∗ Department of Mathematics, Karlsruhe Institute of Technology, D-76128 Karlsruhe, Germany. Corresponding author: nicole.baeuerle@kit.edu, Tel.: +49-721-608-48152, Fax: +49-721-608-46066

Gas storage valuation with regime switching

Abstract.

In this paper we treat a gas storage valuation problem as a Markov Decision Process. As opposed to existing literature we model the gas price process as a regime-switching model. Such a model has shown to fit market data quite well in [10]. Before we apply a numerical algorithm to solve the problem, we first identify the structure of the optimal injection and withdraw policy. This part extends results in [28]. Knowing the structure reduces the complexity of the involved recursion in the algorithms by one variable. We explain the usage and implementation of two algorithms: A Multinomial-Tree Algorithm and a Least-Square Monte Carlo Algorithm. Both algorithms are shown to work for the regime-switching extension. In a numerical study we compare these two algorithms.

- Key words:

-

Gas Storage Valuation, Regime Switching, Markov Decision Process, Least-Square Algorithm, Multinomial-Tree Algorithm.

1. Introduction

In the EU, natural gas is still the second fuel used in final energy consumption with a share of , ahead of electricity at and behind oil products (cp. [12]). A lot of factors influence the gas price like weather conditions, economic growth, prices of other fuel like oil, coal, carbon, growing share of renewables and new production techniques for unconventional gas resources. In order to handle the resulting gas price volatility, the gas storage capacity has been increased constantly. The number of storage facilities in the EU in year 2013 is 142 with a maximum working volume of 96597 million cubic meters (cp. [12]). This storage on one hand can be used to balance supply and demand but also on the other hand to create profit from an active storage management on a mark-to-market basis. Contracts for natural gas storage essentially represent real options on natural gas prices. We refer to [15] for an introduction to the storage valuation problem.

In order to evaluate a contract on a gas storage facility we need a stochastic model for the gas price process and a tool to find the optimal dynamic injection and withdraw policy. The latter problem results in a stochastic control problem and there are quite some papers in the literature which deal with it. Most often, the gas price models are continuous and somehow related to interest rate models. We thus get a continuous stochastic control problem which can be solved via the Hamilton-Jacobi-Bellman equation. However, this equation has to be solved numerically (see e.g. [9, 29, 10]). An alternative approach is to discretize the gas price process first and then treat the resulting discrete-time problem as a Markov Decision Process (see e.g. [5, 28, 19, 6, 14]). An intermediate model has been considered in [7] where the underlying process is continuous, however the operation policies are restricted to switching policies where the storage level switches between full and empty. The task can then be reduced to the discrete problem of finding the optimal stopping times for the switches of operation modes. Surprisingly there is only the paper by [28] which deals with obtaining the analytic structure of the optimal policy. It is crucial there, but also in other papers, that besides the natural upper and lower capacity bound of the storage, there is a restriction on the maximum rate at which gas can be released from the storage and a maximum rate at which gas can be injected into the storage. These rates depend on the storage level and are typically decreasing and convex or concave respectively. In [28] these rates are assumed to be constant. In any case, as a result the optimal action not only depends on the gas price but also on the storage level. The optimal policy can be characterized by three regions which depend on the gas price : When the current gas storage level is below a certain bound , it is optimal to inject gas, either as much as possible or up to which occurs first. If the current gas storage level is above a certain bound , it is optimal to withdraw gas, either as much as possible or down to which occurs first. In case the level is in between, it is optimal to do nothing.

In this paper we extend the result of [28] to more general restrictions on the maximum injection and withdraw rate and to more general gas price processes. Moreover we use the structure of the optimal policy to implement efficient numerical algorithms for the solution of the gas storage problem. More precisely we use a regime-switching model and thus a non-Markovian gas price model. The model is based on the mean-reverting model of [27]. In our setting, there are two regimes which result in different time-dependent, seasonal mean-reversion factors. It has been shown in [27, 17, 10] that a one-factor mean-reverting model does not capture the dynamics of a typical gas forward curve. Hence there is on the one hand the possibility to use multi-factor models, like in [8, 6, 19, 22] or to introduce regime-switches, see e.g. [10]. It is argued in [10] that regime-switching models calibrate quite well to market data and are less complex than multi-factor models. For a further discussion of gas price models see [13]. Our gas price processes have no jumps (for jump models see [9, 10]) but these could be included easily.

As already mentioned, we use the structure of the optimal policy to implement efficient numerical algorithms for the solution of the gas storage problem. The basic structure of the algorithms is given by the usual backward induction algorithm from the theory of Markov Decision Processes. This algorithm suffers from the curse of dimensionality. However, when implemented in a clever way, this effect can be mitigated (see e.g. [24] for approximate dynamic programming). We will see that the usage of the structure of the optimal policy reduces the number of optimization problems which have to be solved by one variable. The two algorithms we compare, differ in the way the expectation in the recursion is computed. In the first algorithm we approximate the continuous gas price process by a recombining tree, using the method proposed in [23]. This method has the advantage that the values of the tree are unaffected by the regime which only influences the transition probabilities. Other methods to construct trees are explained in [17, 14, 1]. However, these methods do not extend easily to the regime-switching model. In the second algorithm we use the Least-Square Monte Carlo Algorithm to approximate the expectation by regression on a number of basis functions. This algorithm is well-known from [20] for the valuation of American options and first used for gas storage valuation by [5]. In [6] the authors use the Least-Square Monte Carlo Algorithm for a multi-factor gas price model and discuss the impact of the choice of the basis functions. Here we show that this method can also be applied to regime-switching models.

