Grid Integration Costs of

Fluctuating Renewable Energy Sources

Abstract

The grid integration of intermittent renewable energy sources (RES) causes costs for grid operators due to forecast uncertainty and the resulting production schedule mismatches. These so-called profile service costs are marginal cost components and can be understood as an insurance fee against RES production schedule uncertainty that the system operator incurs due to the obligation to always provide sufficient control reserve capacity for power imbalance mitigation. This paper studies the situation for the German power system and the existing German RES support schemes. The profile service costs incurred by German transmission system operators are quantified and means for cost reduction are discussed. In general, profile service costs are dependent on the RES prediction error and the specific workings of the power markets via which the prediction error is balanced. This paper shows both how the prediction error can be reduced in daily operation as well as how profile service costs can be reduced via optimization against power markets and/or active curtailment of RES generation.

Index Terms:

Cost Structure of Renewable Energy Sources (RES), Power Markets, Forecast Error, RES Grid IntegrationI Introduction

Since the early 1980s, government support schemes with the specific goal of promoting large-scale deployment of RES were introduced in many countries worldwide. The German Renewable Energy Act, ”Erneuerbare-Energien-Gesetz” (EEG), a well-known support scheme, provides a favorable feed-in tariff (FIT) for a variety of RES since the year 2000 and builds on the good experience with its predecessor, the Stromeinspeisungsgesetz from 1991. It gives priority to electric power in-feed from RES over power in-feed from conventional power plants, i.e., fossil-fueled and nuclear and large, hydro-based power plants. This favorable investment environment has led to a massive build-up notably of wind & photovoltaic (PV) generation in Germany [1, 2]. By year-end 2013, the installed wind and PV power capacities were around 33 GW and 39 GW respectively [3]. The original goal of the FIT, i.e. inciting large-scale RES deployment has thus been achieved.

With a combined installed power capacity of RES units of more than 70 GW, somewhat more than the average load demand in the German power system, of 63-68 GW, and significant annual RES energy shares, about 15% combined, wind & PV units can no longer be treated as exotic, marginal electricity sources. The current RES production already has significant effects on the power market, notably in the form of the so-called merit-order effect. Especially the decoupling of spot market prices and RES in-feed due to FIT regulations, results in lower average spot price levels and also in negative spot prices for several hours each month. One effect of this is that flexible power plants such as gas-fired units cannot be operated profitably because peak spot prices are too often below their marginal operation costs. Another effect is that due to the also associated spread between peak and base base day-ahead prices, energy storage facilities, primarily pumped storage hydro plants cannot be operated profitably either [4]. As a consequence, the production structure is about to be transformed from mainly centralized large power plants to a decentralized structure of small RES plants. This has effects on the operation of the grid and of the electricity markets including significant costs for RES grid integration; in addition to the in-feed tariffs.

The remainder of this paper is outlined as follows: Section II gives an overview of the relevant power market structures and cost drivers for RES grid integration. Section III briefly discusses the employed data, which is further on analyzed in Section IV. Finally, Section V presents the key results.

II Cost Structure of Renewable Energy Sources

II-A Power Market Structures and Cost Drivers

In Germany, the power market is organized as an area pricing market. Thus, the price model operates on the assumption of zero congestion. This results in a full decoupling of power price and production region, which brings the need for re-dispatch measures to compensate for transmission grid congestions.

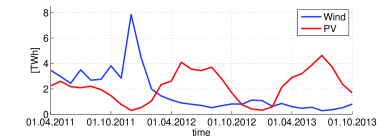

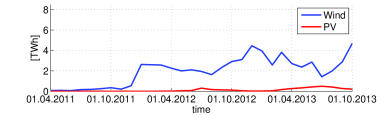

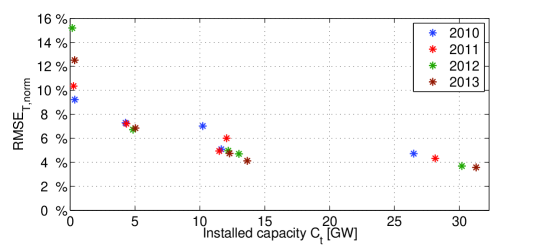

The support scheme for most of RES in Germany is two-fold (since Jan. 2012): A producer can choose between FIT and a premium for direct sales. The constant FIT for RES production pays the producer a fixed amount of money. Furthermore the FIT regulations guarantees an in-feed priority over conventional generation [5]. The power generated under FIT support is sold via the TSO, which also covers the RES forecast error. On the other hand, the direct sale is organized via third party [6]. It does not include guaranteed sell of the power and the forecast error must be handled by the third party. The EEG states that the producers can freely switch between support schemes every month. Fig 1 and 2 show the participation over time in the two support schemes. In 2012 the direct sales support scheme became preferable for wind plant operators. This is a result of the better forecast quality for wind production based on the strong auto-correlation of the wind in-feed.

