Mapping systemic risk: critical degree and failures distribution in financial networks

Abstract

The 2008 financial crisis illustrated the need for a thorough, functional understanding of systemic risk in strongly interconnected financial structures. Dynamic processes on complex networks being intrinsically difficult, most recent studies of this problem have relied on numerical simulations. Here we report analytical results in a network model of interbank lending based on directly relevant financial parameters, such as interest rates and leverage ratios. Using a mean-field approach, we obtain a closed-form formula for the “critical degree”, viz. the number of creditors per bank below which an individual shock can propagate throughout the network. We relate the failures distribution (probability that a single shock induces failures) to the degree distribution (probability that a bank has creditors), showing in particular that the former is fat-tailed whenever the latter is. Our criterion for the onset of contagion turns out to be isomorphic to the condition for cooperation to evolve on graphs and social networks, as recently formulated in evolutionary game theory. This remarkable connection supports recent calls for a methodological rapprochement between finance and ecology.

1 Introduction

In the financial sector, shock propagation mechanisms are at the core of systemic risk [De Bandt and Hartmann, 2000; Allen et al., 2009], and banks play the most important role [Billio et al., 2012]. An important and potentially vulnerable arena for financial contagion is the interbank loan market, which allows banks to rapidly exchange large amounts of capital for short durations to accommodate temporary liquidity fluctuations [Furfine, 1999; Ashcraft and Duffie, 2007; Taylor and Williams, 2008]. Consequently, interbank loan networks have been of particular interest in exploring systemic risk [Gai and Kapadia, 2010; May and Arinaminpathy, 2010; Acemoglu et al., 2013].

In recent years, random network theory [Newman, 2010; Barrat et al., 2008] has provided a useful framework to study cascade effects in interconnected structures [Watts, 2002]. Applied to the financial sector [May et al., 2008], network approaches have clarified the role of connectivity [Nier et al., 2007; Battiston et al., 2012], bank size [Arinaminpathy et al., 2012], shock size [Acemoglu et al., 2013] and overlapping portfolios [Caccioli et al., 2012] in systemic risks. Increased understanding of contagion in finance [Aghion et al., 2000; Furfine, 2003] has led to an increased interest by regulators and central bankers [Kambhu et al., 2007; Bisias et al., 2012] in using network measures to evaluate systemic risk.

An essential insight of Allen and Gale [Allen and Gale, 2000], confirmed in [Gai and Kapadia, 2010] and deepened in [Battiston et al., 2012], is that increasing network connectivity—measured by its mean degree —can have opposite effects depending on the baseline value of . On the one hand, when the network is sparsely connected, increasing will open new channels for contagion and weaken the network. On the other hand, when is sufficiently large, increasing further will dilute the effect of a localized shock and strengthen the network. From this perspective, the key question is not if, but when, enhanced connectivity helps secure network robustness.

Our first goal in this paper is to sharpen these results by introducing a model of interbank lending that allows the “critical degree” separating these two regimes to be computed as an explicit function of a small number of relevant financial parameters: (interbank and external) interest rates, liquidity requirement, leverage ratio. As we shall see, this critical degree is pivotal in deriving an analytical estimate of the number of failures induced by a single shock given these parameters. Our results complement those of [Gai and Kapadia, 2010], who used the mathematics of percolation theory [Newman et al., 2001] to determine the contagion threshold in financial networks, as well as those of [May and Arinaminpathy, 2010], who brought to bear the “mean-field approximation” familiar to statistical physicists.

Our second goal is to analyze the role of degree heterogeneity in financial networks with regard to systemic risk. It has long been known [Albert et al., 2000; Newman, 2002] that network topology is a key determinant of network robustness. Empirical studies of flows over the Fedwire Funds Services [Soramäki et al., 2007; Bech and Atalay, 2010] have found the network to be inhomogeneous, with a strongly connected, strongly reciprocal core and a much more sparse periphery.222Similar analyses have been conducted of interbank loan networks in Belgium [Degryse and Nguyen, 2007], Austria [Boss et al., 2004], the Netherlands [Pröpper et al., 2008], Italy [Mistrulli, 2007], and East Asia [Inoguchi, 2013], with similar results. Nonetheless, most theoretical studies of the systemic risk to date [Allen and Gale, 2000; May and Arinaminpathy, 2010; Gai and Kapadia, 2010] have used homogeneous (Erdös-Rényi) networks. We show that, when banks’ degrees have a fat-tailed distribution, the number of failures induced by a single shock follows a similar distribution—a precise statement of the “robust-yet-fragile” property of financial networks emphasized by several authors [Haldane, 2009; Gai and Kapadia, 2010; Acemoglu et al., 2013].