Our paper is organized as follows: In the next section we formulate the gas storage valuation problem with regime switching gas price as a Markov Decision Process. Afterwards we prove in Section 3 the structure of the optimal policy and consider some special cases. Next in Section 4 we specify our gas price model and explain the Multinomial-Tree Algorithm and the Least-Square Monte Carlo Algorithm. The parameters of the gas price model are taken from [3]. In this section we also discuss an efficient discretization of the gas storage. A numerical analysis of the two algorithms can be found in Section 5, where we use a specific example. We discuss the choice of the number of grid points for the gas storage level, the number of simulations necessary for the Least-Square Monte Carlo Algorithm and the number of nodes for the tree in the Multinomial-Tree Algorithm.

2. The Gas Storage Valuation Problem as a Markov Decision Process with Regime Switching

We formulate the gas storage valuation problem as a Markov Decision Process (MDP) with regime switching. For the theory of Markov Decision Processes we refer to [2, 4, 16, 25]. Let be the stochastic gas price process which is defined on the measurable space , where . This price process is influenced by a Markov chain , such that is a Markov process. We further assume that has finite state space and transition matrix . Additionally assume that and are conditionally independent under and and that , where denotes the law of the corresponding random variables. Using these assumptions we get for , ,

Let be the finite planning horizon and denote by and the minimal and maximal capacity of the gas storage facility, respectively. The state space of the Markov Decision Process is given by and we denote the elements of by where is the current storage level, the current price and the current background state. The action space is given by , where is the change in the amount of gas. Hence means that the amount of is withdrawn and means that is injected. Since we assume that actions are additionally restricted by maximal rates of changes and that depend on the current amount of gas in the storage, the admissible actions are restricted to the set . We assume that and are decreasing functions of the amount of gas in storage . Furthermore is supposed to be concave and non-negative and is supposed to be convex and non-positive in the interval The set of admissible actions is illustrated in Figure 1. A decision rule at time is a measurable mapping and a policy is defined by a sequence of decision rules.

In order to include transaction costs, a loss of gas at the pump and/or a bid ask spread in the market, we introduce the “ask price” and the “bid price” for one quantity of gas. In particular we assume that and , where such that for each . Thus we have fixed and proportional transaction cost. The one stage reward function of the Markov Decision Process is given by

Let denote the terminal reward function, that depends on the current amount of gas in the storage and the current price . We assume that is a concave function of .

Example 2.1 (Some possible terminal reward functions).

One possible terminal reward function could be . Here the terminal reward corresponds to selling the gas that is available in the storage at time . An alternative choice for a terminal reward function that includes a penalty when the amount of gas in the storage is below some amount is

In order not to favour situations where the amount of gas in the storage is above the level , we can replace by for . Another modification is to let the “penalty” grow exponentially to the distance to and not proportionally.

The transition kernel for the Markov Decision Process is given by

| (2.1) |

By definition of the transition kernel we get for any measurable function and admissible that

| (2.2) |

Having introduced all the necessary definitions, the objective is to find an optimal policy that maximizes the expected total reward over time. Therefore we define the value function as the maximal expected accumulated reward from time up to time , that is for

| (2.3) |

where denotes all admissible policies and is a discount factor. denotes the conditional expectation given . Using the Bellman equation we know, that we can solve the problem of finding by

| (2.4) | ||||

| (2.5) | ||||

We introduce the following operators for some measurable function

| (2.6) | ||||

| (2.7) |

such that equation (2.5) can be written as .

Remark 2.2.

It can be shown that if there exists , such that

-

•

-

•

the expected values from the definitions above exist. Thus the value function is well defined. In what follows we denote by

For details see the concept of a bounding function in [2].

3. Properties of the Optimal Gas Storage Policy and the Value Function

In this section we identify the structure of the optimal gas storage policy as explicitly as possible. It follows essentially from some properties of the value function which are shown by induction.

3.1. Structure of the optimal policy for the general model

Proposition 3.1.

Let . If is concave, then is concave on for each fixed and

Proof.

Let be admissible and , . Let . Then there exist and such that

Further we obviously have by checking the restrictions. Thus

where the second inequality follows by assumption and the fact that is concave. The assertion follows by taking ∎

For notational simplicity we now introduce the so called “continuation value”, that is

From Proposition 3.1 and the fact that is concave and is constant, the next corollary can be deduced immediately.

Corollary 3.2.

Both functions and are concave for all and .

Theorem 3.3 (Structure of the optimal policy).

For each there exist and where , such that the optimal policy is given by

| (3.1) |

Proof.

The proof is similar to the proof of Theorem 1 in [28]. Let be fixed but arbitrary. At first we loosen the restrictions of the optimization problem at time and maximize over all . Thus we consider the following problem

where and . Dividing the optimization problem into the case and the case yields

| (3.2) |

Let us denote the two subproblems by

| (3.3) |

| (3.4) |

Moreover, let be the maximizer of (3.3) when and the maximizer of (3.4) when .

In the following we will prove that For fixed let us denote

The function with

is decreasing in since . Thus is equal to plus a decreasing function in . Therefore the maximizer of is smaller or equal to the maximizer of for each fixed but arbitrary. Hence the assertion follows.

