Central limit theorems for functionals of large sample covariance matrix and mean vector in matrix-variate location mixture of normal distributions

Taras Bodnara,111Corresponding author. E-mail address: taras.bodnar@math.su.se.

The second author appreciates the financial support of the Swedish Research Council Grant Dnr: 2013-5180 and Riksbankens Jubileumsfond

Grant Dnr: P13-1024:1, Stepan Mazurb, Nestor Parolyac

a

Department of Mathematics, Stockholm University, SE-10691 Stockholm, Sweden

bDepartment of Statistics, School of Business, Örebro University, SE-70182 Örebro, Sweden

c

Institute of Statistics, Leibniz University of Hannover, D-30167 Hannover, Germany

Abstract

In this paper we consider the asymptotic distributions of functionals of the sample covariance matrix and the sample mean vector obtained under the assumption that the matrix of observations has a matrix-variate location mixture of normal distributions. The central limit theorem is derived for the product of the sample covariance matrix and the sample mean vector. Moreover, we consider the product of the inverse sample covariance matrix and the mean vector for which the central limit theorem is established as well. All results are obtained under the large-dimensional asymptotic regime where the dimension and the sample size approach to infinity such that when the sample covariance matrix does not need to be invertible and otherwise.

ASM Classification: 62H10, 62E15, 62E20, 60F05, 60B20

Keywords: Normal mixtures, skew normal distribution, large dimensional asymptotics, stochastic representation, random matrix theory.

1 Introduction

The functions of the sample covariance matrix and the sample mean vector appear in various statistical applications. The classical improvement techniques for the mean estimation have already been discussed by Stein, (1956) and Jorion, (1986). In particular, Efron, (2006) constructed confidence regions of smaller volume than the standard spheres for the mean vector of a multivariate normal distribution. Fan et al., (2008), Bai and Shi, (2011), Bodnar and Gupta, (2011), Cai and Zhou, (2012), Cai and Yuan, (2012), Fan et al., (2013), Bodnar et al., 2014a , Wang et al., (2015), Bodnar et al., 2016a among others suggested improved techniques for the estimation of covariance matrix and precision matrix (the inverse of covariance matrix).

In our work we introduce the family of matrix-variate location mixture of normal distributions (MVLMN) which is a generalization of the models considered by Azzalini and Dalla-Valle, (1996), Azzalini and Capitanio, (1999), Azzalini, (2005), Liseo and Loperfido, (2003, 2006), Bartoletti and Loperfido, (2010), Loperfido, (2010), Christiansen and Loperfido, (2014), Adcock et al., (2015), De Luca and Loperfido, (2015) among others. Under the assumption of MVLMN we consider the expressions for the sample mean vector and the sample covariance matrix . In particulary, we deal with two products and where is a non-zero vector of constants. It is noted that this kind of expressions has not been intensively considered in the literature, although they are present in numerous important applications. The first application of the products arises in the portfolio theory, where the vector of optimal portfolio weights is proportional to . The second application is in the discriminant analysis where the coefficients of the discriminant function are expressed as a product of the inverse sample covariance matrix and the difference of the sample mean vectors.

Bodnar and Okhrin, (2011) derived the exact distribution of the product of the inverse sample covariance matrix and the sample mean vector under the assumption of normality, while Kotsiuba and Mazur, (2015) obtained its asymptotic distribution as well as its approximate density based on the Gaussian integral and the third order Taylor series expansion. Moreover, Bodnar et al., (2013); Bodnar et al., 2014b analyzed the product of the sample (singular) covariance matrix and the sample mean vector. In the present paper, we contribute to the existing literature by deriving the central limit theorems (CLTs) under the introduced class of matrix-variate distributions in the case of the high-dimensional observation matrix. Under the considered family of distributions, the columns of the observation matrix are not independent anymore and, thus, the CLTs cover a more general class of random matrices.

Nowadays, modern scientific data include large number of sample points which is often comparable to the number of features (dimension) and so the sample covariance matrix and the sample mean vector are not the efficient estimators anymore. For example, stock markets include a large number of companies which is often close to the number of available time points. In order to understand better the statistical properties of the traditional estimators and tests based on high-dimensional settings, it is of interest to study the asymptotic distribution of the above mentioned bilinear forms involving the sample covariance matrix and the sample mean vector.

