Optimal Order Scheduling for Deterministic Liquidity Patterns

Abstract

We consider a broker who has to place a large order which consumes a sizable part of average daily trading volume. The broker’s aim is thus to minimize execution costs he incurs from the adverse impact of his trades on market prices. By contrast to the previous literature, see, e.g., Obizhaeva and Wang [7], Predoiu et al. [8], we allow the liquidity parameters of market depth and resilience to vary deterministically over the course of the trading period. The resulting singular optimal control problem is shown to be tractable by methods from convex analysis and, under minimal assumptions, we construct an explicit solution to the scheduling problem in terms of some concave envelope of the resilience adjusted market depth.

- Keywords:

-

Order scheduling, liquidity, convexification, singular control, convex analysis, envelopes, optimal order execution

1 Introduction

It is well-known that market liquidity exhibits deterministic intraday patterns; see, e.g., Chordia et al. [3] or Kempf and Mayston [6] for some empirical investigations. The academic literature on optimal order scheduling, however, mostly considers time-invariant specifications of market depth and resilience; cf. Obizhaeva and Wang [7], Alfonsi et al. [2], Predoiu et al. [8]. It thus becomes an issue how to account for time-varying specifications of these liquidity parameters when minimizing the execution costs of a trading schedule.

Using dynamic programming techniques and calculus of variations, this problem was addressed by Fruth et al. [5]. These authors show that under certain additional assumptions on these patterns there is a time-dependent level for the ratio of the number of orders still to be scheduled and the current market impact which signals when additional orders should be placed. Explicit solutions are provided for some special cases where the broker is continually issuing orders. The thesis [4] discusses conditions under which the order signal structure persists in case of stochastically varying liquidity parameters. Acevedo and Alfonsi [1] use backward induction arguments in discrete time and then pass to continuous time to compute optimal policies for nonlinear specifications of market impacts which are scaled by a time-dependent factor satisfying some strong regularity conditions. In their approach order schedules are allowed in principle to sell and buy along the way, regardless of the sign of the desired terminal position, and they proceed to identify conditions (deemed to ensure absence of market manipulation strategies) under which optimal schedules will not do so. Optimal schedules are then obtained only under a strong assumption linking resilience and market depth to each other along with their time derivatives.

By contrast to these approaches, we focus from the outset on pure buying or selling schedules and show how to reduce our optimization problem to a convex one. Hence, we do not have to impose conditions ensuring that orders are scheduled in certain ways at certain times. Instead, optimal order sizes and times are derived endogenously from the structure of market depth and resilience alone. This is made possible by the use of convex analytic first-order characterizations of optimality which we show are intimately related to the construction of generalized concave envelopes of a resilience-adjusted form of market depth. Under minimal assumptions, this allows us to characterize when optimal schedules exist and, if so, to construct them explicitly in terms of these envelopes. We illustrate our findings by recovering the analytic solution of Obizhaeva and Wang [7] and we show how optimal schedules depend on fluctuations in market depth and the level of resilience. It turns out that with time-varying market depth optimal order schedules do not have to consist of big initial and terminal trades with infinitesimal ones in between as typically found in the previous literature. We also find that lower resilience will let optimal schedules focus more on (local) maxima of market depth to the extent that with no resilience optimal schedules trade only when market depth is at its global maximum.

2 Setup

We consider a broker who has to place an order of a total number of shares of some stock. The broker knows that, due to limited liquidity of the stock, these orders will be executed at a mark-up over some reference stock price. This mark-up will depend on the broker’s past and present trades. For our specification of the mark-up we adopt the model proposed by Obizhaeva and Wang [7], see also Alfonsi et al. [2] and Predoiu et al. [8] for further motivation of this approach. By contrast to these papers, but in line with Fruth et al. [5] and Acevedo and Alfonsi [1], we will allow for the market’s liquidity characteristics of depth and resilience to be changing over time according to a deterministic pattern.

Specifically, given the broker’s cumulative purchases , a right-continuous increasing process with , the resulting mark-up evolves according to the dynamics

| (1) |

where describes the market’s depth at time and where measures its current resilience. Thus, in our model market impact is taken to be a linear function of order size, the slope at any one time being determined by the market depth. Moreover, market impact decays over time at the rate specified by the market’s resilience.

