A systematic process for evaluating structured perfect Bayesian equilibria in dynamic games with asymmetric information

Abstract

We consider both finite-horizon and infinite-horizon versions of a dynamic game with selfish players who observe their types privately and take actions that are publicly observed. Players’ types evolve as conditionally independent Markov processes, conditioned on their current actions. Their actions and types jointly determine their instantaneous rewards. In dynamic games with asymmetric information a widely used concept of equilibrium is perfect Bayesian equilibrium (PBE), which consists of a strategy and belief pair that simultaneously satisfy sequential rationality and belief consistency. In general, there does not exist a universal algorithm that decouples the interdependence of strategies and beliefs over time in calculating PBE. In this paper, for the finite-horizon game with independent types we develop a two-step backward-forward recursive algorithm that sequentially decomposes the problem (w.r.t. time) to obtain a subset of PBEs, which we refer to as structured Bayesian perfect equilibria (SPBE). In such equilibria, a player’s strategy depends on its history only through a common public belief and its current private type. The backward recursive part of this algorithm defines an equilibrium generating function. Each period in the backward recursion involves solving a fixed-point equation on the space of probability simplexes for every possible belief on types. Using this function, equilibrium strategies and beliefs are generated through a forward recursion. We then extend this methodology to the infinite-horizon model, where we propose a time-invariant single-shot fixed-point equation, which in conjunction with a forward recursive step, generates the SPBE. Sufficient conditions for the existence of SPBE are provided. With our proposed method, we find equilibria that exhibit signaling behavior. This is illustrated with the help of a concrete public goods example.

Index Terms:

Dynamic games, asymmetric information, perfect Bayesian equilibrium, sequential decomposition, dynamic programming, signaling.I Introduction

Several practical applications involve dynamic interaction of strategic decision-makers with private and public observations. Such applications include repeated online advertisement auctions, wireless resource sharing, and energy markets. In repeated online advertisement auctions, advertisers place bids for locations on a website to sell a product. These bids are calculated based on the value of that product, which is privately observed by the advertiser and past actions of other advertisers, which are observed publicly. Each advertiser’s goal is to maximize its reward, which for an auction depends on the actions taken by others. In wireless resource sharing, players are allocated channels that interfere with each other. Each player privately observes its channel gain and takes an action, which can be the choice of modulation or coding scheme and also the transmission power. The reward it receives depends on the rate the player gets, which is a function of each player’s channel gain and other players’ actions (through the signal-to-interference ratio). Finally, in an energy market, different suppliers bid their estimated power outputs to an independent system operator (ISO) that formulates the market mechanism to determine the prices assessed to the different suppliers. Each supplier wants to maximize its return, which depends on its cost of production of energy, which is its private information, and the market-determined prices which depend on all the bids.

Dynamical systems with strategic players are modeled as dynamic stochastic games, introduced by Shapley in [1]. Discrete-time dynamic games with Markovian structure have been studied extensively to model many practical applications, in engineering as well as economics literature [2, 3]. In dynamic games with perfect and symmetric information, subgame perfect equilibrium (SPE) is an appropriate equilibrium concept and there exists a backward recursive algorithm to find all the SPEs of these games (refer to [4, 5, 6] for a more elaborate discussion). Maskin and Tirole in [7] introduced the concept of Markov perfect equilibrium (MPE) for dynamic games with symmetric information, where equilibrium strategies are dependent on some payoff relevant Markovian state of the system, rather than on the entire history. This is a refinement of the SPE. Some prominent examples of the application of MPE include [8, 9, 10]. Ericson and Pakes in [8] model industry dynamics for firms’ entry, exit and investment participation, through a dynamic game with symmetric information, compute its MPE, and prove ergodicity of the equilibrium process. Bergemann and Välimäki in [9] study a learning process in a dynamic oligopoly with strategic sellers and a single buyer, allowing for price competition among sellers. They study MPE of the game and its convergence behavior. Acemoğlu and Robinson in [10] develop a theory of political transitions in a country by modeling it as a repeated game between the elites and the poor, and study its MPE.

In dynamic games with asymmetric information, and more generally in multi-player, dynamic decision problems (cooperative or non-cooperative) with asymmetric information, there is a signaling phenomenon that can occur, where a player’s action reveals part of its private information to other players, which in turn affects their future payoff (see [11] for a survey of signaling models).111There are however instances where even though actions reveal private information, at equilibrium the signaling effect is non-existent [12, 13] and [14, sec III.A]. Thus, MPE is an appropriate equilibrium concept for such games. In [12], authors extend the model of [8] where firms’ set-up costs and scrap values are random and their private information. However, these are assumed to be i.i.d. across time and thus the knowledge of this private information in any period does not affect the future reward. In[13],[14, sec III.A], authors discuss games with one-step delayed information pattern, where all players get access to players’ private information with delay one. In this case as well, signaling does not occur. In one of the first works demonstrating signaling, a two-stage dynamic game was considered by Spence [15], where a worker signals her abilities to a potential employer using the level of education as a signal. Since then, this phenomenon has been shown in many settings, e.g., warranty as a signal for better quality of a product, in [16], larger deductible or partial insurance as a signal for better health of a person, in [17, 18], and in evolutionary game theory, extra large antlers by a deer to signal fitness to a potential mate, in [19].

For dynamic games with asymmetric information, where players’ observations belong to different information sets, in order to calculate expected future rewards players need to form a belief on the observations of other players (where players need not have consistent beliefs). As a result, SPE or MPE, 222SPE and MPE are used for games where beliefs in the game are strategy-independent and consistent among players. Equivalently, these beliefs are derived from basic parameters of the problems and are not part of the definition of the equilibrium concept. are not appropriate equilibrium concepts for such settings. There are several notions of equilibrium for such games, such as perfect Bayesian equilibrium (PBE), sequential equilibrium, and trembling hand equilibrium [4, 5]. Each of these equilibrium notions consist of an assessment, i.e., a strategy and a belief profile for the entire time horizon. The equilibrium strategies are optimal given the equilibrium beliefs and the equilibrium beliefs are derived from the equilibrium strategy profile using Bayes’ rule (whenever possible), with some equilibrium concepts requiring further refinements. Thus there is a cyclical requirement of beliefs being consistent with strategies, which are in turn optimal given the beliefs, and finding such equilibria can be thought of as being equivalent to solving a fixed point equation in the space of strategy and belief profiles over the entire time horizon. Furthermore, these strategies and beliefs are functions of histories and thus their domain grows exponentially in time, which makes the problem computationally intractable. To date, there is no universal algorithm that provides simplification by decomposing the aforementioned fixed-point equation for calculating PBEs.

Some practically motivated work in this category is the work in [20, 21, 22, 23]. Authors in [20, 21, 22] study the problem of social learning with sequentially-acting selfish players who act exactly once in the game and make a decision to adopt or reject a trend based on their estimate of the system state. Players observe a private signal about the system state and publicly observe actions of past players. The authors analyze PBE of the dynamic game and study the convergent behavior of the system under an equilibrium, where they show occurrence of herding. Devanur et al. in [23] study PBE of a repeated sales game where a single buyer has a valuation of a good, which is its private information, and a seller offers to sell a fresh copy of that good in every period through a posted price.

I-A Contributions

In this paper, we present a sequential decomposition methodology for calculating a subset of all PBEs for finite and infinite horizon dynamic games with asymmetric information. Our model, consists of strategic players having types that evolve as conditionally independent Markov controlled processes. Players observe their types privately and actions taken by all players are observed publicly. Instantaneous reward for each player depends on everyone’s types and actions. The proposed methodology provides a decomposition of the interdependence between beliefs and strategies in PBE and enables a systematic evaluation of a subset of PBE, namely structured perfect Bayesian equilibria (SPBE). Furthermore, we show that all SPBE can be computed using this methodology. Here SPBE are defined as equilibria with players strategies based on their current private type and a set of beliefs on each player’s current private type, which is common to all the players and whose domain is time-invariant. The beliefs on players’ types are such that they can be updated individually for each player and sequentially w.r.t. time. The model allows for signaling amongst players as beliefs depend on strategies.

