Asymptotic Lower Bounds for Optimal Tracking:

a Linear Programming Approach

Abstract

We consider the problem of tracking a target whose dynamics is modeled by a continuous Itō semi-martingale. The aim is to minimize both deviation from the target and tracking efforts.

We establish the existence of asymptotic lower bounds for this problem, depending on the cost structure. These lower bounds can be related to the time-average control of Brownian motion, which is characterized as a deterministic linear programming problem. A comprehensive list of examples with explicit expressions for the lower bounds is provided.

Key words: Optimal tracking, asymptotic lower bound, occupation measure, linear programming, singular control, impulse control, regular control.

MSC2010: 93E20

1 Introduction

We consider the problem of tracking a target whose dynamics is modeled by a continuous Itō semi-martingale defined on a filtered probability space with values in such that

Here, is a -dimensional Brownian motion and , are predictable processes with values in and the set of symmetric positive definite matrices respectively. An agent observes and adjusts her position in order to follow . However, she has to pay certain intervention costs for position adjustments. The objective is to stay close to the target while minimizing the tracking efforts. This problem arises naturally in various situations such as discretization of option hedging strategies [14, 50, 15], management of an index fund [46, 31], control of exchange rate [43, 11], portfolio selection under transaction costs [29, 51, 47, 2], trading under market impact [4, 42, 40] or illiquidity costs [44, 49].

More precisely, let be the position of the agent determined by the control , with and let be the deviation of the agent from the target , so that

| (1.1) |

Let be the penalty functional for the deviation from the target and the cost incurred by the control up to a finite horizon . Then the problem of tracking can be formulated as

| (1.2) |

where is the set of admissible strategies. As is usually done in the literature (see for example [30, 41]), we consider a penalty for the deviation from the target of additive form

where is a random weight process and a determinstic function. For example, we can take where is positive definite and is the inner product in . On the other hand, depending on the nature of the costs, the agent can either control her speed at all times or jump towards the target instantaneously. The control and the cost functional belong to one of the following classes:

-

1.

Impulse Control. There is a fixed cost component for each action, so the agent has to intervene in a discrete way. The class of admissible controls contains all sequences where is a strictly increasing sequence of stopping times representing the jump times and satisfying , and for each , is a -measurable random vector representing the size of -th jump. The position of the agent is given by

and the cumulated cost is then given by

where is a random weight process and is the cost of a jump with size . If we take and where is the i-th component of , then represents the total number of actions on each component over the time interval , see [14, 15]. If where , we say that the cost has a fixed component and a proportional component.

-

2.

Singular Control. If the cost is proportional to the size of the jump, then infinitesimal displacement is also allowed and it is natural to model by a process with bounded variation. In this case, the class of admissible controls contains all couples where is a progressively measurable increasing process with , which represents the cumulated amount of intervention and is a progressively measurable process with for all , which represents the distribution of the control effort in each direction. In other words, where denotes the absolute variation of a process, and is the Radon-Nikodym derivative of with respect to . The position of the agent is given by

and the corresponding cost is usually given as (see for example [29, 51])

where is a random weight process and we take (for example) with and . The vector represents the coefficients of proportional costs in each direction.

-

3.

Regular Control. Most often, the process is required to be absolutely continuous with respect to time, see for example [49, 42] among many others. In this case, the class of admissible controls contains all progressively measurable integrable processes with values in , representing the speed of the agent, the position of the agent is given by

and the cost functional is

where is a random weight process and, for example, with a positive definite matrix. Comparing to the case of singular control where the control variables are and , here we optimize over .

-

4.

Combined control. It is possible that several types of control are available to the agent. In that case, where for each , belongs to one of the classes introduced before. For example, in the case of combined regular and impulse control (see [43]), the position of the agent is given by

while the cost functional is given by

Similarly, one can consider other combinations of controls.

The problem (1.1)-(1.2) rarely admits an explicit solution. In this paper, we propose an asymptotic framework where the tracking costs are small and derive a lower bound for (1.1)-(1.2) under this setting. More precisely we introduce a parameter tending to zero and consider a family of cost functionals . For example, we can have for some constant , but different components of the cost functional may also scale with at different rates. We define the control problem

| (1.1-) |

and objective function

| (1.2-) |

Moreover, we assume that the functions , , , possess a homogeneity property.

The main result of this paper is a precise asymptotic relation between and the time-average control problem of Brownian motion with constant parameters, in a variety of settings. Let us give a flavor of the main result in the case of combined regular and impulse control (note that situations involving singular control are considered in Section 3). In this case, the dynamics of the controlled Brownian motion is given by

| (1.1-local) |

and the time-average control problem can be formulated as

| (1.2-local) |

At the level of generality that we are interested in, we need to consider a relaxed formulation of the above control problem, as a linear programming problem on the space of measures. Following [35], we introduce the occupation measures

If the process and the controls are stationary, these measures do not depend on time and therefore

On the other hand, by Itō’s formula, for any ,

| (1.3) |

where

Taking expectation in (1.3) and assuming once again the stationarity of controls, we see that under adequate integrability conditions the measures and satisfy the constraint

| (1.4) |

Therefore, the time-average control problem of Brownian motion (1.1-local)-(1.2-local) is closely related to the problem of computing

| (1.5) |

where is a probability measure and is a finite positive measure satisfying the constraint (1.4). In Section 4 we shall see that this characterization is essentially equivalent to (1.1-local)-(1.2-local) if we formulate the optimal control problem for the Brownian motion as a controlled martingale problem. In the considered case of combined regular and impulse control, our main result is the following.

Main result, combined regular and impulse control. There exists explicitly determined by the cost structure and such that for all and any sequence of admissible strategies , we have

| (1.6) |

where is the optimal cost of the linear programming formulation (1.5) of the time-average control problem of Brownian motion (1.1-local)-(1.2-local) with parameters frozen at time .

The original problem (1.1)-(1.2) is therefore simplified in the sense that the local problem (1.1-local)-(1.2-local) is easier to analyze since the dynamics of the target is reduced to that of a Brownian motion and the cost parameters become constant. In many practically important cases (see Examples 4.3-4.7), we are able to solve explicitly (1.1-local)-(1.2-local) and show that the two formulations of the time-average control problem are equivalent and therefore . Moreover, in a forthcoming paper, we show that for the examples where (1.1-local)-(1.2-local) admits an explicit solution, the lower bound is tight (see Remark 3.1).

