A Representation Theorem for Smooth Brownian Martingales

Sixian Jin111Institute of Mathematical Sciences, Claremont Graduate University, Sixian.Jin@cgu.edu, Qidi Peng222Institute of Mathematical Sciences, Claremont Graduate University, Qidi.Peng@cgu.edu, Henry Schellhorn333Corresponding author, Institute of Mathematical Sciences, Claremont Graduate University, Henry.Schellhorn@cgu.edu

Abstract: We show that, under certain smoothness conditions, a Brownian martingale, when evaluated at a fixed time, can be represented via an exponential formula at a later time. The time-dependent generator of this exponential operator only depends on the second order Malliavin derivative operator evaluated along a ”frozen path”. The exponential operator can be expanded explicitly to a series representation, which resembles the Dyson series of quantum mechanics. Our continuous-time martingale representation result can be proven independently by two different methods. In the first method, one constructs a time-evolution equation, by passage to the limit of a special case of a backward Taylor expansion of an approximating discrete time martingale. The exponential formula is a solution of the time-evolution equation, but we emphasize in our article that the time-evolution equation is a separate result of independent interest. In the second method, we use the property of denseness of exponential functions. We provide several applications of the exponential formula, and briefly highlight numerical applications of the backward Taylor expansion.

Keywords: Continuous martingales, Malliavin calculus.

MSC 2010: 60G15 ; 60G22 ; 60H07

1 Introduction

The problem of representing Brownian martingales has a long and distinguished history. Dambis [5] and Dubins-Schwarz [7] showed that continuous martingales can be represented in terms of time-changed Brownian motions. Doob [8], Wiener and Itô developed what is often called Itô’s martingale representation theorem: every local Brownian martingale has a version which can be written as an Itô integral plus a constant. In this article, we consider a special kind of martingales which are conditional expectations of an -measurable random variable . Recall that, when the random variable is Malliavin differentiable, the Clark-Ocone formula ([4, 20]) states that the integrand in Itô’s martingale representation theorem is equal to the conditional expectation of the Malliavin derivative of . We focus on a less general case, where the Brownian martingale is assumed to be ”infinitely smooth”. Namely, the target random variable is infinitely differentiable in the sense of Malliavin. We show that such a Brownian martingale, when evaluated at time , , can be represented as an exponential operator of its value at the later time .

While smoothness is a limitation to our result, our representation formula opens the way to new numerical schemes, and some analytical asymptotic calculations, because the exponential operator can be calculated explicitly in a series expansion, which resembles the Dyson series of quantum mechanics. Although we still call our martingale’s expansion Dyson series, there are two main differences between our martingale representation and the Dyson formula for the initial value problem in quantum mechanics. First, in the case of martingales, time flows backward. Secondly, the time-evolution operator is equal to one half of the second-order Malliavin derivative evaluated along a constant path, while for the initial value problem in quantum mechanics the time-evolution operator is equal to times the time-dependent Hamiltonian divided by the Planck constant.

Our continuous-time martingale representation result can be proved using two different methods: by discrete time approximation and by approximation from a dense subset. In the first method, the key idea is to construct the backward Taylor expansion (BTE) of an approximating discrete-time martingale. The BTE was introduced in Schellhorn and Morris [17], and applied to price American options numerically. The idea in that paper was to use the BTE to approximate, over one time-step, the conditional expectation of the option value at the next time-step. While not ideal to price American options because of the lack of differentiability of the payoff, the BTE is better suited to the numerical calculation of the solution of smooth backward stochastic differential equations (BSDE). In a related paper, Hu et al. [12] introduce a numerical scheme to solve a BSDE with drift using Malliavin calculus. Their scheme can be viewed as a Taylor expansion carried out until the first order. Our BTE can be seen as a generalization to higher order of that idea, where the Malliavin derivatives are calculated at the future time-step rather than at the current time-step.

The time-evolution equation results then by a passage to the limit, when the time increment goes to zero, of the BTE, following the ”frozen path”. The exponential formula is then a solution of the time-evolution equation, under certain conditions. We stress the fact that both the BTE and the time-evolution equation are interesting results in their own right. Since the time-evolution equation is obtained from the BTE only along a particular path, we conjecture that there might be other types of equations that smooth Brownian martingales satisfy in continuous time. The time-evolution equation can also be seen as a more general result than the exponential formula, in the same way that the semi-group theory of partial differential equations does not subsume the theory of partial differential equations. For instance, other types of series expansion, like the Magnus expansion [22] can be used to solve a time-evolution equation.

