Parabolic free boundary price formation models under market size fluctuations

Abstract.

In this paper we propose an extension of the Lasry-Lions price formation model which includes fluctuations of the numbers of buyers and vendors. We analyze the model in the case of deterministic and stochastic market size fluctuations and present results on the long time asymptotic behavior and numerical evidence and conjectures on periodic, almost periodic and stochastic fluctuations. The numerical simulations extend the theoretical statements and give further insights into price formation dynamics.

1. Introduction

This paper studies the impact of buyer and vendor number fluctuations on the price dynamics in an economic market in which a single good is traded.

In general the formation of the price is a complex process, which results from the interplay of various additional factors such as trading behavior and rules, transaction costs, etc. Understanding these complicated interactions is a central research question in the field of market microstructure, which aims to explain “the process and outcome of exchanging assets under a specific set of rules” (see for example O’Hara [19]).

In 2007 Lasry and Lions introduced a minimalistic mean-field model (a one-dimensional parabolic free-boundary partial differential equation) to describe the price, which enters as the free boundary, of a single good traded between a large group of vendors and a large group of buyers.

Here we study a dynamic trading model, which is motivated by the price formation model proposed by Lasry and Lions. The original model considers a large group of buyers and vendors trading a single good. Each buyer or vendor acts continuously in time with his/her pre-trade price. If no trade takes place, the price diffuses instantaneously into its immediate neighborhood. When (through the diffusion around the pre-trade price) a buyer and vendor transact at this price, trading takes place. The buyer becomes a vendor, at a price which is the trading price plus the transaction cost, and the vendor becomes a buyer at a price which is the trading price minus the transaction cost. The total number of buyers as well as the total number of vendors is conserved in time. In reality however, buyers may not want to resell immediately or sellers may decide to wait with their next purchase. As a result temporal fluctuations in the number of buyers and vendors arise naturally and should be therefore included in the model. It is natural to expect that these fluctuations have independent increments and depend linearly on the total number of buyers and vendors.

There is a plethora of stochastic models, often based on queuing theory, for price formation (see for instance Lachapelle et al. [16] and the references therein), which deal in different degrees of accuracy with the many known phenomena of price formation on a microlevel. The model, which we present here, fulfills this requirement only in a very schematic conceptual sense. It stands out, however, due to its analytic tractability, a feature badly missing in most of the other models. We believe that the stochastic version of the Lasry and Lions model can serve as a building block for other price formation models with more realistic description of the relaxation and fluctuation mechanisms.

The Lasry and Lions model has been studied in a series of papers (see [8, 18, 15, 6, 7]). Burger et al. [3, 4] identified the Lasry and Lions model as the asymptotic limit of a kinetic model, in which trading events between buyers and vendors are described by collisions, giving Boltzmann-type equations for the buyer and vendor densities. The Lasry and Lions model corresponds to the high frequency trading regime, that is markets with high volumes of trade and short holding periods. The short holding periods justify the mass conservation property of both models. Kinetic models were also proposed for various applications in finance, such as wealth and income distribution by Düring and Toscani, Toscani, Brugna and Demichelis as well as Pareschi and Toscani in [12, 25, 20, 21], knowledge growth in a society by Burger, Lorz and Wolfram [5] or opinion formation by Toscani [24]. Degond, Liu and Ringhofer [11, 10] also proposed a kinetic mean-field approach to describe wealth evolution.

Here we generalize the Lasry and Lions model to account for fluctuations in the number of buyers and vendors. The fluctuation are modeled either deterministically or stochastically, and we aim to study their influence on the dynamics of the price. We discuss the long time behavior in either case as well as confirm and extend the analytic findings by several numerical simulations.

The paper is organized as follows: The parabolic price formation model of Lasry and Lions is introduced in Section 2. In Section 3 we present our generalization, which includes deterministic fluctuations in the masses of buyers and vendors. We discuss the large time asymptotics and periodic fluctuations in Section 4. In Section 5 we illustrate the price dynamics with numerical simulations. In Section 5.5 we conclude by studying the price formation process in the case of stochastic mass fluctuations.

2. The Lasry and Lions price formation model

Lasry and Lions [17] consider a market in which a large group of buyers and a large group of vendors trade a certain good. If a buyer and a seller agree on a price, a transaction takes place and the buyer immediately becomes a seller and vice versa. A transaction fee has to be paid by both parties. Buyers and vendors are modeled by densities, which describe the (absolute) number of buyers (vendors) over the price variable . Price formation is modeled by buying at price , paying – due to a transaction cost – the price and adding to the vendor distribution at . The same dynamics hold in the case of selling (again with the transaction cost ). Non trivial dynamics are introduced by allowing for diffusive changes of the buyer and seller distributions between two events of price formation. The numbers of buyers and vendors remain unchanged at each time of the price formation process.

