Hedging under multiple risk constraints111This work was partially funded by Electricité de France. We thank Marie Bernhart for valuable comments on a premiminary version of this paper.

Abstract

Motivated by the asset-liability management of a nuclear power plant operator, we consider the problem of finding the least expensive portfolio, which outperforms a given set of stochastic benchmarks. For a specified loss function, the expected shortfall with respect to each of the benchmarks weighted by this loss function must remain bounded by a given threshold. We consider different alternative formulations of this problem in a complete market setting, establish the relationship between these formulations, present a general resolution methodology via dynamic programming in a non-Markovian context and give explicit solutions in special cases.

Key words: Multiple risk constraints, expected loss, asset liability management, Snell envelope, dynamic programming.

1 Introduction

In various economic contexts, institutions hold assets to cover future random liabilities. Banks and insurance companies are required by the authorities to hold regulatory capital to cover the risks they take. Pension funds face random future liabilities due to longevity risk and the structure of the pension plans which may involve variable annuity-type features. The problem of managing a portfolio of assets under the condition of covering future liabilities or benchmarks, in particular in the context of pension plans, is commonly known as asset-liability management (ALM) [15, 6, 14].

The present study is mainly motivated by the ALM problem of a nuclear power plant operator. In several countries, energy companies operating nuclear power plants are required by law to hold decomissioning funds, to cover the future costs of decontaminating and dismantling the plants, as well as the treatment and long-term storage of the radioactive waste. In France, this obligation was introduced by the Law n∘ 2006-739 of June 28, 2006 relative to sustainable management of radioactive substances and waste. According to this law, the three major players of the civil nuclear industry in France (EDF, AREVA and CEA) must hold portfolios of assets dedicated to future nuclear decomissioning charges [5]. The value of these dedicated assets must be sufficient to cover the discounted value of future liabilities. The discount rate is determined by the operator, but the law stipulates that “it may not exceed the rate of return, as anticipated with a high degree of confidence, of the hedging portfolio, managed with sufficient security and liquidity”. Computing the highest possible discount rate is therefore equivalent to finding the cheapest portfolio which covers the future liabilities with a high degree of confidence. The law does not define the notions such as “high degree of confidence” in a precise manner, but it is clear that since the future liabilities are subject to considerable uncertainty, some kind of probabilistic risk measure criterion such as shortfall probability or Value at Risk should be used.

In other contexts, the regulator stipulates that a specific probabilistic criterion should be used to measure the potential losses arising from not being able to cover the liabilities. Basel II framework uses the Value at Risk to determine regulatory capital for banks. Under the European Solvency II directive, insurance companies are required to evaluate the amount of capital necessary to cover their liabilities for a time horizon of one year with a probability of . Under such frameworks, companies must therefore hold enough assets to limit the losses with respect to a random future benchmark in the sense of a probabilistic loss measure.

Motivated by these issues, in this paper, we consider the problem of an economic agent, who has random liabilities payable at a finite set of future dates, with expected shortfall constraints imposed at each payment date. We consider two related questions: how to find the least expensive portfolio which allows to satisfy the constraints (hedge the liabilities) at each date, and how to determine the relationship between the probabilistic constraints at different dates. For the latter issue, we propose three different formulations: with the European style constraints, the bound is imposed on the expected shortfall at each date, computed at ; in the time-consistent constraint, the bound is imposed at each payment date on the next period’s shortfall; finally, in the lookback-style constraint, the bound is imposed on the expectation of the maximal shortfall over all dates.

In the literature, the problem of hedging a single random liability under a probabilistic constraint has been introduced and studied mainly in the complete market continuous-time setting in [9, 10], where explicit solutions were obtained in the Black-Scholes model. This was generalized to Markovian contexts in [1] using stochastic control and viscosity solutions and later extended to other classes of stochastic target problems in [2, 3]. A related strain of literature deals with portfolio management under additional constraint of outperforming a stochastic benchmark at a given date [12, 4] or a deterministic benchmark at all future dates [8]. The problem of hedging multiple stochastic benchmarks at a finite set of future dates, has, however, received little attention in the literature.

