Zhiyong Zhang, Kaifeng Jiang, Haiyan LiuIn-Sue Oh

University of Notre DameFox School of Business, Temple University

Correspondance should be sent to Zhiyong Zhang, 118 Haggar Hall, Univeristy of Notre Dame, IN 46556. Email: zzhang4@nd.edu.

Bayesian meta-analysis of correlation coefficients through power prior

Abstract

To answer the call of introducing more Bayesian techniques to organizational research (e.g., Kruschke, Aguinis, & Joo, 2012; Zyphur & Oswald, 2013), we propose a Bayesian approach for meta-analysis with power prior in this article. The primary purpose of this method is to allow meta-analytic researchers to control the contribution of each individual study to an estimated overall effect size though power prior. This is due to the consideration that not all studies included in a meta-analysis should be viewed as equally reliable, and that by assigning more weights to reliable studies with power prior, researchers may obtain an overall effect size that reflects the population effect size more accurately. We use the relationship between high-performance work systems and financial performance as an example to illustrate how to apply this method to organizational research. We also provide free online software that can be used to conduct Bayesian meta-analysis proposed in this study. Research implications and future directions are discussed.

1 INTRODUCTION

Meta-analysis is a statistical method of combining findings from multiple studies to get a more comprehensive understanding of the population (Hunter & Schmidt, 2004). A simple way to combine studies is to calculate the weighted average of correlations between two variables (or differences between two treatments) with the sample size being the weight (e.g., Hunter & Schmidt, 2004). In addition to the averaged effect size, the variation of it can also be investigated to see how the effect size changes from one study to another. This method has become increasingly popular in management research in recent years. According to a review by Aguinis, Dalton, Bosco, Pierce, and Dalton (2011), thousands of meta-analyses have been conducted and published in five major management journals from 1982 to 2009. The number of annually published meta-analytically derived effect sizes is also expected to keep growing in the future.

Both fixed-effects and random-effects models have been used in meta-analysis (e.g., Field, 2001; Hedges & Olkin, 1985; Hedges & Vevea, 1998; Hunter & Schmidt, 2004). Fixed-effects models assume the population under study is fixed and homogenous and the finding from each study provides an estimate, ideally unbiased or consistent, of the population effect. For example, if one wants to study the relationship between job satisfaction and job performance, he or she may believe the relationship between the two variables is universal in the population. The differences in the reported correlations in identified studies simply result from sampling variation. Random-effects models assume the population is variable and heterogeneous and can show different effects according to the distinct features that characterize it. For example, for different types of measures, research designs, and research samples, the relationship between job satisfaction and job performance can be quite different (Judge, Thoresen, Bono, & Patton, 2001). Therefore, the differences in the reported correlations reflect the heterogeneous effect sizes in the population.

Meta-analysis has been conducted within both the frequentist and Bayesian frameworks although arguably meta-analysis can naturally be viewed as a Bayesian method in general. The frequentist methods for meta-analysis can be found in many places such as Hedges and Olkin (1985), Hunter and Schmidt (2004), and Rosenthal (1991). Relatively few studies have discussed Bayesian meta-analysis (e.g., Carlin, 1992; Morris, 1992; Smith, Spiegelhalter, & Thomas, 1995; Steele & Kammeyer-Mueller, 2008), which has been considered as having several advantages, such as “full allowance for all parameter uncertainty in the model, the ability to include other pertinent information that would otherwise be excluded, and the ability to extend the models to accommodate more complex, but frequently occurring, scenarios” (Sutton & Abrams, 2001, p. 277).

Traditional meta-analysis, using either the frequentist or Bayesian approach, typically treats each study equivalently. In other words, each study contributes equally to estimated overall effect size after considering the weights proportional to sample sizes. However, in many cases, not all studies included in a meta-analysis should make equal contribution to the overall effect size; treating them equivalently might cause unexpected consequences in meta-analysis. For example, strategic management scholars may be interested in the relationships between financial performance and its antecedents, such as human resource management (HRM) practices (Combs, Liu, Hall, & Ketchen, 2006) and human capital (Crook, Todd, Combs, Woehr, & Ketchen, 2011). Financial performance can be measured objectively using data from archival data or subjectively using survey data. Although both objective and subjective measures are widely adopted in the literature, objective information may reflect a firm’s financial status more accurately than subjective ratings because the latter involves more cognitively demanding assessments and the informants may not always have the best knowledge of the information. Therefore, those using objective measures may provide more reliable information of the relationships between financial performance and other variables than those based on subjective measures. For another example, due to the difficulty of collecting longitudinal data, longitudinal studies often result in a relatively small sample size compared with cross-sectional studies obtaining all information from a single source. Even though longitudinal designs may help avoid common method bias and reduce inflation of correlations (Podsakoff, MacKenzie, Lee, & Podsakoff, 2003), their small sample sizes make them contribute less to the final result. Instead, the cross-sectional studies with inflated relationships may easily dominate the overall effect size because of their large sample sizes. As illustrated in the two examples, treating individual studies equivalently may produce potential misleading results. However, not much attention has been paid to this issue when estimating overall effect size in traditional meta-analysis. To address this research need, this study proposes a Bayesian method for meta-analysis that can control the contribution of each individual study through power prior. As we discuss below, this method can allow meta-analysis researchers more flexibility to estimate overall effect size by specifying power parameters for individual studies.

For illustration, the current study focuses on the meta-analysis of sample correlation although the same method can be applied for other effect size measures. In the following, we first demonstrate the use of power prior through a fixed-effects model and then we extend our method to random-effect models and meta-regression. Free online software is introduced to carry out the Bayesian meta-analysis discussed in this study. The use of Bayesian meta-analysis is further demonstrated through a real meta-analysis example.

2 BAYESIAN META-ANALYSIS THROUGH POWER PRIOR

The proposed method is derived based on the Fisher z-transformation of correlation. Suppose is the population correlation of two variables that follow a bivariate normal distribution. For a given sample correlation from a sample of independent subjects, its Fisher z-transformation, denoted by , is defined as

approximately follows a normal distribution with mean

and variance (Fisher, 1921).