Consider the optimization problem (3.2) for . Obviously, maximizes (3.3). Now consider (3.4). For each admissible we have . Since maximizes the optimization problem (3.4) when , but is not admissible, we know by the concavity of the function that maximizes the problem. Thus we get that maximizes (3.4).

Now we need to determine whether or maximizes (3.2).

Since is admissible for (3.3) and maximizes this problem we get

Inserting the maximizer in (3.4), we get . Thus is maximized by .

Considering the optimization for it can be shown by similar argumentation that maximizes (3.2).

For we have that maximizes both (3.3) and (3.4) and thus (3.2). This is a similar argumentation as in the first case considering the optimization of (3.4).

Now we restrict the admissible in (3.2), such that . Then we consider the problem

| (3.5) |

and get for the maximizers

Transferring this result to the original problem yields the statement. ∎

Remark 3.4.

Under further assumptions it can be shown, that and are monotonically decreasing, see [26].

The interesting fact about the structure of the optimal policy is, that it is not always optimal to withdraw or inject as much gas as possible or do nothing. Instead by using the optimal policy you are trying to reach the calculated bound in the next step or do nothing depending on how much gas is in the storage. Figure 2 illustrates the structure of the optimal policy. The choice of the action depends on the amount of gas in the storage and the optimal policy “divides” the interval into three parts. Assuming the amount of gas in the storage lies between and , then it is optimal to inject gas, either as much as possible (), if you do not or just reach the bound , or just the amount that is missing to reach - although you could inject more. A similar situation arises when the amount of gas in the storage is above .

3.2. Structure considering some special cases

After considering the structure of the optimal policy in general and realizing that it is not of bang-bang type, we focus now on a special case, where we will see a bang-bang structure. Assume that for each and . Thus the restriction set simplifies to

| (3.6) |

We further assume that and are linearly decreasing functions. Notice that this special case includes the case and , where it is possible to empty and fill the storage within one time step, sometimes called the “fast storage”.

Additionally the terminal reward function is supposed to be a linear function of .

Theorem 3.5.

In the previously described special case, the value function is a linear function in , that is

| (3.7) |

where and are suitable functions. Further an optimal policy is of the form

| (3.8) |

with suitable functions .

Proof.

First notice that for functions and there exist functions and such that

| and | |||

We use backward induction. For we get by the linearity of in

Assuming that and going backwards in time from to we get

The last equality holds since and are linear functions of . The last but one equality holds since the two indicator functions are never equal to at the same time. This is true since in that case we would have which is a contradiction to . Further we see that

where and .

Since we have

∎

Remark 3.6.

From the proof we can see that in the case we get . Thus “doing nothing” is optimal only if . Also note that for monotonicity properties of in the price , further assumptions on the price process (like in [28]) are necessary.

4. Algorithms

In the following we set the discount factor for simplification.

4.1. General structure of the algorithms

The general structure of any algorithm to compute the value of the gas storage facility is given by a Backward Induction Algorithm that is based on the Bellman equation (2.5) and Theorem 3.3.

Given a grid in the gas volume level of the storage and the gas price we first compute the value function at time for all grid points in and . Going backward in time we then compute the policy bounds and by solving the corresponding optimization problems for all and finally compute the maximizer and value function at that stage for all and . Figure 3 illustrates the general structure. The arrows indicate for-loops.

Looking at the basic structure of the algorithm it becomes clear, that the key question is how to compute or estimate . In the end every other parameter is given or can be calculated based on .

Remark 4.1 (Potential of using the optimal policy).

Comparing the basic structure of the algorithm illustrated in figure 3 to the structure directly using the Bellman Equation 2.5 we see that instead of solving optimization problems for all it is enough to solve two optimization problems for all . Thus we get a significant reduction of the number of optimization problems which have to be solved. This and the fact that the optimization problems involve an optimization over the whole interval instead of which depends on the current volume level yields a good potential for parallelization in implementing any algorithm using the structure of the optimal policy.

4.2. Specification of the price process

In order to show possible ways to compute or estimate and thus develop algorithms we introduce a specific model of the price process. Later some remarks will indicate to which extend the model can be generalized such that the presented algorithm still works. We will consider a continuous-time model which we will discretize to use our MDP approach.

We assume that the log-prices follow a regime-switching variation of the one-factor Schwartz’ model, see [27], with a possible switch in the time varying mean. It has been shown by [10] that regime-switching models fit real data very well. In what follows suppose that is the continuous process constructed from the discrete-time Markov chain . Thus, the log-price-process satisfies the stochastic differential equation

where is the mean-reversion factor, is the time dependent mean when the Markov Chain is in state , denotes the volatility and is a Brownian Motion. The price process itself is given by . In the description of the two algorithms below, we assume that the state space of consists of two different values only.

Remark 4.2.

Although we assume that the price process can only switch between two regimes, the algorithms below can easily be extended to the case of more regimes, as well as faster switches.

Example 4.3.

[Choice of the parameters] The following parameters were chosen for the numerical examples. Based on a parameter estimation by [3], who fitted a similar model without regime switching to NBP data. We assume that

where , , and . The mean reversion factor is assumed to be and the volatility to be . Further the transition matrix of the Markov chain is given by

Having specified the price model we now introduce two methods to get a grid in the price domain and compute .

