Symmetry reduction and exact solutions of the non-linear Black–Scholes equation

Abstract

In this paper, we investigate the non-linear Black–Scholes equation:

and show that the one can be reduced to the equation

by an appropriate point transformation of variables. For the resulting equation, we study the group-theoretic properties, namely, we find the maximal algebra of invariance of its in Lie sense, carry out the symmetry reduction and seek for a number of exact group-invariant solutions of the equation. Using the results obtained, we get a number of exact solutions of the Black–Scholes equation under study and apply the ones to resolving several boundary value problems with appropriate from the economic point of view terminal and boundary conditions.

keywords:

Black–Scholes equation , symmetry reduction , exact solutions1 Introduction

In modern mathematical finance, the Black–Scholes equation (BSE) is one of the key equations used in option pricing theory. Note that the standard derivative pricing theory is based on the assumption of perfectly liquid markets. In this case, the well studied linear BSE [1, 2] is used. But in recent years much attention is paid to illiquid markets. As noted in [3] (see also [4]), the most comprehensive equation providing the price of a European option is the following non-linear BSE:

| (1) |

where is the price of the European option under study, is the price of the underlying stock, is the risk-free interest rate, and is the volatility function.

For modeling illiquid markets, one can use [4]:

- 1.

-

2.

reduced-form stochastic differential equation (SDE) models with the volatility function

-

3.

equilibrium (reaction-function) models with the volatility function

In all these formulas is the constant (historical) volatility, and is a parameter modeling the liquidity of the market under study222For the market is perfectly liquid (and we have the linear BSE), whereas for large a trade has a substantial impact on the transaction price. For the stock of major U.S. corporations is a small parameter (of the order of ) [6, p. 186]..

Since is often considered to be small, we can replace with its first order Taylor approximation around in the last two formulas. Thus, for small values of we can restrict our considerations by the transaction-cost models and investigate only the BSE of the form:

| (2) |

The non-linear BSE with of the form is widely used in Financial Mathematics. Note that equation (2) is a partial case of equations (1.1) and (28) considered in [7] and [8], respectively. Equation (2) with was also investigated in [3, 4, 6, 9]. In particular, using methods of the Lie group theory, Bobrov [9] find the maximal algebra of invariance of the one, carry out the symmetry reduction and present examples of exact invariant solutions.

Using the notation , , , and , we rewrite (2) in a more convenient form:

| (3) |

In what follows, we consider only the values of independent variables from the domain (this is due to the economic sense of these variables). With a view to avoiding cumbersome calculations made by Bobrov in the case , we reduce (3) to a simpler form using point transformations of variables. Having made the group analysis of the obtained equation and built a number of its exact invariant solutions, we transform them into ones of equation (3) using the inverse transformations of variables.

The structure of this article is as follows. In Section 2, using the simplifying point transformations of variables, we reduce the non-linear BSE (3) to a partial differential equation (PDE), which is a special case of an equation from the famous handbook [10]. In Section 3, we present the optimal system of the one-dimensional sub-algebras of maximal algebra of invariance (MAI) of the obtained equation, carry out the symmetry reduction, and get a number of exact group-invariant solutions of the one. Returning to BSE (3), we obtain a number of its exact solutions in Section 4. Next, we apply the solution found in Section 4 to solving several BVPs with the governing equation (3). Finally, in Section 6, we briefly sum up the results of this paper.

2 Simplifying point transformations of variables

Using the point transformations of variables

| (4) | |||

| (5) |

we can reduce equation (3) to the equation

| (6) |

(hereafter we omit the overlines for convenience).

We get an equation of the form . It is known (see [10, Subs. 12.1.1, No. 2]) that the resulting equation admits traveling-wave solution

| (7) |

where the function is determined by the autonomous ordinary differential equation (ODE)

and a more complicated solution of the form

| (8) |

where the function is determined by the autonomous ODE

3 Symmetry reduction and exact solutions of equation (6)

Using program LIE [11], we obtain that the basis of MAI of equation (6) can be chosen as follows:

Non-zero commutators of this operators are:

Hence, our MAI can be written as a semidirect sum of a one-dimensional algebra and a four-dimensional ideal:

The ideal is of the type (here we apply the notations used in [12]). Using this facts and executing the well-known classification algorithm [13, p. 1450], we obtain the following assertion.

