The existence of optimal bang-bang controls for GMxB contracts††thanks: This work was supported by the Natural Sciences and Engineering Research Council of Canada (NSERC) and by the Global Risk Institute (Toronto).

Abstract

A large collection of financial contracts offering guaranteed minimum benefits are often posed as control problems, in which at any point in the solution domain, a control is able to take any one of an uncountable number of values from the admissible set. Often, such contracts specify that the holder exert control at a finite number of deterministic times. The existence of an optimal bang-bang control, an optimal control taking on only a finite subset of values from the admissible set, is a common assumption in the literature. In this case, the numerical complexity of searching for an optimal control is considerably reduced. However, no rigorous treatment as to when an optimal bang-bang control exists is present in the literature. We provide the reader with a bang-bang principle from which the existence of such a control can be established for contracts satisfying some simple conditions. The bang-bang principle relies on the convexity and monotonicity of the solution and is developed using basic results in convex analysis and parabolic partial differential equations. We show that a guaranteed lifelong withdrawal benefit (GLWB) contract admits an optimal bang-bang control. In particular, we find that the holder of a GLWB can maximize a writer’s losses by only ever performing nonwithdrawal, withdrawal at exactly the contract rate, or full surrender. We demonstrate that the related guaranteed minimum withdrawal benefit contract is not convexity preserving, and hence does not satisfy the bang-bang principle other than in certain degenerate cases.

Keywords: bang-bang controls, GMxB guarantees, convex optimization, optimal stochastic control

1 Introduction

1.1 Main results

A large collection of financial contracts offering guaranteed minimum benefits (GMxBs) are often posed as control problems [3], in which the control is able to take any one of an uncountable number of values from the admissible set at each point in its domain. For example, a contract featuring regular withdrawals may allow holders to withdraw any portion of their account. In the following, we consider a control which maximizes losses for the writer of the contract, hereafter referred to as an optimal control.

A typical example is a guaranteed minimum withdrawal benefit (GMWB). If withdrawals are allowed at any time (i.e. “continuously”), then the pricing problem can be formulated as a singular control [18, 9, 14, 15] or an impulse control [7] problem.

In practice, the contract usually specifies that the control can only be exercised at a finite number of deterministic exercise times [3, 8]. The procedure for pricing such a contract using dynamic programming proceeds backwards from the expiry time as follows:

-

1.

Given the solution as , the solution as is acquired by solving an initial value problem.

-

2.

The solution as is then determined by applying an optimal control, which is found by considering a collection of optimization problems.

If, for example, a finite difference method is used to solve the initial value problem from to , an optimal control is determined by solving an optimization problem at each grid node, in order to advance the solution to . Continuing in this way, we determine the solution at the initial time.

If there exists an optimal bang-bang control, an optimal control taking on only a finite subset of values from the admissible set, the numerical algorithm simplifies considerably. The existence of such a control is a common assumption in insurance applications [2, 19, 13], although no rigorous treatment is present in the literature. In this paper, we will also consider a weaker condition, a bang-bang principle. In this case, although an optimal control is not necessarily a finite subset of values from the admissible set, we will see that a control having this property can result in a large reduction in computational complexity.

Our main result in this paper is the specification of sufficient conditions which can be used to guarantee the existence of an optimal bang-bang control. This result relies on the convexity and monotonicity of the solution and follows from a combination of basic results in convex analysis and parabolic partial differential equations (PDEs). We demonstrate our results on two common contracts in the GMxB family:

-

•

The guaranteed lifelong withdrawal benefit (GLWB) (a.k.a. guaranteed minimum lifelong withdrawal benefits (GMLWB)) admits an optimal bang-bang control. In particular, we prove that a holder can maximize the writer’s losses by only ever performing

-

–

nonwithdrawal,

-

–

withdrawal at the contract rate (i.e. never subject to a penalty), or

-

–

a full surrender (i.e. maximal withdrawal; may be subject to a penalty).

-

–

-

•

On the other hand, the guaranteed minimum withdrawal benefit (GMWB) is not necessarily convexity preserving, and does not satisfy a bang-bang principle other than in certain degenerate cases.

In the event that it is not possible to determine an optimal control analytically, numerical methods are required. Standard techniques in optimization are not always applicable, since these methods cannot guarantee convergence to a global extremum. In particular, without a priori knowledge about the objective functions appearing in the family of optimization problems corresponding to optimal holder behavior at the exercise times, a numerical method needs to resort to a linear search over a discretization of the admissible set. Convergence to a desired tolerance is achieved by refining this partition [23]. Only with this approach can we be assured of a convergent algorithm. However, if an optimal bang-bang control exists, discretizing the control set becomes unnecessary. Theoretically, this simplifies convergence analysis. More importantly, in practice, this reduces the amount of work per local optimization problem, often the bottleneck of any numerical method.

