IEEE Trans. Smart grid-2015 \SetWatermarkScale0.35

Price Discrimination for Energy Trading in Smart Grid: A Game Theoretic Approach

Abstract

Pricing schemes are an important smart grid feature to affect typical energy usage behavior of energy users (EUs). However, most existing schemes use the assumption that a buyer pays the same price per unit of energy to all suppliers at any particular time when energy is bought. By contrast, here a discriminate pricing technique using game theory is studied. A cake cutting game is investigated, in which participating EUs in a smart community decide on the price per unit of energy to charge a shared facility controller (SFC) in order to sell surplus energy. The focus is to study fairness criteria to maximize sum benefits to EUs and ensure an envy-free energy trading market. A benefit function is designed that leverages generation of discriminate pricing by each EU, according to the amount of surplus energy that an EU trades with the SFC and the EU’s sensitivity to price. It is shown that the game possesses a socially optimal, and hence also Pareto optimal, solution. Further, an algorithm that can be implemented by each EU in a distributed manner to reach the optimal solution is proposed. Numerical case studies are given that demonstrate beneficial properties of the scheme.

Index Terms:

Smart grid, cake cutting game, shared facility, discriminate pricing, social optimality, Pareto optimality.I Introduction

One of the main stimuli behind adopting energy management in smart grid is the use of different pricing schemes, in which an energy entity changes the price of per unit electricity according to the generation and demand so as to motivate users to modify their attitudes towards electricity consumption and supply [1, 2, 3]. Particularly, with the advancement of distributed energy resources (DERs), different pricing techniques can assist the grid or other energy entities, such as shared facility controllers (SFCs)111An SFC, as we will see in the next section, is an entity that is responsible for managing energy of different shared facilities of a smart community. to operate reliably and efficiently by obtaining some energy supply from the energy users (EUs) [4].

Over the past few years there has been significant interest in devising pricing schemes for energy management in smart grid. These schemes can be classified into three general categories: time-of-use pricing; day-ahead pricing; and real-time pricing [5]. Time-of-use pricing has three different pricing rates: peak, off-peak and shoulder rates based on the time of electricity use by the EUs [6]. Day-ahead pricing is determined by matching offers from generators to bids from EUs in order to develop a classic supply and demand equilibrium price at an hourly interval [7]. Finally, real-time pricing [5] refers to tariffed retail charges for delivering electric power and energy that vary over hour-to-hour, and are determined through an approved methodology from wholesale market prices. Other pricing schemes that have been discussed in the literature include critical peak pricing, extreme day pricing, and extreme day peak pricing [5]. Discussion of various pricing schemes for energy management in smart grid can be found in [8, 9, 10, 11, 12, 13, 14, 15] and the references therein. Nevertheless, an important similarity in most of these pricing schemes is that all of the EUs decide on the same selling price per unit of energy at a particular time.

With the increase in government subsidies for encouraging the use of renewables, more EUs with DERs are expected to be available in the future [16, 17, 18, 19, 20]. This will subsequently lead to a better completion of purchasing targets for SFCs in order to maintain electricity for shared facilities in a community [21]. This is due to the fact that the opportunity of an SFC to trade electricity with EUs can greatly reduce its dependency on the grid, and consequently decrease the cost of energy purchase. However, not all EUs would be interested in trading their surplus energy if the benefit from the SFC is not attractive [4]. In particular, as we will see shortly, this can happen to EUs with limited energy surplus and/or with higher sensitivity to price whose respective return could be very small. Nevertheless, as shown in [4], one possible way to address this problem is that these EUs can sell their energy at a relatively higher price per unit of energy, within a reasonable margin, compared to EUs with very large DERs (and/or, with lower sensitivity to the choice of price) without affecting their revenue significantly.

It is natural to think that the benefit to the end-user will increase if the price for selling each unit of energy increases. However, we note that in an energy market with a large number of sellers the buyer has many choices to buy the electricity. Hence, a significantly higher price per unit of energy from a seller can motivate the buyer to switch its buying from that expensive option to a seller who is selling at a comparatively cheaper rate [22]. Thus, even with a higher selling price per unit of energy, the net benefit to a user may decrease significantly if the amount of energy that it can sell to the buyers, i.e., the SFC in this case, becomes very small. This type of phenomenon has occurred recently in the global oil market [23]. This can further be illustrated by a toy example as follows.

Consider the numerical example given in Table I where EU1 and EU2 sell their surplus energy to the SFC to meet the SFC’s kWh energy requirement. It is considered that EU1 and EU2 have DERs with capacity of kWh and kWh respectively (and EU1 is significantly larger than EU2 in terms of available energy to supply). In case 1, EU1 and EU2 sell and kWh of energy to the SFC at a price of cents/kWh. Hence, the revenues of EU1 and EU2 are and cents respectively and the total cost to the SFC is cents. In case 2, EU1 and EU2 choose their prices differently and sell their surplus energy at rates of cents/kWh and cents/kWh respectively. Now, due to the change of price in case 2, if EU1 reduces its selling amount to (since the price is reduced) and EU2 increases its surplus amount to kWh (as the current price is high) the resulting revenue changes to and cents respectively for EU1 and EU2 whereas the total cost to the SFC reduces to cents. Thus, according to this example, it can be argued that discriminate pricing is considerably beneficial to EUs with small energy (revenue increment is ) at the expense of relatively lower revenue degradation (e.g., in case of EU1) from EUs with larger energy capacity. It further reduces the cost to the SFC by .

However, one main challenge for such price discrimination among different EUs, which is not discussed in [4] and yet needs to be explored, is the maintenance of fairness of price distribution between different EUs to enable such schemes to be sustained in electricity trading markets. For example, if the EUs are not happy with the price per unit of energy that they use to sell their surplus energy, or if they envy each other for the adopted discrimination, energy markets that practice such discriminate pricing schemes would eventually diminish. Hence, there is a need for solutions that can maintain the price disparity between EUs in a fair manner, whereby considering their available surplus energy and their sensitivity to change of price, an envy-free energy trading environment with a view to obtain a socially optimal222A socially optimal solution maximizes the sum of benefits to all EUs in the smart grid network [24]. energy management solution is ensured.

To this end, this paper complements the existing pricing schemes in the literature by studying the fairness of selecting different prices for different EUs in smart grid. However, unlike [4], where a two-stage Stackelberg game is studied, we take a different approach in this paper. Particularly, we explore a cake-cutting game (CCG) for selecting discriminate prices for different users. In the proposed CCG, the EUs with smaller available energy can decide on a higher unit price, and the price is also adaptive to the sensitivity of EUs to the choice of price. A suitable benefit function is chosen for each of the EUs that enables the generation of discriminate pricing so as to achieve a socially optimal solution of the game. Thus, also, Pareto optimality is directly implied by this socially optimal solution, and hence an envy-free energy trading market is established. We propose an algorithm that can be adopted by each EU in a distributed manner to decide on the price vector by communicating with the SFC, and the convergence of the algorithm to the optimal solution is demonstrated. Finally, we present some numerical case studies to show the beneficial properties of the proposed discriminate pricing scheme.