Assumption 2.1.

The resilience pattern is given by a strictly positive and locally Lebesgue-integrable function .

In the sequel we shall require furthermore

Assumption 2.2.

The pattern of market depth is nonnegative, not identically zero, bounded and upper-semicontinuous with .

The broker’s aim is to minimize the cumulative mark-up costs:

| (3) |

where and

with the notation .

Remark 2.3.

-

1.

Note that the -term in (3) accounts for the costs a non-infinitesimal order will incur due to its own mark-up effect; cf., e.g., Alfonsi et al. [2] or Predoiu et al. [8] who in addition show how costs functionals as in (3) emerge with stochastic reference prices evolving as martingales when the broker is risk-neutral. Note also that, since we let , a value of corresponds to an initial jump of size in the order schedule.

-

2.

To impose liquidation over a finite time horizon , one merely has to let the market depth for . Indeed, following the convention that in the integration (2), and thus the costs will then be infinite for any order schedule which increases after .

-

3.

Strict positivity of comes without loss of generality since if resilience vanishes almost everywhere on an interval there is no need to trade it off against market depth there and it is optimal to trade whatever amount is to be traded at the moment(s) when market depth attains its maximum over this period; cf. Proposition 4.1. Hence, could be assumed to take this maximum value at and the interval then be removed from consideration.

-

4.

The assumption of upper-semicontinuous market depth is necessary to rule out obvious counterexamples for existence of optimal schedules. For unbounded upper-semicontinuous one can easily show that , and so there is no optimal schedule. The -condition is needed to rule out the optimality of deferring part of the order indefinitely.

-

5.

Including a discount factor with locally Lebesgue-integrable discount rate in our mark-up costs is equivalent to considering and , instead of and above.

3 Main result and sketch of its proof

The main result of this paper is the solution to problem (3). It describes up to what mark-up level our broker should be willing to place orders at any point in time in order to minimize mark-up costs:

Theorem 3.1.

Then the optimal order schedule strategy is to place orders at any time if and while the resulting mark-up is no larger than , i.e.,

| (5) |

provided the constant in (5) can be chosen such that . This is the case if and only if the right side of (5) with remains bounded as . If this is not the case, we have and the problem does not have a solution.

The following results outline the proof of this theorem and may be of independent interest. Our first auxiliary result provides a mathematically more convenient formulation of problem (3):

Proposition 3.2.

As a result, with these choices of and , optimization problem (3) is equivalent to the following problem:

| (7) |

Proposition 3.3.

For upper-semicontinuous , the functional of (7) is (strictly) convex for right-continuous, increasing with if and only if is (strictly) positive and (strictly) decreasing.

Convexity can always be arranged for, though, in the following sense:

Theorem 3.4.

Remark 3.5.

For an increasing process we say that is a point of increase towards the right and write if for any . A similar convention applies to decreasing processes and points of decrease towards the right.

The next proposition describes the (necessary and sufficient) first-order conditions for optimality in problem (8). As one would expect, the broker has to strike a balance between the impact of current orders on future mark-up costs (as represented by the left side of (9) below) and the current prospect on future market conditions (as represented by the decreasing envelope of market depth over resilience on the right side of that equation):

Proposition 3.6.