1.2 Insurance applications

The GLWB is a response to a general reduction in the availability of defined benefit pension plans [6], allowing the buyer to replicate the security of such a plan via a substitute. The GLWB is bootstrapped via a lump sum payment to an insurer, which is invested in risky assets. We term this the investment account. Associated with the GLWB contract is the guaranteed withdrawal benefit account, referred to as the withdrawal benefit for brevity. This account is also initially set to . At a finite set of deterministic withdrawal times, the holder is entitled to withdraw a predetermined fraction of the withdrawal benefit (or any lesser amount), even if the investment account diminishes to zero. This predetermined fraction is referred to as the contract withdrawal rate. If holders wish to withdraw in excess of the contract withdrawal rate, they can do so upon the payment of a penalty. Typical GLWB contracts include penalty rates that are decreasing functions of time.

These contracts are often bundled with ratchets (a.k.a. step-ups), a contract feature that periodically increases the withdrawal benefit to the investment account, provided that the latter has grown larger than the former. Moreover, bonus (a.k.a. roll-up) provisions are also often present, in which the withdrawal benefit is increased if the holder does not withdraw at a given withdrawal time. Upon death, the holder’s estate receives the entirety of the investment account. We show that a holder can maximize the writer’s costs by only ever performing nonwithdrawal, withdrawal at exactly the contract rate, or surrendering the entirety of their account. Such a holder will never withdraw a nonzero amount strictly below the contract rate or perform a partial surrender. However, this result requires a special form for the penalty and lapsation functions, which is not universal in all contracts. Pricing GLWB contracts has previously been considered in [21, 13, 10, 1].

Much like the GLWB contract, a GMWB is composed of an investment account and withdrawal benefit initially set to , in which is a lump sum payment to an insurer. At a finite set of withdrawal times, the holder is entitled to withdraw up to a predetermined amount. Note that this amount is not a fraction of the withdrawal benefit, as in the GLWB, but rather a constant amount irrespective of the withdrawal benefit’s size. Furthermore, unlike the GLWB, the action of withdrawing decreases both the investment account and withdrawal benefit on a dollar-for-dollar basis.

The GMWB promises to return at least the entire original investment, regardless of the performance of the underlying risky investment. The holder may withdraw more than the predetermined amount subject to a penalty. Upon death, the contract is simply transferred to the holder’s estate, and hence mortality risk need not be considered. Pricing GMWB contracts has been previously considered in [18, 9, 8, 14, 15].

1.3 Overview

In 2, we introduce the GLWB and GMWB contracts. In 3, we generalize this to model a contract that can be controlled at finitely many times, a typical case in insurance practice (e.g. yearly or quarterly exercise). In 4, we develop sufficient conditions for the existence of an optimal bang-bang control and show that the GLWB satisfies these conditions. 5 discusses a numerical method for finding the cost of funding GLWB and GMWB contracts, demonstrating the bang-bang principle for the former and providing an example of where it fails for the latter.

2 Guaranteed minimum benefits (GMxBs)

We introduce mathematical models for the GLWB and GMWB contracts in this section. Since most GMxB contracts offer withdrawals on anniversary dates, to simplify notation, we restrict our attention to annual withdrawals occurring at

and are referred to as the initial and expiry times, respectively (no withdrawal occurs at ).

In order to ensure that the writer can, at least in theory, hedge a short position in a GMxB with no risk, we assume that the holder will employ a loss-maximizing strategy. That is, the holder will act so as to maximize the cost of funding the GMxB. This represents the worst-case hedging cost for the writer. This worst-case cost is a function of the holder’s investment account and withdrawal benefit. As such, we write , where is the value of the investment account and is the value of the withdrawal benefit. Both of these quantities are nonnegative.

Let denote the hedging fee, the rate continuously deducted from the investment account (while is used to denote a particular value of the investment account, the capital symbol is reserved for the corresponding stochastic process) to provide the premium for the contract. We assume that between exercise times, the investment account of the GMxBs follows geometric Brownian motion (GBM) as per

tracking the index satisfying

where is a Wiener process under the real-world measure. We assume that it is not possible to short the investment account for fiduciary reasons [8], so that the obvious arbitrage opportunity is prohibited.

The worst-case cost of a GMxB is posed as the solution to an initial value problem (IVP) specified by three conditions:

- 1.

- 2.

- 3.

We begin by introducing the IVP for the GMWB before moving to the GLWB for ease of exposition. To distinguish the two contracts, we use the superscripts L and M to denote quantities that pertain to the GLWB and GMWB, respectively. In the following, we denote by the expectation and by a Wiener process under the risk-neutral measure, that which renders the discounted index into a martingale. For a function whose domain is a subset of , we use the notations and to denote the one-sided limits at .

2.1 Guaranteed minimum withdrawal benefit (GMWB)

Since the GMWB is transferred to the holder’s estate upon death, mortality risk is not considered. The worst-case cost of funding a GMWB at time (the expiry) is [9]

corresponding to the greater of the entirety of the investment account or a full surrender at the penalty rate at the th anniversary, . The worst-case cost of funding a GMWB at previous times is derived by a hedging argument in which the writer takes a position in the index [8]. Equivalently, it is given by finding (within the relevant space of functions; see Appendix A) such that (s.t.)

| (2.1) | |||||

| (2.2) | |||||

| (2.3) | |||||

where between exercise times

| (2.4) |

is the risk-free rate, represents the cash flow from the writer to the holder, and represents the state of the contract postwithdrawal. The construction of and is outlined below. The holder is able to withdraw a fraction of the withdrawal benefit at each exercise time.