Meta-analysis of correlation concerns the analysis of correlation between two variables when a set of studies regarding the relationship between the two variables are available. Suppose there are studies that report the sample correlation between two variables. Each study reports a sample correlation with the corresponding sample size . Let denote the Fisher z-transformation of and be the Fisher z-transformation of the population correlation. Then, with .

2.1 Fixed-effects Models

We first investigate the situation where the population can be considered as homogeneous and, therefore, a fixed-effects model can be used. In this case, the population correlation is

and .

The use of Bayesian methods requires the specification of priors (e.g., Gelman, Carlin, Stern, & Rubin, 2003), which provides a perfect way to conduct meta-analysis. A prior represents information on the population correlation, or its Fisher z-transformation, without any data collection. Although a prior is required, it may consist of “no” information through certain types of prior such as Jeffreys’ prior (e.g., Gill, 2002; Jeffreys, 1946). Suppose the prior for follows a normal distribution where and are pre-determined values. For example, could have a prior N(0,1), which means a researcher initially believe the mean value of is 0, corresponding a correlation 0, with variance 1. If little to none information is available, the so-called diffuse prior can be used by specifying a large variance such as .

After collecting data, in the framework of meta-analysis, with the availability of a study, one can get a better picture about the population correlation. Bayesian methods provide a way to update the information on the population correlation through Bayes’ Theorem. Let denote the new information on the correlation after Fisher z-transformation and . The distribution of the population correlation by combining the prior and the study is

where is called the posterior of after considering . From Appendix A, we can conclude that the posterior distribution is also a normal distribution where

| (1) | |||||

| (2) |

Therefore, the posterior mean is the weighted average of prior mean and where the weights are the inverse of variances of prior and data. If the prior is very accurate, e.g., with a small variance, the prior mean will exert a big effect on the posterior. For an extreme case, if , the posterior mean is , which is also the prior mean. On the other hand, if only little prior information is available, reflected by large variance of prior, the prior mean has little influence on the posterior. For a special case where , the posterior mean is and therefore, the posterior is fully determined by data.

The above analysis assumes that is fully reliable or the researcher wants to utilize full information from . However, if, for practical reason, the information in is not accurate enough (e.g., obtained from a flawed research design), it might distort the posterior. In this situation, a researcher might prefer using only partial information from . Using the power prior idea developed by Ibriham and Chen (2000), we can get the posterior

| (3) |

where is a power parameter. Note that if , no information from is used while when , full information of is used. Partial information of can be utilized by setting to be a value between 0 and 1. It can be shown (see Appendix B) that the posterior is still a normal distribution with where

Again the posterior mean is a weighted average of the prior mean and . However, note that the weight is different from the previous situation because it is related to the power . If , then the weight for is smaller than the previous results in Equation 1. This means posterior will rely more on the prior. Note that this is equivalent to let . The information is passed through a normal distribution with the same mean but enlarged variance.

Suppose without data collection, a researcher’s prior information on is . One study in the literature reported a correlation 0.5 with the sample size 28 and, therefore, with variance 0.04. Table 1 shows the posterior mean and variance for with power ranges from 0 to 1. When , the posterior is the same as the prior. When increases from 0.1 to 1, the posterior mean changes towards to because more information from is included in the posterior. Furthermore, the posterior variance is also becoming smaller. In summary, the use of power influences both the posterior mean and posterior variance and can control the contribution of data to the posterior.

| Data | z-transformation | Variance | |

|---|---|---|---|

| 0.549 | 0.04 | ||

| Prior | 0 | 1 | |

| Power | Posterior | ||

| Mean | Variance | ||

| 0 | 0 | 1 | |

| 0.1 | 0.392 | 0.286 | |

| 0.2 | 0.458 | 0.167 | |

| 0.3 | 0.485 | 0.118 | |

| 0.4 | 0.499 | 0.091 | |

| 0.5 | 0.509 | 0.074 | |

| 0.6 | 0.515 | 0.063 | |

| 0.7 | 0.520 | 0.054 | |

| 0.8 | 0.523 | 0.048 | |

| 0.9 | 0.526 | 0.043 | |

| 1 | 0.528 | 0.038 | |

In meta-analysis, data from multiple studies are available. Bayesian methods provide a natural way to combine the data together. For example, suppose we have another study with transformed correlation and its variance as well as the sample size . Furthermore, the power is used when combining this study. We have already obtained the posterior of with the first study in Equation 3. To get the posterior by combining , we can simply view the posterior in Equation 3 as a new prior. Then, the posterior of with both and is

From Appendix C, we know posterior distribution is a normal distribution where

Clearly, the posterior mean is a weighted average of prior and the two studies. More generally, if we have studies with , , and , the posterior distribution of is with

For illustration, we show the combination of two studies where the first study reported a correlation 0.5 with the sample size 28 and the second study reported a correlation 0 with the sample size 103. Therefore, with variance 0.04 and with variance 0.01. A diffuse prior is used here so that the effect of prior is minimized. Table 2 presents the posterior mean and variance for the population correlation with different combinations of power for the two studies. First, when no information from the two studies is utilized (), the posterior is just the prior. Second, when only the information of Study 1 is fully used (, ), the posterior mean and variance are essentially the same as the Fisher z-transformation and its variance of Study 1 because of the use of the diffuse prior. Similarly, one can solely use the information from Study 2 by setting and . Third, when the information of the two studies are used fully (), the posterior mean is about 0.110, the weighted average of 0.549 and 0 but leaning towards 0 because the second study has a smaller variance. When setting , the posterior mean is still 0.110 but the variance is about 0.016, twice of that when . This is because only partial information is used from the two studies. Similar results can be seen from the table when other combination of power is used. In summary, by controlling the power parameter, one can control the contribution of each study to meta-analysis.