We stress that the current grid system does not allow such discriminate pricing among EUs. Nonetheless, the idea of price discrimination is not new and has been extensively used in economic theory. For instance, the effect of price discrimination on social welfare is first investigated in 1933 [25], which is further extended with new results in [26] and [27]. In recent years, the authors in [28] study the airport congestion pricing technique when the airline carriers discriminate with respect to price. In [29], the authors use a new panel of data on buyer-supplier transfers and build a structural model to empirically analyze bargaining and price discrimination in a medical device market. The study of intertemporal price discrimination between consumers who can store goods for future consumption needs is presented in [30], and the effects of third-degree price discrimination on aggregate consumers surplus is considered in [31]. Further, a framework for flexible use of cloud resources through profit maximization and price discrimination is studied in [32]. In this context, we also envision discriminate pricing as a further addition to real-time pricing schemes in future smart grid. Such a scheme is particularly suitable for the energy trading market when the SFC may want to reduce its dependence on a single dominant user. For example, in the toy example the SFC may rely heavily on User who has a large surplus for the same price model. However, by giving more incentive to User , the SFC managed to reduce its dependence on User by buying less energy from it. Please note that this could happen in a real-world scenario in which a buyer pays a small supplier a relatively higher price in order to help the small supplier grow, and at the same time to reduce the dependence on a single big supplier. Such trading will prevent the possibility of the big supplier growing too big and creating a monopoly, which could lead to a serious problem in the long run. Please note that examples of such differentiation can also be found in current standard Feed-in-Tariff (FIT) schemes [33].

| Case 1 | Case 2 | |

| Payment to EU1 (cents/kWh) | ||

| Payment to EU2 (cents/kWh) | ||

| Energy supplied by EU1 (kWh) | ||

| Energy supplied by EU2 (kWh) | ||

| Revenue of EU 1 (cents) | (-) | |

| Revenue of EU 2 (cents) | (+) | |

| Cost to the SFC (cents) | (-) |

The remainder of the paper is organized as follows. The system model is described in Section II and the problem of price discrimination is studied as a CCG in Section III. We provide numerical case studies to show the beneficial properties of the proposed scheme in Section IV. Finally, we draw some concluding remarks in Section V.

II System Description

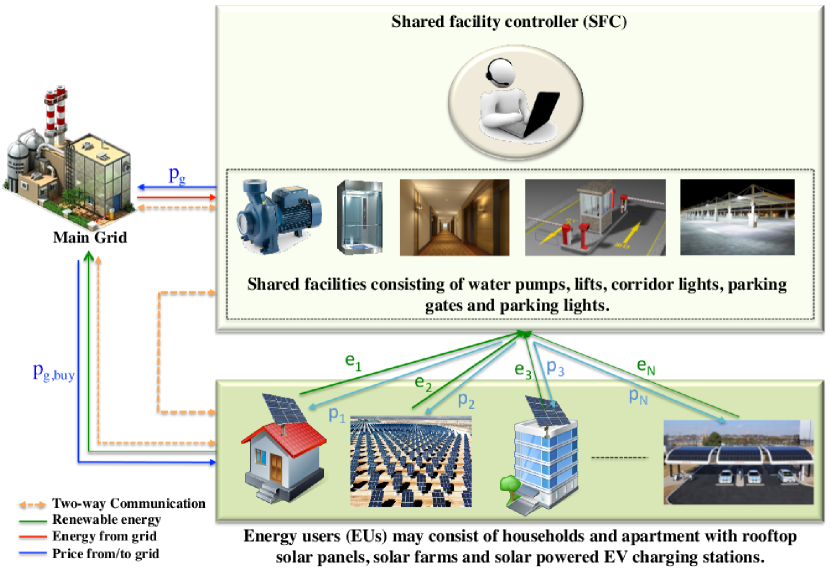

Consider a smart grid system consisting of EUs, where , an SFC and a main grid. Each EU can be considered as a single user or a group of users connected via an aggregator that acts as a single entity. Each EU is equipped with DERs such as solar panels and wind turbines and does not have any storage facility333An example of such a system is a grid-tie solar system without storage device [34].. Hence, EU needs to sell its surplus energy, if there is any, either to the SFC or to the main grid after meeting its essential demand in order to make some extra revenue. Due to the fact that the buying price of a main grid is considerably lower than pricing within a facility [35], it is reasonable to assume that the EUs would be more keen to sell their surplus to the SFC instead of to the grid444For example, in the state of Queensland in Australia, the selling price of electricity is cents/kWh during off peak hours (which is almost double during peak hours) [36], whereas the buying price of electricity is cents/kWh under Queensland’s Feed-in Tariff scheme [37].. Alternatively, if the payment from the SFC is not sufficiently attractive to any EU, the EU may schedule its equipment for extra consumption or may choose to sell to the grid instead of selling to the SFC. The SFC, on the other hand, controls the electricity consumption of equipment and machines that are shared and used by the EUs on a regular basis, and does not have any energy generation capacity. Therefore, the SFC relies on EUs and the grid for its required electricity. Essentially, the SFC is interested in buying as much energy as possible from the EUs as the buying price per unit of energy from the main grid is significantly higher. All the EUs, the main grid and the SFC are connected to each other through power and communication lines [1]. A schematic representation of the considered system model is shown in Fig. 1.

To this end, let us assume that at a particular time during a day each EU has an energy surplus of that it wants to sell either to the SFC or to the grid with a view to make extra revenue. Each EU charges the SFC a price per unit of energy for selling its . do not need to be equal to each other and can be varied according to the amount of surplus at each EU and the EU’s sensitivity to the choice of price. The SFC, on the other hand, wants to buy this energy from each EU in order to meet the demands of the shared facilities of the community. We assume that the SFC has a budget constraint , and hence, the sum of what the SFC needs to pay to all EUs needs to satisfy,

| (1) |

Please note that such a budget is necessary to prevent the EUs from increasing their selling price per unit of energy considerably and thus maintaining market competitiveness, which may arise due to allowing EUs to decide on the selling price through interacting with the SFC555As we will see later, EUs and the SFC interact with each other in the proposed scheme to decide on the price vector.. This budget also enables us to decouple the SFC’s decision making process of buying energy from the EUs (which is the main focus of this work) from the problem of the SFC’s buying energy from the grid. However, the budget, which facilitates price discrimination in the proposed scheme, needs to be chosen such that it is always lower than the total price that the SFC needs to spend buying the same amount of energy from the grid and thus always benefits the SFC in terms of reducing cost. This is due to the fact that if the total money that the SFC pays to the EUs becomes equal to (or greater than) the amount that it needs to pay the grid, the SFC will not be encouraged to buy energy from the EUs as the SFC can buy all its required energy from the grid independently. Nevertheless, a suitable value for a budget may depends on many other factors, e.g., how willing is a user to sell its surplus to the SFC, which requires human behavioral models to obtain reasonable estimates. For example, as a rational entity, each EU would be interested in charging the SFC as much price per unit of energy as possible for selling its surplus. However, on the one hand, a very high price may discourage the SFC from trading any energy with the EU and rather motivate the SFC to buy its energy from the grid. On the other hand, if the selling price of an EU is too small, this may compel the EU to withdraw its surplus from the energy market as the expected revenue from energy trading with the SFC would be significantly lower. Nonetheless, in this paper we consider a general setting, i.e., a budget for the SFC when it buys energy from the EUs.

