Power-law exponent of the Bouchaud-Mézard model on regular random network

Abstract

We study the Bouchaud-Mézard model on a regular random network. By assuming adiabaticity and independency, and utilizing the generalized central limit theorem and the Tauberian theorem, we derive an equation that determines the exponent of the probability distribution function of the wealth as . The analysis shows that the exponent can be smaller than 2, while a mean-field analysis always gives the exponent as being larger than 2. The results of our analysis are shown to be good agreement with those of the numerical simulations.

I Introduction

Since Pareto’s revelation that the distribution of wealth follows a power-lawPareto , many researchers have proposed various models to explain this phenomenon. The simplest of these is the Bouchaud-Mézard (BM) model, which is described by the following stochastic differential equationBouchaud2000 ;

| (1) |

where , , , , , and are the total number of agents, the wealth of agent , a diffusion constant, an adjacent matrix, the noise strength, and normal Brownian motion, respectively. Bouchaud and MézardBouchaud2000 analyzed this model for a globally coupled network, i. e., for all , and found that, although does not have a stationary distribution, the normalized wealth does and its probability distribution function (PDF) is given by

| (2) |

where (here and in the following, we denote the normalized wealth by ). The PDF obeys the power law as , where the exponent is .

Real economic networks, however, are not globally coupled networks, and so the original BM model is extended to that on a complex network. However, it has been shown that the properties of the BM model on a complex network differ from those on a globally coupled network. Bouchaud and MézardBouchaud2000 also reported that, while the mean-field analysis always gives an exponent larger than 2, a smaller exponent can be seen in numerical simulations on a regular random network. This result seems plausible because the real wealth distribution often shows an exponent that is smaller than 2Sinha2006 . So far, a number of papers have been published on this system. For example, Garlaschelli and Loffredo proposed to fit the distribution by Garlaschelli2004 . Ma et al. proposed another assumption that the PDF is given generalized inverse Gamma distributionMa2013 . In these papers, the exponent was obtained by fitting the result of numerical simulations, however, no one had succeeded to obtain analytically.

We recently obtained the wealth distribution of the BM model on the complex network analytically in the case of Ichinomiya2012-1 ; Ichinomiya2012-2 . However, these analysis cannot be applied when , because we derive the result using the central limit theorem. We can apply the central limit theorem only when the variance is finite, therefore this theorem is not applicable when .

Here, a study of the power-law tail of the BM model on a regular random network when is presented. The applications of the generalized central limit theorem and the Tauberian theorem are a key part of this theory. Using these theorems, we derive two equations that relate the PDF of the wealth to that of the average of wealth around each node. These two equations lead us to a simple equation that determines the exponent of the stationary wealth distribution. The result shows that the exponent can be smaller than , which implies that “wealth condensation”(a small number of agents control the greater part of the wealth) can occur.

II Theory

Following the theory presented in Ichinomiya2012-1 ; Ichinomiya2012-2 , we make “adiabatic” and “independent” assumptions. We assume that the PDF of the wealth on each node is independent, allowing the total PDF to be decomposed as . In the case of a regular random network in which all nodes have degree , can be assumed to be independent of the index , i. e., . We also assume “adiabaticity”, that is, varies much faster than the “local mean-field” .

If is constant, the conditional PDF of , , is given by the stationary solution of the following Fokker-Planck equation:

| (3) |

It can be shown that

| (4) |

is the stationary solution of this equation, where

| (5) |

and . Under the adiabatic assumption, changes at a much slower rate than , and so can be written as

| (6) |

where is the distribution of the average of the wealth around node .

To calculate the exponent as , we assume that and . This assumption is consistent with the numerical simulations results for small that are presented in Sec. III. Under this assumption, we can obtain two equations that relate the tail of to as .

The first of these equations is derived by applying the generalized central limit theoremFeller1966 . Because the standard deviation of diverges, we can assume that as and . Under the independent assumption, we can apply the generalized central limit theorem, and the distribution of can be approximated by the stable distribution for large , where , and is the stable distribution function whose characteristic function is given by for and for . In both cases, the tail of , which is the PDF of the stable distribution , is given by

| (7) |

for Nolan2013 . Here, we note that the tail of PDF of and is the same for .

By assuming that and as , we obtain the following equations from Eq.(7) and the expression for ;

| (8) |

| (9) |

and

| (10) |

These equations lead to

| (11) |

which is the first equation we use to determine the exponent .

The second equation is obtained using the Tauberian theorem. We introduce the Laplace transformation of ,

| (12) |

The Tauberian theorem states that as is equivalent to as , provided that .

