Wealth distribution and collective knowledge.

A Boltzmann approach

Abstract

We introduce and discuss a nonlinear kinetic equation of Boltzmann type which describes the influence of knowledge in the evolution of wealth in a system of agents which interact through the binary trades introduced in [11]. The trades, which include both saving propensity and the risks of the market, are here modified in the risk and saving parameters, which now are assumed to depend on the personal degree of knowledge. The numerical simulations show that the presence of knowledge has the potential to produce a class of wealthy agents and to account for a larger proportion of wealth inequality.

Keywords: multi-agent systems, Boltzmann equation, wealth distribution, collective knowledge

1 Introduction

In the last two decades, various concepts and techniques of statistical mechanics have been fruitfully applied to a wide variety of complex extended systems, physical and non-physical, in an effort to understand their emergent properties. Economics is, by far, one of the systems to which methods borrowed from statistical mechanics for particle systems have been systematically applied [6, 7, 9, 11, 13, 21, 25, 39]. Starting from the original idea developed by Angle [2, 3], a variety of both discrete and continuous models for wealth distribution has been proposed and studied in view of the relation between parameters in the microscopic rules and the resulting macroscopic statistics [7, 11, 13, 17, 38]. The basic assumption in most of these models is that wealth is exchanged among agents by means of binary trades, which represent the microscopic level. A typical ingredient of trading is a mechanism for saving, first introduced in [7], which ensures that agents could exchange at most a certain fraction of their wealth in each trade event. Moreover, randomness plays a rôle in virtually all available models, taking into account that many trades are risky, so that the exact amount of money changing hands is not known a priori. In most of the models introduced so far, the trading mechanism leaves the total mean wealth unchanged. Then, depending on the specific choice of the saving mechanism and the stochastic nature of the trades, the studied systems are capable to produce wealth curves with the so-called Pareto power law tails [14, 32]. In other words, if is the probability density function of agents with wealth

where the exponent characterizes the tail behavior and it is related to the amount of wealth inequality in the system.

Among other approaches, the description of market models via kinetic equations of Boltzmann type is a fertile ground for research. This powerful methodology has been recently extended to cover more sophisticated rules for trading. For example, a description of the behavior of a stock price has been developed by Cordier, Pareschi and Piatecki in [10]. Also, price theory has been considered by introducing trades in which agents interacts by exchanging goods according to the Edgeworth box strategy [44]. Further, there have been efforts to include non-microscopic effects, like global taxation (and subsequent redistribution), in recent works of Guala [20], Pianegonda, Iglesias, Abramson and Vega [37], Garibaldi, Scalas and Viarengo [17] and Bisi, Spiga and Toscani [4, 43]. Despite the high number of studies devoted to the subject, well documented by various recent review papers [5, 19, 34, 36, 45, 46], most of the kinetic models depend in general only from the wealth parameter, thus describing a society in which all agents apply the same rules of change to their wealth, independently of any other behavioral aspect.

To this common line of thought, the few exceptions need to be properly quoted. Maybe the most important contribution has been done by Lux and Marchesi [29, 30], who, to give a basis to the possibility to obtain both booms and crashes of economy, considered a system composed by two different dynamical classes of traders, characterized by different behaviours with respect to the trading activity. Their idea has been subsequently applied in [31] to construct a kinetic model in which the personal opinion is responsible of the change of strategy, moving the two groups of traders considered by Lux and Marchesi from one to the other. It is interesting to remark that in [31] these behavioral aspects are justified by resorting to the prospect theory of Kahneman and Tversky [26, 27], namely to the analysis of decision under risk. Other authors studied the importance of the saving parameter in the binary trade, by assuming that the same is not a universal one, but it can vary in a random way [8]. For a recent introduction to the kinetic description of most of the above mentioned models, together with their numerical simulation by Monte Carlo methods, we refer to the recent book [35].

Among the various behavioral aspects, knowledge represents an important variable to be taken into account. Indeed, knowledge is necessary for an individual to gain autonomy from its natural, physiological, and social restrictions, leading the population to improve its life conditions. Hence, it is commonly accepted that knowledge plays a relevant rule in any activity which could lead to an improvement of the social conditions, and it is out of doubts that trading of wealth belongs to this set of activities [23]. Knowledge is a consequence of learning, which is usually intended as any relatively permanent change in behavior which occurs as a result of experience or practice [33]. The way in which knowledge is accumulated is a very complicated matter, and it is very difficult to model it from a mathematical point of view. However, in view of its importance in multi-agent phenomena, various aspect of learning have been recently studied in a number of technical papers (cf. [41, 12, 18, 28] and the references therein). In [24, 22] the authors introduced the notion of economic complexity, as a measure of the total amount of knowledge present in a country’s economy. According to their viewpoint, the more diverse and specialized jobs a country’s citizens have, the greater the country’s ability to produce complex products that few other countries can produce, making the country more prosperous. At the same time economic complexity generates sensible differences in the social conditions among different countries. Indeed, it is believed that knowledge accumulation can be the source of a large proportion of wealth inequality [28].

