Nonparametric Instrumental Variable Estimation Under Monotonicity111First version: January 2014. This version: March 15, 2024. We thank Alex Belloni, Richard Blundell, Stéphane Bonhomme, Moshe Buchinsky, Matias Cattaneo, Xiaohong Chen, Victor Chernozhukov, Andrew Chesher, Joachim Freyberger, Jinyong Hahn, Dennis Kristensen, Simon Lee, Zhipeng Liao, Rosa Matzkin, Eric Mbakop, Ulrich Müller, Markus Reiß, Susanne Schennach, Azeem Shaikh, and Vladimir Spokoiny for useful comments and discussions.

Abstract

The ill-posedness of the inverse problem of recovering a regression function in a nonparametric instrumental variable model leads to estimators that may suffer from a very slow, logarithmic rate of convergence. In this paper, we show that restricting the problem to models with monotone regression functions and monotone instruments significantly weakens the ill-posedness of the problem. In stark contrast to the existing literature, the presence of a monotone instrument implies boundedness of our measure of ill-posedness when restricted to the space of monotone functions. Based on this result we derive a novel non-asymptotic error bound for the constrained estimator that imposes monotonicity of the regression function. For a given sample size, the bound is independent of the degree of ill-posedness as long as the regression function is not too steep. As an implication, the bound allows us to show that the constrained estimator converges at a fast, polynomial rate, independently of the degree of ill-posedness, in a large, but slowly shrinking neighborhood of constant functions. Our simulation study demonstrates significant finite-sample performance gains from imposing monotonicity even when the regression function is rather far from being a constant. We apply the constrained estimator to the problem of estimating gasoline demand functions from U.S. data.

1 Introduction

Despite the pervasive use of linear instrumental variable methods in empirical research, their nonparametric counterparts are far from enjoying similar popularity. Perhaps two of the main reasons for this originate from the observation that point-identification of the regression function in the nonparametric instrumental variable (NPIV) model requires completeness assumptions, which have been argued to be strong (Santos (2012)) and non-testable (Canay, Santos, and Shaikh (2013)), and from the fact that the NPIV model is ill-posed, which may cause regression function estimators in this model to suffer from a very slow, logarithmic rate of convergence (e.g. Blundell, Chen, and Kristensen (2007)).

In this paper, we explore the possibility of imposing shape restrictions to improve statistical properties of the NPIV estimators and to achieve (partial) identification of the NPIV model in the absence of completeness assumptions. We study the NPIV model

| (1) |

where is a dependent variable, an endogenous regressor, and an instrumental variable (IV). We are interested in identification and estimation of the nonparametric regression function based on a random sample of size from the distribution of . We impose two monotonicity conditions: (i) monotonicity of the regression function (we assume that is increasing222All results in the paper hold also when is decreasing. In fact, as we show in Section 4 the sign of the slope of is identified under our monotonicity conditions.) and (ii) monotonicity of the reduced form relationship between the endogenous regressor and the instrument in the sense that the conditional distribution of given corresponding to higher values of first-order stochastically dominates the same conditional distribution corresponding to lower values of (the monotone IV assumption).

We show that these two monotonicity conditions together significantly change the structure of the NPIV model, and weaken its ill-posedness. In particular, we demonstrate that under the second condition, a slightly modified version of the sieve measure of ill-posedness defined in Blundell, Chen, and Kristensen (2007) is bounded uniformly over the dimension of the sieve space, when restricted to the set of monotone functions; see Section 2 for details. As a result, under our two monotonicity conditions, the constrained NPIV estimator that imposes monotonicity of the regression function possesses a fast rate of convergence in a large but slowly shrinking neighborhood of constant functions.

More specifically, we derive a new non-asymptotic error bound for the constrained estimator. The bound exhibits two regimes. The first regime applies when the function is not too steep, and the bound in this regime is independent of the sieve measure of ill-posedness, which slows down the convergence rate of the unconstrained estimator. In fact, under some further conditions, the bound in the first regime takes the following form: with high probability,

where is the constrained estimator, an appropriate -norm, the number of series terms in the estimator , the number of derivatives of the function , and some constant; see Section 3 for details. Thus, the constrained estimator has fast rate of convergence in the first regime, and the bound in this regime is of the same order, up to a log-factor, as that for series estimators of conditional mean functions. The second regime applies when the function is sufficiently steep. In this regime, the bound is similar to that for the unconstrained NPIV estimators. The steepness level separating the two regimes depends on the sample size and decreases as the sample size grows large. Therefore, for a given increasing function , if the sample size is not too large, the bound is in its first regime, where the constrained estimator does not suffer from ill-posedness of the model. As the sample size grows large, however, the bound eventually switches to the second regime, where ill-posedness of the model undermines the statistical properties of the constrained estimator similarly to the case of the unconstrained estimator.

Intuitively, existence of the second regime of the bound is well expected. Indeed, if the function is strictly increasing, it lies in the interior of the constraint that is increasing. Hence, the constraint does not bind asymptotically so that, in sufficiently large samples, the constrained estimator coincides with the unconstrained one and the two estimators share the same convergence rate. In finite samples, however, the constraint binds with non-negligible probability even if is strictly increasing. The first regime of our non-asymptotic bound captures this finite-sample phenomenon, and improvements from imposing the monotonicity constraint on in this regime can be understood as a boundary effect. Importantly, and perhaps unexpectedly, we show that under the monotone IV assumption, this boundary effect is so strong that ill-posedness of the problem completely disappears in the first regime.333Even though we have established the result that ill-posedness disappears in the first regime under the monotone IV assumption, currently we do not know whether this assumption is necessary for the result. In addition, we demonstrate via our analytical results as well as simulations that this boundary effect can be strong even far away from the boundary and/or in large samples.

Our simulation experiments confirm these theoretical findings and demonstrate dramatic finite-sample performance improvements of the constrained relative to the unconstrained NPIV estimator when the monotone IV assumption is satisfied. Imposing the monotonicity constraint on removes the estimator’s non-monotone oscillations due to sampling noise, which in ill-posed inverse problems can be particularly pronounced. Therefore, imposing the monotonicity constraint significantly reduces variance while only slightly increasing bias.

In addition, we show that in the absence of completeness assumptions, that is, when the NPIV model is not point-identified, our monotonicity conditions have non-trivial identification power, and can provide partial identification of the model.

We regard both monotonicity conditions as natural in many economic applications. In fact, both of these conditions often directly follow from economic theory. Consider the following generic example. Suppose an agent chooses input (e.g. schooling) to produce an outcome (e.g. life-time earnings) such that , where summarizes determinants of outcome other than . The cost of choosing a level is , where is a cost-shifter (e.g. distance to college) and represents (possibly vector-valued) unobserved heterogeneity in costs (e.g. family background, a family’s taste for education, variation in local infrastructure). The agent’s optimization problem can then be written as

so that, from the first-order condition of this optimization problem,

| (2) |

if marginal cost are decreasing in (i.e. ), marginal cost are increasing in (i.e. ), and the production function is concave (i.e. ). As long as is independent of the pair , condition (2) implies our monotone IV assumption and increasing corresponds to the assumption of a monotone regression function. Dependence between and generates endogeneity of , and independence of from implies that can be used as an instrument for .

Another example is the estimation of Engel curves. In this case, the outcome variable is the budget share of a good, the endogenous variable is total expenditure, and the instrument is gross income. Our monotonicity conditions are plausible in this example because for normal goods such as food-in, the budget share is decreasing in total expenditure, and total expenditure increases with gross income. Finally, consider the estimation of (Marshallian) demand curves. The outcome variable is quantity of a consumed good, the endogenous variable is the price of the good, and could be some variable that shifts production cost of the good. For a normal good, the Slutsky inequality predicts to be decreasing in price as long as income effects are not too large. Furthermore, price is increasing in production cost and, thus, increasing in the instrument , and so our monotonicity conditions are plausible in this example as well.

Both of our monotonicity assumptions are testable. For example, a test of the monotone IV condition can be found in Lee, Linton, and Whang (2009). In this paper, we extend their results by deriving an adaptive test of the monotone IV condition, with the value of the involved smoothness parameter chosen in a data-driven fashion. This adaptation procedure allows us to construct a test with desirable power properties when the degree of smoothness of the conditional distribution of given is unknown. Regarding our first monotonicity condition, to the best of our knowledge, there are no procedures in the literature that consistently test monotonicity of the function in the NPIV model (1). We consider such procedures in a separate project and, in this paper, propose a simple test of monotonicity of given that the monotone IV condition holds.

