High-Dimensional Asymptotics of Prediction:

Ridge Regression and Classification

Abstract

We provide a unified analysis of the predictive risk of ridge regression and regularized discriminant analysis in a dense random effects model. We work in a high-dimensional asymptotic regime where and , and allow for arbitrary covariance among the features. For both methods, we provide an explicit and efficiently computable expression for the limiting predictive risk, which depends only on the spectrum of the feature-covariance matrix, the signal strength, and the aspect ratio . Especially in the case of regularized discriminant analysis, we find that predictive accuracy has a nuanced dependence on the eigenvalue distribution of the covariance matrix, suggesting that analyses based on the operator norm of the covariance matrix may not be sharp. Our results also uncover several qualitative insights about both methods: for example, with ridge regression, there is an exact inverse relation between the limiting predictive risk and the limiting estimation risk given a fixed signal strength. Our analysis builds on recent advances in random matrix theory.

1 Introduction

Suppose a statistician observes training examples drawn independently from an unknown distribution , and wants to find a rule for predicting on future unlabeled draws from . In other words, the statistician seeks a function , for which is small, where is a loss function; in regression and is the squared error loss, while in classification and is the 0–1 loss. Such prediction problems lie at the heart over several scientific and industrial endeavors in fields ranging from genetics (Wray et al., 2007) and computer vision (Russakovsky et al., 2014) to Medicare resource allocation (Kleinberg et al., 2015).

There are various enabling hypotheses that allow for successful prediction in high dimensions. These encode domain-specific knowledge and guide model fitting. Popular options include the “sparsity hypothesis”, i.e., that there is a good predictive rule depending only on for some sparse weight vector (Candès and Tao, 2007; Hastie et al., 2015), the “manifold hypothesis” positing that the have useful low-dimensional geometric structure (Rifai et al., 2011; Simard et al., 2000), and several variants of an “independence hypothesis” that rely on independence assumptions for the feature distribution (Bickel and Levina, 2004; Ng and Jordan, 2001). The choice of enabling hypothesis is important from a practical perspective, as it helps choose which predictive method to use, e.g., the lasso with sparsity, neighborhood-based methods under the manifold hypothesis, or naive Bayes given independent features.

There are several applications, however, where the above enabling hypotheses are not known to apply, and where practitioners have achieved accurate high-dimensional prediction using dense—i.e., non-sparse—ridge-regularized linear methods trained on highly correlated features. One striking example is the case of document classification with dictionary-based features of the form “how many times does the -th word in the dictionary appear in the current document.” Even though , dense ridge-regularized methods reliably work well across a wide range of problem settings (Sutton and McCallum, 2006; Toutanova et al., 2003), and sometimes even achieve state-of-the-art performance on important engineering tasks (Wang and Manning, 2012). As another example, in a recent bioinformatics test of prediction algorithms (Bernau et al., 2014), ridge regression—and a method that was previously proposed by those same authors—performed best, better than lasso regression and boosting.

The goal of this paper is to gain better understanding of when dense, ridge-regularized linear prediction methods can be expected to work well. We focus on a random-effects hypothesis: we assume that the effect size of each feature is drawn independently at random. This can be viewed as an average-case analysis over dense parameters. Our hypothesis is of course very strong; however, it yields a qualitatively different theory for high-dimensional prediction than popular approaches, and thus may motivate future conceptual developments.

Hypothesis (random effects).

Each predictor has a small, independent random effect on the outcome.

This hypothesis is fruitful both conceptually and methodologically. Using random matrix theoretic techniques (see, e.g., Bai and Silverstein, 2010), we derive closed-form expressions for the limiting predictive risk of idge-regularized regression and discriminant analysis, allowing for the features to have a general covariance structure . The resulting formulas are pleasingly simple and depend on through the Stieltjes transform of the limiting empirical spectral distribution. More prosaically, only enters into our formulas through the almost-sure limits of and , where is the sample covariance and the ridge-regularization parameter. Notably, the same mathematical tools can describe the two problems.

From a practical perspective, we identify several high-dimensional regimes where mildly regularized discriminant analysis performs strikingly well. Thus, it appears that the random-effects hypothesis can at least qualitatively reproduce the empirical successes of Bernau et al. (2014), Sutton and McCallum (2006), Toutanova et al. (2003), Wang and Manning (2012), and others. We hope that further work motivated by generalizations of the random-effects hypothesis could yield a new theoretical underpinning for dense high-dimensional prediction.

1.1 Overview of Results

We begin with an informal overview of our results; in Section 1.4, we switch to a formal and fully rigorous presentation. In this paper we analyze the predictive risk of ridge-regularized regression and classification when jointly. We work in a high-dimensional asymptotic regime where converges to a limiting aspect ratio . The spectral distribution—i.e., the cumulative distribution function of the eigenvalues—of the feature covariance matrix converges weakly to a limiting spectral measure supported on . This allows to be general, and we will see several examples later. In random matrix theory, this framework goes back to Marchenko and Pastur (1967); see, e.g., Bai and Silverstein (2010). It has been used in statistics and wireless communications by, among others, Couillet and Debbah (2011), Serdobolskii (2007), Tulino and Verdú (2004), and Yao et al. (2015).

In this paper, we present results for ridge regression (Hoerl and Kennard, 1970) and regularized discriminant analysis (RDA) (Friedman, 1989; Serdobolskii, 1983). Our first result derives the asymptotic predictive risk of ridge regression. We observe a sample from the linear model , where each row of is random with and where is independent centered noise with coordinate-wise variance 1. Given a new test example , ridge regression then predicts for ; the tuning parameter governs the strength of the regularization. When the regression coefficient is normally distributed with identity covariance, ridge regression is a Bayes estimator, thus a random effects hypothesis is natural. We consider a more general random-effects hypothesis where , and = . Let be the expected signal strength, and let be the sample covariance matrix of the features. Then, under assumptions detailed in Section 2, we show the following result:

Theorem (informal statement).

The predictive risk of ridge regression, i.e.,

has an almost-sure limit under high-dimensional asymptotics. This limit only depends on the signal strength , the aspect ratio , the regularization parameter , and the Stieltjes transform of the limiting eigenvalue distribution of . For the optimal tuning parameter,

| (1) |

where is the companion Stieltjes transform of the limiting eigenvalue distribution of , defined in Section 1.4.

The required functionals of the limiting empirical eigenvalue distribution can be written in terms of almost-sure limits of simple quantities. For example, the result (1) can be written as

For general , the limiting error rate depends on the almost sure limits of both and .

Thanks to the simple form of (1), we can use our results to gain qualitative insights about the behavior of ridge regression. We show that, when the signal-to-noise ratio is high, i.e., , the accuracy of ridge regression has a sharp phase transition at regardless of , essentially validating a conjecture of Liang and Srebro (2010) on the “regimes of learning” problem. We also find that ridge regression obeys an inaccuracy principle, whereby there are no correlation structures for which prediction and estimation of are both easy. For this simplifies to

this bound is tight for optimally-tuned ridge regression. We refer to Section 2.2 for the general relation. We find the simplicity of the inverse relation remarkable.

In the second part of the paper, we study regularized discriminant analysis in the two-class Gaussian problem

| (2) |

where and are unknown. While our results cover unequal class probabilities, for simplicity here we present the case when . We instantiate the random-effects hypothesis by assuming that the pairs are independently and identically distributed for , and write with . We again work in a high-dimensional regime where and the within-class covariance has a limiting spectral distribution. Given this notation, the Bayes-optimal decision boundary is orthogonal to ; meanwhile, the regularized discriminant classifier predicts , where the form of the weight-vector is given in Section 3.

Theorem (informal statement).

In high dimensions, and in the metric induced by , the angle between and , i.e.,

has an almost-sure limit. The classification error of regularized discriminant analysis converges to an almost-sure limit that depends only on this limiting angle, as well as the limiting Bayes error. The limiting risk can be expressed in terms of , , , as well the Stieltjes transform of the limit eigenvalue distribution of the empirical within-class covariance matrix.

We can again use our result to derive qualitative insights about the behavior of RDA. We find that the limiting angle between and converges to a non-trivial quantity as , implying that our analysis is helpful in understanding the asymptotics of RDA even in a very high signal-to-noise regime. Finally, by studying the limits and , we can recover known high-dimensional asymptotic results about Fisher’s linear discriminant analysis and naive Bayes methods going back to Bickel and Levina (2004), Raudys (1967), Saranadasa (1993), and even early work by Kolmogorov.

Mathematically, our results build on recent advances in random matrix theory. The main difficulty here is finding explicit limits of certain trace functionals involving both the sample and the population covariance matrix. For instance, the Stieltjes transform of the empirical spectral distribution satisfies . However, standard random matrix theory does not provide simple expressions for the limits of functionals like or that involve both and . For this we leverage and build on recent results, including the work of Chen et al. (2011), Hachem et al. (2007), and Ledoit and Péché (2011). Our contributions include some new explicit formulas, for which we refer to the proofs. These formulas may prove useful for the analysis of other statistical methods under high-dimensional asymptotics, such as principal component regression and kernel regression.

