Evidence of chaos and nonlinear dynamics in the Peruvian financial market

Resumo

Physicists experimentalists use a large number of observations of a phenomenon, where are the unknown equations that describe it, in order to play the dynamics and obtain information on their future behavior. In this article we study the possibility of reproducing the dynamics of the phenomenon using only a measurement scale. The Whitney immersion theorem ideas are presented and generalization of Sauer for fractal sets to rebuild the asymptotic behaviour of the phenomena and to investigate, chaotic behavior evidence in the reproduced dynamics. The applications are made in the financial market which are only known stock prices

keywords:

Caos; Dinâmica não lineal; Séries temporais., .

1 Introduction

For a study of the asymptotic behavior of solutions of a system, the area of dynamical systems has developed a lot of tools , but in many phenomena as financial markets, equations that model them are unknown and the only available information is a temporal set of measures.

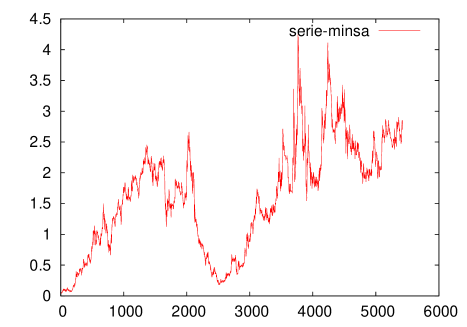

A time series is a function , and its image could be considered as observations taken overtime in a particular phenomenon. Those pieces of observations have information about the system and we are ready to answer questions like does that serie have enough information to rebuild the dynamics? If it is so, can we predestine its future behaviour?. But there is one more general question. Will the financial market have a random behaviour or not?. The chaos theory could give us an answer where systems with an apparently ramdom behaviour, comes from a deterministic system, it means a completely modeling system by equations. Chaotic system complexity lies primarily in sensitivity to initial conditions, small variations produce big changes.This sensitivity is quatified by Lyapunov exponents. We will do our research in a time series of the stock prices in the mining company MINSUR.SA to determine concrete evidence of chaos presence in that series. Graphic(1) shows evolution of stock prices of the company.

2 Teoría do Caos

To show the use of chaos theory in time series, we consider the Lorenz system, which is given by:

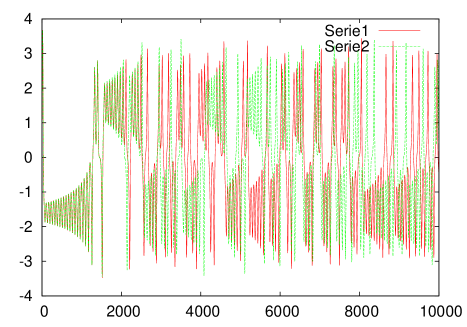

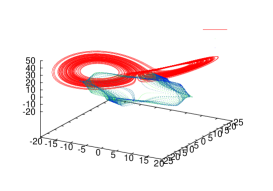

The dynamics of system solutions is shown in the figure(2)

It is well known Lorenz system is sensitive to small variations with initial data, it means, solutions with very close initial data is not exact exponentially[3]. Figure(3) shows such a behaviour in the first component of solutions for very close data initial. The series in the figure(3) were generated with initial data in points and in time with variation in mili seconds. Notice the trajectories differ after 3 seconds, it means, small variations generate big changes quickly. So that, chaos theory could explain some phenomena in the financial market, where variations like speculations generate changes in a short term. One of the goals in this work is to investigate chaotic behavior on time series in the financial market precisely applied in the Peruvian financial system

The main task to study the chaotic behavior in a time series is the rebuilding of the dynamics it has. If a time series comes from a deterministic system, so that it has dependence between its components given by the system of equations that modeling and contains geometric information considering that trajectories converge to an attractor which will be inmerse in some Euclidian space. Using such information and The Whitney immersion theorem ideas in which a dimensional compact manifold can be inmersed in and its generalizations for fractal sets given for Tim Sauer[4], we will rebuild the dynamics knowing the information of one of the components of Lorenz system only.

Now we can see the probabilistic version of Theorem of Withney[4]

3 Main theorems

Theorem 1.

(Prevalent theorem of Whitney) If is a smooth compact manifold of dimension contained on . Almost all smooth map, , is an immersion of .