In our paper, motivated by practical concerns that the liability constraints must be verified at pre-specified given dates, we place ourselves in the discrete-time setting. To find the least expensive hedging portfolio, we adopt the classical complete market framework, which allows us to reformulate the problem as the one of finding the smallest discrete-time supermartingale satisfying a set of stochastic constraints. This can be seen as an extension of the classical notion of Snell envelope, which arises in the problem of superhedging an American contingent claim — see [11, Section 6.5]. The market completeness assumption implies that in our context, the randomness of the future liabilities is mainly determined by “hedgeable” risk factors, such as the market risk, the interest rate risk, the inflation etc., rather than by unpredictable random events like changes in the regulatory framework.

Under the market completeness assumption, it is easy to find a strategy for hedging all future liabilities almost surely. The main difficulty of our problem is due to the fact that the constraints are given by expected loss functions and therefore probabilistic in nature. Furthermore, we are concerned with general discrete-time processes where the Markovian property holds no longer. Our main contribution is to investigate the interplay between the probabilistic constraints at different dates, and to characterize the solution via dynamic programming in a general context. We consider three types of different risk constraints which concern respectively the expected loss at all liability payment dates, the time-consistent conditional loss in a dynamic manner and the maximum of all loss scenarios. For each of the three constraint styles that we use, we obtain a recursive formula for the least expensive hedging portfolio. Explicit examples are then developed for specific loss functions.

Our paper is structured as follows. In Section 2 we introduce three different formulations of the multi-objective hedging problem according to the three different constraint styles. Section 3 presents a non-Markovian dynamic programming approach to the solution. Section 4 provides explicit examples in the case of two payment dates, and Section 5 contains some explicit results for the -dimensional case. Finally, technical lemmas are proven in the appendix.

2 Alternative problem formulations in the complete market setting

We start with a filtered probability space , where is a trivial -field and . On this space, we consider a financial market model with a risk-free asset and risky assets . The risky assets are assumed to be adapted to the filtration . Without loss of generality, we take the risk-free asset to be a constant process: .

We assume that there exists a class of admissible portfolio strategies which does not need to be made precise at this point. To guarantee absence of arbitrage and completeness, we make the following assumption: there exists a probability equivalent to such that all admissible self-financing portfolios are -supermartingales, and for any -supermartingale , there exists an admissible portfolio , which satisfies for all .

Given a finite sequence of deterministic moments , we study the problem of an economic agent, who is liable to make a series of payments at dates , where for each , is -measurable and satisfies . This may model for example the cashflows associated to a variable annuity insurance contract, or to a long-term investment project. The portfolio of the agent, whose value is denoted by is effectively used to make the payments, and therefore satisfies . We assume that the agent has some tolerance for loss, which means that the negative part of must be bounded in a certain probabilistic sense (to be made precise later in this section).

To work with self-financing portfolios we introduce the portfolio augmented with cumulated cash flows:

as well as the benchmark process

| (1) |

The agent is therefore interested in finding the cheapest portfolio process which outperforms, in a certain probabilistic sense, at dates , the benchmark process . Due to our market completeness assumption, this is equivalent to finding the -supermartigale with the smallest initial value which dominates the benchmark in a probabilistic sense at dates .

Introduce a discrete filtration defined by . For a -supermartingale , the discrete-time process defined by is a -supermartingale, and conversely, from a -supermartingale one can easily construct a -supermartingale which coincides with at dates . Therefore, our problem can be reformulated in the discrete time setting as the problem of finding a discrete-time -supermartingale with respect to the filtration with the smallest initial value, such that for , dominates in a probabilistic sense the discrete-time benchmark (we use the same letter for discrete and continuous-time benchmark).

There are many natural ways of introducing risk tolerance into our multiperiod hedging problem. In this paper, following [10], we consider that a bound is imposed on the expected shortfall, weighted by a loss function . Throughout this paper, we will always assume that the following condition on is satisfied.

Assumption 1.

The function is convex, decreasing and bounded from below.

