Threadneedle: An Experimental Tool for the Simulation and Analysis of Fractional Reserve Banking Systems.

Abstract

Threadneedle is a multi-agent simulation framework, based on a double entry book keeping implementation of the banking system’s fundamental transactions. It is designed to serve as an experimental test bed for economic simulations that can explore the banking system’s influence on the macro-economy under varying assumptions for its regulatory framework, mix of financial instruments, and activities of borrowers and lenders. Support is provided for Basel Capital and central bank reserve regulatory frameworks, inter-bank lending and correct handling of loan defaults within the bank accounting framework.

In this paper we provide an overview of the design of Threadneedle, and the rational for the double entry book keeping approach used in its implementation. We then provide evidence from a series of experiments using the simulation that the macro-economic behaviour of the banking system is in some cases sensitive to double entry book keeping ledger definitions, and in particular that loss provisions can be systemically affecting. We also show that credit and money expansion in Basel regulated systems is now dominated by the Basel capital requirements, rather than the older central bank reserve requirements. This implies that bank profitability is now the main factor in providing new capital to support lending, meaning that lowering interest rates can act to restrict loan supply, rather than increasing borrowing as currently believed. We also show that long term liquidity flows due to interest repayment act in favour of the bank making the loan, and do not provide any long term throttling effect on loan expansion and money expansion as has been claimed by Keynes and others.

Introduction

Modern banking systems sit at the centre of a complex network of interacting contractual and financial relationships which together comprise the modern monetary system. Historically analysis of this system has presented considerable challenges, due to its complexity, its nature as an emergent system being modified over time, and also in no small part to its intrinsic operational dynamics, which rely on a mixture of statistical multiplexing and recursive feedback controls.

In this paper we present a simulation framework, Threadneedle, which is designed to allow researchers to explore the behaviour of fractional reserve based banking systems and their surrounding financial frameworks under varying assumptions about their regulatory frameworks, financial instruments, and patterns of borrowing and lending behaviours. Unlike other economic models which are based on mathematical interpretations of the economy, or balance sheet views, Threadneedle is based on the same double entry booking, credit and debit operations, which are used by the banking system’s accounting processes.

We believe this approach offers a number of advantages. It is reproducible. Banking transactions are discrete, regulatory frameworks are defined sets of rules, and the resulting system is computable. Given a set of double entry book keeping operations, and an accompanying regulatory framework, any computer simulation should be capable of reproducing the results of these operations with matching results.111Subject to known limits on decidability within distributed systems[1] In principle such simulations can also be subjected to a standard accounting audit for verification. It is concrete, and falsifiable. By basing the simulation on double entry book keeping practices we ensure that we are reproducing the banking system at its most fundamental level. Questions about these practices can be referred back to their actual implementation in the banking system, and if there are differences between national accounting systems, or between individual institutions, these can be incorporated into the simulation, and a determination made as to whether they are simulation, and by implication, economically affecting. It is scientific. Experiments can be performed on a replica of the actual system, and causal relationships (or their absence) determined; for example comparisons between different forms of lending within the otherwise identical banking systems.

In the rest of this paper we will discuss some of the design considerations involved in banking system simulation, and present results from experiments performed on simple two bank systems. Owing to some of the confusion that surrounds banking operations in the literature, we will start with a brief overview of the standard textbook description of banking, and discuss some of its errors. We will then present some preliminary results from simulations which examine the impact of interest rate changes in a Basel regulatory framework, particularly with respect to liquidity flows between banks. Finally we will examine the significance of these results for economic treatment of the banking system, in particular the banking system’s sensitivity to changes in the regulatory framework, and the implications this has for macro-economic models of the monetary system.

1 Background

Economics theories specific to the banking system typically rest in an uneasy intersection between mathematical models based on formulations derived from observational data that ignore any peculiar or unique role banking may play within the economy, and the empirical reality of periodic banking system instabilities, significant disruption to the economy and over a century of speculation about their precise causes. Economic analysis of the financial system typically relies on a set of assumptions about the behaviour of the banking system which were developed during the 1930’s. Following a remarkably periodic set of banking crises during the 19th century, regulatory controls developed by the British Empire after the panic of 1873 introduced a period of seeming stability (Laidler 2003[2]), at least within the British monetary system. The British Monetary Orthodoxy as Fetter[3] later described it consequently became a template for the regulation of banking systems world wide; it was also embedded in a set of simplifying assumptions for economic theories that depicted banking as a stable, controlled and uniform system, under the watchful regulatory eye of a national central bank, informed on how to conduct its operations by economic theory.

Consequently the banking system came to be regarded as a victim of financial shocks, rather than their cause. Bernanke in 1999[4] for example, describes it as acting simply as an accelerator of endogenous developments in credit markets. As such the banking system required no special analysis, and could be abstracted as a simple supplier of credit. There was no perceived need to examine the possibility that it could be the direct cause of economic shocks, nor to consider the idea that bank credit carried side effects that distinguished it from other forms of lending.

This question of whether banking is the victim of financial shocks, their instigator, or possibly both, is a critical one for economic theory. Treating the banking system as a benign black box, simply supplying credit to the economy considerably simplifies the problem of analyzing an already complex system. For this to be the case though, the behaviour of the system must at a minimum be linear and predictable. If non-linear and dynamic processes can be attributed to the banking mechanisms then we must at least cast this assumption as non-proven. Since the banking system relies on statistical multiplexing techniques, and uses recursive mechanisms for control that embody positive and negative feedback mechanisms, some potential for intrinsic dynamism certainly exists.

Since the credit crisis of 2007 the problems with the assumption of banking system stability have been considerably discussed, especially with respect to current macro-economic models. Proposals to resolve it such as Borio[5] typically revolve around attempts to simplistically add high level observational theories to existing economic models, rather than re-examining the foundations of the models themselves. These economic models rarely present a coherent regulatory framework, and on examination are often a mixture of assumptions from older work on gold standard/reserve based systems and the post-Bretton Woods, Basel Accord capital based systems. Monetary expansion is often attributed purely to government money printing (seignorage) e.g. Krugman 1998[6]), without considering the role of changing reserve requirements, and their effective removal in many countries. No distinction is made between different types of debt within the economy, even though debt created by the banking system is accompanied by side effects on the liability deposit money supply. A commonly expressed view, in this case by Krugman[7] is that "the overall level of debt makes no difference to aggregate net worth – one person’s liability is another person’s asset", and that it is simply the distribution of debt that matters (Krugman 2012[7]). This balance sheet view ignores issues not only with the amount of money required to pay any given quantity of debt, but its distribution to allow debt to be paid. Clearly Krugman’s statement cannot be true for completely arbitrary quantities of debt, as in the limit there would be insufficient money across the economy available to meet monthly principal and interest repayments. Only the mechanisms of fractional reserve banking guarantee matching amounts of money against debt being created. Other sources of debt such as government and corporate borrowing and loan securitization add to the quantity of debt in the economy without increasing the money supply.[8]

Perhaps most critically though, even though specialists in banking such as Borio[9] acknowledge the many defects in economic descriptions of the banking system’s operations; it has become almost impossible to determine from the many claims and counter-claims being made about the system’s behaviour, which is actually correct, since few attempt are made to root these claims in statements or descriptions that can be proved or disproved by reference to concrete operations derived from the banking system’s book keeping operations.

