An implicit method for the finite time horizon Hamilton-Jacobi-Bellman quasi-variational inequalities

Abstract

We propose a new numerical method for solving the Hamilton-Jacobi-Bellman quasi-variational inequality associated with the combined impulse and stochastic optimal control problem over a finite time horizon. Our method corresponds to an implicit method in the field of numerical methods for partial differential equations, and thus it is advantageous in the sense that the stability condition is independent of the discretization parameters. We apply our method to the finite time horizon optimal forest harvesting problem, which considers exiting from the forestry business at a finite time. We show that the behavior of the obtained optimal harvesting strategy of the extended problem coincides with our intuition.

1 Introduction

Solving the Hamilton-Jacobi-Bellman quasi-variational inequality (HJBQVI) is one of the most challenging issues in the stochastic optimal control problem. The HJBQVI is associated with the combined impulse and stochastic optimal control, which can be used to formulate a system which changes drastically under our control. The combined stochastic optimal control is a widely applicable framework. Some of the literature that deals with applications to mathematical finance is as follows. Pliska and Suzuki [PS04], Palczewski and Zabczyk [PZ05] and Kharroubi and Pham [KP10] treat portfolio optimization with transaction costs; Mundaca and Øksendal [MØ98] and Cadenillas and Zapatero [CZ00] study control of the exchange rate by the Central bank; Korn [Kor99] provides an overview relating to applications of the impulse control. Applications to other areas, such as electricity management, problems of maintenance and quality control and information technology, are found in Bensoussan and Lions [BL84] and the references therein.

A common approach to applying the impulse control framework has the issue that problems or models are formulated to have an analytical solution. For the HJBQVI associated with the one-dimensional infinite horizon combined stochastic optimal control problem, the smooth-fit technique is an established method for obtaining the solution. However, this technique is not valid for the general HJBQVI, and to the best of our knowledge there is no established method for the general HJBQVI. Hence, developing a numerical method for solving the HJBQVI is an important avenue of research.

The numerical approaches to solving the HJBQVI are categorized into two types according to the time horizon, which is either infinite or finite. We first discuss the infinite time horizon. Bensoussan and Lions [BL84] approximate the impulse control problem using iterations of the optimal stopping problem, and hence the HJBQVI is translated to HJB variational inequalities (HJBVIs). The numerical method for the HJBVI is well-studied due to the motivation of pricing American options in mathematical finance. An alternative method is proposed in Chancelier et. al. [CMS06]. In this paper, the authors provide a solution method for a fixed-point problem consisting of a contractive operator and a non-expansive operator, and the numerical algorithm for the infinite time horizon HJBQVI appears as an application. They discretize the HJBQVI using a finite difference scheme and the discretized HJBQVI is converted to an equivalent fixed-point problem that is solvable by their algorithm.

In the case of the finite time horizon, we can use backward induction in a fashion similar to that in other optimal control problems with a terminal condition. For instance, Chen and Forsyth [CF08] solve the finite time horizon HJBQVI associated with the annuity pricing problem with a guaranteed minimum withdrawal benefit. They construct a discretized equation that is consistent with the original HJBQVI under the constraint that the time grid size is small enough to satisfy a certain condition depending on the space grid size. We note that this method is dependent on the model, and thus it appears to be difficult to apply directly to other problems.

In the present paper, we propose a new numerical algorithm for solving the finite time horizon HJBQVI. Compared with the infinite time horizon case, we must treat the time variable carefully. We provide an appropriate transformation for the HJBQVI considered, and develop a numerical scheme that does not require a relationship between the time and special discretizations. The key points of the present study are: (i) we discretize the HJBQVI with the forward difference for the time grid; and (ii) the impulse control part is kept in the same time step. Hence the present method is an implicit method.

The main advantage of the present work is providing a numerical scheme independent of the specific model formulation. The stability of the numerical scheme is especially sensitive in the finite time horizon case. Previous research such as [CF08] proves the stability for each of the concerned problems. We give a proof of stability in the general framework, and hence our method can be applied without a stability proof. To support the advantages of our method from the perspective of implementation, we provide a detailed procedure of the algorithm in matrix form.

