Dynamic Multi-Factor Bid-Offer Adjustment Model

A Feedback Mechanism for Dealers (Market Makers) to Deal (Grapple) with the Uncertainty Principle of the Social Sciences

Ravi Kashyap

City University of Hong Kong / Gain Knowledge Group

Originally Created, October 2008; Revised, October 2013

1 Abstract

The objective is to come up with a model that alters the Bid-Offer, currently quoted by market makers, that varies with the market and trading conditions. The dynamic nature of financial markets and trading, as the rest of social sciences, where changes can be observed and decisions can be taken by participants to influence the system, means that our model has to be adaptive and include a feedback loop that alters the bid offer adjustment based on the modifications we are seeing in the market and trading conditions, without a significant time delay. We will build a sample model that incorporates such a feedback mechanism and also makes it possible to check the efficacy of the changes to the quotes being made, by gauging the impact on the Profits. The market conditions here refer to factors that are beyond the direct control of the market maker and this information is usually available publicly to other participants. Trading conditions refer to factors that can be influenced by the market maker and are dependent on the trading book being managed and will be privy only to the market maker and will be mostly confidential to others. The factors we use to adjust the spread are the price volatility, which is publicly observable; and trade count and volume, which are generally only known to the market maker, in various instruments over different historical durations in time. The contributions of each of the factors to the bid-offer adjustment are computed separately and then consolidated to produce a very adaptive bid-offer quotation. The ensuing discussion considers the calculations for each factor separately and the consolidation in detail.

Any model that automatically updates the quotes is more suited for instruments that have a high number of transactions within short intervals, making it hard for traders to manually monitor and adjust the spread; though this is by no means a stringent requirement. We can use similar models for illiquid instruments as well and use the quotations provided by the model as a baseline for further human refinement.

We have chosen currency markets to build the sample model since they are extremely liquid, Over the Counter (OTC), and hence trading in them is not as transparent as other financial instruments like equities. The nature of currency trading implies that we do not have any idea on the actual volumes traded and the number of trades. We simulate the number of trades and the average size of trades from a log normal distribution. The parameters of the log normal distributions are chosen such that the total volume in a certain interval matches the volume publicly mentioned by currency trading firms. This methodology can be easily extended to other financial instruments and possibly to any product with an ability to make electronic price quotations or even be used to periodically perform manual price updates on products that are traded non-electronically.

Thankfully, we are not at a stage where Starbucks will sell coffee using such an algorithm, since it can possibly lead to certain times of the day when it can be cheaper to have a cup of coffee and as people become wary of this, there can be changes to their buying habits, with the outcome that the time for getting a bargain can be constantly changing; making the joys of sipping coffee, a serious decision making affair.

2 Motivation for Multi-Factor Bid-Offer Models

At the outset, let us look at some fundamentals that govern all financial instruments and then delve into the nuances which apply to instruments that are more amenable to adaptive bid-offer models. It is also worthwhile to mention here that for most assertions made below, numerous counter examples and alternate hypothesis can be produced. These are strictly attempts at tracing the essentials rather than getting bogged down with a specific instance. However, building a model for empirical usage requires forming a conceptual framework based on the more common observations, yet being highly attuned to any specifics that can stray from the usual. Also, for the sake of brevity, a number of finer points have been omitted and certain simplifying assumptions have been made.

The various financial instruments that exist today can be broadly viewed upon as vehicles for providing credit and a storage for wealth, for both individuals and institutions alike. The different instruments, both in terms of their nomenclature and their properties, then merely become manifestations of which and how many parties are involved in a transaction and the contractual circumstances or the legal clauses that govern the transaction.

Despite the several advances in the social sciences and in particular economic and financial theory, we have yet to discover an objective measuring stick of value, a so called, True Value Theory. While some would compare the search for such a theory, to the medieval alchemists’ obsession with turning everything into gold, for our present purposes, the lack of such an objective measure means that the difference in value as assessed by different participants can effect a transfer of wealth. This forms the core principle that governs all commerce that is not for immediate consumption in general, and also applies specifically to all investment related traffic which forms a great portion of the financial services industry and hence the mainstay of market making.

Although, some of this is true for consumption assets; because the consumption ability of individuals and organizations is limited and their investment ability is not, the lack of an objective measure of value affects investment assets in a greater way and hence investment assets and related transactions form a much greater proportion of the financial services industry. Consumption assets do not get bought and sold, to an inordinate extent, due to fluctuating prices, whereas investment assets will. Hull [1999] has a description of consumption and investment assets, specific to the price determination of futures and forwards. The price effect on consumptions assets affects the quantity bought and consumed, whilst with investment assets, the cyclical linkage between vacillating prices and increasing number of transactions becomes more apparent.

Another distinguishing feature of investment assets is the existence or the open visibility of bid and ask prices. Any market maker for investment assets quotes two prices, one at which he is willing to buy and one at which he is willing to sell. Consumption assets either lack such an outright two sided quote; or it is hard to painlessly infer viewable buy and sell prices, since it involves some conversion from a more basic form of the product into the final commodity being presented to consumers. Examples for consumption assets are a mug of hot coffee, that requires a certain amount of processing from other rudimentary materials before it can be consumed; or a pack of raw almonds which is almost fit for eating. Coffee shops that sell coffee do not quote a price at which they buy ready drinkable coffee; the price at which a merchant will buy almonds is not readily transparent. Gold is an example of both, a consumption and an investment asset. A jewellery store will sell gold and objects made of gold; but it will also buy gold reflecting its combined consumption and investment trait. This leaves us with financial securities like stocks and bonds that are purely investment assets.

