Business cycle synchronization within the European Union:

A wavelet cohesion approach111We gratefully acknowledge the financial support from the GAUK, No. 366015 and 588314. This article is part of a research initiative launched by the Leibniz Community. The authors are also grateful for funding of part of this research from the European Union Seventh Framework Programme (FP7/2007-2013) under grant agreement No. 619255. Support from the Czech Science Foundation under the P402/12/G097 (DYME - Dynamic Models in Economics) project is also gratefully acknowledged. We would like to thank Mr. Gilles Doufrenot for helpful comments at the 2nd International Workshop on ”Financial Markets and Nonlinear Dynamics” in Paris.

Abstract

In this paper, we map the process of business cycle synchronization across the European Union. We study this synchronization by applying wavelet techniques, particularly the cohesion measure with time-varying weights. This novel approach allows us to study the dynamic relationship among selected countries from a different perspective than the usual time-domain models. Analyzing monthly data from 1990 to 2014, we show an increasing co-movement of the Visegrad countries with the European Union after the countries began preparing for the accession to the European Union. With particular focus on the Visegrad countries we show that participation in a currency union possibly increases the co-movement. Furthermore, we find a high degree of synchronization in long-term horizons by analyzing the Visegrad Four and Southern European countries’ synchronization with the core countries of the European Union.

keywords:

business cycle synchronization , integration , time-frequency , wavelets , co-movement , Visegrad Four , European UnionJEL: E32, C40, F15

1 Introduction

One of the most challenging tasks in economics is to identify, understand, and disentangle the factors and mechanisms that impact the dynamics of macroeconomic variables. Many quantitative econometric techniques have been developed to study the regular fluctuations of macroeconomic indicators and business cycles, e.g., Baxter and King (1999); Hodrick and Prescott (1981); Harding and Pagan (2002). This article investigates business cycle synchronization over different time horizons. In order to disentangle the desired information, we apply wavelet methodology working in a time-frequency space. The analysis considers the case of the Visegrad Four, both in terms of the interior relationships among its constituent countries and in terms of the relationships established within the framework of the European Union (EU).

It has been more than two decades since the break-up of the Eastern Bloc;222The Eastern Bloc was generally formed of the countries of the Warsaw Pact (as Central and Eastern European countries) and the Soviet Union. following its disintegration, these countries began their independent economic and political journeys. While undertaking their economic transformations during this time, the Czech Republic, Hungary, Poland, and Slovakia began discussing mutual cooperation. Despite their originally different levels of economic maturity and development, their willingness and regional proximity led them to establish the Visegrad Four in 1991. One of the chief aims of this group was to help its members to organize their institutions for faster convergence with and integration into the European Union.333The Visegrad countries also joined the North Atlantic Treaty Organization in 1999 and applied for membership in the European Union in 1995-1996. In 2004, these four countries became members of the EU, which obliges them to adopt the Euro currency as part of the integration process. One of the concerns of successful integration into the European Economic and Monetary Union (EMU) is business cycle synchronization, which is motivated by the theory of Optimum Currency Area (OCA) (Mundell, 1961). A country joining the OCA gives up its individual monetary policy, which requires a level of integration of macroeconomic variables and policies and affects the costs and benefits enjoyed by the nations (De Haan et al., 2008). The common currency can be beneficial for both new and former countries in terms of trade transaction costs. Otherwise, at the European level, the European Central Bank controls those policies that apply to all member states, which may be counter-cyclical for countries with low business cycle synchronization (Kolasa, 2013). On one hand, these policies may create difficulties for those countries. On the other hand, countries with low levels of synchronization may benefit from being members of the OCA because the business cycle synchronization appears as an endogenous criterion. This endogeneity of OCA means that forming a monetary union will make its members more synchronized (Frankel and Rose, 1998).444The literature focusing on the evolution and determinants of business cycle synchronization between Central and Eastern European (CEE) countries and the EU is extensive, e.g., Darvas and Szapáry (2008); Artis et al. (2004); Backus et al. (1992).

The literature regarding EU integration – and particularly that focusing on the economic integration of the CEE countries – has grown rapidly. Fidrmuc and Korhonen (2006) conduct a meta-analysis of 35 studies involving the synchronization of the EU and CEE countries and find a high level of synchronization between new member states and the EU. However, only Hungary and Poland among the Visegrad countries reached high synchronization. Artis et al. (2004) and Darvas and Szapáry (2008) obtained the same results studying correlations between the business cycles of the EU and Hungary and Poland. In another model, Jagrič (2002) also implies that the economic co-movement of Hungary and Poland is high. Analogously, Bruzda (2011) shows that Poland’s economic synchronization with the EU rises when intra-EU synchronization is stable. Recently, Aguiar-Conraria and Soares (2011a) examine the industrial production index of Euro-12 countries555These group consists of Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, and Spain. We analyze this group and the Visegrad countries. and analyze business cycle synchronizations within the EU framework, while taking into account the distances among regions. These authors show that countries that are closer to one another show higher synchronization. Moreover, the transition countries show high similarity with the EU after 2005. Nevertheless, Slovakia, a member of the euro area, shows little significant cohesion with the EU. With respect to Hungary and the Czech Republic, their business cycles co-move with the EU-12 after 2005. Jiménez-Rodríguez et al. (2013) also find high correlations of CEE countries (except for the Czech Republic) with the EU business cycle. However, contrary to this result, they find that these countries exhibit a lower level of concordance when a factor model is employed. Crespo-Cuaresma and Fernández-Amador (2013) look at second moments of business cycles in the EU and they report a significant convergence since 90s. Furher, they show there is no decrease in the optimality of the currency area after the EU enlargements.

To assess the degree of similarity or synchronization, researchers have searched for appropriate tools to capture the relevant information. One of the most popular tools is the Pearson correlation coefficient, which simply measures the degree of co-movement in a time domain. However, market-based economies are structured over different time horizons. For this reason, researchers began surveying the behavior of such systems at different frequencies corresponding to different time horizons, and the interest in frequency domain measures has grown. Christiano and Fitzgerald (2003) proposed a model based on a band pass filter that allowed that desired frequencies of time series to be filtered.666Lamo et al. (2013) offer a short presentation of a filtering methodology applied to the business cycles in the euro area. Further, Croux et al. (2001) presented a measure of co-movement, the dynamic correlation, based on a spectral analysis, that equals to basic correlation on a band pass filtered time series. Nevertheless, both the time (static) Pearson correlation and the spectral domain dynamic correlation have several caveats. The first loses information about frequency horizons and the latter omits the co-movement dependence in time. The wavelet analysis overcomes such limitations due to its operation in both time and frequency domains (Torrence and Compo, 1998). Over the past two decades, wavelet applications have been supported by its another advantage, which is the localization of the wavelet basis function in time and its bounded support; hence, the analysis is free from the assumption of covariance-stationarity, from which many filtering methods suffer (Raihan et al., 2005). The literature presents many studies that successfully used wavelets that do not necessitate stationary time series, e.g., Aguiar-Conraria et al. (2008) analysing the evolution of monetary policy in the US, Vacha and Barunik (2012) studying energy markets relationships, and Yogo (2008) using wavelet analysis to determine peaks and valleys of business cycles that correspond to the definition of the National Bureau of Economic Research. Recently, Crowley and Hallett (2015) have used wavelet techniques to disentangle the relationship of the real GDP growth at different frequencies.

To capture the co-movement of two or more time series, we use several wavelet measures that overcome the above mentioned caveats and obtain the desired information about time series relationships. For the bivariate analysis, we employ the wavelet coherence described in Torrence and Compo (1998) and Grinsted et al. (2004). Further, while studying the multiple relationships of several time series, we begin with the bivariate measure proposed by Rua (2010). As Croux et al. (2001) transforms the dynamic correlation to the multivariate measure of cohesion, Rua and Silva Lopes (2012) extends the wavelet quantity of Rua (2010) to the multivariate case of weighted cohesion. The multivariate case relies on the bivariate measure multiplied by fixed weights that represent a share of the value of each pair among all time series. However, to reflect the dynamics and development of economies, we believe that weights may change over time and should not be rigid. Taking that into account, we propose a new approach considering that the weights in the cohesion measure have a time-varying structure. In emerging or developing countries higher growth has been observed and they may converge faster and get closer to developed countries; hence, the ratio of each pair significantly changes over time as countries evolve.

Using state of the art wavelet methods, we find different levels of co-movement between Visegrad countries and the EU during the 1990-2014 period. The Visegrad countries show strong co-movement with respect to long-term business cycles. The pairwise synchronization of Visegrad countries with Germany appears to be significant for long-term business cycles from 2000 onward. The measure of multivariate co-movement confirms that the Visegrad countries are well-synchronized for business cycles periods of 2-4 years. Similarly, we observe higher cohesion for the 16 European countries for those periods, which becomes stronger after 2000. All countries together show no considerable relationship for periods up to 1 year, which may reflect some short-term policy heterogeneity.

The contribution of this paper is twofold: we propose the novel measure of cohesion with time-varying weights and we have conducted an empirical analysis regarding the Visegrad Four within the framework of the European Union during the past 2 decades. The remainder of the paper is structured as follows. Section 2 describes wavelet methodology and introduces the cohesion measure with time-varying weights. Section 3 provides the data description. In section 4, we analyze the results. Finally, Section 5 concludes.

2 Methodology

2.1 Wavelet analysis

Our analysis aims to address the behavior of the dynamics of a time series at different time horizons. The Fourier analysis is convenient for observing relations at different frequencies, but it requires time series to be stationary and comes at the cost of losing some information of the time series when differencing, for instance. Many economic time series might be locally stationary or non-stationary. In other words, using the Fourier transform (FT) makes the analysis time-invariant and not suitable to provide information about the dynamics of a process. For this reason, Gabor (1946) developed the short-time Fourier transform (or windowed FT), which is based on applying the Fourier transform on a shorter part of the process. Nonetheless, this approach has shortcomings that arise with fixed time and frequency resolution, and it is impossible to change the resolution at different frequencies. A series of lower or higher frequencies needs lower or higher time resolution, respectively (Gallegati, 2008). As the window width is constant, the resolution is limited, especially for low frequencies.

The wavelet transform has been developed to find a better balance between time and frequency resolutions. The wavelet functions used for the decomposition are narrow or wide when we analyze high or low frequencies, respectively (Daubechies, 1992). Thus, a wavelet analysis is suitable to research different types of processes using optimal time-frequency resolution in great detail (Cazelles et al., 2008).777It is possible to use methods of evolutionary spectra of non-stationary time series developed by Priestley (1965). However, to run a spectrum over time at different frequencies, larger data are required in order to obtain the same quality time resolution as that obtained using wavelet techniques. And while we study short-term fluctuations (such as 2-4 months), we would not obtain such localized information because of the number of necessary observations to start with. The wavelet analysis is also able to work properly with locally stationary time series (Nason et al., 2000; Crowley, 2007).

