Low-rank diffusion matrix estimation for high-dimensional time-changed Lévy processes

Abstract

The estimation of the diffusion matrix of a high-dimensional, possibly time-changed Lévy process is studied, based on discrete observations of the process with a fixed distance. A low-rank condition is imposed on . Applying a spectral approach, we construct a weighted least-squares estimator with nuclear-norm-penalisation. We prove oracle inequalities and derive convergence rates for the diffusion matrix estimator. The convergence rates show a surprising dependency on the rank of and are optimal in the minimax sense for fixed dimensions. Theoretical results are illustrated by a simulation study.

Abstract

[language=french] In French.

keywords:

and

1 Introduction

Non-parametric statistical inference for Lévy-type processes has been attracting the attention of researchers for many years initiated by the works of Rubin and Tucker, [35] as well as Basawa and Brockwell, [5]. The popularity of Lévy processes is related to their simplicity on the one hand and the ability to reproduce many stylised patterns presented in economic and financial data or to model stochastic phenomena in biology or physics, on the other hand. While non-parametric inference for one dimensional Lévy processes is nowadays well understood (see e.g. the lecture notes [7]), there are surprisingly few results for multidimensional Lévy or related jump processes. Possible applications demand however for multi- or even high-dimensional methods. As a first contribution to statistics for jump processes in high dimensions, we investigate the optimal estimation of the diffusion matrix of a -dimensional Lévy process where may grow with the number of observations.

More general, we consider a larger class of time-changed Lévy process. Let be a -dimensional Lévy process and let be a non-negative, non-decreasing stochastic process with . Then the time-changed Lévy process is defined via for . For instance, in the finance context, the change of time is motivated by the fact that some economical effects (as nervousness of the market which is indicated by volatility) can be better understood in terms of a “business time” which may run faster than the physical one in some periods (see, e.g. Veraart and Winkel, [41]). In view of large portfolios and a huge number of assets traded at the stock markets we have high-dimensional observations.

Monroe, [28] has shown that even in the case of the Brownian motion , the resulting class of time-changed Lévy processes is rather large and basically coincides, at least in the one-dimensional case, with the class of all semi-martingales. Nevertheless, a practical application of this fact for statistical modelling meets two major problems: first, the change of time can be highly intricate - for instance, if has discontinuous trajectories, cf. Barndorff-Nielsen and Shiryaev, [4]; second, the dependence structure between and can be also quite involved. In order to avoid these difficulties and to achieve identifiability, we allow to be a general Lévy processes, but assume independence of and .

A first natural question is which parameters of the underlying Lévy process can be identified from discrete observations for some as This question has been recently addressed in the literature (see Belomestny, [6] and references therein) and the answer turns out to crucially depend on the asymptotic behaviour of and on the degree of our knowledge about We study the so-called low-frequency regime, meaning that the observation distance is fixed. In this case, we have severe identifiability problems which can be easily seen from the fact that subordinated Lévy processes are again Lévy processes. Assuming the time-change is known, all parameters of the underlying Lévy process can be identified as Since any Lévy process can be uniquely parametrised by the so-called Lévy triplet with a positive semi-definite diffusion (or volatility) matrix , a drift vector and a jump measure we face a semi-parametric estimation problem. Describing the covariance of the diffusion part of the Lévy process , the matrix is of particular interest. Aiming for a high dimensional setting, we study the estimation of under the assumption that it has low rank. This low rank condition reflects the idea of a few principal components driving the whole process. We also discuss the case where the diffusion matrix can be decomposed into a low rank matrix and a sparse matrix as has been suggested by Fan et al., [17, 18].

For discretely observed Lévy processes it has been recently shown that estimation methods coming from low-frequency observations attain also in the high-frequency case, where , optimal convergence results, cf. Jacod and Reiß, [21] for volatility estimation and Nickl et al., [31] for the estimation of the jump measure. In contrast to estimators which are tailor-made for high-frequency observations, these low-frequency methods thus turn out to be robust with respect to the sampling frequency. This observation is a key motivation for considering a fixed in the present article. It is very common in the literature on statistics for stochastic processes, that the observations are supposed to be equidistant. In view of the empirical results by [2], this model assumption might however be often violated in financial applications. Our observation scheme can be equivalently interpreted as random observation times of the Lévy process . For one-dimensional Lévy processes general observation distances as been studied by Kappus, [23].

The research area on statistical inference for discretely observed stochastic processes is rapidly growing. Let us only mention some closely related contributions while we refer to [7] for a recent overview of estimation for Lévy processes. Non-parametric estimation for time-changed Lévy models has been studied in [6, 8, 13]. In a two-dimensional setting the jump measure of a Lévy process has been estimated in [12]. For inference on the volatility matrix (in small dimensions) for continuous semi-martingales in a high-frequency regime we refer to [20, 10] and references therein. Large sparse volatility matrix estimation for continuous Itô processes has been recently studied in [42, 37, 38].

Our statistical problem turns out to be closely related to a deconvolution problem for a multidimensional normal distribution with zero mean and covariance matrix convolved with a nuisance distribution which is unknown except for some of its structural properties. Due to the time-change or random sampling, respectively, the normal vector is additionally multiplied with a non-negative random variable. Hence, we face a covariance estimation problem in a generalised mixture model. Since we have no direct access to a sample of the underlying normal distribution, our situation differs considerably from the inference problems which have been studied in the literature on high-dimensional covariance matrix estimation so far.

The analysis of many deconvolution and mixture models becomes more transparent in spectral domain. Our accordingly reformulated problem bears some similarity to the so-called trace regression problem and the related matrix estimation, which recently got a lot of attention in statistical literature (see, e.g. [34, 29, 1, 24]). We face a non-linear analogue to the estimation of low-rank matrices based on noisy observations. Adapting some ideas, especially from Koltchinskii et al., [24], we construct a weighted least squares estimator with nuclear norm penalisation in the spectral domain.

We prove oracle inequalities for the estimator of implying that the estimator adapts to the low-rank condition on and that it also applies in the miss-specified case of only approximated sparsity. The resulting convergence rate fundamentally depends on the time-change while the dimension may grow polynomially in the sample size. Lower bounds verify that the rates are optimal in the minimax sense for fixed dimensions. The influence of the rank of on the convergence rate reveals a new phenomenon which was not observed in multi-dimensional non-parametric statistics before. Namely, in a certain regime the convergence rate in is faster for a larger rank of . To understand this surprising phase transition from a more abstract perspective, we briefly discuss a related regression model.

The paper is organised as follows. In Section 2, we introduce notations and formulate the statistical model. In Section 3 the estimator for the diffusion matrix is constructed and the oracle inequalities for this estimator are derived. Based on these oracle inequalities, we derive in Section 4 upper and lower bounds for the convergence rate. Section 5 is devoted to several extensions, including mixing time-changes, incorporating a sparse component of the diffusion matrix and the related trace-regression model. Some numerical examples can be found in Section 6. In Sections 7 and 8 the proofs of the oracle inequalities and of the minimax convergence rates, respectively, are collected. The appendix contains some (uniform) concentration results for multivariate characteristic functions which are of independent interest.

Acknowledgement. The authors thank Markus Reiß and two anonymous referees for helpful comments. D.B. acknowledges the financial support from the Russian Academic Excellence Project “5-100” and from the Deutsche Forschungsgemeinschaft (DFG) through the SFB 823 “Statistical modelling of nonlinear dynamic processes”. M.T. gratefully acknowledges the financial support by the DFG research fellowship TR 1349/1-1. A part of this paper has been written while M.T. was affiliated to the Université Paris-Dauphine.