Our motivation for considering SPBE stems from ideas in decentralized team problems and specifically the works of Ho [24] and Nayyar et al. [25]. We utilize the agent-by-agent approach in [24] to motivate a Markovian structure where players’ strategies depend only on their current types. In addition, we utilize the common information based approach introduced in [25] to summarize the common information into a common belief on players’ private types. Even though these ideas motivate the special structure of our equilibrium strategies, they can not be applied in games to evaluate SPBE because they have been developed for dynamic teams and are incompatible with equilibrium notions. Our main contribution is a new construction based on which SPBE can be systematically evaluated.

Specifically, for the finite horizon model, we provide a two-step algorithm involving a backward recursion followed by a forward recursion. The algorithm works as follows. In the backward recursion, for every time period, the algorithm finds an equilibrium generating function defined for all possible common beliefs at that time. This involves solving an one-step fixed point equation on the space of probability simplexes. Then, the equilibrium strategies and beliefs are obtained through a forward recursion using the equilibrium generating function obtained in the backward step and the Bayes update rule. The SPBE that are developed in this paper are analogous to MPEs (for games with symmetric information) in the sense that players choose their actions based on beliefs that depend on common information, and private types, both of which have Markovian dynamics.

For the infinite horizon model, instead of the backwards recursion step, the algorithm solves a single-shot time invariant fixed-point equation involving both an equilibrium generating function and an equilibrium reward-to-go function. We show that using our method, existence of SPBE in the asymmetric information dynamic game is guaranteed if the aforementioned fixed-point equation admits a solution. We provide sufficient conditions under which this is true. We demonstrate our methodology of finding SPBE through a multi-stage public goods game, whereby we observe the aforementioned signaling effect at equilibrium.

I-B Relevant Literature

Related literature on this topic include [14, 26] and [27]. Nayyar et al. in [14, 26] consider dynamic games with asymmetric information. There is an underlying controlled Markov process and players jointly observe part of the process and whilst making additional private observations. It is shown that the considered game with asymmetric information, under certain assumptions, can be transformed to another game with symmetric information. A backward recursive algorithm is provided to find MPE of the transformed game. For this strong equivalence to hold, authors in [14, 26] make a critical assumption in their model: based on the common information, a player’s posterior beliefs about the system state and about other players’ information are independent of the past strategies used by the players. This leads to all strategies being non-signaling. Our model is different from this since we assume that the underlying state of the system has independent components, each constituting a player’s private type. However, we do not make any assumption regarding update of beliefs and allow the belief state to depend on players’ past strategies, which in turn allows the possibility of signaling in the game.

Ouyang et al. in [27] consider a dynamic oligopoly game with strategic sellers and buyers. Each seller privately observes the valuation of their good, which is assumed to have independent Markovian dynamics, thus resulting in a dynamic game of asymmetric information. The common belief is strategy dependent and the authors consider equilibria based on this common information belief. It is shown that if all other players play actions based on the common belief and their private information using equilibrium strategies, and if all players use equilibrium belief update function, then player faces a Markov decision process (MDP) with respect to its action with state being the common belief and its private type. Thus calculating equilibrium boils down to solving a fixed-point equation on belief update functions and strategies of all players. Existence of such equilibrium is shown for a degenerate case where players act myopically at equilibrium and the equilibrium itself is non-signaling.

Other than the common information based approach, Li et al. [28] consider a finite horizon zero-sum dynamic game, where at each time only one player out of the two knows the state of the system. The value of the game is calculated by formulating an appropriate linear program. Cole et al. [29] consider an infinite horizon discounted reward dynamic game where actions are only privately observable. They provide a fixed-point equation for calculating a subset of sequential equilibrium, which is referred to as Markov private equilibrium (MPrE). In MPrE strategies depend on history only through the latest private observation.

I-C Notation

We use uppercase letters for random variables and lowercase for their realizations. For any variable, subscripts represent time indices and superscripts represent player indices. We use notation to represent all players other than player i.e. . We use notation to represent the vector when or an empty vector if . We use to mean . We remove superscripts or subscripts if we want to represent the whole vector, for example represents . In a similar vein, for any collection of sets , we denote by . We denote the indicator function of a set by . For any finite set , represents the space of probability measures on and represents its cardinality. We denote by (or ) the probability measure generated by (or expectation with respect to) strategy profile . We denote the set of real numbers by . For a probabilistic strategy profile of players where the probability of action conditioned on is given by , we use the notation to represent . All equalities/inequalities involving random variables are to be interpreted in the a.s. sense. For mappings with range function sets we use square brackets to denote the image of through and parentheses to denote the image of through . A controlled Markov process with state , action , and horizon is denoted by .

The paper is organized as follows. In Section II, we present the model for games with finite and infinite horizon. Section III serves as motivation for focusing on SPBE. In Section IV, for finite-horizon games, we present a two-step backward-forward recursive algorithm to construct a strategy profile and a sequence of beliefs, and show that it is a PBE of the dynamic game considered. In Section V, we extend that methodology to infinite-horizon games. Section VII discusses concrete example of a public goods game with two players and results are presented for both, finite and infinite horizon versions of the example. All proofs are provided in appendices.

II Model and Preliminaries

We consider a discrete-time dynamical system with strategic players in the set . We consider two cases: finite horizon with perfect recall and infinite horizon with perfect recall. The system state is , where is the type of player at time , which is perfectly observed and is its private information. Players’ types evolve as conditionally independent, controlled Markov processes such that

| (1a) | ||||

| (1b) | ||||

| (1c) | ||||

where are known kernels. Player at time takes action on observing the actions where , which is common information among players, and the types , which it observes privately. The sets are assumed to be finite. Let be a probabilistic strategy of player where such that player plays action according to . Let be a strategy profile of all players. At the end of interval , player receives an instantaneous reward . To preserve the information structure of the problem, we assume that players do not observe their rewards until the end of game.333Alternatively, we could have assumed instantaneous reward of a player to depend only on its own type, i.e. be of the form , and have allowed rewards to be observed by the players during the game as this would not alter the information structure of the game The reward functions and state transition kernels are common knowledge among the players. For the finite-horizon problem, the objective of player is to maximize its total expected reward

| (2) |

For the infinite-horizon case, the transition kernels are considered to not depend on time . We also substitute take in the above equation, where is the common discount factor and is the time invariant stage reward function for player . With all players being strategic, this problem is modeled as a dynamic game, for finite horizon and for infinite horizon, with asymmetric information and simultaneous moves.

II-A Preliminaries

Any history of this game at which players take action is of the form . Let be the set of such histories, be the set of all possible such histories in finite horizon and for infinite horizon. At any time player observes and all players together have as common history. Let be the set of observed histories of player at time and be the set of common histories at time . An appropriate concept of equilibrium for such games is PBE [5], which consists of a pair of strategy profile where and a belief profile where that satisfy sequential rationality so that

| (3) |

where the reward-to-go is defined as

| (4) |

and the beliefs satisfy some consistency conditions as described in [5, p. 331]. Similarly, for the game PBE requires:

| (5) |

where the reward-to-go is

| (6) |

In general, a belief for player at time , is defined on history given its private history . Here player ’s private history consists of a public part and a private part . At any time , the relevant uncertainty player has is about other players’ types and their future actions. In our setting, due to independence of types, and given the common history , player ’s type history does not provide any additional information about , as will be shown later. For this reason we consider beliefs that are functions of each player’s history only through the common history . Hence, for each player , its belief for each history is derived from a common belief . Furthermore, as will be shown later, this belief factorizes into a product of marginals . Thus we can sufficiently use the system of beliefs, , where , and , with the understanding that player ’s belief on is . Under the above structure, all consistency conditions that are required for PBEs [5, p. 331] are automatically satisfied.

