Extracting information from the signature of a financial data stream

Abstract

Market events such as order placement and order cancellation are examples of the complex and substantial flow of data that surrounds a modern financial engineer. New mathematical techniques, developed to describe the interactions of complex oscillatory systems (known as the theory of rough paths) provides new tools for analysing and describing these data streams and extracting the vital information. In this paper we illustrate how a very small number of coefficients obtained from the signature of financial data can be sufficient to classify this data for subtle underlying features and make useful predictions.

This paper presents financial examples in which we learn from data and then proceed to classify fresh streams. The classification is based on features of streams that are specified through the coordinates of the signature of the path. At a mathematical level the signature is a faithful transform of a multidimensional time series. (Ben Hambly and Terry Lyons [7]), Hao Ni and Terry Lyons [12] introduced the possibility of its use to understand financial data and pointed to the potential this approach has for machine learning and prediction.

We evaluate and refine these theoretical suggestions against practical examples of interest and present a few motivating experiments which demonstrate information the signature can easily capture in a non-parametric way avoiding traditional statistical modelling of the data. In the first experiment we identify atypical market behaviour across standard 30-minute time buckets sampled from the WTI crude oil future market (NYMEX). The second and third experiments aim to characterise the market ”impact” of and distinguish between parent orders generated by two different trade execution algorithms on the FTSE 100 Index futures market listed on NYSE Liffe.

1 Introduction

The frequency of market events such as order placement and order cancellation in most trading venues has increased dramatically since the introduction of computer based trading. During certain time intervals, orders can be submitted or modified within milliseconds or even faster. It is highly challenging to understand and track the characteristics of a market at a given moment. Quantitative analysts are eager to find methods to compress high frequency data streams without losing information that is relevant for their objectives.

This paper presents financial examples in which we classify streams of data. The classification is based on features of streams that are specified by a property of sample paths known as the signature of the path.

At an abstract mathematical level, the notion of a signature as an informative transform of a multidimensional time series was established by Ben Hambly and Terry Lyons [7], meanwhile Hao Ni and Terry Lyons [12] have introduced the possibility of its use to understand financial data and pointed to the power this approach has for machine learning and prediction.

We evaluate and refine these theoretical suggestions against some real world data and practical examples. In each of the analysed cases, we identify particular features, that is a low dimensional part of the signature that captures information relevant for the characterisation of various features.

In section 2, we recall the definition and key properties of the signature of a data stream. Moreover, we present a few motivating examples which demonstrate what information the signature preserves with special attention on properties which are not captured by the traditional statistical indicators.

Section 3 gives a description of the input data as well as the linear regression-based classification method.

Finally, in section 4, three numerical experiments are presented and the classification accuracy is analysed. In the first experiment we characterise the typical market behaviour within standard 30-minute time buckets sampled from the WTI crude oil future market (NYMEX). The second and third experiments aim to characterise the market impact of parent orders generated by two different trade execution algorithms on the FTSE 100 Index futures market listed on NYSE Liffe.

2 Signature of data streams

2.1 Origins of signature

The mathematical properties of iterated integrals of piece-wise regular multi-dimensional paths were first studied by K.T. Chen [2, 3]. B. Hambly and T. Lyons [7] extended these results to continuous paths of bounded variation.

Iterated integrals of continuous multi-dimensional paths naturally arise in the Taylor-expansion of controlled ordinary differential equations ([10, 13, 11]). Moreover, several numerical approximations of the solution to stochastic differential equations (SDEs) are based on the iterated (stochastic) integrals of Brownian motion (the reader is referred to [8] and the references therein).

Informally, the signature as data transform maps multi-dimensional paths to the sequence of their iterated integrals (1), where the sequence is equipped with some algebraic operations (ref. [10, 13, 11]). The signatures of continuous paths play a central role in the theory of rough paths [10, 13, 11, 4]. Moreover, the algebraic properties of the signature have been extensively used in the construction of numerical methods for approximation of solutions to SDEs [9, 14, 6] as well as for the approximation of solutions to differential equations driven by rough paths [4, 5].

The signature of time series and its application have been established by H. Ni and T. Lyons [12].

2.2 Intuitive introduction

Let be a continuous function of finite length defined on and taking values in , where . Moreover, let denote the set of all multi-indices , where , for . We introduce the notation for :

| (1) |

where is a multi-index with for .

The signature of over the time interval maps to the sequence

The following properties of iterated integrals and the signature are relevant in this paper111For the rigorous treatment of these properties the reader is referred to [11, 7].