Computer simulation, while widely used in other fields, has been relatively under utilized in monetary economics. The Sante Fe Stock Market Simulation is perhaps one of the best known market simulations, but it concentrated purely on market and trading dynamics, and did not include any larger economic context such as borrowing and money supply issues[10]. Lehtinen[11] presents an interesting argument which suggests that this oversight is a consequence of economic thought typically proceeding from top down approaches based on mathematical models of theories of equilibrium, rather than following the bottom up approach of constructing as realistic as possible a simulacrum of the object under study as more typically used in other fields.222For a recent discussion of the pitfalls of models in the financial and monetary context see Pfleiderer[12], Leijonhufvud[13], also provides an entertaining description of the anthropological role models play in the development of economic thought. This appears to be true even with the more recent agent based models. Examination of their source code shows economic theories such as the Cobb-Douglas production function being incorporated directly into these models and the advice to use careful "calibration" of their parameters to achieve desired results. Bianchi’s[14] description of the CATS model provides a typical example of these problems.

An alternate explanation for why simulation of the banking system in particular has not been previously attempted, even though simulations of market trading have, may simply be the absence of reliable literature in this area. Our first attempts to build a banking system simulation (see Mallett 2011) [15] relied on the textbook description of the banking system found in standard economic textbooks such as Mankiw[16] Burda and Wyplozs[17]. The result of this work was to demonstrate that the textbook description could not in fact be implemented as shown, and our conclusion was that this description could not be taken as a reliable model of the banking system’s behaviour.

The description itself appears to originate from an explanation of the deposit expansion process provided in the 1931 Macmillan report to the British Parliament[18] shown here in table 1, which is believed to have been authored by Keynes. The particularly problematic aspect of the modern description seems to arise from a copy and paste error between Keynes’ original description, where he restricted his example very specifically to "occurring in a single bank", and an expanded example where loans are shown being made between a series of banks, originating from one bank and being made to a customer at the next bank in the series. This example breaks down immediately loan repayments are applied. Banks are left with insufficient liquidity to transfer customer re-payments back up the chain after a couple of repayment cycles owing to the leverage created between reserves and deposits. We surmise that Keynes was aware of this issue, since he was careful of his wording, but that subsequent authors apparently were not. It also follows though that this description cannot be generalized as a description for banking systems that do not consist of a single bank.

There are other problems with the canonical description, which when considered in the context of double entry book keeping ledger definitions cannot be excused so lightly, as they appear to violate the fundamental accounting equation1:

| (1) |

| Bank | Amount Deposited | Loans | Reserves |

|---|---|---|---|

| A | 100 | 90 | 10 |

| B | 90 | 81 | 9 |

| C | 81 | 72.9 | 8.1 |

| D | 72.9 | 65.6 | 7.29 |

| etc. | |||

We can deduce from Table 1 that the initial deposit must be a cash deposit since reserves are being shown as withheld from it. Under double entry book keeping this would be defined as an asset, a bank loan is also an asset as is the central bank reserve account (or a reserve of physical cash). The liability deposit that is in actuality being created by the banking system when the loan is issued is not shown. Consequently even the original example it seems, must at best be regarded as incomplete.

While the inadequacies of this introductory description are being acknowledged, most recently by the Bank of England[19], the task of replacing it has yet to be attempted. Documentation at this level of detail for the banking system’s double entry book keeping practices is not easy to find - the old manual processes that were employed to maintain double entry book keeping ledgers and records were computerized in the 1960’s, and are now relatively remote from day to day practices. A number of detailed descriptions of 19th century book keeping practices specifically written for banks do exist: Alexander Shand’s Ginko Bohi Seiho[20] provides a description of the seven fundamental operations of banking and was used by the Japanese Empire to convert their financial system entirely to double entry book keeping shortly after the Meiji Restoration. Meelboom[21] describes both the ledger and the organizational practices and procedures of what was at that time an entirely manual operation in considerable detail for an American bank, but does so shortly before the founding of the Federal Reserve and so does not include the operations of the central bank.

While more recent information can be found on isolated operations, we were unable to find any modern documentation suitable for our purpose. Mecimore’s Bank Controller’s Manual from 2005[22] for example, contains detailed treatment of US regulations and account treatment but stops just above the double entry book keeping level of accounts.

To address this issue, we have created a detailed description of the fundamental bank book keeping operations which are used by the framework, modelled on Shand’s approach. This has been reviewed by subject matter experts in bank accounting, and is available on line[23] at the arxiv.org repository for reference. Worked examples for each double entry book keeping operation supported by the simulation framework are provided in order to ensure that our understanding of these operations is correct. While every effort has been made to validate the operations described, the design of the simulation framework also allows any errors to be easily corrected.

2 Design Considerations

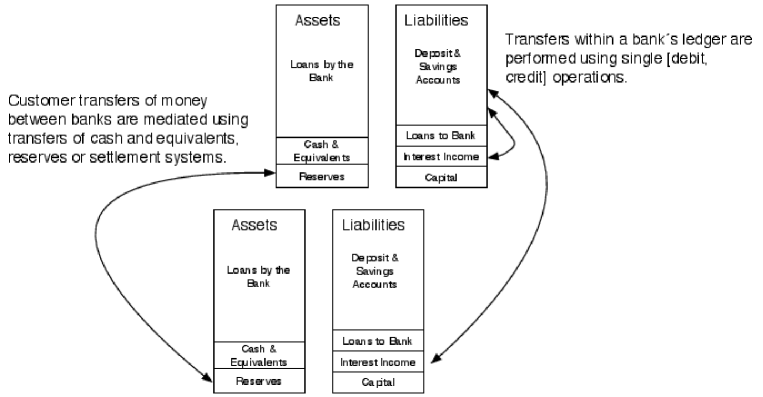

Threadneedle presents the banking system from a ledger perspective, directly matching the underlying books used for double entry book keeping operations. From this perspective, flows within the banking system originate from transfers between accounts, always performed as two simultaneous operations on separate ledgers. For example, Figure 1 shows a high level ledger view of two banks, and the monetary flows that accompany repayment of interest on a bank loan both within and between them.333In this paper we simplify bank operations to a single ledger representing one bank. In practice banks normally operate as a collection of branches, each of which maintains its own general ledger, and inter-branch operations are required to move funds between branches in similar ways to the movement of funds between banks. The impact and variability of such operations is currently an open research question, (See Gudjonsson 2014[24]).

All operations on bank ledgers are performed using double entry book keeping operations, each of which consists of a (credit, debit) tuple, which must be applied to two separate ledgers simultaneously. One of the consequences of this arrangement is that it effectively creates two separate forms of money, asset cash deposited at a bank, and liability deposit accounts, which can be created either by cash deposits, but also by bank lending. Transfers between monetary accounts can only be done on a like for like basis. It is possible to transfer directly between two liability accounts at the same bank, and it is possible to transfer between two asset cash accounts, by removing money from one, and re-depositing it at the other, but it is not possible to transfer from a liability deposit account to an asset cash account in a single operation. The two forms of money are maintained completely separately by the underlying operations.

Threadneedle is structured around this ledger view of the banking system, with banks that individually implement the necessary double entry book keeping operations on a transactional basis. Loans for example are simulated as a transaction that initially credits the borrower’s deposit account, and debits the asset loan account, and then a sequence of debits to the loan’s capital and credits to the bank’s interest income account from the borrower’s deposit account for each payment period of the loan. Within the simulation agents with distinct behaviours required by the banking system, such as capital purchase, are provided and these also provide templates that can be extended to build more sophisticated agents as required. All communication between agents is performed via monetary transactions, that is the agents only respond to the information provided by monetary flow within the simulation and implicit information derived from it such as interest rates and prices. A government agent is responsible for setting the base interest rate through the central bank, government borrowing and taxation. These details can also be controlled by configuration, and changed during the simulation. The framework also provides support for the purchase and sale of arbitrary items directly between agents, or through market mechanisms.