The appropriate central limit theorems, which do not suffer from the “curse of dimensionality” and do not reduce the number of dimensions, are of great interest for high-dimensional statistics because more efficient estimators and tests may be constructed and applied in practice. The classical multivariate procedures are based on the central limit theorems assuming that the dimension is fixed and the sample size increases. However, numerous authors provide quite reasonable proofs that this assumption does not lead to precise distributional approximations for commonly used statistics, and that under increasing dimension asymptotics the better approximations can be obtained [see, e.g., Bai and Silverstein, (2004) and references therein]. Technically speaking, under the high-dimensional asymptotics we understand the case when the sample size and the dimension tend to infinity, such that their ratio converges to some positive constant . Under this condition the well-known Marčenko-Pastur and Silverstein equations were derived [see, Marčenko and Pastur, (1967), Silverstein, (1995)].

The rest of the paper is structured as follows. In Section 2 we introduce a semi-parametric matrix-variate location mixture of normal distributions. Main results are given in Section 3, where we derive the central limit theorems under high-dimensional asymptotic regime of the (inverse) sample covariance matrix and the sample mean vector under the MVLMN. Section 4 presents a short numerical study in order to verify the obtained analytic results.

2 Semi-parametric family of matrix-variate location mixture of normal distributions

In this section we introduce the family of MVLMN which generalizes the existent families of skew normal distributions.

Let

be the observation matrix where is the observation vector. In the following, we assume that the random matrix possesses a stochastic representation given by

| (2) |

where (-dimensional matrix-variate normal distribution with mean matrix and covariance matrix ), is a -dimensional random vector with continuous density function , is a matrix of constants. Further, it is assumed that and are independently distributed. If random matrix follows model (2), then we say that is MVLMN distributed with parameters , , , and . The first three parameters are finite dimensional, while the fourth parameter is infinite dimensional. This makes model (2) to be of a semi-parametric type. The assertion we denote by . If can be parametrized by finite dimensional parameter , then (2) reduces to a parametrical model which is denoted by . If , then we use the notation instead of .

From (2) the density function of is expressed as

| (3) |

In a special case when is the vector formed by the absolute values of every element in where , i.e. has a -variate truncated normal distribution, we get

Proposition 1.

The proof of Proposition 1 is given in the Appendix.

It is remarkable that model (2) includes several skew-normal distributions considered by Azzalini and Dalla-Valle, (1996), Azzalini and Capitanio, (1999), Azzalini, (2005). For example, in case of , , , , and we get

| (5) |

where and are independently distributed; is a correlation matrix and with . Model (5) was previously introduced by Azzalini, (2005).

Moreover, model (2) also extends the classical random coefficient growth-curve model (see, Potthoff and Roy, (1964), Amemiya, (1994) among others), i.e., the columns of can be rewritten in the following way

| (6) |

where are i.i.d. , and , are independent. In the random coefficient growth-curve model, it is typically assumed that and (see, e.g., Rao, (1965)). As a result, the suggested MVLMN model may be useful for studying the robustness of the random coefficients against the non-normality.

3 CLTs for expressions involving the sample covariance matrix and the sample mean vector

The sample estimators for the mean vector and the covariance matrix are given by

where is a symmetric idempotent matrix, i.e., and .

The following proposition shows that and are independently distributed and presents their marginal distributions under model (2). Moreover, its results lead to the conclusion that the independence of and could not be used as a characterization property of a multivariate normal distribution if the observation vectors in data matrix are dependent.

Proposition 2.

Let . Then

-

(a)

(-dimensional Wishart distribution for and -dimensional singular Wishart distribution for with degrees of freedom and covariance matrix ),

-

(b)

,

-

(c)

and are independently distributed.

Proof.

The statements of the proposition follow immediately from the fact that

| (7) |

Indeed, from (7), the multivariate normality of and the independence of and , we get that and are independent; is (singular) Wishart distributed with degrees of freedom and covariance matrix ; has a location mixture of normal distributions with parameters , , and . ∎

For the validity of the asymptotic results presented in Sections 3.1 and 3.2 we need the following two conditions

-

(A1)

Let denote the set of eigenvalues and eigenvectors of . We assume that there exist and such that

uniformly in .

-

(A2)

There exists such that

uniformly in where , , are the columns of .

Generally, we say that an arbitrary -dimensional vector satisfies the condition (A2) if for all .