-

(i)

Invariance to time re-parameterisation: for any continuous and monoton increasing function , and

-

(ii)

Linearity: for all there exist a set , such that

that is any polynomial of iterated integrals can be represented by a linear combination of iterated integrals (ref. [11]),

-

(iii)

Signature of linear paths: if for some and for all , moreover , then

- (iv)

-

(v)

Uniqueness: The main result of [7] is that determines the function for up to tree-like equivalence. A sufficient condition for the uniqueness is the existence of such that is strictly monotone increasing. Moreover, typically, the first few terms of the signature contain most of the information on the path.

In particular, the uniqueness property (v) highlights the relation between paths and their signatures; the truncated signature of a path is regarded as a projection of the path to a lower dimensional space. Furthermore, (ii) enables us to apply linear regression based machine learning techniques when estimating functionals of paths. Points (iii) and (iv) are relevant for the computation of the truncated signatures of data streams. Finally, (i) is used in section 2.5, where we claim that the lead-transform and the lag-transform both preserve the signature of data streams.

2.3 Interpretations of the terms in the signature

The lower order terms in the signature have simple interpretations. Recursively, one can derive the interpretation of the higher order terms. Here, we focus on some terms of order at most three.

Increments.

For

that is the first order terms determine the increments of the components.

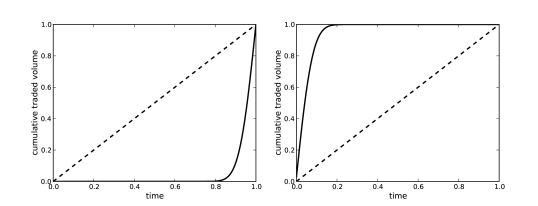

Figure 1 shows two trajectories in two dimensions. The left-hand-side plot, represents a volume profile in which the traded volume is concentrated towards the end of the time interval, whereas on the right-hand-side plot the traded volume is concentrated at the beginning of the time interval. Both curves have unit increments in both of their time and cumulative volume components.

Higher order terms.

Higher order iterated integrals can be interpreted as generalised polynomials of paths. Linear regression on these generalised polynomials can be interpreted as polynomial regression directly on the input paths. In order to obtain better accuracy in machine learning, we explore the relevance of each of these terms.

However, not all terms are required for the unique representation of a path in terms of its iterated integrals. In particular, some of the iterated integrals are determined by other iterated integrals as the following examples show.

These identities are implied by property (ii) in section 2.2. The minimal set of information that uniquely determines all the iterated integrals of a path through non-linear operations is called the log-signature of the path (ref. [10, 11, 4]). The components of the log-signature consist of certain linear combinations of the iterated integrals. We briefly introduce two of these terms – the area and a second order area – below.

Area.

Now, we give a possible interpretation of certain linear combinations of the higher order iterated integrals. For , the terms

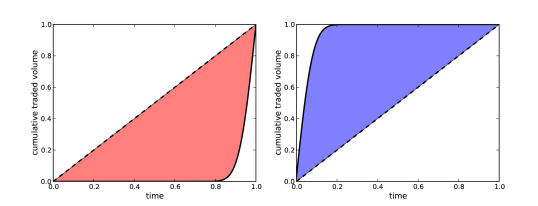

determine the signed area between the curve for and the cord that connects the points and . For example the blue (respectively red) shaded area in figure 2 indicates negative (positive) area. As noted above, the plotted curves have unit increments in both of their components, however one has a relatively large positive area, whereas the other has a relatively large negative area.

Second order area.

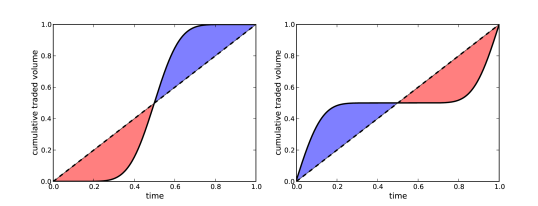

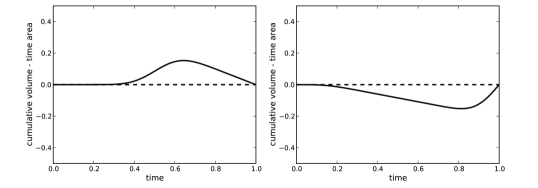

The upper graphs of figure 3 show two paths in two dimensions – the mid-loaded and the front-and-back-loaded volume profiles. Both trajectories have unit increments in both their components, and both have zero signed areas. In order to tell the difference between these two curves through their signature, one has to look into the third order terms. In particular, on the bottom graphs in figure 3 the curve is plotted; the area under this curve is negative for the mid-loaded volume profile, and positive for the front-and-back-loaded volume profile. This second order area is given by the formula

where the last step is implied by property (ii) (the reader is referred to section 2.2.3 of [11] for a rigorous proof).

