Efficiency and complexity of price competition among single-product vendors††thanks: A preliminary version of this paper appeared in Proceedings of the 24th International Joint Conference on Artificial Intelligence (IJCAI), pages 25–31, 2015. This work was partially supported by Caratheodory research grant E.114 from the University of Patras and by a PhD scholarship from the Onassis Foundation.

Abstract

Motivated by recent progress on pricing in the AI literature, we study marketplaces that contain multiple vendors offering identical or similar products and unit-demand buyers with different valuations on these vendors. The objective of each vendor is to set the price of its product to a fixed value so that its profit is maximized. The profit depends on the vendor’s price itself and the total volume of buyers that find the particular price more attractive than the price of the vendor’s competitors. We model the behaviour of buyers and vendors as a two-stage full-information game and study a series of questions related to the existence, efficiency (price of anarchy) and computational complexity of equilibria in this game. To overcome situations where equilibria do not exist or exist but are highly inefficient, we consider the scenario where some of the vendors are subsidized in order to keep prices low and buyers highly satisfied.

1 Introduction

We focus on marketplaces that contain multiple vendors offering a single product and unit-demand buyers. For example, we may think of software development companies, each offering an operating system. Each potential user is interested in buying one operating system from some software company and has preferences over the different options available in the market. Her final choice depends not only on her preferences but also on the prices of the available products; eventually, each user will choose the product with the best value for money, or will simply abstain from purchasing a product if the available options are not satisfactory for her. In turn, vendors are aware of this buyer behaviour and aim to set the price of their product to a value that will maximize their profit. In particular, the dilemma a vendor faces is to select between a very small price that will guarantee a large market share or a huge price that will be attractive only to a few buyers. Of course, there are usually many options in between, and coming up with a pricing that will maximize profits in such an environment is challenging.

We model the above scenario as a two-stage full-information game (with both the vendors and the buyers as players) which we call a price competition game. In the first stage, each vendor selects the price of its product among a set of viable price values (i.e., the price values that are above a fixed production cost per unit of product). Buyers have unit demands and (possibly different) valuations for vendors. Together with the valuations of buyers, a vector of prices (with one price per vendor) determines in a second stage the most attractive vendor for each buyer. Each vendor has full information about the valuations of buyers and can predict their behaviour. The objective of each vendor is to set its price so that its profit (i.e., volume of buyers it attracts times the difference of price and production cost) is maximized given the prices of the other vendors.

A high-level overview of our contribution

We present a list of results for these price competition games. Our starting point is the observation that equilibria (i.e., buyers-to-vendors assignments and corresponding prices so that all vendors and all buyers are satisfied) are guaranteed to exist only when all buyers have the same valuations; price competition games with buyers belonging to at least two different types (with respect to their valuations) may not have equilibria. Even when equilibria exist, they may be highly suboptimal. We use the notion of the price of anarchy (introduced by Koutsoupias and Papadimitriou [15]; see also Papadimitriou [21]) to quantify how low the social welfare of equilibria can be compared to the optimal one. The social welfare is essentially the sum of buyer utilities and vendor profits. We also formulate several variations of equilibrium computation problems and present complexity results about them. These results range from polynomial-time algorithms (e.g., for the problem of determining prices that form an equilibrium together with a given buyers-to-vendors assignment) to hardness results (e.g., for the general problem of deciding whether a given price competition game admits an equilibrium). Motivated by the negative results on the existence and quality of equilibria, we investigate whether efficient buyers-to-vendors assignments can be enforced as equilibria by subsidizing the vendors. Our main contribution here is conceptual: subsidies can indeed overcome the drawbacks of price competition. Our technical contributions include tight bounds on the amount of subsidies sufficient to enforce a social welfare-maximizing buyers-to-vendors assignment as an equilibrium, as well as inapproximability results for the problem of minimizing the amount of subsidies sufficient to do so.

Related work

AI literature has long considered settings where vendors and buyers interact in electronic marketplaces (see e.g. [22]). Our model is very similar to (and actually inspired from) the one considered by Meir et al. [18] who focus on the impact of discounts (i.e., prices that are decreasing functions of demand) on vendors’ profit compared to fixed prices. After observing that price discounts have no impact at all in the full-information setting, they mostly focus on a Bayesian setting with uncertainty on buyers’ valuations. In contrast, we restrict our attention to the full-information model and consider only fixed prices. As we will see, this simple setting is very rich from the computational point of view. With the work of Meir et al. [18] as an exception, our assumptions differ significantly from most of the literature on price competition. For example, unlike early models such as the ones proposed by Cournot and Bertrand (see the book of Mas-Colell et al. [17]) as well as very recent refinements (e.g., the work of Babaioff et al. [3]), we assume that all vendors have unlimited supply. Also, contrary to other recent models that consider buyers with combinatorial valuations for bundles of different products as in the papers of Guruswami et al. [13], Chawla and Roughgarden [8], Babaioff et al. [4], Lev et al. [16] and more, we specifically assume that each buyer is interested in obtaining just a single product. In this way, the decision each buyer faces is rather trivial and this allows us to concentrate on the competition between the vendors. The competition of single-product vendors with unlimited supply differentiates our model also from the concept of Walrasian equilibrium, where the emphasis is on assigning prices to different items so that all buyers are satisfied, see e.g., [12, 13]. In addition, unlike variations of the models studied in these papers (such as in [14]), vendors do not use price discrimination in our case. On a more technical level, we implicitly assume an infinite number of buyers and use the notion of buyer types to distinguish between sets of buyers; this is a less important difference of our model to previous work on pricing. Very recent work, following the conference version of this manuscript, includes Anshelevich and Sekar [1] that introduces seller costs to Bertrand competition and allows for arbitrary supply. They study a two-stage full-information pricing game, where vendors sell edges on a directed graph and buyers wish to buy paths that connect a source to a sink node, and characterize the structure and properties of equilibria of that game. In addition, Borodin et al. [6] consider a pricing game with a single budget-constrained buyer and strategic vendors and characterize equilibria for a large class of valuation functions.

The use of subsidies in price competition games suggests yet another way of introducing external monetary incentives in games; such incentives (or disincentives) have been considered in many different contexts. Much of the work in mechanism design uses such incentives to motivate players to act truthfully (see [20] for an introduction to the field). The (apparently non-exhaustive) list also includes their use in cooperative game theory in order to encourage coalitions of players to reach stability [5] and as a means to stabilize normal form games [19]. As in [2] and [7], the use of monetary incentives in the current paper aims to improve efficiency. Monetary disincentives like taxes have been used to improve the efficiency of network routing (see [9] and the references therein for a relatively recent approach that extends early developments in the literature of the economics of transportation) and, in the recent AI literature, in boolean games [23].