Assumption is a classical condition in random matrix theory (see, Bai and Silverstein, (2004)), which bounds the spectrum of from below as well as from above. Assumption is a technical one. In combination with this condition ensures that , , , , as well as that all the diagonal elements of , , and are uniformly bounded. All these quadratic forms are used in the statements and the proofs of our results. Note that the constants appearing in the inequalities will be denoted by and may vary from one expression to another. We further note, that assumption (A2) is automatically fulfilled if and are sparse (not itself). More precisely, a stronger condition, which verifies (A2) is and for uniformly in . Indeed, using the Cauchy-Schwarz inequality to we get

| (8) |

It is remarkable that is fulfilled if is indeed a sparse vector or if all its elements are of order . Thus, a sufficient condition for (A2) to hold would be either sparsity of and or their elements are reasonably small but not exactly equal to zero. Note that the assumption of sparsity for is quite natural in the context of high-dimensional random coefficients regression models. It implies that if is large dimensional, then it may have many zeros and there exists a small set of highly significant random coefficients which drive the random effects in the model (see, e.g., Bühlmann and van de Geer, (2011)). Moreover, it is hard to estimate in a reasonable way when as (see, e.g., Bodnar et al., 2016c ). In general, however, and do not need to be bounded, in such case the sparsity of eigenvectors of matrix may guarantee the validity of (A2). Consequently, depending on the properties of the given data set the proposed model may cover many practical problems.

3.1 CLT for the product of sample covariance matrix and sample mean vector

In this section we present the central limit theorem for the product of the sample covariance matrix and the sample mean vector.

Theorem 1.

Assume with positive definite and let , as . Let be a -dimensional vector of constants that satisfies condition . Then, under and it holds that

| (9) |

where

| (10) | |||||

| (11) |

Proof.

First, we consider the case of , i.e., has a Wishart distribution. Let and define with , , , and . Similarly, let with , , , and .

Since and are independently distributed, and with probability one, we get from Theorem 3.2.5 of Muirhead, (1982) that . As a result, the application of Theorem 3.2.10 of Muirhead, (1982) leads to

where is the Schur complement.

Let , then

From Theorem 3.2.8 of Muirhead, (1982) it follows that and are independently distributed and . Hence, the stochastic representation of is given by

| (12) |

where , , ; , and are mutually independent. The symbol ”” stands for the equality in distribution.

It is remarkable that the stochastic representation (12) for remains valid also in the case of following the proof of Theorem 4 in Bodnar et al., 2014b . Hence, we will make no difference between these two cases in the remaining part of the proof.

From the properties of -distribution and using the fact that as , we immediately receive

| (13) |

We further get that for all and, consequently, it is also its asymptotic distribution.

Next, we show that and are jointly asymptotically normally distributed given . For any and , we consider

where and with . By Provost and Rudiuk, (1996) the stochastic representation of is given by

where given are independent with , . Here, the symbol denotes a chi-squared distribution with degrees of freedom and non-centrality parameter .

Now, we apply the Lindeberg CLT to the conditionally independent random variables . For that reason, we need first to verify the Lindeberg’s condition. Denoting we get

| (14) |

We need to check if for any small it holds that

First, we get

with and, thus,

Finally, Assumptions and yield

| (15) |

which verifies the Lindeberg condition since

| (16) | |||||

Thus, using (14) and

| (17) |

we get that

and for we have

Denoting and we can rewrite it as

| (24) |

which implies that the vector has asymptotically multivariate normal distribution conditionally on because the vector is arbitrary.

Theorem 1 shows that properly normalized bilinear form itself can be accurately approximated by a mixture of normal distributions with both mean and variance depending on . Moreover, this central limit theorem delivers the following approximation for the distribution of , namely for large and we have

| (27) |

i.e., it has a compound normal distribution with random mean and variance.

The proof of Theorem 1 shows, in particular, that its key point is a stochastic representation of the product which can be presented using a distributed random variable, a standard normally distributed random variable, and a random vector which has a location mixture of normal distributions. Both assumptions (A1) and (A2) guarantee that the asymptotic mean and the asymptotic variance are bounded with probability one and the covariance matrix is invertible as the dimension increases. Note that the case of standard asymptotics can be easily recovered from our result if we set .

Although Theorem 1 presents a result similar to the classical central limit theorem, it is not a proper CLT because of which is random and, hence, it provides an asymptotic equivalence only. In the current settings it is not possible to provide a proper CLT without additional assumptions imposed on . The reason is the finite dimensionality of denoted by which is fixed and independent of and . This assures that the randomness in will not vanish asymptotically. So, in order to justify a classical CLT we need to have an increasing value of with the following additional assumptions:

-

(A3)

Let and . For any vector it holds that

(28) where the distribution of may in general depend on .

-

(A4)

There exists such that

Moreover, has an uniformly bounded spectral norm.