A number of disparate ingredients contribute to this price effect; like how soon the product expires and the frequent use of technology to facilitate a marketplace. EBay is an example of a business where certain consumption goods are being bought and sold. This can happen even if goods are only being sold, through the increased application of technology in the sales process. While not implying that the use of technology is bad, technology, or almost anything else, can be put to use that is bad. Thankfully, we are not at a stage where Starbucks will buy and sell coffee, since it can possibly lead to certain times of the day when it can be cheaper to have a cup of coffee and as people become wary of this, there can be changes to their buying habits, with the outcome that the time for getting a bargain can be constantly changing; making the joys of sipping coffee, a serious decision making affair. Even though this is an extreme example, we will overlook some of these diverse influences for now, since our attempt is to exemplify the principal differences between the varieties of financial transactions and the underlying types of assets that drive these deals.

This lack of an objective measure of value, (henceforth, value will be synonymously referred to as the price of an instrument), makes prices react at varying degrees and at varying speeds to the pull of different macro and micro factors. The greater the level of prevalence of a particular instrument (or even a particular facet of an instrument) the more easily it is affected by macro factors. This also means that policies are enforced by centralized institutions, (either directly by the government or by institutions acting under the directive of a single government or a coalition of governments), to regulate the impact of various factors on such popular instruments. Examples for this would be interest rate dependent instruments, which are extremely sensitive to rates set by central banks since even governments issue such instruments; dividends paid by equity instruments which are clearly more sensitive to the explicit taxation laws that govern dividends than to the level of interest rates; and commodities like oil, which are absolutely critical for the smooth functioning of any modern society and hence governments intervene directly to build up supplies and attempt to control the price. See Tuckman [1995] for interest rate instruments; Bodie, Kane and Marcus [2002] for equity instruments.

Lastly, it is important that we lay down some basics regarding the efficiency of markets and the equilibrium of prices. Surely, a lot of social science principles and methodologies are inspired from similar counterparts in the natural sciences. A central aspect of our lives is uncertainty and our struggle to overcome it. Over the years, it seems that we have found ways to understand the uncertainty in the natural world by postulating numerous physical laws.

These physical laws are deductive and are based on three statements - a specific set of initial conditions, a specific set of final conditions or explicanda and universally valid generalizations. Combining a set of generalizations with known initial conditions yields predictions; combining them with known final conditions yields explanations; and matching known initial with known final conditions serves as a test of the generalizations involved. The majority of the predictions in the physical world hold under a fairly robust set of circumstances and cannot be influenced by the person making the observation and they stay unaffected if more people become aware of such a possibility.

In the social sciences, the situation is exactly the contrary. Popper [2002] gives a critique and warns of the dangers of historical prediction in social systems. In their manifesto, Derman and Wilmott [2009], mention the need to combine art and science in the discipline of finance. While it is possible to declare that, Art is Science that we don’t know about; and Science is Art restricted to a set of symbols governed by a growing number of rules, our current state of affairs necessitate that we remain keenly cognizant of the shortcomings of forecasting. A set of initial conditions yielding a prediction based on some generalization, ceases to hold, as soon as many participants become aware of this situation and act to take advantage of this situation. This means that predictions in the social sciences are valid only for a limited amount of time and we cannot be sure about the length of this time, since we need to constantly factor in the actions of everyone that can potentially influence a prediction, making it an extremely hard task.

All attempts at prediction, including both the physical and the social sciences, are like driving cars with the front windows blackened out and using the rear view mirrors, that give an indication of what type of path has been encountered and using this information to forecast, what might be the most likely type of terrain that lies ahead for us to traverse. The path that has been travelled then becomes historical data that has been collected through observation and we make estimates on the future topography based on this. Best results generally occur, when we combine the data we get in the rear view mirror with the data we get from the side windows, which is the gauge of the landscape we are in now, to get a better comprehension of what lies ahead for us. The quality of the data we gather and what the past and the present hold then give an indication to what the future might be. So if the path we have treaded is rocky, then the chances of it being a bumpy ride ahead are higher. If it has been smooth, then it will be mostly smooth. Surely, the better our predictions, the faster we can move; but then again, it is easy to see that the faster we travel, the more risk we are exposed to, in terms of accidents happening, if the constitution of the unseen scenery in front of us shifts drastically and without much warning.

A paramount peculiarity of the social sciences is that passage on this avenue is part journey and part race. The roads are muddy, rocky and more prone to have potholes. This means being early or ahead on the road brings more winnings. We also have no easy way of knowing how many people are traveling on this path, either with us, ahead of us or even after us. As more people travel on the path, it starts falling apart, making it harder to travel on it, a situation which is accentuated considering we don’t have any vision out front. On the other hand, let us say, physical science roads, being well paved and well-constructed using concrete, hold steady for much longer time durations, so what has been observed in the past can be used to make durable forecasts that hold for lengthier amounts of time in the future.