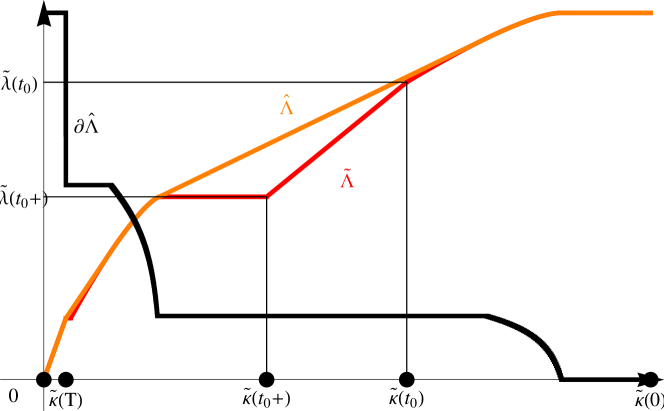

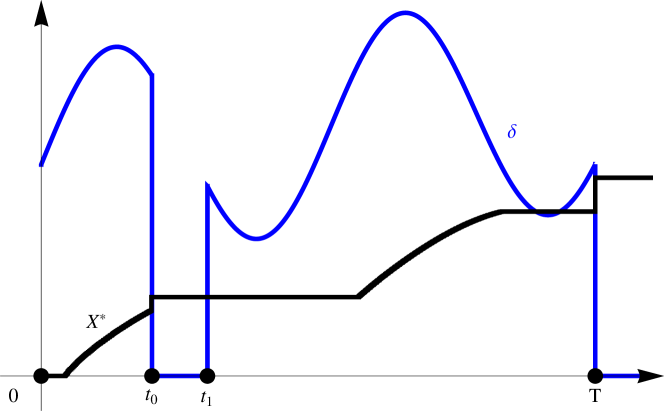

Constructing right-continuous increasing satisfying the first order conditions of (9) can be done by using a time-change and concave envelopes; see also Figure 3 below:

Theorem 3.7.

Then is a continuous increasing map on . Its concave envelope is absolutely continuous with a left-continuous, decreasing density . Moreover, letting , we have that for any and , , , with yields a right-continuous increasing process satisfying (9).

Combining the previous results, we shall obtain the following solution to our original problem (3) which also provides a characterization different from that outlined in Theorem 3.1; see also Figure 2 below:

Corollary 3.8.

Under the assumptions of Theorem 3.7 and using its notation we have the following dichotomy:

In case we can choose uniquely such that

| (10) |

increases from to ; this is an optimal order schedule for problem (3). In the special case where , and the minimal costs are given by .

If, by contrast, then we have and problem (3) does not have a solution.

4 Illustrations

Corollary 3.8 reduces the construction of optimal order schedules to the computation of a concave envelope. This can often be done in closed form, see, e.g., our treatment in Section 4.1 of the constant parameter case from Obizhaeva and Wang [7]. Alternatively, one can resort to highly efficient numerical methods from discrete geometry to come up with solutions to essentially arbitrary liquidity patterns as we illustrate in Section 4.2.

4.1 Constant market depth and resilience

Let us first show how to recover the solution of Obizhaeva and Wang [7] who consider a time horizon and constant market depth and constant market resilience , . In this case we have

Hence,

Thus, is its own concave envelope, i.e., , and its left-continuous density is

Obviously is square integrable (and hence the problem is well-posed) if and only if . In that case, we compute

and for any the order schedule from (10),

with

is optimal for the total volume it trades. In particular, if , we find that

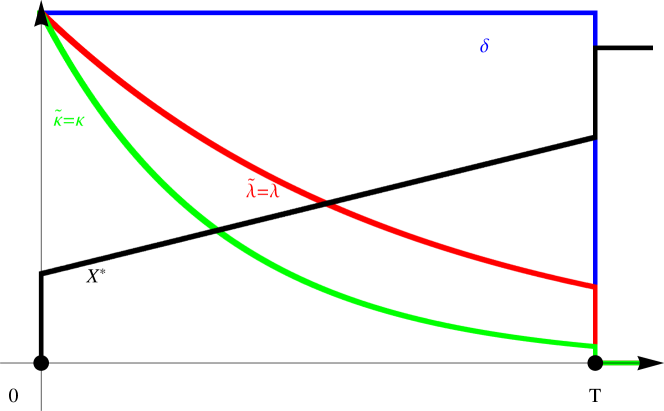

So choosing yields with . We therefore recover the result of Obizhaeva and Wang [7]: If , i.e., if there have been no previous orders, it is optimal to place orders of size at both and , and to place orders at the constant rate in between; cf. Figure 1.