Intuitively, and can be thought of as the value of the contract “immediately before” and “immediately after” the exercise time .

Let denote the predetermined contract withdrawal amount associated with the GMWB so that (, ) is the maximum the holder can withdraw without incurring a penalty (both and are understood to have lower operator precedence than the arithmetic operations). Consider the point with .

-

•

The maximum a holder can withdraw without incurring a penalty is . If the holder withdraws the amount with ,

(2.5) -

•

Let denote the penalty rate at the th anniversary. If the holder withdraws the amount with ,

(2.6) Here, corresponds to a partial surrender and (i.e. ) corresponds to a full surrender.

We can summarize (2.5) and (2.6) by taking

| (2.7) |

and

2.2 Guaranteed lifelong withdrawal benefit (GLWB)

Let be the mortality rate at time (i.e. is the fraction of the original holders who pass away in the interval ), so that the survival probability at time is

We assume is continuous and nonnegative, along with for all times . We assume that mortality risk is diversifiable. Furthermore, we assume the existence of a time s.t. . That is, survival beyond is impossible (i.e. no holder lives forever). is chosen s.t. to ensure that all holders have passed away at the expiry of the contract. As is often the case in practice, we assume ratchets are prescribed to occur on a subset of the anniversary dates (e.g. triennially).

As usual, we assume that the holder of a GLWB will employ a loss-maximizing strategy. Since was picked sufficiently large, the insurer has no obligations at the th anniversary and the worst-case cost of funding a GLWB at time is

| (2.10) |

As with the GMWB, the worst-case cost of funding a GLWB is derived by a hedging argument in which the writer takes a position in the index [10]. Equivalently, it is given by finding (within the relevant space of functions; see Appendix A) s.t.

| (2.11) | |||||

| (2.12) | |||||

| (2.13) | |||||

where between exercise times, is specified by (2.4).

represents the (mortality-adjusted [10]) cash flow from the writer to the holder and represents the state of the contract postwithdrawal. In particular, corresponds to nonwithdrawal, corresponds to withdrawal at or below the contract rate, and corresponds to a partial or full surrender.

Remark 2.1.

We remark that the admissible set of actions is undesirably large (i.e. a continuum). We will apply the results established in 4 to show that an optimal strategy taking on values only from exists. In other words, an equivalent problem can be constructed by substituting the set for the original in the optimization problem (2.12). The resulting problem has smaller computational complexity than the original one (i.e. successive refinements of need not be considered to attain convergence).

The construction of and is guided by the specification of the contract:

-

•

Let denote the bonus rate: if the holder does not withdraw, the withdrawal account is amplified by .

-

•

Let denote the contract withdrawal rate; that is, is the maximum a holder can withdraw without incurring a penalty.

-

•

Let denote the penalty rate at the th anniversary, incurred if the holder withdraws above the contract withdrawal rate.

-

•

Let

Then,

| (2.14) |

and

| (2.15) |

3 General formulation

We generalize now the above IVPs. Let along with the order , in which is referred to as the expiry time. Let be a convex subset of . The set of all actions a holder can perform at an exercise time is denoted by , assumed to be nonempty, and referred to as an admissible set. For brevity, let

| (3.1) |

where and . We write to stress that for each fixed , we consider an optimization problem in the variable . The general problem is to find satisfying the conditions

| (3.2) | |||||

| (3.3) |

along with a condition specifying the evolution of from to (see, for example, (2.3) and (2.13)).

Remark 3.1.

Convexity preservation, a property that helps establish the bang-bang principle, depends on each admissible set being independent of the state of the contract, . This is discussed in Remark 4.18.

4 Control reduction

Definition 4.1 (Optimal bang-bang control).

, a solution to the general IVP introduced in 3, is said to admit an optimal bang-bang control at time whenever

where denotes a finite set independent of .

The above condition is inherently simpler than (3.3), in which there are no guarantees on the cardinality of .

4.2 develops Corollary 4.13, establishing sufficient conditions for the existence of an optimal bang-bang control. This result requires that the relevant solution be convex and monotone (CM). Given a CM initial condition (3.2), we seek to ensure that preserves the CM property at all previous times. 4.3 develops conditions on the functions and to ensure that the supremum (3.3) preserves the CM property. Similarly, 4.4 develops conditions on the dynamics of (and hence the underlying stochastic process(es)) to ensure that the CM property is preserved between exercise times.

For the remainder of this work, we use the shorthand and .

4.1 Preliminaries

In an effort to remain self-contained, we provide the reader with several elementary (but useful) definitions. In practice, we consider only vector spaces over and hence restrict our definitions to this case.

Definition 4.2 (convex set).

Let be a vector space over . is a convex set if for all and , .

Definition 4.3 (convex function).

Let be a convex set and be a vector space over equipped with a partial order . is a convex function if for all and ,

Definition 4.4 (extreme point).

An extreme point of a convex set is a point which cannot be written for any and with .

Definition 4.5 (convex polytope).

Let be a topological vector space over . is a convex polytope if it is a compact convex set with finitely many extreme points. The extreme points of a convex polytope are referred to as its vertices.

Definition 4.6 (monotone function).

Let and be sets equipped with partial orders and , respectively. is monotone if for all , implies .