The wavelet transform decomposes a time series using functions called mother wavelets that are functions of translation (time) and dilation (scale) parameters, and , respectively. In many applications, it is sufficient that the mother wavelet has zero mean, , and that the function has a sufficient decay. These two properties cause the function to behave like a wave. Further, the elementary functions called daughter wavelets resulting from a mother wavelet are defined as

| (1) |

The continuous wavelet transform (CWT) of a process, , with respect to the wavelet ,888For more details regarding the conditions that a mother wavelet must fulfill, see, e.g., Mallat (1999) or Daubechies (1992). is defined as a convolution of the given process and the family ,

| (2) |

where denotes the complex conjugate. As several wavelet functions are available for CWT, in our analysis we use the Morlet wavelet as the mother wavelet. Use of this wavelet is common in the literature due to its well-localized properties in time and frequency (Aguiar-Conraria and Soares, 2011b; Cazelles et al., 2008). The Morlet wavelet is complex, with a real and an imaginary part, which allows us to perform the phase difference analysis. The simple definition of the Morlet wavelet is

| (3) |

For a complex function with a Gaussian envelope, the Morlet wavelet’s parameter (wavenumber) is set equal to 6. With this parameter, we find that a relation between wavelet scales and frequencies is inverse, . This simplifies further interpretation of the results (Grinsted et al., 2004; Torrence and Compo, 1998).

A convenient property of the wavelet transform is that one can reconstruct the original time series back from the wavelet transform,

| (4) |

where comes from the admissibility condition that allows the reconstruction, , where is the Fourier transform of .

Defining the single wavelet power spectrum, , given the wavelet transform, we obtain the measure of the energy of the time series. For a given two time series, and , the cross-wavelet transform is defined as the product of their transforms , where denotes the complex conjugate.

2.2 Wavelet coherence and phase difference

In our application, we use the wavelet coherence to quantify the pairwise relationship of two time series. This coherence in the Fourier analysis is defined as a measure of the correlation between the spectra of two time series (Cazelles et al., 2008). The coherence derives from the definition of the coherence as its power of two. With two time series, and , the wavelet coherence that measures their relationship is defined as (Liu, 1994):

| (5) |

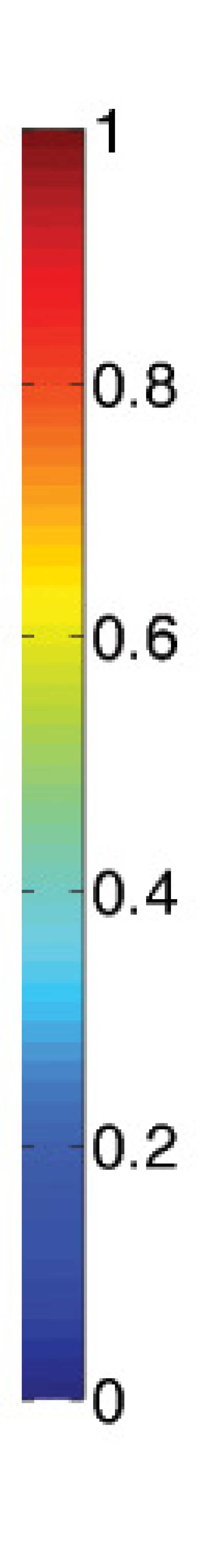

Given that the coherence is as complex a measure as the wavelet powers are, we preferably use the squared wavelet coherence to measure co-movement between two time series, which is given by:

| (6) |

where is a smoothing function as (Grinsted et al., 2004).999We use the package developed by Grinsted et al. (2004) to compute the coherence. For further details, please consult Grinsted et al. (2004). We smooth the coherence through convolution in both time and frequency domains.

Since the wavelet coherence does not have a theoretical distribution, the testing procedure uses Monte Carlo methods to obtain its significance. We follow Torrence and Compo (1998) to assess the statistical significance, which is depicted in figures as a black contour and the level of significance is 5%.

As we work with a finite-length time series and a Fourier transform assumes cyclical data, we would obtain a wavelet power spectrum containing errors at the beginning and end of the analyzed periods. One solution to these edge effects is to pad both ends of the time series with a sufficient number of zeros. The area affected by zero-padding is called the cone of influence (COI). We indicate the COI in figures as a shaded area having -folding shape.101010We use the Morlet wavelet, and the COI is thus -folding. For more details, consult Cazelles et al. (2008); Torrence and Compo (1998).

Moreover, from the cross wavelet transform of two time series, the phase difference provides information regarding the relative position of the two series. The phase difference defined in has the form:

| (7) |

where and are the imaginary and real parts of a cross wavelet transform, respectively. The two time series are positively correlated if , otherwise the correlation is negative. Moreover, the first variable, , leads the second, , if the phase is in and ; when in and , the second variable is leading.

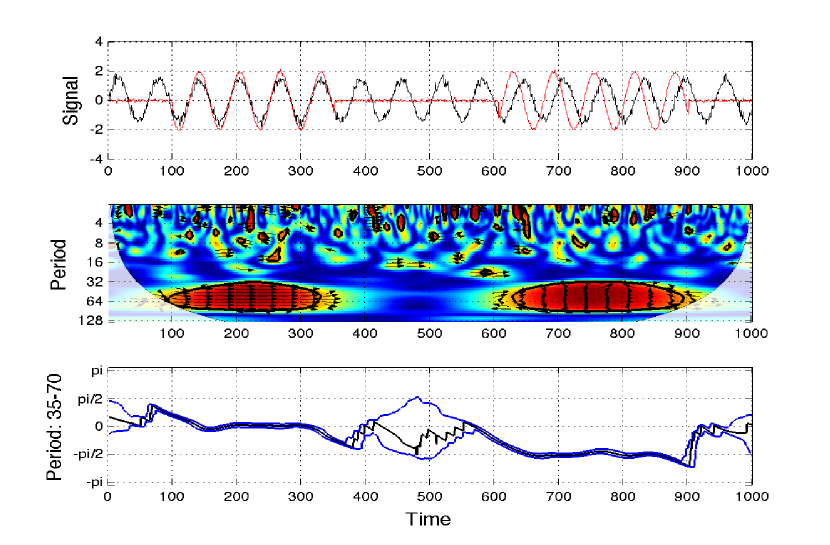

The assessment of statistical significance is always critical. According to Cazelles et al. (2008), bootstrap methods are used to provide the significance of the power spectrum and the cross-spectrum. Those methods are also used for wavelet coherence. However, testing the significance of the phase difference is difficult because there is no “preferred” value because the phase may be distributed on the interval of . Aguiar-Conraria and Soares (2014) indicate that there are no good statistical tests for the phase difference. They conclude with the support of Ge (2008) that the significance of a phase should be connected with the significance of the power spectrum or coherence. To obtain the confidence intervals, we use classical bootstrap techniques.111111We add 5% noise to each analyzed series. We do the wavelet analysis 1,000 times in a Monte Carlo study, then we sort the results and determine the 95% confidence interval of the phase difference. We show the coherence and phase difference of two artificial time series:

| (8) |

| (9) |

We observe that when the coherence is high and significant, the confidence interval of the phase difference is narrow, see Fig. 1. By contrast, for observations around 400-600, we have the sine function with high amplitude and a very noisy time series, which does not resemble the sine in this scale. The phase difference of these two is unstable and the confidence interval at some points covers the interval . This does not provide relevant information about the phase of the two time series.

In order to capture also the negative correlation, Rua (2010) proposes co-movement measure defined as a real number on [-1,1]. It is based on wavelet coherency (Eq. 5), but in the nominator only the real part of a wavelet cross-spectra is used. The measure is given by

| (10) |

where is the real part of the cross-wavelet spectrum of two time series and has the squared root of two power spectra of the given time series in the denominator. Using this measure, Rua and Silva Lopes (2012) developed a wavelet-based measure of cohesion in the time-frequency.

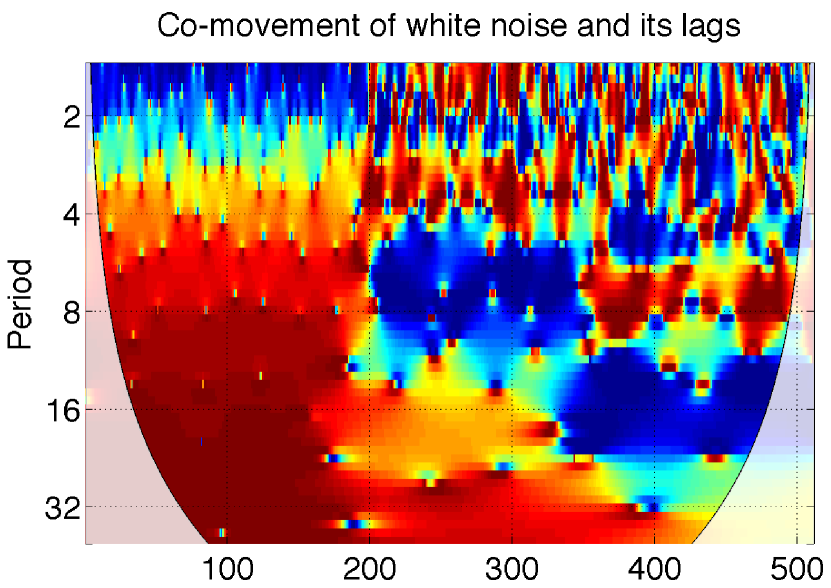

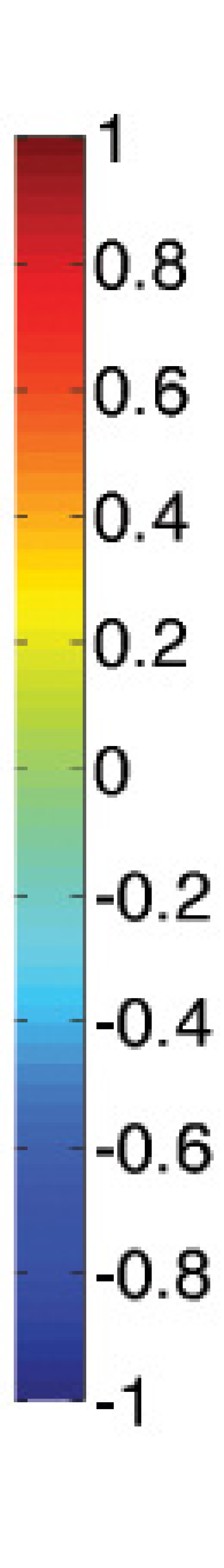

We demonstrate usefulness of the real wavelet-based measure (Eq. 10) that captures the dynamics in time-frequency of two artificial time series in two particular cases. We show the cohesion with constant weights of white noise, and its lagged values, , , and . For the first 200 observations in Fig. 3, we see the negative correlation equal to minus one in the shortest period, which changes to a positive correlation equal to one in the long-term. If we averaged this part of Fig. 3 over time, the obtained result would be same as the dynamic correlation of Croux et al. (2001).121212The correlation follows a curve from at zero frequency to at frequency equals . In the second part of Fig. 3, the series have more lags, and , whose relationship is negative with the original at longer horizons, which demonstrates the possibility of the well-localized information in the time-frequency plane. In Fig. 3, we plot the dynamic correlation of the white noise with its cumulative sum. Contrary to Fig. 3 for lagged noises, these two series are positively correlated in the short-term and not-correlated in the long-term.