Roadmap

The rest of the paper is structured as follows. We begin with preliminary definitions in Section 2. Then, we consider questions about the existence of equilibria in price competition games and their price of anarchy in Section 3. We formulate computational problems for equilibria and study related complexity questions in Section 4. We investigate the potential of subsidizing specific vendor prices in Section 5 and, finally, we conclude with open questions in Section 6.

2 Preliminaries

Our setting includes a set containing vendors targeting a large population of buyers. The buyers are classified into buyer types from a set . We denote by the volume of buyer type ; for example, can have the meaning that there are million buyers of type . Each of these buyers has a non-negative valuation for vendor (representing the satisfaction each buyer of type has when buying the product of vendor ). Essentially, the buyers are classified into types depending on the valuations they have for the vendors.

Each vendor has a non-negative cost per unit of product; we refer to as the production cost of vendor . The objective of each vendor is to determine a price for its product; naturally, so that the vendor always has non-negative profit. A price vector (containing a price per vendor) defines a demand set which, for each buyer type , denotes the set of vendors that maximize the utility of the buyers of type , i.e.,

Intuitively, the demand set for buyers of type consists of the most attractive vendors for these buyers. We assume that the operator returns (a set containing) an artificial vendor which represents an “abstain” option that a buyer has when its maximum utility (over all vendors) is non-positive. With a small abuse of notation, we introduce an extra vendor into in order to represent this abstain option for buyers; this vendor has production cost of , it always has a price of , and the valuations of buyers for it are .

A buyers-to-vendors assignment (or, simply, an assignment) is represented by an matrix which denotes how the volume of the buyers of each type is split among different vendors. In particular, the entry denotes the volume of buyers of type that are assigned to vendor and it must be for every buyer type . An assignment is consistent to a price vector if implies . We can interpret such an assignment as maximizing the utility of buyers given the price vector . We will denote by

the total utility of buyers of type given a price vector and a consistent assignment .

We study the game induced among vendors and buyers and use the term price competition game to refer to it. This can be thought of as a two stage game. At a first stage, the strategy of each vendor is its price. At a second stage, the buyers respond to these prices as described above. The utility of vendor , when the vendors use a price vector and the buyers are assigned to vendors according to an assignment that is consistent to , is defined as

Vendors are utility-maximizers. A price vector and a consistent assignment form a (pure Nash) equilibrium when for every vendor , the price maximizes the utility among all prices and all assignments that are consistent to . Here, the notation is used to represent the price vector where all vendors besides use the prices in and vendor has deviated to price .

The social welfare of an assignment is defined as

This definition does not require the assignment to be consistent to a price vector and can be used to define the optimal social welfare as

When the assignment is consistent to a price vector , the social welfare can be equivalently seen as the total utility of vendors and buyers since

The price of anarchy of a price competition game is the ratio of the optimal social welfare over the minimum social welfare among all equilibria. Of course, this is well-defined only for price competition games that do have equilibria.

Example 1.

Consider a price competition game as shown in Table 1.

vn vn vn bt : bt : bt :

Note that the buyers-to-vendors assignment where , , , while all other entries in are equal to , is consistent to the price vector and maximizes the social welfare. In particular, vendor obtains utility , vendor obtains utility , while vendor has ; since all buyers obtain utility equal to , it holds that . We remark that is not a pure Nash equilibrium, as vendor can lower its price to , where is arbitrarily small, and attract all buyers; the obtained utility under the new assignment is , i.e., .

In the following, we sometimes use the abbreviation instead of and write instead of the set for an integer .

3 Existence and quality of equilibria

As a warm up, we present a negative result that reveals a strong relation of the price of anarchy of price competition games to the number of buyer types.

Lemma 1.

There are one-vendor price competition games with price of anarchy that is arbitrarily close to .

Proof.

Consider a price competition game with buyer types and one vendor with a production cost of . Let . The volume of a buyer type is . The valuation of buyers of type is for and . By setting its price up to for , the vendor can only get a utility of at most by attracting the buyers of type . By the definition of , this utility is at most . This is smaller than the utility the vendor would have by selecting a price of and attracting only the buyers of type (the remaining buyers simply abstain). This is an equilibrium in which the utility of the vendor (as well as the social welfare) is . In contrast, the social welfare of the assignment in which all buyers are assigned to the vendor is ; the inequality holds by the definition of and since

The price of anarchy is then at least which can become arbitrarily close to by selecting appropriately. ∎

Interestingly, the price of anarchy does not depend on any other quantity and the lower bound of Lemma 1 is tight.

Theorem 2.

The price of anarchy of any price competition game with buyer types is at most .

Proof.

Consider an equilibrium of a price competition game. We first claim that if buyers of some type are split between two vendors and , then it must be and (hence, the two vendors have zero utility) and the assignment in which all these buyers are assigned to vendor without changing the prices is still an equilibrium and has the same social welfare. This is due to the fact that, at equilibrium, the utilities of buyers of type assigned to and should be the same. Hence, if one of the two vendors had a price strictly higher than its production cost, it could increase its utility by negligibly decreasing its price; this would result in attracting all buyers of type previously assigned to and . So, by moving all buyers of type from vendor to vendor , we still have an assignment that is consistent to in which the utilities of buyers and vendors do not change. Clearly, this new assignment is an equilibrium with a social welfare equal to the initial one.

So, without loss of generality, we consider an equilibrium such that, for every , all buyers of type are assigned to the same vendor , i.e., . We denote by the vendor where the buyers of type are assigned in . Also, we denote by the vendor to which the buyers of type are assigned in an optimal assignment. Again, if there exists an optimal assignment where buyers of the same type are split among different vendors, we can move all these buyers to a single vendor without decreasing the social welfare, hence is well defined. We can further assume that when , this implies that . If this is not the case and it is , we can consider the optimal assignment that assigns the buyers of type to vendor .

We will show that

| (1) |

for every . Then, the following derivation can prove the theorem:

The first inequality follows by the definition of the social welfare, the second one follows from the fact that the function can assign at most all buyer types to the same vendor, the third one follows from (1) and the last equality follows from the definition of the optimal social welfare.