The above assumptions are natural to describe a loss function. A typical example will be a “call” function. In particular, when , we take the positive part of the loss and the situations when the liability is hedged will not be penalized. In some cases, we need stronger assumptions to get explicit results. The following Assumption 2 allows us to include widely-used utility functions. For example, when with , then Assumption 2 is satisfied.

Assumption 2.

The function is strictly convex, strictly decreasing, bounded from below and of class . In addition, the derivative satisfies the Inada’s condition and .

We next describe the three different constraints for our problem as follows.

European-style constraint

-

Find the minimal value of such that there exits a -supermartingale with

(2) We denote the set of all -supermartingales satisfying (2) by .

Time-consistent constraint

-

Find the minimal value of such that there exits a -supermartingale with

(3) We denote the set of all -supermartingales satisfying (3) by .

The time-consistent constraint has an interesting interpretation as an “American-style” guarantee.

Proposition 1.

Let be an -adapted process. Then the condition

| (4) |

is equivalent to: for all -stopping times and taking values in such that ,

| (5) |

Lookback-style constraint

-

Find the minimal value of such that there exits a -supermartingale with

(6) We denote the set of all -supermartingales satisfying (6) by .

Relationship between different types of constraints

For a given family of bounds , we denote by , and (or , and when there is no ambiguity) the infimum value of where belongs to, respectively, , and . The following proposition shows that

Proposition 2.

The following inclusion holds true: .

Proof.

Clearly, . The inclusion follows from the alternative representation (5) for the time-consistent constraint. ∎

When , the three constraint types coincide. In addition, the value function has an explicit form in some particular cases.

Proposition 3.

Let and assume that .

-

1.

Let Assumption 2 hold true and assume that there exists with , where . Then

where is the inverse function of and is the unique solution of .

-

2.

Assume that . Then,

where .

Proof.

The first part is a particular case of Proposition which will be shown below. This result is also very similar to the solution of the classical concave utility maximization problem for which we refer the reader for example to [13, Theorem 2.0]. The second part is obtained by using the Jensen’s inequality. ∎

The following proposition is a natural generalization of the second case of Proposition 3 and describes another situation when the three value functions coincide. However, we need an extra hypothesis (7) for .

Proposition 4.

Assume that , for and

| (7) |

for any , where . Then,

Assumption (7) is implied for example by the following assumptions.

-

•

The process is a submartingale.

-

•

The process is a submartingale and for .

3 Solution via dynamic programming

In this section, we solve our optimization problem for the three types of constraints. The main method consists of using the dynamic programming principle where the constraints are to be verified at each payment date.

3.1 European-style constraint

We begin by the European-style constraint which consists of a family of expectation constraints. Denote by the infimum value of where . The following result characterizes by using a family of -supermartingales, each of which corresponds to one expectation constraint.

Proposition 5.

equals the infimum value of such that there exist a -supermatingale and a family of -supermartingales , , satisfying and .

Proof.

Denote by the set of all which satisfy the conditions in the proposition and by the infimum value of the related . If , then

Therefore , which implies . Conversely, given a -supermartingale , we construct processes such that and for . The condition implies that is a -supermartingale. It follows that the inverse inequality holds true as well. ∎

For the dynamic solution, we will introduce the value-function process for . Note that, instead of a family of real-valued bounds for , the value function will take as parameters a family of random variables which describe the evolution of the successive bounds on the expected shortfall.

For -measurable random variables , let be the essential infimum of all such that there exists a -supermartingale with for any . We denote by the set of all such -supermartingales which start from . By convention, let and coincide with the set of all -measurable random variables. We have in particular

In fact, if is a -supermartingale such that , then is also a -martingale satisfying this condition and one has .

Similarly to Proposition 5, we can prove that equals the essential infimum of such that there exists a -supermartingale together with a family of -supermartingales such that and that for any .

Lemma 1.

Let , then there exists a supermartingale such that .

Proof.

By definition, and for any . Let be the set , which is -measurable. For any , let . Since , is a -supermartingale. Moreover, and

therefore . ∎

The following result characterizes the value-function process in a backward and recursive form.