2.3 Wavelet cohesion with time-varying weights

Many co-movement measures from the time or frequency domain rely on the bivariate correlation. Croux et al. (2001) propose a powerful tool for studying the relationship of multiple time series. This measure uses the dynamic pairwise correlation and composes a new measure of cohesion over the frequencies. Let be a multiple time series for , then the cohesion measure in the frequency domain is

| (11) |

where is the frequency, , is the weight associated with time series , and .

In the same manner as Croux et al. (2001) define dynamic correlation in the frequency domain, Rua and Silva Lopes (2012) take the advantage of the wavelet-based quantity (Eq. 10) and define the multivariate weighted measure of cohesion in the time-frequency space. The cohesion is a weighted average, where the weights, , are attached to the pair of series, , e.g., for two series we have two weights inversely related. The cohesion exists on the interval of and we have

| (12) |

Measuring co-movement of multiple time series, the cohesion uncovers important information about common dynamics. However, the fixed weights, e.g., population at some time , do not consider that data used for weights may also vary over time. Because the developing or emerging countries may have different speed of development, then the importance of allowing the time-variation of weights appears relevant.

We propose a new approach to map a dynamic multivariate relationship using the time-varying weights in the cohesion measure, which is based on Rua and Silva Lopes (2012):

| (13) |

where is the weight attached to the pair of time series at given time . Cohesion allows for the use of different types of weights. For example, using GDP as a weight representing the size of an economy, a country with smaller or larger GDP can have smaller or larger effect on a co-movement than other countries, and in the cohesion, this may lead to a greater dissimilarity of co-movement within the group.

3 Data

To study business cycle synchronization, we use data of the Index of Industrial Production (IIP) from the database of the Main macroeconomic indicators (OECD, 2015).131313Obtained via Federal Reserve Economic Data, https://research.stlouisfed.org/fred2/ Fidrmuc and Korhonen (2006) cite many studies where the IIP is broadly used in studying business cycle synchronization. The dataset period spans from January 1990 to December 2014 with seasonally adjusted time series. The dataset includes monthly data of 16 EU countries, of which 13 are EMU members (Austria, Belgium, Germany, Greece, Finland, France, Ireland, Italy, Luxembourg, Netherlands, Portugal, Slovakia, Spain) and 3 countries are not (Czech Republic, Hungary, Poland). In the multivariate analysis, we divide the countries into three groups: EU core, Visegrad Four (V4), and PIIGS. Five countries form the PIIGS group: four from Southern Europe (Portugal, Italy, Greece, and Spain) and Ireland. As the EU core, we take Belgium, Germany, Finland, France, Luxembourg, and Netherlands.

For all countries, we also use the data of the Gross Domestic Product (GDP) in current prices (Statistical Office of the European Communities, 2016)141414Obtained via EUROSTAT, http://ec.europa.eu/eurostat/web/products-datasets/-/namq_10_gdp, Jan 18, 2016. and GDP at power purchasing parity (PPP) per capita (World Bank, 2016)151515Obtained via The World Bank http://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD, Jan 13, 2016. to weight the industrial production in the multivariate analysis. The wavelet analysis is data demanding, to cover a longer period, we take an advantage of the IIP data that is on monthly basis to represent the economic activity. And while weighting the IIP in the multivariate analysis, we have the GDP data on quarterly basis (GDP in current prices) and on yearly basis (GDP at PPP per capita). This lower frequency samplings are sufficient to have a pronounced impact through time-varying weights at (longer) business cycle frequencies. Our interest is in co-movements longer than a quarter, thus, the quarterly or yearly based weights are acceptable.

