One-level limit order book models with memory and variable spread

Abstract

We propose a new model for the level I of a Limit Order Book (LOB), which incorporates the information about the standing orders at the opposite side of the book after each price change and the arrivals of new orders within the spread. Our main result gives a diffusion approximation for the mid-price process. To illustrate the applicability of the considered framework, we also propose a feasible method to compute several quantities of interest, such as the distribution of the time span between price changes and the probability of consecutive price increments conditioned on the current state of the book. The proposed method is used to develop an efficient simulation scheme for the price dynamics, which is then applied to assess numerically the accuracy of the diffusion approximation.

Keywords and phrases: Limit Order Book Modeling, Price Process Formation, Heavy Traffic/Diffusion Approximation.

1 Introduction

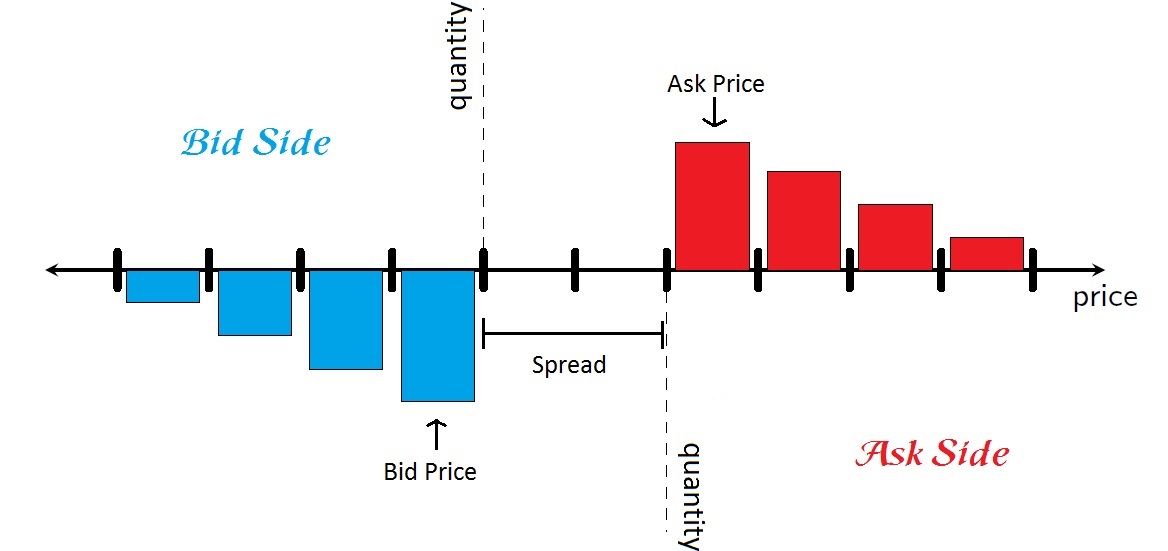

The evolution of trading markets has evolved considerably during the last few years. Most modern exchanges use completely automated platforms called Electronic Communication Networks (ECN), which has significantly increased the speed of trading to only a few milliseconds. ECN are based on a continuous double auction trading mechanism, in which any trader can submit orders to buy or sell an asset. Two type of orders are available: limit and market orders. A bid (ask) limit order specifies the quantity and the price at which a trader is willing to buy (sell) the asset in question. The so-called Limit Order Book (LOB) aggregates all the outstanding limit orders at any given time. Limit orders with the same price are ranked in a first-in-first-out (FIFO) priority execution. More specifically, a LOB can be visualized as a system of (possibly empty) FIFO queues (one for each possible tick price). Figure 1 gives a graphical representation of a LOB. The separation between the lowest price at the ask side (called the ask price) and the highest price at the bid side (called the bid price) is denominated as the spread of the LOB, while the queues corresponding to these best bid and ask prices are called the level I of the book.

By contrast, market orders are requests to buy or sell a certain quantity of the asset at the best available price. Hence, a market order to sell (buy) the asset is matched against outstanding limit orders sitting at the best bid (ask) queue. Other than limit orders and market orders, cancellation of limit orders is another common operation, which account for a considerably large fraction of the operations in an order book (cf. Harris, (2003)). There is obviously a tradeoff between market and limit orders. While the former are immediately and surely executed, they provide the worst possible price. In contrast, executed limit orders would give better prices but there is a possibility that they won’t be executed at all.

From the previous discussion it is clear that a price change occurs when either a queue of the book’s level I gets depleted (due to the cancellation of limit orders or the arrival of a market order) or a new limit order is posted within the spread. Hence, the best bid (ask) price decreases (increases) when the queue of limit orders at the best bid (ask) gets depleted, in which case the next nonempty bid (ask) queue becomes part of the new level I. Similarly, when the spread is larger than one tick, the best bid (ask) price increases (decreases) when a new bid (ask) order is posted within the spread. It is important to point out that the dynamics of the asset’s mid price is determined by the evolution of the book’s level I.

In recent years, there has been a great deal of attention on modeling the dynamics of LOBs. We refer to Gould et al. (2013) for a recent review on the subject. Earlier works in LOB modeling include Luckock (1988), Kruk (2003), Mendelson (1982), and Rosu (2009) to mention just a few. More recently, Cont et al. (2010) proposed a continuous-time Markovian model for the order book, in which the possible ask and bid prices of limit orders are assumed to lie in a finite set . The arrival of limit orders at the different price levels in are driven by independent Poisson processes, whose arrival rates are determined by the distance of their corresponding price level to the best bid/ask prices according to a power law relation. This approach was further developed in Abergel and Jedidi (2011) for a “finite frame LOB model”. More specifically, a fixed number of “potential” bid and ask price levels are considered. A potential bid (ask) price level is one at which a bid (ask) limit order could be submitted. In particular, each time the best bid (ask) price queue gets depleted, the frame of potential ask (bid) price levels are shifted to the left (right), hence, forgetting the information at the right (left) most level in the other side of the book. Similarly, each time a bid (ask) limit order is submitted within the spread, the frame of possible ask (bid) price levels is shifted to the right (left), for which queues at the right (left) most price levels are assumed constant. Under the just described “fixed moving frame” assumption, a diffusive limit for the mid-price process is established therein. See below for further discussion and comparisons with our results.

Our main inspiration for the present work is drawn from Cont and Larrard (2013)’s seminal work, where a Markovian model is considered for the dynamics of level I. The main motivation of considering only the level I and not the entire book is twofold. Firstly, as pointed out above, the asset’s price is determined by the level I and, secondly, the information contained in the level I is key for many high-frequency trading strategies and problems. By preserving a Poissonian order flow and imposing some symmetry conditions on the shape of the order book, Cont and Larrard (2013) prove that the mid-price process, properly scaled in time and space, converges to a Brownian motion. The volatility of the limiting process can explicitly be computed using the input parameters of the model. Unfortunately, the results therein required several strong assumptions, the most important of which are:

-

(i)

a constant volume for all type of orders: market, limit, and cancellations;

-

(ii)

a constant spread of one tick between the best ask and bid prices at all times;

-

(iii)

constant parallel price shifts of one tick after each depletion of a level I queue;

-

(iv)

loss of memory, in the sense that, after each level I queue depletion, the information on the remaining limit orders at the side which was not depleted is reset.

