The authors are grateful to Luciano Campi, Umut Çetin, as well as the anonymous Associate Editor and two referees for their valuable comments which help us improving this paper.

1. Introduction

In the theory of market microstructure, two models, due to Kyle [16] and Glosten and Milgrom [13], are particularly influential. In the Kyle model, buy and sell orders are batched together by a market maker, who sets a unique price at each auction date. In the Glosten Milgrom model, buy and sell orders are executed by the market maker individually, hence bid and ask prices appear naturally. In both models, an informed agent (insider) trades to maximize her expected profit utilizing her private information on the asset fundamental value, while another group of noise traders trade independently of the fundamental value. The cumulative demand of these noise traders is modeled by a Brownian motion in Kyle model, cf. [2], and by the difference of two independent Poisson processes, whose jump size is scaled by the order size, in the Glosten Milgrom model.

When the fundamental value, described by a random variable , has an arbitrary continuous distribution, Back [2] establishes a unique equilibrium between the insider and the market maker. Moreover, the cumulative demand process in the equilibrium connects elegantly to the theory of filtration enlargement, cf. [18]. However much less is known about equilibrium in the Glosten Milgrom model. Back and Baruch [3] consider a Bernoulli distributed . In this case, the insider’s optimal strategy is constructed in [10]. Equilibrium with general distribution of , as Cho [11] puts it, “will be a great challenge to consider”.

In this paper, we consider the Glosten Milgrom model whose risky asset value has a discrete distribution:

| (1.1) |

|

|

|

where , is an increasing sequence and with . This generalizes the setting in [3] where is considered, i.e., has a Bernoulli distribution.

In models of insider trading, inconspicuous trade theorem is commonly observed, cf. e.g., [16], [2], [4], [3], [8], and [9] for equilibria of Kyle type, and [10] for the Glosten Milgrom equilibrium with Bernoulli distributed fundamental value. The inconspicuous trade theorem states, when the insider is trading optimally in equilibrium, the cumulative net orders from both insider and noise traders have the same distribution as the net orders from noise traders, i.e., the insider is able to hide her trades among noise trades. As a consequence, this allows the market maker to set the trading price only considering current cumulative noise trades. Moreover, in all aforementioned studies, the insider’s optimal strategy is of feedback form, which only depends on the current cumulative total order. This functional form is associated to optimizers of the Hamilton-Jacobi-Bellman (HJB) equation for the insider’s optimization problem. However the situation is dramatically different in the Glosten Milgrom model with in (1.1) at least . Theorem 2.6 below shows that, given aforementioned pricing mechanism, the insider’s optimal strategy, if exists, does not correspond to optimizers of the HJB equation. This result roots in the difference between bid and ask prices in the Glosten Milgrom model, which is contrast to the unique price in the Kyle model.

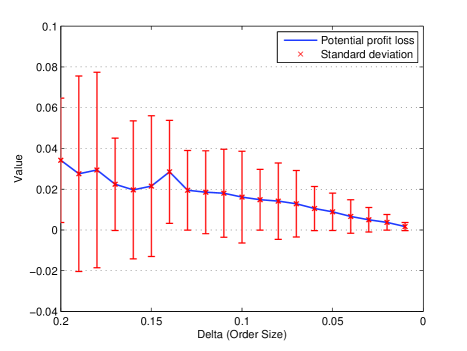

Therefore to establish equilibrium in these Glosten Milgrom models, we propose a weak formulation of equilibrium in Definition 2.11, which is motivated by the convergence of Glosten Milgrom equilibria to the Kyle equilibrium, as the order size diminishing and the trading intensities increasing to infinity, cf. [3] and [10]. In this weak formulation, the insider still trades to enforce the inconspicuous trading theorem, but the insider’s strategy may not be optimal. However, the insider can employ some feedback strategy so that the loss to her expected profit (compared to the optimal value) is small for small order size. Moreover this gap converges to zero when the order size vanishes. We call this weak formulation asymptotic Glosten Milgrom equilibrium and establish its existence in Theorem 2.12.