The theorem(1) says it is possible to rebuild the existing dynamics with projections in Euclidian spaces. Despite we have the theorem of Whitney, we still have a practical problem. We only can get a temporal observation of the dynamics in the financial market, the evolution of the stock prices and we will need 1observations of the phenomenon. So, the obtained results are not enough. Takens assumed this problem adding the contained dynamics in the time series in the Theorem of Whitney. It is a projection via a function of observation of the phase space where the dynamical system is developed for . Therefore it contains information about the dynamics. For this, it defines the delay cordinates, which only need a temporary observation.

Definition 2.

If is a dynamics system over a manifold , a positive integer (called of delay), and a smoth function. We defines the map of delaying coordinates

Taken[7] demonstrated a new version of theorem of Whitney for the delaying coordinates

Theorem 3.

(Takens) is a dimensional compact manifold , a discrete dynamical system over generated by , and a function of classe . is a generic characteristic that of map defined by

is an immersion.

The final generalization used in this article was given by B.Hunt, T. Sauer and J. Yorke[8], that is a fractal version of theorem of Whitney for the delaying maps set with being a fractal set.

Theorem 4.

(Fractal Delay Embedding Prevalence Theorem) A dynamics system over an open subset of , and a compact subset of with box dimension . an integer and . Asume that contains only a finite number of equilibrio points, it does not contains periodic orbits of of period o , a finit number of periodic orbits of of period , , and these periodic orbits linearizations have different eigenvalues. So for almost every smooth function(in the sense prevalente) smooth function over , the delay coordinates map is injective over

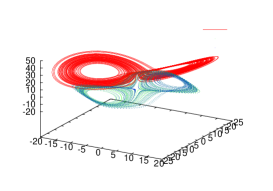

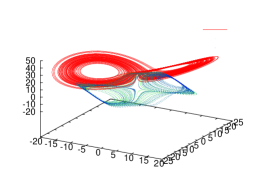

The theorem(4) does not provide an estimative about the smaller dimension for which almost every delaying coordinates map is injective. However there are numerical algorithms which allow calculate the immersion dimension and the delaying time in the reconstruction.Following, we show the reconstruction of the dynamics generated for the system of Lorenz using only the coordinate of the system

4 4. Examples of reconstruction of the attractor using delay coordinates

we use the Lorenz’s attractor to show the technique of delaying coordinates. The function of observation , was the projection in the axis.

The time series will be formed by coordinates of the trajectories that are numerical solutions of the equation. Fixed the dimension, , we change the value of T . According to Lorenz’s we use delaying times, , , , . In the case points in the space are highly correlated and the graphic is almost a straight line. At the other extreme, , points are not correlated and the gotten graphic does not represent the reconstruction of the attractor. The optimal delay time was .

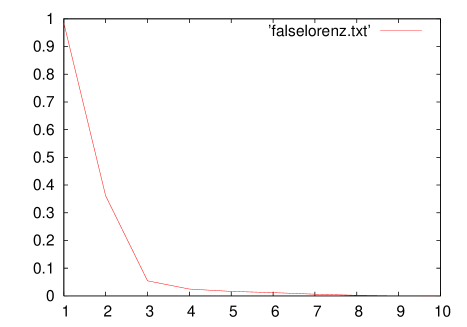

To determine the dimension where is rebuilt the dynamics, the technique of the neighbours is used. The idea is about setting a dimension and calculate the distance between close points, if the attractor does not have enough freedom, so when we raise the dimension of the space, those next points get separeted and are pointed as false neighbours. The procedure goes on until the percentage of false neighbours is small. In the series formed with the first components of Lorenz’s system, the number of false neighbours is almost zero when the dimension of immersion is , figure(5).

5 Identifying non linearity and chaos

First of all, we will give the definition of chaos according to Devaney[5].

Definition 5.

If is an interval. We say that is chaotic over if:

-

1.

has sensibility to initial conditions;

-

2.

is transitive;

-

3.

The periodic points are dense in .

We say that has sensibility to initial conditions when the solutions with initial conditions very close, diverge quickly.

Definition 6.

A map has sensitive dependence in if the next condition holds for some : for each open I on , containing , there is a and such that

Definition 7.