In order to create an environment where the results of different regulatory frameworks on the limits of the money and loan creation processes inherent within banking can be studied in isolation, the framework provides support for the banking system to be exercised independently of a full economy. The eventual goal of the project though is to allow large scale simulation of all monetary transactions in a market based economy including an accurate representation of the banking system, and features have been built into the framework to support this eventual goal as well as the immediate requirements of banking system simulation.

All agents in the simulation can be provided with individual behaviours. This includes organizations such as countries and regions, which can support different tax regimes, and can also provide structural associations between agents. The simulation currently supports a single country, currency, and associated central bank, but multiple regions can be defined within a country. Agents can be restricted to only operate within a single region - allowing geographical structure to be explored. Relationships can also exist between agents, for example companies can employ agents, and in doing so provide income. Inheritance is used widely, so that heterogeneous classes of agents can also be developed, with similar functions but different behaviours within the simulation where this cannot be adequately provided by configuration parameters.

Two base classes of bank are currently supported: one is a non-lending bank which functions purely as a deposit holder, and does not perform fractional reserve lending. This is provided for testing purposes and also allows experiments with constant money economies to be performed. The other supported bank provides an implementation of the Basel regulatory framework, with lending controlled by a risk based weighting of its loan book, and central bank reserve requirement. Both of these can be configured to a range of values, or disabled. Borrowers can be configured to request fixed period, fixed rate compound, simple interest or Icelandic indexed linked loans as required. Banks in the simulation currently operate with a single general ledger, as branch banking operations are not included.

2.1 Cash Handling

Since all double entry transactions consist of a (debit, credit) tuple, the simulation must provide a matching asset debit, or liability at the central bank if the deposit is within the clearing system. While the (asset cash, liability deposit) pairing is straightforward, handling for other accounts such as capital is less clear. Table 2 shows the pairings used for simulations in this paper. For commercial banks cash from investors or depositors is initially placed in an asset cash account, and then transferred to the reserve account as required to meet regulatory requirements.

| Asset | Liability | |

|---|---|---|

| Commercial Bank | Cash | Deposit |

| Cash | Capital | |

| Central Bank | Cash | Reserve account |

| Cash | Deposit Account (Government) |

There are other ways to start a bank, the method chosen above is derived from examination of the Basel Framework and its requirement for bank capital as a regulatory factor, rather than those used by earlier systems. Miner’s 1902 manual on bank book keeping[25] for example, shows an alternate possibility where US Bonds are purchased as an asset in order to obtain circulating notes. This example predates the establishment of central banking in the USA, and also requires that government debt already exists. This is not the case when the simulation is being initialized since it introduces a circular dependency: for government debt to exist, the government must be able to borrow money from existing deposits in the system.

2.2 Expansion from Initial Conditions

The initial expansion of the system poses a particular problem for simulation, since our goal is to deterministically explore the behaviour of a mature banking system from a known set of initial conditions. Owing to the co-dependent relationship between loans and deposits in the system, we view it as impractical to try and attempt to start the system in its mature stage, absent detailed knowledge of the loan book of banks in the system.444The design of the system does not preclude this possibility should access to this level of information become possible.

We can gain some insights into the underlying process if we examine what happens in the United States banking system system when a new bank is established.555The Federal Reserve provides a detailed overview of the process for minority-owned institutions at its partnership for progress sitehttp://www.fedpartnership.gov/bank-life-cycle/start-a-bank/index.cfm The owners of the bank are required to provide capital in the form of an initial deposit of cash (asset) money, for which they receive shares (a liability) in the bank. In addition separate cash deposits are also required which will provide additional asset cash reserves. Presumably transfers from deposit accounts at other banks will also serve. As lending then takes place, the bank’s liability deposits expand over time to the maximum permitted by whichever regulatory framework it is operating under, subject to its interactions with its borrowers, depositors and other banks. The federal reserve expects the bank to take three years to establish itself, and working capital has to be available for that period. Further expansion of its loan book beyond its initial capital in a Basel regulated regime then requires the bank to increase its capital holdings, and possibly its central bank reserve holdings.

2.3 Designing Banking Simulations

The design of individual simulations begins with creating banks and populating them with a mixture of borrowers, savers and investors. Investors buy capital (preferential shares) from the bank in exchange for a cash deposit, Borrowers are programmed to request a loan each round until one is granted, and then to repay it if they have funds to do so. Once they have repaid a loan completely they will then attempt to borrow again. Borrowers can also be given a cash amount to deposit, and receive a matching deposit in their account if they do so. Savers deposit cash, and receive a matching deposit in return. They can be used to provide asset liquidity without additional side effects as desired.

Banks cannot however be so populated ad hoc. In a fractional reserve banking system lending creates a matching liability deposit, leading to the well known expansion of the money supply (as denominated in liability deposits). This initial expansion can distort the subsequent behaviour of the simulation, depending on how it is distributed and the regulatory framework being applied.

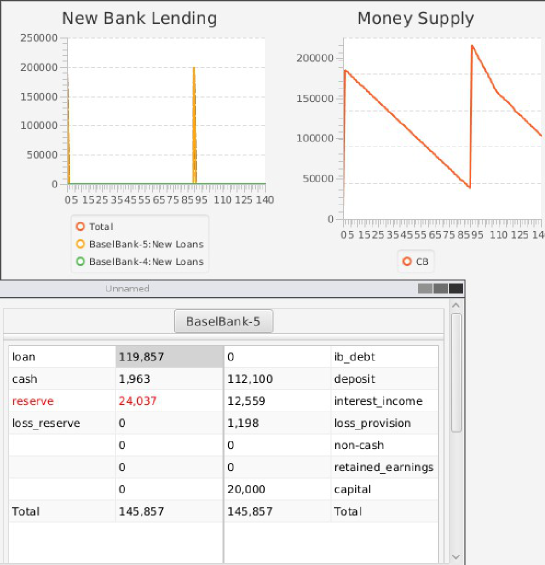

If we take a slightly pathological case as an example. In a strict reserve regulated simulation, if the bank allows a single borrower to borrow the maximum amount allowed, then the entire loan book will consist of a single loan. Until this loan has been sufficiently repaid to free up the necessary loan capacity, no new loans can be made, and the money supply will be seen to contract. Figure 2 shows a single bank simulation, with borrowers configured to request 120 step loans of 200,000. Cyclic behaviour of this nature is typical of simulations of strictly reserve regulated systems with insufficient or poorly distributed lending patterns, owing to the feedback in the regulatory control between lending limits and deposits.

Since we can deduce from modern national monetary statistics that fractional banking systems are typically in a state of continuous expansion, and as far as we are aware no banking system has ever been regulated solely on an absolutely fixed reserve of cash holdings, we can reasonably attribute this as a simulation artifact.

In order to force borrowing to be more evenly distributed, borrowers can be assigned a loan window which restricts the steps in which they can request loans. This in conjunction with appropriately sized loans allows more realistic simulations to be created.

Additional considerations surround asset cash availability. In a reserve regulated system sufficient asset cash must be present in proportion to the size of the loans being made. In both capital and reserve systems there must also be sufficient cash to meet any liquidity requirements arising from inter-bank transfers. In a capital regulated system sufficient capital must be present, again in proportion to the size of loans being requested. To create an even loan distribution which maximize lending, and its associated deposit creation over time, against the regulatory framework in operation, the following guidelines are suggested for simulations designed to saturate the banking system’s loan capacity.

| Loan Window | |||

| No. of Borrowers | |||

| Asset Cash | |||

where:

-

L=

Loan period in steps

-

D=

Average loan amount

-

R=

Central Bank Reserve requirement as a percentage.