In the asymptotic Glosten Milgrom equilibrium, the insider’s strategy is constructed explicitly in Section 5, using a similar construction as in [10]. Using this strategy, the insider trades towards a middle level of an interval, driving the total demand process into this interval at the terminal date. This bridge behavior is widely observed in the aforementioned studies on insider trading. On the other hand, the insider’s strategy is of feedback form. Hence the insider can determine her trading intensity only using the current cumulative total demand. Moreover, as order size diminishes, the family of suboptimal strategies converge to the optimal strategy in Kyle model, cf. Theorem 2.13. In such an asymptotic Glosten Milgrom equilibrium, the insider loses some expected profit. The expression of this profit loss is quite interesting mathematically: it is the difference of two stochastic integrals with respect to (scaled) Poisson occupation time. As the order size vanishes, both integrals converge to the same stochastic integral with respect to Brownian local time, hence their difference vanishes.

The paper is organized as follows. Main results are presented in Section 2. The mismatch between insider’s optimal strategy and optimizers for the HJB equation is proved in Section 3. Then a family of suboptimal strategies are characterized and constructed in Sections 4 and 5. Finally the existence of asymptotic equilibrium is established in Section 6 and a technical result is proved in Appendix.

4. A suboptimal strategy

We start to prepare the proof of Theorem 2.12 from this section.

For the rest of the paper, , assumed in Theorem 2.12, is enforced unless stated otherwise.

In this section we are going to characterize a suboptimal strategy of feedback form in the Glosten Milgrom model with order size , such that the pricing rule (2.5) is rational. To simplify presentation, we will take , hence omit all superscript , throughout this section. Scaling all processes by gives the desired processes when the order size is .

The following standing assumption on distribution of will be enforced throughout this section:

Assumption 4.1.

There exists a strictly increasing sequence such that

-

i)

, , , and ;

-

ii)

, ;

-

iii)

The middle level of the interval is not an integer.

Item i) and ii) have already been assumed in Assumption 2.4. Item iii) is a technical assumption which facilities the construction of the suboptimal strategy. In the next section, when an arbitrary of distribution (1.1) is considered and the order size converges to zero, a sequence together with a sequence of random variables will be constructed, such that Assumption 4.1 is satisfied for each and converges to in law. To simplify notation, we denote by the largest integer smaller than and by the smallest integer larger than . Assumption 4.1 iii) implies and when both and are finite.

Let us now define a function , which relates to the expected profit of a suboptimal strategy and also dominates the value function . First the Markov property implies that is continuously differentiable in the time variable and satisfies

| (4.1) |

|

|

|

Define

| (4.2) |

|

|

|

where and can be considered as ask and bid pricing functions right before time . Since is increasing, is nonnegative and

| (4.3) |

|

|

|

Given as above, is extended to as follows:

| (4.4) |

|

|

|

|

| (4.5) |

|

|

|

|

for and . Since is finite, is bounded, hence takes finite value.

Proposition 4.2.

Let Assumption 4.1 hold. Suppose that the market maker chooses in (2.5) as the pricing rule. Then for any insider’s admissible strategy , with -intensities and , the associated expected profit function satisfies

| (4.6) |

|

|

|

where

| (4.7) |

|

|

|

Moreover (4.6) is an identity when the following conditions are satisfied:

-

i)

a.s. when ;

-

ii)

when , when , when , and when .

Before proving this result, let us derive equations that satisfies. The following result shows that satisfies (3.4) except when and , and satisfies the identity in either (3.1) or (3.2) depending on whether or .

Lemma 4.3.

The function satisfies the following equations: (Here is fixed and the dependence on is omitted in .)

| (4.8) |

|

|

|

|

| (4.9) |

|

|

|

|

| (4.10) |

|

|

|

|

| (4.11) |

|

|

|

|

| (4.12) |

|

|

|

|

Proof.

We will only verify these equations when . The remaining equations can be proved similarly. First (4.2) implies

|

|

|

Combining the previous identity with (4.4),

|

|

|

|

|

|

|

|

where (4.1) is used to obtain the second identity. This verifies (4.11). When , summing up (4.11) at and , and taking time derivative in (4.4), yield

|

|

|

|

|

|

|

|

|

which confirms (4.8) when . When , observe from (4.2), (4.4) and (4.5) that . Then

|

|

|

|

|

|

|

|

|

|

|

|

where the second identity follows from (4.11).

∎

Proof of Proposition 4.2.

