Facilitation and Internalization Optimal

Strategy

in a Multilateral Trading Context

Qinghua Li

Humboldt-Universität zu Berlin, Institut

für

Mathematik

Unter den Linden 6, 10099 Berlin, Germany

Email: Ms.QinghuaLi@Gmail.com

Abstract. This paper studies four trading algorithms of a professional trader at a multilateral trading facility, either internalizing or regular, observing a realistic two-sided limit order book whose dynamics are driven by the order book events. We shall show that the price switching algorithms provide lower and upper bounds of the mixed trading algorithms. The optimal price switching strategy exists and is expressed in terms of the value function. A parallelizable algorithm to numerically compute the value function and optimal price switching strategy for the discretized state process is provided.

Keywords and Phrases: Limit order book,

algorithmic trading, stochastic impulse and optimal control,

parallel computation,

Markets in Financial Instruments Directive.

1 Introduction

1.1 Overview

Market microstructure is an interdisciplinary field involving

economics, finance, probability and optimization, statistics, and

even psychology, which studies the order-driven price formulation

processes in markets like those of stocks, futures and foreign

exchanges. Due to the complexity of the phenomena, the research

works on market microstructure usually focus on individual aspects

of the problem. Interesting questions studied so far include

econometrics of the order books and of the market maker’s inventory

levels, optimal market making, a buyer or seller’s optimal order

execution, and limiting behaviors of the queuing

system of limit orders and bid and ask prices.

The study of market microstructure dates back to at least four decades ago,

and persists up till present time. It is hard to enumerate all the

literature on this field. The books O’Hara (1997) and Hasbrouck (2007) provide an overview of quantitative analysis of

market microstructure. One significant development in recent years

is the prevalence of electronic trading platforms as an alternative

to markets where prices are determined via a market maker’s auction

and the traders’ bidding; the other is the popularity of applying

stochastic control to solving optimal execution and optimal market

making problems. Readers are welcome to Lehalle and Laruelle (2013)

for latest updates in the field

of market microstructure and algorithmic trading.

Stochastic control provides the theory and methodologies to

find actions that optimize an objective, while the actions can

influence the evolution of some random processes to which the

objective is associated. It naturally facilitates the study of

financial markets where participants, the assembly of whose

activities contribute to the price evolution, seek to maximize

profits and minimize losses. The application of stochastic control

to optimizing activities in an order book traces back to early works

like Ho and Stoll (1981).

There have been many frameworks to study trading and order execution in limit order books.

Among them are the equilibrium models surveyed in Parlour and Seppi

(2008), the model with stochastic bid and ask prices

and deterministic order book shape as in Alfonsi, Schied and

coauthors (2009, 2010, 2012) and in Predoiu, Shaikhet and Shreve (2011), the model with stochastic mid price and

deterministic or stochastic spread as in Avellaneda and Stoikov (2008) and Guilbaud and Pham (2013), the Almgren-Chriss model used by many in

the

industry, as in Almgren (2003), Almgren and Chriss (2000), Bouchard, Dang and Lehalle (2011) and Gatheral and Schied (2011), and maximizing

the utility by choosing an

optimal posting distance that determines the intensity of the

execution process as in Guéant, Lehalle and Fernandez-Tapia (2012a, 2012b) and Laruelle, Lehalle and Pagès (2011).

1.2 This paper

An optimal trading scheme is obviously a function of the trading

constraints of the trading agent, translated into its reward

function. To express the adequate trading function, a specific

market model is often needed. Up to now, two main agent types have

been investigated - directional traders and market makers.

* Directional traders: such agents already took the decision to buy

or sell and the amount of shares to buy or sell before the trading

phase. Typically institutional investors like pension funds are of

this kind. The control of associated trading schemes is usually the

local trading rate, and more rarely a price (Guéant, Lehalle and

Fernandez-Tapia, 2012a, 2012b). The associated market models include

classical price

diffusion and a market impact component.

* Market makers: on the opposite, such agents make decisions in

real time, 100% based on the state of the order books; they are

simultaneously buyers and sellers, mostly providing liquidity to

other traders. The part of high frequency traders often seen as the

“new middlemen” are of this kind (Baron, Brogaard and Kirilenko,

2012; Jovanovic and Menkveld, 2011; Menkveld, 2013). Their control

is the buying and selling prices, at which they send limit orders

around the best bid and best ask immediate prices. The associated market models usually embed trading flows abstracted

by a point process, without any market impact component, since the

nature of the market impact of limit orders has not been explored by

now.

This paper models a third kind of agents: the risk taking

intermediaries. The “systematic internalizers” defined by the

European regulation are of this kind. Any investment bank having the

capabilities

(1) to internalize some of its flow against a price improvement for his external or internal clients;

(2) to get rid of its potential inventory imbalance, like in a dark pool,

in a dedicated trading pool at the instantaneous mid price.

The controls will be the number of shares bought and sold up-to-date at every price level in the displayed

order book and in the dedicated trading pool. Hence the

modeled order book dynamics will have to embed full order book

depth.

Our study will be presented as follows. Section 2

introduces the event-driven order book dynamics. Sections 3 and 4 formulate the stochastic control

problems faced by the optimal trader and prove their well-posedness.

Section 5 compares the best expected profits of a

regular trader and a systemic internalizer, either can use mixed

strategies or price switching strategies. Section 6

solves the optimal price switching problem by providing a

representation of the optimal strategy, a discrete-time numerical

algorithm and implementation in a Binomial model. Finally, we suggest a way

to calculate a “fair” internalization premium.

The contribution of this study is multi-fold.

(1) The agent that conducts the trading activities is a risk taking intermediary. Such agents make up a significant proportion of the market participants in terms of the capital amount, but there has not yet been much research into their optimal trading strategies.

(2) One recent development in market microstructure is the event-driven limit order book models, by Rama Cont and co-authors and by Hasbrouck and Saar (2010). Especially when the trader reacts at a super speed (called “high frequency trading”), this kind of models captures the real observations, because the Central Limit Theorem that proves a diffusion-like stock price no longer applies. This paper is the first one that derives optimal trading strategies in a variation of their cutting-edge models.

(3) The optimal trading strategy will balance between the speed and cost of trading, by active orders in the book and passive orders at the mid price in the dark pool. There is another kind of strategies more passive than hidden orders, which is orders queuing up at the best available prices. Interested readers are invited to Huang, Lehalle and Rosenbaum (2013) for an empirical analysis and Lachapelle, Lasry, Lehalle and Lions (2013) for a mean field game modeling of an agent’s optimal queuing.

(4) The optimal price switching problem we shall solve belongs to the classical type of impulse control and optimal control, but its state process is non-standard, more complicated than a textbook SDE driven by Brownian motions and Poisson random measures.

(5) A parallelizable algorithm is provided for numerically computing the value function and the optimal price switching strategy for a discretized state process. The computational complexity of a stochastic control problem using backward induction should have been well known on a serial computer, while to the author’s best knowledge this paper is the first one to document the complexity on a parallel computer.

(6) The results in this paper give insights into trading activities within the Markets in Financial Instruments Directive framework, by different types of traders using different types of trading strategies.

2 The two-sided order book dynamics

As usual in optimal trading (Alfonsi and Schied, 2010, 2012; Bertsimas and Lo, 1998; Bouchard, Dang and Lehalle, 2011; Guéant, Lehalle and Fernandez-Tapia, 2012a, 2012b), the market dynamics are modeled on their own and do not specifically react to the optimal trader’s actions. We will not model any explicit market impact, following usual frameworks allowing the optimal trader to post limit orders (Avellaneda and Stoikov, 2008) as opposite to framework for optimal trading with aggressive orders (Obizhaeva and Wang, 2013) or at a larger time scale than the orderbook one (Almgren and Chriss, 2000). Our optimal trader is a “systematic internalizer” in the MiFID (Markets in Financial Instruments Directive) sense: as an intermediary or a dedicated market maker, he can capture market order flow provided that he pays a premium (i.e. he improves the price) of the liquidity taker. Our optimal trader will such implement a trading scheme close to a market making one: he will capture aggressive flows at the bid and ask, thus earn the bid-ask spread minus twice the premium he provides. As usual, he will face a market risk increasing with his inventory (Ho and Stoll, 2008). In our specific case, the optimal trader will operate a Dark Pool (Cebiroglu, Hautsch and Horst, 2013) or a similar trading platform, where he will try to unwind its inventory at the mid-price. High frequency market makers, like Knight Capital Group, operate such dark pools (“knight link” in this specific case).

2.1 Illustration of the order book

This subsection and the next will introduce the order book dynamics

formed by the aggregate activities of all the market participants,

when the optimal trader does not act.

