A lava attack on the recovery of sums of dense and sparse signals

Abstract.

Common high-dimensional methods for prediction rely on having either a sparse signal model, a model in which most parameters are zero and there are a small number of non-zero parameters that are large in magnitude, or a dense signal model, a model with no large parameters and very many small non-zero parameters. We consider a generalization of these two basic models, termed here a “sparse+dense” model, in which the signal is given by the sum of a sparse signal and a dense signal. Such a structure poses problems for traditional sparse estimators, such as the lasso, and for traditional dense estimation methods, such as ridge estimation. We propose a new penalization-based method, called lava, which is computationally efficient. With suitable choices of penalty parameters, the proposed method strictly dominates both lasso and ridge. We derive analytic expressions for the finite-sample risk function of the lava estimator in the Gaussian sequence model. We also provide an deviation bound for the prediction risk in the Gaussian regression model with fixed design. In both cases, we provide Stein’s unbiased estimator for lava’s prediction risk. A simulation example compares the performance of lava to lasso, ridge, and elastic net in a regression example using feasible, data-dependent penalty parameters and illustrates lava’s improved performance relative to these benchmarks.

Key words: high-dimensional models, penalization, shrinkage, non-sparse signal recovery

1. Introduction

Many recently proposed high-dimensional modeling techniques build upon the fundamental assumption of sparsity. Under sparsity, we can approximate a high-dimensional signal or parameter by a sparse vector that has a relatively small number of non-zero components. Various -based penalization methods, such as the lasso and soft-thresholding, have been proposed for signal recovery, prediction, and parameter estimation within a sparse signal framwork. See Frank and Friedman (1993), Donoho and Johnstone (1995), Tibshirani (1996), Fan and Li (2001), Efron et al. (2004), Zou and Hastie (2005), Zhao and Yu (2006), Yuan and Lin (2006), Bunea et al. (2007), Candes and Tao (2007), Fan and Lv (2008), Bickel et al. (2009), Meinshausen and Yu (2009), Wainwright (2009), Bunea et al. (2010), Zhang (2010), Loh and Wainwright (2013), and others. By virtue of being based on -penalized optimization problems, these methods produce sparse solutions in which many estimated model parameters are set exactly to zero.

Another commonly used shrinkage method is ridge estimation. Ridge estimation differs from the aforementioned -penalized approaches in that it does not produce a sparse solution but instead provides a solution in which all model parameters are estimated to be non-zero. Ridge estimation is thus particularly suitable when the model’s parameters or unknown signals contain many very small components, i.e. when the model is dense. See, e.g., Hsu et al. (2014). Ridge estimation tends to work better than sparse methods whenever a signal is dense in such a way that it can not be well-approximated by a sparse signal.

In practice, we may face environments that have signals or parameters which are neither dense nor sparse. The main results of this paper provide a model that is appropriate for this environment and a corresponding estimation method with good estimation and prediction properties. Specifically, we consider models where the signal or parameter, , is given by the superposition of sparse and dense signals:

| (1.1) |

Here, is a sparse vector that has a relatively small number of large entries, and is a dense vector having possibly very many small, non-zero entries. Traditional sparse estimation methods, such as lasso, and traditional dense estimation methods, such as ridge, are tailor-made to handle respectively sparse signals and dense signals. However, the model for given above is “sparse+dense” and cannot be well-approximated by either a “dense only” or “sparse only” model. Thus, traditional methods designed for either sparse or dense settings are not optimal within the present context.

Motivated by this signal structure, we propose a new estimation method, called “lava”. Let be a general statistical loss function that depends on unknown parameter , and let be the dimension of . To estimate , we propose the “lava” estimator given by

| (1.2) |

where and solve the following penalized optimization problem:

| (1.3) |

In the formulation of the problem, and are tuning parameters corresponding to the - and - penalties which are respectively applied to the dense part of the parameter, , and the sparse part of the parameter, . The resulting estimator is then the sum of a dense and a sparse estimator. Note that the separate identification of and is not required in (1.1), and the lava estimator is designed to automatically recover the combination that leads to the optimal prediction of . Moreover, under standard conditions for -optimization, the lava solution exists and is unique. In naming the proposal “lava”, we emphasize that it is able, or at least aims, to capture or wipe out both sparse and dense signals.