Proposition 1

The optimal system of the one-dimensional subalgebras of MAI of equation (6) consists of the following ones: , , , , , , , , , , , , , , where , , , , , and .

First of all, note that the algebras , , and do not satisfy the necessary conditions for existence of the non-degenerate invariant solutions. Further, we perform the detailed analysis of invariant solutions, which is based on all other algebras from Proposition 1. The results of our investigation are presented in Tables 1 and 2. Table 1 consists of anzatses generated by the subalgebras and corresponding reduced equations, exact solutions of which (or the first order ODEs, if we could not find their solutions) are given in Table 2.

| No. | Algebraa | Ansatz | Reduced equation |

|---|---|---|---|

| 1 | |||

| 2 | |||

| 3 | |||

| 4 | |||

| 5 | |||

| 6 | |||

| 7b | |||

| 8c | |||

| 9 | |||

| 10d | |||

| 11e | |||

| aIn this column, . | |||

| bIn this case, , . | |||

| cIn this case, . | |||

| dIn this case, , . | |||

| eIn this case, . | |||

Remark 1

Reduced equations 6 and 8 (with ) from Table 1 can have real-valued solutions, only if .

| No. | Algebraa | Exact solution or first order ODEb |

| 1 | 1 | |

| 2 | 2 | |

| 3 | 3 | |

| 4 | 4 | |

| 5 | 5 | |

| 6 | 6 () | |

| 7c | 7 ( const) | |

| 8d | 8 () | |

| 9e | 8 () | |

| 10f | 8 () | |

| 11g | 7 ( const) | |

| 12 | 9 | |

| 13h | 10 | |

| 14 | 11 | |

| aIn this column, the numbers of algebras from Table 1 are indicated. | ||

| bIn this column, ; , are arbitrary real constants. | ||

| cIn this case, , if , and , if . | ||

| dIn this case, . | ||

| eIn this case, , . | ||

| fIn this case, , . | ||

| gIn this case, . | ||

| hIn this case, . | ||

Remark 2

In Table 2:

-

1.

solution 1 is trivial and can be included to solution 2;

-

2.

solution 3 is the traveling-wave one, which can be obtained from (7), if we put , ;

-

3.

solution 4 can be obtained from solution 3, if we put ;

-

4.

solution 7 is of the form (8), and one can be obtained, if we put , , ;

- 5.

- 6.

-

7.

ODE 13 is obtained, if we put in ODE 10 from Table 1 ;

-

8.

ODE 14 is obtained, if we put in ODE 11 from Table 1

4 Exact solutions of equation (3)

Using solutions 2–3, 5–10 of equation (6) (see Table 2) and the point transformations of variables (4)–(5), we obtain a number of exact solutions of equation (3) presented in Tables 3 and 4.

| No. | Sol.a | Exact solutionb |

| 1 | 2 | |

| 2 | 5 | |

| 3 | 6 | |

| 4 | 3 | |

| 5c | 7 | |

| 6d | 8 | |

| 7e | 9 | |

| 8f | 10 | |

| aIn this column, the numbers of solutions of equation (6) from Table 2 are indicated. | ||

| bIn this column, ; , are arbitrary real constants. | ||

| cIn this case, , if , and , if . | ||

| dIn this case, . | ||

| eIn this case, , . | ||

| fIn this case, , . | ||

| No. | Sol.a | Exact solutionb |

| 1 | 2 | |

| 2 | 5 | |

| 3 | 6 | |

| 4 | 3 | |

| 5c | 7 | |

| 6d | 8 | |

| 7e | 9 | |

| 8f | 10 | |

| aIn this column, the numbers of solutions of equation (6) from Table 2 are indicated. | ||

| bIn this column, ; , are arbitrary real constants. | ||

| cIn this case, , if , and , if . | ||

| dIn this case, . | ||

| eIn this case, , . | ||

| fIn this case, , . | ||

Compare solutions obtained by us with the solutions found in [9]. Changing constants, we can rewrite the Bobrov solutions in the following form:

| (9) | |||

| (10) | |||

5 Applications to solving various BVPs with the governing PDE (3)

In this section we are going to apply the solutions of the non-linear Black–Sholes equation (3) found in Section 4 to solving various BVPs.

