A Non Convex Singular Stochastic Control Problem

and its Related Optimal Stopping Boundaries111The first and the third authors were supported by EPSRC grant EP/K00557X/1; financial support by the German Research Foundation (DFG) via grant Ri–1128–4–1 is gratefully acknowledged by the second author.

Abstract. Equivalences are known between problems of singular stochastic control (SSC) with convex performance criteria and related questions of optimal stopping, see for example Karatzas and Shreve [SIAM J. Control Optim. (1984)]. The aim of this paper is to investigate how far connections of this type generalise to a non convex problem of purchasing electricity. Where the classical equivalence breaks down we provide alternative connections to optimal stopping problems.

We consider a non convex infinite time horizon SSC problem whose state consists of an uncontrolled diffusion representing a real-valued commodity price, and a controlled increasing bounded process representing an inventory. We analyse the geometry of the action and inaction regions by characterising their (optimal) boundaries. Unlike the case of convex SSC problems we find that the optimal boundaries may be both reflecting and repelling and it is natural to interpret the problem as one of SSC with discretionary stopping.

Keywords: finite-fuel singular stochastic control; optimal stopping; free-boundary; smooth-fit; Hamilton-Jacobi-Bellmann equation; irreversible investment.

MSC2010 subsject classification: 91B70, 93E20, 60G40, 49L20.

1 Introduction and Problem Formulation

It is well known that convexity of the performance criterion suffices to link certain singular stochastic control problems to related problems of optimal stopping (cf. [16], [24] and [25], among others). In this paper we establish multiple connections with optimal stopping for a non convex, infinite time-horizon, two-dimensional, degenerate singular stochastic control problem motivated by a problem of purchasing electricity. The non convexity arises because our electricity price model allows for both positive and negative prices.

We model the purchase of electricity over time at a stochastic real-valued spot price for the purpose of storage in a battery (for example, the battery of an electric vehicle). The battery must be full at a random terminal time, any deficit being met by a less efficient charging method. This feature is captured by inclusion of a terminal cost term equal to the product of the terminal spot price and a convex function of the undersupply. Under the assumption of a random terminal time independent of and exponentially distributed, we show in Appendix A that this optimisation problem is equivalent to solving the following problem.

Letting and be constants, a set of bounded increasing controls, a continuous strong Markov process starting from at time zero and a process representing the level of storage at time :

| (1.1) |

the problem is to find

| (1.2) |

with

| (1.3) |

and the minimising control policy . It is notable that the integrands in (1.3) may assume both positive and negative values: economically this corresponds to the possibility that the price is negative prior to or at the random terminal time in the original optimisation problem discussed in Appendix A.

In common with other commodity prices, the standard approach in the literature is to model electricity prices through a geometric or arithmetic mean reverting process (see, e.g., [21] or [30] and references therein). Motivated by deregulated electricity markets with renewable generation, in which periods of negative electricity prices have been observed due to the requirement to balance real-time supply and demand, we assume an arithmetic model. We assume that follows a standard time-homogeneous Ornstein-Uhlenbeck process222See Appendix B for general facts on the Ornstein-Uhlenbeck process. with positive volatility , positive adjustment rate and positive asymptotic (or equilibrium) value . On a complete probability space , with the filtration generated by a one-dimensional standard Brownian motion and augmented by -null sets, we therefore take as the unique strong solution of

| (1.4) |

We assume that the electricity storage capacity is bounded above by 1 (this resembles a so-called finite-fuel constraint, see for example [16]): for any initial level the set of admissible controls is

and represents the cumulative amount of energy purchased up to time . From now on we make the following standing assumption on the running cost function .

Assumption 1.1.

lies in and is decreasing and strictly convex with .

We note that we do not cover with Assumption 1.1 the case of a linear running cost function, although the solution in the linear case is simpler and follows immediately from the results contained in Sections 2 and 3 below.

With these specifications problem (1.2) shares common features with the class of finite-fuel, singular stochastic control problems of monotone follower type (see, e.g., [6], [11], [16], [17], [25] and [26] as classical references on finite-fuel monotone follower problems). Such problems, with finite or infinite fuel and a running cost (profit) which is convex (concave) in the control variable, have been well studied for over 30 years (see, e.g., [2], [3], [5], [10], [16], [17], [23], [24], [25] and [26], among many others). Remarkably it turns out that convexity (or concavity), together with other more technical conditions, is sufficient to prove that such singular stochastic control problems are equivalent to related problems of optimal stopping; moreover the optimally controlled state process is the solution of a Skorokhod reflection problem at the free-boundary of the latter (see, e.g., [10], [16], [24], [25] and [26]).

In our case the weighting function appearing in the running cost is strictly convex, the marginal cost of exercising control is linear in the control variable, and the set of admissible controls (cf. (1)) is convex. However the Ornstein-Uhlenbeck process of (1.4) can assume negative values with positive probability and is also a factor of the running cost so that the total expected cost functional (1.3) is not convex in the control variable. Therefore the connection between singular stochastic control and optimal stopping as addressed in [16], [24] and [25], among others, is no longer guaranteed for problem (1.2).

The optimisation problem we study (in common with many others in the literature, see for instance [18], [19], [29], [31] or [35]) has two state variables, one which is diffusive and the other which is a control process, a setup typically referred to as degenerate two-dimensional. Our particular problem may be regarded as a two-dimensional (history dependent) relative of a class of one-dimensional problems studied for example in a series of papers by Alvarez (see [1], [2] and [3] and references therein). The latter problems are neither convex nor concave, and the ‘critical depensation’ which they exhibit is also observed in the solutions we find. Their solutions are, however, found in terms of optimal boundaries represented by points on the real axis rather than the free boundary curves studied in the present paper. An advantage of the one-dimensional setting is that general theory may be applied to develop solutions for general diffusion processes. Since additional arguments are required to verify the optimality of the free boundaries in our two-dimensional degenerate setting, however, such generality does not seem achievable and we work with the specific class of Ornstein-Uhlenbeck processes given by (1.4).