In this note, we will introduce a very simple and naive process for the formation of knowledge, which is described in terms of a linear interaction with a background, and it is able to take into account both the acquisition of information and the process of selection, which appear to be natural and universal features. The amount of knowledge will be quantified in terms of a positive variable. The knowledge interaction will be coupled with the binary trade of wealth exchange introduced in [11], which includes both saving propensity and the risks of the market. The novelty here is to assume that both the saving propensity and the risky part of the trade depend on the personal knowledge. A typical and natural assumption is that knowledge could act on the trade process both to increase the expected utility, and to reduce the randomness present in the risk. The interaction rules will subsequently be merged, within the principles of classical kinetic theory, to derive a nonlinear Boltzmann-like kinetic equation for the joint evolution of knowledge and wealth.

For the sake of completeness, a comment on the justification of kinetic models suitable to describe human behaviors is in place. The socio-economic behavior of a (real) population of agents is extremely complex. Apart from elements from mathematics and economics, a sound description – if one at all exists –would necessarily need contributions from various other fields, including psychology. Clearly, the available mathematical models are too simple to even pretend to reflect the real situation. However, the idea to describe evolution of knowledge and wealth in terms of a kinetic equation gives rise to a variety of challenging mathematical problems, both from the theoretical and numerical point of view. In particular, it is remarkable that this class of simple models possesses such a wide spectrum of possible equilibria (some of which indeed resemble distributions seen in the reality, like the presence of a consistent middle class, as well as the persistency of heavy tails in the steady state distribution). Moreover, kinetic models are extremely flexible with respect to the introduction of additional effects [35]. In this way, the described models should be considered as basic building blocks, that can easily be combined, adapted and improved.

The paper is organized as follows. In Section 2 we introduce and discuss a kinetic model for the formation of knowledge in a multi-agent society. This linear model is based on microscopic interactions with a fixed background, and is such that the density of the population knowledge moves towards a steady distribution which is heavily dependent of the microscopic parameters of the microscopic interactions. Then, the knowledge rule is merged with the binary trade of wealth to obtain a nonlinear kinetic model of Boltzmann-type for the joint density of wealth and knowledge. This part is presented in Section 3. Section 4 deals with the derivation of a Fokker–Planck type equation, which models the formation of the joint density of wealth and knowledge in the so-called quasi-invariant limit procedure. Last, Section 5 is devoted to various numerical experiments, which allow to recover the steady distribution of wealth and knowledge in the population for various choices of the relevant parameters.

2 An evolutionary model for the knowledge

Knowledge is in part inherited from parents, but there is general agreement that the environment is the main factor influencing it. Experiences that produce knowledge cannot be inherited from parents, as is the case for the genome, but rather are acquired in the course of life from different elements of the environment surrounding each individual [40]. The process of learning is very complicated and different for each individual of a population. Although the overall conditions for all individuals could be the same, after this process each individual has a different level of knowledge. Differences in the environment or experiences in life, produce different levels of knowledge and, as a consequence, a different behavior that depends on the environment surrounding an individual. Also, it is almost evident that the personal knowledge is the result of a selection, which allows to retain mostly the notions that the individuals consider important, and to discard the rest. This basic aspect of the process of learning has been recently discussed in a convincing way by Umberto Eco [16], one of the greatest philosophers and contemporary Italian writers. In his fascinating lecture, Eco outlines the importance of a drastic selection of the surrounding quantity of information, to maintain a certain degree of ingenuity. This is particularly true nowadays, where the global access to information via web gives to each individual the possibility to have a reservoir of infinite capacity from which to extract any type of (useful or not) information.

