Affine LIBOR models with multiple curves: theory, examples and calibration

Abstract.

We introduce a multiple curve framework that combines tractable dynamics and semi-analytic pricing formulas with positive interest rates and basis spreads. Negatives rates and positive spreads can also be accommodated in this framework. The dynamics of OIS and LIBOR rates are specified following the methodology of the affine LIBOR models and are driven by the wide and flexible class of affine processes. The affine property is preserved under forward measures, which allows us to derive Fourier pricing formulas for caps, swaptions and basis swaptions. A model specification with dependent LIBOR rates is developed, that allows for an efficient and accurate calibration to a system of caplet prices.

Key words and phrases:

Multiple curve models, LIBOR, OIS, basis spread, affine LIBOR models, caps, swaptions, basis swaptions, calibration2010 Mathematics Subject Classification:

91G30, 91G20, 60G441. Introduction

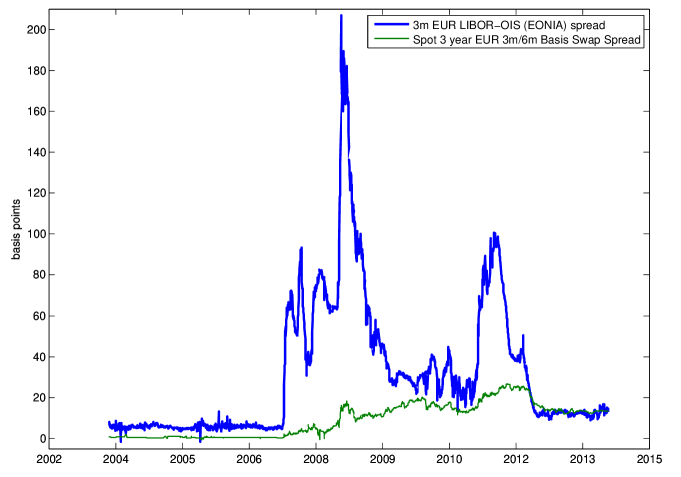

The recent financial crisis has led to paradigm shifting events in interest rate markets because substantial spreads have appeared between rates that used to be closely matched; see Figure 1.1 for an illustration. We can observe, for example, that before the credit crunch the spread between the three month LIBOR and the corresponding Overnight Indexed Swap (OIS) rate was non-zero, however it could be safely disregarded as negligible. The same is true for the three month vs six month basis swap spread. However, since August 2007 these spreads have been evolving randomly over time, are substantially too large to be neglected, and also depend on the tenor length. Therefore, the assumption of a single interest rate curve that could be used both for discounting and for generating future cash flows was seriously challenged, which led to the introduction of the so-called multiple curve interest rate models.

In the multiple curve framework, one curve is used for discounting purposes, where the usual choice is the OIS curve, and then as many LIBOR curves as market tenors (e.g. 1m, 3m, 6m and 1y) are built for generating future cash flows. The difference between the OIS and each LIBOR rate is usually called basis spread or simply basis. There are several ways of modeling the curves and different definitions of the spread. One approach is to model the OIS and LIBOR rates directly which leads to tractable pricing formulas, but the sign of the spread is more difficult to control and may become negative. Another approach is to model the OIS and the spread directly and infer the dynamics of the LIBOR; this grants the positivity of the spread, but pricing formulas are generally less tractable. We refer to Mercurio (2010b, pp. 11-12) for a detailed discussion of the advantages and disadvantages of each approach. Moreover, there exist various definitions of the spread: an additive spread is used e.g. by Mercurio (2010a), a multiplicative spread was proposed by Henrard (2010), while an instantaneous spread was used by Andersen and Piterbarg (2010); we refer to Mercurio and Xie (2012) for a discussion of the merits of each definition.

The literature on multiple curve models is growing rapidly and the different models proposed can be classified in one of the categories described above. Moreover, depending on the modeling approach, one can also distinguish between short rate models, Heath–Jarrow–Morton (HJM) models and LIBOR market models (LMM) with multiple curves. The spreads appearing as modeling quantities in the short rate and the HJM models are, by the very nature of these models, instantaneous and given in additive form. We refer to Bianchetti and Morini (2013) for a detailed overview of several multiple curve models. In the short rate framework, we mention Kenyon (2010), Kijima, Tanaka, and Wong (2009) and Morino and Runggaldier (2014), where the additive short rate spread is modeled, which leads to multiplicative adjustments for interest rate derivative prices. HJM-type models have been proposed e.g. by Fujii, Shimada, and Takahashi (2011), Crépey, Grbac, and Nguyen (2012), Moreni and Pallavicini (2014), Crépey, Grbac, Ngor, and Skovmand (2015a) and Cuchiero, Fontana, and Gnoatto (2014). The models by Mercurio (2009), Bianchetti (2010) (where an analogy with the cross-currency market has been exploited) and Henrard (2010) are developed in the LMM setup, while multiple curve extensions of the Flesaker and Hughston (1996) framework have been proposed in Nguyen and Seifried (2015) and Crépey, Macrina, Nguyen, and Skovmand (2015b). Typically, multiple curve models address the issue of different interest rate curves under the same currency, however, the paper by Fujii et al. (2011) studies a multiple curve model in a cross-currency setup. Filipović and Trolle (2013) offer a thorough econometric analysis of the multiple curve phenomena and decompose the spread into a credit risk and a liquidity risk component. In recent work, Gallitschke, Müller, and Seifried (2014) construct a structural model for interbank rates, which provides an endogenous explanation for the emergence of basis spreads.

Another important change due to the crisis is the emergence of significant counterparty risk in financial markets. In this paper, we consider the clean valuation of interest rate derivatives meaning that we do not take into account the default risk of the counterparties involved in a contract. As explained in Crépey et al. (2015a) and Morino and Runggaldier (2014), this is sufficient for calibration to market data which correspond to fully collateralized contracts. The price adjustments due to counterparty and funding risk for two particular counterparties can then be obtained on top of the clean prices, cf. Crépey et al. (2015a), Crépey et al. (2015b), and in particular Papapantoleon and Wardenga (2015) for computations in affine LIBOR models.

Let us also mention that there exist various other frameworks in the literature where different curves have been modeled simultaneously, for example when dealing with cross-currency markets (cf. e.g. Amin and Jarrow 1991) or when considering credit risk (cf. e.g. the book by Bielecki and Rutkowski 2002). The models in the multiple curve world often draw inspiration from these frameworks.

The aim of this paper is to develop a multiple curve LIBOR model that combines tractable model dynamics and semi-analytic pricing formulas with positive interest rates and basis spreads. The framework of the affine LIBOR models proposed by Keller-Ressel, Papapantoleon, and Teichmann (2013) turns out to be tailor-made for this task, since it allows us to model directly LIBOR rates that are greater than their OIS counterparts. In other words, the non-negativity of spreads is automatically ensured. Simultaneously, the dynamics are driven by the wide and flexible class of affine processes. Similar to the single curve case, the affine property is preserved under all forward measures, which leads to semi-analytical pricing formulas for liquid interest rate derivatives. In particular, the pricing of caplets is as easy as in the single curve setup, while the model structure allows to derive efficient and accurate approximations for the pricing of swaptions and basis swaptions using a linearization of the exercise boundary. In addition, the model offers adequate calibration results to a system of caplet prices for various strikes and maturities.

The paper is organized as follows: in Section 2 we review the main properties of affine processes and the construction of ordered martingales greater than one. Section 3 introduces the multiple curve interest rate setting. The multiple curve affine LIBOR model is presented in Section 4 and its main properties are discussed, in particular the ability to produce positive rates and spreads and the analytical tractability (i.e. the preservation of the affine property). A model that allows for negative interest rates and positive spreads is also presented. In Section 5 we study the connection between the class of affine LIBOR models and the class of LIBOR market models (driven by semimartingales). Sections 6 and 7 are devoted to the valuation of the most liquid interest rate derivatives such as swaps, caps, swaptions and basis swaptions. In Section 8 we construct a multiple curve affine LIBOR model where rates are driven by common and idiosyncratic factors and calibrate this to market data. Moreover, we test numerically the accuracy of the swaption and basis swaption approximation formulas. Section 9 contains some concluding remarks and comments on future research. Finally, Appendix A provides an explicit formula for the terminal correlation between LIBOR rates.

2. Affine processes

This section provides a brief review of the main properties of affine processes and the construction of ordered martingales greater than one. More details and proofs can be found in Keller-Ressel et al. (2013) and the references therein.

Let denote a complete stochastic basis, where and denotes some finite time horizon. Consider a stochastic process satisfying:

Assumption ().

Let be a conservative, time-homogeneous, stochastically continuous Markov process with values in , and a family of probability measures on , such that , -almost surely for every . Setting

| (2.1) |

we assume that

-

(i)

, where denotes the interior of (with respect to the topology induced by the Euclidean norm on );

-

(ii)

the conditional moment generating function of under has exponentially-affine dependence on ; that is, there exist deterministic functions and such that

(2.2) for all .