We also sketch an alternate method, which we call the density method of proof of the exponential formula, which uses the denseness of stochastic exponentials in . The complete proof 444This proof is available from the authors, upon request. goes along the lines of the proof of the exponential formula for fractional Brownian motion (fBm) with Hurst parameter , which we present in a separate paper [15]. We emphasize that it is most likely nontrivial to obtain the exponential formula in the Brownian case by a simple passage to the limit of the exponential formula for fBm when tends to from above. We mention three main differences between Brownian motion and fBm in our context. First, by the Markovian nature of Brownian motion, the backward Taylor expansion leads easily in the Brownian case to a numerical scheme. Second, there is a time-evolution equation in the Brownian case, but probably not in the fBm case, so that the BTE method of proof is unavailable. Third, the fractional conditional expectation (which is defined only for in [3]) in general does not coincide with the conditional expectation.

The structure of this paper is the following. We first expose the discrete time result, namely the backward Taylor expansion for functionals of discrete Brownian sample path. We then move to continuous time, and present the time-evolution equation and exponential formula. We then sketch the density method of proof. Four explicit examples are given, which show the usefulness of the Dyson series in analytic calculations. Example 4 is about the Cox-Ingersoll-Ross model with time-varying parameters, which, as far as we know, is a new result. All proofs of main results are relegated to the appendix.

2 Martingale Representation

2.1 Preliminaries and notation

This section reviews some basic Malliavin calculus and introduces some definitions that are used in our article. We denote by a complete filtered probability space, where the filtration satisfies the usual conditions, i.e., it is the usual augmentation of the filtration generated by Brownian motion on (most results can be easily generalized to Brownian motion on , ). Unless stated otherwise all equations involving random variables are to be regarded to hold -almost surely.

Following by [21], we say that a real function is symmetric if:

for any permutation on . If in addition, , i.e.,

then we say belongs to , the space of symmetric square-integrable functions on . Denote by the space of square-integrable random variables, i.e., the norm of is

The Wiener chaos expansion of , is thus given by

where is a uniquely determined sequence of deterministic functions ( is the so-called -dimensional kernel) with , for , and the operator is defined as

For an element , we denote its Skorohod integral by , which is considered as the adjoint of the Malliavin derivative operator. To be more explicit, it can be defined this way: for all , if the Wiener chaos expansion of is

where for each , is a uniquely determined -dimensional kernel, then the Skorohod integral of is defined to be

where denotes the symmetrization of the -dimensional kernel with respect to its th argument (see Proposition 1.3.1 in [19] for more details):

Following Lemma 4.16 in [21], the Malliavin derivative of (when it exists) satisfies

We denote the Malliavin derivative of order of at time by , as a shorthand notation for . We call the set of random variables which are infinitely Malliavin differentiable and -measurable. A random variable is said to be infinitely Malliavin differentiable if and for any integer ,

| (2.1) |

In particular, we denote by the collection of all satisfying (2.1) for .

We define the freezing path operator on a Brownian motion by

| (2.2) |

with being the indicator function. When Brownian motion is defined as the coordinate mapping process (see [14]), then each trajectory of represents obviously a ”frozen path” – a particular path where the corresponding Brownian motion becomes constant after time . More generally, let be a random variable generated by , namely, there exists an operator such that and is a continuous-time process in , the freezing path operator on is then defined by

where . In the following we denote by

Then for example, let , then

Remark that if in and , then by definition of freezing path operator,

is equivalent to

| (2.3) |

The freezing path operator is obviously linear, however it is generally not preserved by Malliavin differentiation. For instance, let . Then for ,

It is very important to note that should be regarded as a left-operator, namely,

We give in the remarks below some examples of illustrative computations on the frozen path, which can also be viewed as a constructive definition of the operator.

Remark 2.1.

We show hereafter the freezing path transformation of some random variables with particular forms. Let :

-

1.

For a polynomial , suppose with , then .

-

2.

The following equations hold:

-

3.

For a general Itô integral, there is not yet a satisfactory or general approach to compute its frozen path so far. The closed form can be derived if the integral is transformed to an elementary function of Brownian motions. For example, by Itô formula we can get

-

4.

Let be -measurable and let be a continuous function. Then we have for ,

2.2 Backward Taylor Expansion (BTE)

Through this subsection, we assume that (with integer and real number ) is some cylindrical function of Brownian motions. In other words, has the form with being some deterministic infinitely differentiable function.

We now present the BTE of the Brownian martingale evaluated at time , . First recall that , the Hermite polynomial of degree , is defined by and

| (2.4) |

For a real value , we define its floor number by

| (2.5) |

Theorem 2.1.

If satisfies, for each ,

| (2.6) |

then for each ,

| (2.7) |

where and for ,

| (2.8) |

Here are some remarks on Condition (2.6).