The assumption of constant spread is generally well-justified for “large” tick assets, in which the tick size is comparable to a “typical” price increment. Indeed, as illustrated in Cont and Larrard (2013), for some stocks in the US market, the spread could be equal to one tick for more of the observations within a typical day. Besides small-tick assets (e.g., EUR/USD FX), there are other situations in which the constant spread assumption cannot be validated. For instance, Bouchaud et al. (2009) argues that relatively large spreads may be created by monopolistic practices of market makers, high order processing costs, and large market orders. Pomponio and Abergel (2010) (see also Muni Toke and Pomponio (2012)) argue that traders keep track of the amounts of orders at the best quote in the LOB and typically restrict the size of their market orders to be less than these amounts. But, sometimes the speed of execution is more important than the market impact risk of large orders. In that case, orders larger than the size of the first limit (called trades-through) may be submitted. Pomponio and Abergel (2010) argue that even though trade-throughs may rarely occur (with an occurrence probability of less than ), they make up for a non-negligible part of the daily-volume (up to for the DAX index future). Since every trade-through widens the spread, a model that allows for variable spread is desirable.

In this work, we propose a new model as a way to account for the possibility of a variable spread, as described in the previous paragraph, and to relax some of the shortcomings of the framework proposed in Cont and Larrard (2013). More concretely, while keeping some of the assumptions therein, such as the Markovian order flow, one level at each side of the book, and a constant volume of order flow, the proposed model allows for some “memory” in the dynamics of the LOB by keeping the information of the outstanding orders on the other side of the book after each level I queue depletion. For instance, if the best bid queue gets depleted, the best bid price decreases one tick, but both the price and outstanding orders of the best ask price are preserved. In order to avoid perpetual widening of the spread, we also allow the arrival of orders within the spread according to a Poisson process. As in Cont and Larrard (2013), we establish a diffusive approximation for the price process, albeit using an essentially different analysis. Concretely, our results in this direction build on the mathematical theory of countable positive recurrent Harris chains (see, e.g., Meyn and Tweedie (2009)).

One of the main appealing features of the model in Cont and Larrard (2013) is its tractability, which, in particular, enables analytical computation of several LOB features, some of which are relevant for high-frequency trading and intraday risk management. To illustrate the applicability of the framework proposed in this work, we put forward a feasible method to compute several quantities of interest, conditioned on the initial state of the book, such as the distribution of the duration between price changes, the probability of a price increase, and the probability of two consecutive increments on the price. The main tool for the derived formulas is an explicit characterization of the joint distribution of the time of a depletion at the level I and the amount of orders at the remaining queue at such a time based on the eigenvalues and eigenvectors of a certain finite-difference operator. The developed methods are also applied to devise an efficient simulation algorithm for the dynamics of the LOB, which is subsequently used to numerically study the convergence of the midprice process towards its diffusive limit process. The results in this manuscript are on one hand theoretically relevant as they allow to relax some of the strong assumptions of earlier works. On the other hand, these results enable to give a bottom-up construction of the some “efficient” models commonly used at low frequencies (e.g., subordinated Brownian motion models).

Let us finish this introduction with a brief discussion about the connection of our work with some earlier works. As previously mentioned, Abergel and Jedidi (2011) also obtains a diffusive approximation for the mid-price process; however, our model cannot be framed within the approach therein. To realize this, note that the spread the referred paper remains bounded, while in our model, it can potentially take values on , which considerably complicates the analysis. Let us also remark that our model can still account for the empirical observation of Cont and Larrard (2013) that the spread spends a very large amount of time at the value of by taking a large value for the intensity of limit order arrivals within the spread. This feature is, however, not possible to incorporate in the model in Abergel and Jedidi (2011) since the intensity of arrivals at the first potential bid and ask price level is constant regardless this level is already occupied by limit orders or not.

Another relevant work is Cont and Larrard (2012), which relaxes the assumptions of constant volume and no memory of Cont and Larrard (2013) (assumptions (i) and (iv) as described above), but does not establish a diffusive approximation for the price process. Instead, the main result therein is a heavy traffic approximation for the queue sizes of the LOB level I as a Markovian jump-diffusion process in the first quadrant. On the interior of the first quadrant, the process follows a planar Brownian motion with some given drift and covariance matrix. Every time that the process hits one of the axis, this is then shifted to the interior of the quadrant (according to some rules). Therefore, as described in Proposition 1 in Cont and Larrard (2013), the price process is approximated by a random walk which moves one tick to the left or right depending on whether the just described jump-diffusion process hits the x- or y-axis. Note that this is not the same type of continuous diffusive approximation for the price process as considered in this work. Let us also remark that, even though, in principle, Cont and Larrard (2012) relaxes the assumption (iv) of no memory, it imposes other technical assumptions that apparently precludes the type of memory considered in this work (see Remark 2.1 below for further details).

The remainder of this paper is organized as follows. Section 2 analyses the model with variable spread and obtains a Functional Central Limit Theorem for the resultant price process. Section 3 introduces the method described above to efficiently compute several quantities of interest related to the LOB. In Section 4, we analyze, via simulations, the rate of convergence to the limiting process and the behavior of the spread and the asymptotic volatility in relation to the different model’s parameters. To this end, we develop an “efficient” method to simulate the dynamics of the LOB level I based on our results of Section 3. In Section 4, we also compute numerically some of the quantities of interest considered in Section 3 and study their behaviors under both our assumptions and those in Cont and Larrard (2013). Finally, some of the technical proofs are presented in one appendix.

2 A one-level LOB model with memory and variable spread

In this section, we introduce a new framework for the dynamics of the level I of a LOB, which is more realistic than the model introduced in Cont and Larrard (2013) in that, whenever a queue is depleted, the position and size of the remaining queue are preserved, while a new queue is generated one tick to the left or right of the depleted queue depending on whether the latter was at the bid or ask side of the book. The model also incorporates the possibility of limit order arrivals within the spread whenever this is possible. The main result in this section is to establish a diffusive approximation for the mid-price process. More specifically, if denotes the mid-price process of the stock, then, for some appropriate constants and , the following invariance principle holds:

| (1) |

where is a Wiener process and, hereafter, denotes convergence in distribution. Heuristically, if we think of as the time scale at which the process is observed, (1) says that the price process can be approximated by a Brownian motion with drift at “small” scales (typically, 10 or more seconds, depending on the speed of the book events that happen at the order of milliseconds).

This section is organized as follows. We first introduce the model and necessary notation in Subsection 2.1. Subsection 2.2 proves a Law of Large Numbers for the inter arrival times between price changes, which in turn is needed to determine the appropriate time scaling of the price process. Finally, we proceed to obtain a Functional Central Limit Theorem (FCLT) for the price process itself in Subsection 2.3.

2.1 LOB dynamics

As previously explained, we only consider the level I of the order book, which suffices to determine the evolution of the price process of the asset. Concretely, as explained in the introduction, a price change can only occur when the outstanding orders at any side in the book are depleted or when, if possible, a set of new orders arrive within the spread and becomes part of the new level I of the book. Concretely, suppose that the best bid price is at and that its queue gets depleted after a market order or cancellation. Then, a new best bid queue is “generated” at price , hence causing the spread to widen. The size of this new queue of limit orders is assumed to be generated from a distribution on , independently of any other information of the LOB, while the amount and position of the limit orders at the best ask level are kept unchanged. Similarly, if the queue at the best ask price gets depleted after a market order or cancellation, then a new queue is generated at the price , where is the best ask price before the order. The size of the new best ask queue is assumed to be generated from a distribution on , independently of any other information. In that case, the bid side of the book remains unchanged.