The support schemes for RES and the decoupling of the electricity market from the underlying grid structures both result in costs for the energy consumer.

II-A1 Costs at Energy Only Markets

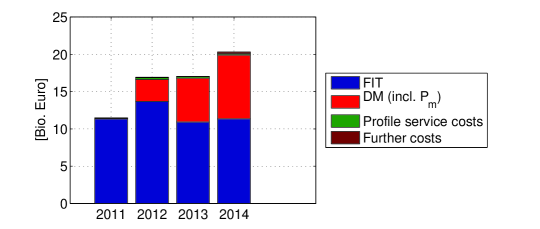

In Germany, two energy only markets exist, the day-ahead market and the intra-day market. Both markets are affected by the deployment of RES and serve different purposes. While the day-ahead market is the main procurement market, the intra-day market is used to settle the majority of the day-ahead forecast error before the use of ancillary services. For FIT supported RES, the direct cost at the day-ahead market is the gap between the guaranteed FIT and the achieved market prices plus the respective variable profile service costs for the FIT production. For the direct sales the cost are the market premium including a management premium for the direct marketing participants. These direct costs are directly transferred to the electricity customer via a RES allocation charge the so called ”EEG-Umlage”. As a result of excess supply, priority of RES in-feed and the lack of competitive market clearing for direct marketing the so-called merit-order effect lowered the market prices significantly in recent times. To ensure the settlement of RES in the auction, the price-independent FIT supported power enters the market with the allowed minimum bid of . The direct sales RES can technically enter the market with minus the market premium plus a small balancing error premium. Both effects shift the merit-order-curve to the right and lower the achieved day-ahead market price. The merit-order-effect is discussed in detail in [7]. The total paid ”EEG-Umlage” in Germany alone was almost 17 billion euros in 2012 and 2013 and estimated almost 20 billion in 2014 as shown in Fig. 3.

The intra-day market provide continues trading until 45 minutes before delivery. Compared to the pay-as-settled day-ahead market, the intra-day market is a pay-as-bid market. Since the market closing is only 45 minutes before delivery, the majority of the prediction errors can be settled on the intra-day market. Compared to the day-ahead market, the costs for balancing actions at the intra-day market are not part of the RES allocation charge but a component in the grid tariff.

II-A2 Costs on Ancillary Services Markets, Structural Changes & Effects

The transformation from centralized production to a decentralized production by small units has considerable ramification, on the power grid. The location mismatch of production and demand, the uncertain character of wind and PV and the shutdown off old, non-profitable, powerplants make ancillary services and re-dispatch more complex and therefore more expensive.

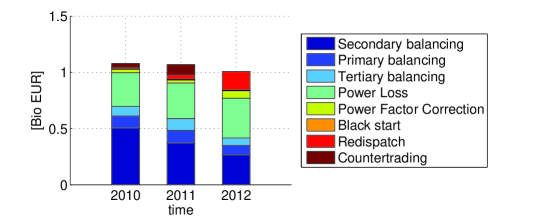

Fig. 4 shows that the costs of ancillary services over the years 2010, 2011 and 2012 were almost constant at 1 billion euros per year [9]. Anyhow, the composition of ancillary services changed over the years. The cost for secondary control (red) has decreased significantly as a result of the settlement of the forecast error (load and RES forecast) at the intra-day market. On the other hand, the major cost increase over the last three years is the compensation of power loss (cyan) in the grid and the re-dispatch measures. In the past, the majority of production was fed into the transmission grid, with low power loss, the areas of large demand close to the production location and proper grid design. With decentralized production the power flow goes from the low voltage levels via the transmission grid, to other low voltage distribution grid areas. More over, large RES production sources like offshore wind parks, are typically far away from the major location of power consumption. Power loss compensation and re-dispatch are performed by the TSOs and are billed to the customers via grid tariffs. While most of the standard prediction errors, such as load prediction errors stay approximately constant, the wind and PV generated in-feed has increased significantly over time [7].