Our result enables us to revisit the asymptotic lower bounds for the discretization of hedging strategies in [14, 15]. In these papers, the lower bounds are deduced by using subtle inequalities. Here we show that these bounds can be interpreted in a simple manner through the time-average control problem of Brownian motion.

The local control problem (1.1-local)-(1.2-local) also arises in the study of utility maximization under transaction costs, see [51, 47, 2, 42]. This is not surprising since at first order, these problems and the tracking problem are essentially the same, see Section 5. In the above references, the authors derive the PDE associated to the first order correction of the value function, which turns out to be the HJB equation associated to the time-average control of Brownian motion. Inspired by [34] and [39], our approach, based on weak convergence of empirical occupation measures, is very different from the PDE-based method and enables us to treat more general situations. Contrary to [34], where the lower bound holds under expectation, we obtain pathwise lower bounds. Compared to [39], we are able to treat impulse control and general dynamics for the target.

The paper is organized as follows. In Section 2, we introduce our asymptotic framework and establish heuristically the lower bound for the case of combined regular and impulse control. Various extensions are then discussed in Section 3. In Section 4, we provide an accurate definition for the time-average control of Brownian motion using a relaxed martingale formulation and collect a comprehensive list of explicit solutions in dimension one. The connection with utility maximization with small market frictions is made in Section 5 and the proofs are given in Sections 6, 7 and 8.

Notation. For a complete, separable, metric space , we define the set of continuous functions on , the set of bounded, continuous functions on , the set of finite nonnegative Borel measures on and the set of probability measures on . The sets and are equipped with the topology of weak convergence. We define the set of nonnegative Borel measures on such that . Denote the restriction of to . We use , and to indicate the state space corresponding to the variables , and . Finally, denotes the set of twice differentiable real functions on with compact support, equipped with the norm

2 Tracking with combined regular and impulse control

Instead of giving directly a general result, which would lead to a cumbersome presentation, we focus in this section on the tracking problem with combined regular and impulse control. This allows us to illustrate our key ideas. Other situations, such as singular control, are discussed in Section 3.

In the case of combined regular and impulse control, a tracking strategy is given by a progressively measurable process with values in and , with an increasing sequence of stopping times and a sequence of -measurable random variables with values in . The process represents the speed of the agent. The stopping time represents the timing of j-th jump towards the target and the size of the jump. The tracking error obtained by following the strategy is given by

At any time the agent is paying a cost for maintaining the speed and each jump incurs a positive cost. We are interested in the following type of cost functional

where and , , and are random weight processes. The cost functions , , , are deterministic functions which satisfy the following homogeneity property

| (2.1) |

for any and

Note that here we slightly extend the setting of the previous section by introducing two functions and which typically represent the fixed and the proportional costs respectively.

In this paper, we essentially have in mind the case where

with such that

| (2.2) |

and . Note that in this situation, we have .

2.1 Asymptotic framework

We now explain our asymptotic setting where the costs are small and provide a heuristic proof of our main result. We assume that there exist and such that

| (2.3) |

Then the asymptotic framework consists in considering the sequence of optimization problems indexed by

with

and

The key observation is that under such setting, the tracking problem can be decomposed into a sequence of local problems. More precisely, let be a partition of the interval with as . Then we can write

with

As tends to zero, we approximately have

We are hence led to study as , which is closely related to the time-average control problem of Brownian motion. To see this, consider the following rescaling of over the horizon :

where , and is to be determined (here is related to the scaling property of Brownian motion). We use the superscript to indicate that the scaled systems correspond to the horizon . Then the dynamics of is given by, see [48, Proposition V.1.5],

with

and

Note that a Brownian motion with respect to . Abusing notation slightly, we write

| (2.4) |

Using the homogeneity properties (2.1) of the cost functions, we obtain

The second approximation can be justified by the continuity of the cost coefficients , ,

and .

Now, if there exists such that

that is,

| (2.5) |

where , then we have

with

| (2.6) |

By suitably choosing , we have

It follows that and for . Therefore, the dynamics of (2.4) is approximately a controlled Brownian motion with diffusion matrix . We deduce that

| (2.7) |

where the term in the right-hand side is defined by

| (2.8) |

with

| (2.9) |

Therefore, we obtain that as :

Then we may expect that (2.8) is equal to the following expected cost criterion

| (2.10) |

see for example [7, 23, 24]. Therefore, we will use the latter version to characterize the lower bound since it is easier to manipulate.

Remark 2.1.

The approach of weak convergence is classical for proving inequalities similar to (2.7), in particular in the study of heavy traffic networks (see [38, section 9] for an overview). The usual weak convergence theorems enable one to show that the perturbed system converges in the Skorohod topology to the controlled Brownian motion as tends to zero. However, since the time horizon tends to infinity, this does not immediately imply the convergence of time-average cost functionals like .

In [39], the authors consider pathwise average cost problems for controlled queues in the heavy traffic limit, where the control term is absolutely continuous. They use the empirical “functional occupation measure” on the canonical path space and characterize the limit as a controlled Brownian motion. The same method has also been used in [10] in the study of single class queueing networks.

However, this approach cannot be applied directly to singular/impulse controls for which the tightness of the occupation measures is difficult to establish. In fact, the usual Skorokhod topology is not suitable for the impulse control term

Indeed, in the case of singular/impulse control, the component is generally not tight under the Skorokhod topology. For example (see [37, p.72]), consider the family where the function equals zero for and jumps upward by an amount at times , until it reaches the value unity. The natural limit of is of course but this sequence is not tight in the Skorokhod topology. The nature of this convergence is discussed in [32] and a corresponding topology is provided in [26].

This difficulty could be avoided by introducing a random time change after which the (suitably interpolated) control term becomes uniformly Lipschitz and hence converges under the Skorokhod topology. This technique is used in [8, 9, 37] to study the convergence of controlled queues with discounted costs. This seems to be a possible alternative way to extend the approach of [39] to singular/impulse controls. Nevertheless, the analysis would probably be quite involved.

Instead of proving the tightness of control terms in weaker topologies, we shall use an alternative characterization of the time-average control problem of Brownian motion. In [34], the authors characterize the time-average control of a Jackson network in the heavy traffic limit as the solution of a linear program. The use of occupation measure on the state space instead of the path space turns out to be sufficient to describe the limiting stochastic control problem. However, the optimization criterion is not pathwise.

2.2 Lower bound

In order to properly state our result for the case of combined regular and impulse control, we first introduce the solution of the following linear programming problem:

| (2.11) |

with satisfying the following constraint

| (2.12) |

where

We will see in Section 4.2 that it is essentially an equivalent characterization of the time-average control problem (2.9)-(2.10). In Example 4.6, we consider a particular case for which and the optimal solution can be explicitly determined. From now on, we make the following assumptions.

