Fluctuation analysis of the three agent groups

herding model

Abstract

We derive a system of stochastic differential equations simulating the dynamics of the three agent groups with herding interaction. Proposed approach can be valuable in the modeling of the complex socio-economic systems with similar composition of the agents. We demonstrate how the sophisticated statistical features of the absolute return in the financial markets can be reproduced by extending the herding interaction of the agents and introducing the third agent state. As well we consider possible extension of proposed herding model introducing additional exogenous noise. Such consistent microscopic and macroscopic model precisely reproduces empirical power law statistics of the return in the financial markets.

1 Introduction

The large number of actors (agents), the non-linear interactions between them and the feedback of the macroscopic behavior of the system on the microscopic behavior of the agents are the essential properties of the complex socio-economic systems. These properties lead to themacroscopic fluctuations, characterized by the power-law distributions and the power-law autocorrelations [1, 2, 3]. The observed empirical properties of the fluctuations in the complex socio-economic systems are both important for the estimation of risks and also give essential information about the system. This information allows us to develop various imitation models of the complex socio-economic systems, enabling the forecast and the control of their behavior [4].

We investigate models encompassing both microscopic description of the complex socio-economic systems, using Markov jumps between different agent groups (states), as well as consistent macroscopic description, using the non-linear stochastic differential equations (abbr. SDEs) obtained analytically from the master equation [5, 4].

In this contribution we consider the statistical properties of the fluctuations in the three agent groups herding model [6] perturbed by exogenous information flow noise. We also compare the properties of the noisy model with the statistical properties of the empirical data extracted from the NYSE Trades and Quotes database.

We start by generalizing the Kirman’s herding model [7] by introducing a variable inter-event times. Next we define the herding interaction between three agent groups. The three groups model is simplified by relating it to the financial markets. Further we couple the endogenous fluctuations of the agent system with the exogenous information flow noise. Finally we discuss the obtained results in the context of the proposed double stochastic model of the returns in the financial markets [8, 9].

2 Generalization of the Kirman’s herding model

In [7] Kirman noticed that entomologists and economists observe similar behavior in distinct systems. For a system with constant number of agents , having two choices, or , with number of agents in state and consequently with the number of agents in state , Kirman proposed a Markovian chain with the following per-agent transition rates:

| (1) |

where , terms define the herding behavior, while terms describe the rates of the individual decisions to change opinion.

In previous work [5] we proposed a generalization to the Kirman model by introducing the feedback of the macroscopic state, , on microscopic transition rates accounting for a variable inter-event time . The generalized per-agent transition rates can be expressed as follows:

| (2) |

Then the macroscopic SDE of herding model with variable rate of herding interaction can be written as:

| (3) |

where we introduced the time scaling with new parameters and .

In [5, 10] we have shown that non-linear transformation of variables (here is driven by eq. (3)) gives SDE:

| (4) |

If and in the limit we can consider only the highest powers of present in the SDE above, in such case the above SDE belongs to the general class of SDEs,

| (5) |

The above general class of SDEs is known to generate power-law statistics [11]. The stationary probability density function (abbr. PDF), , and power spectral density (abbr. PSD), , of the general class of SDEs are given by:

| (6) | |||

| (7) |

The parameters, of eqs. (4) and (5), are related as follows , .

Eq. (5) was previously derived from the point processes and its ability to reproduce power-law statistics was grounded in [11]. Many physical and social systems are characterized by the complex interactions among different components. The power-law autocorrelation in the output of these systems is a common characteristic feature [12, 13, 14, 15, 16, 17]. The applications of such stochastic model might include varying complex systems possessing power-law statistical features. The direct consequence of the comparison is the ability to control the power-law exponents, and , of the statistical features obtained from the agent-based model, eq. (2), and its stochastic treatment, eq. (4). This can be used to reproduce noise with (for details see [5, 10]).

3 Three state herding model

We can extend the herding model by introducing the three state agent dynamics with the fractions of agents in each state, , and . In this case there are six per-agent transition rates:

| (8) |

where is the index of the starting state, is the index for the destination state (i.e. agent leaves state to move to state ). As before, [7, 5], we assume that herding is symmetric, .

Next we can use the one-step, or birth-death process, formalism (the formalism itself is discussed in [18], while the technical details are given in [6]) to obtain the following Fokker-Plank equation for a time-dependent system state PDF, ,

| (9) |

with

| (10) | |||

We will achieve a considerable simplification of this approach after some additional assumptions regarding financial market interpretation.

In the current agent-based modeling of financial markets the most common choice of three types of agents is: fundamentalists, chartists optimists and chartists pessimists [19]. Let us consider fluctuations of market price according its fundamental value , based on fundamental knowledge of fundamentalists. It is common to assume the excess demand of fundamentalists, , as a given by [20]

| (11) |

where is a number of the fundamentalists inside the market. Such assumption ensures the long term convergence of the market price towards its fundamental value , here considered to be constant. stands for the relative log-price, .