The distribution of the agents is described in terms of a signed density function . In particular, the distribution of buyers over the price is the positive part , that is, , while the negative part is the distribution of vendors again over the price . The distribution of buyers is supported to the left of the formed price , whereas the distribution of vendors is supported to the right of reflecting the old principle “buy low and sell high”. The number of transactions at time is given by . The impact of the trading events take place at the agreed price shifted by the transaction cost . The diffusive changes in the buyer and vendor distributions are modeled by second order derivatives with constant diffusivity .

All the above are expressed by the following free boundary problem:

| (1a) | |||

| (1b) | |||

| (1c) | |||

Note that, without loss of generality, . since it can always be achieved by a translation. We assume that the initial distribution of buyers and vendors satisfies

| (A1) | ||||

In the original model (1) the numbers of buyers and vendors are conserved in time and are given by

| (2) |

The ratio of these “masses” determines the large time asymptotic behavior of the price, that is, if , then (cf. [6])

| (3) |

where we use the usual definition for the error function .

As a result the price increases asymptotically like if (number of buyers is larger than number of vendors) and decreases asymptotically like if (number of buyers smaller than the number of vendors). When , the price stabilizes to a constant.

A very useful tool for the analysis and the numerics of the Lasry and Lions model is the following nonlinear transformation (introduced in [6]), which changes (1a) to the heat equation. Define

| (4) |

It follows that satisfies the heat equation

| (5) |

with the (transformed) initial datum

| (6) |

Conversely, if is a solution to (5), then, the density in (1), is recovered by

| (7) |

Note that to obtain (7) it is necessary to ensure that the back-transformed function is positive to the left of the free boundary and negative to the right of it. This follows easily from the structure of the transformed initial datum and the comparison principle for the heat equation.

3. Deterministic market size fluctuations

We introduce deterministic time dependent changes (fluctuations) of the size of the market in the Lasry and Lions model.

This setting is the first step towards the development of a proper stochastic formulation, where mass fluctuations are modeled by typical trajectories of semi-martingales.

Let and denote fluctuations for the buyer and vendor densities and assume that

-

(A2)

, be in with .

Note that can always be achieved by a constant shift , , which will not change the PDE model stated below.

Market size fluctuations are introduced conceptually by the following time splitting scheme, which corresponds to a numerical solution algorithm of a PDE:

-

(1)

Given a signed buyer-vendor distribution at time , solve the Lasry and Lions model (1) from time to .

-

(2)

At the end of each time step modify the market by multiplying the distribution of buyers and vendors by and respectively.

This splitting scheme yields in the (formal) limit , the problem

| (8a) | ||||

| (8b) | ||||

| (8c) | ||||

Assuming that the free boundary is uniquely defined by (8b), we can compute the actual fluctuations of the numbers of buyers and vendors by integrating (8a) over and , respectively and taking into account that for and for .

Let and . Using the definition of in (8b), we obtain

and, therefore, for ,

Hence the proposed time splitting results in exponential market size changes for the buyers and vendors.

The rigorous justification of the convergence of the splitting scheme to (8) follows easily from the reformulation of the problem as the heat equation in each time interval after multiplying the initial datum at from the left and right by the appropriate exponential. We leave the details to the reader.

The results here are based on the transformation

connecting the Lasry and Lions model (1) in a one-to-one way to the heat equation (5). Since market size fluctuations are homogeneous in space the transformation

yields

| (9a) | |||

| (9b) | |||

where the initial datum is given by (6); note that is the zero level set of the function . We can rewrite equation (9), using and , as

| (10) | ||||

Then the exponential transformation gives

| (11a) | |||

| (11b) | |||

We now state the following existence and uniqueness result for (9).

Theorem 3.1.

Proof.

From the Lipschitz continuity of the absolute value function we can deduce the existence of a unique solution of (11). The free boundary corresponds to the zero level set of the function , that is . It follows from Angenent [1] that the function has at most one zero for every , see also [14]. In the former reference Angenent showed that the number of zeros of any solution of

| (12) |

with cannot increase in time. Since is bounded, Lemma 5.1 in [1] guarantees that solutions to (11) cannot vanish identically on any interval . It is, therefore, immediate that the free boundary has no “fat” parts.

Next we show that the free boundary cannot become unbounded in finite time.

Let , write (11a) in the form (12) with .

We write where and are respectively the solutions of

and

For any given set , . Since , the comparison principle gives

where and are solution of the initial value problems

Expressing and in terms of the fundamental solution of the heat equation yields that, for any , all , we have

while and remain bounded away from as and respectively see [6] for full details. We conclude that the signs of in the far fields are determined by the signs of the initial datum , which is positive on the left and negative on the right. The continuity of implies the existence of a zero in between and the free boundary stays locally bounded in time. ∎

It is also of interest to consider market size fluctuation functions with jump discontinuities and , particularly with Levy-type random processes in hindsight. Assume for the

moment that, instead of (A2), we have:

-

(A2’)

There is an increasing sequence , , as such that, for all , with .