III Data Section

As a result of several transparency acts, the data for power markets, energy-only as well as ancillary services, has in recent years become available in good quality. As required by the EEG, the prediction of wind and PV in-feed, as well as the realized in-feed have to be published. Recently Merit-Order Curve (MOC) data became available not only for the energy-only markets but also for the ancillary services markets.

| Data Time-Series | Available since | Source |

| Wind power in-feed | 2011/04 | [8] |

| Solar power in-feed | 2011/04 | [8] |

| Wind in-feed pred | 2011/04 | [8] |

| Solar in-feed pred | 2011/04 | [8] |

| EPEX Day-ahead prices | [10] | |

| EPEX Intra-day prices | 2006/10 | [10] |

| Balancing Energy Price | 2001/02 | [11] |

| Secondary Control MOC | 2007/12 | [12] |

| Tertiary Control MOC | 2007/12 | [12] |

| Management premium | 01/2012 | [6] |

| Other on EEG costs | 01/2011 | [8] |

The used data, the denomination of the variable and the source are given in Table I. All data referring to load has 15 minute resolution, while price data is provided with hourly resolution.

Since Germany is divided in four TSO areas, all data is TSO specific. If the data is TSO specific, the symbol carries the subscript .

In general, the market design, availability and transparency and RES support schemes differ from country to country. By all means Germany is a good study case for a market with a high RES in-feed with good data availability.

IV Analysis of Profile Service Costs

In this section we derive and analyse the profile service costs based on the available data. The day ahead forecast (08:00 AM [13]) of intermittent RES generates an error given by

| (1) |

where and are the day ahead generation forecasts for wind and PV and and the effective generation. The prediction error per TSO, , is defined analog as

| (2) |

Because demand and supply must always match, has to be leveled by the TSO. The prediction error known 45 minutes ahead is settled on the intra-day market. The remaining difference will be covered by secondary or tertiary control reserve. Therefore can also be written as

| (3) |

where is the volume traded at the intra-day market and is the volume balanced via secondary or tertiary control. The time index refers to the delivery period which, in the case of the intra-day market, corresponds with the delivery time on the ancillary services market.

IV-A Cost Structure

Because only the intra-day market and balancing reserve is allowed to be used to cover the forecast errors in the TSO RES balancing area, the profile service cost for time can be stated as the cost for intra-day market and balancing energy cost as

| (4) |

IV-A1 Intra-Day Market Balancing Costs

The intra-day market costs are the difference between the revenue, or costs, on the intra-day market minus the foregone, or achieved, revenue at the European Power Exchange (EPEX) day-ahead market and is given as

| (5) |

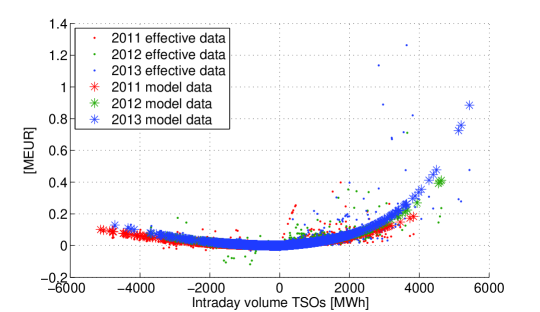

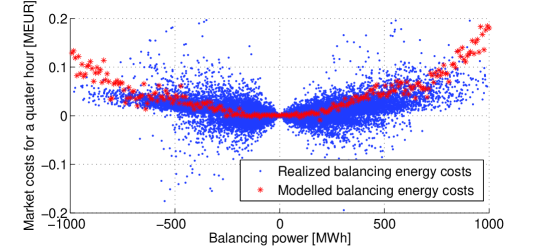

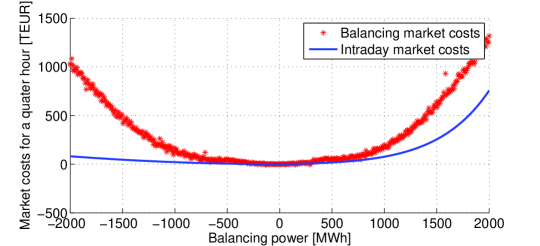

where are the intra-day prices and the day-ahead prices. The costs at the intra-day market are positive for the buyer side if is positive and is bigger than . For the seller side the costs are positive, if is negative and is smaller than . Fig. 5 shows the dependency between and of EPEX market data. The positive cost show an exponential dependency between and positive intra-day volume and a linear correlation between and negative intra-day .

