2.2) |

where

Note that is identified by the data generating process with observables , but is not because is not observable. Since , (2.2) implies that is a low-rank matrix, whose rank is at most Furthermore, we assume is also full rank, so has exactly nonzero eigenvalues.

To see how the equality (2.2) helps achieve the identification of and , for the moment, suppose the following normalization holds:

| (2.3) |

Then right multiplying (2.2) by , by the normalization condition,

We see that the () columns of are the eigenvectors of , corresponding to its nonzero eigenvalues, which also equal to the diagonal entries of . Furthermore, left multiplying on both sides of (2.1), one can see that even if is not observable, is also identified as:

The normalization (2.3) above is useful to facilitate the above arguments. In this paper, they are not imposed. Then the same argument shows that and can be identified up to a rotation matrix transformation.

Let

Assumption 2.1.

Suppose are identically distributed. Assume:

(i) Rank condition: .

(ii) There are positive constants , so that all the eigenvalues of the matrix are confined in , regardless of whether or not.

Condition (i) is the key condition on the explanatory power of on factors, where represents the “signal strength” of the model. We postpone the discussion of this condition after Theorem 2.1. Condition (ii) in Assumption 2.1 can be weakened to allow the eigenvalues of to slowly decay to zero. While doing so allows some of the factors to be weak, it does not provide any new statistical insights, but would bring unnecessary complications to our results and conditions. Therefore, we maintain the strong version as condition (ii).

Generally, we have the following theorem for identifying (up to a rotation transformation).

Theorem 2.1.

Suppose , Assumption 2.1 holds and . Then there is an invertible matrix so that:

(i) The columns of are the eigenvectors of corresponding to the nonzero distinct eigenvalues.

(ii) Given , satisfies:

(iii) Let denote the th largest eigenvalue of , we have

where and are defined in Assumption 2.1. In addition, under the normalization conditions that is a diagonal matrix and that , we have

2.2 Discussions of Condition (i) of Assumption 2.1

In the model

represents the “signal” of the covariate model. We require so that the rank of is . Only if this condition holds are we able to identify all the factor loadings using the eigenvectors corresponding to the nonzero eigenvalues. From the estimation point of view, we are using the PCAs of the estimated , and can only consistently estimate its rank-number of leading eigenvectors. So this condition is also essential to achieve the consistent estimation of the factor loadings.

Note that requiring be of full rank might be restrictive in some cases. For instance, consider the linear case: for a coefficient matrix , also suppose is of full rank. Then , and is full-rank only if . Thus we implicitly require, for linear models, the number of covariates should be at least as many as the number of latent factors. Note that if is highly nonlinear, it is still possible to satisfy the full rank condition even if , and we illustrate this in the simulation section. 222Suppose is nonlinear and can be well approximated by a series of orthogonal basis functions , where , then for some coefficient , we have so . For nonlinear functions, it is not stringent to require be full rank since as .

3 Definition of the estimators

The above identification strategy motivates us to estimate and respectively by and as follows. Let and be some estimator of and , whose definitions will be clear below. Then the columns of are defined as the eigenvectors corresponding to the first eigenvalues of , and

Recall that . We estimate using least squares:

Finally, we estimate by: Estimating and separately allows us to estimate and distinguish the percentage of explained and unexplained components in factors, as well as to quantify the explanatory power of covariates.

Below we introduce the estimators and to be used in this paper.

3.1 Robust estimation for

Recall that , and let us first construct an estimator for as follows. While many standard nonparametric regressions would work, here we choose an estimator that is robust to the tail-distributions of .

Let be a dimensional vector of sieve basis. Suppose can be approximated by a sieve representation: where is an matrix of sieve coefficients. To adapt to different heaviness of the tails of idiosyncratic components, we use the Huber loss function (Huber (1964)) to estimate the sieve coefficients. Define

For some deterministic sequence (adaptive Huber loss), we estimate the sieve coefficients by the following convex optimization:

We then estimate by

An alternative method to the robust estimation of is based on the sieve-least squares, corresponding to the case where . Let which is , and

Then, the sieve least-squares estimator for is . While this estimator is attractive due to its closed form, it is not as good as when the distribution of has heavier tails. As expected, our numerical studies in Section 7 demonstrate that it performs well in light-tailed scenarios, but is less robust to heavy-tailed distributions. Our theories are presented for , but most of the theoretical findings should carry over to .

3.2 Choosing and

The selection of the sieve dimension has been widely studied in the literature, e.g., Li (1987); Andrews (1991); Hurvich et al. (1998), among others. Another tunning parameter is , which diverges in order to reduce the biases of estimating the conditional mean when the distribution of is asymmetric. Throughout the paper, we shall set

| (3.1) |

for some constant , and choose simultaneously using the multi-fold cross-validation333One can also allow to depend on to allow for different scales across individuals. We describe this choice in the simulation section. In addition, the cross-validation can be based on either in-sample fit for or out-of-sample forecast, depending on the specific applications. In time series forecasts, one may also consider the time series cross validation (e.g. Hart, 1994) where the training and testing sets are defined through a moving window forecast. . The specified rate in (3.1) is due to a theoretical consideration, which leads to the “least biased robust estimation”, as we now explain. The Huber-estimator is biased for estimating the mean coefficient in , whose population counterpart is

As increases, it approaches the limit with the speed

for an arbitrarily small , where is defined in Assumption 4.1. Hence the bias decreases as grows. On the other hand, our theory requires the uniform convergence (in ) of (for )

| (3.2) |

where denotes the derivative of . It turns out that cannot grow faster than in order to guard for robustness and to have a sharp uniform convergence for (3.2). Hence the choice (3.1) leads to the asymptotically least-biased robust estimation.

3.3 Alternative estimators

Plugging into (1.1), we obtain

| (3.3) |

A closely related model is:

| (3.4) |

for a nonparametric function , or simply a linear form . Models (3.3) and (3.4) were studied in the literature (Ahn et al., 2001; Bai, 2009; Moon and Weidner, 2015), where parameters are often estimated using least squares. For instance, we can estimate model (3.3) by

| (3.5) |

But this approach is not appropriate in the current context when almost fully explains for all . In this case, , and least squares (3.5) would be inconsistent. 444The inconsistency is due to the fact that for any scalar in the case . Thus is not identifiable in the least squares problem. In addition, in (3.4) would be very close to zero because the effects of would be fully explained by . As a result, the factors in (3.4) cannot be consistently estimated (Onatski, 2012b) either. We conduct numerical comparisons with this method in the simulation section. In all simulated scenarios, the interactive effect approach gives the worst estimation performance.