Now, the choice of price by an EU is also restricted by its sensitivity to the choice of price. For example, as discussed in Table I, a smaller price may not affect an EU with a very large surplus (i.e., lower sensitivity), but it can significantly alter the total revenue of an EU with lower available energy (higher sensitivity). In this context, it is considered that the price per unit of energy that an EU asks from the SFC depends not only on the available energy to the EU but also on the the EU’s sensitivity to the choice of price, which is chosen motivated by the use of preference/reluctance parameters in [21], [22], and [38, 39, 40]. captures the sensitivity of each EU’s benefit from changing the per unit price and thus is used to quantify the different types of players. For example, if one user has a large amount of surplus, he may want to sell the energy at a relatively cheaper price compared to a player who has a small surplus to sell. This is due to the fact that players with larger amount of surplus energy might be more interested in selling all the energy for a higher gain and thus will be flexible in reducing their price for selling more energy. Hence, a relatively lower price may not affect their revenues significantly [15]. On the other hand, a user with a small energy surplus will not be more keen to sell energy unless the price per unit of energy is considerably higher as otherwise the expected return will be very small. Hence, the evaluation of a change in price per unit of energy as well as the willingness to increase the price may not be same to both the players. We capture this aspect through a parameter , which is multiplied by the price per unit of energy (i.e., to capture the fact that a similar price may be interpreted differently by different EUs).

Also, as a rational entity each EU wants to increase the price per unit of energy that it charges the SFC as much as possible. However, the maximum price chosen by each needs to be such that it does not exceed the grid’s selling price per unit of energy. For example, if is greater than grid’s selling price , clearly the SFC will not buy any energy from the EU. To this end, each EU may want to increase to a maximum value of per unit of energy for selling its surplus and the choice of price is determined by 1) the surplus available to EU , 2) EU’s sensitivity to the choice of price , and 3) finally, the budget available to the SFC such that (1) is satisfied.

Now, to determine the energy trading parameter , each EU interacts with the SFC to decide on the price per unit of energy that it wants to charge the SFC for selling its energy with a view to maximizing its benefit. To capture the benefit to each EU , we propose a benefit function666Also known as utility function and welfare function. . In standard game theoretic research, e.g., [41], the benefit function is an input to the game, whose outcome needs to be a real number, and illustrates the change in benefits corresponding to the change of a player’s choice of action or environmental parameters. Note that benefit functions can be a combination of parameters with different dimensions and units to capture the effects of the change of parameters by the players. For instance, in [42], the authors consider a utility function, which is a combination of transmission rate and the cost of transmission in order to show how different choices of price and transmission rate can affect the benefits to the respective player. In [40], the authors use a welfare function for their game, in which the welfare function is a combination of total cost of energy trading and the square of the amount of energy traded by the player. Further, a non-cooperative game is proposed in [43], in which a utility function is combining the cost of energy and the quantity of energy to be sold.

Now, we propose a benefit function , which is based on a linearly decreasing marginal benefit,

| (2) |

contingent on the following assumptions:

-

1.

Each EU is a rational entity and wants to choose a price per unit of energy as close to the maximum possible price , e.g., equal to the grid’s selling price, as possible.

-

2.

EU is sensitive to its choice of price per unit of energy through the parameter , and thus the choice of is restricted by the choice of .

-

3.

An EU with large surplus of energy has relatively lower marginal benefit compared to the EUs with lower surplus for the same choice of price [4].

Note that a utility function with decreasing marginal benefit is shown in [44] to be appropriate for energy users. Then, the same property is also used to design utility functions in [15], [22], [39], and [40], where the players participate in games for making decisions on energy trading parameters including price and energy. To this end, the chosen utility function in (3) also possesses the property of declining marginal benefit and is close to the utility functions used in [15], [22], and [40]. Please note that the authors modeled a two-level game in [40] and Stackelberg games in [15] and [22] for designing energy management for smart grid. Therefore, a similar property is used to model the utility function of the proposed game.

To that end, the net benefit that an EU can attain from selling its surplus to the SFC at a price can be defined as

| (3) | |||||

The benefit function in (3) is a quadratic function of , which leverages the generation of discriminate pricing [4] between different EUs of the system. As can be seen in (3), the proposed benefit function possesses the following properties:

-

1.

The benefit function is a concave function of , i.e., . Hence, the benefit of an EU may decrease for an excessively high . This models the fact that the if the price is very high, the SFC may restrain from buying energy from the EU, which will eventually reduce its expected benefit from energy trading.

-

2.

The benefit function is an increasing function of and a decreasing function of . That is and . Therefore, a EU with higher sensitivity will be prone not to change its selling price significantly.

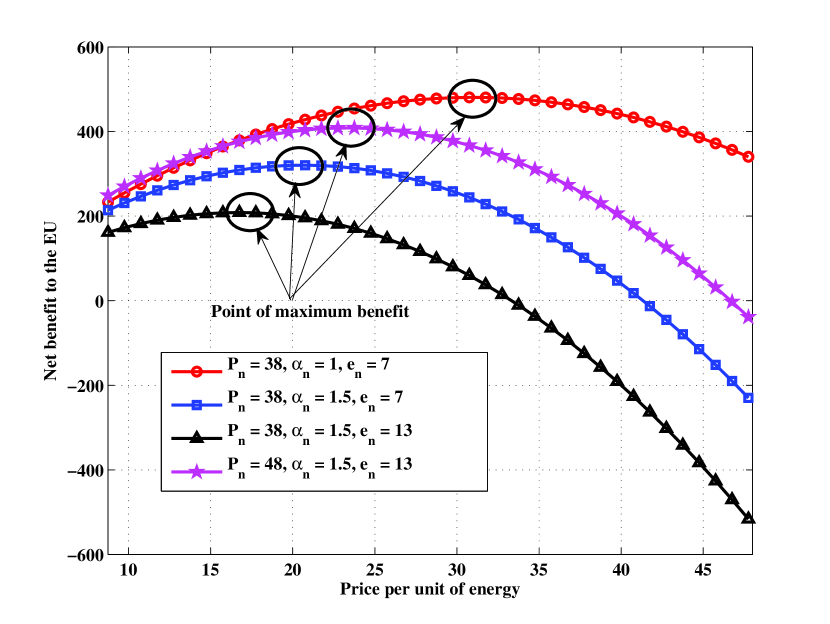

A graphical representation of the properties of the benefit function is shown in Fig. 2.

It is important to note that for sustainable energy trading in a smart grid system the overall system benefits from trading needs to be profitable. Otherwise, EUs with significantly lower revenue from energy trading would not participate in such trading [15], which will eventually diminish the energy trading market. In this context, the objective of each EU in the system is to interact with the SFC in order to determine a price per unit of energy, within the budget in (1) of the SFC, so as to sell its energy surplus such that the sum over all EUs in the system is maximized. Mathematically, the objective can be expressed as

| (4) |

such that . Now, to explore how each EU in the proposed system can identify a price within the budget in (1) such that their objective in (4) can be attained, we propose a CCG in the next section.