The previous remarks are at the basis of a suitable description of the evolution of the distribution of knowledge in a population of agents by means of microscopic interactions with a fixed background. In this picture each variation of knowledge is interpreted as an interaction where a fraction of the knowledge of the individual is lost by virtue of the selection, while at the same time the external background (the surrounding environment) can move a certain amount of its knowledge to the individual. If we quantify the knowledge of the individual in terms of a scalar parameter , ranging from zero to infinity, and by the knowledge achieved from the background in a single interaction, the new amount of knowledge can be computed as

| (2.1) |

In (2.1) the functions and quantify, respectively, the amounts of selection and external learning, while is a random parameter which takes into account the possible unpredictable modifications of the knowledge process. We will in general fix the mean value of equal to zero. Since some selection is always present, and at the same time it can not exceed a certain amount of the total knowledge, it is assumed that , where , and . Likewise, it is reasonable to assume an upper bound for the acquisition of knowledge from the background. Then, , where . Lastly, the random part is chosen to satisfy the lower bound . By these assumptions, it is assured that the post-interaction value of the knowledge is nonnegative.

Let , denote the probability distribution of knowledge of the (fixed) background. It is reasonable to assume that has a bounded mean, so that

| (2.2) |

We note that the distribution of the background will induce a certain policy of acquisition of knowledge. For example, let us assume that the background is a random variable uniformly distributed on the interval , where is a fixed constant. If we choose for simplicity , and the individual has a degree of knowledge , in absence of randomness the interaction will always produce a value , namely a partial decrease of knowledge. In this case, in fact, the process of selection in an individual with high knowledge can not be restored by interaction with the environment.

The study of the time-evolution of the distribution of knowledge consequent to interactions of type (2.1) among individuals can be obtained by resorting to kinetic collision-like models [35]. Let the density of agents which at time are represented by their knowledge . Then, the time evolution of obeys to a Boltzmann-like equation. This equation can be fruitfully be written in weak form. It corresponds to say that the solution satisfies, for all smooth functions (the observable quantities)

| (2.3) |

In (2.3) the post-interaction knowledge is given by (2.1). As usual, represents mathematical expectation. Here expectation takes into account the presence of the random parameter in (2.1).

The meaning of the kinetic equation (2.3) is clear. At any positive time , the variation in time of the distribution of knowledge (the left-hand side) is due to the change in knowledge resulting from interactions of type (2.1) that the system of agents has at time with the environment. This change is measured by the interaction operator at the right-hand side.

It is immediate to show that equation (2.3) preserves the total mass, so that , , remains a probability density if it is so initially. By choosing we recover the evolution of the mean knowledge of the agents system. The mean knowledge satisfies the equation

| (2.4) |

which in general it is not explicitly solvable, unless the functions and are assumed to be constant. However, since , while , the mean value always satisfies the differential inequality

| (2.5) |

which guarantees that the mean knowledge of the system will never exceed the (finite) value given by

If and are constant, equation (2.4) becomes

| (2.6) |

In this case, the linear differential equation can be solved, and

| (2.7) |

Formula (2.7) shows that the mean knowledge converges exponentially to its limit value .

3 A Boltzmann model for wealth and knowledge

In this section, we will join the evolutionary kinetic model for knowledge with a kinetic model for wealth distribution we introduced with Cordier in 2005 [11]. This model belongs to a class of models in which agents are indistinguishable. In most of these models [14, 15] an agent’s state at any instant of time is completely characterized by his current wealth . When two agents encounter in a trade, their pre-trade wealths , change into the post-trade wealths , according to the rule [6, 7, 9]

| (3.1) |

The interaction coefficients and are non-negative random variables. While denotes the fraction of the second agent’s wealth transferred to the first agent, the difference is the relative gain (or loss) of wealth of the first agent due to market risks. It is usually assumed that and have fixed laws, which are independent of and , and of time. This means that the amount of wealth an agent contributes to a trade is (on the average) proportional to the respective agent’s wealth.

Let be the density of agents which at time are represented by their wealth . As explained in Section 2, the time-evolution of the distribution of wealth, say , consequent to binary interactions of type (3.1) among agents of the system, is obtained by resorting to kinetic collision-like models [11, 35]. The time evolution of the distribution of wealth obeys here to a bilinear Boltzmann-like equation, that in weak form reads

| (3.2) |

In (3.2) the post-interaction wealths and are given by (3.1). Also in this case, represents mathematical expectation, and expectation takes into account the fact that the interaction coefficients and are non-negative random variables.