A map is transitive if for each pair of subintervals y de there is such that

Intuitively, is transitive implies the orbit of an interval is dense on .

Given chaos definition, we will investigate the existence of characteristics in a time series. In this article we are interested in searching the characteristic which is characterized by Lyapunov exponents.

It is important to know lineal systems can not be chaotic. We will identify no lineal dependences on data. The most used techniques are: method of surrogates data and the test BDS.

Kantz e Schreiber[18] recommend that before doing any non lineal analysis on a data set, it is good practice to check if there is no linearity. Because the linear systems are not chaotic and the linear stochastic processes can produce very complex series which can be misunderstood as a product of chaotic system. We presented the technique of surrogate data and the BDS test.

5.1 Surrogate data

A very useful technique used by physicist is surrogate generation of Surrogate data, a procedure done by Theiler, Eubank, Longtin, Galdrikan y Farmer[24]. From the original data , it generates a set of random series so that, these keep the linear properties of the original series (average, variance , Fourier spectrum) but eliminating the possible nonlinear dependencies.Then an indicator is evaluated, which is sensitive to nonlinear dependencies and try to reject the null hypothesis, which states that data are obtained by a stochastic linear process. If the null hypothesis is true, then the substitute series procedure would not affect the indicator

The most used indicators are correlation dimension. It was used by Small et. al.[13] and no linear prediction which was used by Kaplan[10].

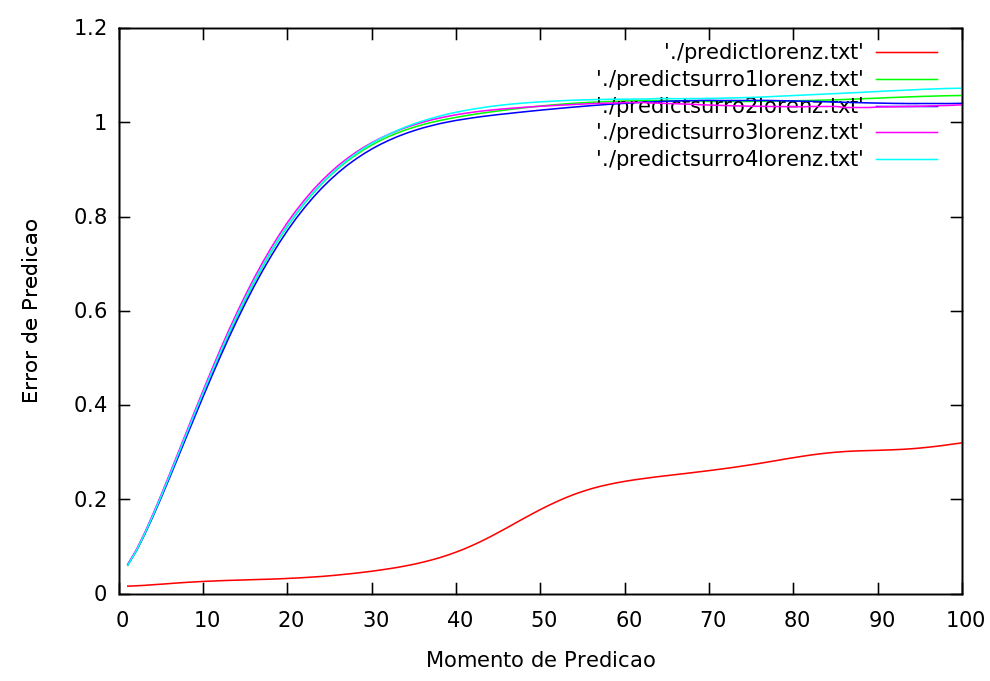

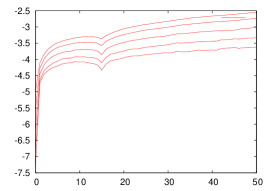

We will illustrate the technique of substitute data applied in Lorenz series and use the nonlinear prediction.

The election was due to deterministic systems the prediction on a short term is possible, in contrast to Stochastic systems in which the prediction in a short term is impossible . For the prediction nonlinear we will use the method developed by Hegger, Kantz and Schreiber[9], where the value of predicting is the average of “future” values. This state , is defined by average of the closed values. It is calculated by the following equation

Where is the neighborhood, are values within and are the values at time . held the prediction, this is compared with the quadratic average error of prediction on future value of the original serie with the surrogate series. If the prediction error of the series original is smaller than all the surrogate series, then we reject the null hypothesis. This graphic shows the results.

