A Stochastic Model of Order Book Dynamics using Bouncing Geometric Brownian Motions

Abstract

We consider a limit order book, where buyers and sellers register to trade a security at specific prices. The largest price buyers on the book are willing to offer is called the market bid price, and the smallest price sellers on the book are willing to accept is called the market ask price. Market ask price is always greater than market bid price, and these prices move upwards and downwards due to new arrivals, market trades, and cancellations. We model these two price processes as “bouncing geometric Brownian motions (GBMs)”, which are defined as exponentials of two mutually reflected Brownian motions. We then modify these bouncing GBMs to construct a discrete time stochastic process of trading times and trading prices, which is parameterized by a positive parameter . Under this model, it is shown that the inter-trading times are inverse Gaussian distributed, and the logarithmic returns between consecutive trading times follow a normal inverse Gaussian distribution. Our main results show that the logarithmic trading price process is a renewal reward process, and under a suitable scaling, this process converges to a standard Brownian motion as . We also prove that the modified ask and bid processes approach the original bouncing GBMs as . Finally, we derive a simple and effective prediction formula for trading prices, and illustrate the effectiveness of the prediction formula with an example using real stock price data.

Keywords: Order book dynamics; Geometric Brownian motions; Reflected Brownian motions; Mutually reflected Brownian motions; Inverse Gaussian distributions; Normal inverse Gaussian distributions; Renewal reward processes; Diffusion approximations; Scaling limits.

1 Introduction

In a modern order-driven trading system, limit-sell and limit-buy orders arrive with specific prices and they are registered in a limit order book (LOB). The price at which a buyer is willing to buy is called the bid price and the price at which a seller is willing to sell is called the ask price. The order book organizes the orders by their prices and by their arrival times within each price. The highest bid price on the book is called the market bid price, and the lowest ask price on the book is called the market ask price. In contrast to the limit orders, market orders have no prices: a market buy order is matched and settled against the sell order at the market ask price and a market sell order is matched and settled against the buy order at the market bid price. (We are ignoring the sizes of the orders in this simplified discussion.) When the market bid price equals the market ask price, a trade occurs, and the two matched traders are removed from the LOB. Thus immediately after the trade the market bid price decreases and the market ask price increases. Clearly the market ask price is always above the market bid price. Between two trading times, the market ask and bid prices fluctuate due to new arrivals, cancellations, market trades, etc.

There is an extensive literature on models of LOBs, including statistical analysis and stochastic modeling. In particular, Markov models have been developed in [2, 3, 14, 12, 13, 16, 17, 22], to name a few. In such models, point processes are used to model arrival processes of limit and market orders, and the market bid and ask prices are formulated as complex jump processes. To simplify such complexity, one tries to develop suitable approximate models. Brownian motion type approximations are established, for example, in [2, 3, 12], and law of large numbers is recently studied in [16, 17].

It is clear that the stochastic evolution of the market ask and bid prices is a result of a complex dynamics of the trader behavior and the market mechanism. It makes sense to ignore the detailed dynamics altogether and directly model the market ask and bid prices as stochastic processes. We let and be the market ask and bid prices at time , respectively, and model and as two stochastic processes with continuous sample paths that bounce off of each other as follows. Initially . Intuitively, we assume that the market bid and ask prices evolve according to two independent geometric Brownian motions (GBMs), and bounce off away from each other whenever they meet. Hence we call this the “bouncing GBMs” model of the LOB. To the best of our knowledge, this is the first time such a model is used to describe the dynamics of the market ask and bid price processes in the LOB.

Bouncing GBMs can be constructed from bouncing BMs (the detailed construction is given Section 2). Bouncing BMs have been studied by Burdzy and Nualart in [10], and a related model of bouncing Brownian balls has been studied by Saisho and Tanaka in [25]. Of these two papers, the one by Burdzy and Nuaalart is most relevant to our model. They study two Brownian motions in which the lower one is reflected downward from the upper one. Thus the upper process is unperturbed by the lower process, while the lower process is pushed downward (by an appropriate reflection map) when it hits the upper process. We use a similar construction in our bouncing GBM model, except that in our case both processes reflect off of each other in opposite directions whenever they meet. We assume that the reflection is symmetric, which will be made precise in Section 2.