It remains to prove inequality (1). If , we use the fact that vendor attracts (at least) the buyers of type at equilibrium. Hence,

If , let . First, we claim that is a valid price for vendor . Indeed, by our assumption above and since , we have

This means that vendor can consider deviating to any price value from the non-empty interval . From the discussion above, it is , which means that, by deviating to , vendor can attract the buyers of type from vendor . Using the equilibrium condition (and denoting by the resulting consistent assignment when vendor deviates to price ), we have that

Since the above inequality holds for any , it must also be

This completes the proof of the theorem. ∎

Recall that the upper bound on the price of anarchy is meaningful only for games that admit equilibria. In the following, we show that games with one buyer type always have equilibria (and, by Theorem 2, all equilibria have optimal social welfare since the price of anarchy is ) while the existence of a second buyer type may result to instability.

Lemma 3.

Price competition games with one buyer type always have at least one equilibrium.

Proof.

Consider a price competition game with one buyer type. We use the simplified notation to denote the valuation of the buyers for vendor . Let and be two vendors with the highest values for the difference . Set and for any vendor . We claim that this price vector together with the consistent assignment that assigns the buyers to vendor is an equilibrium. Indeed, no vendor has any incentive to change its price; a decrease would result in negative utility while an increase would not change the assignment. Moreover, vendor has no incentive to change its price; a decrease can only lower its utility while an increase would result in a new assignment in which all buyers are attracted by vendor . ∎

Lemma 4.

There exists a price competition game with two buyer types that admits no equilibrium.

Proof.

Consider the price competition game with two buyer types of unit volume each and two vendors with a production cost of . We use the terms left and right to refer to the vendors and buyer types. The valuation of the left buyers is for the left vendor and for the right vendor; the valuation of the right buyers is for the left vendor and for the right vendor. We show that no pair of a price vector (with prices and for the left and the right vendor, respectively) and consistent assignment can be an equilibrium. We distinguish between cases.

If only the left vendor is assigned buyers (the argument holds symmetrically for the right vendor), the right vendor can attract the right buyers by setting its price to any non-zero value smaller than and increase its utility from to positive.

The case where the left vendor gets no left buyers and the right vendor gets no right buyers requires the inequalities and , i.e., and ; this implies that and , which in turn implies that no vendor receives any buyers since they all have negative utility and prefer to abstain. Clearly, this is not an equilibrium since a vendor can attract all buyers, by lowering its price to smaller than , and, thus, obtain strictly positive utility.

The only remaining case is when some left buyers are assigned to the left vendor and some right buyers are assigned to the right vendor. This requires the two inequalities and . Clearly, if the first inequality is strict, the left vendor can increase (and, consequently, its utility) so that the first inequality becomes equality. Similarly, the second inequality should be an equality as well. So, the requirements for this case are actually the equalities and . The only prices that satisfy both equalities simultaneously are which do not form an equilibrium since any vendor can set its price to a value negligibly smaller than , attract all buyers, and increase its utility from to arbitrarily close to . The proof is complete. ∎

4 Complexity of equilibria

We begin the discussion of this section by formulating some concrete computational problems related to equilibria of price competition games.

VerifyEquilibrium: Given a price vector and a buyers-to-vendors assignment in a price competition game , decide whether is an equilibrium of .

ComputePrice: Given a buyers-to-vendors assignment in a price competition game , decide whether there exists a price vector to which is consistent so that is an equilibrium of .

PriceCompetition: Decide whether a given price competition game has any equilibrium or not.

4.1 Complexity of VerifyEquilibrium

VerifyEquilibrium can be easily seen to be solvable in time. First, one needs to check whether is consistent to , i.e., whether the utility of each buyer type is maximized at the vendor(s) used in ; this can be done by computing at most buyer utilities. Then, for every vendor , it suffices to sort (in time) the buyer types according to the maximum price that would incentivize them to select vendor , given the prices for the remaining vendors, and, then, compute (in time) the price that maximizes the vendor’s utility when deviating to this price level (a vendor’s utility is equal to the volume of buyers it attracts times the difference of the price level from the production cost). The final decision is YES if is consistent to and the utility of all vendors in is equal to the maximum utility over all the deviations considered; otherwise, it is NO. In the following, we call this algorithm Verify; its pseudocode appears below as Algorithm 1.

4.2 Complexity of ComputePrice

The problem ComputePrice looks significantly more difficult at first glance since there are too many price vectors (to which is consistent) that have to be considered. Interestingly, we will present a polynomial-time algorithm (henceforth called CandidatePrice) which, given a price competition game and a buyers-to-vendors assignment , comes up with a single candidate price vector that can in turn easily be checked whether it forms an equilibrium together with using Verify.

CandidatePrice works as follows; see also Algorithm 2. It first computes a set of seed vendors which will have a price equal to their production cost. In order to define , it is convenient to consider the directed graph that has a node for each vendor and a directed edge from node to node labelled by if buyers of type are assigned to vendor in and, furthermore, . Now, the set is defined recursively as follows:

-

1.

Any vendor that is not assigned any buyer in belongs to ; such a vendor is called empty.

-

2.

Any vendor such that belongs to .

-

3.

Any vendor that is part of a directed cycle in belongs to .

-

4.

Any vendor that has a directed edge to a vendor of also belongs to .

CandidatePrice returns the price vector with for each seed vendor and

| (5) |

for each non-seed vendor.

Example 2.

Consider the price competition game shown in Table 2.

vn vn vn vn bt : bt : bt : bt : bt :

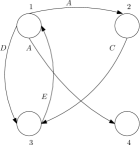

Let be the assignment where all buyers of type are assigned to vendor , all buyers of type are assigned to vendor , buyers of type are assigned to , buyers of type are assigned to vendor and, finally, buyers of type are assigned to vendor . The directed graph is depicted in Figure 1.

Note that vendors , , and are seed vendors since they are part of a directed cycle. This leads to the following price vector . In order to verify that is indeed a pure Nash equilibrium, it suffices to run algorithm Verify with input ; this is true since all buyers are assigned to vendors in their demand set, vendors , and cannot increase their utility by unilaterally increasing their price as, then, they would lose all assigned buyers, while vendor cannot increase its price, since its assigned buyers would move to vendor , and cannot attract new buyers by decreasing its price.

The correctness of the algorithm is given by the following lemma.

Lemma 5.

Let be the price vector returned by CandidatePrice on input a price competition game and a buyers-to-vendors assignment . If admits an equilibrium , then for every non-empty vendor .