Paich and Sterman [1993] inquire into decision making in complex environments and conduct an experiment where subjects must manage a new product from launch through maturity, and make pricing and capacity decisions. They demonstrate that decision making in complex dynamic environments tends to be flawed in specific ways by not accounting sufficiently for feedback loops, time delays and nonlinearities. Even with a decent amount of experience, there is no evidence that environments with high feedback complexity can produce improved decision making ability.

The Sweeney and Sweeney [1977] anecdote about the Capitol Hill baby-sitting crisis exposits the mechanics of inflation, setting interest rates and monetary policies required to police the optimal amount of money. The creation of a monetary crisis in a small simple environment of good hearted people expounds that even with near ideal conditions, things can become messy; then in a large labyrinthine atmosphere, disaster could be brewing without getting noticed and can strike without much premonition. Taleb [2005] is an entertaining narrative of the role of chance in life and in the financial markets. Taleb [2010] calls our attention to Black Swan events, which are extremely hard to detect, highlighting the perils of the prediction business.

This inability to make consistent predictions in the social sciences and the lack of an objective measure of value or a True Price Theory means that is almost impossible for someone to know what a real state of equilibrium is. Elton, Gruber, Brown and Goetzmann [2009] review the concepts related to efficient markets and other aspects of investing; Kashyap [2014] explained the pleasures and pitfalls of managing a portfolio, while emphasizing the cyclical nature of the investment process. The efficient market hypothesis in spite of being a very intriguing proposition, can at best claim that markets have a tendency to move towards being efficient, though a state of equilibrium is never fully attained since no one has an idea what that state of equilibrium is and the actions of the participants serves only to displace any state of equilibrium, if it did exist. The analogy for this would be a pendulum with perpetual motion; it swings back and forth around its place of rest with decreasing amplitude and the place of rest keeps changing with time, starting a new cycle of movement with reinforced vigour.

We can then summarize the above with the Uncertainty Principle of the Social Sciences, which can be stated as, “Any generalization in the social sciences cannot be both popular and continue to yield accurate predictions or in other words, the more popular a particular generalization, the less accurate will be the predictions it yields”. This is because as soon as any generalization and its set of conditions become common knowledge, the entry of many participants shifts the equilibrium or the dynamics, such that the generalization no longer applies to the known set of conditions.

All our efforts as professionals in the field of financial services, will then be to study uncertainty and uncover quasi-generalizations; understand its limitations in terms of what can be the closest states of pseudo-equilibrium; how long can such a situation exist; what factors can tip the balance to another state of temporary equilibrium; how many other participants are aware of this; what is their behaviour and how is that changing; etc., making our professions a very interesting, challenging and satisfying career proposition.

3 Application to Currency Market Making

With the above discussion in mind, we can turn specifically to how it applies to market making in financial assets. The increasing use of algorithms and automation has increased the frequency of trading for most securities that trade in high volumes. Dempster, M. A. H., & Jones, C. M. [2001]; Avellaneda and Stoikov [2008]; Chiu, Lukman, Modarresi and Velayutham [2011] and Chlistalla, Speyer, Kaiser and Mayer [2011] provide detailed accounts of high frequency trading and the evolution of various algorithms used towards that end. The increased frequency of trading means that the bid and offer quoted for a security also need to be constantly changing. It is common practice for market makers to set the bid and offer to depend on the size of the inventory and revise it as the inventory builds up in either direction. This clearly comes with a number of drawbacks, primary among which is the lack of change in the quotes due to the rapidly changing market and the wide variety of variables that capture the trading conditions. The other participants in this market making system, which in this case are the counterparties of the market maker, can observe the quotes and take decisions that will influence the system and the quoting mechanism may not register these new conditions till much later.

Hence to deal with the dynamic nature of the trading and market conditions, our model has to be adaptive and include a feedback loop that alters the bid offer adjustment based on the modifications in the market and trading conditions, without a significant time delay. The market conditions here refer to factors that are beyond the direct control of the market maker and this information is usually available publicly to other participants. Trading conditions refer to factors that can be influenced by the market maker and are dependent on the trading book being managed and will be privy only to the market maker and will be mostly confidential to others.

The market maker has access to a rich set of trading metrics, which are not immediately available to other participants. These metrics can affect the future direction of the price and hence using them to alter the quote leads to better profits. But given that the trading conditions are constantly changing, we need to revise the parameters of the alteration mechanism based on the conditions from the recent past. This forms a feedback loop that keeps changing the model dynamically based on what is happening in the market maker’s trading book. As discussed earlier, prediction is a perilous business; hence it is important to keep the number of parameters to a minimum while not ignoring any significant causes of change. With this motivation, we include the changes coming in from different sources by using adequate yet relatively simple econometrics techniques. This leads to changes in the model outputs that aid the quotation process and the constant revision of the model parameters is geared to deal with shifting regimes.

