Randomized Revenue Monotone Mechanisms for Online Advertising

Abstract

Online advertising is the main source of revenue for many Internet firms. A central component of online advertising is the underlying mechanism that selects and prices the winning ads for a given ad slot. In this paper we study designing a mechanism for the Combinatorial Auction with Identical Items (CAII) in which we are interested in selling identical items to a group of bidders each demanding a certain number of items between and . CAII generalizes important online advertising scenarios such as image-text and video-pod auctions [5]. In image-text auction we want to fill an advertising slot on a publisher’s web page with either text-ads or a single image-ad and in video-pod auction we want to fill an advertising break of seconds with video-ads of possibly different durations.

Our goal is to design truthful mechanisms that satisfy Revenue Monotonicity (RM). RM is a natural constraint which states that the revenue of a mechanism should not decrease if the number of participants increases or if a participant increases her bid.

In a recent work Goel and Khani [5], it was argued that RM is a desired property to have for smooth functioning of a firm. Since popular mechanisms like VCG are not revenue-monotone, they introduced the notion of Price of Revenue Monotonicity (PoRM) to capture the loss in social welfare of a revenue-monotone mechanism. Goel and Khani [5] showed that no deterministic RM mechanism can attain PoRM of less than for CAII, i.e., no deterministic mechanism can attain more than fraction of the maximum social welfare. Goel and Khani [5] also design a mechanism with PoRM of for CAII.

In this paper, we seek to overcome the impossibility result of Goel and Khani [5] for deterministic mechanisms by using the power of randomization. We show that by using randomization, one can attain a constant PoRM. In particular, we design a randomized RM mechanism with PoRM of for CAII.

Finally we study Multi-group Combinatorial Auction with Identical Items (MCAII) which is an important generalization of CAII. In MCAII the bidders are partitioned into multiple groups and the set of winners should be from a single group. The motivation for MCAII is from online advertising scenarios where, for instance, the set of selected ads may be required to have the same format. We give a randomized mechanism which satisfies RM and IC and has PoRM of . This is in contrast to deterministic mechanism that follows from [5].

1 Introduction

Many Internet firms including search engines, social networks, and online publishers rely on online advertising revenue for their business; thus, making online advertising an essential part of the Internet. Online advertising consists of showing a few ads to a user when she accesses a web-page from a publisher’s domain. The advertising can happen in different formats such as text-ads, image-ads, video-ads, or a hybrid of them.

A key component in online advertising is a mechanism which selects and prices the set of winning ads. In this paper we study the design of mechanisms for Combinatorial Auction with Identical Items (CAII). In CAII we want to sell identical items to a group of bidders; each demand a number of items from and has a single-parameter valuation for obtaining them. Although CAII is a well-motivated model on its own, we note that a few important advertising scenarios such as image-text and video-pod auctions can be modeled by CAII. In image-text auction we want to fill an advertising box on a publisher’s web-page with either one image-ad or text-ads. We note that a large portion of Google AdSense’s revenue is from this auction. Image-text auction is a special case of CAII where participants either demand only one item (text-ads) or all items (image-ads). In video-pod auction there is an advertising break of seconds which should be filled with video-ads each with certain duration and valuation.

When designing a mechanism, typically one focusses on attaining incentive-compatibility, and maximizing social welfare and/or revenue. In a recent work, Goel and Khani [5] argue that the mechanisms for online advertising should satisfy an additional property of revenue-monotonicity. Revenue-monotonicity is a natural property which states that the revenue of a mechanism should not decrease as the number of bidders increase or if the bidders increase their bids. The motivation is that any online firm typically has a large sales team to attract more bidders on their inventory or they invest in new technologies to make bids more attractive. The typical reasoning is that more bidders (or higher bids) lead to more competition which should lead to higher prices. However, lack of revenue-monotonicity of a mechanism is conflicting with this intuitive and natural reasoning process, and can create significant confusion from a strategic decision-making point of view.

Even though Revenue Monotonicity (RM) seems very natural, we note that majority of the well-known mechanisms do not satisfy this property [11, 12, 5]. For example the famous Vickrey-Clarke-Groves (VCG) mechanism fails to satisfy RM as adding one more bidder might decreases the revenue to zero. To see this, consider two identical items to be sold to two bidders. One wants one item with a bid 2, and the other one wants both items with a bid 2. In this case the revenue of VCG mechanism is 2 (for a proof, see for instance [10, Chapter 9]). Now suppose we add one more bidder who wants one item with a bid of 2. In this case the revenue of VCG goes down to 0!