4.3. A “Multinomial-Tree” Algorithm

The “Multinomial-Tree” method is based on the idea of approximating the price process by a recombining Binomial tree and thus calculate the conditional expectation “exactly” on that grid. The authors of [23] developed a method for approximating diffusion models, which we will use to get an approximating recombining tree for the log-price process. The advantage of a recombining tree is that the number of nodes grows linearly and not exponentially. For this purpose the time interval is divided into equidistant parts of length . Let for each , ,

be functions on that indicate the probability of the “Up”-movement at gridpoint starting at , as well as the values that are reach by an “Up”- and a“Down”-movement respectively The process is given by

This process, or the corresponding functions, are now constructed such that we get a recombining structure and the local drift and local second moment converge to the drift and volatility of the price process as tends to .

Using the rather intuitive choice of yields a recombining structure and by [23] the “underlying” price tree. Note that only depends on which is not influenced by a regime switch, thus the grid in the price domain for the algorithms is the same in each regime. Figure 4 illustrates the underlying structure of the Binomial tree process.

Based on [23] the probabilities are chosen to be

where

Under some further assumption it has been shown in [23] that the process converges weakly to to the corresponding log-price process as tends to . Thus its exponential converges weakly to the price process.

In order to use this construction in an algorithm to compute

we pick some fixed value and choose such that . Approximating the price process with the method from above we know that the random variable given can take different values denoted by with positive probability. Figure 5 illustrates this for .

Thus the continuation value on that tree can be calculated by

| (4.1) |

The necessary probabilities are computed using from the contruction. For example in the case we simply have and . In the case we get

Because of the recombining structure we get at time at most gridpoints in . There are at most such many gridpoints since some are reached with probability and thus do not need to be considered in the calculation.

Remark 4.4 (More general price process models).

The construction of a recombining tree works according to [23] for any diffusion model of the form

although the construction of the “underlying” price tree is more complicated in some cases. To add a possible regime switching it is necessary that the switch in regimes does not affect the underlying price tree, but only the probabilities. That means we can allow for a switch in mean, not in the volatility. But as we see, it is possible to allow for a time dependent volatility, for example.

Remark 4.5 (Convergence of Multinomial-Tree Algorithm).

It can be shown that with , i.e. the tree is getting finer, the algorithm converges against the true value and the optimal policy converges against the true optimal one. This is essentially due to the fact that according to [23] the tree converges weakly against the true diffusion price process. However, a thorough proof needs a number of technical steps which we will indicate in this remark. In order to do so, let us denote by the value function for the tree price process with nodes per time step and by the value function for the model with diffusion price process. By and we denote the corresponding optimal decision rules.

First note that the set of admissible actions does not depend on the tree, is compact and the set-valued mapping is continuous in the sense of [2] (Definition A.2.1). Thus it follows with Theorem 2.4.10 in [2] that as well as are continuous in and for all . Next it is possible to find for all a r.v. which is larger w.r.t. the increasing convex order than the price for all . Finally for all and we get that for positive constants , since the value of the gas storage can be bounded above by a system where we can sell the complete storage at once at every stage.

4.4. A Least-Square Monte Carlo Algorithm

The second method we present is based on the well known Least-Square Monte Carlo Method of [20] that was first used for gas storage valuation by [5]. We take up that idea and adapt it to the problem with regime switching and moreover use the structure of the optimal policy. Since the whole method is based on a Monte Carlo simulation of the price process, we assume that there are paths of the price process simulated. Thus we have paths of the underlying Markov chain, that indicate the regimes, and paths of the actual corresponding price. The idea is based on the fact, that since is a conditional expectation it is a function of the current price for the current regime and for each . Thus we approximate this function by a linear combination of a set of basis function , i.e. we assume

where , are to be chosen optimal in some sense. For calculating the coefficients a Least-Square method is used. At time point we have simulated prices and corresponding regimes . Let be the indices where and those where . For those two sets of indices we now use a Least-Square method to seperately compute and respectively. As realizations of the conditional expectation on the grid we use the already calculated values . Thus at time step and volume level we need to minimize

| (4.2) |

to get and

| (4.3) |

to get , where denotes the Euclidean norm. In the algorithm we then estimate the conditional expectation by

| (4.4) |

Remark 4.6 (Other price models).

This method can be used for any price model with regime switching, that can be simulated.

Remark 4.7 (Convergence of Least-Square Algorithm).

When the number of simulated paths and the number of chosen basis functions converges to infinity, then the Least-Square Algorithm converges to the true value. This result has been shown in [11] for the general Least-Square Algorithm.

4.5. A Method of building a grid in the storage domain

4.5.1. Motivation.

The most common and intuitive method of choosing a grid in the storage domain is an equidistant grid, i.e. dividing the interval into a fixed number of parts of the same length. But when we see the structure of the optimal policy we recognize that a lot of times the optimal policy is or . That means that from state we often get to state or . These states are not necessarily grid points of an equidistant grid, especially when and are not constant. Thus we get errors in the computation, especially when the equidistant grid is not that fine.