Throughout the proof the is fixed and the dependence on is omitted in . Let and be positive and negative parts of respectively. Then and are -martingales. Applying Itô’s formula to , we obtain

| (4.13) |

|

|

|

where

|

|

|

|

|

|

|

|

Since (4.11) and (4.12) imply is either or , which are both bounded from below by and from above by , hence is an -martingale (cf. [7, Chapter I, T6]). On the right hand side of (4.13), splitting the second integral on , , and , splitting the fourth integral on , , and , utilizing , as well as different equations in Lemma 4.3 in different regions, we obtain

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rearranging the previous identity by putting the profit of to the left hand side, we obtain

| (4.14) |

|

|

|

where

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taking conditional expectation on both sides of (4.14), the left hand side is the expected profit , while, on the right hand side, both and are nonnegative (cf. Definition 2.1 i)). Therefore (4.6) is verified. To attain the identity in (4.6), we need i) a.s. so that a.s. follows from (4.3); ii) when , when , when , and when .

∎

Come back to the statement of Proposition 4.2. If the insider chooses a strategy such that both conditions in i) and ii) are satisfied, then the identity in (4.6) is attained, hence the expected profit of this strategy is . On the other hand, define via

| (4.15) |

|

|

|

The next result shows that dominates the value function , therefore is the upper bound of the potential loss of the expected profit. In Section 6, we will prove this potential loss converges to zero as . Therefore, when the order size is small, the insider losses little expected profit by employing a strategy satisfying Proposition 4.2 i) and ii).

Proposition 4.4.

Let Assumption 4.1 hold. Then , hence , on .

Proof.

Fix and omit it as the first argument of and throughout the proof. We first verify

| (4.16) |

|

|

|

| (4.17) |

|

|

|

for any . Indeed, when , (4.16) is exactly (4.11). When ,

|

|

|

where the second identity follows from and the third identity holds due to (4.12). When ,

|

|

|

where (4.12) is utilized again to obtain the second identity. Therefore (4.16) is confirmed for all cases. As for (4.17), (4.16) yields

|

|

|

On the other hand, we have from (4.4) and (4.5) that

|

|

|

Therefore (4.17) is confirmed after combining the previous two identities.

Now note that , moreover satisfies (4.16) and (4.17). The assertion follows from the same argument as in the high type of [10, Proposition 3.2].

∎

Having studied the insider’s optimization problem, let us turn to the market maker. Given , Definition 2.11 ii) requires the pricing rule to be rational. This leads to another constraint on .

Proposition 4.5.

If there exists an admissible strategy such that

-

i)

and are independent adapted Poisson processes with common intensity ;

-

ii)

, .

Then the pricing rule (2.5) is rational.

Proof.

For any ,

|

|

|

|

where the third identity holds since and have the same distribution, the fourth identity follows from ii) and (2.6).

∎

Remark 4.6.

If the insider places a buy (resp. sell) order when a noise buy (resp. sell) order arrives, Proposition 4.5 i) cannot be satisfied. Therefore in the asymptotic equilibrium the insider will not trade in the same direction as the noise traders, i.e., , so that the market maker can employ a rational pricing rule.

Concluding this section, we need to construct point processes which simultaneously satisfy conditions in Proposition 4.2 ii), Proposition 4.5 i) and ii). This construction is a natural extension of [10, Section 4], where is considered, and will be presented in the next section.

5. Construction of a point process bridge

In this section, we will construct point processes and on a probability space such that , due to Remark 4.6, and satisfy

-

i)

and are independent -adapted Poisson processes with common intensity ;

-

ii)

when , when ;

-

iii)

-a.s. for .

The construction is a natural extension of [10] where is considered. As in [10], and are constructed using two independent sequences of iid random variables and with uniform distribution on , moreover they are independent of and . The insider uses to randomly contribute either buy or sell orders, and uses to randomly cancel noise orders. Throughout this section Assumption 4.1 is enforced. Moreover, we set , hence suppress the superscript . Otherwise and can be scaled by to obtain the desired processes.

In the following construction, we will define a probability space on which takes the form

| (5.1) |

|

|

|

Here is the difference of two independent -adapted Poisson processes with intensity , such that for each .

Before constructing and satisfying desired properties, let us draw some intuition from the theory of filtration enlargement. Let us define be the canonical space where is -valued càdlàg functions, is a probability measure under which and are independent Poisson processes with intensities , is the minimal filtration generated by and satisfying the usual conditions, and . Let us denote by the filtration enlarged with a sequence of random variables .

In order to find the -intensities of and , we use a standard enlargement of filtration argument which can be found, e.g. in [18]. To this end, recall . Note that is strictly positive on . Moreover the Markov property of implies is continuously differentiable in the time variable and satisfies

| (5.2) |

|

|

|

Lemma 5.1.

The -intensities of and at are given by

|

|

|

respectively.

Proof.

