Sequential Detection of Market shocks using Risk-averse Agent Based Models

Abstract

This paper considers a statistical signal processing problem involving agent based models of financial markets which at a micro-level are driven by socially aware and risk-averse trading agents. These agents trade (buy or sell) stocks by exploiting information about the decisions of previous agents (social learning) via an order book in addition to a private (noisy) signal they receive on the value of the stock. We are interested in the following: (1) Modelling the dynamics of these risk averse agents, (2) Sequential detection of a market shock based on the behaviour of these agents.

Structural results which characterize social learning under a risk measure, CVaR (Conditional Value-at-risk), are presented and formulation of the Bayesian change point detection problem is provided. The structural results exhibit two interesting properties: (i) Risk averse agents herd more often than risk neutral agents (ii) The stopping set in the sequential detection problem is non-convex. The framework is validated on data from the Yahoo! Tech Buzz game dataset and it is revealed that (a) The model identifies the value changes based on agent’s trading decisions. (b) Reasonable quickest detection performance is achieved when the agents are risk-averse.

Index Terms:

conditional value at risk (CVaR), social learning filter, market shock, quickest detection, agent based models, monotone Bayesian updateI Introduction

Financial markets evolve based on the behaviour of a large number of interacting entities. Understanding the interaction of these agents is therefore essential in statistical inference from financial data. This motivates the study of “agent based models” for financial markets. Agent based models are useful for capturing the global behaviour of highly interconnected financial systems by simulating the behaviour of the local interacting systems [1], [2], [3], [4]. Unlike standard economic models which emphasize the equilibrium properties of financial markets, agent based models stress local interactions and out-of-equilibrium dynamics that may not reach equilibrium in the long run [5]. Agent based models are commonly used to determine the conditions that lead a group of interacting agents to form an aggregate behaviour [6], [7], [8], [9] and to model stylized facts like correlation of returns and volatility clustering [10], [11]. Agent based models have also been used model anomalies that the standard approaches fail to explain like “fat tails”, absence of simple arbitrage, gain/loss asymmetry and leverage effects [12], [13].

In this paper, we are interested in developing agent based models for studying global events in financial markets where the underlying value of the stock experiences a jump change (shock). Market shocks are known to affect stock market returns [14], cause fluctuations in the economy [15] and necessitate market making [16]. Therefore detecting shocks is essential and when the interacting agents are acting based on private signals and complete history of other agents’ trading decisions, it is non-trivial [17].

The problem of market shock detection in the presence of social learning considered in this paper is different from a standard signal processing (SP) problem in the following ways:

-

1.

Agents (or social sensors) influence the behaviour of other agents, whereas in standard SP sensors typically do not affect other sensors.

-

2.

Agents reveal quantized information (decisions) and have dynamics, whereas in standard SP sensors are static with the dynamics modelled in the state equation.

-

3.

Standard SP is expectation centric. In this paper we use coherent risk measures which generalizes the concept of expected value and is much more relevant in financial applications. Such coherent risk measures [18] are now widely used in finance to model risk averse behaviour.

Properties 1 and 2 above are captured by social learning models. Such social learning models, where agents face fixed prices, are considered in [19], [20], [21], [9]. They show that after a finite amount of time, an informational cascade takes place and all subsequent agents choose the same action regardless of their private signal. Models where agents act sequentially to optimize local costs (to choose an action) and are socially aware were considered in [7], [22]. This paper considers a similar model, but, in order to incorporate property 3 above (risk averse behaviour), we will replace the classical social learning model of expected cost minimizers to that of risk averse minimizers. The resulting risk-averse social learning filter has several interesting (and unusual) properties that will be discussed in the paper.

Main Results and Organization

Section II presents the social learning agent based model and the market observer’s objective for detecting shocks. The formulation involves the interaction of local and global decision makers. Individual agents perform social learning and the market maker seeks to determine if the underlying asset value has changed based on the agent behaviour. The shock in the asset value changes at a phase distributed time (which generalizes geometric distributed change times). The problem of market shock detection considered in this paper is different from the classical Bayesian quickest detection [23], [24], [25] where, local observations are used to detect the change. Quickest detection in the presence of social learning was considered in [17] where it was shown that making global decisions (stop or continue) based on local decisions (buy or sell) leads to discontinuous value function and the optimal policy has multiple thresholds. However, unlike [17] which deals with expected cost, we consider a more general measure to account for the local agents’ attitude towards risk.