Another simpler alternative is to combine , and apply the classical methods on this enlarged dataset. One potential drawback is that the rates of convergence would not be improved, even if has strong explanatory power on the factors. Another drawback, as mentioned before, is that and can provide very different information (e.g. Fama-French factors versus returns of individual stocks).

4 Rates of Convergence

4.1 Assumptions

Let Suppose the conditional distribution of given is absolutely continuous for almost all , with a conditional density .

Assumption 4.1 (Tail distributions).

(i) There are , and , so that for all ,

| (4.1) |

(ii) is a sub-Gaussian vector, that is, there is , for any so that ,

Assumption 4.2 (Sieve approximations).

(i) For , let . Then there is , as ,

(ii) There are so that

Recall . Let be its th component.

Assumption 4.3 (Weak dependences).

(i) (serial independence) is independent and identically distributed;

(ii) (weak cross-sectional dependence) For some ,

(iii) , , and almost surely, where denotes the conditional covariance matrix of given , assumed to exist.

Recall that

Assumption 4.4 (Signal-noise).

(i) There is ,

(ii) There is , so that .

(iii) We have and

Assumption 4.1 allows distributions with relatively heavy tails on . We still require sub-Gaussian tails for the sieve basis functions. Assumption 4.2 is regarding the accuracy of sieve approximations for nonparametric functions. Assumption 4.4 strengthens Assumption 2.1. We respectively regard and as the “signal” and “noise” when using to explain common factors. The explanatory power is measured by these two quantities.

Assumption 4.3 (i) requires serial independence, and we admit that it can be restrictive in applications. Allowing for serial dependence is technically difficult due to the non-smooth Huber’s loss. To obtan the Bahadur representation of the estimated eigenvectors, we rely on the symmetrization and contraction theorems (e.g., van der Vaart and Wellner (1996)), which requires the data be independently distributed. Nevertheless, the idea of using covariates would still be applicable for serial dependent data. For instance, it is not difficult to allow for weak serial correlations when the data are not heavy-tailed, by using the sieve least squares estimator (introduced in Section 3.1) in place of the Huber’s estimator . We conduct numerical studies when the data are serially correlated in the simulations, and find that the proposed methods continue to perform well in the presence of serial correlations.

4.2 Rates of convergence

We present the rates of convergence in the following theorems, and discuss the statistical insights in the next subsection. Recall .

Theorem 4.1 (Loadings).

The optimal rate for in (4.2) is , which results in

| (4.5) |

Here represents the smoothness of , as defined in Assumption 4.2.

Define

Theorem 4.2 (Factors).

These two convergences imply the rate of convergence of the estimated factors due to .

Remark 4.1.

For a general , the rates of convergence of the two factor components are

| (4.8) |

where and

| (4.9) |

In fact is the optimal choice in (4.8) ignoring the terms involving and . The convergence rates presented in Theorem 4.2 are obtained from (4.8) and (4.9) with this choice of .

The presented rates connect well with the literature on both standard nonparametric sieve estimations and the high-dimensional factor models. To illustrate this, we discuss in more detail about the rate of convergence in (4.8). This rate is given by:

More specifically, we have, for ,

| (4.10) |

If were known, we would estimate by regressing the estimated on . Then standard nonparametric results show that the rate of convergence in this “oracle sieve regression” (knowing ) would be

As we do not observe , we are running the regression (4.10) with in place of . This leads to an additional term representing the effect of estimating , which also depends on the strength of the signal . Finally, Huber’s M-estimation to estimate gives rise to a higher order term , and is often negligible.

4.3 The signal-noise regimes

We see that the rates depend on and . Because , they are related through

| (4.11) |

for some , assuming that there is so that . For comparison, we state the rates of convergence of the benchmark PCA estimators: (e.g., Stock and Watson (2002); Bai (2003)) there is a rotation matrix , so that the PCA estimators satisfy:

| (4.12) |

The first interesting phenomena we observe is that both the estimated loadings and are consistent even if is finite, due to the “exact identification”. In contrast, the PCA estimators requires a growing . For more detailed comparisons, we consider three regimes based on the explanatory power of the factors using . To simplify our discussions, we consider the rate-optimal choices of , and ignore the sieve approximation errors, so is treated sufficiently large.

Regime I: strong explanatory power: Because of (4.11), is bounded away from zero. In this case, (4.5)-(4.7) approximately imply (for sufficiently large ):

Compared to the rates of the usual PCA estimators in (4.12), either the new estimated loadings (when ) or the new estimated factors (when ) have a faster rate of convergence. Moreover, if , then directly estimates the latent factor at a very fast rate of convergence:

The improved rates are reasonable due to the strong explanatory powers from the covariates.

Regime II: mild explanatory power: is bounded away from zero; is either bounded away from zero or decays slower than in the case . In this regime, partially explains the factors, yet the unexplainable components are not negligible. (4.5)-(4.7) approximately become:

| (4.13) | |||||

| (4.14) |

We see that the rate for the estimated loadings is still faster than the PCA when is relatively small compared to , while the rates for the estimated factors are the same. This is because

On one hand, due to the explanatory power from the covariates, the loadings can be estimated well without having to consistently estimate the factors. On the other hand, as the covariates only partially explain the factors, we cannot improve rates of convergence in estimating the unexplainable components in the latent factors. However, since has smaller variability than , it can still be better estimated in terms of a smaller constant factor.

Regime III: weak explanatory power: and decays faster than when . In this case, we have

While the new estimators are still consistent, they perform worse than PCA. This finding is still reasonable because the signal is so weak that the conditional expectation loses useful information of the factors/loadings. Consequently, estimation efficiency is lost when running PCA on the estimated covariance .

In summary, improved rates of convergence can be achieved so long as the covariates can (partially) explain the latent factors, this corresponds to either the mild or the strong explanatory power case. The degree of improvements depend on the strength of the signals. In particular, the consistent estimation for factor loadings can also be achieved even under finite . On the other hand, when the explanatory power is too weak, the rates of convergence would be slower than those of the benchmark estimator.

5 Testing the Explanatory Power of Covariates

We aim to test: (recall that )

| (5.1) |

Under , over the entire sampling period , implying that observed covariates fully explain the true factors . In empirical applications with “observed factors”, what have been often used are in fact . Hence our proposed test can be applied to empirically validate the explanatory power of these “observed factors”.