Remark 2.2.

-

1.

A quite large range of random variables fits Condition (2.6). For instance, by applying Stirling’s approximation to the factorials, we can show that:

for some constant , which does not depend on . Thus Condition (2.6) is satisfied by , if there is some constant such that for any integers and any ,

(2.9) A simple example that satisfies (2.9) is , for any .

- 2.

Below is an illustrative example to show how to apply Theorem 2.1 to derive the explicit form of a Brownian martingale.

Example 2.1.

Let . It is well-known that . Now we derive this result by the BTE approach.

Since for , then by Remark 2.2, Condition (2.6) is verified. In view of (2.7), to obtain the BTE of it remains to compute . From (2.8) we see that:

By Theorem 2.1 and some algebraic computations, we get:

Note that (2.7) is a one-step backward time equation. A multiple step BTE expression of can be derived by applying (2.7) recursively:

Corollary 2.1.

Let satisfy Condition (2.6) for each , then we have for each ,

| (2.10) |

We proceed now to discuss two applications of the BTE. Since space is limited, we describe these informally.

-

Application to solving FBSDEs

Consider a forward-backward stochastic differential equation(FBSDE), where the problem is to find a triplet of adapted processes such that:

| (2.11) |

where , , are given deterministic continuous functions; is a given function on the path of from time to . This problem is at the same time more general (because of the path-dependency of ) and less general than a standard FBSDE (because the coefficients of the diffusion do not depend on or ). We define

| (2.12) |

We take the following steps to numerically solve this FBSDE.

- Step 1

- Step 2

- Step 3

-

Again along the same path , we evaluate

where is some sequence of polynomials such that

- Step 4

-

Use the discrete time equation

to establish the backward difference equation

The main numerical difficulty is to evaluate the Malliavin derivatives in Step 2. We can apply the change of variables defined in [6] to calculate the Malliavin derivatives of , and then (mutatis mutandis) the Faa di Bruno formula for the composition of with . We must of course calculate finite sums instead of infinite ones in (2.10). We could then imagine a scheme where, at each step, the ”optimal path” is chosen so as to minimize the global truncation error. We leave all these considerations for future research.

-

Application to Pricing Bermudan Options

Casual observation of (2.10) shows that the complexity of calculations grows exponentially with time. This shortcoming of the BTE does not occur in the problem of Monte Carlo pricing Bermudan options, where the BTE can be competitive as we hint now. Most of the computational burden in Bermudan option pricing consists in evaluating:

| (2.13) |

where and are respectively the continuation value and the exercise value of the option. The data in this problem consists in the exercise value at all times and the continuation value at expiration. The conditional expectation must be evaluated at all times , with and along every scenario. In regression-based algorithms, such as [16] and [25], the continuation value is regressed at each time on a basis of functions of the state variables, so that can be expressed as a formula. The formula is generally a polynomial function of the previous values of the state variable. This important fact, that is available formulaically rather than numerically, makes possible the use of symbolic Malliavin differentiation.555A problem with this approach is the calculation of succesive Malliavin derivatives of the maximum in (2.13). We will show in another article how one can use the conditional expectation as a control variate, where the control variate is calculated using the BTE. Since the formula is a polynomial, there is no truncation error in (2.10) if the state variables are Brownian motion.

2.3 The Time-evolution Equation

A non-intuitive feature of the BTE is that any path from to can be chosen to approximate conditional expectations evaluated at time , as opposed to Monte Carlo simulation where many paths are needed. In this subsection we will choose the frozen paths for to derive our second main result.

For notational simplicity we define:

Define the set of random variables

Let the time-evolution operator be a conditional expectation operator, restricted to some particular subset of . More precisely, we define for any time ,

| (2.14) |

For example, if is -measurable, then for . We also define the time-derivative of the time-evolution operator as: for , provided the limit exists in :

| (2.15) |

Below we state the time-evolution equation, which plays a key role in the proof of Theorem 2.3.

Theorem 2.2.

Let . Suppose and only depends on a discrete Brownian path (). Then the operator satisfies the following equation, whenever the right hand-side is an element in :

| (2.16) |

Note that this equality holds for each in .

We can see the analogy between our time-evolution operator and the one in quantum mechanics. The difference is that in quantum mechanics is replaced by the Hamiltonian divided by . The next theorem will provide a Dyson series solution to Equation (2.16).

2.4 Dyson Series Representation

For esthetical reasons we introduce a ”chronological operator”. In this we follow Zeidler [26]. Let be a collection of operators. The chronological operator is defined by

where is a permutation of such that .