We will only calculate the intensity for . The intensity of can be obtained similarly. All expectations are taken under throughout this proof. For , take an arbitrary and denote . The definition of and the -martingale property of imply

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

These computations for each imply that

|

|

|

defines a -martingale. Therefore the -intensity of follows from .

∎

To better understand intensities in the previous lemma, let us collect several properties for :

Lemma 5.2.

Let Assumption 4.1 hold. The following properties hold for each , :

-

i)

; in particular, .

-

ii)

is strictly increasing when and strictly decreasing when .

Here, when (resp. ), (resp. ).

Proof.

Recall that . Then

|

|

|

|

|

|

|

|

|

|

|

|

where the last identity holds since and have the same distribution. This verifies i). To prove ii), rewrite . Then the statement ii) follows from the fact that is strictly increasing when and strictly decreasing when .

∎

In what follows, given such that , on will be constructed so that -intensity of (resp. ) on match -intensities of (resp. ) on . Matching these intensities ensures that satisfies desired properties, cf. Proposition 5.5 below. Recall and . Subtracting from -intensities of (resp. ) in Lemma 5.1, we can read out intensities of (resp. ). Since property ii) at the beginning of this section implies that and are never positive at the same time. Therefore, when the intensity of is positive, the insider contributes buy orders with such intensity, otherwise the insider submits sell orders with the same intensity to cancel some noise buy orders from . Applying the same strategy to and utilizing Lemma 5.2, we read out -intensities for , :

Corollary 5.3.

Suppose that -intensities of and match -intensities of and respectively, moreover when and when . Then -intensities of , , have the following form on when :

|

|

|

|

|

|

|

|

In particular, , , satisfies the following properties:

-

i)

, , and , when ; , , and , when ;

-

ii)

, ;

-

iii)

.

As described in Corollary 5.3, when is fixed, the state space is divided into two domains and . As making excursions into these two domains, either or is active. In the following construction, we will focus on the domain and construct inductively jumps of until leaves . When excurses in , can be constructed similarly.

When is in , one of the goals of is to make sure that ends up in the interval . In order to achieve this goal, will add some jumps in addition to the jumps coming from . However this by itself will not be enough since also jumps downward due to . Thus, also needs to cancel some of downwards jumps from . Therefore consists of two components and , where complements jumps of and cancels some jumps of . Let us denote by the sequence of jump times for . These stopping times will be constructed inductively as follows. Given and , the next jump time happens at the minimum of the following three random times:

-

•

the next jump of ,

-

•

the next jump of ,

-

•

the next jump of which is not canceled by a jump of .

Here and need to be constructed so that their intensities and match the forms in Corollary 5.3. This goal is achieved by employing two independent sequences of iid random variables and with uniform distribution on . They are also independent of and . These two sequences will be used to generate a random variable and another sequence of Bernoulli random variables taking values in . Let and be jump time of and , respectively. Then, after , the next jump of is at , the next jump of is at , and the next jump of not canceled by jumps of is at . Then the next jump of is at

|

|

|

The construction of and using and is exactly the same as in [10, Section 4], only replacing therein by .

All aforementioned construction is performed in a filtrated probability space such that there exist with and two independent sequences of iid -measurable random variables and with uniform distribution on , moreover these two sequences are independent of both and . These requirements can be satisfied by extending (resp. ) to (resp. ). As for the filtration , we require that it is right continuous and complete under , moreover , as the difference of two independent Poisson processes with intensity , is adapted to . Therefore is independent of , since has independent increments. Finally, we also assume that is rich enough so that and discussed above are -stopping times.

An argument similar to [10, Lemma 4.3] yields:

Lemma 5.4.

Given point processes constructed above, the -intensities of and at are given by

|

|

|

respectively.

Now we are ready to verify that our construction is as desired.

Proposition 5.5.

The process as constructed above satisfies the following properties:

-

i)

a.s. for ;

-

ii)

and are independent Poisson processes with intensity with respect to the natural filtration of ;

-

iii)

is admissible in the sense of Definition 2.2.

Proof.

To verify that satisfies the desired properties, let us introduce an auxiliary process :

|

|

|

When , there is only almost surely finite number of positive (resp. negative) jumps of on when (resp. ). Therefore is finite on these when is fixed. When (resp. ), there is finite number of positive (resp. negative) jumps of on (resp. ) before . Hence on (resp. on ). This analysis implies on for each and . Therefore is well defined positive process with .