Here denotes the inner product on and the expectation with respect to . Moreover, it holds that for , cf. Keller-Ressel and Mayerhofer (2015, Theorem 2.14). In other words, if is such that , then for every .

The functions and satisfy the following system of ODEs, known as generalized Riccati equations

| (2.3a) | ||||

| (2.3b) | ||||

for . The functions and are of Lévy–Khintchine form:

| (2.4a) | ||||

| (2.4b) | ||||

where are admissible parameters and are suitable truncation functions. The functions and also satisfy the semi-flow equations

| (2.5a) | ||||

| (2.5b) | ||||

for all and , with initial condition

| (2.6) |

We refer to Duffie, Filipović, and Schachermayer (2003) for all the details.

The following definition will be used in the sequel, where .

Definition 2.1.

Let be a process satisfying Assumption . Define

| (2.7) |

The quantity measures the ability of an affine process to fit the initial term structure of interest rates and equals infinity for several models used in mathematical finance, such as the CIR process and OU models driven by subordinators; cf. Keller-Ressel et al. (2013, §8).

An essential ingredient in affine LIBOR models is the construction of parametrized martingales which are greater than or equal to one and increasing in this parameter (see also Papapantoleon 2010).

Lemma 2.2.

Consider an affine process satisfying Assumption () and let . Then the process with

| (2.8) |

is a martingale, greater than or equal to one, and the mapping is increasing, for every .

Proof.

Consider the random variable . Since we have that is greater than one and integrable. Then, from the Markov property of , (2.2) and the tower property of conditional expectations we deduce that

| (2.9) |

is a martingale. Moreover, it is obvious that for all , while the ordering

| (2.10) |

follows from the ordering of and the representation . ∎

3. A multiple curve LIBOR setting

We begin by introducing the notation and the main concepts of multiple curve LIBOR models. We will follow the approach introduced in Mercurio (2010a), which has become the industry standard in the meantime.

The fact that LIBOR-OIS spreads are now tenor-dependent means that we cannot work with a single tenor structure any longer. Hence, we start with a discrete, equidistant time structure , where , , denote the maturities of the assets traded in the market. Next, we consider different subsets of with equidistant time points, i.e. different tenor structures , where is a label that indicates the tenor structure. Typically, we have months. We denote the tenor length by , for every . Let denote the collection of all subscripts related to the tenor structure . We assume that and for all . A graphical illustration of a possible relation between the different tenor structures appears in Figure 3.2.

Example 3.1.

A natural construction of tenor structures is the following: Let denote a discrete time structure, where for and . Let , where we assume that is a divisor of for all . Next, set for every

where obviously . Then, we can consider different subsets of , i.e. different tenor structures , which satisfy by construction and also , for all .

We consider the OIS curve as discount curve, following the standard market practice of fully collateralized contracts. The market prices for caps and swaptions considered in the sequel for model calibration are indeed quoted under the assumption of full collateralization. A detailed discussion on the choice of the discount curve in the multiple curve setting can be found e.g. in Mercurio (2010a) and in Hull and White (2013). The discount factors are stripped from market OIS rates and defined for every possible maturity via

We denote by the discount factor, i.e. the price of a zero coupon bond, at time for maturity , which is assumed to coincide with the corresponding OIS-based zero coupon bond for the same maturity.

We also assume that all our modeling objects live on a complete stochastic basis , where denotes the terminal forward measure, i.e. the martingale measure associated with the numeraire . The corresponding expectation is denoted by . Then, we introduce forward measures associated to the numeraire for every pair with and . The corresponding expectation is denoted by . The forward measures are absolutely continuous with respect to , and defined in the usual way, i.e. via the Radon–Nikodym density

| (3.1) |

Remark 3.2.

Since there exists an and a such that . Therefore, the corresponding numeraires and forward measures coincide, i.e. and . See again Figure 3.2.

Next, we define the two rates that are the main modeling objects in the multiple curve LIBOR setting: the forward OIS rate and the forward LIBOR rate. We also define the additive and the multiplicative spread between these two rates. Let us denote by the spot LIBOR rate at time for the time interval , which is an -measurable random variable on the given stochastic basis.

Definition 3.3.

The time- forward OIS rate for the time interval is defined by

| (3.2) |

Definition 3.4.

The time- forward LIBOR rate for the time interval is defined by

| (3.3) |

The forward LIBOR rate is the fixed rate that should be exchanged for the future spot LIBOR rate so that the forward rate agreement has zero initial value. Hence, this rate reflects the market expectations about the value of the future spot LIBOR rate. Notice that at time we have that

| (3.4) |

i.e. this rate coincides with the spot LIBOR rate at the corresponding tenor dates.

Remark 3.5.

In the single curve setup, (3.2) is the definition of the forward LIBOR rate. However, in the multiple curve setup we have that

hence the OIS and the LIBOR rates are no longer equal.

Definition 3.6.

The spread between the LIBOR and the OIS rate is defined by

| (3.5) |

Let us also provide an alternative definition of the spread based on a multiplicative, instead of an additive, decomposition.

Definition 3.7.

The multiplicative spread between the LIBOR and the OIS rate is defined by

| (3.6) |

A model for the dynamic evolution of the OIS and LIBOR rates, and thus also of their spread, should satisfy certain conditions which stem from economic reasoning, arbitrage requirements and their respective definitions. These are, in general, consistent with market observations. We formulate them below as model requirements:

-

(M1)

and , for all , , .

-

(M2)

and , for all , , .

-

(M3)

and , for all , , .

Here denotes the set of -martingales.

Remark 3.8.

If the additive spread is positive the multiplicative spread is also positive and vice versa.

4. The multiple curve affine LIBOR model

We describe next the affine LIBOR model for the multiple curve interest rate setting and analyze its main properties. In particular, we show that this model produces positive rates and spreads, i.e. it satisfies the modeling requirements (M1)–(M3) and is analytically tractable. In this framework, OIS and LIBOR rates are modeled in the spirit of the affine LIBOR model introduced by Keller-Ressel et al. (2013).

Let be an affine process defined on , satisfying Assumption and starting at the canonical value . Consider a fixed and the associated tenor structure . We construct two families of parametrized martingales following Lemma 2.2: take two sequences of vectors and , and define the -martingales and via

| (4.1) |

and

| (4.2) |

The multiple curve affine LIBOR model postulates that the OIS and the LIBOR rates associated with the -tenor evolve according to

| (4.3) |

for every and .

In the following three propositions, we show how to construct a multiple curve affine LIBOR model from any given initial term structure of OIS and LIBOR rates.

Proposition 4.1.

Consider the time structure , let , , be the initial term structure of non-negative OIS discount factors and assume that

Then the following statements hold:

-

(1)

If , then there exists a decreasing sequence in , such that

(4.4) In particular, if , the multiple curve affine LIBOR model can fit any initial term structure of OIS rates.

-

(2)

If is one-dimensional, the sequence is unique.

-

(3)

If all initial OIS rates are positive, the sequence is strictly decreasing.

Proof.

See Proposition 6.1 in Keller-Ressel et al. (2013). ∎

After fitting the initial term structure of OIS discount factors, we want to fit the initial term structure of LIBOR rates, which is now tenor-dependent. Thus, for each , we set

| (4.5) |

where is such that ; see Remark 3.2. In general, we have that , while in the setting of Example 3.1 we simply have , i.e. .

Proposition 4.2.

Consider the setting of Proposition 4.1, the fixed and the corresponding tenor structure . Let , , be the initial term structure of non-negative LIBOR rates and assume that for every

| (4.6) |

The following statements hold:

-

(1)

If , then there exists a sequence in , such that and

(4.7) In particular, if , then the multiple curve affine LIBOR model can fit any initial term structure of LIBOR rates.

-

(2)

If is one-dimensional, the sequence is unique.

-

(3)

If all initial spreads are positive, then , for all .

Proof.

Similarly to the previous proposition, by fitting the initial LIBOR rates we obtain a sequence which satisfies (1)–(3). The inequality follows directly from (4.6). ∎

Proposition 4.3.

Consider the setting of the previous propositions. Then we have:

-

(1)

and are -martingales, for every .

-

(2)

, for every , .

Proof.

Since and are -martingales and the density process relating the measures and is provided by

| (4.8) |

we get from (4.3) that

| (4.9) |

Similarly,

| (4.10) |

Remark 4.4.

The above propositions provide the theoretical construction of affine LIBOR models with multiple curves, given initial term structures of OIS bond prices and LIBOR rates , for any and . The initial term structures determine the sequences and , but not in a unique way, as soon as the dimension of the driving process is strictly greater than one, which will typically be the case in applications. This provides plenty of freedom in the implementation of the model. For example, setting some components of the vectors and equal to zero allows to exclude the corresponding components of the driving processes and thus decide which components of the driving process will affect the OIS rates, respectively the LIBOR rates. Moreover, if the components of are assumed mutually independent, one can create a factor model with common and idiosyncratic components for each OIS and LIBOR rate, as well as various other specific structures. In Section 8.1 we present more details on this issue, see Remark 8.1 in particular.