It is well documented in various fields like economics [26], behavioural economics, psychology [27] that people prefer a certain but possibly less desirable outcome over an uncertain but potentially larger outcome. To model this risk averse behaviour, commonly used risk measures111A risk measure is a mapping from the space of measurable functions to the real line which satisfies the following properties: (i) . (ii) If and then . (iii) if and , then . The risk measure is coherent if in addition satisfies: (iv) If , then . (v) If and , then . The expectation operator is a special case where subadditivity is replaced by additivity. are Value-at-Risk (VaR), Conditional Value-at-Risk (CVaR), Entropic risk measure and Tail value at risk; see [28]. We consider social learning under CVaR risk measure. CVaR [29] is an extension of VaR that gives the total loss given a loss event and is a coherent risk measure [18]. In this paper, we choose CVaR risk measure as it exhibits the following properties [18], [29]: (i) It associates higher risk with higher cost. (ii) It ensures that risk is not a function of the quantity purchased, but arises from the stock. (iii) It is convex. CVaR as a risk measure has been used in solving portfolio optimization problems [30], [31] credit risk optimization [32], order execution [33] and also to optimize an insurer’s product mix [34]. For an overview of risk measures and their application in finance, see [28].

Section III provides structural results which characterize the social learning under CVaR risk measure and its properties. We show that, under reasonable assumptions on the costs, the trading decisions taken by socially aware and risk-averse agents are ordinal functions of their private observations and monotone in the prior information. This implies that the Bayesian social learning follows simple intuitive rules. The change point detection problem is formulated as a Market Observer222The market observer could be the securities dealer (investment bank or syndicate) that underwrites the stock which is later traded in a secondary market. seeking to detect a shock in the stock value (modelled as a Markov chain) by balancing the natural trade-off between detection delay and false alarm.

Section IV discusses the unusual properties exhibited by the CVaR social learning filter and explores the link between local and global behaviour in agent based models for detection of market shocks. We show that the stopping region for the sequential detection problem is non-convex; this is in contrast to standard signal processing quickest detection problems where the stopping set is convex. Similar results were developed in [35, 17, 36].

Finally, Section V discusses an application of the agent based model and change detection framework in a stock market data set. We use a data set from Tech Buzz Game which is a stock market simulation launched by Yahoo! Research and O’Reilly Media to gain insights into forecasting high-tech events and trades. Tech Buzz uses Dynamic parimutuel markets (DPM) as its trading mechanism. DPMs are known to provide accurate predictions in field studies on price formation in election stock markets [37], mechanism design for sales forecasting [38] and betting in sports markets [39], [40].

II CVaR Social Learning Model and Market Observer’s objective

This section presents the Bayesian social learning model and defines the objective of the market observer. As will be shown later in Section III, the model results in ordinal decision making thereby mimicking human behavior and the risk measure captures a trader’s attitude towards risk.

II-A CVaR Social Learning Model

The market micro-structure is modelled as a discrete time dealer market motivated by algorithmic and high-frequency tick-by-tick trading [41]. There is a single traded stock or asset, a market observer and a countable number of trading agents. The asset has an initial true underlying value . The market observer does not receive direct information about but only observes the public buy/sell actions of agents, . The agents themselves receive noisy private observations of the underlying value and consider this in addition to the trading decisions of the other agents visible in the order book [42], [43], [44, 45]. At a random time, determined by the transition matrix , the asset experiences a jump change in its value to a new value. The aim of the market observer is to detect the change time (global decision) with minimal cost, having access to only the actions of these socially aware agents. Let denote agent ’s private observation. The initial distribution is where .

The agent based model has the following dynamics:

-

1.

Shock in the asset value: At time , the asset experiences a jump change (shock) in its value due to exogenous factors. The change point is modelled by a phase type (PH) distribution. The family of all PH-distributions forms a dense subset for the set of all distributions [46] i.e., for any given distribution function such that , one can find a sequence of PH-distributions to approximate uniformly over . The PH-distributed time can be constructed via a multi-state Markov chain with state space as follows: Assume state ‘1’ is an absorbing state and denotes the state after the jump change. The states (corresponding to beliefs ) can be viewed as a single composite state that resides in before the jump. So and the transition probability matrix is of the form

(1) The distribution of the absorption time to state 1 is

(2) where . The key idea is that by appropriately choosing the pair and the associated state space dimension , one can approximate any given discrete distribution on by the distribution ; see [46, pp.240-243]. The event means the change point has occurred at time according to PH-distribution (2). In the special case when is a 2-state Markov chain, the change time is geometrically distributed.

-

2.

Agent’s Private Observation: Agent ’s private (local) observation denoted by is a noisy measurement of the true value of the asset. It is obtained from the observation likelihood distribution as,

(3) -

3.

Private Belief update: Agent updates its private belief using the observation and the prior public belief as the following Hidden Markov Model update

(4) -

4.

Agent’s trading decision: Agent executes an action to myopically minimize its cost. Let denote the cost incurred if the agent takes action when the underlying state is . Let the local cost vector be

(5) The costs for different actions are taken as

(6) where corresponds to the agent’s demand. Here demand is the agent’s desire and willingness to trade at a price for the stock. Here is the quoted price for purchase and is the price demanded in exchange for the stock. We assume that the price is the same during the period in which the value changes. As a result, the willingness of each agent only depends on the degree of uncertainty on the value of the stock.

