Over-the-counter market models with several assets

Abstract

We study two classes of over-the-counter markets specified by systems of ODE’s, in the spirit of Duffie-Gârleanu-Pedersen [6]. We first compute the steady states for many of these ODE’s. Then we obtain the prices at which investors trade with each other at these steady states. Finally, we study the stability of the solutions of these ODE’s.

keywords:

[class=AMS]keywords:

[table]capposition=top \floatsetup[figure]capposition=bottom \setattributejournalname \endlocaldefs

and and

1 Introduction

This article addresses the question of equilibrium price formation and stability in relatively opaque over-the-counter (OTC) markets with several traded assets. The financial crisis of 2008 brought significant concerns regarding the rôle of OTC markets, particularly from the viewpoint of global financial stability. Darrell Duffie’s recent monograph, Dark Markets (see Duffie [5]), documents some of the modelling efforts done to understand the effects of illiquidity associated with search and bargaining. Duffie also notes that this area is still underdeveloped in comparison with the vast literature available on central market mechanisms.

Our goal is to shed some light on foundational issues in asset pricing in OTC markets with several assets. In particular, we study models of OTC markets described by ODE’s which happen to have a financial market (time invariant) equilibrium (that is, a steady state). In doing so, we are lead to ODE’s which have not yet appeared in the differential equations literature. For the specialists in financial economics, it is well known that in OTC markets, an investor who wishes to sell must search for a buyer, incurring opportunity and other costs until one is found (see for instance Duffie, Gârleanu and Pedersen [6]). For the case of one asset, the evolution of an investor’s state can be described by a system of four quadratic differential equations, an overview is given in Chapter 4 of Duffie [5]. There the author develops a search-theoretic model of the cross-sectional distribution of asset returns, under the hypothesis that the eagerness of the investors are the same whether they have the asset or not. Here we study the more general case with several assets for two classes of extended models which are still described by systems of quadratic differential equations, but without the particular hypothesis. One should notice that without changes of positions the system would stop after a finite time and the market would become inefficient.

For the first extended model, we do not track the particular asset an investor wants to buy when she enters the market (it is called the non-segmented model/case); but the frequency at which she enters the market depends on that asset. For the second model, we do keep track of the asset an investor intend to purchase (it is called the partially-segmented model/case). In both of our cases the quantities of each asset do not have to be the same. Here we study these two classes of markets in the spirit of Duffie, Gârleanu and Pedersen [6]. When there is only one traded asset, as in DGP, the two cases collapse to the same model. Unlike, DGP, we do not assume that the investors’ eagerness are the same whether they own the asset or not. The departure from this assumption in DGP requires us to use techniques from the theory of dynamical systems.

In such a framework, the first thing we need to show is the existence of a steady state (this steady state is designated, in the financial literature, by the equilibrium (time-invariant) cross-sectional variation in the distribution of ownership). To gain insights on these systems out of equilibrium, we also show that each of our systems is asymptotically stable for any given number of assets in the case of non-segmented markets and for (one and) two assets in the case of partially segmented markets. We show the latter using the old criterion of Routh-Hurwitz (see, for instance, Dorf and Bishop [3]). The criterion gets very steeply more difficult to handle as we increase the number of assets. (See also Grasselli and Costa Lima [8] for another example of the use of this criterion in a financial context.)

In Section 2, we describe our two classes of models. In Section 3.1, we show the existence of a steady steate and compute it explicitly for the non-segmented case for any given number of assets. In Section 3.2, we do the same for the case of partially-segmented markets with two assets. Then in Section 4, we obtain the prices on which the investors agreed and we give numerical exmples in section 5. Finally, in Section 6, we study the asymptotic stability of our systems.

2 Two classes of models

Duffie [5] and Duffie, Gârleanu and Pedersen [6] present their model of OTC market with one traded asset as a system of four linear ODE’s with two constraints which can be reduced to a system of two differential equations with two constraints. In this section, we describe two extensions of their model involving assets. Before describing each model in details, we would like to set up a few general definitions.