It is known that if we require mechanisms to satisfy both RM and IC, not only the mechanism cannot get the maximum social welfare but it can also not achieve Pareto-optimality in social welfare [12]. In light of this, [5] introduced the notion of Price of Revenue Monotonicity (PoRM) to capture the loss in social welfare for RM mechanisms. Here a mechanism has PoRM of if its social welfare is at least fraction of the maximum social welfare in any type profile of participants. It is shown that, under a mild condition, the PoRM of any deterministic mechanism for the CAII problem is at least , i.e., no deterministic mechanism can obtain more than fraction of the maximum social welfare [5]. In fact this impossibility result holds even for the case when participants demand either all the items or only one item. On the positive side, [5] give a deterministic mechanism with PoRM of for CAII. We note that satisfying RM is hard especially since it is an across instance constraint.

This work is motivated by the desire to design better mechanisms for CAII. However, the above impossibility result of [5] is a bottleneck towards this goal. To overcome this, in this paper, we resort to randomized mechanisms. We say a randomized mechanism satisfies RM if it satisfies RM in expectation111Since in a typical online advertising setting, there is a large number of auctions being run everyday, we get sharp concentration bounds.. Similarly, a randomized mechanism has PoRM of if its expected social welfare is not less than fraction of the maximum social welfare. We significantly improve the performance by designing a randomized mechanism with a constant PoRM. In particular, our randomized mechanism achieves a PoRM of .

Finally, we study Multi-group Combinatorial Auction with Identical Items (MCAII) that generalizes CAII. In MCAII bidders are partitioned into multiple groups and the set of winners has to be only from one group. The motivation is that the publisher sometimes require the ads to be of same format or size for a given ad slot. We design a randomized mechanism for MCAII that satisfies IC and RM with PoRM . An easy corollary of [5] gives a deterministic mechanism with a PoRM .

2 Related Works

Goel and Khani [5] show that RM is a desirable property for web-centeric companies and consider designing mechanisms which satisfy both RM and IC. They introduced the notion of PoRM and study CAII and a special case of it - namely, image-text auction. They [5] give a deterministic mechanism with PoRM of and prove that no mechanism which satisfies RM and IC can obtain PoRM of better than under the following two mild conditions. The first condition is anonymity which states that the outcome shouldn’t depend on the identities of the bidders but their type profile. The second condition is independence of irrelevant alternatives which states that decreasing the bid of any losing participant should not hurt a winning participant. Goel and Khani [5] also give a deterministic mechanism for CAII with PoRM of that satisfies IC and RM.

Rastegari et al. [12] show that for combinatorial auctions, no deterministic mechanism that satisfies RM and IC can get weak maximality. A mechanism is Weakly Maximal (WM) if it chooses an allocation which cannot be augmented to make a losing participant a winner without hurting a winning participant. Rastegari et al. [11] study randomized mechanisms for combinatorial auctions which satisfy RM and IC. Note that a simple mechanism which chooses a maximal allocation uniformly at random ignoring the valuations of bidders satisfies RM, IC, and WM. Rastegari et al. [11] add another constraint that a mechanism has to also satisfy Consumer Sovereignty (CS) which means that if a bidder increases her bid high enough, she can win her desired items. Now a new issue is that there is no randomized mechanism which satisfies RM, IC, WM, and CS [11]. In order to avoid this issue they relax CS constraint as follows. For each participant there has to be different valuations such that for , we have where is the probability of winning for participant and . Roughly speaking relaxed CS constraint means that if participant increases her bid from zero to infinity she sees at least jumps of length in her winning probability. The idea of their mechanism is that for each participant they find constant values such that regardless of valuations of the other bidders; if the bid of bidder is between and then her winning probability is at least . In order to find the constants for each participant they solve a LP whose constraints force RM, IC, Relaxed CS, and WM. As you may notice although this mechanism achieves WM, RM and relaxed CM, but can do very poorly in terms of PoRM. For example suppose you have participants and each of them wants all items. The valuation of each participant is bigger than its highest constant . In this case all the participants can win with probability at most . Now suppose that the valuation of one of the participants is infinity. She still wins with probability which shows that the PoRM of their mechanism is at least .

Dughmi et al. [4] show that VCG is revenue monotone if and only if the feasible subsets of winners form a matroid. Ausubel and Milgrom [1] show that if valuations of bidders satisfy bidder-submodularity then VCG satisfies RM. Here valuations satisfy bidders submodularity if and only if for any bidder and any two sets of bidders with we have , where is the maximum social welfare achievable using only bidders in . Note that we can restrict the set of possible allocations in a way such that bidder-submodularity holds. Then we can use VCG on this restricted set of allocations and hence achieve RM. However we can show that it is not possible to get a mechanism with PoRM better than by using the mentioned tool.