In preparation, let us present a few terminologies that appear

frequently in discussions about a limit order book. For every stock

in the market, there are several types of orders, the most commonly

used types being the limit order and the market

order. A market buy (sell) order only specifies the number of

shares and is executed immediately at the lowest ask (highest bid)

price available in the market. A limit buy (sell) order specifies

the number of shares and the highest (lowest) price at which the

trader is willing to buy (sell). According to the rules of best

price first and FIFO (short for “first in first out”) at the same

price level, limit orders are executed when there are matching sell

(buy) orders at their specified prices. The records of all limit

orders waiting to be executed are maintained. The set of the records

is called a limit order book. A limit order book is a

“reservoir” of limit orders. It records the number of shares, the

price and the time of order arrival or cancelation for every limit

order. Once a limit order is submitted, if it is not executed

immediately, then this order is “stored” in the limit order book

until being “released” and disappearing from the book for one of

the three reasons – execution, cancelation, or expiration. The

total of limit orders at each price level is called one

limit. The lowest ask price (highest bid price) in the book

is called the ask price (bid price) for short. The

difference between the ask price and the bid price is called the

spread. The distance between two adjacent price levels at

which limit orders can

be submitted is called the tick size.

Fig. 2.1 illustrates a snapshot of a typical limit

order book at some time . The vertical axis represents the

different price levels in the book, where is the current

ask price, is the current bid price and is the

tick size. The horizontal axis represents the volume, in other words

the number of shares, of limit orders at each price level. The sell

side of the book is shown in gray and the buy side in dark. For

example, the volume of limit sell orders at the ask price is denoted

as , which equals the length of the gray horizontal line at

the price level ; the volume of limit buy orders at the

price level is denoted as , which equals

the length of the dark horizontal line at that level. The spread is

defined as . Without loss of generality, the

tick size is set as .

All the limit sell (buy) orders at and higher (lower) than

the best ask (bid) price are displayed to the market participants.

The volumes of limit orders beyond the best ask and best bid prices are

constants. In the notations illustrated in Fig. 2.1, this means that

and , for all , where and

are two positive constants. The number of limit sell orders at

the ask price and the number of limit buy orders at the bid

price are two stochastic processes. When the spread is

more than one tick, limit sell orders can arrive one tick below the

ask price , and limit buy orders can arrive one tick above the

bid price . The best ask (bid) price remains constant, until

either all the sell (buy) orders at the current price get depleted

or new limit sell (buy) orders arrive at the price one tick lower

(higher). If the number of all the sell (buy) orders at the best ask

(bid) price reaches zero, then the best ask (bid) price increases

(decreases) by one tick, i.e.

| (2.1) |

and the volume at the new ask (bid) price is given by

| (2.2) |

If limit sell (buy) orders arrive at time at one tick below the ask price (above the bid price ), the ask (bid) price decreases (increases) by one tick, i.e.

| (2.3) |

and each arrival contains () shares, i.e. the

expression (2.2) holds; the number of limit sell

(buy) orders at the old ask price (the old bid price

) remains () at time and resets to

() at time . We could make

and Markov

processes with independent increments. The assumption that they are

constants will significantly reduce the dimensionality of the

control problem while making decisions based on the major driving

forces of the order book dynamics.

Besides all the displayed orders that form the limit order book in Fig. 2.1,

there is a “dark pool” mechanism within the spread. Simultaneously,

the trader has the opportunity to place one mid-price pegged order

in the spread: these orders are posted at the price at any time . He has to choose if

it is a buy order or sell order, since he cannot simultaneously post

a buy and a sell order at the same price. Other market participants

sending orders of the opposite side and having access to the dark

pool will consume () shares of his order.

2.2 Mathematical formulation of the order book dynamics

This subsection will formulate rigorously the dynamics of the limit

order book over a deterministic finite time horizon .

Any change to the limit order book, either in the bid and ask

prices, or in the available shares at each price level, is caused by

one of the four types of events – limit order arrival, limit order

cancelation or expiration, limit order execution, and market order

arrival and immediate execution. The two sources of movements are

the changes in the volumes at the current best prices and the

arrivals within the spread, which in turn result in all the changes

in the prices. The randomness in the order book dynamics is modeled

by the following ingredients.

(1) Probability space .

(2) Positive constants and .

(3) Independent standard Brownian motions and , representing the evolution of and when there is no price change.

(4) Known measurable functions , , and , satisfying .

(5) Inhomogeneous Poisson processes and , with intensities and at time . When the spread is larger than one tick, limit sell and buy orders are posted according to and at a small price improvement - the best bid plus one tick for a buy order and the best ask minus one tick for a sell order.

(6) Inhomogeneous Poisson processes and , with intensities and at time . The trader’s buy and sell orders posted in the dark pool are filled at the mid price according to the liquidity events and .

(7) Conditioning on the spread, the next arrival times of , , and are independent of each other and independent of the future increment of and .

(8) The filtration , generated

by the processes , , , , and .

To prove the well-posedness of

Problem 4.1 and thus Problem 3.1, the

intensities of the order arrival processes within the spread are

assumed uniformly bounded.

Assumption 2.1

The intensity functions , , and of the inhomogeneous Poisson processes , , and satisfy

| (2.4) |

The event-driven limit order book model and the study for an optimal

trading algorithm

based on it are proposed in Section 4.2 by Lehalle (2013). Consistent with existing works, the dynamics indeed

capture the main features of a limit order book. Empirical studies (Cont, Stoikov and Talreja, 2010, and Hasbrouck and Saar, 2010) observe that inhomogeneous Poisson

processes are proper to model the order arrivals and cancelations at

different prices, and that the orders in the neighborhoods closest

to the bid and ask prices being the most influential to the stock

price dynamics. An explanation for the latter observation is that

the limit orders whose execution prices are far away from the bid

and ask prices are more likely to be placed by speculators to profit

from sudden dramatic price changes. Hence, if tracking only the

volumes at the bid and ask prices, it makes a reasonable

approximation to the real limit order books.

The model we use is inspired by Rama Cont and co-authors. Cont,

Kukanov and Stoikov (2014) proposed an order flow imbalance

model to describe the stylized features of an order book, where the

number of shares at each price level beyond the best prices is

constant and limit order arrivals and cancelations occur only at the

best bid and ask prices. Further, Cont and de Larrard (2011, 2013) have shown that a two-dimensional Brownian motion

is a reasonable model for the dynamics of the volumes at first limits, when

the bid-ask spread does not vary too much.

The number of times over that all the orders at the current

ask and bid prices are depleted is

| (2.5) |

At every time the volume at the ask (bid) price is depleted, meaning

that , the (respectively )

shares at the higher (lower) price level are exposed and the ask

(bid) price increases (decreases) by one tick. At every arrival of

limit sell (buy) orders within the spread, meaning that

, the new limit at the lower (higher) price level

contains (respectively ) shares and the ask

(bid) price decreases (increases) by one tick. At any other time,

the volumes move according to the Brownian motions and the prices

remain constants.

Following the above reasoning, the dynamics of the order book can be

described by the four-dimensional process . The

volumes and move according to

| (2.6) |

The prices move according to

| (2.7) |

The process defined in (2.7) and (2.6) is Markovian.