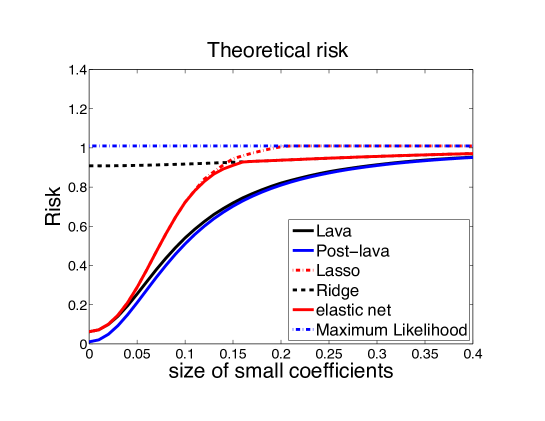

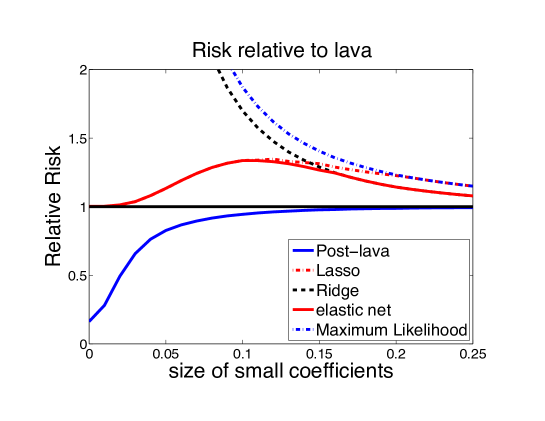

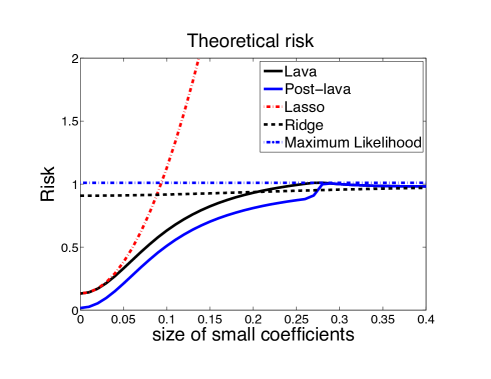

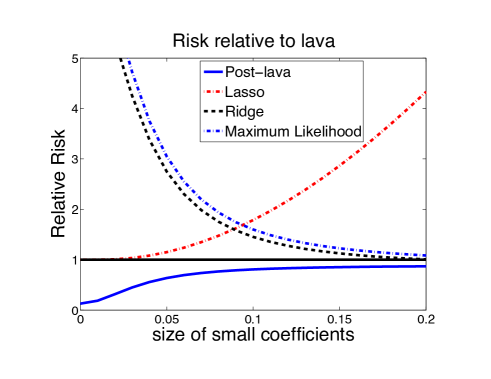

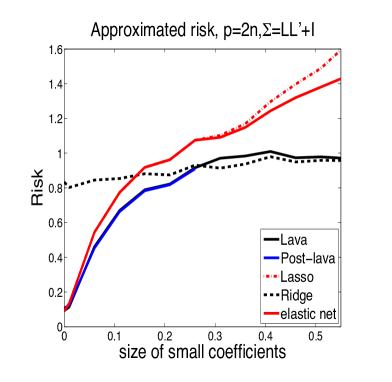

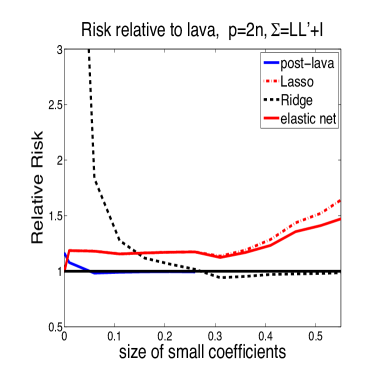

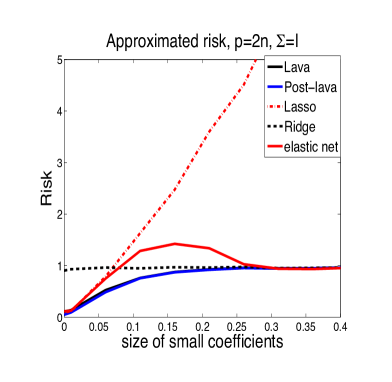

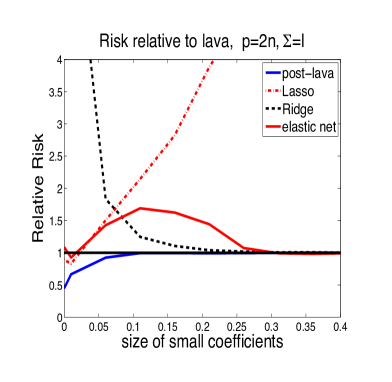

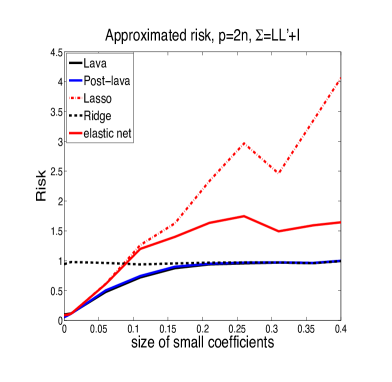

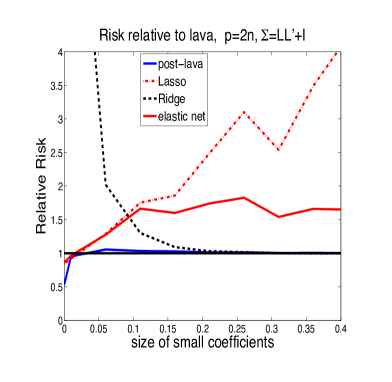

The lava estimator admits the lasso and ridge shrinkage methods as two extreme cases by respectively setting either or .111With or , we set when or when so the problem is well-defined. In fact, it continuously connects the two shrinkage functions in a way that guarantees it will never produce a sparse solution when . Of course, sparsity is not a requirement for making good predictions. By construction, lava’s prediction risk is less than or equal to the prediction risk of the lasso and ridge methods with oracle choice of penalty levels for ridge, lasso, and lava; see Figure 1. Lava also tends to perform no worse than, and often performs significantly better than, ridge or lasso with penalty levels chosen by cross-validation; see Figures 4 and 5.

Note that our proposal is rather different from the elastic net method, which also uses a combination of and penalization. The elastic net penalty function is , and thus the elastic net also includes lasso and ridge as extreme cases corresponding to and respectively. In sharp contrast to the lava method, the elastic net does not split into a sparse and a dense part and will produce a sparse solution as long as . Consequently, the elastic net method can be thought of as a sparsity-based method with additional shrinkage by ridge. The elastic net processes data very differently from lava (see Figure 2 below) and consequently has very different prediction risk behavior (see Figure 1 below).

We also consider the post-lava estimator which refits the sparse part of the model:

| (1.4) |

where solves the following penalized optimization problem:

| (1.5) |

This estimator removes the shrinkage bias induced by using the penalty in estimation of the sparse part of the signal. Removing this bias sometimes results in further improvements of lava’s risk properties.

We provide several theoretical and computational results about lava in this paper. First, we provide analytic expressions for the finite-sample risk function of the lava estimator as well as for other methods in the Gaussian sequence model and in a fixed design regression model with Gaussian errors. Within this context, we exhibit “sparse+dense” examples where lava significantly outperforms both lasso and ridge. Stein’s unbiased risk estimation plays a central role in our theoretical analysis, and we thus derive Stein’s unbiased risk estimator (SURE) for lava. We also characterize lava’s “Efron’s” degrees of freedom (Efron (2004)). Second, we give deviation bounds for the prediction risk of the lava estimator in regression models akin to those derived by Bickel et al. (2009) for lasso. Third, we illustrate lava’s performance relative to lasso, ridge, and elastic net through simulation experiments using penalty levels chosen via either minimizing the SURE or by k-fold cross-validation for all estimators. In our simulations, lava outperforms lasso and ridge in terms of prediction error over a wide range of regression models with coefficients that vary from having a rather sparse structure to having a very dense structure. When the model is very sparse, lava performs as well as lasso and outperforms ridge substantially. As the model becomes more dense in the sense of having the size of the “many small coefficients” increase, lava outperforms lasso and performs just as well as ridge. This is consistent with our theoretical results.