Assumption 2.1 (Regularity of linear programming).

Assumption 2.2 (Model).

The predictable processes and are continuous and is positive definite on .

Assumption 2.3 (Optimization criterion).

The parameters of the cost functional , , and are continuous and positive on .

Assumption 2.4 (Asymptotic framework).

Remark 2.2.

Let us comment briefly the above assumptions. Assumption 2.1 is necessary to avoid pathological cases. In most examples, the function is continuous (see Examples 4.3-4.7). Assumptions 2.2-2.3 impose minimal regularity on the dynamics of and cost parameters. Assumption 2.4 ensures that all the costs have similar order of magnitude.

Second, we introduce the following notion.

Definition 2.1.

Let be random variables on the same probability space . We say that is asymptotically bounded from below by in probability if

We write .

We now give the version of our main result for the case of combined regular and impulse control.

Theorem 2.1 (Asymptotic lower bound for combined regular and impulse control).

Thus, in Theorem 2.1 we have expressed the lower bound for the tracking problem in terms of the integral of the solution of a linear program, which will be interpreted as time-average control of Brownian motion in Section 4. For any subsequence , we can always pick a further subsequence such that

almost surely. Therefore, by Fatou’s lemma, the following corollary holds.

Corollary 2.1.

We have

3 Extensions of Theorem 2.1 to other types of control

In this section, we consider the case of combined regular and singular control and those with only one type of control. In particular, we will see that in the presence of singular control, the operator is different. Formally we could give similar results for the combination of all three controls or even in the presence of several controls of the same type with different cost functions and scaling properties. To avoid cumbersome notation, we restrict ourselves to the cases meaningful in practice, which are illustrated by explicit examples in Section 4.

3.1 Combined regular and singular control

When the fixed cost component is absent, that is , impulse control and singular control can be merged. In that case, the natural way to formulate the tracking problem is to consider a strategy with a progressively measurable process as before, and a possibly discontinuous non-decreasing process such that

and

To avoid degeneracy, we assume that for any ,

| (3.1) |

Using similar heuristic arguments as those in the previous section, we are led to consider the time-average control of Brownian motion with combined regular and singular control

| (3.2) |

where

| (3.3) |

The corresponding linear programming problem is given by

| (3.4) |

with satisfying the following constraint

| (3.5) |

where

We have the following theorem.

Theorem 3.1 (Asymptotic lower bound for combined regular and singular control).

3.2 Impulse control

Consider

with

and

We have the following theorem.

Theorem 3.2 (Asymptotic lower bound for impulse control).

See Example 4.5 for a closed form solution of .

3.3 Singular control

Consider

with

and

We have the following theorem.

Theorem 3.3 (Asymptotic lower bound for singular control).

See Example 4.4 for a closed form solution of .

3.4 Regular control

Consider

with

and

We have the following theorem.

Theorem 3.4 (Asymptotic lower bound for regular control).

Let be given by

with satisfying the following constraint

where

See Example 4.3 for a closed form solution of .

Remark 3.1 (Upper bound).

It is natural to wonder whether the lower bounds in our theorems are tight and if it is the case, what are the strategies that attain them. In a forthcoming work, we show that for the examples provided in Section 4, there are closed form strategies attaining asymptotically the lower bounds. For instance, in the case of combined regular and impulse control, it means that there exist such that

These optimal strategies are essentially time-varying versions of the optimal strategies for the time-average control of Brownian motion.

4 Interpretation of lower bounds and examples

Our goal in this section is to provide a probabilistic interpretation of the lower bounds in Theorems 2.1, 3.1, 3.2, 3.3 and 3.4, which are expressed in terms of linear programming. In particular, we want to connect them with the time-average control problem of Brownian motion. To our knowledge, there is no general result available for the equivalence between time-average control problem and linear programming. Partial results exist in [7, 33, 34, 36, 20] but do not cover all the cases we need. Here we provide a brief self-contained study enabling us to also treat the cases of singular/impulse controls and their combinations with regular control. We first introduce controlled martingale problems and show that they can be seen as a relaxed version of the controlled Brownian motion (1.1-local). Then we formulate the time-average control problem in this martingale framework. We finally show that this problem has an equivalent description in terms of infinite dimensional linear program. While essential ingredients and arguments for obtaining these results are borrowed from [33] and [35], we provide sharp conditions which guarantee the equivalence of these two formulations.

4.1 Martingale problem associated to controlled Brownian motion

In [51, 47, 42, 2], the authors obtain a HJB equation in the first order expansion for the value function of the utility maximization problem under transaction costs, which essentially provides a lower bound for their control problems. They mention a connection between the HJB equation and the time-average control problem of Brownian motion, see also [21]. Here we wish to rigorously establish an equivalence between the linear programs in our lower bounds and the time-average control of Brownian motion. This leads us to introduce a relaxed version for the controlled Brownian motion. We shall see that the optimal costs for all these formulations coincide in the examples provided in the next section.

We place ourselves in the setting of [35], from which we borrow and rephrase several elements, and assume that the state space and control spaces and are complete, separable, metric spaces. Consider an operator and an operator .

Definition 4.1 (Controlled martingale problem).

A triplet with an -valued process and an -valued random variable is a solution of the controlled martingale problem for with initial distribution if there exists a filtration such that the process is -progressive, has distribution and for every ,

| (4.1) |

is an -martingale.

We now consider two specific cases for the operators and , which will be relevant in order to express our lower bounds. Furthermore, we explain why these specific choices of and are connected to combined regular and singular/impulse control of Brownian motion.

Example 4.1 (Combined regular and impulse control of Brownian motion).

Let and define and by

| (4.2) | ||||

| (4.3) |

Here , and .

We call any solution of this martingale problem the combined regular and impulse control of Brownian motion.

Indeed, consider the following process

with a progressively measurable process, a sequence of stopping times and a sequence of -measurable random variables. Define

Then for any , by Itō’s formula,

which is a martingale. Let

Then solves the martingale problem with initial distribution .

Example 4.2 (Combined regular and singular control of Brownian motion).

Take and define

| (4.4) | ||||

| (4.5) |

Here , and .

Any solution of this martingale problem is called combined regular and singular control of Brownian motion.

Indeed, let be given by

with a progressively measurable process, and non-decreasing. By Itō’s formula, we have

which is a martingale for any . Let

Then solves the martingale problem with initial distribution .

