CAN TESTS FOR JUMPS BE VIEWED AS TESTS FOR CLUSTERS?

ABSTRACT

We investigate the utility in employing asymptotic results related to a clustering criterion to the problem of testing for the presence of jumps in financial models. We consider the Jump Diffusion model for option pricing and demonstrate how the testing problem can be reduced to the problem of testing for the presence of clusters in the increments data. The overarching premise behind the proposed approach is in the isolation of the increments with considerably larger mean pertaining to the jumps from the ones which arise from the diffusion component. Empirical verification is provided via simulations and the test is applied to financial datasets.

KEYWORDS: Clustering; Jump diffusions; Merton model; Test for jumps.

1 INTRODUCTION

It is well-known that for an asset pricing model to circumvent arbitrage opportunities, asset prices must follow semimartingales (see Delbaen and Schachermayer (1994) and Harrison and Pliska (1981)). In this context, jump diffusion models are popular in modeling asset prices (log asset prices, usually) in financial applications pioneered by the fundamental paper by Merton (1976). These models are characterized by two components: a continuous component and a jump component. As described in Ait-Sahalia and Jacod (2012), the continuous part of the model is present to capture the normal risk of the asset which is hedgeable whereas the jumps component can capture the default risk or news-related events. In fact, it is nowadays commonplace in applications involving high-frequency data to break up the jumps component into a large and small jump component in an effort to capture price moves which are large on the time-scale of few seconds or minutes but generally not significant on a daily scale. The focus of this article, however, will be on diffusion models with a consolidated jump component. The problem considered in this article is the following: Suppose one observes a time series of asset prices or returns over a finite length of time ; based on these observations, is it possible to ascertain whether the process that generated the observations comprises a jump component? The problem is of obvious importance when prediction is the primary concern. The ramifications, while constructing a model for asset pricing, of not incorporating a jump component when the underlying process which generates the data indeed does possess one, can be quite severe. The problem has received appreciable attention over the years based on several techniques; we refer to a few articles from an exhaustive list: Ait-Sahalia (2002), Ait-Sahalia and Jacod (2009), Carr and Wu (2003), Barndoff-Nielsen and Shephard (2003), Podolskij and Ziggel (2010) and Lee and Mykland (2008).

The problem can be viewed as a deconstruction problem wherein the observed series of returns are deconstructed back to their continuous and jump components. This taxonomy between the continuous and the jump components of the purported model assists us in seeking ‘typical’ behavior of statistics based on observations under the presence and absence of the jump components. Intuitively, by constructing a test statistic which would eventually isolate the jump component under the presence of jumps in the underlying process, a suitable asymptotic hypothesis test can be developed. To elaborate, for simplicity, suppose that jumps are all positive valued and the number of jumps are finite in . Based on a sampling frequency, suppose we consider the increments (difference between successive observations); we would then expect to see, primarily, two groups of data: one centered around a value which is considerably larger than the other corresponding, respectively, to the jumps and the non-jumps. Such behavior is the motivation behind the test statistics based on truncated power variations employed in Ait-Sahalia (2002) and Ait-Sahalia and Jacod (2009). In this article, we approach the problem of constructing a suitable test statistic through a different route: we ask if the isolation of the jumps can be viewed as a model-based clustering behavior wherein the distributional properties of the model, for large samples, leads to the formation of two clusters with cluster centers far apart. Under this setup, this article ought to be viewed as a first step towards providing a general answer applicable to a broad class of semimartingale models; while the alternative hypothesis of ‘jumps’ encompasses a large class of models, we will focus primarily on the Merton-type model wherein the jump component is driven by a Poisson process. The Merton model (Merton (1976)) was the first model for option pricing which allowed for discontinuities in the underlying process by incorporating i.i.d. normal jump sizes with a Poisson process driving the jump process. While in recent times, very general classes of semimartingales have been employed as models for pricing, the Merton model, nonetheless, is a popular model owing to its simplicity and analytical tractability. In Kou (2002) and Kou and Wang (2004), the authors make a persuasive case for the Merton-type models exhorting their use in practice by using double exponential jump sizes. The double exponential jump diffusion model was calibrated and applied to market data in Cont and Tankov (2003) and results were shown to be promising. Generalizations along the lines of having separate volatility and drift process albeit advantageous from a modeling perspective are not conducive for purposes of analytical tractability and interpretability. These considerations point towards use the jump diffusion model as the archetypal model in this article.

In a recent article, motivated by the criterion function in Hartigan (1978), Bharath et al. (2013a) and Bharath et al. (2013b) proposed a clustering criterion for the optimal bifurcation of a set of observations into two clusters; their approach was based on determining the point at which the data would split into clusters and this point corresponded to the zero of their criterion function. They considered sample-based versions of the clustering criterion and its zero, and proved limit theorems. We will motivate the use of clustering methods in constructing a test for jumps and consequently, employ their clustering criterion in our attempt to provide a test for jumps. In section 2 we describe the jump diffusion model and demonstrate how the testing for jumps problem can be viewed as a test for the presence of clusters. In section 3 we detail the clustering criterion proposed in Bharath et al. (2013b) and review the relevant results from their paper. In section 4, we set up the hypothesis test and construct the requisite test statistic. Then, in section 5 we proffer results from simulations examining the performance of the test in comparison to the test proposed by Ait-Sahalia and Jacod (2009) and also investigate the power of our test against particular alternatives; we then apply our test on two datasets pertaining to S&P 500 Index returns across time windows Jan 96 - Dec 2000 and Jan 06 - Dec 10. The two time windows correspond, respectively, to periods of contrasting market behavior and it is seen that our test captures this phenomenon. Finally in section 6, we summarize some of the salient features about our approach, comment on extensions and note some of its shortcomings. Proofs of results are relegated to the Appendix.