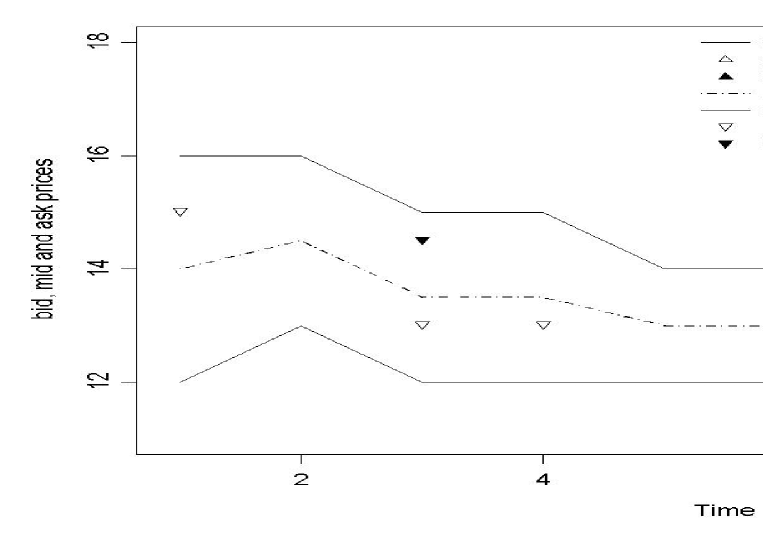

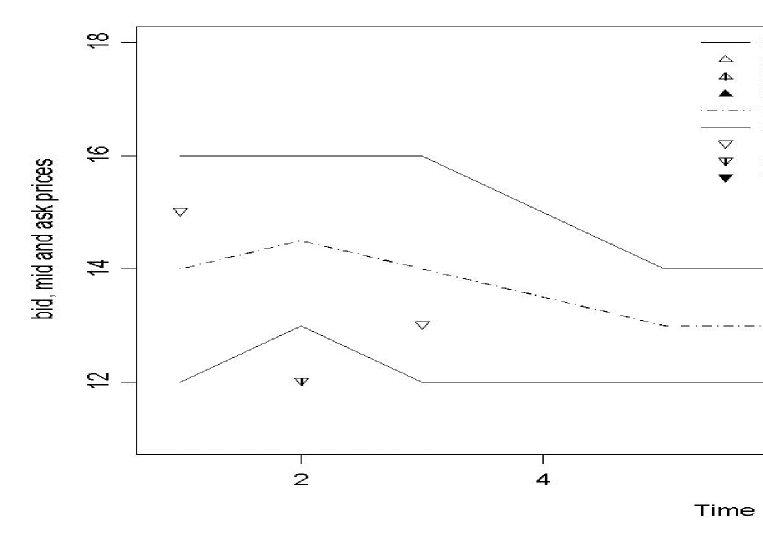

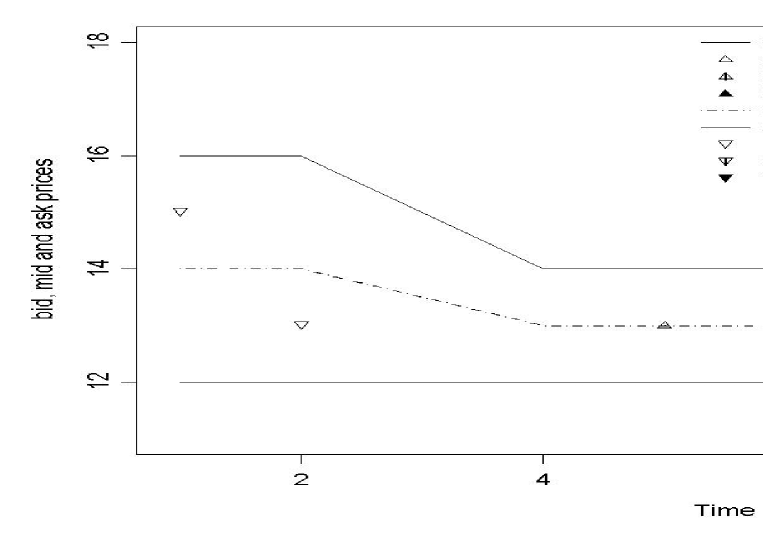

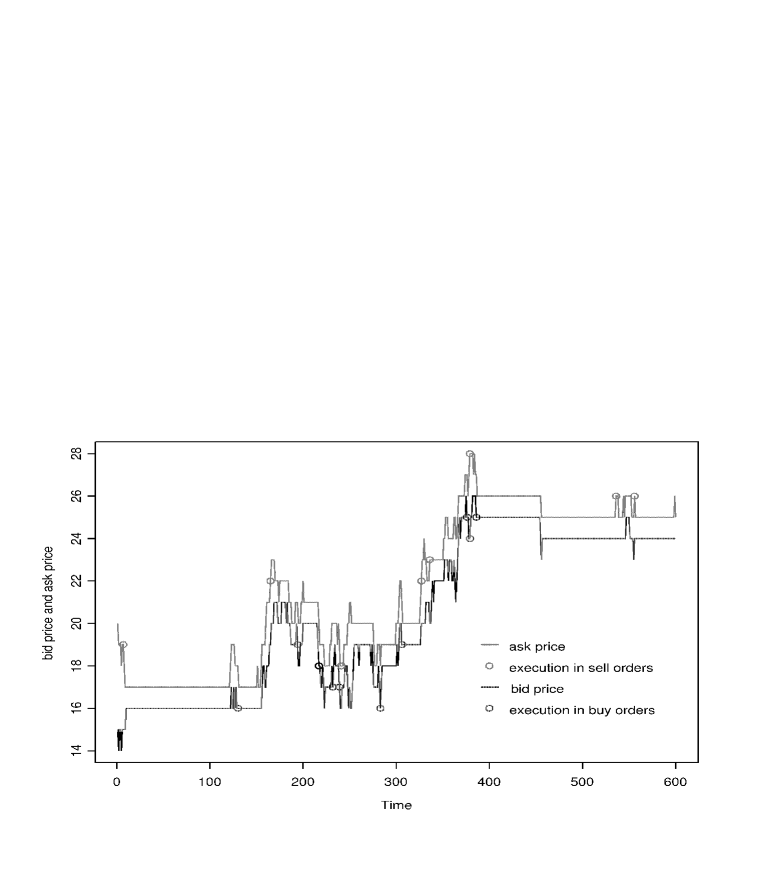

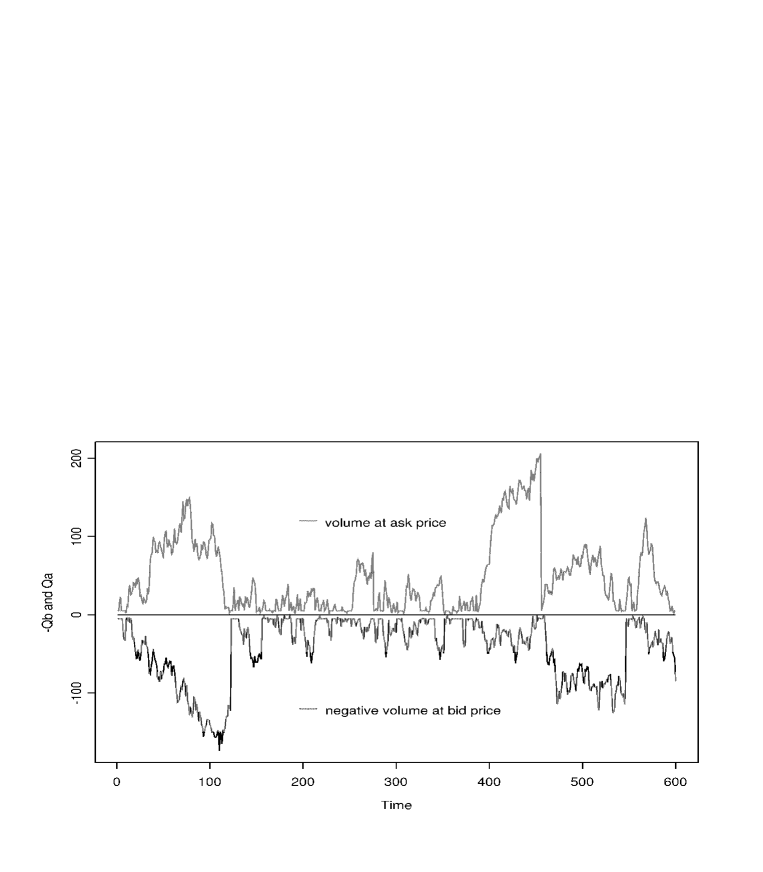

Fig. 2.2 and Fig. 2.3 plot a simulated path of the two-sided order book dynamics

(2.7) and (2.6). Fig. 2.2 shows the ask

(top gray line) and bid (bottom dark line) prices. Each time of

price change due to order depletion is assigned a probability

that it is an execution (indicated by circles) and a

probability that it is a cancelation. Fig. 2.3

shows the volumes at the ask (value of the top gray line) and bid

(absolute value of the bottom dark line) prices respectively in the

positive and negative axis. The parameters are , ,

, ,

and

.

2.3 Execution in the dark pool

This subsection will formulate rigorously the optimal trader’s

activities

inside the dark pool.

The trader’s decision on whether to accept an upcoming liquidity

event in the dark pool is indicated by the set of admissible hidden

order strategies

defined below. Be it an internalizing trader or a regular trader,

the admissible set of hidden order strategies is the same.

Definition 2.1

(hidden order strategy) The trader’s decisions on whether to accept the hidden orders are indicated by the -adapted, right-continuous, -valued processes and . The process equals zero on the set

| (2.8) |

and the process equals zero on the set

| (2.9) |

At any time , and cannot both equal to one. The collection of all such processes are denoted as . The subset of restricted on is denoted as , and is denoted as for short.

In Definition 2.1, the right-continuity of and

guarantees that, for each scenario , the

hidden orders are revised finitely many times over the time horizon

. The value () means that the trader places a

hidden limit buy (sell) order of () shares with

the execution the price (respectively

); the value ()

means that he

does not place the hidden order. The processes and being zero on the sets in (2.8) and (2.9) requires that the trader’s

hidden orders would only buy below the price and sell above the price .

Suppose an liquidity sell (buy) event occurs at time , meaning that

(respectively ). If the trader

placed a hidden limit buy (sell) order right before time with

the execution price (respectively ), then he successfully buys

shares (sells shares) at time and pays

(receives) a cash amount of

(respectively ). Using a

generic hidden order strategy , the

trader’s stock inventory and cash amount from

trading hidden orders are

| (2.10) |

3 The optimal trading problem

Suppose the collective activities of the market participants form

the order book dynamics are described in the previous section. The

optimal trader will trade on top of this aggregated

dynamics. He places a combination of active and hidden orders. The

active orders will immediately “internalize” incoming market

orders. His hidden orders in the dark pool may or may not be

executed at the next moment, but once they are executed the trader

receives a price half the spread lower or higher than the current

ask or bid price. The flexibility to choose between active and

hidden orders enables finding an optimal balance between taking the

decision to internalize orders providing them a price improvement,

and the naturally associated adverse selection he is

exposed to via his inventory.

Depending on his informational advantage, the trader is identified

as either regular or internalizing. Most traders

in today’s markets, including all the traders in Europe, are

regular. They observe and only observe the current records in the

order book. An internalizing trader has the priority of observing

incoming orders and acting upon them immediately before the orders

are displayed to other market participants. It offers an additional

choice to buy or sell at a slightly inferior price so that there is

no impact on the current best price.