The paper is organized as follows. We begin by describing our model of interbank lending networks, first in some generality and then under simplifying assumptions. Next we show how the number of failures induced by an individual shock can be estimated analytically by means of a mean-field-type approximation, in which Cayley trees (regular networks without loops) play an instrumental role. We then compare our results with numerical simulations of both homogenous and scalefree random networks. We close with a few remarks concerning the policy implications of our work, and point out an intriguing biological analogy.

2 Model

2.1 Interbank network

We present a model333A preliminary analysis of this model was reported in [Gupta et al., 2013]. of the structure of interbank lending as a random weighted directed network, in which a node represents a bank and a link with weight a loan of amount made by to . The sum of all weights flowing out of a bank , , is therefore the total interbank exposure of bank ; the sum of weights flowing into , , is in turn the total liability of bank on the interbank market.

2.2 Balance sheets

In addition to its interbank liabilities , we assume that each bank has external, more senior liabilities (e.g. deposits). On the asset side, we further introduce liquid assets (e.g. bonds) as well as illiquid assets (e.g. buildings). The total assets and total liabilities of bank can therefore be written as and ; the difference is the net worth of bank , see Table 1.

| assets | liabilities |

|---|---|

| liquid assets | senior liabilities |

| illiquid assets | interbank borrowings |

| interbank loans | net worth |

Basel III [Basel, 2010] introduced leverage and liquidity requirements for banks. We define for each bank the leverage ratio (ratio of networth to total assets) and the liquidity ratio (ratio of liquid assets to total assets). By definition, lowering the ratios and increases the exposure of bank on the interbank market; we shall see that they have a strong impact on the systemic risk.

2.3 Repayment equation

We now introduce a two-period investment dynamics, through which a bank can either increase or decrease its net worth . In the first step, a bank uses its total liabilities to invest in some external opportunity, at some interest rate . (Successful investments correspond to , hazardous ones correspond to ; in the worst case scenario, the investment is lost in full, viz. .) We denote the profit made in this transaction.444If , we take ; equivalently, the profit is defined by . In the second step, a bank uses this profit and its liquid assets to repay its interbank liabilities with an interest while ensuring the seniority of .

Denoting the amount repaid by bank to bank in the second step, we assume the following repayment rules.555Strictly related rules, inspired from Einsenberg and Noe’s seminal paper [Eisenberg and Noe, 2001], were used recently in [Acemoglu et al., 2013].

-

•

Full repayment: if , bank repays its junior debt in full, hence for each

-

•

Partial default: if , bank repays a fraction of its junior liabilities on a pro rata basis, hence for each

-

•

Complete default: if , bank repays nothing, hence for each .

When a bank can just repay its interbank borrowings, i.e. when

| (1) |

we say that is critical. After all repayments are made, bank has an updated net worth

| (2) |

We call “safe” the banks such that , and “failed” the ones such that .

2.4 Simplifying assumptions

From a mathematical perspective, finding the interbank repayments involves solving the system of coupled, non-linear equations

| (3) |

where and the sum ranges over ’s debtors; the repayment of bank to bank is then given by .

While the set of equations (3) can be studied numerically for various network topologies and different values of the financial parameters , , and , our goal in this paper is to obtain explicit, analytical results about the robustness of financial networks with respect to shocks. To make progress, we make the following—dramatic but empowering—assumptions: all loans are reciprocated, so that the network is actually undirected,666As observed in Ref. [Soramäki et al., 2007], the reciprocity of the “core” financial network is very high, making this assumption less unrealistic than may seem at first sight. all interbank loans have unit value, so that , where is the degree of node , all banks have equal leverage and liquidity ratios , so that the latter can be thought of as model parameters rather than individual variables illiquid assets are negligible (), and external interest rates take the same value for all banks across the network except one (bank , call it the “shocked bank”), for which .

Within this simple setting, our objective is then to estimate the “number of induced failures” (defined as the number of banks such that ) as a function of the financial parameters and of the network topology.

3 Results

3.1 Cayley trees

We begin our investigation of the model by considering the simplest network topology, namely a network with uniform degree and no loops (a “Cayley tree”). On such simple networks, the repayment problem (3) can be solved exactly (see Materials and Methods and SI for details), as follows.