We stress that the proposed problem can also be solved by using other techniques such as dual decomposition or other centralized schemes. In order to solve the problem in a distributed fashion and thus allow the EUs to maintain their privacy (i.e., not to disclose private information like and to the SFC and other EUs in the network), we choose to use a CCG over other centralized techniques. As discussed in [45], sharing such private information not only allows the SFC to control the EUs’ energy usage behavior, but also enables the SFC to access the EUs’ private lifestyles, which is a significant privacy concern at present. Hence, certain information, such as (the sensitivity of a user to the change of price), needs to be kept private and should not be shared with the SFC. In addition, although the SFC may solve the proposed problem in a centralized manner if it has access to the private information, the EUs may be concerned that the SFC could modify , and thus distribute the total budget in favor of the EUs that have good relationships with the SFC, which is especially possible if the EUs and the SFC do not trust each other. Therefore, considering the above-mentioned factors, we choose to use a distributed technique such as the proposed CCG that leads to a solution with desirable properties like social optimality and being envy-free, while at the same time preserving the privacy of the EUs.

III Cake Cutting Game

III-A Brief Background

CCG is a branch of game theory that deals with the division of some finite pool of resources in a way that meets certain valuation criteria or objectives of the players splitting the resource [46]. Formally, the cake can be represented as a convex set, which is the total budget of the SFC in this proposed case. Each player will receive an allocation of this by choosing a suitable with the property . Now, before proceeding to the design of the proposed game, first we discuss some key properties of a CCG [46], which are relevant to the proposed scheme as follows.

-

1.

The allocation vector , which contains the outcome received by each player via distributing the cake is complete if

(5) -

2.

An allocation is called a socially optimal allocation if the allocation has the property

(6) where for any .

-

3.

An allocation possesses the property of Pareto optimality if no player with an allocation can be better off with a share without hurting at least one other player. Mathematically, an allocation with and is Pareto optimal, if there exists no other allocation containing and such that

(7) -

4.

If a complete allocation of a CCG is socially optimal, it is also Pareto optimal [46].

III-B Proposed Game

To decide on the energy trading parameter , each EU in the smart community interacts with the SFC, and we propose a CCG to capture this interaction. In the proposed CCG , each EU decides on its selling price through the considered game and offers the price to the SFC. The SFC, on the other hand, compares the received price vector from all the EUs and decides whether the total expense is within its budget , i.e., if the expense satisfies (1), and thus decides the solution of the game. Formally. the proposed CCG can be defined by its strategic form as777Since the EUs do not have storage facilities, all EUs with energy surplus will be interested in participating in the game to make revenue as long as the offered price is more than the grid’s buying price. Hence, the proposed CCG falls within the example of game theoretic problems where competitive buyers participate in the game to increase their utilities, e.g., studies in [22] and [39], [40]..

| (8) |

where is the set of players, i.e., EUs, in the game and is the set of strategies of EU , i.e., , that satisfy (1). In (8), the choice of each EU affects the choice of other EUs in choosing their suitable selling price due to the presence of (1). Hence, the proposed CCG can be considered as a variational inequality problem [47], in which the choice of strategies of multiple players are coupled through (1). Hence, variational equilibrium, which is the solution concept of variational inequality problems, can be presumed as the solution of the proposed CCG . For the rest of the paper, we will use the term cake cutting solution (CCS) to refer to a variational equilibrium of the proposed CCG .

III-C Properties of CCS

In this section, we investigate the properties of the CCS. In particular, we determine whether there exists a socially optimal CCS of the proposed CCG . Essentially, a socially optimal solution maximizes the total benefit to all the EUs in the smart grid, and thus is suitable for allocation of in order to maximize the overall system benefit.

Theorem 1.

There exists a socially optimal CCS of the proposed CCG between the EUs in the smart grid.

Proof.

First we note that the proposed CCG is a variational inequality problem as we have mentioned earlier. Therefore, the CCG can be defined as , which can be used to determine a vector such that [48]. Here,

| (10) |

and is the vector of all strategies of all EUs in the network. The solution of the is the CCS. Now, the pseudo-gradient of the benefit function (4) is [48]

| (11) |

whose Jacobean is

| (12) |

In (12), for is always positive. Now, by considering the leading principal minor of the leading principal sub-matrix888The order principal sub-matrix can be obtained by deleting the last rows and last columns from a matrix . , it can be shown that is always positive, i.e., and so on. Therefore, is positive definite on , and thus is strictly monotone. Hence, possesses a unique CCS [47]. Furthermore, due to the presence of the joint constraint (1), the CCS is also the unique global maximizer of (4) [47], which subsequently proves that the CCS is the socially optimal solution of the proposed CCG . ∎

Whereas the CCG is shown to have a socially optimal solution, in order to divide the budget among the EUs in an efficient manner it is also necessary that the budget should be Pareto optimal. We note that in a Pareto efficient allocation no EU can change its strategy without hurting at least one another EU in the network. Therefore, if the allocation is both socially and Pareto optimal, the allocation of price per unit of energy between different EUs will be fair and envy-free. To this end, first we note that the social optimality of the CCS has already been shown in Theorem 1. Therefore, according to Property 4 in Section III-A, demonstrating the existence of a complete allocation of price between the EUs will subsequently establish the Pareto optimality of the CCS.

Now, due to the coupled constraint (1), the Karush-Kuhn-Tucker (KKT) condition, using the method of Lagrange multipliers [49], for the EU ’s choice on in (4) can be defined as [47]

| (13) |

and

| (14) |

Here, is the Lagrange multiplier for EU . It is important to note that if any strictly monotone variational inequality problem constitutes a CCS such as the proposed case (according to Theorem 1), the multiplier possesses the property [47]. As a consequence, it is clear from Theorem 1 and (14) that for the proposed CCG the total allocation of budget between the EUs is equal to , i.e., . Thus, the allocation is complete, and consequently the CCS of the proposed CCG is Pareto optimal.

Remark 1.

Since, the solution of the CCG possesses a solution, which is both socially and Pareto optimal, the allocation of price per unit of energy between different EUs will be fair and envy-free999Such an envy-free property allows each EU to trade its surplus energy with the SFC without envying other EUs in the network for the payments they receive, and thus ensures market transparency despite price discrimination and consequently enables such an energy trading market to be sustained..

Another important characteristic of the decision making process of a EU concerning its choice of a price per unit of energy can be explained from (13). Since, ,

| (15) |

Thus, an EU with higher energy surplus and/or higher sensitivity to the choice of price needs to choose a relatively smaller price per unit of energy compared to EUs with lower surplus and/or lower sensitivity in order to reach the socially and Pareto optimal CCS if the proposed CCG is adopted.