We are interested in the case where either or is different from or respectively.

Then the limit of the splitting scheme has to be modified even on the formal level as follows:

On every interval we solve (8) subject to the initial datum

Note that Theorem 3.1 applies on each interval and that the free boundary is globally continuous.

Standard results for the (obvious) time splitting scheme of semilinear parabolic equations with smooth nonlinearities (see [13]) yield the convergence of the scheme. It is immediate that the convergence is retained for less smooth nonlinearities (albeit possibly loosing the convergence order). Applying first the exponential transformation, which gives the splitting scheme for (9) and equivalently for (8), and, consecutively, the transformation (7), we conclude the convergence of the solution of the time spitting scheme.

4. The long time asymptotics

We now consider the asymptotic behavior of (8) for . We use the super- and sub-scripts and to refer to the left and right sides of the free boundary in the following.

In what follows we assume that

-

(A3)

-

(i)

Let ,

-

(ii)

and

-

(iii)

for all with ,

or alternatively we shall use -

(iv)

for all with .

-

(i)

To simplify the argument, we write

Next we consider the exponential transformation of the original problem (10) given by

| (13) |

It is immediate that satisfies the following problem

| (14a) | ||||

| (14b) | ||||

| (14c) | ||||

| (14d) | ||||

To determine the asymptotic behavior in case of deterministic market fluctuations we use the parabolic rescaling and define Then satisfies

| (15a) | ||||

| (15b) | ||||

| (15c) | ||||

| (15d) | ||||

We study the limit as and note that . At first we assume that is known (and smooth) and solve (15) on the left and the right of the free boundary respectively. Let and be the smooth solutions of

Then and can be written as

where and

| (16) |

is the heat kernel.

Since and we find

and

Adding the above equations gives with

| (17a) | ||||

| and | ||||

| (17b) | ||||

We shall use the following estimate in order to compare and asymptotically for .

Note that this implies, that for some , and thus gives the -bound of used in the proof of Theorem 4.3 and 4.5.

Proof.

We remark that holds if, for example has compact support.

Next we consider the rescaled initial datum in the limit .

Proposition 4.2.

Let be given by (6). Then the rescaled initial datum satisfies in , where

Proof.

It is immediate from the definitions of that, for every test function :

| (19) | ||||

It follows that

| (20) | ||||

Note that we split both integrals in the second line of (20) into two parts. The first one is approximated by the rectangle integration rule, while the contributions from the second interval over were included in the terms.

Similar calculations give , which concludes the proof.

∎

Next we introduce the additional notation

| (21) |

Theorem 4.3.

Proof.

Note that since , the bound on that was obtained earlier yields,

with

Since

we find .

Consider now the -fractional integral

It is easy to verify that, if for

Then the asymptotic assumption A3(A3)(iii) on and implies

| (22) |

and, therefore

Since, in view of Proposition (4.2),

using that , we have

This yields together with (22) the equation for :

Hence we obtain

and thus

The claim now follows

which, in view of the rescaling, yields

∎

For the case we shall make use of the following auxiliary Lemma:

Lemma 4.4.

Assume and for with . If , there exists a function such that, for

| (23) |

Proof.

We rewrite

Let and consider . Then

Since for all , we have for

and thus if and

Since, for all ,

we have

The result follows with . ∎

The next result is about the long time asymptotics of when .

Theorem 4.5.

Proof.

We revisit the equation and refine the asymptotics for each term. Recalling (LABEL:e:I1eps) we find:

where we used that and . Since in view of Theorem 4.3 as we have

and, thus, pointwise for a.e. , as we get

Since Lemma 4.4 ensures that for we have

and, by the Lebesgue dominated convergence, we find that

To refine the asymptotics of given by (LABEL:e:I2eps) we use Proposition 4.2 again with replaced by for and for . Letting , we get

Hence becomes

We conclude

with .

Since we obtain the claim.

∎

4.1. Periodic market size fluctuations

We now discuss the price formation model in case of periodic fluctuations, that is we assume for all , there exist and such that

At first we study the highly oscillatory case on time intervals of length , that is we choose small and replace , in

(8) (and (9), (10) and (11)) respectively by , and . The PDE is

then studied on the time interval , where is -independent.

Then the IVP (11) reads:

| (25a) | |||

| (25b) | |||

Note that the exponential transformation (13) of equation (11) gives:

| (26a) | ||||

| (26b) | ||||

| (26c) | ||||

| (26d) | ||||

Assume that is rational, is uniformly positive and is not constant. Then, writing (26c) as

We conclude that converges weakly to a constant (the average of

over the period) and thus and cannot both converge strongly.

Therefore it is not possible to pass to the limit in (26c) directly, that is the most

basic formal argument fails.