Lemma 4.7.

Let be a convex set, and let and be vector spaces over equipped with partial orders and , respectively. If and are convex functions with monotone, then is a convex function.

Remark 4.8.

For the remainder of this work, we equip with the order defined as follows: if , whenever for all .

4.2 Bang-bang principle

Consider a particular exercise time . Suppose the following:

-

(A1)

is CM.

-

(A2)

For each fixed , is bounded above.

Throughout this section, we consider a particular point in order to establish our result pointwise. For the results below, we require the following propositions:

-

(B1)

There exists a collection s.t. and each is compact convex.

-

(B2)

For each , the restrictions and are convex.

-

(B3)

is a finite collection of convex polytopes.

Remark 4.9.

Lemma 4.11.

Proof.

Let . Note that , and hence no generality is lost in considering . Lemma 4.10 establishes the convexity of . Naturally, exists (and hence exists too) due to (A2). Finally, it is well known from elementary convex analysis that the supremum of a convex function on a compact convex set lies on the extreme points of , . See [22, Chap. 32]. ∎

Theorem 4.12 (bang-bang principle).

Proof.

By (B1), we have that . We can, w.l.o.g., assume that all members of are nonempty (otherwise, remove all empty sets). exists due to (A2). Since for each , (Lemma 4.11), two applications of Lemma B.1 allow us to “commute” the supremum with the union to get

∎

Theorem 4.12 reduces the region over which to search for an optimal control. When is a finite collection of convex polytopes, the situation is even nicer, as is a finite set (a finite union of finite sets). If, in addition, is chosen independent of , we arrive at an optimal bang-bang control:

Corollary 4.13 (optimal bang-bang control).

Example 4.14.

Let . We now find s.t. (B1), (B2), and (B3) are satisfied for the GLWB. Take , , and , satisfying (B3). Note that , satisfying (B1). It is trivial to show that the functions and defined in (2.14) and (2.15) are convex as functions of (the maximum of convex functions is a convex function), thereby satisfying (B2). Since was arbitrary and was chosen independent of , we conclude (whenever (A1) and (A2) hold), by Corollary 4.13, that the supremum of occurs at

(corresponding to nonwithdrawal, withdrawal at exactly the contract rate, and a full surrender).

Remark 4.15.

When all the conditions required for Corollary 4.13 hold, with the exception that depends on , then an optimal control is not necessarily bang-bang, but does satisfy the bang-bang principle, Theorem 4.12. In many cases, this still results in considerable computational simplification (see Remark 5.3).

4.3 Preservation of convexity and monotonicity across exercise times

Since the convexity and monotonicity of are desirable properties upon which the bang-bang principle depends (i.e. (A1)), we would like to ensure that they are preserved “across” exercise times (i.e. from to ).

Consider the th exercise time, . Suppose the following:

- (C1)

-

(C2)

For each s.t. , there exist sequences s.t. , and for all , and .

Remark 4.16.

(C2) simplifies greatly if for all , contains its supremum.555It is worthwhile to note that in practice, this is often the case; for fixed , consider compact and continuous for all . Denote this supremum , where is an optimal action at . In this case, the following simpler assumption yields (C2): for each s.t. , there exists s.t. and (take and for all to arrive at (C2)).

This simpler condition states that for each pair of positions , there is an action s.t. the position and cash flow after the event at under action are greater than (or equal to) the position and cash flow after the event at under an optimal action . Intuitively, this guarantees us that the position is more desirable than (from the holder’s perspective). This is not a particularly restrictive assumption, and it should hold true for any model of a contract in which a larger position is more desirable than a smaller one.

Remark 4.18.

Note that the proof of Lemma 4.17 involves using for . If is instead a function of the contract state (i.e. ), then the above proof methodology does not work since it is not necessarily true that for .

Proof.

Example 4.20.

We now show that the GLWB satisfies (C1) and (C2) given (A1) and (A2). It is trivial to show that the functions and defined in (2.14) and (2.15) are convex in (the maximum of convex functions is a convex function), thereby satisfying (C1). (C2) is slightly more tedious to verify. Let s.t. . By (A1), (A2) and the argument in Example 4.14, we can, w.l.o.g., assume , where denotes an optimal action at . Hence, we need only consider three cases:

-

1.

Suppose . Take to get and .

-

2.

Suppose . W.l.o.g., we can assume . Take to get and .

-

3.

Suppose . If , then and , and we can w.l.o.g. assume and once again take to get and . Therefore, we can safely assume that so that

(4.2) - (a)

-

(b)

Suppose . Take to get and

4.4 Preservation of convexity and monotonicity between exercise times

As previously mentioned, to apply Theorem 4.12, we need to check the validity of (A1) (i.e. that the solution is CM at ). In light of this, we would like to identify scenarios in which is CM provided that is CM (i.e. convexity and monotonicity are preserved between exercise times).

Example 4.21.

If we assume that both GLWB and GMWB are written on an asset that follows GBM, then Appendix A establishes the convexity and monotonicity (under sufficient regularity) of given the convexity and monotonicity of . The general argument is applicable to contracts written on assets whose returns follow multidimensional drift-diffusions with parameters independent of the level of the asset (a local volatility model, for example, is not included in this class). Convexity and monotonicity preservation are retrieved directly from a property of the corresponding Green’s function.