Assumption assures that the vector of random coefficients satisfies itself a sort of concentration property in the sense that any linear combination of its elements asymptotically concentrates around some random variable. In a special case of being standard normally distributed (A3) will imply a usual CLT for a linear combination of vector . As a result, assumption is a pretty general and natural condition on taking into account that it is assumed (see, e.g., Rao, (1965)) in many practical situations. Assumption is similar to and and it ensures that and as well as and have the same behaviour as .

Corollary 1 (CLT).

Under the assumptions of Theorem 1, assume and . Let and . Then it holds that

for with and with as where

Proof.

Since

with probability one, we get from the proof of Theorem 1 and assumption (A3) that

| (29) |

where and are independently distributed.

Let denotes the largest eigenvalue of a symmetric positive definite matrix . First, we note that for any vector that satisfies , we get

where is the eigenvector matrix of which is a unitary matrix and, consequently, (see, e.g., Chapter 8.5 in Lütkepohl, (1996))

As a result, we get and .

Furthermore, it holds that

Hence, we have

and, consequently, together with and it ensures that the second summand in (29) will disappear. At last,

for with and with as . ∎

Note that the asymptotic regime ensures that the dimension of the random coefficients is not increasing much faster than the sample size, i.e., and are comparable. It is worth mentioning that due to Corollary 1 the asymptotic distribution of the bilinear form does not depend on the covariance matrix of the random effects . This knowledge may be further useful in constructing a proper pivotal statistic.

3.2 CLT for the product of inverse sample covariance matrix and sample mean vector

In this section we consider the distributional properties of the product of the inverse sample covariance matrix and the sample mean vector . Again we prove that proper weighted bilinear forms involving and have asymptotically a normal distribution. This result is summarized in Theorem 2.

Theorem 2.

Assume , , with positive definite and let , as . Let be a -dimensional vector of constants that satisfies . Then, under and it holds that

| (30) |

where and

Proof.

It holds that

Since and are independently distributed, we get from Theorem 3.2.12 of Muirhead, (1982) that

| (31) |

and it is independent of . Moreover, the application of Theorem 3 in Bodnar and Okhrin, (2008) proves that is independent of for given . As a result, it is also independent of for given and, consequently,

are independent.

From the proof of Theorem 1 of Bodnar and Schmid, (2008) we obtain

| (32) |

where , , and the symbol denotes a -distribution with degrees of freedom, location parameter and scale parameter .

Combining (31) and (32), we get the stochastic representation of given by

where (see, Proposition 2)

with , , and ; , , , and are mutually independent.

Since , , and , the application of Corollary 5.1.3a and Theorem 5.5.1 in Mathai and Provost, (1992) leads to

| (33) |

as well as and are independent given . Finally, using the stochastic representation of a -distributed random variable, we get

| (34) |

with , and being mutually independent. Together with (33) it yields

| (35) | |||||

where the last equality in (35) follows from the fact that

with (non-central -distribution with and degrees of freedom and non-centrality parameter ). Moreover, we have that and ; , , and are mutually independent.

Consequently,

for , as .

Finally, the application of the delta-method (c.f. DasGupta, (2008, Theorem 3.7)) leads to

for , as with

Consequently,

where the asymptotic distribution does not depend on . Hence, it is also the unconditional asymptotic distribution. ∎

Again, Theorem 2 shows that the distribution of can be approximated by a mixture of normal distributions. Indeed,

| (38) |

In the proof of Theorem 2 we can read out that the stochastic representation for the product of the inverse sample covariance matrix and the sample mean vector is presented by using a distributed random variable, a general skew normally distributed random vector and a standard -distributed random variable. This result is itself very useful and allows to generate the values of by just simulating three random variables from the standard univariate distributions and a random vector which determines the family of the matrix-variate location mixture of normal distributions. The assumptions about the boundedness of the quadratic and bilinear forms involving plays here the same role as in Theorem 1. Note that in this case we need no assumption either on the Frobenius norm of the covariance matrix or its inverse.

Finally, in Corollary 2 we formulate the CLT for the product of the inverse sample covariance matrix and the sample mean vector.

Corollary 2 (CLT).

Under the assumptions of Theorem 2, assume and . Let and . Then it holds that

for with and with as where

Proof.

Finally, in a similar way like in Corollary 1 we get from that

| (39) | |||||

| (40) |

for with and with as . ∎

4 Numerical study

In this section we provide a Monte Carlo simulation study to investigate the performance of the suggested CLTs for the products of the (inverse) sample covariance matrix and the sample mean vector.