We conclude the introduction by noting that our proposed approach complements other recent approaches to structured sparsity problems such as those considered in fused sparsity estimation (Tibshirani et al. (2005) and Chen and Dalalyan (2012)) and structured matrix estimation problems (Candès et al. (2011), Chandrasekaran et al. (2011), Fan et al. (2013), and Klopp et al. (2014)). The latter line of research studied estimation of matrices that can be written as low rank plus sparse matrices. Our new results are related to but are sharply different from this latter line of work since our focus is on regression problems. Specifically, our chief objects of interest are regression coefficients along with the associated regression function and predictions of the outcome variable. Thus, the target statistical applications of our developed methods include prediction, classification, curve-fitting, and supervised learning. Another noteworthy point is that it is impossible to recover the “dense” and “sparse” components separately within our framework; instead, we recover the sum of the two components. By contrast, it is possible to recover the low-rank component of the matrix separately from the sparse part in some of the structured matrix estimation problems. This distinction serves to highlight the difference between structured matrix estimation problems and the framework discussed in this paper. Due to these differences, the mathematical side of our analysis needs to address a completely different set of issues than are addressed in the aforementioned structured matrix estimation problems.

We organize the rest of the paper as follows. Section 2 defines the lava shrinkage estimator in a canonical Gaussian sequence model, and derives its theoretical risk function. Section 3 defines and analyzes the lava estimator in the regression model. Section 4 provides computational examples, and Section 5 concludes. We give all proofs in the appendix.

Notation. The notation means that for all , for some constant that does not depend on . The and norms are denoted by (or simply ) and , respectively. The -“norm”, , denotes the number of non-zero components of a vector, and the norm denotes a vector’s maximum absolute element. When applied to a matrix, denotes the operator norm. We use the notation and . We use to denote the transpose of a column vector .

2. The lava estimator in a canonical model

2.1. The one dimensional case

Consider the simple problem where a scalar random variable is given by

We observe a realization of and wish to estimate . Estimation will often involve the use of regularization or shrinkage via penalization to process input into output , where the map is commonly referred to as the shrinkage (or decision) function. A generic shrinkage estimator then takes the form .

The commonly used lasso method uses -penalization and gives rise to the lasso or soft-thresholding shrinkage function:

where and is a penalty level. The use of the -penalty in place of the penalty yields the ridge shrinkage function:

where is a penalty level. The lasso and ridge estimators then take the form

Other commonly used shrinkage methods include the elastic-net (Zou and Hastie (2005)), which uses as the penalty function; hard-thresholding; and the SCAD (Fan and Li (2001)), which uses a non-concave penalty function.

Motivated by points made in the introduction, we proceed differently. We decompose the signal into two components

and use the different penalty functions – the and – for each component in order to predict better. We thus consider the penalty function

and introduce the “lava” shrinkage function defined by

| (2.1) |

where and solve the following penalized prediction problem:

| (2.2) |

Although the decomposition is not unique, the optimization problem (2.2) has a unique solution for any given . The proposal thus defines the lava estimator of :

For large signals such that , lava has the same bias as the lasso. This bias can be removed through the use of the post-lava estimator

where and solves the following penalized prediction problem:

| (2.3) |

The removal of this bias will result in improved risk performance relative to the original estimator in some contexts.

From the Karush-Kuhn-Tucker conditions, we obtain the explicit solution to (2.1).

Lemma 2.1.

For given penalty levels and :

| (2.4) | |||||

| (2.8) |

where The post-lava shrinkage function is given by

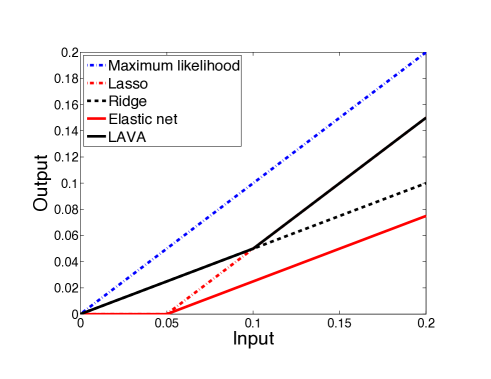

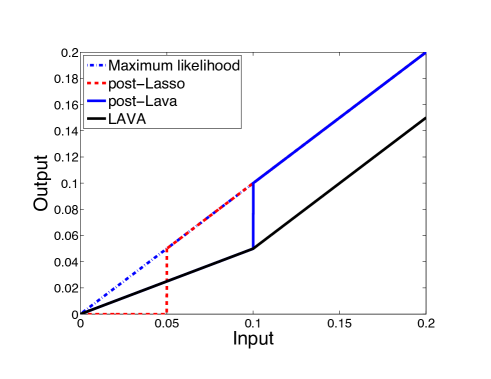

Figure 2 plots the lava shrinkage function along with various alternative shrinkage functions for . The top panel of the figure compares lava shrinkage to ridge, lasso, and elastic net shrinkage. It is clear from the figure that lava shrinkage is different from lasso, ridge, and elastic net shrinkage. The figure also illustrates how lava provides a bridge between lasso and ridge, with the lava shrinkage function coinciding with the ridge shrinkage function for small values of the input and coinciding with the lasso shrinkage function for larger values of the input. Specifically, we see that the lava shrinkage function is a combination of lasso and ridge shrinkage that corresponds to using whichever of the lasso or ridge shrinkage is closer to the 45 degree line.

It is also useful to consider how lava and post-lava compare with the post-lasso or hard-thresholding shrinkage: These different shrinkage functions are illustrated in the bottom panel of Figure 2.

From (2.4), we observe some key characteristics of the lava shrinkage function:

1) The lava shrinkage admits the lasso and ridge shrinkages as two extreme cases. The lava and lasso shrinkage functions are the same when , and the ridge and lava shrinkage functions coincide if .

2) The lava shrinkage function is a weighted average of data and the lasso shrinkage function with weights given by and .

3) The lava never produces a sparse solution when : If , if and only if . This behavior is strongly different from elastic net which produces a sparse solution as long as .

4) The lava shrinkage function continuously connects the ridge shrinkage function and the lasso shrinkage function. When , lava shrinkage is equal to ridge shrinkage; and when , lava shrinkage is equal to lasso shrinkage.

5) The lava shrinkage does exactly the opposite of the elastic net shrinkage. The elastic net shrinkage function coincides with the lasso shrinkage function when ; and when , the elastic net shrinkage is the same as ridge shrinkage.

2.2. The risk function of the lava estimator in the one dimensional case

In the one-dimensional case with , a natural measure of the risk of a given estimator is given by

| (2.9) | |||||

| (2.10) |

Let denote the probability law of . Let be the density function of . We provide the risk functions of lava and post-lava in the following theorem. We also present the risk functions of ridge, elastic net, lasso, and post-lasso for comparison.

Theorem 2.1 (Risk Function of Lava and Related Estimators in the Scalar Case).

Suppose . Then for , , , and , we have

These results for the one-dimensional case provide a key building block for results in the multidimensional case provided below. In particular, we build from these results to show that the lava estimator performs very favorably relative to, and can substantially dominate, the maximum likelihood estimator, the ridge estimator, and -based estimators (such as lasso and elastic-net) in interesting multidimensional settings.