When is sufficiently large, each neighbor of the shocked bank inherits only a small fraction of ’s losses—and none fails. For networks with incrementally decreasing degree , however, the effect of these losses on the net worth of each creditor of gradually increases, until at some point shocked bank ’s weakest neighbor also fails. If degree further decreases, the second (then third, etc.) neighbors of also approach criticality, and start failing as well.

This sequence of transitions, involving higher and higher neighbors of the shocked bank, defines an ordered sequence of “critical degrees” such that

| (4) |

where is the number of nodes at distance from . The values of these critical degrees provide a measure of the robustness of the network with respect to a shock: the higher the critical degrees, the more fragile the financial structure.

The expression for each as a function of the financial parameters can be obtained by solving the repayment equations (3) under these conditions that all banks at distance from the shocked bank are safe, but all -th neighbors of are critical. This gives in particular

| (5) |

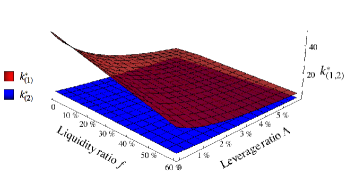

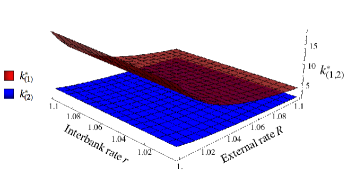

The critical degrees and (given explicitly in SI) are plotted as functions of the financial ratios for and and as functions of the interest rates for and in Fig. 1. As is apparent from these plots, are stricly decreasing functions of and : lower liquidity leverage ratios both enhance the systemic risk—an intuitive conclusion, which is here proved rigorously. Furthermore, we see that, unlike the first critical degree , the second critical degree never becomes appreciably large, , so that failures in effect hardly extend beyond the first neighbors of the shocked bank. Finally, we note that, in the limit where (a regime in which the economy is dominated by interbank transactions), the first critical degree reaches the value ; we will come back to this observation in the concluding section.

3.2 General networks

Real-world financial networks being anything but regular, the usefulness of the exact solution above would seem to be extremely limited. It turns out to be the opposite. In the regime where failures are unlikely to extend beyond the first neighbors of the shocked bank—which the case for most realistic values of the financial parameters, as illustrated in Fig. 1—knowing the first critical degree (hereafter denoted simply ) yields a reliable estimate of the failures distribution on random networks, including scalefree ones.

We will assume that, on a general random network, a first neighbor of the shocked bank will indeed fail if and only if its own degree is smaller than the critical degree given by (5). This is akin to the “mean-field” approximation familiar from statistical mechanics: it replaces the actual, inhomogeneous, environment of in the network by a homogeneous environment in which all banks have the same degrees as , here the Cayley tree with degree . While this approximation clearly cannot capture the dynamics of a single network, it does provides a tractable starting point to study the statistics of failures in a given ensemble of random networks. Within this approximation, we obtain the following results (Materials and Methods and SI).

First, the expected number of failures can be estimated as

| (6) |

where is the probability that a neighbor of the shocked bank has a subcritical degree and the dots indicate that the contribution of higher neighbors of has been neglected. Here is the degree distribution (probability that a node has degree ) and is the conditional degree distribution (probability that a node attached to a node with degree has degree ). Note that formula (6) implies that disassortative financial networks (for which the probability that a neighbor of the shocked bank has subcritical degree increases with the number of neighbors ) tend to be more vulnerable to contagion than assortative or uncorrelated ones [Newman, 2002].777In the latter case, one checks that (6) reduces to , where is independent of .

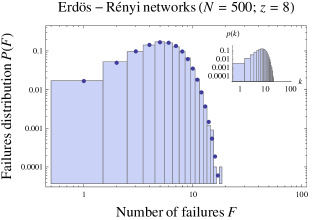

Second, we show888Provided the network is asymptotically uncorrelated, viz. is independent of when ; see SI. that, whether the network is Poisson-distributed () or power-law distributed (), the failures distribution has the same asymptotic behavior as the degree distribution itself. In the scalefree case, this means in particular that has a power-law falloff with exponent , hence is fat tailed. This result can be interpreted as expressing the “robust-yet-fragile” property of scalefree networks noted earlier: even when the expected number of failures is low, the risk remains that a single shock can take down a significant fraction of the network.