3.1 Actively filling displayed orders

An active trading strategy places orders that will be fully and

immediately executed at the best prices available, minus a “price

improvement” offered to his counterpart if necessary.

The total shares that the trader has

bought and sold up till time by actively internalizing the

market orders consist of those filled at the best available price,

denoted by the increasing processes and

, and of those filled at the old prices

plus/minus a price improvement when new limit orders

arrive within the spread, denoted by the processes

and as the proportion of shares filled at the old price with respect

to the total number of existing shares at the old price right before

the transaction. The active trading strategy

is

called

– continuously re-balanced, if and are continuous in the time ;

– discretely re-balanced, if and are pure jump processes;

– mixed, if and are mixtures of the above two.

This subsection formulates mixed active trading

strategies (“mixed trading strategies” for short) respectively for

an internalizing trader and a regular trader.

Definition 3.1

(mixed trading strategy)

(1) The set of admissible mixed trading strategies

of an internalizing trader is the

collection of all trading strategies satisfying the following two criteria.

(1.1) The -adapted càdlàg processes

and are

non-negative and non-decreasing over the time interval . The

-adapted processes and take values within the interval .

(1.2) For two given positive integers ,

the process is flat on

| (3.1) |

and is flat on

| (3.2) |

the process is non-zero only on

| (3.3) |

and the process is non-zero only on

| (3.4) |

(2) The set of admissible mixed trading strategies of a regular trader is defined as

| (3.5) |

Criterion (1.1) in Definition 3.1 defines an

internalizing trader’s mixed trading strategy. The bounded prices in

Criterion (1.2) requires that the trader only buy below the

price and sell above the price . In

practice, when the prices goes outside of their normal range, no

trading reflects a psyche of not to take up risk or push the prices

further

towards the extreme; technically, it will be used to prove the well-posedness of Problem 4.1, or in other words that the value function is finite. The

other requirement about and in Criterion

(1.2) means that it is only necessary to consider filling a

fractional column at the old price when new limit orders arrive

within the spread. Allowing for optimizing over this fraction

enables a path-wise replication of the effect of every mixed trading

strategy by a price switching strategy, as will be shown in section

5. A regular trader’s mixed trading strategy defined

in Criterion (2) is the same as that of an internalizing

trader, except that at the time of order arrival within the spread,

the regular trader can no longer fill the orders at the

old price, which is formulated as .

The rest of the current subsection will write, in the

case of an internalizing trader, the order book dynamics and the

trader’s stock inventory and cash amount in compact formulae. They

can be verified by enumerating all the situations that could trigger

a change in the bid or ask price. To adjust to the case of a regular

trader is only

a matter of setting .

The order book dynamics from equations (2.5),

(2.7) and (2.6), is now controlled by

the trader using an admissible mixed trading strategy . The

number of times over that all the orders at the current ask

and bid prices are depleted can be expressed as

| (3.6) |

For , the changes

| (3.7) |

in the controlled ask and bid price processes at time can be computed by

| (3.8) |

The controlled volumes and at the ask and bid prices move according to

| (3.9) |

The controlled ask and bid prices and move according to

| (3.10) |

At every time , a mixed trading strategy gives the trader an inventory of stock shares

| (3.11) |

Let be the premium per share that the trader pays his counterpart, for internalizing limit orders at the old price upon the arrival of incoming orders at the new better price. Using the mixed trading strategy , the total cash amount that the trader pays the seller (receives from the buyer) of the stock denoted as (respectively ) can be calculated by

| (3.12) |

and

| (3.13) |

In the equation (3.11), the two integrals count the

total number of shares bought and sold at the old prices when limit

orders arrive within the spread. In each of the equations

(3.12) and (3.13), the first integral on

the right hand side of the identity is the amount of cash paid and

received if all the orders placed at the best available prices were

executed at the bid and ask prices observed right before each

transaction, as they are when the prices do not change and there is

no arrival within the spread. The second integral counts the cash

amount paid and received from filling the limit orders at the old

prices when new limit orders arrive within the spread. The third

integral collects the additional cost paid for trading deeper into

the book and the savings from filling the arriving limit orders

within the spread.

The trader’s cumulative cash amount on his account at time

from the mixed trading strategy is

| (3.14) |

3.2 The goal of trading

The trader’s total stock inventory and cash amount are sums of those from trading hidden and displayed orders, being

| (3.15) |

where the real numbers and are the initial stock

inventory and the initial cash amount, and the processes ,

, and are defined in the equations (2.10), (3.11) and (3.14). When there is

no ambiguity on which trading strategies are

used, the superscripts in the stock inventory and the cash amount are omitted.

Let and be two real numbers and

| (3.16) |

be a measurable function with quadratic growth.

Assumption 3.1

There exists a constant , such that for all and all , we have

| (3.17) |

and

| (3.18) |

The trading activities are measured by the reward

| (3.19) |

The trader’s objective of maximizing the reward in expectation is formulated as a stochastic control problem.

Problem 3.1

(1) An internalizing trader looks for an optimal trading strategy

and

to achieve the maximum expected

reward

| (3.20) |

The reward is a function of the premium

, because the cash amount is a function of .

(2) A regular trader looks for an optimal trading strategy

and

to achieve the maximum expected

reward

| (3.21) |

Control problems with reward functions of the form (3.19)

have a five dimensional state process . Problem

3.1 is still solvable for reward functions that are not

linear in , in which case the state process will have the cash

amount a sixth dimension. Assumption 3.1 is a

technical assumption under which Problem 4.1 and thus

Problem 3.1 are well-posed.

Several common situations where the reward criteria satisfy

Assumption 3.1 are linear combination of the cash and

inventory, liquidating or filling a certain number of stock shares,

and holding cash only at the terminal time,

corresponding to the following forms of defined in (3.19):

| (3.22) |

The criterion (3.22)(1) means that the trader

has a utility function linear in cash and inventory. In (3.22)(2), the coefficient is negative, and the

constant is the number of shares that the trader would like to

hold at the terminal time . In (3.22)(3), the

coefficient is positive and and are two positive

integers; if the terminal inventory is positive, the trader

sells all his stocks at the price per share; if

is negative, he pays the price for each

share.

Remark 3.1

In application, a trader in a hedge fund or a proprietary trading firm is entitled to both buying and selling during any trading period, hence , , and can be all positive. For a trader in a brokerage agency, if he trades during the time to fill a buy (sell) order for the customer, a simplest way to comply with the regulations is not to sell (buy) throughout the same time period, hence, when using the results in this paper, he should set , and (respectively , and ) for all . Especially, a regular trader sets . The brokerage agency’s admissible set of equivalent price switching strategies is a modification of Definition 4.1 by setting and (respectively and ). Optimizing over the buying (selling) strategies only is a special case of the algorithm in subsection 6.2.

4 The optimal switching problem

This section presents the problem of how the trader could optimally switch the bid and ask prices and shows the well-posedness of the optimal switching problem. Compared to the optimal trading Problem 3.1, price switching considers a smaller and simpler set of active trading strategies, which are discretely re-balanced strategies in the form of the times to trade and the number of limits to fill at each time.

4.1 Switching prices

Let and respectively denote the integer part

and the fractional part of a real number . The identity

holds. Switching the prices means that the trader

chooses a sequence of times and two sequences

of positive numbers and

, such that the ask and bid prices are

pushed from to and

from to . The ask

and bid prices stay

constants over every time interval .

In the limit order book where the trader and the rest of the market participants all

act, a price change could occur due to two possible reasons.

(1) Limit orders at the ask or bid price is depleted by the noise

trader, or limit orders arrive within the spread. Suppose the

previous time of price switching is , then the next time

when either event happens can be expressed as

| (4.1) |

(2) The trader fills all the shares at the ask or bid price and, at

his choice, some limits beyond the best prices. If he trades at some

time , then he has to fill all the shares

at either the ask price or the bid price to trigger a price

change.

After the th price switching at the time , if he

waits until the time , the trader may choose to fill some

shares at time ; even if he does not trade, the rest of the

market will switch the prices at time any way, in which case

the time of the th price switching is set as . Requiring

that the trader has to “trade” at time , though possibly zero

share, makes sure that the prices are constants between two

switching times and gives a

neater expression of the order book dynamics.

Furthermore, formulating with the help of ’s

reduces the price switching problem from seven-dimensional

path-dependent to five-dimensional Markovian. The actual controlled

state process is

| (4.2) |

Since what matters in is their exponentially

distributed arrival times, the trader only need to monitor whether

or not there is an arrival of limit sell or buy orders within the

spread. Viewing the controlled arrival times ’s as a sequence

of exit times when decision marking has to take place, the state

process is simplified to .

The admissible price switching strategies are switching controls defined below.

Definition 4.1

(switching control) The admissible set of

switching controls of an internalizing trader and that of a regular

trader are denoted respectively as and

. Let the letter represent either the

superscripts “int” or the superscript “reg”. The admissible set

consists of switching controls

satisfying, for every

, the three criteria below, with the convention

that .

