Mechanism Design for Crowdsourcing: An Optimal 1-1/e Competitive Budget-Feasible Mechanism for Large Markets

Abstract

In this paper we consider a mechanism design problem in the context of large-scale crowdsourcing markets such as Amazon’s Mechanical Turk (MTrk), ClickWorker (ClkWrkr), CrowdFlower (CrdFlwr). In these markets, there is a requester who wants to hire workers to accomplish some tasks. Each worker is assumed to give some utility to the requester on getting hired. Moreover each worker has a minimum cost that he wants to get paid for getting hired. This minimum cost is assumed to be private information of the workers. The question then is - if the requester has a limited budget, how to design a direct revelation mechanism that picks the right set of workers to hire in order to maximize the requester’s utility?

We note that although the previous work (Singer (2010); Chen et al. (2011)) has studied this problem, a crucial difference in which we deviate from earlier work is the notion of large-scale markets that we introduce in our model. The notion of a large-scale market that we consider is a natural one which states that the (private) cost of each worker is small compared to the budget of the requester. Without the large market assumption, it is known that no mechanism can achieve a competitive ratio better than and for deterministic and randomized mechanisms respectively (while the best known deterministic and randomized mechanisms achieve an approximation ratio of and respectively). In this paper, we design a budget-feasible mechanism for large markets that achieves a competitive ratio of . Our mechanism can be seen as a generalization of an alternate way to look at the proportional share mechanism, which is used in all the previous works so far on this problem. Interestingly, we can also show that our mechanism is optimal by showing that no truthful mechanism can achieve a factor better than ; thus, fully resolving this setting. Finally we consider the more general case of submodular utility functions and give new and improved mechanisms for the case when the market is large.

1 Introduction

Crowdsourcing is a recent phenomenon that is used to describe the procurement of a large number of workers to do certain tasks. These tasks can be of a variety of natures and - to give a few examples - include image annotation, data labeling for machine learning systems, consumer surveys, rating search engine results, spam detection, product reviews, etc. There are several platforms (such as Amazon’s Mechanical Turk (MTrk)) that facilitate and automate various steps involved in setting up and executing crowdsourcing tasks.

A key challenge in these online labor markets is to be able to properly price the tasks. Since the requester (the one who wants to procure workers) is usually budget constrained, pricing the tasks too high can result in lower output for the requester. On the other hand, pricing the tasks too low can disincentivize workers to work on the tasks. This makes pricing a non-trivial step for the requester when setting up a crowdsourcing task. One idea - to make pricing more automated and to prevent economic loss from poor pricing - is to design a direct revelation mechanism that solicits bids from workers to report their cost of participation, and based on this decide which workers to hire and how much to pay them.

A simple model that captures the above problem is as follows: There is a set of workers. Worker has a private cost and provides utility to the requester on getting hired. We want to design a truthful mechanism that decides which workers to recruit and how much to pay them. The goal is to maximize the requester’s utility without violating her budget constraint.

For the above model, Singer (2010) gave an incentive-compatible mechanism that achieves an approximation ratio of compared to the offline optimum that knows the costs of the workers. Later on Chen et al. (2011) improved the approximation ratio to (and to for randomized mechanisms). Chen et. al. also showed that no deterministic mechanism can achieve an approximation ratio better than , and no randomized mechanism can achieve an approximation ratio better than .

Our work is motivated by the following observation: Most of the crowdsourcing tasks are large-scale in nature in terms of the number of workers involved. On the other hand if one looks at the impossibility result of Chen et al. (2011), they involve only a small number of workers (specifically, only 3 workers). Thus, this leads to a natural open question - Do these lower bounds extend to the case of large markets? or can one design better mechanisms for this important case of large markets?

In this paper, we seek to understand the above question. We show that one can significantly improve the approximation ratio for the case of large markets. We give a mechanism that achieves an approximation ratio of for large markets. In addition, we show that our mechanism is the best possible mechanism by showing that no truthful budget-feasible mechanism can achieve a factor better than . Finally, we look at the more general case of submodular utility functions.

1.1 The Model

We define the model abstractly: Consider a reverse auction scenario with one buyer and sellers, where the set of sellers is denoted by . Each seller owns a single item (denoted by item ) and has a private cost for it. The buyer derives a utility of from item . The buyer has a limited budget , and its goal is to buy a subset of items that maximizes her utility without exceeding her budget.

Note that if the sellers are not strategic and the costs are known to the buyer, then this is the well-known knapsack optimization problem.

However, the cost is assumed to be a private information of seller . Thus we are interested in designing direct-revelation mechanisms where the buyer solicits bids from the sellers, and then computes which sellers to buy from and how much to pay them. More formally, a mechanism consists of two functions and . The allocation function takes as input the costs of sellers and reports the set of winners. The payment function takes as input the costs of sellers and reports how much each seller should pay. Sometimes we will use functions (and similarly ) for each to refer to the restriction of functions and for seller .

The mechanism should satisfy the following properties:

-

1.

Budget Feasibility: The sum of the payments made to the sellers should not exceed , i.e., for all .

-

2.

Individual rationality: A winner is paid at least .

-

3.

Truthfulness/Incentive-Compatibility: Reporting the true cost should be a dominant strategy of the sellers, i.e. for all non-truthful reports from seller , it holds that

Among all mechanisms that satisfy the above properties, we are interested in the ones that give high utility to the buyer. Note that no mechanism can achieve utility larger than , where (or simply for brevity) is the utility of the knapsack optimization problem assuming costs of the sellers are known to the buyer. We say a mechanism is an -approximation (for ) if it gives utility at least for any and .

Indivisible vs Divisible Items. Note that the above description is given for indivisible items, however, we can define the above problem for divisible items as well. For instance, if the item being sold by a seller is his own time, then it can be modeled as a divisible item. For fraction of a divisible item, the cost of seller is and the utility obtained by the buyer is . The allocation function for divisible items is defined as .

More general utility functions. An interesting generalization of the above model is when the utility function over the set of items is a submodular function rather than additive functions. We denote this function by (for additive functions, , for ). We assume that the utility function is known to the buyer.

1.1.1 The Large Market Assumption

Crowd-sourcing systems are excellent examples of large markets. Informally speaking, a market is said to be large if the number of participants are large enough that no single person can affect the market outcome significantly. Our results take advantage of this nature of the crowdsourcing markets to give better mechanisms.

We define the large market assumption as follows: We assume that in our model, the cost of a single item is very small compared to the buyer’s budget . More formally, let . Then, the large market assumption is defined as below.

The Large Market Assumption: .

In other words, we define the largeness ratio of the market to be and analyze our mechanisms for .

This assumption - also known as the small bid to budget ratio assumption - is used in other large-market problems as well (for instance, see Mehta et al. (2007) for a similar definition with application in online advertising). All the mechanisms that we present in the main body of the paper (mechanisms for additive utility functions) will be analyzed under this assumption. The mechanisms that we design for submodular utility functions work under a different large market assumption which is explained below.

An Alternative Assumption

We also suggest another definition for large markets, the discussion of which will be deferred to the appendix. Our mechanisms for submodular utility functions work under this assumption; moreover, we can slightly modify our mechanisms for additive utility functions so that they work under this assumption as well, while preserving their approximation ratio. We define this assumption below.

Let and be the total utility of the optimum solution (i.e. the maximum utility that the buyer can achieve when the costs are known to her). This large market assumption states that:

The Alternative Large Market Assumption: .

In other words, we define the largeness ratio of the market to be and analyze our mechanisms for when .

We note that our impossibility result for additive utilities (Section 6) holds for either of the two definitions.

1.2 Our Results

In this paper, we design optimal budget-feasible mechanisms for large markets. To the best of our knowledge, we are the first ones to study the case of large markets. We list our results below:

-

1.