The projection errors of the original series were smaller than its substitutes. Like this, we reject the null hypothesis.

The following technique is more about statistics.

6 BDS Test

It was developed by Brock, Dechert and Scheinkman[21], It’s based on the correlation dimension to detect nonlinear structure in a time series. Additionally this test can be used to test how good is the fit estimation model

Given a time series , Using the method of delay coordinates, we have vectors in , , where is the delay time, is the immersion dimensión. The correlation dimension is given by the formula,

Where is the function point mass, which indicates the probability where the points are close to each other.

For practical and didactic issues we consider . Now if we will get

Then, implies and .

This allows to say that if the points e are closing to each other, then, the points from series and as well. It happens the same with points and . Thus,

Where indicates the probability. If the data are IID(independent and identically distributed), then and we have,

Thus, in dimension we have

Then,

As . This suggests that the data is IID, then,

Where is the integral of correlation in dimension and is the integral of correlation in dimension one.

In, Brock, Dechert y Scheinkman[21], statistical BDS test is defined by:

Where is the estimation of the standard asymptotic error: . They proved that:

Introducing to BDS test applied in Lorenz series and a series consisting of random numbers.

6.1 BDS Test for Lorenz series

| Dimension of immersion(m) | BDS |

|---|---|

| 1 | 165.270466 |

| 2 | 447.623951 |

| 3 | 578.535241 |

| 4 | 772.617763 |

| 5 | 1078.467687 |

| 6 | 2338.679429 |

| 7 | 3593.653394 |

| 8 | 5640.618871 |

6.2 Test BDS for a series consisting of random numbers

| Dimension of immersion(m) | BDS |

|---|---|

| 1 | 0.560594 |

| 2 | 0.560594 |

| 3 | 0.425293 |

| 4 | 0.069765 |

| 5 | 0.116118 |

| 6 | 0.336857 |

| 7 | 0.633835 |

| 8 | 0.524584 |

To understand the results, let’s start talking about the degree of significance of a hypothesis. To ask a null hypothesis, in the case of the BDS test the null hypothesis is that the observations are independent and identically distributed (IID), it can be make a mistake of rejecting the null hypothesis being true. Suppose that the probability of committing this error is , namely:

is called the degree of significance of this mistake. Now, in the BDS test:

By the test BDS, know that

Then,

So,

If we look at the tables of the normal distribution , we see that you to a degree of signicancia of , . As, we reject the null hypothesis, with degree of signicancia of , if . Noting again the tables we can observe that in the case of Lorenz series, we reject the null hypothesis, the data are IID. Otherwise case series formed by random numbers.

Detected non-linealidade in the time series, the next step is to search sensitive dependence on initial conditions.

6.3 Lyapunov exponents

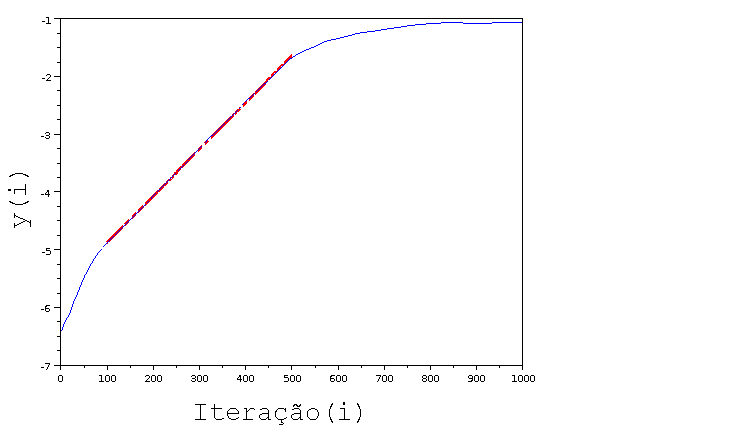

This section we obtain results that characterize the sensitive dependence on initial conditions. The study of the attractor and the dynamics is performed in the space reconstructed using delay coordinates.