Remark.

The agent considers measures of risk in the presence of uncertainty in order to overcome the losses incurred in trading. To illustrate this, let denote the loss incurred with action while at unknown and random state . When an agent solves an optimization problem involving for selecting the best trading decision, it will take into account not just the expected loss, but also the “riskiness” associated with the trading decision . The agent therefore chooses an action to minimize the CVaR measure333 For the reader unfamiliar with risk measures, it should be noted that CVaR is one of the ‘big’ developments in risk modelling in finance in the last 15 years. In comparison, the value at risk (VaR) is the percentile loss namely, for cdf . While CVaR is a coherent risk measure, VaR is not convex and so not coherent. CVaR has other remarkable properties [29]: it is continuous in and jointly convex in . For continuous cdf , . Note that the variance is not a coherent risk measure. of trading as

(7) Here reflects the degree of risk-aversion for the agent (the smaller is, the more risk-averse the agent is). Define

(8) denotes the expectation with respect to private belief, i.e, when the private belief is updated after observation .

-

5.

Social Learning and Public belief update: Agent ’s action is recorded in the order book and hence broadcast publicly. Subsequent agents and the market observer update the public belief on the value of the stock according to the social learning Bayesian filter as follows

(9) Here, , where and

Note that belongs to the unit simplex .

-

6.

Market Observer’s Action: The market observer (securities dealer) seeks to achieve quickest detection by balancing delay with false alarm. At each time , the market observer chooses action444It is important to distinguish between the “local” decisions of the agents and “global” decisions of the market maker. Clearly the decisions affect the choice of as will be made precise below. as

(10) Here ‘Stop’ indicates that the value has changed and the dealer incorporates this information before selling new issues to investors. The formulation presented considers a general parametrization of the costs associated with detection delay and false alarm costs. Define

(11) -

i)

Cost of Stopping: The asset experiences a jump change(shock) in its value at time . If the action is chosen before the change point, a false alarm penalty is incurred. This corresponds to the event . Let denote the cost of false alarm in state with . The expected false alarm penalty is

(12) where and it is chosen with increasing elements, so that states further from ‘’ incur higher penalties. Clearly, .

-

ii)

Cost of delay: A delay cost is incurred when the event occurs, i.e, even though the state changed at , the market observer fails to identify the change. The expected delay cost is

(13) where is the delay cost and denotes the unit vector with 1 in the first position.

-

i)

II-B Market Observer’s Quickest Detection Objective

The market maker chooses its action at each time as

| (14) |

where denotes a stationary policy. For each initial distribution and policy , the following cost is associated

| (15) |

where denotes an economic discount factor. (As long as f is non-zero, stopping is guaranteed in finite time and so is allowed.)

Given the cost, the market observer’s objective is to determine with minimum cost by computing an optimal policy such that

| (16) |

The sequential detection problem (16) can be viewed as a partially observed Markov decision process (POMDP) where the belief update is given by the social learning filter.

II-C Stochastic Dynamic Programming Formulation

The optimal policy of the market observer is the solution of (15) and is given by Bellman’s dynamic programming equation as follows:

| (17) | ||||

where is the CVaR-social learning filter. and from (i)) and (ii)) are the market observer’s costs. Here is the discount factor which is a measure of the degree of impatience of the market observer. As and are non-negative and bounded for , the stopping time is finite for all .

The aim of the market observer is then to determine the stopping set given by:

III Properties of CVar Social Learning Filter

This section discusses the main results regarding the structural properties of the CVaR social learning filter and highlights the significant role it plays in charactering the properties of market observer’s value function and optimal policy. According to Theorem 1, risk-averse agents take decisions that are monotone and ordinal in the observations and monotone in the prior; and its monotone ordinal behaviour implies that a Bayesian model chosen in this paper is a useful idealization.

III-A Assumptions

The following assumptions will be used throughout the paper:

-

(A1)

Observation matrix and transition matrix are TP2 (all second order minors are non-negative)

-

(A2)

Agents’ local cost vector is sub-modular. That is .

The matrices being TP2 [47] ensures that the public belief Bayesian update can be compared with the prior [48] and sub-modular [49] costs ensure that if it is less risky to choose when in , it is also less risky to choose it when in .

III-B Properties of CVaR social learning filter

The local decision likelihood probability matrix (analogous to observation likelihood) can be computed as

| (18) | ||||

where . Here denotes the indicator function.

Let denote the cost with CVaR measure, associated with action and observation for convenience i.e,

| (19) |

Here . indicates the dependence of and hence on the observation. Let denote the optimal action of the agent with explicit dependence on the distribution and observation.