III Motivation for structured equilibria

In this section, we present structural results for the considered dynamical process that serve as a motivation for finding SPBE of the underlying game . Specifically, we define a belief state based on common information history and show that any reward profile that can be obtained through a general strategy profile can also be obtained through strategies that depend on this belief state and players’ current types, which are their private information. These structural results are inspired by the analysis of decentralized team problems, which serve as guiding principles to design our equilibrium strategies. While these structural results provide intuition and the required notation, they are not directly used in the proofs for finding SPBE later in Section IV.

At any time , player has information where is the common information among players, and is the private information of player . Since increases with time, any strategy of the form becomes unwieldy. Thus it is desirable to have an information state in a time-invariant space that succinctly summarizes , and that can be sequentially updated. We first show in Lemma 1 that given the common information and its current type , player can discard its type history and play a strategy of the form . Then in Lemma 2, we show that can be summarized through a belief , defined as follows. For any strategy profile , belief on , , is defined as . We also define the marginals .

For player , we use the notation to denote a general policy of the form , notation , where , to denote a policy of the form , and notation , where , to denote a policy of the form . It should be noted that since is a function of random variables , policy is a special type of policy, which in turn is a special type of policy.

Using the agent-by-agent approach [24], we show in Lemma 1 that any expected reward profile of the players that can be achieved by any general strategy profile can also be achieved by a strategy profile .

Lemma 1

Given a fixed strategy of all players other than player and for any strategy of player , there exists a strategy of player such that

| (7) |

which implies .

Proof:

Please see Appendix A.∎

Since any policy is also a type policy, the above lemma can be iterated over all players which implies that for any policy profile there exists an policy profile that achieves the same reward profile i.e., .

Policies of types still have increasing domain due to increasing common information . In order to summarize this information, we take an equivalent view of the system dynamics through a common agent, as taken in [30]. The common agent approach is a general approach that has been used extensively in dynamic team problems [31, 32, 33, 34]. Using this approach, the problem can be equivalently described as follows: player at time observes and takes action , where is a partial (stochastic) function from its private information to , of the form . These actions are generated through some policy , , that operates on the common information such that . Then any policy of the form is equivalent to .

We call a player ’s policy through common agent to be of type if its actions are taken as . We call a player ’s policy through common agent to be of type where , if its actions are taken as . A policy of type is also a policy of type . There is a one-to-one correspondence between policies of type and of type and between policies of type and of type . In summary, the notation for the various functional form of strategies is

| (8a) | |||

| (8b) | |||

In the following lemma, we show that the space of profiles of type is outcome-equivalent to the space of profiles of type .

Lemma 2

For any given strategy profile of all players, there exists a strategy profile such that

| (9) |

which implies .

Proof:

Please see Appendix B. ∎

The above two lemmas show that any reward profile that can be generated through a policy profile of type can also be generated through a policy profile of type . This is precisely the motivation for using SPBE which are equilibria based on policies of type . It should be noted that the construction of depends only on (as shown in (46)), while the construction of depends on the whole policy profile and not just on , since the construction of depends on in (58). Thus any unilateral deviation of player in policy profile does not necessarily translate to unilateral deviation of player in the corresponding policy profile. Therefore being an equilibrium of the game (in some appropriate notion) does not necessitate the corresponding also being an equilibrium. Thus the set of equilibria of type contains those of type but not vice-versa (in general); characterizing the relationship between the two sets of equilibria is an interesting open problem.

We end this section by noting that although finding general PBEs of type of the games or would be a desirable goal, since the space of strategies is growing exponentially with time, it would be computationally intractable. However, Lemmas 1 and 2 suggest that strategies of type form a rich class that achieves every possible reward profile. Since these strategies are functions of beliefs that lie in a time-invariant space and are easily updatable, equilibria of this type are potential candidates for computation through backward recursion. Our goal is to devise an algorithm to find structured equilibria of type of the dynamic games or .

Definition 1 (SPBE)

A structured perfect Bayesian equilibrium is a PBE of the considered dynamic game where at any time , for any agent , its equilibrium strategy is of type (as in (8b)).

IV A Methodology for SPBE computation in finite horizon

In this section we consider the finite horizon dynamic game . In the previous section, (specifically in Claim 1, included in the proof of Lemma 2 in Appendix B), it is shown that due to the independence of types and their evolution as independent controlled Markov processes, for any strategy of the players, the joint common belief can be factorized as a product of its marginals i.e., . Since in this paper, we only deal with such joint beliefs, to accentuate this independence structure, we define as vector of marginal beliefs where . In the rest of the paper, we will use instead of whenever appropriate, where of course, can be constructed from . Similarly, we define the vector of belief updates as where (using Bayes rule)

| (12) |

The update function defined above depends on time through the kernel (for the finite horizon model). For notational simplicity we suppress this dependence on . We also change the notation of policies of type and as follows, so they depend on instead of

| (13a) | |||

| (13b) | |||

In the following we present a backward-forward algorithm that evaluates SPBE. As will be shown in Theorem 2, this is a “canonical” methodology, in the sense that all SPBE can be generated this way.

IV-A Backward Recursion

In this section, we define an equilibrium generating function , where . In addition, we define a sequence of reward-to-go functions of player at time , , where . These quantities are generated through a backward recursive way, as follows.

-

1.

Initialize ,

(14) -

2.

For , let be generated as follows. Set , where is the solution, if it exists,444The problem of existence in this step will be discussed in Section VI. of the following fixed-point equation, ,

(15) where expectation in (15) is with respect to random variables through the measure and is defined above.

Furthermore, using the quantity found above, define

(16)

It should be noted that in (15), is not the outcome of a maximization operation as is the case in a best response equation of a Bayesian Nash equilibrium. Rather (15) is a different fixed point equation. This is because the maximizer appears in both, the left-hand-side and the right-hand-side of the equation (in the belief update ). This distinct construction is pivotal in the proof of Theorem 1, as will be further elaborated in the Discussion section.

IV-B Forward Recursion

As discussed above, a pair of strategy and belief profile is a PBE if it satisfies (4). Based on defined above in (14)–(16), we now construct a set of strategies and beliefs for the game in a forward recursive way, as follows.555As discussed in the preliminaries subsection on Section II, the equilibrium beliefs in SPBE, are functions of each player’s history only through the common history and are the same for all players. As before, we will use the notation , where is a belief on , and can be constructed from as .

-

1.

Initialize at time ,

(17) -

2.

For

(18) and

(19)

where is defined in (12).

We now state our main result.

Theorem 1

A strategy and belief profile , constructed through the backward-forward recursion algorithm is a PBE of the game, i.e., ,

| (20) |

Proof:

Please see Appendix C. ∎

We emphasize that even though the backward-forward algorithm presented above finds a class of equilibrium strategies that are structured, the unilateral deviations of players in (20) are considered in the space of general strategies, i.e., the algorithm does not make any bounded rationality assumptions.

The following result shows that the backward-forward construction described above is “canonical”, in the sense that all SPBE can be found through this methodology. Clearly, an SPBE can be defined as a PBE of the game that is generated through forward recursion in (17)–(19), using an equilibrium generating function , where , , common belief update function and prior distributions . As a consequence, only depends on current type of player , and on the common information through the set of marginals , and depends only on common information history .

Theorem 2 (Converse)

Let () be an SPBE. Then there exists an equilibrium generating function that satisfies (15) in backward recursion , such that () is defined through forward recursion using .666Note that for for any , can be arbitrarily defined without affecting the definition of .

Proof:

Please see Appendix E. ∎

IV-C Discussion

Several remarks are in order with regard to the above methodology and the result.