In our simulations we put , each element of the vector is uniformly distributed on while each element of the matrix is uniformly distributed on . Also, we take as a diagonal matrix where each diagonal element is uniformly distributed on . It can be checked that in such a setting the assumptions and are satisfied. Indeed, the population covariance matrix satisfies the condition because the probability of getting exactly zero eigenvalue equals to zero. On the other hand, the condition is obviously valid too because the th eigenvector of is .

In order to define the distribution for the random vector , we consider two special cases. In the first case we take , where , i.e., has a -variate truncated normal distribution. In the second case we put , i.e., has a -variate generalized asymmetric Laplace distribution (c.f., Kozubowski et al., (2013)). Also, we put .

We compare the results for several values of . The simulated data consist of independent realizations which are used to fit the corresponding kernel density estimators with Epanechnikov kernel. The bandwith parameters are determined via cross-validation for every sample. The asymptotic distributions are simulated using the results of Theorems 1 and 2. The corresponding algorithm is given next:

-

a)

generate , where , or generate ;

- b)

- b’)

-

c)

compute

and

where

with , .

-

d)

repeat a)-c) times.

It is remarkable that for generating and only random variables from the standard distributions are need. Neither the data matrix nor the sample covariance matrix are used.

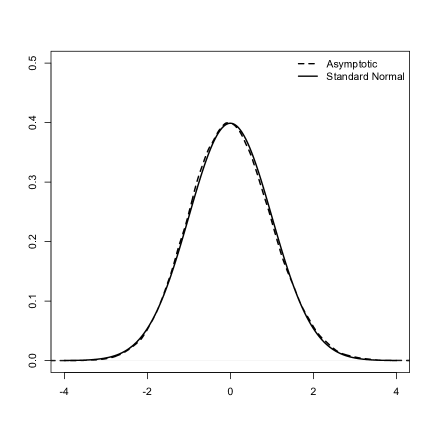

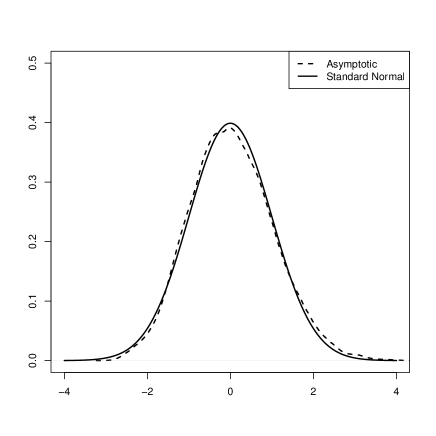

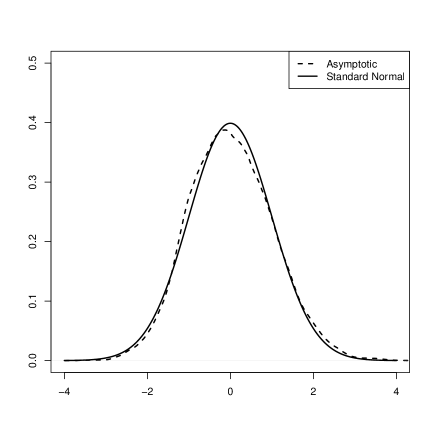

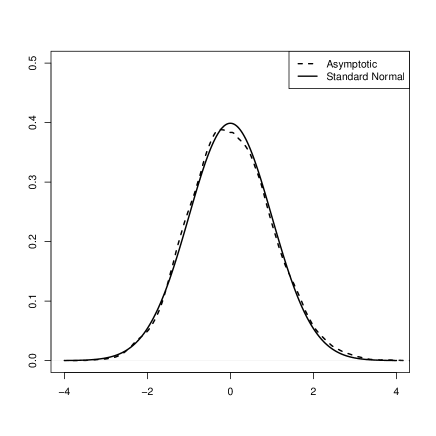

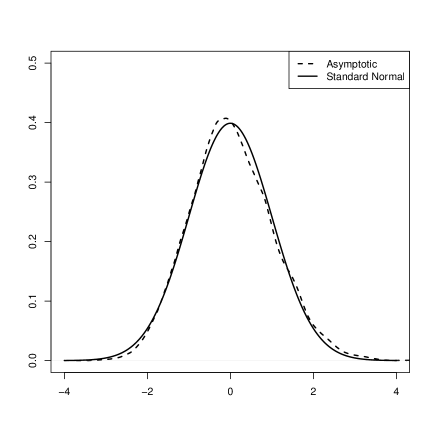

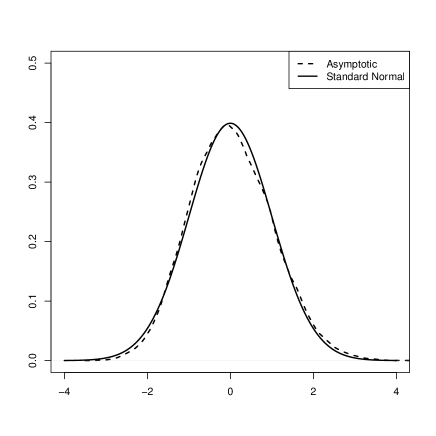