Ausubel and Milgrom [1] design a mechanism which is in the core of the exchange economy for combinatorial auctions. A mechanism is in the core if there is no subset of participants including the seller which can collude and trade among each other such that all of them benefit more than the result of the mechanism. Day and Milgrom [3] show that a core-selecting mechanism which selects an allocation that minimizes the seller’s revenue satisfies RM given bidders follow so called best-response truncation strategy. Therefore, the mechanism of [1] satisfies RM if it selects an allocation that minimizes the seller’s revenue and the participants follow best-response strategy, however, this mechanism does not satisfy IC.

Another line of related works is around characterizing incentive compatible mechanisms. The classic result of Roberts [13] tells that affine maximizers are the only social choice functions which can be implemented using mechanisms that satisfy IC when bidders have unrestricted quasi-linear valuations. Subsequent works study some restricted cases, see e.g. [14, 8, 2, 15].

There is also a large body of research around designing mechanisms with good bounds on the revenue. In the single parameter Bayesian setting Myerson [9] designs a mechanism which achieves the optimal expected revenue. [6, 7] consider optimizing revenue in prior-free settings (see e.g. [10] for a survey on this).

3 Our Results and Overview of Techniques

To give intuition about our approach, we first start with ideas that will not work but are potentially good candidates. To keep the explanation easier let us focus on deterministic mechanisms. Note that the payment of each participant in a deterministic mechanism which satisfies IC is her critical value, i.e., the minimum valuation for which she still remains a winner. Assume that all participants demand only one item. In this case we can simply give all the items to the highest bidders, which sets the critical value (the payment) of each winner to the valuation of the ()th highest bidder. If we add one more participant the valuation of the ()th highest bidder increases, therefore, the payment of each winner increases and hence the mechanism satisfies RM.

Now assume we have two types of bidders: A bidder of type A who demand all items, and a bidder of type B who demands a single item. This scenario is equivalent to the image-text auction for which there is a lower-bound of for the PoRM of deterministic mechanisms [5]. However using randomization we can simply get a PoRM of . Flip a coin and with probability half give all items to the highest type A bidder and with probability half give items to the highest bidders of type B. Here, the expected social welfare is at least half of the maximum social welfare. Note that when the coin flip selects bidders of type A the auction simply transforms to the second price auction of selling one package of items which has RM. When it selects bidders of type B the auction transforms to the case when all bidders demand one item which we explained earlier and has RM. Therefore, the expected revenue is monotone and hence the mechanism satisfies RM. Expanding the above idea we can partition the bidders into groups such that the bidders of each group has demand in . Then, we randomly select one group and choose the winners from the selected group. However, this partitioning approach does not lead to a PoRM better than .

As a second approach instead of partitioning the bidders and sort them by their valuation, we can sort them according to their Price Per Item (ppi) which is the valuation of a participant divided by the number of items she demands. Now consider a simple greedy algorithm as follows. Start from the top of the sorted list of bidders and at each step do the following. If the number of remaining items is enough to serve the current bidder give the items to the bidder and proceed; otherwise stop. Let us call the bidder at which the greedy algorithm stops the runner-up bidder. Note that the runner-up bidder has the largest ppi among the loser bidders and let be her ppi. If each of the winner participant had ppi less than then she could not win. Therefore, the critical value of each winner participant is her demand multiplied by . Although value increases if we add more bidders, the number of items sold might decrease. For example consider the case when the bidder with the highest ppi demands all items. In this scenario she wins all items and pays multiplied by the ppi of the runner-up bidder. Now if we add one more bidder whose ppi is more than the highest bidder but demands only one item; the new bidder wins and we sell only one item. This potentially decreases the revenue of the greedy mechanism.

For our mechanism we use a combination of the above ideas and an extra interesting technique. We partition the bidders into two groups: high-demand bidders who demand more than items, and low-demand bidders who demand less than or equal to items. With probability the winner is a high-demand bidder with the largest valuation. Similar to the partitioning approach the critical value of the winner is the second largest valuation of the high-demand bidders which can only increase if we add more bidders. With probability we do the following with the low-demand bidders. First we run the greedy algorithm over the low-demand bidders and find the runner-up bidder. The important observation here is that because there is no high-demand bidder, sum of winners’ demands () is larger than . Therefore we are sure that we sell at least items where the price of each item is the ppi of the runner-up bidder. Now we select each winner of the greedy algorithm with probability as the true winner of our mechanism. This random selection makes sure that the expected number of sold items is exactly . The exact number is important since the expected revenue of the mechanism is multiplied by the ppi of the runner-up bidder. Therefore as the ppi of the runner-up bidder increases if we add more bidders the expected revenue is monotone.