(1) The switching time is an -stopping time such

that . If , then ; if , then , where defined in (4.1) is the next

time of price change if the trader does not trade.

(2) For the

same positive integers and as in

Definition 3.1, we have , where

| (4.3) |

In expression (4.3), the sets and of real numbers are defined as

| (4.4) |

for an internalizing trader, and as

| (4.5) |

for a regular trader. For and , the set is defined the same as except that . Also, we denote by

| (4.6) |

the set of the first elements of all switching controls in .

In Definition 4.1, Criterion (1) specifies

the trading times . Criterion (2) specifies the

possible numbers of limits to buy and sell at each transaction.

Setting means the trader no longer trades, hence there has

to be .

The admissible switching control sets of an internalizing trader and a

regular trader are different only up to the sets and

defined in (4.4) and (4.5).

Throughout this paper, when a claim is valid for a trader regardless

of whether he is internalizing or regular, the admissible switching

control sets will be generically

denoted as , and .

For , at every

time a switching control causes the

ask price to increase from to

and the bid price to decrease

from to . By

enumerating all the situations that could trigger a price change,

the order book dynamics and the changes in the stock

inventory and cash amount can be summarized in compact formulae.

The order book dynamics can be written in terms of the switching

control

| (4.7) |

the controlled prices move according to

| (4.8) |

the controlled volumes move according to

| (4.9) |

Defining the functions and as

| (4.10) |

then and are respectively the number of shares that the trader buys and sells at the time . The quantity

| (4.11) |

is the change in the trader’s stock inventory from

transactions at the time .

Let be the premium that the trader pays his counterpart for

filling each share at the old price upon the arrival of limit orders

at the new price. Defining the functions and as

| (4.12) |

and

| (4.13) |

then and are respectively the total cash amount that the trader pays the seller (receives from the buyer) of the stock for transactions at the time . The quantity

| (4.14) |

is the change in the trader’s cash amount on his account from

transactions at the

time .

Actively trading according to a generic switching control

defined by Definition 4.1,

the trader’s inventory and cash amount from the

displayed orders are respectively

| (4.15) |

Taking into account the hidden orders, the trader’s total terminal stock inventory and cash amount are respectively

| (4.16) |

where the quantities and are defined in the

equations (2.10). When there is no ambiguity on

which trading strategies are used, the superscripts in

and are omitted.

Since each transaction using active orders causes a change in the prices,

the trader’s trading activities are a matter of choosing when and to

what level to “switch” the ask and bid prices. The profit or cost

from switching at time is the change in his cash amount

expressed as the quantity in (4.14). This is why we give

the name “price switching” to the set of discretely re-balances

trading strategies introduced in this section. Optimizing the

trading algorithm over all the price switching strategies is a

problem of switching control with impact on the state process.

Problem 4.1

(1) An internalizing trader looks for an admissible switching control and an optimal hidden order strategy that achieve the supremum

| (4.17) |

Same as in Problem 3.1, the reward

is a function of the premium .

(2) A regular trader looks for an admissible switching control

and an optimal hidden order strategy

that achieve the supremum

| (4.18) |

Generically for either an internalizing trader or a regular trader, Problem 4.1 requires finding an admissible switching control and an optimal hidden order strategy that achieve the supremum

| (4.19) |

The value process of (4.19) is defined as

| (4.20) |

Then the best expected reward (4.19) can be written as

| (4.21) |

4.2 Well-posedness of the problem

Before looking for an optimal trading strategy that achieves the supremum in (4.19), it is necessary to verify that the optimal switching problem is well-defined. In other words, is the value process in (4.20) finite? This subsection will prove that the answer is yes. Later in Proposition 5.1, we shall see that the optimal price switching problems provide lower and upper bounds of the value functions of the optimal trading problem, hence the optimal trading problem is consequently also well-posed. By Theorem 5.1(6)(8) and Proposition 5.1, we shall see that

| (4.22) |

It suffices to prove the well-posedness of the regular trader’s

price switching problem and the internalizing trader’s price

switching problem with zero premium. Then the well-posedness of

Problem 3.1 and Problem 4.1 all follows.

Throughout this subsection, the

premium equals zero.

The well-posedness is stated as Theorem 4.1 at the end of this subsection.

To prepare for the proof of the theorem, Lemma 4.1

and Lemma 4.2 will respectively provide

uniform or bounds of the prices

, the stock inventory and the

cash amount for all admissible switching controls.

Because the reward criterion defined in (3.19) is a

function of , , and

, the two Lemmas lead to Theorem 4.1. In addition, an interpretation worth noting of Lemma 4.1 is that the trader’s trading activities will not push

the prices towards explosion.

Lemma 4.1

Proof. The total number of downward (upward) movements in the ask (bid) price equals the number of times that limit sell (buy) orders arrive within the spread. The total number of upward (downward) movements in the ask (bid) price equals the number of limits that the trader has filled plus the number of times when the volume at the ask (bid) price is depleted by the rest of the market. The total number of depletions at the ask (bid) price by the rest of the market participants does not exceed a renewal process with independent inter-arrival times identically distributed as the leverage hitting time

| (4.24) |

The highest ask (lowest bid) price happens when no limit sell (buy) orders arrive within the spread and the trader fills all the limit sell (buy) order below the price (above the price ). The lowest ask (highest bid) price happens when there is no depletion by the trader or the noise trader, and limit sell (buy) orders arrive according to the largest possible intensity. The prices have the upper and lower bounds

| (4.25) |

Using the inequalities in (4.25) and the bounds for variances of stationary renewal processes derived in [15] Daley (1978), we get the inequalities in (4.23).

Lemma 4.2

Proof. Throughout the time interval , the ask price (bid price ) moves downward times (upward times). At least one limit at a time, the trader could take at most all the initially existing displayed limit sell (buy) orders and all the displayed limit sell (buy) orders ever arriving within the spread, as long as the ask (bid) price is below (above ). Then the total number of limits that the trader would ever buy (sell) until time does not exceed (respectively ). At any time , each limit of limit sell (buy) orders contains no more than (respectively ) shares. Each time buying (selling), it is impossible to take more than the number of all the currently existing limit sell (buy) orders below (above) the price (respectively ). We may bound the stock inventory and cash amount from displayed orders by

| (4.28) |

Considering the hidden orders, the trader could receive at most shares of hidden limit sell orders and shares of hidden limit buy orders. The greatest possible price for each share does not exceed the bounds in (4.25). The stock inventory and cash amount from hidden orders can be bounded by

| (4.29) |

By the inequations (4.28) and (4.29), by Lemma 4.1, and by applying Burkholder-Gundy-Davis inequality to and , the claim in this lemma can be justified.

Theorem 4.1

There exists a constant , such that for any switching control and any hidden order strategy , we have

| (4.30) |

Furthermore, for all , the value process defined in (4.20) has the growth rate

| (4.31) |

Proof. By Assumption 3.1 (1), equation (3.19) and equation (4.16), we know that

| (4.32) |

Substituting the inequalities (4.26) and (4.27) into inequality (4.32) gives the inequality

(4.30).

Because of the Markov property of the order book dynamics, the

inequality in (4.31) can be derived in the same way as

(4.30).

Theorem 4.1 implies that the value process defined in

(4.20) indeed exists and is finite.

5 Relation between trading and price switching

This section will state in Theorem 5.1 the relation between Problem 3.1 and Problem 4.1. Deriving from Theorem 5.1, the result in Proposition 5.1 tells that the two price switching algorithms provide lower and upper bounds of value functions of the two mixed trading algorithms. Especially, when the premium equals zero, the internalizing trader’s optimal mixed strategy can be achieved among the set of price switching strategies.

Remark 5.1

The results in this section will have three implications.

(1) They help prove well-posedness of all the control problems, as discussed at the beginning of Subsection 4.2.

(2) When the upper and lower bounds in Proposition 5.1 do not differ much, e.g. in Fig. 6.4, the implementable lower bound switching strategy is nearly optimal for the optimal trading problem. Corollary 6.1 will show that the latter is much harder to compute.

(3) The MiFID framework defines different types of traders and strategies. Theorem 5.1 compares their best expected profits.

Definition 5.1

(step trading strategy) The admissible set of step trading strategy of an internalizing trader and that of a regular trader are denoted respectively as and . Let the letter represent either “int” or “reg”. Let be an arbitrary admissible switching control. The processes and , being the total shares that the trader has bought and sold according to the switching control , are computed from

| (5.1) |

where the mappings and are defined in (4.10). When limit orders arrive within the spread, the proportion of shares that the trader fills at the old price is computed from

| (5.2) |

The set of admissible step trading strategies is defined as the collection of all the trading strategies satisfying (5.1) and (5.2) for some switching control . Namely, and .