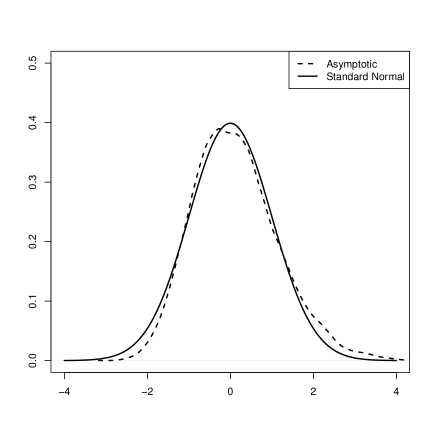

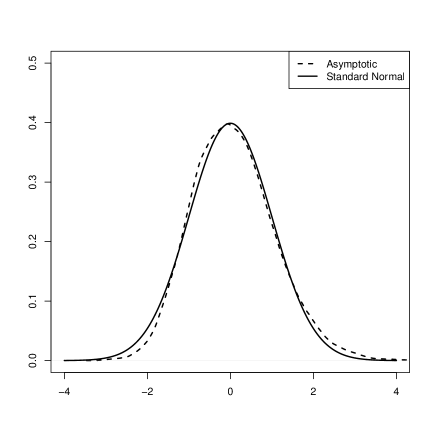

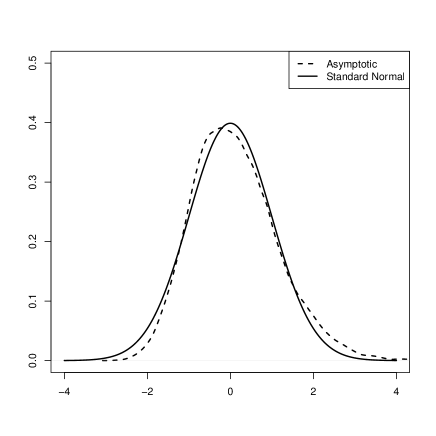

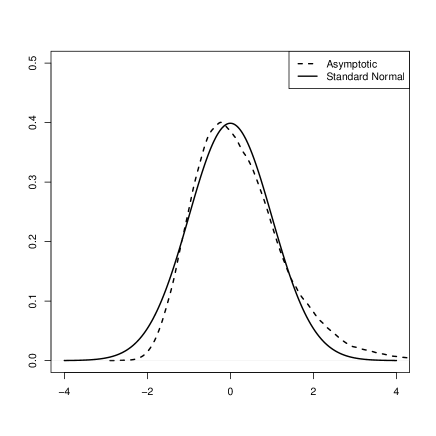

In Figures 1-4 we present the results of simulations for the asymptotic distribution that is given in Theorem 1 while the asymptotic distribution as given in Theorem 2 is presented in Figures 5-8 for different values of . The suggested asymptotic distributions are shown as a dashed black line, while the standard normal distribution is a solid black line. All results demonstrate a good performance of both asymptotic distributions for all considered values of . Even in the extreme case our asymptotic results seem to produce a quite reasonable approximation. Moreover, we observe a good robustness of our theoretical results for different distributions of . Also, we observe that all asymptotic distributions are slightly skewed to the right for the finite dimensions. This effect is even more significant in the case of the generalized asymmetric Laplace distribution. Nevertheless, the skewness disappears with growing dimension and sample size, i.e., the distribution becomes symmetric one and converges to its asymptotic counterpart.

5 Summary

In this paper we introduce the family of the matrix-variate location mixture of normal distributions that generalizes a large number of the existing skew normal models. Under the MVLMN we derive the distributions of the sample mean vector and the sample covariance matrix. Moreover, we show that they are independently distributed. Furthermore, we derive the CLTs under the high-dimensional asymptotic regime for the products of the (inverse) sample covariance matrix and the sample mean vector. In the numerical study, the good finite sample performance of both asymptotic distributions is documented.