| Data | z-transformation | Variance | ||

|---|---|---|---|---|

| 0.549 | 0.04 | |||

| 0 | .01 | |||

| Prior | 0 | 100 | ||

| Power | Posterior | |||

| Mean | Variance | |||

| 0 | 0 | 0 | 100 | |

| 1 | 0 | 0.549 | 0.040 | |

| 0 | 1 | 0.000 | 0.010 | |

| 0.1 | 1 | 0.013 | 0.010 | |

| 1 | 0.1 | 0.392 | 0.029 | |

| 0.5 | 0.5 | 0.110 | 0.016 | |

| 0.2 | 1 | 0.026 | 0.010 | |

| 1 | 0.2 | 0.305 | 0.022 | |

| 0.2 | 0.8 | 0.032 | 0.012 | |

| 0.8 | 0.2 | 0.275 | 0.025 | |

| 1 | 1 | 0.110 | 0.008 | |

2.2 Random-effects Models

When the population is not homogeneous, it is not reasonable to assume that has the same mean . Therefore, we discuss the random-effects models in the Bayesian framework. A random-effects model can be written as a two-level model,

| (4) |

where and . In the model, each has its mean and the grand mean of is . Based on Fisher z-transformation, . It is often assumed that has a normal distribution and, therefore, . For the random-effects model, we have the fixed-effects parameter and the random-effects parameter . The parameter represents the between-study variability. The parameter can be transformed back to correlation that represents the overall correlation across all studies. In addition, we can also estimate the random effects , which can be transformed back to correlations for individual studies.

As for the fixed-effects models, to estimate model parameters for the random-effects models, we need to specify priors. In this study, the normal prior is used for and the inverse gamma prior is used for with , , and denoting known constants. In practice, , , and are often used to reduce the influence of priors. With the priors, the conditional posteriors for , , and can be obtained as in Appendix D. Then, the following Gibbs sampling procedure can be used to get a Markov chain for each parameter. {APAenumerate}

Choose a set initial values for and , e.g., and .

Generate from the normal distribution

Generate from the inverse Gamma distribution IG().

Generate from the normal distribution

Let and and repeat Steps 2-4 to get , and . The above algorithm can be repeated for times to get a Markov chain for , , and . It can be shown that the Markov chains converge to their marginal distributions after a certain period and therefore can be used to infer on the parameters (e.g., Gelman et al, 2003). The period for the Markov chains to converge is called the burn-in period. Suppose the burn-in period is . Then the rest of the Markov chain from th iteration to the th iteration can be used to get the mean and variance of , , and . Because a research is ultimately interested in the correlation, we can also get the Markov chain for and for .

To illustrate the influence of power parameters on the random-effects meta-analysis, we consider a simple example with three studies that report correlations 0.5, 0 and -0.5 with sample sizes 103, 28 and 103. The Fisher z-transformed data and their variances are given in Table 3. Table 3 also reports the estimated overall correlation and individual correlation . When the power is 1 for all three studies, the estimated is approximately 0. Note that the estimated individual population correlations for the first and third studies are smaller than the observed ones. This is called “shrinkage” or “multilevel averaging” effect of multilevel analysis (e.g., Greenland, 2000). The estimated random effects are pulled towards the average effects. If, based on expert opinions or other information, we suspect the reported negative correlation could be because of unreliable study, we might assign it a different weight. For example, if we give the third study a power 0.1, the estimated overall correlation becomes 0.061. Furthermore, if we assign a power 0.01, the overall population becomes 0.215. Therefore, the effect of the observed unreliable negative correlation can be controlled through chosen power parameters.

| Data | z-transformation | Variance | |||||

| 0.549 | 0.01 | ||||||

| 0 | 0.04 | ||||||

| -0.549 | 0.01 | ||||||

| Prior | 0 | 100 | |||||

| Power | Posterior mean | ||||||

| 1 | 1 | 1 | -0.002 | 0.482 | -0.001 | -0.482 | |

| 1 | 1 | 0.1 | 0.061 | 0.476 | 0.022 | -0.305 | |

| 1 | 1 | 0.01 | 0.215 | 0.469 | 0.099 | 0.099 | |

2.2.1 Selection between fixed-effects and random-effects models

The choice of the fixed-effects or random-effects models is often a subjective decision. However, we suggest using two methods to assist such a decision. A random-effects model is only beneficial when there is significant variation in the population effect sizes. Therefore, for the first method, we can test whether the variance of , , is significant. If it is significant, it suggests that a random-effects model is preferred. Otherwise, the fixed-effects model, as a special case of random-effects models, can be used. Some scholars have argued that the significance test may not have enough power to detect variation in population values due to the small number of studies (Hunter & Schmidt, 2004). Therefore, we recommend another method to compare the fixed-effects model and the random-effects model through the deviance information criterion (DIC, Spiegelhalter et al., 2002). If the fixed-effects model has the smaller DIC, it is preferred. Otherwise, the random-effects model is better used.

2.3 Meta-regression Models

When a random-effects model is suggested, it often indicates possible heterogeneity in the population. Therefore, predictors or covariates can be identified to explain such a heterogeneity. Suppose a set of covariates are available, denoted by . Then, a meta-regression model can be constructed as below

| (5) |

where , , and . If a coefficient is significant, is a significant predictor that might be related to the heterogeneity of the population correlation.

To estimate and , we specify the multivariate normal prior for as and the inverse Gamma prior for . Typically, we use the following hyper-parameters for the priors: , with denoting a identity matrix, and .

With the prior, the conditional posteriors for , , and can be obtained as shown in Appendix E. The conditional posterior distribution of is an inverse Gamma distribution . The conditional posterior distribution for is still a multivariate normal distribution

where is the least square estimate of such that with as the design matrix and . The conditional posterior for is

With the set of conditional posteriors, the Gibbs sampling algorithm can be used to generate Markov chain for each unknown parameter as for the random-effects meta-analysis.