This section we obtain results that characterize the sensitive dependence on initial conditions. The study of the attractor and the dynamics is performed in the space reconstructed using delay coordinates. Chaotic systems are, generally, strange attractors which are generated by stretching and contractions. Stretches are responsible for sensitivity on initial conditions and are characterized by the exponential distance in finite time, paths with initial conditions very next. Contractions allow the pathlines may not move away indefinitely and that they remain confined to a bounded phase space region. Distance speed is measured by the Lyapunov exponents.

In the case of a discrete dynamic defined by a map system ,

is the Jacobian matrix of . then writing

The largest Lyapunov exponent is given by:

for almost all vector , for more details see[6]. As we can see the first problem for the calculation of Lyapunov exponents is to obtain the matrizes . In the case of having only a time series the calculation of Lyapunov exponent is even more complicated. Eckman y Ruelle[6],[16] proposed the first algorithms based on the following ideas.

Consider a dynamic generated by the differential equation:

| (1) |

In . If we do in the previous equality we get,

| (2) |

The retrieved system is linear in . Then, if the system(1) solutions are , then the solutions of the system(2) are . So the matrix, , can be calculated integrating the equations (1). This idea for a linear system to calculate the matrix, , was used by Eckman and Ruelle[16] for estimating of Lyapunov exponents from a time series.

Consider a time series, . Using delay coordinates, obtain points , in the space -dimensional of reconstruction. If we develop around point , we would have that for next to it,

| (3) |

So, is estimated by the best linear approximation of the map that for points next to point , takes in points close. This process can be thought as the linear approximation of the derivatives at each point in space lathe overhauled do. With the same ideas, authors such as Wolf, Swift, Swinney Vastano[22], M. Sano, y. Sawada[20] proposed an algorithm for the calculation of Lyapunov exponents.

Another factor to consider is that the Lyapunov exponents are defined in terms of limits, which guarantees its invariance by smooth transformations. If we think of a finite series, there is no guarantee that interference (noise) data, lead to the same exponents. Rosenstein, Collins and De Luca[19] and Holger Kantz[17] directly presented new techniques based on the idea that the greatest exponent of Lyapunov measure the average speed of estrangement of the paths with conditions next. The estimation of the maximum exponent of Lyapunov using the algorithm of Rosenstein was made in the reconstructed attractor of Lorenz. The value of was obtained.

7 Applications

The series studied was the series of prices of the shares of the mining company Minsur, counting on prices from up to with a total of years of daily observations.