Using similar recursive arguments, one can identify higher order areas and represent them in terms of linear combinations of iterated integrals.

Lead-lag relationship.

As the examples of this section show, the terms in the signature capture the lead-lag relationship. In particular, if an increase (respectively decrease) of the component is typically followed by an increase (decrease) in the component , then the area is positive. If a move in is followed by a move in to the opposite direction, the area is negative.

2.4 Signature of data streams

The previous section introduced the signature of continuous trajectories. In financial time series analysis, one can observe data streams, i.e. trajectories defined at and indexed by finitely many time points: in .

A possible way to define the signature of a data stream is via the iterated integrals of its the piece-wise linear interpolation. That is, we introduce the continuous path

and we define signature of the stream as

We note that Ni and Lyons [12] define the signature of data streams by constructing axis paths instead of using piece-wise linear interpolation.

2.5 Quadratic variation

We have shown that the terms of the signature – the iterated integrals – measure various path-dependent quantities. However, the quadratic variation of the process is not directly captured. Since this quantity has a high relevance in financial applications, we have found it crucial to incorporate quadratic variation into the signature. This is possible through the lead-lag transformation of streams.

In particular, given a stream in , we define its lead-transformed stream by

Moreover, we define its lag-transformed stream by

Finally, the lead-lag-transformed stream takes values in and is defined by the paired stream

Note that the axis path corresponding to the lead-transform stream is a time-reparameterisation of the axis path , hence

and similarly

Furthermore, the (signed) area between the th component of the lead-transform and the th component of the lag-transform equals to the quadratic cross-variation of the trajectories and .

In practice, we use a partial lead-lag-transform, that is we take the lead-transform of the input stream, and pair it with the lag-transform of only those components of which the quadratic variation is relevant (see section 3.1).

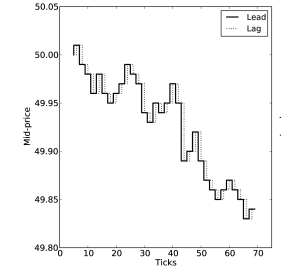

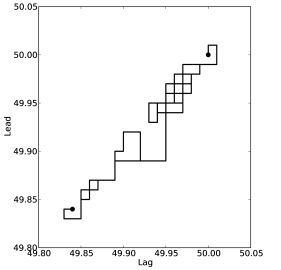

For instance, in figure 4, two representations of the axis path corresponding to the lead-lag transform of a simulated mid-price stream are shown. The signed area between the curve and the cord on the right-hand side plot equals to the quadratic variation of the mid price.

3 Methodology

3.1 Input data

Our numerical tests are focused on two futures markets: WTI crude oil (NYMEX) and FTSE 100 index (NYSE Liffe). We work with sub-sampled level-one order book data of the front-month (closest maturity) futures as raw data, in particular:

-

•

: best ask price,

-

•

: best bid price,

-

•

: number of outstanding orders at best ask price,

-

•

number of outstanding orders at best bid price,

-

•

: cumulative traded volume.

The sampling frequency is specified in the description of the particular tests.

In each test, the input variables are streams of level-one order book data; the features used by the classification algorithm are the terms of the truncated signatures of these streams. The lengths of the input streams depend on the particular test. However, in each case, we transform and normalise the data as follows. For each stream , we define the components:

-

•

the normalised time: ,

-

•

the normalised logarithm of mid-price:

where for each stream, is chosen to satisfy ,

-

•

the standardised spread: where for each stream, is chosen to satisfy ,

-

•

the normalised imbalance ,

-

•

the normalised cumulative volume: .

Using these components and the time stamps, each stream is transformed to .

In order to capture the quadratic variation of the log-price, the lead-transform is computed and is paired with the lag-transform of ; hence, the input streams are of the form:

| (2) |

We compute the signature of each stream up to depth , that is for

all iterated integrals that are indexed with multi-indices of length

at most . The signatures are computed with the sigtools Python package which is based

on the the libalgebra library of the CoRoPa

project222Version 0.3, ref.: http://coropa.sourceforge.net/.

