OPTIMAL SWITCHING PROBLEMS UNDER

PARTIAL INFORMATION

Abstract.

In this paper we formulate and study an optimal switching problem under partial information. In our model the agent/manager/investor attempts to maximize the expected

reward by switching between different states/investments. However, he is not fully aware of his environment and only an observation process, which contains partial information about the environment/underlying, is accessible. It is based on the partial information carried by this observation process that all decisions must be made. We propose

a probabilistic numerical algorithm based on dynamic programming, regression Monte Carlo methods, and stochastic filtering theory to compute the value function.

In this paper, the approximation of the value function and the corresponding convergence result are obtained when the underlying and observation processes satisfy the linear Kalman-Bucy setting. A numerical example is included to show some specific features of partial information.

2000 Mathematics Subject Classification: 60C05, 60F25, 60G35, 60G40, 60H35, 62J02.

Keywords and phrases: optimal switching problem, partial information, diffusion, regression, Monte-Carlo, Euler scheme, stochastic filtering, Kalman-Bucy filter.

1. Introduction

In recent years there has been an increasing activity in the study of optimal switching problems, associated reflected backward stochastic differential equations and systems of variational inequalities, due to the potential use of these types of models/problems to address the problem of valuing investment opportunities, in an uncertain world, when the investor/producer is allowed to switch between different investments/portfolios or production modes. To briefly outline the traditional setting of multi-modes optimal switching problems, we consider a production facility which can be run in () different production modes and assume that the running pay-offs in the different modes, as well as the cost of switching between modes, depend on an -dimensional diffusion process which is a solution to the system of stochastic differential equations

| (1.1) |

where and is an -dimensional Brownian motion, , defined on a filtered probability space . In the case of electricity and energy production the process can, for instance, be the electricity price, functionals of the electricity price, or other factors, like the national product or other indices measuring the state of the local and global business cycle, which in turn influence the price. Given as in (1), let the payoff rate in production mode , at time , be and let be the continuous switching cost for switching from mode to mode at time . A management strategy is a combination of a non-decreasing sequence of -adapted stopping times , where, at time , the manager decides to switch the production from its current mode to another one, and a sequence of -adapted indicators , taking values in , indicating the mode to which the production is switched. At the production is switched from mode (current mode) to . When the production is run under a strategy , over a finite horizon , the total expected profit is defined as

where is the to associated index process. The traditional multi-modes optimal switching problem now consists of finding an optimal management strategy such that

Let from now on denote the filtration generated by the process up to time , i.e., . We let denote the set of all (admissible) strategies such that for , and such that the stopping times and the indicators are adapted to the filtration . Furthermore, given , , we let , be the subset of strategies such that and a.s. We let

| (1.2) |

Then represents the value function associated with the optimal switching problem on time interval , and is the optimal expected profit if, at time , the production is in mode and the underlying process is at . Under sufficient assumptions it can be proved that the vector satisfies a system of variational inequalities, e.g., see [LNO12]. Using another perspective, the solution to the optimization problem can be phrased in the language of reflected backward stochastic differential equations. For these connections, and the application of multi-mode optimal switching problems to economics and mathematics, see [AH09], [DH09], [DHP10], [HM12], [HT07], [PVZ09], [LNO12] and the references therein. More on reflected backward stochastic differential equations in the context of optimal switching problems can be found in [AF12], [DH09], [DHP10], [HT07] and [HZ10].

1.1. Optimal switching problems under partial information

In this paper we formulate and consider a multi-mode optimal switching problem under partial or incomplete information. While assuming that the running pay-offs in the different modes of production, as well as the cost of switching between modes, depend on , with as in (1), we also assume that the manager of the production facility can only observe an auxiliary, and -dependent process, , based on which the manager can only retrieve partial information of the -dimensional stochastic process . More precisely, we assume that the manager can only observe an -dimensional diffusion process which solves the system of stochastic differential equations

| (1.3) |

Here and is an -dimensional Brownian motion, , defined on and independent of . is assumed to be a continuous and bounded function. From here on we let , denote the filtration generated by the observation process up to time . Note that in our set-up we have , and hence knowledge of the process only gives partial information about the process . We emphasize that although the value of the fully observable process is known with certainty at time , the value of the process is not. The observed process acts as a source of information for the underlying process . By construction, in the formulation of an optimal switching problem under partial information we must restrict our strategies, and decisions at time , to only depend on the information accumulated from up to time . Hence, an optimal switching problem under partial information must differ from the standard optimal switching problem in the sense that in the case of partial information, the value of the running payoff functions , and the switching costs , are not known with certainty at time , even though we know . Hence, in this context the production must be run under incomplete information.

Our formulation of an optimal switching problem under partial information is based on ideas and techniques from stochastic filtering theory. Generally speaking, stochastic filtering theory deals with the estimation of an evolving system (“the signal” ) by using observations which only contain partial information about the system (“the observation” ). The solution to the stochastic filtering problem is the conditional distribution of the signal process given the -algebra , and in the context of stochastic filtering theory the goal is to compute the conditional expectations , for suitably chosen test functions . In the following the conditional distribution of given , is denoted by , i.e.,

| (1.4) |

Note that the measure-valued (random) process introduced in (1.4) can be viewed as a stochastic process taking values in an infinite dimensional space of probability measures over the state space of the signal. Concerning stochastic filtering we refer to [CR11] and [BC09] for a survey of the topic.

Based on the above we define, when the production is run using an -adapted strategy , over a finite horizon , the total expected profit up to time as

| (1.5) |

where the to associated index process is defined in the bulk of the paper. Again we are interested in finding an optimal management strategy which maximizes . Let be defined in analogy with but with replaced by , and let, for given , , , be the subset of strategies such that and a.s. Given , and a measure of finite mass , we let

| (1.6) |

Then represents the value function associated with the optimal switching problem under partial information formulated above, on the time interval , and is the optimal expected profit if, at time , the production is in mode , and the distribution of is given by , . Note that for a test function , is an -adapted random variable and hence, the problem in (1.1) can be seen as a full information problem with underlying process . In fact, it is this connection to an optimal switching problem with perfect information that underlies our formulation of the optimal switching problem under partial information. Furthermore, note that if is an -adapted process, then (1.1) reduces to (1.2), i.e., to the standard optimal switching problem under complete information.

The object of study in this paper is the value function introduced in (1.1) and we emphasize and iterate the probabilistic interpretation of the underlying problem in (1.1). In (1.1) the manager wishes to maximize by selecting an optimal . However, the manager only has access to the observed process . The state is not revealed and can only be partially inferred through its impact on the drift of . Thus, must be based on the information contained solely in , i.e., must be -adapted. Hence, the optimal switching problem under partial information considered here gives a model for the decision making of a manager who is not fully aware of the economical environment he is acting in. As pointed out in [L09], one interesting feature here is the interaction between learning and optimization. Namely, the observation process plays a dual role as a source of information about the system state , and as a reward ingredient. Consequently, the manager has to consider the trade-off between further monitoring in order to obtain a more accurate inference of , vis-a-vis making the decision to switch to other modes of production in case the state of the world is unfavorable.