Remark 4.5.

Let us now look more closely at the relationship between the sequences and . Propositions 4.1 and 4.2 imply that and for all . However, we do not know the ordering of and , or whether the sequence is monotone or not. The market data for LIBOR spreads indicate that in a ‘normal’ market situation . More precisely, on the one hand, we have because the LIBOR spreads are nonnegative. On the other hand, if , then the LIBOR rate would be more than two times higher than the OIS rate spanning an interval twice as long, starting at the same date. This contradicts normal market behavior, hence and consequently the sequence will also be decreasing. This ordering of the parameters and is illustrated in Figure 4.3 (top graph). However, the ‘normal’ market situation alternates with an ‘extreme’ situation, where the spread is higher than the OIS rate. In the bottom graph of Figure 4.3 we plot another possible ordering of the parameters and corresponding to such a case of very high spreads. Intuitively speaking, the value of the corresponding model spread depends on the distance between the parameters and , although in a non-linear fashion.

The next result concerns an important property of the multiple curve affine LIBOR model, namely its analytical tractability in the sense that the model structure is preserved under different forward measures. More precisely, the process remains affine under any forward measure, although its ‘characteristics’ become time-dependent. We refer to Filipović (2005) for time-inhomogeneous affine processes. This property plays a crucial role in the derivation of tractable pricing formulas for interest rate derivatives in the forthcoming sections, since it entails that the law of any collection of LIBOR rates is known under any forward measure. The result below is presented in Keller-Ressel et al. (2013, cf. eq. (6.14) and its proof), nevertheless we include a short proof here for completeness. In Section 5 we also provide an alternative proof for the case when is an affine diffusion.

Proposition 4.6.

The process is a time-inhomogeneous affine process under the measure , for every and . In particular

| (4.11) |

where

| (4.12a) | ||||

| (4.12b) | ||||

for every with

| (4.13) |

Proof.

Remark 4.7.

The preservation of the affine property of the driving process under all forward measures is a stability property shared by all forward price models in which the process is modeled as a deterministic exponential transformation of the driving process. This is related to the density process of the measure change between subsequent forward measures given exactly as , see (4.8), which is of the same exponential form, and guarantees that when performing a measure change the driving process remains in the same class. We refer to Eberlein and Kluge (2007) for an example of a forward price model driven by a time-inhomogeneous Lévy process under all forward measures. The models in the spirit of the LIBOR market model (LMM), where it is rather the forward rate which is modeled as an exponential, do not possess this property. The measure change in these models yields the stochastic terms appearing in the characteristics of the driving process (more precisely, in the drift and in the compensator of the random measure of jumps) under any forward measure different from the terminal one, which destroys the analytical tractability of the model. The tractability is often re-established by freezing the value of these terms at their initial value — an approximation referred to as freezing the drift. This approximation is widely known to be unreliable in many realistic settings; cf. Papapantoleon, Schoenmakers, and Skovmand (2012) and the references therein.

On the other hand, in LMMs the positivity of the rate is ensured, which in general may not be the case in the forward price models. Due to their specific construction, the affine LIBOR models are able to reconcile both of these properties: the positivity of the rate and the structure preservation for the driving process under all forward measures. We refer the interested reader to a detailed discussion on this issue in Section 3 of Keller-Ressel et al. (2013). Finally, it should be emphasized that in the current market situation the observed OIS rates have also negative values, but this situation can easily be included in the affine LIBOR models; cf. Section 4.1 below.

Remark 4.8 (Single curve and deterministic spread).

The multiple curve affine LIBOR model easily reduces to its single curve counterpart (cf. Keller-Ressel et al. 2013) by setting for all and . Another interesting question is whether the spread can be deterministic or, similarly, whether the LIBOR rate can be a deterministic transformation of the OIS rate.

Consider, for example, a 2-dimensional driving process where is an arbitrary affine process and the constant process (i.e. . Then, by setting

where we arrive at

Therefore, the LIBOR rate is a deterministic transformation of the OIS rate, although the spread as defined in (3.5) is not deterministic. In that case, the multiplicative spread defined in (3.6) is obviously deterministic.

4.1. A model with negative rates and positive spreads

The multiple curve affine LIBOR model produces positive rates and spreads, which is consistent with the typical market observations. However, in the current market environment negative rates have been observed, while the spreads still remain positive. Negative interest rates (as well as spreads, if needed) can be easily accommodated in this setup by considering, for example, affine processes on instead of or ‘shifted’ positive affine processes where with .

In order to illustrate the flexibility of the affine LIBOR models, we provide below an explicit specification which allows for negative OIS rates, while still preserving the positive spreads. It is based on a particular choice of the driving process and suitable assumptions on the vectors and . Recall from Remark 4.4 that if the driving process is multidimensional, we have a certain freedom in the choice of the parameters and when fitting the initial term structure, that we shall exploit here.

Starting from the affine LIBOR model in (4.3), we have an expression for the OIS rates and we will derive an expression for the multiplicative spreads as defined in (3.6). We choose the multiplicative spreads as a more convenient quantity instead of the additive spreads in (3.5), but obviously the additive spreads can easily be recovered from the multiplicative spreads and the OIS rates, and vice versa, by combining (3.5) and (3.6). Moreover, the two spreads always have the same sign, i.e. if and only if .

The model specification below allows in addition to ensure the monotonicity of the spreads with respect to the tenor length, which is also a feature typically observed in the markets. More precisely, this means that for any two tenors and such that , i.e. such that , the spreads have the following property: for all and such that with , we have

for all . That is, the spreads are lower for shorter tenor lengths. For example, a 3-month spread is lower than a 6-month spread for a 6-month period starting at the same time as the 3-month period.

According to (4.3), the OIS rate , for every and every , is provided by

| (4.15) |

where we note that , for such that . This process is a -martingale by construction. The multiplicative spreads take now the form

| (4.16) |

which is a -martingale by construction.

Let us now present a possible choice of the driving process which allows to accommodate , while keeping , as well as ensuring the monotonicity of the spreads with respect to the tenor length. We assume that the initial term structure of forward OIS rates and of multiplicative spreads are given, for every fixed and all . Moreover, we assume that the initial spreads are monotone with respect to the tenor, i.e. for every two tenors and such that , we have , for all and with .

In order to fix ideas, we shall consider only a 2-dimensional affine process on the state space such that and are independent. The construction can easily be extended to -dimensional affine processes on , with , such that the first components are independent of the last components. The forward OIS rates will be driven by both components of the driving process and for the spreads we shall use only the second component , which takes values in , to ensure the nonnegativity. This can be achieved by imposing appropriate assumptions on the parameters . We split the construction in two steps.

Step 1. Given the initial term structure of forward OIS rates , for every fixed and all , we apply Proposition 4.1 and find a sequence such that the model (4.15) fits the initial term structure. Note that , , do not have to be ordered and , for any .

Step 2. Next, given the initial term structure of multiplicative spreads , for every fixed and all , we calculate the initial LIBOR rates using (3.6). Applying Proposition 4.2 we can find a sequence such that for each , satisfies and the model (4.16) fits the initial term structure. Note that even though we fixed here the first component of each of the vectors , Proposition 4.2 ensures that the initial term structure can be fitted using only the second components . This yields

| (4.17) |

due to the independence of and , see Keller-Ressel (2008, Prop. 4.7). Therefore, is driven only by and the fact that the initial values implies that for all . Consequently, we have , for all , which follows immediately from (4.17).

Finally, it remains to show that the monotonicity of the initial spreads with respect to the tenor implies the monotonicity at all times , , for all and as above. First note that implies and consequently

| (4.18) |

Hence, implies that necessarily by (4.16). This in turn yields , or more precisely since . As a consequence, , for all , since

due to (4.18).

5. Connection to LIBOR market models

In this section, we will clarify the relationship between the affine LIBOR models and the ‘classical’ LIBOR market models, cf. Sandmann, Sondermann, and Miltersen (1995) and Brace, Ga̧tarek, and Musiela (1997), and also Mercurio (2010a) for the extension of the LIBOR market models to multiple curves. This relationship has not yet been investigated even in the single-curve framework of Keller-Ressel et al. (2013). More precisely, we will embed the multiple curve affine LIBOR model (4.3) in the general semimartingale LIBOR market model of Jamshidian (1997) and derive the corresponding dynamics of OIS and LIBOR rates. We shall concentrate on affine diffusion processes for the sake of simplicity, in order to expose the ideas without too many technical details. The generalization to affine processes with jumps is straightforward and left to the interested reader.

