Random Matrix Application to Correlations Among Volatility of Assets

Abstract

In this paper, we apply tools from the random matrix theory (RMT) to estimates of correlations across volatility of various assets in the S&P 500. The volatility inputs are estimated by modeling price fluctuations as GARCH(1,1) process. The corresponding correlation matrix is constructed. It is found that the distribution of a significant number of eigenvalues of the volatility correlation matrix matches with the analytical result from the RMT. Furthermore, the empirical estimates of short and long-range correlations among eigenvalues, which are within the RMT bounds, match with the analytical results for Gaussian Orthogonal ensemble (GOE) of the RMT. To understand the information content of the largest eigenvectors, we estimate the contribution of GICS industry groups in each eigenvector. In comparison with eigenvectors of correlation matrix for price fluctuations, only few of the largest eigenvectors of volatility correlation matrix are dominated by a single industry group. We also study correlations among ‘volatility return’ and get similar results.

I Introduction

Volatility of asset returns is one of the most important elements in financial research. Since the birth of seminal models like Black-Scholes and the Autoregressive Conditional Heteroscedasticity (ARCH/GARCH), increasing attention has been paid to the analysis of the time-varying behavior in volatilities in the past few decades. Unlike the asset prices, the volatility is latent on the market. In other words, it is not directly observed and therefore, some estimations are necessary to make volatility time series “visible” for analysis. There are several well known measures to construct volatility. Broadly, we can classify these methods into the following three categories. The first one is the classical parametric model-based methods, referred as the estimated volatility. In particular, the volatility is generated using the models such as ARCH/GARCH, stochastic volatility models, etc. The second type is called the implied volatility, which is backed up by the option pricing formula, e.g., Black-Scholes. In the last category, the volatility is constructed non-parametrically from the high frequency trading data, namely realized volatility. All these three volatility measures are extensively used in the financial industry.

In this paper, we want to extend the traditional volatility analysis into a multivariate environment. The volatility correlations are naturally introduced in this picture. Note that the correlations among stock price fluctuations for different assets are very important because of their direct use for risk management in the Markowitz portfolio theory markowitz ; bouchaud . However, in practice, there are different sources of noise embedded in the final product of estimated correlations, such as finite-sample bias due to the limiting time domain, estimation errors from the inefficiency in the estimating procedure, measurement errors in the model construction process, etc. In their seminal work bouchaud1 , Laloux et. al. show that this accumulated noise in the correlation matrix for price fluctuations can be accounted by using the tools from the random matrix theory (RMT) mehta ; randm1 ; randm2 . In particular, they find that distribution of eigenvalues of empirical correlation matrix, excluding some of the largest eigenvalues, fits very well in the Marc̆enko-Pastur distribution of the RMT mehta ; randm1 ; randm2 ; sengupta . In stanley1 ; stanley2 , it is further shown that the properties of this correlation matrix resembles with the Gaussian Orthogonal ensemble (GOE). These results strongly suggest that eigenvalues of correlation matrix falling under the Marc̆enko-Pastur distribution contain no genuine information about the financial markets. Hence, one should systematically filter out such noise from the correlations for a more accurate estimation of future portfolio risk (see bouchaud3 and references therein).

The correlations among volatility of different assets are useful in portfolio selection, pricing option book and in certain multivariate econometric models to forecast prices and volatility implied ; multivariate . For example in the context of the Black-Scholes model, the variance of a portfolio of options exposed only to vega risk is given by implied

| (1) |

Here are weights in the portfolio, is the correlation matrix for implied volatility of underlying assets and the vega matrix is defined as

| (2) |

where is the price of option and is the implied volatility of asset underlying option . In volatility arbitrage strategies, generally correlations among the ‘volatility return’, that is the change in volatility, are used. Since volatility correlation matrix in (1) or the correlations among volatility return are always estimated, they contain both systematic and random errors. Hence, for a better forecast of risk, one certainly needs to estimate and remove noise from these correlation matrices.

The use of volatility correlation matrix in risk management and volatility arbitrage strategies can have another important aspect. Once volatility correlation matrix is obtained, one can ask several interesting questions about its eigenvalues and eigenvectors. In both risk management and arbitrage strategies for assets or derivatives, one tries to utilize as much information as available about the market. For example, eigenvectors of correlation matrix for price fluctuations reveal that the most correlated structures in the stock market, which are also stable for a longer time period, are the industry sectors stanley2 ; stanley5 ; stanley4 . In this case, by selecting a portfolio vector orthogonal to all the relevant eigenvectors, one can significantly reduce the portfolio risk. Now in case of volatility correlation matrix, one can naturally ask if its eigenvectors carry any new information about the market and whether they are stable in time. If yes, then how can this be utilized for a better estimation of risk and improving volatility arbitrage strategies?

In this paper, we apply tools from the RMT to volatility correlation matrix. We use one of the well studied econometric models, GARCH, to estimate the time evolution of volatility of assets arch ; garch ; tsay . In the GARCH process, the volatility is measured as the standard deviation of price fluctuations. In econometrics literature, we do realize that there are rather sophisticated models available to measure daily volatility. However, it has been observed that if one is not concerned about the asymmetric response of volatility to price fluctuations, i.e., leverage effect leverage , GARCH(1,1) is not outperformed by any other model to a significant level garch11 ; andersen . Hence, GARCH (1,1) is treated at least as a starting point of the analysis. We leave the use of multivariate models and use of other proxies of volatility for future work.

The rest of the paper is organized as follows. In section II, we discuss the data being used in this study and how do we model the price fluctuations to generate volatility time series. Using volatility time series, we construct the correlation matrix and calculate its eigenvalues in section III. Then, by fitting the cumulative probability distribution of eigenvalues with analytical expression, we find the optimum number of eigenvalues which fall under the Marc̆enko-Pastur distribution of RMT. Once we know which eigenvalues could possibly be pure noises, we perform further tests to ensure that they are indeed random. We study statistical properties of these eigenvalues in section IV. The nearest-neighbor spacing distribution, next to nearest-neighbor spacing distribution and number variance for unfolded eigenvalues are calculated. While first two quantities test the short-range correlations among the eigenvalues, the later evaluates the long-range correlations. We find a very good agreement of these quantities with analytical results for GOE of the RMT. In section V, we study the eigenvector statistics and find that the eigenvector corresponding to the largest eigenvalue is the ‘market mode’. Since the eigenvalue for market mode is of the order of the total number of assets, market has very strong correlations across volatility of assets. As we discuss in section V.1, the market mode also influences the eigenvectors under the Marc̆enko-Pastur distribution. We further calculate the contribution of GICS industry groups in the eigenvectors which are supposed to carry genuine information. The eigenvectors of correlation matrix for price fluctuations, which are outside the Marc̆enko-Pastur distribution, are relatively stable in time and are dominated by particular industry groups stanley5 ; stanley4 ; stanley3 . However, in case of volatility correlation matrix, only few of the largest eigenvectors are dominated by particular industries. In section VI, we discuss the robustness of our results by modeling the time series with small and larger number of parameters compared to GARCH(1,1). Finally in section VII, we summarize our results and discuss future directions. In appendix C, we mention results for application of the RMT to correlation matrix for volatility return 111It is worth mentioning that in this paper three types of correlation matrices are discussed: return correlation matrix defined as (5), volatility correlation matrix given by (11) and correlation matrix for volatility returns in (44)..