We would like to say that a transaction occurs when the market ask price process meets the market bid price process, and the transaction price is the level where they meet. Unfortunately, the bouncing GBMs will meet at uncountably many times in any finite interval of time. This will create uncountably many transactions over a finite interval of time, which is not a good model of the reality. In reality, transactions occur at discrete times. Denote by the -th transaction time, and the price at which the -th transaction is settled. We are interested in studying the discrete time process . To define this correctly and conveniently, we assume a price separation parameter , and construct two modified market ask and bid price processes and from the bouncing GBMs and . One can think of as representing the tick size of the LOB, typically one cent. The construction of and enables us to define a discrete time stochastic process of transaction prices and times. The precise definitions of and are given in Section 3.

We show that the inter-trading times follow an inverse Gaussian (IG) distribution, and the logarithmic return between consecutive trading times follow a normal inverse Gaussian (NIG) distribution. We then formulate the logarithmic trading price process as a renewal reward process in terms of inter-trading times and successive logarithmic returns. It is worth noting that is typically small, and in the numerical example in Section 6, Finally, our main result shows that under a suitable scaling, the logarithmic trading price process converges to a standard Brownian motion as . We also study the limit of the modified market ask and bid price processes as , which is exactly the original bouncing GBMs . Using these asymptotics, we derive a simple and effective prediction formulas for trading prices.

It is interesting to see that we get an asymptotic GBM model for the trading prices in the limit. The GBM model captures the intuition that the rates of returns over non-overlapping intervals are independent of each other, and has been extensively used to model stock prices since the breakthrough made by Black and Scholes [5] and Merton [23]. Another interesting observation is the logarithmic returns between consecutive trading times are NIG distributed. In fact, empirical studies show that logarithmic returns of assets can be fitted very well by NIG distributions (see [6, 7, 24]) and Barndorff-Nielsen proposed NIG models in [8]. Thus our model of bouncing GBMs provides another justification for the GBM model of trading prices.

The rest of the paper is organized as follows. In Section 2, we introduce our model of bouncing GBMs in details. In Section 3 we construct the modified market ask and bid processes and the price-transaction process. All the main results about the distributions of transaction times and prices, and the limiting behaviors are summarized in Section 4. In Section 5, the estimators of the model parameters are derived using the method of moments. In Section 6, we use asymptotic GBM model obtained in Section 4 for trading prices, from which we derive a simple and effective forecasting formula. We also apply the formula to real data, and show that the estimated parameter is indeed very small, and hence the asymptotic results are applicable, and work very well over short time horizons. Finally, all proofs are given in Appendix.

2 Market ask and bid prices

We consider a trading system, where buyers and sellers arrive with specific prices. Recall that the market bid price is the largest price at which buyers are willing to buy, and the market ask price is the smallest price at which sellers are willing to sell. The market ask price cannot be less than the market bid price, and a trade occurs when the market bid and ask prices are matched. We will model the market bid and ask prices as bouncing GBMs, which are defined as exponentials of mutually reflected Brownian motions (BMs). More precisely, let and denote the market ask and bid prices at time , and assume that . For , define

| (2.1) | ||||

| (2.2) |

where are independent standard BMs independent of and , and and are the drift and variance parameters. We assume that We first define a pair of mutually reflected BMs as follows. For , define

| (2.3) | ||||

| (2.4) |

where is the unique continuous nondecreasing process such that

-

(i)

;

-

(ii)

for all ;

-

(iii)

can increase only when , i.e.,

The existence and uniqueness of are from Skorohod lemma (see [20, Lemma 3.6.14]). In fact, has the following explicit formula

| (2.5) |

where for Rougly speaking, the processes and behave like two independent BMs when , and whenever they meet, the process will be pushed up, while will be pushed down, to make for all . Here we assume the pushing effect for and are the same, and thus we have before the regulator process in both (2.3) and (2.4).