The Fama-French three-factor model (Fama and French, 1992) is one of the most celebrated ones in empirical asset pricing. They modeled the excess return on security or portfolio for period as

where and respectively represent the the excess returns of the market, the difference of returns between stocks with small and big market capitalizations (“small minus big”), and the difference of returns between stocks with high book to equity ratios and those with low book to equity ratios (“high minus low”). Ever since its proposal, there is much evidence that the three-factor model can leave the cross-section of expected stock returns unexplained. Different factor definitions have been explored, e.g., Carhart (1997) and Novy-Marx (2013). Fama and French (2015) added profitability and investment factors to the three-factor model. They conducted GRS tests (Gibbons et al., 1989) on the five-factor models and its different variations. Their tests “reject all models as a complete description of expected returns”.

On the other hand, the Fama-French factors, though imperfect, are good proxies for the true unknown factors. Consequently, they form a natural choice for . These observables are actually diversified portfolios, which have explanatory power on the latent factors , as supported by financial economic theories as well as empirical studies. The test proposed in this validates the specification of these common covariates as “factors”.

5.1 The Test Statistic

Our test is based on a Wald-type weighted quadratic statistic

The weight matrix normalizes the test statistic, taken as AVar, where AVar represents the asymptotic covariance matrix of under the null, and is given by

As is a high-dimensional covariance matrix, to simplify the technical arguments, in this section we assume to be cross-sectionally uncorrelated, and estimate by:

The feasible test statistic is defined as

We reject the null hypothesis for large values of . It is straightforward to allow to be a non-diagonal but a sparse covariance, and proceed as in Bickel and Levina (2008). We expect the asymptotic analysis to be quite involved, and do not pursue it in this paper.

We show that the test statistic has the following asymptotic expansion:

where

Thus the limiting distribution is determined by that of . Note that a cross-sectional central limit theorem implies, as ,

Hence each component of can be roughly understood as -distributed with degrees of freedom being the number of common factors, whose variance is . This motivates the following assumption.

Assumption 5.1.

Suppose as .

We now state the null distribution in the following theorem.

5.2 Testing market risk factors for S&P 500 returns

We test the explanatory power of the observable proxies for the true factors using S&P 500 returns. For each given group of observable proxies, we set the number of common factors equals the number of observable proxies. We calculate the excess returns for the stocks in S&P 500 index that are collected from CRSP. We consider three groups of proxy factors () with increasing information: (1) Fama-French 3 factors (FF3); (2) Fama-French 5 factors (FF5); and (3) Fama-French 5 factors plus 9 sector SPDR ETF’s (FF5+ETF9). Here the sector SPDR ETF’s, which are intended to track the 9 largest S&P sectors. The detailed descriptions of sector SPDR ETF’s are listed in Table 5.1.

| Code | Sector | Code | Sector | Code | Sector |

|---|---|---|---|---|---|

| XLE | Energy | XLB | Materials | XLI | Industrials |

| XLY | Consumer discretionary | XLP | Consumer staples | XLV | Health care |

| XLF | Financial | XLK | Information technology | XLU | Utilities |

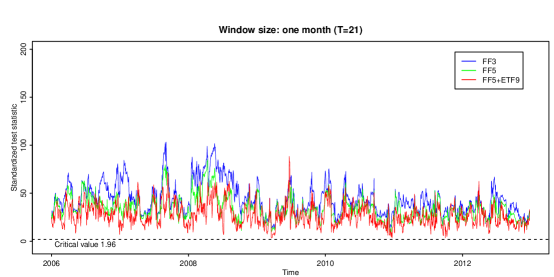

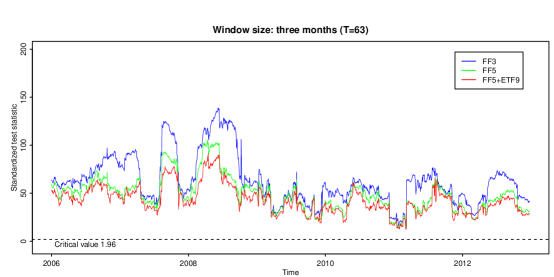

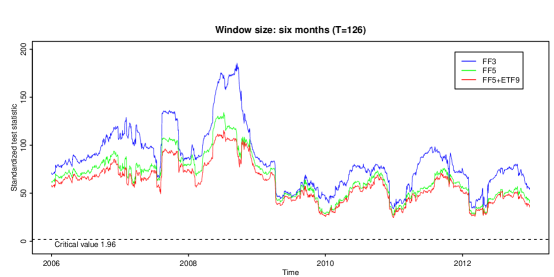

We consider tests using both daily and monthly data. For the daily data, we collect 393 stocks that have complete daily closing prices from January 2005 to December 2013, with a time span of 2265 trading days. We apply moving window tests with the window size () equals one month, three months or six months. The testing window moves one trading day forward per test. Within each testing window, we calculate the standardized test statistic for three groups of proxy factors.

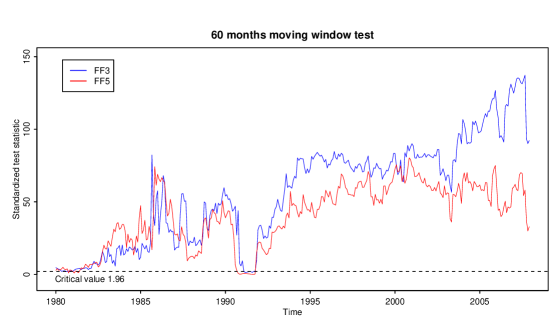

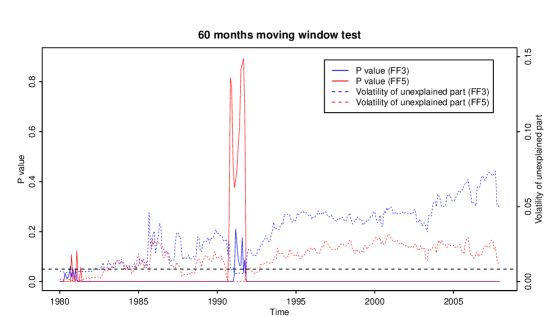

As for the monthly excess returns, we use stocks that have complete record from January 1980 to December 2012, which contains 202 stocks with a time span of 396 months. Here we only consider the first two groups of proxy factors as sector SPDR ETF’s are introduced since 1998. The window size equals sixty months and moves one month forward per test. Within each testing window, besides standardized test statistic and p-value, we also estimate the volatility of , the part of factors that can not be explained by as:

where there are 21 trading days per month. The sieve basis is chosen as the additive Fourier basis with . We set the tuning parameter with constant selected by the 5-fold cross validation.