The following result says that agents choose a trading decision that is monotone and ordinal in their private observation. Humans typically convert numerical attributes to ordinal scales before making decisions. For example, it does not matter if the cost of a meal at a restaurant is $200 or $205; an individual would classify this cost as “high”. Also credit rating agencies use ordinal symbols such as AAA, AA, A.

Theorem 1.

Under (A1) and (A2), the action made by each agent is increasing and hence ordinal in for any prior belief .

Under (A2), is increasing in with respect to the monotone likelihood ratio order (Definition 1 in the appendix).

The proof is given in the appendix. Theorem 1 says that agents exhibit monotone ordinal behaviour. The condition that is monotone in the observation is required to characterize the local decision matrices on different regions in the belief space which is stated next.

Theorem 2.

Under (A1) and (A2), there are at most distinct local decision likelihood matrices and the belief space can be partitioned into the following polytopes:

| (20) | |||

Also, the matrices are constant on each of these polytopes.

IV Social Learning and Change Detection for risk-averse agents

This section illustrates the properties of the risk-averse social learning filter which leads to a non-convex value function and therefore non-convex stopping set of quickest detection.

IV-A Social Learning Behavior of Risk Averse Agents

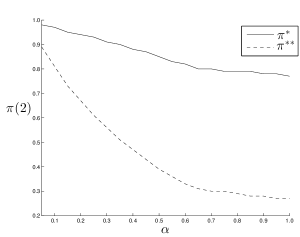

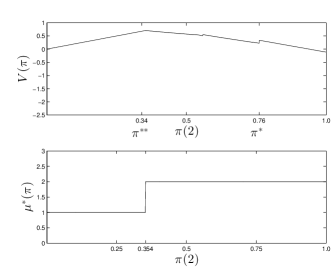

The following discussion highlights the relation between risk-aversion factor and the regions . For a given risk-aversion factor , Theorem 2 shows that there are at most polytopes on the belief space. It was shown in [17] that for the risk neutral case with , and (the value is a random variable) the intervals and correspond to the herding region and the interval corresponds to the social learning region. In the herding region, the agents take the same action as the belief is frozen. In the social learning region there is observational learning. However, when the agents are optimizing a more general risk measure (CVaR), the social learning region is different for different risk-aversion factors. The social learning region for the CVaR risk measure is shown in Fig. 1.

The following parameters were chosen:

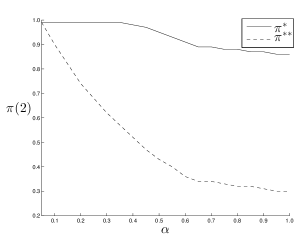

It can be observed that the width of the social learning region decreases as decreases. This can be interpreted as risk-averse agents showing a larger tendency to go with the crowd rather than “risk” choosing the other action. With the same and parameters, but with transition matrix

the social learning region is shown in Fig. 2.

From Fig. 2, it is observed that when the state is evolving and when the agents are sufficiently risk-averse, social learning region is very small. It can be interpreted as: agents having a strong risk-averse attitude don’t prefer to “learn” from the crowd; but rather face the same consequences, when .

IV-B Nonconvex Stopping Set for Market Shock Detection

We now illustrate the solution to the Bellman’s stochastic dynamic programming equation (17), which determines the optimal policy for quickest market shock detection, by considering an agent based model with two states. Clearly the agents (local decision makers) and market observer interact – the local decisions taken by the agents determines the public belief and hence determines decision of the market observer via (14).

From Theorem 2, the polytopes are subsets of . Under (A1) and (A2), , where and are the belief states at which and respectively. From Theorem 2 and (17), the value function can be written as,

The explicit dependence of the filter on the belief results in discontinuous value function. The optimal policy in general has multiple thresholds and the stopping region in general is non-convex.

Example

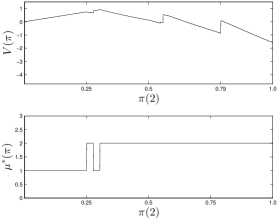

Fig. 3 displays the value function and optimal policy for a toy example having the following parameters:

The parameters for the market observer are chosen as: , , and .

From Fig. 3 it is clear that the market observer has a double threshold policy and the value function is discontinuous. The double threshold policy is unusual from a signal processing point of view. Recall that depicts the posterior probability of no change. The market observer “changes its mind” - it switches from no change to change as the posterior probability of change decreases! Thus the global decision (stop or continue) is a non-monotone function of the posterior probability obtained from local decisions in the agent based model. The example illustrates the unusual behaviour of the social learning filter.