In [11] the trade has been modelled to include the idea that wealth changes hands for a specific reason: one agent intends to invest his wealth in some asset, property etc. in possession of his trade partner. Typically, such investments bear some risk, and either provide the buyer with some additional wealth, or lead to the loss of wealth in a non-deterministic way. An easy realization of this idea [32] consists in coupling saving propensity with some risky investment that yields an immediate gain or loss proportional to the current wealth of the investing agent

| (3.3) |

where is the parameter which identifies the saving propensity. In this case

| (3.4) |

The coefficients are random parameters, which are independent of and , and distributed so that always , i.e. . Unless these random variables are centered, i.e. , it is immediately seen that the mean wealth is not preserved, but it increases or decreases exponentially (see the computations in [11]). For centered ,

| (3.5) |

implying conservation of the average wealth. Various specific choices for the have been discussed [32]. The easiest one leading to interesting results is , where each sign comes with probability . The factor should be understood as the intrinsic risk of the market: it quantifies the fraction of wealth agents are willing to gamble on. Within this choice, one can display the various regimes for the steady state of wealth in dependence of and , which follow from numerical evaluation. In the zone corresponding to low market risk, the wealth distribution shows again socialistic behavior with slim tails. Increasing the risk, one falls into capitalistic, where the wealth distribution displays the desired Pareto tail. A minimum of saving () is necessary for this passage; this is expected since if wealth is spent too quickly after earning, agents cannot accumulate enough to become rich. Inside the capitalistic zone , the Pareto index decreases from at the border with socialist zone to unity. Finally, one can obtain a steady wealth distribution which is a Dirac delta located at zero. Both risk and saving propensity are so high that a marginal number of individuals manages to monopolize all of the society’s wealth. In the long-time limit, these few agents become infinitely rich, leaving all other agents truly pauper.

The analysis in [32] essentially show that the microscopic interaction (3.3) considered in Cordier, Pareschi and Toscani model (briefly CPT model) are such that the kinetic equation (3.2) is able to describe all interesting behaviors of wealth distribution in a multiagent society. In its original formulation, both the saving and the risk were described in terms of the universal constant and of the universal random parameters . Suppose now that these quantities in the trade could depend of the personal knowledge of the agent. For example, one reasonable assumption would be that an individual uses his personal knowledge to reduce the risk connected to trading. Also, knowledge could be used to have a favorable outcome from the trade. Under these assumptions, one is led to modify the binary trade to include the effect of knowledge into (3.3). Given two agents and characterized by the pair (respectively ) of knowledge and wealth, the new binary trade between and now reads

| (3.6) | ||||

In (LABEL:eq.cpt2) the personal saving propensity and risk perception of the agents are contained into the functions and . In this way, the outcome of binary trade results from a combined effect of (personal) saving propensity, knowledge and wealth. Among other possibilities, one reasonable choice is to fix the functions and as non-increasing functions. This reflects the idea that the knowledge could be fruitfully employed both to improve the result of the outcome and to reduce the risks. For example, and , with could be one possible choice.

It is interesting to remark that, even in presence of the personal knowledge (through the functions and ), the trade (LABEL:eq.cpt2) remains conservative in the mean, that is

| (3.7) |

like in the original CPT model (cf. equation (3.5).

Assuming the binary trade (LABEL:eq.cpt2) as the microscopic binary exchange of wealth in the system of agents, the joint evolution of wealth and knowledge is described in terms of the density of agents which at time are represented by their knowledge and wealth . The evolution in time of the density is described by the following kinetic equation (in weak form) [35]

| (3.8) |

In (3.8) the pairs and are obtained from the pairs and by (2.1) and (LABEL:eq.cpt2). Note that, by choosing independent of , that is , equation (3.8) reduces to the equation (2.3) for the marginal density of knowledge . In view of the particular interaction rules, the solution to equation satisfies some important conservation properties. Let us define by the mean wealth present in the system at time , that is

| (3.9) |

Then, since interactions of type (LABEL:eq.cpt2) preserve (in the mean) the total wealth in the single trade, by choosing it follows that is preserved in time. Together with mass conservation, this is the only preserved quantity. In reason of the complicated structure of the binary trade (LABEL:eq.cpt2), which depends on the knowledge variable in a nonlinear way, the analytical study of the kinetic equation (3.8) appears extremely difficult. For this reason, in the remaining of this paper we will resort to some simplification of the system description, and to numerical experiments.

4 Fokker-Planck description

As it is usual in kinetic theory, particular asymptotics of the Boltzmann-type equation result in simplified models, generally of Fokker-Planck type, for which the study of the theoretical properties is often easier [11, 42]. In order to describe the asymptotic process, let us discuss in some details the evolution equation for the mean knowledge, given by (2.6). For simplicity, and without loss of generality, let us assume and constant. Given a small parameter , the scaling

| (4.1) |

is such that the mean value satisfies

If we set , , then

and the mean value of the density solves

| (4.2) |

Note that equation (4.2) does not depend explicitly on the scaling parameter . In other words, we can reduce in each interaction the variation of knowledge, waiting enough time to get the same law for the mean value of the knowledge density.