1.2 A First Example

A key contribution of our theory is a precise understanding of the effect of correlations between the features on regularized discriminant analysis. Correlated features have a non-trivial effect, and cannot be summarized using standard notions such as the condition number of or the classification margin. The full eigenvalue spectrum of matters. This is in contrast with popular analyses of high-dimensional classification methods, in which the bounds often depend on the operator norm (see for instance the review Fan et al. (2011)), thus suggesting that existing analyses of many classification methods are not sharp.

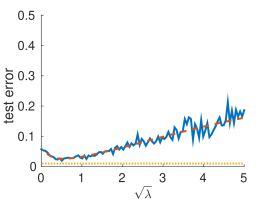

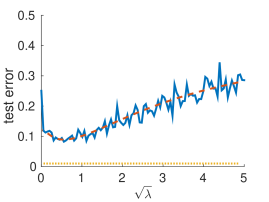

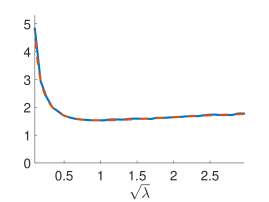

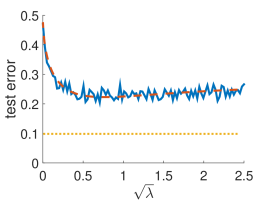

Consider the following examples: First, has eigenvalues corresponding to evenly-spaced quantiles of the standard Exponential distribution; Second, has a depth- BinaryTree covariance structure that has been used in population genetics to model the correlations between populations whose evolutionary history is described by a balanced binary tree (Pickrell and Pritchard, 2012). In both cases, we set the class means such as to keep the Bayes error constant across experiments. Figure 1 plots our formulas for the asymptotic error rate along with empirical realizations of the classification error.

Both covariance structures are far from the identity, and have similar condition numbers. However, the Exponential problem is vastly more difficult for RDA than the BinaryTree problem. This example shows that classical notions like the classification margin or the condition number of cannot satisfactorily explain the high-dimensional predictive performance of RDA; meanwhile, our asymptotic formulas are accurate even in moderate sample sizes. Our computational results are reproducible and open-source software to do so is available from https://github.com/dobriban/high-dim-risk-experiments/.

| BinaryTree | Exponential | |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

1.3 Related Work

Random matrix theoretic approaches have been used to study regression and classification in high-dimensional statistics (Serdobolskii, 2007; Yao et al., 2015), as well as wireless communications (Couillet and Debbah, 2011; Tulino and Verdú, 2004). Various regression and M-estimation problems have been studied in high dimensions using approximate message passing (Bayati and Montanari, 2012; Donoho and Montanari, 2015) as well as methods inspired by random matrix theory (Bean et al., 2013). We also note a remarkably early random matrix theoretic analysis of regularized discriminant analysis by Serdobolskii (1983). In the wireless communications literature, the estimation properties of ridge regression are well understood; however its prediction error has not been studied.

El Karoui and Kösters (2011) study the geometric sensitivity of random matrix results, and discuss the consequences to ridge regression and regularized discriminant analysis, under weak theoretical assumptions. In contrast, we make stronger assumptions that enable explicit formulas for the limiting risk of both methods, and allow us to uncover several qualitative phenomena. Our use of Ledoit and Péché (2011)’s results simplifies the proof.

We review the literature focusing on ridge regression or RDA specifically in Sections 2.3 and 3.5 respectively. Important references include, among others, Bickel and Levina (2004), Dicker (2014), El Karoui (2013), Fujikoshi et al. (2011), Hsu et al. (2014), Saranadasa (1993), and Zollanvari and Dougherty (2015).

1.4 Basics and Notation

We begin the formal presentation by reviewing some key concepts and notation from random matrix theory that are used in our high-dimensional asymptotic analysis. Random matrix theory lets us describe the asymptotics of the eigenvalues of large matrices (see e.g., Bai and Silverstein, 2010). These results are typically stated in terms of the spectral distribution, which for a symmetric matrix is the cumulative distribution function of its eigenvalues: . In particular, the well-known Marchenko-Pastur theorem, given below, characterizes the spectral distribution of covariance matrices. We will assume the following high-dimensional asymptotic model:

Assumption A.

(high-dimensional asymptotics) The following conditions hold.

-

1.

The data is generated as for an matrix with i.i.d. entries satisfying and , and a deterministic positive semidefinite covariance matrix .

-

2.

The sample size while the dimensionality as well, such that the aspect ratio .

-

3.

The spectral distribution of converges to a limit probability distribution supported , called the population spectral distribution (PSD).

Families of covariance matrices that fit the setting of this theorem include the identity covariance, BinaryTree, Exponential and the autoregressive AR-1 model with (see Grenander and Szegő, 1984, for the last one).

Theorem (Marchenko and Pastur (1967); Silverstein (1995)).

Under assumption Assumption A, the spectral distribution of the sample covariance matrix also converges weakly, with probability 1, to a limiting distribution supported on .

The limiting distrbution is called the empirical spectral distribution (ESD), and is determined uniquely by a fixed point equation for its Stieltjes transform, which is defined for any distribution supported on as

Given this notation, the Stieltjes transform of the spectral measure of satisfies

| (3) |

both almost surely and in expectation, for any ; here, we wrote . We also define the companion Stieltjes transform , which is the Stieltjes transform of the limiting spectral distribution of the matrix . This is related to by

| (4) |

In addition, we write the derivatives as111We will denote by the derivative of the Stieltjes transform, , evaluated at ; and not the derivative of the function . and . These derivatives can also be understood in terms of empirical observables, through the relation

Finally, our analysis also relies on several more recent formulas for limits of trace functionals involving both and . In particular, we use a formula due to Ledoit and Péché (2011), who in the analysis of eigenvectors of sample covariance matrices showed that, under certain moment conditions:222See the supplement for more details about this result.

| (5) |

2 Predictive Risk of Ridge Regression

In the first part of the paper, we study the predictive behavior of ridge regression under large-dimensional asymptotics. Suppose that we have data drawn from a -dimensional random-design linear model with independent observations . The noise terms are independent, centered, with variance one, and are independent of the other random quantities. The are arranged as the rows of the matrix , and are the entries of the vector . We estimate by ridge regression: = , for some . We make the following random weights assumption, where is the expected signal strength.

Assumption B.

(random regression coefficients) The true weight vector is random with , and = .

Our result about the predictive risk of ridge regression is stated in terms of the expected predictive risk , where is taken to be an independent test example from the same distribution as the training data, and .

Theorem 2.1.

Under Assumptions Assumption A and Assumption B, suppose moreover that the eigenvalues of are uniformly bounded above:333Below, will denote an arbitrary fixed constant whose meaning can change from line to line. , for all . Also assume for all . Then,

-

1.

Writing and , the finite sample predictive risk converges almost surely

(6) where .

-

2.

Moreover, for any , the predictive risk converges almost surely to the limiting predictive risk , where

The choice minimizes .

Proof outline.

The proof of part 1 is sufficiently simple to outline here; see the supplement for part 2. We begin by verifying formula (6):

On the last line we used the choice of . From the results of Ledoit and Péché (2011), and from , it can be verified that converges almost surely to limit in (5), finishing part 1. ∎

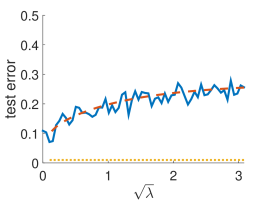

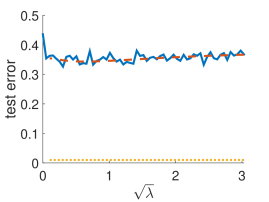

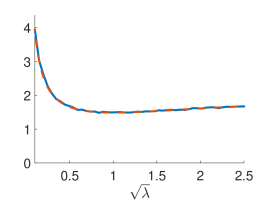

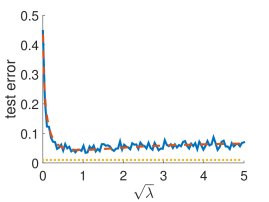

This result fully characterizes the first order behavior of the predictive risk of ridge regression under high-dimensional asymptotics. To verify its finite-sample accuracy, we perform a simulation with the BinaryTree and Exponential models. We compute the limit risks using the algorithms in the supplement. The results in Figure 2 show that the formulas given in Theorem 2.1 appear to be accurate, even in small sized problems. In Figure 2, for BinaryTree we train on samples, where ; for Exponential on . We set the signal strength to and generated , , and as Gaussian random variables with i.i.d. entries and the desired variance. The results are averaged over 500 simulation runs; we evaluated the empirical prediction error using a test set of size 100.

| BinaryTree | Exponential | |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Intriguingly, Figure 2 shows that the prediction performance of ridge regression is very similar on the two problems. This presents a marked contrast to the RDA example given in the introduction, where the two covariance structures led to very different classification performance. Thus, it appears that the loss function and the spectrum of can interact non-trivially.