The distributions and are meant to reflect the stationary behavior of the queue sizes at the next best queues after depletion. Throughout, we assume that both distributions and are supported on , for some fixed , which can be chosen arbitrarily large. This simplifying assumption is imposed in order to guarantee the recurrence of the underlying Markov chain driving the dynamics of the price process. Also, for simplicity, the tick is set to be .

When the spread is more than 1, there is also the possibility of a price change due to the arrival of a new set of orders within the spread at either the ask or bid side of the LOB. In the former case, the best ask price decreases by , while the bid side remains unchanged. In the latter case, the best bid price increases by , while the other side of the order book does not change. As before, the size of a new queue of limit orders is generated from the distribution or , independently of any other variables, depending on whether the new limit order is at the ask or bid side333Our results are still valid if one takes these distributions to be different from the one used when a level I queue gets depleted.

We now proceed to give a formal mathematical formulation of the LOB dynamics. To that end, we need some notation:

-

(i)

Let be the initial spread and , for , be the spread after the price change. The sizes of the best ask and bid queues at time are denoted by and , respectively. Also, for , represents the time span between the and price changes and we set .

-

(ii)

Throughout, and are independent sequences of i.i.d. random variables, taking values on , and with respective distributions and . These will indicate the amount of orders at the best ask or bid queues after that particular side changes in price.

-

(iii)

Let and be independent sequences of independent random variables such that and are exponentially distributed with parameter 444In particular, , a.s., for all .. These variables are also independent of any other variables in the system. Hereafter, . We shall interpret and as the times for a new set of orders to arrive at the ask and bid side, respectively, after the -price change when the spread is at the value .

-

(iv)

For any starting point , let be a continuous time Markov process with state space such that and its transition matrix is given by:

(2) otherwise where and are interpreted as the intensity of arrivals of limit orders at the level I, market orders, and cancellations, respectively.

-

(v)

Finally, for any and , we let and be processes such that

(3) and the collection of processes are mutually independent, and also independent of the processes introduced in the points (ii)-(ii).

We are ready to give a formal construction of the LOB dynamics. Fix and define the processes

| (4) |

for some arbitrary random initial queue sizes , which are assumed to be independent of any of the other processes considered in the points (i)-(v) above. With the notation

at hand, the time of the first price change can now be defined by

| (5) |

while, for , the queue sizes at the best ask and bid prices are respectively given by

The number of orders at each side of the LOB and the spread at time are then set as

This process is continued recursively. Concretely, for , we set

where

The above formulation justifies the following identities:

| (6) | ||||

| (7) |

where and represent’s the sizes at the best bid and ask queues after the prices change. In particular, it follows that

| (8) |

which, also implies the mutual independence of given . Furthermore, it is easy to see that the process

is semimarkov in the sense of Çinlar (1975).

Remark 2.1.

As mentioned in the introduction, one of the key features of the model proposed above is the incorporation of memory. Other recent works have also considered this feature. Notably, Cont and Larrard (2012) assumes that the level I queue sizes after each price change, , is a function of the level I queue sizes before the price change, , and a sequence of i.i.d. random innovations . One of the examples considered therein is the case of “pegged limit orders” in which and , when the best bid queue gets depleted (with a similar relation holding for the case when the best ask queue gets depleted). Here, is a constant proportion and have distribution in . However, Assumption 3 in Cont and Larrard (2012) precludes the situation where , a.s., and , which is the type of memory we consider in this work.

2.2 A law of large numbers for the modified interarrival times

Our first ingredient toward (1) is to establish a law of large numbers (LLN) for the time of the -price change, , using ergodic results for Markov chains. To that end, we first introduce some needed notation. Let denote a Markov chain on a probability measure with countable state space and transition probability matrix . For any probability measure on , , and , we define

As usual, denotes the expectation with respect to the probability measure . We say that an event occurs -a.s. if occurs -a.s. for all .

Let us recall that an irreducible Markov chain on a countable state space is either transient or recurrent, while a set is called Harris recurrent if

A Markov chain is called Harris recurrent if it is irreducible and every set is Harris recurrent. Also, the Markov chain is called positive if it is irreducible and admits an invariant probability measure, while a positive and Harris recurrent chain is called positive Harris (cf. Chapter 10 Meyn and Tweedie (2009)). The following result from Meyn and Tweedie (2009) (Theorem 17.0.1 therein) is key to obtain the aforementioned LLN.

Theorem 2.2.

Suppose that is a positive Harris chain with invariant probability measure . Then, for any satisfying ,

In the sequel, we shall use Theorem 2.2 to show a LLN for by expressing each in terms of an appropriate Markov chain . Concretely, throughout the remaining of this subsection, we take

| (9) |

where we recall that and respectively represent the number of orders at the book’s level I (bid and ask) and the spread after the th price change (see Section 2.1 for details about the notation). By (7), we can see that is a Markov chain with countable state space

Furthermore, fixing and noting that is itself a Markov chain by (6)-(7), it follows that

where and with .

Our first objective is to prove that we can apply Theorem 2.2 to the chain introduced in (9). Since, for a countable state Markov chain, irreducibility reduces to see that all states communicate to one another, by the description of the dynamics of given in the previous section, is clearly irreducible. The existence of the invariant probability measure would hold provided that is positive recurrent (cf. (Asmussen, 2003, Corollary I.3.6)). Furthermore, since for a countable-state Markov chain, Harris recurrence is equivalent to plain recurrence (see the discussion below Theorem 9.0.1 in Meyn and Tweedie (2009)), will then be positive Harris chain, provided that is positive recurrent.

Theorem 2.3.

If , then the Markov chain is positive recurrent.

A well-known sufficient condition for a Markov chain to be positive recurrent over a countable state space is given by the following so-called Foster or mean drift conditions (cf. Theorem I.5.3 in Asmussen (2003)) for some function , a constant , and a finite set :

| (10) |

In order to verify that satisfies the previous conditions, we need two preliminary results. The following result constructs a super-harmonic function , outside the set . Recall that is said to be a super-harmonic function (cf. Section 17.1.2 in Meyn and Tweedie (2009)) at some if

| (11) |

The proof of the next result is deferred to Appendix A.

Lemma 2.4.

The next result is crucial to construct the function satisfying the conditions (10). Its proof is also deferred to Appendix A.

Lemma 2.5.

Using the notation of Lemma 2.4, for any , it holds that .

Finally, we can prove that the Markov chain is positive recurrent.

Proof of Theorem 2.3.

Consider the function as given by Equation (12). Then, by the proof of Lemma 2.4, we know that,

| (13) |

Take any and define , and , for any . Notice that and, by the Lemma 2.5, as . Let be such that for , we have that , and let also . Notice that is a finite set. From the definition of and the fact that for only finitely many , it is clear that satisfies the first two Foster conditions shown in (10). On the other hand, following similar steps as in the proof of Lemma 2.4, we have that, for every ,

This proves the last Foster condition given in (10) and the fact that is positive recurrent follows. ∎

Once we have proved that satisfies the hypothesis of Theorem 2.2, we now introduce the functions on which the theorem is applied. For any , let

We have the following result, whose proof is deferred to Appendix A:

Lemma 2.6.