1.2. Contribution of the paper

The contribution of this paper is fourfold. Firstly, we are not aware of any papers dealing with optimal switching problems under partial information and we therefore think that our paper represent a substantial contribution to the literature devoted to optimal switching problems and to stochastic optimization problems under partial information. Secondly, we propose a theoretically sound and entirely simulation-based approach to calculate the value function in (1.1) when and satisfy the Kalman-Bucy setting of linear stochastic filtering. In particular, we propose a probabilistic numerical algorithm to approximate in (1.1) based on dynamic programming and regression Monte Carlo methods. Thirdly, we carry out a rigorous error analysis and prove the convergence of our scheme. Fourthly, we illustrate some of the features of partial information in a computational example. It is known that in the linear Kalman-Bucy setting it is possible to solve the stochastic filtering problem analytically and describe the a posteriori probability distribution explicitly. Although much of the analysis in this paper also holds in the non-linear case, we focus on the, already quite involved, linear setting. In general, numerical schemes for optimal switching problems, already under perfect information, seem to be a less developed area of research and we are only aware of the papers [ACLP12] and [GKP12] where numerical schemes are defined and analyzed rigorously. Our research is influenced by [ACLP12] but our setting is different since we consider an optimal switching problem assuming only partial information.

1.3. Organization of the paper

The paper is organized as follows. Section 2 is of preliminary nature and we here state the assumptions on the systems in (1), (1.1), the payoff rate in production mode , , and the switching costs , assumptions used throughout the paper. Section 3 is devoted to the general description of the stochastic filtering problem and the linear Kalman-Bucy filter. In Section 4 we prove that the value function in (1.1) satisfies the dynamic programming principle. This is the result on which the numerical scheme, outlined in the subsequent sections, rests. Section 5 gives, step by step, the details of the proposed numerical approximation scheme. In Section 6 we perform a rigorous mathematical convergence analysis of the proposed numerical approximation scheme and the main result, Theorem 6.1, is stated and proved. We emphasize that by proving Theorem 6.1 we are able to establish a rigorous error control for the proposed numerical approximation scheme. Section 7 contains a numerical illustration of our algorithm and the final section, Section 8, is devoted to a summary and conclusions.

2. Preliminaries and Assumptions

We first state the assumptions on the systems (1), (1.1), the payoff rate in production mode , , and the switching costs, , which will be used in this paper. We let denote the (finite) set of available states and we let for . As stated, the profit made (per unit time) in state is given by the function . The cost of switching from state to state is given by the function . Focusing on the problem in (1.5), and in particular on the value function in (1.1), we need to give a precise definition of the strategy process and the notation . Indeed, in our context a strategy , over a finite horizon , corresponds to a sequence , where is a sequence of -adapted stopping times and is a sequence of measurable random variables taking values in and such that is -adapted. Given we let

where is the indicator function for a measurable set , be the associated index process. In particular, to each strategy there is an associated index process and this is the process used in the definition of .

We denote by the space of all real-valued functions such that and all its partial derivatives up to order are continuous and bounded on . Given we let

Similarly, we denote by the space of all real-valued functions such that , , , , and are continuous and bounded on . With a slight abuse of notation we will often write instead of . We denote by the space of of all positive measures on with finite mass. Considering the systems in (1), (1.1), we assume that , and are continuous and bounded functions. Here is the set of all -dimensional real-valued matrices. Furthermore, concerning the regularity of these functions we assume that

| (2.1) |

Clearly (2.1) implies that

| (2.2) |

for some constant , , for all , and whenever . Here is the standard Euclidean norm of . Given (2.1) and (2.2), we see, using the standard existence theory for stochastic differential equations, that there exist unique strong solutions and to the systems in (1) and (1.1). Concerning regularity of the payoff functions and the switching costs , we assume that

For future reference we note, in particular, that

| (2.3) |

for some constants , whenever . Note that (2) implies that and , , are, for fixed, Lipschitz continuous w.r.t. , uniformly in , and vice versa. Concerning the switching costs we also impose the following structural assumptions on the functions ,

| (2.4) | for all , | ||||

| and for any sequence of indices , , , for . |

Note that (2) states that it is always less expensive to switch directly from state to state compared to passing through an intermediate state . We emphasize that we are able to carry out most of the analysis in the paper assuming only (2.1)–(2). However, there is one instance where we currently need to impose stronger structural restrictions on the functions to pull the argument through. Indeed, our final argument relies heavily on the Lipschitz continuity of certain value functions, established in Lemma 6.3 and Lemma 6.4 below. Currently, to prove these lemmas we need the extra assumption that

| (2.5) |

In particular, we need the switching cost to depend only on and the sole reason is that we need to be able to estimate terms of the type appearing in the proof of Lemma 6.3 (Lemma 6.4). While we strongly believe that these lemmas remain true without (2.5), we also believe that the proofs in the more general setting require more refined techniques beyond the dynamic programming principle, and that we have to resort to the connection to systems of variational inequalities with interconnected obstacles and reflected backward stochastic differential equations.

3. The filtering problem

As outlined in the introduction, the general goal of the filtering problem is to find the conditional distribution of the signal given the observation . In particular, given ,

and the aim is to find the (random) measure . Note that can be viewed as a stochastic process taking values in the infinite dimensional space of probability measures over the state space of the signal. Let

where is the transpose of , and let be the following partial differential operator

Using this notation and the assumptions stated in Section 2, one can show, e.g., see [BC09], that the stochastic process satisfies

| (3.1) |

for any . Recall that is the function appearing in (1.1). The non-linear stochastic PDE in (3.1) is called the Kushner-Stratonovich equation. Furthermore, it can also be shown, under certain conditions, that the Kushner-Stratonovich equation has, up to indistinguishability, a pathwise unique solution, e.g., see [BC09]. From here on in we will, to simplify the notation, write

3.1. Kalman-Bucy filter

It is known that in some particular cases the filtering problem outlined above can be solved explicitly and hence the a posteriori distribution is known. In particular, if we assume that the signal and the observation solve linear SDEs, then the solution to the filtering problem can be given explicitly. To be even more specific, assume that the signal and the observation are given by the systems in (1), (1.1), with

| (3.2) |

respectively, where , and are measurable and locally bounded time-dependent functions. Furthermore, assume that , where denotes the -dimensional multivariate normal distribution defined by the vector of means and by the covariance matrix , is independent of the underlying Brownian motions and . Let and denote the conditional mean and the covariance matrix of , respectively. The following results concerning the filter and the processes and , can be found in, e.g., [KB61] or Chapter 6 in [BC09].

Theorem 3.1.

Assume (3.2) and that for some . Then the conditional distribution of , conditional on , is a multivariate normal distribution, .

Theorem 3.2.

Assume (3.2) and that for some . Then the conditional covariance matrix satisfies the deterministic matrix equation

| (3.3) |

with initial condition , and the conditional mean satisfies the stochastic differential equation

| (3.4) |

with initial condition .