The pessimistic and optimistic chartists, are short-term traders, who estimate the future prices based on its recent movement and external information flow. It is reasonable to assume that all chartists at a given time are divided as optimistic, i.e., suggesting to buy and pessimistic, i.e., suggesting to sell. The excess demand of the chartist traders, , is given by [20]

| (12) |

where is a relative impact factor of the chartist trader, and are the total numbers of optimists and pessimists respectively.

As a market price is assumed to reflect the current supply and demand, the Walrasian scenario in its contemporary form may be expressed as

| (13) |

here is a speed of the price adjustment, a total number of traders in the market and . By assuming that the number of traders in the market is large, , the expression for the relative log-price is obtained

| (14) |

Consequently the return, , in the selected time window is given by

| (15) |

Now let us make simplifications to the three group agent-based model. First of all we relate the states’ population fractions to the described agent types:

| (16) |

Now let us note that the optimism and pessimism are essentially identical:

| (17) |

It is also reasonable to assume that chartists among themselves interact times faster than with the fundamentalists, i.e.,

| (18) |

After some more technical mathematical steps with the eq. (10), for details see [6], we derive a system of SDEs corresponding to the Fokker-Plank equation (9),

| (19) | |||

| (20) |

The derived SDEs are interdependent, while it would be preferable to have a system of independent SDEs. Introducing a mood, , as a new variable instead of , helps us to arrive at the independent equations.

In the final version of equations we scale the time, , and appropriately redefine the model parameters: , , . At the same time we recall the generalization of the herding model, eqs. (2) and (3), by introducing the additional variability of the event rate, . In case of the three group model of financial market one will get:

| (21) | |||

| (22) | |||

| (23) |

Note that in this setup is defined, eq. (23), securing zero fluctuations, when number of chartists vanishes. In [6] we have shown that this model possesses a fractured PSD similar to the one introduced earlier in double stochastic model considered in [8, 9].

Described model contains two shortcomings. First of all, as we noticed in [6], the exponent of PSD for the absolute return are too high in the comparison with the empirical data. Also the model itself accounts only for the endogenous fluctuations of agents, when the external noise of information flow has to be accounted for, as well. Here we propose a very simple approach to integrate endogenous and exogenous fluctuations.

4 Exogenous information flow noise

It is widely accepted to describe the movements of stock price, , as a geometric Brownian process

| (24) |

In the above is considered to be an external information flow noise and accounts for the stochastic volatility conditioned by the macroscopic state of the agent system. Here we consider only the most simple case, when fluctuations are slow in comparison with external noise . In such case the return, , in the time period can be written as a solution of eq. (24)

| (25) |

This equation defines instantaneous return fluctuations as a Gaussian random variable with mean and variance .

In [9, 8], while relying on the empirical analysis, we have assumed that the return, , fluctuates as instantaneous q-Gaussian noise with and driven by some stochastic process . The function has a linear form

| (26) |

where parameter serves as a time scale of exogenous noise and quantifies the relative input of exogenous noise. Proposed three state herding model and its combination with external noise driven price, eq. (24), gives a new interpretation to the such approach. One just needs to replace the instantaneous Gaussian fluctuations of the return, eq. (25), by q-Gaussian noise. The in the new interpretation should be a function of the log-price, , defined in eq. (14) to model joint exogenous and endogenous fluctuations of the return,

| (27) | |||

| (28) |

Eq. (27) finally defines double stochastic model of return in financial markets, which integrates the endogenous herding fluctuations of the three groups agent system with exogenous noise of information flow here described by the instantaneous q-Gaussian fluctuations.

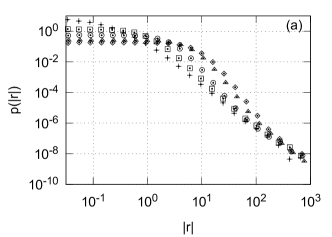

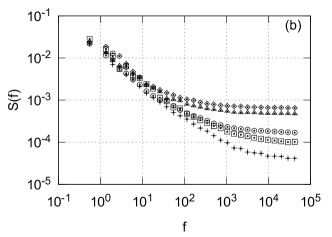

First of all in fig. 1 we present numerical results of the extended three state herding model with exogenous noise for the return defined in eq. (27). It is obvious that external noise increases the exponent of return PDF in its power-law part, (a), and decreases both exponents of PSD, (b). Consequently it has to be possible to adjust exponents of power-law statistics for financial variables with appropriate choice of endogenous and exogenous noise contributions.

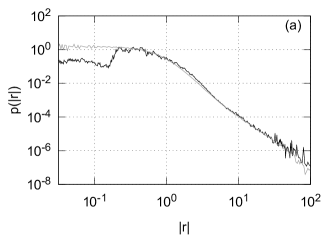

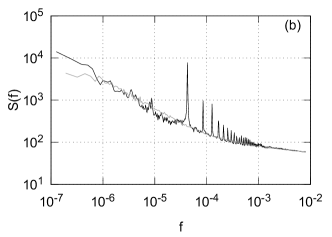

In fig. 2 we compare the absolute return PDF, (a), and PSD, (b), numerically calculated with the noisy three state herding model and empirical data averaged over 24 series of different stocks traded on NYSE in two years period. This provides an evidence that proposed noisy three state herding model can reproduce empirical statistics of return in financial market in very details. From our point of view this result is considerable step in stochastic modeling of financial markets in comparison with previous modeling [9, 8], as incorporates microscopic model of agents and exogenous noise of information flow.

