Backtesting forecast accuracy

Universidad Nacional Autónoma de México

arturo.erdely@comunidad.unam.mx

)

Abstract

A statistical test based on the geometric mean is proposed to determine if a predictive model should be rejected or not, when the quantity of interest is a strictly positive continuous random variable. A simulation study is performed to compare test power performance against an alternative procedure, and an application to insurance claims reserving is illustrated.

Keywords: backtesting, forecast accuracy, accuracy test, geometric mean, claims reserving.

1 Introduction

From Diebold and Mariano (2001):

Prediction is of fundamental importance in all of the sciences, including economics. Forecast accuracy is of obvious importance to users of forecasts because forecasts are used to guide decisions. Forecast accuracy is also of obvious importance to producers of forecasts, whose reputations (and fortunes) rise and fall with forecast accuracy […] Predictive performance and model adequacy are inextricably linked—predictive failure implies model inadequacy.

Several measures of forecast accuracy have been proposed, mainly for the purpose of comparing two or more forecasting competing methods, see for example Hyndman and Koehler (2006) or Shcherbakov et al.(2013), and statistical tests have been proposed for the null hypothesis of equal forecast accuracy of such competing methods, see Diebold and Mariano (2001). But if the objective is to evaluate a single forecasting method, the value itself reported by a measure of forecast accuracy does not allow us to assess how good/bad such method is, since it is made for comparison purposes, it is a relative rather than an absolute measure for the forecasting quality of the predictive model in question.

In the present work a statistical test is proposed to decide whether a single forecasting method should be rejected or not as accurate, based on the geometric mean of the ratios of observed/forecasted values, in the particular case when all the involved quantities are strictly positive. A simulation study is performed to compare the statistical power of the proposed accuracy test versus a binomial test, and an application to insurance claims reserving is illustrated.

2 Accuracy test

Consider the case when all the observed () and forecasted () values are strictly positive, for If we calculate the ratios then means a perfect forecast, implies overestimation, and underestimation by forecast We will assume that in there are no repeated values and that these values may be considered as an observed random sample from a strictly positive and continuous random variable with unknown probability density function (pdf)

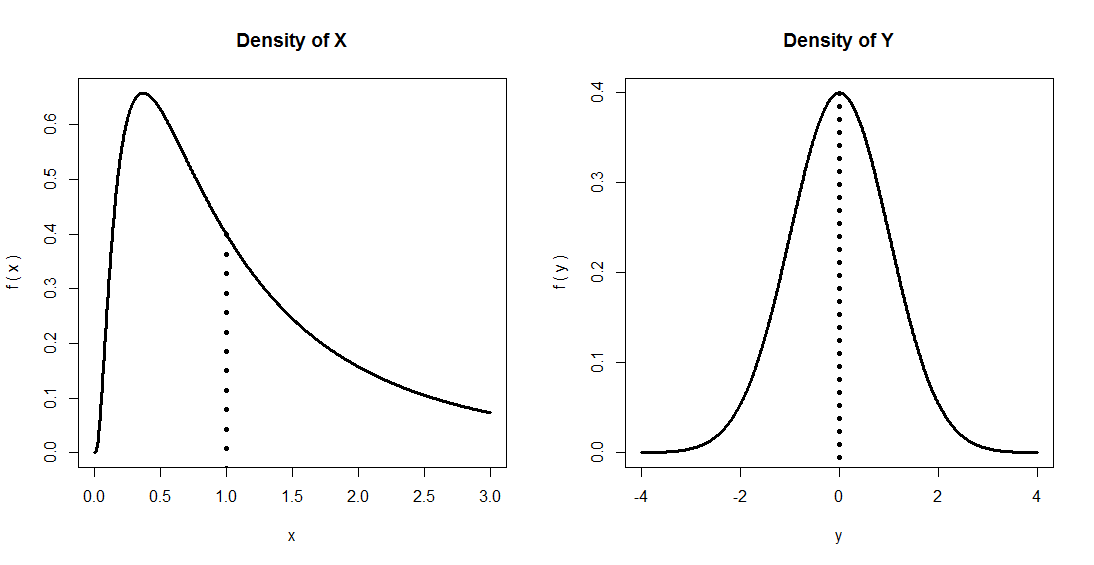

The hypothesis of interest is whether or not is centered around (the value that represents perfect forecasts) under a certain measure of central location. If this is the case, the pdf may look something like in Fig.1(left), and if we make the transformation the resulting pdf may look something like in Figure 1(right), since the function maps values to the open interval and values are mapped to