-

C=

Capital Reserve requirement as a percentage.

Under these guidelines with each borrower only taking one loan at a time, for 10 year loans (120 steps) of 10,000 monetary units each, a minimum configuration for a 10% reserve requirement system would be 600 borrowers. Borrowers should also receive a minimum deposit that allows them to make their first loan repayment.

Capital purchases act to provide the capital requirement, so simulations testing Basel banking systems will in practice need to distribute the initial cash created for the system across investors and borrowers. Savers can be used to provide cash deposits without any further interaction with the banking system if desired, since the base base saver class does not receive interest on their account. It is expected that the saver class will be extended to allow interest bearing accounts, but this creates accompanying flow considerations as discussed below.

2.4 Flow Considerations in Simulation

Simulations only run continuously as long as their monetary flows can be satisfied. Debtors for example, must receive some form of income source so that they can meet the repayments on their loans, adequate loss provisions must be available against which loans that default can be written off. For example, if treasuries are used in the simulation, but the government has no form of revenue, such as taxes, the simulation will quickly halt as monetary flow breaks down due to the government having no income to meet interest and capital payments on its treasuries. In simulations where flow breaks down the cause may lie in economic fundamentals which reflect the actual behaviour of the monetary system, or in artifacts of the simulation’s design, and neither source should be ignored when exploring the reasons for this phenomena.

For simulations that isolate the banking system - such as the ones in this paper - it is necessary to provide a flow of money to a bank’s borrowers in order that they can meet their loan obligations. To achieve this borrowers can be configured to be employed by a bank which then uses its interest income to pay them an amount that allows them to meet their capital and interest repayments for that round. Provided that the bank has sufficient interest income to meet its borrower’s requirements, this provides a continuous flow of money between borrowers and banks which can be used to satisfy the constraints being set by the banks lending behaviour, and exercise the regulatory framework.

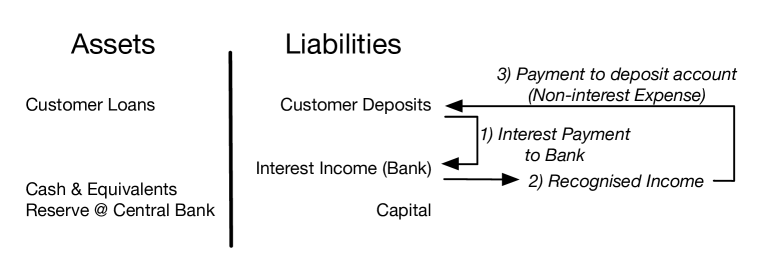

To set this within an economic context, Figure 3 shows an abbreviated example of the flow of money within a single bank, which results from interest payments on loans made by the bank, with the assumption that recipients of non-interest expense payments maintain their deposit account at the same bank as the account originating the interest payment. Payment of interest on bank loans when the depositor’s account is at the same bank as that making the loan is simply:

(debit customer account, credit bank’s interest income account)

since both accounts are classed as liabilities. When an interest (or capital) payment is made from an account that is not at the same bank, a more complex sequence of operations occurs, specifically:

| @ Originating Bank: | (credit cash, debit customer account) |

| @ Receiving Bank: | (debit cash, credit bank’s interest income account) |

with the accompanying asset transfers occurring either through central bank accounts, or dedicated clearing mechanisms. The availability of asset forms of money to support interbank operations is consequently a critical aspect of banking operations, but not necessarily an economic one, leading to the critical distinction in banking interventions between insolvency and illiquidity.

Typically a bank will receive interest payments into its interest income account, from which expenses such as loan defaults must be deducted before it can be recognized as income and paid out as more general expenses such as employee salaries, dividend payments to shareholders, and purchases of additional capital. A stochastic loan default rate can also be applied, and this can be used to create simulations where the sensitivity of the system to default risk can be explored.

Within the larger economy, a series of payments can consequently be envisioned between the recipient of the expense payment by the bank, and the ultimate debtor who makes the interest payment on their loan. In the simulations presented here we effectively short circuit this series to a direct relationship between a borrower and a bank, although not necessarily the same bank as the loan is made from. Only in the case that the bank has insufficient income to make payments will borrowers in the simulation be unable to pay their loans. Configuring borrowers to receive salaries from a different bank to which they are borrowing from allows the interbank transfer mechanisms to be exercised, and can also be used to create deliberately unbalanced interbank flows in order to explore the effects of interest changes on the interbank lending mechanisms under controlled conditions, as we will see below.

This is clearly an artificial arrangement, but it is designed to allow the banking mechanisms to be exercised independently of the larger economy. It also creates a best case for the banking system, since all interest income received by the bank will be looped into loan repayments as necessary. If regulatory mechanisms are unstable under this arrangement, then we can justifiably point to the mechanisms as a cause of problems rather than the nebulously defined catch all of human economic behaviour.

2.5 Central Banking

The Central Bank side of the system is becoming increasingly complex, especially with the fallout from corrective measures taken during the 2007 credit crisis. For example, the Federal Reserve’s 2011 Annual Report shows the majority of its assets as a mixture of government treasuries and mortgage backed securities, the latter having been acquired through the Troubled Asset Relief Program (TARP).666Federal Reserve Annual Report 2011, p327 http://www.federalreserve.gov/publications/annual-report/files/2011-annual-report.pdf. The rather less detailed balance sheet of the Bank of England simply lists ’Other loans and advances’ as the majority asset777Bank of England Annual Report 2011, p50, http://www.bankofengland.co.uk/publications/Documents/annualreport/2011/2011full.pdf while the European Central Bank has a mixture of gold, loans to Euro credit institutions, and securities comprising the majority of its holdings888European Central Bank, Annual Report 2011 p200. It is not known to what extent these differences are systemically affecting.

Central bank holdings of financial instruments that provide income, for example treasuries, also create flows within the system that need to be balanced, which we assume was at least part of the reason for the Federal Reserve to initiate interest payments on reserve holdings to its banks in the wake of the TARP program. Where possible these issues have been delegated to the user and the design of the simulation being constructed, with the framework providing as simple an initialization state as practical. For the time being, the central bank’s holdings have been simplified to cash. For the specific simulations discussed in this paper we have adopted the convention shown in Table 2 where the central bank initially holds a cash asset against its liability (reserve) accounts, and does not have a capital account. Since the main activity of the central bank in the simulation is to support the clearing system through transfers between banks using their reserve accounts, we do not believe this to be systemically affecting for the purpose of these simulations. The government’s bank deposit is also held at the central bank, which appears to be the usual case for the banking systems we have examined. This it should be noted, may be systemically effecting as it then interacts with the central bank’s balance sheet, and is a topic that deserves more investigation. Detailed exploration of the issues on the central bank side of the system is a subject for future research.

2.6 Implementation

The framework is written in Java, and can be run on Windows, Linux or MacOS. All monetary transactions within the framework are performed using full double entry book keeping and a records of all transactions are available through the simulation, and can be audited as required. The asset, liability and capital classification of individual bank ledgers is configurable, which allows experiments to be performed with different ledger classifications if required. A set of base objects such as the Borrower class described above are included, which provide support for simple simulations, and can be extended by users with programming experience to provide customized behaviours as required. The framework currently provides the following:

| Class | Description |

|---|---|

| Govt | Base class for governments. Flat rate tax, and government treasuries. |

| Bank | Provides a non-fractional reserve deposit holding bank which does not perform lending |

| BaselBank | Provides a bank implementing Basel Regulation which can be enabled or disabled as required. |

| Investor | Buys bank shares (capital) and receives interest. |

| Borrower | Borrows from a bank and receives salary. Can take out a loan. |

| Saver | Bank deposit holder. Can be used to simply provide deposit money without side effects |

| Loan | Fixed term, compound interest rate loan |

| Simple | Fixed term, simple interest rate loan |

| IndexedLoan | Icelandic Indexed linked loan |

2.7 Configuration

Simulations can be defined using a drag and drop interface, or from a JSON formatted text configuration file. Data from simulations is displayed on graphs during runtime and can also be exported for separate analysis. The framework provides a command line interface through which parameters can be examined and changed during the simulation, and a batch mode. Batch mode also supports a simple programmable interface that allows simulation parameters to be modified between runs. Although only single country simulations are supported at present, countries are specified in the configuration in order to allow eventual support for larger international simulations, either of countries with different currencies, or multi-national currency unions.