Proof.

Consider the price vector returned by CandidatePrice. We will show that satisfies the very same properties as does, for non-empty seed and non-seed vendors. We begin by arguing about the empty vendors, where it may hold that for an empty vendor .

Empty vendors

Given the price vector , we construct a new price vector by setting for every empty vendor in and for every other vendor . Since is an equilibrium, is an equilibrium as well. To see why, it suffices to show that no buyer has any incentive to deviate to an empty vendor in . Assume otherwise that is not an equilibrium; we will show that should not be an equilibrium as well. Since is not an equilibrium, there must exist some such that buyers of type are assigned to a vendor in and satisfy for some vendor that is empty in . From the definition of , this means that and vendor could set its price to a sufficiently small but strictly higher than its production cost price to attract the buyers of type and increase its utility from (since is an empty vendor according to ) to positive; this contradicts the assumption that is an equilibrium. Now, clearly, has the desired structure (i.e., prices equal to production costs) for vendors that are empty in , and it suffices to prove that .

For the remainder of the proof, recall that, by the definition of , for any non-empty vendor .

Seed vendors

First, observe that for any non-empty vendor with , it should obviously be since is consistent to .

Now, consider a directed cycle of length in ; we have to show that for each vendor . Let , , …, be the vendors in and denote by , , …, the (not necessarily distinct) labels of the corresponding edges. Observe that the (consistency) conditions that guarantee that the buyers of type do not prefer vendor to vendor for and buyers of type do not prefer vendor to vendor together with the conditions defining the directed cycle can only hold if for all and . Now, if there is a vendor with , let be the predecessor of in . Then, by negligibly decreasing , vendor could also attract the buyers assigned to both vendor and itself in ; this would strictly increase its utility, contradicting the fact that is an equilibrium.

We will also show that for every vendor that is identified as a seed vendor by the recursive step 4 of CandidatePrice, it is . Assume otherwise and consider the first vendor that is identified as seed vendor by the recursive step 4 that has . This means that has an edge from to some seed vendor , labelled by , and, hence, . By our assumption that is the first seed vendor with identified at step 4 of the algorithm, it is . Hence, which contradicts the consistency of to .

Non-seed vendors

First, we will prove that for every such vendor , it must be . Consider the subgraph that is induced by the nodes of corresponding to non-seed vendors. By the definition of seed vendors, is acyclic and its vendors are non-empty. We will show that the inequality holds for the leaves of and will then use this fact to also show that it holds for their parents and, recursively, for all vendors in .

Case I: leaf vendors

For a leaf vendor of , its price may satisfy only if there is a buyer type assigned to in and another vendor so that , as otherwise could negligibly increase its price and obtain more utility. But then, it is and, hence, should also contain the directed edge from to . Since is non-seed, should be non-seed as well and the edge should exist in , contradicting the fact that is a leaf in .

Case II: non-leaf vendors

Let be a non-seed vendor with such that all its children in have . Again, there is a buyer type assigned to in and another vendor so that , as, otherwise, vendor could increase its price above its production cost and increase its utility. Since and , our assumptions imply that . Hence, is one of the children of . But then, can negligibly decrease its price to attract (in addition to all the buyers it gets in ) the buyers assigned to as well; this would increase the utility of vendor . This contradicts the fact that is an equilibrium and establishes that for every non-seed vendor .

It remains to show that for every non-seed vendor , is given by the same expression (5) as . If there are no seed vendors, i.e., (the set is empty), assume that there is a vendor with . Then, the only reason that may prevent vendor from increasing its price is that there is a buyer of type assigned to in and another vendor such that . Since is a non-seed vendor, it is and, hence, vendor could negligibly decrease its price to attract (in addition to all the buyers it gets in ) the buyers assigned to as well; this would increase the utility of vendor .

Otherwise, if the set of seed vendors is non-empty, we will show that every non-seed vendor has . First, assume otherwise that . By the definition of , this means that there is a buyer type assigned to in and a seed vendor such that and subsequently (since ), . This contradicts the consistency of to . Finally, assume that . Then, the only reason that may prevent vendor from increasing its price is that there is a buyer of type assigned to in and another vendor such that . If , the last equality also implies that , contradicting our assumption. Hence, it must be , i.e., . Then, vendor could negligibly decrease its price to attract (in addition to the buyers it gets in ) the buyers assigned to as well; this would increase the utility of vendor . This completes the proof that , and, hence, that for any non-empty vendor . ∎

4.3 Complexity of PriceCompetition

We now turn our attention to PriceCompetition and first consider the cases where either the number of buyer types or the number of vendors is constant.

Theorem 6.

PriceCompetition is solvable in polynomial time when the number of buyer types is constant.

Proof.

We begin by arguing that it suffices to consider non-fractional assignments, i.e., assignments where all buyers of the same type are assigned to a single vendor. To see that, consider an equilibrium where buyers of some type are split between two vendors and . Then, it must be and , and the assignment in which all these buyers are assigned to vendor without changing the prices is still an equilibrium. Indeed, at equilibrium the utilities of buyers of type assigned to and should be the same. Hence, if one of the two vendors had a price strictly higher than its production cost, it could increase its utility by negligibly decreasing its price; this would result in attracting all buyers of type previously assigned to and . So, by moving all buyers of type from vendor to vendor , we still have an assignment that is consistent to in which the utilities of buyers and vendors do not change; observe that since , it holds that and, hence, vendor does not lose utility by this change. Clearly, the new assignment is also an equilibrium.

The theorem follows since there are at most different non-fractional buyers-to-vendors assignments and corresponding instances of ComputePrice that we need to consider. ∎

The case of a constant number of vendors (this can be thought of as an oligopoly) is considerably more involved but still computable in polynomial time as we show in the following.

For a fixed price vector , we define the induced preference, denoted by , of buyers of type as if and if . We use the term preference profile to refer to a combination of buyer preferences. The main idea is to enumerate the different preference profiles that are defined for all price vectors . Observe that the sign (from ) of the expression indicates whether buyers of type prefer vendor to vendor (i.e., ), are indifferent between the two (i.e., ), or prefer vendor to (i.e., ). The number of different preferences of buyers between the two specific vendors, when keeping valuations fixed, is given by the number of different sign patterns for the expressions for as the difference runs from to . Since there are at most different values of the difference , this number is at most ; this holds since, at the beginning, all signs are positive and, as increases, the sign of each buyer type will change, first to and then to negative. In total, the number of distinct sign patterns we need to enumerate in order to consider all distinct preference profiles is at most as there are ways to select a pair , of vendors; this is polynomial in when is constant.