II Estimates of volatility and correlation matrix

In this paper, we use daily closing prices for 427 stocks in the S&P 500 over the time period covering from July 1, 2009 to June 28, 2013 yahoo . We represent the total number of stocks by () and the length of the time series for price fluctuations by (). The companies omitted are those that left or joined the S&P 500 list in this time duration 222For few time series, we observe that either they are non-stationary or the GARCH(1,1) is not a good model to estimate the volatility. Hence, these time series are also not considered in the paper. Note that our data belongs to a time duration which contains the aftershocks of economic crisis of year 2008-09. It has been observed that market is generally strongly correlated in volatile periods bouchaud4 . Hence, more eigenvalues of return and volatility correlation matrices tend to deviate from the standard RMT results, as compared to analysis in bouchaud1 ; stanley2 .

To model each time series, we begin with defining the return on stock at time by , where is the price of stock at time . We can normalize the return time series such that they have unit variance and zero mean, and write as an matrix such that

| (3) |

where

| (4) |

In our notation, angle brackets represent the average over the time series until unless stated explicitly. Now the correlation matrix for price fluctuations can be written as

| (5) |

For convenience, we refer as return correlation matrix.

Further, we estimate volatility time series by modeling the return using a univariate GARCH(1,1) process 333It is worth mentioning that unit root tests are preformed to verify the stationarity condition before fitting the data into the GARCH structure forecast ; autoarima1 .. Generally in a GARCH framework, both the conditional mean and conditional variance at , given the information , are functions of time:

| (6) | |||||

| (7) |

Here represents the average over the ensemble and is information about the prices till time .

In this paper, a standard GARCH(1,1) structure is used. There are two equations in the process to model the conditional mean and conditional volatility,

| (8) |

where is a random element drawn from a Gaussian or -distribution. The coefficients , and for stock are estimated using standard econometric packages rugarch . Using these parameters, we can sequentially estimate the volatility time series based on (8).

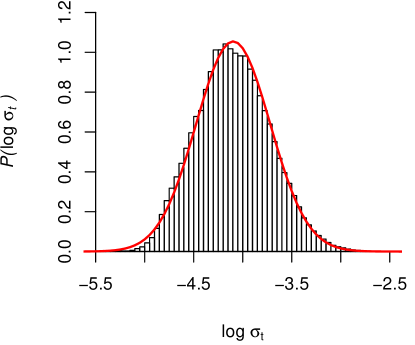

As it is generally observed, we find that volatility has a distribution very close to a lognormal. In figure 1, we draw the distribution of , which fits well in Gaussian distribution with mean and standard deviation . We can again normalize the volatility time series such that it has zero mean and unit variance:

| (9) |

Here and are mean and standard deviation of the volatility time series :

| (10) |

The positive tail in the distribution of fits well with a power-law coefficient 4.5, which is close to 5.4 for daily mean absolute deviation of high-frequency return at an interval of 5 minutes bouchaud . Now, we can arrange the time series for normalized volatility as matrix and then the volatility correlation matrix is given by

| (11) |

Using the volatility correlation matrix, one can compute its eigenvalues and conjugate eigenvectors . Now in the next section, we find the optimum number of eigenvalues that fit in the density distribution from the RMT.

III RMT and Eigenvalue distribution

In this section, we compare the eigenvalue distribution for volatility correlation matrix (11) with the analytical results from the RMT. Note that correlation matrix has independent components and one requires time series of length for estimation of correlation matrix. However, if time series are uncorrelated, an empirical estimation of correlations require time series of infinite length. In the context of the RMT, assume that we have uncorrelated time series of length , with random elements drawn from a Gaussian distribution with zero mean and standard deviation . We can arrange these time series in an matrix . For these time series, we can calculate correlation matrix, that is a Wishart matrix , and distribution of its eigenvalues. In the limit and , such that is fixed, the distribution of eigenvalues becomes the well-known Marc̆enko-Pastur distribution marcenko ; mehta :

| (12) |

where

| (13) |

where represents eigenvalues and . Both the values are greater than zero and only when , the gap between zero and disappears and we recover Wigner semi-circle law. For finite and , the abrupt cut-off at both ends are replaced by rapidly decaying tails. Note that (12) is exact when the elements of random, uncorrelated time series have Gaussian distribution. If random elements are drawn from a power-law distribution outside the Lévy stable range, the eigenvalue distribution is still found to be in good agreement with (12) stanley2 ; randm1 . Since volatility time series roughly follows a lognormal distribution, we have explicitly constructed time series of length with random elements drawn from a lognormal distribution. We find that (12) is consistent with the eigenvalue distribution of correlation matrix for these artificial time series.

Further, as the correlations are introduced among the time series, some eigenvalues begin to move out of the bulk distribution (12) sengupta . These eigenvalues carry genuine information about the market. In this case, effective standard deviation in (12) differs from its original value for the time series. We can refer the bulk of the distribution by ‘noise’ as it represents no-information states. However, the eigenvalues outside this regime correspond to genuine correlations and the associated eigenvectors represent the correlated segments of the market.

In the next section, we show how certain eigenvalues of the correlation matrix form the bulk of the distribution and these fit well with the analytical expression (12) from the RMT. It has been observed that distributions similar to (12) can arise even when time series have well-defined correlations. Consequently, we perform further checks on the eigenvalues falling under the Marc̆enko-Pastur distribution in section IV and compare the results with analytical expressions for GOE.

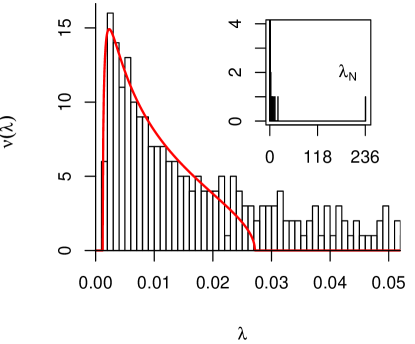

III.1 Eigenvalue density

Using volatility correlation matrix (11), we can calculate its eigenvalues and sort them in a sequence as , where is the smallest and is the largest eigenvalue. The histogram of eigenvalues is shown in figure 2. First we notice that the smallest eigenvalue , which is positive. Second, the tail of the distribution is decaying smoothly, instead of ending abruptly. We also notice that the largest eigenvalue is approximately 237, much larger than the values in the bulk of the distribution. These observations are pretty consistent with the characteristics in our sample data set in which the market was found to be quite volatile and strongly correlated. Note that since the trace of the correlation matrix is fixed to be , when becomes larger, the peak of the distribution moves closer to zero.

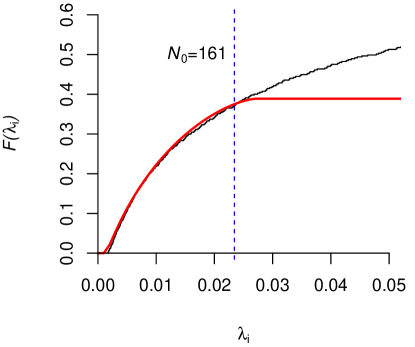

To fit the bulk of the eigenvalue distribution in (12), we use the empirical cumulative distribution function,

| (14) |

Here is the Heaviside step function and we have plotted as a function of eigenvalues in figure 3. Since only a subset of eigenvalues are noise, we fit part of in

| (15) |

with parameters and , keeping fixed. As shown in figure 2, a significant number of eigenvalues are outside the bulk of the distribution. Hence, is introduced to take care of the normalization in (15) when it is compared with only part of empirical cumulative distribution in (14). In addition, when several eigenvalues are outside the RMT fit, the effective standard deviation changes. In particular if time series are weakly correlated, there are only a few eigenvalues greater than , that is the theoretical bound (13) from the RMT. Then, the effective standard deviation is approximately

| (16) |

where is the number of eigenvalues which fall under the Marc̆enko-Pastur distribution (12).