If we define the transformed values these may be considered as an observed random sample from a random variable If a statistical test applied to the values does not reject the null hypothesis of normality this would be equivalent to not rejecting that the values are an observed random sample from a LogNormal distribution, that is, if is a Normal random variable then would be a LogNormal random variable.

As stated in Johnson et al.(1994), even without the lognormality assumption, if are independent and continuous positive random variables, and then and if the independent random variables are such that a central limit type of result applies, then the standardized distribution of would tend to a standard Normal distribution as tends to infinity, and the limiting distribution of would then be LogNormal.

Closely related to the random variable is the concept of sample geometric mean and then (the sample mean of ), so that may also have either an exact or limiting LogNormal distribution, according to the above arguments. As defined in Kotz et al.(2006) for a random variable , a parameter analogous to the sample geometric mean is when In the following, will denote so that Therefore, if is distributed LogNormal then since By the way, for the lognormal distribution the geometric mean is equal to its median.

Assuming we have a random sample of observed/forecasted ratios distributed asLogNormal we have the following equivalent ways of expressing the null hypothesis of interest:

| (1) |

Under the transformation leads to a random sample from a Normal distribution, therefore we may use the standard test of size for with unknown variance see for example Mood et al.(1974), rejecting whenever where and is the quantile of a distribution with degrees of freedom.

Finally, to validate the lognormality assumption of the the observed/forecasted ratios we may apply a normality test to such as the Shapiro-Wilk (1965) test since it is a more powerful test for normality than the tests by Anderson-Darling, Lilliefors and Kolmogorov-Smirnov, according to a power study by Razali and Wah (2011).

3 Power study

Define the random variables and then and If we define the ratio random variable then and since and then is normally distributed with mean and variance (where stands for linear correlation coefficient of and , which is also referred to as log-correlation) and therefore the ratio has LogNormal distribution with parameters equal to the previous mean and variance of This implies that Just as an observation, this is not generally true for the usual mean: is not equal to unless (under lognormality).

Under the above assumptions, the null hypothesis of interest (1) would be equivalent to or Let such that then and (1) will also be equivalent to In a power study for the accuracy test proposed in the previous section, it would be expected a low probability of rejection whenever (type I error) and higher probabilities of rejection as gets closer either to or to

If in addition to we have that then the ratio that is, for fixed the lower the linear correlation between and the larger the variability of and vice versa, as expected. So in this power study several scenarios are considered with different values for both and for fixed and sample sizes

The accuracy test proposed in the previous section is compared to the usual backtesting technique based on a binomial test for the number of exceptions (or violations) of a given (Value-at-Risk of level ) as in (for example) McNeil et al.(2015) with since under it would be expected a balance between forecasts above and below the observed values, and therefore too many forecasts above or below observed values should lead to the rejection of the forecasting method.

To be more specific, as a summary of both the proposed accuracy test and the binomial test of level , given the forecasts and the corresponding observed values calculate the ratios and:

Accuracy test

-

1.

Calculate by

-

2.

Apply Shapiro-Wilk normality test to the set If normality is rejected, the test should not be used; otherwise, continue.

-

3.

Apply a test for to the set If the null hypothesis is rejected (p-value ) the forecast method is considered inaccurate.

Binomial test

-

1.

Calculate the number of values greater than

-

2.

Calculate (two-sided test) p-value with that is, if then p-value is and if then p-value is In case that is exactly the center of the distribution, that is and therefore the p-value should be defined as

-

3.