If the items are divisible, we design a deterministic mechanism which satisfies all the required properties and has an approximation ratio of (Section 5). Note that previously, no mechanism was known for the case of divisible items. In fact, one can show that no bounded approximation ratio is possible for divisible items if the large market assumption is dismissed.

-

2.

If the items are indivisible, we can modify our mechanism and give a randomized truthful mechanism for this case which achieves an approximation ratio of . (Section C)

-

3.

In Section 6, we show that the above results are optimal by proving that no truthful (and possibly) randomized mechanism can achieve approximation ratio better than . Our hardness result holds for both cases of divisible and indivisible items.

-

4.

For the case of submodular utility functions, we design deterministic mechanisms that achieve approximation ratios of and with exponential and polynomial running times respectively. Note that we only consider the case of indivisible items for submodular utility functions. (Section E)

As we saw in Section 1.1.1, one could define a notion of -large market, i.e. a market with largeness ratio . To gain a better understating of the problem, we focus on large markets (i.e. when ) and state our main theorems for this setting. However, our mechanisms do not need “very large” markets to perform well; for instance, in the knapsack problem with additive utilities, the approximation ratio 444we didn’t try to optimize the dependence on in our analysis as we focus on the main ideas for the sake of better understanding. is when all the items have equal utilities (Section 5.2). Thus, say for and (which are reasonable assumptions in many settings) we get approximation factors and respectively.

Also we point out that the above results have applications beyond crowdsourcing - for instance, see Singer (2011) for application in marketing over social networks, and Horel et al. (2013) for application in experiment design. Singer (2011) provides a truthful mechanism with approximation ratio and Horel et al. (2013) provides an approximately truthful mechanism with approximation ratio . For both these settings, large market assumption is a very reasonable assumption to make; thus, our results apply to these applications as well. In particular, our results give fully truthful mechanisms for these applications with approximation ratios (for exponential and polynomial running time respectively) in large markets.

1.3 Related Work

The most relevant related work is that of Singer (2010) and Chen et al. (2011). Singer (2010) first introduced this model (without the large market assumption). For the case of additive utilities and indivisible items, he gave a deterministic mechanism with an approximation ratio of . Chen et al. (2011) later improved it to , and also gave a randomized mechanism with an approximation ratio of . They gave a lower bound of and for deterministic and randomized mechanisms respectively. For the case of submodular utilities, Singer (2010) gave a randomized mechanism with an approximation ratio of which was improved to by Chen et al. (2011). Chen et al. (2011) also gave an exponential time deterministic mechanism for submodular utility functions with an approximation ratio of .

Dobzinski et al. (2011) looked at the more general sub-additive utility functions and gave a and approximation ratio for randomized and deterministic mechanisms respectively. Singla and Krause (2013a) design budget feasible mechanisms for adaptive submodular functions with applications in community sensing.

In another work, Bei et al. (2012) study this problem in the bayesian setting. Singer (2011) looks at the application of this model in marketing over social networks. Horel et al. (2013) study the application of this model in experiment design.

Another related model that has been inspired from crowdsourcing applications is when the workers arrive online. A sequence of papers model this as an online learning problem. See Singla and Krause (2013b); Badanidiyuru et al. (2012); Singer and Mittal (2013) for more details.

Finally, we note that our assumption for large markets is similar to the assumption made in other application areas; notably in the Adwords problem as studied by Mehta et al. (2007). See Goel and Mehta (2008); Devanur and Hayes (2009); Feldman et al. (2010, 2009) for other models motivated by online advertising where they make similar assumptions.

1.4 Roadmap

The readers are encouraged to read this section before proceeding further. We begin by developing some intuition in Section 3. In Section 2, a simple proportional share mechanism which forms the basis for Singer (2010); Chen et al. (2011) is introduced. The mechanism picks a single cutoff for the utility to cost ratio in such a way that the whole budget is consumed. In Section LABEL:sec.nonuniscalef, we generalize the simple proportional share mechanism to a class of mechanisms parameterized by a single-variable allocation function. In later sections, we show that this generalization improves the approximation ratio 555Although the truthfulness is sacrificed, later we augment the mechanism so that it becomes truthful without compromising the approximation ratio in large market.. We develop some intuition by considering a simple instance of our generalized mechanisms: instead of a hard cutoff that is used in the proportional share mechanism, i.e. a two-level allocation rule, we consider a special class of three-level allocation rules and show that they can improve the approximation ratio.

The generalized mechanisms introduced are not in general truthful. In Section LABEL:sec.optmec, we introduce a simple method to make them truthful, while maintaining their individually rational and budget-feasibility. Later when we introduce the optimal mechanism, we show that its approximation ratio does not get compromised by utilizing this method in large markets.

In Section 5, we find one of the generalized mechanisms which provides an approximation ratio of in large markets. In Section 6, we complement this result by showing that no truthful mechanism can achieve approximation ratio better than . In Section C, we adapt our mechanism to the case of indivisible items.

In Section E, we present two mechanisms for submodular utility functions which have exponential and polynomial running times and approximation ratios and , respectively.

2 A Simple -Approximate Truthful Mechanism

In this section, we briefly explain the previous mechanism designed for this problem for the additive utility functions that gives an approximation factor of in large markets.

Definition 1

Cost-per-utility rate of a seller is equal to .

A natural approach to this problem tries to find a single payment-per-utility rate (denoted by rate ) at which all the winning sellers get paid. In other words, this approach picks a single number and makes a payment of to seller if she wins and pays her otherwise. For brevity, we sometimes call the payment-per-utility rate simply the rate when there is no risk of confusion.

Individual rationality implies that a seller is willing to sell her item at rate iff . Initially the buyer declares a very large rate , and then sees which sellers are willing to sell at this rate. If the total cost to buy from all these sellers at rate is higher than the budget , then the buyer decreases the rate . More formally, a natural descending price auction for this problem works as follows:

-

1.

Let denote the set of active sellers, and initially set .

-

2.

Start with a very high rate .

-

3.

Verify if all the active sellers can be paid with rate , i.e. whether or not.

-

4.

If the payment is feasible, then allocate the subset , make the payment and stop.

-

5.

If the payment is not feasible then decrease slightly; update accordingly by removing the sellers for whom ; go to Step 3.

The above auction captures the main idea behind the proportional share mechanisms designed in Singer (2010); Chen et al. (2011)666 It is worth pointing out that for submodular utilities, they need to use an additional trick: constructing a (sorted) list of sellers in a greedy manner before running the auction., although they describe it in a forward auction format. It is not hard to see that the above mechanism is truthful, budget-feasible, and in large markets achieves an approximation ratio of (with small modifications, this can be converted to a randomized -approximation for arbitrary markets as well Chen et al. (2011)).

3 Our Approach

In this section, we give a high level overview of our approach. Sections 3.1 and 3.2 are preliminary sections and must be read before proceeding further. The notions defined in these sections are explained more intuitively using an example in Section 3.3. Also for rest of the paper we will assume that the sellers’ items are divisible, unless we explicitly talk about indivisible items.

3.1 A Notion of An Allocation Rule

To build our new ideas, we first introduce and formalize the notion of an allocation rule.

An allocation rule is a function which determines how much to buy from a given seller. The domain of allocation rules is the cost per utility rate; meaning, given a pair of seller , the allocation rule says that we should buy fraction of seller ’s item. We do not enforce using the same allocation rule for all sellers.

We say an allocation rule is a Standard Allocation Rule if is a decreasing function such that and .777The choice of is just for simplifying the future calculations; it can be replaced with any other constant.

For any standard allocation rule , we can define an associated family of allocation rules

where denotes an allocation rule which is same as except that it is stretched along the horizontal axis with ratio , i.e. for all .

As we will see later, any single standard allocation rule and its corresponding family of allocation rules will uniquely specify our mechanism. At a high level, our mechanism will work as follows: we will pick the largest positive such that is budget-feasible; meaning the sum of the payments with allocation rule does not exceed . However, note that we have not yet defined a payment rule given an allocation rule - we define it next.