Remark 1: The second sub-case in (12) dictates how beliefs are updated for histories with zero probability. The particular expression used is only one of many possible updates than can be used here. Dynamics that govern the evolution of public beliefs at histories with zero probability of occurrence affect equilibrium strategies. Thus, the construction proposed for calculating PBEs in this paper will produce a different set of equilibria if one changes the second sub-case above. The most well-known example of another such update is the intuitive criterion proposed in [35] for Nash equilibria, later generalized to sequential equilibria in [36]. The intuitive criterion assigns zero probability to states that can be excluded based on data available to all players (in our case action profile history ). Another example of belief update is universal divinity, proposed in [37].

Remark 2: To highlight the significance of the unique structure of (15), one can think as follows. When all players other than player play structured strategies, i.e., strategies of the form , one may want to characterize the optimization problem from the viewpoint of the -th player in order to characterize its best response. In particular one may want to show that although player can play general strategies of the form , it is sufficient to best respond with structured strategies of the form as well. To show that, one may entertain the thought that player faces an MDP with state , and action at time . If that were true, then player ’s optimal action could be characterized (using standard MDP results) by a dynamic-programming equation similar to (15), of the form

| (21) |

where, unlike (15), in the belief update equation the partial strategy is also optimized over. However, as it turns out, user does not face such an MDP problem! The reason is that the update equation also depends on which is the partial strategy of player and this has not been fixed in the above setting. If however the update equation is first fixed (so it is updated as , i.e., using the equilibrium strategies even for player ) then indeed the problem faced by user is the MDP defined above. It is now clear why (15) has the flavor of a fixed-point equation: the update of beliefs needs to be fixed beforehand with the equilibrium action even for user , and only then user ’s best response can depend only on the MDP state thus being a structured strategy as well. This implies that his optimal action appears both on the left and right hand side of this equation giving rise to (15).

Remark 3: In this paper, we find a class of PBEs of the game, while there may exist other equilibria that are not “structured”, and can not be found by directly using the proposed methodology. The rationale for using structured equilibria over others is the same as that for using MPE over SPE for a symmetric information game; a focussing argument for using simpler strategies being one of them.

V A Methodology for SPBE computation in Infinite Horizon

In this section we consider the infinite horizon discounted reward dynamic game . We state the fixed-point equation that defines the value function and strategy mapping for the infinite horizon problem. This is analogous to the backwards recursion ((15) and (16)) that define the value function and mapping for the finite horizon problem.

Define the set of functions and strategies (which are generated formally as for given ) via the following fixed-point equation: , ,

| (22a) | ||||

| (22b) | ||||

Note that the above is a joint fixed-point equation in , unlike the backwards recursive algorithm earlier which required solving a fixed-point equation only in . Here the unknown quantity is distributed as , and is defined in (12).

Define the belief inductively similar to the forward recursion from Section IV-B. By construction the belief defined above satisfies the consistency condition needed for a PBE. Denote the strategy arising out of by i.e.,

| (23) |

Note that although the mapping is stationary, the strategy derived from it is not so. Below we state the central result of this section, that the strategy-belief pair constructed from the solution of the fixed-point equation (22) and the forward recursion indeed constitutes a PBE.

Theorem 3

Proof:

Please see Appendix F. ∎

Our approach to proving Theorem 3 is as follows. We begin by noting that the standard contraction mapping arguments used in infinite horizon discounted reward MDPs/POMDPs viewed as a limit of finite horizon problems, do not apply here, since the policy equation (22a) is not a maximization, but a different fixed-point equation. So we attempt to “fit” the infinite horizon problem into the framework of finite-horizon model developed in the previous section. We do that by first introducing a terminal reward that depends on common beliefs, in the backward-forward recursion construction of Section IV for finite horizon games. We consider a finite horizon, , dynamic game with rewards same as in the infinite horizon version and time invariant transition kernels . For each player , there is a terminal reward that depends on the terminal type of player and the terminal belief. It is assumed that is absolutely bounded. We define the value functions and strategies backwards inductively in the same way as in Section IV-A except Step 1, where instead of (14) we set . This consequently results in a strategy/belief pair , based on the forward recursion in Section IV-B. Now, due to the above construction, the value function from above and from (22) are related (please see Lemma 9 in Appendix G). This result combined with continuity arguments as complete the proof of Theorem 3.

VI An Existence Result for the Fixed-Point Equation

In this section, we discuss the problem of existence of signaling equilibria.777In the special case of uncontrolled types where player ’s instantaneous reward does not depend on its private type , the fixed point equation always has a type-independent, myopic solution , since it degenerates to a best-response-like equation similar to the one for computing Nash equilibrium. This result is shown in [27]. While it is known that for any finite dynamic game with asymmetric information and perfect recall, there always exists a PBE [4, Prop. 249.1], existence of SPBE is not guaranteed. It is clear from our algorithm that existence of SPBE boils down to existence of a solution to the fixed-point equation (15) in finite horizon and (22) in infinite horizon. Specifically, for the finite horizon, at each time given the functions for all from the previous round (in the backwards recursion) equation (15) must have a solution for all . Generally, existence of equilibria is shown through Kakutani’s fixed point theorem, as is done in proving existence of a mixed strategy Nash equilibrium of a finite game [4, 38]. This is done by showing existence of fixed point of the best-response correspondences of the game. Among other conditions, it requires the “closed graph” property of the correspondences, which is usually implied by the continuity property of the utility functions involved. For (15) establishing existence is not straightforward due to: (a) potential discontinuity of the update function when the denominator in the Bayesian update is 0 and (b) potential discontinuity of the value functions, . In the following we provide sufficient conditions that can be checked at each time to establish the existence of a solution.

We consider a generic fixed-point equation similar to the one encountered in Section IV and Section V and state conditions under which they are guaranteed to have a solution. To concentrate on the essential aspects of the problem we consider a simple case with , type sets and action sets . Furthermore, types are static and instantaneous rewards do not depend on .

Given public belief , value functions , one wishes to solve the following system of equations for .

| (25) |

where the expectation is evaluated using the probability distribution on ,

| (26) |

The probabilistic policy can be represented by the 4-tuple where and , .

The fixed-point equation of interest reduces to

| (27) |

and three other similar equations for .

| (28a) | ||||

| (28b) | ||||

and in both definitions, if the denominator is then the RHS is taken as .

VI-A Points of Discontinuities and the Closed graph result

Equation (27) and the other three similar equations are essentially of the form (for a given )

| (29) |

with as , respectively.

Define as the set of discontinuity points of and .

For any point , define as the subset of indexes for which is discontinuous at .

Assumption (E1)

At any point , one of the following is satisfied:

-

1.

= 0, or

-

2.

such that (inside an -ball of ) the sign of is same as the sign of .

In the following we provide a sufficient condition for existence.

Theorem 4

Under Assumption (E1), there exists a solution to the fixed-point equation (VI-A).

Proof:

Please see Appendix H. ∎

The above set of results provide us with an analytical tool for establishing existence of a solution to the concerned fixed-point equation.

While the above analytical result is useful in understanding a theoretical basis for existence, it doesn’t cover all instances. For instance, fixed-point equation arising out of (15) for from Section VII-A, does not satisfy assumption (E1). In the following we provide a more computationally orientated approach to establishing existence and/or solving the generic fixed-point equation (VI-A).

We motivate this case-by-case approach with the help of an example. Suppose we hypothesize that the solution to (VI-A) is such that and . Then (VI-A) effectively reduces to checking if there exists such that

| (30a) | |||

| (30b) | |||

Thus the 4-variable system reduces to solving a 2-variable system and 2 conditions to verify. For instance, if , as functions of satisfy the conditions of Theorem 4 then the sub-system (30a) has a solution. If one of these solution is also consistent with (30b) then this sub-case indeed provides a solution to (VI-A).

Generalizing the simplification provided in the above example, we divide solutions into cases888Generally, the number of cases is where is the number of agents and is the number of types for player . based on whether each of are in . There are (1) 16 corner cases where none are in the strict interior ; (2) 32 cases where exactly one is in the strict interior ; (3) 24 cases where 2 variables are in the strict interior ; (4) 8 cases where 3 variables are in the strict interior ; (5) 1 case where all 4 variables are in the strict interior .