4 Results

4.1 Bivariate synchronization of the Visegrad countries and the EU

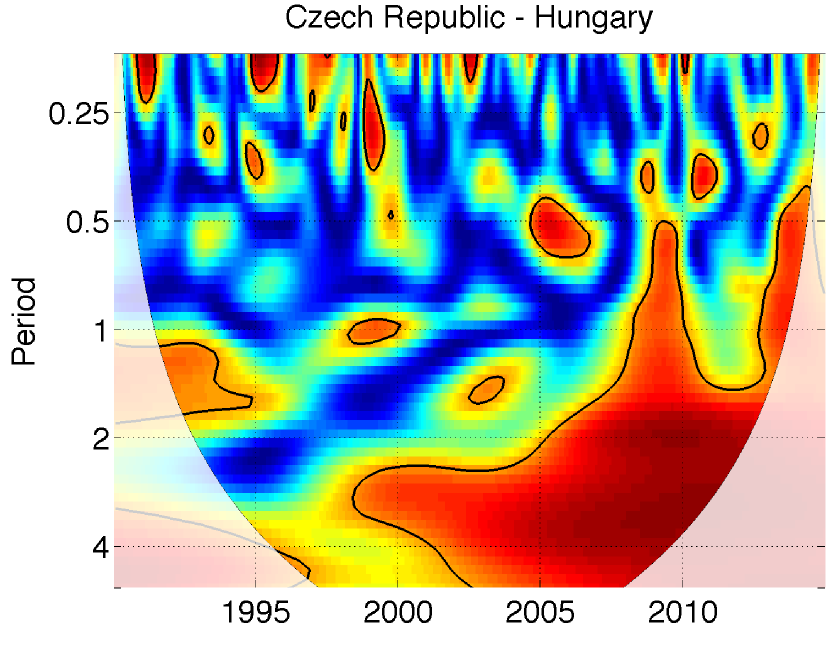

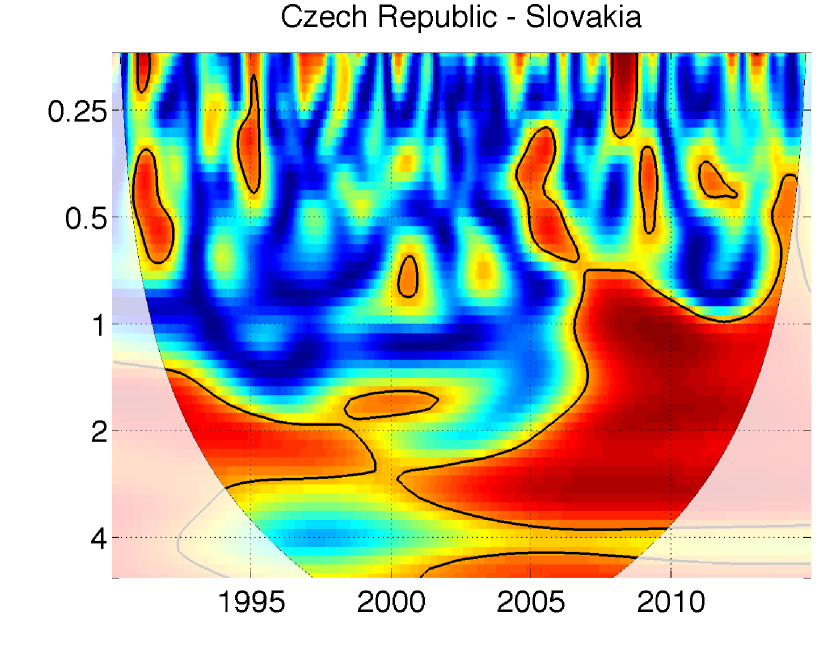

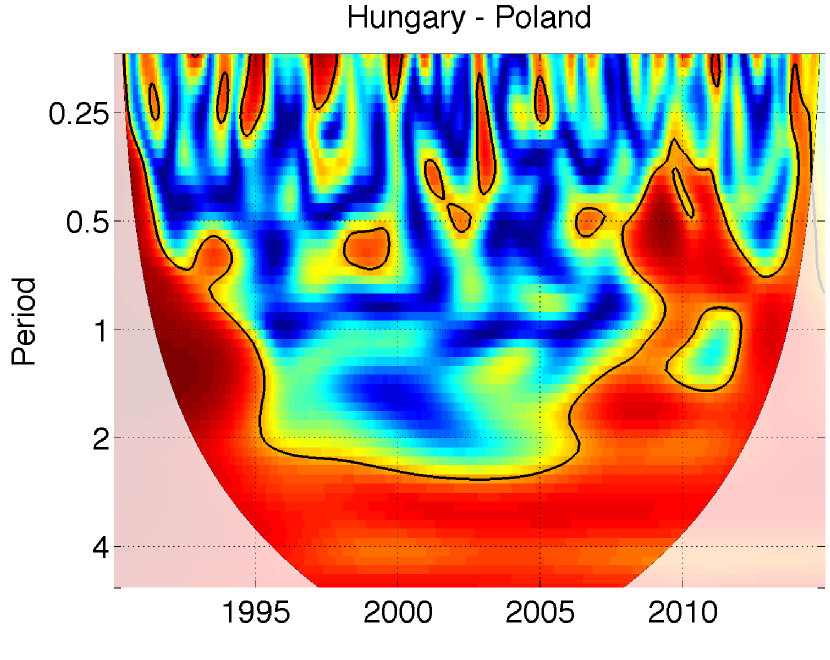

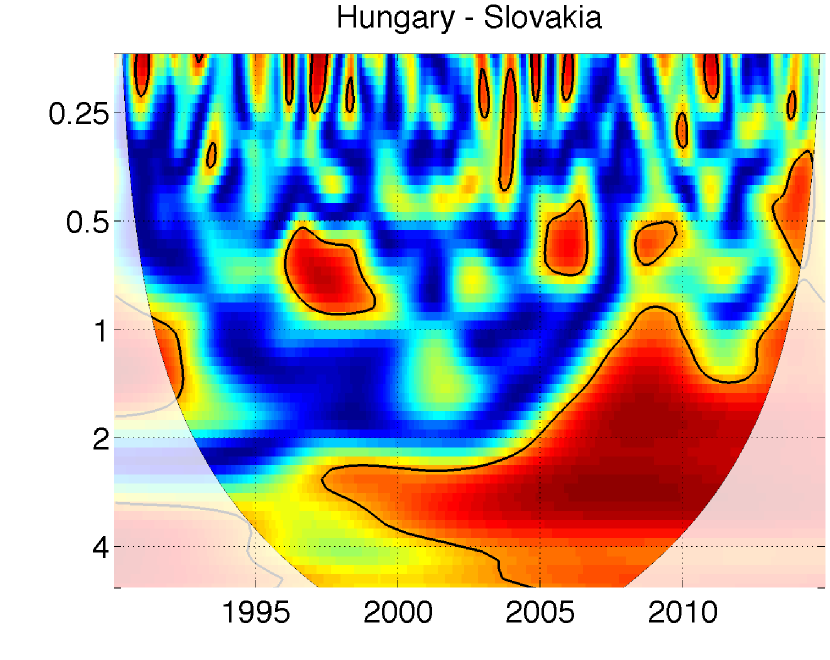

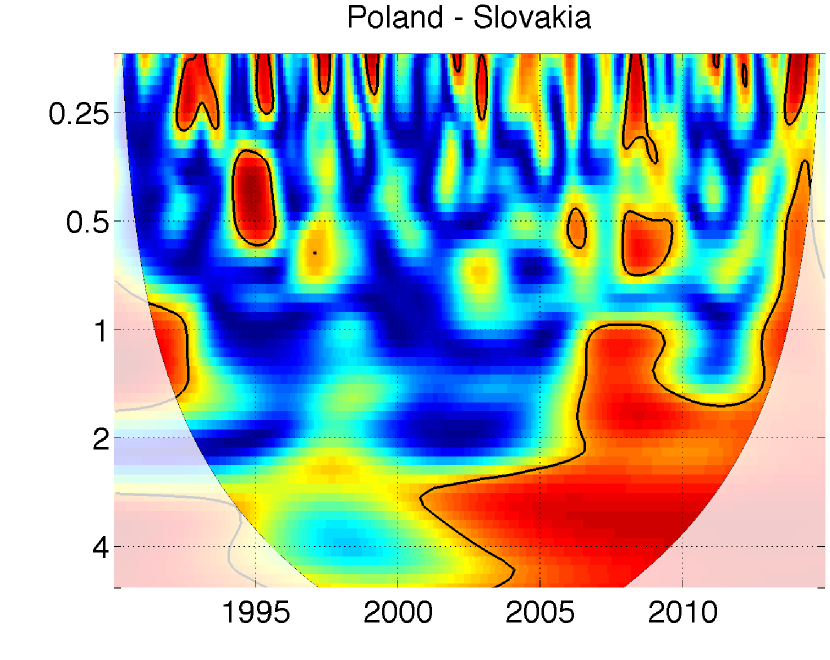

At first, we analyze the business cycles of the V4 on an intra-group basis to disclose similarities in their pairwise co-movements and the development of particular relationships within the group. The V4’s cooperation began in the early 90s, and the countries share higher coherence at the beginning of the transition for 1-2 year period161616In the text, we use notions as ”1-2 year period”, which correspond business cycles at this frequency (period length), thus 1-2 year business cycle. during 3-4 years, see Fig. 4. Another common feature among the V4 countries is a weak relationship of all pairs at short-term business cycles, from 2 months to 1 year during whole 25 years. Only Hungary and Poland co-move significantly around 2010 for periods shorter than one year. The important result is that all pairs show a high degree of synchronization over the 2-4 year period beginning around 1998 for Hungary with Slovakia, 1999 for the Czech Republic with both Poland and Hungary, and 2000 for Poland with Slovakia. In addition, the Czech Republic and Slovakia have been synchronized over a 2-year business cycle period through the whole sample period with a small decrease around 2000. Hungary and Poland show a high degree of synchronization at all business cycle frequencies, 2-5 years. Their co-movement covers the largest part of the frequency spectrum at the beginning of the transition period and during the last 5 years.

We find a short time of higher synchronization for the first 3-5 years in 1-2 year periods. However, we see that all countries have almost zero co-movement around 1995, except for Hungary and Poland. This low degree of similarity may be caused by Slovakia’s cold-shouldered participation in the political discussions during 1993-1997 that translated into the business cycles with a delay. Another possible explanation relevant for all countries can be that after a few years of formally intensive cooperation the monetary and fiscal policies started diverging. For example, during the late 1990s, the Czech Republic went through difficult stabilization years (Antal et al., 2008). These diverging economic situations might cause some asynchrony in business cycle behavior over both the short- and long-terms. This long-term low synchronization may also come from the low level of convergence of other macroeconomic variables (Kutan and Yigit, 2004).

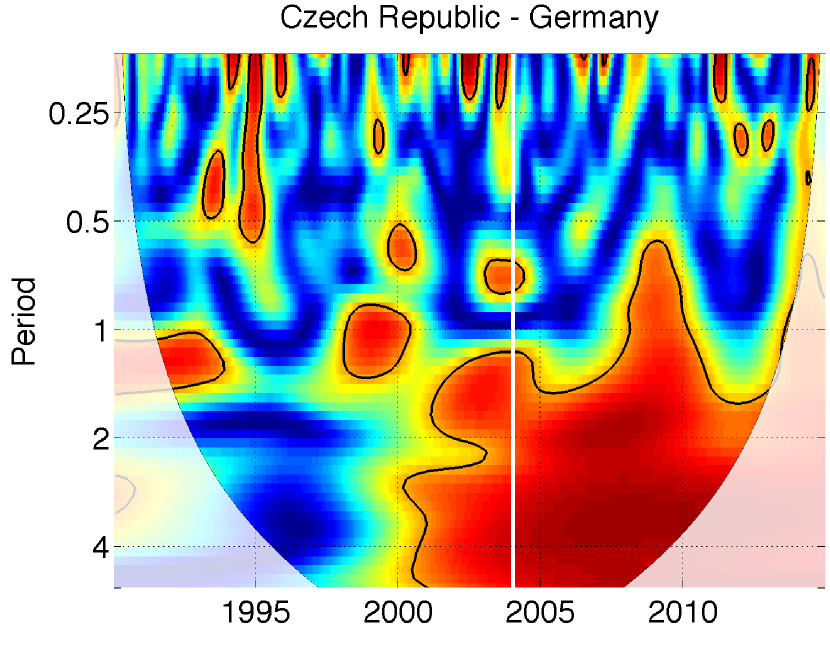

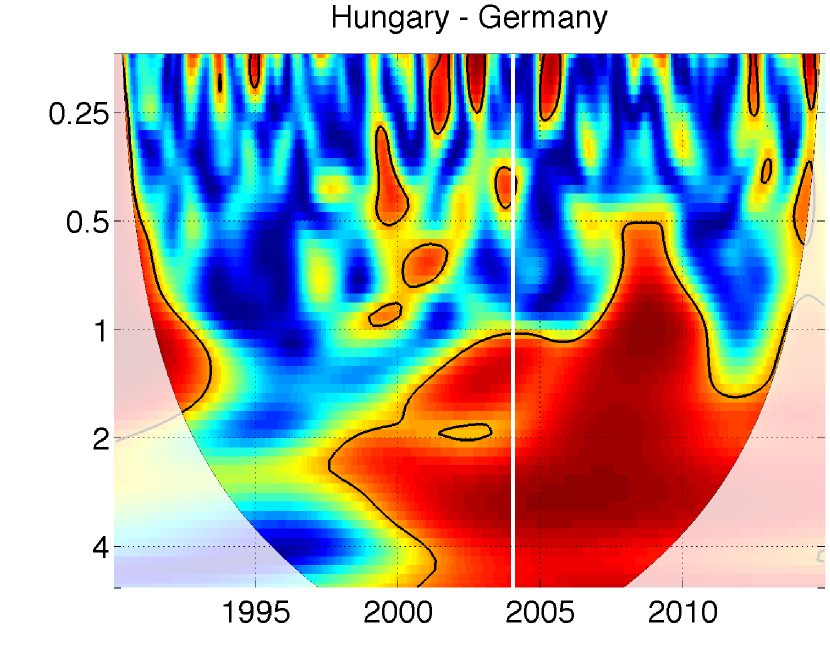

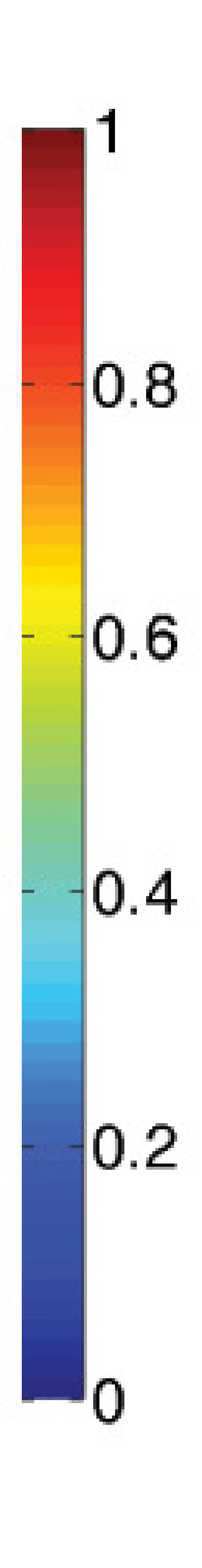

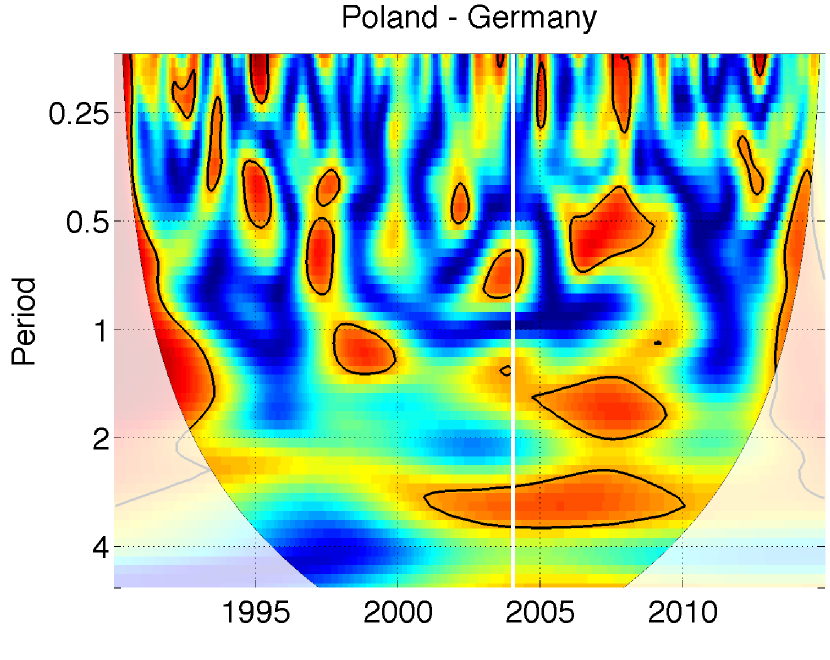

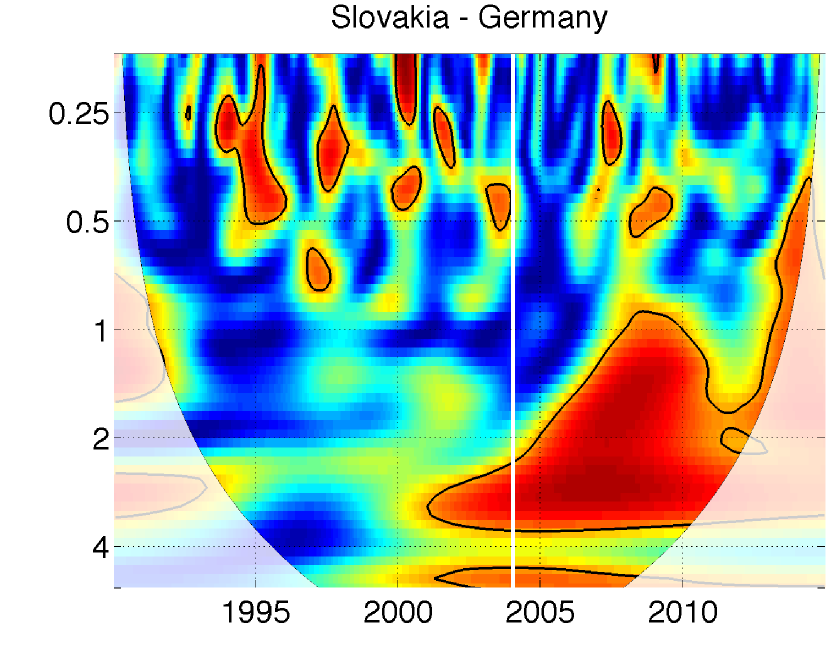

Further, we are interested in the co-movement of each country of the V4 within the framework of the European Union. In the pairwise analysis, we take Germany as a representative of the EU. Germany is often used as a reference country (Fidrmuc and Korhonen, 2006) for the EU. Moreover, a great portion of exports of V4 goes through Germany; meaning it is near the Visegrad region, which also plays a role. We plot the relationships between the V4 and Germany in Fig. 5.