In [7] the following stationary BVP for the equation

| (11) |

under the Dirichlet boundary conditions

| (12) |

for some fixed was considered. In equation (11) the parameter is as follows

The authors proved that under some conditions on the constants , , , and the BVP (11) and (12) admits a convex unique classic solution, which can be obtained as the limit of a non-increasing (respectively non-decreasing) sequence of upper (lower) solutions.

Note that in the case , (11) coincides with the stationary version of equation (2). So, it is convenient here to consider the following stationary BVP

| (13) | |||

| (14) | |||

| (15) |

where , , , , , and . We are going to find an exact solution of the BVP (13)–(15) in explicit form.

This is a solution of the evolution equation (3). To obtain a solution of the stationary one (13), we need to eliminate the time coefficient in formula (16), i.e.

Solving this equation w.r.t. the parameter , we get333It should be noted that here , if , and , if (see Table 4).

In this cases, the relevant equation (13) admits such solution:

| (17) |

where , i.e.,

| (18) |

Substitute solution (17) into the boundary conditions (14) and (15), putting in (14) and . Then (14) is satisfied in the sense of the right limit in , and from (15) we obtain the following condition on the coefficient :

Thus, we get that

| (19) |

Hence, we proved the following statement.

Proposition 2

The slightly different result is obtained in the case . Here the boundary conditions (14) and (15) give

From the second condition we still receive formula (19), but the first one leads to the condition

| (20) |

Thus, the following statement is obtained.

Proposition 3

Now we are going to consider an evolution BVP with the governing equation (3) on and , the terminal condition

and the boundary condition

In the terminal condition, is the so-called pay-off function, which traditionally is taken in the form

| (21) |

and

| (22) |

for the European Call and Put options, respectively. Here is some real constant and the designation

is used.

Note that formulae (21) and (22) are the simplest forms of the pay-off, which have the strong economic sense, but there are no any evidences against using others, more sophisticated, pay-off functions.

In our investigation we deals with the following pay-off :

| (23) |

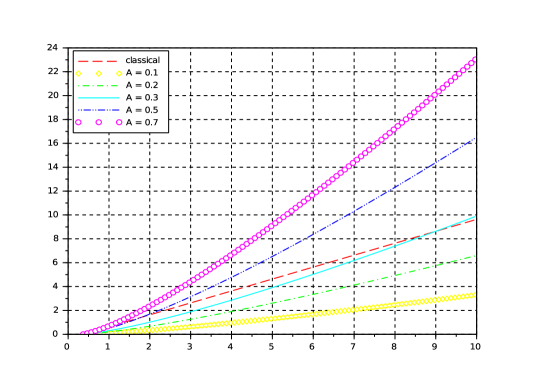

where and are some real constants. It is easy to see that the behavior of function (23) is very close to behavior of the classical pay-off function for the European Call option (21) (see Fig. 1).

Thus, we are dealing with such European Call option type BVP

| (24) | |||

| (25) | |||

| (26) |

where , , , , and are some real constants.

We again intend to use solution 5 of Table 4 (see formula (16)). For convenience, we rewrite this solution in the form

| (27) |

where

and

We also should remind the readers that in (27) , if , and , if .

In view of the terminal condition (25), we are looking for a solution of the BVP (24)–(26) in the form

| (28) |

Substituting formula (28) in the terminal condition (25) and the boundary one (26), we find that

| (29) |

and

| (30) |

Thus, we proved the statement.

Proposition 4

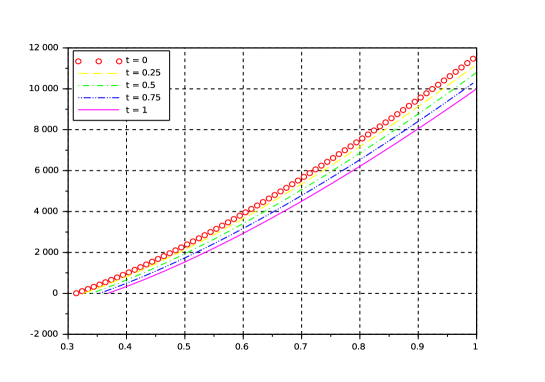

Note that

Example. Let . If we put , and (one year)444Note that our parameters , and are similar to the ones in [15, p. 809]., then , and

Graph of this solution is presented on Fig. 2.