2.3. Multidimensional case

We consider now the canonical Gaussian model or the Gaussian sequence model. In this case, we have that

is a single observation from a multivariate normal distribution where is a -dimensional vector. A fundamental result for this model is that the maximum likelihood estimator is inadmissible and can be dominated by the ridge estimator and related shrinkage procedures when (e.g. Stein (1956)).

In this model, the lava estimator is given by

where is the lava shrinkage function as in (2.8). The estimator is designed to capture the case where

is formed by combining a sparse vector that has a relatively small number of non-zero entries which are all large in magnitude and a dense vector that may contain very many small non-zero entries. This model for is “sparse+dense.” It includes cases that are not well-approximated by “sparse” models - models in which a very small number of parameters are large and the rest are zero - or by “dense” models - models in which very many coefficients are non-zero but all coefficients are of similar magnitude. This structure thus includes cases that pose challenges for estimators such as the lasso and elastic net that are designed for sparse models and for estimators such as ridge that are designed for dense models.

Remark 2.1.

The regression model with Gaussian noise and an orthonormal design is a special case of the multidimensional canonical model. Consider

where and are random vectors and is an random or fixed matrix, with and respectively denoting the sample size and the dimension of . Suppose a.s.. with . Then we have the canonical multidimensional model:

All of the shrinkage estimators discussed in Section 2.1 generalize to the multidimensional case in the same way as lava. Let be the shrinkage function associated with estimator in the one dimensional setting where can take values in the set

We then have a similar estimator in the multidimensional case given by

The risk calculation from the one dimensional case then caries over to the multidimensional case since

Given this fact, we immediately obtain the following result.

Theorem 2.2 (Risk Function of Lava and Related Estimators in the Multi-Dimensional Case).

If , then for any we have that

where is the uni-dimensional risk function characterized in Theorem 2.1.

These risk functions are illustrated in Figure 1 in a prototypical “sparse+dense” model generated according to the model discussed in detail in Section 2.5. The tuning parameters used in this figure are the best possible (risk minimizing or oracle) choices of the penalty levels found by minimizing the risk expression given in Theorem 2.2.

2.4. Canonical plug-in choice of penalty levels

We now discuss simple, rule-of-thumb choices for the penalty levels for lasso (), ridge () and lava (). In the Gaussian model, a canonical choice of is

which satisfies

see, e.g., Donoho and Johnstone (1995). Here denotes the standard normal cumulative distribution function, and is a pre-determined significance level which is often set to 0.05. The risk function for ridge is simple, and an analytic solution to the risk minimizing choice of ridge tuning parameter is given by

As for the tuning parameters for lava, recall that the lava estimator in the Gaussian model is

If the dense component were known, then following Donoho and Johnstone (1995) would suggest setting

as a canonical choice of for estimating . If the sparse component were known, one could adopt

as a choice of for estimating following the logic for the standard ridge estimator.

We refer to these choices as the “canonical plug-in” tuning parameters and use them in constructing the risk comparisons in the following subsection. We note that the lasso choice is motivated by a sparse model and does not naturally adapt to or make use of the true structure of . The ridge penalty choice is explicitly tied to risk minimization and relies on using knowledge of the true . The lava choices for the parameters on the and penalties are, as noted immediately above, motivated by the respective choices in lasso and ridge. As such, the motivations and feasibility of these canonical choices are not identical across methods, and the risk comparisons in the following subsection should be interpreted within this light.

2.5. Some risk comparisons in a canonical Gaussian model

To compare the risk functions of lava, lasso, and ridge estimators, we consider a canonical Gaussian model, where

for some . We set the noise level to be . The parameter can be decomposed as , where the sparse component is , and the dense component is

where describes the “size of small coefficients.” The canonical tuning parameters are , and .

Figure 1 (given in the introduction) compares risks of lava, lasso, ridge, elastic net, and the maximum likelihood estimators as functions of the size of the small coefficients , using the ideal (risk minimizing or oracle choices) of the penalty levels. Figure 3 compares risks of lava, lasso, ridge and the maximum likelihood estimators using the “canonical plug-in” penalty levels discussed above. Theoretical risks are plotted as a function of the size of the small coefficients . We see from these figures that regardless of how we choose the penalty levels – ideally or via the plug-in rules – lava strictly dominates the competing methods in this “sparse+dense” model. Compared to lasso, the proposed lava estimator does about as well as lasso when the signal is sparse and does significantly better than lasso when the signal is non-sparse. Compared to ridge, the lava estimator does about as well as ridge when the signal is dense and does significantly better than ridge when the signal is sparse.

In Section 5 we further explore the use of feasible, data-driven choices of penalty levels via cross-validation and SURE minimization; see Figures 4 and 5. We do so in the context of the Gaussian regression model with fixed regressors. With either cross-validation or SURE minmization, the ranking of the estimators remains unchanged, with lava consistently dominating lasso, ridge, and the elastic net.

Stein (1956) proved that a ridge estimator strictly dominates maximum likelihood in the Gaussian sequence model once . In the comparisons above, we also see that the lava estimator strictly dominates the maximum likelihood estimator; and one wonders whether this domination has a theoretical underpinning similar to Stein’s result for ridge. The following result provides some (partial) support for this phenomenon for the lava estimator with the plug-in penalty levels. The result shows that, for a sufficiently large and , lava does indeed uniformly dominate the maximum likelihood estimator on the compact set .

Lemma 2.2 (Relative Risk of Lava vs. Maximum Likelihood ).

Suppose , where can be decomposed into with . Let and be chosen with the plug-in rule given in Section 2.4. Then uniformly for , when , , and , we have

Remark 2.2.

Note that

measures the proportion of the total variation of around that is explained by the dense part of the signal. If is bounded away from and and are fixed, then the risk of lava becomes uniformly smaller than the risk of the maximum likelihood estimator on a compact parameter space as and . Indeed, if is bounded away from , then

Moreover, we have if . That is, the lava estimator becomes infinitely more asymptotically efficient than the maximum likelihood estimator in terms of relative risk.

2.6. Stein’s unbiased risk estimation for lava

Stein (1981) proposed a useful risk estimate based on the integration by parts formula, now commonly referred to as Stein’s unbiased risk estimate (SURE). This subsection derives SURE for the lava shrinkage in the multivariate Gaussian model.

Note that

| (2.11) |

An essential component to understanding the risk is given by applying Stein’s formula to calculate . A closed-form expression for this expression in the one-dimensional case is given in equation (A.15) in the appendix. The following result provides the SURE for lava in the more general multidimensional case.