4.2 Time-varying market depth

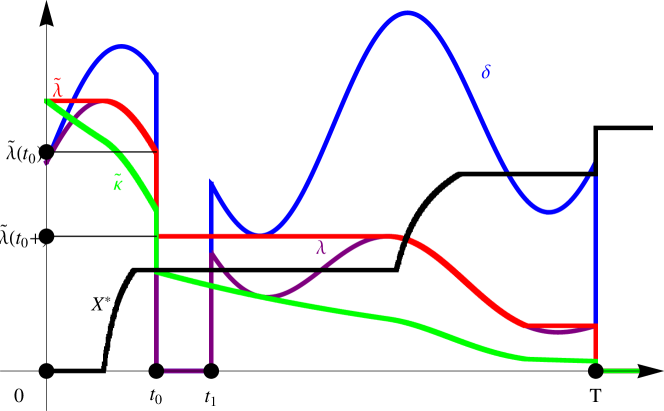

We next illustrate that the above order placement strategy of [7] is indeed strongly dependent on constant market depth and resilience. Figure 2 below exhibits how a fluctuating market depth affects the timing of the optimal order placement as provided by Corollary 3.8. Note that we include a shut-down period for the market over the time period when market depth vanishes. The corresponding concepts introduced by Theorem 3.7 are illustrated in Figure 3 below.

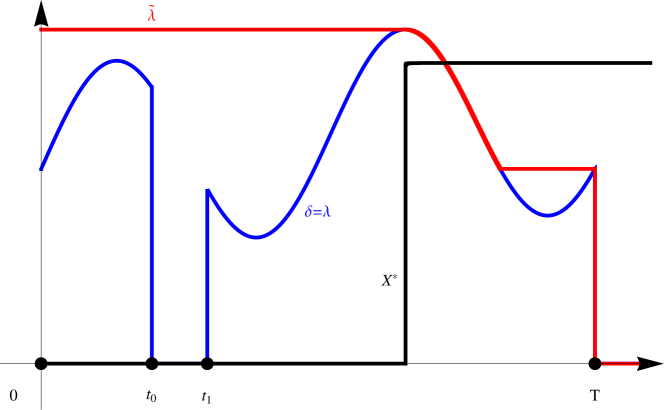

If we decrease the resilience parameter to , i.e., we assume permament price impact of the broker’s orders, the focus on peaks of market depth sharpens to the extent that eventually only one huge order is placed when market depth reaches its global maximum; see Figure 4.

Proposition 4.1.

Proof.

When , and so , . Thus,

with equality for all with . ∎

Conversely, with high resilience, orders tend to be spread out more around local maxima of market depth as illustrated by Figure 5. Figures 2 and 5 also show that the precise moments when it is optimal to issue orders would be hard to guess in advance. Hence, an approach via classical calculus of variations as in Fruth et al. [5] or via the methods of Acevedo and Alfonsi [1] seems infeasible in these general cases.

5 Proofs

Proof of Proposition 3.2 We first observe that for the mapping in (6) defines an increasing right-continuous with . Because , is -integrable and thus finite on . Hence, is finite on this set as well and we conclude . It follows by elementary calculus that and, thus, as desired.

Conversely, for , is -integrable. Since is continuous this implies that is locally -integrable and so given by (6) is right-continuous and increasing with . By the same reasoning as above this implies as well as . ∎

We next characterize when problem (7) is convex:

Proof of Proposition 3.3 If is upper semi-continuous and decreasing, it is also left-continuous and we can use Fubini’s theorem to write

for any right-continuous increasing with . Hence, is obviously convex in such with strict convexity holding true on its domain for strictly decreasing .

Conversely, consider for the function . Then

is convex in if and only if , with strict inequalities corresponding to strict convexity. ∎

In order to prepare the proof of Theorem 3.4 let us recall that for any increasing we let

denote the collection of all points of increase towards the right. For a decreasing we let . In either case we let denote the support of the measure , i.e., the smallest closed set whose complement has vanishing -measure.

Lemma 5.1.

For upper-semicontinuous, bounded , we have that is left-continuous and decreasing with

| (11) |

Moreover, we have the partition

| (12) |

where , , are the disjoint open intervals forming and where and .

Proof.

The main tool in the proof of Theorem 3.4 is the following

Lemma 5.2.

Under the conditions of Theorem 3.4, we can find for any increasing, right-continuous an increasing, right-continuous such that and

-

(i)

,

-

(ii)

,

-

(iii)

.