4.2 Time-average control of Brownian motion

Now we formulate a relaxed version of the time-average control problem of Brownian motion in terms of a controlled martingale problem. This generalizes [33, 20] to combined regular and singular/impulse control of martingale problems, see also [36]. Recall that and are two operators where and . Consider two cost functionals and .

Definition 4.2 (Martingale formulation of time-average control problem).

The time-average control problem under the martingale formulation is given by

| (4.6) |

where the is taken over all solutions of the martingale problem with any initial distribution .

Now, let be any solution of the martingale problem with operators and . Define as

| (4.7) | ||||

| (4.8) |

for and . Then the average cost up to time in (4.6) can be expressed as

On the other hand, for , (4.1) defines a martingale. Taking the expectation, we obtain

If is stationary, we have

Letting tend to infinity, this leads us to introduce the following linear programming problem.

Definition 4.3 (Linear programming (LP) formulation of time-average control).

The time-average control problem under the LP formulation is given by

| (4.9) |

with

| (4.10) |

where the is computed over all and satisfying the constraint

| (4.11) |

We now present the theorem which connects linear programming and time-average control of Brownian motion.

Theorem 4.1 (Equivalence between and ).

Assume that

-

1.

(Condition on the operators and ) The operators and satisfy Condition 1.2 in [35]. In particular, there exist , , and constants depending on such that

(4.12) -

2.

(Condition on the cost function ) The cost function is non-negative and inf-compact, that is is a compact set for each . In particular, is lower semi-continuous.

-

3.

(Condition on cost function ) The cost function is non-negative and lower semi-continuous. Moreover, satisfies

(4.13) -

4.

(Relation between operators and cost functions) There exist constants and such that

(4.14) for and given by (4.12).

Then the two formulations above of the time-average control problem are equivalent in the sense that

We therefore write for both and .

Proof.

We first show that . Given any solution of the martingale problem, we define the occupation measures as (4.7) and (4.8). Without loss of generality, we can assume that where is defined in (4.10) (otherwise we would have ). We will show that .

We consider the one-point compacification and extend to by

where the last inequality is guaranteed by (4.13).

Since is lower semi-continuous, the level sets are compact. By Lemma C.1, we deduce that is a tightness function on . So the family of occupation measures is tight if is viewed as a measure on . It follows that the family of occupation measures indexed by is relatively compact.

Let be any limit point of with canonical decomposition . We claim that satisfies the linear constraint (4.11). Indeed, by (4.12) and (4.14), we have

where is a non-negative real number depending on . Then implies that and are uniformly integrable with respect to and . We therefore have

The right hand side being equal to zero, we obtain

Since and are lower semi-continuous, it follows that (see [13, Theorem A.3.12])

As the choice of the solution of the controlled martingale problem is arbitrary, we conclude that .

Remark 4.1.

We now give natural examples for which .

Corollary 4.1 (Time-average control of Brownian motion with quadratic costs).

Proof.

We consider the impulse case. First, we show that and satisfy [35, Condition 1.2]. (i) It is clear that , and . (ii) Define

then (4.12) is satisfied. (iii) Since equipped with is separable, the third condition is satisfied. (iv) and satisfy the positive maximum principle, so they are dissipative. It is obvious that they verify [35, (1.10)]. Hence they are pre-generators. (v) Obvious. Second, since and are l.s.c. and , the conditions on and are verified. Third, (4.14) holds with .

4.3 Explicit examples in dimension one

We collect here a comprehensive list of examples in dimension one for which explicit solutions are available. Most of these results exist already in the literature under the classical SDE formulation (see for example [12, 23, 24, 22, 51, 2, 42, 15, 20]), but Examples 4.6 and 4.7 are presented here for the first time. The basic idea is to solve explicitly the HJB equation corresponding to the time-average control problem and apply a verification theorem. Similar methods apply under the linear programming framework. However, for completeness we provide in Section 8 detailed proofs tailored to the formulation in terms of linear programming. In fact, we prove only the case of combined regular and impulse control, that is Example 4.6. The proofs for the other examples are similar and hence omitted.

Example 4.3 (Regular control of Brownian motion).

Let and consider the following linear programming problem

| (4.18) |

where satisfies

| (4.19) |

By Corollary 4.1, this is equivalent to the time-average control of Brownian motion with quadratic costs in the sense of Definition 4.2.

Let us explain heuristically how to obtain the optimal solution (a rigorous verification argument for the linear programming formulation is provided in Section 8). Roughly speaking, Definition 4.2 describes the following dynamics

The optimization objective is

where the set of admissible controls contains all progressively measurable processes such that

Consider the associated HJB equation

where the constant must be found as part of the solution. It is easy to find the explicit solution (see also [42, Equation (3.18)]):

Now, let be an admissible control and apply Itō’s formula to :

It follows that

| (4.20) | ||||

Taking expectation, dividing by on both sides, and using the admissibility conditions, we obtain

To show that is indeed the optimal cost, it is enough to show that equality holds in (4.20). for the optimal feedback control given by

Therefore, the optimally controlled process is an Ornstein-Uhlenbeck process

Naturally, the stationary distribution of is the solution of the linear programming problem. We have the following result.

Example 4.4 (Singular control of Brownian motion).

For any parameters , consider the following linear programming problem

| (4.21) |

where and satisfy

| (4.22) |

By Corollary 4.1, this is equivalent to the time-average control of Brownian motion with quadratic deviation penalty and proportional costs in the sense of Definition 4.2.

The dynamics of the solution of the controlled martingale problem is heuristically

where and is a non-decreasing process. The optimization objective is

The associated HJB equation is

An explicit solution for is provided in [51] (see also [24, 30, 12]):

| (4.23) |

with

and

The optimally controlled process is

where are the local times keeping such that

In other words, this is a Brownian motion with reflection on the interval . The optimal solution is the stationary distribution of and the limit of boundary measures

as . We have the following result.

Example 4.5 (Impulse control of Brownian motion).

For any parameters and , consider the following linear programming problem

| (4.26) |

where and satisfy

| (4.27) |

By Corollary 4.1, this is equivalent to the time-average control problem of Brownian motion in the sense of Definition 4.2.

The associated HJB equation is (see also [12, 23, 2, 15])

Let and be solutions of the following polynomial system

where . Let . We can show that the solution of the HJB equation is given by

and

Let . The optimally controlled process is a Brownian motion on the interval , which jumps to when reaching the boundary point . Such processes have been studied in [5, 16]. We have the following result.

Example 4.6 (Combined regular and impulse control of Brownian motion).