Any model that automatically updates the quotes is more suited for instruments that have a high number of transactions within short intervals, making it hard for traders to manually monitor and adjust the spread; though this is by no means a stringent requirement. We can use similar models for illiquid instruments as well and use the quotations provided by the model as a baseline for further human refinement. We have chosen currency markets to build the sample model since they are extremely liquid, Over the Counter (OTC), and hence trading in them is not as transparent as other financial instruments like equities. Copeland [2008] provides a rich discussion on exchange rates and currencies. The nature of currency trading implies that participants other than the market marker do not have any idea on the actual volumes traded and the number of trades. For the purposes of building our model, we simulate the number of trades and the average size of trades from a log normal distribution. Norstad [1999] proves key propositions regarding normal and log normal distributions. The parameters of the log normal distributions are chosen such that the total volume in a certain interval matches the volume publicly mentioned by currency trading firms. This methodology can be easily extended to other financial instruments and possibly to any product with an ability to make electronic price quotations or even be used to periodically perform manual price updates on products that are traded non-electronically.

The factors we incorporate in our model to adjust the currency bid-offer spread are

-

1.

The Exchange Rate Volatility

-

2.

The Trade Count

-

3.

The Volume

The exchange rate volatility is publicly observable; and the trade count and volume, are generally only known to the market maker, in various instruments over different historical durations in time. The contributions of each of the factors to the bid-offer adjustment are computed separately and then consolidated to produce a very adaptive bid-offer quotation. The subsequent sections consider the calculations for each factor separately and the consolidation in detail.

3.1 Exchange Rate Volatility Factor

This factor is calculated based on the conditional standard deviation of the exchange rate returns as a function of the lagged conditional standard deviations and the lagged innovations.

Numerous variations to the above formula are possible by extending it to the GARCH type of models. Engle [1982] is the seminal work on modeling heteroscedastic variance. Bollerslev [1986] extends this technique to a more generalized approach and Bollerslev [2008] lists an exhaustive glossary of the various kinds of autoregressive variance models that have mushroomed over the years. Hamilton [1994] and Gujarati [1995] are classic texts on econometrics methods and time series analysis that accentuate the need for parsimonious models. We prefer the simple nature of the sample model, since we wish to keep the complexity of the system as minimal as possible, while ensuring that the different sources of variation contribute to the modification. This becomes important since we are constantly checking the feedback loop for the system performance. When such a model is being used empirically, less number of parameters eases the burden of monitoring; isolating the causes of feedback failure becomes relatively straight forward; and corrective measures can be quickly implemented, which could involve tweaking the model parameters. Since volatility is mean reverting and has a clustering behavior, it is better to use a model similar to our sample, instead of simply taking the deviation from a historical average as we use for the other factors below. A more common variant that is comparable in simplicity to the one used above is by taking the absolute value of the lagged innovations. It is left to the practitioner to decide on the exact nature of the model to use depending on the suitability for their trading needs and the results they are getting.

The value of the volatility is calculated based on the standard deviation of the rate of change of the exchange rates from a historical period. We use a 30 day historical period to calculate the initial volatility.

We model the innovation, , as the rate of the change of the exchange rates with respect to time. This is calculated as the natural logarithm of the ratio of the exchange rates at two consecutive time periods. In the sample designed to demonstrate the model, we use the time interval between consecutive rates to be 60 seconds.

3.2 Trade Count Factor

We first calculate the historical average of the trade count during a certain time interval. In the sample model, the historical average is based on a 30 day rolling window. The time interval is 60 seconds. We measure how the trade count for the latest time interval differs from the historical average. This is measured as the natural logarithm of the ratio of the trade count for the latest time interval to the historical average of the trade count.

is the Trade Count Factor; is the Trade Count during minute or during a certain interval of consideration;

. It is calculated as a rolling average; is the parameter that is used to scale the trade count factor into a similar size as the price factor. It is the average of the price factor over a suitable historical range. We use the average over the last thirty days.

Note: A 30 day rolling window results in the historical averages getting updated every trading day.

3.3 Volume Factor

We first calculate the historical average of the volume during a certain time interval. In the sample model, the historical average is based on a 30 day rolling window. The time interval is 60 seconds. We measure how the volume for the latest time interval differs from the historical average. This is measured as the natural logarithm of the ratio of the volume for the latest time interval to the historical average of the volume.

is the Volume Factor; is the Volume in USD during minute or during a certain interval of consideration; . It is calculated as a rolling average; is the parameter that is used to scale the volume factor into a similar size as the price factor. It is the average of the price factor over a suitable historical range. We use the average over the last thirty days.

Note: A 30 day rolling window results in the historical averages getting updated every trading day.

4 Consolidation of the Three Factors

The three factors are consolidated by using a weighted sum. In the sample model, all three factors are equally weighted. Henceforth, the consolidated factor will be referred to as the spread factor. Where required, depending on the financial instrument, each of the three individual factors can be scaled down to be in the order of the magnitude of the adjustment we want to make to the bid and the offer. We do not require this step for our sample model, since the order of magnitude of the spread factor is in the same region as the adjustment to the spread we wish to make. We also calculate the historical average and standard deviation of the spread factor. In the sample model, the historical average and standard deviation are based on a 30 day rolling window. We consider the spread factor to be a normal distribution with mean and standard deviation equal to the 30 day historical average and standard deviation. When the spread factor is more than a certain number of standard deviations to the right of the historical average of the spread factor, we increase the bid-offer spread. If the spread factor is more than a certain number of standard deviations to the left of the historical average, we decrease the bid-offer spread. In the sample model, we consider half a standard deviation to the right and a third of a standard deviation to the left of the mean. The increase or decrease of the bid-offer spread is proportional to the magnitude of the spread factor. The maximum spread change is limited to an appropriate pre-set threshold for both the upper and lower limit.

| else | ||

| end if | ||

| else | ||

is the raw Spread Factor; is the rolling average of the raw Spread factor; is the rolling standard deviation of the raw Spread Factor; is the spread factor after adjusting for the upper and lower bounds; ; we have set and ; is the weight for the Price Factor; is the Price Factor; is the weight for the Trade Count Factor; is the Trade Count Factor; is the weight for the Volume Factor; is the Volume Factor.