To prove i), we first show that is a positive -local martingale on . To this end, Itô formula yields that

|

|

|

Here

|

|

|

are all -local martingales. Define and . Consider the sequence of stopping time :

|

|

|

It follows from the definition of that each on is bounded away from zero uniformly in . This implies that is bounded, hence is an -martingale. The construction of yields . Therefore, is a positive -local martingale, hence also a supermartingale, on .

Define , which exists and is finite due to Doob’s supermartingale convergence theorem. This implies on . On the other hand, the construction of yields (resp. ) does not jump at time -a.s. when (resp. ). Therefore on . However by definition can only be either or . Hence on , for each , and the statement i) is confirmed.

As for the statement ii), we will prove that is an -adapted Poisson process. The similar argument can be applied to as well. In view of the -intensity of calculated in Lemma 5.4, one has that, for each ,

|

|

|

is an -martingale, where is the jump time of . We will show in the next paragraph that, when stopped at , is Poisson process in by showing that is an -martingale. (Here note that is an -stopping time.) This in turn will imply that is a Poisson process with intensity on where is the explosion time. Since Poisson process does not explode, this will further imply and, therefore, , -a.s..

We proceed by projecting the above martingale into to see that

|

|

|

is an -martingale when stopped at . Therefore, it remains to show that, for almost all , on ,

| (5.3) |

|

|

|

To this end, we will show, on ,

| (5.4) |

|

|

|

Then (5.3) follows since only for countably many times.

We have seen that is a strictly positive -martingale for each . Define a probability measure on via . It follows from Girsanov’s theorem that is a Poisson process when stopped at and with intensity under . Therefore, they are independent from under . Then, for , we obtain from the Bayes’s formula that

| (5.5) |

|

|

|

where the third identity follows from the aforementioned independence of and under along with the fact that does not change the probability of measurable events so that . As result, (5.4) follows from (5.5) after sending .

Since and are -Poisson processes and they do not jump simultaneously by their construction, they are then independent. To show the strategy constructed is admissible, it remains to show both and are finite for each . To this end, for each , , where and . Similar argument also implies . Finally, since , is bounded, Definition 2.2 iv) is verified using for each .

∎

6. Convergence

Collecting results from previous sections, we will prove Theorems 2.12 and 2.13 in this section. Let us first construct a sequence of random variables , each of which will be the fundamental value in the Glosten Milgrom model with order size .

Adding to the sequence of canonical spaces , defined at the beginning of Section 2.2, we introduce , where is the space of -valued càdlàg functions on with coordinate process , and is the Wiener measure. Denote by the Wiener measure under which a.s.. Let us now define a -valued sequence via

|

|

|

Using this sequence, one can define a pricing rule following the same recipe in (2.5):

| (6.1) |

|

|

|

|

|

|

As we will see later, this is exactly the pricing rule in the Kyle-Back equilibrium. Moreover, the sequence , associated to constructed below, converges to as , helping to verify Definition 2.11 i).

Lemma 6.1.

For any with distribution (1.1) where may not be finite, there exists a sequence of random variables , each of which takes value in , such that

-

i)

Assumption 4.1 is satisfied when therein is replaced by each ;

-

ii)

, as . Here represents the weak convergence of probability measures.

Proof.

For each , will be constructed by adjusting in (1.1) to some , . Starting from , choose , , and set . Moving on to , choose and set . Following this step, we can define inductively. When , we set . This construction gives a sequence of random variables taking values in such that

with , moreover each sequence satisfies Assumption 4.1.

It remains to show as . To this end, note that is either the quantile of the distribution of or above this quantile. When is chosen as , it follows from [12, Chapter 6, Theorem 5.4] that , in particular, . Therefore,

| (6.2) |

|

|

|

For any and , the previous convergence yields the existence of a sufficiently small , such that for any . Hence

|

|

|

|

|

|

|

|

where both convergence follow from and the fact that the distribution of is continuous. Since is arbitrarily chosen, utilizing the continuity of the distribution for again, we obtain from the previous two inequalities

|

|

|

Hence for each and .

∎

After is constructed, it follows from Sections 4 and 5 that a sequence of strategies exists, each of which satisfies conditions in Proposition 4.5. Hence in (2.5) is rational for each . It then remain to verify Definition 2.11 iii) to establish an asymptotic Glosten Milgrom equilibrium.

Before doing this, we prove Theorem 2.13 first.