III-D Algorithm

Now, to design an algorithm for the EUs to reach the desired solution of the CCG , we first note that the proposed game is a strictly monotone variational inequality problem. Therefore, the CCS can be attained by solving the game through an algorithm, which is suitable for solving a monotone variational inequality problem. To this end, we propose to use the S-S method [50], which is shown to be effective to solve monotone variational inequality problems in [15], to solve the proposed CCG . Essentially, the S-S method used in this paper is a hyperplane projection method that requires two-way communications between EUs and the SFC in the network to reach the CCS. A geometrical interpretation is used where two projections per iteration are required. For instance, let be the current approximation of the solution of . Then, first the projection is computed101010Projection [15]. and a point is searched for in the line segment between and such that the hyperplane strictly separates from the solution of the problem. Then, once is constructed, is computed in iteration by projecting onto the intersection of the feasible set with hyperspace , which contains the solution set.

![[Uncaptioned image]](/html/1512.03485/assets/x3.png)

The proposed algorithm is initiated with the announcement of a total budget by the SFC to buy electricity from the connected EUs. The SFC can set the budget using any statistical technique such as a Markov chain model based on historical budget data sets [51]. Upon receiving the information about the budget and determining its own requirement, each EU decides the amount of energy that it wants to sell and submits it to the SFC. Once, the budget is set and the surplus of each EU is determined, all the EUs participate in the proposed CCG through Algorithm 1 and reach the optimal price vector, i.e., the CCS , for selling their surplus energy to the SFC. The details of the algorithm in shown in 1.

Proposition 1.

The algorithm proposed in Algorithm 1 is always guaranteed to reach the CCS of the proposed CCG .

Proof.

To prove Proposition 1, first we note that the S-S method is based on a hyperplane projection technique [48], which is always guaranteed to converge to a non-empty solution if the variational inequality problem is strictly monotone [47]. It is proven in Theorem 1 that the proposed CCG is strictly monotone over the choice of . Therefore, the proposed Algorithm 1 is guaranteed to always reach a non-empty CCS, and thus Proposition 1 is proved. ∎

Note: Please note that the proposed game is a static game and therefore does not consider the effect of the change of parameters across different time slots. Here, we consider a single time instant and keep the entire focus of the study on investigating how the considered energy trading scheme can be conducted in an envy-free environment so as to achieve a socially optimal solution by using the proposed price discrimination technique. Once such price discrimination is established, extending the proposed work to a time-varying environment is an interesting topic for future work. Note that the electricity price in real-time pricing schemes is decided differently at different times of the day based on the conditions of several parameters such as the demand, electricity generation, and the reserve of energy in the system. Therefore, the proposed scheme has the potential to be incorporated into such a real-time pricing scheme, in which the energy controller may decide to adopt the price discrimination at a particular time of the day, whenever it seems beneficial.

IV Case Study

To show the effectiveness of the proposed scheme, we consider an example in which a number of EUs with energy surplus are participating in supplying energy to the SFC in a time of interest. The energy surplus of each EU to supply to the SFC is assumed to be a uniformly distributed random variable in the range kWh [15]. The target per unit price for all is assumed to be cents, which is in fact equal to the grid’s selling price [21]. This value is based on the rationality assumption of the EUs where each EU is willing to charge the SFC as much as the grid for selling its energy. The budget of the SFC is considered to be cents, which is chosen to maintain the condition throughout the simulation process. Further, the choice of is also chosen such that the price for any EU does not go below the grid’s buying price cents/kWh [21]. This is necessary to ensure that all EUs are interested in selling to the SFC instead of to the grid. The sensitivity parameter is chosen randomly from the range . Thus, a consumer with is least sensitive to its choice of price whereas consumers with sensitivity are considered to be strictly constrained to the price choice. Nevertheless, it is important to note that all parameters used in this study are particular for this example only and may vary according to the needs of the SFC, weather conditions, time of day/year and the energy policy of the particular country.

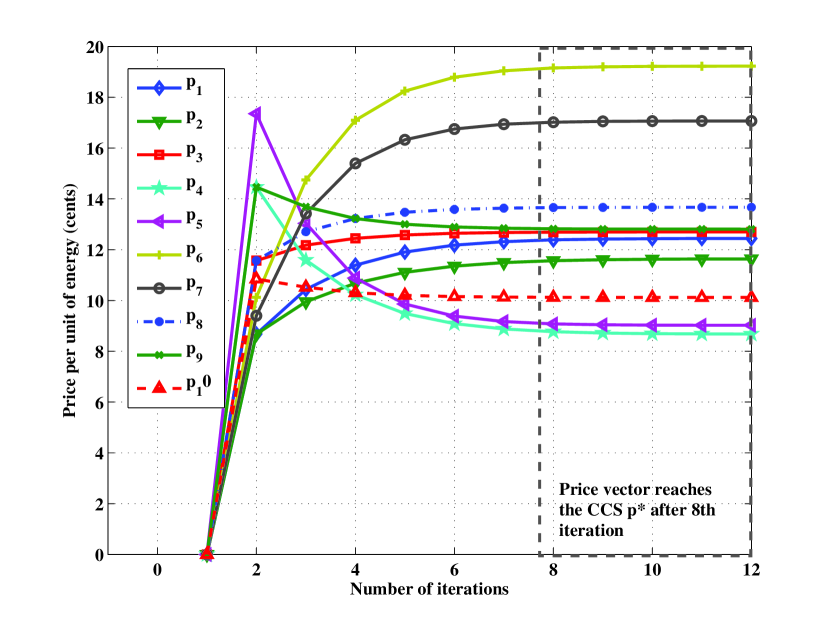

To that end, in Fig. 3, we first show how the proposed game with EUs converges to its CCS solution when we adopt Algorithm 1. Firstly, according to this figure, the choice of price of each of the participating EUs reaches its CCS after the iteration of the algorithm. Hence, the speed of the algorithm is reasonable. Secondly, different EUs determine different prices to pay to the SFC for energy trading, which is mainly due to the way that the pricing scheme is designed. Note that although the target price per unit of energy is considered similar for all EUs, the energy surpluses available to them are different. Also, different EUs have differing sensitivity to the pricing policy. As a consequence, once the CCG reaches the CCS, the socially optimal price vector constitutes a different price per of unit energy for each EU as demonstrated in Fig. 3.