3.2 Linear regression-based classification

In each numerical test (ref. sections 4.1, 4.2 and 4.3) a set of input streams is given, which we partition into two categories along some properties of the streams. The aim of the tests is to predict the category of a stream using its signature, that is when the independent variables – or features – are the terms in the truncated signatures of the input streams. A certain percentage of the streams in each category is used as a learning set and the remaining streams are used for out-of-sample testing. The value of the dependent variable – or response – is defined to be along the streams of one category and along the streams of the other category. The classification method is linear regression combined with LASSO (least absolute shrinkage and selection operator) shrinkage (ref. [1]) in order to identify the relevant terms in the signature. That is, we minimise the following objective function:

where denotes the set of multi-indices of length at most , , denotes the cardinality of the learning set, denotes the axis path corresponding to the th input stream , denotes the category ( or ) of the th input stream, and is the shrinkage parameter. For each test case, the level of is determined by -fold cross-validation.

Since the LASSO shrinkage is sensitive to the rescaling of variables, we centralise and normalise each independent variable across streams based on first and second moments that are estimated using the learning set of streams.

We used the

scikit-learn Python

package333Version 0.14, ref.: http://scikit-learn.org/ to compute the

LASSO-based regression coefficients.

3.3 Statistical indicators

In order to measure the accuracy of the classification, for each test case we compute the following measures based on the regressed values.

-

(i)

The Kolmogorov-Smirnov distance of the distributions of regressed values for each category computed using the learning set of streams.

-

(ii)

The Kolmogorov-Smirnov distance of the distributions of regressed values for each category computed using the out-of-sample streams.

-

(iii)

Setting the decision boundary at the level where the Kolmogorov-Smirnov distance is attained444This choice of threshold maximises the ratio of correct predictions. in (i), the number of true positives, false positives, true negatives, false negatives and the ratio of correct classification are computed.

-

(iv)

We plot the receiver operating characteristic (ROC) curve and compute the area under the ROC curve for the regressed values calculated using the learning set of streams.

-

(v)

We repeat (iv) using the score values computed using the out-of-sample streams.

4 Numerical tests

In this section, we describe various test cases and the numerical results.

4.1 Characterising standard time buckets of a futures market

As an initial exercise, we explore to what extent the signatures of 30-minute data streams determine the time bucket they are sampled from. In particular, we run binary classification on various pairs of time intervals, and explore which time buckets show similar behaviour and which time buckets have unique characteristics.

Since there are recurring patterns in the market activity, the data standardisation described in section 3.1 is done in order to hide the obvious features. Primarily, the order of magnitude of the trading volume or the level of volatility are all discarded through the standardisation process. The information that remains is what is captured by the first and higher order areas (see section 2.3).

Input streams

The underlying instrument is the front-month WTI crude oil future (NYMEX). The input streams are sampled by the minute from standard 30-minute time intervals on each trading date between st January 2011 and st February 2013. From each time-bucket of the streams are randomly selected for learning and the remaining are used for out of sample testing.

14:00-14:30

Despite hiding the obvious features, the 14:00-14:30 EST time bucket shows very distinctive characteristics. Since the open outcry trading closes at 14:30 EST, this result – after all – is not surprising.