For any parameters and , consider the following linear programming problem

| (4.30) |

where and satisfy

| (4.31) |

By Corollary 4.1, this is equivalent to the time-average control problem of Brownian motion in the sense of Definition 4.2.

The corresponding HJB equation is

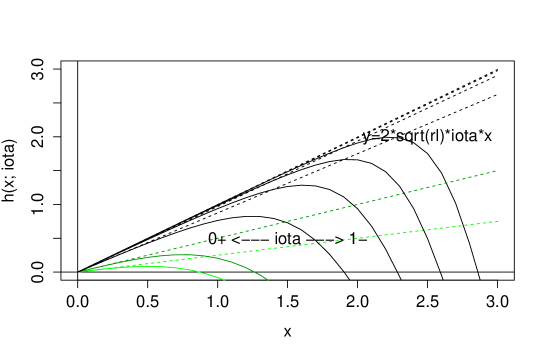

In Section 8, we show that this equation admits a classical solution

| (4.32) |

where is the Kummer confluent hypergeometric function (see Section A) and and are such that and

Moreover,

for some .

Let be defined as

The optimally controlled process is given by

We have the following result.

Example 4.7 (Combined regular and singular control of Brownian motion).

For any parameters , consider the following linear programming problem

| (4.33) |

where and satisfy

| (4.34) |

Again by Corollary 4.1, this is equivalent to the time-average control problem of Brownian motion in the sense of Definition 4.2.

The constant and exist with the same expressions as in Example 4.6. Similarly, we have the following result.

5 Relation with utility maximization under market frictions

As we have already mentioned, the lower bound (1.6) appears also in the study of impact of small market frictions in the framework of utility maximization, see [29, 28, 17, 51, 47, 2, 42, 40].

In this section, we explain heuristically how to relate utility maximization under small market frictions to the problem of tracking. It should be pointed out that we are just making connections between these two problems and no equivalence is rigorously established.

We follow the presentation in [29] and consider the classical utility maximization problem

with

where is the trading strategy. The market dynamics is an Itō semi-martingale

In the frictionless market, we denote by the optimal strategy and by the corresponding wealth process. As mentioned in [29], the indirect marginal utility evaluated along the optimal wealth process is a martingale density, which we denote by :

Note that is a martingale under with

One also defines the indirect risk tolerance process by

Consider the exponential utility function as in [28], that is

Then we have

In a market with proportional transaction costs, the portfolio dynamics is given by

where is a random weight process and a process with finite variation. The control problem is then

When the cost is small, we can expect that is close to and set

Then up to first order quantities, we have

Similarly, in a market with fixed transaction costs , see [2], the portfolio dynamics is given by

and we have

Finally, in a market with linear impact on price, see [49, 42], the portfolio dynamics is given by

and we have

To sum up, utility maximization under small market frictions is heuristically equivalent to the tracking problem if the deviation penalty is set to be

| (5.1) |

Defining the certainty equivalent wealth loss by

it follows that

| (5.2) |

Remark 5.1 (Higher dimension and general utility function).

For the case of higher dimension and general utility function, one should set

| (5.3) |

In other words, utility maximization under market frictions can be approximated at first order by the problem of tracking with quadratic deviation cost (5.3). Thus one can establish a connection between the tracking problem and the utility maximization problems in [2, 42, 19, 18].

Remark 5.2 (General cost structures).

When there are multiple market frictions with comparable impacts, the choice of deviation penalty is the same as (5.3) and one only needs to adjust the cost structure. Our results apply directly in these cases, see [40, 18]. For example, in the case of trading with proportional cost and linear market impact, see [40], the local problem is the time-average control of Brownian motion with cost structure

Indeed, Equations (4.3)-(4.5) in [40] give rise to a verification theorem for the HJB equation of the time-average control problem of Brownian motion under this cost structure.

Remark 5.3 (Non-zero interest rate).

Remark 5.4 (Optimal consumption over infinite horizon).

6 Proof of Theorem 2.1

This section is devoted to the proof of Theorem 2.1. In Section 6.1, we first rigorously establish the arguments outlined in Section 2.1, showing that it is enough to consider a small horizon . Then we prove Theorem 2.1 in Section 6.2. Our proof is inspired by the approaches in [34] and [39]. An essential ingredient is Lemma 6.3, whose proof is given in Section 6.3.

6.1 Reduction to local time-average control problem

We first show that, to obtain (2.13), it is enough to study the local time-average control problem (note that the parameters are frozen at time )

| (6.1) |

where

| (6.2) |

with and depending on in such a way that

| (6.3) |

as . Recall that , which is due to the scaling property of Brownian motion. We can simply put .

Localization

Since we are interested in convergence results in probability, under Assumptions 2.2 and 2.3, it is enough to consider the situation where the following assumption holds.

Assumption 6.1.

There exists a positive constant such that

Furthermore, is a martingale ().

Indeed, set . Then we have . By standard localization procedure, we can assume that all the parameters are bounded as in Assumption 6.1. Let

then by Girsanov theorem, is a martingale under . Since is equivalent to , we only need to prove (2.13) under . Consequently, we can assume that is a martingale without loss of generality.

From now on, we will suppose that Assumption 6.1 holds.

Locally averaged cost

Lemma 6.1.

Under Assumption 6.1, we have almost surely

Proof.

We introduce an auxiliary cost functional:

Note that the parameters inside the integral are not frozen at . Using Fubini theorem, we have

Hence

| (6.4) |

where is given by (6.1) with .

Reduction to local problems

Using previous lemma, we can reduce the problem to the study of local problems as stated below.

Lemma 6.2 (Reduction).

For the proof of Theorem 2.1, it is enough to show that

| (6.6) |

Proof.

6.2 Proof of Theorem 2.1

After Section 6.1, it suffices to prove (6.6) where is given by (6.1)-(6.2). In particular, we can assume that

| (6.7) |

Combining ideas from [39, 34], we first consider the empirical occupation measures of . Define the following random occupation measures with natural inclusion

where is the one-point compactification of . Such compacification of state space appears in [7]. See also the proof of Corollary 4.1 where the compactification of state space is used. Note that for we have the canonical decomposition

with and . Second, we define ,

where the cost functions and are extended to by setting

| (6.8) |

with the point of compactification for . Note that the functions and remain l.s.c. on the compactified space, which is an important property we will need in the following. Moreover, for any , we have

| (6.9) |

Now we have

| (6.10) |

and we can write (6.7) as

| (6.11) |

Lemma 6.3 (Characterization of limits).