We now briefly summarise the main findings that will be discussed and proved in detail in Sections 1.1, 2, 3 and 4. We begin in Section 1.1 with a useful restatement of the problem (1.2) as a singular stochastic control problem with discretionary stopping (SSCDS) (see Eq. (1.9) below). To the best of our knowledge SSCDS problems were originally introduced in [12]. In that paper the authors aimed at minimising total expected costs with a quadratic running cost depending on a Brownian motion linearly controlled by a bounded variation process, and with a constant cost of exercising control. The case of finite-fuel SSCDS was then considered in [28] were a terminal quadratic cost at the time of discretionary stopping was also included. A detailed analysis of the variational inequalities arising in singular control problems with discretionary stopping may be found in [32] and [33].

Our SSCDS problem (1.2) exhibits three regimes depending on the sign of the function

| (1.6) |

over . We will show (Section 3) that for fixed , the sign of the function determines the nature of the relationship between the price level and the net contribution to the infimum (1.2) (equivalently, the infimum (1.9)) from exercising control. In particular, when this relationship is increasing and when it is decreasing.

Since is strictly increasing by the strict convexity of (cf. Assumption 1.1) define as the unique solution of

| (1.7) |

should one exist, in which case may belong to or not depending on the choice of and on the value of the parameters of the model.

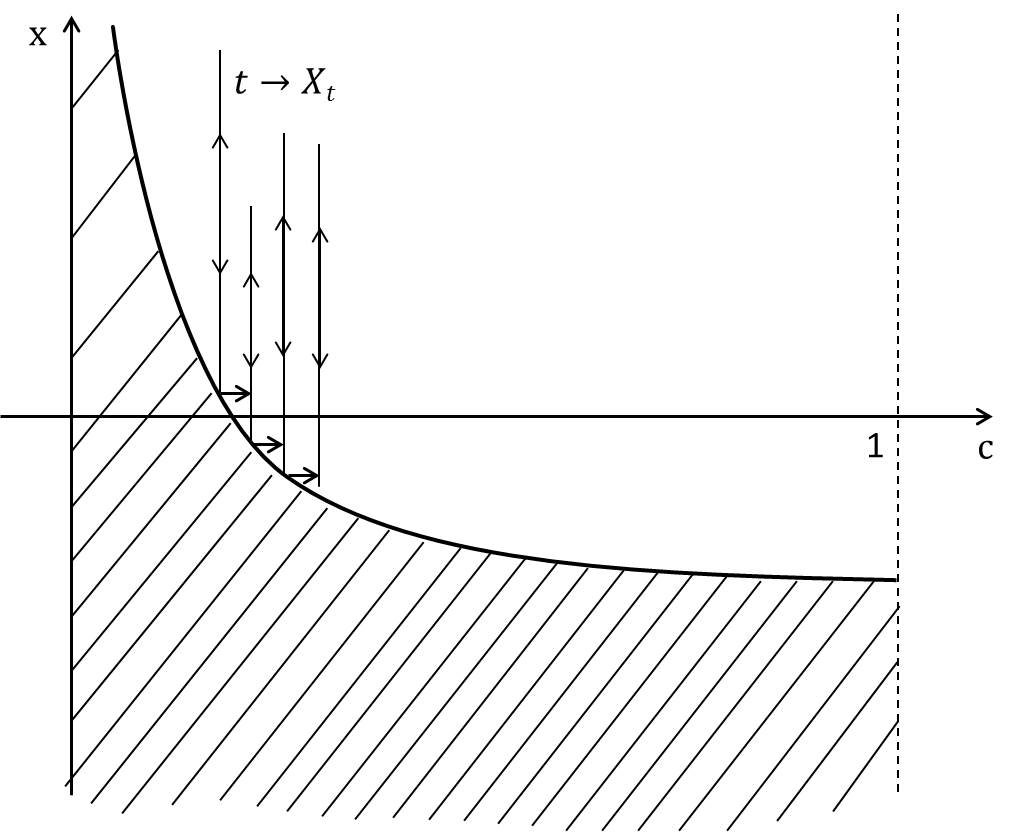

In Section 2 we study the case in which for all (and hence , if it exists). We show that although problem (1.2) is non convex, the optimal control policy behaves as that of a convex finite-fuel singular stochastic control problem of monotone follower type (cf., e.g., [16], [25] and [26]) and, accordingly, (i) the optimal control is of the reflecting type, being the minimal effort to keep the (optimally) controlled state variable inside the closure of the continuation region of an associated optimal stopping problem up to the time at which all the fuel has been spent, and (ii) the directional derivative of (1.2) in the variable coincides with the value function of the associated optimal stopping problem. In this case the infimum over stopping times is not achieved in the SSCDS formulation (1.9), which may be interpreted as a formally infinite optimal stopping time.