3.2 Payment Rule

Recall that given a function and pair for a seller , the value of only tells us what fraction of seller ’s item to buy. But how much should we pay seller in order to give incentives to seller to report its cost truthfully to the mechanism? We compute these payments based on the well known Myerson’s characterization of the truthful mechanisms Myerson (1981).

Let the payment rule for seller is denoted by for an allocation rule . Here maps the reported cost of seller into its payment.

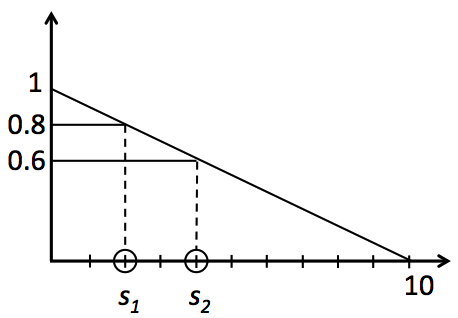

To define , we do the following thought process: Let’s divide seller ’s item into different pieces. Note that now the seller’s cost for each piece is . Thus function can now be seen as mapping the cost of a single piece into the fraction of that piece that we will buy. Let denote the function that maps the cost for a single piece into a payment for that piece. Now, Myerson’s characterization Myerson (1981) says that the payment for each piece is given by the following formula:

Intuitively, represents the area under the curve as seen in Figure 1. Going forward, we will call the function a unit-payment rule. Note that and are related by the following formula:

Thus, to summarize, for an allocation rule , we buy units of her item, and pay her amount of money.

Remark: We make a remark that the above payment rule is truthful only if the allocation rule that is offered to seller doesn’t depend on the private information (cost in this case) of the seller . If the allocation rule does depend on the private information of the seller, then the mechanism may or may not be truthful. In the next section we give a mechanism in which the allocation rule for a seller depends on its reported costs. Later in section 4, we give a mechanism where the allocation rule for a seller doesn’t depend on its reported cost, thus our payment rule will ensure that the resulting mechanism is truthful.

3.3 Example

Suppose the buyer has budget , and sellers each own an item with cost and , respectively. Also, suppose both of the items have utility .

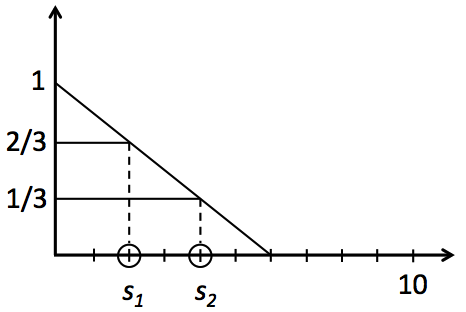

Let the mechanism use the family of curves for where the domain of is . The mechanism should find the largest for which is budget feasible. To this end, we set to be a very large number and decrease until is budget feasible. For instance, suppose we start from (see Figure 2). Observe that the payment of the mechanism in this case would be and to and , respectively. Since the sum of payments exceed , then is not budget feasible. Consequently, we reduce further until the mechanism becomes budget feasible at : At this point, the payment of the mechanism to and would respectively be and , which sum up to be exactly . (see Figure 3)

3.4 First Attempt: A Parameterized Class of Envy-Free Mechanisms

In this section we describe a mechanism (denoted by Mechanism 1()) that is not always truthful, but it will form the basis of our truthful mechanism. Moreover, some structural results about this mechanism will be useful while analyzing our truthful mecahanism, thus we will be talking about this mechanism throughout the paper. This mechanism is parameterized by the choice of a standard allocation rule . The mechanism described in this section offers a single allocation rule to all the sellers, thus it is envy-free (although it may not be truthful).

Definition 2

We say that an allocation rule is a budget-feasible allocation rule if , i.e. the payments defined with respect to sum up to .

Now given any standard allocation rule , the mechanism starts with a very large scaling ratio so that we are guaranteed to have .

Then, the mechanism decreases until the rule becomes a budget-feasible rule (say at ). The mechanism stops at this point and uses and to determine the allocations and payments. The ratio is also called the stopping rate of the mechanism. We define this process formally in Mechanism 1().

One can easily see that the above mechanism is budget-feasible, individually rational, and envy-free; however, it may not be truthful. Also, the efficiency of the above mechanism depends on the choice of function . Thus, an important question is: What is the optimal choice of function ? Let’s first understand the performance of the above mechanism for a simple choice of function .

Definition 3

A standard allocation rule is called a uniform standard allocation rule if for , and otherwise. Figure 4 depicts this curve.

One can show that the above envy-free mechanism when run using a uniform standard allocation rule, mimics the simple factor mechanism presented earlier. Thus, it turns out to be truthful as well for this choice of standard allocation rule. However for more general allocation rules, the above envy-free mechanism might not be truthful. Thus before we answer the harder question about the optimal choice of function , we next describe the truthful version of the above envy-free mechanism.

4 A Parameterized Class of Truthful Mechanisms

We use a simple trick to convert Mechanism 1() to a truthful mechanism. The idea is to define, for each seller , an allocation rule which does not depend on . In particular, we define the allocation rule for seller to be , where will be chosen independently of . For finding , we run Mechanism 1() on the instance which is obtained by setting to be while keeping cost of the other sellers intact; would be the stopping rate of the mechanism 1(). The formal definition of the truthful mechanism appears in Mechanism 2.

In Lemma 2, we prove that Mechanism 2 is individually rational, truthful, and budget-feasible for any given standard allocation rule . First, we state the following useful lemma.

Lemma 1

For any seller we have .

Proof. The proof is based on the fact that is an increasing function of (for a fixed ) and is a decreasing function of (for a fixed ). The proof is by contradiction, suppose . Let for all and let . Observe that

where the first inequality is due to the fact that is a decreasing function of and the second inequality is due to the fact that . However, note that the above inequalities imply that , which contradicts with the budget feasibility of Mechanism 1(): see that represents the payment of 1() when the costs are , and so it can not be larger than .

Lemma 2

Mechanism 2 is individually rational, truthful, and budget-feasible.

Proof. Note that the allocation and payment rules for seller , i.e. , do not depend on the cost reported by her. This fact, along with the fact that is a monotone rule (decreasing function) implies individual rationality and truthfulness. The proof is almost identical to the proof of Myerson’s Lemma and we do not repeat it here.

The proof for budget feasibility needs a bit more work. Let denote the payments to seller respectively in Mechanism 2 and Mechanism 1(), i.e. and . The lemma is proved if we show that , since we have .

To see , note that is an increasing function of (for a fixed ). So, since we have due to Lemma 1, it must be the case that .

5 A ()-Approximate Optimal Truthful Mechanism

So far, we have introduced a parameterized class of individually rational, truthful, and budget-feasible mechanisms for the problem: Passing any standard allocation rule to Mechanism 2 fixes the mechanism which we denote by . Our goal in this section is to find the most efficient mechanism in this class. Formally, given a standard allocation rule , we denote the approximation ratio of by and define it as:

where the infimum is taken over all instances of the problem 888If we are focused on large markets, we take only instances for which the largeness ratio is smaller than some threshold, and take the limiting approximation factor as the threshold goes to . . Here denotes the utility obtained by in instance , and denotes the optimum utility in instance .

The most efficient allocation rule , is the one which maximizes . Our goal, in this section and Section 6, is to find the most efficient allocation rule and its corresponding approximation ratio. Formally, we prove the following theorem.

Theorem 1

The most efficient standard allocation rule for Mechanism 2 is , for which we get , i.e. it has an approximation ratio .

We prove this theorem in two parts: In the first part we show that for ; this is proved in the current section. In the second part, we show that for any standard allocation rule . This fact can be seen as a consequence of our hardness result in Section 6, which states that no truthful mechanism can achieve approximation ratio better than . We also provide a more direct (alternative) proof in Section D that shows our choice of is optimal among all possible choices of the standard allocation rules.