Similar to the calculations above, for each of the 81 cases one can write a sub-system to which the problem (VI-A) effectively reduces to. Clearly, if any one of the 81 sub-systems has a solution then the problem (VI-A) has a solution. Furthermore, searching for a solution reduces to an appropriate sub-problem depending on the case.

The approach then is to enumerate each of these 81 cases (as stated above) and check them in order. However this case-by-case division provides a computational simplification - not all cases require solving the entire fixed-point equation. Whenever a variable, say , is not in the strict interior then the corresponding equation (VI-A) need not be solved, since one only needs to verify the sign at a specific point. Hence, all sub-cases of (1) reduce to simply checking the value of functions at corner points - no need for solving a fixed-point equation. All sub-cases of (2) reduce to solving a 1-variable fixed-point equation and three corresponding conditions to verify, etc.

VII A Concrete Example of Multi-stage investment in Public Goods

Here we discuss both, a two-stage (finite) and an infinite-horizon version of a public goods example to illustrate the methodology described above for the construction of SPBE.

VII-A A two stage public goods game

We consider a discrete version of Example 8.3 from [5, ch.8], which is an instance of a repeated public goods game. There are two players who play a two-period game. In each period , they simultaneously decide whether to contribute to the period public good, which is a binary decision for players . Before the start of period 2, both players know the action profile from period 1. In each period, each player gets a reward of 1 if at least one player contributed and 0 if none contributed. Player ’s cost of contributing is which is its private information. Both players believe that ’s are drawn independently and identically with probability distribution with support ; , and .

In our model this corresponds to and reward for player in period is , with . We set in this two-stage case. We use the backward recursive algorithm from Section IV to find an SPBE of this game. Here the partial functions can equivalently be defined through the scalars , , for and , where

| (31a) | |||

| (31b) | |||

Henceforth, is used interchangeably with .

For and for any fixed , where represents a probability measure on the event . Let be defined through the fixed point equation (15). Since , is the solution. Thus the fixed-point equation can be reduced to, ,

| (32) |

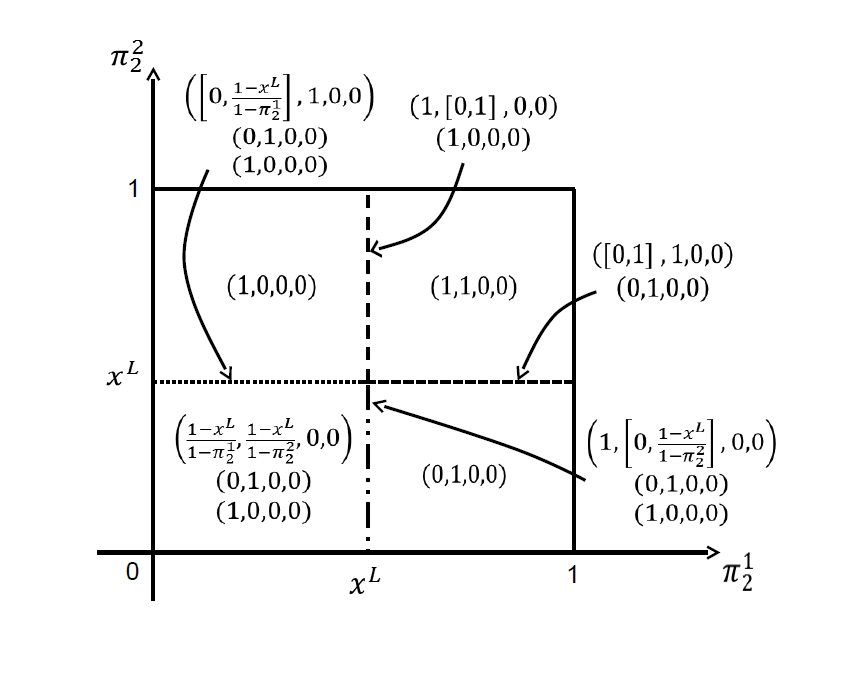

This implies (36) below, the solutions to which are shown in Figure 1 in the space of .

| (36) |

Thus for any , there can exist multiple equilibria and correspondingly multiple can be defined. For any particular , at , the fixed point equation arising out of (15) defines , where denotes the profile of initial belief.

Using one such defined below, we find an SPBE of the game for . We use as one possible set of solutions of (36), described below,

| (41) |

Then, through iteration on the fixed point equation and using the aforementioned , we numerically find (and analytically verify) that is a fixed point. Thus

with beliefs and is an SPBE of the game. In this equilibrium, player 2 at time , contributes according to her type whereas player 1 never contributes, thus player 2 reveals her private information through her action whereas player 1 does not. Since is symmetric, there also exists an (antisymmetric) equilibrium where at time , players’ strategies reverse i.e. player 2 never contributes and player 1 contributes according to her type. We can also obtain a symmetric equilibrium where as a fixed point when , resulting in beliefs where .