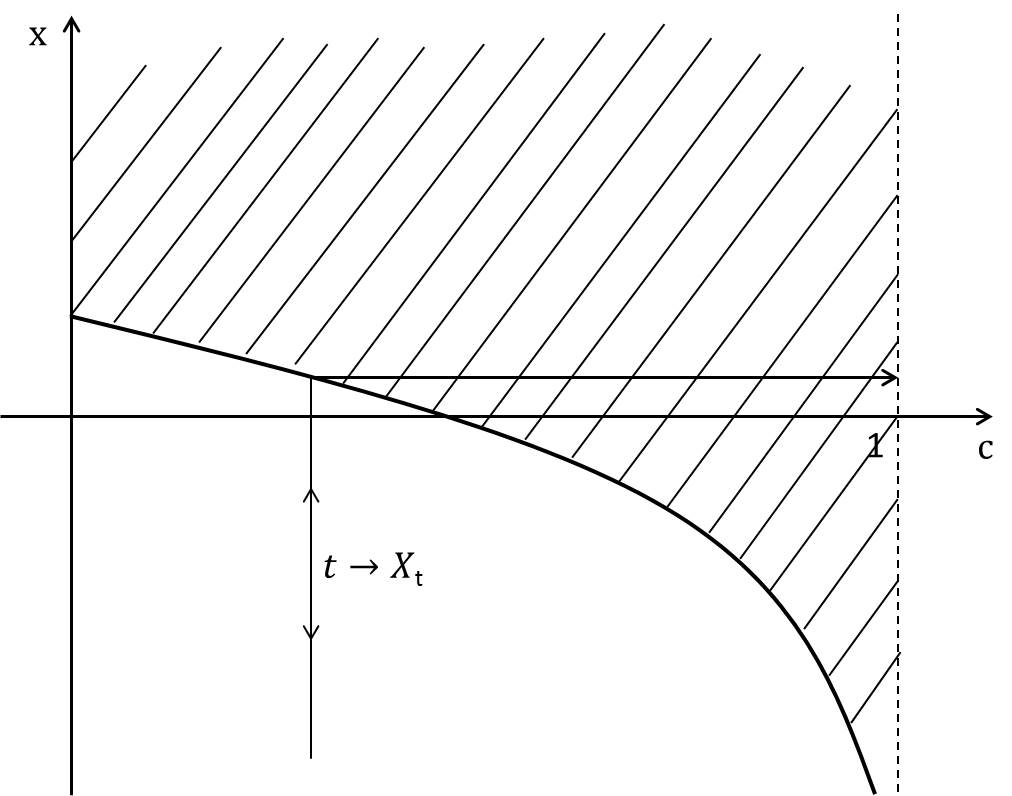

On the other hand, in Section 3 we assume for all (and hence ). In this case the optimal singular control policy in (1.9) is identically zero, which may be interpreted as problem (1.2) becoming a stopping problem in which it is optimal to do nothing up to the first hitting time of at a repelling barrier (in the language of [28]) and then to exercise all the available control. In particular the differential connection between SSC and optimal stopping observed in the previous case breaks down here and, to the best of our knowledge, this is a rare example of such an effect in the literature on SSC problems.

The case when exists in is discussed in Section 4. This case, in general involving multiple free-boundaries, is left as an open problem although we refer to a complete solution of the limiting case (cf. (1.4)) derived in a companion paper [13]. Finally, we collect in the Appendix the model formulation, some well known facts on the Ornstein-Uhlenbeck process and some technical results.

Before concluding this section we observe that problem (1.2) may also fit in the economic literature as an irreversible investment problem with stochastic investment cost. It is well known that in the presence of a convex cost criterion (or concave profit) the optimal (stochastic) irreversible investment policy consists in keeping the production capacity at or above a certain reference level (see, e.g., [9], [15] and [34]; cf. also [4] among others for the case of stochastic investments cost) which has been recently characterized in [19] and [35] where it is referred to as base capacity. The index describes the desirable level of capacity at time . If the firm has capacity , then it faces excess capacity and should wait. If the capacity is below , then it should invest in order to reach the level .

Our analysis shows that in presence of non-convex costs it is not always optimal to invest just enough to keep the capacity at or above a base capacity level. In fact, for a suitable choice of the parameters () the optimal investment policy is of a purely dichotomous bang-bang type: not invest or go to full capacity. On the other hand, for a different choice of the parameters () a base capacity policy is optimal regardless of the non convexity of the total expected costs. To the best of our knowledge this result is a novelty also in the mathematical-economic literature on irreversible investment under uncertainty.

1.1 A Problem with Discretionary Stopping

In this section we establish the equivalence between problem (1.2) and a finite-fuel singular stochastic control problem with discretionary stopping (cf. [12] and [28] as classical references on this topic). We first observe that, for fixed and any , the process and the processes , defined by

| (1.8) |

respectively, are uniformly bounded in , hence uniformly integrable. This is a straightforward consequence of standard properties of the Ornstein-Uhlenbeck process (1.4) (see Appendix B), Assumption 1.1, the finite fuel condition and an integration by parts.

Proposition 1.2.

Proof.

Fix . Take a sequence of deterministic stopping times such that as in the expectation in (1.9) and use uniform integrability, continuity of , , left-continuity of (cf. (1.8)) and that , to obtain in the limit as . To show the reverse inequality, for any admissible and any stopping time set

| (1.10) |

The control is admissible and then from the definition of (cf. (1.2)) it follows that

Since the previous inequality holds for any admissible and any -a.s. finite stopping time we conclude that , hence . ∎

Since the proof of Proposition 1.2 does not rely on particular cost functions (running cost and cost of investment), the arguments apply to a more general class of SSC problems. However in some cases (including the convex or concave SSC problems) it turns out that the infimum over stopping times in (1.9) is not achieved and one should formally take : clearly in those cases an equivalence such as Proposition 1.2 would add no insight to the analysis of the problem. In contrast we show below that depending on the quantity introduced through (1.7), both the control and stopping policies in (1.9) may play either trivial or nontrivial roles through the interplay of two free-boundaries. A complete analysis of the interplay of these two free-boundaries is outside the scope of this paper and a challenging open problem (discussed in Section 4).

2 The Case

In this section we identify when the differential relationship between SSC and optimal stopping known in convex problems of monotone follower type with finite fuel (cf., e.g., [16], [25] and [26]) holds in our non-convex problem. In this case, as discussed above one should formally set in (1.9). We find that the differential relationship holds when (cf. (1.6)) for all or, equivalently, when : in this case the derivative (with respect to , the direction of the control variable) of the value function in (1.2) is given by the value function of the family of optimal stopping problems solved below and the optimal control is of reflection type, being the minimal effort to keep the (optimally) controlled state variable above the corresponding non-constant free boundary. The case is similar, see Remark 2.3.