7.1 Identifying non-linearity and chaos

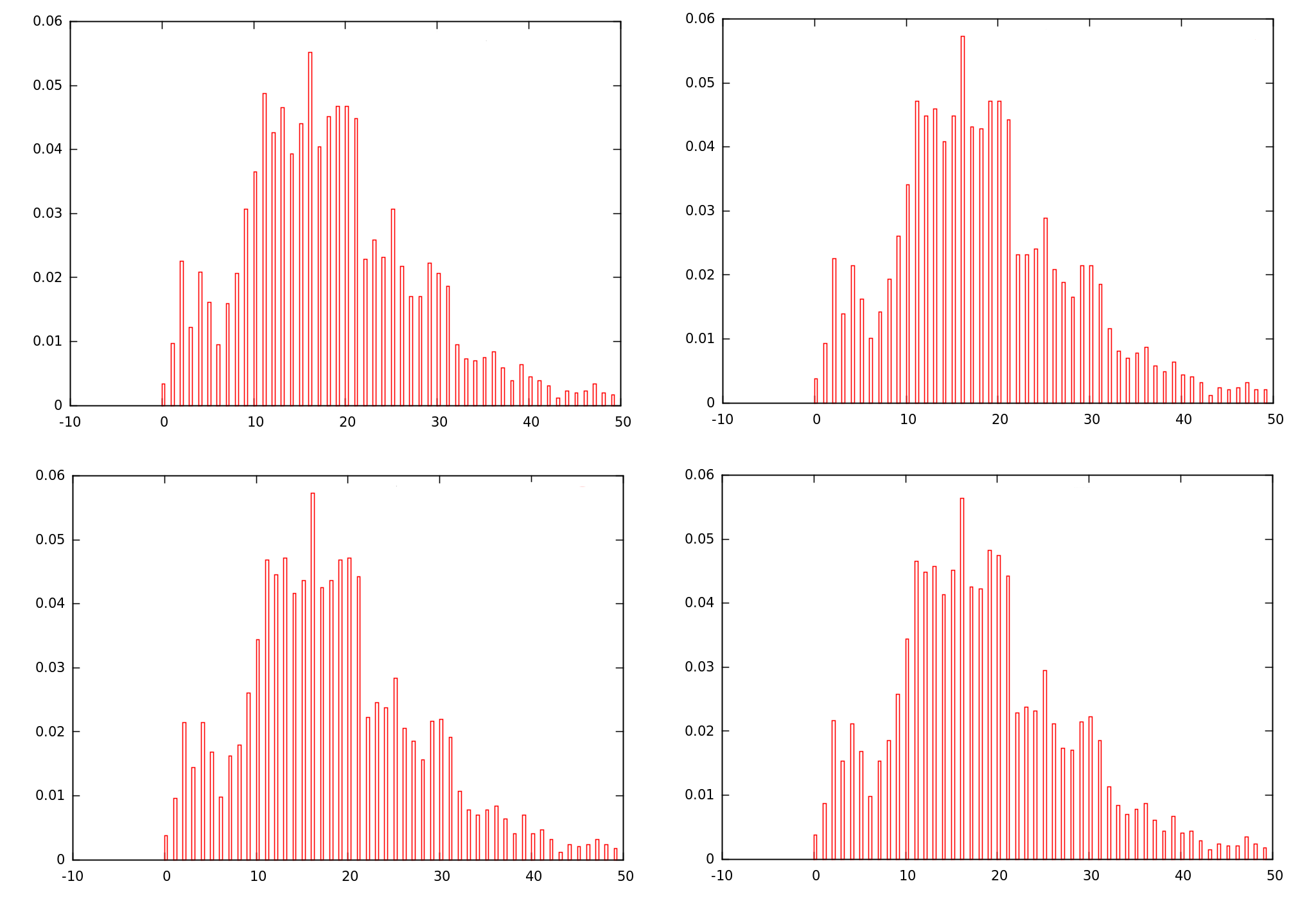

For the use of the surrogates are generated series substitute which preserve linear properties of the original series, for example, the graph(8) shows histograms of the original series as well as his surrogate series.

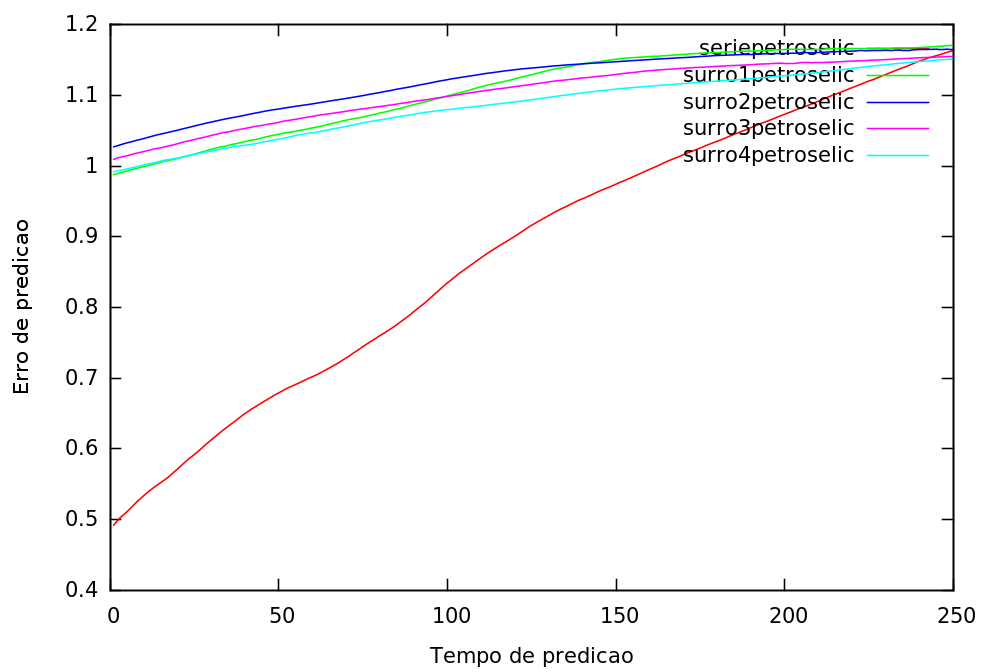

The next step is the calculation of the predictions of each of the series, original and substitute, and comparing related errors. The figure(9) shows that errors of prediction of the original series presents a relatively small short-term prediction error and substitute series shows a high prediction error from the first moment.