Suppose that the conditions of Theorem 2.3 hold and let be the invariance probability of the chain . Then, -a.s.,

| (14) |

In order to obtain the LLN for the interarrival times , we shall show that the Laplace transform of the random variables , properly scaled, converges to the Laplace transform of a random variable , for which we need the following:

Proposition 2.7.

For and , define the functions

Then, under the assumption of Proposition 2.5, for any ,

| (15) |

where is the stationary measure of the Markov chain .

Proof.

First note that the statement is trivial for . By (47), a.s., thus, a.s. Assume now that , then, by Jensen’s inequality,

Therefore, and, thus,

| (16) |

which, by Eq. (14-i), implies that,

Next, note that

where for the first inequality we used that , for , and for the last equality we used the the identity , which is valid for any positive random variable and monotonic differentiable function . Therefore, we have that:

This last inequality, Fatou’s Lemma, and Eq. (14-i) yield,

| (17) |

We are now ready to show the main result of this section.

Theorem 2.8.

Under the assumptions of Proposition 2.7, we have

| (18) |

where is the stationary measure of the Markov chain .

Proof.

Let and . By the conditional independence in (8),

Since for any positive , ,

and, therefore, for every ,

and, by Dominated Convergence Theorem and Proposition 2.7, we get

Finally, since is supported on the positive numbers, by the continuity theorem for Laplace transforms (see theorem 2 in section XIII.1 in Feller (1971)), we obtain (18). ∎

2.3 Long-run dynamics of the price process

In this section, we obtain a diffusive approximation for the dynamics of the midprice process of the model defined in Section 2.1. Throughout, denotes the stock’s midprice at time , while represents the time elapsed between the th and the th price change as described in Section 2.1. Let be the sequence of midprice changes. Clearly, our assumptions for the LOB dynamics described in Section 2.1 imply that It is also easy to see that the midprice process is given by

| (19) |

where hereafter denotes the number of price changes up to time . In this section, we establish the relation (1), for some constants and .

Recall from Section 2.1 that , the number of orders in the level I of the book and the spread after the th price change, is a Markov chain (cf. Eqs. (6)-(7)). Also, recall that, for , and are independent continuous-time Markov processes with common generator defined by ((iv)). Define and also consider the following events:

where and are the random variables defined in Section 2.1.

A positive price change would occur at time if, either the ask queue got depleted (event above) or a new queue arrived at the bid side (event ). Similarly, a negative price change would occur if either the bid queue got depleted (event ) or a new queue arrived at the ask side (event ). Therefore,

| (20) |

represents the th price change, for .

As in the preceding section, an important step for analyzing the price changes would be to express those in terms of an appropriate Markov chain. Let and

| (21) |

for . Note that is a Markov chain over since and depend only on ). Moreover, one can see that the states of communicate to one another and, thus, is irreducible. Also, provided that the assumptions of Lemmas 2.4 and 2.5 hold, one can prove that is recurrent, similarly to the proof of Theorem 2.3, and will then be Harris recurrent due to the countability of ’s state space. As a consequence, would also be positive Harris. Hereafter, we denote the stationary measure and the transition probabilities of by and , respectively.

As mentioned above, our main goal is to establish the coarse-grained behavior of the price process (19). In order to do so, we first analyze the convergence of the process , properly rescaled. To this end, the following Functional Central Limit Theorem (FCLT) for Markov Chains on a countable state space will be useful:

Theorem 2.9 (Meyn and Tweedie (2009), Theorem 17.4.4).

Suppose that is positive Harris on a countable state space with transition and stationary probability measures and , respectively. Let be a function on for which a solution to the Poisson equation,

| (22) |

exists with . Consider the partial sums of the centered functional ,

| (23) |

and let be the continuous piece-wise linear function that interpolates the values of ; i.e.,

| (24) |

Then, if the constant

| (25) |

is positive, it holds that,

| (26) |

Remark 2.10.

By taking , it follows that

The proof of the next result is deferred to Appendix A.

Theorem 2.11.

In the following, we will write if , in probability. The following result is the final ingredient towards (1):

Lemma 2.12.

Proof.

Finally, we can state the main result on this section.

Theorem 2.13.

Proof.

Throughout, let . Let us recall that and , for the Markov chain and given by . Now, we decompose the process as:

where, as in Theorem 2.12, is the stationary measure of the Markov chain . As , clearly, I. Also, by Theorem 2.11,

where is given by Eq. (27). Now, since , for any ,

which, by Proposition 2.12, converges to 0 as . Thus, IIIn converges to 0 in probability. Finally, since is such that , it follows that IV, as , and, thus, we conclude (29). ∎

3 Computation of Some LOB Features of Interest

In this section we develop some numerical tools to evaluate some LOB model features of practical relevance such as the distribution of the time span between price changes, the probability of a price increase, and the probability of two consecutive price increments. The proposed method is based on an explicit characterization of the joint distribution of the time and position at which a certain two-dimensional Markov chain starting in the first quadrant hits the coordinate axes. The developed tools will also be used in Section 4 to devise an efficient simulation algorithm for the midprice dynamics of the order book.

Recall that and . Throughout this section, we let be a collection of independent processes such that, for each ,

| (30) |

where and are defined as in Section 2.1 (see Eq. (3)). We also set

where and are independent exponential variables with parameter . These variables are meant to represent the times for a new set of orders to arrive at the ask and bid side, respectively. Finally, denotes equality in distribution.

3.1 Distribution of the duration between price changes

Here, we develop a numerical method to find the distribution of the first price change time given that, initially at time , there are orders at the bid, at the ask, and the spread is . To this end, we first compute the joint distribution of the vector . This is obtained via the following two lemmas, whose proofs can be found in the Appendix A

Lemma 3.1.

Suppose that, for each fixed , satisfies the following system of differential equations:

| (31) |

where is the finite difference operator given by

| (32) |

and , , , , and . Then, for , , and ,

| (33) |

The next result proves the existence of a solution to the system (31) by giving an explicit representation of in terms of the eigenvalues and eigenvectors of a certain finite difference operator. As a result, we obtain as well an explicit formulation of the joint distribution of . Below, we let

Proposition 3.2.

Let be the symmetric finite difference operator defined for functions as

| (34) |

where , , , , and . Let be the eigenvalues of and be their corresponding eigenvectors so that they constitute an orthonormal basis of . For , let be defined by

| (35) |

Then, the function satisfies the system of differential equations (31) and, therefore, the identity (33) holds true.

Remark 3.3.

We can rewrite Eq. (35) as:

where . The previous expression shows that, as gets larger, the joint probability distribution depends on the parameters and mostly through the quotient . Let us also point out that the eigenvalues of can be proven to be non-positive and, thus, .

We are now ready to compute the distribution of the time it takes for the price to change conditioned on the initial state of the book. For simplicity of notation, throughout represents a random time such that , for any . It is clear that and, thus, from Eq. (35), for ,

| (36) |

where

| (37) |

On the other hand, for , we have that , where as before represents the arrival time of a limit order within the spread. Therefore, from the independence of and , for any and ,

| (38) |

The expressions (36)-(38) provide an efficient numerical method to compute the distribution of the time span between price changes given some initial level I LOB setup. The method is relatively efficient since the main task in their evaluation is the computation of the eigenvalues and eigenvectors , which has to be done only once, for any and .