An affine diffusion process on the state space is the solution of the SDE

| (5.1) |

where is a -dimensional -Brownian motion. The coefficients , and have to satisfy the admissibility conditions for affine diffusions on , see Filipović (2009, Ch. 10). That is, the drift vectors satisfy

| (5.2) |

where denotes the -th element of the column vector . Moreover, the diffusion matrix satisfies

| (5.3) |

where are symmetric, positive semidefinite matrices for all , such that

| (5.4) |

Here, denotes the -th entry of the matrix . Therefore, the affine diffusion process is componentwise described by

| (5.5) |

for all , where (with the unit vector).

5.1. OIS dynamics

We start by computing the dynamics of OIS rates. As in the previous section, we consider a fixed and the associated tenor structure .

Using the structure of the -martingale in (4.1), we have that

| (5.6) |

Hence, applying Itô’s product rule to (4.3) and using (5.6) yields that

Therefore, the OIS rates satisfy the following SDE

| (5.7) |

for all . Now, using the dynamics of the affine process from (5.5) we arrive at

| (5.8) |

where we define the volatility structure

| (5.9) |

On the other hand, we know from the general theory of discretely compounded forward rates (cf. Jamshidian 1997) that the OIS rate should satisfy the following SDE under the terminal measure

| (5.10) |

for the volatility structure given in (5.9). Therefore, we get immediately that the -Brownian motion is related to the terminal Brownian motion via the equality

| (5.11) |

Moreover, the dynamics of under take the form

| (5.12) |

for all . The last equation provides an alternative proof to Proposition 4.6 in the setting of affine diffusions, since it shows explicitly that is a time-inhomogeneous affine diffusion process under . One should also note from (5.1), that the difference between the terminal and the forward Brownian motion does not depend on other forward rates as in ‘classical’ LIBOR market models. As mentioned in Remark 4.7, the same property is shared by forward price models.

Thus, we arrive at the following -dynamics for the OIS rates

| (5.13) |

with the volatility structure provided by (5.9). The structure of shows that there is a built-in shift in the model, whereas the volatility structure is determined by and .

5.2. LIBOR dynamics

Next, we derive the dynamics of the LIBOR rates associated to the same tenor. Using (4.3), (4.2) and repeating the same steps as above, we obtain the following

for all Similarly to (5.9) we introduce the volatility structure

| (5.14) |

and then obtain for the following -dynamics

| (5.15) |

where is the -Brownian motion given by (5.1), while the dynamics of are provided by (5.1).

5.3. Spread dynamics

5.4. Instantaneous correlations

The derivation of the SDEs that OIS and LIBOR rates satisfy allows to provide quickly formulas for various quantities of interest, such as the instantaneous correlations between OIS and LIBOR rates or LIBOR rates with different maturities or tenors. We have, for example, that the instantaneous correlation between the LIBOR rates maturing at and is heuristically described by

therefore we get that

Similar expressions can be derived for other instantaneous correlations, e.g.

Instantaneous correlations are important for describing the (instantaneous) interdependencies between different LIBOR rates. In the LIBOR market model for instance, the rank of the instantaneous correlation matrix determines the number of factors (e.g. Brownian motions) that is needed to drive the model. Explicit expressions for terminal correlations between LIBOR rates are provided in Appendix A.

6. Valuation of swaps and caps

6.1. Interest rate and basis swaps

We start by presenting a fixed-for-floating payer interest rate swap on a notional amount normalized to , where fixed payments are exchanged for floating payments linked to the LIBOR rate. The LIBOR rate is set in advance and the payments are made in arrears, while we assume for simplicity that the timing and frequency of the payments of the floating leg coincides with those of the fixed leg. The swap is initiated at time , where and . The collection of payment dates is denoted by , and the fixed rate is denoted by . Then, the time- value of the swap, for , is given by

| (6.1) |

Thus, the fair swap rate is provided by

| (6.2) |

Basis swaps are new products in interest rate markets, whose value reflects the discrepancy between the LIBOR rates of different tenors. A basis swap is a swap where two streams of floating payments linked to the LIBOR rates of different tenors are exchanged. For example, in a 3m–6m basis swap, a 3m-LIBOR is paid (received) quarterly and a 6m-LIBOR is received (paid) semiannually. We assume in the sequel that both rates are set in advance and paid in arrears; of course, other conventions regarding the payments on the two legs of a basis swap also exist. A more detailed account on basis swaps can be found in Mercurio (2010b, Section 5.2) or in Filipović and Trolle (2013, Section 2.4 and Appendix F). Note that in the pre-crisis setup the value of such a product would have been zero at any time point, due to the no-arbitrage relation between the LIBOR rates of different tenors; see e.g. Crépey, Grbac, and Nguyen (2012).

Let us consider a basis swap associated with two tenor structures denoted by and , where , and . The notional amount is again assumed to be and the swap is initiated at time , while the first payments are due at times and respectively. The basis swap spread is a fixed rate which is added to the payments on the shorter tenor length. More precisely, for the -tenor, the floating interest rate at tenor date is replaced by , for every . The time- value of such an agreement is given, for , by

| (6.3) |

We also want to compute the fair basis swap spread . This is the spread that makes the value of the basis swap equal zero at time , i.e. it is obtained by solving . We get that

| (6.4) |

The formulas for the fair swap rate and basis spread can be used to bootstrap the initial values of LIBOR rates from market data, see Mercurio (2010b, §2.4).

6.2. Caps

The valuation of caplets, and thus caps, in the multiple curve affine LIBOR model is an easy task, which has complexity equal to the complexity of the valuation of caplets in the single-curve affine LIBOR model; compare with Proposition 7.1 in Keller-Ressel et al. (2013). There are two reasons for this: on the one hand, the LIBOR rate is modeled directly, see (4.3), as opposed to e.g. Mercurio (2010a) where the LIBOR rate is modeled implicitly as the sum of the OIS rate and the spread. In our approach, the valuation of caplets remains a one-dimensional problem, while in the latter approach it becomes a ‘basket’ option on the OIS rate and the spread. On the other hand, the driving process remains affine under any forward measure, cf. Proposition 4.6, which allows the application of Fourier methods for option pricing. In the sequel, we will derive semi-explicit pricing formulas for any multiple curve affine LIBOR model. Let us point out that we do not need to ‘freeze the drift’ as is customary in LIBOR market models with jumps (see Remark 4.7).

Proposition 6.1.

Consider an -tenor caplet with strike that pays out at time . The time-0 price is provided by

| (6.5) |

for , assuming that , where , is given by (6.2), while the set is defined as

Proof.

Using (3.3) and (4.3) the time-0 price of the caplet equals

where

| (6.6) |

Now, using Eberlein, Glau, and Papapantoleon (2010, Thm 2.2, Ex. 5.1), we arrive directly at (6.5), where denotes the -moment generating function of the random variable , i.e. for ,

| (6.7) |

The last equality follows from Proposition 4.6, noting that implies . ∎

7. Valuation of swaptions and basis swaptions

This section is devoted to the pricing of options on interest rate and basis swaps, in other words, to the pricing of swaptions and basis swaptions. In the first part, we provide general expressions for the valuation of swaptions and basis swaptions making use of the structure of multiple curve affine LIBOR models. In the following two parts, we derive efficient and accurate approximations for the pricing of swaptions and basis swaptions by further utilizing the model properties, namely the preservation of the affine structure under any forward measure, and applying the linear boundary approximation developed by Singleton and Umantsev (2002). Similarly to the pricing of caplets, also here we do not have to ‘freeze the drift’, while in special cases we can even derive closed or semi-closed form solutions (cf. Keller-Ressel et al. 2013, §8).

Let us consider first a payer swaption with strike rate and exercise date on a fixed-for-floating interest rate swap starting at and maturing at ; this was defined in Section 6.1. A swaption can be regarded as a sequence of fixed payments that are received at the payment dates ; see Musiela and Rutkowski (2005, Section 13.1.2, p. 524). Here is the swap rate of the underlying swap at time , cf. (6.2). Note that the classical transformation of a payer (resp. receiver) swaption into a put (resp. call) option on a coupon bond is not valid in the multiple curve setup, since LIBOR rates cannot be expressed in terms of zero coupon bonds; see Remark 3.5.

The value of the swaption at time is provided by

since the swap rate is given by (6.2) for . Using (3.2), (4.3) and a telescoping product, we get that

Together with (4.3) for , this yields

| (7.1) |

where and the second equality follows from the measure change from to as given in (4.8).

Next, we move on to the pricing of basis swaptions. A basis swaption is an option to enter a basis swap with spread . We consider a basis swap as defined in Section 6.1, which starts at and ends at , while we assume that the exercise date is . The payoff of a basis swap at time is given by (6.3) for . Therefore, the price of a basis swaption at time is provided by

Along the lines of the derivation for swaptions and using (cf. (4.5)), we arrive at

| (7.2) |

where .

7.1. Approximation formula for swaptions

We will now derive an efficient approximation formula for the pricing of swaptions. The main ingredients in this formula are the affine property of the driving process under forward measures and the linearization of the exercise boundary. Numerical results for this approximation will be reported in Section 8.3.