5.1 Finding an optimal for the (non-truthful) Mechanism 1()

In this section, we prove that Mechanism 1() has approximation ratio for . Note that the Mechanism 1() is not truthful, however its analysis will be helpful when analyzing our truthful mechanism in Section 5.2 and in Section A. Here, we analyze Mechanism 1() assuming that the true costs are known; later, in Section 5.2, we use this result to prove that Mechanism 2 has approximation ratio for the same choice of .

5.1.1 Preliminaries

We use to denote the inverse of an allocation rule , i.e. . Given an allocation rule , we also write an alternative definition of its corresponding unit-payment rule . This definition, rather than being in terms of , would be in terms of . This alternative definition is denoted by , and is defined such that . For instance, if a seller owns an item with utility , then we pay her when a fraction of her item is allocated. To be more precise, for we define

We also denote and respectively by and .

Proposition 1

Given the standard allocation rule , it is straight-forward to verify that and . Also, .

From now on in this section, we assume that . Next, we prove a useful inequality in the following lemma which will be used in the analysis of 1().

Lemma 3

For any such that we have

Proof.

5.1.2 Approximation Ratio of Mechanism 1()

In the following lemma, we prove the efficiency of Mechanism 1() when all sellers report true costs.

Lemma 4

If sellers report true costs, then Mechanism 1() has approximation ratio .

Proof. Observe that w.l.o.g. we can assume : If , then we can construct a new instance which is similar to the original instance and has stopping rate . More precisely, there exists some such that if we multiply the budget and the reported costs by , the stopping rate becomes equal to . Note that this operation will not change the optimal solution or the solution of 1() and can be performed w.l.o.g.

Now, suppose that a fraction of item is allocated by 1(). Since , we can use Lemma 3 to write the following set of inequalities:

where is the fraction that is allocated from seller in the optimal solution (recall that we are are comparing 1() with the optimum fractional solution). The above inequalities can be multiplied by on both side and be written as:

By adding up these inequalities, we get:

| (1) |

Now, we show that if

| (2) |

then the lemma is proved using (1) and (2). First we show why (1) and (2) prove the lemma, and then in the end, we prove (2) itself.

5.2 Special case: Analyzing our truthful mechanism for unit utilities

In this section, we prove that Mechanism 2 has approximation ratio in large markets when it uses the standard allocation rule for the special case when all the utilities are equal to . In other words, we will show that approximation ratio approaches as , the market’s largeness ratio, approaches for the case of unit utilities. The proof for the case of general utilities is intricate and appears in Section A.

Note that the assumption of unit utilities imply for any seller . Next, we state two lemmas before proving the approximation ratio. For simplicity in the analysis, w.l.o.g., assume that .

Lemma 5

.

Lemma 6

Let denote the maximum utility that the buyer can achieve with budget (when the items are divisible). Then, is a concave function.

Proofs for both of these lemmas are straight-forward and are deferred to the appendix, Section B.

6 Impossibility Result: On why is the best approximation possible

In this section we show that no truthful (and possibly) randomized mechanism achieves approximation ratio better than . We prove a stronger claim by allowing satisfying budget feasibility in expectation, i.e. we prove that no truthful mechanism that is budget feasible in expectation can achieve ratio better than . From now on in this section, we assume that all the mechanisms that we refer to are truthful, and are also budget feasible in expectation. First, we prove the claim assuming that the items are indivisible, then we will see that the same proof easily extends to divisible items as well.

Proof Outline.

We construct a bayesian instance of the problem and prove that no budget feasible truthful mechanism for this instance can achieve approximation ratio better than ; this also implies that no mechanism for the prior-free setting can achieve ratio better than 999This is so because an -approximate mechanism in the prior-free setting is also -approximate in the bayesian setting.

The proof is done in two steps. First, we show that for any truthful mechanism for this instance, there exist a simple posted price mechanism that achieves at least the same revenue. The posted price mechanism simply offers the same price to every seller and pays to any seller who accepts the offer and to others. In the second step of the proof, we show that for any choice of , such mechanisms can not achieve a ratio better than .

The proof that we present w.l.o.g. analyzes the market in expectation: budget feasibility is satisfied in expectation; also, the utility of the mechanisms are computed in expectation.

We now give the full proof by first giving our hardness instance.

The Hardness Instance.

We construct a bayesian instance of the problem in which all the sellers have unit utility and their costs are drawn i.i.d. from a distribution with CDF , defined as follows:

In other words, denotes the probability that the cost of a seller is at most . Let be the distribution defined by and let denote the expected cost of a seller sampled from , i.e. . We define the budget to be where is an arbitrary integer denoting the number of sellers.

Definition 4

A posted price mechanism is a mechanism that offers a price to any seller , and pays her if she accepts the offer and pays her otherwise.

Definition 5

A uniform posted price mechanism is a posted price mechanism that offers the same price to all sellers.

Definition 6

A cut-off allocation rule is an allocation rule which allocates the whole unit of an item if its cost is less than a certain cut-off and allocate units otherwise. Let denote a cut-off allocation rule with the cut-off price .

It is clear that posted price mechanisms use cut-off allocation rules to allocate items from sellers.

Lemma 7

If the sellers costs are drawn i.i.d. from the distribution , then for any mechanism in this bayesian setting there exists a posted price mechanism with the same approximation ratio.

Proof. Due to Myerson’s Lemma (see footnote LABEL:myersonfnote), any truthful mechanism in the bayesian setting can be seen as a set of allocation and payment rules corresponding to each seller, where the allocation rule is a decreasing function (of the cost) and the payment rule is defined with respect to the allocation rule as we saw in Figure 1. Given such an allocation rule for an arbitrary seller , namely , one can think of a simpler way to implement (in expectation) by finding a distribution over cut-off allocation rules.

More precisely, we find the distribution with PDF such that the distribution over all cut-off allocation rules, which assigns probability density to the cut-off allocation rule , implements the allocation rule in expectation. We prove the existence of in the following claim.

Claim 1

Define the distribution by its CDF such that for any cost . Then would implement in expectation.

Proof. All we need to show that a seller with price would be allocated with probability in . To see this, note that the probability that the seller is allocated is exactly equal to the probability of observing a cut-off price at least when a cut-off price is sampled from . This probability is equal to by the definition of ; this proves the claim.

Now, we claim that the cut-off allocation rule with the cut-off price

| (4) |

achieves the same utility and spends the same budget (in expectation) as the allocation rule paired with its corresponding Myerson payment rule.

Claim 2

For any seller , achieves the same utility and spends the same budget (in expectation) as the allocation rule paired with its corresponding Myerson payment rule.

Proof. The main idea of the proof is that the set of points forms a straight line in the two-dimensional plane; See Figure 5 for a proof by picture.

Note that denotes the expected allocation when a price is offered to a seller and is the corresponding expected payment.

Now, see that the expected utility achieved by the allocation rule is , which is exactly equal to the expected utility achieved by due to (4). To prove the claim, it remains to verify that the Myerson payment rules corresponding to and spend the same budget (in expectation). To this end, just observe that is a straight line; consequently, since the allocation rules allocate equal units of items (in expectation), then they also spend the same amount of the budget (in expectation).

Due to Claim 2, the posted price mechanism that offers price to seller is budget feasible (in expectation) and also achieves an expected utility equal to the utility of the originally given mechanism. This proves the claim.

Lemma 8

If the sellers costs are drawn i.i.d. from the distribution , then for any (budget feasible) posted price mechanism there exists a (budget feasible) uniform posted price mechanism with the same approximation ratio.

Proof. Suppose that denotes the offered prices in a posted price mechanism and let

First, observe that the uniform posted price mechanism with price achieves a utility equal to the utility of the original posted price mechanism; this can be verified simply due to linearity of expectation. It remains to verify that the uniform posted price mechanism is budget feasible. To this end, just observe that the set of points (depicted in Figure 5) is a straight line; consequently, since the posted price mechanism and the uniform posted price mechanism allocate equal units of items (in expectation), then they also spend the same amount of the budget (in expectation).