Theorem 1.

equals the essential infimum of all such that there exist and a family of -supermartingales , , which satisfy the following conditions :

| (8) |

Proof.

By definition, the theorem is true for . In the following, we treat the case by induction. Denote by the essential infimum defined in the theorem. Let be an -measurable random variable and , , be -supermartingales which verify the conditions in (8). Note that the fourth condition, together with the essential infimum property, imply (e.g. [7, V.18]) the existence of a sequence of random variables in such that . Moreover, the previous lemma shows that the sequence can be supposed decreasing without loss of generality. By a similar argument as in Proposition 5, there exist -supermartingales and -supermartingales , , such that

We extend each to a -supermartingale on by taking , . Let for any . Note that the -supermartingale and the -supermartingales , verify the conditions which characterize . Therefore for any , which implies that

where the second inequality comes from the relation and the fact that the sequence is decreasing. Hence we obtain .

Conversely, let be a -supermartingale and be -supermartingales such that and that for any . Without loss of generality, we assume . The conditions in (8) are easily verified for , except the last one. Note that for any , the condition implies

where the first inequality comes from the fact that is a -supermartingale. Therefore, , which leads to the inverse inequality. ∎

The supermartingale condition in the previous theorem can be made simpler where only -measurable random variables are concerned. In particular, we consider the case of real-valued bounds.

Corollary 1.

equals the essential infimum of all conditional expectations , such that there exist -measurable random variables satisfying the following conditions:

| (9) |

Proof.

Denote by the essential infimum defined in the corollary. We begin with -measurable random variables , satisfying the conditions in (9). Let and . We then construct -supermartingales with for , and for . Therefore, .

Note that the essential infimum remains unchanged if we replace the first condition of (9) by “ for any ” since the function is descreasing with respect to each coordinate. Let and satisfy the conditions in (8). We choose and for . By (8), and . Moreover, since , one has

Hence .

∎

3.2 Time-consistent constraint

For the time-consistent constraint, we consider the loss function at each payment date given the market information at the previous time step. The constraint is written by using conditional expectations. The dynamic programming structure in this setting is relatively simple since it only involves two successive dates.

Recall that is the set of all -supermartingales with

In a dynamic manner, denote by the set of all -supermartingales verifying the condition

Note that is the set of all integrable -measurable random variables and coincides with .

Define the value-function process in a backward manner as follows : , and for , let

| (10) |

Proposition 6.

For any ,

Proof.

The case where is trivial. In the following, we assume that the equality has been proved.

Let be an element in . There then exists a -supermartingale such that

which implies that . Therefore by the induction hypothesis. Combining this with the condition , we obtain by definition (10) that . Hence .

For the converse inequality, let such that and . By the induction hypothesis and an argument similar to Lemma 1, there exists a family of -supermartingales indexed by such that

and -measurable sequence is decreasing and . For each , let , and for . Then is a -supermartingale. Moreover,

which implies . Therefore

for any . By taking the limit when goes to the infinity, one obtains by . Since is arbitrary, . The result is thus proved. ∎

By the previous proposition, we can calculate the smallest initial capital by using the recursive formula for the value function (10). With extra regularity condition on the loss function , we can obtain a more explicit result as follows.

Proposition 7.

Let be a loss function satisfying Assumption 2 and let be the inverse function of . Suppose in addition that for any , and there exists a strictly negative random variable such that

| (11) |

Then the value function satisfies a.s. for where is given by

where is the solution of

| (12) |

and for ,

where is the solution of

| (13) |

Proof.

Step 1. Existence of . For any , let be the set of strictly negative -measurable random variables such that

By using the dominated convergence theorem, the condition and assumption (11) imply that the family is not empty. Let be the essential infimum of this family. Note that is stable by taking the infimum of finitely many random variables. Therefore can be written as the limit of a decreasing sequence in . The continuity of the functions and , together with the monotone convergence theorem, show that lies in the family . It remains to show the equality (13). If the equality does not hold, then for sufficiently small , the set of such that

has a strictly postive measure. This implies that also lies in , which leads to a contradiction.