V Dataset Example

V-A Tech Buzz Game and Model:

To validate the framework, we consider the data from Tech Buzz Game, a stock market simulation launched by Yahoo! Research and O’Reilly Media to gain insights into forecasting high-tech events and trades. The game consisted of multiple sub-markets trading stocks of contemporary rival technologies. At each trading instant, the traders (or players) had access to the search “buzz” around each of the stocks. The buzz was an indicator of the number of users scouring Yahoo! search on the stock over the past seven days, as a percentage of all searches in the same market. Thus, if searches for the stock named “SKYPE” make up 80 percent of all Yahoo! searches in the telecommunication application software market, then SKYPE’s buzz score is 80. The buzz scores of all technologies within a market always add up to 100. The dataset was chosen to demonstrate the framework as the trading information was made available by Yahoo!.

The stock market simulation is modelled as follows. The state is chosen to represent value of the stock, with indicating a high valued stock and indicating a stock of low value. It is well known that if the perceived value is more then it is going to be popular. Hence, the noisy observations are taken to be the buzz scores which are a proxy for the popularity of the stock [50]. For tractability, is assumed that all agents have the same attitude towards risk, i.e, is the same for all agents. The agents choose to buy () or sell () depending on the cost and the belief updated using the buzz score. On each day the stock is traded, we consider only the agent which buys or sells maximum shares and record its trading decision (positive or negative values in the dataset) as buying or selling a unit of stock. This is reasonable assumption in the sense that the agent trading maximum shares (“big players” in finance) will significantly influence the public belief.

V-B Dataset

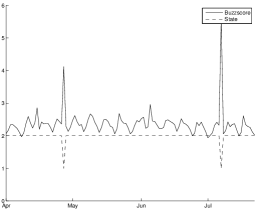

The buzz score for the stocks, SKYPE and IPOD trading in markets VOIP and PORTMEDIA respectively, was obtained for the period from April 1, 2005 to July 27, 2005 from the Yahoo! Dataset 555“Yahoo! Webscope”, http://research.yahoo.com/Academic_Relations

ydata-yrbuzzgame-transactions-period1-v1.0, ydata-yrbuzzgame-buzzscores-period1-v1.0. Value of the stock is basically a function of the payout of the stock and its dividend [50]. The payout and dividend are directly proportional to the buzz score. Using the buzz score, value of the stock was calculated with the method suggested in [50]. Space discretized value of the stocks SKYPE and IPOD during the period is shown in the Fig. 4 and Fig. 7 along with the scaled buzz score.

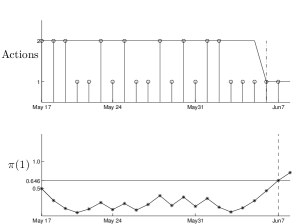

V-B1 Quickest detection for SKYPE

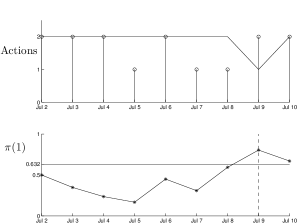

By eyeballing the data in Fig. 4, it is seen that the value changed during the month of June. To apply the quickest detection protocol, we consider a window from May to June . It is observed that the price was (almost) constant during this period with a value close to $13 per stock. The trading decisions (along with the value) and the public belief during this period are shown in Fig. 5.

The local and global costs for the market observer were chosen as:

The model parameters were chosen as follows:

The choice of the parameters for the observation matrix was motivated by the experimental evidence provided in [51], that when there is social learning “alone”, the trading rate was based on peer effects. Since the local decision likelihood matrix in the social learning region (in our model), the parameters were so chosen. Parameters in the transition matrix were chosen to reflect the time window considered, as .

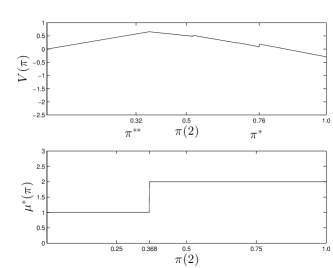

It was observed that the state changed on June and for a risk-aversion factor of , it was detected on June . The value function and the optimal policy for the market observer are shown in Fig. 6. The stopping set corresponds to . The regions and correspond to the regions where social learning is absent. It can be observed that the value function is discontinuous.

V-B2 Quickest detection for IPOD

From Fig. 7, it is seen that the value changed during April and July. To apply the quickest detection protocol, we consider a window from July to July . It is observed that the price was (almost) constant during this period with a value close to $17 per stock. The trading decisions (along with the value) and the public belief during this period are shown in Fig. 8.

The local and global costs for the market observer were chosen as:

The model parameters were chosen as follows:

Parameters in the transition matrix were chosen to reflect the time window considered, as .

It was observed that the state changed on July and for a risk-aversion factor of , it was detected on July . It is seen that when the delay penalty is increased, the change is detected on the same day. The value function and the optimal policy for the market observer are shown in Fig. 9. The stopping set corresponds to .