5 Conclusion

In this contribution we presented a possible extension of the three groups herding model recently proposed in [6]. The main idea is to incorporate into endogenous agent based model an external noise. In such approach the input of agent stochastic behavior and input of external noise into common stochastic fluctuations are adjustable by parameters and in eq. (26). By numerical calculations we demonstrate that exponents of power-law statistics, PDF and PSD, of long term return fluctuations are related to the choice of parameter , figure 1. This solves the shortcomings of earlier proposed three state herding model [6].

Finally we adjust parameters of extended three state herding model to reproduce statistics of return fluctuations in real markets, fig. 2. Averaged PDF and PSD over 24 two years return series of stocks traded on NYSE are reproduced in very details by proposed model. Though this result resembles very much previous modeling of financial markets by SDEs [9, 8], current approach is much more general as derived from microscopic treatment of complex social system. We do consider proposed model as potentially applicable to other social systems with similar three state composition of agents.

References

- [1] J. D. Farmer and D. Foley, “The economy needs agent-based modelling,” Nature, vol. 460, pp. 685–686, 2009.

- [2] T. Lux and F. Westerhoff, “Economic crysis,” Nature Physics, vol. 5, pp. 2–3, 2009.

- [3] C. Schinckus, “Introduction to econophysics: towards a new step in the evolution of physical sciences,” Contemporary Physics, vol. 54, no. 1, pp. 17–32, 2013.

- [4] A. Kononovicius, V. Gontis, and V. Daniunas, “Agent-based versus macroscopic modeling of competition and business processes in economics and finance,” International Journal On Advances in Intelligent Systems, vol. 5, no. 1-2, pp. 111–126, 2012.

- [5] A. Kononovicius and V. Gontis, “Agent based reasoning for the non-linear stochastic models of long-range memory,” Physica A, vol. 391, no. 4, pp. 1309–1314, 2012.

- [6] A. Kononovicius and V. Gontis, “Three state herding model of the financial markets,” EPL, vol. 101, p. 28001, 2013.

- [7] A. P. Kirman, “Ants, rationality and recruitment,” Quarterly Journal of Economics, vol. 108, pp. 137–156, 1993.

- [8] V. Gontis, J. Ruseckas, and A. Kononovicius, “A long-range memory stochastic model of the return in financial markets,” Physica A, vol. 389, no. 1, pp. 100–106, 2010.

- [9] V. Gontis, J. Ruseckas, and A. Kononovicius, “A non-linear stochastic model of return in financial markets,” in Stochastic Control (C. Myers, ed.), InTech, 2010.

- [10] J. Ruseckas, B. Kaulakys, and V. Gontis, “Herding model and 1/f noise,” EPL, vol. 96, p. 60007, 2011.

- [11] J. Ruseckas and B. Kaulakys, “1/f noise from nonlinear stochastic differential equations,” Physical Review E, vol. 81, p. 031105, 2010.

- [12] M. Kobayashi and T. Musha, “1/f fluctuation of heartbeat period,” IEEE Transactions on Biomedical Engineering, vol. 29, pp. 456–457, 1982.

- [13] P. C. Ivanov, L. A. N. Amaral, A. L. Goldberger, and H. E. Stanley, “Stochastic feedback and the regulation of biological rhythms,” EPL, vol. 43, no. 4, pp. 363–368, 1998.

- [14] Y. Ashkenazy, P. C. Ivanov, S. Havlin, C.-K. Peng, A. L. Goldberger, and H. E. Stanley, “Magnitude and sign correlations in heartbeat fluctuations,” Physical Review Letters, vol. 86, pp. 1900–1903, 2001.

- [15] Y. Ashkenazy, J. M. Hausdorff, P. C. Ivanov, and H. E. Stanley, “A stochastic model of human gait dynamics,” Physica A, vol. 316, pp. 662–670, 2002.

- [16] P. C. Ivanov, A. Yuen, B. Podobnik, and Y. Lee, “Common scaling patterns in intertrade times of u. s. stocks,” Physical Review E, vol. 69, no. 5, p. 056107, 2004.

- [17] B. Podobnik, D. Horvati, A. M. Petersen, and H. E. Stanley, “Cross-correlations between volume change and price change,” Proceedings of the National Academy of Sciences of the United States of America, vol. 106, pp. 22079–22084, 2009.

- [18] N. G. van Kampen, Stochastic process in Physics and Chemistry. Amsterdam: North Holland, 2007.

- [19] M. Cristelli, L. Pietronero, and A. Zaccaria, “Critical overview of agent-based models for economics,” in Proceedings of the School of Physics ”E. Fermi”, Course CLXXVI (F. Mallnace and H. E. Stanley, eds.), (Bologna-Amsterdam), pp. 235 – 282, SIF-IOS, 2012.

- [20] S. Alfarano, T. Lux, and F. Wagner, “Estimation of agent-based models: The case of an asymmetric herding model,” Computational Economics, vol. 26, no. 1, pp. 19–49, 2005.