Although the methodology in Appendix A relates convexity and monotonicity to a general property of the Green’s function (including the class of contracts driven by GBM), in the interest of intuition, we provide the reader with an alternate proof below using the linearity of the expectation operator along with the linearity of the stochastic process w.r.t. its initial value. Consider, in particular, the GLWB. Equation (2.13) stipulates

Linearity allows us to consider the two terms appearing in the sum inside the conditional expectation separately. If each is convex in , so too is the entire expression. If ,

between and , where

from which it is evident that is convex in since depends only on time (note that the parameters appearing in are independent of the level of the asset, precluding a local volatility model). It remains to show that the first term is also convex. Fix , , and let . Then, by assuming that is convex in ,

One can use the same technique to show that monotonicity is preserved. An identical argument can be carried out for the GMWB.

Convexity and monotonicity preservation are established for a stochastic volatility model in [4]. For the case of general parabolic equations, convexity preservation is established in [16]. This result is further generalized to parabolic integro-differential equations, arising from problems involving assets whose returns follow jump-diffusion processes [5].

4.5 Existence of an optimal bang-bang control

Once we have established that convexity and monotonicity are preserved across and between exercise times (i.e. 4.3 and 4.4, respectively), we need only apply our argument inductively to establish the existence of an optimal bang-bang control. Instead of providing a proof for the general case, we simply focus on the GLWB contract here. For the case of a general contract, assuming the dynamics followed by the assets preserve the convexity and monotonicity of the cost of funding the contract between exercise times (e.g. GBM, as in Appendix A), the reader can apply the same techniques to establish the existence of a bang-bang control.

Example 4.22.

Consider the GLWB. Suppose that for some s.t. , is CM. By Example 4.21, is also CM. Under sufficient regularity (see Appendix A), for fixed , is bounded above (satisfying (A2)). Since (A1) and (A2) are satisfied, we can use Example 4.14 to conclude that the supremum of , for each , occurs on . By Example 4.20, is convex and monotone.

5 Numerical Examples

To demonstrate the bang-bang principle in practice, we implement a numerical method to solve the GLWB and GMWB problems and examine loss-maximizing withdrawal strategies.

5.1 Contract pricing algorithm

Algorithm 1 highlights the usual dynamic programming approach to pricing contracts with finitely many exercise times. Note that line 2 is purposely non-specific; the algorithm does not presume anything about the underlying dynamics of the stochastic process(es) that is a function of, and as such does not make mention of a particular numerical method used to solve given . Establishing that the control is bang-bang for a particular contract allows us to replace appearing on line 4 with a finite subset of itself.

5.2 Numerical method

The numerical method discussed here applies to both GLWB and GMWB contracts. Each contract is originally posed on . We employ Algorithm 1 but instead approximate the solution using a finite difference method on the truncated domain . As such, since will not necessarily land on a mesh node, linear interpolation is used to approximate on line 4. A local optimization problem is solved for each point on the finite difference grid. Details of the numerical scheme can be found in [1, 10].

Between exercise times, the cost of funding each contract satisfies one of (2.8) or (2.16). Corresponding to line 2 of Algorithm 1, we determine from using an implicit finite difference discretization. No additional boundary condition is needed at or ((2.8) and (2.16) hold along ). The same is true of . At , we impose

| (5.1) |

for some function differentiable everywhere but possibly at the exercise times . Substituting the above into (2.8) or (2.16) yields an ordinary differential equation which is solved numerically alongside the rest of the domain. Errors introduced by the above approximations are small in the region of interest, as verified by numerical experiments.

Remark 5.1.

Since we advance the numerical solution from to using a convergent method, the numerical solution converges pointwise to a solution that is convexity and monotonicity preserving. Although it is possible to show—for special cases—that convexity and monotonicity are preserved for finite mesh sizes, this is not necessarily true unconditionally.

Remark 5.2.

Although we have shown that an optimal bang-bang control exists for the GLWB problem, we do not replace with on line 4 of Algorithm 1 when computing the cost to fund a GLWB in 5.3.1 so as to demonstrate that our numerical method, having preserved convexity and monotonicity, selects an optimal bang-bang control. For both GLWB and GMWB, We assume that nothing is known about and hence form a partition