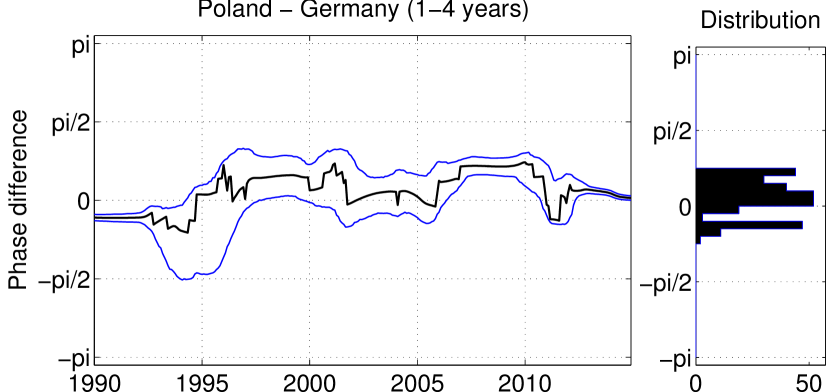

We observe the strongest co-movement of Germany with two countries: the Czech Republic and Hungary. The large area of high coherence for both begins around 2000, for a 1-5 year period. Hungary-Germany high coherence starts slightly before 2000 for a 2-year period but from 2000 it continues for a 1-5 year period onward. These findings are in line with the results of Aguiar-Conraria and Soares (2011a). The synchronization of Slovakia with Germany shows an interesting pattern. The coherence increases gradually from 2000 and spreads from 2-4 years to 1-4 years period around 2008, which is important because that is precisely when Slovakia adopted the Euro, on January 1, 2009. Slovakia may be also considered as an example where the degree of synchronization increases after accession to the EU and EMU, which is consistent with the theory of endogeneity of optimum currency areas. This high coherence may be a reaction to the global financial crisis; however, it may support higher synchronization with the EU as the shock would spill over the euro area to countries, such as those of V4. For all the V4, we see an increase of coherence after beginning their preparations for EU accession, which was shortly before 2000, this support the finding of Kolasa (2013) who reports a substantial convergence with the Eastern enlargement of the EU. The high degree of synchronization of Hungary supports also the previous results of Fidrmuc and Korhonen (2006), for example. However, this same support is not true for Poland because we observe the weakest relationship between Poland and Germany, although we may find a few isolated islands of higher coherence, which are unimportant in comparison with other countries.

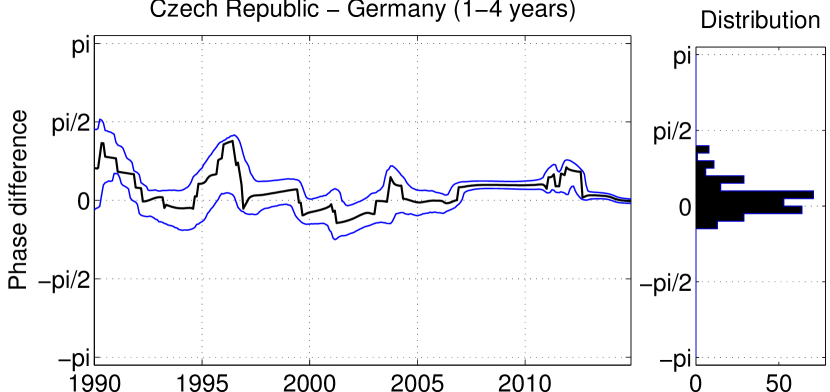

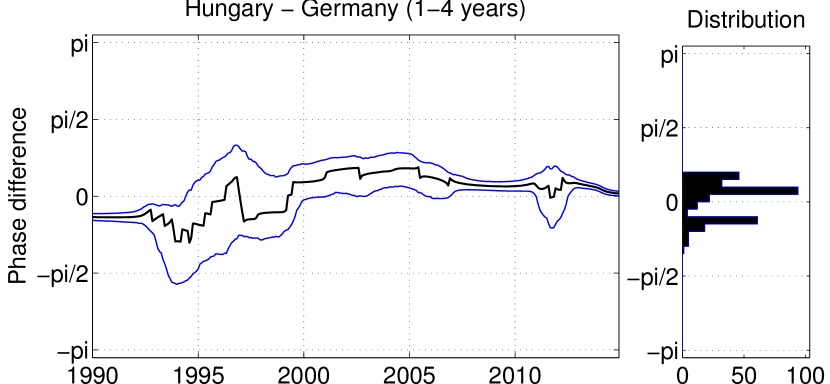

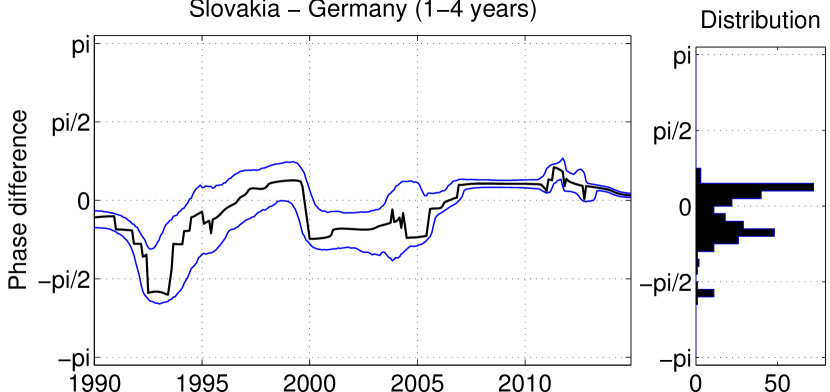

Additionally, we provide the analysis of phase differences between each V4 nation and Germany. The phase difference for the 1-4 year period fluctuates around zero most of the time, which corresponds to changing the lead position between two countries that have a positive relationship – in phase. We present confidence intervals of these phase differences. In the most cases, as the phases fluctuate the confidence intervals overlap zero; thus, we cannot determine for certain which country is in the lead position. Further, the first and last five years of data are affected by edge effects of zero-padding; thus, we do not have complete information here. Following Aguiar-Conraria and Soares (2014), we rely on the significance of coherence to know whether the phase difference is also significant. The coherence is found high and mostly significant for all countries between 2000 and 2010. Fig. 6 shows that the phase difference is significant in 2006-2010 period and it belongs to the interval, which also shows that the V4 business cycles lead the cycles of Germany over the long-term period during the 2006-2010 period. One possible explanation for this finding can be that recessions or rebounds in the productions of the V4 contries happen sooner compared to Germany. For example, in case of Slovakia, we have the significant leading position of Germany during 2000-2004. Showing that the bootstrapped confidence intervals, we demonstrate that this technique is relevant and desired for conclusion about phase differences between time series.

4.2 Multivariate co-movement

Until now, we have used the bivariate analysis, and we have omitted the assessment of synchronization of more than two time series. In this part, we investigate the multivariate relationship of countries in the EU. The proposed measure of cohesion with time-varying weights allows us to assess the co-movement within the groups of countries. In contrast to the coherence, the cohesion may be negative, which means it can capture a counter-cyclical co-movement among the time series. We employ the time series of Gross Domestic Product (GDP) in current prices and GDP at purchasing power parity (PPP) per capita to weight the economic activity. The choice of GDP as weights is particularly to quantify the size of countries’ economies. Compared to the fixed weights of Rua and Silva Lopes (2012), the time-varying weights take into account different developments of countries.171717In the multivariate analysis, we analyze a period of 17 years spanning from 1997M1-2014M3 due to the lack of data for some countries.

4.2.1 Does the size of economies affect business cycle cohesion?

A broader picture about the business cycle synchronization in the region of the V4 countries and Germany can be studied using the cohesion measure. Since the beginning of the transition, we have observed a significant growth of nominal GDPs of the Visegrad countries, see Table 1. Slovakia’s nominal GDP grew by almost 300%, the nominal GDPs of Czech Republic, Hungary and Poland have more than doubled by that time, whereas the nominal GDP of Germany increased only by 52%. The time-varying weights allow us take into account gradual changes of proportions between economies and reflect this development in their business cycle synchronization. The evolving size of economies can project and emphasize possible convergence or divergence among economies. Further, we look at the GDPs at power purchasing parity per capita where, at smaller extent, the same happen. GDPs at PPP per capita more than doubled for the Visegrad countries and for Germany it grew by 75%, almost doubled.

| 1997 vs. 2014 | Germany | Czech Rep. | Hungary | Poland | Slovakia |

|---|---|---|---|---|---|

| GDP level (in %) | 52 | 169 | 133 | 196 | 290 |

| GDP at PPP (in %) | 75 | 102 | 110 | 165 | 151 |

This motivates our new approach to show clearly that the nature of weighting in such measure is crucial. The cohesion puts a weight to each pair in the multivariate analysis with respect to all variables. For instance, when considering Germany and Poland within the group weighted by nominal GDP, their pair has the largest effect on cohesion. Although, their pairwise co-movement is weak and thus, it lowers the multivariate cohesion at many points with respect to weights. In contrary, from previous analysis we know that the Czech Republic and Hungary strongly co-move with Germany in the long-term frequencies, thus the effect on the cohesion can be larger because the presence of Germany in the pair.