The set of available assets will be denoted . Investors can hold at most one unit of any asset and cannot short-sell. Time is treated continuously and runs forever. The market is populated by a continuum of investors. At each time, an investor is characterized by whether he owns the -th asset or not, and by an intrinsic type which is either a ’high’ or a ’low’ liquidity state. Our interpretation of liquidity state is the same as in Duffie, Gârleanu and Pedersen [6]. For example, a low-type investor who owns an asset may have a need for cash and thus wants to liquidate his position. A high-type investor who does not own an asset may want to buy the asset if he has enough cash. Through time, investors’ ownerships will switch randomly because of meetings leading to trades, at a rate , and the investor’s intrinsic type will change independently via an autonomous movement. This dynamics of investor’s type change is modeled by a (non-homogeneous) continuous-time Markov chain on the finite set of states . This set will be described in more details in each one of the following subsections since it depends on the model.

At any given time , let denote the proportion of investors in state , i.e. for each , is a probability law on .

Let denote the proportion of asset , for all .

2.1 Non-segmented markets

In this simpler model, we recall that we do not track the particular asset an investor wants to buy when entering the market. Let and denote respectively a low liquidity and a high liquidity type and let and denote respectively whether an investor owns or does not own an asset. Then, the set of investors’ states is fully described as follows: .

As we said earlier, we do not assume the eagerness of investors is the same when they own the asset and when they don’t. For investors not-owning an asset, let us denote the switching intensity from low-type to high-type by and conversely the switching intensity from high-type to low-type by . For investors owning asset , we will denote the switching intensity from low-type to high-type by and conversely the switching intensity from high-type to low-type by . In addition, investors meet each other at rate , and an exchange of the asset occurs when an investor of type (owns asset but has a low liquidity state) meets one of type (does not own an asset but has a high interest for acquiring one).

Hence, the dynamical system describing the evolution of the proportions of investors in a given state is the following system of equations with constraints for for each :

| (1) | ||||

| (2) | ||||

| (3) | ||||

| (4) |

with the constraints

This is a first generalized version of the system described in Duffie, Gârleanu and Pedersen [6].

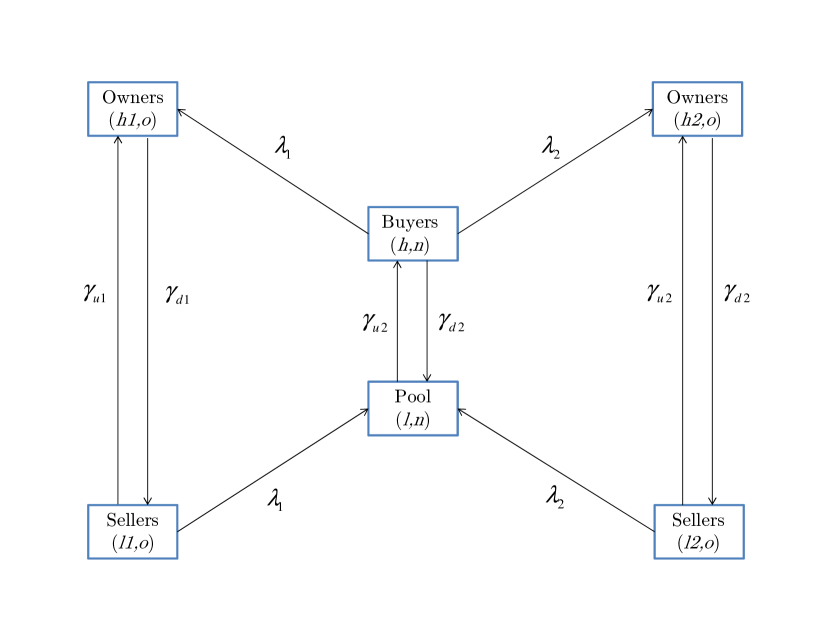

A schematic of the dynamics between investors for this class of market with two assets is illustrated on Figure 1.