Theorem 2

For the case of indivisible items, no truthful budget feasible mechanism can achieve approximation ratio better than .

Proof. We use Lemma 8 and show that no uniform posted price mechanism can achieve ratio better than . Equivalently, we show that the uniform posted price mechanism which spends all the budget in expectation has approximation ratio no better than .

To define the uniform posted price mechanism that spends all the budget in expectation, we need to find such that . Given the definitions of and , we can solve this equation to get . Now, we are ready to compute the approximation ratio. First, note that the (expected) utility of the uniform posted price mechanism is . If we had , then we had (the optimum solution could buy all items), and so we could write the approximation ratio as

which would prove the claim. However, although , the sum is not always bounded by , which means does not always hold. We find a way to fix this issue using Hoeffding bounds (see Section F to see formal statements of Hoeffding bounds). We show that although is not always bounded by , it is concentrated around its mean, , with high probability. We will see that this is enough to prove the theorem.

As a consequence of Hoeffding bounds (stated in Section F), for any we have:

| (5) |

Recall that we defined and that in our hardness instance . Using (5), we will provide an upper bound on the approximation ratio which, for any constant , approaches to as approaches infinity. This proves that the approximation ratio can not be a constant larger than .

To this end, first note that if , then we have ; this holds due to Lemma 6. We can use this fact along with (5) to write the following upper bound on the (expected) approximation ratio:

The above ratio clearly approaches as . Noting that finishes the proof.

Now we use Theorem 2 to prove its counterpart for divisible items.

Corollary 1

For the case of divisible items, no truthful budget feasible mechanism can achieve approximation ratio better than .

Proof. Proof by contradiction. Suppose there exists a mechanism with approximation ratio for some constant . Then, we show that we can convert this mechanism to an -approximation mechanism for indivisible items which is truthful and budget feasible in expectation. This would contradict Theorem 2.

To do this conversion, we repeat the exact same argument that we used to prove Theorem 2. As the result, we can convert the given -approximation mechanism to a uniform posted price mechanism with approximation ratio . Note that all posted price mechanisms allocate items without dividing them. Consequently, we have an -approximation mechanism for indivisible items. Contradiction.

7 Conclusion

Our main contribution is designing optimal budget feasible mechanisms for the knapsack model in large markets. First, we assume that the items are divisible, and study a natural class of deterministic mechanisms: each mechanism in this class is characterized by a decreasing allocation function. All the mechanisms in this class are individually rational, truthful and budget feasible, but they have different approximation ratios based on the choice of the allocation function. We find a mechanism in this class which has an approximation ratio , and prove that no truthful mechanism can achieve a better approximation ratio.

We also provide a mechanism with approximation ratio for the case of indivisible items: the idea is to first run the mechanism for divisible items, and then round the obtained fractional solution (allocation). We design a rounding process that takes the fractional allocation as its input and outputs an integral allocation with its associated payments. Due to the properties of our rounding process, the resulting mechanism is individual rational, truthful-in-expectation, and budget feasible; also, it has approximation ratio in large markets.

Finally, we study the problem for submodular utility functions with indivisible items. For this case, we first design a deterministic mechanism which has approximation ratio in large markets; this mechanism can have an exponential running time in general. Inspired by this mechanism, we also design a polynomial-time deterministic mechanism with approximation ratio . We do not provide any results for when the items are divisible in the submodular model: One has to model the utility function over divisible items; the multilinear extension Vondrak (2008) or Lovàsz extension of submodular functions is a potential choice for this purpose. We leave open this case for future study. Bayesian

Acknowledgments

We acknowledge the comments and ideas of an anonymous reviewer that helped us generalize our impossibility result to the case of bayesian setting.

References

- (1) Amazon’s mechanical turk platform. https://www.mturk.com/.

- (2) Clickworker, virtual workforce. http://www.clickworker.com.

- (3) Crowdflower. http://www.crowdflower.com/.

- (4) Hoeffding bounds. http://en.wikipedia.org/wiki/Hoeffding’s_inequality.

- Badanidiyuru et al. (2012) Badanidiyuru, A., Kleinberg, R., and Singer, Y. 2012. Learning on a budget: Posted price mechanisms for online procurement. In EC.

- Bei et al. (2012) Bei, X., Chen, N., Gravin, N., and Lu, P. 2012. Budget feasible mechanism design: from prior-free to bayesian. In STOC.

- Chen et al. (2011) Chen, N., Gravin, N., and Lu, P. 2011. On the approximability of budget feasible mechanisms. In Proceedings of the Twenty-Second Annual ACM-SIAM Symposium on Discrete Algorithms. SODA ’11. SIAM, 685–699.

- Devanur and Hayes (2009) Devanur, N. R. and Hayes, T. P. 2009. The adwords problem: online keyword matching with budgeted bidders under random permutations. In ACM Conference on Electronic Commerce.

- Dobzinski et al. (2011) Dobzinski, S., Papadimitriou, C. H., and Singer, Y. 2011. Mechanisms for complement-free procurement. In ACM Conference on Electronic Commerce. 273–282.

- Feldman et al. (2010) Feldman, J., Henzinger, M., Korula, N., Mirrokni, V. S., and Stein, C. 2010. Online stochastic packing applied to display ad allocation. In ESA (1). 182–194.

- Feldman et al. (2009) Feldman, J., Korula, N., Mirrokni, V. S., Muthukrishnan, S., and Pál, M. 2009. Online ad assignment with free disposal. In WINE. 374–385.

- Goel and Mehta (2008) Goel, G. and Mehta, A. 2008. Online budgeted matching in random input models with applications to adwords. In SODA.

- Horel et al. (2013) Horel, T., Ioannidis, S., and Muthukrishnan, S. 2013. Budget feasible mechanisms for experimental design. CoRR abs/1302.5724.

- Mehta et al. (2007) Mehta, A., Saberi, A., Vazirani, U. V., and Vazirani, V. V. 2007. Adwords and generalized online matching. J. ACM 54, 5.

- Myerson (1981) Myerson, R. B. 1981. Optimal Auction Design. Mathematics of Operations Research 6, 58–73.

- Singer (2010) Singer, Y. 2010. Budget feasible mechanisms. In FOCS. 765–774.

- Singer (2011) Singer, Y. 2011. How to win friends and influence people, truthfully: Influence maximization mechanisms for social networks. In WSDM.

- Singer and Mittal (2013) Singer, Y. and Mittal, M. 2013. Pricing mechanisms for crowdsourcing markets. In WWW. 1157–1166.

- Singla and Krause (2013a) Singla, A. and Krause, A. 2013a. Incentives for privacy tradeoff in community sensing. In AAAI Conference on Human Computation and Crowdsourcing (HCOMP).

- Singla and Krause (2013b) Singla, A. and Krause, A. 2013b. Truthful incentives in crowdsourcing tasks using regret minimization mechanisms. In WWW. WWW ’13. 1167–1178.

- Sviridenko (2004) Sviridenko, M. 2004. A note on maximizing a submodular set function subject to a knapsack constraint. Operations Research Letters 32, 1, 41 – 43.

- Vondrak (2008) Vondrak, J. 2008. Optimal approximation for the submodular welfare problem in the value oracle model. In Proceedings of the 40th Annual ACM Symposium on Theory of Computing. STOC ’08. ACM, 67–74.

Appendix A Analyzing our Optimal Truthful Mechanism for the general case

In this section we will prove that the approximation ratio of Mechanism 2 approaches as , the market’s largeness ratio, approaches . We emphasize that here we dismiss the extra assumption that was made in Section 5.2: There, we assumed all items have utility , here we give a proof for the general case when item provides utility .

Lemma 9

For each , .