For a positive semi-definite matrix , let denote the unique positive semi-definite matrix such that , where, as above, denotes the transpose of . Recalling that the density defining in , at , equals

we see that the following result follows immediately from Theorem 3.1 and Theorem 3.2.

Corollary 3.1.

The distribution is fully characterized by and and

for any .

Note that the covariance matrix is deterministic and depends only on the known quantities , , , see (3.2), and the distribution of the starting point of . Hence, once the initial distribution is given, the covariance matrix can be determined for all . Furthermore, in the Kalman-Bucy setting, the measure is Gaussian and hence fully characterized by its mean and its covariance matrix . As a consequence, the value function to the partial information optimal switching problem, , can in this setting be seen as a function . We will, when is a Gaussian measure with mean and covariance matrix , write

Remark 3.1.

Consider a fixed , and let , , , whenever . Let and . Let , with initial distribution determined by and , and be given as above for . Furthermore, given and , let and be the unique solutions to the systems in (1) and (1.1), with , , , defined as in (3.2) but with replaced by and with initial data and . In addition, let be defined as in (3.3) and (3.4), with and . Finally, consider the value function and let be the value function of the optimal switching problem on , with replaced by . Then

In particular,

and we see that there is no loss of generality to assume that initial observations are made at .

Remark 3.2.

As the covariance matrix solves the deterministic Riccati equation in (3.3), it is completely determined by the parameters of the model and the covariance matrix of at time . Hence, once the initial condition is given, can be solved deterministically for all , and consequently viewed as a known parameter. Therefore, we omit the dependence of in the value function and instead, with a slight abuse of notation, simply write .

Remark 3.3.

Although (3.3) is a deterministic ordinary differential equation, it may not be possible to solve it analytically. Therefore, in a general numerical treatment of the problem outlined above one has to use numerical methods to find the covariance matrix . The error stemming from the numerical method used to solve (3.3) will have influence on the total error, defined as the absolute value of the difference between the true value function and its numerical approximation derived in this paper. However, as is deterministic, it can be solved off-line and to arbitrary accuracy without effecting the computational efficiency of the main numerical scheme presented in this paper. Therefore, we will throughout this paper consider as exactly known and ignore any error caused by the numerical algorithm used for solving (3.3).

3.2. Connection to the full information optimal switching problem

As mentioned in the introduction, the problem in (1.1) can interpreted as a full information optimal switching problem with underlying process . We here expand on this interpretation in the context of Kalman-Bucy filters. Let, using the notation in Remark 3.2,

whenever , and let be defined through

Furthermore, let and be defined as

Then, for fixed, is a solution to an optimal switching problem with perfect information. Using the above notation, we see that

| (3.5) |

and that the upper bound

holds. Moreover, based on (3.5) we see that also is a solution to an optimal switching problem with perfect information, with payoff rate in production mode , at time , defined by , and with switching cost, for switching from mode to mode at time , defined by .

4. The dynamic programming principle

In this section we prove that the value function associated to our problem satisfies the dynamic programming principle (DPP). This is the result on which the numerical scheme outlined in the next section rests. It should be noted that the dynamic programming principle holds for general systems as in (1) and (1.1), systems which are not necessarily linear.

Theorem 4.1.

Proof.

Let and be the unique solutions to the systems in (1.1), (3.1), with initial conditions and , respectively. Note that these processes, as well as , are Markov processes. Hence, using the strong Markov property of and we have that

| (4.1) |

for any -adapted stopping time and for all such that . Let

for . Then,

Next, using (4.1) and the law of iterated conditional expectations we see that

for any -adapted stopping time and any strategy . In particular, since is arbitrary in this deduction we see that

| (4.2) |

for any -adapted stopping time . To complete the proof it remains to prove the opposite inequality, i.e., to prove that

| (4.3) |

Consider and let and , be a fixed strategy and a fixed -adapted stopping time, respectively. Recall that all stochastic processes are defined on the probability space . By the definition of there exists, for any and for any , , such that

| (4.4) |

Given , , , we define, for all ,

Then and, again using the law of iterated conditional expectations, we obtain that

Finally, using (4.4) and the above display we deduce that

| (4.5) |

Since , and are arbitrary in the above argument we see that (4) implies (4). Combining (4) and (4) Theorem 4.1 follows. We note that the proof of the DPP here outlined follows the usual lines and perhaps a few additional statements concerning measurability issues could have been included. However, we here omit further details and refer to the vast literature on dynamic programming for exhaustive proofs of similar statements. ∎

Remark 4.1.

In this section the dynamic programming principle is proven with the assumption that and are continuous in time. However, the approximation scheme introduced in the following section is based on (Euler) discretized versions of these processes. We here just note that the proof above can be adjusted to also yield the dynamic programming principle in the context of the discretized processes.

5. The numerical approximation scheme

In this section we introduce a simulation based numerical scheme for determining as in (1.1) and give a step by step presentation of the approximations defining the scheme. Recall that is the optimal expected payoff, starting from state at time , with initial conditions and . We will from now on assume the dynamics of and are given by (1) and (1.1), respectively, with assumption (3.2) in effect. Consequently, the results of Section 3 are applicable. Based on Remark 3.2 we in the following write . Likewise, we will write instead of . Furthermore, we can and will, w.l.o.g., assume that the initial distribution is given at time and hence that the value function , at time , is a function of the conditional mean (and the deterministic ), based on the observation , see Remark 3.1. In other words, we assume that the distribution of is given at time and the task of the controller is to run the facility using updated beliefs of the conditional mean of the signal, conditional upon the information carried by the observation .

For the convenience of readers, we in this section list the steps of the proposed numerical scheme and the associated notation. By Theorem 3.1 the a posteriori distribution is a Gaussian measure, and in the following we denote by the Gaussian measure with mean and covariance matrix . We emphasize that the outcome of the numerical scheme to be outlined, is an approximation of

| for | |||

| (5.1) |

Based on (5) we emphasize that we consider the systems in (1) and (1.1) with initial data at , assuming the additional structure in (3.2). In particular, when considering the systems in (3.3) and (3.4), for the calculation in (5) and with data at , the initial conditions boil down, all in all, to the initial condition , at , for .

Given fixed, and a large positive integer, , we let , . We let denote the naturally defined partition of the interval based on , i.e., . Throughout the paper any discretization of time will be identical to . The following steps constitute our numerical approximation scheme in the context of (5) but starting at .

-

(1)

Step 1 – Bermudan approximation. We restrict the manager to be allowed to switch only at the time points . This results in a Bermudan approximation, , of .

-

(2)

Step 2 – Time discretization and Euler discretization of and . and are replaced by corresponding discrete versions, also starting at at , based on the Euler scheme and the partition . This results in an approximation, , of .

-

(3)

Step 3 – Space localization. The processes and are replaced by versions which are constrained to a bounded convex set . This gives an approximation , of .