For example, it is showed in Zeidler [26] on Page 44-45 that:

This will be the only property of the chronological operator we will use in this article.

Definition 2.1.

We define the exponential operator of a time-dependent generator by

| (2.17) |

In quantum field theory, the series on the right hand-side of (2.17) is called a Dyson series (see e.g. [26]).

Theorem 2.3.

Let satisfy

| (2.18) |

for some fixed . Then

| (2.19) |

The importance of the exponential formula (2.19) stems from the Dyson series representation (2.17). By the property of symmetry of the function , we are able to rewrite the Dyson series hereafter in a more convenient way:

| (2.20) | |||||

in which the first term is by convention.

Example 2.2.

We retake Example 2.1 with a new approach of computation. Namely, we apply the exponential formula approach to compute , .

Let . Observe that for ,

| (2.21) |

It follows from (2.20) and (2.21) that

We will use (2.20) for some more analytical calculations, as we show in the next subsection. The analytical calculations become quickly nontrivial, though, and, for numerical applications, one may want to develop an automatic tool that performs symbolic Malliavin differentiation (see the earlier discussion, on the implementation of the BTE).

Remark 2.3.

As mentioned in the introduction, there is another way of proving the exponential formula, by the so-called density method (the denseness of the exponential functions).

Here we just sketch out the idea. Let and define the exponential function of as . Obviously and has an exponential formula representation. Plug into both sides of (2.20). We obtain: on one hand, since is a martingale, the left hand-side of (2.20) is

On the other hand, we have

Thus the right hand-side of (2.20) is equal to

Hence (2.20) holds for . For general , the proof of (2.20) can be completed by using the fact that the linear span of the exponential functions is a dense subset of .

3 Solutions of Some Problems by Using Dyson Series

In this section we apply Dyson series expansion to compute for 4 different . The first example is a very well-known example, but it illustrates nicely the computation of Dyson series in case the random variable (seen as a functional of Brownian motion) is not path-dependent. In the second example, the functional is path-dependent. The third example is path-dependent again and illustrates the problem of convergence of the Dyson series. The fourth example shows a new representation of the price of a discount bond in the Cox-Ingersoll-Ross model (see [23] for a discussion of the problem).

3.1 The Heat Kernel

Consider the random variable

where is some heat kernel satisfying the following differential equation

For ,

It follows that

Then from (2.20) we see that, the Dyson series expansion of coincides with the Taylor expansion of around , evaluated at :

As a particular case,

is such a heat kernel. When taking

we get

Observation: We deliberately took so that would be well-defined and infinitely Malliavin differentiable. This example is not new, in the sense that it could have been obtained by applying , i.e., the time-evolution operator of the heat equation, to the function (see [13], Page 162). This example hints to the fact that our time-evolution operator is an extension of the time-evolution operators for the heat kernel, the latter being applicable to path-independent problems, and the former being applicable to path-dependent problems.

3.2 The Merton Interest Rate Model

Let . By Itô’s formula we have

This implies that for ,

We also observe that

Therefore by (2.20), the Dyson series expansion of is explicitly given as

and it leads to

3.3 Moment Generating Function of Geometric Brownian Motion

Let (, ) be a geometric Brownian motion (the Brownian motion is scaled and noncentral) at time . Recall that is in fact a lognormal random variable. Denote by , then is the moment generating function of evaluated at . In this example we obtain the Dyson series expansion of for and compare it with the Taylor series expansion at .

First, observe that is an infinitely continuously differentiable function of . Then by definition of Malliavin derivative operator (see e.g. Definition 1.2.1 in [19]), for ,

Note that by induction, we can easily show

where for denote the Stirling numbers of the second kind, with convention , and for any . Therefore for ,

and by (2.20), the Dyson series expansion of is given as

| (3.1) |

It is known that the Laplace transform of the lognormal distribution does not have closed-form (see [9]) nor convergent series representation (see e.g. [11]). In particular, it is shown in [24] that the corresponding Taylor series is divergent. However divergence does not mean ”useless”. A number of alternative divergent series can be applied for numerical computation purpose. The study on the approximations of Laplace transforms of lognormal distribution (as well as its characteristic functions) has been long standing and many methods by using divergent series have been developed. For this area we refer to [2, 11, 1] and the references therein. In this example, we obtain the Dyson series (3.1) as a new divergent series representation of the Laplace transform of . Next we compare our Dyson series expansion of (taking , in (3.1)):