Next we consider the problem

| (27) | |||

with a smooth, non-negative function with and a -periodic function with ; here we do

not assume but instead .

We make the following asymptotic ansatz

| (28) |

with being a periodic function in and solving

| (29a) | |||

| (29b) | |||

Noting that satisfies

and we conclude that, for all and ,

| (30a) | |||

| and | |||

| (30b) | |||

Next we determine necessary conditions for the asymptotics (28) to hold. We start by computing

Substituting and its derivatives into (25) gives

where we have used the Taylor expansion of the term and ignored the term. Note that

with . Since

we can rewrite as

and deduce that is -periodic as well. Now we take the mean. This gives

| (31) |

From (30a) we deduce that , while (30b) gives

| (32) |

Substituting (32) in (31) and dividing by gives the necessary condition for periodicity of in the -variable, that is

In the following we present a formal argument in the case . Since we have (as computed before)

We formally obtain that . Thus

where solves the heat equation with initial datum

| (33) |

By using the nonlinear transformation (7) from the heat equation to (1) it follows that the limiting free boundary of the Lasry-Lions model with periodic market fluctuations is given by the free boundary of the original Lasry-Lions model without market fluctuations but with a changed initial buyer-vendor distribution. and are multiplied by the same factors as in (33).

Note that the asymptotics presented here do not even hold formally if the periods and of and , respectively, are not rationally related.

Remark 4.6.

A related problem is to study periodic mass-fluctuations and with -periods and look for the limits as of

the free boundary . After the parabolic rescaling

and and the usual exponential transformation the problem (25) with and as independent variables is obtained, where the initial datum

is replaced by .

A rigorous proof of the homogenization result in the case of periodic market size fluctuations will be the subject of a future paper.

5. Numerical simulations:

We conclude the discussion about the long time asymptotic behavior in the case of deterministic and periodic market size fluctuations by presenting numerical experiments.

The numerical simulations are based on a finite difference discretization of (10) in space and a Runge-Kutta time splitting scheme.

We use the following Strang time splitting scheme (with time step denoted by and ):

-

(1)

Solve the ODE explicitly in time on the interval .

-

(2)

Evolve according to the heat equation for a full time step, that is , using an explicit -th order Runge Kutta time stepping scheme and a classic finite difference discretization in space.

-

(3)

Solve the ODE explicitly in time on the interval .

For the following simulations the computational domain is set to (where corresponds to the scaled maximum price) and is split into equidistant subintervals if not stated otherwise. Then (10) is solved with the following nonlinear boundary conditions

which correspond to homogeneous Neumann boundary conditions in the original Lasry and Lions model. Note that we choose the computational domain sufficiently large, to ensure that the price dynamics are not influenced by the boundary conditions for a large time. However it is not possible to neglect the influence on the numerical simulations as we shall illustrate in the first example.

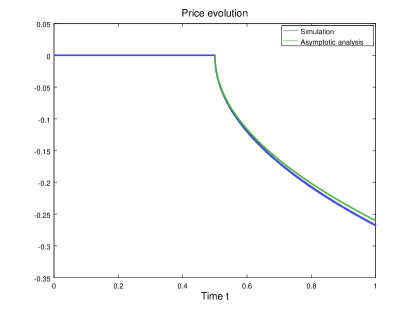

5.1. Price evolution of the classic Lasry and Lions model

In the first example we compare the theoretical long time asymptotic behavior of the Lasry and Lions model (1)

with the simulation results. Note that (1) corresponds to the simulation of (9) with , that is the simulations of the heat equation

with an initial datum of the form .

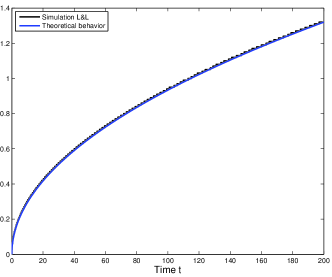

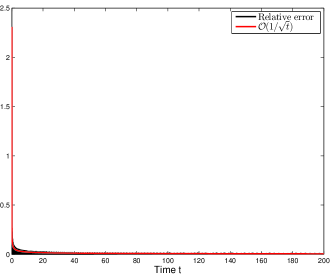

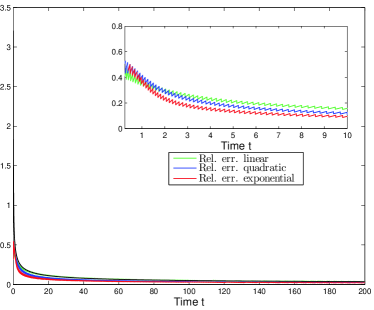

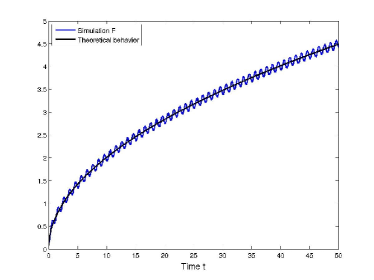

Figure 1 illustrates the behavior of the free boundary for the Lasry and Lions model (1) as a function of time. The relative

error decays fast in a good agreement of the numerically computed price and the theoretical results. In fact the numerical

results indicate that the relative error decays like , see Figure 1b).