3.3 Numerical tests

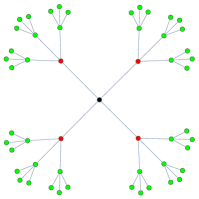

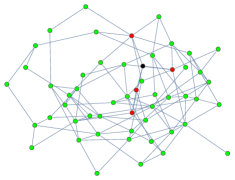

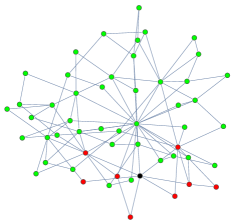

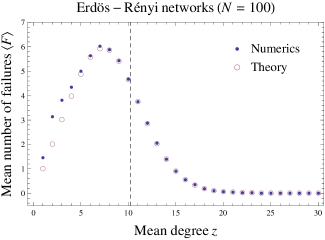

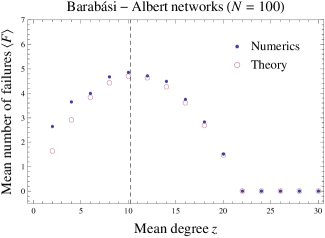

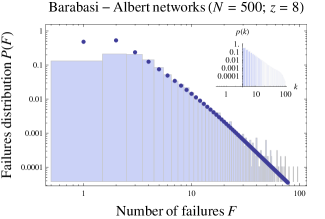

To test the validity of these findings, we analyzed two types of random networks for which the conditional probability distribution is known explicitly as a function of the mean degree (at least in the large limit): the classical Erdös-Rényi (ER) model [Erdős and Rényi, 1959], with Poisson degree distribution, and the Barabási-Albert (BA) model [Barabási and Albert, 1999], with scalefree degree distribution .

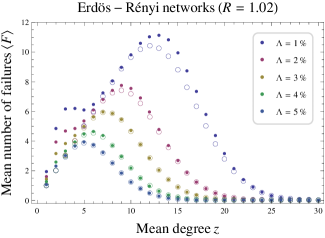

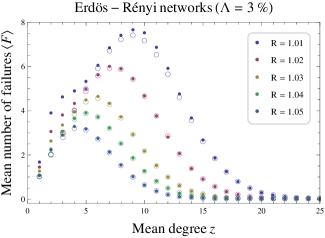

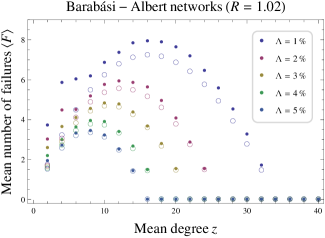

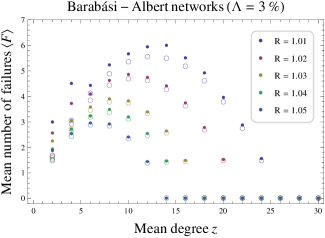

For both network types, we generated random networks for each value of the mean degree . We solved Eq. (3) numerically for each of these networks and, using Eq. (2), we computed the number of induced failures . From this we determined the mean number of failures and the empirical failures distribution at each , and compared them with our mean-field estimates. Finally, we checked that using directed networks (both random and scalefree) does not yield significantly different results, thereby confirming the validity of assumption as a useful first approximation.

Fig. 3(a) shows the mean number of failures as a function of the mean degree for homogeneous ER and scalefree BA networks, in the parameter regime , , and (for which ); see also Fig. S1. Irrespective of the network topology, we find that the empirical value of matches very closely with our estimate (6) provided that the mean degree is not too small. This discrepancy at low has a straightforward explanation: while we neglected their contribution in our mean-field approximation, we saw with Cayley trees that the likelihood of second and higher neighbors failing is a decreasing function of .

Fig. 3(b), in turn, plots the empirical distribution of failures and our analytical estimate thereof (given in Materials and Methods) for ER and BA random networks with , for the same values of the financial parameters. Here too, we find that the agreement between the numerical results and the prediction of our mean-field approximation is very good; Fig. 3(b) confirms in particular that is fat-tailed when is.

The close agreement for these values of the financial parameters (and any other values such that , see SI) is remarkable if one contrasts the complexity of the original problem (3) with the extreme simplicity of our mean-field approximation. To us, this conclusion is the main import of our study: once the expression for the critical degree as a function of the financial parameters has been obtained, Eq. (5), analytical results on the systemic risk are not only possible, but also intuitive and straightforward.