Theorem 2.3 (SURE for lava).

Suppose . Then

In addition, let be identically distributed as for each . Then

is an unbiased estimator of .

3. Lava in the Regression Model

3.1. Definition of Lava in the Regression Model

Consider a fixed design regression model:

where , , and is the true regression coefficient. Following the previous discussion, we assume that

is “sparse+dense” with sparse component and dense component . Again, this coefficient structure includes cases which cannot be well-approximated by traditional sparse models or traditional dense models and will pose challenges for estimation strategies tailored to sparse settings, such as lasso and similar methods, or strategies tailored to dense settings, such as ridge.

In order to define the estimator we shall rely on the normalization condition that

| (3.1) |

Note that without this normalization, the penalty terms below would have to be modified in order to insure equivariance of the estimator to changes of scale in the columns of .

The lava estimator of solves the following optimization problem:

| (3.2) | |||||

| (3.3) |

The lava program splits parameter into the sum of and and penalizes these two parts using the and penalties. Thus, the - penalization regularizes the estimator of the sparse part of and produces a sparse solution . The -penalization regularizes the estimator of the dense part of and produces a dense solution . The resulting estimator of is then simply the sum of the sparse estimator and the dense estimator .

3.2. A Key Profile Characterization and Some Insights.

The lava estimator can be computed in the following way. For a fixed , we minimize

with respect to . This program is simply the well-known ridge regression problem, and the solution is

By substituting into the objective function, we then define an -penalized quadratic program which we can solve for :

| (3.4) |

The lava solution is then given by . The following result provides a useful characterization of the solution.

Theorem 3.1 (A Key Characterization of the Profiled Lava Program).

Define ridge-projection matrices,

and transformed data,

Then

| (3.5) |

and

| (3.6) |

The theorem shows that solving for the sparse part of the lava estimator is equivalent to solving for the parameter in a standard lasso problem using transformed data. This result is key to both computation and our theoretical analysis of the estimator.

Remark 3.1 (Insights derived from Theorem 3.1).

Suppose were known. Let be the response vector after removing the sparse signal, and note that we equivalently have . A natural estimator for in this setting is then the ridge estimator of on :

Denote the prediction error based on this ridge estimator as

Under mild regularity conditions on and the design matrix, Hsu et al. (2014) showed that

Using Theorem 3.1, the prediction error of lava can be written as

| (3.7) |

Hence, lava has vanishing prediction error as long as

| (3.8) |

Condition (3.8) is related to the performance of the lasso in the transformed problem (3.5). Examination of (3.5) shows that it corresponds to a sparse regression model with approximation errors : For ,

| (3.9) |

Under conditions such as those given in Hsu et al. (2014), the approximation error obeys

| (3.10) |

It is also known that the lasso estimator performs well in sparse models with vanishing approximation errors. The lasso estimator attains rates of convergence in the prediction norm that are the sum of the usual rate of convergence in the case without approximation errors and the rate at which the approximation error vanishes; see, e.g., Belloni and Chernozhukov (2013). Thus, we anticipate that (3.8) will hold.

To help understand the plausibility of condition (3.10), consider an orthogonal design where . In this case, it is straightforward to verify that where Hence, is a component of the prediction bias from a ridge estimator with tuning parameter and is stochastically negligible. We present the rigorous asymptotic analysis for the general case in Section 3.5.

3.3. Degrees of Freedom and SURE

Degrees of freedom is often used to quantify model complexity and to construct adaptive model selection criteria for selecting tuning parameters. In a Gaussian linear regression model with a fixed design, we can define the degrees of freedom of the mean fit to be

see, e.g., Efron (2004). Note that this quantity is also an important component of the mean squared prediction risk:

Stein (1981)’s SURE theory provides a tractable way of deriving an unbiased estimator of the degrees of freedom, and thus the mean squared prediction risk. Specifically, write as a function of , conditional on . Suppose is almost differentiable; see Meyer and Woodroofe (2000) and Efron et al. (2004)). For differentiable at , define

Let denote the -th row of , . Then, from Stein (1981), we have that

An unbiased estimator of the term on the right-hand-side of the display may then be constructed using its sample analog.

In this subsection, we derive the degrees of freedom of the lava, and thus a SURE of its mean squared prediction risk. By Theorem 3.1,

| (3.11) | |||||

| (3.12) |

where is the lava estimator on the data and is the lasso estimator on the data with the penalty level . The almost differentiability of the map follows from the almost differentiability of the map , which holds by the results in Dossal et al. (2011) and Tibshirani and Taylor (2012).

The following theorem presents the degrees of freedom and SURE for lava. Let be the active set of the sparse component estimator with cardinality denoted by . Recall that . Let be an submatrix of whose columns are those corresponding to the entries in . Let denote the Moore-Penrose pseudo-inverse of a square matrix .

Theorem 3.2 (SURE for Lava in Regression).

Suppose . Let

be the projection matrix onto the unselected columns of the transformed variables. We have that

Therefore, the SURE of is given by

3.4. Post-lava in regression

We can also remove the shrinkage bias in the sparse component introduced by the -penalization via a post-selection procedure. Specifically, let () respectively denote the lava estimator of the dense and sparse components. Define the post-lava estimator as follows:

Let be an submatrix of whose columns are selected by . Then we can partition , where . Write and . The post-lava prediction for is:

In addition, note that the lava estimator satisfies . We then have the following expression of .

Lemma 3.1.

Let . Then

The above lemma reveals that the post-lava corrects the -shrinkage bias of the original lava fit by adding the projection of the lava residual onto the subspace of the selected regressors. This correction is in the same spirit as the post-lasso correction for shrinkage bias in the standard lasso problem; see Belloni and Chernozhukov (2013).

Remark 3.2.

We note that the SURE for post-lava may not exist, though an estimate of the upper bound of the risk function may be available, because of the impossibility results for constructing unbiased estimators for non-differentiable functions; see Hirano and Porter (2012).

3.5. Deviation Bounds for Prediction Errors

In the following, we develop deviation bounds for the lava prediction error: . We continue to work with the decomposition and will show that lava performs well in terms of rates on the prediction error in this setting. According to the discussion in Section 3.2, there are three sources of prediction error: (i) , (ii) and (iii) . The behavior of the first two terms is determined by the behavior of the ridge estimator of the dense component , and the behavior of the third term is determined by the behavior of the lasso estimator on the transformed data.

We assume that and that is fixed. As in the lasso analysis of Bickel et al. (2009), a key quantity is the maximal norm of the score:

Following Belloni and Chernozhukov (2013), we set the penalty level for the lasso part of lava in our theoretical development as

| (3.13) |

and a constant. Note that Belloni and Chernozhukov (2013) suggest setting and that is easy to approximate by simulation.