of the admissible set and perform a linear search

5.3 Results

5.3.1 Guaranteed Lifelong Withdrawal Benefits

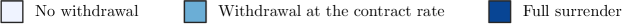

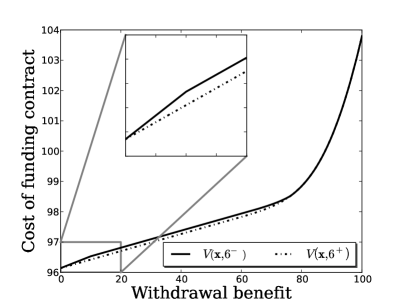

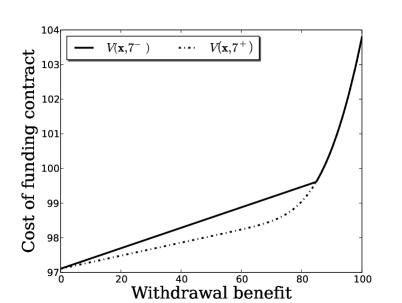

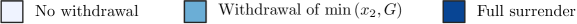

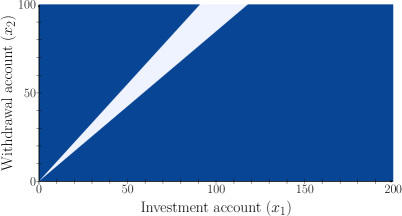

Figure 5.1 shows withdrawal strategies for the holder under the parameters in Table 5.1 on the first four contract anniversaries. We can clearly see that the optimal control is bang-bang from the figures. At any point , we see that the holder performs one of nonwithdrawal, withdrawal at exactly the contract rate, or a full surrender (despite being afforded the opportunity to withdraw any amount between nonwithdrawal and a full surrender).

When the withdrawal benefit is much larger than the investment account, the optimal strategy is withdrawal at the contract rate (the guarantee is in the money). Conversely, when the investment account is much larger than the withdrawal benefit, the optimal strategy is surrender (the guarantee is out of the money), save for when the holder is anticipating the triennial ratchet (times and ). Otherwise, the optimal strategy includes nonwithdrawal (to receive a bonus) or withdrawal at the contract rate. Note that the strategy is constant along any straight line through the origin since the solution is homogeneous of order one in , as discussed in [10].

| Parameter | Value | |

|---|---|---|

| Volatility | 0.20 | |

| Risk-free rate | 0.04 | |

| Hedging fee | 0.015 | |

| Contract rate | 0.05 | |

| Bonus rate | 0.06 | |

| Expiry | 57 | |

| Initial investment | 100 | |

| Initial age at time zero | 65 | |

| Mortality data | [20] | |

| Ratchets | Triennial | |

| Withdrawals | Annual | |

| Anniversary | Penalty |

|---|---|

| 1 | 0.03 |

| 2 | 0.02 |

| 3 | 0.01 |

| 0.00 |

5.3.2 Guaranteed minimum withdrawal benefit

For the GMWB, (C1) is violated. In particular, for , the function is concave as a function of . However, when or ( is considered in [15]), the function (see (2.7)) is linear in , and hence the convexity of can be guaranteed given CM. In this case, it is possible to use the same machinery as was used in the GLWB case to arrive at a bang-bang principle (see Theorem 4.12). The case of corresponds to zero surrender charges at the th anniversary, while corresponds to enforcing that all withdrawals (regardless of size) be charged at the penalty rate.

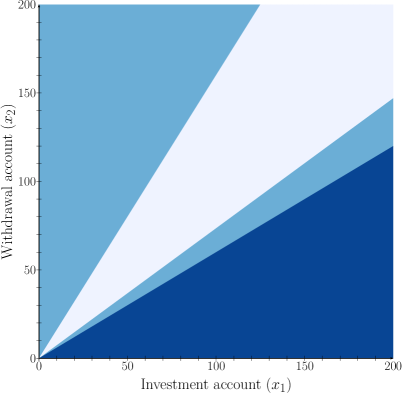

Now, consider the data in Table 5.2. Since for all , the convexity of in is preserved for all . However, since , the convexity is violated as . Figure 5.2 demonstrates this preservation and violation of convexity. As a consequence, will not necessarily be convex in as , and the contract fails to satisfy the bang-bang principle at each anniversary date .

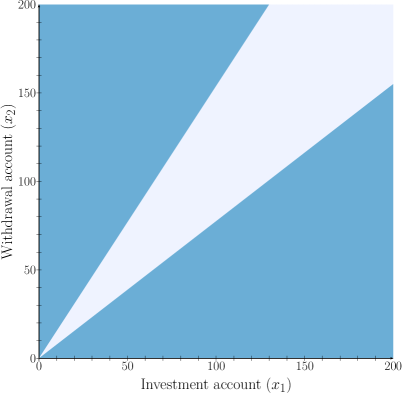

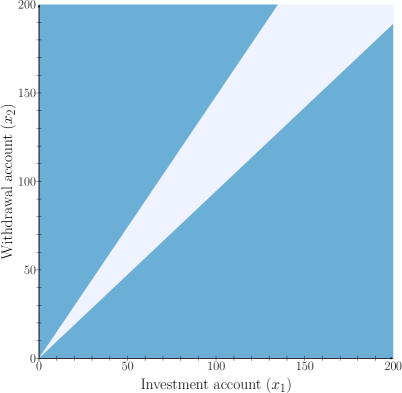

Note that for , the conditions and appearing in (2.7) are equivalent to and , respectively. Assuming that is CM and taking with and yields that there exists an optimal control taking on one of the values in at any point with . These three actions correspond to nonwithdrawal, withdrawing the predetermined amount , or performing a full surrender. This is verified by Figure 5.3, which shows withdrawal strategies under the parameters in Table 5.2 at times and . As predicted, along any line , the optimal control takes on one of a finite number of values. Since at , , we see that the holder is more hesitant to surrender the contract whenever (compare with the same region at ). Control figures for GMWBs not satisfying the bang-bang principle can be seen in the numerical results in [9, 7].

Remark 5.3.