For the daily data, the plots of under various scenarios are reported in Figure 5.1. Under all scenarios, the null hypothesis () is rejected as is always larger than the critical value 1.96. This suggests a strong evidence that the proxy factors can not fully explain the estimated common factors. Under all window sizes, a larger group of proxy factors tends to yield smaller statistics, demonstrating stronger explanatory power for estimated common factors. Also, we find the test statistics increase while the window size increases.

The results for the monthly data are reported in Figure 5.2. For both Fama-French 3 factors and 5 factors, the null hypothesis is rejected most of the time except in early 1980s and 1990s. When the null hypothesis is accepted, Fama-French 5 factors tend to yield larger p-values. The estimated volatility of unexplained part are close to zero over these two periods. For the rest of the time, the standardized test statistics are much larger than the critical value 1.96 and hence the p-values are close to zero. Also the estimated volatilities are not close to zero. This indicates the proxy factors can not fully explain the estimated common factors during these testing periods.

6 Forecast the excess return of US government bonds

We apply our method to forecast the excess return of U.S. government bonds. The bond excess return is the one-year bond return in excess of the risk-free rate. To be more specific, we buy an year bond, sell it as an year bond in the next year and excess the one-year bond yield as the risk-free rate. Let be the log price of an -year discount bond at time . Denote as the log yield with year maturity, and as the log holding period return. The goal of one-step-ahead forecast is to forecast , the excess return with maturity of years in period , where

For a long time, the literature has found a significant predictive power of the excess returns of U.S. government bonds. For instance, Ludvigson and Ng (2009, 2010) predicted the bond excess returns with observable variables based on a factor model using 131 (disaggregated) macroeconomics variables. They achieved the out-of-sample when forecasting one year excess bond return with maturity of two years. Using the proposed method, this section develops a new way of incorporating the explanatory power of the observed characteristics, and investigates the robustness of the conclusions in existing literature.

We analyze monthly data spanned from January 1964 to December 2003, which is available from the Center for Research in Securities Prices (CRSP). The factors are estimated from a macroeconomic dataset consisting of 131 disaggregated macroeconomic time series (Ludvigson and Ng, 2010). The covariates are 8 aggregated macro-economic time series, listed in Table 6.1.

| Linear combination of five forward rates | |

|---|---|

| Real gross domestic product (GDP) | |

| Real category development index (CDI) | |

| Non-agriculture employment | |

| Real industrial production | |

| Real manufacturing and trade sales | |

| Real personal income less transfer | |

| Consumer price index (CPI) |

6.1 Heavy-tailed data and robust estimations

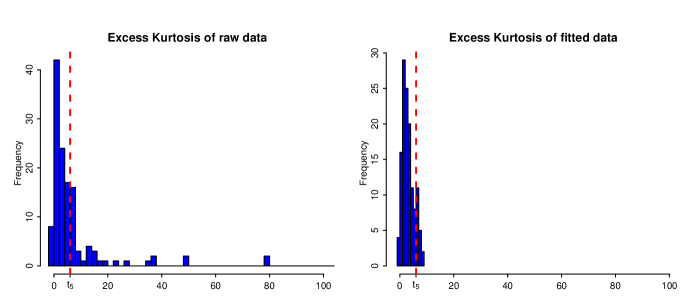

We first examine the excess kurtosis for the time series to assess the tail distributions. The left panel of Figure 6.1 shows 43 among the 131 series have excess kurtosis greater than 6. This indicates the tails of their distributions are fatter than the -distribution with degrees of freedom 5. On the other hand, the right panel of Figure 6.1 reports the histograms of excess kurtosis of the “fitted data” (the robust estimator of using Huber loss), which demonstrates that most series in the fitted data are no longer severely heavy-tailed.

The tuning parameter in the Huber loss is of order . In this study, the constant and the degree of sieve approximation are selected by the out-of-sample 5-fold cross validation as described in Section 3.2.

6.2 Forecast results

We denote our proposed method by SPCA (smoothed PCA), and compare it with SPCA-LS (which uses , the least-squares based smoothed PCA, described in Section 3.1) and the benchmark PCA. We conduct one-month-ahead out-of-sample forecast of the bond excess returns. The forecast uses the information in the past 240 months, starting from January 1984 and rolling forward to December 2003. We compare three approaches to estimating the factors: SPCA, SPCA-LS, and the usual PCA. Also we consider two forecast models as follows:

| Linear model: | (6.1) | ||||

| Multi-index model: | (6.2) |

where is the intercept and is a nonparametric function. The covariate is either or an augmented vector . Here, the latent factors are used by the three methods mentioned above in order to compare their effectiveness. The multi-index model allows more general nonlinear forecasts and are estimated by using the sliced inverse regression (Li, 1991). The number of indices is estimated by the ratio-based method suggested in Lam and Yao (2012) and is usually 2 or 3. We approximate using a weighted additive model . Each individual nonparametric function is smoothed by the local linear approximation.

The performance of each method is assessed by the out-of-sample . Let be the forecast of using the data of the previous months: for and . The forecast performance is assessed by the out-of-sample , defined as

where is the sample mean of over the sample period . The of various methods are reported in Table 6.2. We notice that factors estimated by SPCA and SPCA-LS can explain more variations in bond excess returns with all maturities than the ones estimated by PCA. SPCA yields a 44.6% out-of-sample for forecasting the bond excess returns with two year maturity, which is much higher than the best out-of-sample predictor found in Ludvigson and Ng (2009). It is also observed that the forecast based on either SPCA or SPCA-LS cannot be improved by adding any covariate in . We argue that, in this application, the information of should be mainly used as the explanatory power for the factors.

We summarize the observed results in the following aspects:

-

1.

The factors estimated using additional covariates lead to significantly improved out-of-sample forecast on the US bond excess returns compared to the ones estimated by PCA.

-

2.

As many series in the panel data are heavy-tailed, the robust-version of our method (SPCA) can result in improved out-of-sample forecasts.

-

3.

The multi-index models yield significantly larger out-of-sample ’s than those of the linear forecast models.

-

4.