2 Main setup

Recall that a random time change is an increasing right-continuous process with left limits such that . For each the random variable is a stopping time with respect to the underlying filtration. For a Lévy process the time-changed Lévy process is given by . We throughout assume that is independent of . By reparametrising the time change we can assume without loss of generality that and that the observations are thus given by the increments

for . Note that in general the observations are not independent, in contrast to the special case of low-frequently observed Lévy processes. The estimation procedure relies on the following crucial insight: If the sequence

is stationary and admits an invariant measure , then the independence of and together with the Lévy-Khintchine formula yield that the observations have a common characteristic function given by

where is the Laplace transform of and where the characteristic exponent is given by

| (2.1) |

with the diffusion matrix , for a drift parameter and a jump measure . If and , we end up with the problem of estimating a covariance matrix. The function in (2.1) appears due to the presence of jumps and can be viewed as a nuisance parameter. Let us give some examples of typical time-changes and their Laplace transforms.

Examples 2.1.

-

(i)

Low-frequency observations of with observation distance :

-

(ii)

Poisson process time-change or exponential waiting times with intensity parameter :

-

(iii)

Gamma process time-change with parameters :

-

(iv)

Integrated CIR-process for some such that (which has -mixing increments, cf. [26]):

If the time change is unknown, one faces severe identifiability problems. Indeed, even in the case of a multivariate time-changed Brownian motion we can identify the matrix and only up to a multiplicative factor. More generally, if is not restricted to be Brownian motion there is much more ambiguity as the following example illustrates.

Example 2.2.

Consider two time changes and where is a Gamma subordinator with the unit parameters and is deterministic. We have and Note that Let be a one-dimensional Lévy process with the characteristic exponent and let be another Lévy process with the characteristic exponent (the existence of such Lévy process follows from the well-known fact that is the characteristic function of some infinitely divisible distribution). Then we obviously have for all Hence, the corresponding time-changed Lévy processes and satisfy

for any Moreover, the increments are independent in this case.

The above example shows that even under the additional assumption , we cannot, in general, consistently estimate the parameters of the one-dimensional time-changed Lévy process from the low-frequency observations. As shown by Belomestny, [6] all parameters of a -dimensional (with ) Lévy process can be identified under additional assumption that all components of are independent and However this assumption would imply that the matrix is diagonal and is thus much too restrictive for our setting. Therefore, we throughout assume that the time-change and consequently its Laplace transform are known, see Section 5.1 for a discussion for unknown . Let us note that similar identifications problems appear even in high-frequency setting, see [19].

Before we construct the volatility matrix estimator in the next section, we should introduce some notation. Recall the Frobenius or trace inner product for matrices . For the Schatten- norm of is given by

with being the singular values of . In particular, , and denote the nuclear, the Frobenius and the spectral norm of , respectively. We will frequently apply the trace duality property

Moreover, we may consider the entry-wise norms for with the usual modification denoting the number of non-zero entries of .

For any matrices we write

For we write if there is a constant independent of and the involved parameters such that .

3 The estimator and oracle inequalities

In view of the Lévy-Khintchine formula, we apply a spectral approach. The natural estimator of is given by the empirical characteristic function

which is consistent whenever is ergodic. Even more, it concentrates around the true characteristic function with parametric rate uniformly on compact sets, cf. Theorems A.2 and A.4 in the appendix. A plug-in approach yields the estimator for the characteristic exponent given by

| (3.1) |

where denotes a continuously chosen inverse of the map . Since only appears in the real part of the characteristic exponent, we may use .

Remark 3.1.

For high-frequency observations, that is , the characteristic function of the observations can be written as where is the characteristic exponent as before and where is the Laplace transform of the rescaled time-change increments , which may be assumed to be stationary. Under some regularity assumption on , we obtain the asymptotic expansion

Instead of the inversion in (3.1) the estimator can be used in this case, depending only on Laplace transform via . Note that the latter is given by the first moment of rescaled time-change increments. However, this asymptotic identification can only be applied in the high-frequency regime , while the estimator (3.1) is robust with respect to the sampling frequency.

Applying , estimating the low-rank matrix can thus be reformulated as the regression problem

| (3.2) |

where we have normalised the whole formula by the factor . The design matrix for an arbitrary unit vector is deterministic and degenerated. The second term in (3.2) is a deterministic error which will be small only for large . The last term reflects the stochastic error. Due to the identification via the Laplace transform , the estimation problem is non-linear and turns out to be ill-posed: the stochastic error grows for large frequencies.

Inspired by the regression formula (3.2), we define the diffusion matrix estimator as a penalised least squares type estimator with regularisation parameter and a spectral cut-off :

| (3.3) |

where is a subset of positive semi-definite matrices and is a weight function. We impose the following standing assumption on the weight function which is chosen by the practitioner.

Assumption A.

Let be a radial non-negative function which is supported on the annulus . For any let .

In the special case of a Lévy process with a finite jump activity , we can write remainder from (2.1) as

for . Since the Fourier transform converges to zero as under a mild regularity assumption on the finite measure , we can reduce the bias of our estimator by the following modification

| (3.4) |

with

and some interval . The most interesting cases are , where and coincide, and . The factor in front of is natural, since the ill-posedness of the estimation problem for the jump activity is two degrees larger than for estimating the volatility, cf. Belomestny and Reiß, [9]. As a side product, is an estimator for the jump intensity. By penalising large , the estimator is pushed back to zero if the least squares part cannot profit from a finite . It thus coincides with the convention to set in the infinite intensity case.

Our estimators and are related to the weighted scalar product

with the usual notation . For convenience we abbreviate . The scalar product is the counterpart to the empirical scalar product in the matrix estimation literature. As the following lemma reveals, the weighted norm and the Frobenius norm are equivalent. As the isometry is not restricted to any sparse sub-class of matrices, it is especially implies the often imposed restricted isometry property. The proof is postponed to Section 7.1.

Lemma 3.2.

For any positive semi-definite matrix and any it holds

| (3.5) |

where and .

Using well-known calculations from the Lasso literature, we obtain the following elementary oracle inequality, which is proven in Section 7.2. The condition is trivially satisfied for .

Proposition 3.3.

Let be an arbitrary subset of matrices and define

| (3.6) |

where we set if . Suppose . On the event for some we have

| (3.7) |

If the set is convex, then sub-differential calculus can be used to refine the inequality (3.7). The proof is inspired by Koltchinskii et al., [24, Thm. 1] and postponed to Section 7.3. Note that this second oracle inequality improves (3.7) with respect to two aspects. Instead of we have in the second term on the right-hand side and the nuclear-norm of is replaced by its rank.

Theorem 3.4.

This oracle inequality is purely non-asymptotic and sharp in the sense that we have the constant one in front of on the right-hand side. Combining Lemma 3.2 and Theorem 3.4 immediately yields an oracle inequality for the error in the Frobenius norm.

Corollary 3.5.

Let be a convex subset of the positive semi-definite matrices and let . On the event for some and for from (3.6) we have

for a constant depending only on and .

The remaining question is how the parameters and should be chosen in order to control the event . The answer will be given in the next section.

4 Convergence rates

The above oracle inequalities hold true for any Lévy-process and any independent time-change with stationary increments. However, to find some and such that probability of the event with the error term from (3.6) is indeed large, we naturally need to impose some assumptions. For simplicity we will concentrate on the well-specified case noting that, thanks to Corollary 3.5, the results carry over to the miss-specified situation.