2.1 The Associated Family of Optimal Stopping Problems

The family of infinite time-horizon optimal stopping problems we expect to be naturally associated to the control problem (1.2) is given by

| (2.1) |

where the supremum is taken over all -a.s. finite stopping times (see, for example, [16], [24] or [25], among others). For any given value of , (2.1) is a one-dimensional optimal stopping problem that can be addressed through a variety of well established methods. As varies the optimal stopping boundary points for problem (2.1) will serve to construct the candidate optimal boundary of the action region of problem (1.2) and, as noted in the Introduction, we will therefore require sufficient monotonicity and regularity of this free boundary curve to verify its optimality.

Define

| (2.2) |

| (2.3) |

and let be the infinitesimal generator of the diffusion , i.e.

| (2.4) |

The next theorem is proved in Appendix C.1 and provides a characterisation of in (2.1) and of the related optimal stopping boundary.

Theorem 2.1.

Remark 2.2.

The monotonicity of the boundary, crucial for the verification theorem below, is obtained using specific properties of the diffusion (through the function ) and of the cost functional. To the best of our knowledge general results of this kind for a wider class of diffusions cannot be provided in this non-convex setting either by probabilistic or analytical methods; thus a study on a case by case basis is required. We note in fact that in [13] in a setting similar to the present one but with a different choice of the geometry of the action and inaction regions for the control problem is quite different.

2.2 The Solution of the Stochastic Control Problem

In this section we aim at providing a solution to the finite-fuel singular stochastic control problem (1.2) by starting from the solution of the optimal stopping problem (2.1) (see also (C-1)) and guessing that the classical connection to singular stochastic control holds.

By Theorem 2.1 we know that is strictly decreasing and so has a strictly decreasing inverse. We define

| (2.13) |

Obviously is continuous and decreasing. Moreover, since and (cf. again Theorem 2.1), then exists almost everywhere and it is bounded.

Proposition 2.4.

The function in (2.14) is such that is concave, and the following bounds hold

| (2.15) |

for and some positive constants and .

Proof.

In this proof we will often refer to the proof of Theorem 2.1 in Appendix C.1. Recall (2.7) and that (cf. Theorem 2.1). Concavity of as in (2.14) easily follows by observing that is convex (cf. again Theorem 2.1). It is also easy to verify from (2.2) and (2.7) that is of the form for suitable continuous functions , and , so that is continuous on and is continuous on as well. From the definition of (cf. (2.7)), (2.8), convexity of and continuity of it is straightforward to verify that for , bounded, and are at least bounded by a function . It follows that evaluating and one can pass derivatives inside the integral in (2.14) so to obtain

| (2.16) |

and

| (2.17) |

Therefore by (2.7), (2.8), convexity of (cf. Theorem 2.1) and continuity of (cf. (2.13)).

From standard theory of stochastic control (e.g., see [20], Chapter VIII), we expect that the value function of (1.2) identifies with an appropriate solution to the Hamilton-Jacobi-Bellman (HJB) equation

| (2.18) |

Recall Proposition 2.4.

Proposition 2.5.

For all we have that F is a classical solution of (2.18).

Proof.

We now aim at providing a candidate optimal control policy for problem (1.2). Let and consider the process

| (2.20) |

with as in (2.13) and denoting the positive part.

Proposition 2.6.

The process of (2.20) is an admissbile control.

Proof.

Fix and recall (1). By definition is clearly increasing and such that , for any , since , . The map is continuous, then is continuous, apart of a possible initial jump at , by continuity of paths .

To prove that it thus remains to show that is -adapted. To this end, first of all notice that continuity of also implies its Borel measurability and hence progressive measurability of the process . Then is progressively measurable since , by monotonicity of , and by [14], Theorem IV.33. Hence is -adapted. ∎

To show optimality of we introduce the action and inaction sets

| (2.21) |

respectively and with . Their link to the sets defined in (C-2) is clear by recalling that . The following Proposition, which is somewhat standard (see, e.g., [27], p. 210 and [36] as classical references on the topic), is proved in Appendix C.2.

Proposition 2.7.

Proof.

The proof is based on a verification argument and, as usual, it splits into two steps.

Step 1. Fix and take . Set , take an admissible control , and recall the regularity results for of Proposition 2.4. Then we can use Itô’s formula in its classical form up to the stopping time , for some , to obtain

where and the expectation of the stochastic integral vanishes since is bounded on .

Now, recalling that any can be decomposed into the sum of its continuous part and of its pure jump part, i.e. , one has (see [20], Chapter 8, Section VIII.4, Theorem 4.1 at pp. 301-302)

Since satisfies the HJB equation (2.18) (cf. Proposition 2.5) and by noticing that

| (2.22) |

we obtain

| (2.23) | ||||

When taking limits as we have , -a.s. The integral terms in the last expression on the right-hand side of (2.2) are uniformly integrable (cf. (1.8)) and has sub-linear growth (cf. (2.15)). Then we also take limits as and it follows

| (2.24) |

due to the fact that . Since the latter holds for all admissible we have .