Seen from Definition 4.1 and Definition 5.1, each step trading strategy of an internalizing or regular trader is his price switching strategy denoted in terms of the total numbers of shares bought and sold, so they are the same active trading strategy under different names. The two definitions further imply that

| (5.3) |

Notation 5.1

(1) An internalizing trader’s best expected reward over step trading strategies is denoted as

| (5.4) |

(2) A regular trader’s best expected reward over step trading strategies is denoted as

| (5.5) |

Theorem 5.1

The value functions of the optimal trading problem and the

optimal switching problem have the relations

(1) ; (2) , for all ;

(3) ; (4) , for all ;

(5) , for all ; (6) , for all ;

(7) ;

(8) Viewing as the variable, the two functions and are decreasing in .

Theorem 5.1 can be proved by the results from the next

subsections 5.1 and 5.2. An outline of the

proof is provided here.

Outline of Proof of Theorem 5.1

(1) and (2) By their definitions, step trading strategies

(Definition 5.1) and price switching strategies

(Definition 4.1) have one-to-one correspondence

between each other, because the two sets in fact consist of the same

active trading strategies denoted in different terms. A price

switching strategy denotes the times of transactions and the numbers

of limits to buy and sell at each time; a step strategy denotes the

total numbers of shares bought and sold up-to-date. This explains

the first and last identities in Theorem 5.1.

(3), (4), (5) and (6) The three inequalities come from the

inclusions in Lemma 5.1.

(7) This identity comes from Lemma 5.2, Lemma 5.1(1) and Proposition 5.2. The main idea of the

proof is to construct, in Lemma 5.2, a step trading

strategy that path-wisely replicates

the stock inventory and the cash amount produced by the mixed

trading strategy . By Lemma 5.1(1),

every step trading strategy is a mixed trading strategy.

Furthermore, as will be shown by Proposition 5.2,

an internalizing trader’s two active trading strategies and

path-wisely result in the same bid ask prices, replacing

the former with the latter does not change the stock inventory and

cash amount produced by a passive strategy on the hidden orders.

(8) The quantities defined according to (3.12), (3.13), (3.14) and (3.15), and defined according to

(4.12)-(6.3), viewed as functions in

, are decreasing. The reward criterion defined in

(3.19) is increasing in the cash amount, because the

coefficient is positive. Hence defined

in (3.20) and defined in

(4.17) are decreasing in .

Proposition 5.1

The value functions of the price switching problem provide lower and upper bounds for the value functions of the optimal trading problem. (1) If the optimal trader is regular, then

| (5.6) |

(2) If the optimal trader is an internalizer, then

| (5.7) |

and

| (5.8) |

Proof. (1) The first inequality in (5.6)

comes from Theorem 5.1(1)(3). The second inequality in

(5.6) comes from Theorem 5.1(2)(5)(7).

(2) By Theorem 5.1(2)(7), the identity (5.7) holds. The first inequality in (5.8) comes

from Theorem 5.1(2)(4). To prove the second inequality

in (5.8), by Theorem 5.1(8) it holds that

, the right hand side of

which equals by (5.7).

5.1 Analysis of active strategies

It can be verified that the processes , , and defined in (5.1) and (5.2) satisfy Definition 3.1, so every step trading strategy is a mixed trading strategy in the admissible set , for . However, the contrary is not true, because a mixed trading strategy can be continuous over some time interval, but a step trading strategy is a pure jump process. By Definition 3.1(2), a regular trader’s admissible set of mixed trading strategies is the subset of an internalizing trader’s mixed trading strategies that do not fill orders at the old price at the time of order arrival within the spread. By their definitions in (4.4) and (4.5) of Definition 4.1, there is the set inclusion . It follows that a regular trader’s price switching strategy is a proper subset of an internalizing trader’s price switching strategy.

Lemma 5.1

When the premium equals zero, the set of his admissible step trading strategies performs equally well as an internalizing trader’s set of admissible mixed trading strategies, though the former is a much smaller subset of the latter as stated in Lemma 5.1(1). Whatever stock inventory and cash amount a mixed trading strategy can produce at the terminal time, an internalizing trader can always find a step trading strategy that path-wisely does the same. Hence an internalizing trader’s best expected reward can be achieved over a smaller and simpler set of admissible trading strategies. This is the role of Lemma 5.2.

Lemma 5.2

5.2 Effect on an internalizing trader’s hidden orders

Given an arbitrary admissible mixed trading strategy from the internalizing trader, let the step trading strategy , for some , be the one constructed in Lemma 5.2 to replicate the terminal stock inventory and cash amount. Let and denote the price processes (3.10) controlled by the mixed trading strategy , and and denote the price processes (4.8) controlled by the switching control . The construction is such that the two strategies also produce the same times and amounts of price change, meaning that

| (5.10) |

Let us recall that the intensities of the liquidity event processes and are functions of the spread only. The equations (2.10) and (5.10) further imply that, both the inventory and cash amount from an arbitrary hidden order strategy remain the same regardless of whether the mixed trading strategy or the step trading strategy is used. The analysis in this paragraph has verified a reinforcement of Lemma 5.2, stated as the proposition below.

6 Solving the optimal switching problem

This section will provide the characterization of an optimal trading

strategy and derive a trading algorithm for the optimal switching

Problem 4.1. The solution is valid regardless of

whether the trader is internalizing or regular, hence the admissible

set of switching controls is generically denoted as .

Before getting down to the

solution, a few notations are introduced.

The two-dimensional quantities representing both sides of the order book are

denoted as , ,

, , and for

short. As will be shown in Theorem 6.1, the decision

making would only need to observe the state processes

and , which generate a smaller filtration than

. The domain of the process

is denoted

as

| (6.1) |

To express the change in the order book and in the inventory from the trader’s transaction, the mapping is defined as

| (6.2) |

Immediately after applying the switching control at time , the volumes and inventory become

| (6.3) |

The process defined as

| (6.4) |

is the finite variation part in the Doob-Meyer decomposition of the semimartingale defined in . By the bound in (4.29), the local martingale part of is a martingale. Then the value process defined in (4.20) can be written alternatively as

| (6.5) |

because equals the expectation on the right hand side of the above equation. For every , the process is defined as

| (6.6) |

For every measurable function , the operator is defined as

| (6.7) |

6.1 Optimal trading strategy

This subsection will eventually derive, in Proposition 6.1, expressions of an optimal price switching strategy in terms of the value process. The methodology is based on the principle that the value process of a control problem is a supermartingale, and becomes a martingale if and only if the control is optimal. It is called the “martingale method”, first introduced for optimal stopping problems in Snell (1952) and for stochastic control problems in Davis (1979). The pivot of the arguments is the dynamic programming principle formulated in our setting as Theorem 6.1. A reference of the dynamic programming principle is Fleming and Soner (1993). Lemma 6.1 provides the right continuity of the value process, so that it is a qualified candidate for using the Snell envelop technique to sequentially determine each optimal time of trading. Lemma 6.2 is the characterization of the optimal trading strategy from the martingality of the value process. Because Theorem 4.1 has shown that the value process is finite, the expressions in Proposition 6.1 imply the existence of an optimal trading strategy.

Theorem 6.1

(dynamic programming principle) Given , there exist deterministic measurable functions , and , and a mapping , such that the value process defined by the equation (4.20) satisfies

| (6.8) |

The value functions , and can be computed via the dynamic programming principle

| (6.9) |

when and , and

| (6.10) |

when , . Especially, at the terminal time , the value function satisfies the terminal condition

| (6.11) |

Proof. The existence of the functions , and comes from the Markovian structure of the processes , and the memoryless property of the exponential inter-arrival times for the orders within the spread. In our context, the proof of the dynamic programming principle is routine. To wit, take arbitrary and as defined in Definitions 4.1 and 2.1, and denote for short

| (6.12) |

Then by the same reasoning that derives equation (6.5) and by the law of iterated expectations, we have

| (6.13) |

Because

| (6.14) |

by equations (6.5) and (6.8), we know that

| (6.15) |

Taking supremum over on both sides of the inequality

| (6.16) |

and using the equations (4.20) and (6.13), we prove that is less than or equal to the right hand

side of (6.9).

We know from equations (4.20) and (6.13)

that

| (6.17) |

for arbitrary and . The expressions (6.14) and (6.17) imply that

| (6.18) |

and thus greater than or equal to the right hand side of (6.9). Both sides of the inequality hold, hence

| (6.19) |

When and , by (6.8) there is

| (6.20) |

hence (6.19) takes the form (6.9). When or or , the trader has to “trade” at time , though possibly zero share, hence (6.19) takes the form (6.10) or (6.11).

Lemma 6.1

For every , suppose the trader does not trade over the time interval . Then the processes , , are continuous in the time , meaning that

| (6.21) |

Proof. It suffices to prove the continuity of , then the continuity of and follows from the expression (6.10).

Take two arbitrary times , an arbitrary price switching strategy and an arbitrary hidden order strategy . Denote . Suppose and .

(continuity in the volume ) For any two sets of initial values and , the resulted state processes are respectively denoted as and . If the trader never trades, then, taking the ask side for example, there are three possibilities of the dynamics.

(1) Limit sell orders arrive in the spread before either or reaches zero, in which case the new ask prices and equal and the volumes and both become at the time of arrival.

(2) Limit sell orders does not arrive in the spread before both and reach zero. At the time of arrival the new ask prices and equal and the volumes and still differ by .