Now we explain ideas used to design our mechanism for MCAII. We first note that as a corollary of the result of [5], we get a deterministic mechanism with a PoRM of . In our mechanism, we assign a value to each group and use it as the criterion in order to select the winner group. Note that a simple value that can be assigned to each group is the maximum social welfare obtainable by the group. However, this way we cannot guarantee RM. Because suppose participant of group increases her bid high enough which guarantees that wins against all other groups no matter what are the valuations of the other participants of . Therefore, the critical values of the other members of decreases as increases her bid and hence can decrease the revenue of the mechanism.

We refer to our assigned value to each group as the Maximum Possible Revenue of the Group (mprg). As name mprg suggests, it shows the maximum revenue we can obtain from each group without the fear of violating RM. For each and group , let be the maximum price can be set for a single item so that we can sell at least items to low-demand bidders of group . More formally, is the maximum value where the sum of demands of low-demand bidders whose ppi is larger than in group is at least . The mprg of group is where is the highest valuation of high-demand bidders. Intuitively, mprg either sells items to high-demand bidders and obtains revenue of at most or sells items to low-demand bidders in which we can sell a number of items between and . We select a group with the highest mprg and choose the winners from this group. We are able to show that we can obtain a revenue of at least the second highest mprg. We prove that our mechanism satisfies RM by showing that the second highest mprg increases if we add more bidders.

We show that the mprg of each group is at least fraction of the maximum social welfare obtainable by the group. Therefore, as we select the winning group using the mprgs of groups, the PoRM of our mechanism is . We provide evidence that indeed the mprg of each group is the closest value to its social welfare that can be safely used for selecting the winning group without violating RM. Moreover, any randomization over the groups for selecting the winning one according to mprg cannot improve the PoRM factor.

4 Preliminary

Let assume we have a set of bidders and a set of identical items. Let type profile be a vector containing the type of each bidder which we show by . Here is pair where is the number of items she demands and shows her valuation for getting items. Here we assume the demands are publicly known because in our scenario they represent the length of video-ads stored in database while the valuations are private to bidders.

Note that having higher valuation does not necessarily mean that the bidder is more desirable to the seller as she might have a large demand. We define Price Per Item (ppi) of bidder to be which we use in our mechanism to compare bidders.

We show a randomized mechanism () by pair where shows the winning probability of bidder in type profile and is her expected payment.

We use the following Theorem in this paper frequently which is a well-known characteristic of the truthful randomized mechanisms in the single parameter model (see e.g.[10]).

Theorem 4.1

Randomized mechanism is truthful if and only if for any type profile and any bidder with type the followings hold.

-

1.

Function is weakly monotone in .

-

2.

5 Combinatorial Auction with Identical Items

We build a randomized mechanism () satisfying revenue monotonicity and incentive compatibility such that is equal to .

We call a bidder high-demand bidder if her demand is greater than otherwise we refer it as low-demand bidder. Mechanism partitions the bidders into two groups of low-demand and high-demand bidders and with probability selects the winning set from the high-demand bidders and with probability from the low-demand bidders.

We will see that mechanism favors high-demand bidders with larger valuations and favors low-demand-bidders with larger ppis while breaking the ties by the index number of the bidders.

Definition 1

We call low-demand bidder is more valuable than low-demand bidder and show it by () if . Similarly we call high-demand bidder is more valuable than high-demand bidder and show it by () if .

Let’s assume that there are low-demand bidders and high-demand bidders. By adding some dummy bidders with demand and valuation zero we assume that the sum of demands of low-demand bidders is always greater than . Without loss of generality we assume that the first bidders are low-demand bidders and for any (the ppis of the low-demand bidders decreases by their index) and the remaining bidders are high-demand-bidders while for any (the valuations of the high-demand bidders decreases by their index).

Definition 2

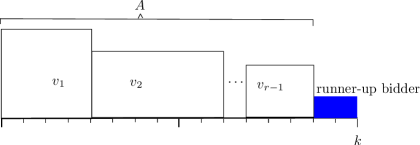

We call low-demand bidder the runner-up bidder if is the smallest value in set for which .

Later we will see that the runner-up bidder is the bidder with the largest ppi and smallest index number who has zero probability of winning. We simply refer to the runner-up bidder as .

We define to be which is the sum of demands of low-demand bidders that have ppis greater than or equal to that of and have positive probability of winning (see Fig 1).

Observation 1

We have .

Proof

Inequality is the direct result of the way we select runner-up bidder . Inequality follows from the fact that and the demand of the runner-up bidder is less than or equal to by definition of low-demand bidders. ∎

Now we are ready to precisely define how selects and charges the set of winners. With probability selects the most valuable high-demand bidder (which is the high-demand bidder with largest valuation breaking the ties by index). Therefore, the winning bidder in this case is and she pays which is the second highest valuation among high-demand bidders. Therefore her expected payment is .