Acknowledgement

The authors are thankful to Professor Niels Richard Hansen, the Associate Editor, and two anonymous Reviewers for careful reading of the manuscript and for their suggestions which have improved an earlier version of this paper.

6 Appendix

Proof of Proposition 1.

Proof.

Straightforward but tedious calculations give

where , , , and

∎

References

- Adcock et al., (2015) Adcock, C., Eling, M., and Loperfido, N. (2015). Skewed distributions in finance and actuarial science: a review. The European Journal of Finance, 21:1253–1281.

- Amemiya, (1994) Amemiya, Y. (1994). On multivariate mixed model analysis. Lecture Notes-Monograph Series, 24:83–95.

- Azzalini, (2005) Azzalini, A. (2005). The skew-normal distribution and related multivariate families. Scandinavian Journal of Statistics, 32:159–188.

- Azzalini and Capitanio, (1999) Azzalini, A. and Capitanio, A. (1999). Statistical applications of the multivariate skew-normal distribution. Journal of the Royal Statistical Society: Series B, 61:579–602.

- Azzalini and Dalla-Valle, (1996) Azzalini, A. and Dalla-Valle, A. (1996). The multivariate skew-normal distribution. Biometrika, 83:715–726.

- Bai and Shi, (2011) Bai, J. and Shi, S. (2011). Estimating high dimensional covariance matrices and its applications. Annals of Economics and Finance, 12:199–215.

- Bai and Silverstein, (2004) Bai, Z. D. and Silverstein, J. W. (2004). CLT for linear spectral statistics of large dimensional sample covariance matrices. Annals of Probability, 32:553–605.

- Bartoletti and Loperfido, (2010) Bartoletti, S. and Loperfido, N. (2010). Modelling air polution data by the skew-normal distribution. Stochastic Environmental Research and Risk Assessment, 24:513–517.

- Bodnar and Gupta, (2011) Bodnar, T. and Gupta, A. K. (2011). Estimation of the precision matrix of multivariate elliptically contoured stable distribution. Statistics, 45:131–142.

- (10) Bodnar, T., Gupta, A. K., and Parolya, N. (2014a). On the strong convergence of the optimal linear shrinkage estimator for large dimensional covariance matrix. Journal of Multivariate Analysis, 132:215–228.

- (11) Bodnar, T., Gupta, A. K., and Parolya, N. (2016a). Direct shrinkage estimation of large dimensional precision matrix. Journal of Multivariate Analysis, 146:223–236.

- (12) Bodnar, T., Hautsch, N., and Parolya, N. (2016b). Consistent estimation of the high dimensional efficient frontier. Technical report.

- Bodnar et al., (2013) Bodnar, T., Mazur, S., and Okhrin, Y. (2013). On the exact and approximate distributions of the product of a wishart matrix with a normal vector. Journal of Multivariate Analysis, 125:176–189.

- (14) Bodnar, T., Mazur, S., and Okhrin, Y. (2014b). Distribution of the product of singular wishart matrix and normal vector. Theory of Probability and Mathematical Statistics, 91:1–14.

- (15) Bodnar, T., Okhrin, O., and Parolya, N. (2016c). Optimal Shrinkage Estimator for High-Dimensional Mean Vector. ArXiv e-prints.

- Bodnar and Okhrin, (2008) Bodnar, T. and Okhrin, Y. (2008). Properties of the singular, inverse and generalized inverse partitioned wishart distributions. Journal of Multivariate Analysis, 99:2389–2405.

- Bodnar and Okhrin, (2011) Bodnar, T. and Okhrin, Y. (2011). On the product of inverse wishart and normal distributions with applications to discriminant analysis and portfolio theory. Scandinavian Journal of Statistics, 38:311–331.

- Bodnar and Schmid, (2008) Bodnar, T. and Schmid, W. (2008). A test for the weights of the global minimum variance portfolio in an elliptical model. Metrika, 67(2):127–143.

- Bühlmann and van de Geer, (2011) Bühlmann, P. and van de Geer, S. (2011). Statistics for High-Dimensional Data: Methods, Theory and Applications. Springer Publishing Company, Incorporated, 1st edition.

- Cai and Yuan, (2012) Cai, T. T. and Yuan, M. (2012). Adaptive covariance matrix estimation through block thresholding. Ann. Statist., 40:2014–2042.

- Cai and Zhou, (2012) Cai, T. T. and Zhou, H. H. (2012). Optimal rates of convergence for sparse covariance matrix estimation. Ann. Statist., 40:2389–2420.