By Lemma 6.3, we have, up to a subsequence,

Write in disintegration form, we have

| (6.12) |

and -almost surely,

| (6.13) |

Since the cost functional is lower semi-continuous, we have

Finally, by definition of , we have

6.3 Proof of Lemma 6.3

First we show the tightness of in . A common method is to use tightness functions (see Section C).

Recall that the cost functions and are extended to by (6.8) such that is lower semi-continuous. Moreover, is a tightness function under Assumption 6.1, see Section C or [13, pp. 309].

Consequently, if (6.11) holds, the family of random measures is tight. Furthermore, by Proposition D.1, we have

up to a subsequence, with

For the rest of the lemma, we use a combination of the arguments in [34] and [39]. Recall that

For , define

Note that is well-defined since . Then we claim that

| (6.14) |

Although , it is not bounded. The first equality in (6.14) does not follow directly from the definition of stable convergence. However, by Corollary 4.1, Condition (4.14) holds, that is there exists and non-negative real number depending on such that

By (6.11), we deduce that is uniformly integrable and obtain the first equality in (6.14) by [25, Theorem 2.16].

For the second equality in (6.14), we apply Itō’s formula to (recall that the dynamics of is given by (2.4)) and obtain that

Combining the definitions of , and , we have

By Assumptions 2.2 and 6.1 and dominated convergence, the term on the right hand side converges to zero. Therefore (6.14) holds.

By definition of and Fubini theorem, we have

Hence we have -a.e.-, . Let be a countable dense subset of . Since is countable we have -a.e.-, for all . Fix for which the property holds. Again by the same argument, we have -a.e-., for all . Since is dense in , holds for .

7 Proof of Theorem 3.1

The rescaled process is given by

with

The empirical occupation measure of singular control is defined by

while is defined in the same way as previously.

8 Proof of Propositions 4.1-4.5

In this section, we prove Propositions 4.1-4.5. First, we provide a verification argument tailored to the linear programming formulation in . Second, we give full details for the proof of Proposition 4.4. The proofs in the remaining cases are exactly the same hence omitted.

8.1 Verification theorem in

Consider and with . The operator is given by

The operator is given by

if , and by

if .

Let and be two cost functions. We consider the following optimization problem:

| (8.1) |

where satisfies

| (8.2) |

Lemma 8.1 (Verification).

Let so that is well-defined point-wisely for and is well-defined for . Assume that

-

1.

For each satisfying (8.2) and , we have .

-

2.

There exists such that

and there exist such that

-

3.

There exists a constant such that

(8.3) (8.4)

Then we have .

If there exists satisfying the LP constraint and

| (8.5) | |||

| (8.6) |

then we have . Moreover, the optimum is attained by and we call the value function of the linear programming problem.

Proof of Lemma 8.1.

Let be any pair satisfying (8.2) and . We have

The first term is well-defined since is defined -everywhere. The second equality follows from the second condition and dominated convergence theorem. Hence

where the last inequality is due to (8.3)-(8.4), and the equality holds if and only if (8.5)-(8.6) are satisfied. ∎

8.2 Verification of Proposition 4.4

In this section, we provide an explicit solution of the following linear programming problem:

| (8.7) |

where and satisfy

| (8.8) |

for any . The following lemma, whose proof is given in the Appendix, and Theorem 8.1 establish the existence of the value function for (8.7)-(8.8).

Lemma 8.2 (Value function for combined regular and impulse control).

There exist , , and such that

| (8.9) | |||

| (8.10) |

where is defined by

| (8.11) |

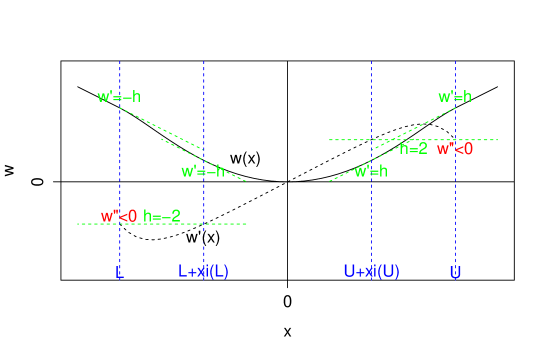

More precisely, we have (c.f. Figure 1)

| (8.12) |

where is the Kummer confluent hypergeometric function (see Section A) and

for some . Moreover, satisfies the following conditions

| (8.13) | |||

| (8.14) | |||

| (8.15) |

and , , and depend continuously on the parameters .

Remark 8.1.

Equations (8.9) and (8.10) correspond essentially to (8.5) and (8.6). The interval is called continuation region. Equation (8.13) is the so called “smooth-fit” condition and guarantees that is a function. Equations (8.14) and (8.15) characterize the growth of the derivatives of and will be useful in the proof of Theorem 8.1.

Proposition 4.4 is a direct consequence of the following theorem.

Theorem 8.1 (Combined regular and impulse control.).

For any parameters and , we have

- 1.

- 2.

Proof.

-

1.

Consider the function defined in Lemma 8.2. First we show that the three conditions in Lemma 8.1 are satisfied by .

i) Note that . For any satisfying the LP constraint, we show that . In particular, . Indeed, let be a sequence of test functions such that , and there exists such that

For example, let with being a piece-wise linear function such that , and and take . Since , we have by dominated convergence theorem

ii) Let be a sequence of indicator functions such that for and

Let . Then is except at and is of compact support. For each , satisfies also the LP constraint

Indeed, let be any convolution kernel and . So satisfies the LP constraint. Moreover, for , for any and . By dominated convergence, satisfies the LP constraint. Finally, a direct computation shows that for some constants and ,

So the second condition is satisfied.

By Lemma 8.1, we then conclude that .

- 2.

∎

Appendix A Kummer confluent hypergeometric function

We collect here some properties of the Kummer confluent hypergeometric function which are useful to establish the existence of value functions of combined control problems in dimension one. Recall that is defined as

with the Pochhammer symbol.

Lemma A.1.

We have the following properties.

-

1.

The function admits the following integral representation

It is an entire function of and and a meromorphic function of .

-

2.

We have

-

3.

We have

-

4.

We have

as .

-

5.

Consider the Weber differential equation

(A.1) The even and odd solutions of this equation are given, respectively, by

(A.2) (A.3)

Appendix B Proof of Lemma 8.2

We first look for in the continuation region . Define (the change of variable comes from [45, pp.260])

where is the odd solution (A.2) of the Weber differential equation (A.1). Then satisfies the following ODE

which is exactly (8.9). Hence we conjecture that the solution in the continuation region is given by

Now we show that there exist suitable values , and such that , and Conditions (8.10)-(8.15) are satisfied. Let

with

We have the following lemma.