If we did not select the largest high-demand bidder then mechanism uniformly at random selects the winner set from the first low-demand bidders where the probability of selecting each bidder is . In this case if bidder gets selected she has to pay . Therefore, her expected payment is since with probability we select low-demand-bidders and with probability bidder gets selected. The probability is selected in a way such that if the low-demand bidders win, the expected number of allocated items is since the sum of demands of the first low-demand bidders is and each of them gets selected with probability .

In summary the expected payments of the bidders in mechanism is the following.

| (1) |

In the following first we prove that the allocation function of is monotone and then we show that the unique expected payments of the winners calculated using Theorem 4.1 is equal to the expected payment of mechanism which proves that truthful.

Observation 2

is monotone in .

Proof

If bidder is a high-demand bidder then clearly increasing her bid just increases her chance to be the high-demand bidder with the largest valuation and hence win with probability . If bidder is a low-demand bidder then increasing her bid just increases her ppi and hence can help her to go over the ppi of the runner-up bidder and win with probability . ∎

The following lemma shows the expected payment of each winner.

Lemma 1

The truthful expected payment of bidder () calculated by Condition 2 of Theorem 4.1 is the following.

| (2) |

Proof

Remember that the first bidders are low-demand bidders which have non-decreasing ppis, is the low-demand runner-up bidder, and finally among high-demand bidders, bidder has the largest valuation and bidder has the second largest valuation.

The probability of winning for bidder when is zero since she is a high-demand bidder who either does not have the highest valuation or has the highest valuation but has larger index number (see Definition 1). Because function is monotone we conclude that is equal to zero for any . Hence by calculating the formula in Condition 2 of Theorem 4.1 we get .

We calculate the truthful expected payment of bidder by using the formula in Condition 2 of Theorem 4.1.

The first equality is Condition 2 of Theorem 4.1, the second equality follows from the fact that probability of winning for bidder () is , the third one is breaking the domain of integration, the forth and fifth equalities are followed by noting that probability of winning for bidder is zero if his valuation is less than and is if his valuation is greater than or equal to .

The probability of winning for bidder when is zero since she is a low-demand bidder which has ppi less than or equal to . Because function is monotone we conclude that is equal to zero for any . Hence by calculating the formula in Condition 2 of Theorem 4.1 we get .

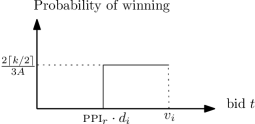

The only part remaining is to show that for using Condition 2 of Theorem 4.1. In order to calculate we consider the curve of allocation function when increases from zero to (see Fig 2).

Observation 3

For any bidder allocation function is equal to zero when and is equal to when .

Proof

Remember the runner-up bidder has the smallest index for which . Mechanism allocates all the low-demand bidders which have index less than (have ppis greater than or equal to the runner-up bidder) with probability . Therefore as far as bidder is more valuable than the runner-up bidder (see Definition 1) and wins with probability in type profile .

Now assume that and . Our objective is to show that the probability of bidder winning is zero for type profile and hence finish the proof of the observation. Note that and in the new type profile bidder has ppi less than the ppis of all bidders where since . In other words, bidder is the least valuable bidder in (see Definition 1) while . Therefore, bidder is either the runner-up bidder in or has ppi less than the runner-up bidder (see Definition 2). Hence has zero probability of winning. ∎

The following equalities shows the expected payment of bidder for .

The first equality is Condition 2 of Theorem 4.1, the second equality follows from the fact that probability of winning for bidder () is , the third one is breaking the domain of integration, the forth and fifth equalities are followed from Observation 3. ∎

Let denotes the expected revenue of mechanism in type profile . We prove the following.

| definiton of revenue | |||||

| Lemma 1 | |||||

| as | (3) | ||||

The following lemma proves that is revenue monotone.

Lemma 2

The expected revenue of mechanism does not decrease if we add one more bidder or a bidder increases her bid.

Proof

The expected revenue of mechanism is by Equation 3. Remember that is the high-demand bidder with the second highest valuation, therefore, if we add one more bidder or a bidder increases her bid this value does not decrease. On the other hand is the ppi of the runner-up bidder (see Definition 2) which is the ppi of the first low-demand bidder that crosses value (see Fig 1) where the bidders are sorted according to their ppis. The proof of the lemma follows by the fact that also does not decrease as we add one more bidder or a bidder increases her bid. ∎

In the following lemma we prove that Price of Revenue Monotoncity (PoRM) of is and finish this section.