2 JUMP DIFFUSION MODEL

We will assume that the log of the asset price follows an one dimensional Itô semimartingale process on a fixed complete probability space , where is a right continuous filtration and is the data generating measure, given by

| (2.1) |

where the scalar represents the drift component of the process, , its spot volatility, is an adapted standard Brownian motion and process is a pure jump process. For simplicity, we shall assume that is equal to 1. We will assume further that model produces observations that are collected at discrete sampling intervals implying a regular sampling interval in ; we will hence suppose that we observe at discrete times where . Our intention is to study the model as as . Based on a discretely observed trajectory or path of , our objective is to assign the observed path to two complementary sets:

| (2.2) |

If we choose , we are implicitly stating that we are choosing with a.s. continuous paths. For technical reasons and also as a natural way to assess if the process has jumped in , it is common to consider the increments

| (2.3) |

If the jump process is assumed to be a Levy process, then by the independent increments property of and , are i.i.d. random variables. The trick usually used is to construct a statistic based on , independent of the model parameters, and any additional parameters for , in such a way that, as , the statistic’s behavior would be dominated by the jumps component if does indeed jump in . For instance, in Ait-Sahalia and Jacod (2012), realized power variations of suitably truncated, of the form

where is a deterministic sequence of truncation levels which tend to 0 as , were considered; typically is taken to be a function of with some other constants not depending on . The idea is that by a judicious choice of , one can eliminate all the increments which correspond to the continuous part of the model to end up with a value for completely dominated by the jump component. The power plays an important role in the behavior of : for , the contributions from the jump component dominates the value of whereas for , the continuous part dominates. Therefore, a finite value for for a certain choice of , or some functional thereof, can be used to construct a test for jumps. This seemingly simple but powerful idea is exploited in a different setting in this article.

In contrast to the approach adopted by Ait-Sahalia and Jacod (2012), it can be intuited that such a forced separation of the increments can be performed by suitably choosing a truncation level too. Our approach is characterized, in a certain sense, by the determination of truncation level , which splits the observations into two clusters: one pertaining to the continuous part and the other to the jump part. Our test statistic will be based on the truncation level at which the two groups clearly bifurcate. To elucidate, suppose we assume that the process is a finite-activity jump process like a Compound Poisson. To aid intuition, suppose additionally that the jump-sizes are all positive. Let us consider the complementary statistics:

where is the empirical distribution function of the . The two statistics correspond to the average of the observations greater and lesser than the truncation level. For an ‘optimal’ choice of a truncation level , one would be able to observe a clear separation between the large values of (jumps) and the smaller values (continuous part); the optimal level would have to be determined by comparing all possible averages of the two groups. In view of this, we ask the question ‘Can the optimal truncation level be determined for the model with no jumps. i.e. the model comprising just the Brownian motion with drift?’. An answer in the affirmative would point towards the usage of an estimate of the optimal truncation level as a candidate for a test statistic for the test for jumps.

The preceding discussion, from a statistician’s perspective at least, would suggest to the use of a mixture model as suitable probabilistic mechanism as an explanation for observed increments —in particular, we are interested in a two component mixture model with a component each for the continuous and the jump parts. Clustering methods have been widely used to analyze mixture models and perform statistical inference. As a first step towards developing a test for a large class of semimartingale models with a Brownian component, in this article we consider the Merton model or its close cousins and demonstrate how clustering methods can be used in constructing a test statistic for jumps. We believe that a good understanding of the simple yet fairly general and popular Merton model would be a step in the right direction towards developing tests for jumps using clustering criteria.

2.1 Merton model

Under the setup of the model in (2.1), the Merton model for assets pricing , is given by,

| (2.4) |

where is a Poisson jump process with intensity with jumps sizes represented by i.i.d. random variables . It is assumed that , and are independent and all parameters are assumed to be unknown. For the purposes of demonstrating the validity our method, we consider a special case of (2.4) when all the jumps are of unknown constant size . While this condition is perhaps not realistic in applications, as a first step towards understanding the utility of clustering to the testing problem, it is reasonable. As a justification, consider the two sets in (2). Indeed, if our test rejects the null hypothesis of no jumps, we assign the observed path of to , a very general class and is independent of our assumption on the nature of the jumps. Obviously, the general nature of the alternative hypothesis might not guarantee good power against a very specific subset of processes with jumps. Nevertheless, if the primary motivation is to just test for the presence or absence of jumps based on discrete observations, the level of any proposed test is independent of the assumed structure of the nature of the jump component. The test proposed, therefore, in a certain sense, would be an omnibus test. The circumscription of our approach in this article to the case of constant positive size jumps is hence reasonable bearing in mind the preceding discussion. Additionally, when jumps are of size , the model in (2.4) reduces to

| (2.5) |

We consider the increments

| (2.6) |

the discretized version of , which, as a consequence of the independent increments property of the Brownian motion and the Poisson process, are i.i.d. with density

| (2.7) |

where , , and represents the density of a normal random variable with mean and standard deviation . The density is an infinite mixture of Gaussian distributions with the mixing proportions obtained from a Poisson distribution with rate . We thus have

Since as and from the orderliness of the Poisson process, goes to as ; the probability of observing two or more jumps in one increment goes to zero as . This implies that we can reduce the infinite mixture density to a two component mixture density since for large , and , we have

Consequently, when is large, for our purposes, we can assume that the increments , are i.i.d. from density

| (2.8) |

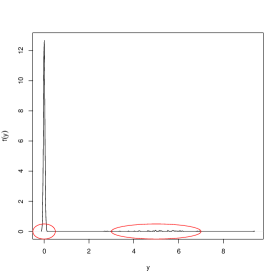

For large , since , and are very close to zero, we would expect to see most of the observations concentrated around 0 and few clustered around . The unknown , in a certain sense, is related to the intensity of the Poisson process typified by the observation that as increases the jumps concentrate around their expected value. Therefore, for large sample sizes, intuitively we would expect the density in (2.8) to almost have point mass at zero and very little mass or ; Figure 1 illustrates this behavior.

Starting from observations from density from (2.7) we have made the transition to observations from (2.8). The relevant density is a two-component Gaussian mixture wherein the component variances and the mixing proportions are going down to zero and one as sample size increases. The problem of testing for jumps based on a discretely observed process can hence be reduced to a statistical problem of testing if the given data is indeed a random sample obtained from a mixture of two normal populations wherein one of the mixing proportions and component variances tend to zero as sample size approaches infinity. This type of mixture is different from classical mixture-models since the weights in our model tend to zero and one with increasing sample size; existing clustering methods for testing in mixture-models are rendered inapplicable in our setup.