3 Results

In this section we present the results from a set of simple experimental simulations, designed to explore some of the questions surrounding the banking system’s response to different forms of regulatory control and macro-economic intervention such as interest rates. In these simplified prototypical banking systems, interest rates are set for the entire system, with no difference between the interbank lending rate and the rate for customer loans. Fixed rate loans are used, where the interest rate applies for the entire period of the loan, i.e. the affects of interest rate changes only take effect when new loans are issued. Long period fixed rate loans are typical of US bank lending, but not generally for European banking systems. We would stress that we are interested in this paper in the mechanical response of the banking system at its limits to changes, rather than the results of these responses on the economy. Ten year (120 repayment periods) loans are used in these examples for illustrative purposes.

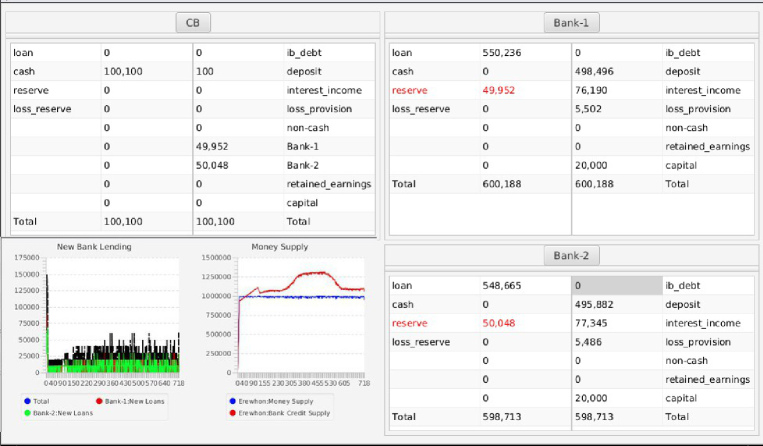

3.1 Central Bank Reserve Regulation

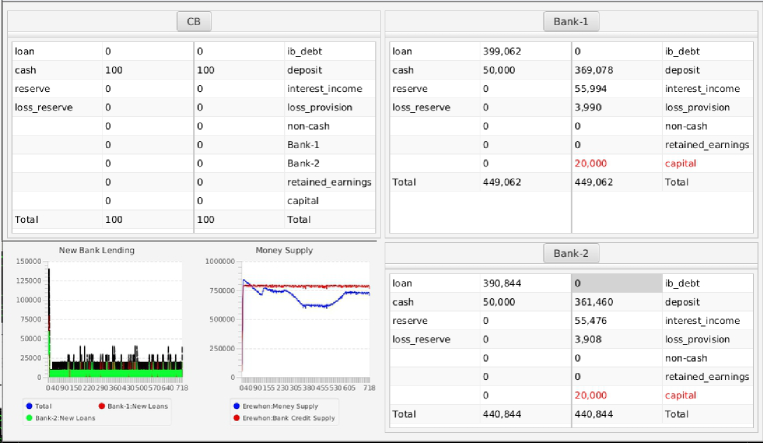

Figure 4 shows a simple central bank reserve regulated banking system with two banks. Each bank has 600 borrowers requesting loans of 10,000 each, 10 year duration, with a base rate that is initially 2%.999Simulation configuration file reference: eea_fig4.json The system’s loan supply is saturated, as can be seen from the highlighted reserve constraint (show in red), and after some perturbation as a result from the expansion from initial conditions (see above) the money supply is stable. All lending is confined to depositors at the loan originating bank, so there is no interbank activity. Reserve regulation in this simulation is based on the textbook calculation of the difference between reserves and customer deposits:

| (2) |

where R is the central bank reserve percentage, in this case 10% providing a theoretical (liability) money multiplier of 10. Capital controls are not enabled. New loans are granted when the bank’s loan capacity is greater than the capital value of the loan. As a consequence there is some variation of the rate of lending over time as shown in the graph of new bank lending. With reference to the reservations previously noted, this simulation is as close as it is possible to come to the standard textbook description of the banking system. In this simulation, the central bank base rate begins at 2%, is increased to 5% at step 240, and returned to 2% again at step 480, resulting in the credit supply behaviour shown

The simulation’s calculation of the reserve limit is based solely on the deposit ledger, and this in turn is effected both by the size of ledgers derived from deposit accounts: loss provisions and interest income. Consequently the actual amount of lending varies directly with interest rates, since increases in interest rates in this simulation cause an increase in the size of the interest income ledger which is not counted as a deposit. This behaviour in the simulation is somewhat artificial since typically a bank’s interest income is not directly coupled to interest rates, as changes also occur to the amount of income being paid out to savers as an expense. However, it does demonstrate the sensitivity within reserve constrained banking system to ledger classifications, since this effect will also apply to changes in loss provisions. Potentially similar effects could occur in reserve based systems due to banks reserving against foreseen losses or periodic dividend payments.

Today banks are required to make loss provisions at the time the loan is made.101010Full book keeping for loss provisions involves a contra-asset loss reserve account, the version shown here is somewhat simplified. The amounts held are partially regulated and partially under each individual bank’s control. Until the mid-1970’s in the USA for example, favourable tax law resulted in higher loss provisions, which were then reduced when the law was changed. This experiment demonstrates that changes to loss provision requirements in conjunction with reserve regulation can potentially alter credit provision, depending on how they are classified within the system and the regulatory framework. According to Balla[26] they are accounted as a contra-asset on the balance sheet, but since they are deducted from expenses on the income statement, in practice they originate from liability deposits. Frait[27] and others have suggested that loss provisioning may be pro-cyclical within a Basel framework however it follows from this result that this question cannot be answered simply by looking at levels of loss provisioning, since the regulatory framework also plays interacts with the system’s response to these levels.

This can be seen in Figure 5 which in contrast shows the identical simulation with capital controls enabled, and reserve controls disabled. The capital control is a 50% Basel risk weighting calculation applied to all loans. In this experiment we see no change in lending as a result of the interest rate changes, since lending is regulated by capital holdings, and loss provisions are being treated as a liability. Instead, the money supply decreases as a result of the increase in interest income. This is, as discussed above, a simulation artifact, the sum of the deposit and interest income ledgers is unchanged. It does show that the main result of interest rate changes in a Basel regulated system - leaving aside affects on loan demand - is to modify the distribution of monetary flows between savers and debtors.

Treated as a liability, loss provisions do not directly interact with Basel regulation of the loan supply, unless by reducing profits, they prevent the bank from expanding its capital base. However, some loss provisions can be included in Tier 2 capital and this does have the potential to interact with loan regulation.

Also of interest is the counter-intuitive response under reserve regulation to the increase in interest rates, with higher interest rates leading to an increase in lending under. This is again due to ledger classification, and the associated increase in interest income with higher interest rates, since the liability money in that ledger is then not counted toward the central bank reserve requirement. The simulation’s mechanics represent the maximum possible size of the response: the actual size of the effect would be dependent on how much and how long interest income was retained within the banking system before being recognized. The possibility of individual banks manipulating this dependency would also appear to exist.