Meanwhile, in the special case of identity covariance, the quantity coincides with the normalized estimation error, so we recover known results described in, e.g., Tulino and Verdú (2004). When , we have an explicit expression for the Stieltjes transform (e.g., Bai and Silverstein, 2010, p. 52), valid for :

| (7) |

Theorem 2.1 implies that the limit predictive risk of ridge regression for general equals

which has an explicit form. Furthermore, the optimal risk has a particularly simple form:

| (8) |

See the supplement for details on these derivations.

2.1 Regimes of Learning

As an application of Theorem 2.1, we study how the difficulty of ridge regression depends on the signal strength . Liang and Srebro (2010) call this the regimes of learning problem and argue that, for small the complexity of ridge regression should be tightly characterized by dimension-independent Rademacher bounds, while for large the error rate should only depend on . Liang and Srebro (2010) justify their claims using generalization bounds for the identity-covariance case , and conjecture that similar relationships should hold in general. Using our results, we can give a precise characterization of the regimes of learning of optimally-regularized ridge regression with general covariance .

From Theorem 2.1, we know that given a signal strength , the asymptotically optimal choice for is , in which case the predictive risk of ridge regression converges to

We now use this formula to examine the two limiting behaviors of the risk, for weak and strong signals. The results below are proved in the supplement, assuming that the population spectral distribution is supported on a set bounded away from 0 and infinity.

The weak-signal limit is relatively simple. First, , reflecting that for a small signal, we predict a near-zero outcome due to a large regularization. Second, , where is the large-sample limit of the normalized traces . Therefore, for small , the difficulty of the prediction is determined to first order by the average eigenvalue, or equivalently by the average variance of the features, and does not depend on the size of the ratio .

Conversely, the strong-signal limiting behavior of the risk depends the aspect ratio , and experiences a phase transition at . When , the predictive risk converges to

regardless of . This quantity is known to be the , limit of the risk of ordinary least squares (OLS). Thus when and we have a very strong signal, ridge regression cannot outperform OLS, although of course it can do much better with a small .

When , the risk can grow unboundedly large with . Moreover, we can verify that

| (9) |

Thus, the limiting error rate depends on the covariance matrix through . In general there is no closed-form expression for , which is instead characterized as the unique for which

In the special case , however, the limiting expression simplifies to = . In other words, when , optimally tuned ridge regression can capture a constant fraction of the signal, and its test-set fraction of explained variance tends to .

Finally, in the threshold case , the risk scales with :

| (10) |

where is the large-sample limit of . Thus, the absolute risk diverges to infinity, but the normalized error goes to 0. This appears to be a rather unusual risk profile. In the case , our expression simplifies further and we get the finite- formula , which scales like .

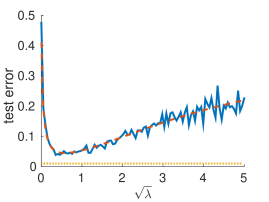

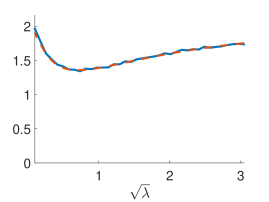

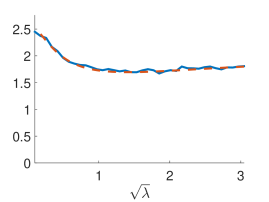

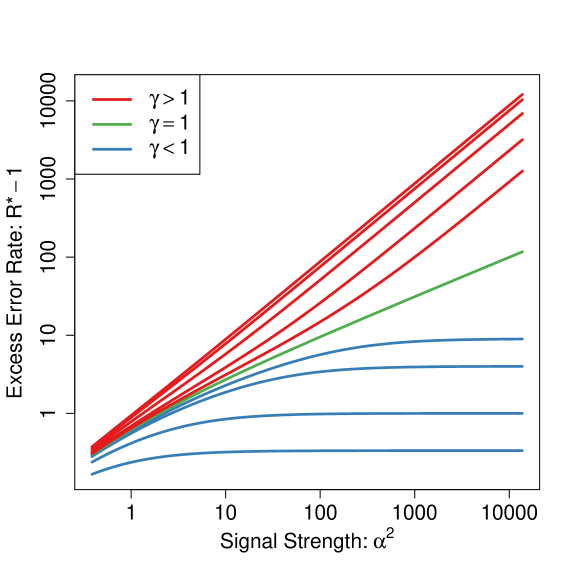

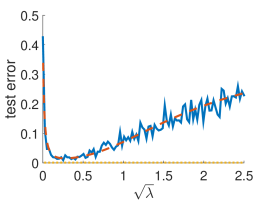

In summary, we find that for general covariance , the strong-signal risk scales as if , as if , and as if . We illustrate this phenomenon in Figure 3, in the case of the identity covariance . We see that when the error rate stabilizes, whereas when , the error rate eventually gets a slope of 1 on the log-log scale. Finally, when , the error rate has a log-log slope of .

Thus, thanks to Theorem 2.1, we can derive a complete and exact answer the regimes of learning question posed by Liang and Srebro (2010) in the case of ridge regression. The results (9) and (10) not only show that the scalings found by Liang and Srebro (2010) with hold for arbitrary , but make explicit how the slopes depend on the limiting population spectral distribution. The ease with which we were able to read off this scaling from Theorem 2.1 attests to the power of the random matrix approach.

2.2 An Inaccuracy Principle for Ridge Regression

Our results also reveal an intriguing inverse relationship between the prediction and estimation errors of ridge regression. Specifically, denoting the mean-squared estimation error as , it is well known that optimally tuned ridge regression satisfies, under the conditions of Theorem 2.1,

where is the Stieltjes transform of the limiting empirical spectral distribution (see, e.g., Tulino and Verdú, 2004, Chapter 3). Combining this result with Theorem 2.1 and (4), we find the following relationship between the limiting predictive risk and the limiting estimation risk .

Corollary 2.2.

Under the conditions of Theorem 2.1, the asymptotic predictive and estimation risks of optimally-tuned ridge regression are inversely related,

The equation holds for all limit eigenvalue distributions of the covariance matrices . Both sides of the above equation are non-negative: cannot fall below the intrinsic noise level , while . When , we get the even simpler equation

The product of the estimation and prediction risks equals the signal strength. Since this holds for the optimal , it also implies that for any we have the lower bound ; we find the explicit formula relating the two risks remarkable. The inverse relationship may be somewhat surprising, but it has an intuitive explanation.444A similar heuristic was given by Liang and Srebro (2010), without theoretical justification. When the features are highly correlated and is correspondingly large, prediction is easy because lies close to the “small” column space of the feature matrix , but estimation of is hard due to multi-collinearity. As correlation decreases, prediction gets harder but estimation gets easier.

2.3 Related Work for High-Dimensional Ridge Regression

Random-design ridge regression in high dimensions is a thoroughly studied topic. In particular, El Karoui (2013) and Dicker (2014) study ridge regression with identity covariance in an asymptotic framework similar to ours; this special case is considerably more restrictive than a general covariance. The study of the estimation error of ridge regression has received substantial attention in the wireless communication literature; see, e.g., Couillet and Debbah (2011) and Tulino and Verdú (2004) for references. To our knowledge, however, that literature has not addressed the behavior of prediction error. Finally, we also note the work of Hsu et al. (2014), who provide finite-sample concentration inequalities on the out-of-sample prediction error of random-design ridge regression, without obtaining limiting formulas. In contrast to these results, we give explicit limiting formulas for the prediction error.

3 Regularized Discriminant Analysis

In the second part of the paper, we return to regularized discriminant analysis and the two-class Gaussian discrimination problem (2). For simplicity we will first discuss the case when the population label proportions are balanced. In this case, the Bayes oracle predicts using (Anderson, 2003)

and has an error rate , where is half the between-class Mahalanobis distance. The Gaussian classification problem has a rich history, going back to Fisher’s pioneering work on linear discriminant analysis (LDA). When we have the same number of examples from both the positive and negative classes, i.e., , LDA classifies using the linear rule

Here is the centered covariance matrix. In the low-dimensional case where gets large while remains fixed, LDA is the natural plug-in rule for Gaussian classification and efficiently converges to the Bayes discrimination function (Anderson, 2003; Efron, 1975). When is on the same order as , however, the matrix inverse is unstable and the performance of LDA declines, as discussed among others by Bickel and Levina (2004). Instead, we will study regularized discriminant analysis, the linear rule where and the weight vector is 555The notation was chosen to emphasize the similarities between ridge regression and RDA. There will be no possibility for confusion with the ridge regression weight vector, also denoted . (Friedman, 1989; Serdobolskii, 1983).

3.1 High-Dimensional Asymptotics

Throughout this section, we make a random-effects assumption about the class means, where the expected signal strength is . We denote the classification error of RDA as . The probability is with respect to a independent test data point from the same distribution as the training data.

Assumption C.

(random weights in classification) The following conditions hold:

-

1.

and are randomly generated as and , where has i.i.d. coordinates with

for some fixed constants and .