Finally, and are defined as

| (2.6) | ||||

| (2.7) |

Thus and behave like two independent GBMs when , and whenever they become equal, they will be pushed away from each other such that for all .

One important quantity is the ratio , which could reflect the ask-bid spread. We note that

From (2.5), is a reflected Brownian motion (RBM). It is well known that a RBM with mean and variance has the following transient cumulative distribution function (CDF) (see Section 1.8 in [15]). For

| (2.8) |

where is the CDF of the standard normal distribution. Thus for , the ratio has the following CDF. Assuming and are deterministic constants, for ,

Consequently, under the condition that , the stationary distribution of is power-law distributed with density function

| (2.9) |

It is interesting to see that only stationary moments of order less than are finite. For finite , a simple description of the -th moment of with is presented in the following lemma, the proof of which is provided in Appendix.

Lemma 2.1.

Assume . Then for ,

| (2.10) |

where

is the CDF of the first-passage-time of from to .

Note that , and so is finite only when . This result is consistent with the moments of the power law distribution in (2.9), and indeed one can easily check that when ,

| (2.11) |

where is a random variable with density function (2.9). Other performance analysis can be done by computing the joint distribution of . However, it is nontrivial to obtain a simple description of the transient behavior of Thus we would like to investigate such problems in a separate paper.

3 Trading times and prices

Assuming that , the first trading time is defined to be the first time that the market ask and bid prices become equal, and we would like to define the th trading time to be the th time the two prices become equal. However, the zero set is uncountably infinite, and we cannot define the th trading time as conveniently as the first one. Also note that in practice every time the market ask and bid prices become equal, they will separate from each other by at least one cent. Thus we consider the following modified market ask and bid price processes and , where the positive constant represents the tick size. We then use and to define the trading times and trading prices. More precisely, let be a strictly positive constant, and recall that and are the initial values of the market ask and bid price processes and , and and are two independent BMs defined in (2.1) and (2.2). For , define the following stopping times: , and

| (3.1) |

Then and almost surely as . We next define the modified market ask and bid price processes. For

| (3.2) | ||||

| (3.3) |

Thus the first trade occurs at , which is the first time the modified market ask and bid prices become equal, and the first trading price is defined as

(Note that and don’t depend on if the initials and are independent of .) Right after the first trade occurs, the market ask and bid prices will separate in the following way.

Starting from , the processes and evolves as two independent GMB’s with initial values and until they meet again at . Recursively, for , the stopping time will be the th meeting time of and , and the th trading price is defined as

| (3.4) |

and the modified market ask and bid prices at move to

| (3.5) |

Right after , the processes and evolve as two independent GBMs with initials and until they meet again at The dynamics of the market ask and bid prices is shown in Figure 1.

The relationship between the modified market ask and bid prices and the original market ask and bid prices is summarized in the following proposition. Its proof can be found in Appendix. In particular, it shows that are also the meeting times of the original price processes and , and that converges to almost surely and uniformly on compact sets of as .

Proposition 3.1.

-

(i)

For and ,

-

(ii)

For and

-

(iii)

For

For convenience, we denote

We are interested in the evolution of the trading prices. Define for ,

| (3.6) |

which gives the number of trades up to time . Now the latest trading price can be formulated as

| (3.7) |

For , let , and so When , we simply let . Thus we have

| (3.8) |

with the convention that We will see in Lemma 4.5 that is a renewal reward process. Our goal is to establish a scaling limit theorem for as , and develop an asymptotic model for real financial data.

4 Main results

We present our main results in this section. In particular, it is shown that are i.i.d. random variables (see Lemma 4.1), and follows a NIG distribution and is IG distributed (see Corollary 4.3). Using these results, it is clear that is a renewal reward process, and the scaling limit theorem is established in Theorem 4.7. All the proofs are provided in Appendix.

4.1 Distribution of

We derive the joint distribution of for each in the following lemma. Note that doesn’t depend on if the intial values and are independent of .

Lemma 4.1.