-

(4)

Step 4 – Representation of conditional expectation using true regression. To calculate we use a regression type technique, replacing the future values by a (true) regression. This results in an approximation, , of .

-

(5)

Step 5 – Replacing the true regression by a sample mean. To calculate we replace the coefficients in the true regression by their corresponding sample means. This results in an approximation, , of .

The final value produced by the algorithm is and this is an approximation of the true value . In the remaining part of this section we will discuss Step 1 – Step 5 in more detail. The rigorous error analysis is postponed to Section 6.

5.1. Step 1 – Bermudan approximation

Let be the set of strategies

such that for all . Based on we let

and we refer to as the value function of the Bermudan version of our optimal switching problem under partial information. The difference is quantified in Proposition 6.1.

For future reference we here also introduce what we call the Bermudan strategy.

Definition 1.

Let and let be given. Let be the strategy in defined by

Then, is the Bermudan strategy associated to and .

5.2. Step 2 – Time discretization and Euler discretization of and .

Given the continuous time we let . In this step we replace the continuous processes and with their corresponding discrete Euler approximations. To be specific, we first calculate (pathwise) the Euler approximation of the signal , denoted by and given by the dynamics

Based on we then introduce the discrete processes and , Euler approximations of and , respectively, and given by

and

Based on this we have

for any . Recall that we consider as completely known, see Remark 3.3, and hence is not subject to discretization. Based on the above processes we let

| (5.2) |

is the value function based on the discretized time and the Euler approximations and . The difference between and is quantified in Proposition 6.2.

In the following we will, in an attempt to slightly ease the notation, omit the bar indicating Euler discretization of and and simply write instead of when we believe there is no risk of confusion. In particular, we let the very notation also symbolize that and are discretized as above.

5.3. Step 3 – Space localization

A localization in space will be necessary when estimating the errors induced by Step and Step below and we here describe this localization. In particular, to be able to work in bounded space time domains we consider, for a fixed parameter , (time dependent) domains such that is a convex domain for all . We assume that there exists a constant , depending only on and , such that , where is the hypercube in with sides of length . Let be the projection of a generic stochastic process onto the domain , i.e., if , and is the, by convexity of , naturally defined unique projection of onto , along the normal direction, otherwise. Following [ACLP12], we assume that can be chosen such that

| (5.3) |

The space can be seen as the domain in which the -dimensional process lives. Roughly speaking, condition (5.3) states that most of the time the -dimensional process will be found inside this domain. As mentioned, this localization in space will be necessary when estimating the errors induced by Step and Step . In particular, based on (5.3) we will in these steps be able to reuse results on the full information optimal switching problem developed in [ACLP12]. We therefore refer to [ACLP12] for more details on the assumption in (5.3) and a constructive example. The construction above stresses generalities but, although not necessary, we will in the follwoing assume, to be consistent and to minimize notation, that

| for all , for some , and that | |||

| (5.4) | for some constants and . |

In other words, is assumed to be a time-independent Cartesian product of hypercubes. The result of this step is that and are replaced by their corresponding projected versions, and , respectively. We let denote the associated value function when and are replaced by and . In particular, when writing , also indicates that the underlying dynamics is that of and . The error introduced by considering and , i.e., the difference between and , is quantified in Proposition 6.3.

5.4. Step 4 – Representation of conditional expectation using true regression

Note that for the discretized Bermudan version of the optimal switching problem, the value function (5.2) can, for any , be simplified to read

| (5.5) |

where on the right hand side, consequently, , . As a result, the DPP for (5.4) in the discretized Bermudan setting, see Remark 4.1, reduces to

Taking (2) and into account this can be further simplified to

| (5.6) |

Based on (5.4) the recursive scheme based on the DPP becomes

| (5.7) |

An important feature of the scheme in (5.4) is that depends explicitly on the value functions at time , . However, these functions are unknown at time . Furthermore, the optimal strategy at time also depends directly on this future value. Indeed, at time it is optimal to switch from state to if the difference between the expected future value retrieved from being in mode and the switching cost , is greater than the expected profit made from staying in state . More precisely, at time it is optimal to switch from state to if

If this inequality holds with replaced by it is optimal to stay in state . To construct an -adapted strategy it is hence necessary to estimate the future expected value at time , based on the information available at time , i.e., to estimate

| (5.8) |

Since we, by assumption and through the space localization in Step 3, consider continuous pay-off functions and switching costs on bounded domains, as well as a finite horizon problem, there exist lower and upper bounds for (5.8). However, a sound way of finding an approximation of the conditional expectation in (5.8) is needed, and this approximation is the focus of this step of the numerical scheme proposed. To perform an approximation of the conditional expectation in (5.8), we make use of an empirical least square regression model based on simulation. In particular, we consider a test function and the function

| (5.9) |

We will use a least square regression onto a set of preselected basis functions, , to create an estimator of . To elaborate on this, assume that we are given basis functions . Given the test function , we define as

| (5.10) |

and set

| (5.11) |

Recall that in our numerical scheme, and . Based on this we define a new set of functions through the recursive scheme

| (5.12) | |||||

In particular, we obtain a new approximation of the true value function, defined through the recursive scheme in (5.4). The error is analyzed in Proposition 6.4.

Remark 5.1.

In the above construction, the set of basis functions used is arbitrary and several options are possible. Furthermore, it is possible to choose a different set of basis functions for each time without adding difficulties beyond additional notation. Also, as pointed out in [ACLP12], one can use stochastic partitions of the domain to enable the use of adaptive partitioning methods, possibly increasing the convergence speed of the numerical scheme.

5.5. Step 5 – Replacing the true regression by a sample mean

Given a test function , in numerical calculations the true regression parameters

will not be known, and they have to be replaced by a sample mean

based on simulations. Recall that in the context of (5) we in the end want to approximate for given and fixed. In particular, this means that in the original model for the process we consider the initial condition , at . This also implies that the approximations of introduced above, and , will also start at at . To outline the estimation of the true regression parameters we let , , denote simulated trajectories of the observed process , starting at at , and we use these to calculate the corresponding values of , as outlined in Section 3 and Subsection 5.2, with initial condition for all . Based on the paths and , , we now compute the empirical vector , estimating as

| (5.13) |

Given , we in this way fix for . In the following we indicate that the estimation of is based on sample paths by writing instead of . Next, using we set

| (5.14) |

whenever . In particular, while the coefficients are estimated based on a finite set of sample paths , , , we use these coefficients in (5.14) to construct an estimator for the conditional expectation

for all . Based on we let be defined through the recursive scheme

| (5.15) |

Then is an approximation of and, since , is an approximation of . Hence, the final value produced by the algorithm, , is an approximation of the true value .