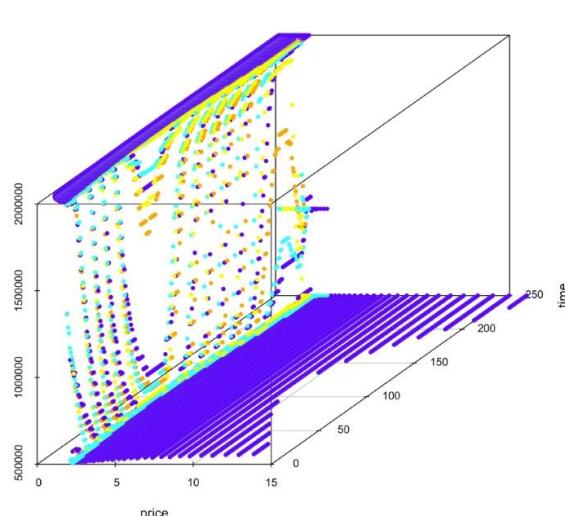

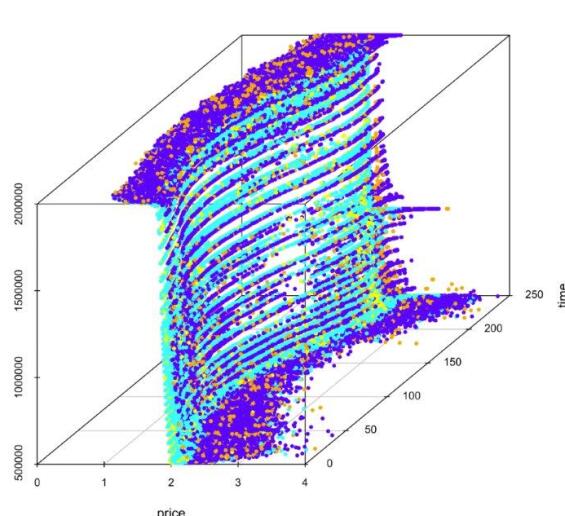

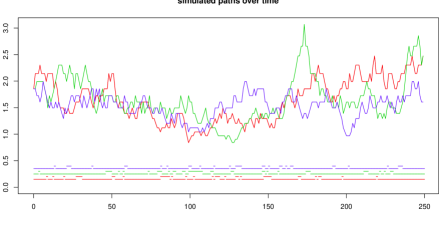

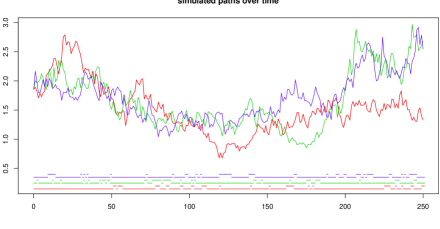

Figure 6 shows the policy bounds using the Mulitnomial-Tree Algorithm and the Least-Square Algorithm with an equidistant grid of grid points. The calculation is based on the example introduced in Section 5. As we can see, the policy bounds equal or most of the time, which makes the decision to be or . This emphasizes the idea of not choosing an equidistant grid, but to use the functions and and rather include points like and instead.

4.5.2. Construction and Example

Clearly the grid we now construct should include the points . Starting from we compute until is reached. In the same way we compute starting from until is reached. As far as does not equal nor we compute starting from the grid points and until the minimal and maximal volume level is reached respectively.

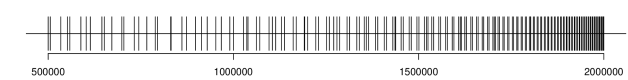

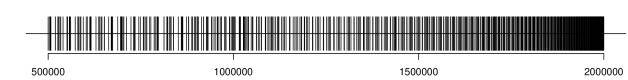

To get an impression of what the grid looks like, Figures 7 and 8 show grids of minimal lengths in the example we used in Chapter 5, that is with

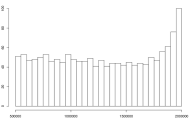

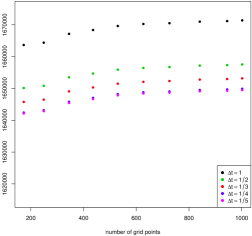

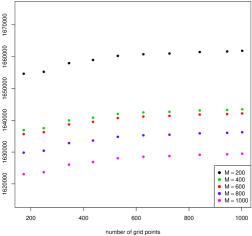

Comparing an equidistant grid to the “new” grid we can see in Figure 9 that in both algorithms, the Multinomial-Tree Algorithm and the Least-Square Monte Carlo Algorithm, we get a faster convergence using the “new grid”. The figure shows the Value of the gas storage using an equidistant grid (star points) and the “new” grid (points) using different and different number of simulations in the example of Chapter 5.

5. Numerical Analysis of the two Algorithms using an example of a gas storage facility

5.1. An example of a gas storage facility

First we recall that the parameters of the price process are given in Example 4.3. The prices here are quoted in pence/therm, where , which will be the unit we use in the following computations. As the initial price and regime we choose and . The “ask-” and “bid-”prices and are given by and . In [28] the parameter and are interpreted as additional costs that result e.g. from abrasion of the pump or other technical devices. They refer to [21], who states that these costs usually won’t exceed 2 cent per MMBtu. On the other hand and can be interpreted as a Bid-Ask-Spread in the market. Gas prices in [18] confirm that the assumption is reasonable. The choice of the parameter and can be interpreted as a loss of gas at the pump, that usually is not more than , see [21]. Details can be found in [28]. Another possible interpretation is to include transaction costs.

A realistic example of a gas storage contract that is based on the Stratton Ridge salt cavern in Texas can be found in [29]. Referring to that salt cavern we choose

We choose further

Thus it takes approximately 20 days to “empty” the storage and 78 days to “fill” the storage.