VII-B Infinite horizon version

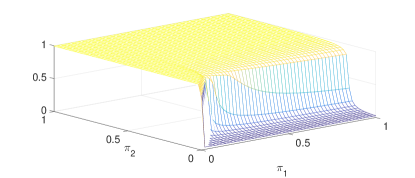

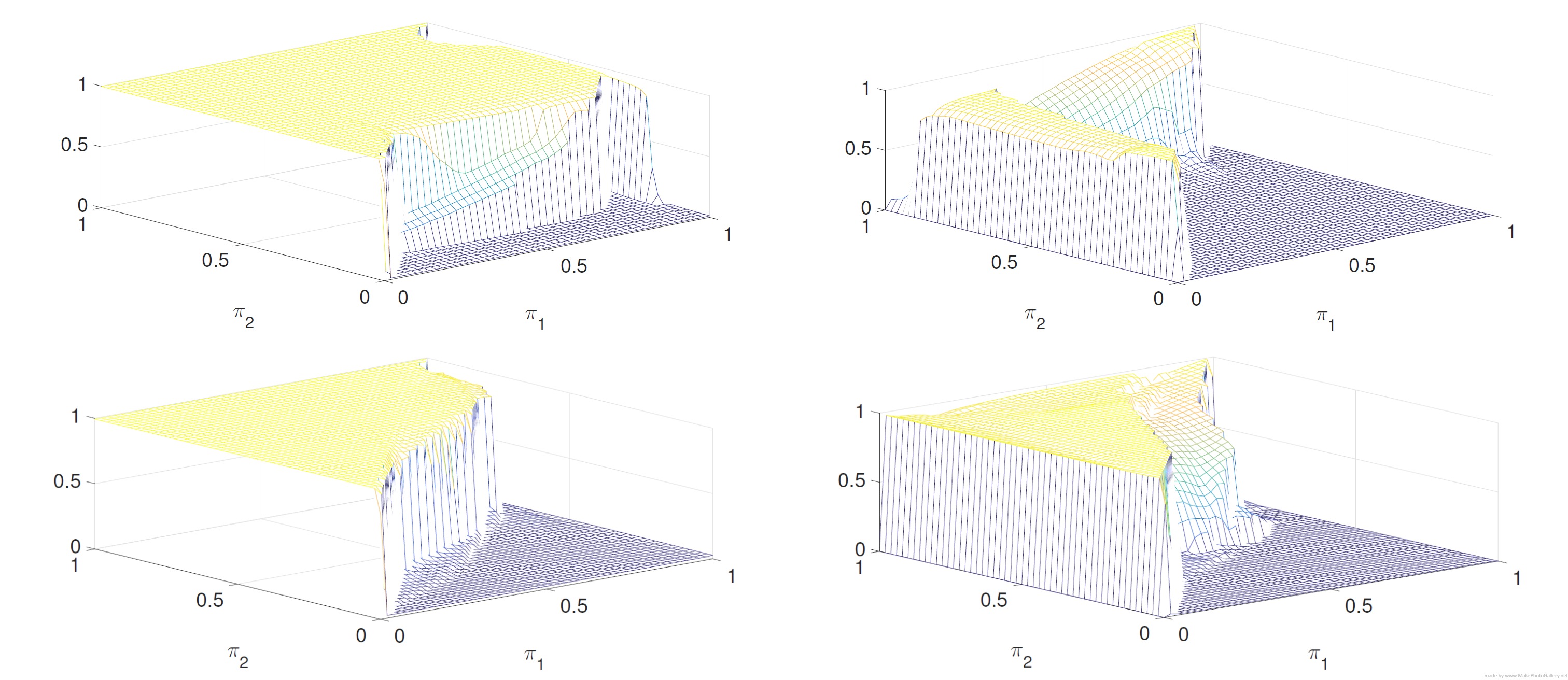

For the infinite horizon version we consider three values and solve the corresponding fixed point equation (arising out of (22)) numerically to calculate the mapping . The fixed-point equation is solved numerically by discretizing the space and all solutions that we find are symmetric w.r.t. players i.e., for is the same as for and similarly for .

For , the game is instantaneous and actually corresponds to the second round play in the finite horizon two-stage version above. Thus whenever player ’s type is , it is instantaneously profitable not to contribute. This gives , for all . Thus we only plot ; in Fig. 2 (this can be inferred from the discussion and Fig. 1 above). Intuitively, with type the only values of for which player 1 would not wish to contribute is if he anticipates player ’s type to be with high probability and rely on player 2 to contribute. This is why for lower values of (i.e., player ’s type likely to be ) we see in Fig. 2.

Now consider plotted in Fig. 2 and 3. As increases, future rewards attain more priority and signaling comes into play. So while taking an action, players not only look for their instantaneous reward but also how their action affects the future public belief about their private type. It is evident in the figures that as increases, at high , up to larger values of player chooses not to contribute when his type is . This way he intends to send a “wrong” signal to player i.e., that his type is and subsequently force player to invest. This way player 1 can free-ride on player ’s investment.

Now consider plotted in Fig. 3. For we know that not contributing is profitable, however as increases from , players are mindful of future rewards and thus are willing to contribute at certain beliefs. Specifically, coordination via signaling is evident here. Although it is instantaneously not profitable to contribute if player ’s type is , by contributing at higher values of (i.e., player ’s type is likely ) and low , player coordinates with player to achieve net profit greater than (reward when no one contributes). This is possible since the loss when contributing is whereas the profit from free-riding on player ’s contribution is .

Under the equilibrium strategy, beliefs form a Markov chain. One can trace this Markov chain to study the signaling effect at equilibrium. On numerically simulating this Markov chain for the above example (at ) we observe that for almost all initial beliefs, within a few rounds players completely learn each other’s private type truthfully (or at least with very high probability). In other words, players manage to reveal their private type via their actions at equilibrium and to such an extent that it negates any possibly incorrect initial belief about their type.

As a measure of cooperative coordination at equilibrium one can perform the following calculation. Compare the value function of agent arising out of the fixed-point equation, for and (normalize it by multiplying with so that it represents per-round value) with the best possible attainable single-round reward under a symmetric mixed strategy with a) full coordination and b) no coordination. Note that the two cases need not be equilibrium themselves, which is why this will result in a bound on the efficiency of the evaluated equilibria.

In case a), assuming both agents have the same type , full coordination can lead to the best possible reward of i.e., agent contributes with probability and agent contributes with probability but in a coordinated manner so that it doesn’t overlap with agent contributing.

In case b) when agents do not coordinate and invest with probability each, then the expected single-round reward is . The maximum possible value of this expression is .

For , the range of values of over is . Whereas full coordination produces and no coordination . It is thus evident that agents at equilibrium end up achieving reward close to the best possible and gain significantly compared to the strategy of no coordination.

Similarly for the range is . Whereas full coordination produces and no coordination . The gain via coordination is evident here too.

VIII Conclusion

In this paper we presented a methodology for evaluating SPBE for games with asymmetric information and independent private types evolving as controlled Markov processes. The main contribution is a time decomposition akin to dynamic programming. This decomposition allows one to find SPBE that exhibit signaling behavior with linear complexity in the time horizon. Using this methodology, dynamic LQG games with asymmetric information are studied in [39] where it is shown that under certain conditions, there exists an SPBE of the game with strategies being linear in players’ private types. In [40], authors extend the finite-horizon model in this paper such that players do not observe their own types, rather make independent noisy observations of their types. An analogous backward-forward algorithm is presented for that model. It is worth noting that although structured strategies are useful in making the equilibrium finding process tractable, no claim can be made about whether the resulting equilibrium outcomes are better or worse than those corresponding to general strategies. We believe this is an interesting future research direction. Another interesting future direction is dynamic mechanism design for asymmetric information systems.

Acknowledgment

The authors wish to acknowledge Vijay Subramanian for his contribution to the paper. Achilleas Anastasopoulos wishes to acknowledge Ashutosh Nayyar for the fruitful discussion and criticism of an early draft of this work presented during the ITA 2012 conference.

Appendix A Proof of Lemma 1

We prove this Lemma in the following steps.

-

(a)

In Claim 1, we prove that for any policy profile and , for are conditionally independent given the common information .

- (b)

-

(c)

For a given policy , we define a policy of player from as .

-

(d)

In Claim 3, we prove that the dynamics of this controlled Markov process under are same as under i.e. .

-

(e)

In Claim 4, we prove that w.r.t. random variables , is sufficient for player ’s private information history i.e. .

-

(f)

From (c), (d) and (e) we then prove the result of the lemma that .

Claim 1

For any policy profile and ,

| (43) |

Proof:

| (44a) | ||||

| (44b) | ||||

| (44c) | ||||

| (44d) | ||||

| (44e) | ||||

∎

Claim 2

For a fixed , is a controlled Markov process with state and control action .

Proof:

For any given policy profile , we construct a policy in the following way,

| (46a) | ||||

| (46b) | ||||

| (46c) | ||||

| (46d) | ||||

Claim 3

The dynamics of the Markov process under are the same as under i.e.,

| (47) |

Proof:

We prove this by induction. Clearly,

| (48) |

Now suppose (47) is true for which also implies that the marginals . Then

| (49a) | ||||

| (49b) | ||||

| (49c) | ||||

where (49b) is true from induction hypothesis, definition of in (46d) and since is a controlled Markov process as proved in Claim 2 and its update kernel does not depend on policy .This completes the induction step.

∎

Claim 4

For any policy ,

| (50) |

Appendix B Proof of Lemma 2

For this proof we will assume the common agents strategies to be probabilistic as opposed to being deterministic, as was the case in Section III. This means actions of the common agent, ’s are generated probabilistically from as , as opposed to being deterministically generated as , as before. These two are equivalent ways of generating actions from and . We avoid using the probabilistic strategies of common agent throughout the main text for ease of exposition, and because it conceptually does not affect the results.

Proof:

We prove this lemma in the following steps. We view this problem from the perspective of a common agent. Let be the coordinator’s policy corresponding to policy profile . Let .

-

(a)

In Claim 5, we show that can be factorized as where each can be updated through an update function and is independent of common agent’s policy .

-

(b)

In Claim 6, we prove that is a controlled Markov process.

-

(c)

We construct a policy profile from such that .

-

(d)

In Claim 7, we prove that dynamics of this Markov process under is same as under i.e. .

-

(e)

In Claim 8, we prove that with respect to random variables , can summarize common information i.e. .

-

(f)

From (c), (d) and (e) we then prove the result of the lemma that which is equivalent to , where is the policy profile of players corresponding to .

Claim 5

can be factorized as where each can be updated through an update function and is independent of common agent’s policy . We also say .