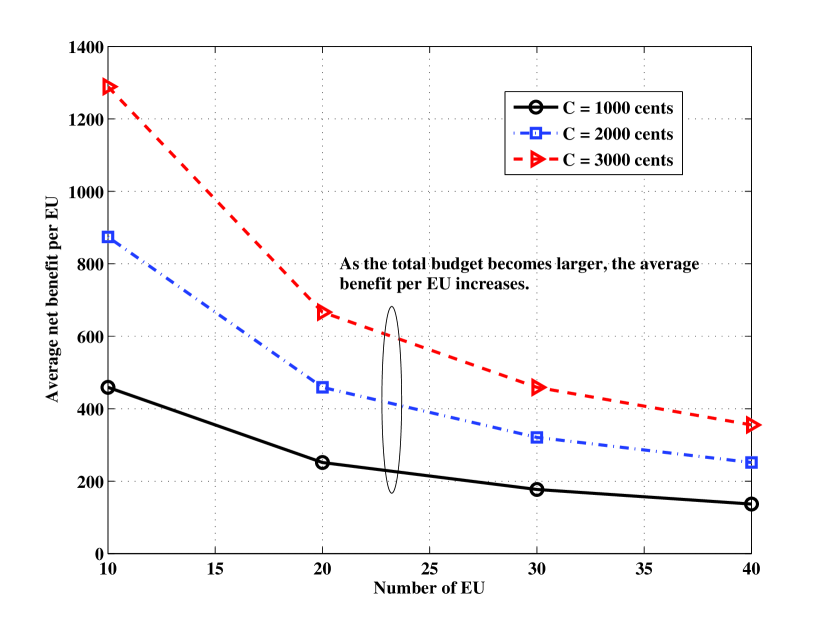

It is important to note that the outcome of the proposed CCG is significantly affected by the size of the cake of the game, i.e., the total budget available to the SFC, and the number of participating EUs that are sharing the cake between them through choosing a suitable price per unit of energy. Now, to show the effect of the number of EUs that are sharing the budget of the SFC through the proposed CCG , we consider an example where four different of EUs are sharing the SFC’s budget in order to maximize their net benefits by choosing a suitable price per unit of energy. The graphical representation of this considered study is shown in Fig. 4. We change the number of EUs from to with an increment of , and show the average net benefits achieved by each EU of each respective case in the figure. According to Fig. 4, first we note that as the number of EUs increases, the average benefit achieved by each EU decreases due to sharing the same budget of the SFC. For instance, as the number of EUs increases from to , the average benefit for sharing cents by choosing a suitable price per unit of energy decreases from to , which is around a decrement. Essentially, more EUs taking part in energy management enables each EU to take a smaller share of the budget, which subsequently reduces their benefits in energy trading with the same total budget.

![[Uncaptioned image]](/html/1512.03485/assets/x6.png)

Another interesting aspect that can be noticed from the effect of the SFC’s budget on the overall energy trading scheme is that the same budget may not be suitable to encourage all the EUs from EU groups of different sizes to trade their energy with the SFC. In this regard, we show the participation rate of EUs from different sizes of EU groups in Table II. It is assumed that if the price per unit of energy that an EU charges the SFC for selling its energy falls below , which is considered to be cents/kWh for this particular case study, it does not participate in energy trading. This is due to the fact that, as explained in Section II, the expected return from selling energy for the EU becomes very small. Now, according to Table II, for a similar budget of the SFC, the participation rate of EUs reduces considerably as the number of EUs in a group increases. For instance, for a budget of cents, EU participation is observed from a group of EUs, whereby the participation rate decreases to , and respectively for EU group size of and . Nonetheless, by increasing the budget , the SFC can encourage more EUs to be involved in the energy trading with the SFC and can reduce its total cost of energy trading. Thus, as shown in Table II, the proposed scheme can essentially assist the SFC in deciding on its budget with a view to increase participation, if appropriate, with the SFC.

Remark 2.

It is important to note from the above discussion in Fig. 4 and Table II that a suitable choice of the SFC’s budget is critical to successful adaptation of energy management in the community through the proposed CCG as this may possibly affect the average net benefit per EU as well as the total cost incurred by the SFC. The proposed scheme has the potential to assist the SFC in deciding on its budget in order to encourage more EUs, if feasible, to take part in energy trading with the SFC.

![[Uncaptioned image]](/html/1512.03485/assets/x7.png)

Furthermore, the choice of price and consequently the obtained net benefit by each EU is also affected by its sensitivity parameter , which we show in Table III. For this case, we assume that all EUs in the system are equally sensitive to their chosen price per unit of energy, i.e., they have the same , whereby their available surpluses to sell to the SFC are different as in previous examples. We consider five sensitivity parameters including and , where refers to the case when the EUs are insensitive to the choice of price per unit of energy and indicates maximum sensitivity of the EU. The average net benefit to the EU at is considered as the baseline and is used to compare how the average net benefit to the EUs varies as their sensitivity is altered in the system. As can be seen in Table III, the average net benefit to the EUs decreases as the sensitivity increases. For a budget of cents, for instance, as the sensitivity parameter increases from to , the average net benefit to the EU reduces by . In fact, as the sensitivity increases, the choice of price becomes more restricted for an EU, which consequently reduces its net benefit. A reduction in net benefit with increasing sensitivity is also observed for a budget of cents. However, for the higher budget, we find two modifications in terms of achieved average net benefit per EU. Firstly, the benefit per EU increases as the budget of the SFC increases, which is explained in Fig. 4. Secondly, the decrement of average net benefit per EU for different sensitivity parameters compared to is relatively lower for a larger budget. For example, as the sensitivity parameter increases from to , the average net benefit per EU reduces to for a budget of cents, whereas this reduction is for cents. This is due to the fact that although is considered the same for all EUs, the available surplus of each EU is different, which enables discriminate pricing. Now, based on the available surplus, each EU chooses its price per unit of energy, which increases for a larger budget (as shown in Fig. 4). As a consequence, the difference between net benefits reduces at a higher budget compared to the case of a lower budget.

Having demonstrated some properties of the proposed discriminate pricing scheme, we now show how the proposed scheme can be beneficial to both the EUs and the SFC compared to the traditional case when both parties trade their energy with the grid. To show this comparison, we assume that the selling and buying prices per unit of energy set by the grid are and cents per kWh as discussed earlier in this section. To this end, we first consider in Table IV how much energy the SFC can buy within its budget if it only buys from the grid, compared to the case in which the SFC buys from the users through the proposed scheme. Then, in Table V, we show the total monetary benefit EUs can attain if they choose to sell their surplus to the SFC instead of selling the surplus to the grid.

![[Uncaptioned image]](/html/1512.03485/assets/x8.png)

In Table IV, we show the amount of energy that an SFC can buy from EUs if the proposed scheme is adopted as the SFC changes its budget from cents to and then cents. We note that as the SFC increases its budget, more EUs would be interested in taking part in energy trading with the SFC (e.g., as shown in Table II), which subsequently increases the amount of energy that the SFC can obtain from the participating EUs. A similar increment in purchasing energy is also observed in the case when the SFC buys its energy from the main grid. However, for each budget, the energy that the SFC can buy from the EUs is considerably larger than the amount that the SFC can buy from the grid. For instance, for a budget of cents, the SFC can buy kWh more energy through the proposed scheme compared to buying exclusively from the grid. This is due to the fact that the grid price is generally very high [35]. Hence, for a fixed budget , the SFC can buy relatively smaller amounts of energy from the grid. As a consequence, the SFC manages to buy considerably more energy with the same budget. This phenomenon is observed for all considered SFC’s budgets as shown in Table IV.

![[Uncaptioned image]](/html/1512.03485/assets/x9.png)

In Table V, we show how the participating EUs in the proposed scheme can benefit in terms of total revenue that they can receive from trading their surplus energy to the SFC compared to selling to the grid. To this end, we first note that the proposed energy scheme through CCG is complete as discussed in Section III-B. Therefore, the total revenue that the participating EUs receive, for , and EUs in the network, becomes equal to the considered budgets of , , and cents respectively. By contrast, as the EUs trade their energy with the grid the total revenue reduces significantly because of the lower buying price per unit of energy from the grid. For example, as EUs participating in the CCG , the total revenue that they receive is equal to the cents budget of the SFC. Nonetheless, as the EUs trade their energy with the main grid, due to a lower per unit price of cents/kWh, the total revenue that the participating EUs receive reduces to cents, which is cents less than the proposed scheme for the considered system parameters. The performance improvement for the proposed case is better for higher numbers of EUs in the network.