Eqs. (4), (5) and (6) indicate that can be obtained from , the Laplace transformation of , as

| (13) |

Using the fact that as and the assumption , we can apply the Tauberian theorem to calculate as ;

| (14) |

for . Therefore, we obtain the second equation,

| (15) |

There are a few things to note about this equation. First, this equation is always satisfied when ; however, it seems counterintuitive that does not depend on the parameter , and so we take the solution that satisfies as the “real” distribution. Second, it should also be noted that in general this equation cannot be solved analytically, but we can obtain in some special cases, e. g., when . In this case, Eq.(16) gives

| (17) |

The solution to this equation,

| (18) |

implies that the variance of the wealth becomes finite when . This result is consistent with that in our previous paperIchinomiya2012-1 , in which we investigated the wealth distribution when . Third, we note also that in the limit , we obtain from Eq.(16), which is the solution of the mean-field analysis; as , the right hand side of Eq.(16) diverges for , and is 0 for . From the fact that has no zero point on the real axis and diverges at , we conclude that as increases, which is consistent with the results of the mean-field analysis. In a final remark about Eq.(16), we see that there is a solution for small , as we show in Sec. III. This appears to be paradoxical, because the average of the normalized wealth must be 1, while it diverges if . This paradox is a result of the independent assumption; because the sum of is conserved, and are related through . In the case of , this restriction is negligible, because for all nodes. However, in the case of , the wealth of the richest node becomes , and the correlation is not negligible. Therefore for the distribution will differ from that derived here; our theory can only be applied in in the region .

Before concluding this section, we make a remark on the generalization of our method to a general complex network. We assume again adiabaticity and independency, and we also assume that the PDF of and that of the local mean-field at node are given by and for , respectively. Under these assumptions, all belong to the same domain of attraction of a stable distribution function. In this case, the distribution of the sum can be obtained from the generalized central limit theoremOtiniano2012 , which leads to

| (19) |

where is the degree of node . By also using the Tauberian theorem we also get

| (20) |

and by eliminating from Eqs.(19) and (20) we obtain

| (21) |

which can be rewritten as

| (22) |

where

| (23) |

Therefore we require to satisfy the condition , and we also require the eigenvector of , whose corresponding eigenvalue is zero, to be non-negative, because for all . In the case of a regular random graph, we can find the solution easily; first, is proportional to the identity matrix, and the condition means that the diagonal part of is equal to an eigenvalue of . Second, is a non-negative matrix and we can apply the Frobenius theorem to find that has a non-negative eigenvector and a corresponding eigenvalue . From these conditions, we can easily obtain Eq.(16). In the case of a general complex network, it is much more difficult to obtain ; is not proportional to the identity matrix, and we need to solve numerically. Moreover, we cannot apply the Frobenius theorem to obtain non-negative eigenvectors, because is not a non-negative matrix. In this case, we will need to follow the following procedure to obtain : First, we find the set of ’s that satisfy . Second, we select those values that give a non-negative eigenvector of whose eigenvalue is zero. We note that it is difficult to carry out this procedure for a large complex network. In the first step, we will find a large number of ’s that satisfy . To estimate the number of solutions of , we consider the case of the regular random graph. In this case, the number of ’s that satisfy this condition is equal to the number of eigenvalues of . Therefore we expect that the number of ’s that satisfy this condition will be for a large complex network. From this set of ’s, we need to choose those that have non-negative eigenvectors. We cannot apply the Frobenius theorem in the case of general complex network, and we need to calculate the corresponding eigenvectors for each obtained in the first step. And even if we succeeded in doing this, we also need to select one appropriate from this set. In the case of a regular random network, we always have the solution , which is rejected because it is counterintuitive. However, it is not known whether we can always distinguish appropriate values from inappropriate values simply by intuition. Further work will be necessary to extend this theory to the case of a general complex network.

III Numerical Simulation

Numerical simulations of the BM model on a regular random graph were carried out for nodes and repeated 10 times using the Euler-Maruyama algorithm with an initial condition for each parameter. The distribution at was taken as the stationary distribution, and here we set .

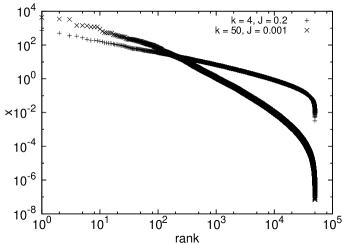

To obtain the exponent at large , we construct a rank plot of ; it has been shown previously that if for , then the wealth of the -th richest agent is approximately proportional to Redner1998 . A rank plot of the wealth for and is shown in Fig.1. The distribution shows clear power-law behavior in the case of , but not in the case of . Although the exponent seems to be constant at ranks of , it increases for smaller . This observation is consistent with the discussion at the end of Sec. II. For and , 76 agents have a wealth larger than 100, and so we cannot assume that in this region. From these observations, we estimate the exponent as , where represents the wealth at rank .