Since equation (2) and equation set (3) can be eliminated respectively by adding (2) to (1) and by adding each equation of (4) to (3), the initial system described by a set of equations is reduced to the following set of equations:

| (5) | ||||

with the constraints

| (6) | ||||

| (7) |

Note that in the first set of constraints, is the fraction of the investors’ population holding the -th asset, with . The second constraint is the investors’ proportions normalisation. Moreover, since all parameters are positive, a minus sign in the system means an exit from the state and a positive sign means an entry in the state.

The system (5) is the Master Equation. It is non-linear but there is nevertheless for each initial law a probability law on the pure jump trajectories on , which has the Markov property. We do not have, however, that this law is the convex combination , where are Dirac masses. The existence of , on the pure jump trajectories, can be obtained by solving a martingale problem which is built with the intensity measure, , defined as follows :

for , other terms being . This intensity measure satisfies the conditions of Theorem 2.1, page 216, of Stroock [9]. So, once we have solved the ODE system, for each initial condition , we see that there exists a probability measure . The fact that this law is supported by the set of pure jump trajectories can be proved as in Lemma 1, page 588, of Sznitman [10]. It is such a description that we use below to obtain an expression for the intrinsic value associated to the state of an investor at each time. Using the properties of this expression we can then evaluate the directly negotiated prices among investors in our relatively opaque market. One can also consult Appendix I of Duffie [4] for a review of the basic theory of intensity-based models.

It is worth noticing that the laws can be obtained by a functional law of large numbers as in Ferland and Giroux [7] or by rewriting the system with the help of a single kernel and then using Theorem 1 of Bélanger and Giroux [1].

Weill [12] proposed a similar system with the assumption that the eagerness is the same for all assets.

2.2 Partially segmented markets

In this class of models, buyers who do not hold an asset enter the market with a specific asset they want to purchase. Hence, the set of investors’ type is given by . As before, the first letter designates the investor’s intrinsic liquidity state and the second letter designates whether the investor owns the asset or not.

In this case, the eagerness’ parametrization is the following: If an investor initially does not own any asset and is a low-type, the switching intensity of becoming a high-type is and it now depends on the asset type. If he initially does not own any asset but is a high-type, he will seek to buy a specific asset and his switching intensity of becoming a low-type is and it now also depends on the asset type. However, if an investor initially is owning that specific asset and is a high-type (that is, he wants to keep his asset), the switching intensity of becoming a low-type is . If he initially owns a specific asset but is a low-type, the switching intensity of becoming a high-type is . In addition, investors meet each other at rate , but an exchange of the asset occurs only if an investor of type meets one of type .

Hence, we have the following dynamical system of investors’ type proportions measure for each , which consists of equations with constraints:

| (8) | |||||

| (9) | |||||

| (10) | |||||

| (11) |

with the constraints

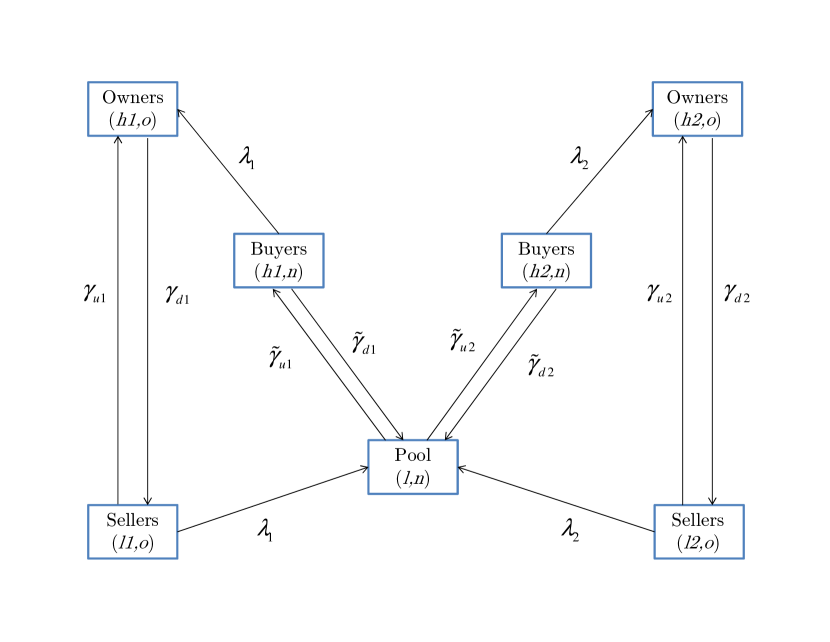

A schematic for the dynamics between investors for this class of models in a two assets-market () is illustrated on Figure 2.

Note that equation (9) of the previous system can be eliminated by adding each equation of (8) to (9). Similarly, each equation of (10) can be eliminated by adding it to the corresponding equation of (11). The system is then reduced to the following system of equations:

| (12) | ||||

with the constraints

| (13) | ||||

| (14) |

The system (12) is our Master Equation and we define the intensity measure, , as follows :

for , other terms being .

Vayanos and Wang [11] proposed a similar two asset market.

3 The steady state of ODE systems

We have a steady state when the left hand side of our systems (5) and (12) are equal to zero. That is, when there is no longer dependence on time.

3.1 Non-segmented markets

Here, we need to solve the following system of equations:

| (15) | ||||

| (16) |

First, note that we can eliminate in (15) by using the constraint equation (7). Thus, (15) becomes

| (17) |

where . Moreover, to simplify the last equation, we then substract the equations of (16) to (17) to have

| By using the constraint equation (6) to replace each in the last equation, we then have | ||||

| (18) | ||||

where .

Furthermore, each of the equations in (16) gives us the identity

| (19) |

which can be substituted into (18) to have

| (20) |

Then, one need to solve for . Hence we get from which we get by (6) , each by identity (19) and finally, each , by (7).

The challenge here is to solve for . First, note that we have

-

1.

since and ;

-

2.

;

-

3.

is a decreasing function for .

So there is a positive root between 0 and which can always be calculated numerically. Thus, there always exist a stationary solution for any .

3.2 Partially segmented markets

From our Master equation (12), we need to solve the following system of equations:

| (21) | ||||

| (22) |

with the constraints

| (23) | ||||

| (24) |

Using each of the constraint (23) and substituting them in each equation of (22) for , we get

and thus

| (25) |

where .

Now, subtracting each (22) to each (21) and using constraint (24) to substitute for , we get:

Using constraint (23) to substitute for and substituting (25) for , we finally get:

| (26) | ||||

Hence, we have to solve a nonlinear system of equations in unknowns . Once we have solved for , we can get by (25) and deduce that , by (23), and that , by (24).

Since the case is the same whether the market is non-segmented or partially segmented, we have the result by the previuous subsection. We will prove the case in the following subsection.

3.2.1 Special case of two assets

From (26) with , we get the following system to solve:

| or by rearanging terms: | ||||

| (27) | ||||

| (28) | ||||

Note that the first curve (27) passes through the following two points in the set , with and :

| and | ||

because . By symmetry, we get that the second curve (28) passes through the points

| and | ||

because .

Hence the two curves must meet in the positive unit square and we have a stationary law.

4 Asset pricing

Let denote the consumption process. Let a utility function and , the money market interest rate (which is assumed to be constant). As before, we also have , our non-homogeneous Markov chain describing investors’ type (similarly to Duffie, Gârleanu and Pedersen [6]). We have the following infinite-horizon expected utility maximization problem:

| (29) |

where the wealth process satisfy the following equation:

| (30) | ||||

with the initial wealth, is the trade price between agents. is the ownership process for the -th asset defined by

| (33) |

Note that here is simply a shorthand for .