We start by presenting some technical tools and assumptions that will be used in the sequel. We define the probability measures , for every , via the Radon–Nikodym density

| (7.3) |

The process is obviously a time-inhomogeneous affine process under every . More precisely, we have the following result which follows directly from Proposition 4.6.

Corollary 7.1.

The process is a time-inhomogeneous affine process under the measure , for every , with

| (7.4) |

where

| (7.5a) | ||||

| (7.5b) | ||||

for every with

| (7.6) |

The price of a swaption is provided by (7), while for simplicity we shall consider the price at time in the sequel. We can rewrite (7) as follows

| (7.7) | ||||

where, recalling (4.1) and (4.2), we define the function by

| (7.8) |

This function determines the exercise boundary for the price of the swaption.

Now, since we cannot compute the characteristic function of explicitly, we will follow Singleton and Umantsev (2002) and approximate by a linear function.

Approximation ().

We approximate

| (7.9) |

where the constants , are determined according to the linear regression procedure described in Singleton and Umantsev (2002, pp. 432-434). The line approximates the exercise boundary, hence and are strike-dependent.

The following assumption will be used for the pricing of swaptions and basis swaptions.

Assumption ().

The cumulative distribution function of is continuous for all .

Let denote the imaginary part of a complex number . Now, we state the main result of this subsection.

Proposition 7.2.

Proof.

Starting from the swaption price in (7.1) and using the relation between the terminal measure and the measures and in (4.8) and (7.3), we get that

| (7.11) |

In addition, from the inversion formula of Gil-Pelaez (1951) and using Assumption , we get that

| (7.12) | |||

| (7.13) |

for each , where we define

However, the above characteristic functions cannot be computed explicitly, in general, thus we will linearize the exercise boundary as described by Approximation . That is, we approximate the unknown characteristic functions with ones that admit an explicit expression due to the affine property of under the forward measures. Indeed, using Approximation , Proposition 4.6 and Corollary 7.1 we get that

| (7.14) | ||||

| (7.15) |

After inserting (7.12) and (7.13) into (7.11) and using (7.1) and (7.1) we arrive at the approximation formula for swaptions (7.2). ∎

Remark 7.3.

The pricing of swaptions is inherently a high-dimensional problem. The expectation in (7) corresponds to a -dimensional integral, where is the dimension of the driving process. However, the exercise boundary is non-linear and hard to compute, in general. See, e.g. Brace et al. (1997), Eberlein and Kluge (2006) or Keller-Ressel et al. (2013, §7.2, §8.3) for some exceptional cases that admit explicit solutions. Alternatively, one could express a swaption as a zero strike basket option written on underlying assets and use Fourier methods for pricing; see Hubalek and Kallsen (2005) or Hurd and Zhou (2010). This leads to a -dimensional numerical integration. Instead, the approximation derived in this section requires only the evaluation of univariate integrals together with the computation of the constants . This reduces the complexity of the problem considerably.

7.2. Approximation formula for basis swaptions

In this subsection, we derive an analogous approximate pricing formula for basis swaptions. Numerical results for this approximation will be reported in Section 8.4.

Similar to the case of swaptions, we can rewrite the time- price of a basis swaption (7.2) as follows:

| (7.16) |

where we define the function by

| (7.17) |

which determines the exercise boundary for the price of the basis swaption. This will be approximated by a linear function following again Singleton and Umantsev (2002).

Approximation ().

We approximate

| (7.18) |

where and are determined via a linear regression.

Proposition 7.4.

Proof.

Starting from the expression for the basis swaption price given in (7.16), we follow the same steps as in the previous section: First, we use the relation between the terminal measure and the measures to arrive at an expression similar to (7.11). Second, we approximate by in (7.18). Third, we define the approximate characteristic functions, which can be computed explicitly:

| (7.20) | ||||

| (7.21) |

for . Finally, putting all the pieces together we arrive at the approximation formula (7.4) for the price of a basis swaption. ∎

8. Numerical examples and calibration

The aim of this section is twofold: on the one hand, we demonstrate how the multiple curve affine LIBOR model can be calibrated to market data and, on the other hand, we test the accuracy of the swaption and basis swaption approximation formulas. We start by discussing how to build a model which can simultaneously fit caplet volatilities when the options have different underlying tenors. Next, we test numerically the swaption and basis swaption approximation formulas (7.2) and (7.4) using the calibrated models and parameters. In the last subsection, we build a simple model and compute exact and approximate swaption and basis swaption prices in a setup which can be easily reproduced by interested readers.

8.1. A specification with dependent rates

There are numerous ways of constructing models and the trade-off is usually between parsimony and fitting ability. We have elected here a heavily parametrized approach that focuses on the fitting ability, as we believe it best demonstrates the utility of our model. In particular, we want to show that affine LIBOR models, which are driven by positive affine processes, can indeed be calibrated well to market data. Moreover, it is usually easier to move from a complex specification towards a simpler one, than the converse.

We provide below a model specification where LIBOR rates are driven by common and idiosyncratic factors which is suitable for sequential calibration to market data. The starting point is to revisit the expression for LIBOR rates in (4.3):

| (8.1) | ||||

According to Proposition 4.2, when the dimension of the driving process is greater than one, then the vectors and are not fully determined by the initial term structure. Therefore, we can navigate through different model specifications by altering the structure of the sequences and .

Remark 8.1.

The following observation allows to create an (exponential) linear factor structure for the LIBOR rates with as many common and idiosyncratic factors as desired. Consider an -valued affine process

| (8.2) |

and denote the vectors by

| (8.3) |

Select a subset , set for all , and assume that are independent of . Then, it follows from (8.1) and Keller-Ressel (2008, Prop. 4.7) that will also be independent of and will depend only on . The same observation allows also to construct a model where different factors are used for driving the OIS and LIBOR rates; see also Section 4.1.

Let and consider the tenor structures where . The dataset under consideration contains caplets maturing on different dates for each tenor, where is less than the number of tenor points in and . In other words, only maturities are relevant for the calibration. The dynamics of OIS and LIBOR rates are driven by tuples of affine processes

| (8.4) | ||||

| (8.5) |

for , where denotes the common and the idiosyncratic factor for the -th maturity. Here , for and are independent Brownian motions. Moreover, are independent compound Poisson processes with constant intensity and exponentially distributed jumps with mean values , for . Therefore, the full process has dimension :

| (8.6) |

and the total number of process-specific parameters equals . The affine processes are mutually independent hence, using Proposition 4.7 in Keller-Ressel (2008), the functions , respectively , are known in terms of the functions and , respectively and , for all . The latter are provided, for example, by Grbac and Papapantoleon (2013, Ex. 2.3).

In order to create a ‘diagonal plus common’ factor structure, where each rate for each tenor is driven by an idiosyncratic factor and the common factor , we will utilize Remark 8.1. We start from the longest maturity, which is driven by the idiosyncratic factor and the common factor . Then, at the next caplet maturity date we add the independent idiosyncratic factor , while we cancel the contribution of by ‘freezing’ the values of and corresponding to that factor. The construction proceeds iteratively and the resulting structures for and are presented in Figures 8.4 and 8.5, where elements of below a certain ‘diagonal’ are ‘frozen’ to the latest-set value and copied to . These structures produce the desired feature that each rate is driven by an idiosyncratic and a common factor, while they do not violate inequalities , that stemm from Propositions 4.1 and 4.2. In Figures 8.4 and 8.5, for , i.e. this function maps caplet maturities into tenor points. Moreover, all elements in these matrices are non-negative and .

The boxed elements are the only ones that matter in terms of pricing caplets when these are not available at every tenor date of . The impact of the common factor is determined by the difference between and . If we set , it follows from Remark 8.1 that will be independent of the common factor and thus determined solely by the corresponding idiosyncratic factor , with . If the values of and are fixed a priori, the remaining values and are determined uniquely by the initial term structure of OIS and LIBOR rates; see again Propositions 4.1 and 4.2. This model structure is consistent with if and only if the sequences and are decreasing, and for every . Moreover, this structure will be consistent with the ‘normal’ market situation described in Remark 4.5 if, in addition, and for every .

The corresponding matrices for the tenor are constructed in a similar manner. More precisely, is constructed by simply copying the relevant rows from . Simultaneously, for the elements are introduced in order to fit the -initial LIBOR term structure, as well as the elements which determine the role of the common factor. We present only four rows from these matrices in Figures 8.7 and 8.7, for the sake of brevity.

8.2. Calibration to caplet data

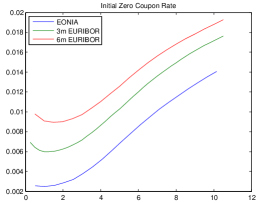

The data we use for calibration are from the EUR market on 27 May 2013 collected from Bloomberg. These market data correspond to fully collateralized contracts, hence they are considered ‘clean’. Bloomberg provides synthetic zero coupon bond prices for EURIBOR rates, as well as OIS rates constructed in a manner described in Akkara (2012). In our example, we will focus on the 3 and 6 month tenors only. The zero coupon bond prices are converted into zero coupon rates and plotted in Figure 8.8.