Let and be the maximum diagonal element of

Then by the union bound and Mill’s inequality:

| (3.14) |

Thus the choice is strictly sharper than the union bound-based, classical choice . Indeed, is strictly smaller than even in orthogonal design cases since union bounds are not sharp. In collinear or highly-correlated designs, it is easy to give examples where ; see Belloni et al. (2014). Thus, the gains from using the more refined choice can be substantial.

We define the following design impact factor: For ,

where is the restricted set, and where if .

The design impact factor generalizes the restricted eigenvalues of Bickel et al. (2009) and and is tailored for bounding estimation errors in the prediction norm (cf. Belloni et al. (2014)). Note that in the best case, when the design is well-behaved and is a constant, we have that

| (3.15) |

where is a constant. Remarks given below provide further discussion.

The following theorem provides the deviation bounds for the lava prediction error.

Theorem 3.3 (Deviation Bounds for Lava in Regression).

We have that with probability

where and

Remark 3.3.

As noted before, the “sparse+dense” framework does not require the separate identification of . Consequently, the prediction upper bound is the infimum over all the pairs such that . The upper bound thus optimizes over the best “split” of into sparse and dense parts, and . The bound has four components. is a qualitatively sharp bound on the performance of the lasso for -transformed data. It involves two important factors: and the design impact factor . The term is the size of the impact of the noise on the ridge part of the estimator, and it has a qualitatively sharp form as in Hsu et al. (2014). The term describes the size of the bias for the ridge part of the estimator and appears to be qualitatively sharp as in Hsu et al. (2014). We refer the reader to Hsu et al. (2014) for the in-depth analysis of noise term and bias term . The term appearing in the bound is also related to the size of the bias resulting from ridge regularization. In examples like the Gaussian sequence model, we have

| (3.16) |

This result holds more generally whenever , which occurs if stochastically dominates the eigenvalues of (see our supplementary material Chernozhukov et al. (2015) for detailed derivations).

Remark 3.4 (Comments on Performance in Terms of Rates).

It is worth discussing heuristically two key features arising from Theorem 3.3.

1) In dense models where ridge would work well, lava will work similarly to ridge. Consider any model where there is no sparse component (so ), where the ridge-type rate is optimal (e.g. Hsu et al. (2014)), and where (3.16) holds. In this case, we have since , and the lava performance bound reduces to

2) Lava works similarly to lasso in sparse models that have no dense components whenever lasso works well in those models. For this to hold, we need to set . Consider any model where and with design such that the restricted eigenvalues of Bickel et al. (2009) are bounded away from zero. In this case, the standard lasso rate

of Bickel et al. (2009) is optimal. For the analysis of lava in this setting, we have that . Moreover, we can show that and that the design impact factor obeys (3.15) in this case. Thus,

and follows due to .

Note that we see lava performing similarly to lasso in sparse models and performing similarly to ridge in dense models in the simulation evidence provided in the next section. This simulation evidence is consistent with the observations made above.

Remark 3.5 (On the design impact factor).

The definition of the design impact factor is motivated by the generalizations of the restricted eigenvalues of Bickel et al. (2009) proposed in Belloni et al. (2014) to improve performance bounds for lasso in badly behaved designs. The concepts above are strictly more general than the usual restricted eigenvalues formulated for the transformed data. Let . For any vector , respectively write and . Define

The restricted eigenvalue is given by

Note that and that

Now note that . When is relatively large, is approximately equal to . Hence, behaves like the usual restricted eigenvalue constant as in Bickel et al. (2009), and we have a good bound on the design impact factor as in (3.15). To understand how depends on more generally, consider the special case of an orthonormal design. In this case, and with . Then , and the design impact factor becomes .

Thus, the design impact factor scales like when restricted eigenvalues are well-behaved, e.g. bounded away from zero. This behavior corresponds to the best possible case. Note that design impact factors can be well-behaved even if restricted eigenvalues are not. For example, suppose we have two regressors that are identical. Then , but in this case; see Belloni et al. (2014)).

4. Simulation Study

The lava and post-lava algorithm can be summarized as follows.

-

1.

Fix , and define , .

-

2.

For and , solve for

-

3.

Define The lava estimator is

-

4.

For , solve for

-

5.

The post-lava estimator is

We present a Monte-Carlo analysis based on a Gaussian linear regression model: , . The parameter is a -vector defined as

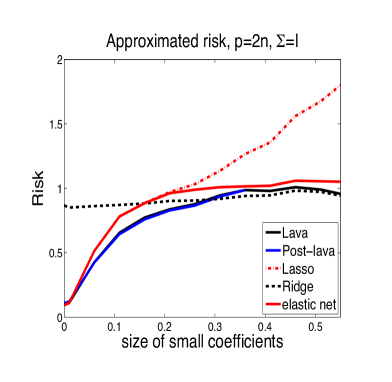

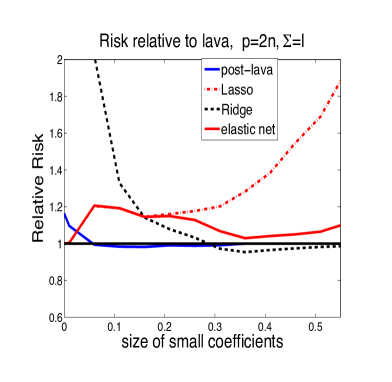

where denotes the “size of small coefficients”. When is zero or small, can be well-approximated by the sparse vector . When is relatively large, cannot be approximated well by a sparse vector. We set and , and compare the performance of formed from one of five methods: lasso, ridge, elastic net, lava, and post-lava.222Results with , where OLS is also included, are available in supplementary material. The results are qualitatively similar to those given here, with lava and post-lava dominating all other procedures. The rows of are generated independently from a mean zero multivariate normal with covariance matrix . We present results under an independent design, , and a factor covariance structure with where the rows of are independently generated from . In the latter case, the columns of depend on three common factors. We focus on a fixed design study, so the design is generated once and fixed throughout the replications.

To measure performance, we consider the risk measure where the expectation is conditioned on . For each estimation procedure, we report the simulation estimate of this risk measure formed by averaging over simulation replications. Figures 4 and 5 plot the simulation estimate of for each estimation method as a function of , the size of the “small coefficients”. In Figure 4, all the tuning parameters are chosen via minimizing the SURE as defined in Theorem 3.2; and the tuning parameters are chosen by 5-fold cross-validation in Figure 5. The SURE formula depends on the error variance , which must be estimated. A conservative preliminary estimator for can be obtained from an iterative method based on the regular lasso estimator; see, e.g., Belloni and Chernozhukov (2013). On the other hand, -fold cross-validation does not require a preliminary variance estimator.