3.2 Probability of a price increase

We now consider the probability of a price increase conditioned on the current state of the order book:

A price increase occurs if the best ask queue gets depleted or if a new set of orders arrives at the bid side. Recall from Lemma 3.1 that has an explicit form given by Eq. (35). Set

| (39) |

and note that, if the spread is ,

| (40) |

where

In order to find for , note that

| (41) |

By conditioning on and recalling that ,

| (42) |

For the second term, using the symmetry between and , and, thus,

| (43) |

where is defined as in (37). Again, once the eigenvalues and eigenvectors of have been computed, one can readily compute via (3.2)-(43), for any and .

3.3 Probability of two consecutive price increments

Let be the probability of two consecutive increments in the price given that initially there were orders at the best bid, orders at the best ask, and a spread of . These probabilities are highly dependent on the initial spread. The case of an initial spread of 1 is relatively easier to analyze than any other spread due to the possibility of a new set of orders within the spread before the depletion of any of the level I queues. As will be shown below, in the latter situation, we will have to consider a probability of the form , for any . The aforementioned probability will be reformulated in terms of the solution to a certain initial value problem along the lines of Proposition 3.2.

Recall that every time there is a price change, a new number of orders in the LOB side that got depleted is generated from a discrete distribution, or , supported on , depending on whether the best ask or bid queues got depleted. For simplicity, in what follows we assume that . Denote a random variable with distribution . In addition to the collection of random walks described at the beginning of Section 3.1, we also need to consider another independent copy and fix . Similarly, in addition to , we consider an independent copy and fix . We are ready to compute .

For , clearly,

where we recall that denotes the probability of a price increase if there are orders at the bid, orders at the ask, and a spread of . The probability can be computed according to (41), while can readily be found from (35) by making . It is worth mentioning that the case is arguably the most important in practice since, as empirically observed in several studies, the spread spends a great deal of time at level .

Next, let . Now, for ,

Hence, using that , we can write

The probability can be computed according to (40), while can readily be found from (35). The problem of computing is analyzed below. Before that, let us note that, using similar arguments,

A similar identity holds for with . Therefore, the only remaining step is the computation of . This can be done by first computing using similar arguments to those used in Proposition 3.2. More concretely, it turns out that solves the initial value problem:

| (44) |

4 Numerical Examples

The purpose of this section is twofold. First, we analyze numerically the convergence of the midprice process towards its diffusive limit process as established in Theorem 2.13. Second, we compute some of the quantities of interest described in Section 3 and numerically study their behaviors under both our assumptions and those in Cont and Larrard (2013). For the first problem, we develop an efficient simulation scheme for the price process dynamics, which is much more efficient than the direct simulation of all the LOB events (i.e., limit, market, and cancellation orders).

Recall that for the model introduced in Section 2, the input parameters are the rates , , , and . The first three parameters refer to the arrival rates of limit orders, market orders, and cancellation, respectively, while is the rate at which a new set of limit orders arrive in-between the bid-ask spread. Also, we need the distributions and for the sizes of queues at the best bid and ask price, respectively, after the best bid and ask price changes. For simplicity, we set and recall that we are assuming that are supported on the finite set .

For the subsequent numerical examples, we shall use the empirically estimated intensities described in Table 4 below, which are borrowed from Cont and Larrard (2013) (see Table 3 therein). The time units in the sequel are in seconds. The maximum queue size is assumed to be , with each unit representing a batch of 100 shares. Unless otherwise specified, the initial level I queue’s configuration are set to be , while the initial spread is . The distribution is taken to be uniformly distributed in . Finally, two different choices of are considered: and .

| Stock | ||

|---|---|---|

| Citigroup | 2204 | 2331 |

| General Electric | 317 | 325 |

| General Motors | 102 | 104 |

4.1 Simulation and Convergence Assessment

The most natural (and naive) way to simulate the price dynamics would consist of generating all the LOB events or, equivalently, all the Poisson arrival times of orders (limit, market, and cancellations), until the time at which either the bid or ask queue gets depleted and there is consequently a price change. We would then reset the queue size at the side that got depleted and continue this process. Unfortunately, this procedure is computationally intensive and not suitable to study the coarse-grain behavior of the price process, especially for the purpose of Monte Carlo analysis where we require a large number of simulations. Instead, we propose a more efficient method, in which we directly simulate the random vector , without simulating the events leading to it. This in turn would allow us to obtain directly the time at which the level I of the order book gets depleted (or equivalently, the time of a price change) and the amount of outstanding limit orders at the opposite side of the book. To simulate , we take advantage of the representation for their joint probability given by Eq. (35). This representation has several advantages since its computation requires to find the eigenvalues and eigenfunction , only once, regardless of and .

By Proposition 2.12 and Theorem 2.13, we have

| (45) |

In the sequel, we shall study the performance of the above asymptotic approximations for “large” . Our goal is to assess how close the distribution of is to its diffusive approximation for some sampling time spans, , commonly used in practice (say, 1 min and 5 min). To compute the expectations and variances appearing in (45), we use a Monte Carlo method with 200 simulations of the order book. The results are shown in Table 4.1. As expected, the larger are the rates and , the smaller gets and, as a result, the larger the expected rate of return becomes. We also observe that, in that case, there seems to be a significant increment in the volatility of the asset price. This is due to the fact that increasing and simultaneously is equivalent to speeding up the dynamics of the process, which will necessarily result in higher variability.

| Scenario 1: , | Scenario 2: , | Scenario 3: , | ||||||||||

| Case | ||||||||||||

| -7.02 | -6.44 | -6.69 | -6.55 | -3.50 | -3.55 | -3.35 | -3.61 | -1.57 | -1.74 | -1.78 | -1.62 | |

| 240 | 238 | 320 | 322 | 161 | 114 | 113 | 143 | 50 | 45 | 60 | 58 | |

Next, we turn our attention to the behavior of the spread. Based again on simulation and an initial spread of 4, Table 4.1 shows the percentage of the time that the spread spends at each state during the time interval for the different values of , , and . As shown therein, the larger are the rates and , the longer time the spread spends in one tick. This is due to the fact that the larger these rates are, the quicker the spread change and, by the choice of , the quicker it will shrink to 1. More importantly, these results show that, when is large enough, our model can closely replicate the stylized empirical behavior of the spread as illustrated, for instance, in Cont and Larrard (2013) (see Table 2 therein).