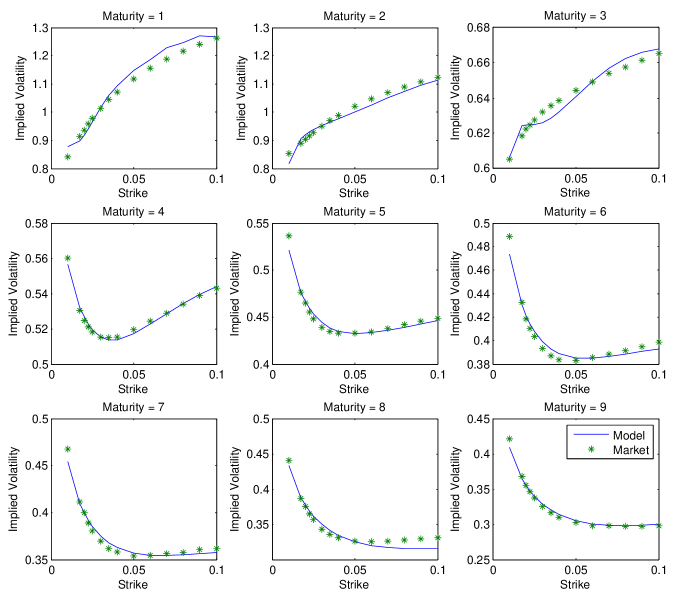

Cap prices are converted into caplet implied volatilities using the algorithm described in Levin (2012). The implied volatility is calculated using OIS discounting when inverting the Black (1976) formula. The caplet data we have at our disposal correspond to 3- and 6-month tenor structures. More precisely, in the EUR market caps written on the 3-month tenor are quoted only up to a maturity of 2 years, while 6-month tenor caps are quoted from maturity 3 years and onwards. Moreover, we have option prices only for the maturities corresponding to entire years and not for every tenor point. We have a grid of 14 strikes ranging from to as quoted in Bloomberg. We calibrate to caplet data for maturities years and the OIS zero coupon bond defines the terminal measure111We found that the model performs slightly better in calibration using this numeraire, than when choosing 10 years as the terminal maturity.. We fix in advance the values of the parameters , and , as well as the parameters of the process . The impact of is determined by the spread between and , and and for the 3m and 6m tenor caplets respectively, and we will simplify by setting constant. The constant , along with and are not identified by the initial term structures and have to be determined in some other manner (e.g. by calibration to swaptions or basis swaptions). They also cannot be chosen completely freely and one has to validate that the values of and stemming from these procedures satisfy the necessary inequalities, i.e. . Having this in mind, we chose these values in a manner such that accounts for approximately 50% of the total variance of LIBOR rates from maturities 4 until 10, and about 10% of the total variance for maturities 1 until 3. We have verified through experimentation that this ad-hoc choice of dependence structure does not have a qualitative impact on the results of the following sections. Alternatively, these parameters could be calibrated to derivatives such as swaptions, basis swaptions or other derivatives partly determined by the dependence structure of the LIBOR rates. However, since interest rate derivative markets remain highly segmented and joint calibration of caplets and swaptions is a perennial challenge, see e.g. Brigo and Mercurio (2006) or Ladkau, Schoenmakers, and Zhang (2013), we will leave this issue for future research.

The model construction summarized in Figures 8.4–8.7 has the advantage that caplets can be calibrated sequentially one maturity at a time starting at the longest maturity and then moving backwards. In the calibration procedure we fit the parameters of each idiosyncratic process to caplet prices with maturity while simultaneously choosing and to match the corresponding values of the initial OIS and LIBOR rates. Caplets are priced using formula (6.5) and the parameters are found using standard least-squares minimization between market and model implied volatility. The results222All calibrated and chosen parameter values as well as the calibrated matrices for are available from the authors upon request. from fitting the caplets are shown in Figure 8.9. We can observe that the model performs very well for different types of volatility smiles across the whole term structure, with only minor problems for extreme strikes in maturities 1-3. These problems are however mainly cosmetic in nature as these prices and more importantly the deltas for these contracts are very close to zero anyway, making any model error in this region economically insignificant.

8.3. Swaption price approximation

The next two sections are devoted to numerically testing the validity of the swaption and basis swaption price approximation formulas derived in Sections 7.1 and 7.2. We will run a Monte Carlo study comparing the true price with the linear boundary approximation formula. The model parameters used stem from the calibration to the market data described in the previous section.

Let us denote the true and the approximate prices as follows:

where and were defined in (7.1) and (7.9) respectively. The Monte Carlo (MC) estimator333We construct the Monte Carlo estimate using 5 million paths of with 10 discretization steps per year. In each discretization step the continuous part is simulated using the algorithm in Glasserman (2003, §3.4.1) while the jump part is handled using Glasserman (2003, pp. 137–139) with jump size distribution changed from log-normal to exponential. of is denoted by and we will refer to it as the ‘true price’. Instead of computing using Fourier methods, we will form another MC estimator . This has the advantage that, when the same realizations are used to calculate both MC estimators, the difference will be an estimate of the error induced by the linear boundary approximation which is minimally affected by simulation bias.

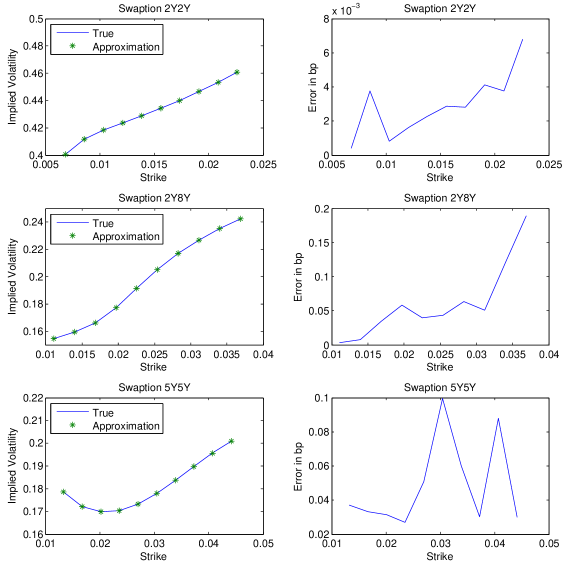

Swaption prices vary considerably across strike and maturity, thus we will express the difference between the true and the approximate price in terms of implied volatility (using OIS discounting), which better demonstrates the economic significance of any potential errors. We price swaptions on three different underlying swaps. The results for the 3m underlying tenor are exhibited in Figure 8.10. The corresponding results for the 6m tenor swaptions have errors which are approximately one half the level in the graphs shown here and have been omitted for brevity.

On the left hand side of Figure 8.10, implied volatility levels are plotted for the true and the approximate prices. The strikes are chosen to range from 60% to 200% of the spot value of the underlying fair swap rate, which is the normal range the products are quoted. The right hand side shows the difference between the two implied volatilities in basis points (i.e. multiplied by ). As was also documented in Schrager and Pelsser (2006), the errors of the approximation usually increase with the number of payments in the underlying swap. This is also the case here, however the level of the errors is in all cases very low. In normal markets, bid-ask spreads typically range from 10 to 300 bp (at the at-the-money level) thus even the highest errors are too small to be of any economic significance. This is true even in the case of the 2Y8Y swaption which contains 32 payments.

8.4. Basis swaption price approximation

In order to test the approximation formula for basis swaptions, we will follow the same methodology as in the previous subsection. That is, we calculate MC estimators for the following two expectations:

where , while and were defined in (7.2) and (7.18). Using the same realizations, we plot the level, absolute and relative differences between both prices measured in basis points as a function of the spread for three different underlying basis swaps. The spreads are chosen to range from 50% to 200% of the at-the-money level, i.e. the spread that sets the underlying basis swap to a value of zero, see again (6.4),

The numerical results can be seen in Figure 8.11. We have chosen these maturities to be representative of two general patterns. The first is that the errors tend to increase with the length of the basis swap, which is exemplified by comparing errors for the 2Y8Y, 5Y5Y and 6Y2Y contracts. The second pattern relates to when the majority of payments in the contract are paid out. We can notice that the errors for the 2Y2Y contract are much larger than for the corresponding 6Y2Y, even though both contain the same number of payments. Furthermore, we can also see that the 2Y2Y contract has larger errors than the 2Y8Y even though both have the same maturity and the latter has more payments. This anomalous result can be explained by the convexity of the term structure of interest rates. In Figure 8.8 we can notice that the majority of the payments of the 2Y2Y contract fall in a particularly curved region of the term structure. This will result in an exercise boundary which is also more nonlinear, thus leading to the relative deterioration of the linear boundary approximation. However, it must be emphasized that the errors are still at a level easily deemed economically insignificant, with a maximum relative error of 0.4% in a spread region where the price levels are particularly low.