Note: A 30 day rolling window results in the historical average and standard deviation getting updated every trading day.

5 Dataset Construction

To construct a sample model, we need the following data items: the price, the trade count and the volume of the security over different time intervals. We have chosen the currency markets since it is an ideal candidate for a dynamic quotation model, but the price is not publicly disclosed as in the equity markets. We take the average of the high, low, open and close prices over a certain interval as a proxy for the trade price. Many market making firms disclose such a data set at different intervals facilitating the creation of a reasonable hypothetical price. The data is available over our chosen interval of one minute as well.

The trade count and trade volume over a minute are not publicly available. But many providers disclose total quarterly, total monthly and average daily volumes. The volume over a minute is the product of the number of trades and the size of each trade during that minute. We can pick random samples from a log normal distribution to get the trade count and trade size for each minute. The mean and standard deviation of the log normal distributions can be set such that the total volume will match the publicly disclosed figure. We can make an assumption that there will be sixty trades on average in a minute and set the average trade size based on the total volume. Please see endnote [1] and [2] in the references for further details on the publicly available data sets and Appendix 10.1 for details of the model parameters. Any market maker wishing to use this model can easily substitute the simulated variables with the actual values they observe.

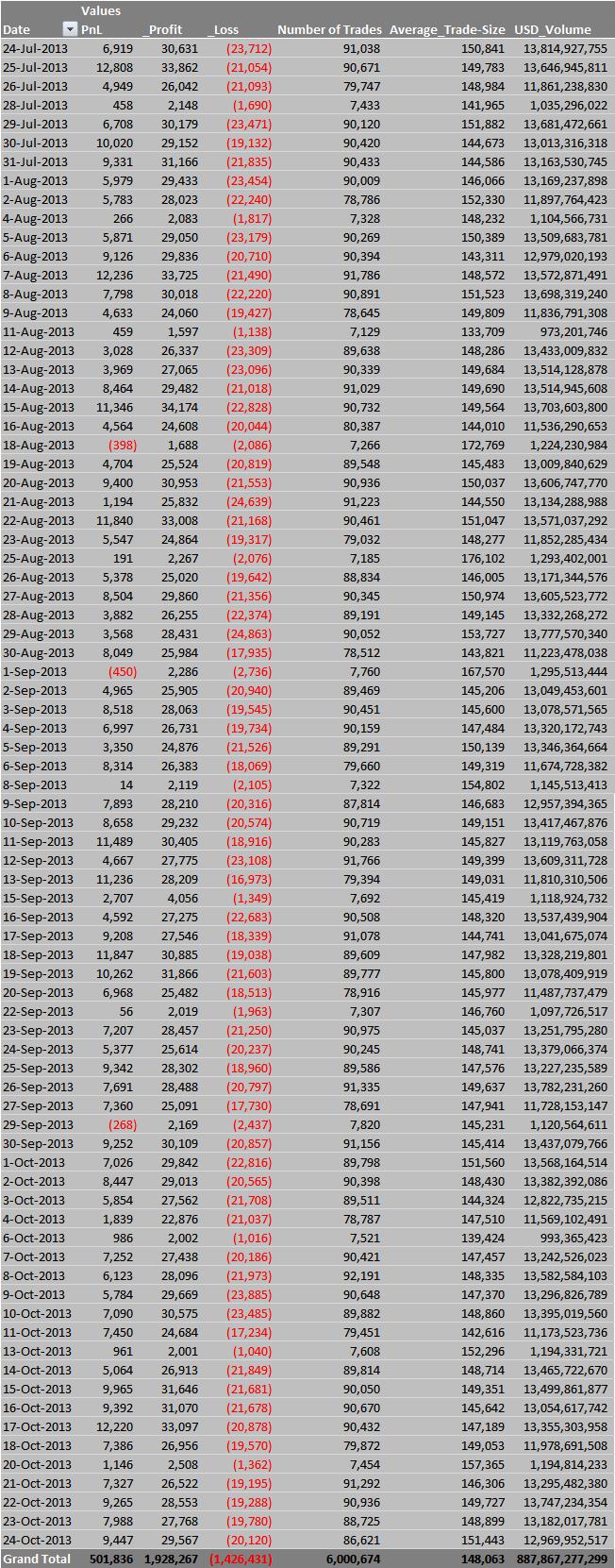

6 Model Testing Results

-

1.

The model was tested on a time horizon between 24-Jul-2013 to 24-Oct-2013. The currency pair used was the EUR-USD currency pair and the hypothetical trade price is the average of the high, low, open and close during a certain interval, which in our case was a minute. The high, low, open and close is publicly available from a number of providers.

-

2.