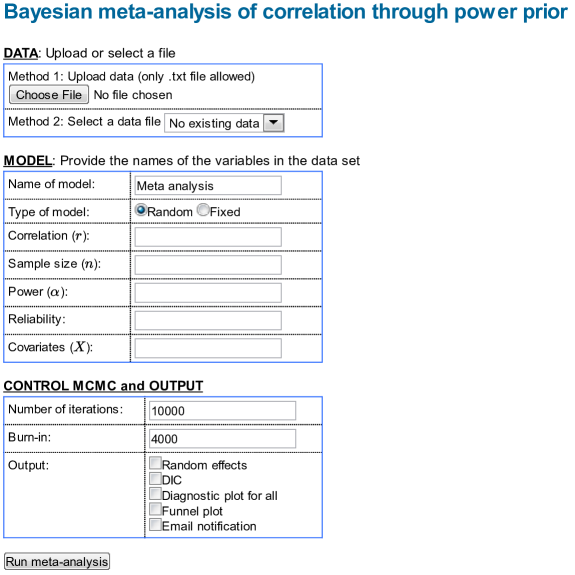

3 SOFTWARE

To facilitate the use of Bayesian meta-analysis method through power prior, we developed a free online program that can be accessed with the URL http://webbugs.psychstat.org/modules/metacorr/. The online program can be used within a typical Web browser. It has an interface shown in Figure 1. To use the program, one needs either to upload a new data file or select an existing file. Note names of the existing files are shown in the drop down menu. The existing file has to be a text file in which the data values are separated by one or more white spaces. The first line of the data file will be the variable names, which will be used in the model.

Next, a user chooses the model to use. For example, the user can choose to use either the random-effects model (default option) or the fixed-effects model. Then, information on the model can be provided. Both the Correlation and Sample size are required for all analysis, which can be specified using the variable names in the data set. For example, if we use “fi” to represent the correlation between financial performance and another variable in the data set, then “fi” should be input in the field of Correlation in the interface. Similarly, “n” is used in the Sample size field because in the data set, “n” is also the variable name for sample size. In addition, a user can also specify the variables for power and covariates used in the model.

Finally, one can elect to control Markov chain Monte Carlo (MCMC) method and output of the meta-analysis. For example, the total number of Monte Carlo iteration and the burn-in period can be specified. In the output, one can require the output of the estimates for random effects , DIC, and diagnostic plots for all model parameters including the random effects. If one checks the option Email notification, an email will be sent to the user once the analysis is completed.

4 AN EXAMPLE

We use the relationship between high-performance work systems (HPWS) and financial performance as an example to illustrate the use of Bayesian meta-analysis with power prior. HPWS refers to a bundle of human resource management (HRM) practices that are intended to enhance employees’ abilities, motivation, and opportunity to make contribution to organizational effectiveness, including practices such as selective hiring, extensive training, internal promotion, developmental performance appraisal, performance-based compensation, flexible job design, and participation in decision making (Lepak, Liao, Chung, & Harden, 2006). Strategic HRM scholars have devoted considerable effort to studying the influence of HPWS on firm performance in the past three decades and consistently found that the use of HPWS is positively related to employee and firm performance (Paauwe, Wright, & Guest, 2013). Indeed, recent meta-analyses have demonstrated the positive relationships between HPWS and a variety of performance outcomes (Combs et al., 2006; Jiang, Lepak, Hu, & Baer, 2012; Subramony, 2009), including employee outcomes (e.g., human capital, employee motivation), operational outcomes (e.g., productivity, service quality, and innovation), and financial outcomes (e.g., profit, return on assets, and sales growth). The purpose of this study is not to compare the results obtained from Bayesian meta-analysis to those of previous research. Instead, we just use the research on HPWS as an example and specifically focus on the relationship between HPWS and financial performance, which is one of the most important considerations of strategic HRM research.

We used several search techniques to identify previous empirical studies that examined the relationship between HPWS and financial performance. First, we searched for published studies in the databases Business Source Premier, Google Scholar, Web of Science, and PsycINFO by combining keywords associated with HPWS (e.g., HRM systems, high-performance work systems, high-commitment HRM practices, and high-involvement HRM practices) and with keywords related to financial performance (e.g., financial performance, profit, return on assets, return on equity, Tobin’s Q, and sales growth). Second, we checked the references of previous reviews on HPWS (e.g., Combs et al., 2006; Jiang et al., 2012; Subramony, 2009) and added the articles that were missed in the database searches. Third, we conducted a manual search of major management journals that often publish strategic HRM research, including Academy of Management Journal, Journal of Management, Journal of Applied Psychology, Personnel Psychology, Strategic Management Journal, Organization Science, Journal of Management Studies, Human Resource Management, Human Resource Management Journal, and International Journal of Human Resource Management, to locate studies that were not included in the previous searches. Finally, we searched ProQuest Digital Dissertations and conference proceedings for the annual meetings of the Academy of Management for unpublished dissertations and conference papers from 2008 to 2013.

We used four criteria to include studies in the following meta-analysis. First, we only included studies that examined the relationship between HPWS and financial performance at the unit-level of analysis (e.g., teams, stores, business units, and firms). Studies conducted at the individual level of analysis were excluded from the analysis. Second, we only included studies that examined HRM practices as a system. Those examining the relationships between individual HRM practices and financial performance were not considered in this research. Third, consistent with previous meta-analyses (e.g., Combs et al., 2006; Jiang et al., 2012; Subramony, 2009), we limited financial performance to variables indicating financial or accounting outcomes, such as profit, return on assets, return on invested capital, return on equity, Tobin’s Q, sales growth, and perceived financial performance. Those only reporting the relationships between HPWS and other types of outcomes (e.g., employee outcomes and operational outcomes) were not included in the analysis. Fourth, the studies need to report at least two pieces of information in order to be included in the meta-analysis – correlation coefficient between HPWS and financial performance and sample size. This procedure resulted in 56 independent studies that were entered in the following analysis.

Before conducting Bayesian meta-analysis, we first corrected the observed correlation from each sample for unreliability by following the procedure outlined by Hunter and Schmidt (2004). Because HPWS has been considered as a formative construct (Delery, 1998) for which a high internal reliability (e.g., Cronbach’s alpha) is not required, we used a reliability of 1 for the measure of HPWS. Similarly, we used a reliability of 1 for the objective measures of financial performance and used Cronbach’s alpha as the reliability of the subjective measures of financial performance.