Lemma B.1.

The function satisfies

and

Proof.

The limits of follow from the asymptotic behaviour of . To show that is increasing, we use Properties 2 and 3 in Lemma A.1 and obtain

Note that , so near . Since for and for , cannot leave the band . ∎

We now state a second lemma.

Lemma B.2.

The function satisfies the following properties.

-

1.

For , we have

Let be the first zero of . We have

where and

-

2.

For , we have

and

We have

and hence

Proof.

For fixed . The asymptotic behaviour of follows from Lemma B.1. The second property is clear since

with . Finally, we get

Furthermore, we have

which is strictly positive term by term for .

For fixed . The limit of as follows from the fact that is entire in . Now we show that is monotone in . Let , we have

with . It is enough to show that the last term is positive. Using the series representation of and (see Lemma A.1), write

with

We get

Then the coefficient of is given by

This term is positive since is increasing in . Hence . Thus is increasing in for fixed .

From the relation between and , is the first solution of

Moreover, we have

Then uniformly on , is bounded from below by on , hence

Finally, we have

∎

Proposition B.1.

For any parameters and , there exist and such that

Moreover, depends continuously on .

Proof.

Existence. Let . Since is monotone in and as , there exists such that

We have

so by the implicit function theorem, and depend continuously on . Define

Then is continuous in and

Hence there exists such that

. The remaining property of is easily verified.

If , then there exists exactly one such that the maximum of is and is attained by such that

Since , depends continuously on by the implicit function theorem.

Continuous dependence. Since and depend continuously on , it suffices to show that depends continuously on the parameters . To see this, note that is determined by

But, we have

Thus depends continuously on the parameters by the implicit function theorem. ∎

Appendix C Tightness function

Definition C.1.

A measurable real-valued function on a metric space is a tightness function if

-

1.

.

-

2.

, the level set is a relatively compact subset of .

Lemma C.1.

If is a tightness function on a Polish space , then

-

1.

The function is a tightness function on .

-

2.

If in addition where is a positive constant and is compact, then is a tightness function on .

Proof.

Note that is a metric space, thus sequential compactness is equivalent to relative compactness (see [13, pp. 303] for the metric). For the first property, see [13, pp. 309]. For the second property, we consider the level set and let be any sequence in the level set. By [6, Theorem 8.6.2], it is enough to show that

-

1.

The sequence of nonnegative real numbers is bounded.

-

2.

The family is tight.

Since , we have . Hence the first condition is true. On the other hand, for any , we consider . Then , if . Since is a tightness function, we deduce that is tight. Therefore is tight and the second condition follows.∎

Appendix D Convergence in probability, stable convergence

Let be a measurable space and a Polish space where is the Borel algebra of . Define

Let be the set of bounded mesurable functions such that is a continuous application for any . Let be the set of finite positive measures on , equiped with the weakest topology such that

is continuous for any .

We fix a probability measure on . Let be the set of probability measures on with marginal on , equiped with the induced topology from . Note that is a closed subset of . For any random variable defined on the probability space , we define

Definition D.1 (Stable convergence).

Let be random variables defined on the same probability space with values in the Polish space . We say that converges stably in law to , written , if in .

We use the following properties in our proofs.

Proposition D.1.

Let be random variables on the probability space with values in .

-

1.

We have if and only if

for all bounded random variables on and all bounded continuous functions .

-

2.

Assume that . Then

(D.1) for any bounded from below with lower semi-continuous section on .

-

3.

Let be a random variable defined on . We have

-

4.

The sequence is relatively compact in if and only if is relatively compact as subset of . In particular, if is compact, then is compact.

Proof.

1. This is a direct consequence of [25, Proposition 2.4].

2. This is generalization of the Portmanteau theorem, see [25, Proposition 2.11].

3. The implication is obvious. Let us prove the other. Consider . On the one hand, we have by definition. On the other hand, for any we have

by Markov inequality. We deduce that .

4. See [25, Theorem 3.8 and Corollary 3.9]. ∎

Lemma D.1.

Let be positive random variables on the probability space . If, for any random variable defined on with where are positive constants depending on ,

then

Proof.

Let be any real number and, without loss of generality, let be a minimizing sequence of as . Considering the one-point compactification , we can assume that converge stably to with canonical realization . Then we have

where the first inequality comes from the fact that is u.s.c. on and [25, Prop 2.11]. Since is arbitrary, we conclude that . Then by stable convergence of to , we have ∎

References

- [1] M. Abramowitz and I. A. Stegun, Handbook of mathematical functions, Dover New York, 1972.

- [2] A. Altarovici, J. Muhle-Karbe, and H. M. Soner, Asymptotics for fixed transaction costs, Finance and Stochastics, (2013).

- [3] L. U. Ancarani and G. Gasaneo, Derivatives of any order of the confluent hypergeometric function with respect to the parameters or , Journal of Mathematical Physics, (2008).

- [4] P. Bank, M. H. Soner, and M. Voß, Hedging with transient price impact. Preprint, 2015.

- [5] I. Ben-Ari and R. G. Pinsky, Ergodic behavior of diffusions with random jumps from the boundary, Stochastic processes and their applications, 119 (2009), pp. 864–881.

- [6] V. I. Bogachev, Measure theory, vol. 2, Springer Science & Business Media, 2007.

- [7] V. S. Borkar and M. K. Ghosh, Ergodic control of multidimensional diffusions I: The existence results, SIAM Journal on Control and Optimization, 26 (1988), pp. 112–126.

- [8] A. Budhiraja and A. P. Ghosh, Diffusion approximations for controlled stochastic networks: An asymptotic bound for the value function, Annals of Applied Probability, 16 (2006), pp. 1962–2006.

- [9] , Controlled stochastic networks in heavy traffic: Convergence of value functions, The Annals of Applied Probability, 22 (2012), pp. 734–791.

- [10] A. Budhiraja, A. P. Ghosh, and C. Lee, Ergodic rate control problem for single class queueing networks, SIAM Journal on Control and Optimization, 49 (2011), pp. 1570–1606.

- [11] A. Cadenillas and F. Zapatero, Classical and impulse stochastic control of the exchange rate using interest rates and reserves, Mathematical Finance, 10 (2000), pp. 141–156.

- [12] J. G. Dai and D. Yao, Brownian inventory models with convex holding cost, part 1: Average-optimal controls, Stochastic Systems, 3 (2013), pp. 442–499.