We choose a duration of year that corresponds to trading days starting from February, since the prices were fitted starting from that time. The terminal reward function is given by

5.2. Further computations and comparison of the two algorithms

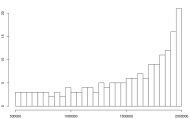

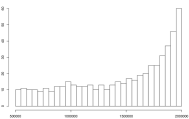

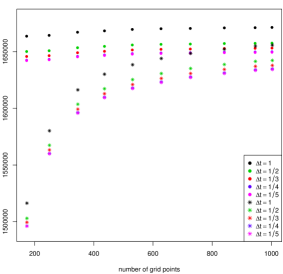

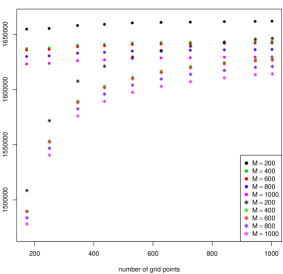

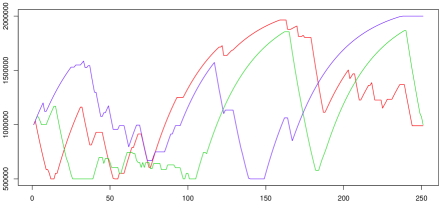

Before we look at further computations we investigate the influence of some of the parameters of the algorithms. Figure 10 shows the value of the gas storage using the Multinomial-Tree Algorithm (left) and the Least-Square Algorithm right with different values of and respectively and with different number of grid points. We see a little kink in all computation at about grid points in the grid. This is the number we use for the grid size in the following.

Next we want to take a closer look at the Multinomial-Tree Algorithm and see how influences the value of the gas storage. Table 1 shows the computed values of the gas storage using different trees (cp. Figure 5) with . Since the difference between and is rather small, we have chosen .

| Value of the gas storage (in £) |

|---|

[2mm]

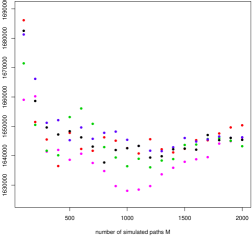

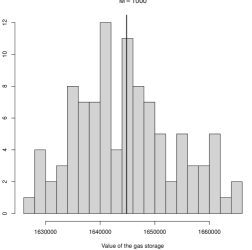

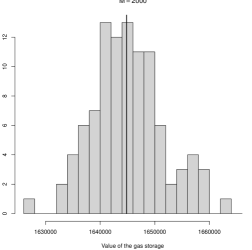

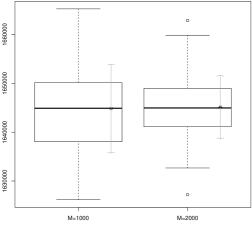

In case of the Least-Square Algorithm we need to decide how many paths are to be simulated. Figure 11 shows the value of the gas storage as a function of for simulation studies. As basis functions we took . The variance of the value still seems pretty high for , which is due to a spike in the lowest simulation. Thus we take a further look at more simulations in Figures 12 and 13, that show histograms and boxplots for simulations each using and . In the histograms we additionally plotted the means, that are for and for . These means are also indicated in the boxplots as star points together with the standard deviations, that are and respectively. One can see that the difference in mean is not high, where the variance as we would expect, decays from to by a bigger amount.

Remark 5.1 (Comparison of the algorithms).

As we can see both algorithms return a value of approximately Million £. While the Multinomial-Tree Algorithm only needs to be run once, since we are computing in the end the “exact” value on the grid, the Monte-Carlo Algorithm needs to be run several times to get a better impression of the estimate. This fact makes the Multinomial-Tree Algorithm in case of runtime more interesting compared to the Least-Square Algorithm. Although the Multinomial-Tree Algorithm might be more complicated in implementation, especially when gets even smaller than , once it is implemented it runs faster than the Least-Square Algorithm, e.g. because of less grid points. The advantage of the Least-Square Algorithm is clearly the applicability to a wider range of price models.