In addition, we consider firm size as a potential moderator of the relationship between HPWS and financial performance in order to test the meta-regression model of this study. Firm size is commonly included as a control variable in strategic HRM research, but its moderating effect has rarely been explored in either primary studies or a meta-analysis. Two competing hypotheses can be proposed in terms of its moderating role. On the one hand, some researchers have suggested that large organizations are likley to use more sophisticated HRM practices (e.g., HPWS) compared with small and mediem enterprises (e.g., Guthrie, 2001; Jackson & Schuler, 1995). As firm size increases, firms may also have more advantages such as economy of scale (e.g., Pfeffer & Salancik, 1978) and thus be more likely to gain benefit from their investment in HRM practices. On the other hand, large firms’ financial performance may be more affected by other factors beyond human resources (Capon, Farley, & Hoenig, 1990). In this case, the role of HPWS in enhancing financial performance may be limited in large firms than in small and medium firms. Taking these considerations together, we expect that firm size may moderate the relationship between HPWS and financial performance but make no directional prediction of this effect. Firm size is usually indicated by the number of employees. Studies with average number of employees greater than 250 were coded as 1 (i.e., large firms) and the others were coded as 0 (i.e., small and medium firms).

Table 4 shows the summary statistics of the data used in this example. Among the total of 56 studies, 46 measured financial performance using the archival data (i.e., objective performance) and 10 used subjective measures of financial performance (i.e., subjective performance). In addition, 37 studies were coded as large firms and 19 were coded as small and medium firms. The observed correlations ranged from 0.01 to 0.52 with sample sizes ranging from 50 to 2136.

| Minmum | Mean | Median | Maximum | Standard deviation | |

|---|---|---|---|---|---|

| Correlation | 0.01 | 0.22 | 0.200 | 0.52 | 0.13 |

| Sample size | 50 | 281 | 191 | 2136 | 325 |

| Reliability | 0.74 | 0.97 | 1 | 1 | 0.07 |

| Small & Medium: 19 | Large: 37 | ||||

| Objective studies: 46 | Subjective studies: 10 | ||||

Four power schemes are considered in the meta-analysis. First, every study is given the power of 1. In this case, every study contributes to the meta-analysis result fully and equally. This is equivalent to conduct traditional meta-analysis using Bayesian methods. Second, the reliability of financial performance of each study is used as power. The reason for this choice is that, if a measure is not reliable, only partial information will be used in meta-analysis. Third, two studies have sample sizes larger than 1000 (1212 and 2136, respectively). In order to avoid the dominant influence of the two studies on the final result, we assign them a power of 0.1 and the rest of studies a power of 1 in meta-analysis. Fourth, arguably a study with a large effect size is more likely to be published, which might cause publication bias. Therefore, reducing the influence of the studies with large effect sizes might be helpful in reducing publication bias. In this power scheme, we set the power at 0.5 for studies with correlations larger than 0.2. For the power schemes 3 and 4, the choice of power is rather liberal. A more serious analysis might consider different levels of power.

4.1 Results of Fixed-effects Meta-analysis

We first apply the fixed-effects meta-analysis model to the example data. Table 5 shows the results using the four different power schemes. When every study is assigned the equal power of 1 (Power 1), the estimated population correlation is 0.263 ( is the Fisher z-transformed estimate). If the reliability of financial performance is used as power (Power 2), the estimated correlation is about 0.264. However, when the two studies with the largest sample size are assigned a power of 0.5 (Power 3), the estimated correlation becomes 0.226. Note the estimated correlation in this condition is significantly different from the other two correlation estimates simply based on the credible interval estimates. In the observed studies, the correlations for the two study are 0.34 and 0.45, respectively, both of which are larger than the estimated fixed-effect correlation. When no power is used, the two studies pull the estimates close to them because their large sample sizes lead to big weights in the estimated correlation. Under the situation where the studies with large correlation are assigned a weight 0.5 (Power 4), the estimated correlation is 0.22, which is even smaller than the situation of Power 3. This is because the large correlations are downweighted.

| Estimate | sd | CI | DIC | |||

|---|---|---|---|---|---|---|

| Power 1 | 0.27* | 0.008 | 0.254 | 0.285 | 184 | |

| 0.26* | 0.007 | 0.249 | 0.278 | |||

| Power 2 | 0.27* | 0.008 | 0.255 | 0.286 | 175.9 | |

| 0.26* | 0.008 | 0.249 | 0.279 | |||

| Power 3 | 0.23* | 0.009 | 0.212 | 0.247 | 72.11 | |

| 0.23* | 0.008 | 0.209 | 0.242 | |||

| Power 4 | 0.22* | 0.009 | 0.205 | 0.242 | 77.44 | |

| 0.22* | 0.009 | 0.202 | 0.237 | |||

4.2 Results of Random-effects Meta-analysis

Table 6 shows the results from the random-effects meta-analysis. First, the estimated correlations from the random-effects and fixed-effects methods are quite different (0.23 vs. 0.27) when the power is not considered. This is because for the random-effects method, the between-study variability is considered. Therefore, extreme studies (e.g., those with unusual large sample sizes) are shrunk towards the average. Furthermore, within the random-effects method, there is not much difference in the estimated correlation. Second, only for power scheme 4, the estimated correlation shows notable difference from the rest of the power schemes. The reason is because studies with large correlations are downweighted. Third, in all situation, the variance estimate of is significant. This indicates there is sufficient variability in the studies to consider a random-effects meta-analysis to model the heterogeneity in the population.