When considering a preference profile , we compute the following assignment which should be given to CandidatePrice in order to return a price vector ; the pair will in turn be given to Verify to detect whether it corresponds to an equilibrium or not. For each buyer type with a unique top preference (i.e., strictly preferring a particular vendor to all others), assigns buyers of type to their most preferred vendor. For each buyer type that has a set of at least two vendors tied as its top preference, assigns to a(ny) vendor of maximizing . We call this algorithm Enumerate; its pseudocode appears as Algorithm 3.

Clearly, on input a price competition game that does not admit an equilibrium, Enumerate will not find any. The next lemma completes the proof of correctness of Enumerate.

Lemma 7.

On input a price competition game, Enumerate returns an equilibrium if one exists.

Proof.

Assume that Enumerate is applied on input a price competition game that admits an equilibrium . If is the unique assignment that is consistent to , Enumerate will consider the preference profile corresponding to vector and will pass the uniquely defined assignment as input to CandidatePrice to compute a price vector ; by Lemma 5, will form an equilibrium of .

Now, assume that is not the unique assignment that is consistent to . Denote by the assignment computed by Enumerate (notice that is consistent to as well) when considering the preference profile that corresponds to the price vector . We will show that is an equilibrium as well; then, Lemma 5 guarantees that an equilibrium will be found when Enumerate will run CandidatePrice with input assignment .

Consider a buyer type with and for two different vendors and . By our assumptions, we have (since buyers of type are indifferent between vendors and in ) and (since Enumerate sets ). We will show that and . Indeed, assume that . Then, by negligibly decreasing its price in , vendor could increase its utility by attracting (in addition to the buyers it gets in ) all the buyers of type . Hence, and . By the inequality , we obtain that . The lemma follows since the different assignments of buyers in and does not affect the utility of the corresponding vendors (which is zero). ∎

By the discussion above and Lemma 7, we obtain the following.

Theorem 8.

PriceCompetition is solvable in polynomial time when the number of vendors is constant.

The restrictions on the numbers of vendors or buyer types are necessary in order to come up with efficient algorithms for PriceCompetition (unless ).

Theorem 9.

PriceCompetition is NP-hard.

Proof.

We use a reduction from the well-known NP-hard Exact--Cover problem (XC) which is formally described as follows.

Exact-3-Cover: Given a universe of elements and a collection of -sized subsets of , is there a cover consisting of disjoint sets?

Given an instance of XC we describe an instance of PriceCompetition as follows; see also Table 3:

-

•

For every subset , there is a set-vendor ;

-

•

for every element , there are two vendors and ;

-

•

for every element , there is an element-buyer type with volume , and valuations for every vendor such that , for vendor , and for vendor ;

-

•

for every element , there is a buyer type with volume and valuation for vendor , and for vendor ;

-

•

for every subset , there are two buyer types: one buyer type with volume and valuation for vendor , and one buyer type with volume and valuation for vendor ;

-

•

all valuations not mentioned above and all production costs are zero.

vn vn vn bt : bt : bt : bt :

First, observe that in any equilibrium , a vendor corresponding to the set of may have been assigned

-

•

either all buyers of type by setting its price to , i.e., equal to the valuation ;

-

•

or all buyers of types , , , , and by setting its price to , i.e., equal to the valuation .

To see why the above claim is true, observe that, in any of the two cases, the utility of vendor at equilibrium is . Clearly, by decreasing its price so that it lies in the ranges or , the utility of the vendor becomes strictly smaller than since any consistent assignment will belong to one of the two cases. By setting the price in the range , no consistent assignment includes the buyers of type and, hence, the utility of vendor is at most .

Now, assume that the initial X3C instance is a YES instance with a cover consisting of -sets from . Then, consider the price vector with for every set , for every set , and and for every . Let be the consistent assignment that assigns each element buyer of type to the set vendor such that and , assigns the buyers of type to vendor for every set , assigns the buyers of type to vendor for every set while the buyers of type abstain for every set , and assigns the buyers of type to vendor . We now argue that is an equilibrium. First, observe that all set vendors follow one of the two strategies mentioned above and are at equilibrium. Now, for every element , the vendors and are essentially engaged in a two-vendor game competing only for buyers of type since the buyers of type have a utility of at vendor with and their deviation to a vendor among and would never increase their utility to above . The prices and form an equilibrium in this two-vendor game. Indeed, the utility of vendor is zero (since it is not assigned any buyers according to ) and its price equals its production cost, which means that this vendor cannot gain any utility by deviating. Moreover, the utility of vendor is and it cannot be increased (since the buyers of type would then go to vendor or abstain) or decreased (since the vendor would then have less utility).

On the other hand, if the initial X3C instance is a NO instance, we claim that no assignment of buyers to vendors can be consistent to a price vector so that is an equilibrium. Assume otherwise and consider all set vendors. By the discussion above, each set vendor has set its price either to or to at equilibrium. We remark that there exists at least one element-buyer type that has no buyers assigned to any set vendor that corresponds to a subset containing element ; this holds since the initial X3C instance is a NO instance. Therefore, all these set vendors, that are candidate vendors for buyers of type , have set their price to exactly in the equilibrium and, so, the buyers of type can only be assigned to vendors or . Hence, the vendors and can compete not only for the buyers of type but also for the buyers of type . But then, observe that these two vendors and the buyers of type and would follow the circular dynamics in the counter-example of Lemma 4; this implies that no equilibrium exists and the proof is complete. ∎

5 Enforcing equilibria using subsidies

We now consider the option to use subsidies. A subsidy given to a vendor aims to compensate it for setting its price at a particular value. In this way, subsidies can be used to enforce a particular pair of price vector and consistent buyers-to-vendors assignment. Formally, given a price vector and a consistent assignment , denote by the maximum utility of vendor over all deviations and all assignments that are consistent to . Vendor has no incentive to follow any such deviation when it is given an amount of subsidies . If this inequality holds for every vendor , we say that the pair is enforced as an equilibrium. We denote by the entry-wise minimum subsidy vector that enforces as an equilibrium, i.e., . We use the terms “total amount” and “cost” to refer to the sum of all entries of a subsidy vector.

Our first observation is that a large amount of subsidies may inherently be necessary in order to enforce any equilibrium.