- [13] P. Dupuis and R. S. Ellis, A weak convergence approach to the theory of large deviations, vol. 902, John Wiley & Sons, 2011.

- [14] M. Fukasawa, Asymptotically efficient discrete hedging, Stochastic Analysis with Financial Applications, (2011), pp. 331–346.

- [15] E. Gobet and N. Landon, Almost sure optimal hedging strategy, The Annals of Applied Probability, 24 (2014), pp. 1652–1690.

- [16] I. Grigorescu and M. Kang, Brownian motion on the figure eight, Journal of Theoretical Probability, 15 (2002), pp. 817–844.

- [17] P. Guasoni and M. Weber, Dynamic trading volume. Available from www.ssrn.com, 2012.

- [18] , Nonlinear price impact and portfolio choice. Available from www.ssrn.com, 2015.

- [19] , Rebalancing multiple assets with mutual price impact. Available from www.ssrn.com, 2015.

- [20] K. Helmes, R. H. Stockbridge, and C. Zhu, Impulse control of standard Brownian motion: long-term average criterion, System Modeling and Optimization, (2014).

- [21] R. Hynd, The eigenvalue problem of singular ergodic control, Communications on pure and applied mathematics, LXV (2012), pp. 649–682.

- [22] A. Jack and M. Zervos, Impulse and absolutely continuous ergodic control of one-dimensional Itô diffusions, in From Stochastic Calculus to Mathematical Finance: the Shiryaev Festschrift, Y. Kabanov, R. Lipster, and J. Stoyanov, eds., Springer, Berlin, 2006, pp. 295–314.

- [23] A. Jack and M. Zervos, Impulse control of one-dimensional Itô diffusions with an expected and a pathwise ergodic criterion, Applied mathematics and optimization, 54 (2006), pp. 71–93.

- [24] , A singular control problem with an expected and a pathwise ergodic performance criterion, International Journal of Stochastic Analysis, 2006 (2006).

- [25] J. Jacod and J. Mémin, Sur un type de convergence intermédiaire entre la convergence en loi et la convergence en probabilité, Séminaire de Probabilités XV 1979/80, (1981), pp. 529–546.

- [26] A. Jakubowski, A non-Skorohod topology on the Skorohod space, Electronic Journal of Probability, 2 (1997), pp. 1–21.

- [27] K. Janeček and S. Shreve, Futures trading with transaction costs, Illinois Journal of Mathematics, 54 (2010), pp. 1239–1284.

- [28] J. Kallsen and S. Li, Portfolio optimization under small transaction costs: a convex duality approach, arXiv preprint arXiv:1309.3479, (2013).

- [29] J. Kallsen and J. Muhle-Karbe, The general structure of optimal investment and consumption with small transaction costs, Mathematical Finance, (2015), pp. 1–38.

- [30] I. Karatzas, A class of singular stochastic control problems, Advances in Applied Probability, 15 (1983), pp. 225–254.

- [31] R. Korn, Some applications of impulse control in mathematical finance, Mathematical Methods of Operations Research, 50 (1999), pp. 493–518.

- [32] T. G. Kurtz, Random time changes and convergence in distribution under the Meyer-Zheng conditions, The Annals of probability, (1991), pp. 1010–1034.

- [33] T. G. Kurtz and R. H. Stockbridge, Existence of Markov controls and characterization of optimal Markov controls, SIAM Journal on Control and Optimization, 36 (1998), pp. 609–653.

- [34] , Martingale problems and linear programs for singular control, in 37th annual Allerton Conference on Communication Control and Computing, 1999.

- [35] , Stationary solutions and forward equations for controlled and singular martingale problems, Electronic Journal of Probability, 6 (2001), pp. 1–52.

- [36] , Linear programming formulations of singular stochastic control problems. Personal communication, 2015.

- [37] H. J. Kushner, Heavy traffic analysis of controlled queueing and communication networks, vol. 47, Springer, 2001.

- [38] , A partial history of the early development of continuous-time nonlinear stochastic systems theory, Automatica, 50 (2014), pp. 303–334.

- [39] H. J. Kushner and L. F. Martins, Limit theorems for pathwise average cost per unit time problems for controlled queues in heavy traffic, Stochastics: An International Journal of Probability and Stochastic Processes, 42 (1993), pp. 25–51.

- [40] R. Liu, J. Muhle-Karbe, and M. Weber, Rebalancing with linear and quadratic costs, arXiv preprint arXiv:1402.5306, (2014).

- [41] J. L. Menaldi, M. Robin, and M. I. Taksar, Singular ergodic control for multidimensional Gaussian processes, Mathematics of Control, Signals and Systems, 5 (1992), pp. 93–114.

- [42] L. Moreau, J. Muhle-Karbe, and H. M. Soner, Trading with small price impact, arXiv preprint arXiv:1402.5304, (2014).

- [43] G. Mundaca and B. Oksendal, Optimal stochastic intervention control with application to the exchange rate, Journal of Mathematical Economics, 29 (1997), pp. 225–243.

- [44] F. Naujokat and N. Westray, Curve following in illiquid markets, Mathematics and Financial Economics, 4 (2011), pp. 299–335.

- [45] B. Oksendal and A. Sulem, Applied stochastic control of jump diffusions, Springer, 2005.

- [46] S. R. Pliska and K. Suzuki, Optimal tracking for asset allocation with fixed and proportional transaction costs, Quantitative Finance, 4 (2004), pp. 233–243.

- [47] D. Possamaï, H. M. Soner, and N. Touzi, Homogenization and asymptotics for small transaction costs: the multidimensional case, Communications in Partial Differential Equations, (2015), pp. 1–42.

- [48] D. Revuz and M. Yor, Continuous martingales and Brownian motion, Springer, Berlin, 1999.

- [49] L. C. Rogers and S. Singh, The cost of illiquidity and its effects on hedging, Mathematical Finance, 20 (2010), pp. 597–615.

- [50] M. Rosenbaum and P. Tankov, Asymptotically optimal discretization of hedging strategies with jumps, The Annals of Applied Probability, 24 (2014), pp. 1002–1048.

- [51] H. M. Soner and N. Touzi, Homogenization and asymptotics for small transaction costs, SIAM Journal on Control and Optimization, 51 (2013), pp. 2893–2921.

- [52] A. Whalley and P. Wilmott, An asymptotic analysis of an optimal hedging model for option pricing with transaction costs, Mathematical Finance, 7 (1997), pp. 307–324.