Therefore the null(: error of the original series prediction = surrogate series prediction error)hypothesis is rejected since the original series prediction error is less than all their substitute series prediction error. Therefore, we reject the fact that the original series is generated by a linear stochastic process.

On the other hand, the BDS test is an alternative more statistics to detect non-linear units, perform the test for several dimensions of immersion. In the chart are the values of the BDS statistics to dimensions of to .

| Dimension of immersion(m) | BDS |

|---|---|

| 1 | 165.270466 |

| 2 | 195.653634 |

| 3 | 236.554950 |

| 4 | 296.226274 |

| 5 | 382.825922 |

| 6 | 508.150676 |

| 7 | 690.060422 |

| 8 | 955.415301 |

| 9 | 1344.764026 |

| 10 | 1919.802065 |

| 11 | 2774.198843 |

| 12 | 4050.599850 |

| 13 | 5967.524832 |

| 14 | 8860.578053 |

| 15 | 13419.054424 |

We see the table that .Therefore, we reject the null hypothesis (that the data are IID), with a degree of significance of .

Identified the non-linearity in the series, the next step is the search for evidence of chaotic dynamics.

7.2 The greatest exponent of Lyapunov

Finally, we calculate the greatest exponent of Lyapunov as an indicator of chaos. The theorem ergodic justice Oseledec method Rosenstein and Kantz to estimate the maximum exponent of Lyaunov by the formula(6.3).In practice it is convenient to only calculate the maximum exponent of Lyapunov, Since the whole spectrum depends on the dimension of immersion and colors more exponents than actually exist, or less.

8 Conclusions

Using the analysis nonlinear and chaos theory applied in the series of prices of the shares of the mining company MINSUR obtained the following results:

-

1.

The data contains non-linear dependence.

-

2.

We cannot conclude the existence of chaos in the series.

Even considering non-linear dependence in the data results to detect chaos are not conables. Some authors[29] estimated the largest Lyapunov exponent using only the first iteration of estrangement.

A job to follow is the search for presence of orbits periodically unstable, using for this purpose, the recurrence maps or maps of Poincaré, as well as the presence of a fractal attractor.

9 Acknowledgements

The authors are so grateful to the Department of mathematics applied of the Universidad Federal de Rio de Janeiro, UFRJ, and the Department of Sciences of the University private of the North, UPN, Trujillo-Perú, where this study was developed.

Referências

- [1] HOLGER KANTZ, THOMAS SCHREIBER, Nonlinear Time Series Analysis. Cambridge University Press 2004.

- [2] J.P. ECKMANN, D.RUELLE, Ergodic Theory of chaos and strange attractor, Reviews of Modern Physics, vol 57 No 3, Part I, 1985.

- [3] MAÑE, R., On the dimension of the compact invariant sets of certain nonlinear maps. Dinamical Systems and turbulence. Warwick, Lecture Notes in Mathematics 898, pp 230-242..

- [4] TIM SAUER, JAMES A. YORKE, MARTIN CASDAGLI, Embedology. Springer Netherlands, Journal of Statistical Physics, Pages 579-616.

- [5] R.L. Devaney, An Introduction to Chaotic Dynamical System, Second ed., Addison-Wesley, Menlo Park California, 1989.

- [6] J.P. Eckman, D. Ruelle(1985). Ergodic theory of chaos and strange attractors. The American Physical Society. Rev. Mod. Phys. 57, 617656

- [7] Floris Takens(1981). Detecting strange attractors in turbulence. Springer Berlin, Book Series Lecture Notes in Mathematics, Volume 898/1981, Pages 366-381.

- [8] Tim Sauer, James A. Yorke, Martin Casdagli(1992). Embedology. Springer Netherlands, Journal of Statistical Physics, Pages 579-616.