Matzkin (1994) advocates the use of shape restrictions in econometrics and argues that economic theory often provides restrictions on functions of interest, such as monotonicity, concavity, and/or Slutsky symmetry. In the context of the NPIV model (1), Freyberger and Horowitz (2013) show that, in the absence of point-identification, shape restrictions may yield informative bounds on functionals of and develop inference procedures when the regressor and the instrument are discrete. Blundell, Horowitz, and Parey (2013) demonstrate via simulations that imposing Slutsky inequalities in a quantile NPIV model for gasoline demand improves finite-sample properties of the NPIV estimator. Grasmair, Scherzer, and Vanhems (2013) study the problem of demand estimation imposing various constraints implied by economic theory, such as Slutsky inequalities, and derive the convergence rate of a constrained NPIV estimator under an abstract projected source condition. Our results are different from theirs because we focus on non-asymptotic error bounds, with special emphasis on properties of our estimator in the neighborhood of the boundary, we derive our results under easily interpretable, low level conditions, and we find that our estimator does not suffer from ill-posedness of the problem in a large but slowly shrinking neighborhood of constant functions.

Other related literature.

The NPIV model has received substantial attention in the recent econometrics literature. Newey and Powell (2003), Hall and Horowitz (2005), Blundell, Chen, and Kristensen (2007), and Darolles, Fan, Florens, and Renault (2011) study identification of the NPIV model (1) and propose estimators of the regression function . See Horowitz (2011, 2014) for recent surveys and further references. In the mildly ill-posed case, Hall and Horowitz (2005) derive the minimax risk lower bound in -norm and show that their estimator achieves this lower bound. Under different conditions, Chen and Reiß (2011) derive a similar bound for the mildly and the severely ill-posed case and show that the estimator by Blundell, Chen, and Kristensen (2007) achieves this bound. Chen and Christensen (2013) establish minimax risk bounds in the sup-norm, again both for the mildly and the severely ill-posed case. The optimal convergence rates in the severely ill-posed case were shown to be logarithmic, which means that the slow convergence rate of existing estimators is not a deficiency of those estimators but rather an intrinsic feature of the statistical inverse problem.

There is also large statistics literature on nonparametric estimation of monotone functions when the regressor is exogenous, i.e. , so that is a conditional mean function. This literature can be traced back at least to Brunk (1955). Surveys of this literature and further references can be found in Yatchew (1998), Delecroix and Thomas-Agnan (2000), and Gijbels (2004). For the case in which the regression function is both smooth and monotone, many different ways of imposing monotonicity on the estimator have been studied; see, for example, Mukerjee (1988), Cheng and Lin (1981), Wright (1981), Friedman and Tibshirani (1984), Ramsay (1988), Mammen (1991), Ramsay (1998), Mammen and Thomas-Agnan (1999), Hall and Huang (2001), Mammen, Marron, Turlach, and Wand (2001), and Dette, Neumeyer, and Pilz (2006). Importantly, under the mild assumption that the estimators consistently estimate the derivative of the regression function, the standard unconstrained nonparametric regression estimators are known to be monotone with probability approaching one when the regression function is strictly increasing. Therefore, such estimators have the same rate of convergence as the corresponding constrained estimators that impose monotonicity (Mammen (1991)). As a consequence, gains from imposing a monotonicity constraint can only be expected when the regression function is close to the boundary of the constraint and/or in finite samples. Zhang (2002) and Chatterjee, Guntuboyina, and Sen (2013) formalize this intuition by deriving risk bounds of the isotonic (monotone) regression estimators and showing that these bounds imply fast convergence rates when the regression function has flat parts. Our results are different from theirs because we focus on the endogenous case with and study the impact of monotonicity constraints on the ill-posedness property of the NPIV model which is absent in the standard regression problem.

Notation.

For a differentiable function , we use to denote its derivative. When a function has several arguments, we use with an index to denote the derivative of with respect to corresponding argument; for example, denotes the partial derivative of with respect to . For random variables and , we denote by , , and the joint, conditional and marginal densities of , given , and , respectively. Similarly, we let , , and refer to the corresponding cumulative distribution functions. For an operator , we let denote the operator norm defined as

Finally, by increasing and decreasing we mean that a function is non-decreasing and non-increasing, respectively.

Outline.

The remainder of the paper is organized as follows. In the next section, we analyze ill-posedness of the model (1) under our monotonicity conditions and derive a useful bound on a restricted measure of ill-posedness for the model (1). Section 3 discusses the implications of our monotonicity assumptions for estimation of the regression function . In particular, we show that the rate of convergence of our estimator is always not worse than that of unconstrained estimators but may be much faster in a large, but slowly shrinking, neighborhood of constant functions. Section 4 shows that our monotonicity conditions have non-trivial identification power. Section 5 provides new tests of our two monotonicity assumptions. In Section 6, we present results of a Monte Carlo simulation study that demonstrates large gains in performance of the constrained estimator relative to the unconstrained one. Finally, Section 7 applies the constrained estimator to the problem of estimating gasoline demand functions. All proofs are collected in the appendix.

2 Boundedness of the Measure of Ill-posedness under Monotonicity

In this section, we discuss the sense in which the ill-posedness of the NPIV model (1) is weakened by imposing our monotonicity conditions. In particular, we introduce a restricted measure of ill-posedness for this model (see equation (9)) and show that, in stark contrast to the existing literature, our measure is bounded (Corollary 1) when the monotone IV condition holds.

The NPIV model requires solving the equation for the function . Letting be the linear operator defined by and denoting , we can express this equation as

| (3) |

In finite-dimensional regressions, the operator corresponds to a finite-dimensional matrix whose singular values are typically assumed to be nonzero (rank condition). Therefore, the solution is continuous in , and consistent estimation of at a fast convergence rate leads to consistent estimation of at the same fast convergence rate. In infinite-dimensional models, however, is an operator that, under weak conditions, possesses infinitely many singular values that tend to zero. Therefore, small perturbations in may lead to large perturbations in . This discontinuity renders equation (3) ill-posed and introduces challenges in estimation of the NPIV model (1) that are not present in parametric regressions nor in nonparametric regressions with exogenous regressors; see Horowitz (2011, 2014) for a more detailed discussion.

In this section, we show that, under our monotonicity conditions, there exists a finite constant such that for any monotone function and any constant function , with and , we have

where is a truncated -norm defined below. This result plays a central role in our derivation of the upper bound on the restricted measure of ill-posedness, of identification bounds, and of fast convergence rates of a constrained NPIV estimator that imposes monotonicity of in a large but slowly shrinking neighborhood of constant functions.

We now introduce our assumptions. Let and be some constants. We implicitly assume that , , and are close to whereas , , and are close to . Our first assumption is the monotone IV condition that requires a monotone relationship between the endogenous regressor and the instrument .

Assumption 1 (Monotone IV).

For all ,

| (4) |

Furthermore, there exists a constant such that

| (5) |

and

| (6) |

Assumption 1 is crucial for our analysis. The first part, condition (4), requires first-order stochastic dominance of the conditional distribution of the endogenous regressor given the instrument as we increase the value of the instrument . This condition (4) is testable; see, for example, Lee, Linton, and Whang (2009). In Section 5 below, we extend the results of Lee, Linton, and Whang (2009) by providing an adaptive test of the first-order stochastic dominance condition (4).

The second and third parts of Assumption 1, conditions (5) and (6), strengthen the stochastic dominance condition (4) in the sense that the conditional distribution is required to “shift to the right” by a strictly positive amount at least between two values of the instrument, and , so that the instrument is not redundant. Conditions (5) and (6) are rather weak as they require such a shift only in some intervals and , respectively.

Condition (4) can be equivalently stated in terms of monotonicity with respect to the instrument of the reduced form first stage function. Indeed, by the Skorohod representation, it is always possible to construct a random variable distributed uniformly on such that is independent of , and equation holds for the reduced form first stage function . Therefore, condition (4) is equivalent to the assumption that the function is increasing for all . Notice, however, that our condition (4) allows for general unobserved heterogeneity of dimension larger than one, for instance as in Example 2 below.