Following [ACLP12], we will in this paper use indicator functions on hypercubes as basis functions, , for our regression and subsequent error analysis. These hypercubes are defined in relation to the space (time) localization domain . Here we briefly outline the idea of using such a basis for regression but we also refer to [ACLP12]. Recall that is assumed to have the structure specified in (5.3). We let be a partition of the bounded domain into hypercubes, i.e., we split in to open hypercubes such that and if . Furthermore, to achieve notational simplicity, we in the following also assume that each hypercube has side length in each dimension. Using we define basis functions to be used in the regression as

for , and . By definition if and otherwise. Note that we use the same symbol to denote both the -th hypercube and its corresponding basis function/indicator function. Since conditional expectation is mean-square error-minimizing, this choice of basis functions reduces the vectors (5.10) and (5.13) to

| (5.16) |

and

with the convention that if, at time , no path lies inside the hypercube . Hence, in our numerical scheme, if the expected future value

will be approximated by . The error is estimated in Proposition 6.5.

6. Convergence analysis

In this section we establish the convergence of the numerical scheme outlined in the previous section by proving Theorem 6.1 stated below. However, we first recall degrees of freedom, at our disposal, in the numerical scheme proposed.

-

•

– the time discretization parameter,

-

•

– the error tolerance when choosing the bounded convex domains for the projection,

-

•

– the edge size of the hypercubes used in the regression,

-

•

– the number of simulated trajectories of and , used in (5.13).

Recall that is the underlying probability space and in the following with norm . We prove the following convergence theorem.

Theorem 6.1.

Assume that and that all assumptions and conditions stated and used in the previous sections are fulfilled. Then there exist a constant , independent of , , and , and a constant , independent of , and , such that

where

is a strictly positive quantity. In particular, if , , and such that

then

We first note, using the notation introduced in the previous section, that

where

In the subsequent subsections we prove that the errors can be controlled and we ending the section with a summary proving Theorem 6.1.

6.1. Preliminary lemmas

Before deducing the relevant error estimates, i.e., quantifying to , we here state and prove some auxiliary results, Lemma 6.1 – Lemma 6.4, which will be used in the subsequent proofs.

Lemma 6.1.

Proof.

Let denote the trivial strategy, i.e., no switches. Then, using (2.1), (2) and (2), we see that

Now, let be a strategy with an unbounded number of switches. Then, by (2) and (2) , it follows that . Hence, the optimal strategy must consist of a finite number of switches. Finally, let be an arbitrary strategy with a finite number of switches and assume that . Then, using (2) and (2) we see that

In particular, . ∎

Lemma 6.2.

Let be a -dimensional Brownian motion defined on a filtered probability space . Then, for any there exists a finite constant such that

Proof.

This is Theorem 1 in [FN10].∎

Lemma 6.3.

Proof.

We claim that there exist positive constants and , independent of , such that the following holds. There exists a sequence of constants such that

| (6.1) |

whenever and such that

| (6.2) |

To prove this we proceed by (backward) induction on and we let if (6.1) holds with a constant whenever , and if is related to the bounds as stated in (6.1). We want to prove that whenever . Since for all , we immediately see that . Assuming that for some we next prove that by constructing . To do this we first note, simply by the (discrete) DPP, that

Furthermore, by elementary manipulations the above can be rewritten as

In particular,

where

We now need to bound the terms and with . We first treat the term using the Lipschitz property of . Indeed, recalling Corollary 3.1 we first have

Hence, by the Lipschitz property of we see that

| (6.3) |

where is simply the Lipschitz constant of . In particular,

To treat the term we first note that

where and indicate that at the processes and are starting at and , respectively. Now, using the induction hypothesis , i.e., the Lipschitz property of and , we can conclude that

| (6.4) |

Next, using (6.4), the equation for and elementary estimates, e.g., see the proof of Lemma in [ACLP12], we can conclude that

for some constant independent of , and . Finally, using the assumption in (2.5) we see that . Putting the estimates together we can conclude that

where we have chosen in the definition of . In particular, if for some , then and hence the lemma follows by induction. ∎

Lemma 6.4.

Proof.

The proof of the lemma is analogous to the proof of Lemma 6.3 and we here omit further details. ∎

Remark 6.1.

We emphasize that in this paper the structural assumption (2.5) is only used in the proof of Lemma 6.3 and Lemma 6.4. These lemmas are then only used in the proof of Proposition 6.4 stated below. In particular, if Lemma 6.3 and Lemma 6.4 can be proved without assuming (2.5) all of the remaining arguments go through unchanged.

6.2. Step 1: Controlling

Proposition 6.1.

There exist positive constants and , independent of , such that

whenever .

Proof.

Recall that

and

| (6.5) |

Using Lemma 6.1 we may assume that . Given we consider the strategy , where

Then and it is the Bermudan strategy associated to , see Definition 1. Using this and (6.2) we see that

Furthermore, since we also have that . Putting these estimates together we can conclude that

where

Since, by assumption, is bounded we immediately see that

Furthermore, using Lemma 6.1 we see that

Putting these estimates together we can conclude that

and this gives the appropriate bound on . To estimate we first note that

where

By using that by construction, (2) , and that is -adapted, we see that there exists a constant such that

| (6.6) |

We now recall that

where is a standard -dimensional Brownian motion. Hence,

since is a bounded function. Applying Lemma 6.2 gives

| (6.7) |

Combining (6.2), (6.7), Lemma 6.1, and the Cauchy-Schwartz inequality we can therefore conclude that

and this completes the estimate of . Hence, it now only remains to prove that . To start the estimate, recall that satisfies the Kushner-Stratonovich equation (3.1), i.e., for and , we have

| (6.8) |

Furthermore, since is a probability-measure valued process we have for any such that

where denotes the upper bound of . We also note, using (6.8), that

for yet another constant , independent of and . Note that essentially only depends on the -bounds of and the functions/parameters defining the system for . Now, applying this, with , , recalling Lemma 6.1 and that , we can conclude that

This completes the proof of the proposition. ∎

Remark 6.2.

If we have no -dependence on the switching costs, then .

6.3. Step 2: Controlling

Proposition 6.2.

There exist positive constants , , and , independent of , such that

whenever .

Proof.

We immediately see that

where

and where , denote the Euler discretizations, starting at at , of and , respectively. The rest of the proof is now a combination of the techniques used in the proofs of Lemma 6.3 and Proposition 6.1, in combination with standard error estimates for the Euler approximation. To be more precise, by proceeding along the lines of the proof of Proposition 6.1 we see that

To estimate , let

Then

where

Now, using the Lipschitz property of , and arguing as in (6.3), we the see that

In particular,

Using standard error estimates for Euler approximations, e.g., see [KP92] Section 10.2, we also have that

for all . In particular,

Finally, repeating the argument for , with replaced by , and invoking Lemma 6.1 we also see that

and hence the proof of the proposition is complete. ∎

6.4. Step 3: Controlling

Proposition 6.3.

There exists a constant , independent of , such that

whenever .

6.5. Step 4: Controlling

Proposition 6.4.

There exists a constant , independent of and , such that

whenever .

Proof.