-

(i)

Assume , and . For and we have

(4.1) In particular, follows IG distribution with the following density function

(4.2) and given , follows normal distribution with mean and variance .

-

(ii)

The sequence is an i.i.d. sequence, which is independent of and has the same distribution as in (i) with and

To derive the marginal distributions of , we introduce the following definitions of IG and NIG distributions (see [26]).

Definition 4.2.

-

(i)

An inverse Gaussian (IG) distribution with parameters and has density function

which is usually denoted by

-

(ii)

A random variable follows a normal inverse Gaussian (NIG) distribution with parameters with notation if

The density function of is given as

where is the modified Bessel function of the third kind with index .

Using the above definitions, we have the following conclusion on the marginal distributions of .

Corollary 4.3.

-

(i)

Assume , , and . Then

and

-

(ii)

For , and follow the same IG and NIG distributions as in (i) with and

Let be a generic random variable with the same joint distribution as . Next we find the moment generating function of , which will be used in the proof of Theorem 4.7 and Section 5.

Lemma 4.4.

There exists such that the moment generating function of exists for , and is given by

| (4.3) |

where is defined as follows.

| (4.4) |

In particular, the first two moments of are as given below:

Furthermore, for and , there exists some constant such that

| (4.5) |

4.2 Asymptotics of

In this section we study the behaviors of the process as either or . First from Corollary 4.3, it is clear that for each , is a renewal reward process, and we summarize it in the following lemma.

Lemma 4.5.

For , is a renewal reward process and is a semi-Markov process.

The next result from Brown and Solomon [9] characterizes the asymptotic first and second moments of as , and is also helpful to identify the proper scaling in Theorem 4.7.

Theorem 4.6 (Brown and Solomon [9]).

We have

| (4.6) |

where

| (4.7) |

and

| (4.8) |

where

| (4.9) |

Here is a function that converges to a finite constant as .

The main result is given in the following theorem. For , define

Theorem 4.7.

Assume that . Then the process converges weakly to a standard Brownian Motion as .

5 Parameter estimations

The process is observable, while may not be publicly observable. The market ask and bid processes may be accessible to the brokers and dealers, but not to common traders. The question becomes how to find the parameters of by observing . In this section we will estimate the parameters , , , and using the method of moments.

Suppose that the sample data for the th trading time and the th trading price are given for . Let

Then the sample data is given by . Let

We aim to derive explicit estimators of the five parameters , , , , using moment estimations. Define the estimators of , , , , as follows.

| (5.1) | ||||

where

For convinence, denote and Let be the differentiable function such that

Note that can be uniquely determined by (5.1) and has an explicit expression.

Lemma 5.1.

The estimators is well defined, i.e.,

| (5.2) |

and as

| (5.3) |

Furthermore, converges weakly to a five dimensional normal distribution with zero mean and covariance matrix , where is the covariance matrix of , and is the gradient of

6 Numerical examples

In this section we apply our model to the real data, with an aim to forecast the trading price movement over a short period. We develop an asymptotic GBM model for trading prices as follows. Given the sample data , we first estimate the parameters and as in (5.1), and use the estimators and to compute and by substituting with , respectively, in (4.7) and (4.9). Typically, the estimator is small (see Figures 6 - 9) and so from Theorem 4.7, we approximate by a random variable. Hence the prediction formula for is