VI Conclusion

The paper provided a Bayesian formulation of the problem of quickest detection of change in the value of a stock using the decisions of socially aware risk averse agents. It highlighted the reasons for this problem to be non-trivial - the stopping region is in general non-convex; and it also accounted for the agents’ risk attitude by considering a coherent risk measure, CVaR, instead of the expected value measure in the agents’ optimization problem. Results which characterize the structural properties of social learning under the CVaR risk measure were provided and the importance of these results in understanding the global behaviour was discussed. It was observed that the behaviour of these risk-averse agents is, as expected, different from risk neutral agents. Risk averse agents herd sooner and don’t prefer to “learn” from the crowd, i.e, social learning region is smaller the more risk-averse the agents are. Finally, the model was validated using a financial dataset from Yahoo! Tech Buzz game. From a signal processing point of view, the formulation and solutions are non-standard due to the three properties described in Section I.

In current work, we are interested in determining structural results for the optimal change detection. Structural results for POMDPs were developed in [52, 36] and it is worthwhile extending these results to the current framework. When the market observer incurs a measurement cost, quickest change detection often has a monotone policy as described in [53]. It is of interest to generalize these results to the current setup.

Appendix A Preliminaries and Definitions:

Definition 1.

MLR Ordering [54] (): Let be any two belief state vectors. Then if

Definition 2.

First-Order Stochastic Dominance (): Let be any two belief state vectors. Then if

Lemma 3.

[54] iff for all , , where denotes the space of - dimensional vectors , with non-increasing components, i.e, .

Lemma 4.

[54] iff for all , , where denotes the space of - dimensional vectors , with non-decreasing components, i.e, .

Let

Definition 3.

Submodular function [49]: A function is submodular if , for .

Definition 4.

Single Crossing Condition [49]: A function satisfies a single crossing condition in if

for and . For any such function ,

| (21) |

Theorem 5.

[49] If is sub-modular, then there exists a satisfying,

Appendix B Proofs

The following lemmas are required to prove Theorem 1 and Theorem 2. The results will be proved for general state and observation spaces having two actions.

Lemma 6.

For a finite state and observation alphabet, is equal to for some .

Proof.

Let be the belief update (p.m.f) with observation , i.e, . Let denote the cumulative distribution function. For simplicity of notation, let . The extremum of is attained where the derivative is zero. It is obtained as follows.

Also, and therefore . We have, . Since is a random variable, is a random variable with realizations for . Hence for some . ∎

The result of Lemma 6 is similar to Proposition in [55]. It was shown in [48] that . Also, MLR dominance implies first order dominance, i.e, .

Lemma 7.

Let be the index such that and be the index such that . For all , .

Proof.

Proof is by contradiction. From lemma (6), we have and . Suppose . We know that is a monotone function in . Since , . But, by definition of first order stochastic dominance, for all . Therefore, , a contradiction. ∎

Lemma 8.

if .

Proof.

From the definitions of and we have,

| (22) |

Equation (B) follows from lemma 3 and can be simplified as

where is such that for and for . Clearly, and decreasing. Right hand side of inequality attains its maximum when and and for all . Therefore, we have

After rearrangement we have,

Since and (follows from lemma 7 and assumption (A2)), we have . ∎

Lemma 9.

if .

Proof.

From the definitions of and we have,

| (23) |

Equation (B) follows from lemma 4 and can be simplified as

where is such that for and for . Clearly, and decreasing. Right hand side of inequality attains its maximum when and and for all . Therefore, we have

After rearrangement we have,

| (24) |

Since and (follows from lemma 7 and assumption (A2)), we have . ∎

Lemma 10.

Let . The function satisfies the single crossing condition i.e,

Proof.

Proof of Theorem 1: From lemma 10, satisfies the single crossing condition and hence is sub-modular in . Using Theorem 5, we get is increasing in .

Proof of Theorem 2: From lemma 10, satisfies the single crossing condition. It is easily verified that the belief states satisfy the following property

| (27) |

Equation (27) says that the curves do not intersect. Also from (18) and (27), it is easily verified that there are at most local decision likelihood matrices (can be less than when ). The matrices from (18) and Theorem 1 are constant on each of the polytopes.

References

- [1] B. LeBaron, “Agent-based computational finance,” Handbook of computational economics, vol. 2, pp. 1187–1233, 2006.

- [2] ——, “Agent-based computational finance: Suggested readings and early research,” Journal of Economic Dynamics and Control, vol. 24, no. 5, pp. 679–702, 2000.

- [3] E. Samanidou, E. Zschischang, D. Stauffer, and T. Lux, “Agent-based models of financial markets,” Reports on Progress in Physics, vol. 70, no. 3, p. 409, 2007.

- [4] V. Alfi, M. Cristelli, L. Pietronero, and A. Zaccaria, “Minimal agent based model for financial markets I,” The European Physical Journal B, vol. 67, no. 3, pp. 385–397, 2009.

- [5] L. Tesfatsion and K. L. Judd, Handbook of computational economics: agent-based computational economics. Elsevier, 2006, vol. 2.