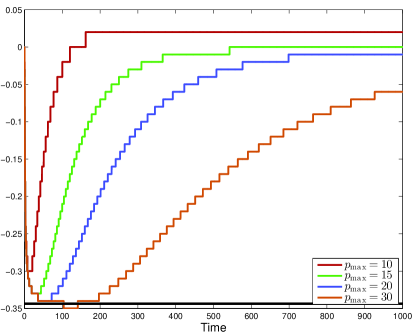

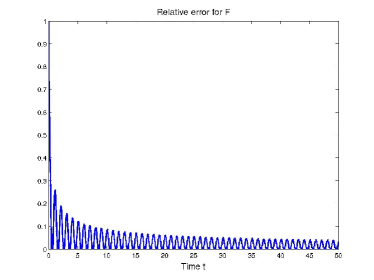

The next example illustrates the influence of the boundary on the price dynamics. Note that the stationary price in the classic Lasry and Lions model on a bounded domain with Neumann boundary conditions is given by

| (34) |

We choose an initial datum with equal masses of buyers and vendors, i.e.

While the asymptotic analysis on the unbounded domain postulates the convergence towards the constant given by (24), the stationary price on the bounded domain, given by (34), corresponds to . Figure 2 clearly illustrates the change of the price dynamics for differently sized domains . The black line at corresponds to the predicted analytic constant - we observe that the prices initially converge to this value, but then reverse their dynamics towards due to the influence of the boundary conditions. The smaller the computational domain the earlier the reversal happens.

5.2. Price evolution for stabilizing market size fluctuations

Next we compare the simulated price dynamics for different choices of and with the theoretical results. We consider the three cases:

| (35) | ||||

with . The fluctuations of the vendor market size distribution have the respectively same form with . Hence and . We start with simulations in the case of different initial masses of buyers and vendors. The initial datum is given by

.

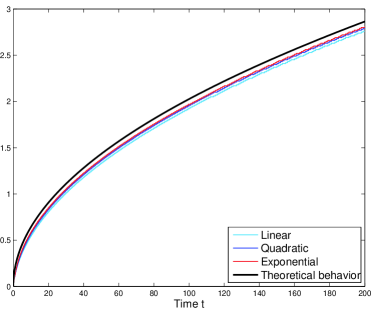

Figure 3 compares the theoretical long time asymptotics based on the results of Theorem 4.3 and the numerical simulations. We observe that

the convergence rate of the functions and towards their asymptotic value determines the constant - the faster the convergence the closer the

behavior with respect to the theoretical predictions. The relative errors for the respective cases in Figure 3b) illustrate the fast convergence of the free boundary, they decay

like (the inset in Figure 3(b) corresponds to the enlarged view of the price dynamics for small times).

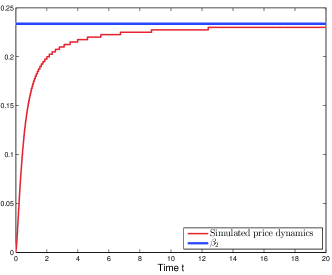

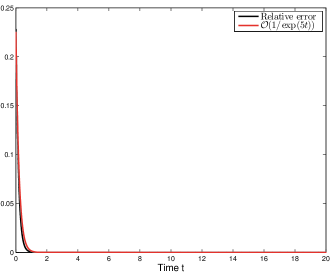

Next we consider the case , that is the number of buyers and vendors converge to the same long-time limit. Theorem 4.5 states that the long time asymptotic behavior is driven by the first order moments of the initial data. We choose the following initial datum:

Furthermore we set

with and . Note that the functions and satisfy Assumption A3(A3)(iv) and that the parameter choices imply . The evolution of the price is depicted in Figure 4. We observe the expected long time behavior towards the theoretically predicted constant , but the decay is different. It decreases like , illustrated in Figure 4b), and not like as in the case .