| (3.2) |

to its Taylor series expansion

| (3.3) |

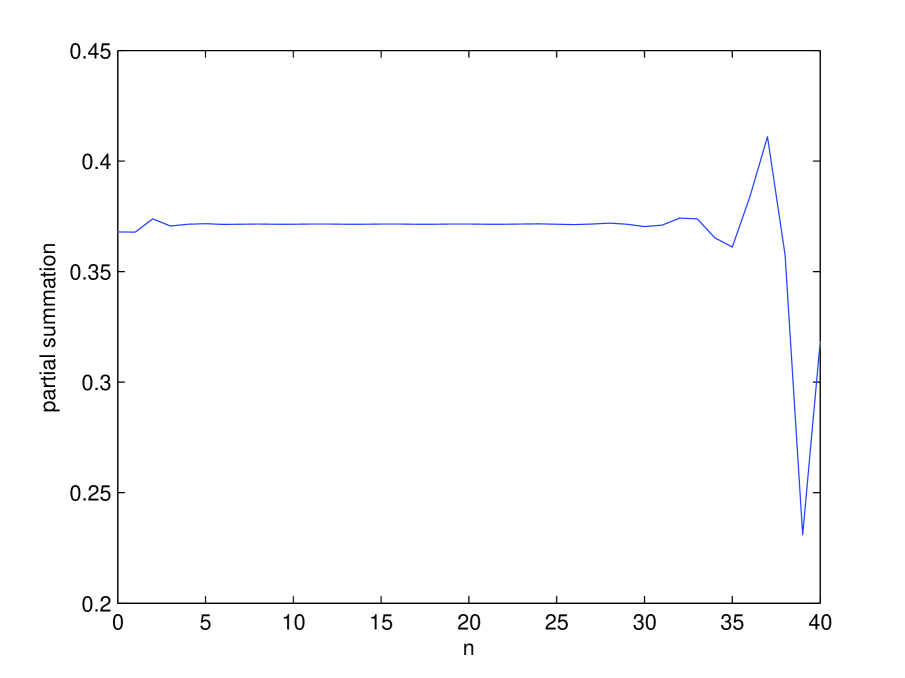

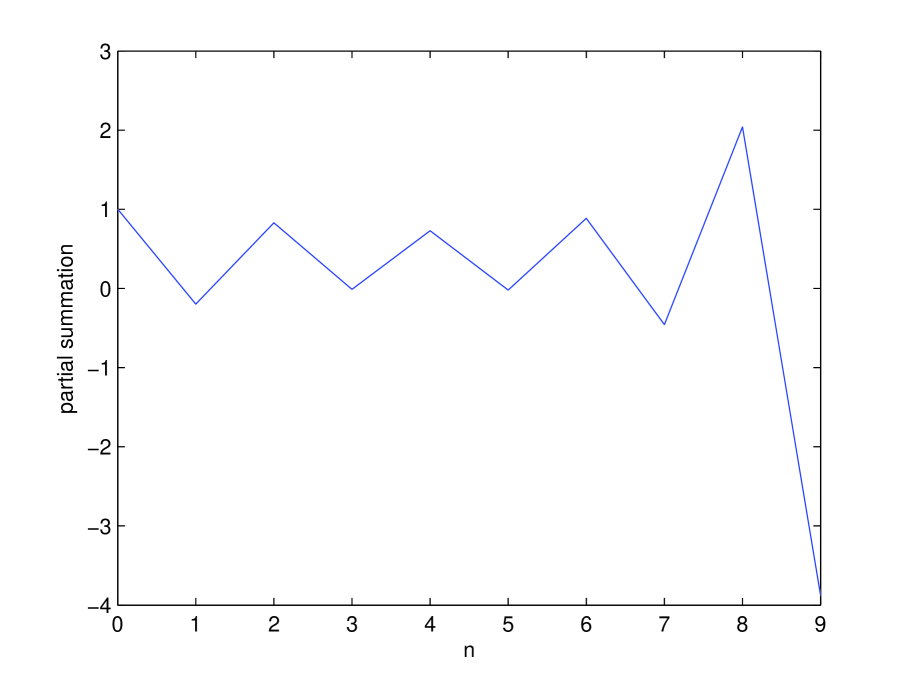

by using numerical methods. Namely, in a particular parameter setting , we compute the first 40 partial sums of Dyson series and the first 10 partial sums of Taylor series of . The results are presented below as illustrations and tables.

| Sum of first terms (Dyson series) | Sum of first terms (Taylor series) | |

| 0 | 0.3679 | 1 |

| 1 | 0.3679 | -0.1972 |

| 2 | 0.3679 | 0.8300 |

| 3 | 0.3679 | -0.0122 |

| 4 | 0.3738 | 0.7301 |

| 5 | 0.3706 | -0.0201 |

| 6 | 0.3706 | 0.8855 |

| 7 | 0.3714 | -0.4575 |

| 8 | 0.3714 | 2.0403 |

| 9 | 0.3717 | -3.8787 |

| True value | 0.3717 | 0.3717 |

From the results we see that interesting phenomena arise:

- (1)

-

The Taylor series (3.3) diverges much earlier (as increases) and has overall much larger deviation than the Dyson series (3.2). From Figures 1-2, we observe that the summation of the first terms of series (3.1) starts to diverge at around and the signal amplitude is less than , while the Taylor expansion diverges at with a jump larger than .