Proof:

We prove this by induction. Since , the base case is verified. Now suppose . Then,

| (55a) | ||||

| (55b) | ||||

| (55c) | ||||

| (55d) | ||||

| (55e) | ||||

| (55f) | ||||

where (55e) follows from induction hypothesis. It is assumed in (55c)-(55e) that the denominator is not 0. If denominator corresponding to any is zero, we define

| (56) |

where still satisfies (55f). Thus and where and are appropriately defined from above. ∎

Claim 6

is a controlled Markov process with state and control action

Proof:

| (57a) | ||||

| (57b) | ||||

| (57c) | ||||

| (57d) | ||||

∎

For any given policy profile , we construct policy profile in the following way.

| (58) |

Claim 7

| (59) |

Proof:

We prove this by induction. For ,

| (60) |

Now suppose is true for , then

| (61a) | ||||

| (61b) | ||||

| (61c) | ||||

where (61b) is true from induction hypothesis, definition of in (58) and since is a controlled Markov process as proved in Claim 6 and thus its update kernel does not depend on policy . This completes the induction step. ∎

Claim 8

For any policy ,

| (62) |

Proof:

| (63a) | ||||

| (63b) | ||||

| (63c) | ||||

∎

Finally,

| (64a) | ||||

| (64b) | ||||

| (64c) | ||||

| (64d) | ||||

| (64e) | ||||

where (64b) follows from (62), (64c) is due to change of measure and (64d) follows from (59).

∎

Appendix C Proof of Theorem 1

Proof:

We prove (20) using induction and the results in Lemma 3, 4 and 5 proved in Appendix D.

| For base case at , | ||||

| (65a) | ||||

| (65b) | ||||

where (65a) follows from Lemma 5 and (65b) follows from Lemma 3 in Appendix D.

Let the induction hypothesis be that for , ,

| (66a) | |||

| (66b) | |||

| Then , we have | |||

| (67a) | |||

| (67b) | |||

| (67c) | |||

| (67d) | |||

| (67e) | |||

| (67f) | |||

where (67a) follows from Lemma 5, (67b) follows from Lemma 3, (67c) follows from Lemma 5, (67d) follows from induction hypothesis in (66b) and (67e) follows from Lemma 4. Moreover, construction of in (15), and consequently definition of in (18) are pivotal for (67e) to follow from (67d).

Appendix D Intermediate lemmas used in proof of Theorem 1

Lemma 3

| (68) |

Proof:

We prove this Lemma by contradiction.

Suppose the claim is not true for . This implies such that

| (69) |

We will show that this leads to a contradiction.

Construct

| (70) |

Lemma 4

and

| (72a) | |||

| (72b) | |||

Thus the above quantities do not depend on .

Proof:

Essentially this claim stands on the fact that can be updated from and , as as in Claim 5. Since the above expectations involve random variables , we consider the probability

| (73) |

where

| (74a) | ||||

| (74b) | ||||

| (74c) | ||||

| where (74c) follows from the conditional independence of types given common information, as shown in Claim 1, and the fact that probability on given depends on through . Similarly, the denominator in (73) is given by | ||||

| (74d) | ||||

| (74e) | ||||

Lemma 5

,

| (75) |

Proof:

| We prove the lemma by induction. For , | |||

| (76a) | |||

| (76b) | |||

where (76b) follows from the definition of in (16) and the definition of in the forward recursion in (18).

Suppose the claim is true for , i.e.,

| (77) |

Then , we have

| (78a) | |||

| (78b) | |||

| (78c) | |||

| (78d) | |||

| (78e) | |||

where (78b) follows from Lemma 4 in Appendix D, (78c) follows from the induction hypothesis in (77), (78d) follows because the random variables involved in expectation, do not depend on and (78e) follows from the definition of in the forward recursion in (18), the definition of in (19) and the definition of in (16). ∎

Appendix E Proof of Theorem 2

Proof:

We prove this by contradiction. Suppose for any equilibrium generating function that generates through forward recursion, there exists such that for , (15) is not satisfied for i.e. for ,

| (79) |

Let be the first instance in the backward recursion when this happens. This implies such that

| (80) |

This implies for ,

| (81a) | |||

| (81b) | |||

| (81c) | |||

| (81d) | |||

| (81e) | |||

| (81f) | |||

where (81b) follows from Lemma 4, (81c) follows from the definitions of and and Lemma 5, (81d) follows from (80) and the definition of , (81e) follows from Lemma 3, (81f) follows from Lemma 4. However, this leads to a contradiction since is a PBE of the game. ∎

Appendix F Proof of Theorem 3

We divide the proof into two parts: first we show that the value function is at least as big as any reward-to-go function; secondly we show that under the strategy , reward-to-go is .

Part 1

For any , define the following reward-to-go functions

| (82a) | |||

| (82b) | |||

Since are finite sets the reward is absolutely bounded, the reward-to-go is finite .

For any , ,

| (83) |

Combining results from Lemmas 8 and 9 in Appendix G, the term in the first bracket in RHS of (83) is non-negative. Using (82), the term in the second bracket is

| (84) |

The summation in the expression above is bounded by a convergent geometric series. Also, is bounded. Hence the above quantity can be made arbitrarily small by choosing appropriately large. Since the LHS of (83) does not depend on , this results in

| (85) |

Part 2

Since the strategy generated in (23) is such that depends on only through and , the reward-to-go , at strategy , can be written (with abuse of notation) as

| (86) |

For any ,

| (87a) | |||

| (87b) |

Repeated application of the above for the first time periods gives

| (88a) | |||

| (88b) |

Here is the step belief update under strategy and belief prescribed by .

Taking differences results in

| (89) |

Taking absolute value of both sides then using Jensen’s inequality for and finally taking supremum over reduces to

| (90) |

Now using the fact that are bounded and that we can choose arbitrarily large, we get .

Appendix G Intermediate Lemma used in Proof of Theorem 3

In this section, we present four lemmas. Lemma 6 and 7 are intermediate technical results needed in the proof of Lemma 8. Then the results in Lemma 8 and 9 are used in Appendix F for the proof of Theorem 3. The proofs for Lemma 6 and 7 below aren’t stated as they are analogous (the only difference being a non-zero terminal reward in the finite horizon model) to the proofs of Lemma 3 and 4, from Appendix D, used in the proof of Theorem 1.

Define the reward-to-go for any agent and strategy as

| (91) |

Here agent ’s strategy is whereas all other agents use strategy defined above. Since are assumed to be finite and absolutely bounded, the reward-to-go is finite .

In the following, any quantity with a in the superscript refers the finite horizon model with terminal reward . For further discussion, please refer to the comments after the statement of Theorem 3.

Lemma 6

For any , , and ,

| (92) |

Lemma 7

| (93) |

The result below shows that the value function from the backwards recursive algorithm is higher than any reward-to-go.

Lemma 8

For any , , and ,

| (94) |

Proof:

The following result highlights the similarities between the fixed-point equation in infinite horizon and the backwards recursion in the finite horizon.

Lemma 9

Proof:

Use backward induction for this. Consider the finite horizon algorithm at time , noting that ,

| (97a) | ||||

| (97b) | ||||

Comparing the above set of equations with (22), we can see that the pair arising out of (22) satisfies the above. Now assume that for all . At time , in the finite horizon construction from (15), (16), substituting in place of from the induction hypothesis, we get the same set of equations as (97). Thus satisfies it. ∎

Appendix H Proof of Theorem 4

Denote the vector correspondence defined by the RHS of (VI-A) by

| (98) |

where . For any , is non-empty and closed, since the solution always exists and is one of . If in addition also has a closed graph then by Kakutani Fixed Point Theorem there exists a solution to (VI-A).

Consider any sequence such that ,

| (99a) | |||

| (99b) | |||

We need to verify that (99) also holds for the limit . If then due to continuity, (99) indeed holds at the limit. For , for any if then in the relation to be verified, the requirement is either of , which is always true. For , if then for any sequence , for large the points in the sequence are within and thus for large . This means that the relation from (99) holds at the limit (noting that are continuous at in this case).