(3) Limit sell orders arrive in the spread when one of and has reached zero and the other one has not.

In cases (1) and (2), the difference in the trader’s stock inventory does not exceed , and that in the cash amount does not exceed . The probability that type (3) events ever happen over the entire time horizon converges to zero, as . By Assumption 3.1 (2) and from the bounds of the price, stock inventory and cash amount in Lemma 4.1 and Lemma 4.2, we know that

| (6.22) |

(continuity in the time ) Take any initial values and any number . Let denote the active trading strategies with the terminal time replaced by . Then there is the relation

| (6.23) |

Because the change in the order book dynamics during the time interval is of the order , the best expected reward from terminating at the time or at the time differs up to , meaning that

| (6.24) |

The continuity of the process can be concluded

from the identities (6.22) and (6.24) and from the properties of Brownian motions and Poisson

processes that drive the state

process.

The proofs of Lemma 6.2 and Proposition 6.1 follow the routine procedure on how to characterize the

optimal control and optimal stopping time via the martingale method.

Because they are very long, the proofs are not provided here.

Interested readers could find the original idea in Davis (1979) and

Snell (1952), and the arguments for a most similar result in Section

2.2.2 of Li (2011).

Lemma 6.2

The price switching strategy and hidden order strategy achieve the supremum in (6.9),

if

and only if all of the four conditions below hold.

(1) is a supermartingale, for every ;

(2) is a martingale;

(3) either , or ;

(4)

Proposition 6.1

There exist an optimal switching control and an optimal hidden order strategy , which are defined in the following way. Let . For , the optimal trading time can be expressed as

| (6.25) |

If , then ; otherwise

| (6.26) |

Denoting as

| (6.27) |

for , the optimal hidden order strategy can be expressed as

| (6.28) |

6.2 Numerical algorithm

This subsection will present the numerical algorithm to compute the

value function and optimal trading strategy for the discretized

version of the optimal price switching Problem 4.1. We

shall specify different complexities of this algorithm on a serial

computer and on a GPU cluster.

The time and the state process are discretized over a grid

, where as the grid for

the time is defined as

| (6.29) |

and as the grid for the state process is a bounded set in with elements. When the grid tends finer and finer, the limit

| (6.30) |

is assumed to be a dense set in .

The algorithm takes the three steps to be specified below.

Its outputs will be the value function and the optimal trading

strategy

when limit orders do not arrive within , and

when limit sell (buy)

orders arrive within , for all

. The pseudo codes are provided in Table 6.1.

Step 1. (at the terminal time) At the time , the

terminal condition is

.

Step 1.1 Compute the reward from trading at the terminal time for every trading strategy as

| (6.31) |

Step 1.2 The maximum reward from trading at the terminal time is

| (6.32) |

The optimal trading strategy is

| (6.33) |

Step 2. (simulate the controlled state process) With the initial values

| (6.34) |

simulate the state process

| (6.35) |

according to

| (6.36) |

So that the state process remains within the grid , the truncated value from each simulation is obtained from

| (6.37) |

(It is possible to directly simulate the truncated values.)

Run simulations to get according

to the equations (6.35), (6.36) and

(6.37). The simulated values are denoted as

. For

, simulate Poisson random variables

with the intensity

to represent whether limit orders arrive

within the spread during the time interval .

Step 3. (value function and optimal trading strategy)

This step conducts the optimization procedure by the dynamic

programming principle

| (6.38) |

Step 3.1 (approximating the expectation) The conditional

expectation

in (6.38) is approximated by computing

| (6.39) |

Step 3.2 (value function and trading strategy when no arrival within the spread) This is the case when there is no limit order arrival within the spread throughout the time interval , meaning that , for and . The reward from using a generic trading strategy and is

| (6.40) |

The optimal value from trading is

| (6.41) |

The optimal trading strategy is

| (6.42) |

Step 3.3 (value function and trading strategy when there is arrival within the spread) This is the case when limit orders arrive within the spread at some point during the time interval , meaning that , for or . The reward from using a generic trading strategy is

| (6.43) |

The optimal value from trading is

| (6.44) |

The optimal trading strategy is

| (6.45) |

We would like to distinguish between the computational

complexities of the backward induction algorithm on a CPU and on a

GPU. The corollary below draws conclusion from the discretization

via the dynamic programming of the price switching problem, which is

of the type of combined impulse control and optimal control.

Interested readers may verify if the result is the same for other

methods (PDE or backward SDE, if applicable) and other control

types.

Corollary 6.1

Let , and respectively be the mesh sizes of the discretized time grid, space grid and admissible control set, and be the number of simulation paths to estimate the conditional expectation. Using serial computation, the time complexity of the algorithm is . Using parallel computation to switch as much as possible the complexity to space complexity, the space complexity of the algorithm is , and the time complexity can be reduced to at most .

Proof. Table 6.1 lists the pseudo codes of the algorithm, the computational complexity at every step and whether it is parallelizable or not. The computation at every node in the state space is always parallelizable, because it uses results from the previously computed time step, and does not use any other nodes at the same time step. The number is the complexity to get the maximum expected reward among all admissible controls, hence it cannot be carried out in parallel. For example, to get the maximum among the numbers , one can inductively compute and , for . Then .

Remark 6.1

There are two important observations from Corollary 6.1.

(1) Because all the nodes in the state space at every time step can be computed in parallel, stochastic control problems of mediumly high dimension is no longer numerically forbidding.

(2) The minimum time complexity on a GPU cluster is , which is the number of time steps multiplies the size of the admissible control set. The admissible set of mixed strategies is the cube , while the admissible set of price switching strategies is only the integer points inside that cube, hence the price switching problem is much simpler to implement.

6.3 Implementation

This subsection implements the algorithm in a simpler Binomial

model, to the best capability of the author’s PC. An interesting

application of the numerical results would be to calculate a “fair”

internalization premium .

From every time step to , the randomness in the model

is captured by six Binomial variables. Independence is assumed

unless mentioned otherwise. Other features remaining the same, the

modifications from the previous subsection are the following.

(1) The change in the volume caused by market participants other than the trader is a random variable with probabilities , .

(2) Let the pair of random variables indicate whether limit sell and buy orders arrive (value one) or not (value zero) at one tick below the ask price and one tick above the bid price, when the spread is greater than one tick. The three scenarios are assigned probabilities , where .

(3) Let the pair of random variables indicate whether there is a liquidity event (value one) or not (value zero) that consumes the trader’s hidden buy and sell orders at the mid price. The three scenarios are assigned probabilities .

(4) In addition, internalization here means only filling

() shares at the time price (),

when at time limit sell (buy) orders arrive at a better

price

(), indicated by ().

We use , and . The time mesh is

| (6.46) |

At the terminal time , the trader’s stock inventory is

valued at per share if it’s positive, and

per share if negative.

Because the state space is infinite, it has to be truncated somehow

on the boundary. The largest grid that the author’s PC can accept is

| (6.47) |

The grid contains 104181 admissible points where .

How the trader’s optimal trading strategy interacts with simulated

price paths is illustrated in Fig. 6.1 (regular trader), Fig. 6.2

(systemic internalizer) and Fig. 6.3 (systemic internalizer). The

initial time is and terminal time . The initial values

are , , and . The

trader’s activities in all three figures display an attempt to sell

short and push down the price. He indeed uses combinations of

different order types - active, hidden and internalizing orders. Due

to the truncation on the inventory, it is however not quite

informative to compute the profit. More advanced devices are needed

to allow for a

wider grid, especially a larger range of the inventory variable.

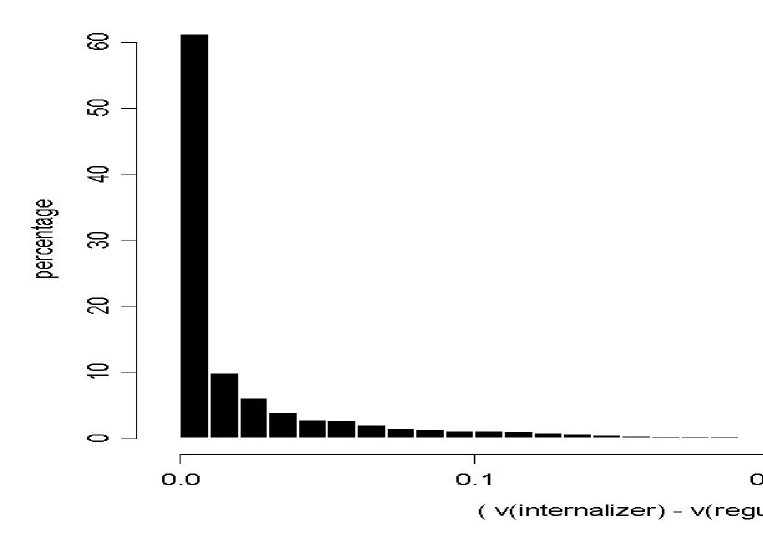

It is interesting to see the effect of internalization on the trader’s

best expected profit. The relative difference in best expected

profits between a systemic internalizer and a regular trader is

defined as

| (6.48) |

where and are respectively the time- value functions of systemic internalizer and regular trader defined in (4.20), and is the internalization premium. Fig. 6.4 shows the distribution of , with the initial values ranging over the 104181 admissible points on the grid. The systemic internalizer’s best expected profit is - higher than that of the regular trader on about of the admissible points. This means that internalization, when applied in the right situations, can be on average profitable. Furthermore, it suggests a way to specify a “fair” value of the internalization premium, so that both parties of the transaction will gain.