The ideal starting historical values are to be calculated based on data from the month preceding this period. Other shorter time intervals can be considered as appropriate to the needs of the specific trading desks.

- 3.

-

4.

The spread was increased 47,347 times; decreased 48,244 times; the spread factor was greater than the upper bound on 19,605 times and lower than the lower bound on 27,535 times.

-

5.

The volume that was affected by the increased spread was approximately 444.95 Billion; volume affected by the decreased spread was 443.19 Billion.

-

6.

More detailed results are included in the Appendices.

7 Improvements to the Model

-

1.

We can skew the change in the bid offer spread to be more on the bid or the offer side based on the buy and sell volumes. We have not considered this exclusively in our model since we only look at the change in the spread and not on which side of the quote the change happens. It is simple to adjust both sides equally or be cleverer in how we split the total spread change into the bid or the offer side.

-

2.

The assumption of normality and the use of a log normal distribution can be relaxed in favor of other distributions. It is also possible to use different distributions that change over time, as a result of the feedback we receive from the system. This is a more realistic portrayal of empirical data which tend to fall into different distributions as regimes change.

-

3.

Each of the variables can be modeled using more advanced econometric techniques like the GARCH model. Care needs to be taken that the additional parameters do not impact the feedback loop and when results are not satisfactory, we can easily investigate the reason for issues.

-

4.

For simplicity, we have ignored the question of negative spreads or reverse quotes, where the bid is greater than the offer, resulting in a crossed market. This can happen when the magnitude of the spread factor is greater than the difference between the bid and the offer. This can be handled easily by reducing the size of the spread factor when such an event occurs. Additional ways to handle this are considered in the below points.

-

5.

The model can be made to adapt its scaling factors, the alpha and the beta so that the difference in the average of the increase and the average of the decrease in the spread are equal over a certain time period. With this, the overall spread change stays the same and the market maker is seen to be quoting competitive spreads, though this results in better profitability based on the volume and price movements it is experiencing. See Appendix-I for details on the model parameters.

-

6.

In our current model, we limit the size of the spread change on both the positive and negative sides depending on the value of the spread factor. A variation to this can be to change the spread only when the spread factor lies above or below a certain threshold. The spread change can be a constant value; or two constant values, one for the increment and one for the decrement or it can be made to depend on the spread factor as well.

-

7.

The consolidated spread factor computed as the weighted sum of the exchange rate volatility, trade count and volume factors can be made to depend more on the volatility and trade count by adjusting the corresponding weights.

-

8.

The time interval considered for the factors is 60 seconds. Smaller time intervals will result in better performance for currency markets. Larger time intervals might be more suited for other securities.

-

9.

The rolling average can be taken over shorter or longer intervals depending on the results and the security under consideration. It is also possible to weight different contributors to the average differently resulting in a Moving Average model.

-

10.

The trade count and volume factors can also be modeled similar to the Exchange Rate Volatility Factor. The point to bear in mind is that the exchange rate volatility is mean reverting and the trade count and volume factors have always had an upward trend. This is because we expect more trading to happen and all trading desks are bullish about their activities. Given the volume projections, we can expect the upward trajectory for these two factors to continue. For 30 day rolling windows, we can assume that the trade count and volume follow a mean reverting property. For our purpose, the deviations from the 30 day historical average for the trade count and volume factors produce satisfactory results.

-

11.

A central question is whether the changing spread will have a negative impact on the volumes traded and hence on the overall profitability of the desk. This needs to be monitored closely and the size of the changes need to be adjusted accordingly.

-

12.

Other factors can be included, like the percentage of flow handled by the market marker to the average flow in that currency pair over the course of a trading day. This factor indicates the extent of monopoly that the market maker enjoys and indicates pricing power. This ratio can be used to adjust the spread in the favor of the market maker or in the feedback loop to tweak the parameters that are used for other factors.

8 Conclusion

The need for a dynamic quotation model comes from the feature of the social sciences and trading, where observations coupled with decision making can impact the system. This aspect was illustrated in detail and summarized as the uncertainty principle of the social sciences. To deal with this phenomenon, we need a feedback mechanism, which incorporates trading conditions into the quotation process, without too much of a temporal lag.

A model was constructed, using price, trade count and volume factors over one minute intervals, to vary the quotes being made. The models constructed are rich enough to capture the effect of the various relevant factors, yet simple enough to accord constant monitoring and to ensure the effectiveness of the feedback loop. The real test of any financial model or trading strategy is the effect on the bottom line and hence when we looked at the performance of our methodology, we found the positive effect on the P&L to be significant, without too much of a change to the way the trading happens or an accompanying increasing in risk or leverage of the trading desk.

Numerous improvements to the model are possible and can be considered depending on the type of instrument being traded and the technology infrastructure available for trading. Future iterations of this study will look to extend this methodology to other asset classes.

9 References and Notes

-

1.

For further details on the publicly available datasets, see http://forexmagnates.com/fxcm-posts-records-quarterly-revenues-and-july-volume-metrics/ and http://ir.fxcm.com/releasedetail.cfm?ReleaseID=797967

-

2.

The author has utilized similar algorithms for market making in various OTC as well as exchange traded instruments for more than the last ten years. As compared to the sample model, the interval trade count and volumes used in the empirical model were the actual observations; yet the overall results are somewhat similar.

-

3.