3 A SUITABLE CLUSTERING CRITERION

Bearing in mind the density in (2.8), the objective is to construct a test statistic by estimating the optimal truncation level which would bifurcate the observations corresponding to the continuous and the jump parts; furthermore, the truncation level ought to be independent of the parameters since we do not wish to estimate them thereby compromising on the power. As a consequence, we consider the nonparametric clustering criterion proposed in Bharath et al. (2013b). Their criterion is based on determining the point at which data is broken up into clusters—this is precisely what is required for our test for jumps. In this section, we review some preliminaries of the clustering criterion proposed with the view of constructing a test statistic that can be used to test for the presence of clusters in a set of observations; in other words, we would construct a test for the presence of jumps.

While it is tempting to recast the general setup in Bharath et al. (2013b) in terms of our specific problem of data from a normal mixture, it is important to understand why their criterion function can be useful at all in determining the truncation level. We thus adopt the general setup used in their article and comment, wherever necessary, on the adaptation of their results to the testing problem. It is to be noted, however, that their results in their existing form are not amenable for direct application in our setting. This point will be elucidated in the subsequent sections; we are hence tasked with suitably modifying their results to tailor our needs.

Suppose are i.i.d. random variables with cumulative distribution function . Denote by the quantile function associated with . We make the following assumptions:

- .

-

is the unique inverse for and is absolutely continuous with respect to the Lebesgue measure with density .

- .

-

and .

- .

-

is twice continuously differentiable at any .

Remark 1.

Note that assumptions and are satisfied by the distribution function of a normal random variable; assumption will be clarified soon. This is relevant since the test for presence of jumps has been reduced to the test for the presence of clusters in a sample from a normal population(s).

3.1 Empirical Cross-over Function

The cross-over function, for , is defined as

| (3.1) |

A point which solves is referred to as the split point.

Remark 2.

The cross-over function is a function of the derivative of

referred to as the split function in Hartigan (1978). The function can be viewed as the between cluster sums of squares and the point at which is maximized (with respect to ) coincides with the zero . Hartigan (1978) considered sample versions of and and investigated their asymptotic behavior. A test statistic for test for bimodality was constructed using the sample version of .

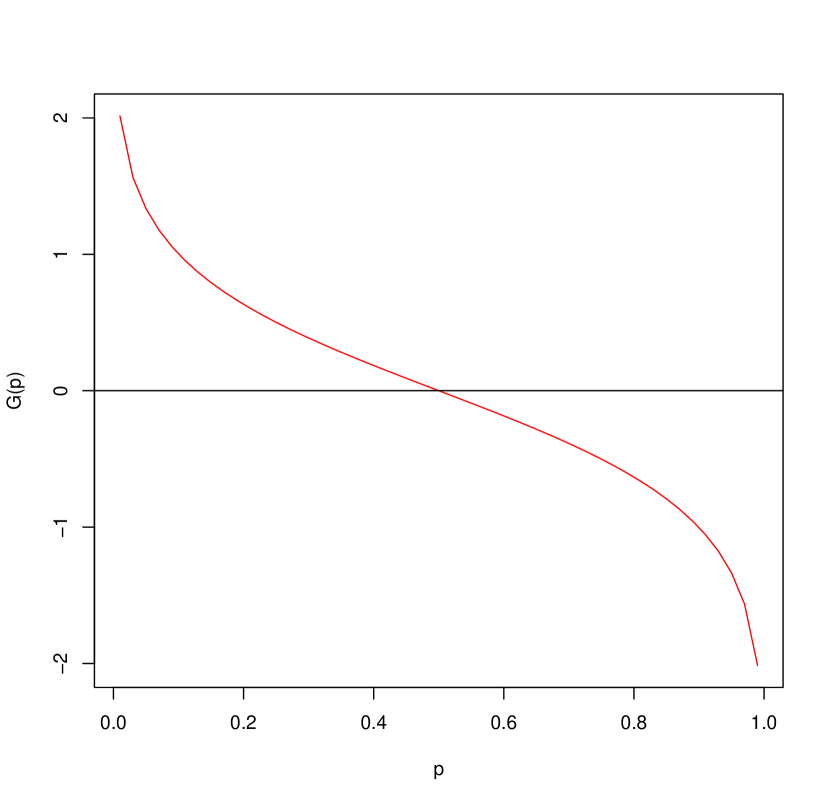

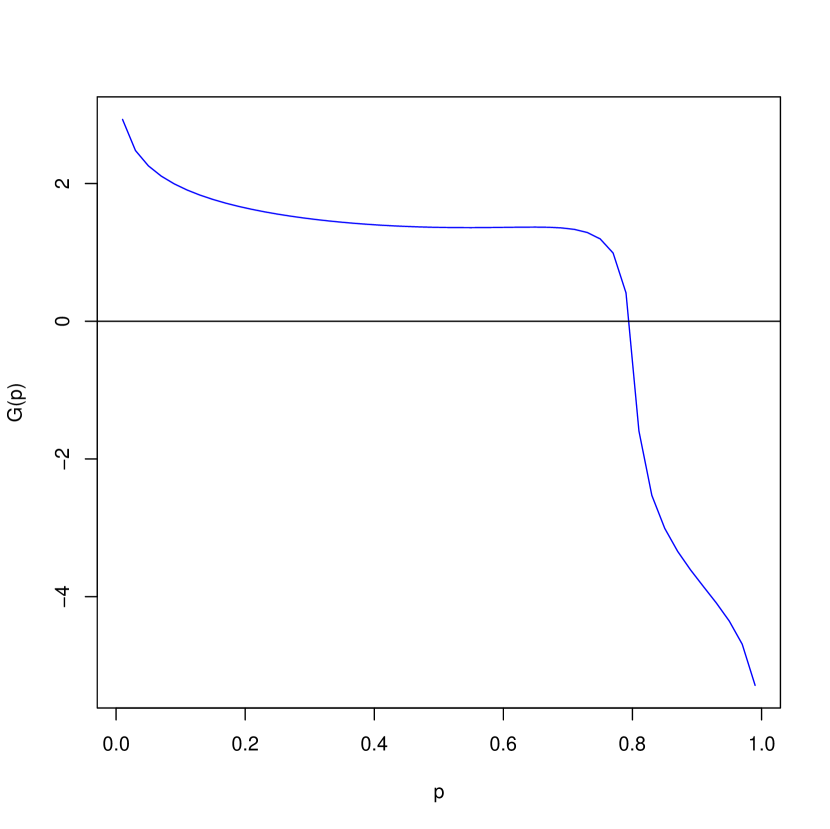

Let us briefly examine the behavior of the cross-over function : It starts positive, crosses zero and assumes negative values; the point of crossing is of chief interest and its location in can be used as an indication of the nature of the underlying distribution: symmetric, unimodal or not unimodal.