Assumption B.

Let the jump measure of fulfil:

-

(i)

for some and for some constant let

(4.1) -

(ii)

for some .

Assumption C.

Let the time-change satisfy:

-

(i)

for some .

-

(ii)

The sequence , is mutually independent and identically distributed with some law on .

-

(iii)

The derivatives of the Laplace transform satisfy for some for all with .

If the Laplace transform decays polynomially, we may impose the stronger assumption

-

(iv)

for some for all with .

Remarks 4.1.

-

(i)

For Assumption B(i) allows for Lévy processes with infinite jump activity. In that case in (4.1) is an upper bound for the Blumenthal–Getoor index of the process. A more pronounced singularity of the jump measure at zero corresponds to larger values of . The lower bound is natural, since any jump measure satisfies . On the contrary, in (4.1) implies that is a finite measure. In that case we could further profit from its regularity which we measure by the decay of its Fourier transform. Altogether, the parameter will determine the approximation error that is due to the term in (3.2).

-

(ii)

Assumption B(ii) implies that for all and together with the moment condition Assumption C(i), we conclude that , cf. Lemma 8.1. Assumption C(ii) implies that the increments are independent and identically distributed. Note that being stationary with invariant measure is necessary to construct the estimator of . The independence can, however, be relaxed to an -mixing condition as discussed in Section 5.2. Finally, Assumptions C(iii) and (iv) are used to linearise the stochastic error.

In the sequel we denote by the -dimensional ball of radius . We can now state the first main result of this section.

Theorem 4.2.

In order to prove this theorem, we decompose into a stochastic error term and a deterministic approximation error. More precisely, the regression formula (3.2) and for any yield

| (4.2) | ||||

The order of the deterministic error is , cf. Lemma 8.3, which decays as . The rate deteriorates for higher jump activities. This is reasonable since even for high frequency observations it is very difficult to distinguish between small jumps and fluctuations due to the diffusion component, cf. Jacod and Reiß, [21]. The stochastic error is dominated by its linearisation

which is increasing in due to the denominator as . To obtain a sharp oracle inequality for the spectral norm of the linearised stochastic error, we use the noncommutative Bernstein inequality by Recht, [32]. To bound the remainder, we apply a concentration result (Theorem A.4) for the empirical characteristic function around , uniformly on .

The lower bound on reflects the typical dependence on the dimension that also appear is in theory on matrix completion, cf. Corollary 2 by Koltchinskii et al., [24]. Our upper bound on ensures that the remainder term in the stochastic error is negligible.

The choice of is determined by the trade-off between approximation error and stochastic error. Since neither nor depend on the rank of , the theorem verifies that the estimator is adaptive with respect to . Supposing lower bounds for that depend only on the radius , the only term that depends on the dimension is . Owing to , it is uniformly bounded by the volume of the unit ball in which in turn is uniformly bounded in (in fact it is decreasing as ). If , we even have . We discuss this quite surprising factor further after Corollary 4.4 and, from a more abstract perspective, in Section 5.5.

For specific decay behaviours of we can now conclude convergence rates for the diffusion matrix estimator. In contrast to the nonparametric estimation of the coefficients of a diffusion process, as studied by Chorowski and Trabs, [15], the convergence rates depend enormously on the sampling distribution (resp. time-change). We start with an exponential decay of the Laplace transform of . This is especially the case if the Lévy process is observed at equidistant time points for some and thus .

Corollary 4.3.

Grant Assumptions B and C(i)-(iii) and let . Suppose that , where is a convex subset of positive semi-definite matrices and let . If for with and for some , we set

for some and a constant which can be chosen independently of and . Then we have for sufficiently large

with probability larger than for some depending only on and .

The assertion follows from Corollary 3.5 and Theorem 4.2 (setting ), taking into account that due to (2.1) (and (8.1)) we have

This corollary shows that the exponential decay of leads to a severely ill-posed problem and, as a consequence, the rate is only logarithmic. Therein, the interplay between sample size and dimension , i.e. the term has been also observed for matrix completion [24, Cor. 2]. Whenever there is some such that the logarithmic term in the upper bound simplifies to . The slow rate implies that is consistent in absolute error only if . Considering the relative error , this restriction vanishes. Note also that in a high-dimensional principal component analysis, the spectral norm may grow in , too, cf. the discussion for the factor model by Fan et al., [18].

If decays only polynomially, as for instance for the gamma subordinator, cf. Examples 2.1, the estimation problem is only mildly ill-posed and the convergence rates are polynomial in .

Corollary 4.4.

Grant Assumptions B and C(i)-(iv) and assume . For a convex subset of positive semi-definite matrices, let , and . Suppose and for with and for some such that . Denoting the smallest strictly positive eigenvalue of by , we set

for a constant independent of and . Then we have for sufficiently large

with probability larger than for some depending only on and .

Remarks 4.5.

-

(i)

The convergence rate reflects the regularity and the degree of ill-posedness of the statistical inverse problem, where is the decay rate of the characteristic function and we gain two degrees since grows like . The term appearing in the denominator is very surprising since the rate becomes faster as the rank of increases up to some critical threshold value . To see this, it remains to note that the assumption yields

In order to shed some light on this phenomenon, we consider a related regression problem in Section 5.5.

-

(ii)

It is interesting to note that for very small we almost attain the parametric rate. Having the example of gamma-distributed increments in mind, a small corresponds to measures which are highly concentrated at the origin. In that case we expect many quite small increments where the jump component has only a small effect. On the other hand, for the remaining few rather large increments, the estimator is not worse than in a purely low-frequency setting. Hence, heuristically corresponds to an interpolation between high- and low-frequency observations, cf. also Kappus, [23].

-

(iii)

If the condition is not satisfied, the linearised stochastic error appears to be smaller than the remainder of the linearsation. It that case we only obtain the presumably suboptimal rate (for fixed ). It is still an open problem whether this condition is only an artefact of our proofs or if there is some intrinsic reason.

Let us now investigate whether the rates are optimal in the minimax sense. The dependence on the the rank of is the same as usual in matrix estimation problems and seems natural. The optimality of the influence of the dimension is less clear. In lower bounds for matrix completion, cf. Koltchinskii et al., [24, Thm. 6], a similar dependence appears except for the fact that we face non-parametric rates. In the following we prove lower bounds for the rate of convergence in the number of observations for a fixed . More general lower bounds in a high-dimensional setting where may grow with are highly intricate since usually lower bounds for high-dimensional statistical problems are based on Kullback-Leibler divergences in Gaussian models - an approach that cannot be applied in our model. This problem is left open for future research.

Let us introduce the class of all Lévy measures satisfying Assumption B with and a constant . In order to prove sharp lower bounds, we need the following stronger assumptions on the time change:

Assumption D.

Grant (i) and (ii) from Assumption C. For and let the Laplace transform satisfy

-

(m)

for some and all

or

-

(s)

for some and all with

Theorem 4.6.

Fix and let and .

- (i)

-

(ii)

Under the Assumption D(s) with it holds for any that

Note that the infima are taken over all estimators of based on independent observations of the random variable whose law we denoted by .

Up to a logarithmic factors in the mildly ill-posed case, the upper and lower bounds coincide and thus our convergence rates are minimax optimal for fixed .

5 Discussions and extensions

In this section we discuss several generalisations of the previously developed theory.