Following Duffie, Gârleanu and Pedersen [6], we will assume for simplicity that investors are risk-neutral, that is we can let . Hence, from (29), we define the following optimization problem:

| (34) |

subject to the budget equation

| (35) |

where

| (36) |

4.1 The intrinsic values

We now want to calculate for each state the intrinsic prices at time

| (37) |

Let be the time of the first jump in the chain after time , so we can rewrite (37) as

By conditional iteration, the second term can be written as

and thus

In the next subsections, we present the intrinsic value for each state for the non-segmented and the partially segmented models. The details of calculation are in Appendix A.1.

4.1.1 Intrinsic values for the non-segmented markets

The details of calculation for this class of models are in Appendix A.1.1. The results are:

| (38) | |||||

4.1.2 Intrinsic values for the partially segmented markets

The details of calculation for this class of models are in Appendix A.1.2. The results are:

4.2 ODE’s for

As we want to compute the steady prices, we first need to compute the derivative of in time for each states . We can note from the previous section that is always of the form

Thus, we have

Explicit details of these calculations are presented in Appendix A.2.

4.2.1 ODE’s for for the non-segmented markets

The details of calculation for this class of models are in Appendix A.2.1. The results are:

| (46) | |||||

| (48) | |||||

4.2.2 ODE’s for for the partially segmented markets

The details of calculation for this class of models are in Appendix A.2.2. The results are:

| (50) | |||||

| (52) | |||||

4.3 Equilibrium intrinsic values and prices

The equilibrium intrinsic value are computed by putting for each state .

4.3.1 Equilibrium prices for the non-segmented markets

From the four equations (46), (4.2.1), (48) and (4.2.1), we get the following system:

Rewriting this system, we get

Written in a similar manner as the system A5 in Appendix of Duffie, Gârleanu and Pedersen [6], but without marketmakers (), we have the following generalized system:

Now, to find the price , we first rewrite the system in terms of the reservation prices for buyers and sellers . As we must have , it implies that

| (54) |

where represents the bargaining power of agents and is assumed to be the same for each asset . Then,

Define and and rewrite the system:

which is a linear system of equations in unknowns. If we define the vectors

| (55) |

and

| (56) |

it gives us the following system to solve (which is similar to the system A7 in Appendix of Duffie, Gârleanu and Pedersen [6]):

| (57) |

where is a coefficient matrix defined in Appendix B.1.

If is invertible, we can solve this system by computing and then compute asset’s price using (54).

4.3.2 Equilibrium prices for the partially segmented markets

Thus, from the four equations (50), (4.2.2), (52) and (4.2.2) of , it gives us the following system:

By rewriting this system, we have

Now, to find the price , we first rewrite the system in terms of the reservation prices for buyers and sellers . As we must have , it implies that

| (58) |

where represents the bargaining power of agents and is assumed to be the same for each asset . Then, we have

Define and and rewrite the system:

which is a linear system of equations in unknowns. If we define the vectors

| (59) |

and

| (60) |

it gives us the following system to solve:

| (61) |

where is a matrix defined in Appendix B.2.

If is invertible, we can solve this system by computing and then compute asset’s prices using (58).

5 Numerical examples for markets with two assets

This section contains a few numerical results for our two classes of models. We present these examples primarily for an illustrative purpose.