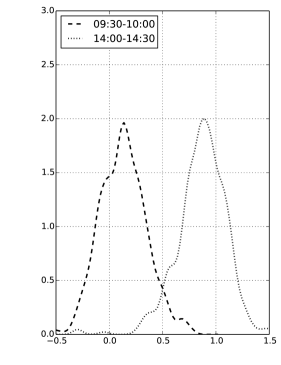

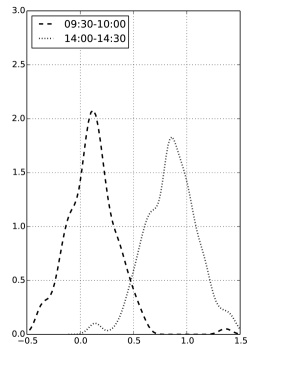

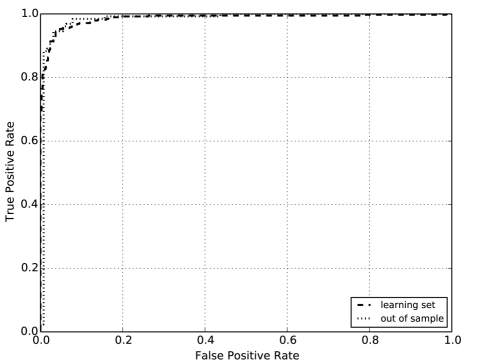

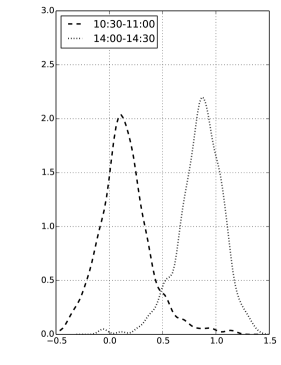

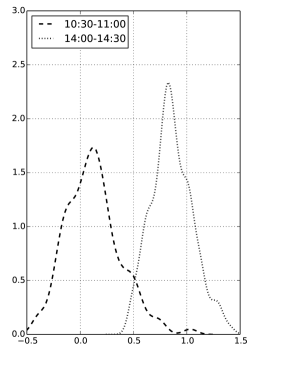

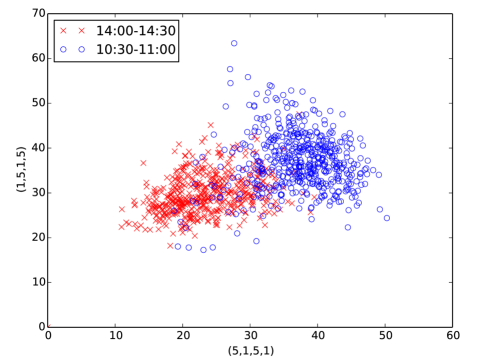

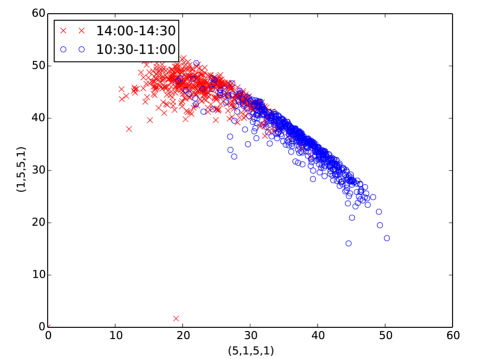

In figure 5, we present the classification results (the estimated densities of regressed values and the ROC curve) when we compare the 9:30-10:00 time bucket to 14:00-14:30 time bucket. Similarly, in figure 6, the results of the binary classification of the 10:30-11:00 and 14:00-14:30 intervals are shown.

| Kolmogorov-Smirnov | Area under | Ratio of correct | ||||

|---|---|---|---|---|---|---|

| distance | ROC curve | classification | ||||

| bucket | LS | OS | LS | OS | LS | OS |

| 9:30-10:00 | 0.906 | 0.914 | 0.986 | 0.984 | 0.952 | 0.946 |

| 10:30-11:00 | 0.880 | 0.922 | 0.976 | 0.986 | 0.939 | 0.946 |

| 11:30-12:00 | 0.940 | 0.961 | 0.995 | 0.992 | 0.969 | 0.973 |

| 12:30-13:00 | 0.888 | 0.906 | 0.986 | 0.988 | 0.942 | 0.950 |

| 13:30-14:00 | 0.882 | 0.914 | 0.979 | 0.974 | 0.940 | 0.942 |

“LS”: learning set, “OS”: out-of-sample set.

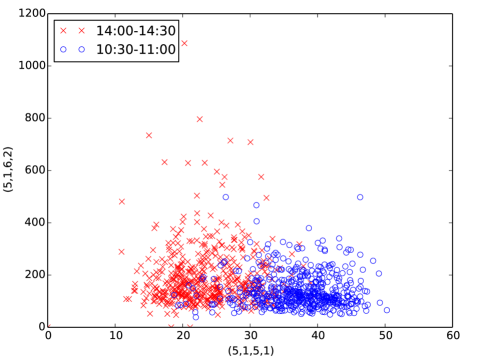

Table 1 contains some more results. Apart from the Kolmogorov-Smirnov distance, area under ROC curve and ratio of correct classification, the table shows the number of relevant variables identified by the LASSO shrinkage algorithm. In particular, the most relevant terms are fourth order iterated integrals such as the ones that correspond to these multi-indices:

where , , and are the indices of , , and respectively. The first three terms are involved in the higher order characteristics of the cumulative volume profile. The last term includes the lead-lag-transformed log-mid price, hence it is related to the quadratic variation of the mid-price. In figures 7, 8 and 9, the signatures of the input streams are projected on to two-dimensional subspaces that are spanned by pairs of the most relevant features. The projections demonstrate how the particular fourth order terms capture the difference between the two time buckets.

11:30-12:00

As another example, we also discuss how the 11:30-12:00 EST time bucket is distinguished from the other time-buckets.

| Kolmogorov-Smirnov | Area under | Ratio of correct | ||||

|---|---|---|---|---|---|---|

| distance | ROC curve | classification | ||||

| bucket | LS | OS | LS | OS | LS | OS |

| 9:30-10:00 | 0.621 | 0.609 | 0.884 | 0.846 | 0.810 | 0.798 |

| 10:30-11:00 | 0.455 | 0.461 | 0.800 | 0.782 | 0.727 | 0.713 |

| 10:30-11:00 | 0.455 | 0.461 | 0.800 | 0.782 | 0.727 | 0.713 |

| 12:30-13:00 | 0.399 | 0.313 | 0.760 | 0.688 | 0.699 | 0.636 |

| 14:00-14:30 | 0.940 | 0.961 | 0.995 | 0.992 | 0.969 | 0.973 |

“LS”: learning set, “OS”: out-of-sample set.