-

2.

is either fixed, or random and independent of , and , and satisfies almost surely for some fixed constants and .

Theorem 3.1.

Under parts 2 and 3 of Assumption Assumption A, and Assumption Assumption C, suppose moreover that that the eigenvalues of are uniformly bounded as for some fixed constants and . Finally, suppose that we have a balanced population and equal class sizes . Then, the classification error of RDA converges almost surely

and , , and are determined by the problem parameters and :

Here, is the Stieltjes transform of the limit empirical spectral distribution of the covariance matrix , and is the companion Stieltjes transform defined in (4).

The proof of Theorem 3.1 (in the supplement) is similar to Theorem 2.1, but more involved. The main difficulty is to evaluate explicitly the limits of certain functionals of the population and sample covariance matrices. We extend the result of Ledoit and Péché (2011), and rely on additional results and ideas from Hachem et al. (2007) and Chen et al. (2011). In particular, we use a derivative trick for Stieltjes transforms, similar to that employed in a related context by El Karoui and Kösters (2011), Rubio et al. (2012), and Zhang et al. (2013). The limits are then combined with results on concentration of quadratic forms.

The above result can also be extended to RDA with uneven sampling proportions. Since the limit error rates get more verbose, this is the only place where we discuss uneven sampling. Suppose that the conditions of Theorem 3.1 hold, except now we have unequal underlying class probabilities , , and our training set is comprised of samples with label such that . We do not assume that . Consider a general regularized classifier , where for some , where , are defined in the usual way. We prove in the supplement that

Theorem 3.2.

Under the conditions of Theorem 3.1, and with unequal sampling, the classification error of RDA converges almost surely:

| (11) |

where the effective classification margins have the form

In this section we assumed Gaussianity, but by a Lindeberg–type argument it should be possible to extend the result to non-Gaussian observations with matching moments. It should also be interesting to study how sensitive the results are to the particular assumptions of our model, such as independence across samples.

It is worth mentioning that the regression and classification problems are very different statistically. In the random effects linear model, ridge regression is a linear Bayes estimator, thus the ridge regularization of the covariance matrix is justified statistically. However, for classification, the ridge regularization is merely a heuristic to help with the ill-conditioned sample covariance. It is thus interesting to know how much this heuristic helps improve upon un-regularized LDA, and how close we get to the Bayes error. We now turn to this problem, which can be studied equivalently from a geometric perspective.

3.2 The Geometry of RDA

The asymptotics of RDA can be understood in terms of a simple picture. The angle between the Bayes decision boundary hyperplane and the RDA discriminating hyperplane tends to an asymptotically deterministic value in the metric of the covariance matrix, and the limiting risk of RDA can be described in terms of this angle.

Recall that, in the balanced and case, the estimated RDA weight vector is , while the Bayes weight vector is . Writing for the inner product in the -metric, the cosine of the angle—in the same metric—between the two is

As discussed earlier, the Bayes error rate for the two-class Gaussian problem is , with .666To show this, we observe that the quantity converges almost surely to under the conditions of Theorem 3.1. This follows by a concentration of quadratic forms argument stated in the supplement, and because the spectrum of converges to , so in particular . Therefore, from Theorem 3.1 it follows that the cosine of the angle has a deterministic limit, denoted by , given by

where is the classification margin of RDA with the dependence on each parameter made explicit. The limit of the cosine quantifies the inefficiency of the RDA estimator relative to the Bayes one.

We gain some insight into this angle for two special cases: when , and by taking the limit . First, with , or equivalently , we curiously find that the effects of the signal strength and regularization rate decouple completely, as shown in Corollary 3.3 below. See the supplement for a proof of the following result.

Corollary 3.3.

Examining , we can attribute the suboptimality to two sources of noise: We need to pay a price for estimating , while the cost of estimating is . If we knew that , we could send . It is easy to verify that this would eliminate the second term, leading to a loss of efficiency .

In the case of a general covariance matrix we get a similar asymptotic decoupling in the strong-signal limit . The following claim follows immediately from Theorem 3.1.

Corollary 3.4.

Under the conditions of Theorem 3.1, the cosine of the angle between the optimal and learned hyperplanes has the limit as :

Thus, RDA is in general inconsistent for the Bayes hyperplane in the case of strong signals. Corollary 3.4 also implies that, in the limit , the optimal for RDA converges to a non-trivial limit that only depends on the spectral distribution . No such result is true for ridge regression, where as , regardless of . This contrast arises because ridge regression is a linear Bayes estimator, while RDA is a heuristic which is strictly suboptimal to the Bayes classifier.

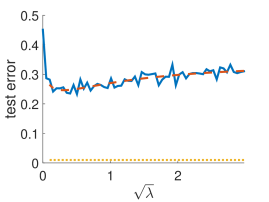

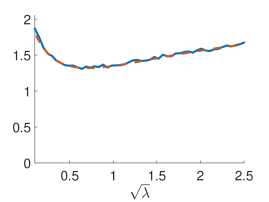

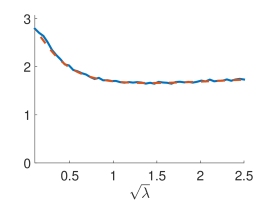

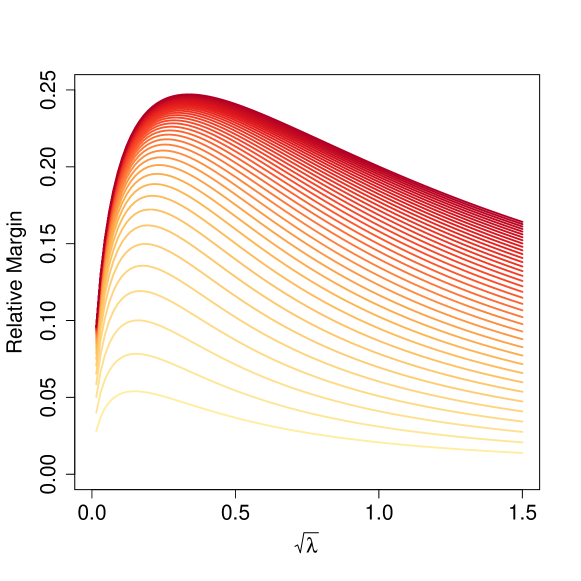

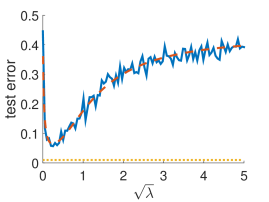

We illustrate the behavior of the cosine for the AR-1(0.9) model in Figure 4, which displays for values of ranging from to . We see that the -curve converges to its large- limit fairly rapidly. Moreover, somewhat strikingly, we see that the optimal regularization parameter , i.e., the maximizer of , increases with the signal strength .

Finally, we note that Efron (1975) studies the angle in detail for low-dimensional asymptotics where is fixed while ; in this case, converges in probability to , and the sampling distribution of converges to a (scaled) distribution. Establishing the sampling distribution in high dimensions is interesting future work.

3.3 Do existing theories explain the behavior of RDA?

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Theorems 3.1 and 3.2 give precise information about the error rate of RDA. It is of interest to compare this to classical theories, such as Vapnik-Chervonenkis theory or Rademacher bounds, to if they explain the qualitative behavior of RDA. In this section, we study a simple simulation example, and conclude that existing theory does not precisely explain the behavior of RDA.

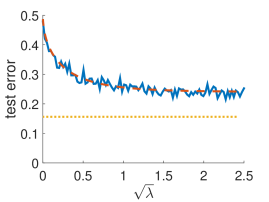

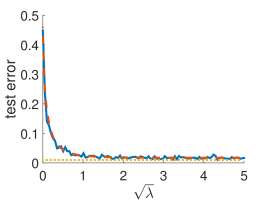

We consider a setup with , an auto-regressive (AR-1) matrix such that , and . This is a natural model when the features can be ordered such that correlations decay with distance; for instance in time series and genetic data. We run experiments for different values of in two different settings: once with constant effect size , and once with constant oracle margin . Given and one can verify using the description of the limit population spectrum (Grenander and Szegő, 1984), and by elementary calculations, that the limiting oracle classification margin in the AR-1 model is ; thus, with constant the oracle classifier improves as increases.

Existing results give us some intuition about what to expect. Since , classical heuristics based on the theory of Vapnik and Chervonenkis (1971) as well as more specialized analyses (Saranadasa, 1993; Bickel and Levina, 2004) predict that unregularized LDA will not work. As we will see, this matches our simulation results. Meanwhile, Bickel and Levina (2004) study worst-case performance of the independence rule relative to the Bayes rule. In our setting, it can be verified that their results imply , where the error rate of the independence rule is . This predicts that independence rules will work better for small correlation , which again will match the simulations.

The existing theory, however, is much less helpful for understanding the behavior of RDA for intermediate values of . A learning theoretic analysis based on Rademacher complexity suggests that the generalization performance of RDA should depend on terms that scale like for large values of (e.g., Bartlett and Mendelson, 2003). In other words, based on a classical approach, we might expect that mildly regularized RDA should not work, but using a large may help. Rademacher theory is not tight enough to predict what will happen for .