Proof. We just need to prove that is not a fit rule (i.e. does not consume all of the budget) when we set the cost of item to . First of all, note that

Here we used the fact that is a decreasing function. This implies that . This expression is the budget consumed by the rule without setting the cost of item to . When we set to , the amount of budget consumed can be bounded in the following manner

| (6) |

Note that is defined to be the area of the shaded region as seen in figure 1. Therefore one can crudely upper bound the difference by for any . Now letting , and substituting in inequality 6 we get

This completes the proof.

Lemma 10

Mechanism 2 has an approximation ratio approaching as approaches .

Proof. W.l.o.g. assume that (since we can scale the budget and costs by an appropriate scaling factor). Now let us pick a constant threshold and partition the indices into two sets and : let be the set of indices where and let be the complement.

Let be the minimum where . If happens to be empty, let . Let be the budget consumed by the allocation rule , i.e. let . We will prove that is close to . If , this is obviously true because . So assume that for some .

Because of the way is chosen, we have

| (7) |

Here we used the fact that (since we assumed ). Note that . Combining this with the inequality 7 we get

Using lemma 6, one can see that . But we also know from lemma 4 that the utility achieved by is at least . Therefore we have

| (8) |

For an item , we have (we used lemma 9). Therefore

One can easily verify that is a concave function. Therefore for is minimized at . This means that

If we let , then for every we have

Similarly, for every item , and therefore .

We just proved that for every , . Combining this with inequality 8 we get

So the approximation ratio for Mechanism 2 is at least

For any fixed , strictly smaller than , one can observe that the ratio above approaches as . We will not attempt to optimize the value of for the sake of brevity.

Appendix B Missing Proofs from Section 5.2

Proof of Lemma 5:

For any such that , we prove that , this would prove the lemma. The proof is by contradiction, suppose . First, note that represents the sum of payments in 1() when the cost of is set to . Since 1() spends all of the budget, then we have:

| (9) |

Also, note that represents the sum of payments in 1() when the cost of is set to ; a similar argument shows that

| (10) |

Taking the difference between (9) and (10) implies that

| (11) |

Now, observe that since and , then we have that and . This contradicts with (11).

Proof of Lemma 6: We need to prove that for and

Let be the amount of item we allocate to achieve and let be the amount of item we allocate to achieve .

Now let . Note that since , we also have . If we allocate from item , the utility we get will be

The cost paid by these allocations is simply

Therefore ’s are an allocation that spend a budget of at most and yet achieve a utility of . This proves that

Appendix C Mechanisms for Indivisible Items

In this section, using our mechanism for divisible items, we design a mechanism for indivisible items with approximation ratio . The idea is to first run the mechanism for divisible items, and then round the obtained fractional solution (allocation). We design a rounding process that takes the fractional allocation as its input and outputs an integral allocation with its associated payments. Due to the properties of our rounding process, the resulting mechanism is individual rational, truthful, and budget feasible; also, it has approximation ratio in large markets.

First, we explain a set of properties that we need the rounding procedure to satisfy. If the rounding procedure satisfies these properties, then its individual rationality, truthfulness, and budget feasibility would be guaranteed. Also, these properties guarantee that the approximation ratio would remain . First we explain these properties in Section C.1, then, we state our rounding procedure and prove that it satisfies these desired properties in Section C.2.

C.1 Properties of the Rounding Procedure

Let represent a fractional allocation where denotes the allocated fraction from seller ; also, let be the associated payments for this allocation. We round this solution to an integral solution, represented by the allocation and payments , such that:

-

1.

Item is bought with probability .

-

2.

If item is bought, then , and otherwise.

-

3.

.

Properties 1 and 2 imply individual rationality and truthfulness: Verifying individual rationality is straight-forward due to the individual rationality of the fractional solution. For truthfulness, just see that and , which implies . This just means that, in the mechanism for indivisible items, cannot benefit (in expectation) by misreporting, since she is already receiving the maximum possible expected utility that she can ever achieve.

Properties 1 and 2 also imply budget feasibility in expectation, however, Property 3 provides a much stronger guarantee: the budget will not be violated by an additive factor more than .101010We can always reduce the budget slightly to get strict budget feasiblility, e.g. we can reduce the budget to for an arbitrary small . This will not affect the approximation ratio (asymptotically) in a large market.

C.2 Description of the Rounding Procedure

In this section, we focus in designing a rounding procedure which satisfies Properties 1, 2 and 3. To this end, we first need to define a polytope that represents all the (fractional) allocations which, in a certain sense, are budget feasible:

First, we prove that extreme points of are “almost” integral.

Definition 7

A point is called semi-integral if there is at most one entry of which is non-integral, i.e. there is at most one index such that .

Lemma 11

All the extreme points of are semi-integral.

Proof. The proof is straight-forward, we give a high-level description and omit the formal details. The idea is to see as the intersection of a hypercube and a hyperplane; the hypercube is and the hyperplane is . So, any extreme point of either is an extreme point of the hypercube (which is integral), or is on the intersection of the hyperplane and an edge of the hypercube. In the latter case, it can be seen that such a point has at most one fractional entry, since any two adjacent vertices on the hypercube are different in at most one entry.

Outline of the Rounding Procedure

The procedure accepts the fractional allocation constructed by the mechanism, i.e. , and then writes it as a convex combination of extreme points of . Then, it samples an extreme point from the convex combination, where each point is selected with probability proportional to its coefficients in the convex combination. Finally, it rounds the sampled extreme point (which is a semi-integral point) to an integral point. We use the following fact about semi-integral points for implementing the last step:

Fact 1

A semi-integral point can be written as the convex combination of two integral points which differ in at most one entry, i.e. where are integral points which differ in at most one entry.

Now we are ready to formally state our main rounding procedure.

[htbp] input : Allocation vector and Payment vector Find extreme points and positive numbers summing up to one such that ;

Proof. It is straight-forward to verify that Properties 1 and 2 hold; for any seller we have:

which implies Property 1 since is a binary random variable. Property 2 trivially holds by the construction of Procedure C.2.

It remains to prove Property 3. To this end, define for any . We prove the claim by showing that . Equivalently, we can show that and . We prove this only for , the proof for is identical. The claim is trivial if , since in this case we have , which means . So suppose . Recall that we have

where are two adjacent vertices on the hypercube. Also, recall that any two adjacent vertices on the hypercube are different in exactly one entry, so suppose are different in entry , i.e. . Now, we prove the lemma by showing that

| (12) |

First verify that the first inequality in (12) holds since and are only different in their -th entry: if , then ; if , then it is straight-forward to verify that . Having that the first inequality holds, (12) is proved if we show that

| (13) | ||||

| (14) |

To verify (13), just note that . To verify (14), recall that and for some ; we will prove the following bounds on :

| (15) | ||||

| (16) |

Observe that combining (15) and (16) implies (14). So, we are done if we prove (15) and (16) hold. To prove (15), it is enough to note that , i.e. the area under the curve that represents the payment per unit of utility to seller fits in a rectangle with width and height ; this implies . It is also straight-forward to verify (16) holds due to the concavity of .

Appendix D The Optimal Standard Allocation Rule

Mechanism 2 is defined uniquely by the standard allocation rule . Here we provide an alternative proof for showing that our choice of is optimal, in the sense that Mechanism 2 attains the best approximation ratio under this choice. Although this fact is also a consequence of what we already proved in Section 6, we provide a more direct proof here with a prior-free hardness instance.

For simpler analysis, we first ignore the trick that we used for making our mechanism truthful: we work with the non-truthful, but cleaner mechanism 1() and we prove that no approximation ratio better than is attainable using any standard allocation rule . In the end, we see that the trick that makes mechanisms truthful only worsens the approximation ratio. Therefore the optimality result also applies to the family of truthful mechanisms defined by Mechanism 2.

We provide hardness examples with unit utilities, i.e. with for all . We also drop the indices from payment functions . This is done because all the payment functions are identical: Note that 1() uses the same allocation rule for all the sellers, which means the unit-payment functions are identical. Also, since all the utilities are , then the unit-payment functions are identical to the payment functions, i.e. . Unless specified otherwise we also assume that the scaling ratio is . i.e. we have and .