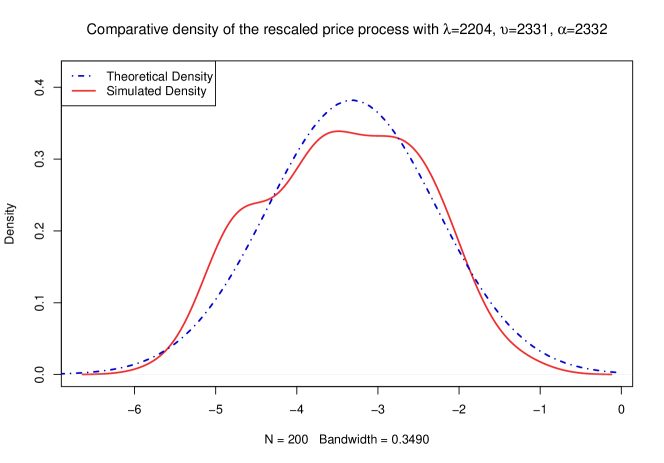

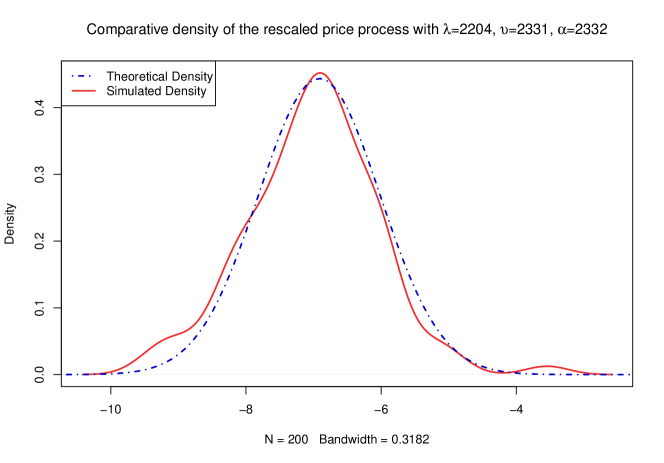

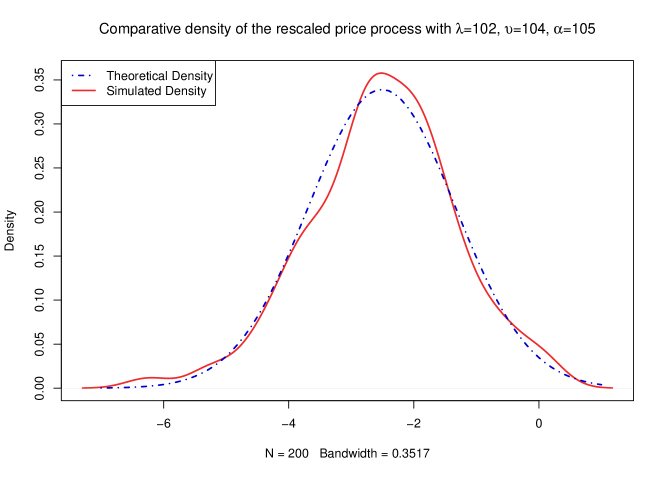

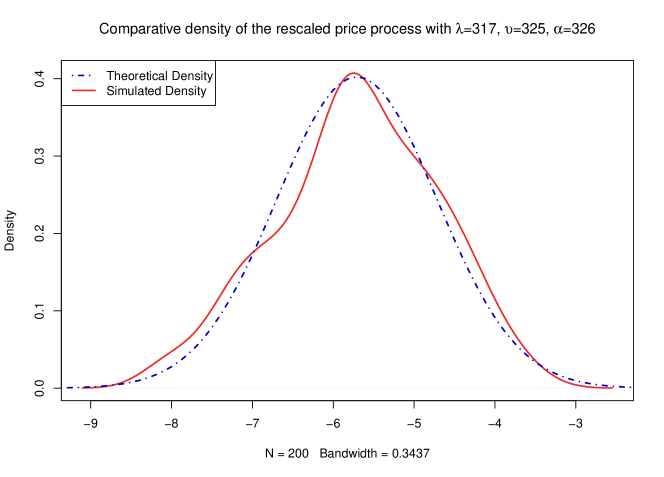

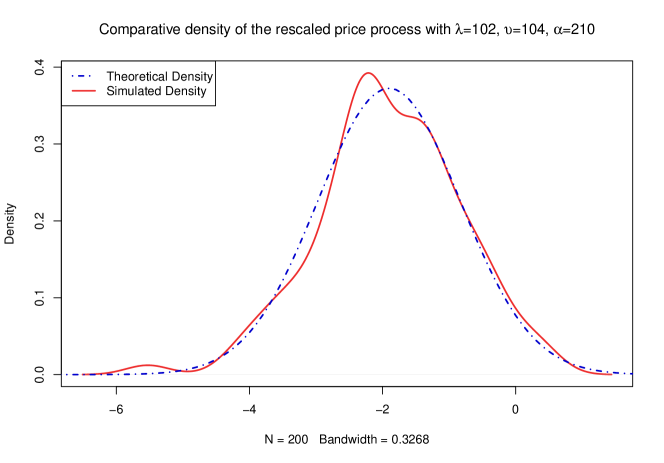

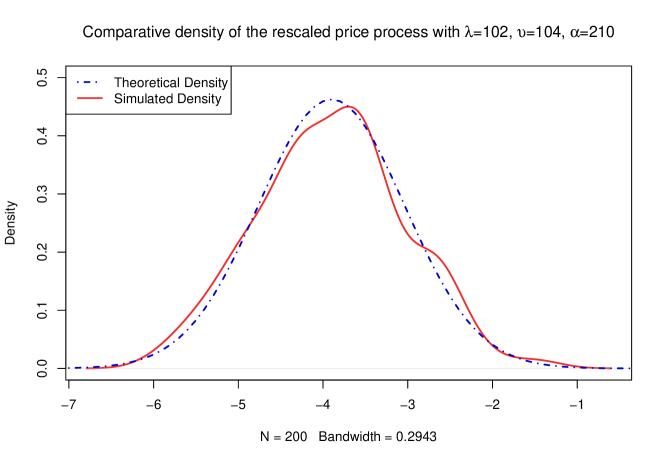

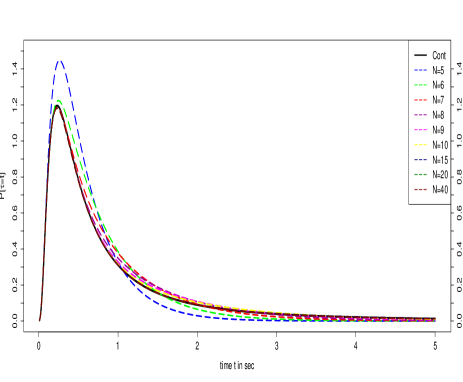

Finally, Figures 2-4 compare the empirical density of , based on simulations, to a Gaussian density with mean and variance set equal to the respective sample mean and variance of the 200 replicas of . We do this for min and min, which are commonly used as sampling frequencies of many statistical estimation methods. The empirical density is obtained using the R function “density”, which computes a kernel density estimate555We use the default parameter settings for the kernel and bandwidth given by R, which are respectively given according to a Gaussian kernel and the Silverman’s “rule of thumb” (Silverman, 1986, Eq. (3.31)).. For sake of space, we only show the graphs corresponding to (there is no significant changes when ). As seen in the graphs, the distribution of is relatively well approximated by a Normal distribution for these two values of .

| Case | 1 Tick | 2 Ticks | 3 Ticks | 4+ Ticks | |

|---|---|---|---|---|---|

| , | 0.97248 | 0.02716 | 0.00035 | 0.00001 | |

| , | 0.906891 | 0.088491 | 0.004135 | 0.000564 | |

| , | 0.86881 | 0.12084 | 0.008868 | 0.001482 | |

| , | 0.98627 | 0.01365 | 0.00007 | 0.00001 | |

| , | 0.95327 | 0.045697 | 0.000956 | 0.000077 | |

| , | 0.94383 | 0.054443 | 0.001579 | 0.000148 | |

4.2 Evaluation of some quantities of interest

To understand the impact of the assumptions made in the model and draw some further comparisons to the model presented in Cont and Larrard (2013), in this section, we numerically compute some of the quantities of interest introduced in Section 3.