Condition (4) is related to a corresponding condition in Kasy (2014) who assumes that the (structural) first stage has the form where , representing (potentially multidimensional) unobserved heterogeneity, is independent of , and the function is increasing for all values . Kasy employs his condition for identification of (nonseparable) triangular systems with multidimensional unobserved heterogeneity whereas we use our condition (4) to derive a useful bound on the restricted measure of ill-posedness and to obtain a fast rate of convergence of a monotone NPIV estimator of in the (separable) model (1). Condition (4) is not related to the monotone IV assumption in the influential work by Manski and Pepper (2000) which requires the function to be increasing. Instead, we maintain the mean independence condition .

Assumption 2 (Density).

(i) The joint distribution of the pair is absolutely continuous with respect to the Lebesgue measure on with the density satisfying for some finite constant . (ii) There exists a constant such that for all and . (iii) There exists constants such that for all .

This is a mild regularity assumption. The first part of the assumption implies that the operator is compact. The second and the third parts of the assumption require the conditional distribution of given or and the marginal distribution of to be bounded away from zero over some intervals. Recall that we have and . We could simply set in the second part of the assumption but having and is required to allow for densities such as the normal, which, even after a transformation to the interval , may not yield a conditional density bounded away from zero; see Example 1 below. Therefore, we allow for the general case and . The restriction for all imposed in Assumption 2 is not actually required for the results in this section, but rather those of Section 3.

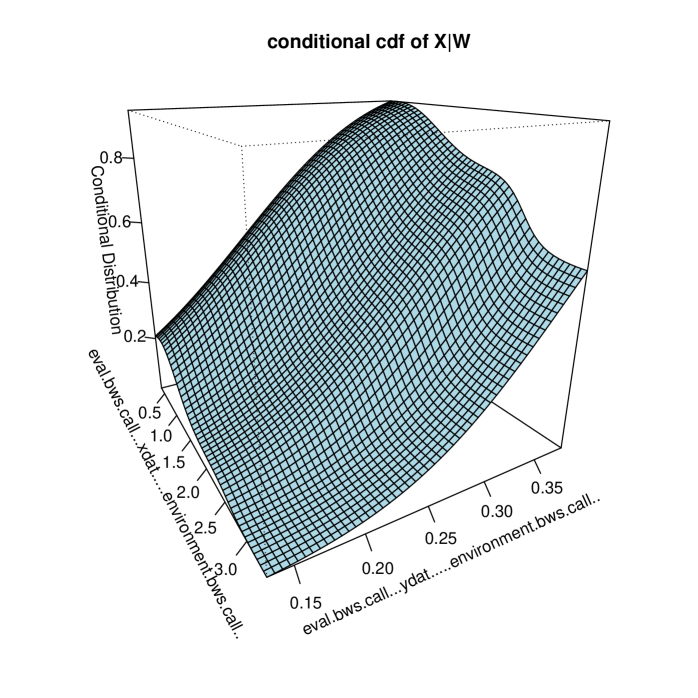

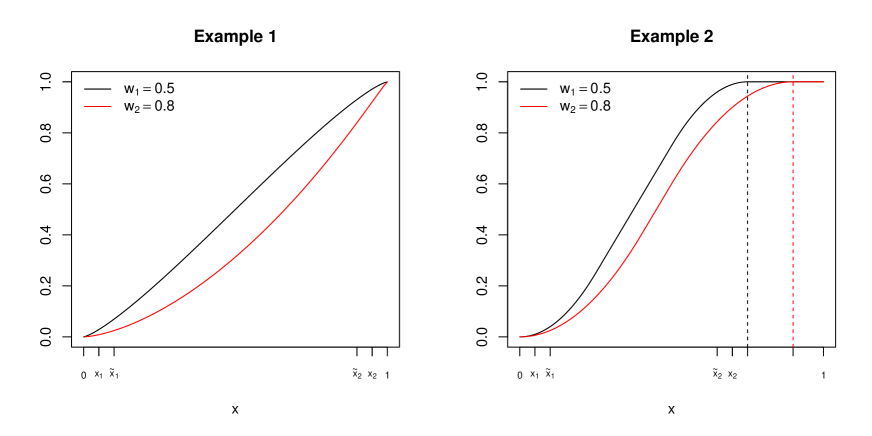

We now provide two examples of distributions of that satisfy Assumptions 1 and 2, and show two possible ways in which the instrument can shift the conditional distribution of given . Figure 1 displays the corresponding conditional distributions.

Example 1 (Normal density).

Let be jointly normal with mean zero, variance one, and correlation . Let denote the distribution function of a random variable. Define and . Since for some standard normal random variable that is independent of , we have

where is independent of . Therefore, the pair satisfies condition (4) of our monotone IV Assumption 1. Lemma 7 in the appendix verifies that the remaining conditions of Assumption 1 as well as Assumption 2 are also satisfied.

Example 2 (Two-dimensional unobserved heterogeneity).

Figure 1 shows that, in Example 1, the conditional distribution at two different values of the instrument is shifted to the right at every value of , whereas, in Example 2, the conditional support of given changes with , but the positive shift in the cdf of occurs only for values of in a subinterval of .

Before stating our results in this section, we introduce some additional notation. Define the truncated -norm by

Also, let denote the set of all monotone functions in . Finally, define . Below is our first main result in this section.

Theorem 1 (Lower Bound on ).

To prove this theorem, we take a function with and show that is bounded away from zero. A key observation that allows us to establish this bound is that, under monotone IV Assumption 1, the function is monotone whenever is. Together with non-redundancy of the instrument implied by conditions (5) and (6) of Assumption 1, this allows us to show that and cannot both be close to zero so that is bounded from below by a strictly positive constant from the values of in the neighborhood of either or . By Assumption 2, must then also be bounded away from zero.

Theorem 1 has an important consequence. Indeed, consider the linear equation (3). By Assumption 2(i), the operator is compact, and so

| (8) |

Property (8) means that being small does not necessarily imply that is small and, therefore, the inverse of the operator , when it exists, cannot be continuous. Therefore, (3) is ill-posed in Hadamard’s sense444Well- and ill-posedness in Hadamard’s sense are defined as follows. Let be a continuous mapping between metric spaces and . Then, for and , the equation is called “well-posed” on in Hadamard’s sense (see Hadamard (1923)) if (i) is bijective and (ii) is continuous, so that for each there exists a unique satisfying , and, moreover, the solution is continous in “the data” . Otherwise, the equation is called “ill-posed” in Hadamard’s sense., if no other conditions are imposed. This is the main reason why standard NPIV estimators have (potentially very) slow rate of convergence. Theorem 1, on the other hand, implies that, under Assumptions 1 and 2, (8) is not possible if belongs to the set of monotone functions in for all and we replace the -norm in the numerator of the left-hand side of (8) by the truncated -norm , indicating that shape restrictions may be helpful to improve statistical properties of the NPIV estimators. Also, in Remark 1, we show that replacing the norm in the numerator is not a significant modification in the sense that for most ill-posed problems, and in particular for all severely ill-posed problems, (8) holds even if we replace -norm in the numerator of the left-hand side of (8) by the truncated -norm .

Next, we derive an implication of Theorem 1 for the (quantitative) measure of ill-posedness of the model (1). We first define the restricted measure of ill-posedness. For , let

be the space containing all functions in with lower derivative bounded from below by uniformly over the interval . Note that whenever and that is the set of increasing functions in . For continuously differentiable functions, belongs to if and only if . Further, define the restricted measure of ill-posedness:

| (9) |

As we discussed above, under our Assumptions 1 and 2, if we use the -norm instead of the truncated -norm in the numerator in (9). We show in Remark 1 below, that for many ill-posed and, in particular, for all severely ill-posed problems even with the truncated -norm as defined in (9). However, Theorem 1 implies that is bounded from above by and, by definition, is increasing in , i.e. for . It turns out that is bounded from above even for some positive values of :

Corollary 1 (Bound for the Restricted Measure of Ill-Posedness).

This is our second main result in this section. It is exactly this corollary of Theorem 1 that allows us to obtain a fast convergence rate of our constrained NPIV estimator not only when the regression function is constant but, more generally, when belongs to a large but slowly shrinking neighborhood of constant functions.

Remark 1 (Ill-posedness is preserved by norm truncation).