Theorem 10.

For every , there exists a price competition game, in which no subsidy assignment of cost smaller than can enforce any pair of price vector and consistent buyers-to-vendors assignment as an equilibrium.

Proof.

Consider a price competition game with two buyer types of unit volume each and two vendors with a production cost of . We use the terms left and right to refer to the vendors and buyer types. Let ; then the valuations are and . We will show that no price vector and consistent buyers-to-vendors assignment can be enforced as an equilibrium using an amount of subsidies less than . The optimal social welfare is and the theorem will follow by setting to a sufficiently small positive value.

Consider a buyers-to-vendors assignment and let and be the two prices to which is consistent. First observe that the left vendor will attract buyers of both types by setting its price to (any value that is negligibly smaller than) (if positive) while it can attract the buyers of left type by setting its price to (any value that is negligibly smaller than) ; the two terms in the expression denote the price necessary so that the buyers do not abstain and prefer the left vendor to the right one. Hence, by expressing the subsidies in terms of the maximum utility of the vendors at any deviation minus their current utility we get an amount of subsidies that is

| (6) |

We will distinguish between cases (omitting symmetric ones) depending on the price values and and will use (6) to show that in any case.

Case 1: . All buyers abstain and both expressions evaluate to at least .

Case 2: and . The left buyers abstain and the right buyers may either abstain or be assigned to the right vendor. By just considering the last two terms of (6), we get .

Case 3: and . The right vendor may attract all buyers and the amount of subsidies in it is at least . The amount of subsidies at the left vendor is then at least . In total, .

Case 4: . The left (respectively, right) buyers can only be assigned to the left (respectively, right) vendor. Since the expressions of (6) evaluate to and , we obtain .

Case 5: and . The right hand side of (6) is minimized when buyers of different types are assigned to different vendors. The expressions are at least and at least . Altogether, we get .

Case 6: . We have to distinguish between a few subcases. First, consider the subcase where each vendor receives the buyers of a different type. Clearly, the expressions evaluate to at least and ; altogether, we get . If, in contrast, buyers of both types are assigned to the same (say, left) vendor, this should be due to the fact that (so that the right buyer prefers the left vendor). Then, the first expression is at least while the second one is at least . Overall, we have that . ∎

In the following, we restrict ourselves to optimal assignments and show tight bounds on the cost of subsidies that are necessary and sufficient to enforce these assignments as equilibria.

Theorem 11.

In every price competition game, the optimal assignment can be enforced as an equilibrium using an amount of subsidies that is at most . This bound is tight. In particular, for every , there exists a price competition game in which the optimal assignment cannot be enforced as an equilibrium with a total amount of subsidies less than .

Proof.

We first prove the upper bound. Consider an optimal assignment with for every buyer type/vendor pair and the price vector with ; clearly, is consistent to . By deviating to any other price, vendor cannot get any buyers that are not assigned to it in the optimal assignment; it can, however, increase its utility by raising the price for those buyers that are already assigned to it. Hence, it suffices to assign a subsidy of to each vendor ; this obviously yields a total amount of subsidies equal to that enforces the optimal assignment as an equilibrium, since each vendor obtains the maximum utility from its assigned buyers.

For the lower bound, let and consider the price competition game with two buyer types of unit volume and valuations and for a single vendor of production cost of . The optimal social welfare is . Observe that the utility of the vendor is maximized to by setting its price to while any price that is consistent to assigning both buyer types to the vendor is at most for a vendor utility of at most . Hence, the amount of subsidies required to enforce the optimal assignment as an equilibrium is at least which becomes at least by setting sufficiently large. ∎

Even though the minimum amount of subsidies that is sufficient to enforce the optimal assignment as an equilibrium can be large in terms of the optimal social welfare, one might hope that it could be efficiently computable. Unfortunately, this is far from true as we show below in Theorem 12. Before presenting the theorem, let us formally define the corresponding optimization problem:

MinSubsidies: Given a price competition game with an optimal assignment , compute a price vector that minimizes the cost over all price vectors to which is consistent.

Notice that MinSubsidies should return an equilibrium when one exists. This can be efficiently decided using algorithm CandidatePrice. The hardness of the problem manifests itself in instances that do not admit equilibria. It is not hard to show that, in this case, CandidatePrice does not minimize the amount of subsidies required. This is shown in the following example.

Example 3.

Consider the price competition game in the proof of Lemma 4; we repeat it in the following table.

vn vn bt : bt :

Consider the allocation where all buyers of type are assigned to vendor and all buyers of type are assigned to vendor . By applying algorithm CandidatePrice, we obtain the price vector and the corresponding subsidy vector ; this amount of subsidies is required so that no vendor has incentive to lower the price to and obtain all buyers and a utility of . One can observe that the price vector and the corresponding subsidy vector enforces the optimal assignment as an equilibrium using half the amount of subsidies.

We now formally prove that no polynomial time algorithm can approximate the minimum amount of subsidies within a constant factor.

Theorem 12.

Approximating MinSubsidies within any constant is NP-hard.

Proof.

We will use an approximation-preserving reduction from the Node Cover problem in -uniform hypergraphs (i.e., hypergraphs in which every edge consists of nodes), which is formally described as follows.

Node Cover: Given a -uniform hypergraph , compute a node subset of minimum size so that every (hyper)edge has at least one of its nodes in .

The quantity in the definition of Node Cover is a constant. It is known that, for every constant , approximating Node Cover within is NP-hard [10]. Given a -uniform hypergraph , we construct the following price competition game; see also Table 5:

-

•

for every edge of , there is an edge vendor and a buyer type with volume and valuation for vendor ;

-

•

for every node of , there are: one node vendor , one auxiliary vendor , one buyer type with volume and valuations for vendor and for every vendor such that , and a buyer type with volume and valuations for vendor and for vendor .

-

•

all valuations not mentioned above as well as all production costs are zero.

vn vn vn bt : 0 0 bt : 0 bt : 0

In the optimal assignment , for every node of , buyers of type are assigned to vendor , and buyers of type are assigned to vendor and, for every edge of , buyers of type are assigned to vendor . We will show that the minimum amount of subsidies required to enforce this optimal assignment as an equilibrium is equal to the size of a minimum node cover of . We will need the following lemma.

Lemma 13.

Let be a price vector to which assignment is consistent. Then, for every auxiliary vendor , edge vendor , and node vendor ,

| (7) | |||||

| (8) | |||||

| (9) | |||||

where111The quantity equals when the event is true and is otherwise. .