| Estimate | sd | CI | DIC | |||

|---|---|---|---|---|---|---|

| Power 1 | 0.23* | 0.02 | 0.191 | 0.269 | -98.45 | |

| 0.016* | 0.004 | 0.01 | 0.026 | |||

| 0.226* | 0.019 | 0.189 | 0.263 | |||

| Power 2 | 0.23* | 0.02 | 0.191 | 0.27 | -97.18 | |

| 0.016* | 0.004 | 0.01 | 0.026 | |||

| 0.226* | 0.019 | 0.189 | 0.263 | |||

| Power 3 | 0.228* | 0.02 | 0.19 | 0.267 | -93.99 | |

| 0.016* | 0.004 | 0.009 | 0.025 | |||

| 0.224* | 0.019 | 0.187 | 0.261 | |||

| Power 4 | 0.218* | 0.02 | 0.178 | 0.259 | -85.4 | |

| 0.015* | 0.004 | 0.008 | 0.024 | |||

| 0.214* | 0.019 | 0.177 | 0.253 | |||

4.3 Results of Meta-regression

From the random-effects meta-analysis, we concluded that the population should be considered as heterogeneous.Through meta-regression analysis, we investigate whether the heterogeneity is related to firm size of different studies. Based on the results in Table 7, firm size is not significantly related to the individual differences in the population correlation because the slope parameter is not significant regardless of the choice of power. Furthermore, the results from the first three power schemes are very close. Comparing all four power schemes, power scheme 4 has smaller intercept while larger absolute slope. Combined, the results do not suggest the moderating effect of firm size on the relationship between HPWS and financial performance. It implies that HPWS used in both large firms and small and medium firms are salutary for enhancing financial performance.

| Estimate | sd | CI | DIC | |||

|---|---|---|---|---|---|---|

| Power 1 | (intercept) | 0.248* | 0.034 | 0.181 | 0.316 | -97.9 |

| (size) | -0.028 | 0.042 | -0.113 | 0.053 | ||

| 0.017* | 0.004 | 0.01 | 0.026 | |||

| Power 2 | (intercept) | 0.249* | 0.034 | 0.181 | 0.317 | -96.63 |

| (size) | -0.029 | 0.042 | -0.113 | 0.053 | ||

| 0.016* | 0.004 | 0.01 | 0.026 | |||

| Power 3 | (intercept) | 0.245* | 0.034 | 0.179 | 0.312 | -93.5 |

| (size) | -0.027 | 0.042 | -0.111 | 0.054 | ||

| 0.016* | 0.004 | 0.009 | 0.025 | |||

| (intercept) | 0.24* | 0.035 | 0.172 | 0.31 | -84.79 | |

| Power 4 | (size) | -0.034 | 0.043 | -0.121 | 0.048 | |

| 0.015* | 0.004 | 0.008 | 0.025 | |||

4.4 Fixed-effects Meta-analysis, Random-effects Meta-analysis, or Meta-regression?

Selection among different methods deserves much more investigation. Here, we just illustrate several possibilities using the example above, which certainly have their limitations. In choosing between fixed-effects and random-effects meta-analysis, one can check whether the variance parameter from the random-effects meta-analysis is significant. If it is significant, random-effects meta-analysis can be used. Our example showed that random-effects meta-analysis might be preferred. For the choice between random-effects meta-analysis and meta-regression, one can focus on the significance of the regression coefficients for predictors. If the coefficients are not significant, it might suggest that there is no need to include the proposed predictor in meta-regression.

We can also directly compare fixed-effects meta-analysis, random-effects meta-analysis, and meta-regression using DIC. The model with the smallest DIC indicates it fits the data best. However, DIC should only be used to compare models under the same power scheme. The calculation of DIC across power schemes would utilize different information and therefore is not valid. For example, under power scheme 1, DICs for the three models are 184, -98.45, and -97.9. This suggests that the meta-regression fits the current data best. However, there is no given cut-off on when a model can be considered as fitting data significantly better.

5 DISCUSSION

The current study presents a Bayesian method for meta-analysis. A unique feature of our method is to enable researchers to control the contribution of individual studies included in a meta-analysis through power prior. The motivation of this approach comes from the notion that not all studies should be treated equivalently when estimating the overall effect size in a meta-analysis. By developing an online program and using the example of the relationship between HPWS and financial performance, we have shown how to apply this method into management research. In the rest of this article, we briefly summarize the example results derived from the method we proposed. And then we discuss some implications of this method to meta-analysis in the field of management.

In the example study, we use four power schemes to assign powers to individual studies included in the meta-analysis. As shown in fixed-effects, random-effects, and meta-regression models, using the reliability of financial performance as power does not dramatically change the results obtained from regular meta-analysis that uses full information provided by each study. This is because that only ten studies used subjective measures of financial performance and the use of reliability as power would only influence how the ten out of 56 studies contribute to the final results. Moreover, the reliabilities for the subjective measures are typically high, so the vast majority of the information they provide still contributes to the overall effect size. If one uses another example with more subjective measures, the difference in effect size between regular meta-analysis and meta-analysis using reliability as power may be more obvious. Either way, our method provides a way to evaluate whether reliability influences meta-analysis results.

When power is used to reduce the influence of two studies with large sample sizes, the overall effect size in fixed-effects model becomes significantly different from what is obtained in the regular model, and the change is less obvious in random-effects and meta-regression models. This is because between-study variability is taken into account in random-effects model, which can shrink extreme effect sizes towards the average. However, this does not mean that using power to modify the impact of extremely large samples always has a larger impact on fixed-effects model than on random-effects model. It may also depend on the observed correlations of studies with large sample sizes. For example, if the correlation of a large sample is similar to the weighted average of the rest of the studies, assigning a small power to the large sample may not significantly change the overall effect size in either fixed-effects model or random-effects model.

The influence of power becomes more salient under power scheme 4 where studies with correlations larger than 0.2 are assigned a power of 0.5. We argue that this setting can potentially be used to deal with publication bias. For example, if we believe the studies with large effect sizes are over-sampled, we can assign them power smaller than 1. On the other hand, if one believes the studies with small effect sizes are under-sampled, power larger than 1 can also be used. Certainly the choice of power needs careful consideration.

Combined, the example of the relationship between HPWS and financial performance provides an initial illustration of our Bayesian approach of meta-analysis. We encourage researchers who are interested in this approach to test their data using the developed software and compare the results derived from different power schemes. In the following, we shift attention to the implications of this method to meta-analysis in management research.