- (2)

-

The first terms of Dyson series are good approximations of the Laplace transform, while the Taylor series’ are not. In Table 1, we compare the first 10 partial sums of the series to the ”true value” of by Monte Carlo simulation: 0.3717. The latter value is obtained through generating the lognormal variable times. We see that the first 10 partial sums of Dyson series have bias less than 0.0038, while the first 10 partial sums of Taylor series are not good estimates at all. Heuristically speaking, Dyson series representations perform much better on approximation because the exponential formula of is an expansion around , but the Taylor series is based on an expansion around (its first term in the series is always ).

In conclusion, numerical experiments show the Dyson series (3.1) provides new and good approximations of the Laplace transforms of lognormal distribution.

Also it is interesting to observe that (3.1) resembles the moment generating function for a Poisson random variable , which can be expressed as:

where is a Poisson random variable with mean parameter .

3.4 Bond Pricing in the Extended Cox-Ingersoll-Ross Model

Assume that the interest rate is given by

| (3.4) |

where , and are deterministic functions and is a positive integer.

By Itô’s lemma and Lévy’s theorem (see e.g.[23]) the interest rate can be represented as

| (3.5) |

where is the Ornstein-Uhlenbeck process defined by

with for all and being independent standard Brownian motions. Let

Our goal is to find the bond price for . Since can be written as where , then we can decompose into product of independent conditional expectations:

| (3.6) |

Below we compute for each to obtain by applying (2.20). We remark that, for each , acting the operator means to freeze its corresponding . Two cases are discussed according to whether is time-dependent or not.

- Case 1

-

We first consider the simple case .

From Itô formula we see

| (3.7) |

For each , take . Then by Remark 2.1, we obtain

| (3.8) |

By (3.6), (2.20) and (3.4), the first terms of the Dyson series are explicitly given as

| (3.9) |

Let us denote by the coefficients of in the expansion (3.4), respectively. Then (3.4) can be represented by

| (3.10) |

To be more explicit we denote as the remainder of the series expansion of ( corresponds the multiplicity of integral of ’s first term) and can write

Remark: It is worth noting that the explicit forms of remain unknown (it is notoriously difficult to compute the remaining terms and this subject of calculus is still quite open). As a consequence, it is not sure whether are the coefficients of in the Taylor expansion of around , namely we can not show theoretically for all . However, if we suppose exists and where , it is not hard to show by induction that for all positive integer and , can be bounded by , is a constant which does not depend on and . Moreover, we can interestingly check our coefficients of first terms with some known results. For example, in the particular case , , there is an existing analytical formula (see [23] again):

| (3.11) |

where , denote hyperbolic secant and hyperbolic tangent respectively. Applying Taylor expansion around in (3.11) leads to

| (3.12) |

By taking , in (3.4), we see that our first terms agree with those in (3.4).

- Case 2

-

We now consider a more general case, where is a non-zero deterministic function.

Again, the problem of obtaining the general term in the series (2.20) for is still open. Instead we compute the first 2 terms of its Taylor expansion around . Denote by , then by Itô formula, for each ,

By using a similar computation as in (3.10),

| (3.13) |

with

Now let’s introduce an application of (3.13) to some pricing problem. Recall that (see [23]) the bond price is affine with respect to and satisfies

| (3.14) |

where solves the time-dependent Riccati equation below:

| (3.15) |

and satisfies . By (3.13) and the Taylor expansion of the right-hand side of (3.14), we have:

The above equation allows us to obtain the solution of the Riccati equation (3.15) as

In the meanwhile

4 Conclusion and Future Work

For future work, we intend to design and analyze new numerical schemes that implement the Dyson series to solve BSDEs. The main weakness of Theorem 2.3 is that it currently requires the functional to be infinitely Malliavin differentiable. It is unknown at this point whether this smoothness requirement can be relaxed. Theorem 2.3 can certainly be extended to a filtration generated by several Brownian motions, and probably to Lévy processes. A generalization from representation of martingales to representation of semi-martingales would also be interesting.