Consider a GMWB with for all withdrawal times . As suggested by the above, this contract satisfies the bang-bang principle (in particular, Theorem 4.12 is satisfied) everywhere. However, the GMWB does not necessarily yield an optimal bang-bang control since depends on (Corollary 4.13 is not satisfied). For example, consider an optimal control for the GMWB taking on the value at each with . Such a control’s range is a superset of (not a finite set). However, in this case, the bang-bang principle guarantees that for fixed , a finite subset of the admissible set need only be considered in the corresponding optimization problem. Computationally, this is just as desirable as the case of an optimal bang-bang control.

| Parameter | Value | |

|---|---|---|

| Volatility | 0.15 | |

| Risk-free rate | 0.05 | |

| Hedging fee | 0.01 | |

| Contract rate | 10 | |

| Expiry | 10 | |

| Initial investment | 100 | |

| Withdrawals | Annual | |

| Anniversary | Penalty |

|---|---|

| 1 | 0.08 |

| 2 | 0.07 |

| 3 | 0.06 |

| 4 | 0.05 |

| 5 | 0.04 |

| 6 | 0.03 |

| 0.00 |

6 Conclusion

Although it is commonplace in the insurance literature to assume the existence of optimal bang-bang controls, there does not appear to be a rigorous statement of this result. We have rigorously derived sufficient conditions which guarantee the existence of optimal bang-bang controls for GMxB guarantees.

These conditions require that the contract features be such that the solution to the optimal control can be formulated as maximizing a convex objective function, and that the underlying stochastic process assumed for the risky assets preserves convexity and monotonicity.

These conditions are non-trivial, in that the conditions are satisfied for the GLWB contract but not for the GMWB contract with typical contract parameters. From a practical point of view, the existence of optimal bang-bang controls allows for the use of very efficient numerical methods.

Although we have focused specifically on the application of our results to GMxB guarantees, the reader will have no difficulty in applying the sufficient conditions to other optimal control problems in finance. We believe that we can also use an approach similar to that used here to establish the existence of optimal bang-bang controls for general impulse control problems. In the impulse control case, these conditions will require that the intervention operator have a particular form and that the stochastic process (without intervention) preserve convexity and monotonicity. We leave this generalization for future work.

Appendix A Preservation of convexity and monotonicity

In this appendix, we establish the convexity and monotonicity of a contract whose payoff is CM and written on assets whose returns follow (multidimensional, possibly correlated) GBM. We do so by considering the PDE satisfied by and the fundamental solution corresponding to the operator appearing in the log-transformed version of this PDE. Considering the log-transformed PDE allows us to eliminate the parabolic degeneracy at the boundaries and to argue that the resulting fundamental solution for the log-transformed operator should be of the form .

We begin by describing some of the notation used in this appendix:

-

•

Let where and is a convex subset of a partially ordered vector space over with order . can thus be considered as a convex subset of the vector space over .

-

•

We write an element of in the form with and in order to distinguish between elements of and .

-

•

The partial order we consider on is simply inherited from the orders on (Remark 4.8) and . Specifically, if and only if and .

Suppose satisfies

| (A.1) |

and

| (A.2) |

where

| (A.3) |

In the above, . We will, for the remainder of this appendix, assume the following:

-

(D1)

, , and (i.e. the functions , and are independent of ).

-

(D2)

is uniformly elliptic.

Example A.1.

For the GLWB guarantee, is given in (2.9) and .

Remark A.2.

We now describe the log-transformed problem. For ease of notation, let

and . Let be a solution of the Cauchy problem (A.1) and (A.2). Let

and . Then, satisfies

| (A.4) |

and

| (A.5) |

where

Note that (D2) implies that is uniformly elliptic.

In order to guarantee that a solution to the log-transformed Cauchy problem (A.4) and (A.5) exists, and is unique, sufficient regularity must be imposed on , , and . We summarize below.

-

(E1)

For each , is continuous on .

-

(E2)

The coefficients of are sufficiently regular.

-

(E3)

For each , is sufficiently regular.

-

(E4)

satisfies a growth condition as .

For an accurate detailing of the required regularity, see [11, Chap. 1: Thms. 12 and 16].

When (D2) and (E1)—(E4) are satisfied, the solution can be written as

| (A.6) |

where is the fundamental solution for (whose construction was first detailed by [17]). We first note that (E1) follows immediately if is convex, as shown below.

Lemma A.3.

If is convex w.r.t. the order (see Definition 4.3), then for all , is continuous on .

Proof.

We have assumed that is convex w.r.t. on . From this it follows that for all , is convex in on w.r.t. to the order on . This in turn yields that for all , is continuous in on . Therefore, is continuous in on .∎

Theorem A.4.

Proof.

appearing in (A.6) depends on and through alone since by (D1), , and are independent of the spatial variables [11, Chap. 9: Thm. 1]. Therefore

Let . From the above, whenever for all ,

Denote by the elementwise product of and . The substitution into the above yields

Since is [11, Chap. 2: Thm. 11] (a related, arguably more general result is given in [12, Chap. IV: Prop. 1.11]), from the convexity and monotonicity of and , it follows immediately that is CM on for any .

Remark A.5.