Definition 8

Assume that we are given a standard allocation rule . Define the set as follows

where is the payment rule associated with the allocation rule (i.e. . Also define the set as the downward closure of , i.e.

Note that in our definition we simply work with the standard function and not its scaled variants . The following lemma gives us a way to find out if the approximation ratio attained by the mechanism is worse than a number .

Lemma 13

Suppose that the point lies in the convex hull of . Then the mechanism defined by has approximation ratio at most .

Proof. Assume that the point can be written as the convex combination of points in in the following way

where , , and . Because of the way is defined, for each one can find a value such that and . Then this means that

| (17) | ||||

| (18) |

Now let be a very large number and consider sellers. For each , let fraction of the sellers price their item at . The issue of not being integral can be easily dealt with, but would unnecessarily complicate the proof, hence we assume is integral. Assume that each seller’s item is worth one unit to the buyer. Now let the buyer’s budget be

With this definition, we are simply saying that is fit with respect to our budget, or in other words, the mechanism consumes all of the budget at .

Because of (18), our budget is at least as large as the sum of the costs of all items . Therefore we could buy all of the items and obtain a utility of , if we were not constrained by the mechanism. But because of (17), our mechanism obtains a utility of . Therefore the approximation ratio in this example is .

It is worth mentioning that the reverse of lemma 13 is also true under some mild conditions, but in this section we are only concerned with the direction proved.

Building on top of our lemma, we can now prove that is the best approximation factor among the mechanisms defined by a standard allocation rule.

Theorem 3

Given any standard allocation rule , the mechanism 1() has approximation ratio at most .

Proof. To prove this, we simply need to show that the point is inside the convex hull of for every .

Suppose the contrary is true. So for some , the point is not inside the convex hull of . Since the point is not inside the convex hull, there is a line that separates them. We can further assume that this line passes through the point and is therefore given by the equation for some slope . Since is downward closed with respect to the coordinate, must fall completely below this line. Since , this means that must also fall completely below this line which means that for all , we have

| (19) |

We can safely assume that . If this was not true, then for , we would necessarily have . But this already shows that the mechanism never buys more than a fraction of of any item, and therefore the approximation factor cannot be larger than .

Now consider the function for some given . For this alloaction function let be the Myerson’s payment rule, i.e. (the shaded area in figure 1). One can easily verify that for

and therefore

| (20) |

If we choose so that , then equation 20 becomes very similar to the inequality 19. If we subtract equation 20 from the inequality 19, then we get

| (21) |

This inequality holds for . For , we get that . Therefore .

Let . This supremum is strictly greater than , because otherwise we would have for all , which would mean that , which is a contradiction. This supremum is also finite because for we have and .

Because is the supremum, we can find a sequence of points , such that for all , and . For each such , we have , and therefore the inequality 21 holds. This means that

By rearranging the terms we get

Here we used the fact that and .

But now as we take the limit as , we get

which is a contradiction because for , we have , and so the integral cannot be negative.

Theorem 4

For any standard allocation rule , Mechanism 2 has approximation ratio at most .

Appendix E Submodular Utility Functions

In this section, we present truthful mechanisms for the knapsack problem when the utility function for the buyer is a monotone submodular function rather than an additive function. More precisely, a monotone submodular function defines the utility that the buyer derives from buying a subset of . The buyers problem then becomes selecting a subset such that is budget feasible, i.e. , and has the highest utility, , among all the budget feasible subsets. (recall that denotes )

This problem has first been studied in Singer (2010) for arbitrary markets and a -approximation is presented for it. Later, Chen et al. (2011) improved this result by giving an exponential-time deterministic mechanism with approximation ratio and a polynomial-time randomized mechanism with approximation ratio .

Our Results

In this section, we focus on studying this problem in large markets where each individual can not significantly affect the market (see Section E.1 for a formal definition). Under this assumption, we design a deterministic mechanism which has approximation ratio , but has an exponential running time. Later, we will see that the exponential running time is solely due to the computational difficulty of solving the knapsack problem for submodular functions. In fact, our mechanism is also a polynomial-time -approximation when it has access to a -approximation oracle for solving the knapsack problem (see Section E.3). To the extent of our knowledge, the best existing approximation oracle has due to Sviridenko (2004); this provides us a mechanism with approximation ratio .

We take a step further and improve this result by presenting a deterministic polynomial-time -approximation mechanism in Section E.4. This mechanism, although using a greedy optimization oracle with , has approximation ratio equal to (rather than ).

Oneway-Truthfulness

All of the mechanisms that we have are truthful, however, we first present a simpler version of them which are not fully truthful but satisfy truthfulness in a weaker form, which we call oneway-truthfulness. Briefly, by this property, players only have incentive to report costs lower than their true cost.

This notion is formally defined in Section E.2.2.

In Section E.5, we convert our oneway-truthful mechanisms to (fully) truthful mechanisms only by changing the payment rule.

It is worth pointing out that analyzing the performance ratio of oneway-truthful mechanisms is not much different than analyzing truthful mechanisms: Since the cost of optimum solution may only decrease if players report lower costs, then any -approximate solution for the reported instance is also an -approximate solution for the original instance.

E.1 Preliminaries

In this section, first we state a a few basic definitions. Then, we formally define the large market assumption and oneway-truthfulness. Finally, we state a few definitions regarding submodular functions which are used in our mechanisms.

E.2 Basic Definitions

Similar to before, we say a subset of sellers is budget feasible if . Utility of the subset is defined by . The optimum subset, , is the budget feasible subset with the highest utility. We call the optimum utility and also denote it by .

E.2.1 The Large Market Assumption

Our large market assumption here is almost identical to the alternative large market assumption that was discussed in Section 1.1.1. Intuitively, it says that no individual affects the (optimum solution of the) market significantly. This assumption is formally defined below.

Let and be the total utility of the optimum solution (i.e. the maximum achievable utility when the costs are known). This large market assumption states that

Definition 9

We say that a market is large if .

In other words, we define the largeness ratio of the market to be and analyze our mechanisms for when .

E.2.2 Oneway-Truthfulness

Think of a reverse auction with a set of sellers where each seller has a private cost . In a truthful mechanism, no seller wants to report a fake cost regardless of what others do. In a oneway-truthful mechanism, no seller wants to report a cost higher than its true cost regardless of what others do.

For clarification, we first define the notion of cost vector briefly: when we say a cost vector , we mean a vector which has an entry corresponding to any seller , where represents the cost associated with seller . Now we formally define the notion of oneway-truthfulness as follows:

Definition 10

A mechanism is oneway-truthful if, for any seller and any cost vector for which , we have:

where denotes any cost vector corresponding to the rest of players except and denotes the utility of player .

E.2.3 Submodular Functions

Given the submodular function , we define an ordering of the elements of with respect to , which we call the greedy sequence and denote it by . For simplicity in the definition, we first define an auxiliary notion as follows: let for all , and let . The sequence is constructed such that

for all positive .

It is easy to verify that can be constructed in polynomial time by finding the values of one by one in the order that they appear in . After constructing of the greedy sequence, define for all .

E.3 The Exp-Time Mechanism

In this Section, we present an extremely simple mechanism which we call the Oracle Mechanism. Given a submodular function , the mechanism first finds the optimal budget feasible subset, i.e. the subset such that is budget feasible and has the highest utility among all the budget feasible subsets. Let and . We also call respectively the optimum utility and the optimum cost per utility rate. We also call the optimum rate when there is no risk of confusion.

Winner Selection

The Mechanism constructs the sequence and chooses the largest integer such that . Then, it reports as the set of winners.