We can consequently investigate the situation in which most of the interactions produce a very small variation of knowledge (), while at the same time the evolution of the knowledge density is such that (4.2) remains unchanged. We will call this limit quasi-invariant knowledge limit. Analogous procedures have been successfully applied to kinetic models in economics [11] and opinion formation [42].

The same strategy applies to the microscopic wealth exchange, if we scale the parameters quantifying the propensity and risk in (LABEL:eq.cpt2)

| (4.3) |

Let now assume that the centered random variable has bounded moments at least of order , with . Likewise, let us assume that the centered random variables , are independent and equidistributed, with bounded moments up to order three, and such that , . Moreover, we assume that is independent of , .

Using the previous properties of the random quantities , equations (2.1) for the knowledge variable, and (LABEL:eq.cpt2) for the wealth give

| (4.4) | ||||

and

| (4.5) | ||||

Hence, by expanding the smooth function in Taylor series up to order two, we obtain

| (4.6) | |||

Clearly, denotes the remainder of the Taylor expansion.

Let us consider now the situation in which both the scaling (4.1) and (4.3) are applied. Then

| (4.7) |

Consequently,

while

Within the same scaling

We remark that, by construction, the scaled remainder depends in a multiplicative way on higher moments of the random variables and , , so that for (cf. the discussion in [10, 42], where similar computations have been done explicitly). Identical formulas hold for the differences and , which are obtained simply exchanging with , with and viceversa in (LABEL:var1) and in later. If we now set , and for any given we define , we obtain that satisfies

| (4.8) | ||||

In (4.8) we denoted

| (4.9) | ||||

When the remainder converges to zero as , the density tends towards satisfying

| (4.10) | ||||

Equation (LABEL:ww1) is the weak form of the Fokker-Planck equation

| (4.11) |

The formal derivation of the Fokker-Planck equation (4.11) can be made rigorous repeating the analogous computations of [10, 42], which refer to one-dimensional models. This derivation requires to start with initial data that possess moments bounded up to a certain order (typically , with ). Moreover, the smooth function is required to belong to a suitable space (for example , the space of functions of bounded support continuous with three derivatives) [42]. It is interesting to remark that the balance (respectively ) are the right ones which maintain in the limit equation both the effects of knowledge in terms of the intensity , as well as the effects of the randomness through the variance (respectively the effects of saving in terms of and risk in terms of , ). As explained in [42] for the case of opinion formation, different balances give in the limit purely diffusive equations, of purely drift equations.

Returning to the original expressions of the quantities and into (4.11) we finally obtain that solves the Fokker-Planck equation

| (4.12) |

where we denoted

| (4.13) |

In the simpler case in which the saving propensity remains a universal constant, so that , the drift term in the Fokker-Planck equation (4.12) simplifies, and, by resorting to the conservation of the mean wealth, we obtain that the density solves the equation

| (4.14) |

where now represents the (constant) value of the quantity in (4.13).

Despite its apparent simplicity (with respect to the kinetic model (3.8)), the analytic description of the steady state of the Fokker–Planck equation (4.14) is difficult. Therefore, we will resort to numerical computations of the solution to both the Boltzmann and Fokker–Planck equations for the joint density.

5 Numerical experiments

This section contains a numerical description of the solutions to both the Boltzmann-type equation (3.8) and the Fokker-Planck equations (4.12) and (4.14). For the numerical approximation of the Boltzmann equation we apply a Monte Carlo method, as described in Chapter 4 of [35]. If not otherwise stated the kinetic simulation has been performed with particles.

The numerical experiments will help to clarify the role of knowledge in the final distribution of the wealth density among the agents. It is evident that, thanks to the mean wealth conservation, the density will converge to a stationary distribution [35]. As usual in kinetic theory, this stationary solution will be reached in an exponentially fast time.

In what follows we will denote by the random process which represents the knowledge of the population at time . Its density is given by the solution of equation (2.3). Hence

We will denote by the distribution function of , that is

Likewise, we will denote by the random process which represents the wealth of the population at time . Given the solution of equation (3.8), its density is given by the marginal density

Lastly, will denote the distribution function

We will evaluate the marginal distributions and for different values of the parameters and different kinds of microscopic wealth interactions. In this way we will recognize first the role of background and selection in the distribution of knowledge (differences in tails etc.), and, second, the importance of knowledge (through the personal saving and risk perception) in the distribution of wealth.