Although reserve regulation is successful in this set of artificial circumstances, this should not be taken as indicative of its actual effectiveness. This experiment did not include inter-bank lending, and it has been known since the 1920’s that the regulatory role of central bank reserves could be partially circumvented by both interbank lending and re-discounting. Keynes discusses this as one of the results of divergent practices between the US Federal Reserve Banks and the Bank of England in 1929[28]. It is hard to know the full impact of these problems on the banking systems of their time, without a complete description of their regulatory framework, including their capital relationships, and ledger classifications.111111Under the 1844 Banking Act, London Banks were required to publish their holdings weekly. They developed the practice of doing this on different days of the week, which allowed inter-bank lending to be used to mask reserve discrepancies if necessary.

The most significant result from these simulations is the evidence that the banking system and by extension, the macro-economy within which it is operating, can be affected by accounting definitions operating at the lowest levels of its implementation. This not only indicates a system that has a considerably greater degree of sensitivity to the minutiae of its regulatory and accounting frameworks than may have previously been assumed, but also suggests that national macro-economic variations may be in part due to seemingly inconsequential differences in bank regulation.

3.2 The effects of lending on bank asset liquidity

Modern banking systems vary considerably in their use of central bank reserve requirements, and have generally moved away from using them in a regulatory role. No banking system appears to apply them to bank deposits in their entirety: at one extreme the Bank of England has no formal reserve requirements but has introduced liquidity requirements which are similar if not identical in their effects. The Euro banking system applies a 2% reserve requirement to all deposit accounts, excepting time deposits of greater than 2 years duration, and while the US applies a 10% reserve requirement to net transaction accounts, in practice there is considerable scope for account reclassification which allows its banks significant latitude over the size of their reserve accounts. Highly liquid forms of debt instrument such as treasuries can also be used to meet some of this requirement.

The expansion from initial conditions show in all simulations here demonstrates that in the absence of some form of regulation the banking system will rapidly expand its lending and the associated liability money supply. If most modern banking systems do not have strict reserve requirements, then what, besides borrower demand, is limiting the expansion of modern banking systems?

A claim made in the Macmillan Report, economic textbooks, and repeated recently by McLeay et. al.[19]121212Section(i) Limits on how much banks can lend p5 is that liquidity considerations play a role in throttling lending and money expansion. Specifically because funds being lent will be wholly or partly transferred to other banks in the banking system, the bank must restrict its lending to prevent it losing asset money. In the period of the Macmillan report of course such an affect would have interacted directly with the formal reserve requirements applied at the time, acting as an immediate restriction on further lending.

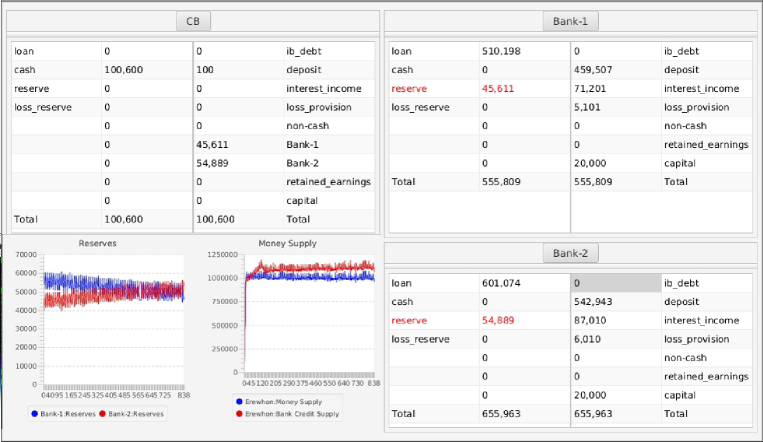

This argument however overlooks the long term flows of money associated with loan repayment, and in particular interest payments. The total amount of money transferred to the loan originating bank just as interest repayment on a 25 year loan at 6.5% is approximately equal to the original capital. Banks originating loans can consequently expect a net inflow of asset money over time, even if there is a short term outflow at the time the loan is made. The long term and dominating effect on liquidity is consequently the exact opposite to that claimed by Keynes et. al.

Figure 6 shows the same simulation used in the previous two experiments, with a single addition, a borrower with an account at Bank 1, receiving salary payments from Bank 1, but taking out a loan of 10,000 (2̃% of the bank’s total loan book) from Bank 2. As shown over time, there is a steady transfer of reserves from Bank 1 to Bank 2, as interest and capital repayments are made on the loan.

The size of this transfer is directly proportional to the interest rate on the loan, so as interest rates increase, the accrual of assets at the originating bank will also increase. This mechanism points to an explanation for the observed effect reported by Ennis[29] for the USA, Benito[30] for the Spanish system, and Wilson[31] for the four largest European systems, namely that banking systems tend to consolidate over long periods of time, i.e. systems with large numbers of small banks progressively become systems with small numbers of large banks, unless they are specifically regulated to prevent this. If we simply assume a randomly distributed number of loans across the system being paid from non-originating banks, we can see that probabilistically large banks will tend to cannibalize small banks of their asset money over time.

In practice, banks monitor their liquidity very carefully, and many require that their borrowers maintain accounts at their bank, presumably in part because of the initial liquidity issues lending can cause. 131313In Iceland, Arion Banki charges a higher interest rate to other banks’ customers, while the new MP Banki places no such restriction on its lending. However, banks have little or no control over their customers activities over time. For example, a bank that deliberately restricted lending to customers employed by a company that was also an account holder, would still not be able to guard against customers who changed employers. Clearly a bank that was aware of this effect could potentially exploit it competitively, but the timescale for the strategy to be effective would be several years.

Since increases in interest rates accelerate this mechanism, we hypothesize that it can be a cause of stress on the interbank lending mechanisms, and that increasing interest rates would put additional pressure on banks that were experiencing net asset outflows possibly leading to bank failure. The movement within the banking system of interest and capital flows due to securitized lending could also be expected to provide further stress on liquidity provisions due to these factors. Clearly though, we must look elsewhere for restrictions on the actual amount of lending being performed by the banking system.

Taken in conjunction with the result shown previously that interest rates do not directly affect the credit supply of the system, this result also allows us to determine the Nyquist limit for the banking system. The Nyquist limit is an important result from signal processing, which places a lower bound of twice the frequency under study, for determining the minimum sampling period for a time based system which avoids the detection of spurious signals due to aliasing.

Since there appears to be no impact on supply from interest rate changes, with the assumption that most banking systems are supply constrained, the main influence within the system on the money and credit supply seem to stem from the creation and destruction of money within the system which occurs as loans are made and repaid. This implies that the average loan period in conjunction with the regulatory limits on lending dominates in determining the response of the system to its regulatory framework. With the majority of loans in modern systems being of 20-30 year duration, this implies that macro-economic analysis based on monetary data must span a minimum of 40-60 years to avoid any spurious results due to aliasing. This is significantly longer than the mean time between significant regulatory changes intended to alter the behaviour of the system, suggesting that observational data may be of limited benefit in assessing the long term economic consequences of any given regulatory and accounting framework for this system.

3.3 Basel Capital Regulation

The introduction of the Basel Accords[32] from 1988 onwards imposed a new regulatory control on banking systems, one which attempted to regulate lending according to the default risk of particular categories of loans.141414See Alfriend[33] for a review of the shift in regulation toward capital controls from the 1940’s. In contrast to the central bank reserve requirement which established a leveraged ratio between money represented as liability deposits, to asset deposits of cash151515Central bank reserves are an asset from the perspective of the bank which owns them, and a liability on the central bank side; the Basel requirements establish a leveraged ratio between a bank’s capital (a liability), and its loans (an asset) according to a risk weighted multiplier based on the type of loan being made.