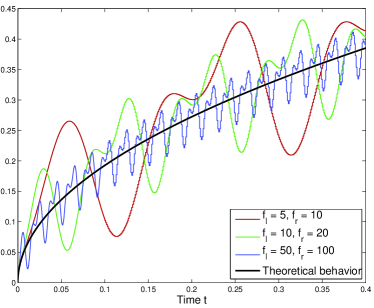

5.3. Price evolution in the case of periodic market size fluctuations

Next we consider periodic fluctuations in the buyer and vendor market sizes. First we choose fluctuations of the form

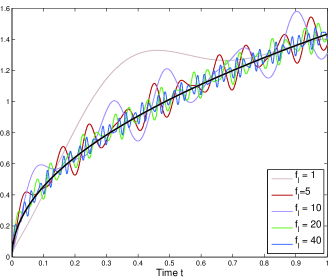

| (36) |

Figure 5 illustrates the behavior of the free boundary on the time interval for different values of and , when the ratio is rational. We observe that the maximum amplitude of the computed price from the theoretical predictions decreases as , an

observation also confirmed in Table 1.

| / | 5/10 | 10/20 | 20/40 | 50/100 |

|---|---|---|---|---|

| amplitude | 0.1389 | 0.1018 | 0.0777 | 0.0538 |

Note that the functions and are one-periodic with zero mean in the first example and . To illustrate the impact of mass fluctuations with non-zero mean we choose functions and of the form:

| (37) |

For this setting the corresponding evolution is illustrated in Figure 6 (using the same simulation parameters as in the previous example).

Again we observe a very good agreement with the predicted theoretical price dynamics (based on the modified initial datum (33)), even though they are based on

formal arguments.

Finally we study the effect of periodic mass fluctuations on the free boundary. We choose an initial datum with equal mass, that is to clearly distinguish the influence of the market size fluctuations from the price dynamics due to the market imbalance of buyers and vendors. The functions and are set to

| (38) |

Table 2 states the computed amplitude and frequency for the different values of . Note that mass oscillations of order amplitude result in -amplitude fluctuations in the free boundary and that we have ’numerical’ strong convergence of the free boundary.

| 5 | 10 | 20 | 100 | |

|---|---|---|---|---|

| amplitude | 0.1415 | 0.10446 | 0.075766 | 0.03982 |

| frequency | 4.8832 | 9.766 | 20.142 | 99.9456 |

5.4. Almost periodic market size fluctuations

We would like to argue numerically that the formal asymptotic for the periodic case, i.e. that the limiting dynamics of the price correspond to the dynamics of the original Lasry-Lions model with a changed initial buyer-vendor distribution (33), holds also in the case of Besicovitch almost periodic market size fluctuations, cf. [2]. Note that the space of Besicovitch almost periodic functions corresponds to the closure of the trigonometric polynomials under the seminorm

These functions have an expansion of the form with finite and ; their mean value is defined by

| (39) |

We set

with integer frequencies and and choose an initial datum of the form .

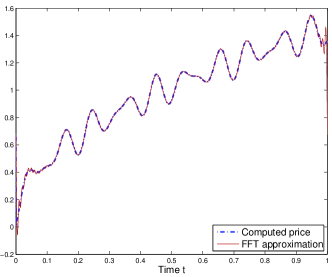

Figure 7 illustrates the price dynamics for the time interval and the frequencies . The black line

corresponds to the theoretical prediction computed as in the periodic case, using the parameters , and .

As already explained we observe convergence of the price towards the formal theoretical prediction in the periodic case, see (33). The numerical results indicate also the validity of the formal asymptotics in the almost periodic case.

We would like to remark that it is difficult to determine if the discrete price dynamics are almost-periodic functions. Figure 7 shows the approximation of the price in the case , which is based on the leading FFT coefficients of the discrete price.

5.5. Price formation with stochastic market size fluctuations

Finally we consider the Lasry and Lions model (1) with stochastic fluctuations in the numbers of buyers and vendors, which we model by two independent Brownian motions and replacing the deterministic functions and in Section 3. Since under sufficient regularity conditions (such that Wong-Zakai type theorems for SPDEs hold, see [26]) stochastic partial differential equations (SPDE) involving the Stratonovich integral are obtained in the limit (in probability) when Brownian motions are (reasonably) approximated by smooth functions. We shall use the Stratonovich version of the Lasry and Lions model following the common convention that denotes Stratonovich integration against .

Notice that the Stratonovich formulation is well defined when the Ito integral is well defined and the integrand is a semimartingale. In our case this can be guaranteed due to the special structure of the SPDE’s characteristics if sufficiently regular initial values are chosen. Also the Stratonovich correction term has a simple expression, since and lead at least formally to the correction term . In the sequel we do not enter too much into the stochastic details but assume enough regularity for the initial values such that our considerations hold true.

Here we discuss the well posedness of the equation, but leave a more refined analysis, that is of long term limits, for future research. As a matter of fact we show that the influence of multiplicative stochastic market size fluctuations on the price evolution is relatively weak.