In particular, it is easy to see that for the standard normal density is the split point (Figure 2(a)). What is important is that in the case of a mixture of two normals with same variance but differing means, the split point is not 0.5. This can be clearly inferred from the density in Figure 2(b) where the split point is approximately 0.8. These considerations suggest using the split point as an indicator for the presence or absence of clusters. One may question the behavior of the and the location of the split point for an entire parametric class of normals; fortunately, by virtue of the definition of , the split point is invariant to scaling and translations of the standard normal density. This fact is very convenient in our setup of testing for jumps as we can then disregard the estimation of the parameters , and in our attempt to construct a suitable test statistic.

Since the cross-over function appears to be a good candidate for use in the testing problem, we now review its empirical counterpart proposed in Bharath et al. (2013b). Suppose are the order statistics corresponding to the i.i.d. observations . The Empirical Cross-over Function (ECF) is then defined as

| (3.2) |

for and

| (3.3) |

for , where .

Remark 3.

Observe that for a fixed

where represents the smallest integer not less than . For a fixed , the sums shown above are trimmed sums. More precisely, since and , they represent the case of heavy trimming. We will employ the two notations interchangeably when there is no confusion.

The random quantity , represents the empirical version of the cross-over function and determines the split point for the given data. The intuition behind the sample criterion function is simple: is based on the distances between the sample quantiles and and the means of the observations lesser and greater than them respectively. Then, by checking the distances for all possible indices , one hopes to ascertain the particular at which the distances match up, viz., the function becomes . Based on that particular index , one is then able to infer if the sample perhaps was obtained from a population with ‘more than one mean’, and estimate the split point. Notice the striking similarity between the rationale employed here and the one proposed while considering the statistics for for determining the optimal truncation level . Indeed, the statistics are based on truncated sums as opposed to the trimmed sums used in the definition of . This difference is not of great significance; Bharath (2012) employed an alternative definition of using truncated sums and obtained very similar asymptotic results.

It is noted in Bharath et al. (2013a) that the ECF is an L-statistic with irregular weights and hence not amenable for direct application of existing asymptotic results for L-statistics. Observe that

This simple observation captures the typical behavior of the empirical cross-over function. As is the case with , it starts positive and then at some point crosses the zero line. The index at which this change occurs determines the datum at which the split occurs. In Bharath et al. (2013a), it is shown that is a consistent estimator of for each and a functional CLT was also proved for for with ; it was shown that the limit stochastic process was Gaussian.

3.2 Empirical split point

Our interest, however, is in the split point . On the scale of the random variables, the optimal truncation level is . Since this quantity is unknown, we would like to estimate it using the data; this leads us to the empirical split point defined in Bharath et al. (2013b). There is a technical issue here: in Bharath et al. (2013b) the empirical split point is defined on where and all the asymptotic results were proved on . In our application, the jumps or the clusters, for large , are close to the boundary near 1. In order to use the results in Bharath et al. (2013b), we would first need to amend their definition of the empirical split point to when the underlying distribution is normal and then ensure that their results are still valid in our setting. We shall demonstrate that this is possible and we therefore redefine the empirical split point as

Notice that we are defining the empirical split point to be the index immediately after which becomes negative. Implicitly, the assumption here is the upon crossing the line , can only perhaps crossover again within a small neighborhood of true split point ; such as assumption is required while proving asymptotic properties of . In general, such an assumption is difficult to verify and conditions on the distribution function which guarantee such a behavior is not clear; this was noted in Bharath et al. (2013b) and they hence restricted their results to with . We extend their results for using the following lemma:

Lemma 1.

Suppose is the standard normal distribution function. Then, there exists a such that, as ,

Remark 4.

Lemma 1 is imperative for the employment of and in the problem of testing for jumps since the cluster corresponding to the jumps can, in principle, be formed very close to ; we do not have the luxury of restricting ourselves to a closed sub-interval of . Since the ECF tends to as we are assured that would do crossover the line far away from the true split . Thus , in conjunction with , can be used as a tool to develop a test for the presence of clusters by examining the asymptotic behavior of under the null hypothesis of no-jumps. Indeed, the fact that our sample is from a normal distribution assists us in the proof. However, it is pertinent to note that the result of Lemma 1 is applicable under a broader setup for distribution functions which have tail behavior similar to the normal.

Remark 5.

From a practical perspective, what is important is that is invariant to scaling and translations of the data. Notice that if for constants and and ,

and we define to be the ECF based on , then,

and therefore, and cross-over at the same point; this shows that is invariant to scaling and translations. This is of primary importance to us while constructing the test for jumps since it frees us from having to estimate the drift and the volatility coefficients and provides the rationale behind assumption .

How accurate is the estimate of the split point ? The following two theorems, which are similar to their counterparts in Bharath et al. (2013b), shed light on this issue. We essentially extend their results for in with to all . The proofs for the theorems carry over with minimal change from theirs assisted by Lemma 1. We hence just state them under the our modified setup and omit the proofs.

Theorem 1.

Assume hold. Suppose that has a unique solution, . Then for any

as .

The empirical split point is shown to be a consistent estimator of the theoretical split point; however, for constructing a test, we need more. We require the nature of the deviation of from and a Central Limit Theorem (CLT) is proved in Bharath et al. (2013b). Before stating their theorem, define

Note that,

| (3.4) |

Theorem 2.

Assume hold. Suppose that has a unique solution, , and . Then, as ,

Theorem 2, theoretically, provides us with a test statistic suitable to for the presence of clusters or jumps. However, the asymptotic variance involves population quantities and which are unknown. We will provide a consistent estimator for the asymptotic variance which can then be used to develop the test.

Proposition 1.