There is no indication that the Basel Accords were directly intended to limit monetary expansion, they were explicitly designed to ensure that banks maintained sufficient capital to provide protection against insolvency by ensuring that banks would have sufficient capital to handle loan defaults, in the event that their loss provisions and profits were inadequate for this purpose. There are no limits set on the total capital expansion by the entire banking system for example: individual banks are simply responsible for obtaining sufficient capital to cover their lending books with respect to the risk weighted lending requirements of their loan book.

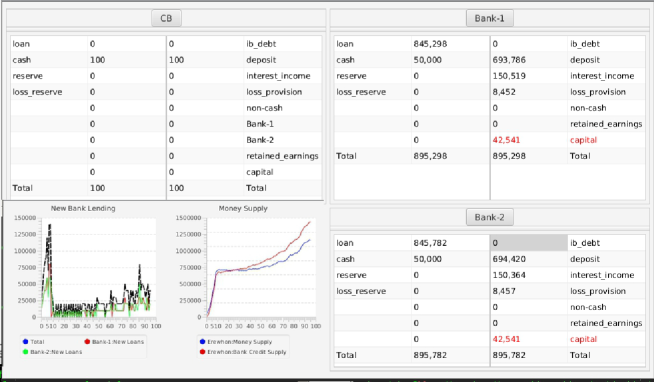

This not withstanding, under simulation it is clear that the Basel capital requirements do exert at least a throttle on lending and monetary expansion within the system, as shown in Figure 7. This simulation uses an identical configuration to the previous examples with reserve controls disabled, and capital controls enabled. The base interest rate is set to 5% in order to ensure that banks have sufficient interest income to pay dividends to their investors. In contrast to the previous example where no increase in capital was allowed, Investors are paid a dividend of 5% on their share holdings if sufficient income is available, and can use this to purchase new capital every 12 steps. As a consequence the credit and money supplies expand, in this instance approximately doubling over 10 years of simulation. This also suggests that the capital controls could be used for direct regulation of money and credit expansion if desired, which may be worth of further investigation, since in conjunction with risk weighting it would also seem possible to influence sectoral lending.

Part of the answer then, to what is regulating monetary expansion in modern banking systems, appears to be the Basel capital requirement. While increases to the capital on which the requirement is calculated are not explicitly limited, they are also not completely arbitrary. Increases to the capital reserve depend on a combination of each individual bank’s profitability, their willingness to use their profits to expand their capital base, as opposed to salary, dividend and bonus payments etc., and any changes in regulatory levels on their capital that have been imposed. One of the responses to the 2007 credit crisis for example was a regulatory requirement that banks increase their capital ratio by 2018, and this has probably had a contractionary effect on some economies over the last 5 years.

However, we do not rule out that in countries that still have reasonably comprehensive reserve requirements, reserve regulation is not also playing a role. The history of the reserve requirement since the 1940’s is for a progressive reduction, as computerized handling considerably reduced the time required for inter-bank processing, and hence liquidity161616Except in China where attempts have been made to actively use the reserve requirement for regulation. Reductions to the reserve requirement will allow credit and money supplies to expand over time, up to the new limit. If this expansion is simultaneously throttled by the capital requirements, then the gradual arrival at the new limit may not be obvious for several years until after it has occurred.

4 Conclusion

Discrete event simulations have been widely used in engineering as a tool for both exploring and testing regulatory controls on complex system behaviour. While not all systems lend themselves to this approach, the banking system is by its very nature a discrete event system, and we believe that this approach has considerable potential in analysing the response of banking systems to changes in the regulatory and financial framework.

Accounting rules are determined by accounting principals which are typically determined by a national standard boards and regulatory oversight bodies. Many countries are converging on the International Financial Reporting Standards (IFRS) established by the International Accounting Standards Board. These rules are primarily designed to provide an accurate view of the business state of the individual companies that use them, rather than the stability of the banking system within which they operate. Consequently the sensitivity to conditions demonstrated in this paper of significant concern, since it indicates that the banking system can be influenced by features of accounting and book keeping practices that are in practical terms invisible to macro-economic analysis.

Another matter deserving re-examination is the precise influence of interest rate changes on modern banking systems. The idea that the system can be controlled through interest rate manipulations is based on theoretical arguments originating from the early 20th century gold standard system as operated in Britain. There does not however appear to be any concrete proof that this "control" operates in the way commonly claimed. Nor does there appear to have been any attempt made to verify that it applies to banking systems besides those of the early 20th century gold standard, if indeed it was applicable then. The results in this paper with respect to interest rates suggest that these assumptions do not hold true for Basel regulated systems, and this is supported by the experience in Iceland between 2005-2007 where an acceleration in lending led to a doubling of liability deposits in the Icelandic banking system, despite the central bank raising the base interest rate to over 18% to prevent it.

The illusion of control is a well known phenomena in psychology originating from work by Langer in 1975[34]. The dominant characteristics of banking systems: continuously varying rates of expansion in the credit and money supply over long periods, periodic shocks, and interactions within a complex and dynamic economy, in conjunction with what appears to be considerable sensitivity to relatively small changes provides an ideal setting for this phenomena. Notable events will always be occurring in the economy somewhere, and without recourse to a detailed analysis based on fundamental mechanisms, it is impossible to ascribe causal relationships with any certainty. As a consequence, while economic theories and their mathematical models can find a source of supporting empirical evidence for theories applied to short time scales - longer periods present considerably more challenge.

We can for example, use the evidence from the simulations presented here to suggest an alternative narrative to that of the popular "zero-bound" hypothesis. If the influence of the banking system is linked to the period of its loans, rather than short term interest rate changes, then the banking system’s behaviour must evolve over decade long time scales, rather than months. In the absence of any direct influence of interest rates on lending supply, and several indications that second order effects are directly rather than inversely influenced by interest rates, it would seem reasonable to conclude that increasing interest rates in a Basel regime may increase the rate of money and credit expansion, rather than reducing it as generally believed.

We can consequently hypothesize that a long term process is occurring, where well intentioned policy interventions are having the opposite effect to that desired. As liquidity issues periodically arise in the banking system, either due to inevitably occurring imbalances caused by long term interest rate flows, or by an excess of lending in the larger economy, a higher loan default rate occurs than can be absorbed by the system on either the asset or liability side of the balance sheet. Initially this manifests itself as a reduction in credit availability, which then triggers a Fisher cascade failure[35] owing to the general reliance within the economy on a continuously expanding supply of credit and money from the banking system. This reduction in lending triggers intervention by the central banks to stimulate the economy by dropping interest rates. Since however the system is supply rather than demand constrained, this hinders the ability of banks to increase their capital and absorb loan losses, leading to a further reduction in economic activity.171717This may be partially offset if lower interest rates act to reduce loan defaults by lowering the repayment burden on the borrower. Eventually the banking system begins to once again expand lending, as loan defaults are finally absorbed, and the central bank shortly thereafter, following accepted economic theory, reacts by raising interest rates to prevent the economy overheating. In the short term this again has the opposite effect to that desired, as higher interest rates increase bank income181818Nominally, bank income is interest rate neutral since banks also pay interest on their savings accounts. However not all accounts attract interest, and banks also have more leeway to increase spreads in a high interest rate period than a low one. It could be argued this is an example of the zero bound influencing the system, but again in an opposite direction to that generally believed., allowing increased capital expansion and lending191919The Icelandic banking system in the 2005-7 years presents an extreme example of this with some highly questionable methods being used to increase capital., and the central bank in its turn raises interest rates higher. Eventually this triggers a new credit crisis either through the build up of liquidity imbalances caused by long term interest rate flows, or by causing excessive loan defaults as borrowers are unable to meet their interest repayments. Since the early 1980’s this series of events would also have been exacerbated by the widespread use of loan securitization, which we can infer from the experiment involving cross bank lending, would act to further unbalance liquidity flows within the banking system and place increased stress on the asset side of the system.