Step 2. If then . Take then , as in Proposition 2.7 and define . We can repeat arguments of Step 1. on Itô’s formula with replaced by to find

If we now recall Proposition 2.5, Proposition 2.7 and (2.22), then from the above we obtain

| (2.25) |

As , again , clearly , -a.s. and . Moreover, we also notice that since and for the integrals in the last expression of (2.25) may be extended beyond up to so as to obtain

| (2.26) |

Then and is optimal. ∎

3 The Case

In this section we examine the opposite regime to that of Section 2, when the infimum in (1.9) is attained by an almost surely finite stopping time and the constant control policy . Equivalently the solution to (1.2) does not exert control before the price process hits a repelling boundary, at which point all available control is exerted. We show that this regime occurs when for all (cf. (1.6)), or equivalently . We confirm this contrast with the differential relationship holding in Section 2 (i.e. the break-down of the classical connection to optimal stopping) by showing that the principle of smooth fit does not hold for the value function of the control problem, whose second order mixed derivative is not continuous across the optimal boundary. The case is similar, see Remark 3.3.

We begin by observing that exercising no control produces a payoff equal to

| (3.1) |

(cf. (1.2)). Suppose instead that we exert a small amount of control at time zero and exercise no further control. In this case the cost of control is and, approximating , the payoff reads

| (3.2) |

recalling that (cf. (B-1)) to obtain the second term. Comparing (3.1) and (3) we observe that the relative net contribution to the infimum (1.2) (equivalently, the infimum (1.9)) from exercising the amount of control is given by the second term in the second line of (3), which for fixed depends only on the term . When the second term in (3) is negative and therefore favourable, while when it is positive and unfavourable. This suggests that in the present case, when , we should expect the inaction region to correspond to for some function . Moreover, since the curve is strictly decreasing as is strictly convex, small control increments in this profitable region keep the state process inside the same region. It thus follows that infinitesimal increments due to a possible reflecting boundary as in Section 2 do not seem to lead to an optimal strategy. Instead a phenomenon similar to ‘critical depensation’ in optimal harvesting models is suggested, where it becomes optimal to exercise all available control upon hitting a repelling free boundary (see for example [1] for one-dimensional problems but note that in our setting the free boundary will in general be non-constant).

We solve the optimisation problem (1.2) by directly tackling the associated Hamilton-Jacobi-Bellmann equation suggested by the above heuristic and the dynamic programming principle. It is not difficult to show from (1.2) that has at most sub-linear growth: indeed, integrating by parts the cost term and noting that the martingale is uniformly integrable, we can write for any

for some suitable , by (B-1), Assumption 1.1 and the fact that any admissible is nonnegative and uniformly bounded.

We seek a couple solving the following system

| (3.7) |

We will verify a posteriori that then also satisfies but does not satisfy , which is a smooth fit condition often employed in the solution of singular stochastic control problems (see, for example, [18] and [31]).

Theorem 3.1.

Let be the increasing fundamental solution of (cf. (B-3) in Appendix) and define

| (3.8) |

where There exists a unique couple solving (3.7) with satisfying and . The function is decreasing and, if , it is on . For each , is the unique solution of

| (3.9) |

For the function may be expressed in terms of as

| (3.12) |

Moreover the map is not across the boundary and one has , .

Proof.

The proof will be carried out in several steps.

Step 1. The first equation in (3.7) is an ordinary differential equation solved by

| (3.13) |

with and as in (B-2) and (B-3), respectively. Since for sub-linear growth is fulfilled as ; however, as one has that with a super-linear trend. Since we are trying to identify , it is then natural to set . Imposing the third and fourth conditions of (3.7) at we find

| (3.14) |

and

| (3.15) |

from which it follows that should solve (3.9). Since any solution of (3.9) must be in the set and so (3.9) is equivalent to finding such that with

| (3.16) |

Since and (cf. (B-3) and (B-4)) it follows by direct calculation that and on ; moreover, since there exists a unique solving (3.9). Now from (3.9), (3.14) and (3.15) we can equivalently set

| (3.17) | |||||

and (3.12) follows by extending to be for .

Step 3. In order to establish the monotonicity of we study the derivative with respect to of the map . Differentiating we obtain

| (3.18) |

where the last inequality holds since by strict convexity of . Now (3.18) guarantees that is increasing and then the implicit function theorem and arguments similar to those that led to (C-13) in the proof of Proposition C.3 allow us to conclude that lies in (if ) and is decreasing (for see Remark 3.3 below).

Step 4. We now aim to prove the second condition in (3.7). Recalling that has been extended to be for the result is trivial in that region. Consider only . From (3.12) we have

| (3.19) |

and since is differentiable, recalling (2.2) and rearranging terms we have

| (3.20) | ||||

where the last equality follows since solves (3.9). Note that as a byproduct of (3) we also have . Differentiating (3) with respect to and taking gives

| (3.21) |

and hence from (2.2) and (3.9) we obtain

| (3.22) | |||||

Since , and by the convexity of we conclude that

| (3.23) |

For we can differentiate with respect to and the first equation in (3.7), set and find

| (3.24) |

with boundary condition . Taking and using Itô’s formula we find

| (3.25) |

It follows from (3) and recurrence of that , -a.s. Moreover, and (3.23) imply that the right-hand side of (3.25) is strictly negative. It follows that for all and hence is decreasing. Since by (3), then we can conclude for all . ∎

Remark 3.2.

If were the value function of an optimal stopping problem with free boundary we would expect the principle of smooth fit to hold, i.e. across the boundary . In the literature on singular stochastic control, continuity of is usually verified (cf. for instance [18] and [31]) and often used to characterise the optimal boundary. However equation (3.23) confirms that this property does not hold in this example, and indeed the differential relationship between singular control and optimal stopping (in the sense, e.g., of [16], [24], [25]) breaks down.

Remark 3.3.

It is interesting to note that if one has and hence , otherwise a contradiction is found when passing to the limit in (3.9) with .

Since solving (3.9) is the unique candidate optimal boundary we set from now on.

Proof.

The boundary condition at follows from (3.12). Since solves (3.7) it also solves (2.18) for , . It thus remains to prove that for . Note that since in that region then . Set

| (3.26) |

where again , and observe that for all . To conclude we need only show that for . It suffices to prove that (cf. (3.16)) and the result will follow since is strictly increasing and such that .