If p-value the forecast method is considered inaccurate.

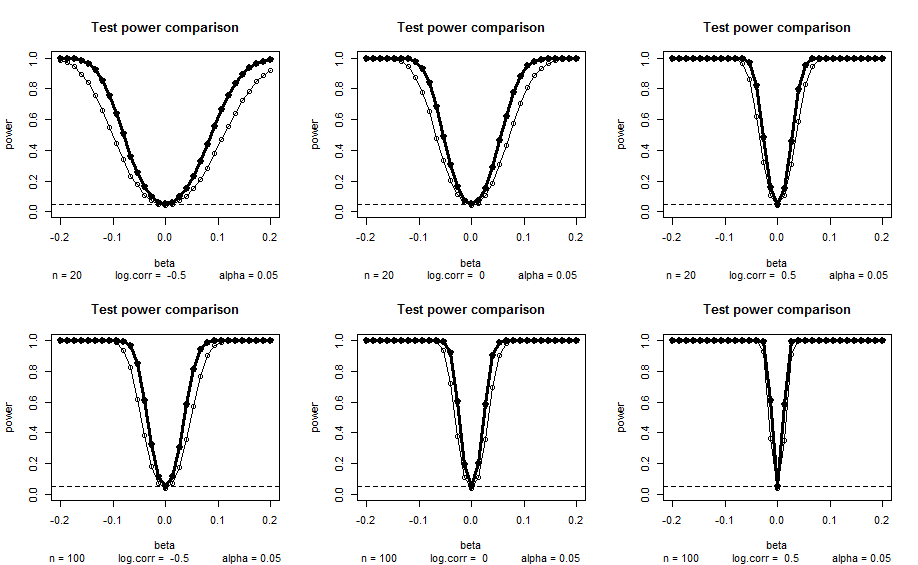

simulations were used to estimate each point of the power functions and the results obtained are summarized in Figure 2 where it is clear that in all cases the proposed accuracy test (thick line) is uniformly more powerful than the binomial test (thin line), which should not be a surprise mainly for two reasons: first, the lognormality assumption is guaranteed; second, the proposed accuracy test is based on the sample geometric mean, which is a sufficient statistic for the theoretical geometric mean, while the binomial test is based on counts of observed above/below forecasts, which is certainly not a sufficient statistic for the parameter of interest.

Now let and be continuous strictly positive non LogNormal random variables, such that and Define and then and Define the ratio random variable then is finite since

and so Under these assumptions, the null hypothesis of interest (1) would be (again) equivalent to or Let such that then and (1) will also be equivalent to In a power study for the accuracy test proposed in the previous section, it would be expected a low probability of rejection whenever (type I error) and higher probabilities of rejection as gets closer either to or to

Lets analyze, for example, the case when and where the pdf for a Gamma random variable with parameters and is given by

with and so where is the digamma function given by We get then the following equivalences:

| (2) |

Given if we define the transformation then is a continuous random variable with support the whole real line and with a standard probability transformation procedure the following is the resulting pdf of

| (3) |

and clearly is not Normal when is Gamma (in fact, the probability distribution of is known as LogGamma distribution.) If and and then and clearly is not Normal, therefore is not LogNormal. But it is still valid to calculate which leads to

| (4) |

From (4) we have that if and then For a power study to compare statistical tests for the null hypothesis we may use, as before, the equation with and the hypothesis of interest would be equivalent to We will consider two cases:

| (5) |

| (6) |

Since does not involve the (possible) dependence between and then depends only on the marginal parameters of and That is not the case of the variance:

| (7) | |||||

where is the linear correlation between and and is the trigamma function defined by Therefore, the dependence between and affects the variability of but not its geometric mean and since the hypothesis of interest only involves the geometric mean, without loss of generality we will assume that and are independent Gamma random variables, for the purpose of a power comparison study.