Let

where

and

Also, let

Then, as ,

4 TEST FOR JUMPS

For the i.i.d. increments from density (2.8), it appears that the order statistic corresponds to the estimate of the optimal truncation level which would separate the increments into the continuous and the jumps clusters. However, it is not immediately clear from the asymptotic results for clustering, why would be a good choice bearing in mind the rather unusual nature of the density in (2.8): a mixture distribution with some of the parameters tending to zero with increasing sample size. The key question to be addressed is the following: why is it the case that when is large and there is a clear separation between two clusters—one corresponding to the Brownian component around 0 and another around — the Empirical Cross-over Function (ECF) captures it? We will prove a theorem showing why the ECF is useful in our setting; Lemma 1 is key in this regard and ensures that the jumps, which are observed close to , can be captured accurately. We first provide an informal explanation as to why the theorem is reasonable.

Recall that for large , we can assume that the density of the i.i.d. (to be accurate, they form a triangular array) increments is

where , , and . Using the results from Section 3, suppose we were to use the ECF and determine the empirical split point . Let , the index after which the ECF turns negative. Note that for the density , for large , there is a separation of approximately between the adjacent order statistics, and . Since the variances of the clusters are tending to zero together, intuition tells us that should be approximately . It would then make it necessary for the ECF to have crossed 0 between the two clusters. Before stating the theorem, we need a couple of Lemmas first.

Lemma 2.

For fixed , suppose are i.i.d. random variables satisfying assumptions and with for . Then as ,

Lemma 3.

Suppose are i.i.d continuous random variables satisfying assumptions and with support over with ; here is fixed and does not change with . Then, as ,

This now leads us to the theorem which proves why the ECF captures the clusters.

Theorem 3.

Let denote the total random number of observations in the first cluster and suppose that . Then,

-

1.

for , with probability tending to one,

-

2.

for , with probability tending to one,

Once we have satisfied ourselves of the fact that for large , the ECF crosses over zero between the two clusters, we can proceed to construct the test for jumps based on . The central limit theorem for in theorem 2 provides us with the test for the presence of jumps based on the following observation: suppose we have a sample from the mixture density given in 2.8; if there are no clusters amongst the observations, viz., no jumps in the process, then we do not have a mixture density and instead can regard the observations as arising from a normal density with mean and variance . In that case the true split point solving is , owing to the symmetry of the normal density. Our test for jumps or for the presence of clusters should then ascertain, based on the observations, if the empirical split point is ‘far’ away from —if this is the case, then the test signifies the presence of clusters or jumps. More generally, we are interested in testing if the observed sample path falls in or defined in (2).

Our test can formally be stated as follows: Define

where is as defined in Proposition 1. To choose which of the complementary sets and the discretely observed path of on at times falls in, we employ the following decision rule:

where is the standard normal percentile. Our test statistic is free of and and we therefore are not required to estimate them. In view of this, it becomes evident that our test for jumps based on is asymptotically of level . It is pertinent to note that for large and free from . That is, with probability , even for large , we would, in our sample, not have any observations from the second component of the mixture distribution. The implication of this is that no matter how large our sample is, any test constructed, can never attain power equal to . This is so, since we are observing the process for it might be the case that might not have had any jumps in despite comprising of a jump component.

5 SIMULATIONS AND EMPIRICAL FINDINGS

In this section, we investigate the effectiveness of our test via simulations and its performance on two datasets pertaining to S&P 500 Index. Comparison is also made with the test proposed by Ait-Sahalia and Jacod (2009), hereafter referred to as ST test. All computations and results presented in this section have been performed using the estimator for the asymptotic variance of .

5.1 Simulations

5.1.1 Accuracy under

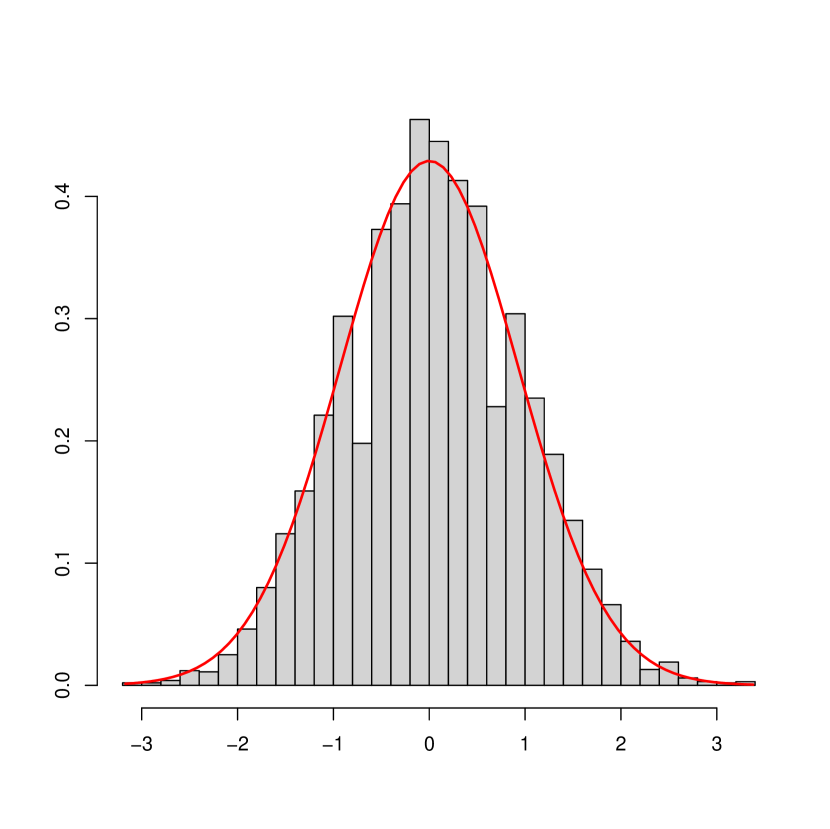

We first use the theoretical results of in order to set up a simulation of the rejection rate of our test under the null hypothesis of no jumps or in choosing the set . We simulate increments at sampling rate from a model containing just the Brownian motion with constant drift and spot volatility ; this is done since our test and the ST test are independent of the parameters and remain unaffected by their choice. The test statistic from the ST test in Ait-Sahalia and Jacod (2009) given by equation (12) in their paper is computed with , . The asymptotic level of our test is verified using the CLT for and is compared to the performance of the ST test; it is found that our test requires fewer number of observations, as compared to the ST test, to attain level . This should not be surprising since the ST test is applicable under a very general setup for a large class of semimartingales. Figure 3 depicts the empirical distribution of the non-standardized and standardized test statistic . The result from Theorem 2 appears to be verified by Monte-Carlo simulations.