Remark 8.2.

The approximative formulas from Propositions 7.2 and 7.4 can be used for calibration to swaptions and basis swaptions. Error bounds for these approximations are not available in closed form and thus accuracy in the entire parameter space cannot be guaranteed. Any desired accuracy in pricing is achievable using Monte Carlo methods, which means that the accuracy of the approximate formula can always be validated numerically. However, when performing a full calibration, which may require several hundreds of iterations in order to achieve convergence in a numerical optimization procedure, Monte Carlo methods are slow in comparison to the analytical approximation. Thus, in order to calibrate to swaption prices, one would prefer the approximation to the Monte Carlo method. Then one can perform a Monte Carlo simulation (just one) to validate that the approximation is also correct for the parameters found by the numerical optimization. Let us also mention that in a typical calibration procedure an acceptable error is around 2%, well above the error of the approximative formulas, else the risk of overifitting the data is present.

8.5. A simple example

The purpose of this section is to provide a simple example to help the reader’s intuition regarding the numerical implementation of the model. We present a fully constructed and more manageable numerical toy example of fitting the model parameters and to the initial term structures, which can be reproduced by the reader himself/herself as opposed to the full calibration example in Sections 8.3 and 8.4. Moreover, we show in this simple setting how Approximations and are computed.

We start by choosing a simple two factor model with

| (8.7) |

where we set

| 1 | 0.5000 | 0.1000 | 1.5300 | 0.2660 | 0 | 0 |

|---|---|---|---|---|---|---|

| 2 | 9.4531 | 0.0407 | 0.0591 | 0.4640 | 0.0074 | 0.2499 |

The initial term structures are constructed from a Nelson–Siegel parametrization of the zero coupon rate

| (8.8) |

We limit ourselves to two tenors, corresponding to 3 months and corresponding to 6 months. We construct the initial curves from the following parameters

| Curve | ||||

|---|---|---|---|---|

| OIS | 0.0003 | 0.01 | 0.07 | 0.06 |

| 3m | 0.0032 | 0.01 | 0.07 | 0.06 |

| 6m | 0.0050 | 0.01 | 0.07 | 0.06 |

In particular, we use (8.8) to construct the initial 3- and 6-month LIBOR curves via the expression

for , and a third one to construct an initial OIS curve consistent with the system

Moreover, we construct the matrices and in the following simple manner

| (8.9) | ||||

| (8.10) | ||||

| (8.11) | ||||

| (8.12) |

and , where for . The bond defines the terminal measure, thus and . We set , and . The remaining values can then be determined uniquely using equations (4.4) and (4.6), i.e. by fitting the initial term structures. We get that

| 0 | - | 0.008966 | - | 0.009035 |

|---|---|---|---|---|

| 1 | 0.008638 | 0.008641 | 0.008286 | 0.008358 |

| 2 | 0.008286 | 0.008289 | 0.007505 | 0.007577 |

| 3 | 0.007908 | 0.007911 | 0.006625 | 0.006697 |

| 4 | 0.007505 | 0.007507 | 0.005652 | 0.005725 |

| 5 | 0.007077 | 0.007079 | 0.004591 | 0.004664 |

| 6 | 0.006625 | 0.006627 | 0.003447 | 0.003520 |

| 7 | 0.006150 | 0.006152 | 0.002225 | 0.002298 |

| 8 | 0.005652 | 0.005654 | 0.000929 | 0.001003 |

| 9 | 0.005132 | 0.005135 | 0 | - |

| 10 | 0.004591 | 0.004594 | ||

| 11 | 0.004029 | 0.004032 | ||

| 12 | 0.003447 | 0.003450 | ||

| 13 | 0.002847 | 0.002848 | ||

| 14 | 0.002225 | 0.002228 | ||

| 15 | 0.001586 | 0.001589 | ||

| 16 | 0.000929 | 0.000932 | ||

| 17 | 0.000254 | 0.000257 | ||

| 18 | 0 | - |

We can observe that all sequences for are decreasing, which corresponds to the ‘normal’ market situation; see again Remark 4.5.

8.5.1. Swaption approximation

Let us consider a 2Y2Y swaption on 3 month LIBOR rates, i.e. a swaption in the notation of Section 7.1 with and . We run a Monte Carlo study equivalent to the one in Section 8.3 and the results are reported for four different strikes:

| Strike () | Error | IV (%) | IV Error | |||

|---|---|---|---|---|---|---|

| 0.013238 | 176.17 | 2.06e-08 | 30.38 | 2.326e-10 | -5.5403 | (1.1596 1) |

| 0.023535 | 52.214 | 4.31e-08 | 26.78 | 1.818e-10 | -10.2982 | (1.1605 1) |

| 0.033831 | 9.7898 | 4.09e-08 | 24.82 | 2.971e-10 | -15.0481 | (1.1615 1) |

| 0.044128 | 1.4016 | 7.90e-09 | 23.72 | 2.016e-10 | -19.7899 | (1.1625 1) |

where

-

•

and IV denote the MC estimator of the price (in basis points) and the implied volatility (with OIS discounting) using the true exercise boundary defined in (7.1).

-

•

Error , where denotes the MC estimator of the price (in basis points) using the approximate exercise boundary defined in (7.9).

-

•

IV Error = , where denotes the implied volatility (with OIS discounting) calculated from .

-

•

and determine the linear approximation to the exercise boundary defined by the function in (7.1):

Applying the procedure in Singleton and Umantsev (2002, pp. 432–434), we first calculate the upper and lower quantiles for using Gaussian approximations for speed. We solve for and in

Then, and are computed by fitting the straight line

through the two points and .

8.5.2. Basis swaption approximation

Let us also consider a 2Y2Y basis swaption. This is an option to enter into a basis swap paying 3 month LIBOR plus spread and receiving 6 month LIBOR, which starts at year 2 and ends at year 4. Once again we conduct a Monte Carlo study equivalent to Section 8.4, and get that

| Spread () | Price Error | |||

|---|---|---|---|---|

| 0.0010945 | 13.778 | 2.103e-06 | -7.7191 | (1 5.7514) |

| 0.0019458 | 3.7972 | 4.784e-05 | -14.0029 | (1 5.7694) |

| 0.0027971 | 0.64406 | 9.364e-05 | -20.2158 | (1 5.7868) |

| 0.0036484 | 0.080951 | 5.852e-05 | -26.3597 | (1 5.8037) |

where

-

•

denotes the MC estimator of the price (in basis points) using the true exercise boundary defined in (7.2).

-

•

Price Error := , where similarly denotes the MC estimator of the price (in basis points) using the approximate exercise boundary defined in (7.18).

-

•

and determine the linear approximation to the exercise boundary defined by the function in (7.2):

Applying again the same procedure, we first calculate the upper and lower quantiles for and solve for and in

Then, and are computed by fitting the straight line

through the two points and .

9. Concluding remarks and future research

Finally, let us conclude with some remarks that further highlight the merits of the affine LIBOR models and some topics for future research. Consider the following exotic product: a loan with respect to a 1$ notional over a monthly tenor structure with optional interest payments due to the following scheme: At time the product holder may contract to settle the first interest payment either after one, three, or six months (as long as the maturity is not exceeded). Next, at the first settlement date, the holder may choose again either the one, three, or six month LIBOR to be settled one, three or six months later (while not exceeding ). She/He continues until the last payment is settled at and the notional is payed back. Clearly, the value of this product at in the single curve (pre-crisis) LIBOR world would be simply zero. However, in the multiple curve world the pricing of this product is highly non-trivial. In particular, such an evaluation would involve the dynamics of any LIBOR rate over the periods where equals one, three or six months. As a matter of fact, the affine LIBOR model with multiple curves presented in this paper is tailor made for this problem as it produces ‘internally consistent’ LIBOR and OIS rates over any sub-tenor structure. This means that for all sub-tenor structures the rates have the same type of dynamics and the driving process remains affine under any forward measure. To the best of our knowledge, this is the only multiple curve LIBOR model in the literature that naturally produces this consistency across all different tenors. The full details of the pricing of this product are, however, beyond the scope of this article.

The property of ‘internal consistency’ is beneficial already in the single curve LIBOR models. More precisely, the dynamics of LIBOR rates in the ‘classical’ LIBOR market models are specified by setting a ‘natural’ volatility structure of a LIBOR system based on a particular tenor structure. As a consequence, the volatilities of the LIBOR rates spanning e.g. a double period length are immediately hard to determine, as they contain the LIBOR rates of the shorter period. On the contrary, in the single curve affine LIBOR models the dynamics of the LIBOR are specified via ratios of martingales that are connected with different underlying tenors, thus one has simultaneously specified the dynamics of all possible LIBOR rates in an internally consistent way.