Using the same transformation (4) as in the beginning of Section 3 we obtain the stochastic equivalent of (10), in particular a heat equation with a multiplicative Lipschitz non-linearity in the stochastic term:

| (40) | ||||

We apply the transformation

| (41) |

and obtain using the Stratonovich chain rule that

| (42) |

The corresponding Ito equation is given by

| (43) | ||||

Another exponential transformation

yields, since ,

| (44a) | |||

| (44b) | |||

This equation can be analyzed by the DaPrato-Zabczyk methodology (see [9]), which roughly speaking says that on every Hilbert space of real valued functions on where

-

(1)

the map is globally Lipschitz on , and

-

(2)

the one-dimensional Laplacian generates a strongly continuous semigroup (appropriately closed) on ,

there exists a unique mild solution of the SPDE. This process , indexed in time and taking values in , satisfies, for every initial value , the Duhamel formulation

| (45) | ||||

As usual we suppress the space (price) variable in this notation. The uniqueness of the solution of (44) is understood in the Banach space of cadlag processes with norm

Note that the form is not restricted to independent Brownian motions. In fact (45) can be solved for any two dimensional semi-martingale driving process , in particular also for Lévy processes; see Protter [23] and, Peszat and Zabczyk [22] for more information.

From (45) we conclude that is given by the Feyman-Kac formula

This representation formula is justified by approximating the Brownian motions by piecewise constant interpolations and an application of the classical Feynman-Kac formula. Differentiating (45) with respect to , we find

| (46) | ||||

which then gives the Feynman-Kac representation namely

It is an easy consequence of this representation that for monotonically decreasing non-constant initial data positivity of holds instantaneously for .

This implies that, for such initial data, there exists at most one zero of for every , that is the free boundary cannot turn back or develop fat parts

in finite time. By smoothing the Brownian processes and in (44) we conclude for general initial data that the zero level set of the solution is the graph limit

of a sequence of functions of time. This excludes in particular that the free boundary can turn back but it does not exclude the formation of fat parts.

Although the main focus of this paper was the long time behavior of the free boundary we conclude with a short heuristic calculation which illustrates why we cannot expect very volatile dynamics in the case of Brownian drivers: we consider an (exponential) Euler step for a short period of time denoted by . Let denote the heat semigroup and the random operator defined for by

| (47a) | |||

| and for by | |||

| (47b) | |||

We evaluate the concatenation of these operators for a function with precisely one zero at with for small times and for close to . We have

where is the standard normal density and

For small times we obtain

which implies that for small times is of the form:

| (48) |

This formula implies that we do actually observe asymptotics weighted with factors stemming from for small times as well. The asymptotics are also of order of magnitude due to the Brownian increments in the exponent. This implies that the increments of the price process are even in the presence of Brownian drivers, and therefore of finite total variation for . Hence the price process does not admit a martingale part, which implies that even proportional fluctuations of buyers and vendors densities by independent Brownian motions do not lead to price curves as observed in realistic markets.

On the other hand the short time asymptotics give a hint how to introduce “more” randomness to obtain a martingale price process . This is that the densities of the buyer and vendor must be perturbed on small intervals of length by multiplicative noises of . This, however, does not lead to the type of SPDE (45) originally proposed in this section.

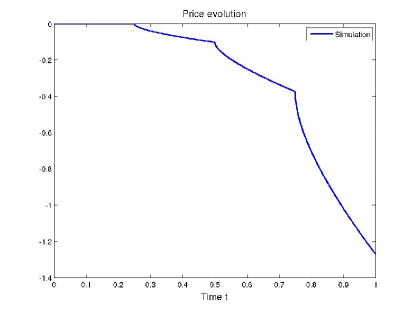

Numerical simulations

In the first example we would like to confirm the small time asymptotic behavior of the free boundary given by (48). We start with an initial datum of the form

and set . We use the domain to and run the simulation on the time interval . The spatial discretization corresponds to equidistant intervals of size , while the time steps are set to . At time we choose two independent normally distributed random numbers , with standard deviation and multiply the distribution left of the price with and the right of the price with . Figure 8 illustrates the small time asymptotics - the initial price up to time equals to zero due to the same total number of buyers and vendors. Then the stochastic fluctuations in the buyer and vendor density initiate a new price dynamic, which confirms the estimated behavior given by (48).

We conclude with an example illustrating the necessity to add “more” randomness to the model. We start with an initial datum of the form and time steps of . At time and we multiply the right and left distribution by two independent normally distributed random numbers and with standard deviation , where denotes the slow time scale, that is . The corresponding price dynamics are depicted in Figure 9, which depicts a sequence of square-root like curves. Each one evolves according to the estimated behavior discussed in this subsection.

Acknowledgment

We are grateful to Panagiotis Souganidis for generously sharing his ideas with us during the course of this research and for helpinng us

substantially in improving the presentation.

MTW acknowledges financial support from the Austrian Academy of Sciences ÖAW via the New Frontiers Group NFG-001.

PES was partially supported by the NSF.

References

- [1] S. Angenent. The zero set of a solution of a parabolic equation. J. Reine Angew. Math, 390:79–96, 1988.