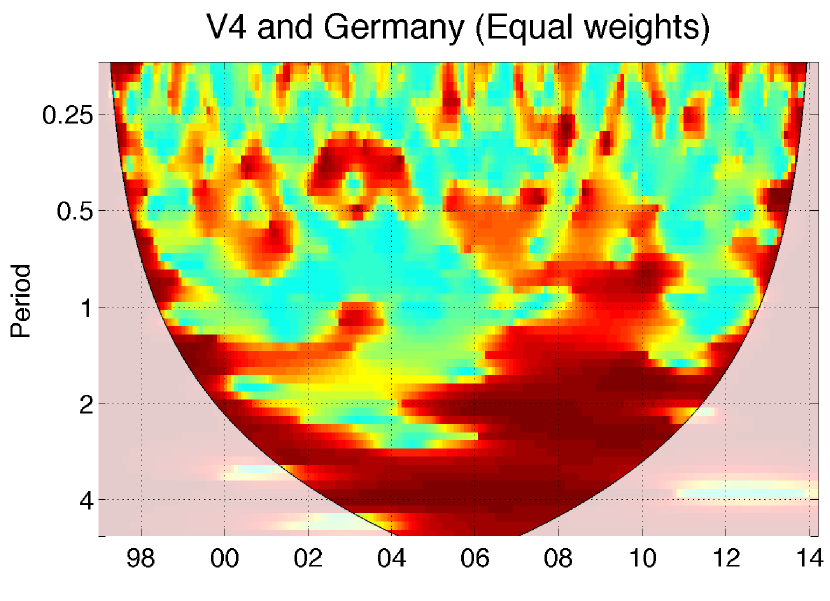

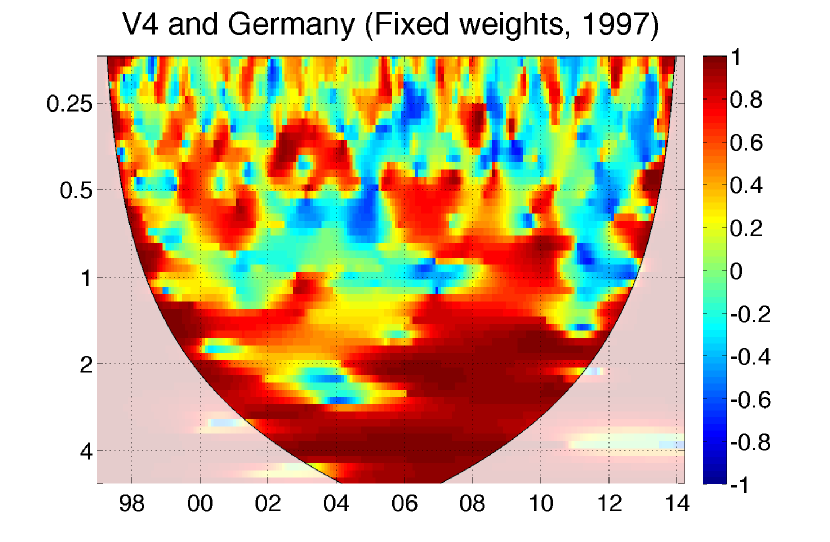

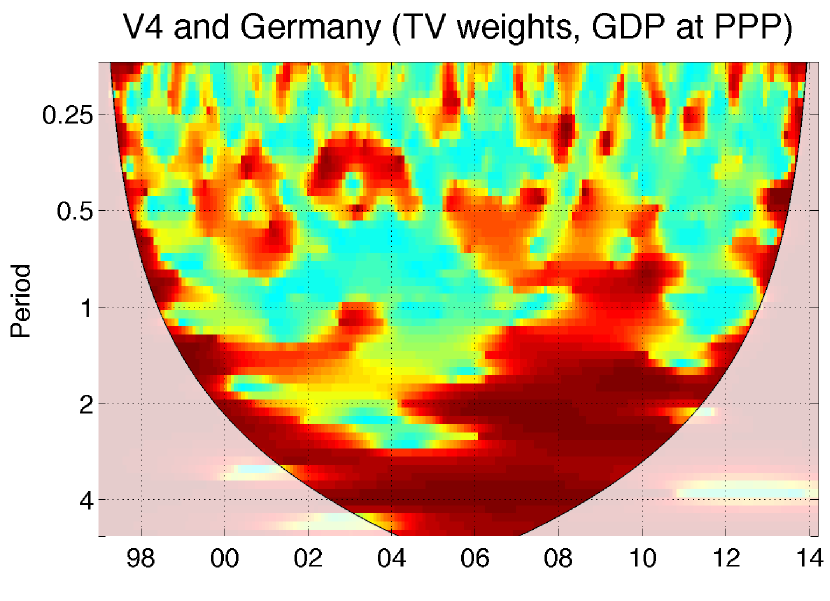

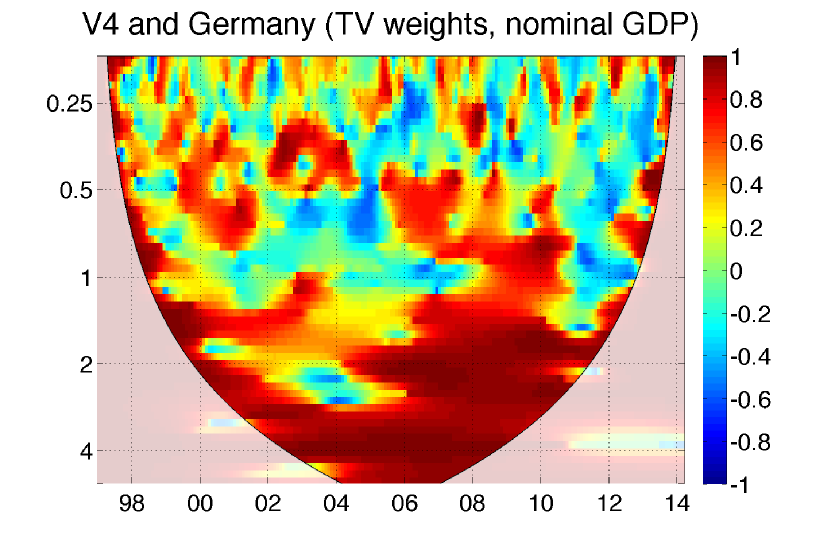

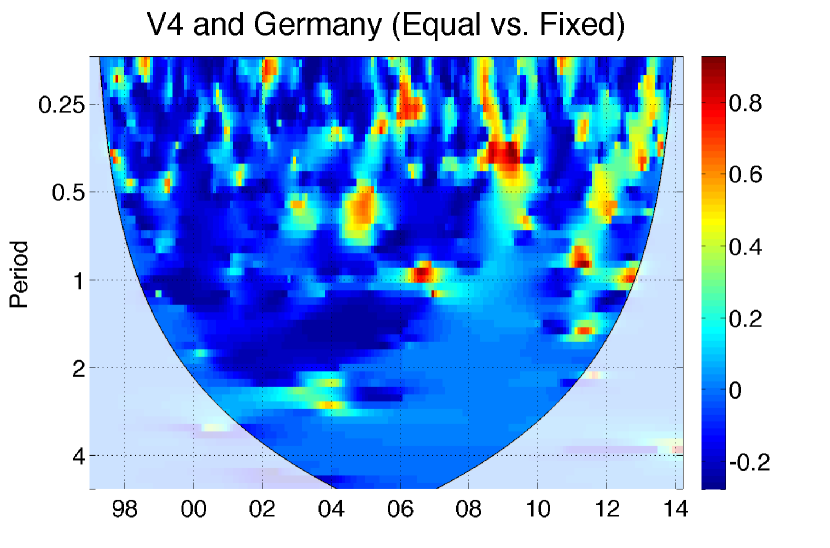

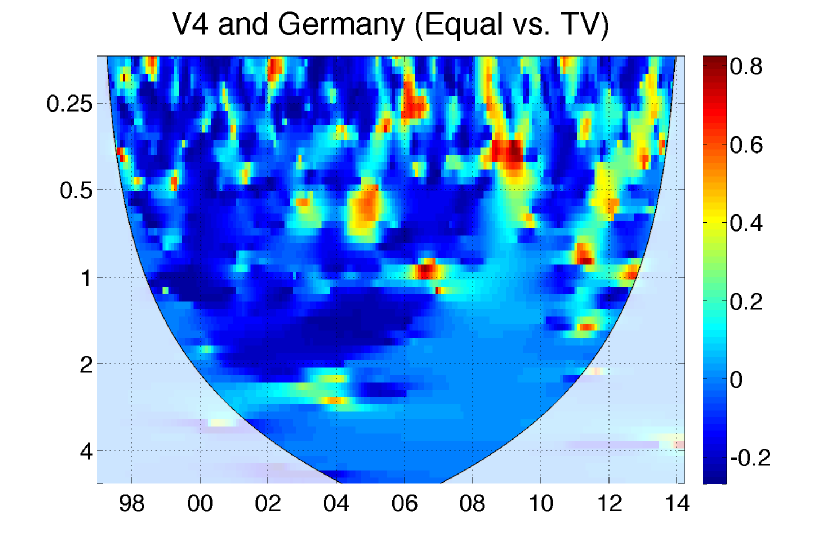

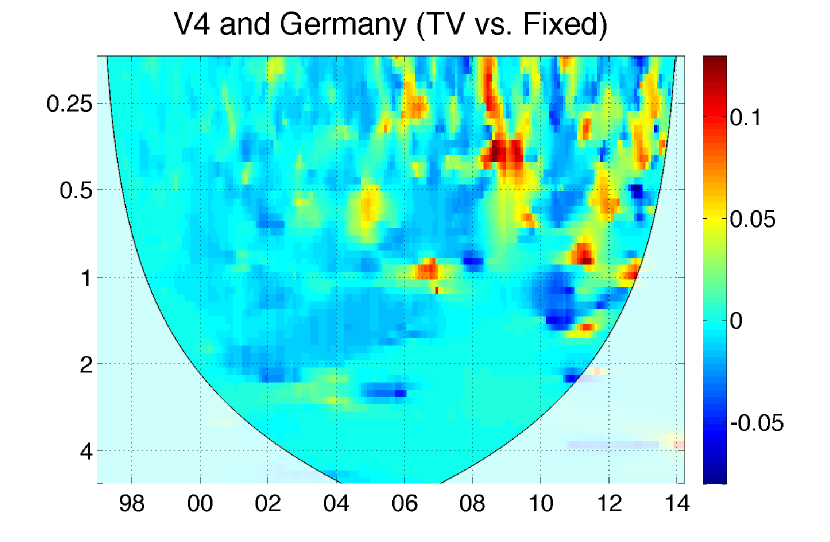

To illustrate the advantage of dynamic weights, we compare four cases of weighting: equal weights – each country has equal size, fixed weight corresponding to one moment – 1997Q1 (Eq. 12), and then two cases of employing time-varying weights (Eq. 13). Further, the distinction was made and we show the differences between cohesions that employing equal, fixed, and time-varying weights yields different results, Fig. 7 and 8.

In Fig. 7, we observe high cohesion of 2-4 year business cycles of the Visegrad countries and Germany. Further, the cohesion is quite mild (around zero) at one-half to 1 year business cycle period. There appear several areas of positive cohesion at shorter periods, as well as, few small areas of negative cohesion distributed over periods from a quarter to 1 year. In the case when the nominal GDP is used, we observe that the negative areas of cohesion are not that sharp as when fixed weights were used. This refers that changes of proportions between economies lower counter-cyclicalities in cohesion of the Visegrad Four and Germany.181818For example, when we would analyze commodity prices and taking their volume as weights, the two figures of fixed (sum of volumes) and time-varying weights (daily volume) showed greater differences than in our case. Comparing the two GDP weights, we conclude that proportions between countries when considering GDP at PPP per capita get closer to the situation when countries have equal position, thus equal effects on synchronization. It is shown in figures on the left of Fig. 7 that the cohesion weighted by GDP per capita does not differ much in comparison to the one with equal weights.