Given this background, Figure 5 displays the performance of RDA for different values of , along with our theoretically derived error from Theorem 3.1. In the case, we find that—as predicted—unregularized LDA does poorly. However, when is large, mildly regularized RDA does quite well.

Strikingly, RDA is able to benefit from the growth of the oracle classification margin with , but only if we use a small positive value of . The analyses based on unregularized LDA or “infinitely regularized” independence rules do not cover this case. Moreover, this phenomenon is not predicted by Rademacher theory, which requires to improve over basic Vapnik-Chervonenkis bounds. Results from constant margin case reinforce the same interpretations. Finally, our formulas for the error rate are accurate despite the moderate sample size .

3.4 Linear Discriminant Analysis vs. Independence Rules

Two points along the RDA risk curve that allow for particularly simple analytic expressions occur as and : the former is just classical linear discriminant analysis while the latter is equivalent to an independence rule (or “naïve Bayes”). In this section, we show how taking these limits we can recover known results about the high-dimensional asymptotics of linear discriminant analysis and naïve Bayes. Further, we compare these two methods over certain parameter classes.

Note that leads to a linear discriminant rule with weight vector . Usual independence rules take the form . We will assume that all features are normalized to have equal variance, . In this case the rule corresponds to an independence rule with oracle information about the equality of variances; which we still call “indpendence rule” for simplicity.

Extending our previous notation, we define the asymptotic margin of LDA and independence rules, by taking the limits of at 0 and :

Both limits are well-defined and admit simple expressions, as given below.

Theorem 3.5.

Let be the limit population spectral distribution of the covariance matrices ; and let be a random variable with distribution . Under the conditions of Theorem 3.1, the margins of LDA and independence rules are equal to

The formula for LDA is valid for while that for IR is valid for any .

This result is proved in the supplement. The formulas are simpler than Theorem 3.1, as they involve the population spectral distribution directly through its moments. For RDA, the error rate depends on implicitly through the Stieltjes transform of the ESD .

These formulas are equivalent to known results, some of which were obtained under slightly different parametrization. In particular, Serdobolskii (2007) attributes the IR formula with to unpublished work by Kolmogorov in 1967, while the Raudys and Young (2004) attributes it to Raudys (1967). The LDA formula was derived by Deev (1970) and Raudys (1972); see Section 3.5. Here, our goal was to show how these simple formulas can be recovered from the more powerful Theorem 3.1.

Saranadasa (1993) also obtains closed form expressions for the limit risk of two classification methods, the D-criterion and the A-criterion. One can verify that these are asymptotically equivalent to LDA and IR, respectively. Our results are consistent with those of Saranadasa (1993); but they differ slightly in the modeling assumptions. In our notation, his results (as stated in his Theorem 3.2 and Corollary 3.1) are: These results are nearly identical to Theorem 3.5, but our equations have an extra term involving in the denominator: for LDA and for IR. The reason is that we consider as random, whereas Saranadasa (1993) considers them as fixed sequences of vectors; this extra randomness yields additional variance terms.

Theorem 3.5 enables us to compare the worst-case performance of LDA and IR over suitable parameter classes of limit spectra. For we define the class

The bounds control the ill-conditioning of the population covariance matrix. We normalize such that the average population eigenvalue is 1, to ensure that the scaling of the problem does not affect the answer. This parameter space is somewhat similar to the one considered by Bickel and Levina (2004). Perhaps surprisingly, however, a direct comparison over these natural problem classes appears to be missing from the literature, and so we provide it below (see the supplement for a proof).

Corollary 3.6.

Under the conditions of Theorem 3.5, consider the behavior of LDA and independence rules for .

-

1.

The worst-case margin of LDA is:

The least favorable distribution for LDA from the class is the point mass at 1: , i.e., .

-

2.

The worst-case margin for independence rules is:

If the least favorable distribution is the mixture , where the weights are and ; while if , it is the point mass at 1: .

This result shows a stark contrast between the worst-case behavior of LDA and independence rules: for fixed signal strength, the worst-case risk of LDA over only depends on , and is attained with the limit of identity covariances regardless of the values of . In contrast, the worst-case behavior of IR occurs for a least favorable distribution that is as highly spread as possible. This highlights the sensitivity of IR to ill-conditioned covariance matrices. For , we see that IR are better than LDA in the worst case over , i.e. , if and only if

In particular IR performs better than LDA for strong signals ; with weaker signals, LDA can sometimes have an edge, particularly if the covariance is poorly conditioned, quantified by a large measure of spread .

3.5 Literature Review for High-Dimensional RDA

There has been substantial work in the former Soviet Union on high-dimensional classification; references on this work include Raudys and Young (2004), Raudys (2012), and Serdobolskii (2007). Raudys (1967)777Raudys (1967) is in Russian; see Raudys and Young (2004) for a review. derived the asymptotic error rate of independence rules in identity-covariance case , while Deev (1970) and Raudys (1972) obtained the error rate of un-regularized linear discriminant analysis (LDA) for general covariance , again in the regime.888Serdobolskii (2007) attributes some early results on independence rules with identity covariance to Kolmogorov in 1967, and calls the framework , the Kolmorogov asymptotic regime. However, Kolmogorov apparently never published on the topic. As shown in the previous section, these results can be obtained as special cases of our more general formulas.

For RDA, Serdobolskii (1983) (see also Chapter 5 of Serdobolskii (2007)) considered a more general setting than this paper: classification with a weight vector of the form instead of just , where the scalar function admits the integral representation for a suitable measure , and is extended to matrices in the usual way. He derived a limiting formula for the error rate of this classifier under high-dimensional asymptotics. However, due to their generality, his results are substantially more involved and much less explicit than ours. In some cases it is unclear to us how one could numerically compute his formulas in practice. Furthermore, his results are proved when , and show convergence in probability, not almost surely. We also note the work of Raudys and Skurichina (1995), who derived results about the risk of usual RDA with vanishingly small regularization , and for the special case .

In another line of work, a Japanese school (e.g., Fujikoshi et al., 2011, and references therein) has studied the error rates of LDA and RDA under high-dimensional asymptotics, with a focus on obtaining accurate higher-order expansions to their risk. For instance Fujikoshi and Seo (1998) obtained asymptotic expansions for the error rate of un-regularized LDA, which can be verified to be equivalent to our results in the limit. More recently, Kubokawa et al. (2013) obtained a second-order expansion of the error rate of RDA with vanishingly small regularization parameter in the case .

Finally, in the signal processing and pattern recognition literature, Zollanvari et al. (2011) provided asymptotic moments of estimators of the error rate of LDA, under an asymptotic framework where ; however, this paper assumes that the covariance matrix is known. More recently, Zollanvari and Dougherty (2015) provide consistent estimators for the error rate of RDA in a doubly asymptotic framework, using deterministic equivalents for random matrices. The goal of our work is rather different from theirs, in that we do not seek empirical estimators of the error rate of RDA, but instead seek simple formulas that help us understand the behavior of RDA.

Acknowledgment

We are grateful to everyone who has provided comments on this manuscript, in particular David Donoho, Jerry Friedman, Iain Johnstone, Percy Liang, Asaf Weinstein, and Charles Zheng. E. D. is supported in part by NSF grant DMS-1418362.

References

- Anderson (2003) T. W. Anderson. An Introduction to Multivariate Statistical Analysis. Wiley New York, 2003.

- Bai and Silverstein (2010) Z. Bai and J. W. Silverstein. Spectral Analysis of Large Dimensional Random Matrices. Springer, 2010.

- Bartlett and Mendelson (2003) P. L. Bartlett and S. Mendelson. Rademacher and Gaussian complexities: Risk bounds and structural results. J. Mach. Learn. Res., 3:463–482, 2003.

- Bayati and Montanari (2012) M. Bayati and A. Montanari. The LASSO risk for Gaussian matrices. IEEE Trans. Inform. Theory, 58(4):1997–2017, 2012.

- Bean et al. (2013) D. Bean, P. J. Bickel, N. El Karoui, and B. Yu. Optimal M-estimation in high-dimensional regression. Proc. Natl. Acad. Sci. USA, 110(36):14563–14568, 2013.

- Bernau et al. (2014) C. Bernau, M. Riester, A.-L. Boulesteix, G. Parmigiani, C. Huttenhower, L. Waldron, and L. Trippa. Cross-study validation for the assessment of prediction algorithms. Bioinformatics, 30(12):i105–i112, 2014.

- Bickel and Levina (2004) P. J. Bickel and E. Levina. Some theory for Fisher’s linear discriminant function, “naive Bayes”, and some alternatives when there are many more variables than observations. Bernoulli, pages 989–1010, 2004.

- Candès and Tao (2007) E. Candès and T. Tao. The Dantzig selector: Statistical estimation when is much larger than . Ann. Statist., 35(6):2313–2351, 2007.