Remark 3.

It is clear from Table IV and Table V that the proposed scheme is beneficial for both the SFC and the participating EUs in the smart grid network for the system parameters considered in the given case studies. Hence, the proposed scheme has the potential to be adopted in practical systems in order to benefit all participating entities.

V Conclusion

This paper has demonstrated a viable method to discriminate price per unit of energy between different energy users in a smart grid system when the EUs sell their surplus energy to a shared facility controller. A cake cutting game has been proposed to leverage the generation of discriminate pricing within a constrained budget of the SFC. To study the fairness of the proposed scheme, it has been shown that the CCG can be modeled as a variational inequality problem that possesses the solution of the game, i.e., the cake cutting solution. The properties of the CCS have been studied and the existence of a socially optimal solution, which is also Pareto optimal, has been validated. An algorithm has been proposed that can be adopted by each EU interacting with the SFC in a distributed manner and the convergence of the algorithm to the optimal CCS has been confirmed. Finally, the properties of the game have been studied, and the advantages of discriminate pricing for both the SFC and the EUs have been demonstrated via simple comparisons with energy trading with the main grid.

An important extension of the proposed scheme would be to establish a relationship between the budget of the SFC and the total number of EUs participating in the energy trading with a view to enabling efficient price discrimination, e.g., by using an interactive Stackelberg game with imperfect information of the total budget. Another potential extension is to conduct studies that determine when such a discriminate pricing technique can be used as a real-time pricing scheme. In addition, extending the proposed scheme to a time-varying environment is another interesting topic for future work.

References

- [1] X. Fang, S. Misra, G. Xue, and D. Yang, “Smart grid - The new and improved power grid: A survey,” IEEE Commun. Surveys Tuts., vol. 14, no. 4, pp. 944–980, Oct. 2012.

- [2] Y. Cao, T. Jiang, and Q. Zhang, “Reducing electricity cost of smart appliances via energy buffering framework in smart grid,” IEEE Trans. Parallel Distrib. Syst., vol. 23, no. 9, pp. 1572–1582, Sep. 2012.

- [3] L. Yu, T. Jiang, and Y. Cao, “Energy cost minimization for distributed internet data centers in smart microgrids considering power outages,” IEEE Trans. Parallel Distrib. Syst., vol. 26, no. 1, pp. 120–130, Jan. 2015.

- [4] W. Tushar, C. Yuen, B. Chai, D. B. Smith, and H. V. Poor, “Feasibility of using discriminate pricing schemes for energy trading in smart grid,” in Proc. IEEE Global Communications Conference (GLOBECOM), Austin, TX, Dec. 2014, pp. 1–7.

- [5] P. Yi, X. Dong, A. Iwayemi, C. Zhou, and S. Li, “Real-time opportunistic scheduling for residential demand response,” IEEE Trans. Smart Grid, vol. 4, no. 1, pp. 227–234, Feb. 2013.

- [6] H. Asano, S.Sagai, E. Imamura, K. Ito, and R. Yokoyama, “Impacts of time-of-use rates on the optimal sizing and operation of cogeneration systems,” IEEE Trans. Power Syst., vol. 7, no. 4, pp. 1444–1450, 1992.

- [7] S. de la Torre, J. Arroyo, A. Conejo, and J. Contreras, “Price maker self-scheduling in a pool-based electricity market: A mixed-integer lp approach,” IEEE Trans. Power Syst., vol. 17, no. 4, pp. 1037–1042, 2002.

- [8] T. Jiang, Y. Cao, L. Yu, and Z. Wang, “Load shaping strategy based on energy storage and dynamic pricing in smart grid,” IEEE Trans. Smart Grid, vol. 5, no. 6, pp. 2868–2876, Nov 2014.

- [9] K. Ma, G. Hu, and C. Spanos, “Distributed energy consumption control via real-time pricing feedback in smart grid,” IEEE Trans. Control Syst. Technol., vol. 22, no. 5, pp. 1907–1914, Sept 2014.

- [10] J. H. Yoon, R. Baldick, and A. Novoselac, “Dynamic demand response controller based on real-time retail price for residential buildings,” IEEE Trans. Smart Grid, vol. 5, no. 1, pp. 121–129, Jan 2014.

- [11] C. Wan, Z. Xu, Y. Wang, Z. Y. Dong, and K. P. Wong, “A hybrid approach for probabilistic forecasting of electricity price,” IEEE Trans. Smart Grid, vol. 5, no. 1, pp. 463–470, Jan 2014.

- [12] P. Wang, H. Zareipour, and W. Rosehart, “Descriptive models for reserve and regulation prices in competitive electricity markets,” IEEE Trans. Smart Grid, vol. 5, no. 1, pp. 471–479, Jan 2014.

- [13] M. Rahimiyan, L. Baringo, and A. Conejo, “Energy management of a cluster of interconnected price-responsive demands,” IEEE Trans. Power Syst., vol. 29, no. 2, pp. 645–655, March 2014.

- [14] Z. Y. Xu, W. S. Xu, W. H. Shao, and Z. Y. Zeng, “Real-time pricing control on generation-side: Optimal demand-tracking model and information fusion estimation solver,” IEEE Trans. Power Syst., vol. 29, no. 4, pp. 1522–1535, July 2014.

- [15] W. Tushar, J. A. Zhang, D. B. Smith, H. V. Poor, and S. Thiébaux., “Prioritizing consumers in smart grid: A game theoretic approach,” IEEE Trans. Smart Grid, vol. 5, no. 3, pp. 1429–1438, May 2014.

- [16] Y. Liu, C. Yuen, S. Huang, N. U. Hassan, X. Wang, and S. Xie, “Peak-to-average ratio constrained demand-side management with consumer’s preference in residential smart grid,” IEEE J. Sel. Topics Signal Process., vol. 8, no. 6, pp. 1084–1097, Dec. 2014.

- [17] N. U. Hassan, M. A. Pasha, C. Yuen, S. Huang, and X. Wang, “Impact of scheduling flexibility on demand profile flatness and user inconvenience in residential smart grid system,” Energies, vol. 6, no. 12, pp. 6608–6635, Dec. 2013.

- [18] Y. Liu, C. Yuen, N. U. Hassan, S. Huang, R. Yu, and S. Xie, “Electricity cost minimization for a microgrid with distributed energy resources under different information availability,” IEEE Trans. Ind. Electron., vol. 62, no. 4, pp. 2571–2583, Apr. 2015.

- [19] N. U. Hassan, Y. I. Khalid, C. Yuen, and W. Tushar, “Customer engagement plans for peak load reduction in residential smart grids,” IEEE Trans. Smart Grid, vol. 6, no. 6, pp. 3029–3041, Nov. 2015.