The Payment Rule

For simplicity, assume that the winners are indexed from . The Payment to winner is equal to , where is the optimum cost per utility rate for the instance in which seller is removed from the set of sellers, . In other words, think of an auxiliary instance in which we are given budget and the cost of every seller is the same as the original instance except that . Then, is the optimum cost per utility rate in this instance.

Below we prove that the Oracle Mechanism is individually rational, oneway-truthful, and it has approximation ratio in large markets. Also, it is almost budget feasible, i.e. we can show that the total sum of its payments is at most . So, all we need for having a strictly budget feasible mechanism is starting with a slightly decreased budget. We will see that this does not affect the approximation ratio of the mechanism asymptotically due to the large market assumption. The formal proof for this is deferred to Section E.6.

Simplifying Assumption

Through out the analysis, w.l.o.g. we assume that the sellers appear in the greedy sequence in an increasing order, i.e. for all .

Lemma 14

The Oracle Mechanism is individually rational.

Proof. We show that and . These two imply which is individual rationality. First we prove as follows. Let denote the optimum utility when seller is removed. Clearly, we have . This just means since we have .

It remains to show that . Note that we only need to show this for the last winner, i.e. it suffices to prove that since we have iff . The proof is by contradiction, suppose .

For more intuition, we first explain our argument for contradiction in words and then we state it more formally. From the definition of the greedy sequence , it can be seen that conditioned on buying the subset , the cost for buying each extra unit of utility is at least , which is more than . So, even if we get the subset for free, the cost for buying an additional units of utility (which is needed for the optimum solution) would be

This means cost of the optimum solution is more than .

To formalize this contradiction, just note that by monotonicity of , we have

| (22) |

Now observe that by the definition of the greedy sequence , the cost for buying each extra unit of utility conditioned on having is at least . This fact, and (22) together imply that

| (23) |

On the other hand, recall that , so we can write (23) as

This implies which is a contradiction with the budget feasibility of .

Lemma 15

The Oracle Mechanism is oneway-truthful.

Proof. For contradiction, suppose there exists a seller who has incentive to report a cost which is higher that its true cost . Assuming that the mechanism picked as the set of winners, we have either or . The proof is done separately in each of these cases.

If , then see that seller can not change the first elements of by reporting a higher cost. Now, see that if , then again will be chosen as the set of winners, which is a contradiction with the incentive of seller for misreporting. If , then see that will be chosen as a subset of the winners; in this case, the set of winners can possibly contain other sellers, but not certainly not seller (due to the monotonicity of ). Consequently, seller remains a loser even by reporting . Contradiction.

It remains to do the proof for when . Recall that the payment to seller is . Since is not a function of the cost reported by seller , then see that the only way that can increase her utility by misreporting, is increasing . But by reporting a cost higher than , seller can not change the first elements of , which means she can only decrease by reporting a higher cost. So, the payment to does not increase if she reports a higher cost. This concludes the lemma.

Lemma 16

In a -large market, the Oracle Mechanism has approximation ratio , i.e. asymptotically equal to in a large market.

Proof. It is enough to note that , which implies due to the large market assumption.

Now, we prove that sum of the payments in the Oracle Mechanism is at most , or in simple words, it is almost budget feasible.

Definition 11

A mechanism is almost budget feasible if its payments sum up to at most .

As we mentioned before, (in large markets) we can convert any almost budget feasible mechanism to a budget feasible mechanism without any loss in its approximation ratio (asymptotically). This can be done simply by running the mechanism with a slightly reduced budget; the proof is deferred to Section E.6.

Lemma 17

The Oracle Mechanism is almost budget feasible.

Proof. Recall that the sum of payments is equal to . To prove the lemma, it is enough to show that for any seller , we have ; because then we have

which proves the lemma.

To prove , let denote the optimum utility when seller is removed. By the large market assumption, we have . This fact, and the fact that , imply that .

The Oracle Mechanism in Polynomial Time

In the Oracle Mechanism, we solve a submodular optimization problem which cannot be solved in polynomial-time, i.e. finding the optimum cost per utility rate which is equivalent to finding the optimum budget feasible subset. Although this problem cannot be solved in polynomial-time, there are approximation algorithms that can find near-optimal solutions for it.

Definition 12

Suppose we are given an instance of the problem with a submodular function , budget , and (publicly known) costs and utilities. A polynomial-time algorithm for solving this problem is called a -approximation oracle if, for any instance, it finds a solution with utility at least .

Given a -approximation oracle, we can run the Oracle mechanism in polynomial time by finding estimates for and ’s using the -approximation oracle, i.e. instead of computing and ’s directly, we compute them using the -approximation oracle. The following theorem clarifies the resulting mechanism further and states the properties it satisfies.

Theorem 5

Suppose the Oracle Mechanism has access to a polynomial-time -approximation oracle for the knapsack optimization problem. Then, it is a polynomial-time -approximation mechanism and its payments sum up to at most .

Proof. We use the -approximation oracle for finding an estimate (lower bound) for . Instead of computing directly, let be the solution which is returned by the -approximation oracle. Also, for computing , remove seller and then compute the optimal utility, namely , using the -approximation oracle. Everything else remains identical to Mechanism 3.

The proofs for individual rationality and truthfulness follow from the proofs for Mechanism 3. It remains to prove that the payments sum up to at most . For this, we follow the proof of Lemma 17. The key point in the proof of Lemma 17 was that . Here, we prove a weaker inequality . Given this inequality, the rest of the proof remains similar to the proof of Lemma 17. We do not repeat the full proof here and just show that the weaker inequality holds.

Recall that in this proof, and denote the utilities computed by the -approximation oracle. Then, by the large market assumption, we have . This fact, and the fact that , imply that .

Corollary 2 (of Theorem 5)

Suppose the Oracle Mechanism has access to a -approximation oracle. Then, if instead of budget , the mechanism is given a reduced budget , it would be an almost budget feasible mechanism with approximation ratio .

E.4 An Improved Polynomial-Time Mechanism

In this section, we present a polynomial-time mechanism with approximation ratio . The mechanism follows the idea of the oracle mechanism, except that instead of computing the optimum cost per utility rate (which requires exponential running time), the mechanism computes an estimate for the cost per utility rate, which we call the stopping rate. Before presenting the mechanism, we need to formally define the notion of stopping rate.

Definition 13

Suppose we are given an instance of the problem with cost vector , submodular utility function and budget . Construct the sequence and choose the largest integer such that . The stopping rate, denoted by , is then defined to be . We sometimes denote the stopping rate simply by when are clear from the context.

Now we define the mechanism by presenting the winner selection and payment rules.

Winner Selection

The Mechanism constructs the sequence and chooses the largest integer such that . Then, it reports as the set of winners.

The Payment Rule

For simplicity, assume that the winners are indexed from to . The Payment to winner is equal to , where and is the cost vector which is identical to the original cost vector except that is set to (i.e. intuitively, seller is removed from ). In other words, think of an auxiliary instance in which we are given budget and seller is removed from the set of sellers . Then, is the stopping rate in this instance.

The above definitions are formally put together in Mechanism 4. We also address our polynomial-time mechanism as Mechanism 4. In the rest of this section, we prove that Mechanism 4 is individually rational, oneway-truthful and budget feasible, and also, it has approximation ratio . As we mentioned before, this mechanism can be converted to a (fully) truthful and strictly budget feasible mechanism without any (asymptotic) loss in the approximation ratio; the details are discussed in Sections E.5 and E.6.

Simplifying Assumption

Through out the analysis, w.l.o.g. we assume that the sellers appear in the greedy sequence in an increasing order, i.e. for all .

Lemma 18

Mechanism 4 is individually rational.

Proof. According to the payment rule, it is enough to show that for each winner we have . Let denote the greedy sequence for when is removed. Also, let denote the subset containing first elements of , and .

Note that for all . Now, consider the following two cases for the proof: Let be the largest integer satisfying . We either have that or . We prove the lemma by proving that in each of these cases.

First, suppose . This means . Also, note that (since ). The two latter facts, along with the fact that together imply that .