Step 2. Representation for . By Proposition 6,

Taking , we see that . On the other hand, for every strictly negative random variable , where is the Legendre transformation of . Note that one has . So

where the last equality comes from the relation . Taking to be the solution of (12), we find that , which proves the desired representation of .

Step 3. General case. We now proceed to the proof of the general case by induction on . Assume that we have already established the equality . By Proposition 6 and this induction hypothesis,

We choose

which is bounded from below by and satisfies . In fact, it is clear that this inequality holds on the set . Moreover, on the set , one has , so

which implies on this set by the definition of . Hence

The opposite inequality is straightforward on the set . It remains to establish the inequality on the set . We have by a variable change

for any strictly negative . On the set , the last constraint above can be replaced by

Now we choose to be the solution of (13) to obtain the following constraint

Therefore on the set , we have

which implies the inequality . The theorem is thus proved. ∎

In the risk-neutral case where , we can relax Assumption 2 and obtain a similar result under Assumption 1 only.

Proposition 8.

We assume that and that for any , .

-

1.

The value function satisfies a.s. for where

where is the solution of

(14) -

2.

If the loss function , with for all , then the value function satisfies a.s. for where

Proof.

-

1.

The formula for follows directly from Jensen’s inequality. We prove the general case by induction. Assume that we have already established the equality . To prove the formula for , we first follow Step 1 in the proof of Proposition 7 to establish the existence of . Next, let

Clearly, . In addition,

where we denote . This proves that .

The opposite inequality only needs to be shown on the set . As in the proof of Proposition 7, we have,

Let be any random variable satisfying the constraints. Then, by convexity,

where denotes any number belonging to the subdifferential of the convex function at the point , defined by

Since , this implies

By the assumption of the proposition, on the set , and may not be the solution of Equation (14). Therefore, almost surely, and

on , which finishes the proof.

-

2.

The formula for follows from part 1. When , , and the formulas hold true. Assume then that . First we observe that a.s., otherwise on the set where , and the conditional expectation cannot be equal to . Therefore,

∎

3.3 Lookback-style constraint

The lookback constraint involves the maximum value of the loss function during the whole period. So the dynamic programming structure takes into account this variable.

Recall that denotes the set of all -supermartingales with

Define , where is a pair of -measurable random variables, to be the essential infimum of all such that there exist a -supermartingale and a -supermartingale verifying

| (15) |

We denote the set of all such -supermartingales by . By convention, let

Proposition 9.

Proof.

Let and be respectively and supermartingales which verify (15) with . Then

Therefore

Hence . Therefore

Conversely, given a -supermartingale in , we can choose

and , and to construct a -supermartingale verifying the condition (15) with . Thus . The result is proved. ∎

Proposition 10.

equals the essential infimum of all , such that there exists a random variable satisfying

| (16) |

Proof.

Denote by the essential infimum defined in the theorem. Let and be random variables which verify (16). By an argument similar to Lemma 1, there exists a decreasing sequence of random variables in such that . Moreover, there exist -supermartingales and -supermartingales verifying

| (17) |

and . Let and . The processes and are respectively and supermartingales which satisfy the condition (15). Therefore, for any , which implies . So .

Conversely, let and be respectively -supermartingale and -supermartingale which verify the condition (15). Without loss of generality, we may assume and that is a -martingale. Note that can also be written as

By the definition of ,

which shows that and verify the conditions in (16). Therefore . Since is arbitrary, we obtain .

∎

4 Explicit examples for

In this section, we apply the dynamic programming results obtained in the previous section under the three types of constraints and we give the explicit form of the smallest hedging portfolio value in the setting of two time steps.