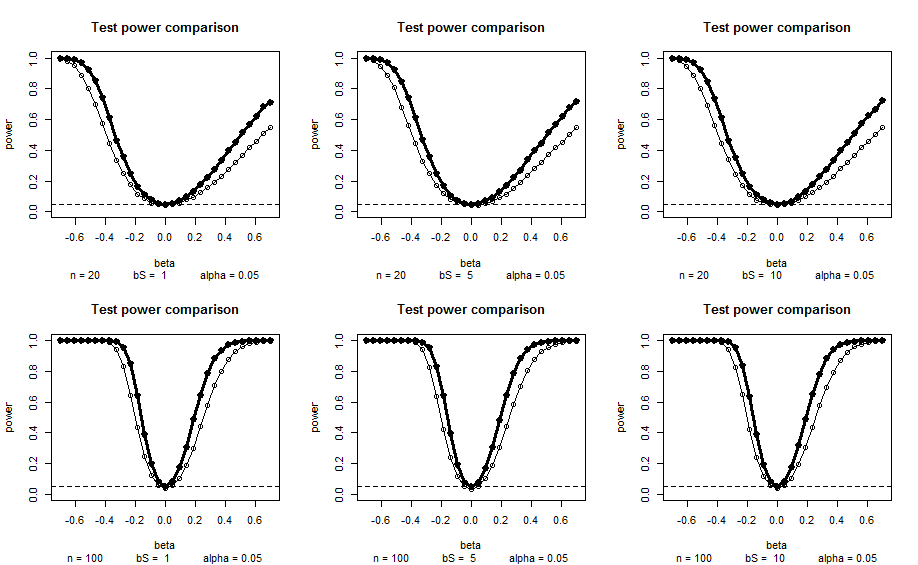

The results obtained for the case (5) are summarized in Figure 3 where it is clear that in all cases the proposed accuracy test (thick line) is uniformly more powerful than the binomial test (thin line). simulations were used to estimate each point of the power functions with and sample sizes As expected, the power of both tests increases with a larger sample size, but remains the same independently of and since the variance of does not depend on them, see (7).

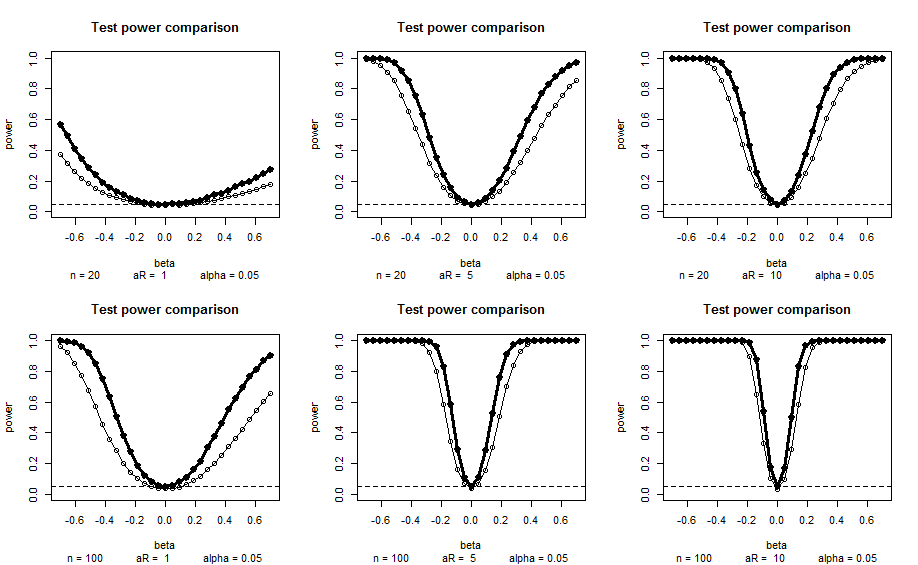

The results obtained for the case (6) are summarized in Figure 4 where it is clear that in all cases the proposed accuracy test (thick line) is again uniformly more powerful than the binomial test (thin line). simulations were used to estimate each point of the power functions with and sample sizes As expected, the power of both tests increases with a larger sample size, but now their power is affected by the values of and since the variance of does depend on them, see (7).