5.1 Estimating the time-change

In order to define the diffusion matrix estimator we have assumed that the Laplace transform of the time-change increments is known. In the context of random observation times it is reasonable to suppose that we additionally observe for some sample size . Using empirical process theory, it is not difficult to show that

converges uniformly to for with -rate as exploited by Chorowski and Trabs, [15]. This result could be generalised to appropriate arguments on the complex plane and may allow for replacing by for the estimator of the characteristic exponent (3.1).

More precisely, we need to invert the function This is not a trivial problem, since the inverse function should be well defined on a complex plane (we are going to plug in a complex-valued function ). We use the Lagrange inversion formula to compute the derivatives of at point and then expand this function into Taylor series around This approximation turns out to be very stable and can even improve the quality of estimating , see Section 6.2. We have a formal expansion

In the case of a continuous distribution of for any with probability one and the inverse function exists and is unique. In some vicinity of the point in the complex plan, we obtain the expansion

| (5.1) |

with

where are partial Bell polynomials. Formula (5.1) can then be used to obtain another estimator for the characteristic exponent which adapts to the unknown Laplace transform:

We investigate the numerical performance of the this approach in Section 6.2.

5.2 Mixing time-change

Motivated by the integrated CIR process from Example 2.1(iv), for instanced used by Carr et al., [14] to model stock price processes, we will generalise the results from the previous section to time-changes , whose increments are not i.i.d., but form a strictly stationary -mixing sequence. Recall that the strong mixing coefficients of the sequence are defined by

for and . We replace Assumption C by the following

Assumption E.

Let the time-change satisfy:

-

(i)

for some .

-

(ii)

The sequence , is strictly stationary with invariant measure and -mixing with

for some positive constants and

-

(iii)

The Laplace transform satisfies for some for all with .

If is -mixing, Lemma 7.1 by Belomestny, [6] shows that the sequence inherits the mixing-property from the sequence . In combination with the finite moments for we can apply a concentration inequality on the empirical characteristic function , see Theorem A.4 below, which follows from the results by Merlevède et al., [27].

In the -mixing case, a noncommutative Bernstein inequality is not known (at least to the authors’ knowledge) and thus we cannot hope for a concentration inequality for analogous to Theorem 4.2. Possible workarounds are either to estimate

| (5.2) |

where , or to bound for the maximum entry norm for . While the former estimate leads to suboptimal rates for polynomially decaying , we loose a factor in the latter bound which is critical in a high-dimensional setting.

Having in mind that the Laplace transform of the integrated CIR process decays exponentially, we pursue the first idea and obtain the following concentration result:

Theorem 5.1.

The suboptimal term in lower bound of comes from the estimate (5.2). The term could be omitted with a more precise estimate of the linearised stochastic error term (similar to the proof of Theorem 4.2), but let us keep the proof of Theorem 5.1 simple, see Section 8.3. For exponentially decaying Laplace transforms the resulting rate is already sharp and coincides with our results for the independent case as soon as for some .

5.3 Low rank plus sparse matrix

In view of Fan et al., [17, 18] it might be interesting in applications to relax the low rank assumption on the diffusion matrix to case where for a low-rank matrix and a sparse matrix . The underlying idea is that reflects a low dimensional factor model while represents a sparse error covariance matrix. Sparsity in means here that most entries of are zero or very small, see for instance [11] for this approach to sparsity. More precisely, let us assume that the entry-wise -norm for some is small. For the sake of clarity, we focus on extending the estimator from (3.3) while it can be easily seen how to modify the following for the bias corrected estimator .

In terms of the vectorisation operator for any we rewrite

Hence, defining the set and the matrices

we obtain the representation

Motivated by this reformulation, we introduce the estimator where

| (5.3) |

for a subset . Since , the nuclear norm penalisation in (5.3) will enforce a low rank structure in and a sparse structure in . In order to carry over the oracle inequalities, we first need verify the isometry property for the modified weighted norm

Indeed, we easily deduce from Lemma 3.2 and :

Lemma 5.3.

For any symmetric matrix we have

where and .

We recover the exact structure for which Theorem 3.4 has been proven and thus conclude:

Proposition 5.4.

Noting and using Lemma 5.3, we obtain an oracle inequality for the estimation error of in the Frobenius norm. The extension from to can be proven as Corollary 2 by Rigollet and Tsybakov, [33].

Theorem 5.5.

Let is a convex subset of the symmetric matrices. On the event for some and for from (5.4) we have for a constant depending only on and :

where the infimum is taken over all such that . Moreover, for another constant and any we have

The analysis of the error term can be done as in Section 4 noting that has very similar properties as , especially and . We omit the details.

5.4 Incorporating positive definiteness constraints

Consider the optimisation problem

| (5.5) |

In general, the solution of (5.5) has to be searched in a space of dimension . Solving such a problem becomes rapidly intractable for large . In order to solve (5.5) at a reduced computational cost, we assume that In order to handle the positive definiteness constraint, we let with and rewrite the problem (5.5) as

5.5 A related regression problem

In order to understand the dimension effect that we have observed in the convergence rates in Corollary 4.4, we will take a more abstract point of view considering a related regression-type problem in this section. Motivated from the regression formula (3.2), we study the estimation of a possibly low-rank matrix , based on the observations

| (5.7) |

where is an unknown deterministic nuisance function satisfying as and are centred, bounded random variables such that:

| (5.8) |

for some symmetric function and . The covariance structure of includes on the one hand that the variance of increases (polynomially) as , implying some ill-posedness, and on the other hand the random variables and decorrelate as the distance of and increases (supposing that is a reasonable regular function).

Following our weighted Lasso approach, we define the statistic

and introduce the weighted least squares estimator

| (5.9) |

for a convex subset , a weight function for some radial function with support and a penalisation parameter .

Our oracle inequalities easily carry over to the regression setting. We define the weighted scalar product and corresponding (semi-)norm

as well as the error matrix

Along the lines of Proposition 3.3 we obtain

It is now crucial to compare the weighted norm with the Frobenius norm . Analogously to Lemma 3.2, we have for any positive definite matrix with diagonal matrix and orthogonal matrix that

| (5.10) |

Hence, compared to the Frobenius norm the weighted norm becomes stronger as and increase. In the well specified case we conclude

Theorem 3.4 corresponds to the following stronger inequality which can be proved analogously. Because is not normalised in the sense of inequality (5.10), we have to be a bit careful in the very last step in Section 7.3 in order not to oversee a factor .

Theorem 5.6.

Let us now estimate the spectral norm of the error matrix

| (5.12) |

The second term is a deterministic error term which is bounded by

using . The dimension occurs here as a consequence of how the regularity (decay of ) is measured in this problem. For the first term in (5.12) we apply, for instance, non-commutative Bernstein inequality noting that are i.i.d., bounded and centred. The Cauchy-Schwarz inequality, or more precisely the estimate (8.4), yields

Note that the dependence of the variance on and is the usual non-parametric behaviour. Therefore,

We thus choose and conclude from (5.11)

| (5.13) |

If , then we face a bias-variance trade-off. Supposing for some , we may choose the optimal and obtain the rate

This rate coincides with our findings in Corollary 4.4. Note that the second regime in the mildly ill-posed case comes from the auto-deconvolution structure of the Lévy process setting which is not represented in the regression model (5.7).

From this analysis we see that root for the surprising dimension dependence is the factor in the isometry property (5.10). Intuitively, it reflects that we “observe” more frequencies in the annulus as increases and, due to the function in (5.8), we can profit from these since the observations decorrelate if the frequencies have a large distance from each other.