Lemma 3

.

Proof

We prove the lemma by showing that the expected social welfare of in type profile is at least of the maximum social welfare (). Let be an arbitrary subset of bidders which VCG selects and realizes the maximum social welfare . Let be the sum of valuations of low-demand bidders in and be the sum of valuations of high-demand bidders in . Therefore, we have:

| (4) |

There can be at most one high-demand bidders in since they have demand more than . As is the high-demand bidder with the largest valuation we have the following.

| (5) |

We also have

| (6) |

since and the first bidders have larger ppis than the rest as they are sorted non-increasingly according to their ppis.

Remember that selects bidder with probability or selects each of the first low-demand bidders with probability . The following equalities finishes the proof of the lemma.

| definition of expected social welfare | ||||

| by Equation 5 and Equation 6 | ||||

| algebra | ||||

| by Equation 4 | ||||

References

- Ausubel and Milgrom [2002] Lawrence M Ausubel and Paul Milgrom. Ascending auctions with package bidding. Frontiers of Theoretical Economics, 1(1):1–42, 2002.

- Bikhchandani et al. [2006] Sushil Bikhchandani, Shurojit Chatterji, Ron Lavi, Ahuva Mu’alem, Noam Nisan, and Arunava Sen. Weak monotonicity characterizes deterministic dominant-strategy implementation. Econometrica, 74(4):1109–1132, 2006.

- Day and Milgrom [2008] Robert Day and Paul Milgrom. Core-selecting package auctions. International Journal of game Theory, 36(3-4):393–407, 2008.

- Dughmi et al. [2009] Shaddin Dughmi, Tim Roughgarden, and Mukund Sundararajan. Revenue submodularity. In Proceedings of the 10th ACM conference on Electronic commerce, pages 243–252. ACM, 2009.

- Goel and Khani [2014] Gagan Goel and Mohammad Reza Khani. Revenue monotone mechanisms for online advertising. In International World Wide Web Conference (WWW), 2014. Available online at https://www.cs.umd.edu/~khani/papers/rm.pdf.

- Goldberg et al. [2001] Andrew V Goldberg, Jason D Hartline, and Andrew Wright. Competitive auctions and digital goods. In Symposium on Discrete Algorithms, pages 735–744, 2001.

- Goldberg et al. [2006] Andrew V Goldberg, Jason D Hartline, Anna R Karlin, Michael Saks, and Andrew Wright. Competitive auctions. Games and Economic Behavior, 55(2):242–269, 2006.

- Lavi et al. [2003] Ron Lavi, Ahuva Mu’Alem, and Noam Nisan. Towards a characterization of truthful combinatorial auctions. In Foundations of Computer Science, pages 574–583, 2003.

- Myerson [1981] Roger B Myerson. Optimal auction design. Mathematics of Operations Research, 6(1):58–73, 1981.

- Nisan et al. [2007] Noam Nisan, Tim Roughgarden, Eva Tardos, and Vijay V Vazirani. Algorithmic game theory. Cambridge University Press, 2007.

- Rastegari et al. [2009] Baharak Rastegari, Anne Condon, and Kevin Leyton-Brown. Stepwise randomized combinatorial auctions achieve revenue monotonicity. In Symposium on Discrete Algorithms, pages 738–747, 2009.

- Rastegari et al. [2011] Baharak Rastegari, Anne Condon, and Kevin Leyton-Brown. Revenue monotonicity in deterministic, dominant-strategy combinatorial auctions. Artificial Intelligence, 175(2):441–456, 2011.

- Roberts [1979] Kevin Roberts. The characterization of implementable choice rules. Aggregation and Revelation of Preferences, 12(2):321–348, 1979.

- Rochet [1987] Jean-Charles Rochet. A necessary and sufficient condition for rationalizability in a quasi-linear context. Journal of Mathematical Economics, 16(2):191–200, 1987.

- Saks and Yu [2005] Michael Saks and Lan Yu. Weak monotonicity suffices for truthfulness on convex domains. In Electronic Commerce, pages 286–293, 2005.

Appendix 0.A Multigroup Combinatorial Auction with Identical Items

In this section we describe our Mechanism for Multigroup Combinatorial Auction with identical items (mmca). We prove that mmca satisfies IC and RM while has PoRM of at most .

In the following we define required notations to be used throughout this section. Let’s assume we have groups . We always show the group index of any variable within parenthesis in superscript. For group let be the type of a high-demand bidder with the highest valuation, be the types of low-demand bidders, and be the ppi of th low-demand bidder. Without loss of generality, for each group we assume that the number of low-demand bidders is larger than and . The following defines the maximum price per item with which we can sell at least items to the low-demand bidders of group .