This paper is organized as follows. We present the mathematical formulation of the HJBQVI in Section 2. The goal of this section is to display the discretized HJBQVI in matrix form. Section 3 provides details of our algorithm. In Section 3.1, the matrix form of the HJBQVI obtained in Section 2 is translated into an equivalent fixed-point problem. We describe the procedure for solving the fixed-point problem in detail from the view point of the computational implementation in Section 3.2. In Section 4, we apply the proposed method to the optimal forest harvesting problem. This problem determines the optimal harvesting strategy for ongoing forestry. We use the mathematical formulation of the problem proposed by Willassen [Wil98] based on an infinite time horizon impulse control framework where analytical solutions of the value function and optimal strategy are provided. We introduce a terminal time representing the time of exit from the forestry business, which turns the above problem into a finite time horizon problem. In this case, the analytical solution is unavailable and thus we solve it numerically using the proposed algorithm.

2 Mathematical formulation

2.1 Model

We consider the following combined stochastic and impulse control problems over a finite time horizon with the performance criterion

| (1) |

The controlled process is governed by

| (2) |

where is a -dimensional Brownian Motion on a filtered probability space , , , , , and . The combined control consists of the Markov control strategy , a -valued stochastic process of the form for some function , and the impulse control strategy . Here , are -stopping times and , , are -measurable random variables. The performance is measured using the following three functions: the profit rate function , the bequest function , and the intervention profit function .

We denote by the set of admissible combined controls, that is, satisfies: (i) a unique strong solution of the SDE (2) with control exists; (ii) almost surely. We also assume that for ,

The value function corresponding to problem (1) is defined by , . Hence the corresponding HJBQVI is given by (see, for example, [ØS07])

| (3) |

with terminal condition , , where is the partial differential operator with respect to , and is the infinitesimal generator of the process at time :

for . Here is the -th order partial differential operator with respect to and indicates transposition. The continuation set at time is defined by

We impose the condition , on the control set, that is, a control which intervenes in all regions is not admissible. A simple way to satisfy this condition is that the intervention times satisfy the following statement: for each , there exists such that and where . We are usually able to find such an from the problem formulation: an example of this is given in Section 4.1.

As with other numerical problems, we face the issue of the computer not dealing well with the unbounded domain. Since our state process leaves any bounded region until the termination time with non-zero probability, this problem is unavoidable. To cope with it, we restrict ourselves to problems with a bounded domain. Let be the domain and be the boundary. We assume that (i) , ; (ii) the intervention function satisfies . The boundary condition is given by the function .

2.2 Discretization

We discretize the QVI (3) using the standard finite difference scheme with the central difference. Let be the finite difference steps with respect to and . We denote by the spacial grid, so that . The discretized boundary may also be represented by . For convenience we introduce symbols for the time grid points, , , and for the spacial grid points including the boundary, , , where is the number of time grid points, is the number of spacial grid points and is the number of discretized boundary points. We note that the subsequences and represent the spacial (internal) grid points and discretized boundary points respectively. Furthermore, the time grid points are defined sequentially as , , , . We implicitly assume that is the number supporting the existence of such that . Let be a discretized set of the impulse control, and assume that: (i) , (ii) we can take space indices which allow to define an integer function such that

| (4) |

and .

The discretized QVI of the QVI (3) is defined as follows:

| (5) |

for , with terminal condition , , where and is the operator such that

for . Here we have used the notation

and have omitted the arguments of and , that is, and .

We use the central difference to obtain the discretized QVI (5). If we use the one-sided difference, the discretized operator becomes

Finally, we represent the discretized QVI using the central difference (5) in matrix QVI form:

| (6) |

for with terminal condition , , where is an -dimensional vector such that , , , , , is an matrix such that, for ,

where is an -dimensional vector such that , is an matrix such that and is an -dimensional vector such that . We have again omitted the arguments of and , that is, and .