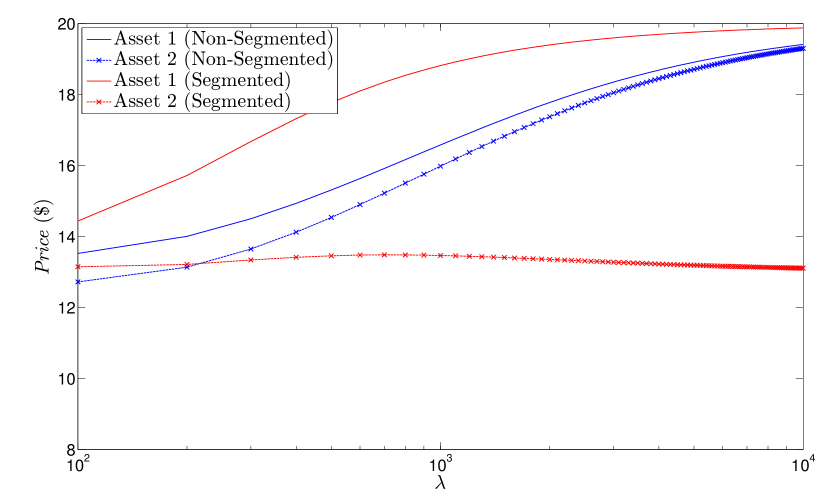

We will use (and modify) the parameters used in Duffie [5]. We also refer to the reader to this book for the empirical justification of these parameters. That is, we assumed that and for the non-segmented class, and and for the segmented class. We moreover assumed that . For comparison purpose we split in two Duffie’s value of and use .

We can see in Table 1, for the non-segmented class, under these parameters, and , where and are the steady states for Duffie’s one-asset market. Note also that the prices are identical and equal to the price obtained in Duffie [5]. The steady state proportions are different for the partially segmented market because the expected return times of the states are different. For example, it is shorter to return to because so , equal to the reciprocal of that expected return time, is greater than in the non-segmented market. Conversely, we get a smaller because of the longer cycle in the chain that passes through , . In turn, the misallocation of assets, , decreases slightly the steady state price (see previous scheme on Figure 2).

| Asset | ||||||

| Non-segmented | ||||||

| Asset 1 | - | 0.1118 | 0.0014 | 0.3986 | 0.0882 | 18.5451 |

| Asset 2 | - | 0.1118 | 0.0014 | 0.3986 | 0.0882 | 18.5451 |

| 0.0028 | 0.7972 | |||||

| Segmented | ||||||

| Asset 1 | 0.0772 | - | 0.0020 | 0.3980 | 0.0456 | 18.3930 |

| Asset 2 | 0.0772 | - | 0.0020 | 0.3980 | 0.0456 | 18.3930 |

| 0.1544 | 0.0039 | 0.7961 | ||||

We now turn our attention to the sensitivity of prices with respect to . We still assume that . We can see generally that the price will tend to the perfect market price () when frictions diminish, i.e. when . The prices of the second asset in the partially segmented market exhibit a different behavior though. Its parameters and were doubled (see Figure 3).

6 Asymptotic stability

We analyse the asymptotic stability of our ODE’s systems by computing the characteristic polynomial of their Jacobian. If we can prove that all eigenvalues have negative real parts, then we have asymptotic stability (see Braun [2]). We do it directly, in a manner similar to that of Weill [12] for the non-segmented markets with any given number of assets. Thus, it gives us, in particular, the asymptotic stability for partially segmented markets with one asset. In order to prove the asymptotic stability for partially segmented markets with two assets, we resort to the Routh-Hurwitz criterion which gives specific conditions on the coefficients of a polynomial to ensure that the real part of all its root are negative (see Dorf and Bishop [3]).

As mentioned before, our limitation in this latter case comes from the fact that the Routh-Hurwitz stability criterion gets very steeply harder to verify as we increase the number of assets.

Because the Jacobian calculations involves a linear approximation of our systems close to its steady state, we prove in fact local stability. That is, we have asymptotic stability of our systems for a subset of initial laws close to the steady state. Duffie, Gârleanu and Pedersen [6] prove, more generally, the stability of their system for any initial law . Their technique relies on the fact that they have a single asset and their assumption on investors’ eagerness.

To simplify notations in the following subsections, we define , and . Moreover, let denote the eigenvalue of the following characteristic polynomial of each system’s Jacobian matrix.

6.1 Non-segmented markets

For this class of models, we will prove the system’s stability for any assets by showing directly that all eigenvalues of the Jacobian have negative real parts.