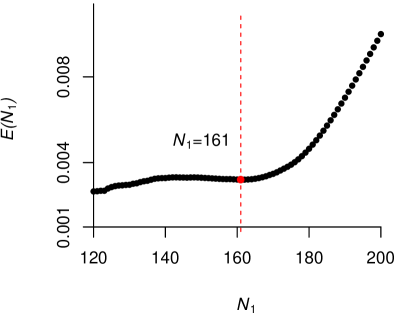

To fit the data in (15), we first choose a subset of eigenvalues and corresponding data points in empirical cumulative distribution (14). Then we fit these data points in (15) and estimate and by minimizing the root-mean-square error (RMSE). This minimized RMSE for selected data points can be represented by,

| (17) |

We draw as a function of in figure 4. It appears that there is a local minimum in around and beyond this threshold, begins to increase almost linearly. In this way, we find an ‘optimum’ number of eigenvalues which are used to fit in the RMT result (15). Note that the value of is sensitive to the fitting procedure and the indicator being used. However, the precise distribution of noise have a decaying tail, instead of a sharp edge as in (12). Hence a minor change in do not overestimate noise.

For , the estimated parameters are and . Using (13), we also estimate and . For these values of parameters, the probability density (12) is shown in figure 2. Finally, we find that there are eigenvalues such that and they fall under the Marc̆enko-Pastur distribution. We notice that the estimated values of and are close to what we get from (16), that is and .

IV Statistical properties of eigenvalues

In previous section, we investigated which eigenvalues fall under the Marc̆enko-Pastur distribution and possibly are pure noise. However, it is quite possible for time series to contain genuine correlations and then have a distribution very similar to the Marc̆enko-Pastur distribution. For this reason, we perform further diagnostic tests to ensure that the eigenvalues bounded by the RMT limits are indeed noise. Since correlation matrix is a real symmetric matrix, we use the data to evaluate the null hypothesis that it belongs to GOE of the RMT. To do so, we compare the short and long-range correlations among eigenvalues with analytical results for GOE.

By definition, GOE of random matrices has two important properties. First, if is a real symmetric matrix and an element of GOE, all of its elements are statistically independent. Second, the ensemble is invariant under the orthogonal transformation. In other words, any transformation of an element , where is a real orthogonal matrix, leaves the joint probability of elements of invariant. Now because of this symmetry, the elements of GOE display some universal properties. Since, some of these properties are self-averaging, one can observe these by studying a single, large element of GOE. In particular, we study the short-range correlations by calculating the nearest-neighbor and next to nearest-neighbor spacing distributions for unfolded eigenvalues. We also compare long-range correlations among eigenvalues by calculating the number variance. Even for a small number of eigenvalues falling within the RMT bounds, that is , we find a very good agreement with universal properties of GOE.

IV.1 Nearest-neighbor spacing distribution

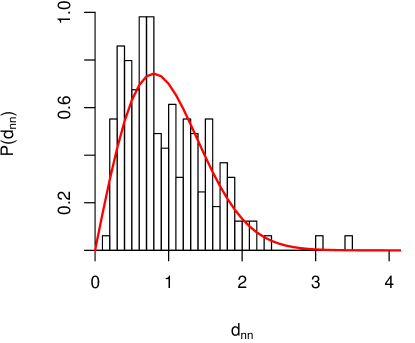

The first test for GOE is the distribution of nearest-neighbor spacing for unfolded eigenvalues of volatility correlation matrix. To unfold the eigenvalues, we use the technique of Gaussian broadening as it is used in the context of Hubbard model in broadening . The Gaussian unfolding procedure is briefly summarized in appendix A. We consider all the eigenvalues within the theoretical bounds (13) and calculate the unfolded eigenvalues . By definition (36), the unfolded eigenvalue is a map from to such that, has a uniform distribution. Now we estimate the distribution for nearest-neighbor spacing and it is shown in figure 5. One of the standard results from the RMT is that the distribution of nearest-neighbor spacing of unfolded eigenvalues for GOE is the famous Wigner surmise mehta ; randm1 ; randm2 :

| (18) |

We fit the estimated density of nearest-neighbor spacing in with normalization parameter . As shown in figure 5, the empirical data fits well in analytical expression for GOE. We find , which is very close to the exact value . We further find that for nearest-neighbor spacing distribution, the Kolmogorov-Smirnov statistics is 0.066 and p-value is 0.48. At the significance level of .05, p-values for Kolmogorov-Smirnov test with reference to their distributions discard GUE and GSE.

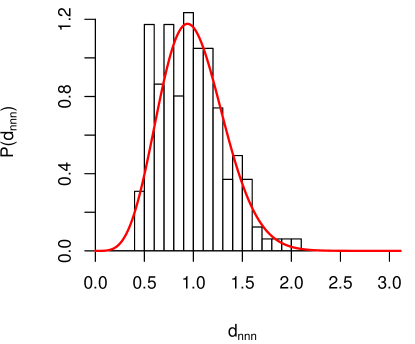

IV.2 Next to nearest-neighbor spacing distribution

The second test of GOE is to compare the next to nearest-neighbor spacing distribution of unfolded eigenvalues with RMT results. For GOE, the distribution of next to nearest-neighbor spacing of unfolded eigenvalues is shown to be equivalent to nearest-neighbor spacing distribution for GSE mehta ; randm1 ; randm2 . This is called the GSE test of GOE. The analytical expression for nearest-neighbor spacing for GSE is,

| (19) |

To calculate empirical values of next to nearest-neighbor spacing, we select all the eigenvalues within RMT bounds (13). We further divide these eigenvalues in two sets with even and odd index . Now, both sets are such that next to nearest-neighbor eigenvalues of original sequence are in the same groups. For each set, following the procedure in appendix A, we perform Gaussian broadening and calculate unfolded eigenvalues . Using these unfolded eigenvalues, we calculate the nearest-neighbor spacings in each set. Now we combine data from both of the sets to get probability density for next to nearest-neighbor spacing in original sequence of eigenvalues. The density distribution is shown in figure 6 and we fit it in with the normalization constant . We find that , very close to the exact value one. The Kolmogorov-Smirnov statistics for next to nearest-neighbor distribution is 0.063 and p-value can not discard the null-hypothesis at the significance level of 0.5.