| Mean value of | Rejection rate in simulations | |||

|---|---|---|---|---|

| Asymptotic | Simulations | Our test | ST | |

| 500 | 0.5 | 0.484 | ||

| 1000 | 0.5 | 0.491 | ||

| 5000 | 0.5 | 0.503 | ||

| 10000 | 0.5 | 0.499 | ||

| 25000 | 0.5 | 0.500 | ||

| 50000 | 0.5 | 0.501 | ||

5.1.2 Power against specific alternatives

In order to examine the power of our test against particular alternatives, we consider two models which differ in their jump components. We consider the model

| (5.1) |

where is a Compound Poisson process with jump sizes given by Double Exponential jumps with location and scale , proposed in Kou (2002) and Kou and Wang (2004); we also consider the same model with corresponding to normal jumps with means , and variances , respectively. Finally, we consider a model with a the jump component driven by a Bernoulli process with success probability . This model was proposed in Trippi et al. (1992) and stands in direct comparison to the Merton model with constant jump sizes and the resulting density in (2.8). Results pertaining to the simulations are in Table 2.

| Compound Poisson process | Bernoulli process | |||

|---|---|---|---|---|

| jumps | jumps | jumps | jumps | |

| 100 | 0.036 | 0.081 | 0.291 | |

| 1000 | 0.048 | 0.043 | 0.216 | |

| 5000 | 0.044 | 0.053 | 0.187 | |

| 10000 | 0.049 | 0.047 | 0.204 | |

| 25000 | 0.052 | 0.050 | 0.166 | |

The results in Table 2 further corroborate our assumption of the constant jump size in Section 2. Our claim was on the insensitivity of our clustering-based test in practice on the actual nature of the jump sizes as long as they were large jumps; the power of our test against the models with Compound Poisson jump component and Normal or Double exponential jumps is quite good. The Bernoulli jump component is an interesting case in the sense that its compatibility with the density in (2.8) offers a natural setting for the employment of our test. What is clear also is the ordinary performance of our test in the case of small jumps as with the normal jumps with mean 1.5. Our test appears to find it hard to separate out the small jumps since their means is quite close to the Brownian drift .