5 Appendix

5.1 Proof of Theorem 2.1

Fix , we denote by and for simplifying notations. We remind the reader of Proposition 1.2.4 in [19], namely, if 666The definition of this space is given on Page 26 in [19]. It is sufficient to note that in this work belongs to , a subspace of ., then for ,

| (5.1) |

Using (5.1) and the Clark-Ocone formula (see, e.g. Proposition 1.3.5 in [19]), we get, for any integer :

| (5.2) | |||||

Since is assumed to be cylindrical, then by the definition of Malliavin derivative operator, we have

| (5.3) |

It results from (5.2) and (5.3) that

We thus obtain

We continue the expansion iteratively:

| (5.4) |

where the remainder is given as

Note that the partial sum (5.1) converges in as is equivalent to as . We then introduce two useful lemmas. For simplifying notations, we denote the multiple Skorohod integral of a stochastic process by :

where and similarly we denote in the sequel. The following lemma represents .

Lemma 5.1.

For a stochastic process indexed by , its multiple Skorohod integral is well-defined if . Moreover, we have

This lemma is given by (2.12) in [18], where the proof is not provided. We came up with a proof, which is available upon request.

Lemma 5.2.

We have

Proof.

The proof is based on finding a fine upper bound of the remainder ’s norm. We first observe that

| (5.5) |

where

| (5.6) |

is a symmetric function with being the collection of all permutations on . Then according to Lemma 5.1 and Fubini’s theorem, we obtain

| (5.7) |

with , for . By definition of in (5.6),

Similarly, we also have

It follows from (5.1), Cauchy-Schwarz inequality, the fact that is cylindrical and the inequality that

| (5.9) |

where the function

is symmetric among each of the three groups of variables: and . We thus obtain

| (5.10) |

with . Recall that by basic calculation the following property holds:

| (5.11) |

It results from (5.1), (5.1), (5.1) and (5.11) that

| (5.12) |

Finally, combining (5.5), (5.1) and Condition (2.6) implies

Lemma 5.2 is proved. ∎

In view of (5.1) and Lemma 5.2, we claim that

| (5.13) |

with convention that the first term in the above series is . In order to establish (2.7), we rely on Lemma 5.3 below.

Lemma 5.3.

Proof.

For simplifying notation we define, for any integer ,

Our strategy of proving lemma 5.3 is by induction. We first recall the Skorohod integral of a process multiplied by a random variable formula (see e.g. (1.49) in [19]): for a random variable and a process such that , we have for ,

| (5.15) |

When , by (5.15), the fact that for and the definition of Hermite polynomials, we show (5.14) holds:

Now assume that (5.14) holds for with some integer . Recall that (see e.g. [21])

| (5.16) |

Therefore we write

| (5.17) | |||||

(5.17) then yields

For each , using again (5.15), the fact that for and Fubini’s theorem, we obtain

| (5.19) |

It follows from (5.1), (5.1) and (5.16) that (5.14) holds for , hence it holds for all integer . Lemma 5.3 is proved. ∎

5.2 Proof of Theorem 2.2

Given is -measurable. Let and suppose is generated on . Fix . Now we are going to prove the following: for ,

| (5.21) |

Proof.

Denote by . Let , thus . First, suppose that . Then there exists such that for all , . Similar to (5.1), we compute as

| (5.22) |

where

On one hand, by Lemma 5.2,

| (5.23) |

The above upper bound is finite, due to the fact that . On the other hand, when acted on freezing path operator, the terms in (5.2) become

| (5.24) | |||

| (5.25) |

Thus combining (5.2)-(5.25) and the fact that , we get

Suppose now that . Then similarly we can choose such that when , and then clearly (5.2)-(5.25) also hold. Thus the proof is completed. ∎

5.3 Proof of Theorem 2.3

For , there exists such that . We first construct a sequence satisfying

Since is a continuous Gaussian process, it can be showed by the Stone-Weierstrass theorem and Wiener chaos decomposition that there exists a sequence of polynomial functions such that

where is some positive integer only depending on and . Also observe that, each Wiener integral has a ”Riemann sum” approximation as

with being polynomials. Therefore by the continuity of the Brownian paths and polynomials, we have for all ,

For , define . We remark that Theorem 2.2 in fact holds for any cylindrical random variable . Since is some polynomial of a discrete Brownian path, it belongs to . Then from (5.21), we obtain: for ,

| (5.26) |

For positive integer we define the operator by

where

Then by iterating (5.26) we obtain: for ,

| (5.27) |

Remark that for a general of the form , we have

is continuous with respect to . We note here is explicitly defined by: if

then

Since for all , then the closability of the Malliavin derivative operator (see Lemma 1.2.2 in [19]) implies the fact that for all ,

Hence by remark (2.3), we obtain

Equivalently,

| (5.28) |

Thus according to assumption (2.18) and (5.28), we get

| (5.29) |

We now take and let in (5.27). By (5.3),

| (5.30) |

Letting in (5.30), then using (5.28), dominated convergence theorem and assumption (2.18), we obtain

Acknowledgements

We thank Josep Vives and Hank Krieger for reviewing our manuscript. All errors are ours.