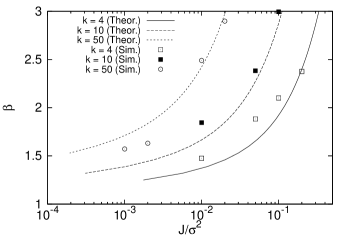

Fig.2 compares the exponents obtained in the numerical simulation for several parameters with those of the theory presented in Sec. II. Good agreement is observed, especially in case of , but at lower values there is a small discrepancy between the theoretical and simulation values. We suspect that this discrepancy is caused by the errors in the estimation of the exponent. As shown in Fig.1, the wealth distribution does not exhibit a power-law in the case of due to the correlation for large . We use data that have a rank of larger than 100 to avoid the effect of this correlation; however, the correlation will still remain. We also note that becomes too small to assume , which is an assumption used in the derivation of Eq. (13). If another method is used to estimate the exponent, such as , then we will obtain a slightly different exponent. Despite this problem, the difference in the value of the exponent obtained by our theory and that obtained from the numerical simulations is less than , and we can conclude that our theory gives a good estimation of the exponent even in the case of .

IV Discussion and Conclusion

In summary, we have analyzed the stationary PDF of wealth in the BM model on a regular random network. Using the generalized central limit theorem and the Tauberian theorem, we obtained an equation for the tail exponent . We found that at small coupling the exponent becomes smaller than 2, and the results of this analysis were in good agreement with those of the numerical simulations.

This work has raised a number of points that require further investigation.

The first important point to be addressed is the generalization of our theory to the BM model on a complex network. As discussed at the end of Sec. II, we need to obtain a value of that satisfies the condition that the matrix has a zero eigenvalue and that the corresponding eigenvector is non-negative. In practice, it is difficult to find a value of that satisfies these conditions. In the case of a regular random graph, we can assume that for all . This assumption cannot be applied if the network is heterogeneous. Numerical simulations on a heterogeneous network may suggest other assumptions on , which would assist in calculating .

The second important point is an estimation of the effects of correlation. MedoMedo2008 showed that there is a spatial correlation in the BM model on complex networks. We have already reported that such a correlation is not negligible in the case of a Watts-Strogatz networkIchinomiya2012-2 . In this paper, we found that another kind of correlation emerges from the wealth conservation. This correlation can occur in any complex network and is not negligible especially for . Further studies for a more accurate estimation of the effects caused by this correlation are needed.

The final point is the unification of this work with our previous work for . In the case of , we can approximate by a Gaussian distribution using the central limit theorem. Unfortunately, we cannot apply the Tauberian theorem in this case. This theorem is applicable only when for , where is a slowly varying function of , i.e., as for all . If is a Gaussian, then there is no that satisfies this condition, and so we cannot apply the Tauberian theorem. We will need another approach to unify both cases into a single theory.

Acknowledgements.

The author thanks Hiroya Nakao, Satoru Morita, and Takaaki Aoki for helpful discussions.References

- (1) V. Pareto, Cours d’économie politique Macmilan, London 1897.

- (2) J. Bouchaud and M. Mézard, Physica A 282 536 (2000).

- (3) S. Sinha, Physica A 359 555 (2006).

- (4) D. Garlaschelli and M. I. Loffredo, Physica A. 338 113 (2004).

- (5) T. Ma, J. G. Holden, and R. A. Serota, Physica A, 392 2434 (2013).

- (6) T. Ichinomiya, Phys.Rev. E 86 036111 (2012).

- (7) T. Ichinomiya, Phys.Rev. E 86 066115 (2012).

- (8) W. Feller, An Introduction to Probability Theory and Its Application, Wiley, New York, 1966.

- (9) J. P. Nolan, Stable Distributions - Models for Heavy Tailed Data, Birkhauser, Boston 2013 (in progress).

- (10) C. E. G. Otiniano, T. R. Sousa, and P. N. Rathie, Journal of Computational and Applied Mathematics, 242 1 (2013).

- (11) S. Redner, Eur. Phys. J. B. 4 131 (1998).

- (12) M. Medo, J. Stat. Mech., 2009 P02014 (2009).