Let us recall the Kyle-Back equilibrium. Following arguments in [16] and [2], the equilibrium pricing rule is given by (6.1) and the equilibrium demand satisfies the SDE

|

|

|

where is a -Brownian motion modeling the demand from noise traders. Hence the insider’s strategy in the Kyle-Back equilibrium is given by

|

|

|

Proof of Theorem 2.13.

As we have seen in Lemma 6.1, Assumption 4.1 is satisfied by each . It then follows from Proposition 5.5 i) and ii) that the distribution of on is the same as the distribution of conditioned on . Denote as the cumulative demand in Kyle Back equilibrium when the fundamental value is . The same argument as in [10, Lemma 5.4] yields

|

|

|

for each . It then follows

| (6.3) |

|

|

|

where the filtration is initially enlarged by .

Recall from (5.1) that , moreover . Combining (6.3) with , we conclude from [14, Proposition VI.1.23] that as .

∎

In the rest of the section, Definition 2.11 iii) is verified for strategies , which concludes the proof of Theorem 2.12. We have seen in Proposition 4.2 that the expected profit of the strategy , constructed in Section 5, satisfies

|

|

|

where

| (6.4) |

|

|

|

This expression for follows from changing the order size in (4.7) from to and utilizing from Corollary 5.3 i) and iii), from Remark 4.6, and the expectations are taken under . Here the largest integer multiple of smaller than and by the smallest integer multiple of larger than .

To prove Theorem 2.13, let us first show

| (6.5) |

|

|

|

In the rest development, we fix and denote .

Before presenting technical proofs for (6.5), let us first introduce a heuristic argument. First, since , (6.4) can be rewritten as

| (6.6) |

|

|

|

where

|

|

|

and is the scaled occupation time of at level . Here is, in its natural filtration, the difference of two independent Poisson and with jump size and intensity , cf. Proposition 5.5 ii). For the integrands in and , we expect that , where is a -Brownian motion. As for the integrators, we will show both and converge weakly to , which is the Brownian local time at level . Then the weak convergence of both integrands and integrators yield

|

|

|

Finally passing the previous convergence to conditional expectation, the two terms on the right hand side of (6.6) cancel each other in the limit.

To make this heuristic argument rigorous, let us first prepare several results.

Proposition 6.2.

On the family of filtration , generated by ,

|

|

|

Proof.

To simplify presentation, we will prove

| (6.7) |

|

|

|

The assertions with can be proved by replacing by . First, applying Itô’s formula and utilizing (4.1) yield

| (6.8) |

|

|

|

where and are compensated jump processes.

For on the right hand side, the same argument in Lemma 6.1 yields . As for the other two stochastic integrals, we will show that they converge weakly to

|

|

|

where and are two independent Brownian motion. These estimates then imply the right hand side of (6.8) converges weakly to

|

|

|

where is another Brownian motion. Since satisfies , the previous process has the same law as . Therefore (6.7) is confirmed.

To prove the aforementioned convergence of stochastic integrals, let us first derive the convergence of on . To this end, it follows from (2.5) that

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here is the difference of two independent Poisson random variables with common parameter under . Hence the fourth identity above follows from the probability distribution function of the Skellam distribution: , where is the modified Bessel function of the second kind and , cf. [20]. The convergence above is locally uniformly in according to [1, Theorem 2]. The last identity above follows from taking derivative to , cf. (6.1). Combining the previous locally uniform convergence of with the weak convergence in their natural filtration, we have from [5, Chapter 1, Theorem 5.5]:

|

|

|

As for the integrators in (6.8), and . Moreover, both and are predictable uniform tight (P-UT), since , for any , cf. [14, Chapter VI, Theorem 6.13 (iii)]. Then

combining weak convergence of both integrands and integrators, we obtain from [14, Chapter VI, Theorem 6.22] that

|

|

|

A similar weak convergence holds for the other stochastic integral in (6.8) as well. Therefore the claimed weak convergence of stochastic integrals on the right hand side of (6.8) is confirmed.

∎

Having studied the weak convergence of integrands in and , let us switch our attention to the integrators and .

Proposition 6.3.

On the family of filtration , for any ,

|

|

|

Proof.

For simplicity of presentation, we will prove

| (6.9) |

|

|

|

Since follows from (6.2), the statement of the proposition follows from replacing by (or by ) and by in the rest of the proof. To prove (6.9), applying Itô’s formula to yields

| (6.10) |

|

|

|

where the third identity follows from for any .

On the other hand, Tanaka formula for Brownian motion is

| (6.11) |

|

|

|

where when or when .