Proof.

First, observe that the buyers of type are still assigned to vendor when deviates to any price that is at most (the valuation of for vendor ) and such that the assignment is still consistent to the new price vector , i.e., . Hence, is equal to the maximum (over all price deviations ) utility of the vendor minus the vendor’s utility at price ; this is expressed by (7).

A vendor corresponding to an edge of can attract the buyers of type by deviating to a price up to for a utility of (up to ). Also, vendor can attract the buyers of type by deviating to a price such that the utility of buyers of type when assigned to vendor is not lower than their utility when assigned to vendor , i.e., or . In such a case, the vendor will also attract the buyers of type as well. When the deviation to a price attracts the buyers of and node buyers corresponding to a subset of at most nodes of , the utility will be up to . This is never more than since for must be up to (the valuation of buyers of type for vendor ) so that is consistent to the price vector . Finally, by deviating to any price up to , the utility will be , i.e., up to . Again, is equal to the maximum (over all price deviations ) utility of the vendor minus the vendor’s utility at price , which is expressed by (8).

A node vendor can attract buyers of type by deviating to a price up to (the valuation of buyers of type for vendor ) such that for all edge vendors corresponding to edges incident to node in . Hence, this price can be up to . Also, vendor can attract buyers of type (from vendor ) by deviating to a price that satisfies ; this price can be up to . Hence, the maximum utility of vendor is achieved when deviating to one of the two prices. The volume of buyers attracted is when deviating to the lowest of the two values and either (the volume of buyers of type ) or (the volume of buyers of type ) when deviating to the highest among the two values. The quantity in the statement of the lemma denotes the volume of buyers attracted by vendor in the latter case. Then, is given by the difference between the maximum utility at a deviation and the current vendor’s utility in (9). ∎

Given a node cover of , we construct the price vector with for every auxiliary vendor , for every edge vendor , for every node vendor corresponding to a node , and for every other node vendor . It is easy to see that the optimal assignment is consistent to . By Lemma 13, we have that for every auxiliary vendor , for every edge vendor , for every node vendor and , otherwise. Obviously the cost of is .

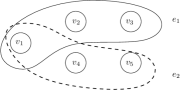

We will now show that for any price vector to which the optimal assignment is consistent, there is a node cover of of size at most the cost of . In order to show this, we will start with an arbitrary price vector to which is consistent and will transform it, through a sequence of rounds that will not violate the consistency of to prices and will not increase the cost of the corresponding subsidies, to a price vector with the following properties: all edge vendors have prices equal to , auxiliary node vendors have prices equal to , node vendors corresponding to a node cover of have prices equal to while the remaining node vendors have prices equal to . The corresponding subsidies are in every node vendor corresponding to a node of and elsewhere. We describe these rounds in the following. An example of this process is presented in Figure 2 and Table 6.

First, we consider the edge vendors one by one and increase the price of each of them to . Clearly, the increase of the price of any edge vendor can only cause a decrease in the subsidy at the edge vendor (from equation (8)). Also, the increase of the price of any edge vendor that, initially, has value at least does not increase the subsidy in any auxiliary or node vendor (from equations (7) and (9)). Now consider a vendor corresponding to the edge that initially has a price of for some . Increasing this price to causes a decrease of in the subsidy of the edge vendor . If does not have the minimum price among the edge vendors corresponding to edges containing node for every , the price increase does not affect the subsidies in node vendors . Otherwise, by inspecting the right-hand side of (9), we have that the initial subsidies in are at least . Clearly, after the edge vendor price increase and since , the subsidies in node vendor are at most ; the subsidies in any other vendor are not affected. Overall, we have a decrease in the total amount of subsidies by at least which is strictly positive since .

After the above round, each edge vendor has a price of and, since for any vendor , the subsidy of node vendor is exactly . In a second round, we consider all node vendors with prices strictly smaller than and increase them to and all auxiliary vendors with prices strictly smaller than and increase them to . Observe that (from (7)) the subsidy of an auxiliary vendor is after this round (i.e., it does not increase), the subsidies at edge vendors are not affected (since no node vendor price increases above ; see (8)), and the subsidies in node vendors (which are now given by the expression ) can only decrease.

So, after the first two rounds, all auxiliary vendor prices are equal to , all edge vendor prices are equal to , and the node vendor prices are in . In the third round, we consider all edges of one by one; for each edge , we set the minimum price among , , …, to . Let be this vendor; assuming that the price of is when it is considered (with ), this causes a decrease of in the subsidy of the edge vendor (as well as possible decreases in the subsidies of other edge vendors corresponding to other edges containing node ) and an increase of in the subsidy of the node vendor , i.e., no overall increase. During the last round, all node vendor prices that are strictly higher than are set to . Increasing the price of a node vendor can only decrease the subsidies in , does not affect the subsidies in , and does not affect the subsidy of any edge vendor corresponding to an edge containing node , since there is a node so that the price of the node vendor has already been set to , implying an edge vendor subsidy of zero (this follows from (8)). Again, this last round does not increase the total amount of subsidies. Observe that the nodes corresponding to node vendors with price equal to form a node cover in . The subsidies in each of these node vendors is exactly while no subsidies correspond to the remaining vendors. ∎

6 Discussion and open problems

In this work, we have posed and answered a long list of questions about price competition games among single-product vendors. Of course, our work reveals a lot more open problems. We mention a few here. First, we remark that identifying broad classes of games that always admit equilibria is very interesting. It is not hard to see that games with single-minded buyers, i.e., where each buyer only wishes to be assigned to a single vendor, always have pure equilibria, as essentially each vendor sets the price that maximizes its utility and the buyers either abstain or choose their preferred vendor; note that, in this setting, there is no price competition among vendors. Another class of games that always admits pure equilibria is the following extension of the case in Lemma 3: let there be buyer types, where , for where is a constant. Note that, in this setting, all buyer types agree on the same ranking of vendors and that, for fixed , is constant for any pair of vendors ; we can adapt the proof of Lemma 3 to prove this claim. However, one can show that the case, where all buyer types agree on the same ranking of vendors but may vary for different pairs , , does not always admit equilibria. To see that, consider a game with two vendors of production cost and two buyer types of volume . Let , , and , where again denotes the valuation of a buyer of type for vendor ; it is not hard to show that this game does not admit equilibria.