Recall that with . We claim that there exist positive constants and , independent of and , such that the following holds. There exists a sequence of constants such that

| (6.9) |

whenever and such that

| (6.10) |

We prove (6.9), (6.5) by (backward) induction on and we say that if (6.9) holds with a constant whenever , and if is related to the bounds ,…, as stated in (6.5). We want to prove that whenever . Since we immediately see that . Assuming that for some we next prove that by construct . Note that and are degrees of freedom appearing in the following argument and the important thing is, in particular, that and do not depend on . To start the proof, recall the conditional expectation defined in (5.9) and the approximate conditional expectation defined in (5.11). The recursive scheme (5.4) can be written as

Hence,

| (6.11) |

Using Lemma 6.3 and Lemma 6.4, we know that

whenever . In particular, is Lipschitz continuous w.r.t. the -dimensional process and with Lipschitz constant independent of . Now, using this and Lemma 3.4 in [ACLP12] we can conclude that there exist constants and , independent of , , and , such that

Essentially is the Lipschitz constant of , i.e., . In particular,

| (6.12) |

where for some harmless constant . Note that and are now fixed and, in particular, independent of . Next, by the definition of , see (5.11) and (5.5),

Hence, using this, and the induction hypothesis , we can conclude that

| (6.13) |

Combining (6.5), (6.12) and (6.13), we see that

By symmetry the same inequality holds for and thus

with defined as

In particular, (6.9) and (6.5) hold for and we have proved that if for some , then also . Hence for all by induction. Based on (6.9) and (6.5) we complete the proof of the proposition by observing that, for any ,

∎

6.6. Step 5: Controlling

Proposition 6.5.

There exist a constant , independent of , , and , and a constant , independent of , , and , such that

whenever . Here

is a strictly positive quantity.

Proof.

is strictly positive quantity due to the fact that the domain is bounded. To prove the proposition we claim that there exist a positive constant , independent of , , and , and a constant , independent of , , and , such that the following holds. There exists a sequence of constants such that

| (6.14) |

whenever and such that

| (6.15) |

We prove (6.14),(6.6) by (backward) induction on and we say that if (6.14) holds with a constant whenever , and if is related to the bounds ,…, , as stated in (6.6). We want to prove that whenever . Again, we immediately see that . Assuming that for some we next prove that by constructing . Note that is a degree of freedom appearing in the following argument and the important thing is, in particular, that does not depend on . To start the proof, given we in the following let and be such that (see (5.4) and (5.5))

Note that and are not neccessarily equal, at time , for . Hence, by proceeding as in the proof of Proposition 6.4, we see that

In particular, by symmetry we can use this inequality to conclude that

for all , where

In particular,

| (6.16) |

and, hence, we need to find proper bounds for and . Firstly, to bound we can simply apply Lemma 3.6 of [ACLP12] to conclude that

| (6.17) |

where is independent of , , and , while is independent of , , and . Furthermore, and are independent of . Secondly, to bound we first note, by definition (5.14), that

where

Hence, using the induction hypothesis we see that

| (6.18) |

We now let , and define

Then, using (6.16), (6.17) and (6.18) we conclude that

whenever . In particular, (6.14) and (6.6) hold for and we have proved that if for some , then also . Hence for all by induction. Based on (6.14) and (6.6) we complete the proof of Proposition 6.5 by observing that, for any ,

∎

Remark 6.3.

As can be seen from Propositions 6.1 – 6.4, errors to are obtained in the pathwise sense, because these approximations are constructed for each path of . However, recalling Subsection 5.5, at time , the -adapted , defined in (5.11), is approximated by as in (5.14). The corresponding regression coefficient is a Monte Carlo type approximation of constructed by using independent trajectories of the process . Therefore, instead of in the pathwise sense, is controlled in the associated -norm, at each . In addition, since the sample mean approximations are done independently of each other, and backwards in time, the error at time is controlled by the sum of errors at later time steps. This is the statement of Proposition 6.5.

6.7. The final proof of Theorem 6.1

7. A numerical example

In this section we present a simplistic numerical example showing some of the features stemming from our set up with only partial information. In particular, we consider our optimal switching problem under partial information with two modes, , and we use the numerical scheme proposed and detailed in the previous sections to estimate . To simplify the presentation, we will only focus on the value function starting in mode , i.e., we will here only estimate . We will in this section slightly abuse notation and let denote both the true value function as well as its approximation . The interpretation should be clear from the context. We consider constants parameters and, if nothing else is specified, the parameters laid forth in Table 1 are the ones used in the simulations.

| Description | Symbol | Value | Description | Symbol | Value |

| Amount of information | G | 1 | # paths | M | 5000 |

| Volatility of signal | C | 1 | Time horizon | T | 1 |

| Drift of signal | F | 0 | Time step | ||

| Cost of opening | 0.01 | # basis functions | R | 100 | |

| Cost of closing | mean | 0 | |||

| Running payoff state 1 | variance | 0 | |||

| Running payoff state 2 | 0 | 0 |

We emphasize that although the following example may seem simplistic, the numerical scheme proposed can handle general Kalman-Bucy type partial information optimal switching problems. The reason for making a rather crude choice of parameters is twofold. Firstly, using only limited computational power, we wish to keep our numerical model simple to limit the computational time required. With the data presented in Table 1, and with no effort to optimize the code, the average time for a simulation was about two minutes (per grid point) on a standard laptop PC, and it took around 24 hours to generate the figures in this section. Secondly, we think that the specific features of partial information are made more clear with few modes and constant parameters.

7.1. Comparison with a deterministic method

Although the numerical scheme proposed here is shown to converge to the true value function (1.1), the rate of convergence is not clear from the above. Therefore, to check the validity of our model with paths, basis functions and , we compare the results produced by our numerical scheme with the results in [O14], where a deterministic method based on partial differential equations is used to solve the optimal switching problem under partial information. For the parameter values given in Table 1, the relative error between the deterministic solution in [O14] and the numerical scheme proposed here is less then , when calculating , see Table 2. This indicates that the number of simulated paths, time steps and basis functions considered in this example are large enough to give a reasonable estimate of the value function.