The results are summarised in table 2. The 11:30-12:00 time bucket shows more similarities with the reference time intervals, however it is still distinguishable, although more variables are required. Similarly as in the previous case, all the relevant variables correspond to certain fourth order iterated integrals; apart from the higher order characteristics of the cumulative volume profile and the quadratic variation, iterated integrals that contain the spread are also identified.

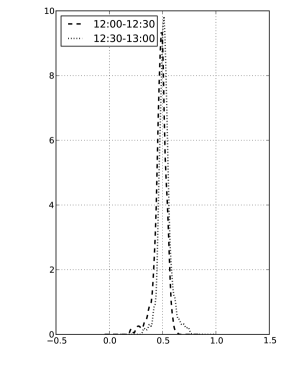

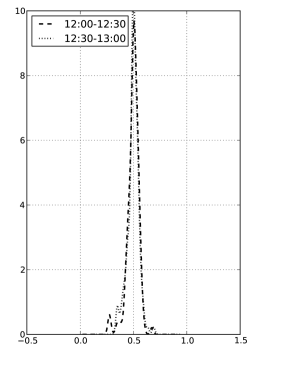

12:00-12:30 versus 12:30-13:00

Naturally, the market shows similar behaviour in certain pairs of time intervals. For instance, the signatures of the data streams observed in the 12:00-12:30 EST and 12:30-13:00 EST intervals indicate no significant difference. Figure 10 demonstrates the low-accuracy classification results in this particular case.

4.2 Characterising the traces of trade execution algorithms

The second numerical experiment aims to characterise the traces of trade execution algorithms. For this purpose, we use data streams sampled from the FTSE 100 index futures market (NYSE Liffe), which we transform as described in section 3.1. The start and finish time of the sampled streams are determined by the start and completion time of parent orders generated by two different trade execution algorithms. We label these trade execution algorithms by A and B. In the observed time period, the execution team randomly selected a trade execution algorithm for each trading signal. There is no significant difference in distributions of order size and start time of parent orders that have been executed with algorithm A and algorithm B respectively.

Note that the time variable is normalised in each data stream, hence the length of the execution period of the parent orders is not visible by the signatures. Besides the start and completion time of the parent orders, we have also been given the size of the parent order (in terms of number of lots) and the direction of the trade (sell or buy). We did not use any other specifics of the parent orders; in particular no information on the order submission, order cancellations and realised trades were used.

Investors in general aim to minimise their losses when trading. In particular, they aim to trade at favourable prices and minimise their market impact. This objective is particularly crucial for market participants who trade in large volumes. In the light of these facts, we approached this numerical experiment with moderately high expectations. Moreover, many trading algorithms operate simultaneously on the market; some of these algorithms might possess similar characteristics to the algorithms A and B in the focus of our experiment. This can results in noisy observations.

Input streams

The data set contains and data streams that are subsampled from buy parent orders and sell parent orders respectively over the time period 1/4/2012-1/10/2012. The experiment is focused on parent orders of a trade size between and contracts.