From the algorithmic point of view, observe that we have made no particular attempt to optimize the running time of our algorithms. We believe that there is much room for improvement on the running time of CandidatePrice and Enumerate. In particular, it would be interesting to come up with FPT algorithms (see Downey and Fellows [11]) for PriceCompetition with respect to different parameters. Second, in spite of our inapproximability result (Theorem 12), we believe that it is important to design polynomial-time approximation algorithms for MinSubsidies. For example, is there a logarithmic approximation algorithm? What about additive approximations using an amount of subsidies that exceeds the minimum by at most for some small ?

Another set of open problems comes from introducing constraints to price competition games such as supply limitations. For example, consider additional input parameters that indicate the maximum volume of buyers each vendor can support. We believe that this subtle difference in the definition makes the setting even richer from the computational point of view. Another question concerns mixed equilibria. Do such equilibria always exist? Observe that the strategy spaces of vendors have infinite size in this case. Can they be computed efficiently? What is their price of anarchy? What about generalizations of our model that include uncertainty for buyer valuations? It is our firm belief that these questions deserve investigation.

An alternative model for using subsidies is to reimburse the vendors so that a given buyers-to-vendors assignment results in an equilibrium with the vendors figuring out the corresponding price vector on their own. Instead, our model reimburses the vendors so that a given pair is an equilibrium. Apart from the requirement that the vendors compute collectively an appropriate price vector, we remark that there are cases where this variant leads to higher subsidies; the price competition game in Example 3 is such a case.

Finally, it makes sense to consider vendors with concave production costs (that model economies of scale), as opposed to fixed production costs per unit that we consider in the paper. Clearly, all our negative results, such as the existence of price competition games with no pure Nash equilibria and the NP-completeness results, still hold but we do not know if the positive results carry over to this more general setting. We remark that this modification also affects the consequences after a price change. For example, a vendor may decrease its price in order to attract more buyers and, after these buyers select that vendor, the vendor can further reduce its price as now its production cost per item has decreased. These model variants deserve investigation as well.

References

- [1] E. Anshelevich, S. Sekar, Price competition in networked markets: How do monopolies impact social welfare?, in: Proceedings of the 11th International Conference on Web and Internet Economics (WINE), 2015, pp. 16–30.

- [2] J. Augustine, I. Caragiannis, A. Fanelli, C. Kalaitzis, Enforcing efficient equilibria in network design games via subsidies, Algorithmica 72 (1) (2015) 44–82.

- [3] M. Babaioff, B. Lucier, N. Nisan, Bertrand networks, in: Proceedings of the 14th ACM Conference on Electronic Commerce (EC), 2013, pp. 33–34.

- [4] M. Babaioff, N. Nisan, R. Paes Leme, Price competition in online combinatorial markets, in: Proceedings of the 23rd International Conference on World Wide Web (WWW), 2014, pp. 711–722.

- [5] Y. Bachrach, E. Elkind, R. Meir, D. Pasechnik, M. Zuckerman, J. Rothe, J. S. Rosenschein, The cost of stability in coalitional games, in: Proceedings of the 2nd International Symposium on Algorithmic Game Theory (SAGT), 2009, pp. 122–134.

- [6] A. Borodin, O. Lev, T. Strangway, Budgetary effects on pricing equilibrium in online markets, in: Proceedings of the 15th International Conference on Autonomous Agents and Multiagent Systems (AAMAS), 2016, pp. 95–103.

- [7] N. Buchbinder, L. Lewin-Eytan, J. Naor, A. Orda, Non-cooperative cost sharing games via subsidies, Theory of Computing Systems 47 (1) (2010) 15–37.

- [8] S. Chawla, T. Roughgarden, Bertrand competition in networks, in: Proceedings of the 1st International Symposium on Algorithmic Game Theory (SAGT), 2008, pp. 70–82.

- [9] R. Cole, Y. Dodis, T. Roughgarden, How much can taxes help selfish routing?, Journal of Computer and System Sciences 72 (3) (2006) 444–467.

- [10] I. Dinur, V. Guruswami, S. Khot, O. Regev, A new multilayered PCP and the hardness of hypergraph vertex cover, SIAM Journal on Computing 34 (5) (2005) 1129–1146.

- [11] R. G. Downey, M. R. Fellows, Parameterized Complexity, Springer-Verlag, 1999.

- [12] F. Gul, E. Stacchetti, Walrasian equilibria with gross substitutes, Journal of Economic Theory 87 (1) (1999) 95–124.

- [13] V. Guruswami, J. D. Hartline, A. Karlin, D. Kempe, C. Kenyon, F. McSherry, On profit-maximizing envy-free pricing, in: Proceedings of the 16th Annual ACM-SIAM Symposium on Discrete Algorithms (SODA), 2005, pp. 1164–1173.

- [14] A. Kelso, P. Crawford, Job matching, coalition formation and gross substitutes, Econometrica 50 (6) (1982) 1483–1504.

- [15] E. Koutsoupias, C. H. Papadimitriou, Worst-case equilibria, Computer Science Review 3 (2) (2009) 65–69.

- [16] O. Lev, J. Oren, C. Boutilier, J. S. Rosenschein, The pricing war continues: on competitive multi-item pricing, in: Proceedings of the 29th AAAI Conference on Artificial Intelligence (AAAI), 2015, pp. 972–978.

- [17] A. Mas-Colell, M. D. Whinston, J. R. Green, Microeconomic Theory, Oxford University Press, 1995.

- [18] R. Meir, T. Lu, M. Tennenholtz, C. Boutilier, On the value of using group discounts under price competition, Artificial Intelligence 216 (2014) 163–178.

- [19] D. Monderer, M. Tennenholtz, K-implementation, Journal of Artificial Intelligence Research 21 (2004) 37––62.

- [20] N. Nisan, Introduction to mechanism design (for computer scientists), in: Algorithmic Game Theory, chap. 9, Cambridge University Press, 2007, pp. 209–241.

- [21] C. H. Papadimitriou, Algorithms, games, and the Internet, in: Proceedings of the 33rd Annual ACM Symposium on Theory of Computing (STOC), 2001, pp. 749–753.

- [22] D. Sarne, S. Kraus, Cooperative exploration in the electronic marketplace, in: Proceedings of the 20th AAAI Conference on Artificial Intelligence (AAAI), 2005, pp. 158–163.

- [23] M. Wooldridge, U. Endriss, S. Kraus, J. Lang, Incentive engineering for boolean games, Artificial Intelligence 195 (2013) 418–439.