Two conclusions can be drawn from the analysis and modelling of data. First, purchase on the EPEX intra-day market is more expensive than sales of excessive energy as a result of the exponential function shape shown in Fig. 5. Second, modelling of purchase costs may underestimate the extreme costs arising in situations of market supply scarcity as indicated by the positive outliers shown in Fig. 5.

IV-A2 Costs for Balancing energy

Accordingly to the costs of the intra-day energy, the cost for balancing energy is defined as the product of balanced volume and difference of the price for balancing energy and the EPEX day-ahead market . This gives

| (6) |

The price of balancing energy is defined as the costs of activation of balancing reserve over the balancing saldo for all balancing regions in Germany [14] as

| (7) |

To avoid extreme prices for very low and other price anomalies, is restricted in certain cases. For more information please refer to [14]. The balancing energy saldo is defined as the sum of all activated secondary- and tertiary control reserves and as

| (8) |

where and are the index of the last considered bid of secondary and tertiary control reserve respectively.

The consist of the following variables:

-

•

(residual prediction error of the TSOs)

-

•

residual prediction error from direct marketing

-

•

residual demand prediction error

-

•

demand fluctuations

-

•

unexpected power plant shutdowns

The costs can be defined as the sum of the costs of the activation of secondary and tertiary control as

| (9) |

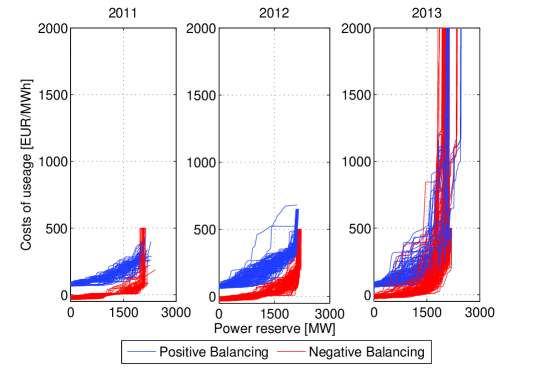

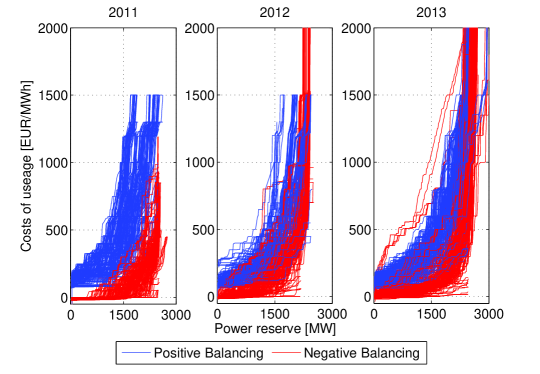

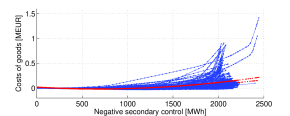

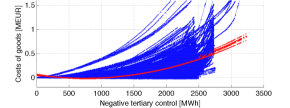

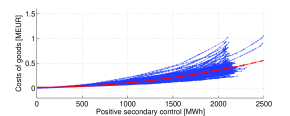

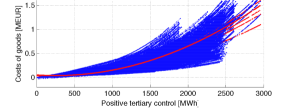

where is the index of a balancing capacity which offers secondary control reserve for an activation price , and is the index of a balancing capacity which offers tertiary control for an activation price . Fig. 6 and Fig. 7 show the 15 minutes MOC for the years 2011 to 2013 for secondary and tertiary control [12]. We train a model based on a quadratic function to model as a function of . The modelling is performed on aggregated data of all products corresponding to either of the four groups, negative secondary control reserve, positive secondary control reserve, negative tertiary control reserve and positive tertiary control reserve. Fig. 8 shows the fit of the quadratic function (red) to the aggregated MOCs data from the years 2011 to 2013.

The total balancing need can be derived as a function of . Using the four cost functions for the activation of control reserve to shown in Fig. 8 the total costs of activation can be calculated. Using (7) the price can then be calculated based on and . Fig. 9 shows the results of the simulation in comparison to the effective data over the last three years. Compared to the intra-day results, where the cost of negative and positive power is significantly different, the cost structure of balancing energy is almost symmetric and rises similar for negative and positive balancing. The cost uncertainty is larger than the uncertainty as a result of a more complex and harder to train model.