and the upper and lower bounds are chosen to be

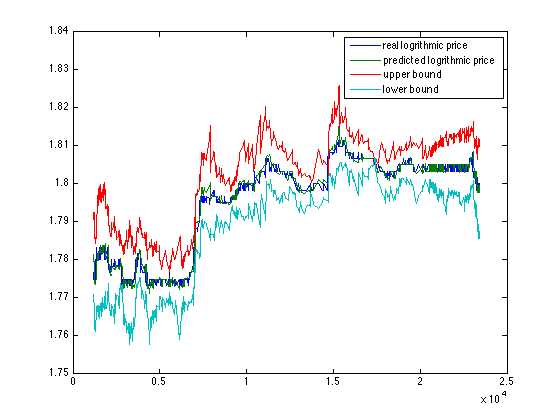

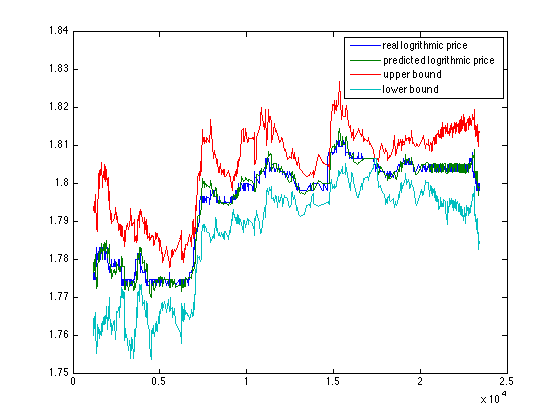

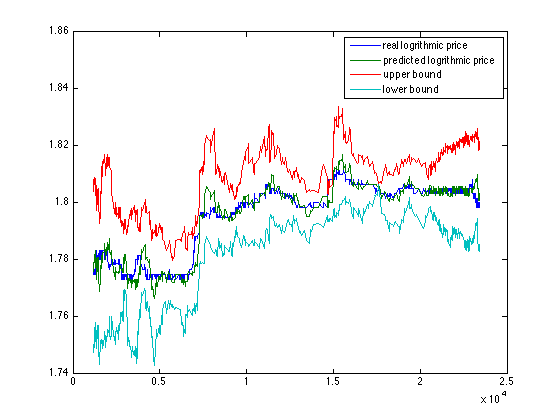

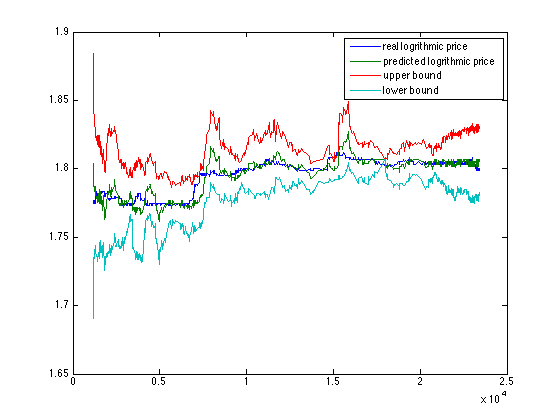

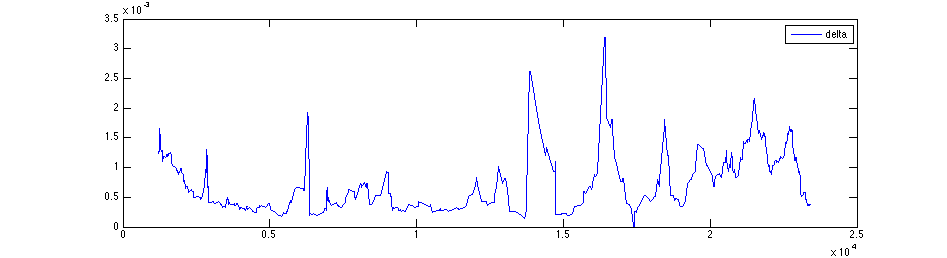

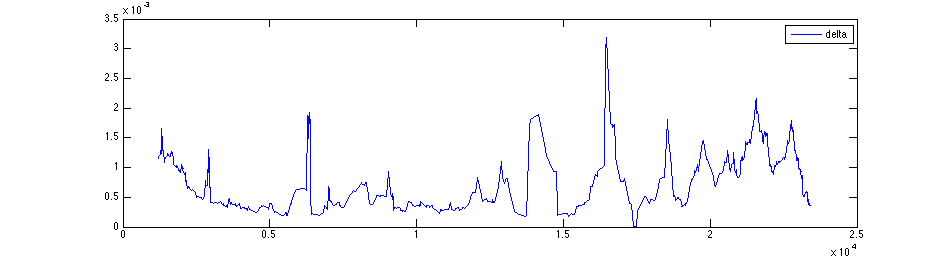

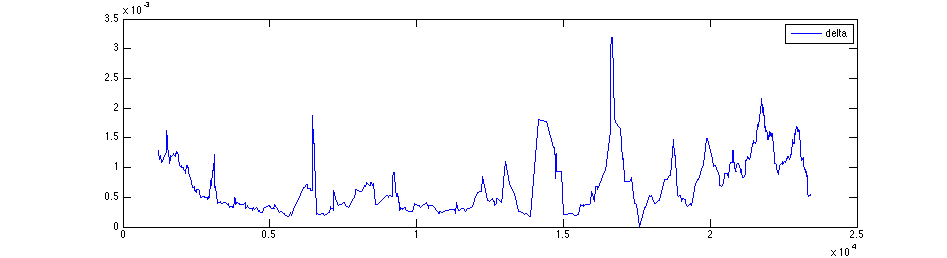

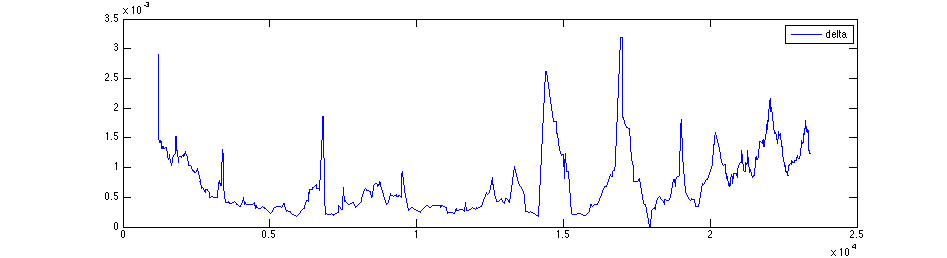

We next apply the above formulas to real data. Here we select the stock SUSQ (Susquehanna Bancshares Inc). The data is chosen from 01/04/2010 9:30AM to 01/04/2010 4:00PM, including the trading prices and trading times. The unit of trading prices is dollars and the unit of the difference of consecutive trading times is seconds. We perform the back test to evaluate the performance of the prediction. To be precise, we predict the logarithmic trading price at each trading time using the -minute data -minute before the trading time. For example, observing that there is a trade at 10:34:56, we then use the data from 10:23:56 to 10:33:56 to estimate the parameters and predict the logarithmic trading price at 10:34:56, and the last trading price during the time interval from 10:23:56 to 10:33:56 is regarded as . At the same time we calculate the upper and lower bounds of the prediction at that trading time. We note that even though the drift and volatility parameters in the asymptotic model (4.10) is constant, the estimated parameters for predictions are actually time-varying. We compare this predicted logarithmic trading prices with the real trading prices in Figure 2. We do the similar prediction for each trading time but using the -minute data -, -, -minute before the trading time respectively. The comparisons are shown in Figures 3-5. Define

For the predictions -, -, -, -minute into the future, the maximum absolute REs are , , , , respectively. We see that the prediction -minute into the future provides very good forecasting, and the accuracy of the prediction deteriorates as we try to predict farther into the future, which is to be expected. We note that our asymptotic model is obtained when is small. We present the values of for all four predictions in Figures 6 - 9, and observe that all values are . Thus it is reasonable to use the asymptotic results in the regime

Appendix

Proof of Lemma 2.1.

We note that , and is a RBM with mean and variance . Thus using Taylor series expansion and Fubini’s theorem, we have

| (6.1) |

where from Theorem 1.3 in [1],

| (6.2) |

Here is the weak limit of as , and is a gamma density with mean and variance . We note that from (2.8), follows an exponential distribution with mean , and thus

| (6.3) |

Furthermore, the gamma density function is given by

| (6.4) |

Putting (6.3),(6.4) and (6.2) into (Proof of Lemma 2.1.), using Fubini’s theorem again, we have

∎

Proof of Proposition 3.1.