Let , , … , and . Then, by substituting constraint (7) for and constraints (6) for each , we can rewrite the system (5) as:

We compute the following Jacobian matrix of the system at its steady state:

where

with , , and .

Let and let be the eigenvalue for associated with the eigenvector , where and . Then we have:

| (62) | |||

| (63) |

The inner product of with (62) gives

| (64) |

If we expand (63), we get

| (65) |

Thus, subtracting (65) to (64), we get

Case : We have

In this case, we must have and the system is asymptotically stable.

Case : We can suppose without loss of generality that . So,

Then (62) becomes

It implies that:

Since

there exists such that

Then we see that

Thus, the system is asymptotically stable for any number of assets.

6.2 Partially segmented markets

Because the partially segmented and the non-segmented markets are equivalent for one asset, the stability for one asset in this case is already proved. So we will verify it for the case .

Let , , and . Then, as before, we can rewrite the system as:

We compute the following Jacobian matrix of the system at its steady state:

The characteristic polynomial of is

where:

We can readily see that We need furthermore to check that in order to satisfy the Routh-Hurwitz criterion which enables us to conclude that the system is stable. This last step is done using Mathematica. We expand the algebraic expression and then simplify it to see that the result is a (very long) multiplication and addition of positive numbers. This shows, by Routh-Hurwitz, that the real parts of all eigenvalues are strictly negative ensuring the asymptotic stability of the system.

7 Acknowledgements

The first author would like to thank the Université de Sherbrooke and its Faculté d’administration for their start-up grant.

Appendix A Calculation details

A.1 Intrinsic values

A.1.1 Intrinsic values for the non-segmented markets

For the non-segmented markets, we have:

Case : In this case, the only jump possible is towards the state with a time , where . Then, for , from (33) and (36), we have , , which implies that and

Case : The next jump will be towards or , for any . Since the investor automatically buys the first available asset, we have the time until the next jump, where but, for each , has a jump intensity and the following probability distribution(see Lemma 1 of Sznitman [10]):

In this case, for , we have and , but for , we have

We now compute the intrinsic value as follows:

Because we know the full intensity measure, we have that the densities are and . Since the probabilities in the integrals are

then

Case : The only jump possible is towards with a time , where . In this case, for , we have and , so

Case : The next jump will be towards or , for some . Thus, we have the time until the next jump, where , but has a jump intensity and the following probability distribution (see Lemma 1 of Sznitman [10]):

In this case, for , we have and , but for , we have

We now compute the intrinsic value as follows:

and thus, by knowing the density , we have

A.1.2 Intrinsic values for the partially segmented markets

For the segmented markets, we have:

Case : The next jump will be towards for any . Thus, we have , the time until the next jump to the state , where independently. Then, we have and , , and thus

Case : The next jump will be towards or , for some . Thus, we have , the time until the next jump, where but has a jump intensity with the following probability distribution (see Lemma 1 of Sznitman [10]):

In this case, for , we have and , but for , we have

We now compute the intrinsic value as follows:

and thus

Case : In this case, the intrinsic value calculation details are identical to the case in the partially segmented market.

Case : The next jump will be towards or . Thus, we have the time until the next jump, where but has a jump intensity and the following probability distribution (see Lemma 1 of Sznitman [10]):

In this case, for , we have and , but for , we have

The remaining intrinsic value calculation details are very similar to the case in the partially segmented market.

A.2 ODE’s for

A.2.1 ODE’s for for the non-segmented markets

For the non-segmented markets, we have:

A.2.2 ODE’s for for the partially segmented markets

For the segmented markets, we have:

Case : In this case, the calculation details are identical to the case in the partially segmented market.

Case : In this case, and we have

The remaining calculation details are very similar to the case in the partially segmented market.

Appendix B Details of the matrices

B.1 The non-segmented markets

The coefficients matrix in this case is defined as follows:

where , , and .

B.2 The partially segmented markets

(On next page)

The coefficients matrix in this case is defined as follows:

where , , and .