The convergence (6.9) is then confirmed by comparing both sides of (6.10) and (6.11). To this end, since and the absolute value is a continuous function, then follows from [5, Chapter 1, Theorem 5.1]. Then (6.9) is confirmed as soon as we prove the martingale term on the right hand side of (6.10) converges weakly to the martingale in (6.11), which we prove in the next result.

∎

Lemma 6.4.

Let and . Then on as .

Proof.

Define for and observe

|

|

|

It is clear that converges to locally uniformly on . On the other hand, and the law of is continuous. It then follows from [5, Chapter 1, Theorem 5.5] that . As for the integrators , as we have seen in the proof of Proposition 6.2, they converge weakly to and are P-UT. Then [14, Chapter VI, Theorem 6.22] implies

|

|

|

Similar argument yields

|

|

|

Here and are independent Brownian motion. Defining , we obtain from the previous two convergence that

|

|

|

∎

Propositions 6.2 and 6.3 combined yields the weak convergence of and . Moreover the sequence of local time in Proposition 6.3 also converge in expectation.

Corollary 6.5.

On the family of filtration , for any ,

|

|

|

Proof.

The statement follows from combining Propositions 6.2 and 6.3, and appealing to [14, Chapter VI, Theorem 6.22]. In order to apply the previous result, we need to show that both and are P-UT. This property will be verified for . The same argument works for as well. To this end, since is a nondecreasing process, is P-UT as soon as is tight, where is the variation of the process , cf. [14, Chapter VI, 6.6]. Note , since is nondecreasing. Then the tightness of is implied by Proposition 6.3.

∎

Corollary 6.6.

For any and ,

|

|

|

Proof.

For simplicity of presentation, we will prove . Then the statement of the corollary follows from replacing by or in the rest of the proof. Since the stochastic integrals in (6.10) are -martingales,

|

|

|

Since for any , is uniformly integrable. It then follows from [12, Appendix, Proposition 2.3] and that . Therefore the claim follows since cf. (6.11).

∎

Collecting previous results, the following result confirms (6.5).

Proposition 6.7.

For the strategies constructed in Section 5,

|

|

|

Proof.

Fix any . Corollary 6.5 implies that . Recall from Lemma 6.1. It then follows

|

|

|

On the other hand, since is finite, is bounded uniformly in . Then there exists constant such that , where the expectation of the upper bound converges, cf. Corollary 6.6. Therefore appealing to [12, Appendix Theorem 1.2] and utilizing from Lemma 6.1, we obtain

| (6.12) |

|

|

|

On the other hand, since , there exists a constant such that

|

|

|

where the convergence follows from applying Corollary 6.6 twice. For the difference of Brownian local time, Lévy’s result (cf. [15, Chapter 3, Theorem 6.17]) yields

|

|

|

where is a -Brownian motion and is utilized to obtain the third identity. Now the previous two estimates combined yield

| (6.13) |

|

|

|

Estimates in (6.12) and (6.13) also hold when is replaced by . These estimates then yield

|

|

|

Sending in the previous inequality, the first term on the right side vanishes in the limit, because both conditional expectations converge to the same limit, the limit superior of both second and third terms are less than . Now since is arbitrarily choose, sending yields . Similar argument leads to , which concludes the proof.

∎

Finally the proof of Theorem 2.12 is concluded.

Proof of Theorem 2.12.

It remains to verify Definition 2.11 iii).

Fix and throughout the proof. We have seen from Proposition 4.4 that . On the other hand, Proposition 4.2 yields . Therefore

|

|

|

Since is proved in Proposition 6.7, it suffices to show .

To this end, from the definition of ,

| (6.14) |

|

|

|

The second identity above follows from (4.12) which reads for when the order size is . Therefore is confirmed after sending in (6.14).

∎

Appendix A Viscosity solutions

Proposition 3.1 will be proved in this section. To simplify notation, and are fixed throughout this section. First let us recall the definition of (discontinuous) viscosity solution to (2.8). Given a locally bounded function , its upper-semicontinuous envelope and lower-semicontinuous envelope are defined as

| (A.1) |

|

|

|

Definition A.1.

Let be locally bounded.

-

i)

is a (discontinuous) viscosity subsolution of (2.8) if

|

|

|

for all , , and any function continuously differentiable in the second variable such that is a maximum point of .

-

ii)

is a (discontinuous) viscosity supersolution of (2.8) if

|

|

|

for all , , and any function continuously differentiable in the second variable such that is a minimum point of .