Proof.

We let , , denote the disjoint intervals of Lemma 5.1 forming the complement of and we will use , to denote their respective boundaries. For the one interval whose left bound is we now redefine, for simplicity of notation, provided that ; if, by contrast, this is just the negative half line we can and shall remove it from consideration in the sequel. Similarly, if for some , it follows from Assumption 2.2 that on which thus can be disregarded as well.

Observe then that

| (13) |

by upper semi-continuity of and our choice when to include in and when not.

Assertion (i) is readily checked using the partition given by (12). For assertion (ii) it suffices to observe that all , , are contained in .

In order to prove assertion (iii), we first note that is an immediate consequence of (ii) and (11). To establish we decompose this difference into its contributions from the different parts in the partition given by (12), each of which will be shown to be nonnegative.

From we collect

which is nonnegative because and because for by construction.

From , , we get the contribution

for which we note that its -part can be written as

Hence, using (13) again, we obtain with if and otherwise that

where the second estimate holds since because of (ii). Since is increasing by assumption, we have

and thus

as remained to be shown. ∎

With the preceding policy improvement lemma it is now easy to give the

Proof of Theorem 3.4 By Lemma 5.2 and using its notation, we can find for any a such that

As a result, . Moreover, if attains the latter infimum we can apply Lemma 5.2 to and instead of and to obtain another optimal which satisfies in addition . By Lemma 5.1, the latter set is contained in and thus this is also contained in and optimal for (7) as well. ∎

Let us next derive the first-order conditions of the convexified problem (8) in the

Proof of Proposition 3.6 Recalling that , we obtain by Fubini’s theorem

| (14) |

For necessity, we observe that for any and we have

which, upon division by and letting , yields that also solves the linear problem

| (15) |

Equivalently, due to Fubini’s theorem, is a solution to the problem:

| (16) |

As a consequence, can solve (15) only if exclusively at those times when attains its infimum over . Hence, this infimum is actually a minimum and is thus strictly positive. Denoting it by shows the necessity of (9).

For sufficiency we use (14) again to deduce that for :

The last term is nonnegative if solves (15), which due to the equivalence of (15) and (16) amounts to our first-order condition (9). ∎

The construction of solutions to the first order conditions given in Theorem 3.7 can now be established:

Proof of Theorem 3.7 is continuous on since so is because of the strict monotonicity of and, thus, of on . is increasing because, along with , also is decreasing in . Absolute continuity of the concave envelope follows from the continuity of .

The monotonicity of is obvious from the monotonicity of and . For its right-continuity note that by left-continuity of and its definition at . Hence, our assertion amounts to where and . If there is nothing to show. In case , for and, thus, is linear with slope on this interval. As a consequence, is linear there as well and, thus, by left-continuity of . Hence, it suffices to show that there is no downward jump in at . If there was such a jump then, by the properties of concave envelopes, necessarily and . Hence, for we would have

where the first estimate is due to the monotonicity of , the second is the envelope property of , the third follows from its concavity and the last is a consequence of the just derived properties of and at . We would thus have equality everywhere in the above estimates and in particular . This is a contradiction to the presumed downward jump of at .

To verify that satisfies the first oder condition (9), let us first argue that

Indeed, the first estimate is immediate from the definition of . The first identity follows by the change-of-time formula for Lebesgue-Stieltjes-integrals: just observe that by Assumption 2.2 and that is constant on those intervals contained in which jumps across because is linear on such intervals. The second identity follows from the absolute continuity of and because , again by Assumption 2.2. The second estimate holds because by definition of concave envelopes and for the last identity we note that if and otherwise. Finally, we observe that can only happen when has increased above which ensures equality in the first of the above estimates. Equality in the second holds for such as well because if increases at time , must decrease at , and so coincides with its concave envelope at this point. ∎

We are now in a position to wrap up and give the

Proof of Corollary 3.8 Let , and define , , .

As a first step we check that

| (17) |

In fact, we will show that for such . If , this is obvious. So let us suppose that and assume that there is such that for . In that case, is constant on the interval . Because , the density must decrease at and so the envelope coincides with at this point. Concavity and monotonicity of then imply, however, that around , a contradiction to its decrease there.