References

- Bélanger and Giroux [2013] {barticle}[author] \bauthor\bsnmBélanger, \bfnmA.\binitsA. and \bauthor\bsnmGiroux, \bfnmG.\binitsG. (\byear2013). \btitleSome new results on information percolation. \bjournalStochastic Systems \bvolume3 \bpages1-10. \endbibitem

- Braun [1993] {bbook}[author] \bauthor\bsnmBraun, \bfnmMartin\binitsM. (\byear1993). \btitleDifferential Equations and Their Applications, \bedition4 ed. \bpublisherSpringer-Verlag. \endbibitem

- Dorf and Bishop [2011] {bbook}[author] \bauthor\bsnmDorf, \bfnmR.\binitsR. and \bauthor\bsnmBishop, \bfnmR. H.\binitsR. H. (\byear2011). \btitleModern Control Systems. \bpublisherPearson. \endbibitem

- Duffie [2001] {bbook}[author] \bauthor\bsnmDuffie, \bfnmDarrell\binitsD. (\byear2001). \btitleDynamic Asset Pricing Theory, \bedition3 ed. \bpublisherPrinceton University Press. \endbibitem

- Duffie [2012] {bbook}[author] \bauthor\bsnmDuffie, \bfnmDarrell\binitsD. (\byear2012). \btitleDark Markets: Asset pricing and information transmission in over-the-counter markets. \bpublisherPrinceton University Press. \endbibitem

- Duffie, Gârleanu and Pedersen [2005] {barticle}[author] \bauthor\bsnmDuffie, \bfnmDarrell\binitsD., \bauthor\bsnmGârleanu, \bfnmNicolae\binitsN. and \bauthor\bsnmPedersen, \bfnmLasse Heje\binitsL. H. (\byear2005). \btitleOver-the-Counter Markets. \bjournalEconometrica \bvolume73 \bpages1815-1847. \endbibitem

- Ferland and Giroux [2008] {barticle}[author] \bauthor\bsnmFerland, \bfnmR.\binitsR. and \bauthor\bsnmGiroux, \bfnmG.\binitsG. (\byear2008). \btitleLaw of large numbers for dynamic bargaining markets. \bjournalJournal of Applied Probability \bvolume45 \bpages45-54. \endbibitem

- Grasselli and Costa Lima [2012] {barticle}[author] \bauthor\bsnmGrasselli, \bfnmM. R.\binitsM. R. and \bauthor\bsnmCosta Lima, \bfnmB.\binitsB. (\byear2012). \btitleAn analysis of the Keen model for credit expansion, asset price bubbles and financial fragility. \bjournalMathematics and Financial Economics (Springer). \endbibitem

- Stroock [1975] {barticle}[author] \bauthor\bsnmStroock, \bfnmD. W.\binitsD. W. (\byear1975). \btitleDiffusion processes associated with L vy generators. \bjournalZ. Wahrscheinlichkeitstheorie und Verw. Gebiete \bvolume32 \bpages209-244. \endbibitem

- Sznitman [1984] {barticle}[author] \bauthor\bsnmSznitman, \bfnmA. S.\binitsA. S. (\byear1984). \btitle quations de type Boltzmann spatialement homog nes. \bjournalZ. Wahrscheinlichkeitstheorie und Verw. Gebiete \bvolume66 \bpages209-244. \endbibitem

- Vayanos and Wang [2007] {barticle}[author] \bauthor\bsnmVayanos, \bfnmD.\binitsD. and \bauthor\bsnmWang, \bfnmT.\binitsT. (\byear2007). \btitleSearch and Endogeneous Concentration of Liquidity in Asset Markets. \bjournalJournal of Economic Theory \bvolume136 \bpages66-104. \endbibitem

- Weill [2002] {bunpublished}[author] \bauthor\bsnmWeill, \bfnmP. O.\binitsP. O. (\byear2002). \btitleLiquidity Premium in a Dynamic Bargaining Market. \bnoteWorking paper, Stanford University. \endbibitem