References

- [1] S. Asmussen, J. L. Jensen and L. Rojas-Nandayapa, On the Laplace transform of the lognormal distribution, Methodology and Computing in Applied Probability (2014).

- [2] R. Barakat, Sums of independent lognormally distributed random variables, Journal of the Optical Society of America 66 (1976), pp. 211-216.

- [3] F. Biagini, Y. Hu, B. Øksendal and T. Zhang, Stochastic Calculus for Fractional Brownian Motion and Applications. Springer, London, 2008.

- [4] J. M. C. Clark, The representation of functionals of Brownian motion by stochastic integrals, The Annals of Mathematical Statistics 41 (1970), pp. 1282-1295.

- [5] K. E. Dambis, On the decomposition of continuous submartingales, Theory of Probability and its Applications 10 (1965), pp. 401-410.

- [6] J. Detemple, R. Garcia and M. Rindisbacher, Representation formulas for Malliavin derivatives of diffusion processes, Finance and Stochastics 9(3) (2005), pp. 349-367.

- [7] L. Dubins and G. Schwarz, On continuous martingales, Proc. Nat. Acad. Sci. USA 53 (1965), pp. 913-916.

- [8] J. L. Doob, Stochastic Processes, Wiley, New York, 1953.

- [9] C. C. Heyde, On a property of the lognormal distribution, Journal of the Royal Statistical Society, Series B (Methodological) 25 (2) (1963), pp. 392-393,

- [10] D. J. Higham, An algorithmic introduction to numerical Simulation of stochastic differential equations, SIAM Review 43 (3) (2001), pp. 525-546.

- [11] P. Holgate, The lognormal characteristic function, Communications in Statistical - Theory and Methods 18 (12) (1989), pp. 4539-4548.

- [12] Y. Hu, D. Nualart and X. Song, Malliavin calculus for backward stochastic differential equations and application to numerical solutions, The Annals of Applied Probability 21 (6) (2011), pp. 2379-2423.

- [13] J. Hunter and B. Nachtergaele, Applied Analysis, World Scientific, 2007.

- [14] I. Karatzas and S. Shreve, Brownian Motion and Stochastic Calculus, Springer, 1991.

- [15] S. Jin, Q. Peng and H. Schellhorn, Fractional Hida-Malliavin derivatives and series representations of fractional conditional expectations, Communications on Stochastic Analysis 9(2) (2015), pp. 213-238.

- [16] F. Longstaff and E. Schwartz, Valuing American options by simulation: a simple least-squares approach, Review of Financial Studies 14 (2001), pp. 113-147.

- [17] H. Morris an H. Schellhorn, A Differential Tree Approach to Price Path-dependent American Options Using Malliavin Calculus, IAENG Transactions on Engineering Technologies Volume II, American Institute of Physics, 2009.

- [18] I. Nourdin and D. Nualart, Central limit theorem for multiple Skorohod integrals, Journal of Theoretical Probability 23 (2010), pp. 39-64.

- [19] D. Nualart, The Malliavin Calculus and Related Topics, Series Probability and its Applications, Springer, 1995.

- [20] D. Ocone, Malliavin calculus and stochastic integral representation of diffusion processes, Stochastics 12 (1984), pp. 161-185.

- [21] B. Øksendal, An introduction to Malliavin calculus with applications to economics, Norwegian School of Economics and Business Administration (1997).

- [22] J. Oteo and J. Ros, From time-ordered products to Magnus expansion, Journal of Mathematical Physics 41 (5) (2000), pp. 3268-3277.

- [23] S. Shreve, Stochastic Calculus for Finance II: Continuous-time Models, Springer, 2004.

- [24] C. Tellambura, Accurate computation of the MGF of the lognormal distribution and its application to sums of lognormal, IEEE Transactions on Communication 58 (5) (2010), pp. 1568-1577.

- [25] J. Tsitsiklis and B. Van Roy, Optimal stopping of Markov processes: Hilbert space theory, approximation algorithms, and an application to pricing high-dimensional financial derivatives, IEEE Transactions on Automatic Control 44 (1999), pp. 1840-1851.

- [26] E. Zeidler, Quantum Field Theory I: Basics in Mathematics and Physics, Springer, 2006.