- [9] Rainer Hegger, Holger Kantz, and Thomas Schreiber(1999). Practical implementation of nonlinear time series methods: The TISEAN package. Chaos 9, 413 (1999); doi:10.1063/1.166424.

- [10] Kaplan, D.(2002). Making and using surrogate data. http://www.macalester.edu/~kaplan/barcelona/surrogatewrap.pdf.

- [11] Andre M. Fraser, Harry. L. Swinney(1986). Independent coordinates for strange attractors from mutual information. Physical Review A (General Physics), Volume 33, Issue 2, pp.1134-1140

- [12] Provenzale, A., Smith, L. A., Vio, R., Murante G.(1992). Distinguishing between low-dimensional dynamics and randomness in measured time series. Physica D, 58, 31.

- [13] Michael Small, Dejin Yu, Jennifer Simonotto, Robert G Harrison, Neil Grubb, K.A.A Fox.(2002). Uncovering non-linear structure in human ECG recordings. Chaos, Solitons, Fractals Volume 13, Issue 8, Pages 1755-1762.

- [14] C. E. Shannon(1948). A mathematical theory of communication. Bell System Technical Journal, vol. 27, pp. 379-423 and 623-656

- [15] Thomas Schreiber, Andreas Schmitz(1999). Improved surrogate data for nonlinearity tests. Phys. Rev. Lett. 77, 635.

- [16] J.P. Eckman, S. Oliffson Kamphorst, D. Ruelle, S. Ciliberto(1986). Lyapunov exponents from time series. Phys. Rev. A 34, 49714979

- [17] Holger Kantz(1994). A robust method to estimate the maximal Lyapunov exponent of a time series. Physics Letters A, Volume 185, Issue 1, p. 77-87.

- [18] Holger Kantz, Thomas Schreiber(1997). Nonlinear Time Series Analysis. Cambridge University Press.

- [19] Michael T. Rosenstein, James J. Collins, Carlo J. De Luca(1993). A practical method for calculating largest Lyapunov exponents from small data sets. Physica D: Nonlinear Phenomena Volume 65, Issues 1-2, Pages 117-134

- [20] M. Sano, Y. Sawada (1985). Measurement of the Lyapunov Spectrum from a Chaotic Time Series. APS Journals Phys. Rev. Lett. Volume 55, ssue 10 Phys. Rev. Lett. 55, 10821085

- [21] W. A. Broock, J. A. Scheinkman, W. D. Dechert, B. LeBaron(1996). A test for independence based on the correlation dimension. Journals in its journal Econometric Reviews.Volume 15, Issue 3, Pages: 197-235

- [22] Wolf, Alan; Swift, Jack B.; Swinney, Harry L.; Vastano, John A.(1984). Determining Lyapunov exponents from a time series. Physica D: Nonlinear Phenomena, Volume 16, Issue 3, p. 285-317.

- [23] Scheinkman, Jose A.(1990). Nonlinearities in Economic Dynamics. Royal Economic Society, Economic Journal, Issue 400, Pages: 33-48.

- [24] Theiler, James; Eubank, Stephen; Longtin, André; Galdrikian, Bryan; Doyne Farmer, J.(1992). Testing for nonlinearity in time series: the method of surrogate data. Physica D: Nonlinear Phenomena, Volume 58, Issue 1-4, p. 77-94.

- [25] Thomas Schreiber, Andreas Schmitz.(1999). Improved surrogate data for nonlinearity tests. Phys. Rev. Lett. 77 (1996) 635.

- [26] David A. Hsieh.(1991). Chaos and Nonlinear Dynamics: Application to Financial Markets. The Journal of Finance, Vol. 46, No. 5 (Dec., 1991), pp. 1839-1877.

- [27] Thomas Willey.(1992). Testing for nonlinear dependence in daily stock indices. Journal of Economics and Business Volume 44, Issue 1, Pages 63-76.

- [28] Apostolos Serletis, Periklis Gogas.(1997). Chaos in East European black market exchange rates. Research in Economics Volume 51, Issue 4, Pages 359-385.

- [29] Michael Bask.(1996). Dimensions and Lyapunov Exponents from Exchange Rate Series. Chaos, Solirons and Fractals Vol. 7, No. 12, pp. 2199-2214.