Fix and denote and (cf. (3.8)) for simplicity. Then we have

| (3.27) |

where the last equality follows from (3.26). Since and solves we obtain

| (3.28) |

and from the right-hand side of (3.27) also

| (3.29) |

The inequality above implies so that . Hence for .

∎

Introduce the stopping time

| (3.30) |

and for any define the admissible control strategy

| (3.33) |

Proof.

The proof employs arguments similar to those used in the proof of Theorem 2.8. We recall the regularity of by Theorem 3.1 and note that for a suitable . Then an application of Itô’s formula in the weak version of [20], Chapter 8, Section VIII.4, Theorem 4.1, easily gives for all (cf. also arguments in step 1 of the proof of Theorem 2.8).

On the other hand, taking , , with as in (3.33), and applying Itô’s formula again (possibly using localisation arguments as in the proof of Theorem 2.8) we find

| (3.34) | ||||

Since for , then the third and fourth term on the right-hand side of (3) equal zero, whereas for the first term we have from (3.7) and (3.33)

| (3.35) |

For the second term on the right-hand side of (3) we have

| (3.36) |

since by Assumption 1.1. Now, (3), (3) and (3.36) give , and is optimal. ∎

4 Considerations in the case

In this section we discuss the remaining case when , equivalently when the function of (1.6) changes its sign over .

For it can be seen that setting the strictly convex penalty function in (1.3) equal to reduces problem (1.2) to that of Section 2. The optimal control strategy for is therefore of reflecting type and it is characterised in terms of a decreasing boundary defined on . As expected the classical connection with optimal stopping holds in the sense that on with as in (2.1).

When the optimal policy depends both on the local considerations discussed at the beginning of Section 3 and also on the solution for given in point above. Assuming that the analytic expression of is known for then the HJB equation in the set has a natural boundary condition at and its solution is expected to paste (at least) continuously with . Since the expression for obtained in Section 2 is non-explicit in general, analysis of the geometry of the action and inaction regions is more challenging in this case and its rigorous study is beyond the scope of this paper; nevertheless we will discuss some qualitative ideas based on the findings of the previous sections.

The local considerations at the beginning of Section 3 hold in the same way in this setting and therefore we may expect a repelling behaviour of the boundary of the action region. Conjecturing the existence of a decreasing free boundary defined on two possible optimal controls can be envisioned, depending on the position of relative to in the -plane. For an initial inventory , once the uncontrolled diffusion hits the inventory should be increased as follows: if all available control is exerted, otherwise the inventory is increased just enough to push inside the portion of inaction region in (i.e. the subset of bounded below by ). As a result the optimal boundaries and exhibit a strong coupling which together with the difficulty in handling the expressions for and challenges the methods of solution employed in this paper.

We note that determining the geometry of two coexisting free boundaries in a two dimensional state space is not a novelty in the context of SSCDS but explicit solutions can only be found in some specific models (see for instance [28] where a Brownian motion and a quadratic cost are considered). Indeed it is possible to provide a solution when , for which we refer the reader to [13]. Before concluding this section we show that the latter results are consistent with the above ideas. In [13] the interval for the values of the inventory is again split into two subintervals by a point that here we denote by for clarity (in [13] it is denoted by ). In the portion of the state space of [13] the boundary of the action region is of repelling type consistent with point 3 above, although in this case two repelling boundaries are present. For the free boundary in [13] is constant with respect to and, although the optimal policy is therefore of bang-bang type, it is not difficult to see that it may equally be interpreted as the limit of reflecting boundaries. Indeed smooth fit holds at this boundary when , along with the differential connection with optimal stopping (see p. 3 in the Introduction of [13] and Remark 3.3 therein) so that the qualitative behaviour is the same as that described in point above.

Appendix A A Problem of Storage and Consumption

A problem naturally arising in the analysis of power systems is the optimal charging of electricity storage. We consider the point of view of an agent that commits to fully charging an electrical battery on or before a randomly occurring time of demand. At any time prior to the arrival of the demand the agent may increase the storage level (within the limits of its capacity, which is one unit) by buying electricity at the spot price . Several specifications of the spot price dynamics can be considered. We take as a continuous, strong Markov process adapted to a filtration on a complete probability space .

If the battery is not full at time then it is filled by a less efficent method so that the terminal spot price is weighted by a strictly convex function , and so is equal to with (cf. Assumption 1.1). The storage level can only be increased and the process follows the dynamics (1.1) with (cf. (1)). For simplicity and with no loss of generality we assume that costs are discounted at a rate .

The aim of the agent is to minimise the future expected costs by optimally increasing the storage within its limited capacity. Then the agent faces the optimisation problem with random maturity

| (A-1) |

Various specifications for the law of are clearly possible. Here we consider only the case of independent of the filtration and distributed according to an exponential law with parameter ; that is,

| (A-2) |

This setting effectively models the demand as completely unpredictable. By the assumption of independence of and , for any we easily obtain

| (A-3) |

and

| (A-4) |

where the integrals were exchanged by an application of Fubini’s theorem. It then follows that problem (A-1) may be rewritten as in (1.2) and (1.3).

Appendix B Facts on the Ornstein-Uhlenbeck Process

Recall the Ornstein-Uhlenbeck process of (1.4). It is well known that is a positively recurrent Gaussian process (cf., e.g., [7], Appendix 1, Section 24, pp. 136-137) with state space and that (1.4) admits the explicit solution

| (B-1) |

We introduced its infinitesimal generator in (2.4); the characteristic equation , , admits the two linearly independent, positive solutions (cf. [22], p. 280)

| (B-2) |

and

| (B-3) |

which are strictly decreasing and strictly increasing, respectively. In both (B-2) and (B-3) is the cylinder function of order (see [8], Chapter VIII, among others) and it is also worth recalling that (see, e.g., [8], Chapter VIII, Section 8.3, eq. (3) at page 119)

| (B-4) |

where is the Euler’s Gamma function.