- Chen et al. (2011) L. S. Chen, D. Paul, R. L. Prentice, and P. Wang. A regularized Hotelling’s test for pathway analysis in proteomic studies. J. Amer. Statist. Assoc., 106(496), 2011.

- Couillet and Debbah (2011) R. Couillet and M. Debbah. Random Matrix Methods for Wireless Communications. Cambridge University Press, 2011.

- Deev (1970) A. Deev. Representation of statistics of discriminant analysis and asymptotic expansion when space dimensions are comparable with sample size. In Sov. Math. Dokl., volume 11, pages 1547–1550, 1970.

- Dicker (2014) L. Dicker. Ridge regression and asymptotic minimax estimation over spheres of growing dimension. Bernoulli, to appear, 2014.

- Dobriban (2015) E. Dobriban. Efficient computation of limit spectra of sample covariance matrices. arXiv preprint arXiv:1507.01649, 2015.

- Donoho and Montanari (2015) D. L. Donoho and A. Montanari. Variance breakdown of Huber (M)-estimators: . arXiv preprint arXiv:1503.02106, 2015.

- Efron (1975) B. Efron. The efficiency of logistic regression compared to normal discriminant analysis. J. Amer. Statist. Assoc., 70(352):892–898, 1975.

- El Karoui (2013) N. El Karoui. Asymptotic behavior of unregularized and ridge-regularized high-dimensional robust regression estimators: rigorous results. arXiv preprint arXiv:1311.2445, 2013.

- El Karoui and Kösters (2011) N. El Karoui and H. Kösters. Geometric sensitivity of random matrix results: consequences for shrinkage estimators of covariance and related statistical methods. arXiv preprint arXiv:1105.1404, 2011.

- Fan et al. (2011) J. Fan, Y. Fan, and Y. Wu. High dimensional classification. In T. Cai and X. Shen, editors, High-dimensional Data Analysis, pages 3–37. World Scientific, New Jersey, 2011.

- Friedman (1989) J. H. Friedman. Regularized discriminant analysis. J. Amer. Statist. Assoc., 84(405):165–175, 1989.

- Fujikoshi and Seo (1998) Y. Fujikoshi and T. Seo. Asymptotic aproximations for EPMCs of the linear and the quadratic discriminant functions when the sample sizes and the dimension are large. Random Oper. Stoch. Equ., 6(3):269–280, 1998.

- Fujikoshi et al. (2011) Y. Fujikoshi, V. V. Ulyanov, and R. Shimizu. Multivariate Statistics: High-dimensional and Large-sample Approximations. John Wiley & Sons, 2011.

- Grenander and Szegő (1984) U. Grenander and G. Szegő. Toeplitz forms and their applications, 1984.

- Hachem et al. (2007) W. Hachem, P. Loubaton, and J. Najim. Deterministic equivalents for certain functionals of large random matrices. The Annals of Applied Probability, 17(3):875–930, 2007.

- Hachem et al. (2008) W. Hachem, O. Khorunzhiy, P. Loubaton, J. Najim, and L. Pastur. A new approach for mutual information analysis of large dimensional multi-antenna channels. IEEE Trans. Inform. Theory, 54(9):3987–4004, 2008.

- Hastie et al. (2015) T. Hastie, R. Tibshirani, and M. Wainwright. Statistical Learning with Sparsity: The Lasso and Generalizations. CRC Press, 2015.

- Hoerl and Kennard (1970) A. E. Hoerl and R. W. Kennard. Ridge regression: Biased estimation for nonorthogonal problems. Technometrics, 12(1):55–67, 1970.

- Hsu et al. (2014) D. Hsu, S. M. Kakade, and T. Zhang. Random design analysis of ridge regression. Found. Comput. Math., 14(3):569–600, 2014.

- Kleinberg et al. (2015) J. Kleinberg, J. Ludwig, S. Mullainathan, Z. Obermeyer, et al. Prediction policy problems. American Economic Review, 105(5):491–95, 2015.

- Kubokawa et al. (2013) T. Kubokawa, M. Hyodo, and M. S. Srivastava. Asymptotic expansion and estimation of EPMC for linear classification rules in high dimension. J. Multivariate Anal., 115:496–515, 2013.

- Ledoit and Péché (2011) O. Ledoit and S. Péché. Eigenvectors of some large sample covariance matrix ensembles. Probab. Theory Related Fields, 151(1-2):233–264, 2011.

- Liang and Srebro (2010) P. Liang and N. Srebro. On the interaction between norm and dimensionality: Multiple regimes in learning. In ICML, 2010.

- Marchenko and Pastur (1967) V. A. Marchenko and L. A. Pastur. Distribution of eigenvalues for some sets of random matrices. Mat. Sb., 114(4):507–536, 1967.

- Ng and Jordan (2001) A. Ng and M. Jordan. On discriminative vs. generative classifiers: A comparison of logistic regression and naive Bayes. In NIPS, 2001.

- Pickrell and Pritchard (2012) J. K. Pickrell and J. K. Pritchard. Inference of population splits and mixtures from genome-wide allele frequency data. PLoS genetics, 8(11):e1002967, 2012.

- Raudys (1967) Š. Raudys. On determining training sample size of linear classifier. Comput. Systems (in Russian), 28:79–87, 1967.

- Raudys (1972) Š. Raudys. On the amount of a priori information in designing the classification algorithm. Technical Cybernetics (in Russian), 4:168–174, 1972.

- Raudys (2012) Š. Raudys. Statistical and Neural Classifiers: An integrated approach to design. Springer Science & Business Media, 2012.

- Raudys and Skurichina (1995) Š. Raudys and M. Skurichina. Small sample properties of ridge estimate of the covariance matrix in statistical and neural net classification. New Trends in Probability and Statistics, 3:237–245, 1995.

- Raudys and Young (2004) Š. Raudys and D. M. Young. Results in statistical discriminant analysis: A review of the former Soviet Union literature. J. Multivariate Anal., 89(1):1–35, 2004.

- Rifai et al. (2011) S. Rifai, Y. Dauphin, P. Vincent, Y. Bengio, and X. Muller. The manifold tangent classifier. Advances in Neural Information Processing Systems, 24:2294–2302, 2011.

- Rubio et al. (2012) F. Rubio, X. Mestre, and D. P. Palomar. Performance analysis and optimal selection of large minimum variance portfolios under estimation risk. IEEE Journal of Selected Topics in Signal Processing, 6(4):337–350, 2012.

- Russakovsky et al. (2014) O. Russakovsky, J. Deng, H. Su, J. Krause, S. Satheesh, S. Ma, Z. Huang, A. Karpathy, A. Khosla, M. Bernstein, et al. ImageNet large scale visual recognition challenge. International Journal of Computer Vision, pages 1–42, 2014.

- Saranadasa (1993) H. Saranadasa. Asymptotic expansion of the misclassification probabilities of D-and A-criteria for discrimination from two high dimensional populations using the theory of large dimensional random matrices. J. Multivariate Anal., 46(1):154–174, 1993.

- Serdobolskii (1983) V. I. Serdobolskii. On minimum error probability in discriminant analysis. In Dokl. Akad. Nauk SSSR, volume 27, pages 720–725, 1983.

- Serdobolskii (2007) V. I. Serdobolskii. Multiparametric Statistics. Elsevier, 2007.

- Silverstein (1995) J. W. Silverstein. Strong convergence of the empirical distribution of eigenvalues of large dimensional random matrices. J. Multivariate Anal., 55(2):331–339, 1995.

- Silverstein and Choi (1995) J. W. Silverstein and S.-I. Choi. Analysis of the limiting spectral distribution of large dimensional random matrices. J. Multivariate Anal., 54(2):295–309, 1995.

- Silverstein and Combettes (1992) J. W. Silverstein and P. L. Combettes. Signal detection via spectral theory of large dimensional random matrices. IEEE Trans. Signal Process., 40(8):2100–2105, 1992.

- Simard et al. (2000) P. Y. Simard, Y. A. Le Cun, J. S. Denker, and B. Victorri. Transformation invariance in pattern recognition: Tangent distance and propagation. International Journal of Imaging Systems and Technology, 11(3):181–197, 2000.

- Sutton and McCallum (2006) C. Sutton and A. McCallum. An introduction to conditional random fields for relational learning. Introduction to statistical relational learning, pages 93–128, 2006.

- Toutanova et al. (2003) K. Toutanova, D. Klein, C. D. Manning, and Y. Singer. Feature-rich part-of-speech tagging with a cyclic dependency network. In NAACL, 2003.

- Tulino and Verdú (2004) A. M. Tulino and S. Verdú. Random matrix theory and wireless communications. Communications and Information theory, 1(1):1–182, 2004.

- Vapnik and Chervonenkis (1971) V. N. Vapnik and A. Y. Chervonenkis. On the uniform convergence of relative frequencies of events to their probabilities. Theory Probab. Appl., 16(2):264–280, 1971.

- Wang and Manning (2012) S. Wang and C. D. Manning. Baselines and bigrams: Simple, good sentiment and topic classification. In Proceedings of the 50th Annual Meeting of the Association for Computational Linguistics: Short Papers-Volume 2, pages 90–94. Association for Computational Linguistics, 2012.