Similarly if and for any .For if and then there exists an such that we have and . From this it follows that the relation (99) holds at the limit. Similar argument works for any other sign combination of .

The two arguments above cover all cases.

References

- [1] L. S. Shapley, “Stochastic games,” Proceedings of the national academy of sciences, vol. 39, no. 10, pp. 1095–1100, 1953.

- [2] T. Baş ar and G. Olsder, Dynamic Noncooperative Game Theory, 2nd Edition. Society for Industrial and Applied Mathematics, 1998.

- [3] J. Filar and K. Vrieze, Competitive Markov decision processes. Springer Science & Business Media, 2012.

- [4] M. J. Osborne and A. Rubinstein, A Course in Game Theory, ser. MIT Press Books. The MIT Press, 1994, vol. 1.

- [5] D. Fudenberg and J. Tirole, Game Theory. Cambridge, MA: MIT Press, 1991.

- [6] G. J. Mailath and L. Samuelson, Repeated games and reputations: long-run relationships. Oxford university press, 2006.

- [7] E. Maskin and J. Tirole, “Markov perfect equilibrium: I. observable actions,” Journal of Economic Theory, vol. 100, no. 2, pp. 191–219, 2001.

- [8] R. Ericson and A. Pakes, “Markov-perfect industry dynamics: A framework for empirical work,” The Review of Economic Studies, vol. 62, no. 1, pp. 53–82, 1995.

- [9] D. Bergemann and J. Välimäki, “Learning and strategic pricing,” Econometrica: Journal of the Econometric Society, pp. 1125–1149, 1996.

- [10] D. Acemoğlu and J. A. Robinson, “A theory of political transitions,” American Economic Review, pp. 938–963, 2001.

- [11] D. M. Kreps and J. Sobel, “Chapter 25 signalling,” ser. Handbook of Game Theory with Economic Applications. Elsevier, 1994, vol. 2, pp. 849 – 867.

- [12] U. Doraszelski and A. Pakes, “A framework for applied dynamic analysis in IO,” Handbook of industrial organization, vol. 3, pp. 1887–1966, 2007.

- [13] E. Altman, V. Kambley, and A. Silva, “Stochastic games with one step delay sharing information pattern with application to power control,” in Game Theory for Networks, 2009. GameNets’ 09. International Conference on. IEEE, 2009, pp. 124–129.

- [14] A. Nayyar, A. Gupta, C. Langbort, and T. Başar, “Common information based Markov perfect equilibria for stochastic games with asymmetric information: Finite games,” IEEE Trans. Automatic Control, vol. 59, no. 3, pp. 555–570, March 2014.

- [15] M. Spence, “Job market signaling,” The quarterly journal of Economics, pp. 355–374, 1973.

- [16] S. J. Grossman, “The informational role of warranties and private disclosure about product quality,” The Journal of Law & Economics, vol. 24, no. 3, pp. 461–483, 1981.

- [17] C. Wilson, “A model of insurance markets with incomplete information,” Journal of Economic theory, vol. 16, no. 2, pp. 167–207, 1977.

- [18] M. Rothschild and J. Stiglitz, “Equilibrium in competitive insurance markets: An essay on the economics of imperfect information,” in Foundations of Insurance Economics. Springer, 1976, pp. 355–375.

- [19] A. Zahavi, “Mate selection–a selection for a handicap,” Journal of theoretical Biology, vol. 53, no. 1, pp. 205–214, 1975.

- [20] A. V. Banerjee, “A simple model of herd behavior,” The Quarterly Journal of Economics, pp. 797–817, 1992.

- [21] S. Bikhchandani, D. Hirshleifer, and I. Welch, “A theory of fads, fashion, custom, and cultural change as informational cascades,” Journal of Political Economy, vol. 100, no. 5, pp. pp. 992–1026, 1992. [Online]. Available: http://www.jstor.org/stable/2138632

- [22] L. Smith and P. Sörensen, “Pathological outcomes of observational learning,” Econometrica, vol. 68, no. 2, pp. 371–398, 2000. [Online]. Available: http://dx.doi.org/10.1111/1468-0262.00113

- [23] N. R. Devanur, Y. Peres, and B. Sivan, “Perfect Bayesian equilibria in repeated sales,” in Proceedings of the Twenty-Sixth Annual ACM-SIAM Symposium on Discrete Algorithms. SIAM, 2015, pp. 983–1002.

- [24] Y.-C. Ho, “Team decision theory and information structures,” Proceedings of the IEEE, vol. 68, no. 6, pp. 644–654, 1980.

- [25] A. Nayyar, A. Mahajan, and D. Teneketzis, “Optimal control strategies in delayed sharing information structures,” IEEE Trans. Automatic Control, vol. 56, no. 7, pp. 1606–1620, July 2011.

- [26] A. Gupta, A. Nayyar, C. Langbort, and T. Başar, “Common information based Markov perfect equilibria for linear-gaussian games with asymmetric information,” SIAM Journal on Control and Optimization, vol. 52, no. 5, pp. 3228–3260, 2014.

- [27] Y. Ouyang, H. Tavafoghi, and D. Teneketzis, “Dynamic oligopoly games with private Markovian dynamics,” in Proc. 54th IEEE Conf. Decision and Control (CDC), 2015.

- [28] L. Li and J. Shamma, “Lp formulation of asymmetric zero-sum stochastic games,” in 53rd IEEE Conference on Decision and Control, Dec 2014, pp. 1930–1935.

- [29] H. L. Cole and N. Kocherlakota, “Dynamic games with hidden actions and hidden states,” Journal of Economic Theory, vol. 98, no. 1, pp. 114–126, 2001.

- [30] A. Nayyar, A. Mahajan, and D. Teneketzis, “Decentralized stochastic control with partial history sharing: A common information approach,” IEEE Transactions on Automatic Control, vol. 58, no. 7, pp. 1644–1658, July 2013.

- [31] A. Mahajan, “Optimal decentralized control of coupled subsystems with control sharing,” Automatic Control, IEEE Transactions on, vol. 58, no. 9, pp. 2377–2382, 2013.

- [32] A. Mahajan and D. Teneketzis, “On the design of globally optimal communication strategies for real-time communcation systems with noisy feedback,” IEEE J. Select. Areas Commun., no. 4, pp. 580–595, May 2008.

- [33] A. Nayyar and D. Teneketzis, “On globally optimal real-time encoding and decoding strategies in multi-terminal communication systems,” in Proc. IEEE Conf. on Decision and Control, Cancun, Mexico, Dec. 2008, pp. 1620–1627.

- [34] D. Vasal and A. Anastasopoulos, “Stochastic control of relay channels with cooperative and strategic users,” IEEE Transactions on Communications, vol. 62, no. 10, pp. 3434–3446, Oct 2014.

- [35] I.-K. Cho and D. M. Kreps, “Signaling games and stable equilibria,” The Quarterly Journal of Economics, vol. 102, no. 2, pp. 179–221, 1987.

- [36] I.-K. Cho, “A refinement of sequential equilibria,” Econometrica, vol. 55, no. 6, pp. 1367–1389, 1987.

- [37] J. S. Banks and J. Sobel, “Equilibrium selection in signaling games,” Econometrica, vol. 55, no. 3, pp. 647–661, 1987.

- [38] J. Nash, “Non-cooperative games,” Annals of mathematics, pp. 286–295, 1951.

- [39] D. Vasal and A. Anastasopoulos, “Signaling equilibria for dynamic LQG games with asymmetric information,” in Proc. IEEE Conf. on Decision and Control, Dec. 2016, pp. 6901–6908.

- [40] ——, “Decentralized Bayesian learning in dynamic games,” in Proc. Allerton Conf. Commun., Control, Comp., Sept. 2016.