3 Algorithm

3.1 The equivalent fixed-point problem

We convert the matrix QVI (6) to the following equivalent fixed-point problem:

| (8) |

where is an -dimensional vector and is an matrix defined respectively as follows:

| (9) |

Here, is a positive number such that

and is an matrix such that where is the Kronecker delta. Then the fixed-point problem (8) satisfies the conditions for applying the method proposed by Chancelier et al. [CMS06]. The details are discussed in Appendix B.

3.2 Procedures

We are able to solve problem (8) by the backward method. In the following steps, we assume that we have already found .

- step1

-

set ,

- step2

-

search for the controls and such that

and define an index set such that

- step3

-

determine an matrix and an -dimensional vector as follows:

- step4

-

solve the linear equation , where is an -dimensional vector and is an identity matrix,

- step5

-

if exceeds the admissible error, replace by and go back to step2, else replace by and go to step6,

- step6

-

if , replace by and go back to step1, else determine the Markov control , the set and the impulse control as follows:

where and .

The control obtained by the above procedure satisfies , , , , and hence is an optimal control.

4 Numerical results

We apply our method to the finite horizon optimal forest harvesting problem based on Willassen’s formulation. The mathematical formulations of the original and extended problems are described in Section 4.1. The original work considers the infinite time horizon impulse control problem and gives the analytical solution in an unbounded domain. We first restrict the domain to be bounded, and add the boundary condition that gives a solution equivalent to that for the unbounded domain. In Section 4.2 we discuss the validity of this boundary condition using a numerical experiment. Our main target problem, the finite time horizon optimal forest harvesting problem for which a solution has not been obtained analytically, is discussed in Section 4.3.

4.1 Optimal forest harvesting problem

Let be the biomass of a forest at time and let be the harvesting times. We cut all trees in the forest at time and replant the biomass . Suppose that the growth of the biomass follows a geometric Brownian motion so that is governed by

| (10) |

where and are positive constants. Furthermore, we suppose that satisfies the conditions to be the intervention time, that is, is an -stopping time and almost surely. Then has a unique strong solution and is the admissible impulse control strategy.

The original problem formulated by Willassen [Wil98] is defined as the infinite time horizon optimal impulse control problem. Let be the proportional harvesting cost and be the replanting cost of the biomass . Then the performance criterion is

| (11) |

where is the discounting factor. We impose on , and the condition that : if this is not the case then the optimal strategy is that we harvest trees immediately after replanting which is a vacuous solution. Harvesting immediately after replanting also suggests that for any .

The value function corresponding to the criterion (11) is defined by , , and hence the corresponding HJBQVI is given by

| (12) |

Willassen solved the HJBQVI (12) explicitly:

| (13) |

where

and is a solution of

We call the strategy switch point. The key ideas for obtaining the solution are as follows: (i) the condition for the cost suggests that we should wait to harvest until exceeds a certain value ; (ii) because the partial differential equation has a general analytical solution, we obtain the value function by connecting this analytical solution and smoothly at .

We extend the above problem by considering the case that the farmer exits the forestry business at time , meaning that he harvests the all trees and does not replant at time . Then the problem becomes a finite time horizon problem and the performance criterion is modified as follows:

| (14) |

The value function corresponding to this problem is defined by , , , and thus the corresponding HJBQVI is given by

| (15) |

with terminal condition .

In this case an analytical solution is not available. However, we can anticipate the behavior of the solution of the HJBQVI (15). Because the performance criterion is equivalent to that for the infinite time horizon case (11) in the limit as , the value function and the optimal control coincide with those for the infinite horizon provided is large enough and .

4.2 Determination of the bounded domain and boundary condition

The idea of introducing the strategy switch point is significant for determining the candidate finite domain and boundary condition. Let be a positive real value, let be the candidate bounded domain and let the boundary be the candidate boundary. We first define as the function giving the boundary condition in the infinite time horizon case such that

| (16) |

Because we cannot expect forest growth after the biomass reaches 0, the value function should be 0 at . We should expect that this boundary condition will give the same solution in the infinite domain case if is sufficiently larger than .