The observed covariates (e.g. forward rates, employment and inflation) contain strong explanatory powers of the latent factors. The gain of forecasting bond excess returns is more substantial when these covariates are incorporated to estimate the common factors (using the proposed procedure) than directly used for forecasts.

| SPCA | SPCA-LS | PCA | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Maturity(Year) | Maturity(Year) | Maturity(Year) | ||||||||||

| 2 | 3 | 4 | 5 | 2 | 3 | 4 | 5 | 2 | 3 | 4 | 5 | |

| linear model | ||||||||||||

| 38.0 | 32.7 | 25.6 | 22.9 | 37.4 | 33.4 | 25.4 | 22.6 | 23.0 | 20.7 | 16.8 | 16.5 | |

| 37.7 | 32.4 | 25.4 | 22.7 | 37.1 | 31.9 | 25.3 | 22.1 | 23.9 | 21.4 | 17.4 | 17.5 | |

| multi-index model | ||||||||||||

| 44.6 | 43.0 | 38.8 | 37.3 | 41.2 | 39.1 | 35.2 | 34.1 | 30.1 | 25.5 | 23.2 | 21.3 | |

| 41.5 | 38.7 | 35.2 | 33.8 | 41.1 | 35.7 | 32.2 | 30.0 | 30.8 | 26.3 | 24.6 | 22.0 | |

7 Simulation Studies

7.1 Model settings

We use simulated examples to demonstrate the finite sample performance of the proposed method, which is denoted by SPCA (smoothed PCA), and compare it with SPCA-LS (which uses , the least-squares based smoothed PCA, described in Section 3.1) and the benchmark PCA. We set and . The supplementary material contains additional simulation results under other and combinations, as well as the case of serially dependent data. The findings are similar.

Consider the following data generating process,

where is drawn from i.i.d. standard Normal distribution and is drawn from either the i.i.d standard Normal distribution or i.i.d. re-scaled Log-Normal distribution , where and are chosen such that has mean zero and variance .

Here and respectively represent the signal and noise levels. Set and , where controls the ratio between the explained and unexplained parts in the latent factors. To address different signal-noise regimes, we set and to represent strong, mild and weak explanatory powers respectively. The baseline is drawn from i.i.d. standard Normal distribution and the baseline function is set to be one of the following two models:

-

(I)

Linear model: We set and is drawn from i.i.d. standard Normal distribution. Let , where is a matrix with each entry drawn from ;

-

(II)

Nonlinear model: We set and is drawn from i.i.d. uniform distribution . Let with for . The coefficients and are calibrated from a nonlinear test function with so that forms its leading Fourier bases. To save the space, we refer to the example 2 of Dimatteo et al. (2001) for the plot of .

For each , we normalize and such that they have means zero, and standard deviations one.

Throughout this section, the number of factors is estimated by the eigen-ratio method (Lam and Yao, 2012; Ahn and Horenstein, 2013). In the following simulated examples, the eigen-ratio method can correctly select in most replications. The sieve basis is chosen as the additive polynomial basis. To account the scale of the noise variance, we also consider the tuning parameter in the Huber loss to admit , where and is smoothed by sieve least squares using additive polynomial basis of order 5. In Subsection 7.2, the tuning parameters and are selected by the in-sample 5-fold cross validation, while in subsection 7.3, they are chosen using the out-of-sample 5-fold cross validation.

7.2 In-sample Estimation

First, we compare the in-sample model fitting among SPCA, SPCA-LS and PCA under different scenarios. For each scenario, we conduct 200 replications. As the factors and loading may be estimated up to a rotation matrix, the canonical correlations between the parameter and its estimator can be used to measure the estimation accuracy (Bai, 2003). For Model (I) and (II) we report the sample mean of the median of 5 canonical correlations between the true loading and factors and the estimated ones.

The results are presented in Table 7.2. SPCA-LS and SPCA are comparable for light-tail distributions, and are both slightly better than PCA. This implies that we pay little price for the robustness and that the proposed estimators are potentially better than PCA when is relatively small, due to the merit of the “finite-” asymptotics of the proposed estimators. However, when the error distributions have heavy tails, SPCA yields much better estimation than other methods as expected. SPCA-LS out-performs PCA when has strong or mild explanatory powers of which is in line with the discussion in Section 4.3. When , the observed is not as informative and hence the performance of SPCA and SPCA-LS are close to regular PCA.

7.3 Out-of-sample Forecast

We now consider using latent factors in a linear forecast model where is drawn from i.i.d. standard normal distribution. For each simulation, the unknown coefficients in are independently drawn from uniform distribution to cover a variety of model settings.

We conduct one-step ahead rolling window forecast using the linear model by estimating and . The factors are estimated from (7.1) by SPCA, SPCA-LS or PCA. In each replication, we generate observations in total. For , we use the observations to forecast . We use PCA as the benchmark and define the relative mean squared error (RMSE) as:

where is the forecast of based on either SPCA or SPCA-LS while is the forecast based on PCA. For each scenario, we simulate 200 replications and calculate the averaged RMSE as a measurement of the one-step-ahead out-of-sample forecast.

The results are presented in Table 7.1. Again, when the tails of error distributions are light, SPCA and SPCA-LS perform comparably. But SPCA outperforms SPCA-LS when the errors have heavy tails. On the other hand, both SPCA and SPCA-LS outperform PCA when exhibits strong or mild explanatory powers of , but are slightly worse when is small. In general, the SPCA method performs the best under heavy-tailed cases.

| Model (I) | Model (II) | ||||

| SPCA | SPCA-LS | SPCA | SPCA-LS | ||

| Normal | 10 | 0.86 | 0.85 | 0.88 | 0.87 |

| 1 | 0.91 | 0.91 | 0.92 | 0.92 | |

| 0.1 | 1.01 | 1.01 | 1.02 | 1.01 | |

| LogN | 10 | 0.45 | 0.60 | 0.49 | 0.64 |

| 1 | 0.52 | 0.62 | 0.51 | 0.66 | |

| 0.1 | 0.55 | 0.65 | 0.56 | 0.70 | |

7.4 Compare with the interactive effect approach

Here we consider three pairs of sample sizes: ; and . We compare the proposed SPCA method with SPCA-LS (Section 3.1), regular PCA and pure least squares (LS), which models the covariates and estimates the parameters by simply using

In Tables 7.2–7.3, we report sample mean of the median of 5 canonical correlations between the true loading and factors and the estimated ones. Under various sample size combinations, the findings are similar as discussed in Section 7.2: (1) both SPCA and SPCA-LS outperform PCA under light-tail distributions when has strong or mild explanatory powers of ; (2) when the error distributions have heavy tails, SPCA outperforms other methods as expected; (3)when has weak explanatory power, the performance of SPCA and SPCA-LS are close to regular PCA; (4) under all simulated scenarios, the LS approach gives the worst estimation performance.