4.1 European-style constraint

In the following, we assume that the function satisfies Assumption 2. We have by Corollary 1,

By Proposition 7,

| (18) |

where is the -measurable random variable such that

and

We then use (9) again to compute the value of , which identifies with the essential infimum of , such that and that there exists verifying and . Namely,

| (19) |

4.1.1 Exponential utility case

Consider the loss function where , with . Direct computations yield , and . Therefore,

from which we deduce

| (20) |

Denote by

From (20) we have that

Hence is the infimum of the expectations , where such that

| (21) |

We will use Lagrange multiplier method (with Kuhn-Tucker conditions) to study this problem. If realizes the infimum of subjected to the constraints (21), then verifies the first order condition

where and are respectively positive solutions to the equations

and

We introduce the notation and rewrite the above equations as

from which we obtain

| (22) |

by taking a linear combination. Moreover, the quotient of the two equations shows that verifies the following equation (provided that )

where . Note that

- •

-

•

If

then only the first constraint in (21) is saturated and one should take . In this case the first order condition becomes

with . Therefore, one has

Thus we obtain

-

•

If

then only the second constraint in (21) is saturated, and one has . In this case the first order condition becomes

with . Therefore, one obtains

Finally, we obtain

4.2 Time-consistent constraint

4.2.1 Exponential utility

From (20) as in the European case,

By Proposition 7, may be found using the following algorithm:

-

•

Compute .

-

•

If then the constraint at date is not binding, and the solution is given by .

-

•

If then the constraint at date is binding and we proceed as follows:

-

–

Compute by solving the equation

-

–

The solution is given by

-

–

4.3 Lookback-style constraint

By Proposition 10,

4.4 Risk-neutral case

As we have already mentioned, in the three cases, the value functions at time coincide. In the risk-neutral case where , we have , so

For the initial value at time , we have the following results :

-

•

European-style constraint :

-

•

American-style constraint :

-

•

Lookback-style constraint :

4.5 Numerical illustration

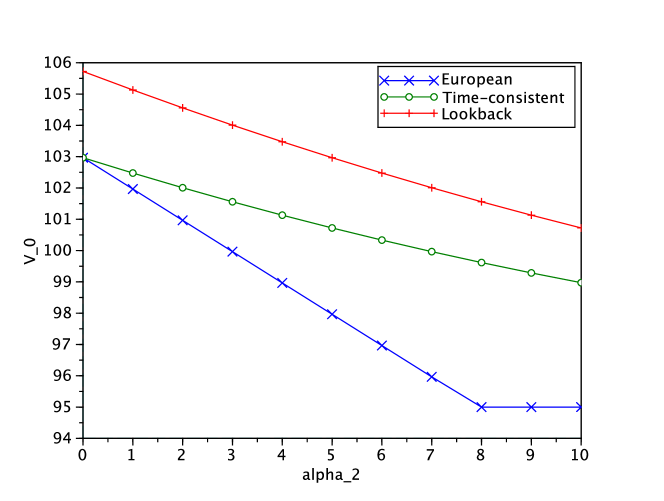

We compare the cost for hedging two objectives under the three probabilistic constraints in a numerical example.

In Figure 1, we consider the risk-neutral case where and the loss function is given by . The model is as follows : and where , and and are standard normal random variables with correlation . We fix the loss tolerance at the first date to be and plot the hedging value for three different constraint styles as a function of the loss tolerance at the second date .

Not surprisingly, all the three curves are decreasing w.r.t. the constraint level . Moreover, among the three constraints we consider, the European constraint corresponds to the lowest hedging cost and the lookback constraint to the highest one, which is coherent with Proposition 2. Finally, the cost of almost sure hedging is higher than the three probabilistic constraints.

5 Explicit examples for arbitrary

For the multi-objective hedging problem, it is in general difficult to get explicit solutions by using the recursive formulas. In this section, we first present a situation where the explicit solution may be obtained for the expected loss and then extend our framework to discuss the conditional Value at Risk.

Our first result deals with the expected loss constraint given as a call function under a risk-neutral probability.

Proposition 11.

Let . Assume that , and that the process is non-decreasing. Then,

| (24) |

Proof.

We have up to now considered risk constraints given by (conditional) expected loss. In the literature and in practice, the risk constraint is often described by using risk measures. Let us now extend our framework to cover loss constraints expressed in terms of the conditional Value at Risk. We once again assume that and denote by the set of all supermartingales such that for any , where is the risk measure defined by

| (25) |

where represents the loss. It is also well known to satisfy

and

The minimum above is attained, so that one can write

| (26) |

Moreover, the simplified formula

holds whenever has continuous distribution.