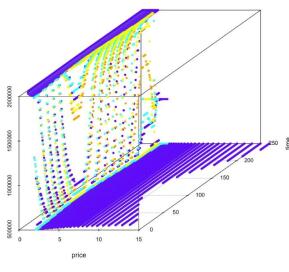

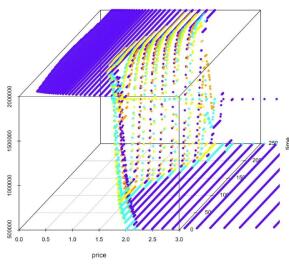

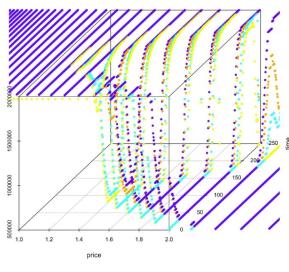

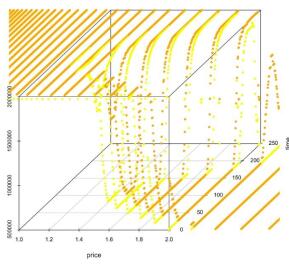

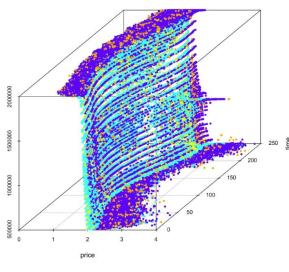

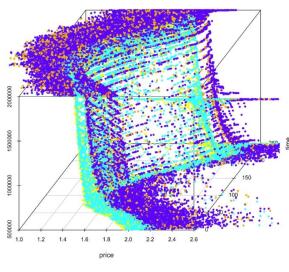

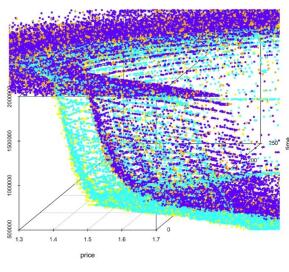

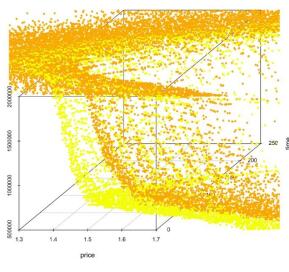

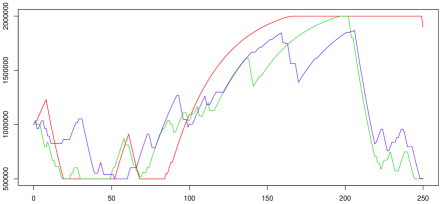

To get an impression of the structure of the optimal policy we now have a closer look at the policy bounds. Figures 14 and 15 show the policy bounds computed by the Multinomial-Tree Algorithm with and the Least-Square Algorithm with . The lower bounds and are marked light blue and yellow, where the upper bounds and are marked blue and orange. The figure shows three pictures of all bounds, where we “zoom in” to the part where the bounds do not equal or . The picture at the right shows just the bounds at regime in order to see more clearly that they have the same structure as those in regime . Recall that the optimal policy is to inject gas to possibly reach if the current amount of gas is below and if the current amount of gas is above to withdraw gas if possible to reach , and do nothing in between.

As we can see from the figures the bounds are decreasing as the price increases, which follows the intuitive decision to sell gas if the price is high and to buy gas if the price is low. Also in many cases the bounds equal or that corresponds to the decision withdraw all gas possible and inject all gas possible, respectively. There is only a small band around the time dependent means of the price model where these bounds do not equal those specific cases. The gap, where “do nothing” is optimal, is caused by the fact that and are not equal, since those two functions make the difference in the optimization problems that need to be solved to get the policy bounds. The policy bounds at the end of the time horizon highly depend on the terminal reward function and thus have a different structure than the ones before.

As we can guess from the figures of the policy bounds, the optimal policy is in many cases of “bang-bang”-type in the sense that it is optimal to inject as much gas as possible, to withdraw as much gas as possible or do nothing. This policy is a rather intuitive policy. We compare the best bang-bang policy which we compute by restricting the decisions in the algorithms to the extreme ones to the optimal policy.

Looking at Table 2 we see that using the best “bang-bang” type policy leads to a lower value than using the optimal policy , but the difference is rather small. It lies below .

| value of gas storage | value of gas storage | difference | |

| method | using optimal | using best bang-bang | in procent |

| Multinomial-Tree Algorithm | |||

| Least-Square Algorithm |

[2mm]

Thus we look at how many times we actually decide not to inject/withdraw all gas possible. Table 3 shows the absolute value in three sample paths, see Figures 16 and 17. Here optimal decision or means deciding to hit those bounds in the next step and not having injected or withdrawn all possible gas. We can see that we use those actions very rarely. So in the end, if we are using a rather intuitive bang-bang-type policy the error is not that big, though we need to realize that there is a difference.

| optimal decision | ||||||

|---|---|---|---|---|---|---|

| method | path | |||||

| Multinomial-Tree Algorithm | red | 1 | 3 | 139 | 48 | 59 |

| green | 0 | 14 | 131 | 43 | 62 | |

| blue | 1 | 3 | 149 | 30 | 61 | |

| Least-Square Algorithm | red | 0 | 0 | 94 | 20 | 136 |

| green | 1 | 5 | 120 | 49 | 75 | |

| blue | 1 | 3 | 120 | 49 | 77 | |

[2mm]

Finally Figures 16 and 17 show on the one hand three simulated gas price paths as well as the corresponding underlying Markov chain for the regimes. On the other hand the figures show the volume level over time that results from using the optimal policy computed with the Multinomial-Tree and the Monte Carlo Algorithm respectively. In total we see that, there is no general rule as “fill in summer, empty in winter” for the gas storage, since in the end it highly depends on the current price. Recall that time corresponds to the beginning of February. For example we see that in figure 16 at time point about we use the high spike in the green curve to empty the storage and then fill up the storage again. Or in the blue curve we use the rather low prices at the beginning to fill up the storage before emptying it. In figure 17 we see that we use the rather high prices in the red curve to empty the storage really fast, where later the low prices result in a rather fast filling of the storage starting from time point .

6. Conclusion

As we have seen, the result from [28] concerning the structure of the optimal policy can be extended to price processes with regime switching and storage-dependent injection and withdrawal rates. Both algorithms, the Multinomial-Tree Algorithm and the Least-Square Algorithm, work quite well for the price models with regime switching. Hints on how to choose the critical parameters of the algorithm have been given. In particular a clever choice of the grid of the gas storage level has been shown to be important. On the other hand we also conclude that instead of maximizing over all feasible policies it is almost optimal to maximize over bang-bang policies only.

Further research needs to be done in order to extend the presented algorithms to price models with jumps. While it should not be a problem to include jumps in the Least-Square Algorithm, since the process only needs to be simulated in the end, it would be interesting to find out if there is a way to approximate the price model by a recombing tree in a similar way. Further [6] and [5] present some simulation studies on the choice of the basis functions in the Least-Square Algorithm. Their result that the choice of basis functions does not have a big effect on the value of the algorithm needs to be verified in the Least-Square Algorithm with regime switching. Here it would also be interesting to investigate in what extend a regression in has an effect on the storage value compared to the separate regressions in each regime.