The comparisons are similar in both figures with lava and post-lava dominating the other procedures. It is particularly interesting to compare the performance of lava to lasso and ridge. The lava and post-lava estimators perform about as well as lasso when the signal is sparse and perform significantly better than lasso when the signal is non-sparse. The lava and post-lava estimators perform about as well as ridge when the signal is dense and perform much better than ridge when the signal is sparse. When the tuning parameters are selected via cross-validation, the post-lava performs slightly better than the lava when the model is sparse. The gain is somewhat more apparent in the independent design. Additional simulations are presented in our supplementary material (Chernozhukov et al. (2015)).

5. Discussion

We propose a new method, called “lava”, which is designed specifically to achieve good prediction and estimation performance in “sparse+dense” models. In such models, the high-dimensional parameter is represented as the sum of a sparse vector with a few large non-zero entries and a dense vector with many small entries. This structure renders traditional sparse or dense estimation methods, such as lasso or ridge, sub-optimal for prediction and other estimation purposes. The proposed approach thus complements other approaches to structured sparsity problems such as those considered in fused sparsity estimation (Tibshirani et al. (2005) and Chen and Dalalyan (2012)) and structured matrix decomposition problems (Candès et al. (2011), Chandrasekaran et al. (2011), Fan et al. (2013), and Klopp et al. (2014)).

There are a number of interesting research directions that remain to be considered. An immediate extension of the present results would be to consider semi-pivotal estimators akin to the root-lasso/scaled-lasso of Belloni et al. (2011) and Sun and Zhang (2012). For instance, we can define

Thanks to the characterization of Theorem 3.1, the method can be implemented by applying root-lasso on appropriately transformed data. The present work could also be extended to accommodate non-Gaussian settings and settings with random designs, and it could also be extended beyond the mean regression problem to more general M- and Z- estimation problems, e.g., along the lines of Negahban et al. (2009).

Appendix A Proofs for Section 2

A.1. Proof of Lemma 2.1

Fixing , the solution for is given by . Substituting back to the original problem, we obtain

Hence , and . Consequently, .

A.2. A Useful Lemma

The proofs rely on the following lemma.

Lemma A.1.

Consider the general piecewise linear function:

Suppose . Then

Proof.

We first consider an expectation of the following form: for any , and , by integration by part,

| (A.1) | |||

| (A.2) | |||

| (A.3) |

This result will be useful in the following calculations. Setting , and , respectively yields

Therefore, for any constant ,

| (A.5) | |||||

| (A.7) | |||||

If none of are zero, by setting , ; and respectively, we have

| (A.8) | |||

| (A.9) | |||

| (A.10) | |||

| (A.11) | |||

| (A.12) | |||

| (A.13) | |||

| (A.14) |

If any of is zero, for instance, suppose , then which can also be written as the first equality of (A.8). Similarly, when either or , (A.8) still holds.

Therefore, summing up the three terms of (A.8) yields the desired result.

A.3. Proof of Theorem 2.1

Recall that is a weighted average of and the soft-thresholded estimator with shrinkage parameters and . Since is a soft-thresholding estimator, results from Donoho and Johnstone (1995) give that

Therefore, for ,

| (A.15) |

Next we verify that

| (A.16) |

By definition,

| (A.17) |

Let . The claim then follows from applying Lemma A.1 by setting , , , , and .

Hence

The risk of lasso is obtained from setting and in the lava risk. The risk of ridge is obtained from setting and in the lava risk.

As for the risk of post-lava, note that

Hence applying Lemma A.1 to , i.e. by setting and , we obtain:

Finally, the elastic net shrinkage is given by

The risk of elastic net then follows from Lemma A.1 by setting , , and .

A.4. Proof of Lemma 2.2

For , we have

We now bound uniformly over . We have that

where with penalty level . Hence

Bounding I. Note that . The first term is thus the bias of a ridge estimator, with .

Bounding II. Note that . By Mill’s ratio inequality, as long as , . In addition,

Since , by Theorem 2.1 with (since ),

where (1) follows from the Mill’s ratio inequality: for . Also note that since and . Hence we can apply the Mill’s ratio inequality respectively on and . In addition, the first two terms on the right hand side are negative. (2) is due to since and . (3) follows since when . Finally, for any , and any , . Set ; when , . Hence , which gives (4). Therefore,

On the other hand, applying (A.1) and by the same arguments as above, uniformly for ,

Moreover, . Hence

Bounding III. By Donoho and Johnstone (1995), Hence (note that )

implying

Summarizing, we obtain (note that )

Finally, due to , we have

where the last equality is due to for

A.5. Proof of Theorem 2.3

Appendix B Proofs for Section 3

B.1. Proof of Theorem 3.1

Let . Then for any

The second claim of the theorem immediately follows from this.

Further, to show the first claim, we can write for any ,

The sum of these terms is equal to

where the equality follows from the observation that, since and , we have

Therefore, after multiplying by , the profiled objective function in (3.4) can be expressed as:

This establishes the first claim.

B.2. Proof of Theorem 3.2

B.3. Proof of Lemma 3.1

Note that and . Hence it suffices to show that . In fact, let be the vector of zero components of , then . So since

B.4. Proof of Theorem 3.3

Step 1. By (3.7),

since as shown below. Step 2 provides the bound for the first term, and Step 3 provides the bound on the second term.

Furthermore, since , we have

Also, to show that , we let be the eigen-decomposition of , then . Note that all the nonzero eigenvalues of are the same as those of , and are , where is the th largest eigenvalue of . Thus

Combining these bounds yields the result.

Step 2. Here we claim that on the event , which holds with probability , we have

By (3.5), for any ,

Note that , which implies the following basic inequality: for , on the event ,

or, equivalently,

If , then we are done. Otherwise we have that

Thus and hence by the definition of the design-impact factor

Combining the two cases yields the claim.

Step 3. Here we bound We have

By Hsu et al. (2014)’s exponential inequality for deviation of quadratic form of sub-Gaussian vectors the following bound applies with probability :

where the second inequality holds by Von Neumann’s theorem (Horn and Johnson (2012)), and the last inequality is elementary.

Furthermore, note that . Hence

References

- Belloni and Chernozhukov (2013) Belloni, A. and Chernozhukov, V. (2013). Least squares after model selection in high-dimensional sparse models. Bernoulli 19 521–547.

- Belloni et al. (2011) Belloni, A., Chernozhukov, V. and Wang, L. (2011). Square-root lasso: pivotal recovery of sparse signals via conic programming. Biometrika 98 791–806.