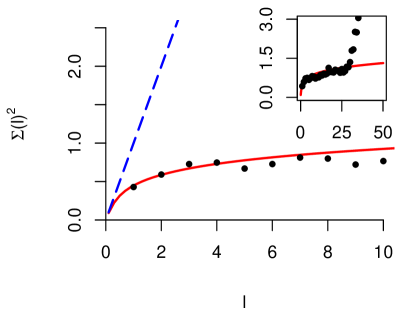

IV.3 Number variance

In this section, we compare long-range correlations among eigenvalues with the analytical results for GOE. There are examples of systems, for which the Hamiltonion do not belong to GOE but short-range correlations in the spectrum do resemble with short-range correlations in GOE randm1 . Hence, to establish the fact that the eigenvalues under the Marc̆enko-Pastur distribution are pure noise, it is required to compare the long-range correlations among eigenvalues with analytical results for GOE. One of the quantities that probes long-range, two-level correlations among the eigenvalues is the number variance. It is defined as the variance of number of unfolded eigenvalues in the interval of length around each unfolded eigenvalue mehta ; randm1 ; randm2 :

| (20) |

Here is number of unfolded eigenvalues and is the number of eigenvalues in the interval . Further, is the average of number of eigenvalues in the interval and here averaging is done over the unfolded eigenvalues . Since unfolded eigenvalues have a uniform distribution, . Now if the spectrum is translation invariant, the number variance can be written as

| (21) |

where is related to the two-point correlations. If there are no long-range correlations among eigenvalues, one gets the Poisson spectrum with and . However, the expression of for GOE takes the following form

| (22) |

where

| (23) |

To estimate number variance empirically, we unfold the eigenvalues using the Gaussian broadening procedure in appendix A. Since number variance takes into account the long-range correlations, it is affected by both of the edges at and , particularly when is not very large compared to . Hence, we estimate number variance only using the eigenvalues deep in the bulk of the distribution. The empirical estimates and theoretical value of number variance (20) for GOE are shown in figure 7. We find that for , the fit is in very good agreement with the exact result. However, for larger values of , as it is shown in the inset, number variance diverges to Poisson spectrum. This behavior is common for the cases where the number of eigenvalues is not very large.

The results from the sections IV.1, IV.2 and IV.3 show that the short and long-range correlations for eigenvalues of volatility correlation matrix resemble very well with the analytical results for GOE of the RMT. These results strongly support the hypothesis that eigenvalues of the correlation matrix, which fall under the Marc̆enko-Pastur distribution, are pure noise. In the next section, we investigate the properties of eigenvectors of volatility correlation matrix and compare these with the eigenvectors of return correlation matrix.

V Eigenvector statistics

In this section, we study the properties of eigenvectors of volatility correlation matrix. We first recall some results for eigenvectors of return correlation matrix (5). In case of price fluctuations, it has been observed that most of the eigenvalues fall under the Marc̆enko-Pastur distribution and only few of them are outside the bulk. The components of the eigenvectors, which are conjugate to noisy eigenvalues, have Gaussian distribution bouchaud1 ; stanley1 ; stanley2 . The eigenvector conjugate to the largest eigenvalue is the ‘market mode’. This mode is equivalent to a portfolio in which every asset is equally weighted. Furthermore, other larger eigenvalues, which are outside the theoretical edges from the RMT, are expected to carry genuine correlations. Few of the largest eigenvectors are found to be stable in time over a duration as long as ten years stanley5 ; stanley4 . However, as one moves from the largest to some smaller eigenvalues, the time duration of stability reduces and eventually eigenvectors become random. To understand the information contained in these largest eigenvectors, one of the approaches is to decompose them in industry groups stanley5 ; stanley4 . It has been observed that while most of the small eigenvectors randomly distribute the weight to all the industries, the largest eigenvectors are dominated by one or two sectors. In section V.2, we follow the same approach to study the properties of the eigenvectors of volatility correlation matrix.

In section V.1, first we discuss the distribution of eigenvectors of volatility correlation matrix. We find that similar to return correlation matrix, the eigenvector conjugate to the largest eigenvalue is the market mode. Then we focus on the distribution of eigenvectors conjugate to the eigenvalues within the RMT bounds. Since the largest eigenvalue of correlation matrix is of the order of the total number of eigenvalues , we find that it significantly affects the other eigenvectors. However, once we remove the effect of the market mode, we find that the eigenvector distribution is Gaussian, consistent with the RMT. Next, we investigate on the information content of the eigenvectors conjugate to the largest eigenvalues in section V.2. After removing the effect of the common market mode, we estimate the weights of different industry groups in these eigenvectors. Interestingly, we find that compared to return correlation matrix, very few of the largest eigenvectors of volatility correlation matrix are dominated by a few industry groups.

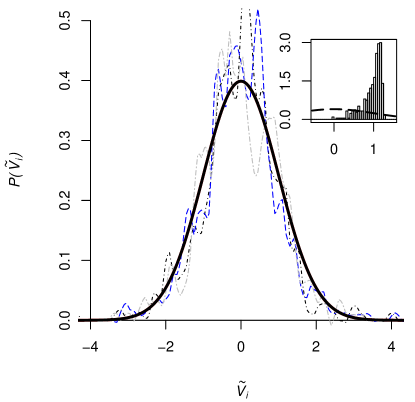

V.1 Distribution of eigenvectors

To study the eigenvector statistics, we first normalize each eigenvector , associated with eigenvalue , such that . We find that for the largest eigenvalue , most of the components of associated eigenvector are clustered around one. This eigenvector is the market mode and its distribution is shown in the inset of figure 8. Now we examine the eigenvectors conjugate to the eigenvalues falling under the Marc̆enko-Pastur distribution. According to the RMT, these eigenvectors should have a Gaussian distribution. However, we find that the distribution is peaked more sharply than a Gaussian distribution. We also observe similar behavior in the return eigenvectors but it is not as strong. Since the largest eigenvalue in both cases are much bigger in comparison with eigenvalues in the bulk, market mode has a significant influence on other eigenvectors stanley5 ; stanley4 ; marsili2 . Hence, it is reasonable to remove the effect of the market mode and re-examine the eigenvector distribution.

To remove the effect of the market mode, we regress the volatility time series on the market mode variable and use the residual to re-calculate the correlation matrix stanley5 ; stanley4 . If the market mode is the eigenvector , we can write the volatility time series for the market as

| (24) |

is an matrix containing time series for normalized volatility , as defined in (9). To remove the influence of the market mode, which is a common factor to all the assets, we construct the following regression,

| (25) |

where and are stock specific constants and the residual is such that and . The estimated residual from the above regression is used to construct the corresponding correlation matrix , its eigenvalues and eigenvectors .

There are several observations. First, we find that one of the eigenvalues, which was related to the market mode earlier, is zero. We also observe that after a proper rescaling, the eigenvalues under the Marc̆enko-Pastur distribution are quite close to their original values . To see this, we recall that the sum of eigenvalues is , i.e., . Previously for original correlation matrix , the sum of the eigenvalues, excluding the largest eigenvalue , was . Now if we homogeneously rescale the new eigenvalues such that their sum is , we find that are reasonably close to . One can also see this rescaling from the change in the effective variance of the original time series. We give more details on this in appendix B.

After removing the common market factor, we find that the eigenvector distribution for fits reasonably well with a Gaussian distribution. We have shown distribution of several eigenvectors in the figure 8. Note that the eigenvectors are normalized such that . In this figure, the thick black line is the Gaussian distribution with variance one.

V.2 Industry groups and comparison with return eigenvectors

In this section, we compare the information contained in the relevant eigenvectors of volatility correlation matrix with that of the return correlation matrix. The main finding is that very few of the volatility eigenvectors, which are supposed to carry genuine information about the market, are dominated by the industry groups as compared to the corresponding return eigenvectors. This result is consistent with the observation that in financial markets, it is much harder to diversify the volatility risk for portfolios 444We thank Samuel Vazquez for pointing this out to us.. We first estimate the contributions of GICS industry groups in the eigenvectors. Then, by comparing inverse participation ratio of industry contributions, we observe that relatively fewer volatility eigenvectors receive dominating contributions from particular industry groups.