7.5 Serial dependent case

In this subsection, we compare the in-sample model fitting among SPCA, SPCA-LS and PCA under serial dependences. The simulation settings are similar as in Section 5.1 except both and are generated from a stationary VAR(1) model as follows

with and . The th entry of is set to be 0.5 when and when . In addition, and are drawn form i.i.d. .

The performance under 200 replications are presented in Table 7.4 below. Our numerical findings for the independent data continue to hold for serially dependent data: both SPCA and SPCA-LS outperform PCA when and are serially correlated. SPCA gives the best performance when the error distributions are heavy-tailed.

| Model (I) | Model (II) | |||||||

|---|---|---|---|---|---|---|---|---|

| SPCA | SPCA-LS | PCA | SPCA | SPCA-LS | PCA | |||

| Loadings | Normal | 10 | 0.91 | 0.91 | 0.82 | 0.90 | 0.90 | 0.75 |

| 1 | 0.88 | 0.89 | 0.82 | 0.84 | 0.84 | 0.75 | ||

| 0.1 | 0.83 | 0.83 | 0.82 | 0.77 | 0.79 | 0.75 | ||

| LogN | 10 | 0.81 | 0.50 | 0.36 | 0.77 | 0.48 | 0.31 | |

| 1 | 0.77 | 0.45 | 0.36 | 0.73 | 0.42 | 0.31 | ||

| 0.1 | 0.72 | 0.41 | 0.36 | 0.70 | 0.39 | 0.31 | ||

| Factors | Normal | 10 | 0.90 | 0.90 | 0.74 | 0.90 | 0.90 | 0.72 |

| 1 | 0.82 | 0.83 | 0.74 | 0.81 | 0.82 | 0.72 | ||

| 0.1 | 0.75 | 0.76 | 0.74 | 0.74 | 0.74 | 0.72 | ||

| LogN | 10 | 0.83 | 0.54 | 0.31 | 0.81 | 0.57 | 0.26 | |

| 1 | 0.80 | 0.53 | 0.31 | 0.77 | 0.50 | 0.26 | ||

| 0.1 | 0.75 | 0.48 | 0.31 | 0.74 | 0.46 | 0.26 | ||

| Model (I) | Model (II) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SPCA | SPCA-LS | PCA | LS | SPCA | SPCA-LS | PCA | LS | |||

| Loading | Normal | 10 | 0.95 | 0.95 | 0.88 | 0.82 | 0.93 | 0.93 | 0.85 | 0.78 |

| 1 | 0.92 | 0.92 | 0.88 | 0.83 | 0.88 | 0.88 | 0.85 | 0.79 | ||

| 0.1 | 0.85 | 0.86 | 0.88 | 0.86 | 0.84 | 0.84 | 0.85 | 0.83 | ||

| LogN | 10 | 0.86 | 0.59 | 0.44 | 0.38 | 0.84 | 0.55 | 0.41 | 0.34 | |

| 1 | 0.83 | 0.55 | 0.44 | 0.40 | 0.80 | 0.52 | 0.41 | 0.36 | ||

| 0.1 | 0.79 | 0.48 | 0.44 | 0.43 | 0.75 | 0.44 | 0.41 | 0.39 | ||

| Factors | Normal | 10 | 0.94 | 0.94 | 0.83 | 0.75 | 0.91 | 0.91 | 0.81 | 0.74 |

| 1 | 0.86 | 0.86 | 0.83 | 0.78 | 0.83 | 0.83 | 0.81 | 0.76 | ||

| 0.1 | 0.81 | 0.82 | 0.83 | 0.82 | 0.79 | 0.79 | 0.81 | 0.79 | ||

| LogN | 10 | 0.85 | 0.66 | 0.40 | 0.33 | 0.84 | 0.64 | 0.37 | 0.30 | |

| 1 | 0.81 | 0.60 | 0.40 | 0.35 | 0.80 | 0.61 | 0.37 | 0.32 | ||

| 0.1 | 0.77 | 0.54 | 0.40 | 0.38 | 0.75 | 0.56 | 0.37 | 0.35 | ||

| Model (I) | Model (II) | |||||||

|---|---|---|---|---|---|---|---|---|

| SPCA | SPCA-LS | PCA | SPCA | SPCA-LS | PCA | |||

| Loadings | Normal | 10 | 0.89 | 0.90 | 0.78 | 0.87 | 0.87 | 0.73 |

| 1 | 0.84 | 0.84 | 0.78 | 0.82 | 0.82 | 0.73 | ||

| 0.1 | 0.80 | 0.81 | 0.78 | 0.76 | 0.77 | 0.73 | ||

| LogN | 10 | 0.75 | 0.47 | 0.25 | 0.73 | 0.45 | 0.22 | |

| 1 | 0.69 | 0.41 | 0.25 | 0.69 | 0.39 | 0.22 | ||

| 0.1 | 0.64 | 0.38 | 0.25 | 0.62 | 0.35 | 0.22 | ||

| Factors | Normal | 10 | 0.88 | 0.89 | 0.71 | 0.88 | 0.88 | 0.68 |

| 1 | 0.81 | 0.82 | 0.71 | 0.80 | 0.81 | 0.68 | ||

| 0.1 | 0.73 | 0.74 | 0.71 | 0.72 | 0.72 | 0.68 | ||

| LogN | 10 | 0.80 | 0.59 | 0.24 | 0.78 | 0.55 | 0.19 | |

| 1 | 0.74 | 0.51 | 0.24 | 0.72 | 0.49 | 0.19 | ||

| 0.1 | 0.70 | 0.45 | 0.24 | 0.69 | 0.40 | 0.19 | ||

8 Conclusions

We study factor models when the factors depend on observed explanatory characteristics. The proposed method incorporates the explanatory power of these observed covariates, and is robust to possibly heavy-tailed distributions. We focus on the case is finite, and on the rates of convergence for the estimated factors and loadings. Under various signal-noise ratios, substantial improved rates of convergence can be gained.

Related to the above, the idea could be easily extended to the case that is slowly growing (with respect to ). On the other hand, allowing to be fast-growing would require some dimension-reduction treatment combined with covariate selections. In addition, selecting the covariates would be also useful as the quality of the signal is crucial. We shall leave these open questions for future studies.

Appendix A Proof of Theorem 2.1

Proof.