Under Assumptions 1 and 2, the integral operator satisfies (8). Here we demonstrate that, in many cases, and in particular in all severely ill-posed cases, (8) continues to hold if we replace the -norm by the truncated -norm in the numerator of the left-hand side of (8), that is, there exists a sequence in such that

| (11) |

Indeed, under Assumptions 1 and 2, is compact, and so the spectral theorem implies that there exists a spectral decomposition of operator , , where is an orthonormal basis of and is a decreasing sequence of positive numbers such that as , and . Also, Lemma 6 in the appendix shows that if is an orthonormal basis in , then for any , for infinitely many , and so there exists a subsequence such that . Therefore, under a weak condition that as , using for all , we conclude that for the subsequence ,

leading to (11). Note also that the condition that as necessarily holds if there exists a constant such that for all large , that is, if the problem is severely ill-posed. Thus, under our Assumptions 1 and 2, the restriction in Theorem 1 that belongs to the space of monotone functions in plays a crucial role for the result (7) to hold. On the other hand, whether the result (7) can be obtained for all without imposing our monotone IV Assumption 1 appears to be an open (and interesting) question.

Remark 2 (Severe ill-posedness is preserved by norm truncation).

One might wonder whether our monotone IV Assumption 1 excludes all severely ill-posed problems, and whether the norm truncation significantly changes these problems. Here we show that there do exist severely ill-posed problems that satisfy our monotone IV Assumption 1, and also that severely ill-posed problems remain severely ill-posed even if we replace the -norm by the truncated -norm . Indeed, consider Example 1 above. Because, in this example, the pair is a transformation of the normal distribution, it is well known that the integral operator in this example has singular values decreasing exponentially fast. More specifically, the spectral decomposition of the operator satisfies for all and some . Hence,

Since as exponentially fast, this example leads to a severely ill-posed problem. Moreover, by Lemma 6, for any and ,

for infinitely many . Thus, replacing the norm by the truncated norm preserves the severe ill-posedness of the problem. However, it follows from Theorem 1 that uniformly over all , Therefore, in this example, as well as in all other severely ill-posed problems satisfying Assumptions 1 and 2, imposing monotonicity on the function significantly changes the properties of the ratio .

Remark 3 (Monotone IV Assumption does not imply control function approach).

Our monotone IV Assumption 1 does not imply the applicability of a control function approach to estimation of the function . Consider Example 2 above. In this example, the relationship between and has a two-dimensional vector of unobserved heterogeneity. Therefore, by Proposition 4 of Kasy (2011), there does not exist any control function such that (i) is invertible in its second argument, and (ii) is independent of conditional on . As a consequence, our monotone IV Assumption 1 does not imply any of the existing control function conditions such as those in Newey, Powell, and Vella (1999) and Imbens and Newey (2009), for example.555It is easy to show that the existence of a control function does not imply our monotone IV condition either, so our and the control function approach rely on conditions that are non-nested. Since multidimensional unobserved heterogeneity is common in economic applications (see Imbens (2007) and Kasy (2014)), we view our approach to avoiding ill-posedness as complementary to the control function approach.

Remark 4 (On the role of norm truncation).

Let us also briefly comment on the role of the truncated norm in (7). There are two reasons why we need the truncated -norm rather than the usual -norm . First, Lemma 2 in the appendix shows that, under Assumptions 1 and 2, there exists a constant such that

for any increasing and continuously differentiable function . This result does not require any truncation of the norms and implies boundedness of a measure of illposedness defined in terms of -norms: . To extend this result to -norms we need to introduce a positive, but arbitrarily small, amount of truncation at the boundaries, so that we have a control for some constant and all monotone functions . Second, we want to allow for the normal density as in Example 1, which violates condition (ii) of Assumption 2 if we set .

Remark 5 (Bounds on the measure of ill-posedness via compactness).

Another approach to obtain a result like (7) would be to employ compactness arguments. For example, let be some (potentially large) constant and consider the class of functions consisting of all functions in such that . It is well known that the set is compact under the -norm , and so, as long as is invertible, there exists some such that for all since (i) is continuous and (ii) any continuous function achieves its minimum on a compact set. This bound does not require the monotone IV assumption and also does not require replacing the -norm by the truncated -norm. Further, defining for all and using the same arguments as those in the proof of Corollary 1, one can show that there exist some finite constants such that for all . This (seemingly interesting) result, however, is not useful for bounding the estimation error of an estimator of because, as the proof of Theorem 2 in the next section reveals, obtaining meaningful bounds would require a result of the form for all for some sequence such that , even if we know that and we impose this constraint on the estimator of . In contrast, our arguments in Theorem 1, being fundamentally different, do lead to meaningful bounds on the estimation error of the constrained estimator of .

3 Non-asymptotic Risk Bounds Under Monotonicity

The rate at which unconstrained NPIV estimators converge to depends crucially on the so-called sieve measure of ill-posedness, which, unlike , does not measure ill-posedness over the space , but rather over the space , a finite-dimensional (sieve) approximation to . In particular, the convergence rate is slower the faster the sieve measure of ill-posedness grows with the dimensionality of the sieve space . The convergence rates can be as slow as logarithmic in the severely ill-posed case. Since by Corollary 1, our monotonicity assumptions imply boundedness of for some range of finite values , we expect these assumptions to translate into favorable performance of a constrained estimator that imposes monotonicity of . This intuition is confirmed by the novel non-asymptotic error bounds we derive in this section (Theorem 2).

Let , , be an i.i.d. sample from the distribution of . To define our estimator, we first introduce some notation. Let and be two orthonormal bases in . For and , denote

Let and . Similarly, stack all observations on in . Let be a sequence of finite-dimensional spaces defined by

which become dense in as . Throughout the paper, we assume that where is a large but finite constant known by the researcher. We define two estimators of : the unconstrained estimator with

| (12) |

which is similar to the estimator defined in Horowitz (2012) and a special case of the estimator considered in Blundell, Chen, and Kristensen (2007), and the constrained estimator with

| (13) |

which imposes the monotonicity of through the constraint .

To study properties of the two estimators we introduce a finite-dimensional, or sieve, counterpart of the restricted measure of ill-posedness defined in (9) and also recall the definition of the (unrestricted) sieve measure of ill-posedness. Specifically, define the restricted and unrestricted sieve measures of ill-posedness and as

The sieve measure of ill-posedness defined in Blundell, Chen, and Kristensen (2007) and also used, for example, in Horowitz (2012) is . Blundell, Chen, and Kristensen (2007) show that is related to the singular values of .666In fact, Blundell, Chen, and Kristensen (2007) talk about the eigenvalues of , where is the adjoint of but there is a one-to-one relationship between eigenvalues of and singular values of . If the singular values converge to zero at the rate as , then, under certain conditions, diverges at a polynomial rate, that is . This case is typically referred to as “mildly ill-posed”. On the other hand, when the singular values decrease at a fast exponential rate, then , for some constant . This case is typically referred to as “severely ill-posed”.

Our restricted sieve measure of ill-posedness is smaller than the unrestricted sieve measure of ill-posedness because we replace the -norm in the numerator by the truncated -norm and the space by . As explained in Remark 1, replacing the -norm by the truncated -norm does not make a crucial difference but, as follows from Corollary 1, replacing by does. In particular, since for all by Corollary 1, we also have for all because . Thus, for all values of that are not too large, remains bounded uniformly over all , no matter how fast the singular values of converge to zero.

We now specify conditions that we need to derive non-asymptotic error bounds for the constrained estimator .

Assumption 3 (Monotone regression function).

The function is monotone increasing.

Assumption 4 (Moments).

For some constant , (i) and (ii) .

Assumption 5 (Relation between and ).

For some constant , .

Assumption 3, along with Assumption 1, is our main monotonicity condition. Assumption 4 is a mild moment condition. Assumption 5 requires that the dimension of the vector is not much larger than the dimension of the vector . Let be some constant.

Assumption 6 (Approximation of ).

There exist and a constant such that the function , defined for all , satisfies (i) , (ii) , and (iii) .

The first part of this condition requires the approximating function to be increasing. The second part requires a particular bound on the approximation error in the -norm. De Vore (1977a, b) show that the assumption holds when the approximating basis consists of polynomial or spline functions and belongs to a Hölder class with smoothness level . Therefore, approximation by monotone functions is similar to approximation by all functions. The third part of this condition is similar to Assumption 6 in Blundell, Chen, and Kristensen (2007).

Assumption 7 (Approximation of ).

There exist and a constant such that the function , defined for all , satisfies .

This condition is similar to Assumption 3(iii) in Horowitz (2012). Also, define the operator by

where .

Assumption 8 (Operator ).

(i) The operator is injective and (ii) for some constant , for all .

This condition is similar to Assumption 5 in Horowitz (2012). Finally, let

We start our analysis in this section with a simple observation that, if the function is strictly increasing and the sample size is sufficiently large, then the constrained estimator coincides with the unconstrained estimator , and the two estimators share the same rate of convergence.