Let us next prove that if and only if is -integrable. To see this we argue that with we have

Indeed, the first identity is just (17) and the definition of and . The second identity holds because at points where changes; the third identity follows from an application of Fubini’s theorem after writing and the last equality holds since is left-continuous and constant over intervals that jumps across.

So if , then , , is real-valued, right-continuous and increasing in . Moreover, is increasing in with and as . In fact, for (where ) and, for , where . Hence, is in fact continuous and strictly increasing from 0 to in and we thus obtain existence and uniqueness of with . Hence, we can conclude that is contained in (and that thus the corresponding of (6) is contained in ) once we have established that . For this it suffices to observe that and that by the same arguments as in our previous calculation of we have

We next show that and are optimal, respectively, for problem (3) and problems (7) and (8). In fact, due to Theorem 3.7, satisfies the first order condition (9) and, by Proposition 3.6, is thus optimal for the convexified problem (8) provided that is also contained in . To see that even and to deduce the optimality of also for problem (7) (and thus, by Proposition 3.2, optimality of for the original problem (3)) it suffices by Theorem 3.4 to check which, in fact, is immediate from (17).

The formula for the minimal costs when is an immediate consequence of our above computations for . It thus remains to show that our optimization problems do not have a solution if . To see this note that in this case there is, for any sufficiently large , a schedule which is optimal for instead of when . This follows from our earlier results once we note that the corresponding concave envelope always has a bounded density because , and thus a solution to this finite time horizon problem exists provided its market depth does not vanish identically. This latter condition clearly holds for when is chosen sufficiently large, for otherwise after some time which would rule out the presumed explosion of at . Note that we can futhermore choose such that coincides with at these points. This ensures that on and hence as .

Now because

where denotes the cost of any when , we obtain

where we used our formula for the optimal costs . Because of our special choice of , the second term vanishes for any fixed as . The first term vanishes for because has to be unbounded for to increase to as . Indeed: . ∎

References

- Acevedo and Alfonsi [2012] José Infante Acevedo and Aurélien Alfonsi. Optimal execution and price manipulations in time-varying limit order books. Preprint, 2012. URL http://arxiv.org/abs/1204.2736v1.

- Alfonsi et al. [2010] Aurélien Alfonsi, Antje Fruth, and Alexander Schied. Optimal execution strategies in limit order books with general shape functions. Quant. Finance, 10(2):143–157, 2010. ISSN 1469-7688. doi: 10.1080/14697680802595700. URL http://dx.doi.org/10.1080/14697680802595700.

- Chordia et al. [2001] Tarun Chordia, Richard Roll, and Avanidhar Subrahmanyam. Market liquidity and trading activity. Journal of Finance, 56:501–530, 2001.

- Fruth [2011] Antje Fruth. Optimal Order Execution with Stochastic Liquidity. PhD thesis, TU Berlin, 2011. URL http://opus.kobv.de/tuberlin/volltexte/2011/3174/.

- Fruth et al. [2011] Antje Fruth, Torsten Schöneborn, and Michael Urusov. Optimal trade execution and price manipulation in order books with time-varying liquidity. to appear in Mathematical Finance, 2011. URL http://homepage.alice.de/murusov/papers/11fsu-opt_exec_pm_determ.pdf.

- Kempf and Mayston [2008] A. Kempf and D. Mayston. Commonalities in the liquidity of a limit order book. Journal of Financial Research, 31:25–40, 2008.

- Obizhaeva and Wang [2005] Ana Obizhaeva and Jiang Wang. Optimal trading strategy and supply/demand dynamics. Preprint, 2005. URL http://papers.ssrn.com/sol3/papers.cfm?abstract_id=686168.

- Predoiu et al. [2011] Silviu Predoiu, Gennady Shaikhet, and Steven Shreve. Optimal execution in a general one-sided limit-order book. SIAM J. Financial Math., 2:183–212, 2011. ISSN 1945-497X. doi: 10.1137/10078534X. URL http://dx.doi.org/10.1137/10078534X.