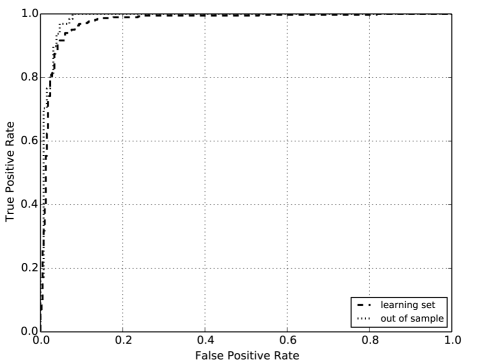

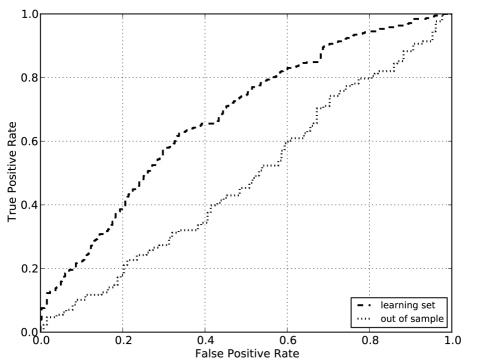

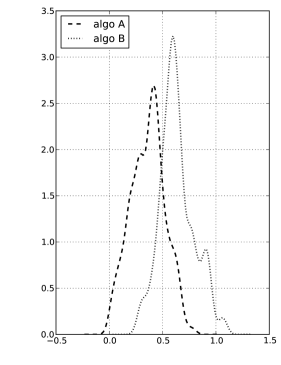

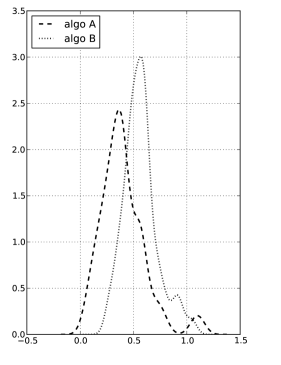

Classification results

We selected 75% of buy (sell) orders randomly 50 times, and for each learning set we trained the linear regression based classifier. In each case, the remaining 25% of the data was used for out of sample testing. In each case we computed the statistical indicators as described in section 3.3. The percentiles of the computed statistical indicators are shown in table 3 (buy orders) and in table 4 (sell orders). As a sanity check, we shuffled the algo A and algo B labels randomly 50 times, and for each case we ran the classification and computed the statistical indicators of the. The 95% percentile of these indicators is included in the “Ref” columns of the tables 3 and 4 as a reference.

The tables indicate that the signature based learning identifies significant difference between the trading algorithms A and B. Moreover, it is more likely to perform better on buy orders than on sell orders.

For a particular choice of learning set of buy orders, the distribution of score values and the ROC curve are plotted in figure 11. In this particular training, the LASSO shrinkage method identified 56 relevant variables. The multi-indices of the top 15 relevant variables and the corresponding regression coefficients are listed in tables 5; the indices , , , , and correspond to the variables , , , , and respectively.

| Min | 5% | 10% | 25 % | 50% | 75 % | 90% | 95% | Max | Ref | |

| Kolmogorov-Smirnov distance | ||||||||||

| LS | 0.270 | 0.542 | 0.556 | 0.624 | 0.670 | 0.707 | 0.746 | 0.763 | 0.802 | |

| OS | 0.179 | 0.220 | 0.252 | 0.280 | 0.353 | 0.422 | 0.456 | 0.486 | 0.518 | 0.263 |

| Area under ROC curve | ||||||||||

| LS | 0.663 | 0.839 | 0.851 | 0.882 | 0.906 | 0.927 | 0.938 | 0.941 | 0.957 | |

| OS | 0.575 | 0.604 | 0.618 | 0.646 | 0.685 | 0.721 | 0.747 | 0.779 | 0.796 | 0.588 |

| Ratio of correct classification | ||||||||||

| LS | 0.634 | 0.769 | 0.776 | 0.810 | 0.833 | 0.852 | 0.871 | 0.879 | 0.899 | |

| OS | 0.525 | 0.570 | 0.578 | 0.601 | 0.644 | 0.670 | 0.703 | 0.709 | 0.744 | 0.572 |

| Min | 5% | 10% | 25 % | 50% | 75 % | 90% | 95% | Max | Ref | |

| Kolmogorov-Smirnov distance | ||||||||||

| LS | 0.290 | 0.404 | 0.463 | 0.535 | 0.595 | 0.712 | 0.782 | 0.809 | 0.926 | |

| OS | 0.121 | 0.154 | 0.158 | 0.189 | 0.260 | 0.314 | 0.345 | 0.403 | 0.457 | 0.226 |

| Area under ROC curve | ||||||||||

| LS | 0.677 | 0.744 | 0.780 | 0.830 | 0.871 | 0.924 | 0.955 | 0.966 | 0.994 | |

| OS | 0.525 | 0.538 | 0.544 | 0.578 | 0.609 | 0.650 | 0.680 | 0.699 | 0.715 | 0.579 |

| Ratio of correct classification | ||||||||||

| LS | 0.644 | 0.701 | 0.730 | 0.766 | 0.795 | 0.853 | 0.888 | 0.902 | 0.960 | |

| OS | 0.473 | 0.519 | 0.529 | 0.551 | 0.584 | 0.618 | 0.639 | 0.660 | 0.685 | 0.568 |

| Multi-index | coefficient | Multi-index | coefficient | Multi-index | coefficient |