- Wray et al. (2007) N. R. Wray, M. E. Goddard, and P. M. Visscher. Prediction of individual genetic risk to disease from genome-wide association studies. Genome research, 17(10):1520–1528, 2007.

- Yao et al. (2015) J. Yao, Z. Bai, and S. Zheng. Large Sample Covariance Matrices and High-Dimensional Data Analysis. Cambridge University Press, 2015.

- Zhang et al. (2013) M. Zhang, F. Rubio, D. P. Palomar, and X. Mestre. Finite-sample linear filter optimization in wireless communications and financial systems. IEEE Trans. Signal Process., 61(20):5014–5025, 2013.

- Zollanvari and Dougherty (2015) A. Zollanvari and E. R. Dougherty. Generalized consistent error estimator of linear discriminant analysis. IEEE Trans. Signal Process., 63(11), 2015.

- Zollanvari et al. (2011) A. Zollanvari, U. M. Braga-Neto, and E. R. Dougherty. Analytic study of performance of error estimators for linear discriminant analysis. IEEE Trans. Signal Process., 59(9):4238–4255, 2011.

4 Supplement

5 Efficient computation of the risk formulas

Consider the spectral distribution of the companion matrix . Since its spectral distribution differs from by zeros, it follows that has a limit ESD , given by . The companion Stieltjes transform satisfies the Silverstein equation (Silverstein and Combettes, 1992; Silverstein and Choi, 1995):

| (12) |

It is known that for , is the unique solution of the Silverstein equation with such that .

We now explain how to compute the key quantities that will come up in our risk formulas. On the interval , Silverstein and Choi (1995) prove that the functional inverse of has the explicit form:

| (13) |

This result enables the efficient computation of the function for . Indeed, assuming one can compute the corresponding integral against , one can tabulate (13) on a dense grid of , to find pairs , where . Then for the values , the Silverstein and Choi (1995) result shows that . Further, the Silverstein equation can be differentiated with respect to to obtain an explicit formula for in terms of :

Therefore, once is computed for a value , the computation of can be done conveniently in terms of and , assuming again that the integral involving can be computed. This is one of the main steps in the Spectrode method for computing the limit ESD (Dobriban, 2015). Finally, can be computed from via the equation (4), and can be computed from by differentiating (4): .

6 Proofs for Ridge Regression

6.1 Proof of Theorem 2.1

The risk equals

where is the noise in the new observation. Now , and , where is the vector of noise terms in the original data. Hence

When we plug this back into the risk formula , and use that are conditionally independent given , we see that the cross-term involving cancels. The risk simplifies to

Now using that the components of and are each uncorrelated conditional on , we obtain the further simplification

Introducing and , and splitting the last term in two by using this yields

| (14) |

For the particular choice , we obtain the claimed formula . Next, we show the convergence of for arbitrary fixed . First, by assumption we have . Therefore, it is enough to show the almost sure convergence of the two functionals:

The convergence of the first one follows directly from the theorem of Ledoit and Péché (2011), given in (5). The second is shown later in the proof of Lemma 7.4 in Section 7.1.4. In that section it is assumed that the eigenvalues of are bounded away from 0 an infinity; but one can check that in the proof of Lemma 7.4 only the upper bound is used, and that holds in our case. Therefore the risk converges almost surely for each .

Next we find the fomulas for the limits of the two functionals. The limit of equals by (5). In the proof of Lemma 7.4 in Section 7.1.4, it is shown that the limit of is .

Simplified expression for : Putting together the results above, we obtain (with ) the desired claim:

Second part: Convergence: First, we note that for , the finite sample risk equals by (14)

Introduce the function . We need to show . First, we notice that , and almost surely. Second, we verify the equicontinuity of as a function of , by proving the stronger claim that the derivatives of are uniformly bounded:

The last inequality holds for some finite constant because by the convergence and boundedness of the spectral distribution of .

Therefore, by the equicontinuity of the family as a function of , we obtain . Further, the explicit form of shows that the limit equals by (5), as desired.

Optimality of : The limiting risk is the same if we assume Gaussian observations. In this case, the finite sample Bayes-optimal choice for is . We will use the following classical lemma to conclude that the limit of the minimizers is the minimizer of the limit.

Lemma 6.1.

Let be an equicontinuous family of functions on an interval , converging pointwise to a continuous function, . Suppose is a minimizer of on , and . Then is a minimizer of .

Proof.

Since is a minimizer of , we have

| (15) |

for all . But . As , by the convergence of and by the equicontinuity of the family ; and for all by the convergence of . Therefore, taking the limit as in (15), we obtain for any , showing that is a minimizer of . ∎

We use the notation for the risk, showing that it depends on . Fix an arbitrary sequence of matrices on the event having probability one where . By an argument similar to the one given above, the sequence of functions equicontinuous in on the set . Since converges to for each , and is a sequence of minimizers of that converges to , by Lemma 6.1 is a minimizer of .

6.2 The Risk of Ridge Regression with Identity Covariance

6.3 Proof of strong-signal limit of ridge

We will first show the results for the strong-signal limit. We start by verifying the following lemma.

Lemma 6.2.

Suppose the limit population eigenvalue distribution has support contained in a compact set bounded away from 0. Let be the companion Stieltjes transform of the ESD. Then

-

1.

If , .

-

2.

If , .

-

3.

If , .

Proof.

Let be the ESD of the companion matrix . It is related to via . It is well known (e.g., Bai and Silverstein, 2010, Chapter 6), that for whose support is contained in a compact set bounded away from 0, the following hold for and : if , then has support contained in a compact set bounded away from 0, and has a point mass of at 0; while if , then has support contained in a compact set bounded away from 0, and has a point mass of at 0.

If , we let be distributed according to . Since for some , we have by the dominated convergence theorem

Since , this shows .

Similarly, if , we let be distributed according to . Since for some , we have This shows . Further, we can find the equation for by taking the limit as in the Silverstein equation (12). We see that is well-defined, bounded away from 0, and has positive imginary part for in a neighborhood of , so the limit is justified by the dominated convergence theorem. This leads to the equation that was claimed:

Finally, for , the Silverstein equation (12) is equivalent to

Therefore the real quantity is not finite; otherwise, we could take the limit as , , similarly to above, and obtain the contradiction that . Since is increasing as , it follows that . Multiplying the Silverstein equation above with

We can take the limit in this equation as similarly to above, and note that the right hand side converges to by the dominated convergence theorem. This shows . ∎

Consequently, using the formula for the optimal risk from Theorem 2.1, we have for , . For ,

Finally, for ,

The explicit formula for is obtained by plugging in the expression (7) into the formula for the optimal risk.

Next we argue about the weak-signal limit. Using the above notations, , so by the dominated convergence theorem, , and consequently . Furthermore, , leading to , and consequently .

7 Proofs for Regularized Discriminant Analysis

7.1 Proof of Theorem 3.1

We will first outline the high-level steps to prove our main result for classification, Theorem 3.1. We break down the proof into several lemmas, whose proof is deferred to later sections. These lemmas are then put together to prove the theorem in the final part of the proof outline.

We start with the well-known finite-sample formula for the expected test error of an arbitrary linear classifier in the Gaussian model (2), conditional on the weight parameters and the means :

| (16) |

In RDA the weight vector is and the offset is . The first simplification we notice is that .

Lemma 7.1.

Under the conditions of Theorem 3.1, we have .

Lemma 7.1 is proved in Section 7.1.1. Since the denominator in the error rate (16) converges almost surely to a fixed, strictly positive constant (see Lemmas 7.4 and 7.5), this will allow us to use the following simpler formula - that does not involve - in evaluating the limit of the error rate.

| (17) |

Recall that , . The second simplification we notice is that .

Lemma 7.2.

Under the conditions of Theorem 3.1, we have .

Lemma 7.2 is proved in Section 7.1.2. By the same argument as above, this Lemma allows us to use the following even simpler formula - that does not involve - in evaluating the limit of the error rate:

| (18) |

To show the convergence of , we argue that the linear and quadratic forms involving concentrate around their means, and then apply random matrix results to find the limits of those means. We start with the numerator.

Lemma 7.3.

We have the limit , where is the Stieltjes transform of the limit empirical eigenvalue distribution of the covariance matrix .

Lemma 7.3 is proved in Section 7.1.3. To prove the convergence of the denominator, we decompose it as:

| (19) |

where and

One can show similarly to the analysis of the error terms in the proof of Lemmas 7.1 and 7.3; we omit the details. The two remaining terms will converge to nonzero quantities. First we show that:

Lemma 7.4.

We have the convergence , where

with the companion Stieltjes transform of the ESD of the covariance matrix, defined in (4). Expressing the derivative explicitly, we have the limit . The limit is strictly positive.

Lemma 7.4 is proved in Section 7.1.4, using Ledoit and Péché (2011)’s result and a derivative trick similar to that employed in a similar context by El Karoui and Kösters (2011); Rubio et al. (2012); Zhang et al. (2013). Finally, the last statement that we need is:

Lemma 7.5.