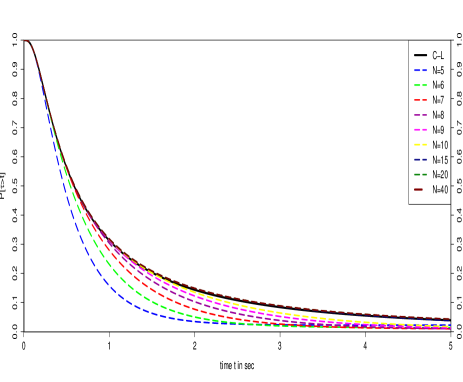

We first consider the distribution of the time span between price changes. This distribution was compute in Proposition 1 of Cont and Larrard (2013), under the assumptions therein. The survival function was also plotted in Figure 4 therein with , , , and as the input parameters. In the left panel of Figure 5 below, this survival probability distribution is reproduced and compared with the distributions obtained by the method introduced in Section 3.1 (see Eq.(36)-(38)), conditional on a spread of , for different values of . The right panel of Figure 5 also depicts the densities of the time for the next price change. As it can be seen from the plots, for values of close to 5, the density is more concentrated around 0, which is natural since the queue sizes cannot increase more than , causing this time to occur faster. Bu, as it is expected, the survival and density functions under our model converge to those of Cont and Larrard (2013) when increases.

The distribution of the time for the next price to occur, when the spread is 2, is not plotted, because this is very similar to the one of an exponential random variable with parameter . This is due to the fact that the recurrence condition implies that it is far more probable that a price change occurs due to the arrival of a new set of limit orders within the spread than the depletion of a level I queue.

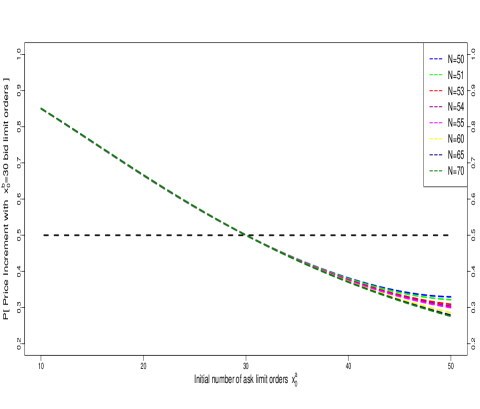

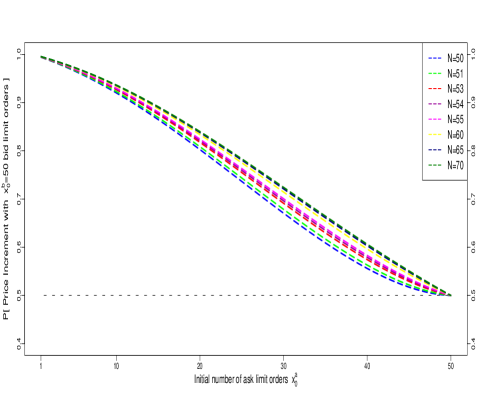

Next, we compare the probability of a price increase for different values of , , and , when the spread is set to be 1. Cont and Larrard (2013) provides a formula (see Proposition 3), under the assumptions therein, but, unfortunately, this formula is difficult to implement in the asymmetric order flow case. In contrast, the method proposed in Subsection 3.2 is more efficient, since all of the quantities therein rely on the spectral decomposition of the discrete Laplacian (34), which, once is fixed, just has to be done once. Figures 6 graphs the probability of price increase as a function of , for fixed (left panel) and (right panel). By symmetry, we would have the same graph against for fixed values of . Notice that, in the first case, when , the probability of a price increase does not varies significantly with , for a most of the values of . It is only when becomes close to the value of that some discrepancies start to show. On the other hand, when , which is a closer value for , the probability significantly varies with regardless of the value of . The dashed lines therein show that, regardless of , the probability of a price increase is always 0.5, as it should be, when .

5 Conclusions

In this paper, a new Markovian limit order book model is presented, which allows to incorporate a non-constant spread and to keep the information about the outstanding orders after a level I queue gets depleted at either side of the LOB. Although the general rules governing the order book in the latter setting create a more complex dynamics, a novel efficient method was developed to analyze several features of the LOB model of relevance in high-frequency trading.

Our main result characterizes the coarse-grain behavior of the midprice process in terms of a Brownian motion with drift. This was made possible by expressing the price changes in terms of a suitable Markov chain. To this end, two key assumptions were needed: the boundedness of the queue sizes at every moment and a sufficiently high arrival rate of new orders in between the spread compared to the intensity of arrivals of market order/cancellations. The latter condition is also intuitive since it prevents the spread to grow indefinitely with positive probability. These two conditions provide a tractable framework, without lost of realism, for the LOB, and become relevant when studying the diffusive behavior of the price process for this model.

It is known that markets exhibit relatively large price shifts in a small time period and, thus, the incorporation of these “jumps” into an order book model is appealing. A natural approach to address this problem may be the introduction of more levels in the order book, governed by similar rules to those imposed in our second proposed model. The approach presented in this work is also expected to be applicable for such models.

Acknowledgments: The first author’s research was supported in part by the NSF Grant DMS-1149692. The authors are grateful to two anonymous referees and both the associate editor and the editor-in-chief for their constructive and insightful comments that greatly helped to improve the paper.

Appendix A Additional Proofs

Proof of Lemma 2.4.

Throughout, we set , , , and . Also, let , where , and . In that case,

which, using that , can then be decomposed and simplified as follows:

Since for with and , for any ,

Thus,

From the previous expression, a sufficient condition for to be super-harmonic, is to satisfy the linear difference equation , whose particular solution, satisfying the desired boundary conditions, is given by (12). ∎

Proof of Lemma 2.5.

Throughout, we set and . First, we will prove that the condition implies an upper bound for . The independence of and implies that , where is the probability density functions of . Using integration by parts,

| (46) |

Let be the event that there is neither a cancellation nor an arrival of market orders before time at either side of the book. Since , by (46) and the assumption that ,

Thus, regardless of the sign of , since , we have that . ∎

Proof of Lemma 2.6.

We apply Theorem 2.2, for which we need to prove that and . The latter assertions hold true if we can show that, for all ,

| (47) |

for a constant , since

To show (47), we first need some notation. Let be defined as in Lemma 2.4. Note that

| (48) |

where the last inequality holds, since , where , i=1,2, is the hitting time at 0 of a 1-dimensional birth and death process with birth rate and death rate starting at (for which is known the expectation is finite) and is independent of . Next, let and let

Since, for any , , it follows that for all and . Therefore,

This implies (47), which in turn implies the result as explained above. ∎

Proof of Theorem 2.11.

Since the state space, , is countable, every finite subset of the state space is an atom (e.g., see (Meyn and Tweedie, 2009, Chapter 5, pg 105) ) and, hence, we are able to construct explicitly the solution of the Poisson equation (22). Indeed, by Equation (17.38) in Meyn and Tweedie (2009) and the discussion therein, for , we have that

| (49) |

where . Since for any , , and, thus, . Therefore, to conclude that the invariance principle (26) holds true, it suffices to show that

| (50) |

Let . Each is finite and forms a partition of . Clearly, for every , if , with , then . Moreover, with the notation of Lemma 2.4 and, as prove in the proof of Lemma 2.5, for any

Consider now a birth and death process with birth probability and death probability , and note that

Denote by the first hitting time of to the point . That is, . Then, since dies more frequently than , for any ,

| (51) |

where, in the last equality we use that (see Sericola (2013)[Section 3.1]).