6 Simulations

6.1 Known time change

Let us analyse a model based on a time-changed normal inverse Gaussian (NIG) Lévy process. The NIG Lévy processes, characterised by their increments being NIG distributed, have been introduced in [3] as a model for log returns of stock prices. Barndorff-Nielsen, [3] considered classes of normal variance-mean mixtures and defined the NIG distribution as the case when the mixing distribution is inverse Gaussian. Shortly after its introduction it was shown that the NIG distribution fits very well the log returns on German stock market data, making the NIG Lévy processes of great interest for practioneers.

An NIG distribution has in general the four parameters and with having different effects on the shape of the distribution: is responsible for the tail heaviness of steepness, affects symmetry, scales the distribution and determines its mean value. The NIG distribution is infinitely divisible with the characteristic function

Therefore one can define the NIG Lévy process which starts at zero and has independent and stationary increments such that each increment is distributed. The NIG process has no diffusion component making it a pure jump process with the Lévy density

| (6.1) |

where is the modified Bessel function of the third kind. Taking into account the asymptotic relations

we conclude that Assumption B is fulfilled for and any

A Gamma process is used for the time change which is a Lévy process such that its increments have a Gamma distribution, so that is a pure-jump increasing Lévy process with Lévy density

where the parameter controls the rate of jump arrivals and the scaling parameter inversely controls the jump size. The Laplace transform of is of the form

It follows from the properties of the Gamma distribution that Assumption C (with (iv)) is fulfilled for the Gamma process for any Introduce a time-changed Lévy process

where is a -dimensional Wiener process, is a positive semi-definite matrix, is a -dimensional Lévy process with independent NIG components and is a Gamma process. Note that the process is a multi-dimensional Lévy process since was itself a Lévy process (subordinator). Let us be more specific and set

where and is a randomly generated orthogonal matrix. We choose and distributed increments of the coordinate Lévy processes . Take also and for the parameters of the Gamma process

Simulating a discretised trajectory of the process of the length , we estimate the covariance matrix with from (3.3). We solve the convex optimisation problem

| (6.2) |

where and . The integral in (6.2) is approximated by a Monte Carlo algorithm using independent draws from the uniform distribution on In order to ensure that the estimate is a positive semi-definite matrix, we compute the nearest positive definite matrix which approximates To find such an approximation we use R package Matrix (function nearPD).

We choose the tuning parameters according to the rule of thumb A data-driven selection procedure adapting to the unknown quantities and would be interesting, but is behond the scope of this paper. In view of the decompostion (4.2) and our concentration inequalities for , a model selection procedure or a Lepski method could be developed, cf. [22] or, in the very similar deconvolution setting with unknown error distribution, [16].

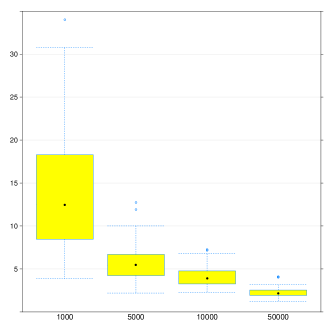

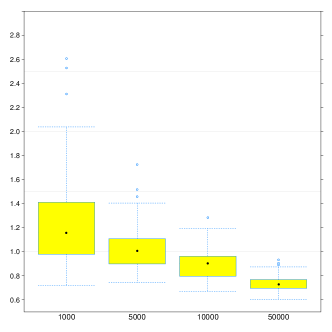

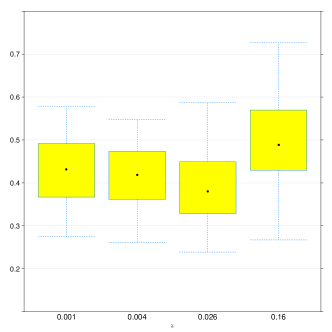

Figure 6.1 shows box plots of the relative estimation error for sample sizes based on 100 simulation iterations. As one can see, the nuclear norm penalisation stabilises the estimates especially for smaller sample sizes. Without penalisation the approximated mean squared error is 5 to 10 times larger than the estimation error with penalisation choosing .

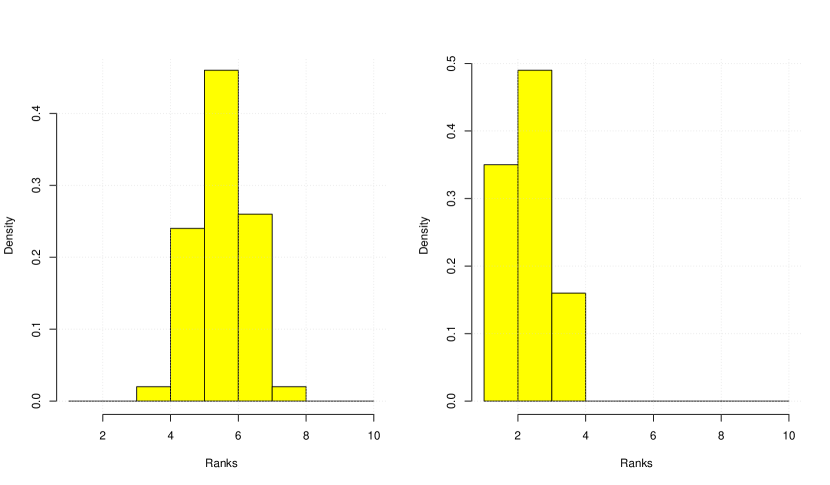

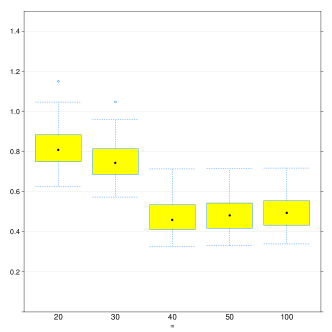

Next we look at the ranks of estimated matrices The corresponding histograms (obtained over simulation runs each consisting of observations) are presented in Figure 6.2, where the ranks were computed using the function rankMatrix from the package Matrix with tolerance for testing of “practically zero” equal to As expected the ranks of the estimated matrices are significantly lower in the case of nuclear norm penalization () and concentrate around the true rank.

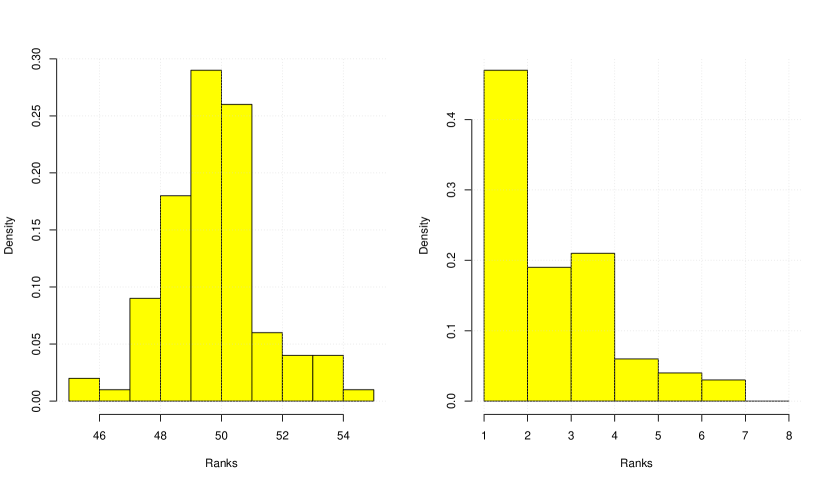

Let us now increase the dimension of the matrix to by adding zeros to eigenvalues, i.e., we set with and randomly generated orthogonal matrix We take -dimensional time-changed Lévy process with independent NIG components and run our estimation algorithm with and The Figure 6.3 shows the histograms of ranks based on repetitions of the estimation procedure. The relative estimation error under an optimal choice of is of order