- Christiansen and Loperfido, (2014) Christiansen, M. and Loperfido, N. (2014). Improved approximation of the sum of random vectors by the skew normal distribution. Journal of Applied Probability, 51(2):466–482.

- DasGupta, (2008) DasGupta, A. (2008). Asymptotic Theory of Statistics and Probability. Springer Texts in Statistics. Springer.

- De Luca and Loperfido, (2015) De Luca, G. and Loperfido, N. (2015). Modelling multivariate skewness in financial returns: a SGARCH approach. The European Journal of Finance, 21:1113–1131.

- Efron, (2006) Efron, B. (2006). Minimum volume confidence regions for a multivariate normal mean vector. Journal of the Royal Statistical Society: Series B, 68:655–670.

- Fan et al., (2008) Fan, J., Fan, Y., and Lv, J. (2008). High dimensional covariance matrix estimation using a factor model. Journal of Econometrics, 147:186–197.

- Fan et al., (2013) Fan, J., Liao, Y., and Mincheva, M. (2013). Large covariance estimation by thresholding principal orthogonal complements. Journal of the Royal Statistical Society: Series B, 75:603–680.

- Gupta and Nagar, (2000) Gupta, A. and Nagar, D. (2000). Matrix Variate Distributions. Chapman & Hall/CRC.

- Jorion, (1986) Jorion, P. (1986). Bayes-stein estimation for portfolio analysis. Journal of Financial and Quantative Analysis, 21:279–292.

- Kotsiuba and Mazur, (2015) Kotsiuba, I. and Mazur, S. (2015). On the asymptotic and approximate distributions of the product of an inverse Wishart matrix and a Gaussian random vector. Theory of Probability and Mathematical Statistics, 93:96–105.

- Kozubowski et al., (2013) Kozubowski, T. J., Podgórski, K., and Rychlik, I. (2013). Multivariate generalized Laplace distribution and related random fields. Journal of Multivariate Analysis, 113:59–72.

- Liseo and Loperfido, (2003) Liseo, B. and Loperfido, N. (2003). A Bayesian interpretation of the multivariate skew-normal distribution. Statistics & Probability Letters, 61:395–401.

- Liseo and Loperfido, (2006) Liseo, B. and Loperfido, N. (2006). A note on reference priors for the scalar skew-normal distribution. Journal of Statistical Planning and Inference, 136:373–389.

- Loperfido, (2010) Loperfido, N. (2010). Canonical transformations of skew-normal variates. TEST, 19:146–165.

- Lütkepohl, (1996) Lütkepohl, H. (1996). Handbook of Matrices. New York: John wiley & Sons.

- Marčenko and Pastur, (1967) Marčenko, V. A. and Pastur, L. A. (1967). Distribution of eigenvalues for some sets of random matrices. Sbornik: Mathematics, 1:457–483.

- Mathai and Provost, (1992) Mathai, A. and Provost, S. B. (1992). Quadratic Forms in Random Variables. Marcel Dekker.

- Muirhead, (1982) Muirhead, R. J. (1982). Aspects of Multivariate Statistical Theory. Wiley, New York.

- Potthoff and Roy, (1964) Potthoff, R. F. and Roy, S. N. (1964). A generalized multivariate analysis of variance model useful especially for growth curve problems. Biometrika, 51(3/4):313–326.

- Provost and Rudiuk, (1996) Provost, S. and Rudiuk, E. (1996). The exact distribution of indefinite quadratic forms in noncentral normal vectors. Annals of the Institute of Statistical Mathematics, 48:381–394.

- Rao, (1965) Rao, C. R. (1965). The theory of least squares when the parameters are stochastic and its application to the analysis of growth curves. Biometrika, 52(3/4):447–458.

- Silverstein, (1995) Silverstein, J. W. (1995). Strong convergence of the empirical distribution of eigenvalues of large-dimensional random matrices. Journal of Multivariate Analysis, 55:331–339.

- Stein, (1956) Stein, C. (1956). Inadmissibility of the usual estimator of the mean of a multivariate normal distribution. In Neyman, J., editor, Proceedings of the third Berkeley symposium on mathematical and statistical probability. University of California, Berkley.

- Wang et al., (2015) Wang, C., Pan, G., Tong, T., and Zhu, L. (2015). Shrinkage estimation of large dimensional precision matrix using random matrix theory. Statistica Sinica, 25:993–1008.

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |

| (a) | , , . |

| (b) | , , . |

| (c) | , , |

| (d) | , , |