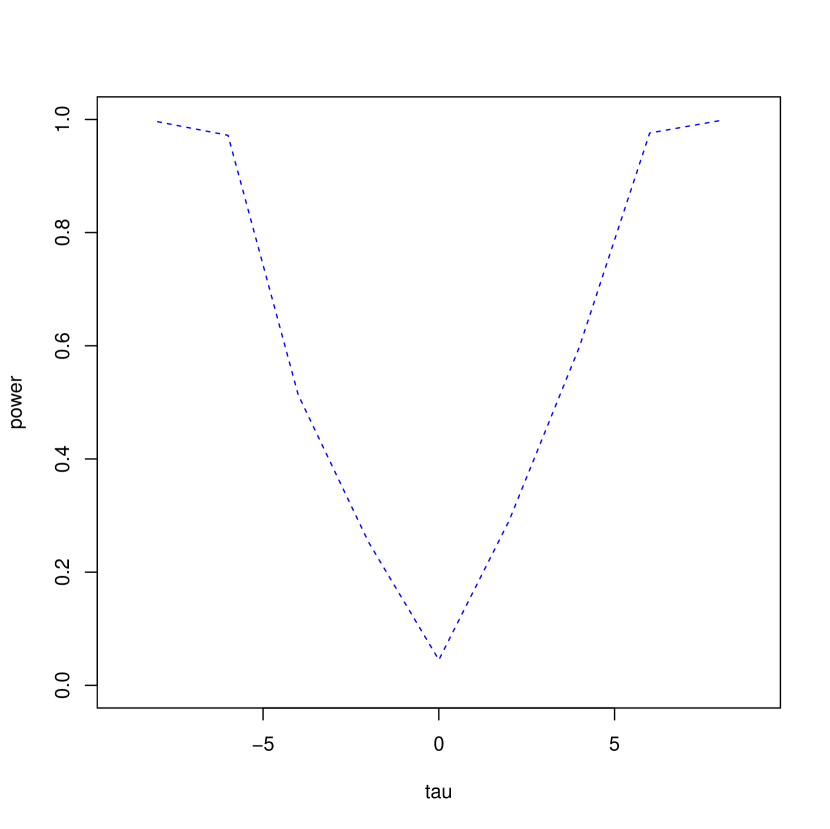

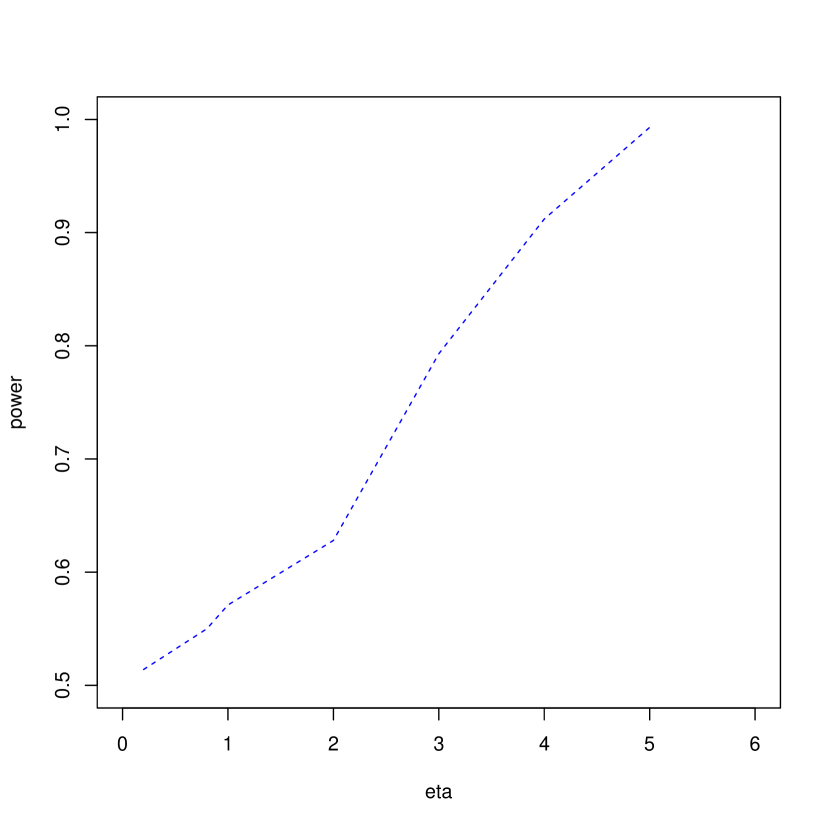

We now examine the power curves obtained for the model in (5.1) with being a Compound Poisson process with rate and are i.i.d. normal random variables with mean and variance . Power curves by varying and are provided in Figure 4. The fact that our test is essentially a ‘story-of-means’ is captured in the power functions. Our test, based on the clustering criterion, has good power against models with very large or very small jumps as opposed to models which have small jumps which are comparable to the ‘jumps’ due to the diffusion; this behavior is captured by the fact that when the size of the jumps is similar to the drift, we are required to have high variability in the jump sizes to detect departures from the model with no jumps.

5.2 Empirical study

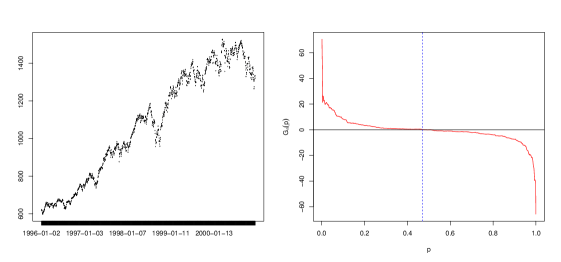

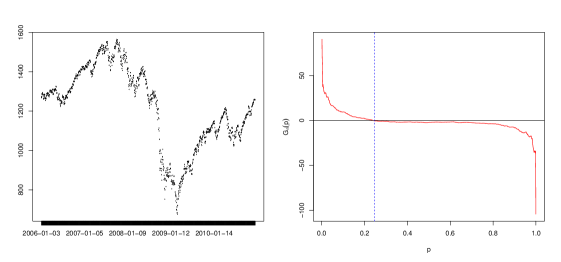

We conduct the test for two interesting datasets pertaining to daily S&P 500 Index returns for 500 leading companies which are publicly held on either NYSE or NASDAQ and covers 75% of U.S equities. Data was obtained from the Federal Reserve Bank of St. Louis Database (research.stlouisfed.org/fred2/series/SP500/downloaddata) which is publicly available. The first dataset is on index values from Jan 1 1996 to Dec 31 2000 collected daily, wherein there was no discernable jumps in the market; the second dataset is on the index values from Jan 1 2006 to Dec 31 2010, a time window which coincides with the market crash in late 2008.

For the first data shown in Figure 5, the ECF crosses over zero very close to 0.5 with A 95% confidence interval for the true split point is and since is included in this interval, our test would fail to reject the null hypothesis of no jumps and choose the set . This appears reasonable upon viewing the raw index values shown on the left panel of Figure 5. In contrast, for the second dataset the ECF crosses over far away from 0.5 with with a corresponding 95% confidence interval being not containing 0.5; this results appears to be consistent with the raw index data which comprises a clear jump downwards corresponding to the market crash in late 2008. In fact, the ST test is in agreement with our test on both the datasets; we omit details in the interests of brevity.

6 CONCLUDING REMARKS

We have proposed a novel test for the presence of jumps in discretely observed jump diffusion models used in financial applications, based on the simple idea of clustering of observations. The ascendant premise is on the bifurcations of increments of the observed continuous time stochastic process model into those which correspond to the continuous component of the model and those which belong to jumps. While existing methods have concentrated on techniques based on power variations, we have developed our test based on identifying the optimal level of truncation which provides the necessary bifurcation.

In the case of the popular Merton model for option pricing and its variants, it is shown that the problem of testing for jumps can be reduced to an equivalent one of testing for the presence of clusters in the increments data. Consequently, the asymptotic results from the clustering criterion proposed in Bharath et al. (2013b) are used in developing the test. It is to be noted, however, that their results, in existing form, are not directly applicable to the testing problem; one of the contributions in this article is in the modification of the results in Bharath et al. (2013b) to suit the requirements of the problem of testing for jumps.

While the article primarily illustrates the idea of clustering on a special case of the jump diffusion models wherein the drift and instantaneous volatility coefficients are constants, its contribution ought to be viewed as a first step towards investigating the utility in viewing the testing for jumps problem as a testing for clusters problem; indeed, literature is rife with statistical methodologies for handling clustering problems. More importantly, as argued in Kou (2002) and Kou and Wang (2004), the jump diffusion model is popular amongst practitioners for its analytical tractability and ease of interpretation. In this regard, the results presented here are potentially useful as a quick, perhaps exploratory, check for the presence of jumps; indeed, a simple -means algorithm would suffice. Notwithstanding the absence of generality in the assumed model, it can be noted that the power of the proposed test against various alternatives models which are jump diffusions is promising. The next step would be to consider a more general class of semimartingale models—not unlike the one is Ait-Sahalia and Jacod (2009)—and examine the utility of the clustering framework under such a setup. Much work remains to be done in this direction.

7 APPENDIX

7.1 Proof of Proposition 1:

Let us first look at the estimator which is used to estimate , given by

We will describe in detail how is consistent for ; the argument to show the consistency of for follows along similar lines once it is noted (following some cumbersome algebra) that is described completely by the following terms: , , , , ,

We will hence omit the relevant details in that setting.