Let us now illustrate the importance of including the intercept in the optimisation problem (3.4) for Lévy processes with . Consider a model of the type:

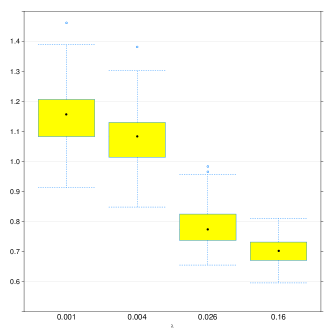

where is a -dimensional Wiener process, is a positive semi-definite matrix as before, is a -dimensional Lévy process of compound Poisson type and is a Gamma process with parameters as before. In particular, we take each Lévy process to be of the form where is a Poisson process with intensity and are i.i.d standard normals. We compute and compare the estimates and for different values of (). As can be seen from Figure 6.4, the estimate has much better performance than Moreover, larger values of (stronger penalisation) can make the difference between and less severe.

6.2 Estimated time change

Let us now illustrate the performance of our estimation algorithm in the case of unknown distribution of the time change where the Laplace tranform is estimated according to Section 5.1. In practice we need to cut the expansion of from (5.1). We thus consider an approximation of the form

| (6.3) |

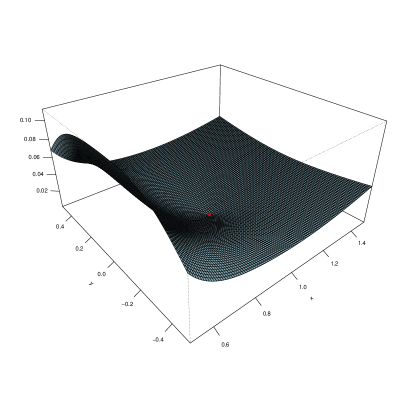

for some integer Figure 6.5 (left) shows a typical realisation of the difference for and in the case of a Gamma subordinator with parameters as before. On the right hand side of Figure 6.5, one can see box plots of the error when using instead of for different values of and other parameters being the same as in the -dimensional example of Section 6.1. As can be seen, already relatively small values of lead to reasonable estimates of Moreover by comparing Figure 6.5 with Figure 6.1, one can even observe a slight improvement of the error rate for . This can be due to a regularising effect of the series truncation in (6.3).

7 Proofs of the oracle inequalities

7.1 Proof of the isometry property: Lemma 3.2

Let has rank and admit the singular value decomposition for the diagonal matrix and an orthogonal matrix . Noting that for all , we have

with and . On the other hand the Cauchy-Schwarz inequality yields

where the last equality follow from for any since has the spectrum . ∎

7.2 Proof of the first oracle inequality: Proposition 3.3

For convenience define . It follows from the definition of that for all and

Hence,

Due to the trace duality we have on the good event that and as a result

Consequently, choosing yields

| ∎ |

7.3 Proof of the second oracle inequality: Theorem 3.4

We first introduce some abbreviations. Define with elements and the convention . Note that convexity of and implies convexity of . Moreover, we write and . As above we use .

The proof borrows some ideas and notation from the proof of Theorem 1 in [24]. First note that a necessary condition of extremum in (3.4) implies that there is , i.e. is an element of the subgradient of the nuclear norm, such that the matrix

belongs to the normal cone at the point i.e. for all Hence

or equivalently

Furthermore

for any Fix some of rank with the spectral representation

where are singular values of Due to the representation for the subdifferential of the mapping (see Watson, [43])

where is the support of , is a projector on the linear vector subspace , we get

By the trace duality, there is such that

and for this

since ( and ). Using the identities

we deduce

On the good event the trace duality yields

with Next by the Cauchy-Schwarz inequality,

as well as

since . Combining the above inequalities, we get

which is equivalent to

Finally, we choose and apply Lemma 3.2 as well as the standard estimate for any to obtain on the good event

| ∎ |

8 Proof of the convergence rates

8.1 Proof of the upper bound: Theorem 4.2

We start with an auxiliary lemma:

Lemma 8.1.

Let be a -dimensional Lévy process with characteristic triplet . If for , then for any where is the smallest even natural number satisfying .

Proof.

We decompose the Lévy process into two independent Lévy processes and with characteristics and , respectively. The triangle inequality yields

Let be an even integer. Due to the compactly supported jump measure of , the -th moment of is finite and can be written as a polynomial of degree of its first cumulants. Since all cumulants of are linear in , we conclude with Jensen’s inequality

Since is a compound Poisson process, it can be represented as for a Poisson process with intensity and a sequence of i.i.d. random variables which is independent of . Hence,

Note that is finite owing to the assumption . ∎

Remark 8.2.

While the upper bound is natural, the order is sharp too in the sense that for a Brownian motion and we have .

To show the upper bound, we start with bounding the approximation error term in the decomposition (4.2).

Lemma 8.3.

Proof.

Let us start with the case and . For all we have

Hence, we obtain

In the case and , we have such that

| ∎ |

In order the bound the stochastic error term in (4.2), we apply the following linearisation lemma. We denote throughout .

Lemma 8.4.

Proof.

First note that

and in particular . Hence, the Taylor formula yields

with

| (8.2) |

for some intermediate point depending on . For another intermediate point we estimate

| (8.3) |

Therefore, we have on the event for any in the support of

Under Assumption C(iv) we can obtain a sharper estimate. More precisely, (8.2) and (8.3) imply together with the faster decay that

Using and again (8.3), we have on

We conclude

| ∎ |

Denoting the linearised stochastic error term by

we obtain the following concentration inequality

Lemma 8.5.

Define . There is some depending only on such that for any and any

Proof.

We write

where are independent, centred and symmetric matrices in . In order to apply the noncommutative Bernstein inequality in [32, Thm. 4], we need to bound and . Since , we have

Using that for and symmetry in , the Variance of is bounded as follows:

To estimate we bound the spectral norm of the integral by the integral over the spectral norms (Minkowski inequality). Moreover, we use that for any functions and with the Cauchy-Schwarz inequality and Fubini’s theorem yield

| (8.4) |

Taking into account the compact support of and applying the previous estimate to the functions and , we obtain

Using , we conclude

Consequently, Theorem 4 from [32] yields

for some constant depending only on . ∎

Proof of Theorem 4.2.

We write again if Assumption C(iv) is satisfied and otherwise. Applying Lemmas 8.3 and 8.4 we deduce from (4.2) on the event , defined the linearisation lemma,

for some constant depending only on and . Writing again and defining , we obtain

| (8.5) |

The first probability is bounded by Lemma 8.5. Defining

and using that by assumption, we can bound the second probability in (8.5) by Theorem A.2:

for some numerical constant , provided for some and . The probability of the complement of can be similarly estimated by

which yields the claimed bound owing to Theorem A.2 and . ∎

8.2 Proof of the lower bounds: Theorem 4.6

We follow the standard strategy to prove lower bounds adapting some ideas by Belomestny et al., [7, Chap. 1]. We start with the proof of (i) which is divided into several steps.