We show that the time-varying weights, representing sizes of the economies, have substantial effect for business cycle synchronization measure. In our particular case, the absolute maximum in the difference between fixed and time-varying weights results is approximately 0.2, which comprises 10% of the scale , see Fig. 8 (right). The time varying weights correspond to precise moment of time, the information should be truly localized than that keeping weights constant. The results are shown in greater accordance with reality.

4.2.2 Cohesion of the Visegrad Four and the EU

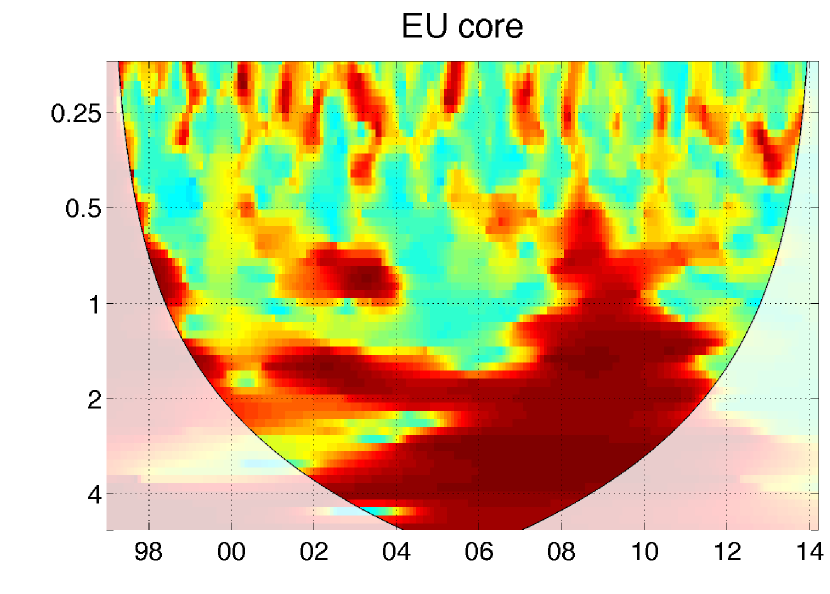

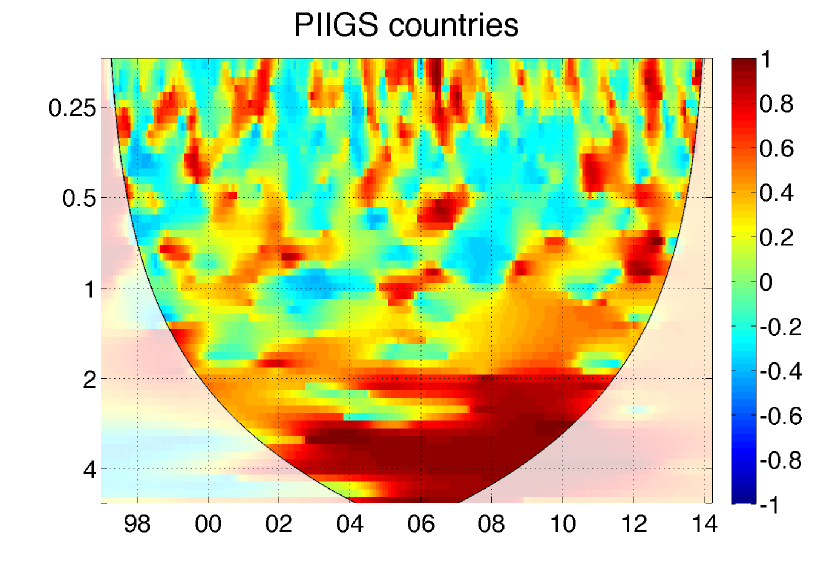

We compute the multivariate relationship quantities for three groups of countries: the V4, the EU core, and the PIIGS countries. We analyze those groups individually as well as in combination.191919By combination we mean the co-movement of all countries from both groups with respect to their weights. We concentrate on the V4 itself and within the framework of the EU. Examining the synchronization of the PIIGS countries with the EU core, we directly compare already integrated countries with those in the process of integration.

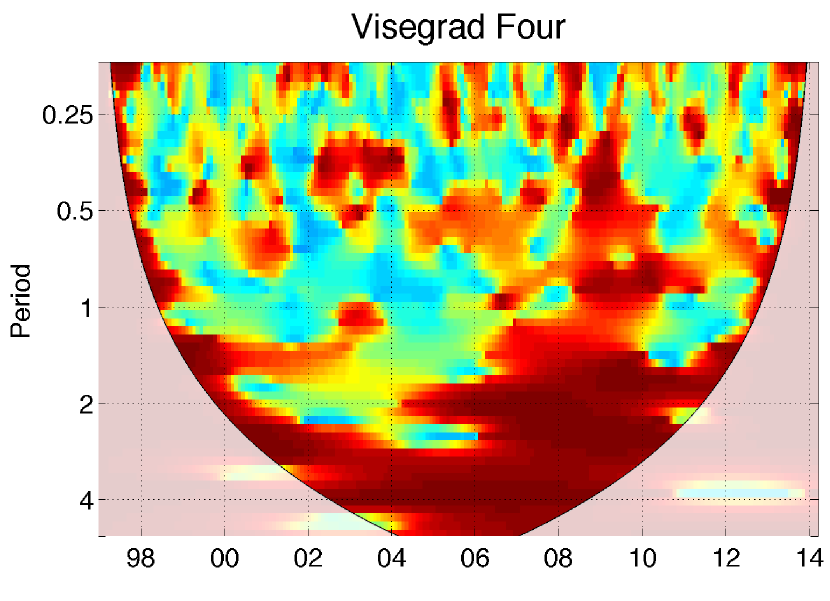

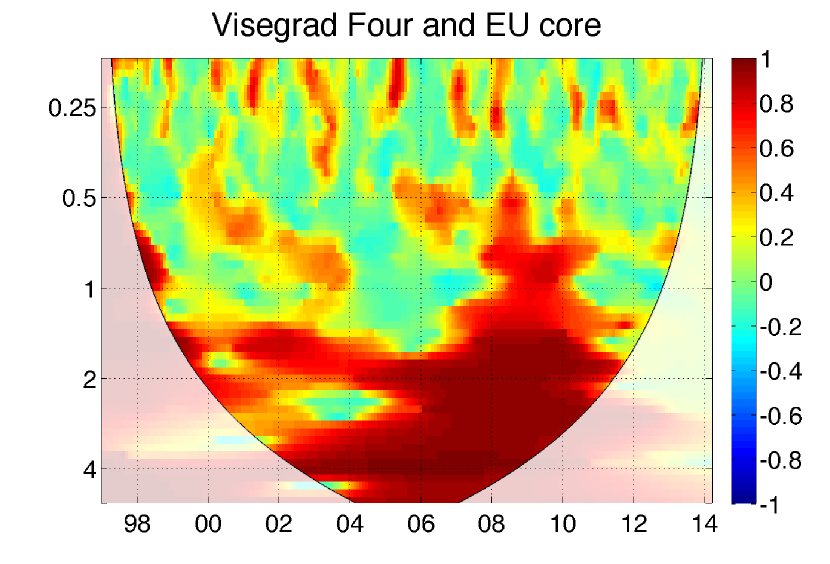

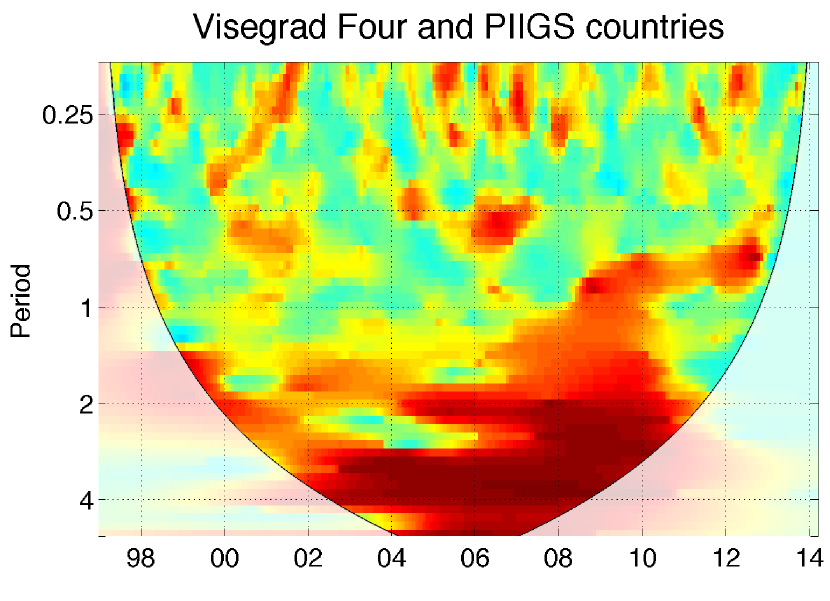

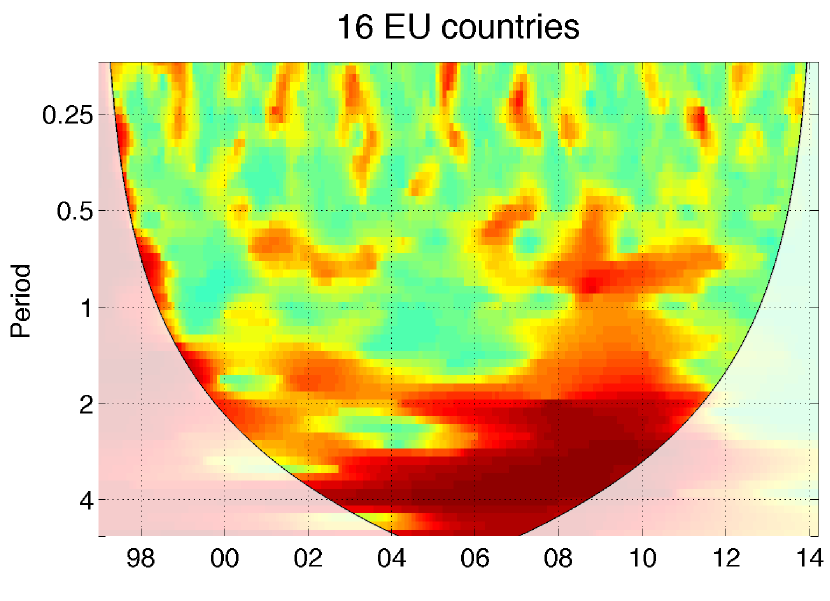

With regard to the V4, in Fig. 9, we show that the degree of synchronization within this region is high in the long-term period. The strong co-movement of 2-4 year periods lasts from 1997 to 2014; beginning in 2008, it spreads over a 0.5-5 year period. The short-term synchronization, up to 1 year, provides some insights that countries often co-move at that frequency but only for short periods of time. This short-term fluctuation co-movement appears as well as for groups of EU core and PIIGS countries in Fig. 10, which may reflect common reactions to events in the markets.

Comparing the multiple relationships of V4 and EU core, EU core and PIIGS, and V4 and PIIGS countries in Fig. 9, we observe similar patterns of co-movement over the long-term. This result of is in line with Rua and Silva Lopes (2012), who find a large cohesion of the long-term dynamics. Regarding the Visegrad counties within the EU, in the period after 2000, the strongest relationship is among the V4 countries and the EU core compared to other groups.