Numerical experiments will also report the joint density of wealth and knowledge in the agent system. The following numerical tests have been considered.

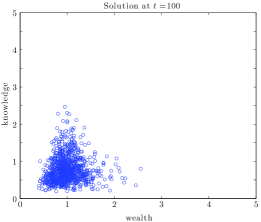

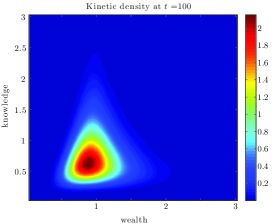

Test 1

In the first test we consider the case of a risk dependent knowledge with

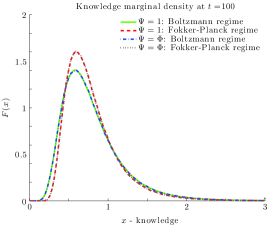

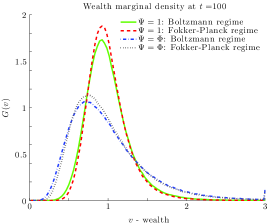

with and a constant . First we take . These parameters correspond to the Boltzmann regime. We consider a time step of and a final computation time of , where the steady state is practically reached. Since the evolution of the knowledge in the model is independent from the wealth, the latter is scaled in order to fix the mean wealth equal to . We report the results for the particle density and the kinetic density in Figure 5.1. In Figure 5.3 and 5.4 we plot the marginal densities together with the tail distribution

which are plotted in loglog scale to visualize the tails behavior. It is clear that the effect of the knowledge in minimizing the risk produces a tendency for well educated people to occupy the region around the mean wealth, the so-called middle class. In contrast the reach part of the people is composed by those who are brave enough to take the risk in potentially remunerative transactions.

The same test has been also performed in a Fokker-Planck regime, scaling all interaction parameters by a factor . The final computation time is the same, but the time steps is now chosen as . The results in Figures 5.3 and 5.4 show a good agreement with the Boltzmann description. As observed in [11] the major differences are noticed in the peak of the distribution and in the lower part of the population densities where the Fokker-Planck solution is closer to zero. This latter effect is due to the consistency of the boundary condition in and for the Fokker–Planck equation.

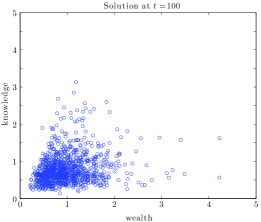

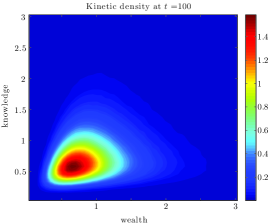

Test 2

In this new test, we maintain the same values for the parameters, and we modify the microscopic wealth interaction allowing for the knowledge to play a rule in the binary transaction. More precisely we assume that in (LABEL:eq.cpt2)

In this way the binary transaction is still conservative but a larger knowledge will correspond to a gain in the transaction. The results are reported in Figure 5.2 for the full density and in Figure 5.3 and 5.4 for the marginal densities and their tail distribution. It can be observed how this choice produces a shift of the whole distribution towards a more wealthy state for people with a higher knowledge. In particular the tails of the marginal density for the wealth are fatter if compared to the first test case. This shows that knowledge can play a relevant rule in the formation of wealth inequalities.

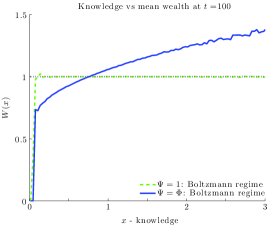

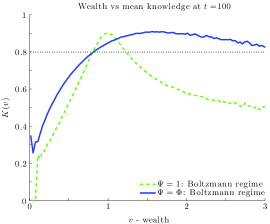

Lastly, for the above test cases in the Boltzmann regime, we report the profiles of the local mean wealth and local mean knowledge

The profiles clearly show that the strategy of minimizing the risk is not enough to produce a class of well-educated and rich people. The main outcome is a concentration of agents with high values of knowledge around the mean wealth, but beside this the overall mean wealth for a given knowledge status is essentially independent from the knowledge.

On the contrary, when the personal knowledge produces a certain advantage in the outcome of the binary trade, a shift is produced on the concentration of people with higher knowledge towards the richest classes and a strict correlation between wealth and knowledge is created (see Figure 5.5).