Step 1: We need to construct two alternatives of Lévy triplets. Let be a kernel given via its Fourier transform

Since is real and even, is indeed a real valued function. For each we define two jump measures and on via their Lebesgue density, likewise denoted by and , respectively. Slightly abusing notation we define the densities on and set the remaining coordinates equal to zero. Denoting the Laplace operator by , we set

for such that and , some positive sequence , to be chosen later and a sufficiently small constant . Since for any it holds uniformly and due to the assumption , and are non-negative finite measures. In particular, they are Lévy measures.

By construction for any and some (by rescaling can be arbitrary). To verify that holds for some sufficiently small and for all , we first note that for . In the case we use

owing to the compact support of .

Now define the rank diagonal matrix (i.e., ones followed by zeros) and its perturbation . Finally define

with a Brownian motion and with and being compound Poisson processes independent of , with jump measures and , respectively.

Step 2: We now bound the distance of the observation laws and . First we observe that both laws are equal on the last coordinates, namely being a Dirac measure in zero. Owing to the diffusion component, the marginals and admit Lebesgue densities on denoted by and , respectively (cf. [36, Thm. 27.7]). Since the observations are i.i.d., is uniformly bounded in , if

for some constant . The density is given by , where denotes the density of . Since is of compound Poisson type, its marginal density is given by the convolution exponential

with the density of the -distribution. Using that there is some interval with and that is independent of , we obtain

By Plancherel’s identity we thus have

where and denote the characteristic functions of and , respectively.

Step 3: We have to estimate the distance of the characteristic functions. Let us denote the characteristic exponents of the Lévy processes and (restricted on the first coordinates) by and , respectively. Then,

Note that is real valued because is even. Using Taylor’s formula, we obtain

Defining , we thus have

where the partial derivatives of the composition can be computed with Faà di Bruno’s formula. Since , we have

and in particular uniformly over and for . Taking into account the properties

for all and some , we see that is zero for and that for and . We conclude

Due to monotonicity of for and for , , the previous estimate and Step 2 yield as

if . Hence, remains bounded for and with some sufficiently small .

Step 5: For the second case, i.e., , we modify our construction as follows: We use the jump measures and from before, but only on the first derivative. We use the same rank diffusion matrix with ones on the diagonal, but choose the alternative as where the last entries are zero. Since the corresponding laws and are product measures which differ only on the first coordinate, the calculations from Step 2 and 3 yield

where the integral is finite by the assumption . Hence, we have shown the second lower bound Theorem 4.6(i).

The result in (ii) can be deduced analogously, choosing . In Step 3 we obtain under the corresponding assumption on that with some constant

which remains bounded if . ∎

8.3 The mixing case: Proof of Theorem 5.1

Appendix A Multivariate uniform bounds for the empirical characteristic function

A.1 I.i.d. sequences

Let us recall the usual multi-index notation. For a multi-index , a vector and a function we write

We need a multivariate (straight forward) generalisation of Theorem 4.1 by Neumann and Reiß, [30]. For a sequence of independent random vectors we define the empirical process corresponding to the empirical characteristic function by

Proposition A.1.

Let be a multi-index and let be iid. -dimensional random vectors satisfying for some . Using the weight function , for some , there is a constant such that

Proof.

The proof relies on a bracketing entropy argument and we first recall some definitions. For two functions a bracket is given by . For a set of functions the -bracketing number denotes the minimal number of brackets satisfying which are necessary to cover . The bracketing integral is given by

A function is called envelop function of if for any .

Decomposing into the real and the imaginary part, we consider the set where

Noting that has the envelop function , Lemma 19.35 in van der Vaart, [40] yields

Since the real and the imaginary part can be treated analogously, we concentrate in the following on . Owing to , we have for and

To cover , we define for some grid and

with

We have for . Denoting the Lipschitz constant of by , it holds

Therefore, if . Since any (Euklidean) ball in with radius can be covered with fewer than cubes with edge length and each of these cubes can be covered with a ball of radius (use ), we choose to see that

By the choice of it holds and Markov’s inequality yields . The bracketing entropy is thus bounded by

and the entropy integral can be estimated by

Applying Talagrand’s inequality, we conclude the following concentration result, see also Proposition 3.3 in Belomestny et al., [7, Chap. 1].

Theorem A.2.

Let be i.i.d. -dimensional random vectors satisfying for some . For any there is some numerical constant independent of such that

for any .

A.2 Mixing sequences

If the sequence is not i.i.d., but only -mixing, there is no Talagrand-type inequality to work with. At least Merlevède et al., [27] have proven to following Bernstein-type concentration result. The bound of the constant has been derived by Belomestny, [6].

Proposition A.3 (Merlevède et al., [27]).

Let be a strongly mixing sequence of centred real-valued random variables on the probability space with mixing coefficients satisfying

| (A.1) |

If a.s., then there is a positive constant depending on and such that

for all and where

Morover, there is a constant such that

| (A.2) |

provided the expectations on the right-hand side are finite.

Let , be a sequence of random vectors in with corresponding empirical characteristic function

Theorem A.4.

Suppose that the following assumptions hold:

-

(AZ1)

The sequence , is strictly stationary and -mixing with mixing coefficients satisfying

for some and

-

(AZ2)

It holds for some .

For arbitrary let the weighting function be given by

| (A.3) |

Then there are depending only on the characteristics of and , such that for any and for all the inequality

| (A.4) |

holds for constants independent of and .

Proof.

We introduce the empirical process

Consider the sequence . As discussed in the proof of Proposition A.1, we can cover each ball with small balls with radius and some centres .

Since as , there is for any some finite integer such that . For we use the bound

to obtain

| (A.5) |

It holds for any

| (A.6) |

where is the Lipschitz constant of . Markov’s inequality and the moment inequality by Yokoyama, [44] yield

for any and where is some constant depending on and from Assumption (AZ1). In combination with (A.6) we obtain

Setting , we conclude

with some constant depending neither on nor .

We turn now to the first term on the right-hand side of (A.5). If , then it follows from Proposition A.3

with some constant depending only on the characteristics of the process and . The same bound holds true for . Choosing for any and taking into account the choice of from above, we get

with positive constants . Fix such that and compute

If we obtain for any

On the interval for appropriate , we thus get (A.4). ∎

References

- Agarwal et al., [2012] Agarwal, A., Negahban, S., and Wainwright, M. J. (2012). Noisy matrix decomposition via convex relaxation: optimal rates in high dimensions. Ann. Statist., 40(2):1171–1197.

- Aït-Sahalia and Mykland, [2003] Aït-Sahalia, Y. and Mykland, P. A. (2003). The effects of random and discrete sampling when estimating continuous–time diffusions. Econometrica, 71(2):483–549.

- Barndorff-Nielsen, [1997] Barndorff-Nielsen, O. E. (1997). Processes of normal inverse gaussian type. Finance and stochastics, 2(1):41–68.

- Barndorff-Nielsen and Shiryaev, [2010] Barndorff-Nielsen, O. E. and Shiryaev, A. (2010). Change of Time and Change of Measure. World Scientific.

- Basawa and Brockwell, [1982] Basawa, I. V. and Brockwell, P. J. (1982). Non-parametric estimation for non-decreasing Lévy processes. Journal of the Royal Statistical Society. Series B (Methodological), pages 262–269.

- Belomestny, [2011] Belomestny, D. (2011). Statistical inference for time-changed Lévy processes via composite characteristic function estimation. Ann. Statist., 39(4):2205–2242.

- Belomestny et al., [2015] Belomestny, D., Comte, F., Genon-Catalot, V., Masuda, H., and Reiß, M. (2015). Lévy matters. IV, volume 2128 of Lecture Notes in Mathematics. Springer. Estimation for Discretely Observed Lévy Processes.