We examine this candidate domain and boundary condition by solving the corresponding HJBQVI (12) numerically. The method for solving the infinite horizon HJBQVI was proposed by Øksendal and Sulem [ØS07]. Because our state process is a 1-dimensional geometric Brownian motion, we are able to use their method with no extra assumptions. The HJBQVI is discretized using the standard finite difference scheme with a central difference, and we denote by be the finite difference step and by the number of grid points. We determine the parameters from Table 1. In this situation, the value of the strategy switch point is .

| Parameter | Description | Value |

|---|---|---|

| right limit of the domain | 10 | |

| initial | 1 | |

| harvesting cost rate | 10% | |

| replanting cost | 2 | |

| expected growth rate | 1 | |

| volatility | 1 | |

| discount factor | 2 |

The numerical results obtained using the algorithm are as follows.

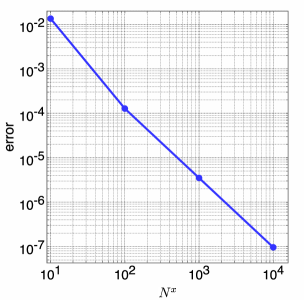

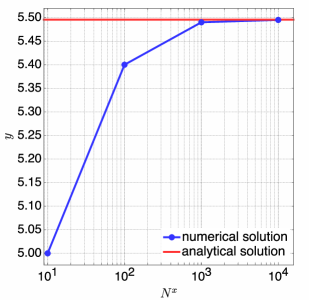

Figure 2 shows the maximum error of the value function when comparing the analytical solution (13) and the numerical solution. The order of the error is , which coincides with that implied by the finite difference scheme with a central difference. Figure 2 displays the analytical strategy switch point with a red line and the numerical strategy with a blue line, indicating that the numerical results with the switch point agree with the -order. Therefore we conclude that our candidate domain and boundary condition are valid.

We next define the boundary condition in the finite time horizon case to be slightly modified from that in the infinite time horizon case:

This boundary condition works well in the case that is sufficiently large: the value of should be larger than in the infinite time horizon case. Because of the replanting cost , we expect that the optimal strategy close to the terminal time is to not cut down the trees. However our boundary condition enforces cutting at the boundary point . We can avoid this contradiction by taking the value of to be large enough, so that the contribution of the cost to the value function vanishes. The reasons for this are that the harvest profit increases with the growth of the biomass , and the cost does not depend on the biomass . We discuss this issue again in the following section with reference to the numerical results.

At the end of this subsection, we mention the computational load for solving the infinite time horizon HJBQVI using this algorithm.