- [6] R. Cont and J.-P. Bouchaud, “Herd behavior and aggregate fluctuations in financial markets,” Macroeconomic Dynamics, vol. 4, pp. 170–196, May 2000.

- [7] C. Avery and P. Zemsky, “Multidimensional uncertainty and herd behavior in financial markets,” American economic review, pp. 724–748, 1998.

- [8] A. Park and H. Sabourian, “Herding and contrarian behavior in financial markets,” Econometrica, vol. 79, no. 4, pp. 973–1026, 2011.

- [9] C. Chamley, Rational herds: Economic Models of Social Learning. Cambridge University Press, 2004.

- [10] R. Cont, “Volatility clustering in financial markets: Empirical facts and agent–based models,” Long memory in economics; edited by A Kirman and G Teyssiere (Springer), Apr 2007.

- [11] F. LeGland and L. Mevel, “Exponential forgetting and geometric ergodicity in hidden Markov models,” Mathematics of Controls, Signals and Systems, vol. 13, no. 1, pp. 63–93, 2000.

- [12] D. Challet, M. Marsili, and Y. Zhang, “Minority games: interacting agents in financial markets,” OUP Catalogue, 2013.

- [13] M. Cristelli, L. Pietronero, and A. Zaccaria, “Critical overview of agent-based models for economics,” arXiv preprint arXiv:1101.1847, 2011.

- [14] N. Apergis and S. M. Miller, “Do structural oil-market shocks affect stock prices?” Energy Economics, vol. 31, no. 4, pp. 569 – 575, 2009.

- [15] S. Gilchrist, V. Yankov, and E. Zakrajšek, “Credit market shocks and economic fluctuations: Evidence from corporate bond and stock markets,” Journal of Monetary Economics, vol. 56, no. 4, pp. 471 – 493, 2009.

- [16] S. Das and M. Magdon-Ismail, “Adapting to a market shock: Optimal sequential market-making,” in Advances in Neural Information Processing Systems, 2009, pp. 361–368.

- [17] V. Krishnamurthy, “Quickest detection POMDPs with social learning: Interaction of local and global decision makers,” IEEE Transactions on Information Theory, vol. 58, no. 8, pp. 5563–5587, 2012.

- [18] P. Artzner, F. Delbaen, J. Eber, and D. Heath, “Coherent measures of risk,” Risk management: value at risk and beyond, p. 145, 2002.

- [19] S. Bikchandani, D. Hirshleifer, and I. Welch, “A theory of fads, fashion, custom, and cultural change as information cascades,” Journal of Political Economy, vol. 100, no. 5, pp. 992–1026, October 1992.

- [20] I. Welch, “Sequential sales, learning, and cascades,” Journal of Finance, pp. 695–732, 1992.

- [21] A. Banerjee, “A simple model of herd behavior,” Quaterly Journal of Economics, vol. 107, no. 3, pp. 797–817, August 1992.

- [22] L. Glosten, “Insider trading, liquidity, and the role of the monopolist specialist,” Journal of Business, vol. 62, no. 2, pp. 211–235, Dec 1989.

- [23] A. N. Shiryaev and A. Aries, Optimal stopping rules. Springer-Verlag, 2007, vol. 8.

- [24] H. V. Poor and O. Hadjiliadis, Quickest Detection. Cambridge University Press, 2008.

- [25] M. Frisén, “Optimal sequential surveillance for finance, public health, and other areas,” Sequential Analysis, vol. 28, no. 3, pp. 310–337, 2009.

- [26] R. A. Cohn, W. G. Lewellen, R. C. Lease, and G. G. Schlarbaum, “Individual investor risk aversion and investment portfolio composition,” The Journal of Finance, vol. 30, no. 2, pp. 605–620, 1975.

- [27] B. . Donkers and A. Soest, “Subjective measures of household preferences and financial decisions,” Journal of Economic Psychology, vol. 20, no. 6, pp. 613 – 642, 1999.

- [28] S. Mitra and T. Ji, “Risk measures in quantitative finance,” International Journal of Business Continuity and Risk Management, vol. 1, no. 2, pp. 125–135, 2010.

- [29] R. T. Rockafellar and S. Uryasev, “Optimization of conditional value-at-risk,” Journal of risk, vol. 2, pp. 21–42, 2000.

- [30] J. Palmquist, S. Uryasev, and P. Krokhmal, Portfolio optimization with conditional value-at-risk objective and constraints. Department of Industrial & Systems Engineering, University of Florida, 1999.

- [31] C. Lim, H. D. Sherali, and S. Uryasev, “Portfolio optimization by minimizing conditional value-at-risk via nondifferentiable optimization,” Computational Optimization and Applications, vol. 46, no. 3, pp. 391–415, 2010.