Using the time series (3) for normalized returns, we calculate the correlation matrix (5). We follow the procedure described in the section III. It is found that eigenvalues of return correlation matrix fall under the analytical bounds from the RMT. The movement of the market hides several correlations among its components stanley5 ; stanley4 ; marsili2 . Hence, to see the presence of industry groups in eigenvectors, we remove the influence of the market mode using the technique discussed in (25). In the cleaned-up volatility and return eigenvectors, we then calculate the contributions of different industry groups as follows.

We classify companies in the GICS industry groups using a four-digit code system. 24 groups are achieved by the classification. Each group has companies, where with . The number of companies in each group, that is , range from to . Now, we can define a projection matrix , which estimates the fraction of each industry contributing in the eigenvectors stanley5 ; stanley4 . The entries in the projection matrix are,

| (26) |

In , row is a vector with a weight to all the companies in group . We also define a vector conjugate to each eigenvector such that its components are square of the later, i.e., . Note that represents eigenvectors of correlation matrices after removing the effect of the market mode. The projection matrix acts on vectors and gives -dimensional weight vector :

| (27) |

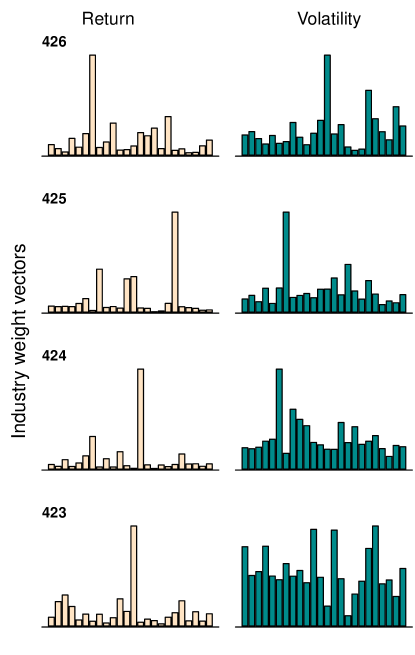

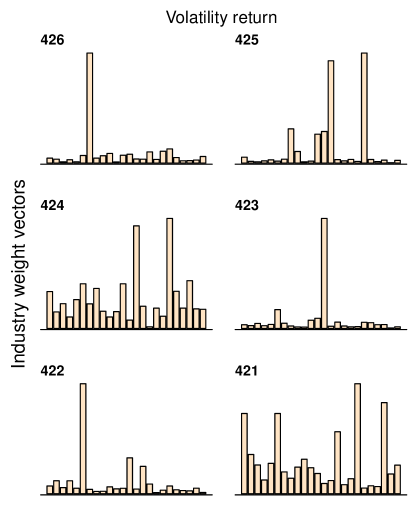

Here is the normalization constant such that . Ideally for the market mode , all the components of should be . In figure 9, we compare four weight vectors of return and volatility correlation matrix. Now we can simply use inverse participation ratio ,

| (28) |

of the weight vectors as an indicator of the dominance of a single industry in corresponding eigenvector . If an eigenvector is dominated by a single industry, then in the weight vector, all the elements will be zero excluding one. In this case inverse participation ratio will be one. However, if all the industry groups contribute equally in an eigenvector, the inverse participation ratio will become .

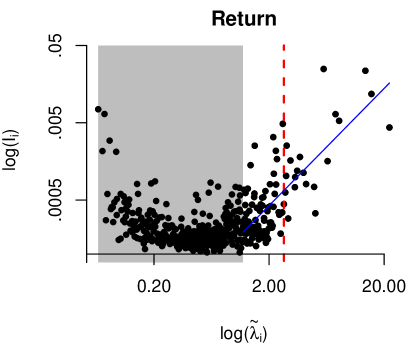

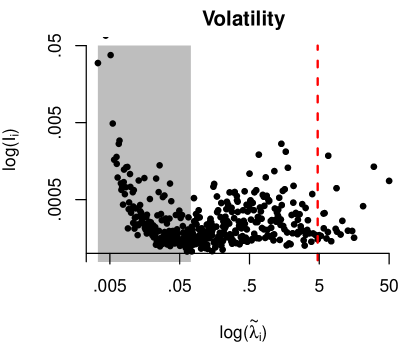

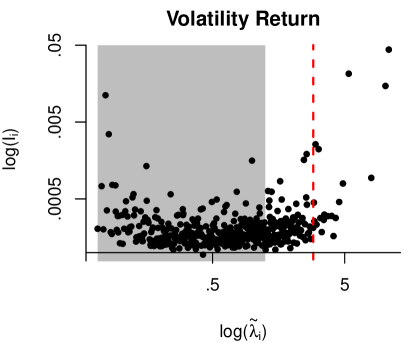

In figure 10 and 10, we plot inverse participation ratio of weight vectors on log-log plot for return and volatility correlation matrices. The x-axis is eigenvalues , that we get after removing influence of the market mode from normalized return and volatility time series. The gray area indicates the region bounded by the RMT limits (13) in both cases. In stanley5 ; stanley4 , authors studied return correlation matrix for 1000 stocks and observed that eigenvectors related to twenty largest eigenvalues were almost stable on the time scale of a year. However, as one moves to the smaller eigenvalues, the eigenvectors become more and more unstable over time. In figure 10 and 10, we have drawn vertical dashed lines to indicate the position, beyond which the twenty largest eigenvalues fall.

Now, we concentrate on investigating these twenty largest eigenvectors. The structure of industry weights in eigenvectors are apparently different between return and volatility eigenvectors. As shown in figure 10, in case of return correlation matrix, the largest eigenvalues have large inverse participation ratio and they are dominated by only a few industry groups. In fact outside the RMT bounds, inverse participation ratio appears to follow a power-law as a function of eigenvalues with an exponent 1.52. Deep within the RMT bounds, the inverse participation ratio is of the order of . This indicates that all the industry groups randomly contribute in these eigenvectors.

Correspondingly, in the case of volatility correlation matrix in figure 10, the number of eigenvectors with small inverse participation ratio is quite large as compared to the return correlation matrix. For the sake of comparison, let us set a benchmark value of inverse participation ratio . This is the inverse participation ratio for a hypothetical weight vector such that it contains equal contribution from half of the industry groups and no contribution from rest. Sixteen out of twenty largest volatility eigenvectors have inverse participation ratio less than this benchmark value. For return eigenvectors, this number is only two. We also notice that for some smallest eigenvectors of return and volatility correlation matrices, the inverse participation ratio is large. Consistent with stanley2 , we observe that these eigenvectors are ‘localized’ and receive large contributions from a few stocks in a particular industry group.

The above observations suggest that the eigenvectors of volatility correlation matrix do not carry as much information about the industry groups as the return correlation matrix does. However, it is quite possible that our approach to remove effect of the market mode is inadequate and strong non-linear effects due to the market still hide information about the industry groups in volatility eigenvectors. To confirm that the residual time series in (25) are indeed independent of the market mode , we can use a quantity called generalized kurtosis bouchaud . The idea is to first transform the residuals and the market mode to and , such that distribution of each and is a Gaussian with unit variance. Now if and are independent, then so are and . To test this assumption behind our linear model, we can study the generalized kurtosis,

| (29) |

which should be very small if (25) succeeds if removing effect of the market mode. We can further define the following measure

| (30) |

as a merit of any model in this context. The value of this indicator for volatility eigenvectors is and for return eigenvectors, it is . Both of these values are reasonably small and indicate that model (25) does succeed in removing the effect of the market mode. In fact, indicates that in comparison to return, this model works better for volatility!