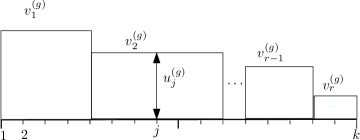

Definition 3 (th-item value)

For each we define th-item value () of group to be equal to the valuation of th low-demand bidder where is the minimum number for which is greater than or equal to (see Fig 3).

We are interested in assigning a value to each group which represents how much revenue can be obtained if we give the items to bidders of the group. Then, we give the items to bidders of a group with the highest assigned value.

Definition 1 ()

The Maximum Possible Revenue of Group () is equal to

The intuition for is the following. The value is the maximum revenue we can obtain if we sell exactly items to low-demand bidders of group , see Definition 3. Note that number is taken from the set meaning that we consider selling at most items. This is because low-demand bidders have different demands from the range , therefore, we can guarantee selling at most items without overselling the items. In fact with randomization we make sure that we sell exactly items in expectation. Finally we take the maximum of the highest valuation of high-demand bidders () and value .

The rest of this section is organized as follow. First, we describe the allocation function of mmca. Second, we use Lemma 1 to derive the expected payments of the winners which determines the revenue of mmca. Third, we show that the revenue does not decrease if we add one more bidder or a bidder increases her bid. Finally, we show that PoRM of mmca is at most .

Let be the group with highest mprg, , and be the group with the second highest mprg. Mechanism mmca selects the winners from group . Let be equal to . We think of as a reserved value such that we must obtain at least revenue from group . In the rest of this section all the discussions are about group unless mentioned otherwise, henceforth, we drop the group identifiers from variables.

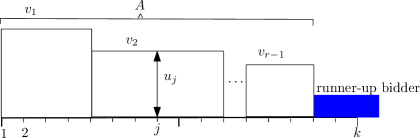

Similar to Section 4, in the following, we define runner-up bidder to be the low-demand bidder with highest ppi which cannot be a winner if we sort bidders by their ppis (see Fig 4).

Definition 4 (runner-up bidder)

We call low-demand bidder the runner-up bidder if is the smallest number in set for which

Remember that is equal to the second largest mprg of groups, is the largest valuation of high-demand bidders of the winning group , and is largest price of an item for which we can sell at least items to low-demand bidders of (see Definition 3). Note that as of is larger than we have either: (1) or (2) .

Case (1) is easy, if then the set of winners contains only a high-demand bidder with valuation breaking the ties arbitrarily. In Case(2) let be the largest number from such that . If is less than then the set of winners is all low-demand bidders whose ppi is greater than or equal to . Otherwise if is equal to then we need to include all the low-demand bidders whose ppi is larger than or equal to since, roughly speaking, their ppi is high enough to win against both high-demand bidders and the group with second highest mprg. Note that the sum of demands of such bidders might exceed , therefore, we need randomization to guarantee selling exactly items in expectation.

Definition 5 ( and )

If , we define to be the largest number in such that , i.e., number is the smallest index in the set of all low-demand bidders that have index greater than the runner-up bidder and have ppi larger than or equal to . We also define number to be the sum of demands of the first low-demand bidders, i.e., .

Now we are ready to formally define the allocation function of mmca.

Definition 6 (Allocation Function of mmca)

-

1.

If then the set of winners contains only a high-demand bidder with valuation breaking the ties arbitrarily.

-

2.

If is less than then the set of winners is all low-demand bidders whose ppi is greater than or equal to .

-

3.

If is equal to then each of the first low-demand bidder wins with probability independently.

In the following lemma we calculate the critical values of winners using Theorem 4.1.

Lemma 4

The critical values of winners are the following considering different conditions of Definition 6.

-

1.

If Condition 1 happens then the critical value of the winner is where is the second highest valuation of high-demand bidders.

-

2.

If Condition 2 happens then the critical value of each winner is .

-

3.

If Condition 3 happens then the critical value of each winner is .

Proof

We consider all the three conditions separately.

Condition 1: We show that if the valuation of the winner goes below then player cannot be a winner. If the value of is equal to then decreasing to a value less than causes a group with the second highest mprg win and hence changes player to a loser participant. If it is equal to then decreasing to a value less than causes low-demand bidders win and hence changes player to a loser participant. If it is equal to then decreasing to a value less than causes the high-demand bidder with valuation win and hence changes player to a loser participant.

Condition 2: Remember that is the largest number from such that . Therefore if the valuation of any winner goes below then there exist no in such that is larger than . Hence the winning set changes to either another group if or to high-demand bidders if .