V results

In the following section, we will discuss the results of our analysis. Profile service costs are additional costs for system operation and thus, for the end consumer, the overall goal must be the reduction of those. Based on our analysis, the following measures may be used to reduce the profile service costs:

-

1.

the reduction of the forecast error

-

2.

selection between available markets

-

3.

the shut down of intermittent supply

V-A Reduction of the Forecast Error

The forecast error depends mainly on three parameters: First, the prediction horizon, second, the quality of the prediction model and third, the spatial distribution of intermittent supply. Because of the market environment in Germany, the prediction horizon is fixed to 16h to 40h [13]. To prove the influence of the parameters on , the root mean square error (RMSE) of for the years 2010 till 2013 has been normalized by the generation capacity to and is given by

| (10) |

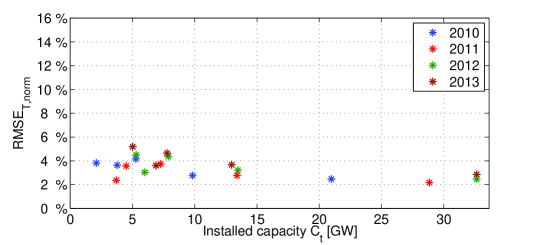

where is the average installed wind & PV generation capacity in the TSO area for the given year [15],[16]. The resulting are shown in Fig. 10 and Fig. 11.

The figures confirm that the latter two parameters do have a significant impact on . First, the introduction of more accurate prediction models for wind generation reduces the relative error for wind generation over time. The blue stars in Fig. 10, representing the prediction error for 2010 per TSO are significantly higher than the prediction in later years. This result is not significant for PV as shown in Fig. 11. Second, the aggregation of larger installed capacities reduces the relative prediction error as shown in Fig. 10. This result is also not significant for PV.

The two measures decrease relative profile service costs for big market actors or big balancing groups. Expensive forecast models can be covered by many installations, improving the prediction quality in combination with the reduced due to the big balance group size. Independent of the support schemes, big single actors are able to dispatch RES generated power more efficiently than small ones and save costs for the end consumer. This is a result of, first, the general larger number of production facilities and therefore better statistical properties and second local disturbances affect the system less.

V-B Selection Between Available Markets

For big balancing areas like the RES balancing area from the German TSOs, it could be shown that there is a correlation between trading volumes and costs. Therefore portions of and in (3) can be selected to reduce in (4).

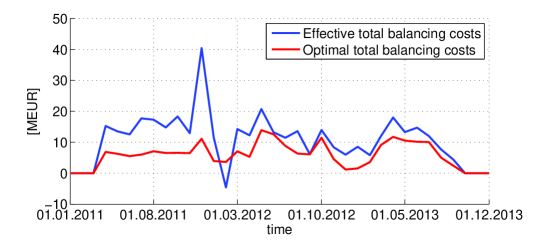

Fig. 12 shows the modelled price curves for a 15 minute product on the intra-day market in comparison to the expected costs for balancing energy. Fig. 13 shows the theoretical optimum of balancing cost versus the achieved optimum. The theoretical optimum is significantly lower than the TSO procurement of profile service costs for the RES balancing.

The results show, that for market actors it is possible to optimize themselves against the market, even though it is prohibited by law for balancing areas to stay long or short by choice before the activation of balancing reserve.

V-C Shut down of intermittent supply

Profile service costs of the RES balancing area can be normalized by the dispatched energy given by

| (11) |

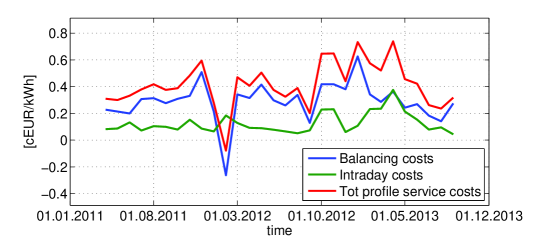

where is the marginal cost of market actors per sold kWh. If marginal costs of generation are higher than the expected revenues from the market, generation capacity has to be shut down to avoid short term losses for the operator. Because of the support schemes structure in Germany, RES installations still generate profits due to premium payments, even for hours when marginal costs are higher than the EPEX day-ahead market prices. Fig. 14 shows the effective monthly average profile cost for the TSOs. The sale of RES generation on the EPEX day-ahead market under its marginal costs is therefore for certain hours, where the EPEX day-ahead market price is lower than , economically inefficient.