Eventhough the log-ratio of two independent Gamma random variables is not normally distributed, the proposed accuracy test had a better power performance than the binomial test. In Table 1 we show the rejection rate (% of times p-value in simulations) by the Shapiro-Wilk normality test for a ratio of two independent Gamma random variables under sample sizes with the different and values used in the test power comparisons in Figures 3 and 4. As a reference, the rejection rate even if the sample is standard normal would be 5%, and as expected, all the rejection rates are above but in some cases for not so much, which means that these Gamma log-ratios are not too far from being normally distributed.

| case | a | b | n | % reject |

|---|---|---|---|---|

| 1 | 3 | 1 | 20 | 6.94 |

| 2 | 3 | 5 | 20 | 7.07 |

| 3 | 3 | 10 | 20 | 6.89 |

| 4 | 3 | 1 | 100 | 10.98 |

| 5 | 3 | 5 | 100 | 10.98 |

| 6 | 3 | 10 | 100 | 10.99 |

| 7 | 1 | 3 | 20 | 11.65 |

| 8 | 5 | 3 | 20 | 6.17 |

| 9 | 10 | 3 | 20 | 5.49 |

| 10 | 1 | 3 | 100 | 30.33 |

| 11 | 5 | 3 | 100 | 8.00 |

| 12 | 10 | 3 | 100 | 6.26 |

4 Application to claims reserving

According to Kotz et al.(2006):

Although less obvious as a measure of location than the arithmetic mean, the geometric mean does arise naturally as a measure of location in at least three circumstances: when observations possess a certain relation between their conditional means and variances, when observed values are thought to be the results of many minor multiplicative (rather than additive) random effects, and when products of moderate to large numbers of random variables are of interest […] The second circumstance when the geometric mean is relevant occurs when X is the cumulative result of many minor influences which combine in a multiplicative way, so that the same influence has a greater absolute effect on a larger result than on a smaller one. Since is thus the sum of a great many small random effects, the central limit theorem suggests that may well be close to log-normal in distribution, even if the contributing influences are not all independent.

The above interpretation fits well when the objective is to compare claim amounts paid by an insurance company along several periods (), and the forecasted claims for such periods To determine if certain actuarial claims reserving method may or may not be considered as accurate, more important than the absolute differences is to measure how large is that difference as a percentage of what was forecasted, that is means that happened to be above (if ) or below (if ) forecast

Both the proposed accuracy test and the binomial test were applied to the data analyzed in Aguilar and Avendaño (2009) as “Modelo A”, where the authors made a mistake in applying the binomial test by calculating the p-value as instead of the two-sided cumulative probability of the tails, as it should be in two-sided statistical tests.