6 Conclusions

In this article, we investigated the non-linear Black–Scholes equation (2) from the group theoretic point of view.

First, in Section 2, using the point transformations of variables (4)–(5), we reduced the equation to the more simple and canonical form (6). We found that for this equation there are known several exact solutions. Our main purpose was to carry out the symmetry analysis of the equation in order to obtain a comprehensive list of self-similar (invariant) exact solutions of the one using the method of symmetry reduction to the ordinary differential equations.

In Section 3, we found the MAI of equation (6). This algebra is the five-dimensional Lie one, which can be written as a semi-direct sum of a one-dimensional algebra and a four-dimensional solvable ideal. Taking into account the widely known classification of sub algebras of low dimensional Lie algebras [13] and using the Patera–Winternitz–Zassenhaus algorithm, we found the optimal system of one-dimensional sub-algebras of MAI of equation (6). Using the ones, which satisfy the necessary conditions of existence of the non-degenerate invariant solutions, we carried out the symmetry reduction of the equation to the ordinary differential equations of the first and second order (see Table 1) and found several general solutions of the ones. For a number of the reduced equations we could not find the general solutions in the explicit form in elementary functions (see Cases 11–14 in Table 2).

Using the obtained general solutions of the reduced equations, in Section 4, we constructed a set of exact solutions of the Black–Scholes equation under study. The complete list of the solutions is presented in Tables 3 and 4. Finally, we compared our solutions with the ones found previously.

In Section 5, we applied results found in the previous section for solving several BVPs with the governing Black–Scholes equation (3) in the case . We utilized solution 5 of Table 4 to find exact classical solutions of both the stationary (13)–(15) and non-stationary (24)–(26) BVPs of the Dirichlet and European Call option types, respectively.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

References

References

- [1] Black F, Scholes M. The pricing of options and corporate liabilities. J Political Econ. 1973;81:637–59.

- [2] Merton RC. Theory of rational option pricing. Bell J Econ. 1973;4:141–83.

- [3] Agliardi R, Popivanov P, Slavova A. On nonlinear Black–Scholes equations. Nonlinear Anal Differ Equ 2013;1(2):75–81.

- [4] Bordag LA, Frey R. Nonlinear option pricing models for illiquid markets: scaling properties and explicit solutions. In: Ehrhardt M, editor. Nonlinear Models in Mathematical Finance: New Research Trends in Option Pricing, New York: Nova Science Publishers Inc.; 2008.

- [5] Çetin U, Jarrow RA, Protter P. Liquidity risk and arbitrage pricing theory. Finance Stoch 2004;8:311–41.

- [6] Frey R, Polte U. Nonlinear Black–Scholes equation in finance: associated control problems and properties of solutions. SIAM J Control Optim 2011;49(1):185–204.

- [7] Amster P, Averbuj CG, Mariani MC, Rial D. A Black–Scholes option pricing model with transaction costs. J Math Anal Appl 2005;303:688–95.

- [8] Bakstein D., Howison S. A non-arbitrage liquidity model with observable parameters for derivatives. Oxford University Preprint 2003.

- [9] Bobrov MV. The fair price valuation in illiquid markets. Master’s Thesis in Financial Mathematics, Technical report IDE0738, Halmstad University, Sweden, 2007.

- [10] Polyanin AD, Zaitsev VF. Handbook of nonlinear partial differential equations. Boca Raton: CRC Press; 2012.

- [11] Head AK. LIE, a PC program for Lie analysis of differential equations. Comput Phys Commun 1996;96:311–13.

- [12] Basarab-Horwath P, Lahno V, Zhdanov R. The structure of Lie algebras and the classification problem for partial differential equations. Acta Appl Math 2001;69:43–94.

- [13] Patera J, Winternitz P. Subalgebras of real three- and four-dimensional Lie algebras. J Math Phys 1977;18:1449–55.

- [14] Polyanin AD, Zaitsev VF. Handbook of exact solutions for ordinary differential equations. Boca Raton: CRC Press; 2003.

- [15] Ankudinova J, Ehrhardt M. On the numerical solutions of nonlinear Black–Scholes equations. Comput Math Appl 2008;56:799–812.