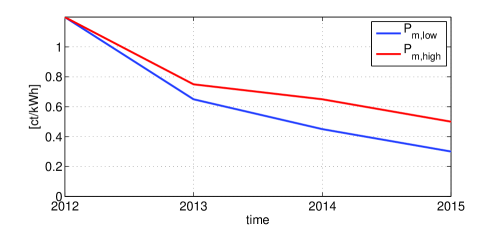

RES installation owners are free to choose every month between direct marketing or fixed FIT. Market actors using direct sale for their RES generated power have to pay a premium compared to FIT to get the assignment. Fig. 15 shows the development of management premium payments for wind & PV installations for 2012 to 2015. is paid to controllable installations and is paid to non-controllable installations. payments are decreasing for the future whereas the realized profile service costs of the TSO RES balance group are already rising for certain months above the payments. It therefore can be expected, that operators profile service costs rise above the payments and wind installation owner move back to the FIT support scheme.

VI Conclusion

This paper presented an analysis of the profile service cost as additional marginal costs for RES deployment. We presented a model to approximate the profile service costs for the TSOs and provide recommendations how to lower the profile service cost via better predictions especially in the case of wind production.

References

- [1] AG Energiebilanzen e.V., “Energiestatistiken,” 2013. [Online]. Available: www.ag-energiebilanzen.de

- [2] BDEW Bundesverband der Energie- und Wasserwirtschaft e.V., “Erneuerbare Energien und das EEG: Zahlen, Fakten, Grafiken (2013),” Jan. 2013. [Online]. Available: www.bdew.de

- [3] r2b energy consulting GmbH, “Endbericht Jahresprognose zur deutschlandweiten Strom- erzeugung aus EEG geförderten Kraftwerken für das Kalenderjahr 2013,” 2013.

- [4] M. Hildmann, A. Ulbig, and G. Andersson, “Electricity Grid In-feed from Renewable Sources: A Risk for Pumped-Storage Hydro Plants,” in 8th International Conference on the European Energy Market (EEM11), Zagreb, Croatia, 2011.

- [5] M. Hildmann, E. Kaffe, Y. He, and G. Andersson, “Combined Estimation and Prediction of the Hourly Price Forward Curve,” in 2012 IEEE POWER & ENERGY SOCIETY GENERAL MEETING, 2012.

- [6] Bundesministerium für Umwelt, Germany, “Act on granting priority to renewable energy sources (renewable energy sources act - eeg),” pp. 2–82, 2012.

- [7] M. Hildmann, A. Ulbig, and G. Andersson, “Revisiting the merit-order effect of renewable energy sources,” arXiv preprint arXiv:1307.0444, 2013.

- [8] 50Hz, Amprion, TenneT, TransnetBW, “Grid transparency page from the four TSO in Germany,” 2014. [Online]. Available: http://www.netztransparenz.de/de/Transparenzanforderungen.htm

- [9] Bundesnetzagentur Germany, “Monitoringbericht 2011 - 2013,” 2011 - 2013.

- [10] European Energy Exchange AG (EEX), “EPEX Market Data,” 2014. [Online]. Available: https://www.eex.com

- [11] Amprion GmbH, “Netzkennzahlen,” 2014. [Online]. Available: http://www.amprion.net/netzkennzahlen

- [12] 50Hz, Amprion, TenneT, TransnetBW, “Website zur Veröffentlichung der Deutschen Zahlen zu Regelleistung,” 2014. [Online]. Available: http://www.regelleistung.net

- [13] V. Lenzi, A. Ulbig, and G. Andersson, “Impacts of forecast accuracy on grid integration of renewable energy sources,” in PowerTech (POWERTECH), 2013 IEEE Grenoble. IEEE, 2013, pp. 1–6.

- [14] 50Hz, Amprion, TenneT, TransnetBW, “Modell zur Berechnung der Ausgleichsenergiepreise der 4 ÜNB,” 2012.

- [15] Frauenhofer Institut, “Installierte Nennleistung [MW] aller WEA in Deutschland,” 2014. [Online]. Available: http://windmonitor.iwes.fraunhofer.de/

- [16] Bundesnetzagentur Germany, “List of German Powerplants of the Bundesnetzagentur,” 2014. [Online]. Available: http://www.bundesnetzagentur.de/