The results in this section strongly suggest that the interpretation of largest eigenvectors of volatility correlation matrix in terms of industry groups is inadequate. In our opinion, this could be attributed to following two reasons. First, it might be that excluding the largest two or three eigenvectors of the volatility correlation matrix, other eigenvectors are quite unstable in time. Another possibility could be that, volatility divides the market in sectors which differ from the industry groups. A better understanding of time evolution and information content of largest eigenvectors of volatility correlation matrix will certainly have important applications in volatility risk management. In this context, it would be interesting to apply tools from cluster analysis mantegna1 ; mantegna2 ; marsili1 ; coron1 and further study the time evolution of eigenvectors along the line of stanley5 ; stanley4 ; allez1 ; allez2 ; fenn ; conlon .

VI Robustness of results

In this section, we do some robust diagnostic analysis on our results. In our procedure, we estimate the volatility time series by modeling 427 individual return time series as GARCH(1,1) processes. In total, there are estimated parameters in the pool. We explore two different regimes of number of parameters. First, we consider a single GARCH(1,1) model for all the 427 time-series

| (31) |

Here is the return at time and is a random variable drawn from student’s -distribution. Coefficients , and are parameters to be estimated. The estimation is done using the standard maximum likelihood estimation procedure with the joint log-likelihood function defined as follows,

| (32) |

Here represents the log-likelihood function for individual return time series for stock .

The motivation of doing this exercise comes from the observation that for , the largest eigenvalue for the return correlation matrix is around 193. This implies that the conjugate eigenvector, i.e., the market itself, is strongly correlated. Hence, one can assume that a universal GARCH model governs the market. We do find that all the estimated parameters are statistically significant. Repeating the calculations in sections III, IV and V, we find that although there are small changes in the numerical values, the main results are qualitatively the same.

Our second experiment is that instead of fitting return time-series in a GARCH(1,1), as in section II, we model the each time series as a more generalized ARMA-GARCH(1,1) process tsay . This model is given by

| (33) | |||||

The first equation is the ARMA mean equation and other two equations are GARCH(1,1) volatility equations. is the auto-regressive coefficient and is moving average parameter. , and are standard GARCH(1,1) parameters. We first find the ‘optimum’ values of and by modeling the time series as ARMA process based on BIC measure forecast ; autoarima1 . With these optimal orders, we simultaneously fit the model (33) and estimate all the free parameters rugarch . As expected, we find that although there is a small difference in the numerical values, the main results in sections III, IV and V remain intact.

VII Discussion

In this paper, we study the properties of eigenvalues and eigenvectors of volatility correlation matrix. We estimate volatility time series for 427 stocks in S&P 500 by modeling the price fluctuations as GARCH(1,1) process. The empirical distribution for the estimated volatility fits well with the lognormal distribution. Using these volatility time series, we construct the volatility correlation matrix and study distribution of its eigenvalues. By fitting the empirical cumulative probability distribution in analytical expression, we find that approximately 40% eigenvalues fall under the Marc̆enko-Pastur distribution (12). Whereas, for the same time period, approximately 75% eigenvalues of return correlation matrix are within the analytical bounds from the RMT. We also find that the largest eigenvalue for the volatility correlation matrix is 237 whereas for return correlation matrix it is 193. This suggests that correlations in volatility of assets across the market are relatively stronger compared to correlations in the price fluctuations. To further establish that volatility eigenvalues falling under the Marc̆enko-Pastur distribution are pure noise, we study the short and long-range correlations among eigenvalues in section IV. Since volatility correlation matrix is a real symmetric matrix, we compare the statistical properties of eigenvalues with the analytical results from GOE. We find that for optimum values of unfolding parameters, the nearest-neighbor spacing distribution, next to nearest-neighbor spacing distribution and number variance fit well in theoretical results for GOE. These results strongly suggest that approximately 40% eigenvalues of volatility correlation matrix carry no relevant information about the market.

In section V.1, we study the distribution of eigenvectors associated with eigenvalues within the RMT bounds. We find that eigenvector distribution is sharply peaked around zero as compared to a Gaussian distribution. We attribute this behavior to the strong correlations in volatility across the market. Once the market mode is removed from the volatility time series, we find that eigenvectors indeed have a distribution close to a Gaussian. In section V.2, we study the properties of eigenvectors which are outside the RMT distribution. These eigenvectors are supposed to carry genuine information about the market. Similar to return correlation matrix bouchaud1 ; stanley1 , we find that the largest eigenvector is the market mode. The largest eigenvectors of return correlation matrix are relatively stable in time and are dominated by only a few industry groups stanley5 ; stanley4 . We use inverse participation ratio of industry weight vectors (27) as an indicator of large contributions from a few industries and compare it for return and volatility eigenvectors. We find that in comparison with return eigenvectors, very few of largest volatility eigenvectors are dominated by a few industry group. This result is consistent with what is observed in practice. For instance, one can reduce risk of a portfolio by diversifying it across different economic sectors but it is much harder to remove volatility risk. Finally in section VI, we discuss the robustness of our results. Since our results are based on estimation of parameters for all the GARCH(1,1) processes (8), it is necessary to understand how they are affected when we have a very small or large number of parameters. Though there are small quantitative differences, our results remain invariant qualitatively in both scenarios.

In appendix C, we have also summarized results on application of RMT to correlations among volatility returns, which are defined as (43). In this case, we found that the largest eigenvalue is 91 and 73% eigenvalues are pure noise. Compared to return eigenvectors, there are less eigenvectors of volatility return correlation matrix which are dominated by a few industry groups. However, in comparison with volatility correlation matrix, these eigenvectors carry more information about the industry groups. In the five largest eigenvectors, we also find that dominating industry groups are same as what appear in the five largest return eigenvectors.

In this paper, we use one of the simplest methods, GARCH(1,1), to estimate daily volatility. However, there are various other proxies and methods of estimation. For example, there are other multivariate models of volatility engle02 . The implied volatility of an asset is estimated by observing the option prices in the market. One can also use high-frequency data to estimate variance or mean absolute deviation of prices. It will be interesting to apply tools from the RMT on all these indicators for a deeper understanding of correlations among volatility. Since implied volatility for an underlying asset varies both with the strike and maturity, we expect an even rich structure in correlations. This paper certainly provides a first step in these directions.

Note that the original applications of the RMT in financial market were on correlations among price fluctuations bouchaud1 . In this paper, we instead focus on the second moment of these fluctuations. A deeper understanding of financial market will require information about all the correlations among its components. Hence, it will be interesting to extend our work on realized higher moments, e.g., skewness and kurtosis, which can be estimated empirically.

One of the main results of this paper is to show that a significant number of eigenvalues of volatility correlation matrix are pure noise. Since volatility correlation matrix has applications in risk management and forecasting implied ; multivariate , it will be natural to understand how volatility correlation matrix can be cleaned to carry only genuine information. The next step will be to see how this cleaned volatility correlation matrix improves the price forecast and risk estimates. We only list few here, but there is a vast literature where matrix cleaning methods are applied to financial correlations potters1 ; sharifi ; daly1 ; daly2 ; bouchaud3 ; papp ; urban . It is expected that these tools will also find applications to volatility correlation matrix.