4 Discussion

We have considered the effect of financial variables such as interest rates, leverage ratio and financial exposure on the robustness of interbank systems vis-à-vis individual shocks. Focusing first on regular networks, we obtained an explicit formula for the critical degree, below which failures begin to propagate through the network. From this, we then showed how to derive a simple but reliable approximation of the expected number of failures and failures distribution in random (and possibly strongly heterogeneous) networks. Interesting extensions of our work could include a non-linear relation between interbank exposure and network degree,999See [Soramäki et al., 2007] for empirical measures of the correlation between loan size and network degree. overlapping portfolios, multiple or probabilistic shocks and multiple-period dynamics.

The highly stylized character of our model notwithstanding, our results shed new light on important aspects of systemic risks, such as the association between contagion and interest rate policy [Freixas et al., 2010]. Using plausible values for interest rates, liquidity requirement and leverage, we found critical degrees of the order of to . An empirical analysis of the FedFunds market [Soramäki et al., 2007] found a mean degree , but almost half of the banks had out-degrees less than , thus vulnerable to contagion. In the 2008 financial crisis, mean degrees in the interbank network declined, increasing systemic risk [Minoiu and Reyes, 2013]. While regulators do not directly control the topology of financial networks, it is useful to understand how tools already in place—interest rates, leverage and liquidity requirements—can affect the critical degree.

We observed that our formula (5) for the critical degree reduces to in the high leverage, low liquidity limit. This limiting value can be expressed as a “cost-benefit” rule of thumb, as follows. If bank lends to bank and does not repay , will have lost ; if on the other hand makes a successful investment with the money borrowed from and repays it in full, will have made a profit profit . The critical degree is then just the ratio of the potential loss to the potential profit of each transaction. Given the great difficulty of the problem of assessing the robustness of actual financial networks, this simple rule of thumb could prove a handy “order-zero” approximation.

What is more, this interpretation establishes a direct link with a seemingly unrelated problem: the condition for the evolution of cooperation, famously investigated by Hamilton [Hamilton, 1964]. Ref. [Ohtsuki et al., 2006] recently extended his insights to graphs and social networks, showing that “natural selection favours cooperation, if the benefit of the altruistic act, , divided by the cost, , exceeds the average number of neighbours, , which means ”.101010More precisely, the criterion for natural selection to favour cooperation is , where is the mean nearest-neighbor degree, see [Konno, 2011]. This simple rule is precisely the same as the one we found for shock propagation in high-leverage, low liquidity interbank networks: the critical degree is given by the ratio of the activities promoting systemic propagation (benefit of cooperation and interbank lending respectively) to the activities inhibiting systemic propagation (cost of cooperation and external profits respectively). This unexpected connection supports the convergence of ecology and finance advocated by Haldane and May after the 2008 crisis [Haldane and May, 2011], and points to a unified perspective on resource sharing in networks.

Materials and Methods

Networks

In this paper we considered three classes of networks: Cayley trees, ER networks and BA networks. They are defined as follows.

-

•

Cayley trees are graphs without loops in which each node is connected to a fixed number of neighbors . Given an (arbitrarily chosen) “root” node , the number of nodes at distance from is .

-

•

ER networks are the simplest random networks: given nodes, each possible edge is included in the network with probability , independently from every other edge. When , this results in a random network with Poisson degree distribution

(7) where is the mean degree. The absence of correlations in such networks entails that the conditional degree distribution—the probability that a node connected to a node with degree has degree —is just .

-

•

BA networks are obtained by means of a stochastic growth process. Starting from a complete graph over (say) initial nodes, each new node is added to existing nodes with a probability that is proportional to the number of links that the existing nodes already have. In the large time limit, this process defines a correlated random network with (conditional) degree distribution [Fotouhi and Rabbat, 2013]

(8) (9) where ; the mean degree is given by .

Failures distribution

Consider a random network with degree distribution and conditional degree distribution . Suppose that the shocked bank has degree , and let be the probability that a neighbor of the shocked bank has a subcritical degree. According to our “mean-field” assumption, the probability that first neighbors of fail is given by the probability that neighbors have subcritical degree, times the probability that neighbors have supercritical degree, times the number of choices of failing neighbors among . Weighing this by the probability that has neighbors, we arrive at

| (10) |

The expected number of failures (6) is then obtained by evaluating (see SI). Note that expression (10) is strongly reminiscent of the classical theory of percolation on complex networks, where one shows [Cohen et al., 2001] that the degree distributions after the removal of a fraction of the nodes is given in terms of the old degree distribution by . This is no surprise: the whole point of our mean-field approximation is to reduce a dynamical problem (computation of repayments) to a topological one (failure depends on degree only).