- [32] F. Andersson, H. Mausser, D. Rosen, and S. Uryasev, “Credit risk optimization with conditional value-at-risk criterion,” 2001.

- [33] Y. Feng, F. Rubio, and D. Palomar, “Optimal order execution for algorithmic trading: A CVaR approach,” in Signal Processing Advances in Wireless Communications (SPAWC), 2012 IEEE 13th International Workshop on, June 2012, pp. 480–484.

- [34] J. T. Tsai, J. L. Wang, and L. Y. Tzeng, “On the optimal product mix in life insurance companies using conditional value at risk,” Insurance: Mathematics and Economics, vol. 46, no. 1, pp. 235–241, 2010.

- [35] V. Krishnamurthy, “Bayesian sequential detection with phase-distributed change time and nonlinear penalty – a lattice programming POMDP approach,” IEEE Transactions on Information Theory, vol. 57, no. 3, pp. 7096–7124, Oct. 2011.

- [36] V. Krishnamurthy and H. V. Poor, “A tutorial on interactive sensing in social networks,” IEEE Transactions on Computational Social Systems, vol. 1, no. 1, pp. 3–21, March 2014.

- [37] R. Forsythe, T. A. Rietz, and T. W. Ross, “Wishes, expectations and actions: a survey on price formation in election stock markets,” Journal of Economic Behavior & Organization, vol. 39, no. 1, pp. 83–110, 1999.

- [38] C. R. Plott and K.-Y. Chen, “Information aggregation mechanisms: Concept, design and implementation for a sales forecasting problem,” 2002.

- [39] R. H. Thaler and W. T. Ziemba, “Parimutuel betting markets: Racetracks and lotteries,” Journal of Economic perspectives, vol. 2, no. 2, pp. 161–174, 1988.

- [40] J. M. Gandar, W. H. Dare, C. R. Brown, and R. A. Zuber, “Informed traders and price variations in the betting market for professional basketball games,” Journal of Finance, pp. 385–401, 1998.

- [41] A. Cartea and S. Jaimungal, “Modelling asset prices for algorithmic and high-frequency trading,” Applied Mathematical Finance, vol. 20, no. 6, pp. 512–547, 2013.

- [42] A. N. Akansu and M. U. Torun, A Primer for Financial Engineering: Financial Signal Processing and Electronic Trading. Academic Press, 2015.

- [43] M. Avellaneda and S. Stoikov, “High-frequency trading in a limit order book,” Quantitative Finance, vol. 8, no. 3, pp. 217–224, Apr 2008.

- [44] V. Krishnamurthy and A. Aryan, “Quickest detection of market shocks in agent based models of the order book,” in Proceedings of the 51st IEEE Conference on Decision and Control, Maui, Hawaii, Dec. 2012.

- [45] ——, “Detecting asset value dislocations in multi-agent models for market microstructure,” in ICASSP 2013, May 2013.

- [46] M. F. Neuts, Structured stochastic matrices of M/G/1 type and their applications. N.Y.: Marcel Dekker, 1989.

- [47] S. Karlin and Y. Rinott, “Classes of orderings of measures and related correlation inequalities. I. Multivariate totally positive distributions,” Journal of Multivariate Analysis, vol. 10, no. 4, pp. 467–498, December 1980.

- [48] W. S. Lovejoy, “Some monotonicity results for partially observed Markov decision processes,” Operations Research, vol. 35, no. 5, pp. 736–743, Sept.-Oct. 1987.

- [49] D. M. Topkis, Supermodularity and Complementarity. Princeton University Press, 1998.

- [50] Y. Chen, D. M. Pennock, and T. Kasturi, “An empirical study of dynamic pari-mutuel markets: Evidence from the tech buzz game,” in Proceedings of the Web Mining and Web Usage Analysis workshop (WebDKK), Las Vegas, Nevada, 2008.

- [51] L. Bursztyn, F. Ederer, B. Ferman, and N. Yuchtman, “Understanding mechanisms underlying peer effects: Evidence from a field experiment on financial decisions,” Econometrica, vol. 82, pp. 1273–1301, 2014.

- [52] V. Krishnamurthy and D. Djonin, “Structured threshold policies for dynamic sensor scheduling–a partially observed Markov decision process approach,” IEEE Transactions on Signal Processing, vol. 55, no. 10, pp. 4938–4957, Oct. 2007.

- [53] V. Krishnamurthy, “How to schedule measurements of a noisy Markov chain in decision making?” IEEE Transactions on Information Theory, vol. 59, no. 9, pp. 4440–4461, July 2013.

- [54] A. Muller and D. Stoyan, Comparison Methods for Stochastic Models and Risk. Wiley, 2002.

- [55] R. T. Rockafellar and S. Uryasev, “Conditional value-at-risk for general loss distributions,” Journal of banking & finance, vol. 26, no. 7, pp. 1443–1471, 2002.