Further, we investigate the relationship of all 16 selected countries and the sub-samples of the EU core and the PIIGS countries. Surprisingly, the analysis reveals low cohesion in the short-term, 0.5-1 year, although it is quite high in the long-term. Regarding the EU core, there is more commonality in short-term dynamics. Further for all groups, we note that the cohesion is high for long-term business cycles. In the second half of the sample, the relationship has increased for the shorter periods. With respect to the case of PIIGS counties, their cohesion appears to be along the same lines, but these countries do not exhibit any co-movement over the 1-2 year period. Notably, we have seen that the cohesion of the V4 with the EU core is stronger than that of the 16 European countries. For example, in Slovakia, there was a gradual increase of co-movement with Germany after accession and after the Euro adoption. In terms of synchronization, the V4 could benefit from joining the EMU, but we do not know the specific sources of the higher co-movement.

5 Concluding remarks

Business cycle synchronization is a central question of economic integration and thus it needs a rigorous examination. We have overcome the problems of traditional measures, such as operation in time or frequency domain only and of the necessity of stationary time series, by using wavelet methodology. In this paper, we have proposed the multivariate measure of co-movement with time-varying weights called wavelet cohesion. This wavelet-based measure allows for precise localization of information in time and frequency.

We have investigated the impact of V4 cooperation, which has one of its aims to converge faster towards the EU. We have found short but high co-movement for the first years of their cooperation until the economic turbulences of the late 90s. During the 1995-1999 period, their business cycles for 2-5 year periods show very low levels of synchronization.

Further, we have studied the business cycle synchronization of the V4 with Germany. The results confirmed some already known but interesting patterns. Slovakia’s synchronization with the EU was poor before its accession to the EU but gets stronger after 2005, which supports the theory of the endogeneity of the OCA and the adoption of Euro. We have revealed that the highest coherence is between Germany and both the Czech Republic and Hungary beginning in 2000. By contrast, the degree of synchronization of the business cycles of Poland and Germany is the lowest among V4.

Employing a multivariate measure, we have uncovered relationships in both time and frequency domains for multiple time series. Regarding the V4, the EU core countries, and/or the PIIGS countries, we show that there is a very weak synchronization of short-term dynamics,less than 1 year, among those countries. Conversely, we have found that cohesion within the EU is high after 2000 in 2-5 year periods. Finally, we have found high co-movement of the long-term business cycles of the V4 and of the EU core countries over the whole sample. This supports that countries tend to have similar approaches to their long-term dynamics or policies.

References

References

- Aguiar-Conraria et al. (2008) Aguiar-Conraria, L., N. Azevedo, and M. J. Soares (2008). Using wavelets to decompose the time–frequency effects of monetary policy. Physica A: Statistical Mechanics and its Applications 387(12), 2863–2878.

- Aguiar-Conraria and Soares (2011a) Aguiar-Conraria, L. and M. J. Soares (2011a). Business cycle synchronization and the Euro: A wavelet analysis. Journal of Macroeconomics 33(3), 477–489.

- Aguiar-Conraria and Soares (2011b) Aguiar-Conraria, L. and M. J. Soares (2011b). The continuous wavelet transform: A primer. Technical report, NIPE-Universidade do Minho.

- Aguiar-Conraria and Soares (2014) Aguiar-Conraria, L. and M. J. Soares (2014). The continuous wavelet transform: Moving beyond uni- and bivariate analysis. Journal of Economic Surveys 28(2), 344–375.

- Antal et al. (2008) Antal, J., M. Hlaváček, and T. Holub (2008). Inflation target fulfillment in the Czech Republic in 1998–2007: Some stylized facts. Czech Journal of Economics and Finance (Finance a uver) 58(09-10), 406–424.

- Artis et al. (2004) Artis, M. J., M. Marcellino, and T. Proietti (2004). Characterizing the business cycle for accession countries. CEPR Discussion Papers 4457, C.E.P.R. Discussion Papers.

- Backus et al. (1992) Backus, D. K., P. J. Kehoe, and F. E. Kydland (1992). International real business cycles. Journal of Political Economy 100(4), 745–775.

- Baxter and King (1999) Baxter, M. and R. G. King (1999). Measuring business cycles: approximate band-pass filters for economic time series. Review of economics and statistics 81(4), 575–593.

- Bruzda (2011) Bruzda, J. (2011). Business Cycle Synchronization According to Wavelets-the Case of Poland and the Euro Zone Member Countries. Bank i Kredyt (3), 5–31.

- Cazelles et al. (2008) Cazelles, B., M. Chavez, D. Berteaux, F. Ménard, J. O. Vik, S. Jenouvrier, and N. C. Stenseth (2008). Wavelet analysis of ecological time series. Oecologia 156(2), 287–304.

- Christiano and Fitzgerald (2003) Christiano, L. J. and T. J. Fitzgerald (2003). The band pass filter. International Economic Review 44(2), 435–465.

- Crespo-Cuaresma and Fernández-Amador (2013) Crespo-Cuaresma, J. and O. Fernández-Amador (2013). Business cycle convergence in EMU: A first look at the second moment. Journal of Macroeconomics 37, 265–284.

- Croux et al. (2001) Croux, C., M. Forni, and L. Reichlin (2001). A measure of comovement for economic variables: theory and empirics. Review of Economics and Statistics 83(2), 232–241.

- Crowley (2007) Crowley, P. M. (2007). A guide to wavelets for economists. Journal of Economic Surveys 21(2), 207–267.

- Crowley and Hallett (2015) Crowley, P. M. and A. H. Hallett (2015). Great moderation or ”Will o’ the Wisp”? A time–frequency decomposition of GDP for the US and UK. Journal of Macroeconomics 44, 82–97.

- Darvas and Szapáry (2008) Darvas, Z. and G. Szapáry (2008). Business cycle synchronization in the enlarged EU. Open Economies Review 19(1), 1–19.

- Daubechies (1992) Daubechies, I. (1992). Ten lectures on wavelets, Volume 61. SIAM.

- De Haan et al. (2008) De Haan, J., R. Inklaar, and R. Jong-A-Pin (2008). Will business cycles in the euro area converge? A critical survey of empirical research. Journal of Economic Surveys 22(2), 234–273.

- Fidrmuc and Korhonen (2006) Fidrmuc, J. and I. Korhonen (2006). Meta-analysis of the business cycle correlation between the euro area and the CEECs. Journal of Comparative Economics 34(3), 518–537.

- Frankel and Rose (1998) Frankel, J. A. and A. K. Rose (1998). The Endogeneity of the Optimum Currency Area Criteria. Economic Journal 108(449), 1009–25.

- Gabor (1946) Gabor, D. (1946). Theory of communication. Part 1: The analysis of information. Journal of the Institution of Electrical Engineers-Part III: Radio and Communication Engineering 93(26), 429–441.

- Gallegati (2008) Gallegati, M. (2008). Wavelet analysis of stock returns and aggregate economic activity. Computational Statistics & Data Analysis 52(6), 3061–3074.

- Ge (2008) Ge, Z. (2008). Significance tests for the wavelet cross spectrum and wavelet linear coherence. Annales Geophysicae 26(12), 3819–3829.

- Grinsted et al. (2004) Grinsted, A., J. C. Moore, and S. Jevrejeva (2004). Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Processes in Geophysics 11(5/6), 561–566.

- Harding and Pagan (2002) Harding, D. and A. Pagan (2002). Dissecting the cycle: a methodological investigation. Journal of Monetary Economics 49(2), 365–381.

- Hodrick and Prescott (1981) Hodrick, R. J. and E. C. Prescott (1981). Post-War U.S. Business Cycles: An Empirical Investigation. Discussion Papers 451, Northwestern University, Center for Mathematical Studies in Economics and Management Science.

- Jagrič (2002) Jagrič, T. (2002). Measuring business cycles–a dynamic perspective. Banka Slovenije, Prikazi in analize X/1, Ljubljana.

- Jiménez-Rodríguez et al. (2013) Jiménez-Rodríguez, R., A. Morales-Zumaquero, and B. Égert (2013). Business cycle synchronization between Euro Area and Central and Eastern European countries. Review of Development Economics 17(2), 379–395.

- Kolasa (2013) Kolasa, M. (2013). Business cycles in EU new member states: How and why are they different? Journal of Macroeconomics 38, Part B, 487–496.

- Kutan and Yigit (2004) Kutan, A. M. and T. M. Yigit (2004). Nominal and real stochastic convergence of transition economies. Journal of Comparative Economics 32(1), 23–36.

- Lamo et al. (2013) Lamo, A., J. J. Pérez, and L. Schuknecht (2013). The cyclicality of consumption, wages and employment of the public sector in the euro area. Applied Economics 45(12), 1551–1569.

- Liu (1994) Liu, P. C. (1994). Wavelet spectrum analysis and ocean wind waves. Wavelets in geophysics 4, 151–166.

- Mallat (1999) Mallat, S. (1999). A Wavelet Tour of Signal Processing. Electronics & Electrical. Academic Press.

- Mundell (1961) Mundell, R. A. (1961). A theory of optimum currency areas. The American Economic Review 51(4), 657–665.

- Nason et al. (2000) Nason, G. P., R. Von Sachs, and G. Kroisandt (2000). Wavelet processes and adaptive estimation of the evolutionary wavelet spectrum. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 62(2), 271–292.

- OECD (2015) OECD (2015, April). Main economic indicators - complete database. April 2015.

- Priestley (1965) Priestley, M. B. (1965). Evolutionary spectra and non-stationary processes. Journal of the Royal Statistical Society. Series B (Methodological) 27(2), 204–237.

- Raihan et al. (2005) Raihan, S. M., Y. Wen, and B. Zeng (2005). Wavelet: A new tool for business cycle analysis. Federal Reserve Bank of St. Louis Working Paper Series (2005-050).

- Rua (2010) Rua, A. (2010). Measuring comovement in the time-frequency space. Journal of Macroeconomics 32(2), 685–691.

- Rua and Silva Lopes (2012) Rua, A. and A. Silva Lopes (2012). Cohesion within the euro area and the US: a wavelet-based view. Banco de Portugal, Working Paper (4).

- Statistical Office of the European Communities (2016) Statistical Office of the European Communities (2016). EUROSTAT: GDP and main components (output, expenditure and income). Retrived from http://ec.europa.eu/eurostat/web/products-datasets/-/namq_10_gdp.

- Torrence and Compo (1998) Torrence, C. and G. P. Compo (1998). A practical guide to wavelet analysis. Bulletin of the American Meteorological Society 79(1), 61–78.

- Vacha and Barunik (2012) Vacha, L. and J. Barunik (2012). Co-movement of energy commodities revisited: Evidence from wavelet coherence analysis. Energy Economics 34(1), 241–247.

- World Bank (2016) World Bank (2016). The World Bank, International Comparison Program database. Retrived from http://data.worldbank.org/indicator/NY.GDP.PCAP.PP.CD.

- Yogo (2008) Yogo, M. (2008). Measuring business cycles: A wavelet analysis of economic time series. Economics Letters 100(2), 208–212.