Let be the eigenvectors of , corresponding to the eigenvalues . Due to , and by the assumption that , the rank of equals Hence for all

(i) Let Let be a matrix, whose columns are the eigenvectors of . Then is a diagonal matrix, with diagonal elements being the eigenvalues of . Let Then

In addition, hence the columns of are the eigenvectors of , corresponding to the nonzero eigenvalues.

(ii) From , we have . This leads to the desired expression of .

(iii) The nonzero eigenvalues of equal those of

which are also the same as those of . Note that

∎

Appendix B Proofs for Section 4

B.1 A bird’s-eye view of the major technical steps

We first provide a bird’s-eye view of the major steps in the proof. The key intermediate result is to prove the following Bahadur representation of the estimated eigenvectors:

| (B.2) | |||||

for some invertible matrix . Here the first term on the right hand side is the leading term that results in the presented rate of convergence in Theorem 4.1, where denotes the derivative of Huber’s loss function; is a -dimensional diagonal matrix of the eigenvalues of . The second term is a higher order random term that depends on both and , where .

To have an general idea of how we prove (B.2), recall that , where each element of is with being the M-estimator of the sieve coefficients of , obtained by minimizing the Huber’s loss:

Then by the definition of ,

| (B.3) |

The above is the key equality we shall use to derive (B.2). To use this equality, we need to obtain the Bahadur representations of and in the following steps.

Step 1: bias of sieve coefficients. Define, for ,

Note that the sieve expansion of is (to be proved in Lemma LABEL:lb.1ad). But is biased for estimating , and asymptotically converges to . As , is expected to converge to uniformly in . This is true given some moment conditions on

Step 2: Expansion of .

The first order condition gives But we cannot directly expand this equation because is not differentiable. As in many M-estimations, define , and . So we have

and is differentiable. We shall apply the standard empirical process theory for independent data (the symmetrization and contraction theorems, e.g., Bühlmann and van de Geer (2011) ) to prove the stochastic equicontinuity of and thus the convergence of . This will eventually lead to an expansion of , to be given in Lemma LABEL:lb1.

Step 3: Expansion of . Combining steps 1 and 2 will eventually lead to

| (B.4) |

where is a high-order remainder term that depends on , and is the Hessian matrix. We shall bound in Proposition LABEL:pb3.

Step 4: Expansion of . Substituting the expansion of to (B.4), with replaced by its expansions, we will eventually obtain (B.2). Then (B.2) can be directly applied to obtain the rate of convergence for the estimated loadings. This will be done in Section LABEL:sd.3, where we show that the remainder term is of a smaller order than the leading term.

Importantly, both the signal strength and the “noise” plays an essential role in (B.3), which are to be reflected in the rate of convergence.

B.2 Estimating the loadings

Throughout the proofs, as , either grows or stays constant.

Write be an matrix, whose th row is given by

Write , where was defined in Proposition LABEL:pb3. Then the Bahadur representation in Proposition LABEL:pb3 can be written in the vector form: ,

| (B.5) |

Let be a diagonal matrix, whose diagonal elements are the first eigenvalues of . By the definition of , Plugging in (B.5), with we have,

| (B.6) |

where for ,

We derive the rates of convergence by examining each term of (B.6).

B.2.1 Proof of Theorem 4.1:

Proposition B.1.

Suppose , and . Then

Proof.

From Lemma LABEL:lb2 and Proposition LABEL:pb3, we obtain

under the assumption , and . Hence from Lemma LABEL:lb2 and Proposition LABEL:pb3,

The last equality is due to , granted by and . Q.E.D.

B.2.2 Proof of Theorem 4.1:

Proof.

By Lemma LABEL:lb4 . Let respectively denote the th row of . We have

Hence

where the last equality follows from

under assumptions and .

B.3 Proof of Theorem 4.2: factors

Recall that . By (B.5), , where

The convergence of in this theorem is proved in the following proposition.

Proposition B.2.

As and either grows or stays constant,

Proof.

Therefore, as ,

Finally, let denote the th row of , . Then

Thus

where (1) is due to , and ,

and (so ). Q.E.D.

Proposition B.3.

Note that and Hence from (B.5)

| (B.7) |

where are as defined earlier, and

Hence for a constant , We look at terms on the right hand side one by one. First of all,

This implies where

As for , let and let denote its th row, . By (LABEL:eb.5), and ,

Then

Terms and were bounded in the proof of Proposition B.2:

Term is given in Lemma LABEL:lb8 below:

By Lemmas LABEL:lb6, LABEL:lb7,

So combined with Lemmas LABEL:lb3, Proposition LABEL:pb3,

where (1) follows from that ; (2) is due to and that due to Assumption 4.1; (3) is due to .

Finally, Hence

Appendix C Proof of Theorem 5.1

The proof of the limiting distribution of under the null is divided into two major steps.

step 1: Asymptotic expansion: under ,

step 2: The effect of estimating is first-order negligible:

The result then follows from the asymptotic normality of the first term on the right hand side. We shall prove this using Lindeberg’s central limit theorem.

We achieve each step in the following subsections.

C.1 Step 1 asymptotic expansion of

Proposition C.1.

Under ,

Proof.

Since , it follows from (B.7) that it suffices to prove under , and

By the proof of Propositions B.2, LABEL:pb3, Lemmas LABEL:lb3, LABEL:lb8 and that ,,

The last equality holds so long as , , .

By Lemma LABEL:lb7,

The proof of is given in Lemmas LABEL:lc.2 and LABEL:lc.3. It then leads to the desired result.

C.2 Step 2 Completion of the proof

We now aim to show . Once this is done, it then follows from the facts that and ,

As a result, by Proposition C.1,

Hence

To finish the proof, we now show two claims:

(1)

(2) .

Proof of (1) We define and . Then Also by Assumption 4.1, , hence we have for all large . For any , by the dominated convergence theorem, for all large ,

This then implies the Lindeberg condition, Hence by the Lindeberg central limit theorem,

The result then follows since

Proof of (2) By the triangular inequality,

Using the established bounds for in Theorem 3.1, it is straightforward to verify . Other terms require sharper bounds yet to be established. These are given in Proposition LABEL:lc.4. It then follows that . This completes the proof.

Q.E.D.

References

- Ahn and Horenstein (2013) Ahn, S. and Horenstein, A. (2013). Eigenvalue ratio test for the number of factors. Econometrica 81 1203–1227.

- Ahn et al. (2001) Ahn, S., Lee, Y. and Schmidt, P. (2001). Gmm estimation of linear panel data models with time-varying individual effects. Journal of Econometrics 101 219–255.