We denote by the probability measure on induced by the process , i.e. such that , , and by the expectation under this measure. Then, it is a well known result on one-dimensional regular diffusion processes (see, e.g., [7], Chapter I, Section 10) that

| (B-5) |

with and as in (B-2) and (B-3) and the hitting time of at level . Due to the recurrence property of the Ornstein-Uhlenbeck process one has -a.s. for any .

Appendix C Some Proofs from Section 2

C.1 Proof of Theorem 2.1

The proof goes through a number of steps which we organise in Lemmas, Propositions and Theorems. Integrating by parts in (2.1) and noting that the martingale is uniformly integrable we can write

| (C-1) |

with as in (1.6). For each we define the continuation and stopping regions of problem (C-1) by

| (C-2) |

respectively. From standard arguments based on exit times from small balls one notes that as it is never optimal to stop immediately in its complement . Since is increasing, lies below and we also expect the optimal stopping strategy to be of threshold type.

Now, for any given and we define the hitting time . For simplicity we set . A natural candidate value function for problem (C-1) is of the form

| (C-3) |

An application of Fubini’s theorem, (B-1) and some simple algebra leads to

Lemma C.1.

For all and with as in (2.2) one has

| (C-4) |

Recall and as in the statement of Theorem 2.1. The analytical expression of is provided in the next

Lemma C.2.

For as in (C-3) it holds

| (C-7) |

Proof.

From (C-3), (2.2) and strong Markov property we have that for all

where the last equality follows since is positively recurrent and by using well known properties of hitting times summarised in Appendix B for completeness (cf. (B-5)).

∎

The candidate optimal boundary is found by imposing the familiar principle of smooth fit, i.e. the continuity of the first derivative at the boundary . This amounts to solving problem (2.8).

Proposition C.3.

Proof.

Since we are only interested in finite valued solutions of (2.8) and for all we may as well consider the equivalent problem of finding such that , where

| (C-9) |

We first notice that (cf. (2.2) and (2.3)) and since , then (i) for , (ii) for and (iii) for all . Hence

| (C-10) |

Recall also that is strictly convex (cf. (B-2) and (B-4) in Appendix B), then it easily follows by (2.2) and (C-9) that

| (C-11) |

Moreover, for all and so if exists such that then . Derivation of (C-11) with respect to gives

which implies that is continuous, strictly increasing and strictly concave on . Hence, by (C-10) there exists a unique solving (and equivalently (2.8)). Since for all (cf. (C-11)), then from the implicit function’s theorem, with

| (C-12) |

We now show that is strictly decreasing. A direct study of the sign of the right-hand side of (C-12) seems non-trivial so we use a different trick. It is not hard to verify from (2.3) that is strictly decreasing since is strictly increasing. Setting in (2.8), straightforward calculations give

so that is strictly decreasing. Since is continuous it is always possible to pick sufficiently close to so that (hence ) and one finds

| (C-13) |

and therefore . It follows that , since is increasing for . Then is a strictly decreasing map. ∎

We verify the optimality of in the next theorem and note that a stopping time is optimal for (C-1) if and only if it is optimal for (2.1).

Theorem C.4.

Proof.

The candidate value function (cf. (2.7)) is such that by Proposition C.3 and it is convex. Hence it is also nonnegative, since by (2.7) and (2.8).

It is easily checked that

| (C-16) |

We claim (and we will prove it later) that

| (C-17) |

so that for all .

Fix . Take now such that and define . By convexity of , the Itô-Tanaka formula (see, for example, [27], Chapter 3, Section 3.6 D) and the principle of smooth fit we have

| (C-18) |

for an arbitrary -a.s. finite stopping time . Now as and the integral inside the expectation on the right-hand side of (C-18) is uniformly integrable. Then taking limits as and using that we obtain

Since is arbitrary we can take the supremum over all stopping times to obtain .

To prove the reverse inequality we take to have strict inequality in (C-18). Then we notice that for so that recurrence of implies that

| (C-19) |

Therefore

| (C-20) |

and in the limit we find .

To conclude the proof we only need to show that (C-17) holds true. Set for simplicity. We have

| (C-21) |

by (2.2), (C-9) and (2.3); since and we also have

| (C-22) |

It is clear that if then the right-hand side of (C-21) is strictly positive and . On the other hand, if then and from (C-22) we get

| (C-23) |

Now plugging (C-23) into the right-hand side of (C-21) we find so that again . ∎

C.2 Proof of Proposition 2.7

By monotonicity of we have

since . Hence follows.

To prove fix and suppose that for some we have , i.e. . We distinguish two cases. In the case that , we have and then by monotonicity of we have . By continuity of we deduce that is constant in the interval for some . In the case that , we have and then again by monotonicity and continuity of , and continuity of , there exists such that and so for all .

Summarising, we have shown that if then is constant in a right (stochastic) neighbourhood of , establishing the second part.

Acknowledgments. This work was started when the authors were visiting the Hausdorff Research Institute for Mathematics (HIM) at the University of Bonn in the framework of the Trimester Program “Stochastic Dynamics in Economics and Finance”. We thank HIM for the hospitality. Part of this work was carried out during a visit of the second author at the School of Mathematics of the University of Manchester. The hospitality of this institution is gratefully aknowledged. We wish also to thank G. Peskir, F. Riedel and M. Zervos for many useful discussions.

References

- [1] Alvarez, L.H.R. (1998). Optimal Harvesting under Stochastic Fluctuations and Critical Depensation, Math. Biosci. 152(1), pp. 63-85.