| PDE method ([O14]) | Simulation method | Error | Error ( of ) | |

|---|---|---|---|---|

| -0.5 | 0.0627 | 0.0621 | 0.0006 | 0.96 |

| 0 | 0.7897 | 0.8078 | 0.0181 | 2.3 |

| 0.5 | 5.0351 | 5.1019 | 0.0668 | 1.3 |

7.2. The influence of information

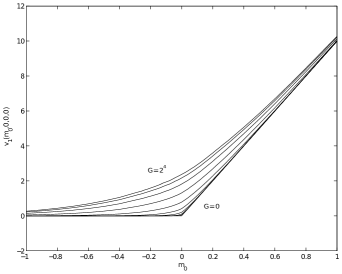

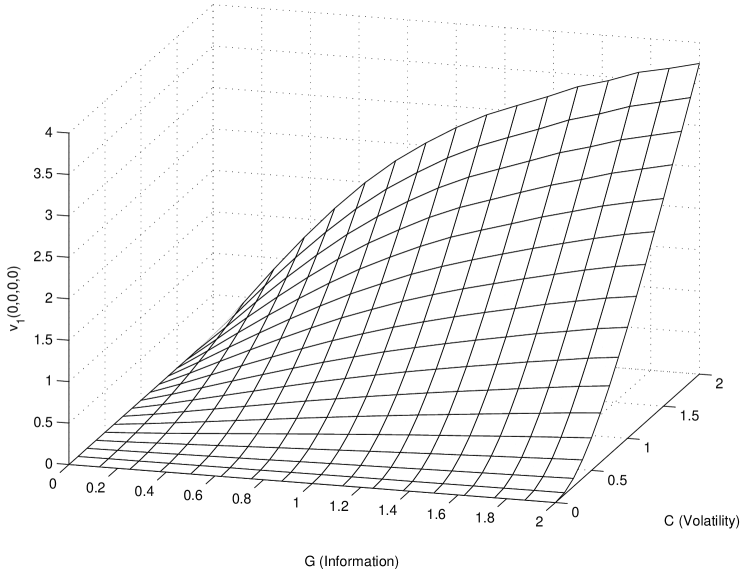

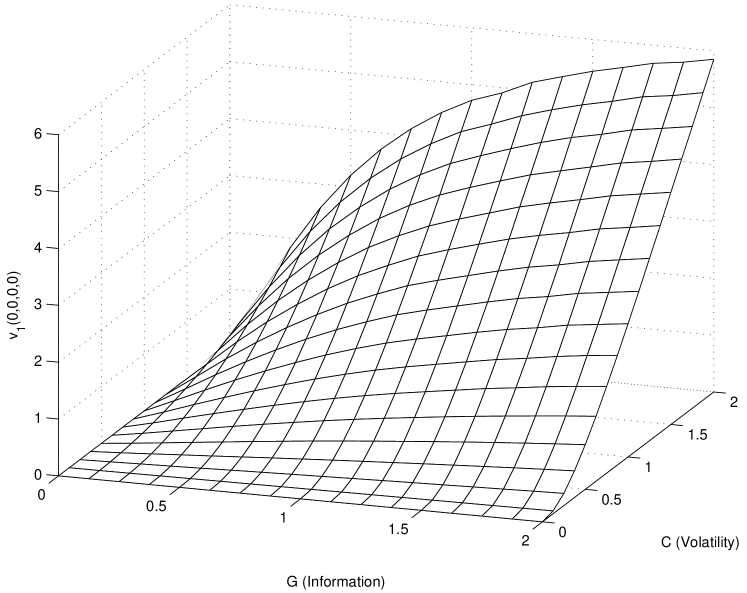

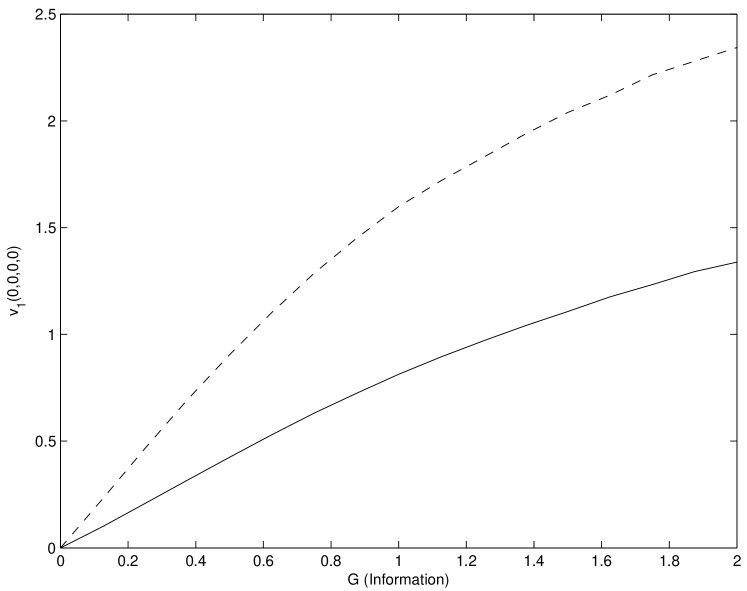

We now turn to study the dependence of the value function on the amount of available information, the latter being determined through the function defining , see (3.2). Larger means more information while smaller means less information. As shown by Figures 1, 2 and 3 (a), the value function increases as the amount of available information increases. The reason for this behaviour is intuitively clear. When the amount of information increases, it becomes easier for the controller to make the correct decision concerning when to open/close the facility, increasing the possible output of the facility. For comparison, consider the case with no switching costs, i.e., . It is intuitively clear that the optimal strategy is then to open the facility as soon as the underlying is positive and to close as soon as it becomes negative. If the controller has full information, he knows exactly when the signal switches sign and can thus implement this strategy. However, when the observation of the signal is noisy, the possibility of making correct decisions decreases and, consequently, the value decreases. Note that the case yields , since implies

The limiting cases (full information) and (no information) give upper and lower bounds, respectively, for the value function .

It can also be seen from Figure 3 (a) that, for fixed volatility of the underlying process, the volatility being determined through the function in (3.2), the value function is concave as a function of . When , there is no information about the underlying signal in the observation. In other words, we only observe noise. As mentioned above, the more information about the underlying we know with certainty, the more valuable it is for the decision making. This phenomenon is even more significant when the proportion of the information contained in is relatively small compared with the noise (i.e. when is small). This is because when is small, increasing increases the ratio between information and noise (in the observation) much faster than when i large. In other words, for small the value function should increase more rapidly.

As becomes larger, the percentage of information in becomes larger, and our problem starts to resemble that of complete information (). In this case, increasing by a small amount may not have a noticeable effect in the observation, i.e., the ratio between the underlying and the noise in the observation becomes stable when is large. This means that the observation will not change as significantly as before when increases, leading to the flattening of the value function seen in Figure 3 (a).

(a )

(b)

(a) ,

(b)

7.3. The influence of volatility of the underlying signal X

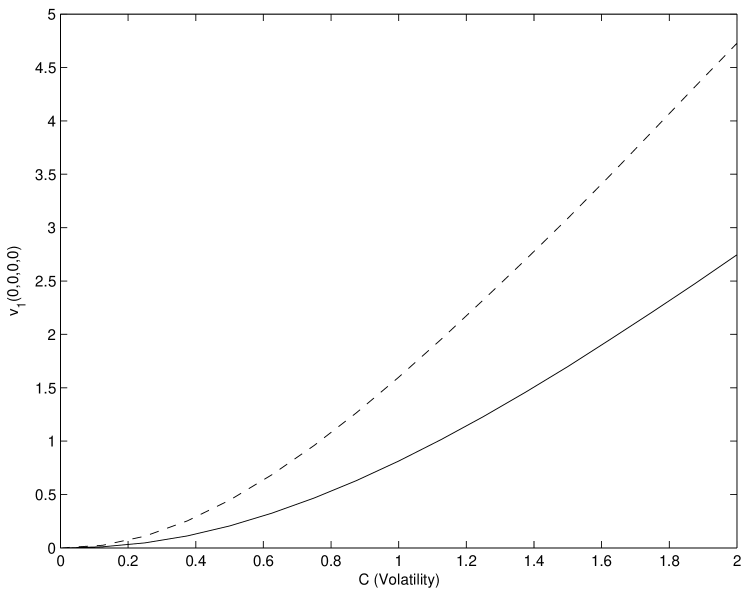

As for the amount of available information, the value function is monotonically increasing with respect to the volatility of the underlying signal. This behaviour comes from the fact that the possible gain increases when the chance of the signal being high increases, while the risk of making big losses is eliminated by the possibility for the controller to turn the facility off (it is here relevant to compare to the monotonicity of the value function of an American option). In total, this makes the value function increase. Similarly to the above, yields , since implies . This is also confirmed by the figures.