Large asymptotics

Let us now consider the limit of (10) when (hence for shocked banks with degree ), assuming that becomes independent of in this limit. (This amounts to saying that correlations between the degrees and of adjacent nodes become immaterial when ; this holds for both ER and BA networks.) Let us consider Poisson-distributed and power-law distributed networks separately (see SI for details).

-

•

Poisson networks. Given the Poisson degree distribution , resumming (10) is straighforward and gives

(11) Thus, in Poisson distribued networks, the failures distribution is Poissonian with mean .

-

•

Scalefree networks. For scalefree networks we observe that, when is an integer and for sufficiently large , the Pochhammer symbol can be substituted to in the degree distribution . This allows to perform the sum (10) explicitly, yielding

(12) where in the second step we used the asymptotics of the Gauss hypergeometric function for large parameters [Temme, 2003]. Analytical continuation in then shows that is scalefree with exponent also for non-integer .

In both cases, the tail of has the same nature (Poisson or power-law) as the degree distribution itself.

Acknowledgements

We thank the participants and staff of the 2013 Santa Fe Institute Complex Systems Summer School (where this project was initiated) for a very stimulating experience. We are especially indebted to T. J. Carter, R. Martinez and M. M. King and for their help in the early stages of this research, and to B. Vaitla for drawing our attention to Ref. [Ohtsuki et al., 2006]. Useful discussions with V. Bonzom are gratefully acknowledged. Research at the Perimeter Institute is supported in part by the Government of Canada through Industry Canada and by the Province of Ontario through the Ministry of Research and Innovation.

References

- Acemoglu et al. [2013] D. Acemoglu, A. Ozdaglar, and A. Tahbaz-Salehi. Systemic risk and stability in financial networks. Columbia Business School Research Paper No. 13-4, Jan. 2013.

- Aghion et al. [2000] P. Aghion, P. Bolton, and M. Dewatripont. Contagious bank failures in a free banking system. Eur. Econ. Rev., 44(4-6):713–718, May 2000.

- Albert et al. [2000] R. Albert, H. Jeong, and A.-L. Barabási. Error and attack tolerance of complex networks. Nature (London), 406(6794):378–382, July 2000.

- Allen and Gale [2000] F. Allen and D. Gale. Financial Contagion. J. Polit. Econ., 108(1):1–33, Feb. 2000.

- Allen et al. [2009] F. Allen, A. Babus, and E. Carletti. Financial Crises: Theory and Evidence. Annu. Rev. Fin. Econ., 1(1):97–116, Dec. 2009.

- Arinaminpathy et al. [2012] N. Arinaminpathy, S. Kapadia, and R. M. May. Size and complexity in model financial systems. Proc. Natl. Acad. Sci. USA, 109(45):18338–18343, 2012.

- Ashcraft and Duffie [2007] A. B. Ashcraft and D. Duffie. Systemic illiquidity in the federal funds market. Am. Econ. Rev., 97(2):221–225, May 2007.

- Barabási and Albert [1999] A.-L. Barabási and R. Albert. Emergence of scaling in random networks. Science, 286(5439):509–512, 1999.

- Barrat et al. [2008] A. Barrat, M. Barthelemy, and A. Vespignani. Dynamical processes on complex networks. Cambridge University Press, 2008.

- Basel [2010] C. Basel. Basel III: A global regulatory framework for more resilient banks and banking systems. Basel Committee on Banking Supervision, 2010.

- Battiston et al. [2012] S. Battiston, D. Delli Gatti, M. Gallegati, B. Greenwald, and J. E. Stiglitz. Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. J. Econ. Dyn. Control, 36(8):1121–1141, Aug. 2012.

- Bech and Atalay [2010] M. L. Bech and E. Atalay. The topology of the federal funds market. Physica A, 389(22):5223–5246, 2010.

- Billio et al. [2012] M. Billio, M. Getmansky, A. W. Lo, and L. Pelizzon. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J. Finan. Econ., 104(3):535–559, 2012.

- Bisias et al. [2012] D. Bisias, M. D. Flood, A. W. Lo, and S. Valavanis. A Survey of Systemic Risk Analytics. U.S. Department of Treasury, Office of Financial Research, 0001, Jan. 2012.

- Boss et al. [2004] M. Boss, H. Elsinger, M. Summer, and S. Thurner. Network topology of the interbank market. Quant. Financ., 4(6):677–684, Dec. 2004.