We define

| (27) |

Let us start with some simple observations:

The following representation reduces the problem (27) to that of hedging under expected loss constraints.

Proposition 12.

where is a shorthand for , and

Proof.

For every fixed, the set contains the set of supermartingales satisfying , which shows that

On the other hand, for any , there exists an -supermartingale satisfying and such that

Since the infimum in (24) is attained, we can also find such that . But this means that

which completes the proof since is arbitrary. ∎

We close this section by presenting a particular case when the solution of problem (27) is completely explicit.

Proposition 13.

If is an increasing process, then

Appendix

Lemma 2.

Let be a probability space, and . Then,

and

Proof.

First part. By considering only one of the two constraints, we have clearly

In addition,

and so

To finish the proof, we need to find which satisfies the constraint and realizes the equality.

Assume first that

This is equivalent to

In this case we can take

If

we take

If finally

then we can take

Second part. Since satisfies the constraint, . On the other hand,

∎

We now consider the case when is arbitrary but the objectives are ordered.

Lemma 3.

Let be a probability space, with a.s. and . Then,

Proof.

-

1.

Assume that there exists such that

(29) Then the constraint implies since

We can then remove the constraint without modifying the value function. Repeating the same argument for all other indices satisfying (29), we can assume with no loss of generality that,

(30) We then need to prove that

-

2.

Removing all the constraints except the last one, it is easy to see that

To finish the proof, it is then enough to find which satisfies the constraints and is such that .

-

3.

If , we let

and

Otherwise, let and

By construction, and since , also . To check the other constraints, observe that if then a.s. and so . On the other hand, if then a.s. and so by (30)

∎

References

- [1] B. Bouchard, R. Elie, and N. Touzi, Stochastic target problems with controlled loss, SIAM Journal on Control and Optimization, 48 (2009), pp. 3123–3150.

- [2] B. Bouchard, L. Moreau, and M. Nutz, Stochastic target games with controlled loss, Annals of Applied Probability, to appear.

- [3] B. Bouchard and T. N. Vu, A stochastic target approach for P&L matching problems, Mathematics of Operations Research, 37 (2012), pp. 526–558.

- [4] P. Boyle and W. Tian, Portfolio management with constraints, Mathematical Finance, 17 (2007), pp. 319–343.

- [5] Cour de Comptes (French public auditor), Les coûts de la filière électronucléaire. Public report, January 2012.

- [6] J. Detemple and M. Rindisbacher, Dynamic asset liability management with tolerance for limited shortfalls, Insurance: Mathematics and Economics, 43 (2008), pp. 281–294.

- [7] J. L. Doob, Measure theory, vol. 143 of Graduate Texts in Mathematics, Springer-Verlag, New York, 1994.

- [8] N. El Karoui, M. Jeanblanc, and V. Lacoste, Optimal portfolio management with American capital guarantee, Journal of Economic Dynamics and Control, 29 (2005), pp. 449–468.

- [9] H. Föllmer and P. Leukert, Quantile hedging, Finance and Stochastics, 3 (1999), pp. 251–273.

- [10] H. Föllmer and P. Leukert, Efficient hedging: cost vs. shortfall risk, Finance and Stochastics, 4 (2000), pp. 117–146.

- [11] H. Föllmer and A. Schied, Stochastic Finance, De Gruyter, Berlin, 2002.

- [12] A. Gundel and S. Weber, Robust utility maximization with limited downside risk in incomplete markets, Stochastic Processes and Their Applications, 117 (2007), pp. 1663–1688.

- [13] D. Kramkov and W. Schachermayer, The asymptotic elasticity of utility functions and optimal investment in incomplete markets, Annals of Applied Probability, 9 (1999), pp. 904–950.

- [14] L. Martellini and V. Milhau, Dynamic allocation decisions in the presence of funding ratio constraints, Journal of Pension Economics and Finance, 11 (2012), p. 549.

- [15] J. H. Van Binsbergen and M. W. Brandt, Optimal asset allocation in asset liability management, tech. rep., National Bureau of Economic Research, 2007.