Figure 3 (b) shows the intersections of Figure 2 (a) and (b) at and it indicates that is a convex function of for fixed. In this case, the volatility of the underlying varies, but the proportion of the information of contained in the observation stays unchanged. means that the underlying is deterministic, in this case the observation is useless because can be known deterministically from its initial value and its deterministic dynamics.

When we increase , the underlying process becomes random, which means that we are not able to determine the position of merely from its initial data. In this case the observation begins to play a role as it contains information about the now unknown signal . The value function should become larger as increases, as the volatility of can make it grow significantly, and this growth can be exploited by the manager thanks to the information obtained through the process . The impact of observing is not dramatically significant for small values of as for small , the unknown is only modestly volatile and can be well estimated by considering only the deterministic part of its dynamics. However, when continues growing, making more and more volatile, less and less of the signal can be known based only on its initial values. The observation hence becomes increasingly important as it provides insight on how to optimally manage the facility in a now highly volatile environment. This explains the convexity of the curves in Figure 3 (b).

7.4. Influence of the drift of the underlying process

In the discussion above, the drift of the underlying signal process is assumed to be . We conclude this numerical example by briefly discussing the impact of the drift of the underlying signal, i.e., what happens when the drift . In the case of constant coefficient functions exemplified here, we will assume that . Obviously, a positive drift of the signal should have a positive impact on the value function since is monotonically increasing in . This behavior is also observed in Figure 2 (b) and Figure 3.

8. Summary and future research

In this paper we introduced and studied an optimal switching problem under partial information. In particular, we examined, in detail, the case of a Kalman-Bucy system and we constructed a numerical scheme for approximating the value function. We proved the convergence of our numerical approximation to the true value function using stochastic filtering theory and previous results concerning full information optimal switching problems. Through a numerical example we showed the influence of information on the value function, and after comparison with a deterministic PDE method we could conclude that our numerical scheme gives a reliable estimate of the value function for computationally manageable parameter values.

It should be noted that, although we obtain the complete convergence result for the Kalman-Bucy setting, parts of the analysis does not rely on the linear structure. To the authors’ knowledge, the difficulties of extending the complete result to the non-linear setting are twofold. Firstly, we rely heavily on the Gaussian structure and explicit expression of the measure to obtain the Lipschitz continuity of the value function, and the Lipschitz property is crucial in the subsequent convergence proof. For the general non-linear setting, however, we do not explicitly know the distribution and are not able to ensure Lipschitzness. Secondly, apart from the temporal parameter , in the Kalman-Bucy setting the value function depends only on three parameters, , and . However, in the non-linear setting, we may have to use the particle method to approximate and subsequently construct the value function based on this approximating measure. In this case the number of parameters that the value function will depend on will be at least equal to the number of particles in the approximating measure. Hence, the numbers of parameters may not be fixed and can be arbitrarily large in this non-linear setting.

The two problems discussed above are challenges when generalizing our analysis to the non-linear setting and naturally lead to interesting directions for future research. To be specific, in future studies we intend to extend our study to the non-linear setting and, in this generalized setting, develop a computationally tractable numerical scheme for estimating the value function.

References

- [ACLP12] R. Aid, L. Campi, N. Langrené, H. Pham, A probabilistic numerical method for optimal multiple switching problem and application to investments in electricity generation, arXiv:1210.8175v1, 2012.

- [AF12] B. El-Asri, I. Fakhouri, Optimal multi-modes switching with the switching cost not necessarily positive, arXiv:1204.1683v1, 2012.

- [AH09] B. El-Asri, S. Hamadène, The finite horizon optimal multi-modes switching problem: The viscosity solution approach Applied Mathematics & Optimization, 60 (2009), 213-235.

- [BC09] A. Bain, D. Crisan, Fundamentals of stochastic filtering, Stochastic Modelling and Applied Probability, vol. 60, Springer, 2009.

- [CR11] D. Crisan, B. Rozovsky, editors, The Oxford Handbook of Nonlinear Filtering, Oxford University Press, 2011.

- [DH09] B. Djehiche, S. Hamadène, On A Finite Horizon Starting And Stopping Problem With Risk Of Abandonment, International Journal of Theoretical and Applied Finance, 12 (2009), 523-543.

- [DHP10] B. Djehiche, S. Hamadène, A. Popier, A Finite Horizon Optimal Multiple Switching Problem, SIAM Journal on Control and Optimization, 48 (2010), 2751-2770

- [FN10] M. Fischer, G. Nappo, On the moments of the modulus of continuity of Ito processes Stochastic Analysis and Applications, 28 (2010), 103-122.

- [GKP12] P. Gassiat, I. Kharroubi, H. Pham, Time discretization and quantization methods for optimal multiple switching problem, arXiv:1109.5256v2, 2012.

- [HM12] S. Hamadène, M.A. Morlais, Viscosity Solutions of Systems of PDEs with Interconnected Obstacles and Multi-Modes Switching Problem, arXiv:1104.2689v2

- [HT07] Y. Hu, S. Tang, Multi-dimensional BSDE with Oblique Reflection and Optimal Switching, Probability Theory and Related Fields, 147 (2010), 89-121.

- [HZ10] S. Hamadène, J. Zhang, Switching Problem and Related System of Reflected Backward SDEs, Stochastic Processes and their Applications, 120 (2010), 403-426.

- [KB61] R. Kalman, R. Bucy, New results in linear filtering and prediction theory, Journal of Basic Engineering, 83D:95-108, 1961.

- [KP92] P. E. Kloeden, E. Platen, Numerical Solution of Stochastic Differential Equations, Springer-Verlag, Berlin, 1992.

- [L09] M. Ludkovski, A simulation approach to optimal stopping under partial information, Preprint, 2009.

- [LNO12] N.L.P. Lundström, K. Nyström, M. Olofsson, Systems of variational inequalities in the context of Optimal Switching Problems and Operators of Kolmogorov Type, to appear in Annali di Mathematica Pura ed Applicata.

- [O14] M. Olofsson, A PDE approach to optimal switching under partial information, In preparation, 2014.

- [PVZ09] H. Pham, V. L. Vath, X. Y. Zhou, Optimal Switching over Multiple Regimes SIAM journal on control and optimization, 48 (2009), 2217-2253.