- [2] Alvarez, L.H.R. (1999). A Class of Solvable Singular Stochastic Control Problems, Stoch. Stoch. Rep. , pp. 83–122.

- [3] Alvarez, L.H.R. (2001). Singular Stochastic Control, Linear Diffusions, and Optimal Stopping: a Class of Solvable Problems, SIAM J. Control Optim. 39(6), pp. 1697–1710.

- [4] Baldursson, F.M., Karatzas, I. (1997). Irreversible Investment and Industry Equilibrium, Finance Stoch. , pp. 69–89.

- [5] Bank, P. . Optimal Control under a Dynamic Fuel Constraint, SIAM J. Control Optim. 44, pp. 1529–1541.

- [6] Beneš, V.E., Shepp, L.A., Witsenhausen, H.S. (1980). Some Solvable Stochastic Control Problems, Stochastics , pp. 39–83.

- [7] Borodin, A.N., Salminen, P. (2002). Handbook of Brownian Motion-Facts and Formulae 2nd edition. Birkhäuser.

- [8] Bateman, H. (1981). Higher Trascendental Functions, Volume II. McGraw-Hill Book Company.

- [9] Bertola, G. (1998). Irreversible Investment, Res. Econ. , pp. 3–37.

- [10] Chiarolla, M.B., Haussmann, U.G. (1994). The Free-Boundary of the Monotone Follower, SIAM J. Control Optim. 32, pp. 690–727.

- [11] Chow, P.L., Menaldi, J.L., Robin, M. (1985). Additive Control of Stochastic Linear Systems with Finite Horizon, SIAM J. Control Optim. , pp. 858–899.

- [12] Davis, M., Zervos, M. (1994). A Problem of Singular Stochastic Control with Discretionary Stopping, Ann. Appl. Probab. , pp. 226–240.

- [13] De Angelis, T., Ferrari, G., Moriarty, J. (2014). A solvable two-dimensional degenerate singular stochastic control problem with non convex costs. Preprint. arXiv:1411.2428.

- [14] Dellacherie, C., Meyer, P. (1978). Probabilities and Potential, Chapters I–IV, North-Holland Mathematics Studies .

- [15] Dixit, A.K., Pindyck, R.S. . Investment under Uncertainty, Princeton University Press, Princeton.

- [16] El Karoui, N., Karatzas, I. (1988). Probabilistic Aspects of Finite-fuel, Reflected Follower Problems. Acta Applicandae Math. , pp. 223–258.

- [17] El Karoui, N., Karatzas, I. (1991). A New Approach to the Skorokhod Problem and its Applications. Stoch. Stoch. Rep. , pp. 57–82.

- [18] Federico, S., Pham, H. (2013). Characterization of the Optimal Boundaries in Reversible Investment Problems, SIAM J. Control Optim. , pp. 2180–2223.

- [19] Ferrari, G. . On an Integral Equation for the Free-Boundary of Stochastic, Irreversible Investment Problems, arXiv:1211.0412v1. Forthcoming on Ann. Appl. Probab.

- [20] Fleming, W.H., Soner, H.M. (2005). Controlled Markov Processes and Viscosity Solutions, 2nd Edition. Springer.

- [21] Geman, H., Roncoroni, A. (2006). Understanding the Fine Structure of Electricity Prices, J. Business , pp. 1225-1261.

- [22] Jeanblanc, M., Yor, M., Chesney, M. . Mathematical Methods for Financial Markets, Springer.

- [23] Karatzas, I. (1983). A Class of Singular Stochastic Control Problems, Adv. Appl. Probability 15, pp. 225–254.

- [24] Karatzas, I., Shreve, S.E. (1984). Connections between Optimal Stopping and Singular Stochastic Control I. Monotone Follower Problems, SIAM J. Control Optim. , pp. 856–877.

- [25] Karatzas, I. (1985). Probabilistic Aspects of Finite-fuel Stochastic Control, Proc. Nat’l. Acad. Sci. U.S.A., 82(17), pp. 5579–5581.

- [26] Karatzas, I., Shreve, S.E. (1986). Equivalent Models for Finite-fuel Stochastic Control, Stochastics , pp. 245–276.

- [27] Karatzas, I., Shreve, S.E. (1998). Brownian Motion and Stochastic Calculus 2nd Edition. Springer.

- [28] Karatzas, I., Ocone, D., Wang, H., Zervos, M. (2000). Finite-Fuel Singular Control with Discretionary Stopping, Stoch. Stoch. Rep. , pp. 1–50.

- [29] Kobila, T. Ø. (1993). A Class of Solvable Stochastic Investment Problems Involving Singular Controls, Stoch. Stoch. Rep. , pp. 29–63.

- [30] Lucia, J., Schwartz, E.S. (2002). Electricity Prices and Power Derivatives: Evidence from the Nordic Power Exchange, Rev. Derivatives Res. , pp. 5-50.

- [31] Merhi, A., Zervos, M. (2007). A Model for Reversible Investment Capacity Expansion, SIAM J. Control Optim. , pp. 839–876.

- [32] Morimoto, H. (2003). Variational Inequalities for Combined Control and Stopping, SIAM J. Control Optim. , pp. 686–708.

- [33] Morimoto, H. (2010). A Singular Control Problem with Discretionary Stopping for Geometric Brownian Motion, SIAM J. Control Optim. , pp. 3781–3804.

- [34] Pindyck, R.S. . Irreversible Investment, Capacity Choice, and the Value of the Firm, Am. Econ. Rev. , pp. 969–985.

- [35] Riedel, F., Su, X, (2011). On Irreversible Investment, Finance Stoch. , pp. 607–633.

- [36] Skorokhod, A.V. (1961). Stochastic equations for Diffusion Processes in Bounded Region, Theory Probab. Appl. 6, pp. 264–274.