Lemma 1 (Asymptotic equivalence of constrained and unconstrained estimators).

The result in Lemma 1 is similar to that in Theorem 1 of Mammen (1991), which shows equivalence (in the sense of (14)) of the constrained and unconstrained estimators of conditional mean functions. Lemma 1 implies that imposing monotonicity of cannot lead to improvements in the rate of convergence of the estimator if is strictly increasing. However, the result in Lemma 1 is asymptotic and only applies to the interior of the monotonicity constraint. It does not rule out faster convergence rates on or near the boundary of the monotonicity constraint nor does it rule out significant performance gains in finite samples. In fact, our Monte Carlo simulation study in Section 6 shows significant finite-sample performance improvements from imposing monotonicity even if is strictly increasing and relatively far from the boundary of the constraint. Therefore, we next derive a non-asymptotic estimation error bound for the constrained estimator and study the impact of the monotonicity constraint on this bound.

Theorem 2 (Non-asymptotic error bound for the constrained estimator).

This is the main result of this section. An important feature of this result is that since the constant depends only on the constants appearing in Assumptions 1-8, the bounds (15) and (16) hold uniformly over all data-generating processes that satisfy those assumptions with the same constants. In particular, for any two data-generating processes in this set, the same finite-sample bounds (15) and (16) hold with the same constant , even though the unrestricted sieve measure of ill-posedness may be of different order of magnitude for these two data-generating processes.

Another important feature of the bound (15) is that it depends on the restricted sieve measure of ill-posedness that we know to be smaller than the unrestricted sieve measure of ill-posedness, appearing in the analysis of the unconstrained estimator. In particular, we know from Section 2 that and that, by Corollary 1, is uniformly bounded if is not too large. Employing this result, we obtain the bound (16) of Theorem 2.777Ideally, it would be of great interest to have a tight bound on the restricted sieve measure of ill-posedness for all , so that it would be possible to optimize (15) over . Results of this form, however, are not yet available in the literature, and so the optimization is not possible.

The bound (16) has two regimes depending on whether the following inequality

| (17) |

holds. The most interesting feature of this bound is that in the first regime, when the inequality (17) is satisfied, the bound is independent of the (unrestricted) sieve measure of ill-posedness , and can be small if the function is not too steep, regardless of whether the original NPIV model (1) is mildly or severely ill-posed. This is the regime in which the bound relies upon the monotonicity constraint imposed on the estimator . For a given sample size , this regime is active if the function is not too steep.

As the sample size grows large, the right-hand side of inequality (17) decreases (if grows slowly enough) and eventually becomes smaller than the left-hand side, and the bound (16) switches to its second regime, in which it depends on the (unrestricted) sieve measure of ill-posedness . This is the regime in which the bound does not employ the monotonicity constraint imposed on . However, since , potentially at a very fast rate, even for relatively large sample sizes and/or relatively steep functions , the bound may be in its first regime, where the monotonicity constraint is important. The presence of the first regime and the observation that it is active in a (potentially very) large set of data generated processes provides a theoretical justification for the importance of imposing the monotonicity constraint on the estimators of the function in the NPIV model (1) when the monotone IV Assumption 1 is satisfied.

A corollary of the existence of the first regime in the bound (16) is that the constrained estimator possesses a very fast rate of convergence in a large but slowly shrinking neighborhood of constant functions, independent of the (unrestricted) sieve measure of ill-posedness :

Corollary 2 (Fast convergence rate of the constrained estimator under local-to-constant asymptotics).

Remark 6 (On the condition ).

The condition , for , is satisfied if the sequences and consist of commonly used bases such as Fourier, spline, wavelet, or local polynomial partition series; see Belloni, Chernozhukov, Chetverikov, and Kato (2014) for details.

The local-to-constant asymptotics considered in this corollary captures the finite sample situation in which the regression function is not too steep relative to the sample size. The convergence rate in this corollary is the standard polynomial rate of nonparametric conditional mean regression estimators up to a factor, regardless of whether the original NPIV problem without our monotonicity assumptions is mildly or severely ill-posed. One way to interpret this result is that the constrained estimator is able to recover regression functions in the shrinking neighborhood of constant functions at a fast polynomial rate. Notice that the neighborhood of functions that satisfy is shrinking at a slow rate because , in particular the rate is much slower than . Therefore, in finite samples, we expect the estimator to perform well for a wide range of (non-constant) regression functions as long as the maximum slope of is not too large relative to the sample size.

Remark 7 (The convergence rate of is not slower than that of ).

If we replace the condition in Theorem 2 by a more restrictive condition , then in addition to the bounds (15) and (16), it is possible to show that with probability at least , we have

This implies that the constrained estimator satisfies which is the standard minimax optimal rate of convergence established for the unconstrained estimator in Blundell, Chen, and Kristensen (2007).

In conclusion, in general, the convergence rate of the constrained estimator is the same as the standard minimax optimal rate, which depends on the degree of ill-posedness and may, in the worst-case, be logarithmic. This case occurs in the interior of the monotonicity constraint when is strictly monotone. On the other hand, under the monotone IV assumption, the constrained estimator converges at a very fast rate, independently of the degree of ill-posedness, in a large but slowly shrinking neighborhood of constant functions, a part of the boundary of the monotonicity constraint. In finite samples, we expect to experience cases between the two extremes, and the bounds (15) and (16) provide information on what the performace of the constrained estimator depends in that general case. Since the first regime of bound (16) is active in a large set of data generating processes and sample size combinations, and since the fast convergence rate in Corollary 2 is obtained in a large but slowly shrinking neighborhood of constant functions, we expect the boundary effect due to the monotonicity constraint to be strong even far away from the boundary and for relatively large sample sizes.

Remark 8 (Average Partial Effects).

We expect similar results to Theorem 2 and Corollary 2 to hold in the estimation of linear functionals of , such as average marginal effects. In the unconstrained problem, estimators of linear functionals do not necessarily converge at polynomial rates and may exhibit similarly slow, logarithmic rates as for estimation of the function itself (e.g. Breunig and Johannes (2015)). Therefore, imposing monotonicity as we do in this paper may also improve statistical properties of estimators of such functionals. While we view this as a very important extension of our work, we develop this direction in a separate paper.

Remark 9 (On the role of the monotonicity constraint).

Imposing the monotonicity constraint in the NPIV estimation procedure reduces variance by removing non-monotone oscillations in the estimator that are due to sampling noise. Such oscillations are a common feature of unconstrained estimators in ill-posed inverse problems and lead to large variance of such estimators. The reason for this phemonon can be seen in the convergence rate of unconstrained estimators,888see, for example, Blundell, Chen, and Kristensen (2007) , in which the variance term is blown up by the multiplication by the measure of ill-posedness . Because of this relatively large variance of NPIV estimators we expect the unconstrained estimator to possess non-monotonicities even in large samples and even if is far away from constant functions. Therefore, imposing monotonicity of can have significant impact on the estimator’s performance even in those cases.

Remark 10 (On robustness of the constrained estimator, I).

Implementation of the estimators and requires selecting the number of series terms and . This is a difficult problem because the measure of ill-posedness , appearing in the convergence rate of both estimators, depends on and can blow up quickly as we increase . Therefore, setting higher than the optimal value may result in a severe deterioration of the statistical properties of . The problem is alleviated, however, in the case of the constrained estimator because satisfies the bound (16) of Theorem 2, which is independent of for sufficiently large . In this sense, the constrained estimator possesses some robustness against setting too high.

Remark 11 (On robustness of the constrained estimator, II).

Notice that the fast convergence rates in the local-to-constant asymptotics derived in this section are obtained under two monotonicity conditions, Assumptions 1 and 3, but the estimator imposes only the monotonicity of the regression function, not that of the instrument. Therefore, our proposed constrained estimator consistently estimates the regression function even when the monotone IV assumption is violated.

Remark 12 (On alternative estimation procedures).

In the local-to-constant asymptotic framework where , the rate of convergence in (18) can also be obtained by simply fitting a constant. However, such an estimator, unlike our constrained estimator, is not consistent when the regression function does not drift towards a constant. Alternatively, one can consider a sequential approach to estimating , namely one can first test whether the function is constant, and then either fit the constant or apply the unconstrained estimator depending on the result of the test. However, it seems difficult to tune such a test to match the performance of the constrained estimator studied in this paper.

Remark 13 (Estimating partially flat functions).