However, the other side of this coin is that a proper choice of the driving affine process, and the effective calibration of the affine LIBOR models entailed, are far from trivial. In fact these issues require the development of new approaches and thus provide a new strand of research on its own. Therefore the calibration experiments in this paper are to be considered preliminary and merely to demonstrate the potential flexibility of the affine LIBOR model with multiple curves.

Appendix A Terminal correlations

This appendix is devoted to the computation of terminal correlations. The expression ‘terminal correlation’ is used in the same sense as in Brigo and Mercurio (2006, §6.6), i.e. it summarizes the degree of dependence between two LIBOR rates at a fixed, terminal time point. Here the driving process is a general affine process and not just an affine diffusion as in Section 5.4.

We start by introducing some shorthand notation

where and for . Then, we have from (4.3) that

| (A.1) |

for and . We also denote the moment generating function of under the measure as follows

| (A.2) |

Therefore we get that

| (A.3) | ||||

| (A.4) | ||||

| (A.5) |

The formula for terminal correlations follows after inserting the expressions above in the definition of correlation and doing some tedious, but straightforward, computations

References

- Akkara (2012) G. Akkara. OIS discounting and dual-curve stripping methodology at Bloomberg. Technical documentation, Bloomberg L.P., 2012.

- Amin and Jarrow (1991) K. Amin and R. Jarrow. Pricing foreign currency options under stochastic interest rates. J. Int. Money and Finance, 10:310–329, 1991.

- Andersen and Piterbarg (2010) L. B. G. Andersen and V. V. Piterbarg. Interest Rate Modeling, 3 Vols. Atlantic Financial Press, 2010.

- Bianchetti (2010) M. Bianchetti. Two curves, one price. Risk, pages 74–80, August 2010.

- Bianchetti and Morini (2013) M. Bianchetti and M. Morini, editors. Interest Rate Modelling After the Financial Crisis. Risk Books, 2013.

- Bielecki and Rutkowski (2002) T. R. Bielecki and M. Rutkowski. Credit Risk: Modeling, Valuation and Hedging. Springer, 2002.

- Black (1976) F. Black. The pricing of commodity contracts. J. Financ. Econ., 3:167–179, 1976.

- Brace et al. (1997) A. Brace, D. Ga̧tarek, and M. Musiela. The market model of interest rate dynamics. Math. Finance, 7:127–155, 1997.

- Brigo and Mercurio (2006) D. Brigo and F. Mercurio. Interest Rate Models: Theory and Practice. Springer, 2nd edition, 2006.

- Crépey et al. (2012) S. Crépey, Z. Grbac, and H.-N. Nguyen. A multiple-curve HJM model of interbank risk. Math. Financ. Econ., 6:155–190, 2012.

- Crépey et al. (2015a) S. Crépey, Z. Grbac, N. Ngor, and D. Skovmand. A Lévy HJM multiple-curve model with application to CVA computation. Quant. Finance, 15:401–419, 2015a.

- Crépey et al. (2015b) S. Crépey, A. Macrina, T. M. Nguyen, and D. Skovmand. Rational multi-curve models with counterparty-risk valuation adjustments. Preprint, arXiv/1502.07397, 2015b.

- Cuchiero et al. (2014) C. Cuchiero, C. Fontana, and A. Gnoatto. A general HJM framework for multiple curve modeling. Preprint, arXiv/1406.4301, 2014.

- Duffie et al. (2003) D. Duffie, D. Filipović, and W. Schachermayer. Affine processes and applications in finance. Ann. Appl. Probab., 13:984–1053, 2003.

- Eberlein and Kluge (2006) E. Eberlein and W. Kluge. Exact pricing formulae for caps and swaptions in a Lévy term structure model. J. Comput. Finance, 9:99–125, 2006.

- Eberlein and Kluge (2007) E. Eberlein and W. Kluge. Calibration of Lévy term structure models. In M. Fu, R. A. Jarrow, J.-Y. Yen, and R. J. Elliott, editors, Advances in Mathematical Finance: In Honor of Dilip B. Madan, pages 155–180. Birkhäuser, 2007.

- Eberlein et al. (2010) E. Eberlein, K. Glau, and A. Papapantoleon. Analysis of Fourier transform valuation formulas and applications. Appl. Math. Finance, 17:211–240, 2010.

- Filipović (2005) D. Filipović. Time-inhomogeneous affine processes. Stochastic Process. Appl., 115:639–659, 2005.

- Filipović (2009) D. Filipović. Term-Structure Models: A Graduate Course. Springer, 2009.

- Filipović and Trolle (2013) D. Filipović and A. Trolle. The term structure of interbank risk. J. Financ. Econom., 109:707–733, 2013.

- Flesaker and Hughston (1996) B. Flesaker and L. P. Hughston. Positive interest. Risk Magazine, 9:46–49, 1996.

- Fujii et al. (2011) M. Fujii, Y. Shimada, and A. Takahashi. A market model of interest rates with dynamic basis spreads in the presence of collateral and multiple currencies. Wilmott Mag., 54:61–73, 2011.

- Gallitschke et al. (2014) J. Gallitschke, S. Müller, and F. T. Seifried. Post-crisis interest rates: XIBOR mechanics and basis spreads. Preprint, SSRN/2448657, 2014.

- Gil-Pelaez (1951) J. Gil-Pelaez. Note on the inversion theorem. Biometrika, 38:481–482, 1951.

- Glasserman (2003) P. Glasserman. Monte Carlo Methods in Financial Engineering. Springer, 2003.

- Grbac and Papapantoleon (2013) Z. Grbac and A. Papapantoleon. A tractable LIBOR model with default risk. Math. Finan. Econ., 7:203–227, 2013.

- Henrard (2010) M. Henrard. The irony in the derivatives discounting part II: the crisis. Wilmott Journal, 2:301–316, 2010.

- Hubalek and Kallsen (2005) F. Hubalek and J. Kallsen. Variance-optimal hedging and Markowitz-efficient portfolios for multivariate processes with stationary independent increments with and without constraints. Working paper, TU München, 2005.

- Hull and White (2013) J. Hull and A. White. LIBOR vs. OIS: The derivatives discounting dilemma. J. Invest. Management, 11(3):14–27, 2013.

- Hurd and Zhou (2010) T. R. Hurd and Z. Zhou. A Fourier transform method for spread option pricing. SIAM J. Financial Math., 1:142–157, 2010.

- Jamshidian (1997) F. Jamshidian. LIBOR and swap market models and measures. Finance Stoch., 1:293–330, 1997.

- Keller-Ressel (2008) M. Keller-Ressel. Affine Processes: Theory and Applications to Finance. PhD thesis, TU Vienna, 2008.

- Keller-Ressel and Mayerhofer (2015) M. Keller-Ressel and E. Mayerhofer. Exponential moments of affine processes. Ann. Appl. Probab, 25:714–752, 2015.

- Keller-Ressel et al. (2013) M. Keller-Ressel, A. Papapantoleon, and J. Teichmann. The affine LIBOR models. Math. Finance, 23:627–658, 2013.

- Kenyon (2010) C. Kenyon. Short-rate pricing after the liquidity and credit shocks: including the basis. Risk, pages 83–87, November 2010.

- Kijima et al. (2009) M. Kijima, K. Tanaka, and T. Wong. A multi-quality model of interest rates. Quant. Finance, 9:133–145, 2009.

- Ladkau et al. (2013) M. Ladkau, J. Schoenmakers, and J. Zhang. Libor model with expiry-wise stochastic volatility and displacement. Int. J. Portfolio Analysis and Management, 1:224–249, 2013.

- Levin (2012) K. Levin. The Bloomberg volatility cube. Technical documentation, Bloomberg L.P., 2012.

- Mercurio (2009) F. Mercurio. Interest rates and the credit crunch: New formulas and market models. Preprint, SSRN/1332205, 2009.

- Mercurio (2010a) F. Mercurio. A LIBOR market model with a stochastic basis. Risk, pages 84–89, December 2010a.

- Mercurio (2010b) F. Mercurio. LIBOR market models with stochastic basis. Preprint, SSRN/1563685, 2010b.

- Mercurio and Xie (2012) F. Mercurio and Z. Xie. The basis goes stochastic. Risk, pages 78–83, December 2012.

- Moreni and Pallavicini (2014) N. Moreni and A. Pallavicini. Parsimonious HJM modelling for multiple yield-curve dynamics. Quant. Finance, 14:199–210, 2014.

- Morino and Runggaldier (2014) L. Morino and W. J. Runggaldier. On multicurve models for the term structure. In R. Dieci, X. Z. He, and C. Hommes, editors, Nonlinear Economic Dynamics and Financial Modelling, pages 275–290. Springer, 2014.

- Musiela and Rutkowski (2005) M. Musiela and M. Rutkowski. Martingale Methods in Financial Modelling. Springer, 2nd edition, 2005.