- [2] A. S. Besicovitch. Almost periodic functions. Dover Publications, Inc., New York, 1955.

- [3] M. Burger, L. Caffarelli, P. Markowich, and M.-T. Wolfram. On a Boltzmann-type price formation model. Proc. R. Soc. A, 469(2157), 2013.

- [4] M. Burger, L. Caffarelli, P. A. Markowich, and M.-T. Wolfram. On the asymptotic behavior of a Boltzmann-type price formation model. Commun. Math. Sci., 12(7):1353–1361, 2014.

- [5] M. Burger, A. Lorz, and M.T. Wolfram. On a Boltzmann mean field model for knowledge growth. Technical report, arxiv, submitted, 2015.

- [6] L. A. Caffarelli, P. A. Markowich, and J.-F. Pietschmann. On a price formation free boundary model by Lasry and Lions. C. R. Math. Acad. Sci. Paris, 349(11-12):621–624, 2011.

- [7] L. A. Caffarelli, P. A. Markowich, and M.-T. Wolfram. On a price formation free boundary model by Lasry and Lions: the Neumann problem. C. R. Math. Acad. Sci. Paris, 349(15-16):841–844, 2011.

- [8] L. Chayes, M. del Mar González, M. P. Gualdani, and I. Kim. Global existence and uniqueness of solutions to a model of price formation. SIAM J. Math. Anal., 41(5):2107–2135, 2009.

- [9] G. Da Prato and J. Zabczyk. Stochastic equations in infinite dimensions, volume 152 of Encyclopedia of Mathematics and its Applications. Cambridge University Press, Cambridge, second edition, 2014.

- [10] P. Degond, J.-G. Liu, and C. Ringhofer. Evolution of wealth in a non-conservative economy driven by local Nash equilibria. Philosophical Transactions of the Royal Society of London A: Mathematical, Physical and Engineering Sciences, 372(2028), 2014.

- [11] P. Degond, J.-G. Liu, and C. Ringhofer. Large-scale dynamics of mean-field games driven by local Nash equilibria. Journal of Nonlinear Science, 24(1):93–115, 2014.

- [12] B. Düring and G. Toscani. Hydrodynamics from kinetic models of conservative economies. Physica A: Statistical Mechanics and its Applications, 384(2):493–506, 2007.

- [13] E. Faou. Analysis of splitting methods for reaction-diffusion problems using stochastic calculus. Mathematics of Computation, 78(267):1467–1483, 2009.

- [14] V. A. Galaktionov. Geometric Sturmian theory of nonlinear parabolic equations and applications. Chapman & Hall/CRC Applied Mathematics and Nonlinear Science Series, 3. Chapman & Hall/CRC, Boca Raton, FL, 2004.

- [15] M. del Mar González and M. P. Gualdani. Asymptotics for a symmetric equation in price formation. Appl. Math. Optim., 59(2):233–246, 2009.

- [16] A. Lachapelle, J.M. Lasry, C.A. Lehalle, and P.-L. Lions. Efficiency of the price formation process in presence of high frequency participants: a mean field game analysis. arXiv preprint arXiv:1305.6323, 2013.

- [17] J.M. Lasry and P.-L. Lions. Mean field games. Jpn. J. Math., 2(1):229–260, 2007.

- [18] P. A. Markowich, N. Matevosyan, J.-F. Pietschmann, and M.-T. Wolfram. On a parabolic free boundary equation modeling price formation. Math. Models Methods Appl. Sci., 19(10):1929–1957, 2009.

- [19] M. O’Hara. Market microstructure theory, volume 108. Blackwell Cambridge, MA, 1995.

- [20] L. Pareschi and G. Toscani. Interacting Multiagent Systems: Kinetic equations and Monte Carlo methods. OUP Oxford, 2013.

- [21] L. Pareschi and G. Toscani. Wealth distribution and collective knowledge: a Boltzmann approach. Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, 372(2028):20130396, 2014.

- [22] S. Peszat and J. Zabczyk. Stochastic partial differential equations with Lévy noise, volume 113 of Encyclopedia of Mathematics and its Applications. Cambridge University Press, Cambridge, 2007. An evolution equation approach.

- [23] P. E. Protter. Stochastic integration and differential equations, volume 21 of Stochastic Modelling and Applied Probability. Springer-Verlag, Berlin, 2005. Second edition. Version 2.1, Corrected third printing.

- [24] G. Toscani. Kinetic models of opinion formation. Communications in Mathematical Sciences, 4(3):481–496, 2006.

- [25] G. Toscani, C. Brugna, and S. Demichelis. Kinetic models for the trading of goods. Journal of Statistical Physics, 151(3-4):549–566, 2013.

- [26] N. Toshiyuki. Support theorem for mild solutions of SDE’s in Hilbert spaces. J. Math. Sci. Univ. Tokyo, 11(3):245–311, 2004.