In section V.2, we compare the information contained in the largest eigenvectors about the GICS industry groups. We observe that very few of the largest eigenvectors of volatility correlation matrix are dominated by industry groups. Since we expect these eigenvectors to carry genuine information about the market, this result hints two possibilities. First, it has been observed for the eigenvectors of return correlation matrix that few largest eigenvectors are quite stable in time. Therefore, these eigenvectors are dominated by a particular industry group for a longer time period. As one moves to smaller eigenvalues, the time scale of stability begins to reduce. It is quite possible that for volatility correlation matrix, only two or three largest eigenvectors are stable and rest of them are just ‘random’. However, this possibility do not reconcile with the fact that compared to return correlations, volatility correlations are much stronger in the same time period. So this leads to a second scenario that volatility might organize itself in non-linear structures which are overlapped of different industry groups. Since these ideas are useful in the volatility risk management and volatility arbitrage strategies, it will be very interesting to study time evolution and structure of volatility eigenvectors mantegna1 ; mantegna2 ; marsili1 ; coron1 ; stanley5 ; stanley4 ; allez1 ; allez2 ; fenn ; conlon .

Acknowledgments: We thank Samuel Vazquez and John Nieminen for their insightful comments and suggestions. AS would like to thank Robert Myers for his support and encouragement in this work. AS also thanks Apurva Narayan and Heidar Moradi for several interesting discussions. This research was supported in part by Perimeter Institute for Theoretical Physics. Research at Perimeter Institute is supported by the Government of Canada through Industry Canada and by the Province of Ontario through the Ministry of Research and Innovation.

Appendix A Gaussian broadening and unfolded eigenvalues

In this appendix, we discuss the Gaussian broadening procedure for the eigenvalues of volatility correlation matrix. The empirical cumulative probability distribution for eigenvalues of a random matrix is given by,

| (34) |

where is the total number of eigenvalues and is the Heaviside step function. This probability distribution can be divided into two parts,

| (35) |

where is the average part and is the fluctuating part, which is zero when averaged over the ensemble. Now one can get unfolded eigenvalues using the average part of the cumulative probability distribution,

| (36) |

The unfolded eigenvalues are a map from eigenvalues to , such that they have a uniform distribution. Also, note from (34) and (36), are independent of .

To separate , from the estimated cumulative probability (34), we use the procedure of Gaussian broadening broadening . We replace delta function peaks at each eigenvalue in (34) by a Gaussian distribution with mean and standard deviation . To estimate an optimum value of for each eigenvalue, we divide the eigenvalue scale in artificial ‘sub-bands’ of width and number them as . We calculate the average distance between eigenvalues in each sub-band and represent it by . Then for each eigenvalue , we find the standard deviation

| (37) |

where is a broadening parameter and is such that the eigenvalue belongs to sub-band .

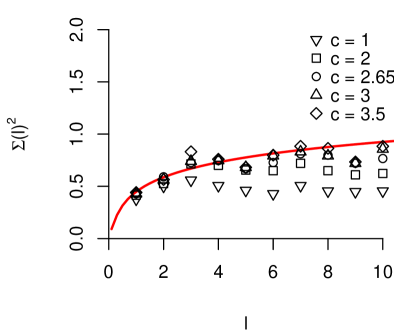

The values of sub-band width and broadening parameter are generally chosen to get the best fit for short-range and long-range correlations when compared with the theoretical results. For discussion in section IV, where we compare the correlations among eigenvalues of volatility correlation matrix with GOE, we have used and . Note that in case of next to nearest-neighbor spacing distribution in section IV.2, we classify eigenvalues in two different groups with even and odd , and then unfold each group separately. So in these cases, to keep the correlation structure consistent with unfolding in sections IV.1 and IV.3, we use .

Finally, while comparing the properties of empirical data with RMT results, one needs to ensure that the agreement is not because of a particular choice of unfolding parameters. One should observe that as the unfolding parameters are varied in a particular range, the empirical results converge to theoretical values. Generally, short-range correlations are less sensitive to the unfolding procedure and this convergence is more visible in long-range correlations. In figure 11, we have shown number variance for various values of , keeping fixed. One can clearly see that as reaches the optimum value, the estimates for number variance approach to the theoretical values for GOE. We observe similar behavior when varies, keeping fixed.

Appendix B Eigenvalues after removing the market mode

To remove the effect of the market mode, we regress the normalized volatility time series with the market mode (24) as discussed in section V.1. As shown in (25), the residual time series can be obtained from

| (38) |

which is further used to calculate the correlation matrix . The elements of correlation matrix are related to original correlation matrix as follows

| (39) | |||||

| (40) |

Here is the standard deviation for residual time series . In obtaining (40), we have also used , and that variance of time series is one. If market is weakly correlated, will not be very large. Also, the dynamics of overall market will have less influence on individual time series and coefficients will be small. In this case, if for all , to the leading order from (40),

| (41) |

Also, let us assume that only the market mode is outside the the Marc̆enko-Pastur distribution. In this case, all the are approximately equal and . Using this in the variance of residual time series ,

| (42) |

This can further be used in (41) to get . Note that this is consistent with the arguments from the normalization of eigenvalues in the discussion after equation (25). However, if is very large, the corrections to (41) will not be negligible. In case of volatility correlation matrix, the largest eigenvalue is of the order of . Hence, although are close to , we observe that there are noticeable corrections.

Appendix C Correlations among volatility return

In this appendix, we briefly mention our results on the application of RMT on volatility return. Using volatility time series in (8), we can define the volatility return

| (43) |

These volatility return time series are further normalized such that they have zero mean and unit variance. We can arrange these time series in matrix and define the correlation matrix

| (44) |

For this matrix, the smallest eigenvalue is and largest eigenvalue is . We can follow the procedure in section III and find that now 73% eigenvalues fall under the Marc̆enko-Pastur distribution. The statistical properties of eigenvalues are also consistent with that of GOE.

We further find that eigenvectors corresponding to eigenvalues within the RMT bounds have a Gaussian distribution. The largest eigenvector is again the market mode. Following procedure in section V.1, we can remove the influence of the market mode and using projection matrix (26), we can calculate the industry weight vectors. The measure (30) for the merit of linear model (25) for the volatility return correlations is . In figure 12, we have shown weight vectors for six largest eigenvectors, excluding the market mode. Once again, in comparison to return eigenvectors, there are less volatility return eigenvectors which are dominated by a few industries. For the weight vectors, we can also calculate inverse participation ratio and it is shown in figure 13. We can further compare the inverse participation ratios with the benchmark value , that we defined in section V.2. We find that twelve among the twenty largest eigenvectors of volatility return correlation matrix have an inverse participation ratio less than this benchmark value. This number is less than sixteen, that we get for volatility correlation matrix. This indicates that for the data we have discussed, volatility return eigenvectors contain more information about the industry groups as compared to volatility eigenvectors. We also notice that the dominating industry groups in five largest eigenvectors for return and volatility return correlation matrices are the same.

References

- [1] Harry Markowitz. Portfolio selection. The Journal of Finance, 7(1):77–91, 1952.

- [2] J.P. Bouchaud and M. Potters. Theory of Financial Risk and Derivative Pricing: From Statistical Physics to Risk Management. Cambridge University Press, 2003.

- [3] L. Laloux, P. Cizeau, J.-P. Bouchaud, and M. Potters. Noise Dressing of Financial Correlation Matrices. Physical Review Letters, 83:1467–1470, 1999.