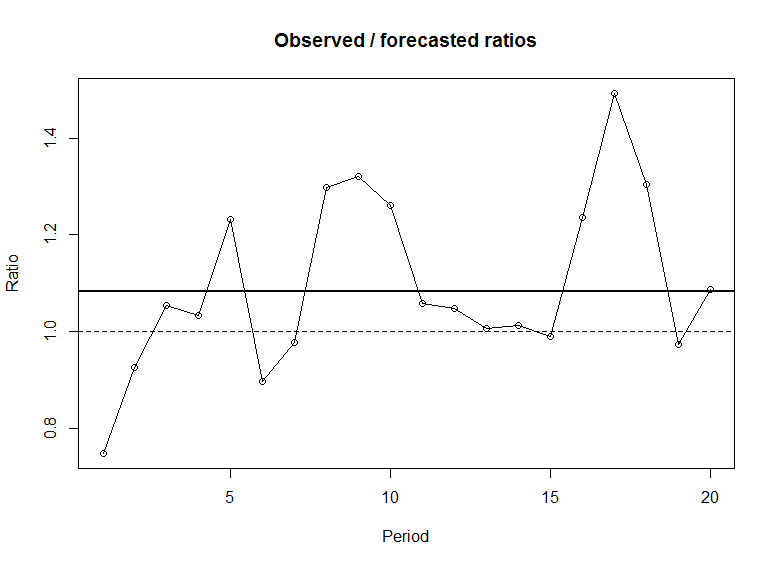

The ratios for are shown in Fig.5 and the horizontal thick line level is the sample geometric mean The proposed accuracy test gives a p-value of with a Shapiro-Wilk normality p-value of (so lognormality assumption for ratios is not rejected), while the binomial test gives a p-value of therefore for a significance level the proposed accuracy test rejects that the forecast method is accurate, but the binomial test fails to reject. Because the lognormality assumption for the ratios is not rejected, we prefer the conclusion from the proposed accuracy test since it is based on a sufficient statistic for the parameter of interest (the geometric mean).

5 Final remarks

In case the lognormality assumption of the ratios observed versus forecasted is not rejected by the Shapiro-Wilk normality test applied to the log-ratios, the proposed accuracy test shows a better power performance than the binomial test, and since it is based on a sufficient statistic for the hypothesis of interest it would be expected to have a good performance compared to some other test.

In case the normality of the log-ratios is rejected, there is still the possibility of trying with the more general Box-Cox (1964) transformation for some (recall that the limit of this transformation when is ).

An example where the ratios are not lognormal was analyzed (a ratio of Gamma random variables) and the power of the proposed accuracy test seems to be still better than the binomial test, but a more thorough analysis could be made in future work in order to assess the robustness of the proposed test under some other kind of departures from lognormality. But as stated in Johnson et al.(1994), even without the lognormality assumption, if are independent and continuous positive random variables, and if the independent random variables are such that a central limit type of result applies, then the standardized distribution of would tend to a standard Normal distribution as tends to infinity, and the limiting distribution of the sample geometric mean would then be LogNormal, and the proposed accuracy test may be applied.

References

P. Aguilar-Beltrán, J. Avendaño-Estrada (2009) Backtesting Insurance Reserves, Mexican Association of Insurance Companies (AMIS). Document retrieved on September 16th 2015 at the following internet link http://www.amis.org.mx/InformaWeb/Documentos/Archivos

/Articulo_%20Backtesting_Septiembre_2009.pdf

Permanent link https://goo.gl/9PxE82

G.E.P. Box, D.R. Cox (1964) An analysis of transformations. J. Royal Statist. Soc. B 26 (2), 211–252.

F.X. Diebold, R.S. Mariano (2002) Comparing Predictive Accuracy. Journal of Business & Economic Statistics 20(1), 134–144.

R.J. Hyndman, A.B. Koehler (2006) Another look at measures of forecasting accuracy. International Journal of Forecasting 22, 679–688.

N.L. Johnson, S. Kotz, N. Balakrishnan (1994) Continuous univariate distributions, Volume 1, Wiley, New York.

S. Kotz, N. Balakrishnan, C.B. Read, B. Vidakovic, N.L. Johnson (2006) Encyclopedia of Statistical Sciences, Wiley, New Jersey.

A.J. McNeil, R. Frey, P. Embrechts (2015) Quantitative Risk Management, Princeton University Press, New Jersey.

A.M. Mood, F.A. Graybill, D.C. Boes (1974) Introduction to the Theory of Statistics, McGraw-Hill, New York.

N.M. Razali, Y.B. Wah (2011) Power comparisons of Shapiro-Wilk, Kolmogorov-Smirnov, Lilliefors, and Anderson-Darling tests. Journal of Statistical Modeling and Analytics 2 (1), 21–33.

S.S. Shapiro, M.B. Wilk (1965) An Analysis of Variance Test for Normality. Biometrika 52 (3-4), 591–611.

M.V. Shcherbakov, A. Brebels, N.L. Shcherbakova, A.P. Tyukov, T.A. Janovsky, V.A. Kamaev (2013) A Survey of Forecast Error Measures. World Appl. Sci. J. 24 (Information Technologies in Modern Industry, Education & Society), 171–176.