- Belloni et al. (2014) Belloni, A., Chernozhukov, V. and Wang, L. (2014). Pivotal estimation via square-root lasso in nonparametric regression. The Annals of Statistics 42 757–788.

- Bickel et al. (2009) Bickel, P., Ritov, Y. and Tsybakov, A. (2009). Simultaneous analysis of lasso and dantzig selector. The Annals of Statistics 37 1705–1732.

- Bunea et al. (2007) Bunea, F., Tsybakov, A. and Wegkamp, M. (2007). Sparsity oracle inequalities for the lasso. Electronic Journal of Statistics 1 169–194.

- Bunea et al. (2010) Bunea, F., Tsybakov, A. B., Wegkamp, M. H. and Barbu, A. (2010). Spades and mixture models. The Annals of Statistics 38 2525–2558.

- Candes and Tao (2007) Candes, E. and Tao, T. (2007). The dantzig selector: Statistical estimation when p is much larger than n. The Annals of Statistics 35 2313–2351.

- Candès et al. (2011) Candès, E. J., Li, X., Ma, Y. and Wright, J. (2011). Robust principal component analysis? Journal of the ACM (JACM) 58 11.

- Chandrasekaran et al. (2011) Chandrasekaran, V., Sanghavi, S., Parrilo, P. A. and Willsky, A. S. (2011). Rank-sparsity incoherence for matrix decomposition. SIAM Journal on Optimization 21 572–596.

- Chen and Dalalyan (2012) Chen, Y. and Dalalyan, A. (2012). Fused sparsity and robust estimation for linear models with unknown variance. Advances in Neural Information Processing Systems 1259–1267.

- Chernozhukov et al. (2015) Chernozhukov, V., Hansen, C. and Liao, Y. (2015). A lava attack on the recovery of sums of dense and sparse signals. Tech. rep., MIT.

- Donoho and Johnstone (1995) Donoho, D. L. and Johnstone, I. M. (1995). Adapting to unknown smoothness via wavelet shrinkage. Journal of the American Statistical Association 90 1200–1224.

- Dossal et al. (2011) Dossal, C., Kachour, M., Fadili, J. M., Peyré, G. and Chesneau, C. (2011). The degrees of freedom of the lasso for general design matrix. arXiv preprint:1111.1162 .

- Efron (2004) Efron, B. (2004). The estimation of prediction error. Journal of the American Statistical Association 99 619–642.

- Efron et al. (2004) Efron, B., Hastie, T., Johnstone, I. and Tibshirani, R. (2004). Least angle regression. The Annals of statistics 32 407–499.

- Fan and Li (2001) Fan, J. and Li, R. (2001). Variable selection via nonconcave penalized likelihood and its oracle properties. Journal of the American Statistical Association 96 1348–1360.

- Fan et al. (2013) Fan, J., Liao, Y. and Mincheva, M. (2013). Large covariance estimation by thresholding principal orthogonal complements (with discussion). Journal of the Royal Statistical Society, Series B 75 603–680.

- Fan and Lv (2008) Fan, J. and Lv, J. (2008). Sure independence screening for ultrahigh dimensional feature space. Journal of the Royal Statistical Society: Series B (with discussion) 70 849–911.

- Frank and Friedman (1993) Frank, L. E. and Friedman, J. H. (1993). A statistical view of some chemometrics regression tools. Technometrics 35 109–135.

- Hirano and Porter (2012) Hirano, K. and Porter, J. R. (2012). Impossibility results for nondifferentiable functionals. Econometrica 80 1769–1790.

- Horn and Johnson (2012) Horn, R. A. and Johnson, C. R. (2012). Matrix analysis. Cambridge university press.

- Hsu et al. (2014) Hsu, D., Kakade, S. M. and Zhang, T. (2014). Random design analysis of ridge regression. Foundations of Computational Mathematics 14 569–600.

- Klopp et al. (2014) Klopp, O., Lounici, K. and Tsybakov, A. B. (2014). Robust matrix completion. arXiv preprint arXiv:1412.8132 .

- Loh and Wainwright (2013) Loh, P.-L. and Wainwright, M. J. (2013). Regularized m-estimators with nonconvexity: Statistical and algorithmic theory for local optima. In Advances in Neural Information Processing Systems.

- Meinshausen and Yu (2009) Meinshausen, N. and Yu, B. (2009). Lasso-type recovery of sparse representations for high-dimensional data. The Annals of Statistics 37 246–270.

- Meyer and Woodroofe (2000) Meyer, M. and Woodroofe, M. (2000). On the degrees of freedom in shape-restricted regression. The Annals of Statistics 28 1083–1104.

- Negahban et al. (2009) Negahban, S., Yu, B., Wainwright, M. J. and Ravikumar, P. K. (2009). A unified framework for high-dimensional analysis of -estimators with decomposable regularizers. In Advances in Neural Information Processing Systems.

- Stein (1956) Stein, C. M. (1956). Inadmissibility of the usual estimator for the mean of a multivariate distribution. Proc. Third Berkeley Symp. Math. Statist. Prob. 197 –206.

- Stein (1981) Stein, C. M. (1981). Estimation of the mean of a multivariate normal distribution. The Annals of Statistics 9 1135–1151.

- Sun and Zhang (2012) Sun, T. and Zhang, C.-H. (2012). Scaled sparse linear regression. Biometrika 99 879–898.

- Tibshirani (1996) Tibshirani, R. (1996). Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society, Series B 58 267–288.

- Tibshirani et al. (2005) Tibshirani, R., Saunders, M., Rosset, S., Zhu, J. and Knight, K. (2005). Sparsity and smoothness via the fused lasso. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 67 91–108.

- Tibshirani and Taylor (2012) Tibshirani, R. J. and Taylor, J. (2012). Degrees of freedom in lasso problems. The Annals of Statistics 40 1198–1232.

- Wainwright (2009) Wainwright, M. (2009). Sharp thresholds for noisy and high-dimensional recovery of sparsity using l1-constrained quadratic programming (lasso). IEEE Transactions on Information Theory 55 2183–2202.

- Yuan and Lin (2006) Yuan, M. and Lin, Y. (2006). Model selection and estimation in regression with grouped variables. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 68 49–67.

- Zhang (2010) Zhang, C.-H. (2010). Nearly unbiased variable selection under minimax concave penalty. The Annals of Statistics 38 894–942.

- Zhao and Yu (2006) Zhao, P. and Yu, B. (2006). On model selection consistency of lasso. The Journal of Machine Learning Research 7 2541–2563.

- Zou and Hastie (2005) Zou, H. and Hastie, T. (2005). Regularization and variable selection via the elastic net. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 67 301–320.