-

iii)

We say that is a (discontinuous) viscosity solution of (2.8) if it is both subsolution and supersolution.

For the insider’s optimization problem, let us recall the dynamic programming principle (cf. e.g. [19, Remark 3.3.3]). Given an admissible strategy , any valued stopping time , and the fundamental value , denote the associated profit by

|

|

|

|

|

|

|

|

where .

Then the dynamic programming principle reads:

-

DPP i)

For any admissible strategy and any -valued stopping time ,

|

|

|

-

DPP ii)

For any , there exists an admissible strategy such that for all -valued stopping time ,

|

|

|

The viscosity solution property of the value function follows from the dynamic programming principle and standard arguments in viscosity solutions, (see e.g. [19, Propositions 4.3.1 and 4.3.2].) Therefore Proposition 3.1 i) is verified.

Remark A.2.

The proof of DPP ii) utilizes the measurable selection theorem. To avoid this technical result, one could employ the weak dynamic programming principle in [6]. For the insider’s optimization problem, the weak dynamic programming principle reads:

-

WDPP i)

For any -valued stopping time ,

|

|

|

-

WDPP ii)

For any -valued stopping time and any upper-semicontinuous function on such that , then

|

|

|

Conditions A1, A2, and A3 from Assumption A in [6] are clearly satisfied in the current context. Condition A4 from Assumption A can be verified following the same argument in [6, Proposition 5.4]. Therefore aforementioned weak dynamic programming principle holds. Hence the value function is a viscosity solution to (2.8) following from arguments similar to [6, Section 5.2].

Now the proof of Proposition 3.1 ii) is presented. To prove , observe from the viscosity supersolution property of that , hence . On the other hand, for any integrable intensities , and , due to Definition 2.2 iv), one can show

is a continuous function in . As a supremum of a family of continuous function (cf. (2.7)), is then lower-semicontinuous in . Therefore , which implies for any , . It then follows from (3.1) and (3.2) that

| (A.2) |

|

|

|

Taking limit supremum in in the previous inequalities and utilizing the continuity of , it follows that the previous inequalities still hold when is replaced by , which means for any , . As a result, and have the reduced form (3.3) where is replaced by and , respectively. Hence Definition A.1 implies that is a viscosity solution of (3.4).

To prove Proposition 3.1 iii) and iv), let us first derive a comparison result for (3.4). The function has at most polynomial growth in its first variable if there exist and such that , for any .

Lemma A.3.

Assume that (resp. ) has at most polynomial growth and that it is upper-semicontinuous viscosity subsolution (resp. lower-semicontinuous supersolution) to (3.4). If , then in .

Assume this comparison result for a moment. Inequalities (A.2) and Assumption 2.5 combined imply that is of at most polynomial growth. Then Lemma A.3 and (A.1) combined yield , which implies the continuity of , hence Proposition 3.1 iii) is verified. On the other hand, one can prove is of at most polynomial growth and is another viscosity solution to (3.4). Then Lemma A.3 yields

|

|

|

which confirms Proposition 3.1 iv) via the Markov property of .

Proof of Lemma A.3.

For , define and . One can check (resp. ) is a viscosity subsolution (resp. supersolution) to

| (A.3) |

|

|

|

Since the comparison result for (A.3) implies the comparison result for (2.8), it suffices to consider (resp. ) as the viscosity subsolution (resp. supersolution) of (A.3).

Let and be constants such that on . Consider for some constants and . It follows

|

|

|

when . Choosing satisfying the previous inequality, then , for any , is a viscosity supersolution to (A.3).

Once we show , the statement of the lemma then follows after sending .

Since both and have at most linear growth

| (A.4) |

|

|

|

Replacing by , we can assume that (resp. ) is a viscosity subsolution (resp. supersolution) to (A.3) and

|

|

|

Then follows from the standard argument in viscosity solutions (cf. e.g. [19, Theorem 4.4.4]), which we briefly recall below.

Assume and the maximum is attained at . For any , define

|

|

|

The upper-semicontinuous function attains its maximum, denoted by , at . One can show, using the same argument as in [19, Theorem 4.4.4],

|

|

|

Here for sufficiently small . Now observe that

-

•

is a local maximum of ;

-

•

is a local minimum of .

Then the viscosity subsolution property of and the supersolution property of imply, respectively,

|

|

|

|

|

|

Taking difference of the previous inequalities yields

|

|

|

Sending on both sides, we obtain

|

|

|

which contradicts with .