We can extend our construction to by taking limits of up to the boundary. Since the codomain of is Hausdorff, this extension is unique.

∎

Appendix B Commutativity of union and supremum

Let be a poset with order satisfying the least-upper-bound property. All supremums are taken w.r.t. .

Lemma B.1.

Let be an indexed family of nonempty subsets of . Let and

Then, whenever is bounded above.

Proof.

Suppose is empty. Then both and are empty, and hence the expressions agree.

Suppose is nonempty and that is bounded above. Since is bounded above, its supremum must occur in . For each , is an upper bound of , and since is a nonempty subset of , for some . Thus, . Since for each , is an upper bound of . Since is nonempty, is nonempty and hence has a least upper bound with . Let . Then for some , and hence so that is an upper bound of . Since , and hence . ∎

References

- [1] P. Azimzadeh, P. A. Forsyth, and K. R. Vetzal. Hedging costs for variable annuities under regime-switching. In R. Mamon and R. Elliot, editors, Hidden Markov Models in Finance Volume II: Further Developments and Applications, pages 503–528. Springer, New York, 2014.

- [2] A. R. Bacinello, P. Millossovich, A. Olivieri, and E. Pitacco. Variable annuities: A unifying valuation approach. Insurance Math. Econom., 49(3):285–297, 2011.

- [3] D. Bauer, A. Kling, and J. Russ. A universal pricing framework for guaranteed minimum benefits in variable annuities. ASTIN Bulletin-Actuarial Studies in Non Life Insurance, 38(2):621–651, 2008.

- [4] Y. Z. Bergman, B. D. Grundy, and Z. Wiener. General properties of option prices. J. Finance, 51(5):1573–1610, 1996.

- [5] B. Bian and P. Guan. Convexity preserving for fully nonlinear parabolic integro-differential equations. Methods Appl. Anal, 15:39–51, 2008.

- [6] B. A. Butrica, H. M. Iams, K. E. Smith, and E. J. Toder. The disappearing defined benefit pension and its potential impact on the retirement incomes of baby boomers. Social Security Bulletin, 69, 2009.

- [7] Z. Chen and P. A. Forsyth. A numerical scheme for the impulse control formulation for pricing variable annuities with a guaranteed minimum withdrawal benefit (GMWB). Numer. Math., 109:535–569, 2008.

- [8] Z. Chen, K. R. Vetzal, and P. A. Forsyth. The effect of modelling parameters on the value of GMWB guarantees. Insurance Math. Econom., 43(1):165–173, 2008.

- [9] M. Dai, Y. K. Kwok, and J. Zong. Guaranteed minimum withdrawal benefit in variable annuities. Math. Finance, 18(4):595–611, 2008.

- [10] P. A. Forsyth and K. R. Vetzal. An optimal stochastic control framework for determining the cost of hedging of variable annuities. J. Econom. Dynam. Control, 44:29–53, 2014.

- [11] A. Friedman. Partial differential equations of parabolic type. 1964.

- [12] M. G. Garroni and J. L. Menaldi. Green functions for second order parabolic integro-differential problems. Pitman Res. Notes Math. Ser. 275, Longman Scientific & Technical, Harlow, UK, 1992.

- [13] D. Holz, A. Kling, and J. Ruß. GMWB for life an analysis of lifelong withdrawal guarantees. Zeitschrift für die gesamte Versicherungswissenschaft, 101(3):305–325, 2012.

- [14] Y. Huang and P. A. Forsyth. Analysis of a penalty method for pricing a guaranteed minimum withdrawal benefit (GMWB). IMA J. Numer. Anal., 32:320–351, 2012.

- [15] Y. T. Huang and Y. K. Kwok. Analysis of optimal dynamic withdrawal policies in withdrawal guarantee products. J. Econom. Dynam., 45:19–43, 2014.

- [16] S. Janson and J. Tysk. Preservation of convexity of solutions to parabolic equations. J. Differential Equations, 206(1):182–226, 2004.

- [17] E. E. Levi. Sulle equazioni lineari totalmente ellittiche alle derivate parziali. Rendiconti del circolo Matematico di Palermo, 24(1):275–317, 1907.

- [18] M. A. Milevsky and T. S. Salisbury. Financial valuation of guaranteed minimum withdrawal benefits. Insurance Math. Econom., 38(1):21–38, 2006.

- [19] A. Ngai and M. Sherris. Longevity risk management for life and variable annuities: The effectiveness of static hedging using longevity bonds and derivatives. Insurance Math. Econom., 49(1):100–114, 2011.

- [20] U. Pasdika and J. Wolff. Coping with longevity: The new German annuity valuation table DAV 2004 R. In The Living to 100 and Beyond Symposium, Orlando Florida, 2005.

- [21] G. Piscopo and S. Haberman. The valuation of guaranteed lifelong withdrawal benefit options in variable annuity contracts and the impact of mortality risk. North American Actuarial Journal, 15(1):59–76, 2011.

- [22] R. T. Rockafellar. Convex analysis. Princeton University press, Princeton, N.J., 1997.

- [23] J. Wang and P. A. Forsyth. Maximal use of central differencing for Hamilton-Jacobi-Bellman PDEs in finance. SIAM J. Numer. Anal., 46(3):1580–1601, 2008.