First of all, we want to make it clear that it is not necessary to apply power prior to all meta-analyses. However, if researchers believe certain factors may impact the credibility of research findings and they can distinguish between more reliable and less reliable studies, we would recommend them to estimate the overall effect size with power prior, at least for the purpose of comparison. For example, reliability has been commonly used to correct for measurement error in meta-analysis (Hunter & Schmidt, 2004). As reliability decreases, the corrected effect size is more likely to be enlarged. However, a low reliability often indicates poor quality of a measure, which may not accurately reflect the intended construct. Therefore, the study using the measure with low reliability may be less likely to represent the true relationship of interest. In addition, research design (e.g., cross-sectional vs. longitudinal, single-source data vs. multiple-source data, self-report ratings vs. observer ratings, field studies vs. experimental studies) may also affect the extent to which a study can provide reliable information of the relationship between two variables. Combining study findings without considering the credibility of the information may lead to misleading results. Although researchers can summarize studies of different characteristics separately (e.g., Judge, Colbert, & Ilies, 2004; Oh, Wang, & Mount, 2011; Sin, Nahrgang, & Morgeson, 2009), they may still need to combine all studies to yield overall effect sizes that can be used as inputs of other analyses, such as meta-analytic structural equation modeling (MASEM; Viswesvaran & Ones, 1995). In these cases, researchers may choose to use more information from reliable studies through power prior in order to obtain overall effect sizes that can better represent the true relationships.

Bayesian meta-analysis with power prior can also be used to deal with outliers, including outliers of observed correlations and outliers of sample sizes. Traditionally, researchers often eliminate the most extreme data points to attenuate the influence of outliers on overall effect sizes (e.g., Hedges, 1987, Huber, 1980, Tukey, 1960). This is similar to assigning a power of 0 to studies considered as outliers and using no information of the eliminated studies in analysis. However, rather than deleting the data points completely, researchers can also choose to use only a small part of their information by assigning a small non-zero power to those studies.

One important issue that is out of the discussion of this article is what power value should be assigned to each study in meta-analysis with power prior. The method proposed in this study cannot determine whether a power prior scheme is realistic or not to reflect the contribution of each study to the final results. It is more reasonable for researchers who are familiar with the nature of the included studies to make the decisions. The general guideline is to identify the criteria that can indicate the credibility of research findings and use it to guide power prior decision in meta-analysis. One attempt of this study is to use reliability as a power for studies relying on subjective measures, which may reduce the overcorrection for unreliability due to extremely low reliabilities. In addition, we recommend that one should always compare the results from the analysis with and without power priors to inform the influence of the use of power priors. We encourage more efforts to further explore this issue in the future.

This study can be improved and extended in many ways. First, in both random-effects meta-analysis and meta-regression, we assume that the random effects follow a normal distribution. This assumption might not be valid when there are extreme values. Further study can incorporate robust Bayesian analysis to deal with the problem (e.g., Zhang, Lai, Lu, & Tong, 2013). Second, the current study has focused on the development of the method for correlation. However, the method can be equally applied to other effect sizes such as mean differences and odds ratios. Third, we have discussed the use of DIC for model comparison. The performance of it can be investigate through rigor simulation in the future.

6 REFERENCES

Aguinis, H., Dalton, D. R., Bosco, F. A., Pierce, C. A., & Dalton, C. M. 2011. Meta-analytic choices and judgment calls: Implications for theory building and testing, obtained effect sizes, and scholarly impact. Journal of Management, 37: 5-38.

Carlin, J. B. 1992. Meta-analysis for 22 tables: A Bayesian approach. Statistics in Medicine, 11: 141-158.

Capon, N., Farley, J. U., & Hoenig, S. 1990. Determinants of financial performance: A meta-analysis. Management Science, 36: 1143-1159.

Combs, J., Liu, Y., Hall, A., & Ketchen, D. 2006. How much do high-performance work practices matter? A meta-analysis of their effects on organizational performance. Personnel Psychology, 59: 501-528.

Crook, T. R., Todd, S. Y., Combs, J. G., Woehr, D. J., & Ketchen Jr, D. J. 2011. Does human capital matter? A meta-analysis of the relationship between human capital and firm performance. Journal of Applied Psychology, 96: 443-456.

Delery, J. E. 1998. Issues of fit in strategic human resource management: Implications for research. Human Resource Management Review, 8: 289-309.

Field, A. P. 2001. Meta-analysis of correlation coefficients: A Monte Carlo comparison of fixed- and random-effects methods. Psychological Methods, 6: 161-180.

Field, A. P., & Gillett, R. 2010, How to do a meta-analysis. British Journal of Mathematical and Statistical Psychology, 63: 665-694.

Fisher, R. A. 1921. On the probable error of a coefficient of correlation deduced from a small sample. Metron, 1: 3-32.

Gelman, A., Carlin, J. B., Stern, H. S., & Rubin, D. B. 2003. Bayesian data analysis. Chapman & Hall/CRC.

Gill, J. 2002. Bayesian methods: A social and behavioral sciences approach. CRC Press.

Greenland, S. 2000. Principles of multilevel modelling. International Journal of Epidemiology, 29: 158-167.

Guthrie, J. P. 2001. High-involvement work practices, turnover, and productivity: Evidence from New Zealand. Academy of management Journal, 44: 180-190.

Hedges, L. V. 1987. How hard is hard science, how soft is soft science: The empirical cumulativeness of research. American Psychologist, 42: 443-455.

Hedges, L. V. (1992). Meta-analysis. Journal of Educational Statistics, 17: 279-296.

Hedges, L. V., & Olkin, I. 1985. Statistical methods for meta-analysis. New York: Academic.

Hedges, L. V., & Vevea, J. L. 1998. Fixed- and random-effects models in meta-analysis. Psychological Methods, 3(4): 486-504.

Huber, P. J. 1980. Robust statistics. New York: Wiley.

Hunter, J. E., & Schmidt, F. L. 2004. Methods of meta-analysis: Correcting error and bias in research findings (2nd ed.). Newbury Park, CA: Sage.