Condition 3: In this case we show that if the valuation of winner goes below then she has zero probability of winning and if it is larger than or equal to then she has probability of winning. If the valuation of is more than then by the way we define the allocation function (see Definition 6) he has probability of winning otherwise her ppi is less than . If ppi of is less than (the ppi of the runner-up bidder) then she cannot be a winner since the sum of demands of participants who have higher ppi than her is larger than . If ppi of is less than then she cannot win because of the way we select winners in the allocation function (Condition 3 of Definition 6). ∎

Now we prove that mmca satisfies RM.

Lemma 5

If we add one more bidder or a bidder increases her bid the revenue of mmca does not decrease.

Proof

Let be the new participant or the participant who has increased her bid. Let be the type profile before adding and be the type profile after adding . We need to prove that . First we prove that the revenue of mmca is between the mprg of the highest group and the second highest group.

Observation 4

We have .

Proof

If Condition 1 of Definition 6 happens then the revenue of mmca is by Lemma 4. Note that in this case the revenue is less than and more than and hence the proof of the observation follows.

If Condition 2 of Definition 6 happens then the revenue of mmca is by Lemma 4 since we sell items. Note that in this case the revenue is less than and more than and hence the proof of the observation follows.

If Condition 3 of Definition 6 happens then the revenue of mmca is by Lemma 4 since we sell items in expectation. Note that in this case the revenue is less than and more than and hence the proof of the observation follows. ∎

By Observation 4 we know that the revenue of mmca is between mprg of the highest group and mprg of the second highest group. Therefore if we add participant and the group with highest mprg changes then it means that the revenue in is now and hence increases.

Now we assume that after adding the winning group does not change. Here we can check all the three cases that can happen in allocation function of mmca (Definition 6) for new type profile and see that adding can only increase the revenue. ∎

Now we prove that PoRM of mmca is at most .

Lemma 6

Proof

First we show that for any group mprg of is at least fraction of the maximum social welfare obtainable by group .

Observation 5

For any group we have .

Proof

Let set contain bidders of which obtain the maximum social welfare and be equal to . Note that set can contain at most one high-demand bidder since their demand is larger than . Moreover, the valuation of high-demand bidder of cannot be more than because otherwise mprg of will be larger than . Therefore the total social welfare of from high-demand bidders is at most .

Now let us sort the low-demand bidders of by their ppi and define value to be the maximum price per item with which we can sell at least items to the low-demand bidders of , similar to Definition 3. Note that for any we have because otherwise mprg of will be larger than . Moreover for any we have because we sort by ppi. Therefore the social welfare of from low-demand bidders is at most which is at most .

Set can get social welfare of at most from the high-demand bidders and from low-demand bidders, therefore, the proof of the observation follows. ∎

Note that by the way we define the allocation function of mmca it always selects a set of winners such that their expected social welfare is at least the mprg of the winning group, see Definition 6. Since mmca selects a group with the highest mprg as the winning group by Observation 5 we know that the maximum social welfare cannot be more than times the highest mprg and hence the proof of the lemma follows. ∎

Now we provide evidence that no randomized algorithm can obtain PoRM better than . Note that an optimum randomized mechanism () has to first give a probability distribution to groups and pick the winning group according to that distribution. Let’s assume be the function which maps each group to its probability of winning. Now we argue that cannot be dependent to the social welfare of otherwise will not satisfy RM. Because, in this case a bidder can increase her bid high enough so that probability goes to its upper-limit which decrease the critical value of the other bidders and hence break RM. We further argue that should be dependent to one factor of each group which is the same across the group. For example if it is dependent to two factors then increasing the first factor might remove the load from the second factor and hence the second factor is free to go down without changing the probability. If is dependent to only one factor then the best way to make it as close as possible to social welfare is to define (see Definition 3) for each group similar to our mprg value assigned to each group. Therefore, we have evidence that function can be dependent to a value which can be off from social welfare by factor .

Now consider the simple case of image-text auction where we have two groups: text-ads and image-ads. We want to assign the winning probabilities to each group. Now suppose we are given two values for image-ads and for text-ads, and also we know that social welfare of text-ads is either or . If we pick each group with probability and , the expected social welfare is approximation to its max value. The question is can we do better by having a more clever randomization.

We prove that no other randomization can give us a factor better than . Suppose the value of is equal to and the value of is equal to where the social welfare of text-ads can be . Now suppose gives the items to image-ads with probability and to text-ads with probability . If the social welfare of text-ads is , we get PoRM of and if the social welfare of text-ads is , we get PoRM of . If we want to maximize the minimum of the two PoRMs we have to set to which gives PoRM of . Note that if the number of groups increases to then this factor changes to , therefore, the best way is to give probability one to the group with the best assigned value and lose factor .