Avellaneda, M., & Stoikov, S. (2008). High-frequency trading in a limit order book. Quantitative Finance, 8(3), 217-224.

-

4.

Bodie, Z., Kane, A., & Marcus, A. J. (2002). Investments. International Edition.

-

5.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of econometrics, 31(3), 307-327.

-

6.

–. (2008). Glossary to arch (garch). CREATES Research Paper, 49.

-

7.

Chiu, J., Lukman, D., Modarresi, K., & Velayutham, A. (2011). High-frequency trading. Standford, California, US: Stanford University.

-

8.

Chlistalla, M., Speyer, B., Kaiser, S., & Mayer, T. (2011). High-frequency trading. Deutsche Bank Research, 1-19.

-

9.

Copeland, L. S. (2008). Exchange rates and international finance. Pearson Education.

-

10.

Dempster, M. A. H., & Jones, C. M. (2001). A real-time adaptive trading system using genetic programming. Quantitative Finance, 1(4), 397-413.

-

11.

Derman, E., & Wilmott, P. (2009). The Financial Modelers’ Manifesto. In SSRN: http://ssrn. com/abstract (Vol. 1324878).

-

12.

Elton, E. J., Gruber, M. J., Brown, S. J., & Goetzmann, W. N. (2009). Modern portfolio theory and investment analysis. John Wiley & Sons.

-

13.

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society, 987-1007.

-

14.

Gujarati, D. N. (1995). Basic econometrics, 3rd. International Edition.

-

15.

Hamilton, J. D. (1994). Time series analysis (Vol. 2). Princeton university press.

-

16.

Hull, J. C. (1999). Options, futures, and other derivatives. Pearson Education India.

-

17.

Kashyap, R. "The Circle of Investment." International Journal of Economics and Finance, Vol. 6, No. 5 (2014), pp. 244-263.

-

18.

Marcus, A. J., Bodie, Z., & Kane, A. (2002). Investments. McGraw Hill.

-

19.

Norstad, J. (1999). The normal and lognormal distributions.

-

20.

Paich, M., & Sterman, J. D. (1993). Boom, bust, and failures to learn in experimental markets. Management Science, 39(12), 1439-1458.

-

21.

Popper, K. R. (2002). The poverty of historicism. Psychology Press.

-

22.

Sweeney, J., & Sweeney, R. J. (1977). Monetary theory and the great Capitol Hill Baby Sitting Co-op crisis: comment. Journal of Money, Credit and Banking, 86-89.

-

23.

Taleb, N. (2005). Fooled by randomness: The hidden role of chance in life and in the markets. Random House LLC.

-

24.

–. (2010). The Black Swan: The Impact of the Highly Improbable Fragility.

-

25.

Tuckman, B. (1995). Fixed Income Securities-Tools for Today’s Markets.

10 Appendix

10.1 Model Parameters and Key Metrics

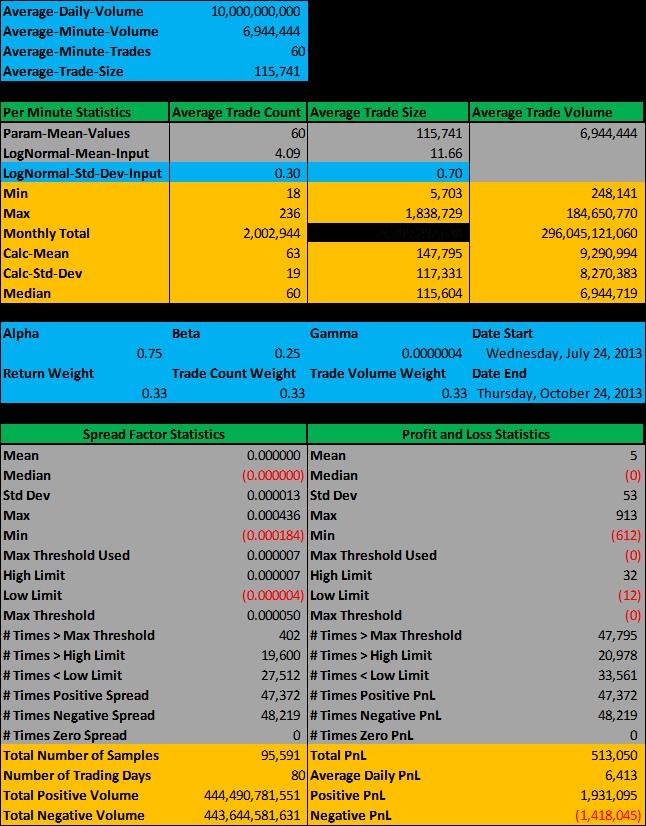

In Figure 1, values in blue are model parameters that can be used to optimize the model. In the sample model, these act as user inputs and can be changed to see how the model behaves under different conditions. Values in green are common categories that apply to different metrics. Values in bright yellow are important metrics, some of which form a key part of the feedback loop and it would be good to monitor these closely. Alpha and Beta are the parameters used to model the volatility of the price. Gamma is the parameter that is used to scale the trade and volume factors into a similar size as the price factor.