Ibrahim, J. G., & Chen, M. H. 2000. Power prior distributions for regression models. Statistical Science, 15: 46-60.

Jackson, S. E., & Schuler, R. S. 1995. Understanding human resource management in the context of organizations and their environments. Annual Review of Psychology, 46: 237-264.

Jeffreys, H. 1946. An invariant form for the prior probability in estimation problems. Proceedings of the Royal Society of London. Series A, Mathematical and Physical Sciences, 186(1007): 453-461.

Jiang, K., Lepak, D. P., Hu, J., & Baer, J. C. 2012. How does human resource management influence organizational outcomes? A meta-analytic investigation of mediating mechanisms. Academy of Management Journal, 55: 1264-1294.

Judge, T. A., Colbert, A. E., & Ilies, R. 2004. Intelligence and leadership: a quantitative review and test of theoretical propositions. Journal of Applied Psychology, 89: 542-552.

Judge, T. A., Thoresen, C. J., Bono, J. E., & Patton, G. K. 2001. The job satisfaction–job performance relationship: A qualitative and quantitative review. Psychological Bulletin, 127: 376-407.

Kruschke, J. K., Aguinis, H., & Joo, H. 2012. The time has come: Bayesian methods for data analysis in the organizational sciences. Organizational Research Methods, 15: 722-752.

Lepak, D. P., Liao, H., Chung, Y., & Harden, E. E. 2006. A conceptual review of human resource management systems in strategic human resource management research. Research in Personnel and Human Resources Management, 25: 217-271.

Morris, C. N. 1992. Hierarchical models for combining information and for meta-analysis. Bayesian Statistics, 4: 321-44.

Oh, I. S., Wang, G., & Mount, M. K. 2011. Validity of observer ratings of the five-factor model of personality traits: A meta-analysis. Journal of Applied Psychology, 96: 762-773.

Paauwe, J., Wright, P. M., & Guest, D. E. 2013. HRM and performance: What do we know and where should we go? In J. Paauwe, D. E. Guest, & P. M. Wright (Eds), HRM & performance: Achievements & challenges (pp. 1-13). Chichester: Wiley.

Pfeffer, J. & Salancik, G. R. 1978. The external control of organizations: A resource dependence perspective. New York, NY: Harper and Row.

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. 2003. Common method biases in behavioral research: a critical review of the literature and recommended remedies. Journal of Applied Psychology, 88: 879-903.

Rogatko, A. 1992. Bayesian-approach for meta-analysis of controlled clinical-trials. Communications in Statistics – Theory and Methods, 21: 1441-1462.

Rosenthal, R. 1991. Meta-analytic procedures for social research. Newbury Park, CA: Sage.

Sin, H. P., Nahrgang, J. D., & Morgeson, F. P. 2009. Understanding why they don’t see eye to eye: An examination of leader–member exchange (LMX) agreement. Journal of Applied Psychology, 94: 1048-1057.

Smith, T. C., Spiegelhalter, D. J., Thomas, A. 1995. Bayesian approaches to random-effects meta-analysis: A comparative study. Statistics in Medicine, 14: 2685-2699.

Spiegelhalter, D. J., Best, N. G., Carlin, B. P., & Linde, A. v. d. 2002. Bayesian measures of model complexity and fit. Journal of the Royal Statistical Society, Series B (Statistical Methodology), 64: 583-639.

Steel, P. D. G. & Kammeyer-Mueller, J. 2008. Bayesian Variance Estimation for Meta-Analysis: Quantifying Our Uncertainty. Organizational Research Methods, 11: 54-78.

Subramony, M. 2009. A meta-analytic investigation of the relationship between HRM bundles and firm performance. Human Resource Management, 48: 745-768.

Sutton, A. J. & Abrams, K. R. 2001. Bayesian methods in meta-analysis and evidence synthesis. Statistical Methods in Medical Research, 10: 277-303.

Tukey, J. W. 1960. A survey of sampling from contaminated distributions. In I. Olkin, J.G. Ghurye, W. Hoeffding, W. G. Madoo, & H. Mann (Eds.), Contributions to probability and statistics. Stanford, CA: Stanford University Press.

Viswesvaran, C., & Ones, D. S. 1995. Theory testing: Combining psychometric meta-analysis and structural equations modeling. Personnel Psychology, 48: 865-885.

Zhang, Z., Lai, K., Lu, Z., & Tong, X. 2013. Bayesian inference and application of robust growth curve models using student’s t distribution. Structural Equation Modeling, 20(1): 47-78.

Zyphur, M. J., & Oswald, F. L. 2013. Bayesian estimation and inference: A user’s guide. Journal of Management.

7 APPENDIX A

With the prior and the information from the first study, the posterior, based on Bayes’ Theorem, is

where

The denominator is

Therefore, the posterior is

a normal distribution with mean

and variance

8 APPENDIX B

With the power parameter , the posterior

where

and . From Appendix A, the posterior is where

9 APPENDIX C

Show the posterior

The denominator is

The posterior is where

10 APPENDIX D

The joint posterior distribution is

Now we obtain the conditional posterior distributions.

First, we get the conditional posterior distribution of , which is

Therefore, the posterior is inverse Gamma distribution IG().

Second, the conditional posterior distribution of is

Therefore, the conditional posterior is a normal distribution

Third, the conditional posterior distribution of is

which is a normal distribution

11 APPENDIX E

The joint posterior distribution for the meta-regression model is

The conditional posterior distribution of is

| (6) |

Therefore, . The conditional posterior distribution for is

| (7) |

Let be the vector of , and be the least square estimate such that with as the design matrix. Then the conditional posterior distribution of is a multivariate normal distribution

For , its conditional distribution is

a normal distribution

12 FOOTNOTES

The results are based on a total of 10,000 iterations with the first 4,000 iterations as burn-in.

* .

Power 1: each study is given a power of 1. Power 2: the reliability of financial performance is used as power. Power 3: the two studies with the largest sample sizes are given a power of 0.1. Power 4: studies with correlations larger than 0.2 are given a power of 0.5, otherwise, 1.