Since the inversion of the operator is a global inversion in the sense that the resulting estimators and depend not only on the shape of locally at , but on the shape of over the whole domain, we do not expect convergence rate improvements from imposing monotonicity when the function is partially flat. However, we leave the question about potential improvements from imposing monotonicity in this case for future research.

Remark 14 (Computational aspects).

The implementation of the constrained estimator in (13) is particularly simple when the basis vector consists of polynomials or B-splines of order . In that case, is linear in and, therefore, the constraint for all needs to be imposed only at the knots or endpoints of , respectively. The estimator thus minimizes a quadratic objective function subject to a (finite-dimensional) linear inequality constraint. When the order of the polynomials or B-splines in is larger than , imposing the monotonicity constraint is slightly more complicated, but it can still be transformed into a finite-dimensional constraint using a representation of non-negative polynomials as a sum of squared polynomials:999We thank A. Belloni for pointing out this possibility. one can represent any non-negative polynomial as a sum of squares of polynomials (see the survey by Reznick (2000), for example), i.e. where is the vector of monomials up to some order and a matrix of coefficients. Letting , our monotonicity constraint can then be written as for some matrix that depends on . This condition is equivalent to requiring the matrix to be positive semi-definite. thus minimizes a quadratic objective function subject to a (finite-dimensional) semi-definiteness constraint.

For polynomials defined not over whole but only over a compact sub-interval of , one can use the same reasoning as above together with a result attributed to M. Fekete (see Powers and Reznick (2000), for example): for any polynomial with for , there are polynomials and , non-negative over whole , such that . Letting again , one can therefore impose our monotonicity constraint by imposing the positive semi-definiteness of the coefficients in the sums-of-squares representation of and .

Remark 15 (Penalization and shape constraints).

Recall that the estimators and require setting the constraint in the optimization problems (12) and (13). In practice, this constraint, or similar constraints in terms of Sobolev norms, which also impose bounds on derivatives of , are typically not enforced in the implementation of an NPIV estimator. Horowitz (2012) and Horowitz and Lee (2012), for example, observe that imposing the constraint does not seem to have an effect in their simulations. On the other hand, especially when one includes many series terms in the computation of the estimator, Blundell, Chen, and Kristensen (2007) and Gagliardini and Scaillet (2012), for example, argue that penalizing the norm of and of its derivatives may stabilize the estimator by reducing its variance. In this sense, penalizing the norm of and of its derivatives may have a similar effect as imposing monotonicity. However, there are at least two important differences between penalization and imposing monotonicity. First, penalization increases bias of the estimators. In fact, especially in severely ill-posed problems, even small amount of penalization may lead to large bias. In contrast, the monotonicity constraint on the estimator does not increase bias much when the function itself satisfies the monotonicity constraint. Second, penalization requires the choice of a tuning parameter that governs the strength of penalization, which is a difficult statistical problem. In contrast, imposing monotonicity does not require such choices and can often be motivated directly from economic theory.

4 Identification Bounds under Monotonicity

In the previous section, we derived non-asymptotic error bounds on the constrained estimator in the NPIV model (1) assuming that is point-identified, or equivalently, that the linear operator is invertible. Newey and Powell (2003) linked point-identification of to completeness of the conditional distribution of given , but this completeness condition has been argued to be strong (Santos (2012)) and non-testable (Canay, Santos, and Shaikh (2013)). In this section, we therefore discard the completeness condition and explore the identification power of our monotonicity conditions, which appear natural in many economic applications. Specifically, we derive informative bounds on the identified set of functions satisfying (1). This means that, under our two monotonicity assumptions, the identified set is a proper subset of all monotone functions .

By a slight abuse of notation, we define the sign of the slope of a differentiable, monotone function by

and the sign of a scalar by . We first show that if the function is monotone, the sign of its slope is identified under our monotone IV assumption (and some other technical conditions):

Theorem 3 (Identification of the sign of the slope).

This theorem shows that, under certain regularity conditions, the monotone IV assumption and monotonicity of the regression function imply identification of the sign of the regression function’s slope, even though the regression function itself is, in general, not point-identified. This result is useful because in many empirical applications it is natural to assume a monotone relationship between outcome variable and the endogenous regressor , given by the function , but the main question of interest concerns not the exact shape of itself, but whether the effect of on , given by the slope of , is positive, zero, or negative; see, for example, the discussion in Abrevaya, Hausman, and Khan (2010)).

Remark 16 (A test for the sign of the slope of ).

In fact, Theorem 3 yields a surprisingly simple way to test the sign of the slope of the function . Indeed, the proof of Theorem 3 reveals that is increasing, constant, or decreasing if the function is increasing, constant, or decreasing, respectively. By Chebyshev’s association inequality (Lemma 5 in the appendix), the latter assertions are equivalent to the coefficient in the linear regression model

| (19) |

being positive, zero, or negative since and

by the law of iterated expectations. Therefore, under our conditions, hypotheses about the sign of the slope of the function can be tested by testing the corresponding hypotheses about the sign of the slope coefficient in the linear regression model (19). In particular, under our two monotonicity assumptions, one can test the hypothesis of “no effect” of on , i.e. that is a constant, by testing whether or not using the usual t-statistic. The asymptotic theory for this statistic is exactly the same as in the standard regression case with exogenous regressors, yielding the standard normal limiting distribution and, therefore, completely avoiding the ill-posed inverse problem of recovering .

It turns out that our two monotonicity assumptions possess identifying power even beyond the slope of the regression function.

Definition 1 (Identified set).

We say that two functions are observationally equivalent if . The identified set is defined as the set of all functions that are observationally equivalent to the true function satisfying (1).

The following theorem provides necessary conditions for observational equivalence.

Theorem 4 (Identification bounds).

Under Assumption 3 that is increasing, Theorem 4 suggests the construction of a set that includes the identified set by where denotes all increasing functions in and

| (20) |

We emphasize that is not empty, which means that our Assumptions 1–3 possess identifying power leading to nontrivial bounds on . Notice that the constant depends only on the observable quantities , , and from Assumptions 1–2, and on the known constants , , , , , and . Therefore, the set could, in principle, be estimated, but we leave estimation and inference on this set to future research.

Remark 17 (Further insight on identification bounds).

It is possible to provide more insight into which functions are in and thus not in . First, under the additional minor condition that for all , all functions in have to intersect ; otherwise they are not observationally equivalent to . Second, for a given and such that is monotone, the inequality in condition (20) is satisfied if is not too large relative to . In the extreme case, setting shows that does not contain elements that disagree with on and such that is monotone. More generally, does not contain elements whose difference with is too close to a monotone function. Therefore, for example, functions that are much steeper than are excluded from .

5 Testing the Monotonicity Assumptions

In this section, we propose tests of our two monotonicity assumptions based on an i.i.d. sample , , from the distribution of . First, we discuss an adaptive procedure for testing the stochastic dominance condition (4) in our monotone IV Assumption 1. The null and alternative hypotheses are

respectively. The null hypothesis, , is equivalent to stochastic monotonicity of the conditional distribution function . Although there exist several good tests of in the literature (see Lee, Linton, and Whang (2009), Delgado and Escanciano (2012) and Lee, Song, and Whang (2014), for example), to the best of our knowledge there does not exist any procedure that adapts to the unknown smoothness level of . We provide a test that is adaptive in this sense, a feature that is not only theoretically attractive, but also important in practice: it delivers a data-driven choice of the smoothing parameter (bandwidth value) of the test whereas nonadaptive tests are usually based on the assumption that with some rate in a range of prespecified rates, leaving the problem of the selection of an appropriate value of in a given data set to the researcher (see, for example, Lee, Linton, and Whang (2009) and Lee, Song, and Whang (2014)). We develop the critical value for the test that takes into account the data dependence induced by the data-driven choice of the smoothing parameter. Our construction leads to a test that controls size, and is asymptotically non-conservative.

Our test is based on the ideas in Chetverikov (2012) who in turn builds on the methods for adaptive specification testing in Horowitz and Spokoiny (2001) and on the theoretical results on high dimensional distributional approximations in Chernozhukov, Chetverikov, and Kato (2013c) (CCK). Note that , so that for a fixed , the hypothesis that for all is equivalent to the hypothesis that the regression function is decreasing. An adaptive test of this hypothesis was developed in Chetverikov (2012). In our case, requires the regression function to be decreasing not only for a particular value but for all , and so we need to extend the results obtained in Chetverikov (2012).