6 Conclusions

Distribution of wealth in a society of agents depends on many aspects, even if it appears to have very stable features, like heavy tails, and a relevant presence of the so-called middle class [35]. In this note, we introduced and discussed a kinetic model for the joint evolution of wealth and knowledge, based on the assumption that knowledge can influence the distribution of wealth by acting on the risk perception, as well as in producing a better outcome from trades. Numerical experiments put in evidence that the role of knowledge in the distribution of wealth does not modify in a radical way the distribution of wealth, which remains heavy tailed in all the considered experiments. However, it is noticeable that the possibility to achieve a sensible richness strongly depends on the risky part of the trade. Hence, in all cases in which knowledge induces to choose less-risky trades, the biggest part of the population which belongs to the middle class (with respect to knowledge) also end up with a location in the middle class (with respect to wealth). On the other hand when knowledge produces an advantage in the binary transaction it can account for strong wealth differences between the agents and a larger wealth inequality is originated.

Acknowledgement. This work has been done under the activities of the National Group of Mathematical Physics (GNFM). The support of the MIUR Research Projects of National Interest “Bayesian methods: theoretical developments and novel applications”, “Variational, functional-analytic, and optimal transport methods for dissipative evolutions and stability problems” and “Advanced numerical methods for kinetic equations and balance laws with source terms” is kindly acknowledged.

References

- [1]

- [2] J. Angle, The surplus theory of social stratification and the size distribution of personal wealth. Social Forces 65 293–326 (1986)

- [3] J. Angle, The inequality process as a wealth maximizing process. Physica A 367 388–414 (2006)

- [4] M. Bisi, G. Spiga, and G. Toscani, Kinetic models of conservative economies with wealth redistribution. Commun. Math. Sci. 7 (4) 901–916 (2009)

- [5] A.S. Chakrabarti, and B.K. Chakrabarti, Statistical Theories of Income and Wealth Distribution. Economics, Open-accessment E-Journal http://www.economics-ejournal.org/economics/journalarticles/2010-4. Discussion Paper Nr. 2009-45 (2009)

- [6] A. Chakraborti, Distributions of money in models of market economy. Int. J. Modern Phys. C 13, 1315–1321 (2002)

- [7] A. Chakraborti, and B.K. Chakrabarti, Statistical Mechanics of Money: Effects of Saving Propensity. Eur. Phys. J. B 17, 167-170 (2000)

- [8] A. Chatterjee, B.K. Chakrabarti, and S.S. Manna, Pareto law in a kinetic model of market with random saving propensity. Physica A 335 (2004), 155–163.

- [9] A. Chatterjee, B.K. Chakrabarti, and R.B. Stinchcombe, Master equation for a kinetic model of trading market and its analytic solution. Phys. Rev. E 72, 026126 (2005)

- [10] S. Cordier, L. Pareschi, and C. Piatecki, Mesoscopic modelling of financial markets. J. Stat. Phys. 134 (1), 161–184 (2009)

- [11] S. Cordier, L. Pareschi, and G. Toscani, On a kinetic model for a simple market economy. J. Stat. Phys. 120, 253-277 (2005)

- [12] L. da Fontoura Costa, Learning about knowledge: A complex network approach. Phys. Rev. E 74, 026103 (2006)

- [13] A. Drǎgulescu, and V.M. Yakovenko, Statistical mechanics of money. Eur. Phys. Jour. B 17, 723-729 (2000)

- [14] B. Düring, D. Matthes, and G. Toscani, Kinetic Equations modelling Wealth Redistribution: A comparison of Approaches. Phys. Rev. E, 78, 056103 (2008)

- [15] B. Düring, D. Matthes, and G. Toscani, A Boltzmann-type approach to the formation of wealth distribution curves. (Notes of the Porto Ercole School, June 2008) Riv. Mat. Univ. Parma (1) 8 199-261 (2009)

- [16] U. Eco, Memoria e dimenticanza. (2011), in http://www.3dnews.it/node/1824

- [17] U. Garibaldi, E. Scalas, and P. Viarengo, Statistical equilibrium in simple exchange games II. The redistribution game. Eur. Phys. Jour. B 60(2) 241–246 (2007)

- [18] J.C. Gonzalez–Avella, V.M. Eguiluz, M. Marsili, F. Vega–Redondo, and M. San Miguel, Threshold learning dynamics in social networks. PLoS ONE 6 (5) e20207 (2011).