- Caccioli et al. [2012] F. Caccioli, M. Shrestha, C. Moore, and J. D. Farmer. Stability analysis of financial contagion due to overlapping portfolios. SFI working paper, 2012-10-018, Oct. 2012.

- Cohen et al. [2001] R. Cohen, K. Erez, D. ben Avraham, and S. Havlin. Breakdown of the Internet under Intentional Attack. Phys. Rev. Lett., 86(16):3682–3685, Apr. 2001.

- De Bandt and Hartmann [2000] O. De Bandt and P. Hartmann. Systemic risk: A survey. ECB Working Paper, 35, 2000.

- Degryse and Nguyen [2007] H. Degryse and G. Nguyen. Interbank exposures: An empirical examination of contagion risk in the Belgian banking system. Int. J. Cent. Bank., 3(2):123–171, 2007.

- Eisenberg and Noe [2001] L. Eisenberg and T. H. Noe. Systemic risk in financial systems. Management Sci., 47(2):236–249, 2001.

- Erdős and Rényi [1959] P. Erdős and A. Rényi. On random graphs. Publ. Math.-Debrecen, 6:290–297, 1959.

- Fotouhi and Rabbat [2013] B. Fotouhi and M. Rabbat. Degree correlation in scale-free graphs. Eur. Phys. J. B, 86(12):1–19–19, 2013.

- Freixas et al. [2010] X. Freixas, A. Martin, and D. Skeie. Bank liquidity, interbank markets, and monetary policy. FRB of New York Staff Report, 371, 2010.

- Furfine [1999] C. H. Furfine. The Microstructure of the Federal Funds Market. Financ. Mark. Inst. Instrum., 8(5):24–44, Dec. 1999.

- Furfine [2003] C. H. Furfine. Interbank Exposures: Quantifying the Risk of Contagion. J. Mon. Cred. Bank., 35(1):111–128, Feb. 2003.

- Gai and Kapadia [2010] P. Gai and S. Kapadia. Contagion in financial networks. Proc. R. Soc. A, 466(2120):2401–2423, 2010.

- Gupta et al. [2013] A. Gupta, M. M. King, J. S. Magdanz, R. Martinez, M. Smerlak, and B. Stoll. Critical connectivity in banking networks. In SFI CSSS. SFI CSSS report, Sept. 2013.

- Haldane [2009] A. Haldane. Why banks failed the stress test. BIS Review, 18, 2009.

- Haldane and May [2011] A. G. Haldane and R. M. May. Systemic risk in banking ecosystems. Nature (London), 469(7330):351–355, 2011.

- Hamilton [1964] W. D. Hamilton. The genetical evolution of social behaviour. I. J. Theor. Biol., 7(1):1–16, 1964.

- Inoguchi [2013] M. Inoguchi. Interbank market, stock market, and bank performance in East Asia. Pac.-Basin Fin. J., 25:136–156, 2013.

- Kambhu et al. [2007] J. Kambhu, S. Weidman, and N. Krishnan. New directions for understanding systemic risk: a report on a conference cosponsored by the Federal Reserve Bank of New York and the National Academy of Sciences. National Academies Press, 2007.

- Konno [2011] T. Konno. A condition for cooperation in a game on complex networks. J. Theor. Biol., 2011.

- May and Arinaminpathy [2010] R. M. May and N. Arinaminpathy. Systemic risk: the dynamics of model banking systems. J. Roy. Soc. Interface, 7(46):823–838, Mar. 2010.

- May et al. [2008] R. M. May, S. A. Levin, and G. Sugihara. Complex systems: Ecology for bankers. Nature (London), 451(7181):893–895, 2008.

- Minoiu and Reyes [2013] C. Minoiu and J. A. Reyes. A network analysis of global banking: 1978–2010. J. Financ. Stab., 9(2):168–184, June 2013.

- Mistrulli [2007] P. E. Mistrulli. Assessing financial contagion in the interbank market: Maximum entropy versus observed interbank lending patterns. J. Bank. Financ., 35(5):1114–1127, 2007.

- Newman [2002] M. Newman. Assortative Mixing in Networks. Phys. Rev. Lett., 89(20):208701, Oct. 2002.

- Newman [2010] M. Newman. Networks: An Introduction. Oxford University Press, Mar. 2010.

- Newman et al. [2001] M. E. Newman, S. H. Strogatz, and D. J. Watts. Random graphs with arbitrary degree distributions and their applications. Phys. Rev. E, 64(2):026118, 2001.