The next step is to bound the terms for . To shorten notation, define . Recall that if the spread is larger than one, the spread will widen or shrink right after every price change, whereas if the spread is 1, it will surely widen at the next step. Thus, for any and any with , and . By the definition of a stationary measure,

which implies that

| (52) |

Analogously,

which implies that

| (53) |

Next, note that, for ,

| (54) |

Therefore,

| (55) |

Applying the previous equation recursively, for all even ,

and, thus, by (52),

| (56) |

However, if is odd, by (53),

| (57) |

Equations (56)-(57) imply that

However, by the definition of a stationary measure,

The previous two equations yield the following relation,666Eq. (58) gives some insight into the structure of the stationary measure and can be regarded as a “batch” version of the so-called Detailed Balance Conditions for Markov Chains, which are important for analyzing reversible processes (c.f. Kelly (2011)[Chapter 1.2]).

| (58) |

We are now ready to bound the term . To that end, notice that for any , and, thus,

Therefore, , which, by induction, implies that

| (59) |

Finally, by (51) and (59) and the fact that , for some bounded constant ,

| (60) |

It only remains to show that the variance in the FCLT can be written as (27). But, by Theorem 17.5.3 in Meyn and Tweedie (2009), it is enough to show that he Markov chain is ergodic and there exists a function such that and

| (61) |

for a constant and a finite set , where is the operator (c.f. Section 14.2.1 in Meyn and Tweedie (2009)). However, it is known (c.f. Section 13.1.2 Meyn and Tweedie (2009)) that aperiodic positive Harris chains over a countable state space are ergodic and by Proposition 14.1.2 and Theorem 14.2.3(ii) therein, the function satisfies (61), where is the first hitting time of the set in (61). Since it was proven above that , we take to conclude the proof. ∎

Proof of Lemma 3.1.

Let us start by noting that the generator of the two-dimensional random walk is given by the finite difference operator defined in (32). More concretely, for a function , is defined analogously to (32) but replacing with . For simplicity, we denote and remark that is an absolutely continuous random variable. Let be an arbitrary bounded function such that is for all and is bounded. Fix and let . Under the stated conditions, belongs to the domain of the generator and, thus, the process

is a local martingale. Therefore,

is a martingale. Let . By the Optional Sampling Theorem,

| (62) |

Now, suppose that solves the following initial value problem,

| (63) |

In that case, by Eq. (62),

which implies that . ∎

Proof of Proposition 3.2.

Let

Fix and note that satisfies the system (66) if and only if is a solution to the initial value problem:

| (64) |

Let and be such that and . Using the first representation, the left-hand side of the first equation in (64) becomes

Similarly, the right-hand side of the first equation in (64) is given by

Combining the previous two expressions and recalling that is an orthonormal basis, it follows that the function will solve the system (64) if and only if, for every , the function satisfies the following equation:

| (65) |

with the initial condition . It is easy to see that the previous differential equation is well posed and has solution

Therefore,

satisfies the initial value problem (64), which in turn, implies that

is a solution of (31). Then, the representation (35) immediately follows by noting that and rewriting the previous expression in terms of . ∎

Lemma A.1.

Proof.

The proof is standard and is omitted. ∎

References

- Abergel and Jedidi (2011) Abergel, F. and Jedidi, A. A Mathematical Approach to Order Book Modeling. International Journal of Theoretical and Applied Finance, 16(05), 2013.

- Anderson (2013) Anderson, D. Introduction to Stochastic Processes with Applications in the Biosciences. Available at http://www.math.wisc.edu/~anderson/605F13/Notes/StochBio.pdf, 2013.

- Asmussen (2003) Asmussen, S. Applied Probability and Queues 2nd. edition, Springer 2003.

- Billingsley (1995) Billingsley, P. Probability and Measure Theory. 3rd edition, Wiley Series in Probability and Statistics 1995.

- Bouchaud et al. (2009) Bouchaud, J. P., Farmer, J.D., and Lillo, F. How markets slowly digest changes in supply and demand. In T. Hens, K. Schenk-Hoppe, eds., Handbook of Financial Market: Dynamics and Evolution, Elsevier: Academic Press, 57-160, 2008.

- Çinlar (1975) Çinlar, E. Introduction to Stochastic Processes. Prentice-Hall 1975.

- Cont and Larrard (2012) Cont, R. and de Larrard, A. Order book dynamics in liquid markets: limit theorems and diffusion approximations. Preprint available in arXiv:1202.6412v1, 2012.

- Cont and Larrard (2013) Cont, R. and de Larrard, A. Price dynamics in a Markovian limit order market. SIAM Journal for Financial Mathematics, 4(01), 2013.

- Cont et al. (2010) Cont, R. Stoikov, R. and Talreja, S. A Stochastic Model for Order Book Dynamics. Operations Research, (58)3, 2010.

- Feller (1971) Feller, W. An Introduction to Probability Theory and its Applications. 2nd edition, John Wiley and Sons, 1971.

- Gould et al. (2013) Gould, M., Porter, M., Williams, S., McDonald, M., Fenn, D. and Howison, S. Limit Order Books. Quantitative Finance, 13(11), 1709-1742, 2013

- Gut (2005) Gut, A. Probability: A Graduate Course. Springer, 1995.

- Harris, (2003) Harris, L. Trading and exchanges: market microstructure for practitioners. Oxford University Press, 2003.

- Ikeda and Watanabe (1981) Ikeda, N. and Watanabe, S. Stochastic Differential Equations and Diffusion Processes. North Holland Publishing Company, 1981.

- Karatzas and Shreve (1988) Karatzas, I. and Shreve, S. Brownian Motion and Stochastic Calculus. Springer, 1988.

- Karlin and Taylor (1975) Karlin, S. and Taylor, H. A First Course in Stochastic Processes. 2nd edition, Elsevier Academic Press, 1975.

- Kelly (2011) Kelly, F. P. Reversibility and Stochastic Networks. Cambridge University Press, 2011.

- Kruk (2003) Kruk, L. Functional Limit Theorems for a simple auction. Mathematics of Operations Research, 28(04), 2003.

- Kruk (2012) Kruk, L. Limiting distribution for a simple model of order book dynamics. Central European Journal of Mathematics, 10(06), 2012.

- Luckock (1988) Luckock, H. A steady-state model of the continuous double auction, Quantitative Finance, 3(05), 1988.

- Mendelson (1982) Mendelson, H. Market behavior in a clearing house. Econometrica, 50(06), 1982.

- Meyn and Tweedie (2009) Meyn, S. and Tweedie R. Markov Chains and Stochastic Stability. 2nd edition, Cambridge University Press, 2009.

- Muni Toke and Pomponio (2012) Muni Toke, I. and Pomponio, F. Modelling Trades-Through in a Limit Order Book Using Hawkes Processes. Economics: The Open-Access, Open-Assessment E-Journal, 6, 1-23, 2012.

- Pomponio and Abergel (2010) Pomponio, F., and Abergel, F. Trade-throughs: Empirical facts - Application to lead-lag measures. Proceedings of the Vth Kolkata Econophysic conference, 2011.

- Rosu (2009) Rosu, I. A Dynamic Model of the Limit Order Book. Review of Financial Studies, 22(11), 2009.

- Sericola (2013) Sericola, B. Markov Chains: Theory and Applications. 1st edition, ISTE. Wiley, 2013.

- Silverman (1986) Silverman, B. W. Density Estimation. London: Chapman and Hall, 1986.