Whatever may be thought of this particlar argument, the larger problem remains. How do we determine if or when, this or any other explanation is correct? The banking system presents a complex set of transactions, interacting within a dynamic economy. It is not the case after all that current economic theory is lacking plausible explanations for observed phenomena, what is absent is any reliable mechanism for determining which theory is correct, and given the long history of systemically effecting changes to the banking system, when.

The approach outlined in this paper offers a way out of this impasse. Threadneedle is not designed to simulate any particular banking system, but rather to allow banking system simulations to be constructed. This allows experimental banking systems to be constructed and used to isolate the behaviour of the different components of the system, accounting treatments, financial instruments, or regulatory requirements. These results can then be used as the basis for larger and more realistic economic simulations and models tailored to the regulatory peculiarities of individual national banking systems.

More work is needed to develop the features available within Threadneedle, in particular a richer set of financial instruments is required, as well as central bank, commercial bank and borrower behaviours, and the inclusion of international banking, foreign exchange and stock and commodity markets. This will require research into determining the actual accounting mechanisms being used for these operations, and any regional or national differences that exist, but lies well within the scope of current computer technology.

Basing simulations on double entry book keeping operations also opens up the eventual possibility of linking economic simulations. Double entry book keeping provides a common set of financial operations identical to those used in the actual financial system, and as a consequence also provides a common reference point that can be used to link simulations together. This opens up the possibility of detailed simulation of the economy at the national and international level by multiple teams. It should be acknowledged though that constructing large complex simulations of poorly understood systems, however accurate they may be, is not necessarily a step forward. They are likely to be just as difficult to analyze as their real life counterparts. We suspect that the real power of systems like Threadneedle will be to allow small systems to be constructed that are tractable to analysis, and teaching, which can then be extended to larger systems, as a more strongly founded understanding of banking and its interaction with the economy is progressively established.

References

- [1] Michael J. Fischer and Nancy A. Lynch and Michael S. Paterson. Impossibility of Distributed Consensus with One Faulty Process. Journal of the Association for Computing Machinery, 32(2), April 1985.

- [2] David Laidler. The Price Level, Relative Prices and Economic Stability: Aspects of the Interwar Debate. Working Paper 136, BIS, 2003.

- [3] Frank Whiston Fetter. Development of British Monetary Orthodoxy, 1797-1875. Harvard University Press, 1965.

- [4] Ben Bernanke, Mark Gertler, and Simon Gilchrist. The financial accelerator in a quantitative business cycle framework. In J. B. Taylor and M. Woodford, editors, Handbook of Macroeconomics, volume 1, pages 1341–393. Elsevier Science B.V., 1999.

- [5] Claudio Borio. The financial cycle and macroeconomics: What have we learnt? Working Paper 395, BIS, December 2012.

- [6] Paul Krugman. Balance sheets, the transfer problem, and financial crises. International Tax and Public Finance, 6:459–472, 1999.

- [7] Gauti B. Eggertsson and Paul Krugman. Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo approach. The Quarterly Journal of Economics, 127(3):1469–1513, June 2012.

- [8] Jacky Mallett. What are the limits on Commercial Bank Lending? Journal of Advances in Complex Systems, August 2012.

- [9] Piti Disyatat Claudio Borio. Unconventional monetary policies: an appraisal. Working Paper 292, BIS, November 2009.

- [10] Blake LeBaron. Building the Sante Fe Artificial Stock Market. Working paper, Brandeis School of International Economics and Finance, 2002.

- [11] Aki Lehtinen and Jaakko Kuorikoski. Computing the Perfect Model: Why do Economists Shun Simulation? Philosophy of Science, pages 304–329, July 2007.

- [12] Paul Pfleiderer. Chameleons: The misuse of theoretical models in finance and economics. Working paper, Stanford, 2014.

- [13] Axel Leijonhufvud. Life among the econ. Western Economic Journal, pages 327–337, September 1973.

- [14] Carlo Bianchi, Pasquale Cirillo, Mauro Gallegati, and PietroA. Vagliasindi. Validating and calibrating agent-based models: A case study. Computational Economics, 30(3):245–264, 2007.

- [15] Jacky Mallett. Analysing the behaviour of the textbook fractional reserve banking model as a complex dynamic system. Proceedings of the Eighth International Conference on Complex Systems, VIII, 2011.

- [16] N. Gregory Mankiw. Principles of Economics. The Dryden Press, 1997.

- [17] Michael Burda and Charles Wyplosz. Macroeconomics A European Text. Oxford University Press, 6 edition, 2013.

- [18] British Parliamentary Reports on International Finance: The Report of the Macmillan Committee. H.M.Stationery Office, London, 1931.

- [19] Michael McLeay and Amar Radia and Ryland Thomas. Money creation in the modern economy. Quarterly bulletin, Bank of England, March 2014.

- [20] Alexander Allan Shand. Ginko-Boki-Seiho (Book keeping System of Banks). Tokyo: Ministry of Finance, 1874.

- [21] John A. Meelboom and Charles F. Hannaford. Bank Book keeping and Accounts. Gee. & Co., 34 Moorgate St, E.C., 2nd edition, 1904.

- [22] Charles Mecimore and Gary Deutsch. Bank Controller’s Manual. Sheshunoff, 2005.

- [23] Jacky Mallett. Description of the Operational Mechanics of a Basel Regulated Banking System. Working Paper: Available for review at www.arxiv.org, 2012.

- [24] David S. Gudjonsson. Exploring the Potential Macroeconomic Impacts of Branch Bank Practices. Master’s thesis, Reykjavik University, 2014.

- [25] George W. Miner. Book Keeping Banking. Ginn and Company, 1902.

- [26] Eliana Balla, Morgan J. Rose, and Jessie Romero. Loan Loss Reserve Accounting and Bank Behavior. Economic Brief, Federal Reserve Bank of Richmond, February 2012.

- [27] Jan Frait and Zlatuše Komárková. Loan loss provisioning in selected european banking sectors: Do banks really behave in a procyclical way? Czech Journal of Economics and Finance, 4(63):308–326, 2013.

- [28] John Maynard Keynes. A Treatise on Money. Macmillan, 1929.

- [29] Huberto M. Ennis. On the Size Distribution of Banks. Economic Quarterly, 87(4), 2001.

- [30] Enrique Benito. Size, Growth and Bank Dynamics. Working paper, Banco de España, 2008.

- [31] J. O. S. Wilson and J. M. Williams. The size and growth of banks: evidence from four European countries. Applied Economics, 32(9):1101–1109, 2000.

- [32] Basel Committee on Banking Supervision. International convergence of capital measurement and capital standards. Publication, Bank of International Settlements, 2006.

- [33] Malcolm C. Alfriend. Interational Risk-Based Capital Standard: History and Explanation. Economic Review, pages 28–34, November-December 1988.

- [34] Ellen J. Langer. The illusion of control. Journal of Personality and Social Psychology, pages 311–328, 1975.

- [35] Irving Fisher. The Debt-Deflation Theory of Great Depressions. Publications of the Federal Reserve, 1933.