- Andrews (1991) Andrews, D. (1991). Asymptotic optimality of generalized , cross-validation, and generalized crossvalidation in regression with heteroskedastic errors. Journal of Econometrics 47 359-377.

- Bai (2003) Bai, J. (2003). Inferential theory for factor models of large dimensions. Econometrica 71 135–171.

- Bai (2009) Bai, J. (2009). Panel data models with interactive fixed effects. Econometrica 77 1229–1279.

- Bai and Ng (2002) Bai, J. and Ng, S. (2002). Determining the number of factors in approximate factor models. Econometrica 70 191–221.

- Bickel and Levina (2008) Bickel, P. and Levina, E. (2008). Covariance regularization by thresholding. Annals of Statistics 36 2577–2604.

- Bühlmann and van de Geer (2011) Bühlmann, P. and van de Geer, S. (2011). Statistics for high-dimensional data, methods, theory and applications. The first edition ed. Springer, New York.

- Carhart (1997) Carhart, M. M. (1997). On persistence in mutual fund performance. Journal of finance 52 57–82.

- Chamberlain and Rothschild (1983) Chamberlain, G. and Rothschild, M. (1983). Arbitrage, factor structure and mean-variance analyssi in large asset markets. Econometrica 51 1305–1324.

- Dimatteo et al. (2001) Dimatteo, I., Genovese, C. and Kass, R. (2001). Bayesian curve fitting with free-knot splines. Biometrika 88 1055–1071.

- Doz et al. (2012) Doz, C., Giannone, D. and Reichlin, L. (2012). A quasi-maximum likelihood approach for large, approximate dynamic factor models. The Review of Economics and Statistics 94 1014–1024.

- Fama and French (1992) Fama, E. F. and French, K. R. (1992). The cross-section of expected stock returns. Journal of Finance 47 427–465.

- Fama and French (2015) Fama, E. F. and French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics 116 1–22.

- Fan et al. (2017) Fan, J., Li, Q. and Wang, Y. (2017). Estimation of high dimensional mean regression in the absence of symmetry and light tail assumptions. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 79 247–265.

- Fan et al. (2013) Fan, J., Liao, Y. and Mincheva, M. (2013). Large covariance estimation by thresholding principal orthogonal complements (with discussion). Journal of the Royal Statistical Society, Series B 75 603–680.

- Forni et al. (2005) Forni, M., Hallin, M., Lippi, M. and Reichlin, L. (2005). The generalized dynamic factor model: one-sided estimation and forecasting. Journal of the American Statistical Association 100 830–840.

- Gibbons et al. (1989) Gibbons, M., Ross, S. and Shanken, J. (1989). A test of the efficiency of a given portfolio. Econometrica 57 1121–1152.

- Gungor and Luger (2013) Gungor, S. and Luger, R. (2013). Testing linear factor pricing models with large cross sections: A distribution-free approach. Journal of Business & Economic Statistics 31 66–77.

- Hart (1994) Hart, J. D. H. (1994). Automated kernel smoothing of dependent data by using time series cross- validation. Journal of the Royal Statistical Society, Series B 56 529–542.

- Huang and Lee (2010) Huang, H. and Lee, T.-H. (2010). To combine forecasts or to combine information? Econometric Reviews 29 534–570.

- Huber (1964) Huber, P. (1964). Robust estimation of a location parameter. The Annals of Mathematical Statistics 35 73–101.

- Hurvich et al. (1998) Hurvich, C., Simonoff, J. and Tsai, C. (1998). Smoothing parameter selection in nonparametric regression using an improved akaike information criterion. Journal of the Royal Statistical Society, Series B 60 271-293.

- Lam and Yao (2012) Lam, C. and Yao, Q. (2012). Factor modeling for high dimensional time-series: inference for the number of factors. Annals of Statistics 40 694–726.

- Lawley and Maxwell (1971) Lawley, D. and Maxwell, A. (1971). Factor analysis as a statistical method. The second edition ed. Butterworths, London.

- Li et al. (2016) Li, G., Yang, D., Nobel, A. B. and Shen, H. (2016). Supervised singular value decomposition and its asymptotic properties. Journal of Multivariate Analysis 146 7–17.

- Li (1987) Li, K. (1987). Asymptotic optimality for , cross-validation, and generalized cross-validation: Discrete index set. Annals of Statistics 15 958-975.

- Li (1991) Li, K.-C. (1991). Sliced inverse regression for dimension reduction. Journal of the American Statistical Association 86 316–327.

- Ludvigson and Ng (2009) Ludvigson, S. and Ng, S. (2009). Macro factors in bond risk premia. Review of Financial Studies 22 5027–5067.

- Ludvigson and Ng (2010) Ludvigson, S. and Ng, S. (2010). A factor analysis of bond risk premia. Handbook of Empirical Economics and Finance 313–372.

- Mammen (1989) Mammen, E. (1989). Asymptotics with increasing dimension for robust regression with applications to the bootstrap. The Annals of Statistics 382–400.

- Moon and Weidner (2015) Moon, R. and Weidner, M. (2015). Linear regression for panel with unknown number of factors as interactive fixed effects. Econometrica 83 1543–1579.

- Network (2012) Network, C. G. A. (2012). Comprehensive molecular portraits of human breast tumours. Nature 490 61–70.

- Novy-Marx (2013) Novy-Marx, R. (2013). The other side of value: The gross profitability premium. Journal of Financial Economics 108 1–28.

- Onatski (2012a) Onatski, A. (2012a). Asymptotics of the principal components estimator of large factor models with weakly influential factors. Journal of Econometrics 168 244–258.

- Onatski (2012b) Onatski, A. (2012b). Asymptotics of the principal components estimator of large factor models with weakly influential factors. Journal of Econometrics 168 244–258.

- Pesaran and Yamagata (2012) Pesaran, H. and Yamagata, T. (2012). Testing capm with a large number of assets. Tech. rep., University of South California.

- Portnoy (1985) Portnoy, S. (1985). Asymptotic behavior of m estimators of p regression parameters when p2/n is large; ii. normal approximation. The Annals of Statistics 1403–1417.

- Stock and Watson (2002) Stock, J. and Watson, M. (2002). Forecasting using principal components from a large number of predictors. Journal of the American Statistical Association 97 1167–1179.

- van der Vaart and Wellner (1996) van der Vaart, A. and Wellner, J. (1996). Weak convergence and empirical processes. The first edition ed. Springer.