Since converges in probability to and using the asymptotic normality of the heavily trimmed sums proved by Stigler (1973), we have

Note that

is the only other quantity in the expression for which requires some care with respect to consistent estimation. By assumption , we have, by definition,

For , if are order statistics corresponding to random variables, then

where is the uniform spacing . Since we are dealing with central order statistics, i.e. , it clear that

as , whenever the density is finite and continuous at the quantile ; assumption guarantees the fulfillment of these sufficient conditions. In order to obtain , note that , for a fixed , if is the empirical distribution function corresponding to based on ,

Furthermore, since is consistent for , is consistent for (see p. 308 of van der Vaart (2000) for instance). Therefore, a natural estimate of of the inverse of the density at the quantile would be

| (7.1) |

Based on the preceding discussion, we can claim that . Combining these, with a repeated continuous mapping argument, it is easy to note that converges in probability to . Putting together these individual pieces along with a continuous mapping argument with the function, it is easy to see note that converges in probability to .

7.2 Proof of Lemma 1:

Pick any . Now

By assumption and the Law of Large Numbers for i.i.d. random variables the first term converges to in probability. Since is consistent for , as , . As a consequence, the proof of the Lemma would be complete if we can show that

is bounded in probability for arbitrarily close to 1.

Let . Now, observe that

where are the spacings. By the Cauchy-Schwartz inequality,

and hence

It is now required that the sum of the squares of the spacings be bounded in probability be of order , in which the expression to the right of the preceding inequality would be of order ; choosing a close to 1 then completes the proof. This, however, is readily available from Theorem 3 in Hall (1984), sufficient conditions for which are easily satisfied by the normal distribution. This concludes the proof.

7.3 Proof of Lemma 2:

Proof.

Denote , and with ,. From theorem of Arnold (1985), substituting for ,

By Hölder’s inequality, the RHS is

for , since and . ∎

7.4 Proof of Lemma 3:

Proof.

Fix . Choose such that

Since , we have that

and hence by Borel-Cantelli’s lemma,

Therefore, there exists such that

For all , we have

∎

7.5 Proof of Theorem 3:

We start first with which says that is non-positive after it crosses the first cluster comprised of points. For ,

Note that the Poisson jump component ensures that the number of observations in the second cluster, is finite a.s; it is hence the case that as . If we can now show that events and tend to zero for an arbitrary , then the probability of their intersection would go to zero. This would then imply a clear separation of between the two clusters and prove that with high probability for . The probability of both the events tend to 0 owing to Lemmas 2 and 3 respectively. This concludes the proof of part 1. We now turn our attention to part 2. For , we have

A similar argument using Lemmas 2 and 3 as in part 1 concludes the proof.

References

- Ait-Sahalia (2002) Y Ait-Sahalia. Telling from Discrete Data Whether the Underlying Continuous Time Model is a Diffusion . Journal of Finance, 57:2075–2112, 2002.

- Ait-Sahalia and Jacod (2009) Y Ait-Sahalia and Jean Jacod. Testing for Jumps in a Discretely Observed Process. Annals of Statistics, 37:184–222, 2009.

- Ait-Sahalia and Jacod (2012) Y Ait-Sahalia and Jean Jacod. Analyzing the Spectrum of Asset Returns: Jump and Volatility Components in High Frequency Data. Journal of Economic Literature, 50:1007–1050, 2012.

- Arnold (1985) Barry C Arnold. -Norm Bounds on the Expectation of the Maximum of a Possibly Dependent Sample . Journal of Multivariate Analysis, 17:316–332, 1985.

- Barndoff-Nielsen and Shephard (2003) O E Barndoff-Nielsen and N Shephard. Econometrics of Testing for Jumps. Journal of Financial Econometrics, 4:1–30, 2003.

- Bharath (2012) K Bharath. Asymptotics of Clustering Criteria for Smooth Distributions. Ph.D. Dissertation, University of Connecticut, 2012.

- Bharath et al. (2013a) K Bharath, V Pozdnyakov, and D K Dey. Asymptotics of Empirical Cross-over Function. Annals of Institute of Statistical Mathematics (to appear), 2013a.

- Bharath et al. (2013b) K Bharath, V Pozdnyakov, and D K Dey. Asymptotics of a Clustering Criterion for Smooth Distributions. Electronic Journal of Statistics, 7:1078–1093, 2013b.

- Carr and Wu (2003) P Carr and L Wu. What Type of Process Underlies Options? A Simple Robust Test. Journal of Finance, 58:2581–2610, 2003.

- Cont and Tankov (2003) R Cont and P Tankov. Calibration of Jump-diffusion Option Pricing Models. Journal of Computational Finance, 7:1–49, 2003.

- Delbaen and Schachermayer (1994) F Delbaen and W Schachermayer. A General Version of the Fundamental Theorem of Asset Pricing. Mathematische Annalen, 300:463–520, 1994.

- Hall (1984) P Hall. Limit Theorems for Sums of General Functions of -spacings. Mathematical Proceedings of the Cambridge Philosophical Society, 96:517–532, 1984.

- Harrison and Pliska (1981) M J Harrison and S R Pliska. Martingales and Stochastic Integrals in the Theory of Continuous Trading. Stochastic Processes and Their Applications, 11:215–260, 1981.

- Hartigan (1978) J Hartigan. Asymptotic Distributions for Clustering Criteria. Annals of Statistics, 6:117–131, 1978.

- Kou (2002) S G Kou. A Jump-Diffusion Model for Option Pricing. Management Science, 48:1086–1101, 2002.

- Kou and Wang (2004) S G Kou and H Wang. Option Pricing Under a Double Exponential Jump Diffusion Model. Management Science, 50:1178–1192, 2004.

- Lee and Mykland (2008) S S Lee and P A Mykland. Jumps in Financial Markets: A New Nonparametric Test and Jump Dynamics. The Review of Financial Studies, 21:2535–2563, 2008.

- Merton (1976) R C Merton. Option Pricing When Underlying Stock Returns Are Discontinuous. Journal of Financial Economics, 3:125–144, 1976.

- Podolskij and Ziggel (2010) M Podolskij and D Ziggel. New test for jumps in semimartingale models. Statistical Inference for Stochastic Processes, 13:15–41, 2010.

- Stigler (1973) S M Stigler. The Asymptotic Distribution of the Trimmed Mean. Ann.Statist., 1:472–477, 1973.

- Trippi et al. (1992) R R Trippi, E A Brill, and R B Harriff. Pricing Options on an Asset with Bernoulli Jump-Diffusion Return . The Financial Review, 27:57–79, 1992.

- van der Vaart (2000) A W van der Vaart. Asymptotic Statistics. Cambridge University Press, Cambridge, 2000.