For (i), recall that for ,

where . So it suffices to show that

Now recall that and , and so , and for . Thus

and so

To show (ii) and (iii), we first recall that

Now for , noting that and that must be great than , we have that

| (6.5) |

Thus for , , and

| (6.6) |

which yields

| (6.7) |

Similarly, it can be shown that for , and

| (6.8) |

∎

Proof of Lemma 4.1.

Let for ,

Then and are the first meeting time and point of and . Let , and define

and for

Let

We note that

Noting that is a standard Brownian motion, using Girsonov theorem, and from (5.12) in [20, Chapter 3.5.C], we have for

Next noting that and are independent, we have for and ,

where the last equality follows from the identities that

This proves (i). For (ii), we see that for ,

Thus from the strong Markov property of Brownian motions, and are independent Brownian motions with the initial values and , and the same drifts and variances as and . Furthermore, they are independent of , where

| (6.9) |

Thus if we let and denote the first meeting time and meeting point of and , then is an i.i.d. sequence, which is independent of , and has the same distribution as with and Finally, noting that , we have that the first meeting time of and is given by

and the first meeting point of and is given by

To summarize, we have shown that is an i.i.d. sequence, which is independent of , and has the same distribution as with and ∎

Proof of Lemma 4.4.

Assume and . Then has the same distribution as Let

where and are arbitrary real numbers. Then and are independent, and is a martingale (see the beginning of Section 5 of Chapter 7 in [21]), where is defined in (6.9). We also note that is an stopping time with finite mean and variance ( follows IG distribution from Lemma 4.1). Hence optional stopping theorem yields

and so . More precisely, we have

Let

Solving and in terms of and , we obtain

Letting , and noting that follows inverse Gaussian distribution (see (4.2)), the moment generating function of is

Thus the solutions of should be as in (4.4), and the moment generating function of is given by (4.3) with instead of as in (4.4). To compute the moments, we first need some simple results about as follows.

Therefore,

Similarly, we obtain

Finally, for and , (4.5) follows by noting that

where as ∎

Proof of Theorem 4.6.

From Brown and Solomon [9], we have the following results for a renewal reward process generated by :

where

Using the results of Lemma 4.4 in the above equation, we get Equation (4.7). The same paper also states that

where

Substituting the moments of from Lemma 4.4 into the above equation and simplifying, we get Equation (4.9). ∎

Proof of Theorem 4.7.

Consider an arbitrary nonnegative sequence such that as Define for ,

We note that for each , is an i.i.d. sequence. Furthermore,

We claim that satisfies Lindeberg condition, i.e., for any ,

| (6.10) |

We will prove (6.10) at the end of this proof. Thus from [4, Theorem 18.2], letting

then

where is a two dimensional Brownian motion with drift and covariance matrix

Next from [18, Theorem 1] and [19, Corollary 3.33], if

then as , where and are the first and second components of the Brownian motion . Finally, we note that

Furthermore, observing that

we have that

and it is easy to check that the weak limit on the right hand side is a standard Brownian motion. Consequently, converges weakly to a standard Brownian motion as . At last, we give the proof of the claim given in (6.10). The proofs for and are similar, and we only consider . We first note that from Lemma 4.4,

and using conditional expectations, we have that for some ,

Next using Markov inequality, Holder’s inequality and (4.5), we have for some

∎

Proof of Lemma 5.1.

For convenience, we omit the superscript for the estimators of and . Using the moments in Lemma 4.4, we consider the following equations.

| (6.11) | ||||

| (6.12) | ||||

| (6.13) | ||||

| (6.14) | ||||

| (6.15) |

Next we solve the above equations for , , , , in terms of . Let

We then note that

Letting , we obtain

and

To see the above estimators are well-defined, we only need to show (5.2). We first note that

It is clear that

We next note that

This shows the first inequality in (5.2). To show the last two inequalities in (5.2), we observe that

Hence it suffices to show

After simplifying above inequality, it suffices to show that . Note that

is equivalent to

and the latter one is proved above. This completes the proof of (5.2). Next from the construction of the estimators, we see that they are the unique solutions of (6.11) – (6.15). Using the strong law of large numbers and the continuous mapping theorem, we have (5.3). Finally, the central limit theorem for follows immediatly from Delta method (see [11]) and the central limit theorem for , i.e.,

where is the covariance matrix of ∎

References

- [1] J. Abate and W. Whitt. Transient behavior of regulated brownian motion, i: Starting at the origin. Advances in applied probability, 19(3):560–598, 1987.