- [19] A.K. Gupta, Models of wealth distributions: a perspective. In Econophysics and sociophysics: trends and perspectives B.K. Chakrabarti, A. Chakraborti, A. Chatterjee (Eds.) Wiley VHC, Weinheim 161-190 (2006)

- [20] S. Guala. Taxes in a simple wealth distribution model by inelastically scattering particles. Interdisciplinary Description of Complex Systems 7(1), 1-7, (2009)

- [21] B. Hayes, Follow the money. American Scientist 90 (5), 400-405 (2002)

- [22] R. Hausmann, C.A. Hidalgo, S. Bustos, M. Coscia, S. Chung, J. Jimenez, A. Simoes, and M.A. Yildirim. The Atlas of Economic Complexity. Mapping paths to prosperity. Puritan Press, (2011). (http://atlas.media.mit.edu).

- [23] P. Herd, K. Holden, and Y.T. Su, The links between early-life cognition and schooling and late-life financial knowledge. The Journal of Consumer Affairs, Fall 2012, 411-435 (2012)

- [24] C.A. Hidalgo, and R. Hausmann. The building blocks of economic complexity. Proc. Natl. Acad. Sci. 106, 10570-10575 (2009)

- [25] S. Ispolatov, P.L. Krapivsky, and S. Redner, Wealth distributions in asset exchange models. Eur. Phys. Jour. B 2, 267-276 (1998)

- [26] D. Kahneman, and A. Tversky, Prospect theory: an analysis of decision under risk, Econometrica 263–292 (1979).

- [27] D. Kahneman, and A. Tversky, Choices, Values, and Frames, Cambridge University Press, Cambridge, 2000.

- [28] A. Lusardi, P-C. Michaud, and O.S. Mitchell, Optimal financial knowledge and wealth inequality, NBER Working Paper No. 18669 (2013).

- [29] T. Lux, and M. Marchesi, Volatility clustering in financial markets: a microscopic simulation of interacting agents, International Journal of Theoretical and Applied Finance 3 675–702 (2000).

- [30] T. Lux, and M. Marchesi, Scaling and criticality in a stochastic multi-agent model of a financial market, Nature 397 (11) 498–500 (1999).

- [31] D. Maldarella, and L. Pareschi, Kinetic models for socio–economic dynamics of speculative markets, Physica A, 391 715–730 (2012).

- [32] D. Matthes, and G. Toscani, On steady distributions of kinetic models of conservative economies. J. Stat. Phys. 130, 1087-1117 (2008)

- [33] C.T. Morgan, A Brief Introduction to Psychology McGraw–Hill, New York, (1974).

- [34] G.Naldi, L.Pareschi, and G.Toscani Eds. Mathematical Modeling of Collective Behavior in Socio-Economic and Life Sciences, Birkhauser, Boston (2010).

- [35] L. Pareschi, and G. Toscani, Interacting multiagent systems. Kinetic equations & Monte Carlo methods, Oxford University Press, Oxford (2013)

- [36] M. Patriarca, E. Heinsalu, and A. Chakraborti, Basic kinetic wealth-exchange models: common features and open problems. Eur. Phys. J. B 73, 145–153 (2010)

- [37] S. Pianegonda, J.R. Iglesias, G. Abramson, and J.L. Vega, Wealth redistribution with finite resources. Physica A 322 (2003) 667–675

- [38] E. Scalas, U. Garibaldi, and S. Donadio, Statistical equilibrium in the simple exchange games I. Methods of solution and application to the Bennati–Dragulescu–Yakovenko (BDY) game. Eur. Phys. J. B 53 267–272 (2006)

- [39] F. Slanina, Inelastically scattering particles and wealth distribution in an open economy. Phys. Rev. E 69, 046102 (2004)

- [40] R.C. Teevan, and R.C. Birney, Readings for Introductory Psychology Harcourt, Brace & World, New York, (1965).

- [41] A. Ticona Bustillos, and P.M.C. de Oliveira, Evolutionary model with genetics, aging, and knowledge. Phys. Rev. E 69, 021903 (2004)

- [42] G. Toscani, Kinetic models of opinion formation, Commun. Math. Sci. 4 481–496 (2006).

- [43] G. Toscani, Wealth redistribution in conservative linear kinetic models with taxation. Europhysics Letters 88 (1) (2009) 10007

- [44] G. Toscani, C. Brugna, and S. Demichelis, Kinetic models for the trading of goods. J. Stat. Phys. 151 549–566 (2013).

- [45] V.M. Yakovenko, Econophysics, Statistical Mechanics Approach to. Encyclopedia of Complexity and System Science, Springer http://refworks.springer. (2007)

- [46] V.M. Yakovenko, and J.B. Rosser, Colloquium: Statistical mechanics of money, wealth and income. Rev. Mod. Phys. 81 (4) 1703–1725 (2009)