Let be a kernel function satisfying the following conditions:

Assumption 9 (Kernel).

The kernel function is such that (i) for all , (ii) for all , (iii) is continuous, and (iv) .

We assume that the kernel function has bounded support, is continuous, and is strictly positive on the support. The last condition excludes higher-order kernels. For a bandwidth value , define

Suppose is satisfied. Then, by the law of iterated expectations,

| (21) |

for all and . Denoting

taking the sum of the left-hand side in (21) over , and rearranging give

or, equivalently,

| (22) |

where

To define the test statistic , let be a collection of bandwidth values satisfying the following conditions:

Assumption 10 (Bandwidth values).

The collection of bandwidth values is for some where is such that for some constants .

The collection of bandwidth values is a geometric progression with the coefficient , the largest value , and the smallest value converging to zero not too fast. As the sample size increases, the collection of bandwidth values expands.

Let , and for some small . We define our test statistic by

| (23) |

The statistic is most closely related to that in Lee, Linton, and Whang (2009). The main difference is that we take the maximum with respect to the set of bandwidth values to achieve adaptiveness of the test.

We now discuss the construction of a critical value for the test. Suppose that we would like to have a test of level (approximately) . As succinctly demonstrated by Lee, Linton, and Whang (2009), the derivation of the asymptotic distribution of is complicated even when is a singleton. Moreover, when is not a singleton, it is generally unknown whether converges to some nondegenerate asymptotic distribution after an appropriate normalization. We avoid these complications by employing the non-asymptotic approach developed in CCK and using a multiplier bootstrap critical value for the test. Let be an i.i.d. sequence of random variables that are independent of the data. Also, let be an estimator of satisfying the following conditions:

Assumption 11 (Estimator of ).

The estimator of is such that (i)

for some constants , and (ii) for all .

This is a mild assumption implying uniform consistency of an estimator of over . Define a bootstrap test statistic by

Then we define the critical value101010In the terminology of the moment inequalities literature, can be considered a “one-step” or “plug-in” critical value. Following Chetverikov (2012), we could also consider two-step or even multi-step (stepdown) critical values. For brevity of the paper, however, we do not consider these options here. for the test as

We reject if and only if . To prove validity of this test, we assume that the conditional distribution function satisfies the following condition:

Assumption 12 (Conditional Distribution Function ).

The conditional distribution function is such that for all and some constants .

The first theorem in this section shows that our test controls size asymptotically and is not conservative:

Theorem 5 (Polynomial Size Control).

Remark 18 (Weak Condition on the Bandwidth Values).

Our theorem requires

| (26) |

for all , which is considerably weaker than the analogous condition in Lee, Linton, and Whang (2009) who require , up-to logs. This is achieved by using a conditional test and by applying the results of CCK. As follows from the proof of the theorem, the multiplier bootstrap distribution approximates the conditional distribution of the test statistic given . Conditional on , the denominator in the definition of is fixed, and does not require any approximation. Instead, we could try to approximate the denominator of by its probability limit. This is done in Ghosal, Sen, and Vaart (2000) using the theory of Hoeffding projections but they require the condition . Our weak condition (26) also crucially relies on the fact that we use the results of CCK. Indeed, it has already been demonstrated (see Chernozhukov, Chetverikov, and Kato (2013a, b), and Belloni, Chernozhukov, Chetverikov, and Kato (2014)) that, in typical nonparametric problems, the techniques of CCK often lead to weak conditions on the bandwidth value or the number of series terms. Our theorem is another instance of this fact.

Remark 19 (Polynomial Size Control).

Note that, by (24) and (25), the probability of rejecting when is satisfied can exceed the nominal level only by a term that is polynomially small in . We refer to this phenomenon as a polynomial size control. As explained in Lee, Linton, and Whang (2009), when is a singleton, convergence of to the limit distribution is logarithmically slow. Therefore, Lee, Linton, and Whang (2009) used higher-order corrections derived in Piterbarg (1996) to obtain polynomial size control. Here we show that the multiplier bootstrap also gives higher-order corrections and leads to polynomial size control. This feature of our theorem is also inherited from the results of CCK.

Remark 20 (Uniformity).

The constants and in (24) and (25) depend on the data generating process only via constants (and the kernel) appearing in Assumptions 2, 9, 10, 11, and 12. Therefore, inequalities (24) and (25) hold uniformly over all data generating processes satisfying these assumptions with the same constants. We obtain uniformity directly from employing the distributional approximation theorems of CCK because they are non-asymptotic and do not rely on convergence arguments.

Our second result in this section concerns the ability of our test to detect models in the alternative . Let be the constant appearing in the definition of via the set .

Theorem 6 (Consistency).

This theorem shows that our test is consistent against any model in (with smooth ) whose deviation from is not on the boundary, so that the deviation occurs for . It is also possible to extend our results to show that Theorems 5 and 6 hold with at the expense of additional technicalities. Further, using the same arguments as those in Chetverikov (2012), it is possible to show that the test suggested here has minimax optimal rate of consistency against the alternatives belonging to certain Hölder classes for a reasonably large range of smoothness levels. We do not derive these results here for the sake of brevity of presentation.

We conclude this section by proposing a simple test of our second monotonicity assumption, that is, monotonicity of the regression function . The null and alternative hypotheses are

respectively. The discussion in Remark 16 reveals that, under Assumptions 1 and 2, monotonicity of implies monotonicity of . Therefore, under Assumptions 1 and 2, we can test by testing monotonicity of the conditional expectation using existing tests such as Chetverikov (2012) and Lee, Song, and Whang (2014), among others. This procedure tests an implication of instead of itself and therefore may have low power against some alternatives. On the other hand, it does not require solving the model for and therefore avoids the ill-posedness of the problem.

6 Simulations

In this section, we study the finite-sample behavior of our constrained estimator that imposes monotonicity and compare its performance to that of the unconstrained estimator. We consider the NPIV model , , for two different regression functions, one that is strictly increasing and a weakly increasing one that is constant over part of its domain:

- Model 1:

-

- Model 2:

-

where and . The regressor and instrument are generated by and , respectively, where is the standard normal cdf and . The errors are generated by .

We vary the parameter in to study how the constrained and unconstrained estimators’ performance compares depending on the maximum slope of the regression function. governs the dependence of on the regression error and the strength of the first stage. All results are based on MC samples and the normalized B-spline basis for and of degree and , respectively.

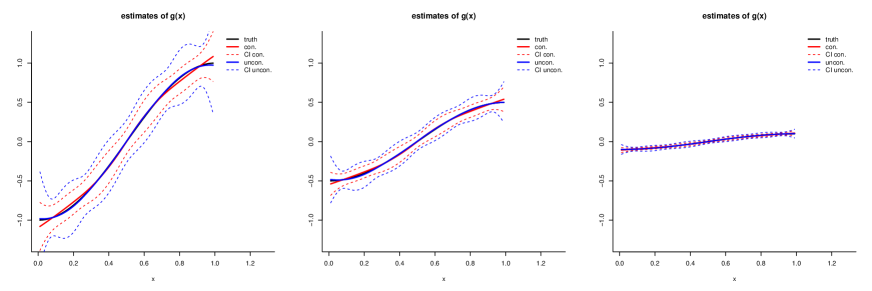

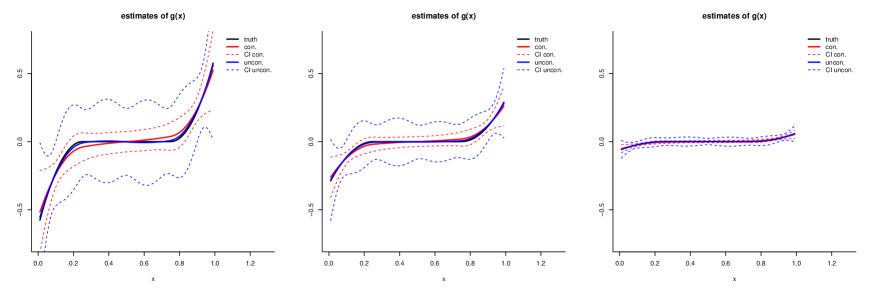

Tables 1–4 report the Monte Carlo approximations to the squared bias, variance, and mean squared error (“MSE”) of the two estimators, each averaged over a grid on the interval . We also show the ratio of the constrained estimator’s MSE divided by the unconstrained estimator’s MSE. and denote, respectively, the number of knots used for the basis and . The first two tables vary the number of knots, and the latter two the dependence parameters and . Different sample sizes and different values for , , and yield qualitatively similar results. Figures 2 and 3 show the two estimators for a particular combination of the simulation parameters. The dashed lines represent confidence bands, computed as two times the (pointwise) empirical standard deviation of the estimators across simulation samples. Both, the constrained and the unconstrained, estimators are computed by ignoring the bound in their respective definitions. Horowitz and Lee (2012) and Horowitz (2012) also ignore the constraint and state that it does not affect the qualitative results of their simulation experiment.