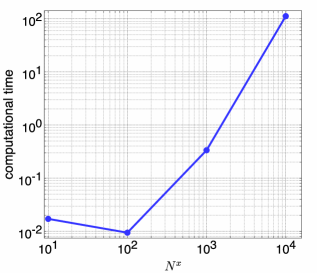

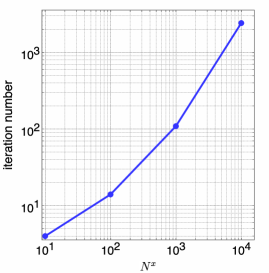

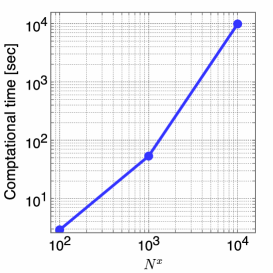

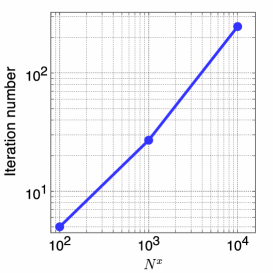

Figure 4 describes the computational time as a function of the number of grid points 111 The details of our computational resources are as follows. The computer we use has an Intel Core i5 650 @3.20GHz and 4GB RAM. Our code is parallelized using OpenMP, and we use PARDISO [SG04] for solving linear equations. . We see that the computational time grows exponentially as becomes finer. The main load is the growth in the size of the linear equations, which is inevitable until we use the finite difference scheme. The search for the optimal regular and impulse controls on each grid point is the second load: the index takes a larger range of values when increases. There is the possibility that we can reduce this factor through massive parallel computing such as GPGPU. Figure 4 shows the inherent load of this algorithm. Since the finer finite difference step allows us to compute a more accurate value function, we need more iterations to reach the fixed point.

4.3 Finite time horizon case

We now treat the main issue of this section. In this situation, the matrix operators in our algorithm are defined as follows:

We set and . The other parameters have the same values as in Table 1, except for .

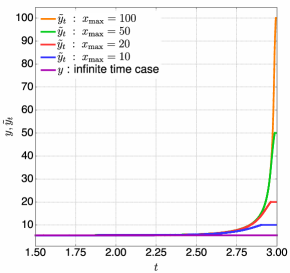

The first numerical result we discuss in this subsection is the behavior of , the strategy switch point at time . As mentioned in Section 4.1, we expect that should converge to , the strategy switch point for the infinite time horizon case, if approaches and is large enough. We also recall that contains error if is not large enough. Hence, we examine the various values of . The results are shown in Figure 5.

We first mention that, remarkably, converges to regardless of the value of . This coincides with our expectation discussed in the previous subsection. We can understand the behavior of as follows. The behavior of close to , which takes a much larger value than , suggests that we should keep the trees. If the time disengages from , the benefit of the waiting to harvest caused by the replanting cost vanishes and hence the value of decreases.

We next discuss the error due to the improper boundary condition. In the previous subsection we hypothesized that the error vanishes. The behavior of gives evidence supporting this hypothesis as follows. First, the length of the time interval for which is fixed at near the terminal time . The length of this time interval decreases as increases, and we cannot distinguish the interval in the case that in Figure 5. Second, behave consistently when . When approaches , begin to behave inconsistently with regard to the value of .

Finally, we discuss the computational load. We set and display the results in Figure 7 and Figure 7.

Figure 7 describes the computational time where the horizontal axis is the number of grid points. The new load factor is obviously the time grid size . The growth in the size of the linear equations and the search cost for the optimal controls and are the same as in the previous subsection. However, the number of iterations for convergence to the fixed point is slightly different. Figure 7, which shows that the maximum number of iterations for each time step, suggests that we only need approximately 10% of the iterations compared with the same grid size in the infinite time horizon case. This is due to the determination of the initial value of . Because is small enough, the difference between and is expected to be small. Hence we are able to reduce the number of iterations from the infinite case where we have no information about the solution.

5 Summary

We have proposed a new numerical method for solving the HJBQVI associated with the combined impulse and stochastic optimal control problem over a finite time horizon.

The key points of our numerical scheme are that (i) we discretize the HJBQVI using the forward difference for the time grid; (ii) the impulse control part is kept in the same time step. Hence the present method is an implicit method. The main advantage of the present method is that it is independent of the specific model formulation. The present work gives a proof of stability in the general framework and hence our method can be applied without a stability proof. We have provided a detailed procedure for the algorithm in matrix form for the sake of easy implementation.

We also apply our method to the optimal forest harvesting problem. The original problem formulated by Willassen [Wil98] is defined as an infinite time horizon impulse control problem and has an analytical solution. We introduce a terminal time representing the time of exit from the forestry business which turns the above problem into a finite time horizon problem. Because the original problem is defined on an unbounded domain, we introduce an equivalent bounded domain and boundary condition and verify them through a numerical experiment.

The analytical solution of our finite time horizon problem is unavailable and hence we solve it using our algorithm. The behavior of the obtained optimal strategy is reasonable: the strategy coincides with the infinite time horizon strategy when the terminal time approaches infinity; the strategy switch point, the threshold for harvesting the trees, is much higher than in the infinite horizon case near the terminal time.