- [20] N. U. Hassan, Y. I. Khalid, C. Yuen, S. Huang, M. A. Pasha, K. L. Wood, and S. G. Kerk, “Framework for minimum user participation rate determination to achieve specific demand response management objectives in residential smart grids,” Elsevier nternational Journal of Electrical Power & Energy Systems, vol. 74, pp. 91–103, Jan. 2016.

- [21] W. Tushar, B. Chai, C. Yuen, D. B. Smith, K. L. Wood, Z. Yang, and H. V. Poor, “Three-party energy management with distributed energy resources in smart grid,” IEEE Trans. Ind. Electron., vol. 62, no. 4, pp. 2487–2498, Apr. 2015.

- [22] W. Tushar, W. Saad, H. V. Poor, and D. B. Smith, “Economics of electric vehicle charging: A game theoretic approach,” IEEE Trans. Smart Grid, vol. 3, no. 4, pp. 1767–1778, Dec 2012.

- [23] J. Bartash, “This is the only major u.s. industry cutting jobs,” August 7 2015, Capitol Report, Available:http://www.marketwatch.com/story/this-is-the-only-major-us-industry-cutting-jobs-2015-08-07?mod=MW_story_recommended_default&Link=obnetwork.

- [24] E. Yudovina and G. Michailidis, “Socially optimal charging strategies for electric vehicles,” IEEE Trans. Autom. Control, vol. 60, no. 3, pp. 837–842, Mar. 2015.

- [25] J. Robinson, Economics of imperfect competitions. London: Macmillan, 1933.

- [26] R. Schmalensee, “Output and welfare implications of monopolistic third-degree price discrimination,” The American Economic Review, vol. 71, no. 1, pp. 242–247, Mar. 1981.

- [27] H. R. Varian, “Price discrimination and social welfare,” The American Economic Review, vol. 75, no. 4, pp. 870–875, Sep. 1985.

- [28] A. I. Czerny and A. Zhang, “Airport congestion pricing when airlines price discriminate,” Elsevier Transportation Research Part B: Methodological, vol. 65, pp. 77–89, July 2014.

- [29] M. Grennan, “Price discrimination and bargaining: Empirical evidence from medical devices,” Wharton School, University of Pennsylvania, pp. 1–53, Feb. 2012, available at SSRM:http://ssrn.com/abstract=1721145.

- [30] I. Hendel and A. Nevo, “Intertemporal price discrimination in storable goods markets,” The American Economic Review, vol. 103, no. 7, pp. 2722–2751, Dec. 2013.

- [31] S. Cowan, “Third-degree price discrimination and consumer surplus,” The Journal of Industrial Economics, vol. 60, no. 2, pp. 333–345, June 2012.

- [32] K. Tsakalozos, H. Kllapi, E. Sitaridi, M. Roussopoulos, D. Paparas, and A. Delis, “Flexible use of cloud resources through profit maximization and price discrimination,” in IEEE International Conference on Data Engineering (ICDE), Hannover, Germany, Apr. 2011, pp. 75–86.

- [33] Wholesale Solar, “Grid-tied solar power systems with battery,” website, 2012, http://www.solarchoice.net.au/blog/which-electricity-retailer-is-giving-the-best-solar-feed-in-tariff/.

- [34] SolarRay, “Grid-tie package systems without batteries,” website, 2015, http://www.solarray.com/CompletePackages/Grid-Tie-No-BatteriesT.php.

- [35] E. McKenna and M.Thomson, “Photovoltaic metering configurations, feed-in tariffs and the variable effective electricity prices that result,” IET Renewable Power Generation, vol. 7, no. 3, pp. 235–245, May 2013.

- [36] DEWS, “Current electricity prices,” June 2015, Queensland Government: Department of Energy and Water Supply, Available:https://www.dews.qld.gov.au/energy-water-home/electricity/prices/current-prices.

- [37] SolarMatters, “Feed-in tariff for grid connected solar power system,” 2015, Solar Matters, Australia, Available:http://www.energymatters.com.au/rebates-incentives/feedintariff/#queensland .

- [38] Z. Fan, “Distributed demand response and user adaptation in smart grids,” in Proc. IFIP/IEEE International Symposium on Integrated Network Management, Dublin, Ireland, May 2011, pp. 726–729.

- [39] P. Samadi, A.-H. Mohsenian-Rad, R. Schober, V. Wong, and J. Jatskevich, “Optimal real-time pricing algorithm based on utility maximization for smart grid,” in Proc. IEEE Int’l Conf. Smart Grid Commun. (SmartGridComm), Gaithersburg, MD, Oct. 2010, pp. 415–420.

- [40] B. Chai, J. Chen, Z. Yang, and Y. Zhang, “Demand response management with multiple utility companies: A two-level game approach,” IEEE Trans. Smart Grid, vol. 5, no. 2, pp. 722–731, Mar. 2014.

- [41] Z. Han, D. Niyato, W. Saad, T. Başar, and A. Hjøorungnes, Game Theory in Wireless and Communication Networks. UK: Cambridge University Press, 2014.

- [42] T. Başar and R. Srikant, “Revenue-maximizing pricing and capacity expansion in a many-users regime,” in Proc. IEEE International Conference on Computer Communications, vol. 1, New York, NY, June 2002, pp. 294–301.

- [43] Y. Wang, W. Saad, Z. Han, H. V. Poor, and T. Başar, “A game-theoretic approach to energy trading in the smart grid,” IEEE Trans. Smart Grid, vol. 5, no. 3, pp. 1439–1450, May 2014.

-

[44]

M. Fahriog̃lu and F. L. Alvarado, “Designing cost effective demand

management contracts using game theory,” December 10 1998, Report PSerc,

Available:http://pserc.wisc.edu/documents/publications/papers/1998_general

_publications/reportmurat.pdf. - [45] F. Mármol, C. Sorge, O. Ugus, and G. Pérez, “Do not snoop my habits: preserving privacy in the smart grid,” IEEE Commun. Mag., vol. 50, no. 5, pp. 166–172, May 2012.

- [46] P. Bartal and I. Nagy, “Game theoretic approach for achieving optimum overall efficiency in DC/DC converters,” IEEE Trans. Ind. Electron., vol. 61, no. 7, pp. 3202–3209, July 2014.

- [47] F. Facchinei and C. Kanzow, “Generalized Nash equilibrium problems,” 4OR, vol. 5, no. 3, pp. 173–210, Sep. 2007.

- [48] D. Arganda, B. Panicucci, and M. Passacantando, “A game theoretic formulation of the service provisioning problem in cloud system,” in Proc. International World Wide Web Conference, Hyderabad, India, Apr. 2011, pp. 177–186.

- [49] D. Bertsekas, Nonlinear Programming. Belmont, MA, USA: Athena Scientific, 1995.

- [50] M. V. Solodov and B. S. Svaiter, “A new projection method for variational inequality problems,” SIAM J. Control Optim., vol. 37, pp. 767–776, 1999.

- [51] A. Shamshad, M. A. Bawadi, W. M. A. W. Hussin, T. A. Majid, and S. A. M. Sanusi, “First and second order Markov chain models for synthetic generation of wind data time series,” Energy, vol. 30, no. 5, pp. 693–708, Apr 2005.