We have the limit

where the companion Stieltjes transform of the ESD of the covariance matrix, defined in (4).

Lemma 7.5 is proved in Section 7.1.5, as an application of the results of Hachem et al. (2008) and Chen et al. (2011). With all these results, we can now prove Theorem 3.1.

Final proof of Theorem 3.1.

By Lemma 7.5, the second term is strictly positive. Therefore, combining with Lemma 7.3 and the continuous mapping theorem, we have

| (20) |

Denote by the parameter on the right hand side. After algebraic simplification, we obtain that has exactly the form stated in the theorem for the margin of RDA. To finish the proof, we show that the error rate is indeed determined by . From (20) and the continuous mapping theorem, recalling the error rate from (18), we have

Finally, from Lemma 7.1 and the definition of the error rate in Equation (16), we can discard the offset , and move from to :

The last three statements imply that , which finishes the proof of Theorem 3.1. ∎

In the proofs of the lemmas we will use the following well-known statement repeatedly:

Lemma 7.6 (Concentration of quadratic forms, consequence of Lemma B.26 in Bai and Silverstein (2010)).

Let be a random vector with i.i.d. entries and , for which and for some and . Moreover, let be a sequence of random symmetric matrices independent of , with uniformly bounded eigenvalues. Then the quadratic forms concentrate around their means: .

Lemma 7.6 requires a small proof, which is provided in Section 7.1.6. The rest of this section contains the proofs of the lemmas.

7.1.1 Proof of Lemma 7.1

We start by conditioning on the random variables , or equivalently on . Conditional on , we have that , independently of . Therefore, , and independently . Further - still conditionally on - it holds that and are independent by Gaussianity. This shows that conditionally on , the random variables are independent.

Hence there exist two standard normal random vectors independent of conditionally on , such that we can represent

| (21) |

Crucially, this representation has the same form regardless of the value of , , therefore the random variables are unconditionally independent of . The unconditional indepdendence of will lead to convenient simplifications.

We decompose according to (21) into the four terms that arise from expanding :

where and

| (22) | ||||

| (23) | ||||

| (24) | ||||

| (25) |

The proof proceeds by showing that each of the converge to zero.

The first term: . Let us denote . Then by the independence and the zero-mean property of the coordinates of

Note that we have for some constant by the increasing relation between norms and by . Therefore, with denoting some constant whose meaning may change from line to line

By the boundedness of the operator norm of , we see . By assumption, almost surely for sufficiently large . Therefore almost surely for sufficiently large ; and this bound is summable in . Using the Markov inequality for the fourth moment, , and by the Borel-Cantelli lemma, it follows that almost surely.

The second term: . This term differs from because replaces . To show the convergence we only used the properties of the first four moments of . The moments of scale in the same way with as the moments of . Therefore, the same proof shows .

The last two terms: and . The convergence of these terms follows directly from a well-known lemma, which we cite from Couillet and Debbah (2011):

Lemma 7.1 (Proposition 4.1 in Couillet and Debbah (2011)).

Let and be independent sequences of random vectors, such that for each the coordinates of and are independent random variables. Moreover, suppose that the coordinates of are identically distributed with mean 0, variance for some and fourth moment of order . Suppose the same conditions hold for , where the distribution of the coordinates of can be different from those of . Let be a sequence of random matrices such that is uniformly bounded. Then .

While this lemma was originally stated for complex vectors, it holds verbatim for real vectors as well. The lemma applied with , and shows convergence of ; and similarly it shows . This finishes the proof of Lemma 7.1.

7.1.2 Proof of Lemma 7.2

7.1.3 Proof of Lemma 7.3

Proof.

We decompose

| (26) |

We will analyze the two terms separately, and show that the second term converges to 0.

The first term in (26): . Let us denote by the Stieltjes transform of the empirical spectral distribution (ESD) of . We compute expectations using the assumption (where is the Kronecker symbol that equal 1 if and 0 otherwise), and using that is independent of :

We now argue that , where is the Stieltjes transform of the limit ESD of sample covariance matrices , where has i.i.d. entries of mean 0 and variance 1, and the spectrum of converges to . Indeed, this follows from the Marchenko-Pastur theorem, given in Equation (3): ; in addition we need to argue that centering the covariance matrix does not change the limit. Since our centered covariance matrix differs from the usual centered sample covariance matrix, for completeness we state this result as a lemma below:

Lemma 7.7.

Let be the centered and rescaled covariance matrix used in RDA. Then

-

1.

Under the conditions of Theorem 3.1, the limit ESD of equals, with probability 1, the limit ESD of sample covariance matrices , where is with i.i.d. entries of mean 0 and variance 1. Therefore centering the covariance does not change the limit.

-

2.

The Stieltjes transform of , converges almost surely and in expectation to , the Stieltjes transform of . For each , ; and .

Proof of Lemma 7.7.

Let be the centered data points, for the positive training examples, and for the negative training examples. The have mean 0 and covariance matrix . Let further be the centered mean of the positive training examples; and define analogously. We observe that

where is the matrix with each row equal to , which are i.i.d. Gaussian vectors with i.i.d. entries of mean 0 and variance 1. Also, is the projection matrix , where the vectors are the indicator vectors of the training examples with labels . Recalling that is the uncentered, -normalized covariance matrix, the difference between and is

It is easy to check that the two error terms and are small. Specifically, we can verify that the Frobenius norm . Therefore, By Corollary A.41 in Bai and Silverstein (2010) it follows that can be ignored when computing the limit ESD. Further, is of rank at most two by the definition of . Therefore, by Theorem A.44 in Bai and Silverstein (2010), does not affect the limit ESD. Putting these together, it follows that has the same ESD as ; the latter exists due to the Marchenko-Pastur theorem given in Equation (3). Therefore, the ESD of converges, with probability 1, to . This finishes the first claim in the Lemma.

Claim 2 then follows immediately by the properties of weak convergence of probability measures, because the Stieltjes transform is a bounded continuous functional of a probability distribution.

∎

Therefore, going back to the proof of Lemma 7.3, we obtain using Lemma 7.7, that . Now note that each eigenvalue of is uniformly bounded in , is independent of , and the -th moment of is uniformly bounded, so by the concentration of quadratic forms, Lemma 7.6:

Putting everything together, we have shown that the first term converges almost surely to .

The second term in (26) converges to zero: Using the decomposition (21) from the proof of Lemma 7.1 in Section 7.1.1, and the notation we can write

This has the same distribution as , because are identically distributed, independently of . In Lemma 7.1, we showed , so . ∎

7.1.4 Proof of Lemma 7.4

In this proof it will be helpful to use some properties of smooth complex functions. Let be a domain, i.e. a connected open set of . A function is called analytic on if it is differentiable as a function of the complex variable on . The following key theorem, sometimes known as Vitali’s theorem, ensures that the derivatives of converging analytic functions also converge.

Lemma 7.8 (see Lemma 2.14 in Bai and Silverstein (2010)).

Let be analytic on the domain , satisfying for every and in . Suppose that there is an analytic function on such that for all . Then it also holds that for all .

We can now prove Lemma 7.4.

Proof of Lemma 7.4.

We need to prove the convergence of , where . Using the assumption , and that are indpendent, we get .

Now, the eigenvalues of are bounded above by , and those of are bounded above by ; this shows the eigenvalues of are uniformly bounded above. Further, are independent, and has -th moments, so we can use the concentration of quadratic forms, Lemma 7.6, to conclude . It remains to get the limit of .

To do this we use a derivative trick; this technique is similar to those employed in a similar context by El Karoui and Kösters (2011); Rubio et al. (2012); Zhang et al. (2013). We will construct a function with two properties: (1) its derivative is the quantity that we want, and (2) its limit is convenient to obtain. Based on these two properties, Vitali’s theorem will allow us to obtain the limit of .

Accordingly, consider two general positive definite matrices and introduce the function Note that the derivative of with respect to is

This suggests that the function we should use in the derivative trick is ; indeed the limit we want to compute is . Conveniently, the limit of is known by the Ledoit-Peche result (5):

for all .

Next we check the conditions for applying Vitali’s theorem, Lemma 7.8. By inspection, the function is an analytic function of on with derivative

Furthermore, is bounded in absolute value:

This shows that is a bounded sequence. Therefore, we can apply Lemma 7.8 to the sequence of analytic functions on the domain , on the set of full measure on which converges, to obtain that the derivatives also converge on : Finally, since the functions are bounded, the dominated convergence theorem implies that . Since , this shows that , as required.

Finally, to see that the limit of , we use that by assumption the eigenvalues of are lower bounded by some , and those of are upper bounded by , hence

Since has i.i.d. standard normal entries, it is well known that the operator norm of is bounded above almost surely (see Theorem 5.8 in (Bai and Silverstein, 2010), which requires only a fourth moment on the entries of ). Therefore, for some fixed constant .

∎

7.1.5 Proof of Lemma 7.5