Appendix A Stability

We define and as

where

Then the -dimensional linear equation is equivalent to the matrix QVI (8). Our goal is to show that is invertible and that where is a constant independent of the grid sizes and .

We first consider the case that . By condition (7), we find that , and for and . This implies that is an M-matrix and hence is invertible. Next, we define as . Because for and for , we have

Evaluating the left- and right-hand sides of the last inequality:

Hence we obtain

From the definition of the constants and functions, we find that , where C is a constant independent of and .

We next consider the general . Let be the -th decomposition of the function with control set at time and let . By equation (4), we find that

| (17) |

Hence the -dimensional equation is reduced to the ()- dimensional equation , where is the number of elements in . Equation (17) implies that , , and . We find that is invertible and that in the same manner as when .

Appendix B From the matrix QVI (6) to the fixed-point problem (8)

We first verify that the matrix QVI (6) and the fixed-point problem (8) are equivalent. The equations (9) imply that

Hence the matrix QVI (6) can be rewritten in the following form:

The parameters and are positive numbers, and thus this is equivalent to 222 Note that is equivalent to for every .

Therefore we obtain the fixed-point problem (8).

We next show that is a contraction map displayed in matrix form. By the definition of , condition (7) and equation (9), we find that

| (18) | |||

| (19) |

Thus we obtain

Hence is a contraction map displayed in matrix form.

Finally, we show that satisfies the discrete maximum principle, that is, that

To do so, we obtain a contradiction to the above statement. Assume that and that for . Then we have

Hence we obtain

which establishes the statement.

References

- [BL84] A. Bensoussan and J.L. Lions, Impulse control and quasi-variational inequalities, Gauthier-Villars, 1984.

- [CF08] Zhuliang Chen and Peter a. Forsyth, A numerical scheme for the impulse control formulation for pricing variable annuities with a guaranteed minimum withdrawal benefit (GMWB), Numerische Mathematik 109 (2008), no. 4, 535–569.

- [CMS06] Jean-Philippe Chancelier, Marouen Messaoud, and Agnès Sulem, A policy iteration algorithm for fixed point problems with nonexpansive operators, Mathematical Methods of Operations Research 65 (2006), no. 2, 239–259.

- [CZ00] Abel Cadenillas and Fernando Zapatero, Classical and Impulse Stochastic Control of the Exchange Rate Using Interest Rates and Reserves, Mathematical Finance 10 (2000), no. 2, 141–156.

- [Kor99] Ralf Korn, Some applications of impulse control in mathematical finance, Mathematical Methods of Operations Research (ZOR) 50 (1999), no. 3, 493–518.

- [KP10] Idris Kharroubi and Huyên Pham, Optimal Portfolio Liquidation with Execution Cost and Risk, SIAM Journal on Financial Mathematics 1 (2010), no. 1, 897–931.

- [MØ98] Gabriela Mundaca and Bernt Øksendal, Optimal stochastic intervention control with application to the exchange rate, March 1998, pp. 225–243.

- [ØS07] Bernt Øksendal and Agnès Sulem, Applied stochastic control of jump diffusions, Springer, 2007.

- [PS04] Stanley R Pliska and Kiyoshi Suzuki, Optimal tracking for asset allocation with fixed and proportional transaction costs, Quantitative Finance 4 (2004), no. 2, 233–243.

- [PZ05] J Palczewski and J Zabczyk, Portfolio diversification with Markovian prices, Probability and Mathematical Statistics 25 (2005), no. 1, 75–95.

- [SG04] Olaf Schenk and Klaus Gärtner, Solving unsymmetric sparse systems of linear equations with PARDISO, Future Generation Computer Systems 20 (2004), no. 3, 475–487.

- [Wil98] Yngve Willassen, The stochastic rotation problem: A generalization of Faustmann’s formula to stochastic forest growth, Journal of Economic Dynamics and Control 22 (1998), no. 4, 573–596.