- [4] M. Mehta. Random Matrices. Academic Press, New York, USA, 1995.

- [5] T. Guhr, A. M. Groeling, and H. A. Weidenmüller. Random-matrix theories in quantum physics: common concepts. Physics Reports, 299(4–6):189–425, 1998.

- [6] T. A. Brody, J. Flores, J. B. French, P. A. Mello, A. Pandey, and S. S. M. Wong. Random-matrix physics: spectrum and strength fluctuations. Rev. Mod. Phys., 53:385–479, 1981.

- [7] A. M. Sengupta and Partha P. Mitra. Distributions of singular values for some random matrices. Physical Review E, 60(3):3389, 1999.

- [8] V. Plerou, P. Gopikrishnan, B. Rosenow, L. A. Nunes Amaral, and H. E. Stanley. Universal and Nonuniversal Properties of Cross Correlations in Financial Time Series. Physical Review Letters, 83:1471–1474, 1999.

- [9] V. Plerou, P. Gopikrishnan, B. Rosenow, L. A. Amaral, T. Guhr, and H. E. Stanley. Random matrix approach to cross correlations in financial data. Physical Review E, 65(6):066126, 2002.

- [10] J. P. Bouchaud and M. Potters. Financial Applications of Random Matrix Theory: a short review. arXiv:q-fin/0910.1205, 2009.

- [11] R. F. Engle and S. Figlewski. Modeling the dynamics of correlations among implied volatilities.

- [12] Luc Bauwens, Sébastien Laurent, and Jeroen V. K. Rombouts. Multivariate garch models: a survey. Journal of Applied Econometrics, 21(1):79–109, 2006.

- [13] P. Gopikrishnan, B. Rosenow, V. Plerou, and H. E. Stanley. Identifying Business Sectors from Stock Price Fluctuations. arXiv:cond-mat/0011145, 2000.

- [14] P. Gopikrishnan, B. Rosenow, V. Plerou, and H. E. Stanley. Quantifying and interpreting collective behavior in financial markets. Physical Review E, 64:035106, 2001.

- [15] Robert F. Engle. Autoregressive conditional heteroscedasticity with estimates of the variance of united kingdom inflation. Econometrica, 50(4):987–1007, 1982.

- [16] Tim Bollerslev. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3):307–327, 1986.

- [17] R.S. Tsay. Analysis of Financial Time Series. CourseSmart. Wiley, 2010.

- [18] Fischer Black. Studies of stock price volatility changes. In Proceedings of the 1976 Meetings of the American Statistical Association, Business and Economics Statistics Section, pages 177–181, 1976.

- [19] A. Lunde and P. R. Hansen. A forecast comparison of volatility models: does anything beat a garch(1,1)? Journal of Applied Econometrics, 20(7):873–889, 2005.

- [20] T. G. Andersen and T. Bollerslev. Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International Economic Review, 39(4):885–905, 1998.

- [21] Y. Liu, P. Gopikrishnan, P. Cizeau, M. Meyer, C.-K. Peng, and H. E. Stanley. Statistical properties of the volatility of price fluctuations. Phys. Rev. E, 60:1390–1400, 1999.

- [22] Yahoo!finance, 2013.

- [23] J.-P. Bouchaud and M. Potters. More stylized facts of financial markets: leverage effect and downside correlations. Physica A: Statistical Mechanics and its Applications, 299(1–2):60 – 70, 2001.

- [24] Alexios Ghalanos. rugarch: Univariate GARCH models., 2013. R package version 1.2-7.

- [25] V. A. Marčenko and L. A. Pastur. Distribution of eigenvalues for some sets of random matrices. Mathematics of the USSR-Sbornik, 1(4):457, 1967.

- [26] H. Bruus and J.-C. Anglès d’Auriac. The spectrum of the two-dimensional hubbard model at low filling. EPL (Europhysics Letters), 35(5):321, 1996.

- [27] C. Borghesi, M. Marsili, and S. Miccichè. Emergence of time-horizon invariant correlation structure in financial returns by subtraction of the market mode. Phys. Rev. E, 76(2):026104, 2007.

- [28] R.N. Mantegna. Hierarchical structure in financial markets. The European Physical Journal B - Condensed Matter and Complex Systems, 11(1):193–197, 1999.

- [29] N. Vandewalle G. Bonanno and R. N. Mantegna. Taxonomy of stock market indices. Phys. Rev. E, 62:7615–7618, 2000.

- [30] L. Giada and M. Marsili. Data clustering and noise undressing of correlation matrices. Phys. Rev. E, 63(6):061101, 2001.

- [31] C. Coronnello, M. Tumminello, F. Lillo, S. Micciche, and R. N. Mantegna. Sector Identification in a Set of Stock Return Time Series Traded at the London Stock Exchange. Acta Physica Polonica B, 36:2653, 2005.

- [32] R. Allez and J.-P. Bouchaud. Eigenvectors dynamic and local density of states under free addition. arXiv:math/1301.4939, 2013.

- [33] R. Allez and J.-P. Bouchaud. Eigenvector dynamics: General theory and some applications. Phys. Rev. E, 86(4):046202, 2012.

- [34] D. J. Fenn, M. A. Porter, S. Williams, M. McDonald, N. F. Johnson, and N. S. Jones. Temporal evolution of financial-market correlations. Phys. Rev. E, 84(2):026109, 2011.

- [35] T. Conlon, H. J. Ruskin, and M. Crane. Cross-correlation dynamics in financial time series. Physica A Statistical Mechanics and its Applications, 388:705–714, 2009.

- [36] Rob J Hyndman with contributions from George Athanasopoulos, Slava Razbash, Drew Schmidt, Zhenyu Zhou, Yousaf Khan, and Christoph Bergmeir. forecast: Forecasting functions for time series and linear models, 2013. R package version 4.06.

- [37] Rob J. Hyndman and Yeasmin Khandakar. Automatic time series forecasting: The forecast package for r. Journal of Statistical Software, 27(3):1–22, 7 2008.

- [38] Robert Engle. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3):339–50, 2002.

- [39] S. Pafka, M. Potters, and I. Kondor. Exponential Weighting and Random-Matrix-Theory-Based Filtering of Financial Covariance Matrices for Portfolio Optimization. arXiv:cond-mat/0402573, 2004.

- [40] S. Sharifi, M. Crane, A. Shamaie, and H. Ruskin. Random matrix theory for portfolio optimization: a stability approach. Physica A: Statistical and Theoretical Physics, 335(3-4):629–643, 2004.

- [41] J. Daly, M. Crane, and H.J. Ruskin. Random matrix theory filters in portfolio optimisation: A stability and risk assessment. Physica A: Statistical Mechanics and its Applications, 387(16–17):4248 – 4260, 2008.

- [42] J Daly, M Crane, and H J Ruskin. Random matrix theory filters and currency portfolio optimisation. Journal of Physics: Conference Series, 221(1):012003, 2010.

- [43] G. Papp, S. Pafka, M. A. Nowak, and I. Kondor. Random Matrix Filtering in Portfolio Optimization. Acta Physica Polonica B, 36:2757, 2005.

- [44] K. Urbanowicz, P. Richmond, and J. A. Hołyst. Risk evaluation with enhanced covariance matrix. Physica A: Statistical Mechanics and its Applications, 384(2):468 – 474, 2007.