7. Acknowledgement

The authors would like to thank Alfred Müller for helpful comments and suggestions on the PhD thesis of Viola Riess which also entered the paper.

References

- [1] Olivier Bardou and Sandrine Bouthemy and Gilles Pages, Optimal quantization for the pricing of swing options, Applied Mathematical Finance, 16, 183–217, (2009)

- [2] Nicole Bäuerle and Ulrich Rieder, Markov Decision Processes with Applications to Finance, pp. 388. Springer, Berlin Heidelberg (2011)

- [3] Fred Espen Benth and Jurate Saltyte Benth and Steen Koekebakker, Stochastic Modelling of electricity and related markets, pp. 337. World Scientific, Singapore (2008)

- [4] Dimitri P. Bertsekas, Dynamic programming and optimal control. Vol. II, pp. 303. Athena Scientific, Belmont (2001)

- [5] Alexander Boogert and Cyriel de Jong, Gas Storage Valuation Using a Monte Carlo Method, The Journal of Derivatives, 15, 81–98, (2008)

- [6] Alexander Boogert and Cyriel de Jong, Gas storage valuation using a multifactor price process, The Journal of Energy Markets, 4, 29–52, (2011)

- [7] René Carmona and Michael Ludkovski, Valuation of energy storage: An optimal switching approach, Quantitative Finance, 10, 359–374, (2010)

- [8] Alvaro Cartea and Thomas Williams, UK gas markets: The market price of risk and applications to multiple interruptible supply contracts, Energy Economics, 30, 829–846, (2008)

- [9] Zhuliang Chen and Peter A. Forsyth, A semi-Lagrangian approach for natural gas storage valuation and optimal operation, SIAM Journal on Scientific Computing, 30, 339–368, (2007)

- [10] Zhuliang Chen and Peter A. Forsyth, Implications of a regime-switching model on natural gas storage valuation and optimal operation, Quantitative Finance, 10, 159–176, (2010)

- [11] Emmanuelle Clément and Damien Lamberton and Philip Protter, An analysis of a least squares regression method for American option pricing, Finance and Stochastics, 6, 449–471, (2002)

- [12] Eurogas, Eurogas Statistical Report 2013, http://www.eurogas.org/statistics/, 1–16, (2013)

- [13] Alexander Eydeland and Krzysztof Wolyniec, Energy and power risk management: New developments in modeling, pricing, and hedging, pp 504. John Wiley & Sons, Hoboken (2003)

- [14] Bastian Felix and Christoph Weber, Gas storage valuation applying numerically constructed recombining trees, European Journal of Operational Research, 216, 178–187, (2012)

- [15] Helyette Geman, Modeling and Pricing for Agriculturals, Metals and Energy, pp. 416. John Wiley & Sons, Chichester (2005)

- [16] Onésimo Hernández-Lerma and Jean Bernard Lasserre, Discrete-time Markov control processes, pp. 216. Springer-Verlag, New York (1996)

- [17] Patrick Jaillet abd Ehud Ronn and Stathis Tompaidis, Valuation of commodity-based swing options, Management Science, 50, 909–921, (2004)

- [18] Cyriel de Jong and Kasper Walet, To store or not to store, Energy Risk, 8–11, (2003)

- [19] Guoming Lai and François Margot and Nicola Secomandi, An approximate dynamic programming approach to benchmark practice-based heuristics for natural gas storage valuation, Operations Research, 58, 564–582, (2010)

- [20] Francis A. Longstaff and Eduardo S. Schwartz, Valuing American Options by Simulation: A Simple Least-Squares Approach, The Review of Financial Studies, 14, 113–147, (2001)

- [21] Spyros Maragos, Valuation of the Operational Flexibility of Natural Gas Storage Reservoirs, In: Real options and energy management : using options methodology to enhance capital budgeting decisions, 431–456, (2004)

- [22] Jan Müller and Guido Hirsch and Alfred Müller, Modeling the price of natural gas with temperature and oil price as exogenous factors, In: Innovations in Quantitative Risk Management, 1–20, (2015)

- [23] Daniel B. Nelson and Krishna Ramaswamy, Simple Binomial Processes as Diffusion Approximations in Financial Models, The Review of Financial Studies, 3, 393-430, (1990)

- [24] Warren B. Powell, Approximate Dynamic Programming: Solving the curses of dimensionality, pp. 627. John Wiley & Sons, Hoboken (2007)

- [25] Martin L. Puterman, Markov decision processes: discrete stochastic dynamic programming, pp. 649. John Wiley & Sons, New York (1994)

- [26] Viola Riess, Gasspeicherbewertung : Strukturelle Analyse und Algorithmen, PhD Thesis KIT, http://digbib.ubka.uni-karlsruhe.de/volltexte/1000041239, (2014)

- [27] Eduardo Schwartz, The Stochastic Behavior of Commodity Prices: Implications for Valuation and Hedging, The Journal of Finance, 52, 923-973, (1997)

- [28] Nicola Secomandi, Optimal Commodity Trading with a Capacitated Storage Asset, Management Science, 56, 449-467, (2010)

- [29] Matt Thompson and Matt Davison and Henning Rasmussen, Natural gas storage valuation and optimization: A real options application, Naval Research Logistics, 56, 226–238, (2009)