|---|---|---|---|---|---|

| (1,6,4,1) | 0.070366 | (1,1,6,4) | 0.061548 | (1,4,2,3) | -0.047923 |

| (1,4,2,5) | 0.043171 | (1,4,4,1) | -0.042334 | (2,3,5,4) | -0.040247 |

| (4,1,3,4) | -0.039719 | (6,3,6,5) | 0.037544 | (4,2,4,2) | 0.032859 |

| (3,4,4,3) | -0.031906 | (2,1,2,5) | 0.031789 | (3,1,6,1) | -0.026957 |

| (4,2,4) | 0.026546 | (2,4,2,3) | -0.025268 | (3,2,6,4) | -0.025219 |

Estimated regression coefficients

4.3 Robustness of classification

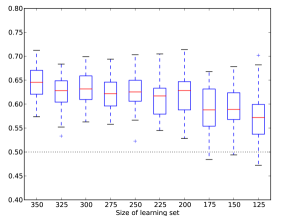

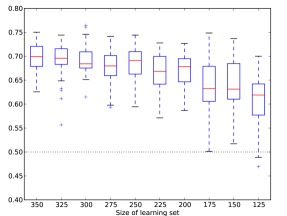

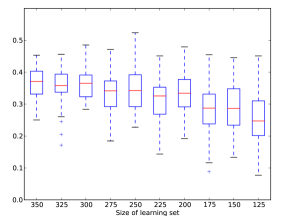

In order to get a better understanding of the prediction power of our classification method, we trained the tool on randomised learning sets of different sizes. In particular, the learning sets were randomly sampled from the first 353 data streams that corresponded to buy orders 50 times for each learning set size. Moreover, each trained classifier was tested on the same out of sample test. Figure 12 shows the distribution of the various statistical indicators corresponding to trainings as a function of the size of the learning set. We observe that the classification performance is reasonable robust when the learning set has 200 streams or more. For learning set of less than 200 streams the variance of the indicators increases, and the classification accuracy drops.

5 Conclusions

We use the terms in the signature of a data stream to define features for supervised learning algorithms. In particular, we extract information from noisy market data and classify data streams along various properties with a degree of high accuracy. The numerical examples demonstrate that the signature-based classification has great potential in machine learning.

References

- [1] Peter Bühlmann and Sara van der Geer, Statistics for High-Dimensional Data: Methods, Theory and Applications, Springer Series in Statistics, Springer, 2011.

- [2] Kuo-Tsai Chen, Integration of paths, geometric invariant and generalized Campbell-Baker-Hausdorff formula, Ann. Math. 65 (1957), no. 1, 163–178.

- [3] , Integration of paths – a faithful representation of paths by non-commutative formal power series, Trans. Amer. Math. Soc. 89 (1958), 395–407.

- [4] Peter Friz and Nicolas Victoir, Multidimensional Stochastic Processes as Rough Path, Cambridge University Press, 2010.

- [5] Lajos Gergely Gyurkó, Numerical Methods for Approximating Solutions to Rough Differential Equations, DPhil Thesis, University of Oxford, 2009.

- [6] Lajos Gergely Gyurkó and Terry Lyons, Rough Paths based Numerical Algorithms in Computational Finance, Mathematics in Finance (Santiago Carrillo Menéndez and José Luis Fernández Pérez, eds.), American Mathematical Society, Real Sociedad Matemática Española, 2010, pp. 397–405.

- [7] Ben Hambly and Terry Lyons, Uniqueness for the signature of a path of bounded variation and the reduced path group, Annals of Mathematics 171 (2010), no. 1, 109–167.

- [8] E. Peter Kloeden and Eckhard Platen, Numerical Solution of Stochastic Differential Equations, Springer-Verlag Berlin Heidelberg New York, 1999.

- [9] Shigeo Kusuoka, Approximation of expectation of diffusion process based on Lie algebra and Malliavin calculus, Adv. Math. Econ. 6 (2004), 69–83.

- [10] Terry Lyons, Differential equations driven by rough signal, Revista Matematica Iberoamericana 14 (1998), no. 2, 215–310.

- [11] Terry Lyons, Michael Caruana, and Thierry Lévy, Differential Equations Driven by Rough Paths, Ecole d’Eté de Porbabilités de Saint-Flour XXXIV - 2004, Lecture Notes in Mathematics, Springer, 2007.

- [12] Terry Lyons, Hao Ni, and Daniel Levin, Learning from the past, predicting the statistics of the future, learning an evolving system, Preprint, 2013.

- [13] Terry Lyons and Zhongmin Qian, System Control and Rough Paths, Oxford Mathematical Monographs, Clarendon Press, 2002.

- [14] Terry Lyons and Nicolas Victoir, Cubature on Wiener Space, Proc. R. Soc. Lond. A 460 (2004), 169–198.