- Belomestny and Panov, [2013] Belomestny, D. and Panov, V. (2013). Estimation of the activity of jumps in time-changed Lévy models. Electron. J. Stat., 7:2970–3003.

- Belomestny and Reiß, [2006] Belomestny, D. and Reiß, M. (2006). Spectral calibration of exponential Lévy models. Finance and Stochastics, 10(4):449–474.

- Bibinger et al., [2014] Bibinger, M., Hautsch, N., Malec, P., and Reiss, M. (2014). Estimating the quadratic covariation matrix from noisy observations: local method of moments and efficiency. Ann. Statist., 42(4):80–114.

- Bickel and Levina, [2008] Bickel, P. J. and Levina, E. (2008). Covariance regularization by thresholding. The Annals of Statistics, pages 2577–2604.

- Bücher and Vetter, [2013] Bücher, A. and Vetter, M. (2013). Nonparametric inference on Lévy measures and copulas. Ann. Statist., 41(3):1485–1515.

- Bull, [2014] Bull, A. (2014). Estimating time-changes in noisy Lévy models. Ann. Statist., 42(5):2026–2057.

- Carr et al., [2003] Carr, P., Geman, H., Madan, D. B., and Yor, M. (2003). Stochastic volatility for Lévy processes. Mathematical Finance, 13(3):345–382.

- Chorowski and Trabs, [2016] Chorowski, J. and Trabs, M. (2016). Spectral estimation for diffusions with random sampling times. Stochastic processes and their applications, 126(10):2976–3008.

- Dattner et al., [2016] Dattner, I., Reiß, M., Trabs, M., et al. (2016). Adaptive quantile estimation in deconvolution with unknown error distribution. Bernoulli, 22(1):143–192.

- Fan et al., [2011] Fan, J., Liao, Y., and Mincheva, M. (2011). High-dimensional covariance matrix estimation in approximate factor models. Ann. Statist., 39(6):3320–3356.

- Fan et al., [2013] Fan, J., Liao, Y., and Mincheva, M. (2013). Large covariance estimation by thresholding principal orthogonal complements. J. R. Stat. Soc. Ser. B. Stat. Methodol., 75(4):603–680. With 33 discussions by 57 authors and a reply by Fan, Liao and Mincheva.

- Figueroa-López, [2009] Figueroa-López, J. E. (2009). Nonparametric estimation of time-changed Lévy models under high-frequency data. Advances in Applied Probability, 41(04):1161–1188.

- Jacod and Podolskij, [2013] Jacod, J. and Podolskij, M. (2013). A test for the rank of the volatility process: the random perturbation approach. Ann. Statist., 41(5):2391–2427.

- Jacod and Reiß, [2014] Jacod, J. and Reiß, M. (2014). A remark on the rates of convergence for integrated volatility estimation in the presence of jumps. Ann. Statist., 42(3):1131–1144.

- Kappus, [2014] Kappus, J. (2014). Adaptive nonparametric estimation for Lévy processes observed at low frequency. Stochastic Processes and their Applications, 124(1):730–758.

- Kappus, [2015] Kappus, J. (2015). Nonparametric estimation for irregularly sampled Lévy processes. Statistical Inference for Stochastic Processes, pages 1–27.

- Koltchinskii et al., [2011] Koltchinskii, V., Lounici, K., and Tsybakov, A. B. (2011). Nuclear-norm penalization and optimal rates for noisy low-rank matrix completion. The Annals of Statistics, 39(5):2302–2329.

- Massart, [2007] Massart, P. (2007). Concentration inequalities and model selection, volume 1896 of Lecture Notes in Mathematics. Springer, Berlin.

- Masuda, [2007] Masuda, H. (2007). Ergodicity and exponential -mixing bounds for multidimensional diffusions with jumps. Stochastic processes and their applications, 117(1):35–56.

- Merlevède et al., [2009] Merlevède, F., Peligrad, M., and Rio, E. (2009). Bernstein inequality and moderate deviations under strong mixing conditions. In High dimensional probability V: the Luminy volume, volume 5 of Inst. Math. Stat. Collect., pages 273–292. Inst. Math. Statist., Beachwood, OH.

- Monroe, [1978] Monroe, I. (1978). Processes that can be embedded in Brownian motion. The Annals of Probability, 6:42–56.

- Negahban and Wainwright, [2011] Negahban, S. and Wainwright, M. J. (2011). Estimation of (near) low-rank matrices with noise and high-dimensional scaling. Ann. Statist., 39(2):1069–1097.

- Neumann and Reiß, [2009] Neumann, M. H. and Reiß, M. (2009). Nonparametric estimation for Lévy processes from low-frequency observations. Bernoulli, 15(1):223–248.

- Nickl et al., [2015] Nickl, R., Reiß, M., Söhl, J., and Trabs, M. (2015). High-frequency Donsker theorems for Lévy measures. Probability Theory and Related Fields.

- Recht, [2011] Recht, B. (2011). A simpler approach to matrix completion. J. Mach. Learn. Res., 12:3413–3430.

- Rigollet and Tsybakov, [2012] Rigollet, P. and Tsybakov, A. B. (2012). Comment:” minimax estimation of large covariance matrices under -norm”. Statistica Sinica, 22(4):1358–1367.

- Rohde and Tsybakov, [2011] Rohde, A. and Tsybakov, A. B. (2011). Estimation of high-dimensional low-rank matrices. The Annals of Statistics, 39(2):887–930.

- Rubin and Tucker, [1959] Rubin, H. and Tucker, H. (1959). Estimating the parameters of a differential process. The Annals of Mathematical Statistics, 30:641–658.

- Sato, [2013] Sato, K.-i. (2013). Lévy processes and infinitely divisible distributions, volume 68 of Cambridge Studies in Advanced Mathematics. Cambridge University Press, Cambridge. Translated from the 1990 Japanese original, Revised edition of the 1999 English translation.

- Tao et al., [2011] Tao, M., Wang, Y., Yao, Q., and Zou, J. (2011). Large volatility matrix inference via combining low-frequency and high-frequency approaches. Journal of the American Statistical Association, 106(495):1025–1040.

- Tao et al., [2013] Tao, M., Wang, Y., and Zhou, H. H. (2013). Optimal sparse volatility matrix estimation for high-dimensional Itô processes with measurement errors. The Annals of Statistics, 41(4):1816–1864.

- Tsybakov, [2009] Tsybakov, A. B. (2009). Introduction to nonparametric estimation. Springer Series in Statistics. Springer, New York. Revised and extended from the 2004 French original, Translated by Vladimir Zaiats.

- van der Vaart, [1998] van der Vaart, A. W. (1998). Asymptotic statistics, volume 3 of Cambridge Series in Statistical and Probabilistic Mathematics. Cambridge University Press, Cambridge.

- Veraart and Winkel, [2010] Veraart, A. and Winkel, M. (2010). Time change. In R.Cont, editor, Encyclpedia of quantitative finance. Wiley.

- Wang and Zou, [2010] Wang, Y. and Zou, J. (2010). Vast volatility matrix estimation for high-frequency financial data. The Annals of Statistics, 38(2):943–978.

- Watson, [1992] Watson, G. A. (1992). Characterization of the subdifferential of some matrix norms. Linear Algebra and its Applications, 170:33–45.

- Yokoyama, [1980] Yokoyama, R. (1980). Moment bounds for stationary mixing sequences. Z. Wahrsch. Verw. Gebiete, 52(1):45–57.