The MSE of the constrained estimator (and, interestingly, also of the unconstrained estimator) decreases as the regression function becomes flatter. This observation is consistent with the error bound in Theorem 2 depending positively on the maximum slope of .

Because of the joint normality of , the simulation design is severely ill-posed and we expect high variability of both estimators. In all simulation scenarios, we do in fact observe a very large variance relative to bias. However, the magnitude of the variance differs significantly across the two estimators: in all scenarios, even in the design with a strictly increasing regression function, imposing the monotonicity constraint significantly reduces the variance of the NPIV estimator. The MSE of the constrained estimator is therefore much smaller than that of the unconstrained estimator, from about a factor of two smaller when is strictly increasing and the noise level is low (), to around 20 times smaller when contains a flat part and the noise level is high (). Generally, the gains in MSE from imposing monotonicity are larger the higher the noise level in the regression equation and the higher the first-stage correlation .111111Since Tables 1 and 2 report results for the lower level of , and Tables 3 and 4 results for the lower noise level , we consider the selection of results as, if at all, favoring the unconstrained estimator.

7 Gasoline Demand in the United States

In this section, we revisit the problem of estimating demand functions for gasoline in the United States. Because of the dramatic changes in the oil price over the last few decades, understanding the elasticity of gasoline demand is fundamental to evaluating tax policies. Consider the following partially linear specification of the demand function:

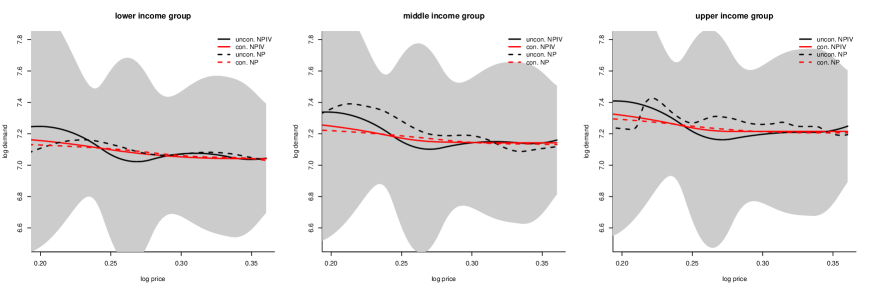

where denotes annual log-gasoline consumption of a household, log-price of gasoline (average local price), log-household income, are control variables (such as population density, urbanization, and demographics), and distance to major oil platform. We allow for price to be endogenous, but assume that is exogenous. serves as an instrument for price by capturing transport cost and, therefore, shifting the cost of gasoline production. We use the same sample of size from the 2001 National Household Travel Survey and the same control variables as Blundell, Horowitz, and Parey (2012). More details can be found in their paper.

Moving away from constant price and income elasticities is likely very important as individuals’ responses to price changes vary greatly with price and income level. Since economic theory does not provide guidance on the functional form of , finding an appropriate parametrization is difficult. Hausman and Newey (1995) and Blundell, Horowitz, and Parey (2012), for example, demonstrate the importance of employing flexible estimators of that do not suffer from misspecification bias due to arbitrary restrictions in the model. Blundell, Horowitz, and Parey (2013) argue that prices at the local market level vary for several reasons and that they may reflect preferences of the consumers in the local market. Therefore, one would expect prices to depend on unobserved factors in that determine consumption, rendering price an endogenous variable. Furthermore, the theory of the consumer requires downward-sloping compensated demand curves. Assuming a positive income derivative121212Blundell, Horowitz, and Parey (2012) estimate this income derivative and do, in fact, find it to be positive over the price range of interest. , the Slutsky condition implies that the uncompensated (Marshallian) demand curves are also downward-sloping, i.e. should be monotone for any , as long as income effects do not completely offset price effects. Finally, we expect the cost shifter to monotonically increase cost of producing gasoline and thus satisfy our monotone IV condition. In conclusion, our constrained NPIV estimator appears to be an attractive estimator of demand functions in this setting.

We consider three benchmark estimators. First, we compute the unconstrained nonparametric (“uncon. NP”) series estimator of the regression of on and , treating price as exogenous. As in Blundell, Horowitz, and Parey (2012), we accommodate the high-dimensional vector of additional, exogenous covariates by (i) estimating by Robinson (1988)’s procedure, (ii) then removing these covariates from the outcome, and (iii) estimating by regressing the adjusted outcomes on and . The second benchmark estimator (“con. NP”) repeats the same steps (i)–(iii) except that it imposes monotonicity (in price) of in steps (i) and (iii). The third benchmark estimator is the unconstrained NPIV estimator (“uncon. NPIV”) that accounts for the covariates in similar fashion as the first, unconstrained nonparametric estimator, except that (i) and (iii) employ NPIV estimators that impose additive separability and linearity in .

The fourth estimator we consider is the constrained NPIV estimator (“con. NPIV”) that we compare to the three benchmark estimators. We allow for the presence of the covariates in the same fashion as the unconstrained NPIV estimator except that, in steps (i) and (iii), we impose monotonicity in price.

We report results for the following choice of bases. All estimators employ a quadratic B-spline basis with knots for price and a cubic B-spline with knots for the instrument . Denote these two bases by and , using the same notation as in Section 3. In step (i), the NPIV estimators include the additional exogenous covariates in the respective bases for and , so they use the estimator defined in Section 3 except that the bases and are replaced by and , respectively, where , , stacks the observations and denotes the tensor product of the columns of the two matrices. Since, in the basis , we include interactions of with , but not with , the resulting estimator allows for a nonlinear, nonseparable dependence of on and , but imposes additive separability in . The conditional expectation of given , , and does not have to be additively separable in , so that, in the basis , we include interactions of with both and .131313Notice that and include constant terms so it is not necessary to separately include in addition to its interactions with and , respectively.

We estimated the demand functions for many different combinations of the order of B-spline for , the number of knots in both bases, and even with various penalization terms (as discussed in Remark 15). While the shape of the unconstrained NPIV estimate varied slightly across these different choices of tuning parameters (mostly near the boundary of the support of ), the constrained NPIV estimator did not exhibit any visible changes at all.

Figure 4 shows a nonparametric kernel estimate of the conditional distribution of the price given the instrument . Overall the graph indicates an increasing relationship between the two variables as required by our stochastic dominance condition (4). We formally test this monotone IV assumption by applying our new test proposed in Section 5. We find a test statistic value of and -critical value of .141414The critical value is computed from bootstrap samples, using the bandwidth set , and a kernel estimator for with bandwidth which produces the estimate in Figure 4. Therefore, we fail to reject the monotone IV assumption.

Figure 5 shows the estimates of the demand function at three income levels, at the lower quartile (), the median (), and the upper quartile (). The area shaded in grey represents the 90% uniform confidence bands around the unconstrained NPIV estimator as proposed in Horowitz and Lee (2012).151515Critical values are computed from bootstrap samples and the bands are computed on a grid of equally-spaced points in the support of the data for . The black lines correspond to the estimators assuming exogeneity of price and the red lines to the NPIV estimators that allow for endogeneity of price. The dashed black line shows the kernel estimate of Blundell, Horowitz, and Parey (2012) and the solid black line the corresponding series estimator that imposes monotonicity. The dashed and solid red lines similarly depict the unconstrained and constrained NPIV estimators, respectively.

All estimates show an overall decreasing pattern of the demand curves, but the two unconstrained estimators are both increasing over some parts of the price domain. We view these implausible increasing parts as finite-sample phenomena that arise because the unconstrained nonparametric estimators are too imprecise. The wide confidence bands of the unconstrained NPIV estimator are consistent with this view. Hausman and Newey (1995) and Horowitz and Lee (2012) find similar anomalies in their nonparametric estimates, assuming exogenous prices. Unlike the unconstrained estimates, our constrained NPIV estimates are downward-sloping everywhere and smoother. They lie within the uniform confidence bands of the unconstrained estimator so that the monotonicity constraint appears compatible with the data.