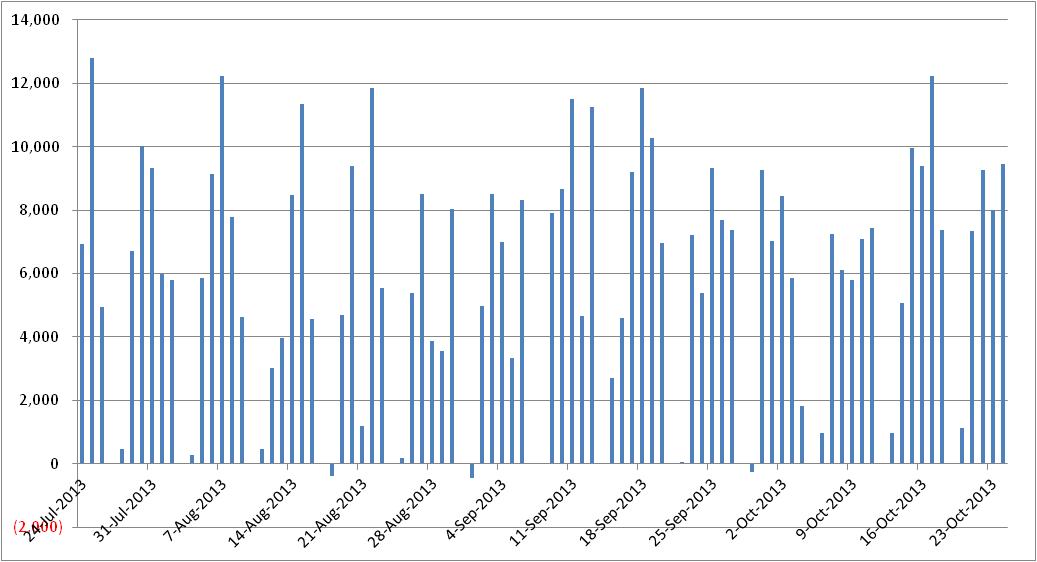

10.2 USD Profit & Loss by Trading Day

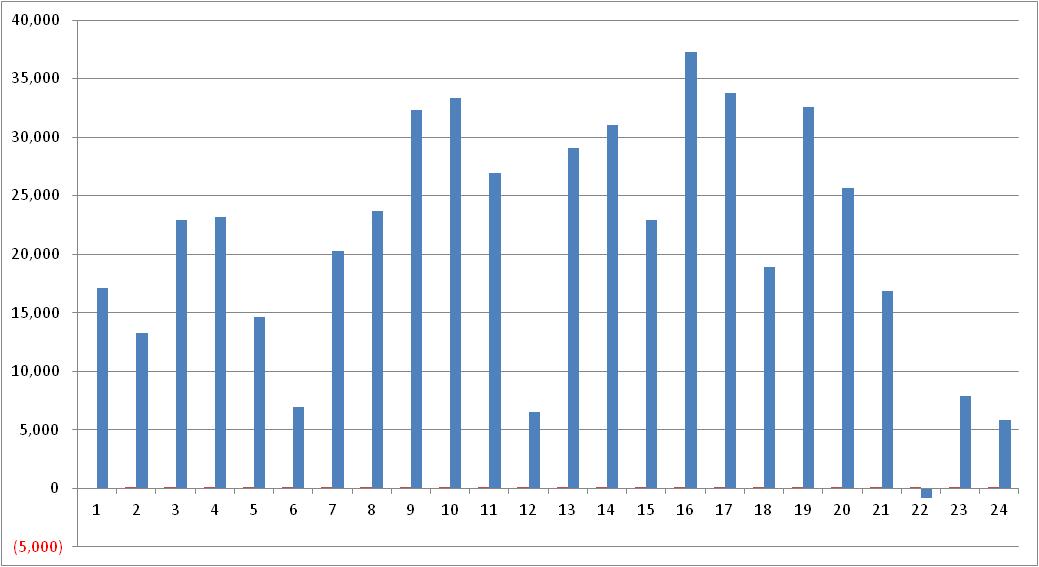

10.3 USD Profit & Loss by Trading Hour

10.4 Key Metrics by Trading Day

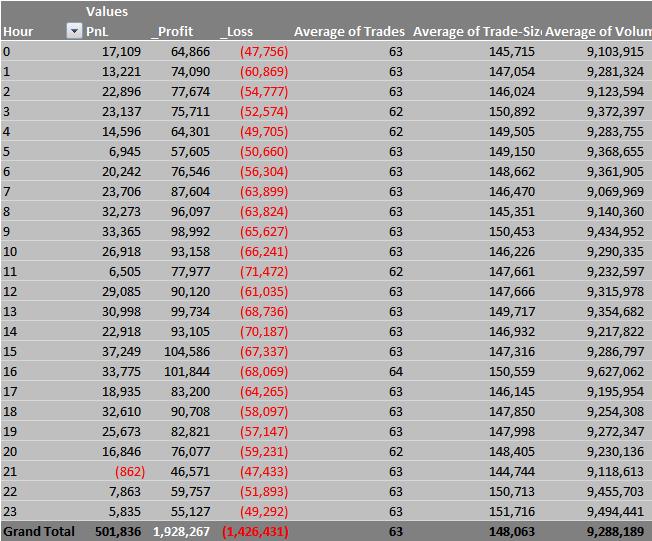

10.5 Key Metrics by Trading Hour