Remark 6.2

Let a weight function ; represent the likelihood of each point in the state space, satisfying

| (6.49) |

For some commonly recognized reward criterion in equation (3.19), some typical duration of a trading period and some proper grid of the state space, the “fair” internalization premium should be a strictly positive number such that the weighted average

| (6.50) |

is somewhere above zero.

Since internalization is an additional choice that brings a higher best expected profit, should be positive. Since internalization provides price improvements to his counterpart, should be low enough to keep it profitable for a systemic internalizer to do so.

Acknowledgements

I would like to thank many people from conversations with whom I

started to learn about market microstructure. I am mostly grateful

to Charles-Albert Lehalle at Crédit Agricole Cheuvreux and

Capital Fund Manegement, for sharing with me his insights into

market microstructure and algorithmic trading, through discussions

during the breaks at academic seminars, in his office and via

numerous emails. His insights provided a guideline of where the

mathematics should go at every step of the work. In this paper, the

title, the limit order book model, the idea of a “fair”

internalization premium and most of the deep understandings about

the literature and about the European market should be attributed to

Charles-Albert. Besides, the course on programming GPU in CUDA/C

language, taught by Dr. Lokman A. Abbas

Turki at TU Berlin, gave me much more concrete knowledge about parallel computation.

A very primitive idea of this paper was initiated when I was graduating from Columbia

University in New York, while the actual work took place

consecutively at Université d’Evry, at Humboldt-Universität

zu Berlin and during my current transition. I would like to

acknowledge the financial support kindly provided by l’Institut

Europlace de Finance and l’Institut Louis Bachelier Paris, by

Matheon Berlin and by my mother.

References

- 1 Alfonsi A., A. Fruth and A. Schied, 2010, Optimal Execution Strategies in Limit Order Books with General Shape Functions, Quantitative Finance 10(2), 143-157.

- 2 Alfonsi A. and A. Schied, 2010, Optimal Trade Execution and Absence of Price Manipulations in Limit Order Book Models, SIAM J. on Financial Mathematics 1, 490-522.

- 3 Alfonsi A., A. Schied and A. Slynko, 2012, Order Book Resilience, Price Manipulation, and the Positive Portfolio Problem, SIAM J. on Financial Mathematics 3, 511-533.

- 4 Almgren R., 2003, Optimal Execution with Nonlinear Impact Functions and Trading-Enhanced Risk, Applied Mathematical Finance 10, 1-18.

- 5 Almgren R. and N. Chriss, 2000, Optimal Execution of Portfolio Transactions Journal of Risk 3, 5-39.

- 6 Avellaneda M. and S. Stoikov, 2008, High-Frequency Trading in a Limit Order Book, Quantitative Finance 8(3), April 2008, 217-224.

- 7 Baron M., J. Brogaard and A. Kirilenko, 2012, The Trading Profits of High Frequency Traders, Preprint.

- 8 Bertsimas, D. and A. W. Lo, 1998, Optimal Control of Execution Costs, Journal of Financial Markets 1, 1-50.

- 9 Bouchard B., N-M. Dang and C-A. Lehalle, 2011, Optimal Control of Trading Algorithms: A General Impulse Control Approach, SIAM J. Finan. Math. 2, 404-438.

- 10 Cebiroglu G., N. Hautsch and U. Horst, 2013, Does Hidden Liquidity Harm Price Efficiency? Equilibrium Exposure under Latent Demand, Preprint.

- 11 Cont R., S. Stoikov and R. Talreja, 2010, A Stochastic Model for Order Book Dynamics, Operations Research 58(3), May-June 2010, 549-563.

- 12 Cont R., A. Kukanov and S. Stoikov, 2013, The Price Impact of Order Book Events, Journal of Financial Econometrics.

- 13 Cont R. and A. de Larrard (2013, Price Dynamics in a Markovian Limit Order Market. SIAM J. Finan. Math. 4(1), 1-25.

- 14 Cont R. and A. de Larrard, 2011, Order Book Dynamics in Liquid Markets: Limit Theorems and Diffusion Approximations, Preprint.

- 15 Daley D. J., 1978, Bounds for the Variance of Certain Stationary Point Processes, Stochastic Processes and Their Applications. 7, 255-264.

- 16 Davis M. H. A., 1979, Martingale Methods in Stochastic Control, Lecture Notes in Control and Information Sciences 16. Springer-Verlag, Berlin.

- 17 Fleming W. H., and H. M. Soner, 1993, Controlled Markov Processes and Viscosity Solutions, Springer, New York.

- 18 Gatheral J. and A. Schied, 2011, Optimal Trade Execution under Geometric Brownian Motion in the Almgren and Chriss Framework, International Journal of Theoretical and Applied Finance 14(3), 353-368.

- 19 Guéant O., C-A. Lehalle and J. Fernandez-Tapia, 2012a, Optimal Portfolio Liquidation with Limit Orders, SIAM J. Finan. Math. 3(1), 740-764.

- 20 Guéant O., C-A. Lehalle and J. Fernandez-Tapia, 2012b, Dealing with Inventory Risk: a Solution to the Market Making Problem, Mathematics and Financial Economics, September 2012.

- 21 Guilbaud F. and H. Pham, 2013, Optimal High Frequency Trading with Limit and Market Orders, Quantitative Finance 13(1), 79-94.

- 22 Hasbrouck J., 2007, Empirical Market Microstructure, Oxford University Press.

- 23 Hasbrouck J. and G. Saar, 2010, Low-Latency Trading. Johnson School Research Paper Series No. 35-2010.

- 24 O’Hara M., 1997, Market Microstructure Theory. Blackwell Publishing.

- 25 Ho T. and H. Stoll, 1981, Optimal Dealer Pricing Under Transactions and Return Uncertainty, Journal of Financial Economics 9(1), 47-73.

- 26 Huang W., C-A. Lehalle and M. Rosenbaum, 2013, Simulating and Analyzing Order Book Data: The Queue-Reactive Model, Preprint.

- 27 Jovanovic B. and A. J. Menkveld, 2011, Middlemen in Limit-Order Markets, Preprint.

- 28 Lachapelle A., J-M. Lasry, C-A. Lehalle and P-L. Lions, 2013, Efficiency of the Price Formation Process in Presence of High Frequency Participants: a Mean Field Game Analysis, Preprint.

- 29 Laruelle S., C-A. Lehalle and G. Pagès, 2011, Optimal Posting Distance of Limit Orders: a Stochastic Algorithm Approach, Mathematics and Financial Economics. Forthcoming.

- 30 Lehalle C-A., 2013, Market Microstructure Knowledge Needed for Controlling an Intra-Day Trading Process. J.-P. Fouque & J. Langsam, eds, Handbook on Systemic Risk, Cambridge University Press.

- 31 Lehalle C-A. and S. Laruelle (editors), 2013, Market Microstructure in Practice. World Scientific.

- 32 Li Q., 2011, Non-Zero-Sum Stochastic Differential Games of Control and Stopping, Dissertation, Columbia University.

- 33 Menkveld A. J., 2013, High Frequency Trading and the New-Market Makers, Preprint.

- 34 Obizhaeva, A. A. and J. Wang, 2012, Optimal Trading Strategy and Supply/Demand Dynamics, Journal of Financial Markets.

- 35 Parlour C. A. and D. J. Seppi. Limit Order Markets: a Survey, 2008, Handbook of Financial Intermediation and Banking, Anjan V. Thakor and Arnoud W. A. Boot, Editors. North Holland.

- 36 Predoiu S., G. Shaikhet and S. E. Shreve, 2011, Optimal Execution in a General One-Sided Limit-Order Book, SIAM J. Finan. Math. 2, 183-212.

- 37 Snell J. L., 1952, Applications of Martingale Systems Theorems, Transactions of the American Mathematical Society 73(2), 293-312.

Table

| Pseudo Codes | Computational Complexity | Parallelizable? |

|---|---|---|

| for ( in ) | ||

| { | ||

| for ( in ) | ||

| { | ||

| Step 1.1 | yes | |

| } | ||

| Step 1.2 | in | |

| print and to file | ||

| } | ||

| for(, , ) | no | |

| { | ||

| for ( in ) | ||

| { | ||

| for ( in and in ) | yes | |

| { | ||

| Step 2 | ||

| Step 3.1 | ||

| equation (6.40) in Step 3.2 | ||

| } | ||

| equation (6.41) in Step 3.2 | in | |

| equation (6.42) in Step 3.2 | in | |

| print , and to file | ||

| } | ||

| for ( in ) | ||

| { | ||

| for ( in ) | ||

| { | ||

| equation (6.43) in Step 3.3 | yes | |

| } | ||

| equation (6.44) in Step 3.3 | in | |