- Nier et al. [2007] E. Nier, J. Yang, T. Yorulmazer, and A. Alentorn. Network models and financial stability. J. Econ. Dyn. Control, 31(6):2033–2060, June 2007.

- Ohtsuki et al. [2006] H. Ohtsuki, C. Hauert, E. Lieberman, and M. A. Nowak. A simple rule for the evolution of cooperation on graphs and social networks. Nature (London), 441(7092):502–505, 2006.

- Olver [2010] F. W. J. Olver. NIST Handbook of Mathematical Functions. Cambridge University Press, May 2010.

- Pröpper et al. [2008] M. Pröpper, I. van Lelyveld, and R. Heijmans. Towards a Network Description of Interbank Payment Flows. 177:1–27, May 2008.

- Soramäki et al. [2007] K. Soramäki, M. L. Bech, J. Arnold, R. J. Glass, and W. E. Beyeler. The topology of interbank payment flows. Physica A, 379(1):317–333, 2007.

- Taylor and Williams [2008] J. B. Taylor and J. C. Williams. A Black Swan in the Money Market. NBER Working Paper, 13943:36, 2008.

- Temme [2003] N. M. Temme. Large parameter cases of the Gauss hypergeometric function. J. Comput. Applied. Math., 153(1-2):441–462, Apr. 2003.

- Watts [2002] D. J. Watts. A simple model of global cascades on random networks. Proc. Natl. Acad. Sci. USA, 99(9):5766–5771, Apr. 2002.

Mapping systemic risk: critical degree and failures distribution in financial networks

Supplementary Information

Appendix A Computation of the critical degrees and

On a regular graph with degree , the liquid assets , senior liabilities and investment profit of a bank given assumptions are all proportional to , given respectively by

| (13) | |||||

| (14) | |||||

| (15) |

with if and if . The repayment equation (3) can therefore be written as

| (16) |

where the sum ranges over the neighbors of . Moreover, since in a Cayley tree all banks at the same distance from the shocked bank are equivalent, their repayments must take a common value , with . Thus (16) becomes

| (17) |

for the shocked bank itself and

| (18) |

for its first, second and higher neighbors. From (17) and (18) it is easy to compute the first few critical degrees .

By definition the first critical degree is such that

-

•

only the shocked bank defaults, viz.

(19) -

•

the first neighbors of are critical, viz.

(20)

Solving (17) and (20) for yields

| (21) |

Similarly, the second critical degree corresponds to the situation where

-

•

only the shocked bank and its first neighbors default, viz.

(22) -

•

the second neighbors of are critical, viz.

(23)

This gives (assuming , so that ):

| (24) |

Observe that , hence the second critical degree grows much more slowly than the first critical degree . This suggests that, except in the extreme case where (which can happen only if and ), the direct propagation of failures to second and higher neighbors of the shocked bank is excluded in our model (within assumptions ).

Appendix B Proof of Eq. (6)

Given the estimate (10), the expected number of failures can be written as

| (25) |

Now, using Newton’s binomial formula it is easy to show that, for any two numbers and ,

| (26) |

Using relation (26) with and in Eq. (25) gives

| (27) |

Note that, for uncorrelated networks (for which ), is independent of , hence .

Appendix C Proof of Eq. (12)

The Gauss hypergeometric function with parameters is defined as the series

| (28) |

where is the Pochhammer symbol and is a complex number. (Note the potentially confusing notation: is the Gauss hypergeometric function, and is the number of failures induced by a shock.) Its asymptotic behavior in the limit of large parameter is given by Watson’s expansion [Olver, 2010, p. 397], yielding in particular

| (29) |

Using the connection formula

| (30) |

this gives

| (31) |

Appendix D Mean number of failures: varying interest rate and leverage ratio

In sec. 3.3 we studied the mean number of failures induced by a single shock within two network ensembles: Erdös-Rényi random networks and Barabási-Albert scalefree networks. Specifically, we compared our analytical estimate (6) with numerical results obtained by averaging over networks for each value of the mean degree .

Fig. S1 presents further results showing the effect of varying the leverage ratio and the external interest rate . While the agreement between theory (circles) and numerics (dots) remains qualitatively good for all considered values, we observe that systematic discrepancies—notably at low —arise when and get large. This corresponds to regimes where the critical degree . In such regimes, second and higher neighbors of the shocked bank are likely to fail, as the second critical degree becomes significantly larger than zero. It is an interesting challenge to extend our mean-field approximation so as to capture such higher-neighbor effects.