- [2] F. Abergel and A. Jedidi. A mathematical approach to order book modeling. International Journal of Theoretical and Applied Finance, 16(5), 2013.

- [3] E. Bayraktar, U. Horst, and R. Sircar. Queueing theoretic approaches to financial price fluctuations. In J. R. Birge and V. Linetsky, editors, Handbooks in OR & MS, pages 637–677. 2008.

- [4] P. Billingsley. Convergence of Probability Measures. Wiley, New York, second edition, 1999.

- [5] F. Black and M. Scholes. The pricing of options and corporate liabilities. The Journal of Political Economy, 81(3):637–654, 1973.

- [6] O.E. Brander-Nielsen. Normal inverse Gaussian processes and the modelling of stock returns. Research Report 300, Dept. Theor. Statistics, Aarhus University, 1995.

- [7] O.E. Brander-Nielsen. Normal inverse Gaussian distributions and stochastic volatility modelling. Scand. J. Statist., 24:1–13, 1996.

- [8] O.E. Brander-Nielsen. Process of normal inverse Gaussian type. Finance and Stochastics, second:41–68, 1998.

- [9] S. Brown and H. Solomon. A second-order approximation for the variance of a renewal reward process. Stochastic Processes and Their Applications, 3:301–314, 1975.

- [10] K. Burdzy and D. Nualart. Brownian motion reflected on brownian motion. Probab. Theory Relat. Fields, 122:471–493, 2002.

- [11] G. Casella and R. Berger. Statistical Inference. Duxbury Press, second edition, 2001.

- [12] R. Cont and A. De Larrard. Order book dynamics in liquid markets: Limit theorems and diffusion approximations. Preprint, SSRN 1757861, 2012.

- [13] R. Cont and A. De Larrard. Price dynamics in a Markovian limit order market. SIAM Journal of Financial Mathematics, 4:1–25, 2013.

- [14] R. Cont, S. Stoikov, and R. Talreja. A stochastic model for order book dynamics. Operations research, 58(3):549–563, 2010.

- [15] J. M. Harrison. Brownian Motion and Stochastic Flow Systems. Wiley, New York, 1985.

- [16] U. Horst and M. Paulsen. A law of large numbers for limit order books. arXiv preprint arXiv:1501.00843, 2015.

- [17] U. Horst and M. Paulsen. A weak law of large numbers for a limit order book model with fully state dependent order dynamics. arXiv preprint arXiv:1502.04359, 2015.

- [18] Donald L. Iglehart and Ward Whitt. The equivalence of functional central limit theorems for counting processes and associated partial sums. The Annals of Mathematical Statistics, 42(4):1372–1378, 1971.

- [19] J. Jacod and A.N. Shiryaev. Limit Theorem for Stochastic Processes. Springer-Verlag, Berlin, 2 edition, 2003.

- [20] I. Karatzas and S.E. Shreve. Brownian Motion and Stochastic Calculus. Springer, second edition, 1991.

- [21] S. Karlin and H.M. Taylor. A First Course in Stochastic Processes, Volume 1. Gulf Professional Publishing, 1975.

- [22] L. Kruk. Functional limit theorems for a simple auction. Mathematics of Operations Research, 28(4):716–751, 2003.

- [23] R.C. Merton. Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics, 3:125–144, 1976.

- [24] T.H. Rydberg. The normal inverse Gaussian Levy process: Simulation and approximation. Stochastic Models, 13(4):887–910, 1997.

- [25] Y. Saisho and H. Tanaka. Stochastic differential equations for mutually reflecting brownian balls. Osaka J. Math., 23:725– 740, 1986.

- [26] V. Sephardi. The Inverse Gaussian Distribution: A Case Study in Exponential Families. Oxford University Press, 1993.